RAM Benchmarks

•Engagement Rate – 85%

•Prospect to Visit – 20-30%

•Visit to Lease – 25-35%

•Prospect To Lease – 7-10%

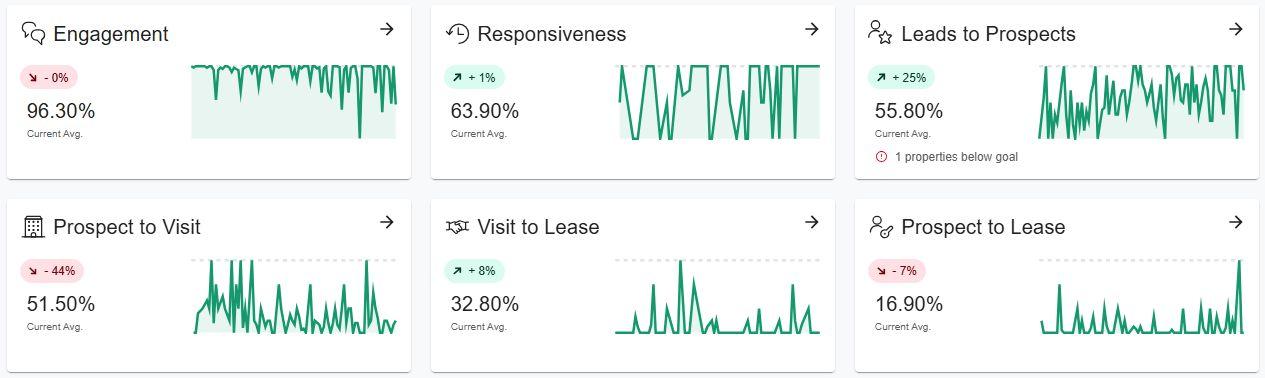

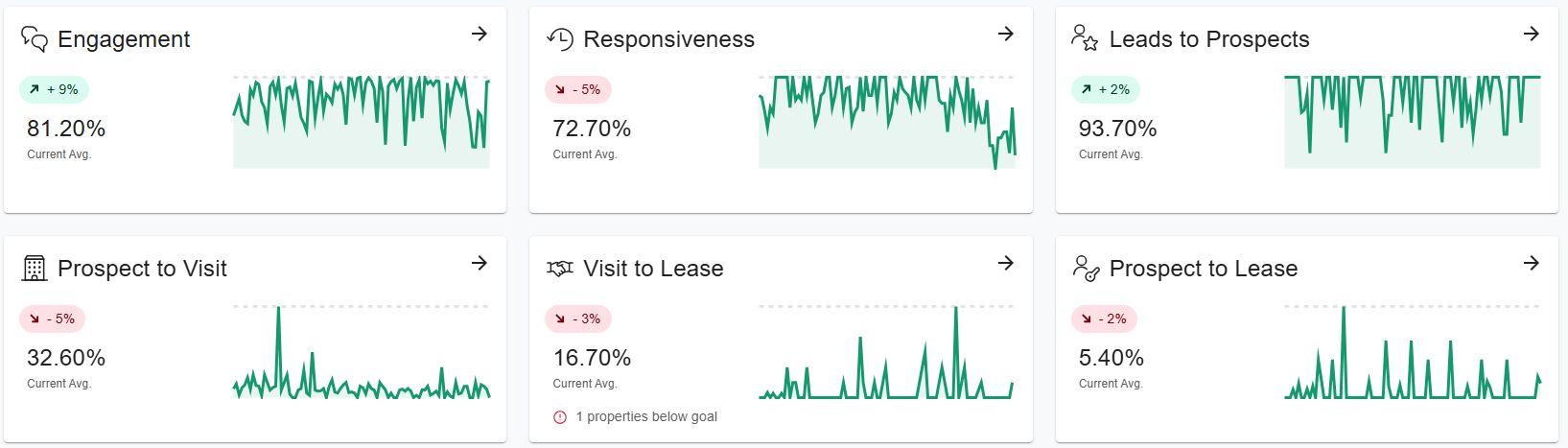

● The property had an extremely healthy engagement rate of 96.30%, which exceeded the RAM benchmark of 85%.

● The conversion rates for prospect to visit, visit to lease, and prospect to lease either exceeded or met the benchmark.

● As of 1/16/2025, The Dempsey is 87.59% leased and 84.48% occupied.

● As of 1/16/2025, the property has 41 available units.

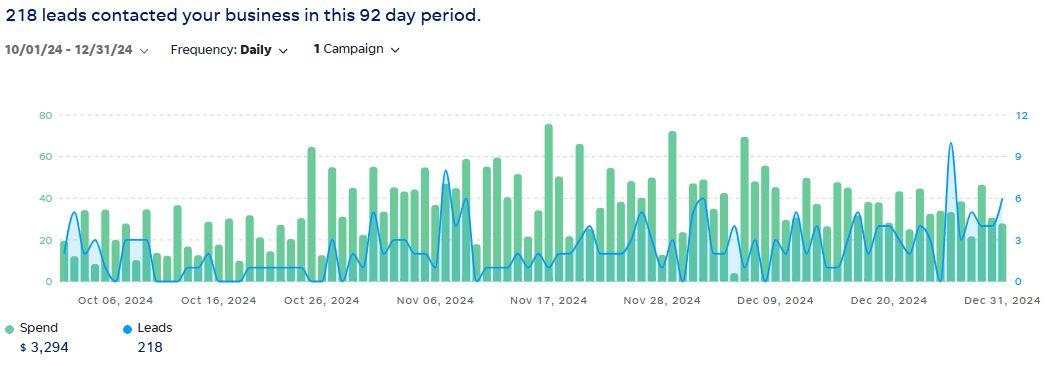

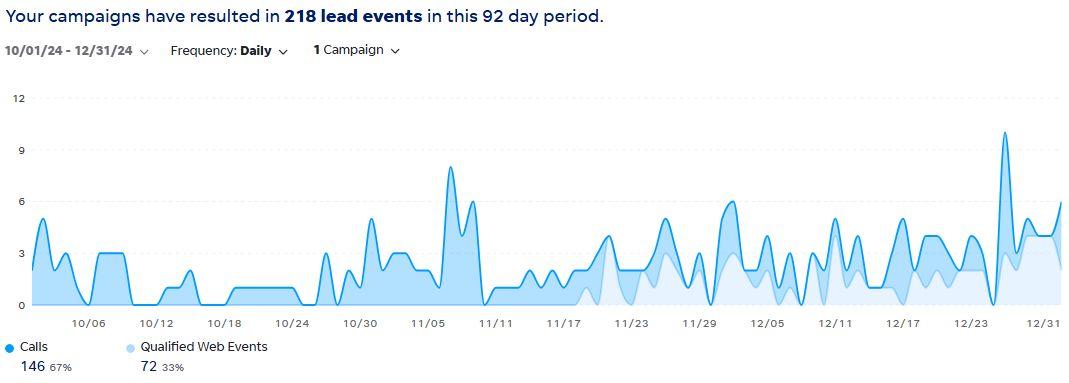

● Prospect volume was insufficient during Q4. Increase the marketing channels package visibility to increase the lead pipeline.

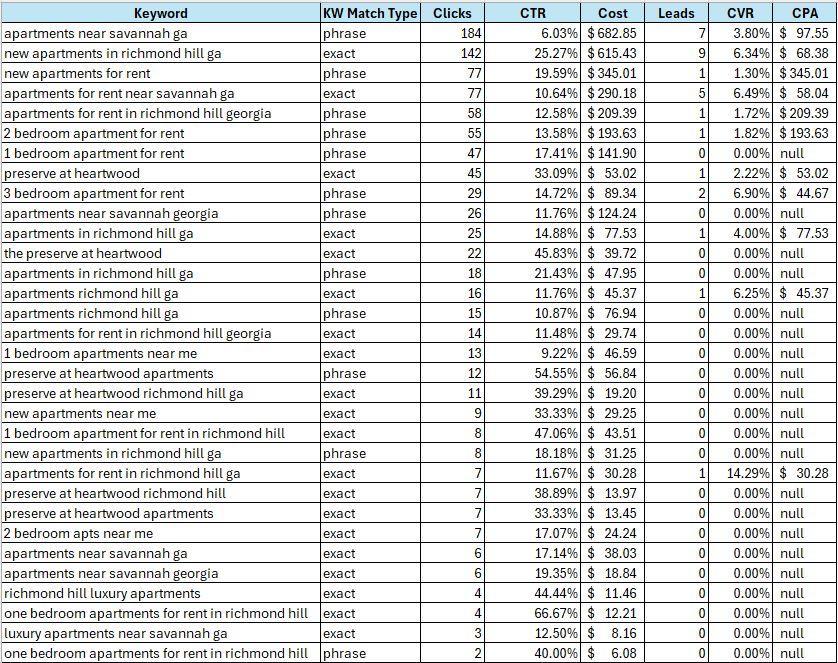

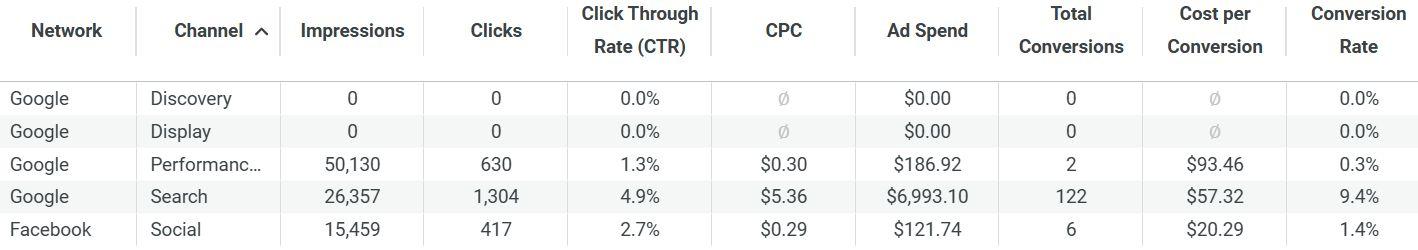

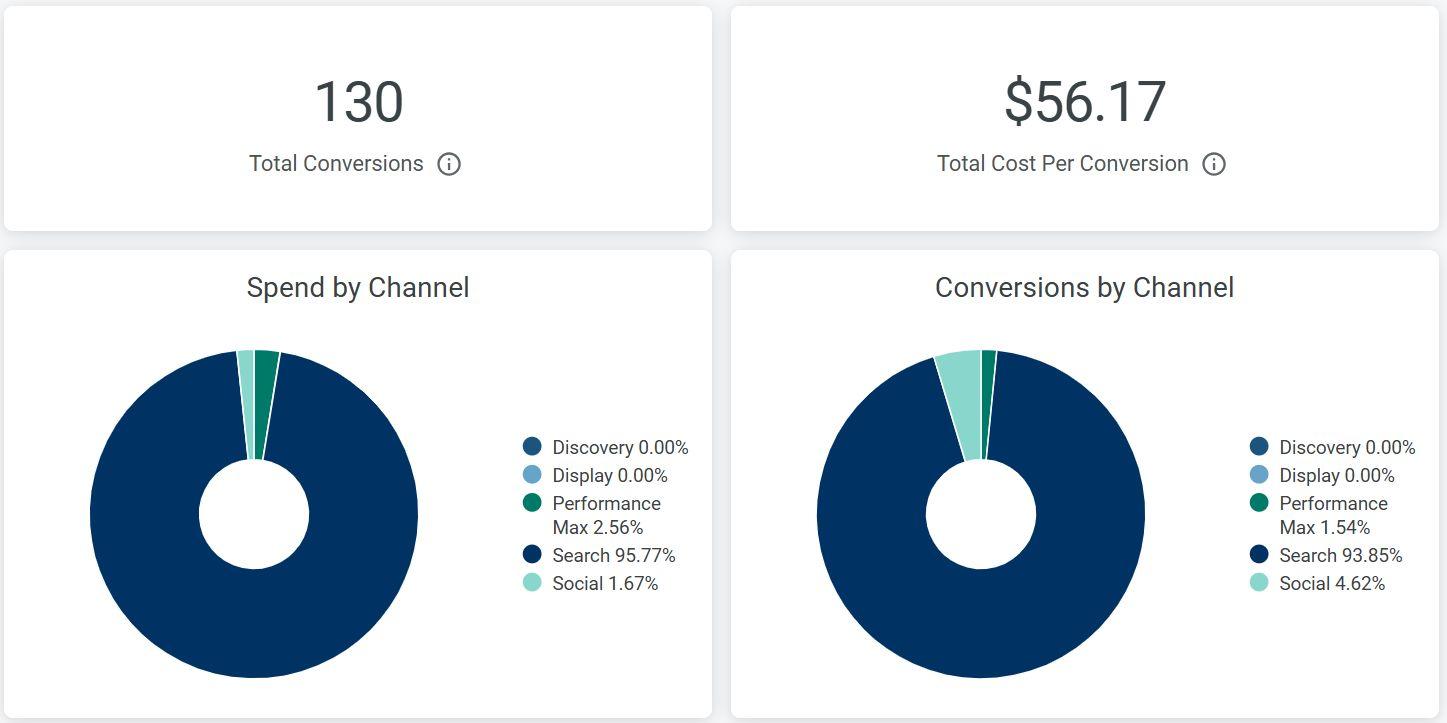

● The total cost per conversion of $56.17 was cheaper than the RAM benchmark of $60.00 per conversion.

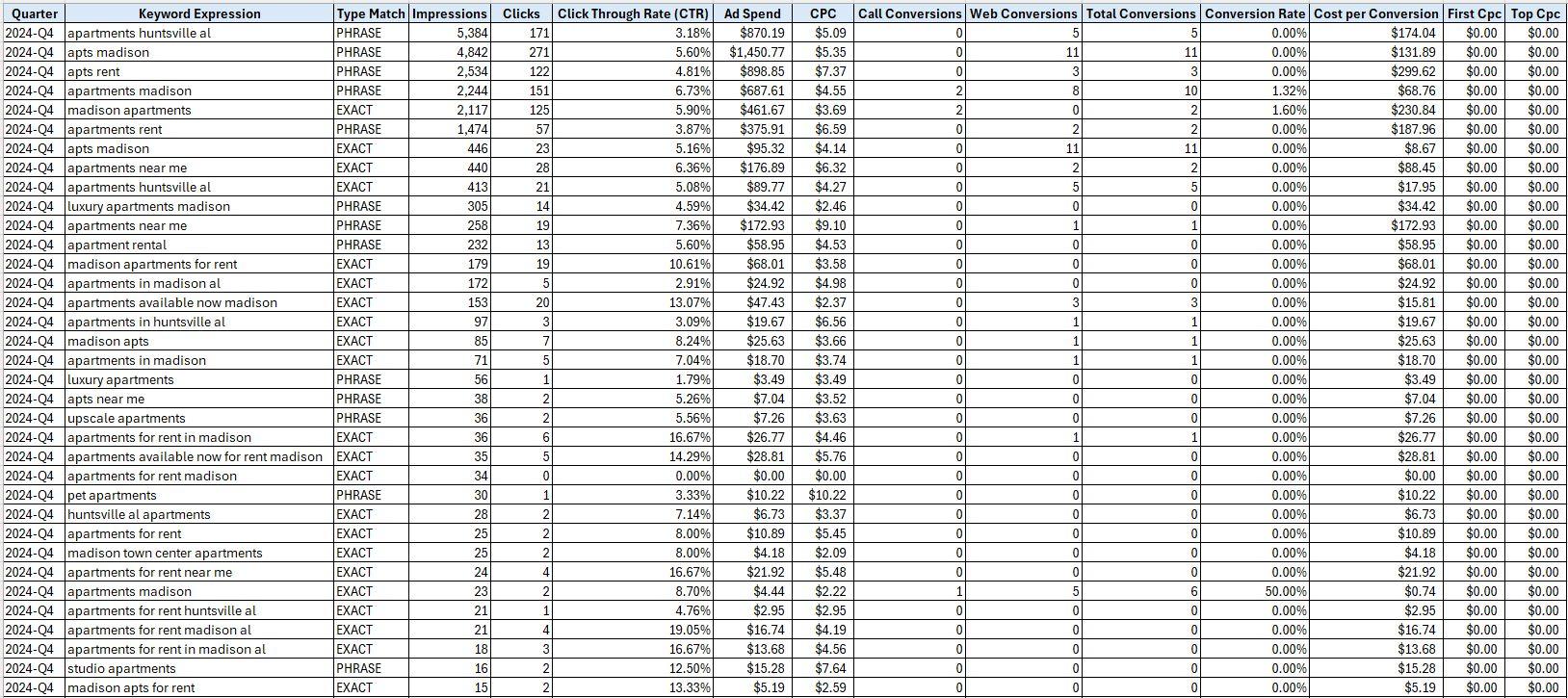

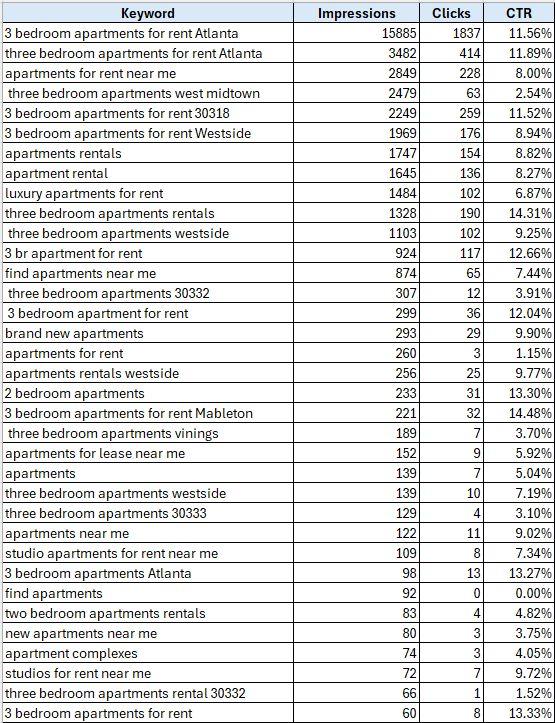

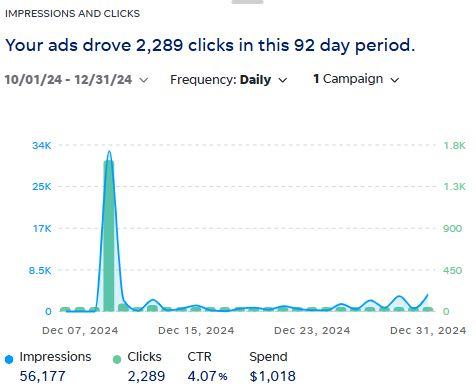

● The cost per click of $5.36 was around the RAM benchmark of $3-$5 per click.

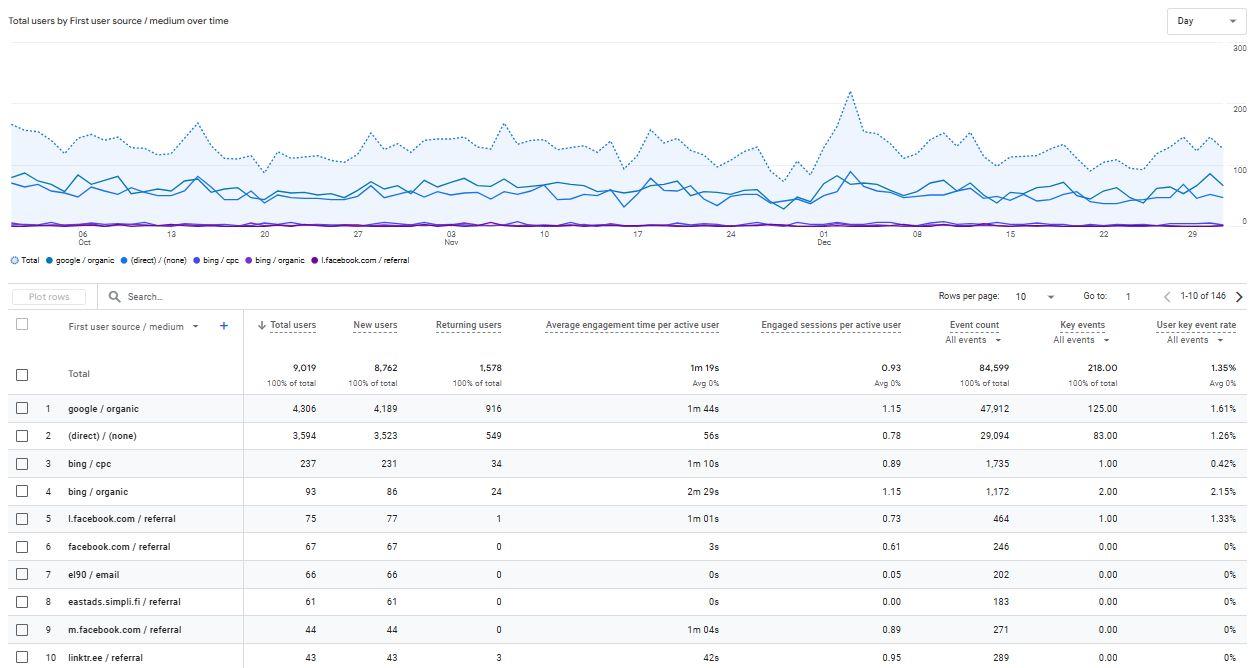

● Click through rate of 4.9% for Google Ads is below the RAM benchmark of 8%. RAM is reviewing low converting Keyword Groups for adjustments to improve CTR.

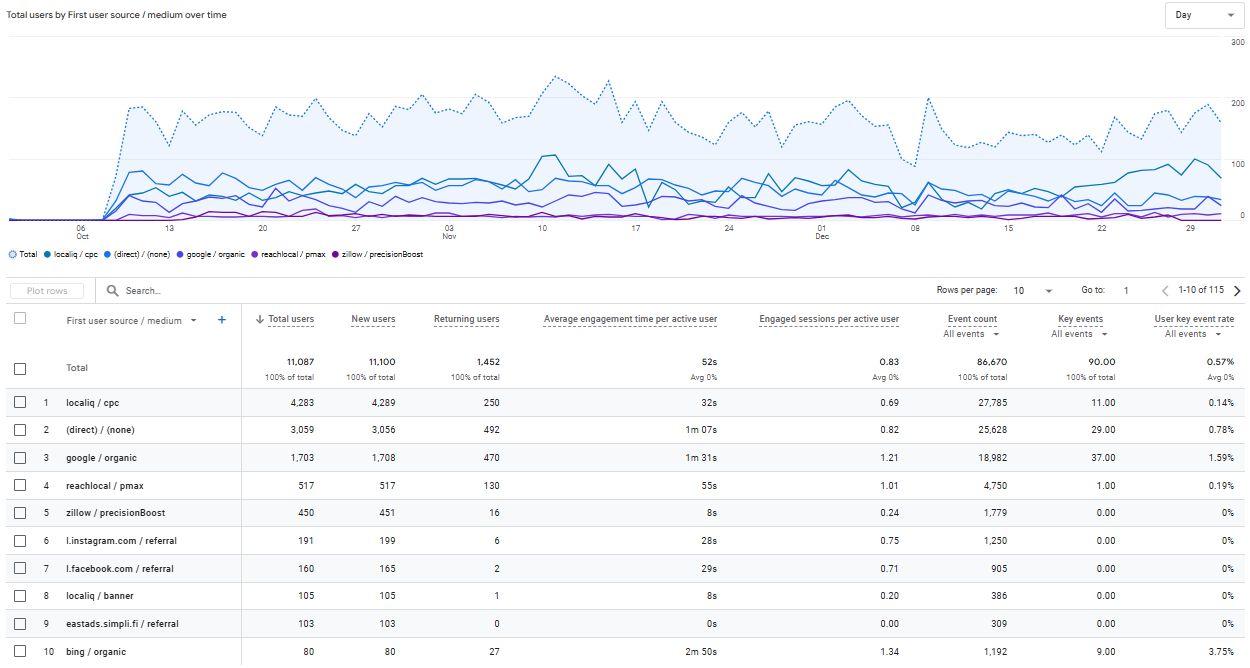

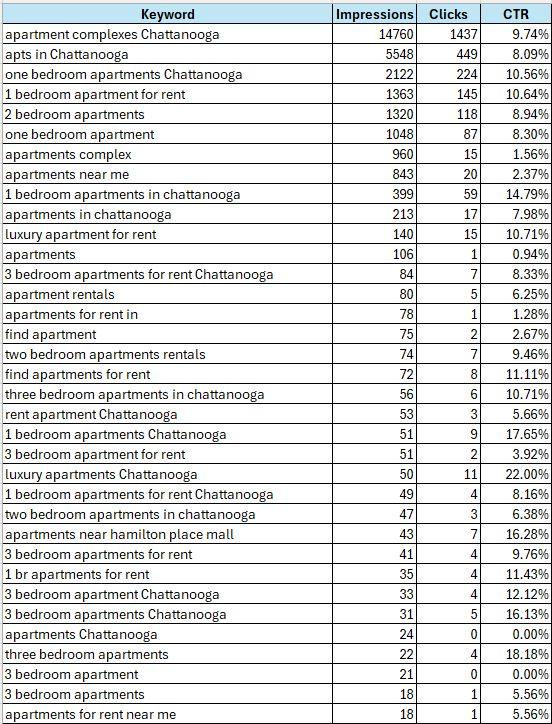

Top Keywords October 1, 2024 - December 31, 2024

Current Marketing Spend

● G5 PPC - $2,432.00/month

● Apartments.com (Diamond Package) - $2,167.00/month

● Zillow - $525.00/lease

● Apartment List - $419.00/lease

● PERQ - $449.00/month

● Opiniion - $110.00/month

Recommendations and Notes

● Increase Apartment List Lift package to $700/lease since the property received 12 visits and 3 leases from Apartment List. This cost is within the RAM benchmark. The Lift package will increase impressions by 1.2x-1.31x. The current rank among competitors is 43. The Lift package will increase the property’s position to 23.

● Depending on budget, increase the PPC campaign so the property can achieve 90% occupancy. G5 says the current spending is “okay.” G5’s recommendation for better is $3,780/month. The property had a healthy conversion cost of $56.17, which is cheaper than the RAM benchmark of $60/conversion.

● Property had excellent conversion rates for prospect to tour and visit to lease, which exceeded or met the RAM benchmark. To increase monthly leases, the property needs to receive more leads in the pipeline. An increase in the PPC and Apartment List should result in a higher number of monthly leases.

● Convert all assets from Knock to CRM IQ to save money. Knock currently costs $1.50/month/unit. CRM has no additional costs.

RAM Benchmarks

•Engagement Rate – 85%

•Prospect to Visit – 20-30%

•Visit to Lease – 25-35%

•Prospect To Lease – 7-10%

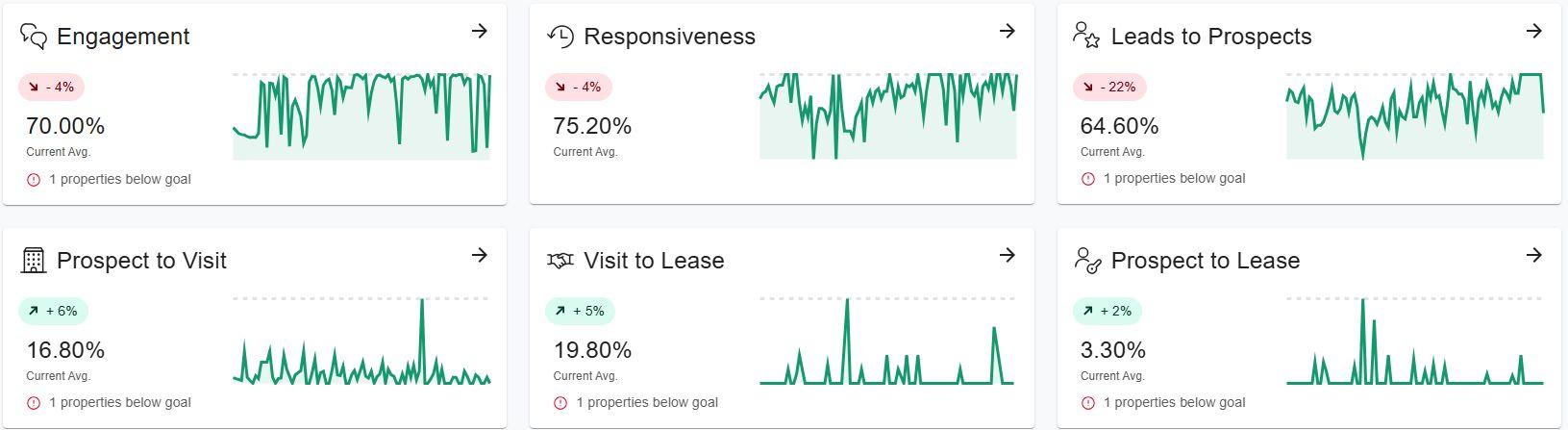

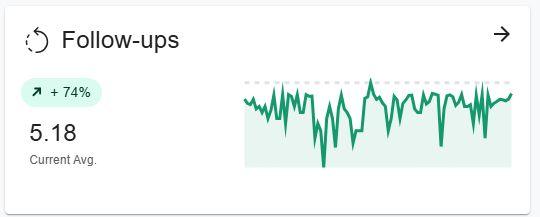

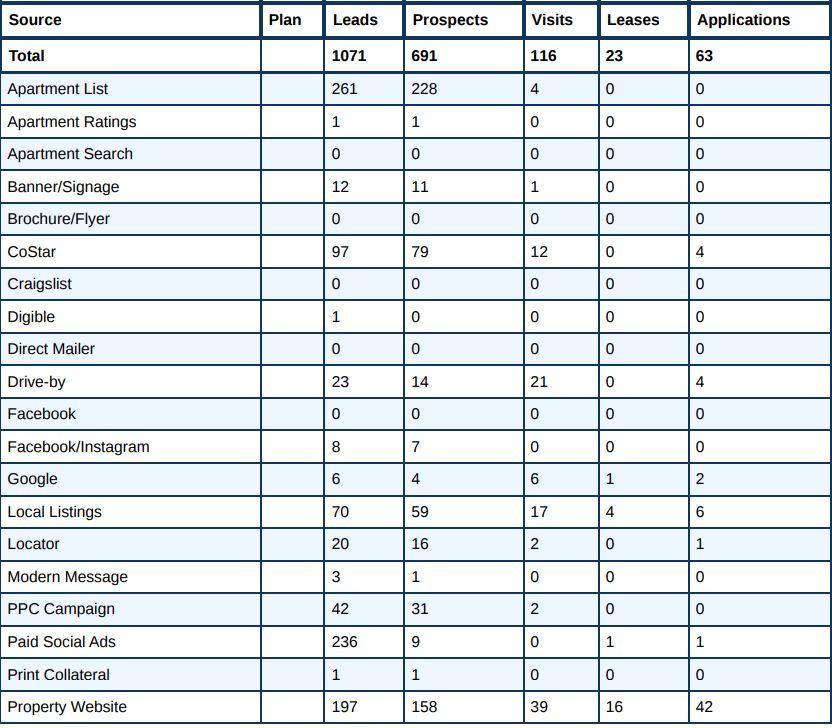

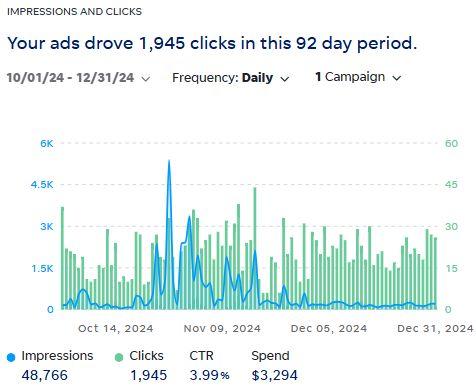

● Engagement rate was below the RAM benchmark of 85%.

● The conversion rates for prospect to visit, visit to lease, and prospect to lease were below the RAM benchmark.

● As of 1/16/2024, Populus Westside is 74.48% leased and 69.93% occupied.

● As of 1/16/2025, the property has 79 available units.

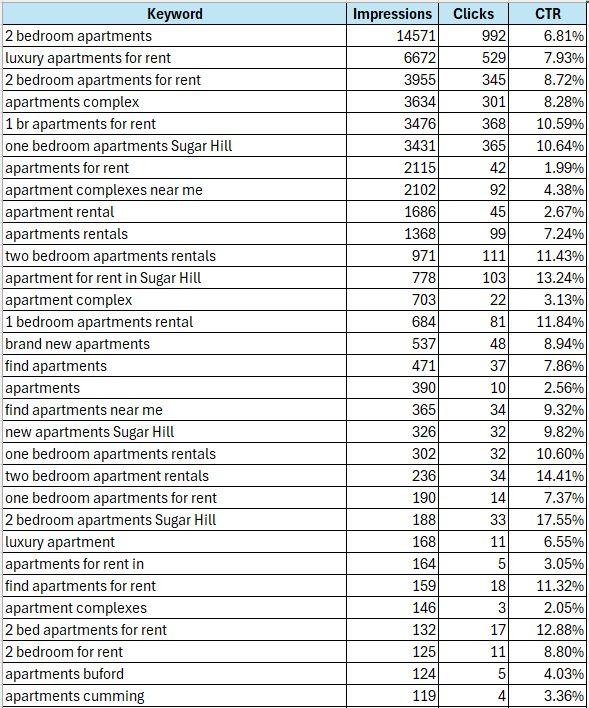

● The click through rate of 9.74% was extremely healthy and exceeded the RAM benchmark of 8%.

● The ad popped up the most for 3 bedroom apartments.

● Bid higher on keywords for 1 bedroom and 2 bedroom apartments. Most available units consist of 1 and 2 bedrooms.

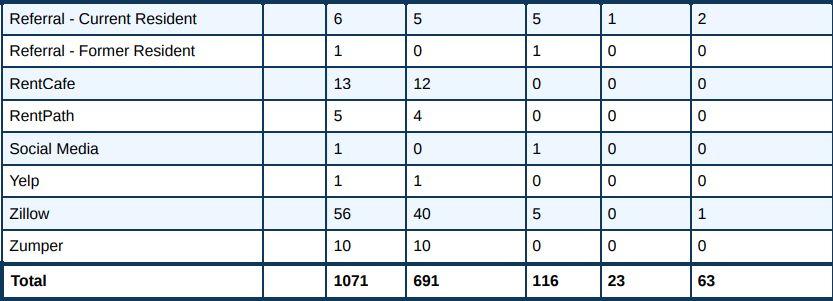

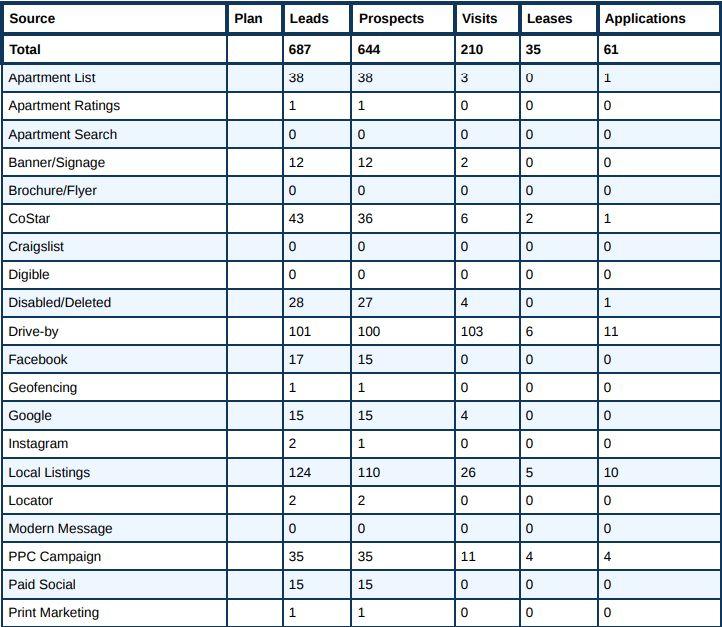

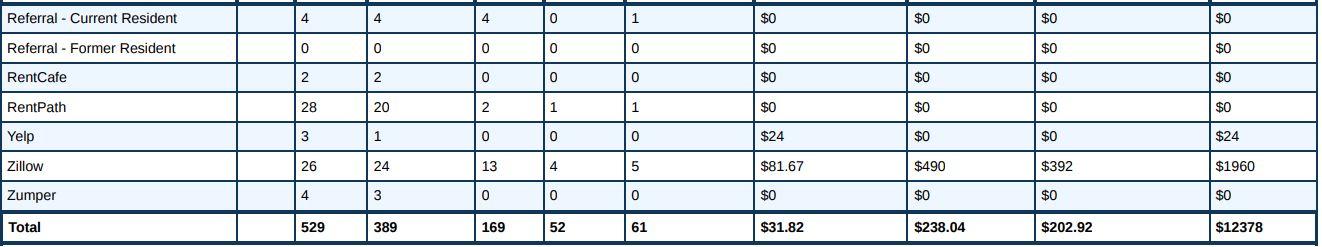

October 1, 2024 - December 31, 2024

Current Marketing Spend

● Local IQ

○ PPC - $8,100.00/month

○ Youtube - $750.00

○ Targeted Display - $500.00/month

○ Facebook - $500.00/month

○ Pmax - $750.00/month

● Zumper - $225.00/month

● Apartments.com (Diamond Package) - $2,167.00/month

● Zillow - $525.00/lease + Boost PT $1,000.00/month

● Apartment List - $1,202.00/lease

● Repli SEO - $350.00/month

● Knock Bot

● Community Rewards

● Opiniion - $110.00/month Updates

● Youtube will be canceled on Feb 1st.

● Facebook social will be canceled on Feb 1st.

● PPC reduced to $4,850 on Feb 1st.

● Pmax campaign increase to $1,000 on Feb 1st.

Notes

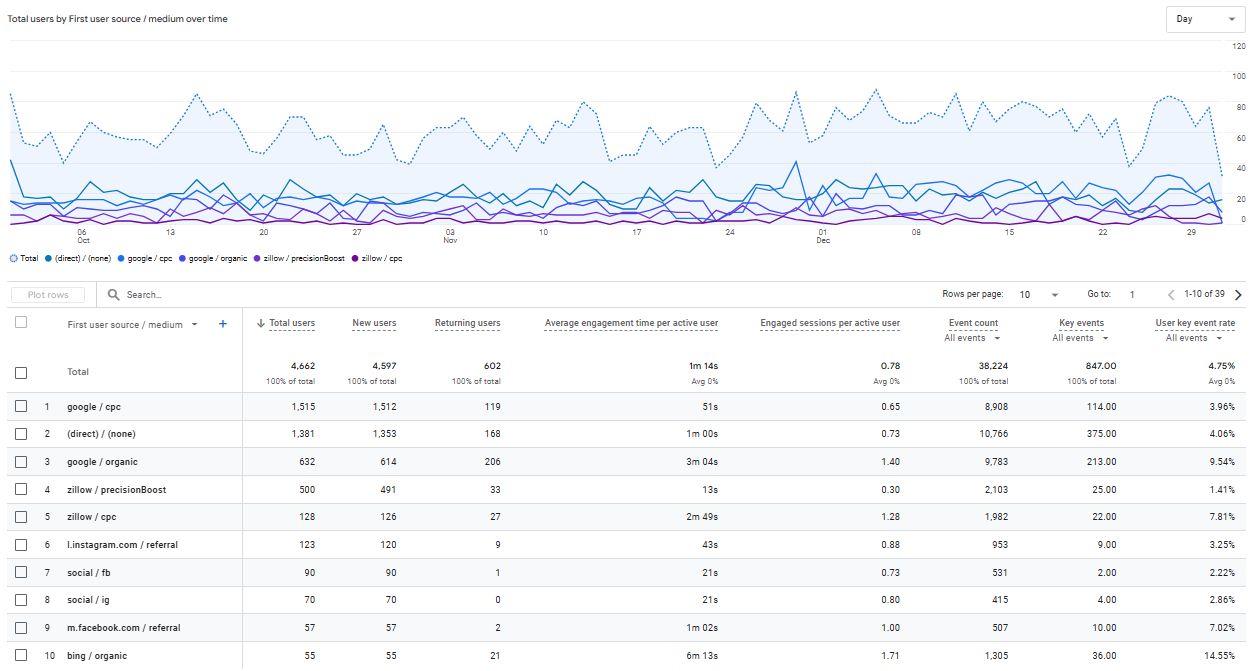

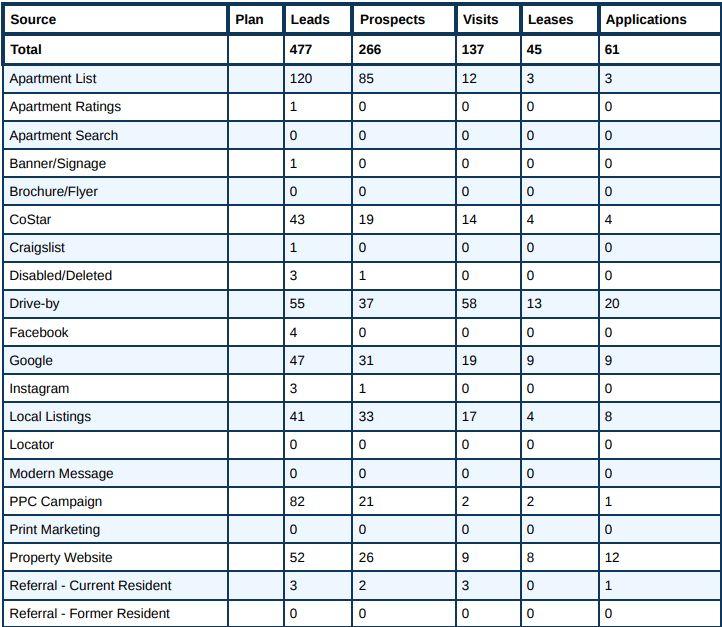

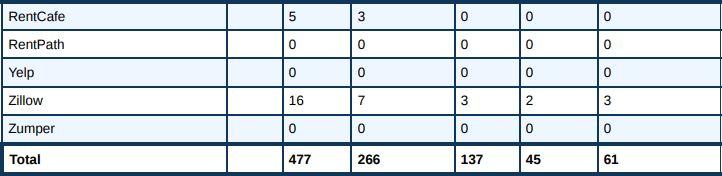

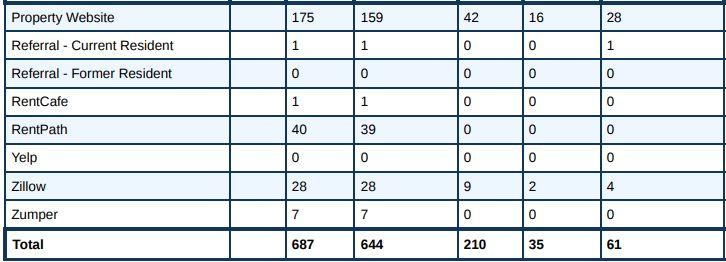

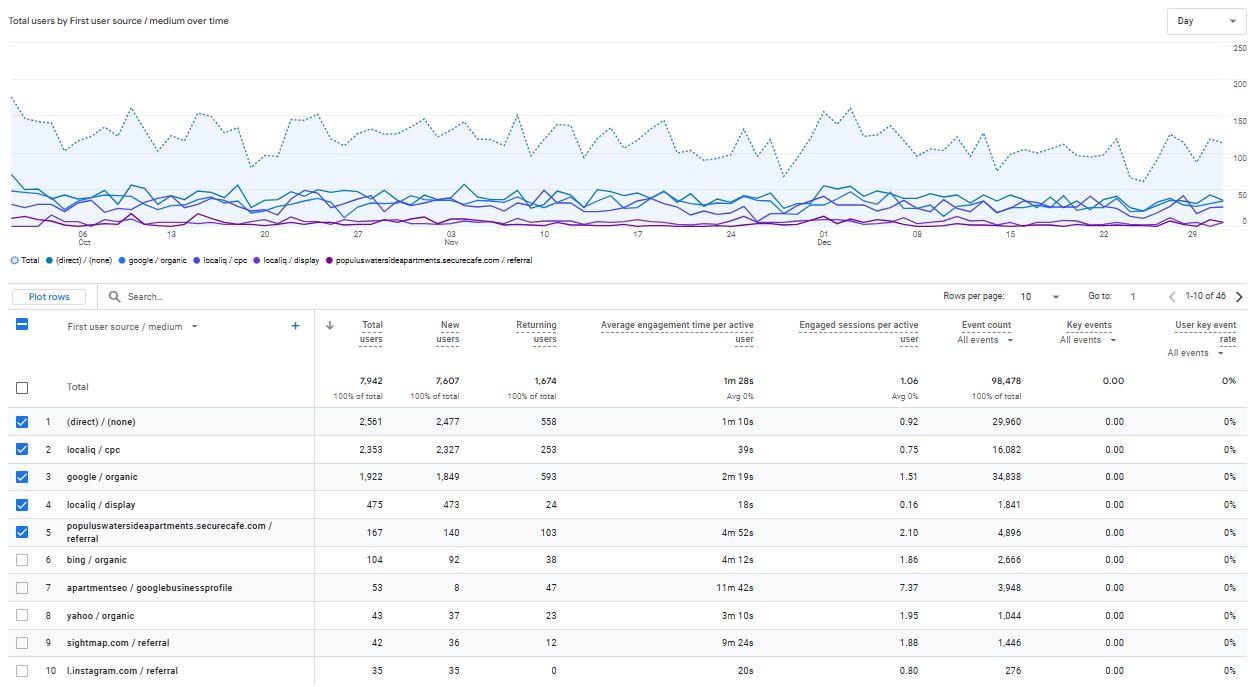

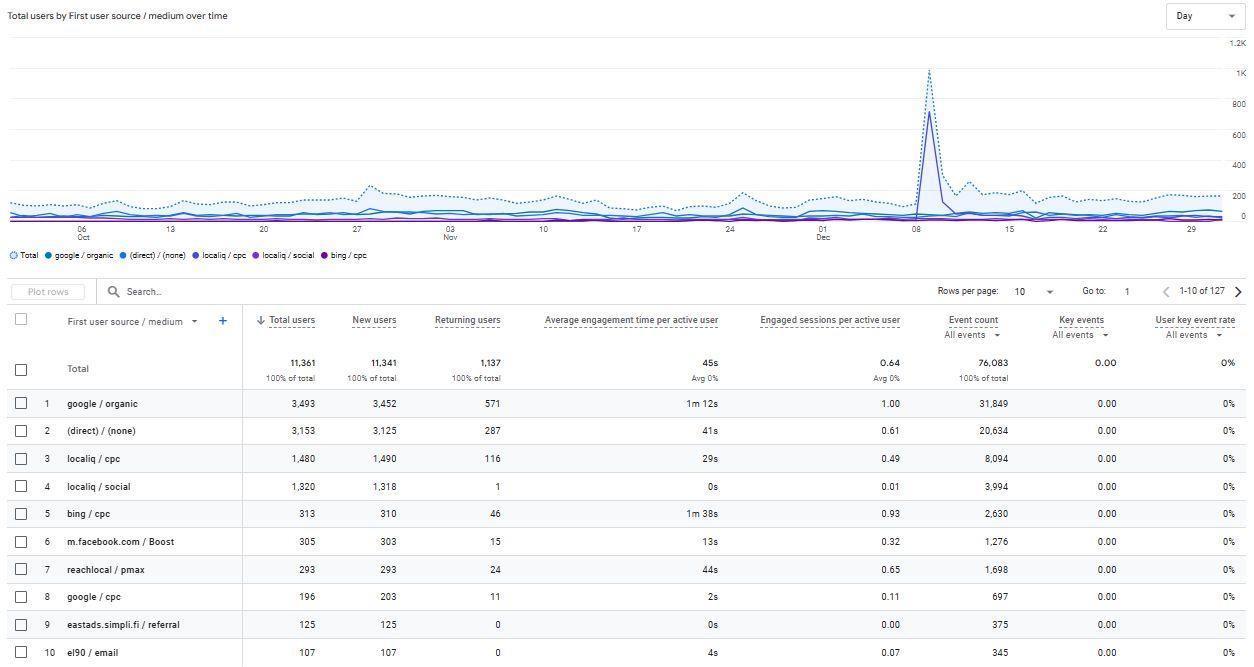

● Pmax, Local IQ PPC, Direct, Google Organic, and Zillow Boost were the top 5 sources for leading website traffic in Q4.

● According to Google Analytics, seo traffic appeared extremely healthy in Q4. Organic traffic users were spending over 1m 30s on the website, demonstrating a strong interest in the property.

● Convert all assets from Knock to CRM IQ to save money. Knock currently costs $1.50/month/unit. CRM has no additional costs.

RAM Benchmarks

•Engagement Rate – 85%

•Prospect to Visit – 20-30%

•Visit to Lease – 25-35%

•Prospect To Lease – 7-10%

● Prospect to visit conversion rate was within the RAM benchmark.

● Engagement rate, visit to lease rate, and prospect to lease rate were below the RAM benchmark.

● As of 1/16/2025, Springside Apartments is 66.37% leased and 60.62% occupied.

● As of 1/16/2025, the property has 80 available units.

● The click through rate of 8.26% exceeded the RAM benchmark of 8%.

● The cost per click of $3.13 was between the RAM benchmark of $3-$5 per click.

● Springside Apartments had 27 leads from search ads.

Current Marketing Spend and Recommendations

Current Marketing Spend

● Local IQ

○ PPC - $4,100.00/month

○ Targeted Display - $500.00/month

○ Facebook - $500.00/month

● Zumper - $225.00/month

● Apartments.com (Campus Network Diamond) - $2,567.00/month

● Zillow - $525.00/lease + Boost $500.00/month

● Apartment List - $419.00/lease

● Rent Marketplace (Platinum Package) - $923.00/month

● Repli SEO - $350.00/month

● PERQ - $350.00/month

● Opiniion - $110.00/month

Recommendations

October 1, 2024 - December 31, 2024

● Reallocate spending from Targeted Display Ads and Facebook Ads toward Pmax campaign. Pmax campaigns for other properties have been performing well. According to Knock, paid social ads (Facebook) only had 15 prospects and 0 property visits. Paid media ads are best for brand awareness, while Performance Max campaigns focus on conversions.

● Convert all assets from Knock to CRM IQ to save money. Knock currently costs $1.50/month/unit. CRM has no additional costs.

RAM Benchmarks

•Engagement Rate – 85%

•Prospect to Visit – 30%

•Visit to Lease – 25-35%

•Prospect To Lease – 7-10%

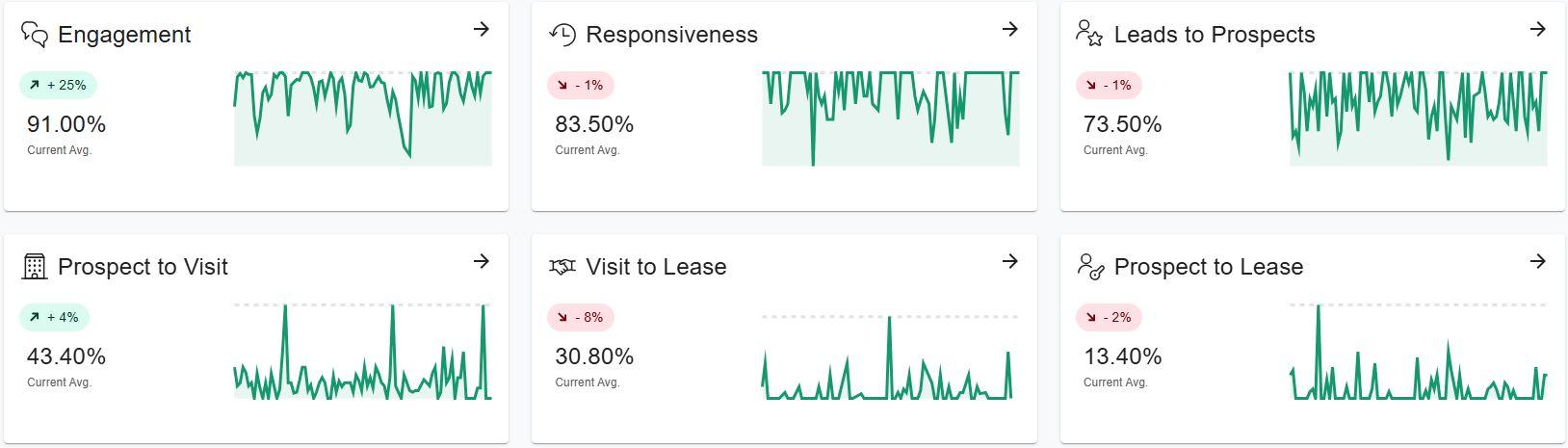

● Populus Waterside had extremely healthy conversion rates for engagement, prospect to visit, visit to lease, and prospect to lease. All these rates exceeded or met the RAM benchmarks.

● As of 1/16/2025, Populus Waterside is 60.47% leased and 59.30% occupied.

● As of 1/16/2025, the property has 140 available units.

● The click through rate of 8.95% exceeded the RAM benchmark of 8%.

● The cost per click of $2.48 was extremely healthy and cheaper than the RAM benchmark of $3-$5 per click.

● Populus Waterside received 46 leads in Q4.

Current Marketing Spend and Recommendations

Current Marketing Spend

● Local IQ

○ PPC - $2,700.00/month

○ Targeted Display - $500.00/month

● Zumper - $225.00/month

● Apartments.com (Diamond Plus) - $3,965.00/month

● Zillow - $525.00/lease

● Apartment List - $419.00/lease

● Rent Marketplace (Gold Package) - $714.00/month

● Apartment SEO - $575.00/month

● Knockbot

● Opiniion - $110.00/month

Recommendations and Notes

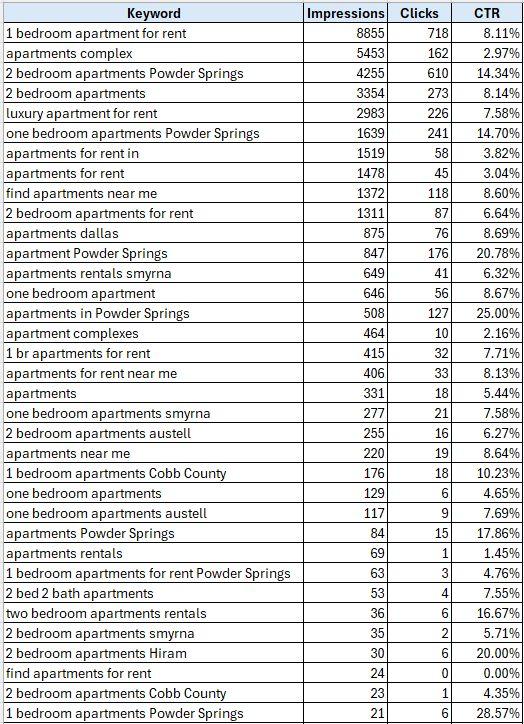

October 1, 2024 - December 31, 2024

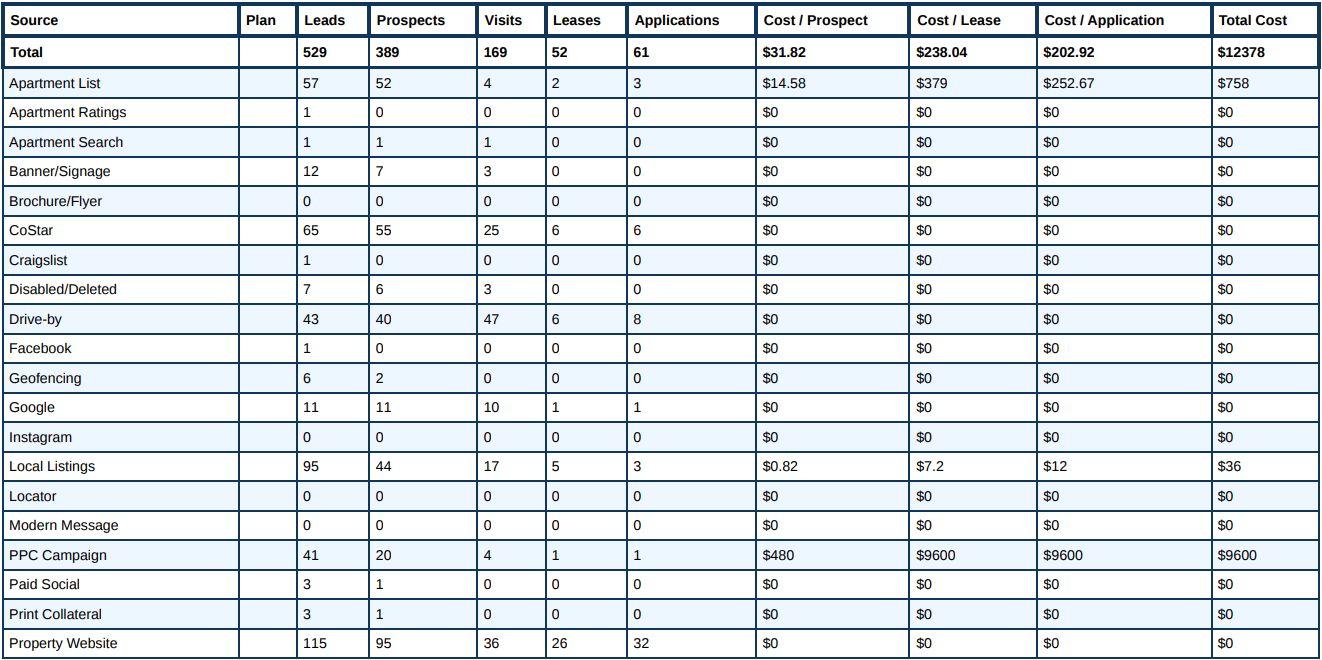

● Cancel Rent Marketplace since it is underperforming. In Q4, the property only had 20 prospects, 2 visits, and 1 lease.

● Remain on Apartments.com until the end of Q1 since it produced 6 leases and gives the property additional exposure. Downgrade to Diamond in Q2 if the lease cost does not decrease by the end of February/early March since the cost per lease was $2,973/lease in Q4.

● Implement Zillow Boost for $500 for 3 months to increase traffic in the spring. The property had 13 visits, 5 applications, and 4 leases. The property was paying per lease in Q4.

● Implement Apartment List Lift campaign for $650/lease. This will increase impressions by 1.14x-1.23x. The rank will increase from 18 to 10. Apartment List had 4 visits, 3 applications, and 2 leases in Q4.

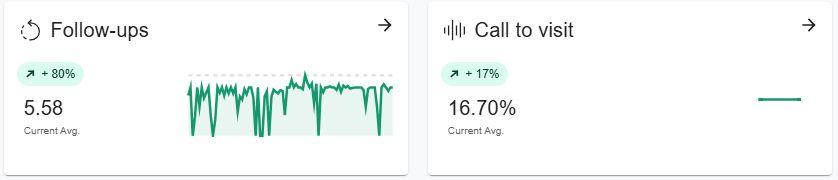

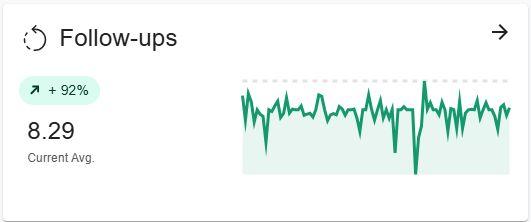

● Property team is doing a great job of following up with prospects. The average number of follow-ups per prospect is 8.29. The team is also doing a great job getting prospects to visit the property and closing.

● Convert all assets from Knock to CRM IQ to save money. Knock currently costs $1.50/month/unit. CRM has no additional costs.

RAM Benchmarks

•Engagement Rate – 85%

•Prospect to Visit – 30%

•Visit to Lease – 25-35%

•Prospect To Lease – 7-10%

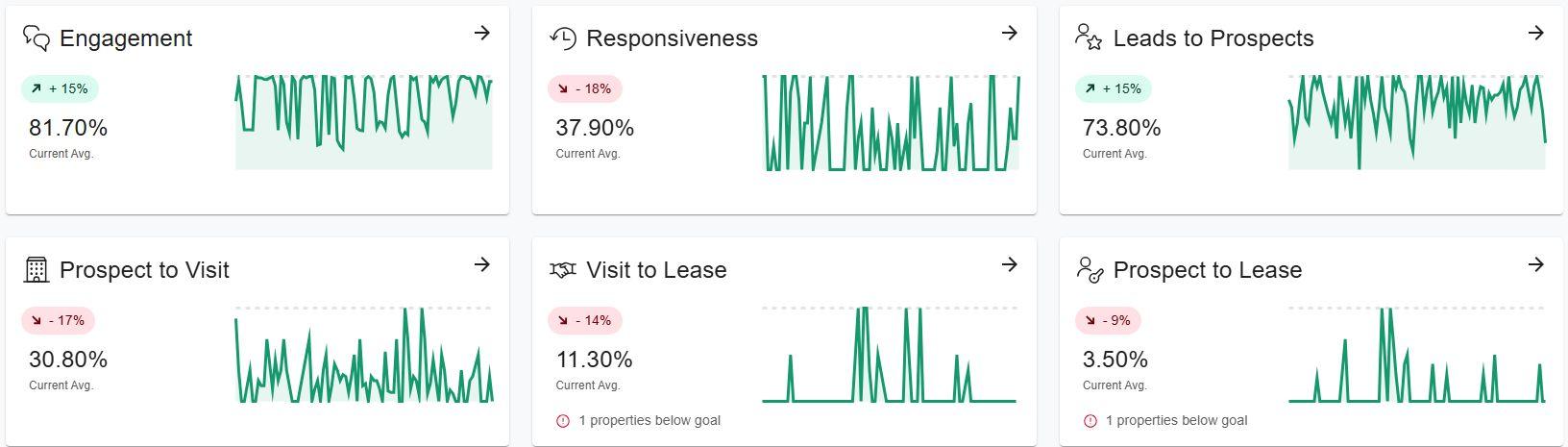

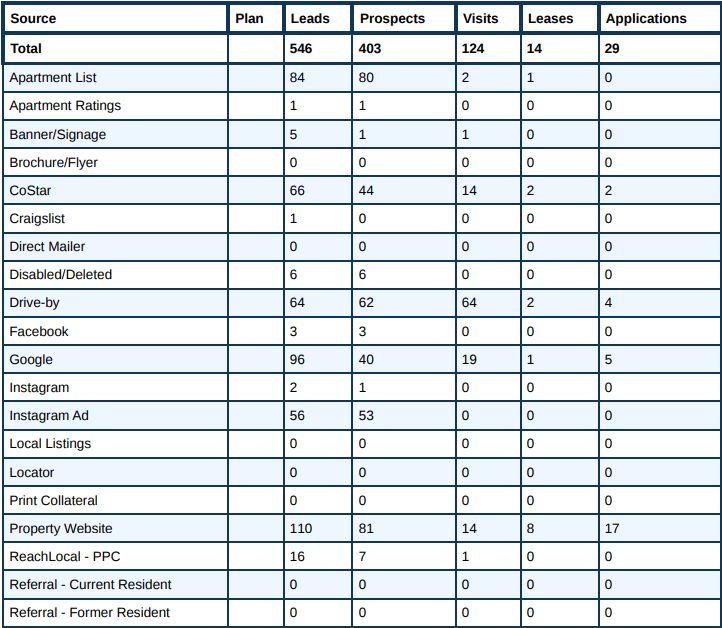

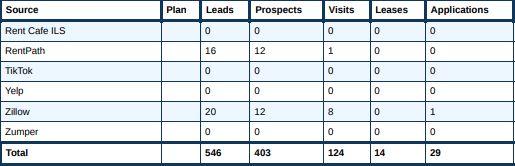

● The prospect to visit conversion rate was within the RAM benchmark of 25-35%.

● Engagement rate, visit to lease conversion rate, and prospect to lease conversion rate were below the RAM benchmarks.

● As of 1/16/2025, Conclave Sugar Hill is 24.18% leased and 21.24% occupied.

● As of 1/16/2025, the property has 232 available units.

● The click through rate of 7.61% was around the RAM benchmark of 8%.

● The cost per click of $4.12 was within the RAM benchmark of $3-$5 per click.

● Conclave at Sugar Hill received 15 leads in Q4.

Current Marketing Spend

● Local IQ

○ PPC - $6,150.00/month

○ TikTok - $1,200.00/month

■ canceled in January

○ Targeted Display - $500.00

○ Facebook - $500.00/month

○ Pmax - $1,800/month

● Zumper - $225.00/month

● Apartments.com (Diamond Plus) - $5,350.00/month

● Zillow -$525.00/month

● Apartment List - $770.00/month

● Rent Marketplace (Silver Package) - $439.00/month

● Repli SEO - $350.00/month

● PERQ - $449.00/month

● Opiniion - $110.00/month

Recommendations and Notes

● Consider decreasing Apartments.com ad package to Diamond due to low volume of activity for a premium price.

● Remain on Facebook ads for additional exposure despite the prospects not converting into visits or leases. Facebook is primarily used for brand awareness.

● The team should focus on closing techniques to improve the closing rate.

● The team should send E-blast monthly and emphasize the specials.

● Convert all assets from Knock to CRM IQ to save money. Knock currently costs $1.50/month/unit. CRM has no additional costs.

October 1, 2024 - December 31, 2024

RAM Benchmarks

•Engagement Rate – 85%

•Prospect to Visit – 20-30%

•Visit to Lease – 25-35%

•Prospect To Lease – 7-10%

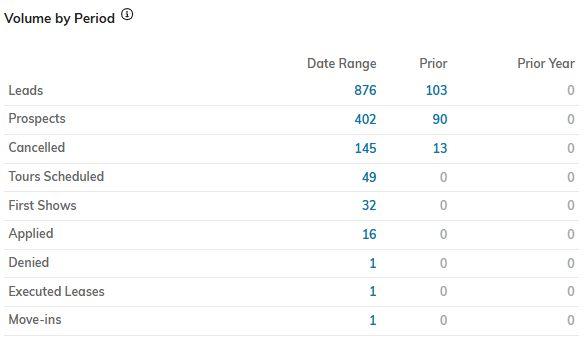

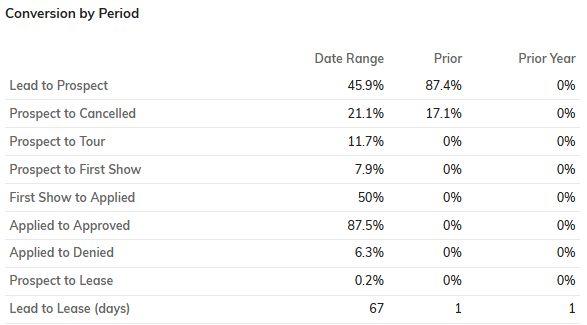

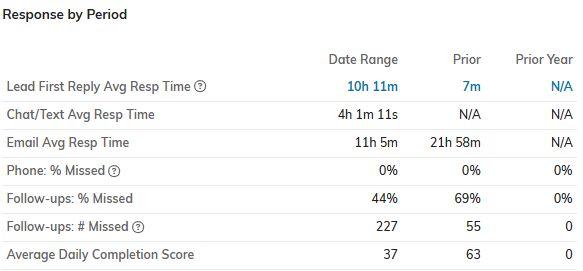

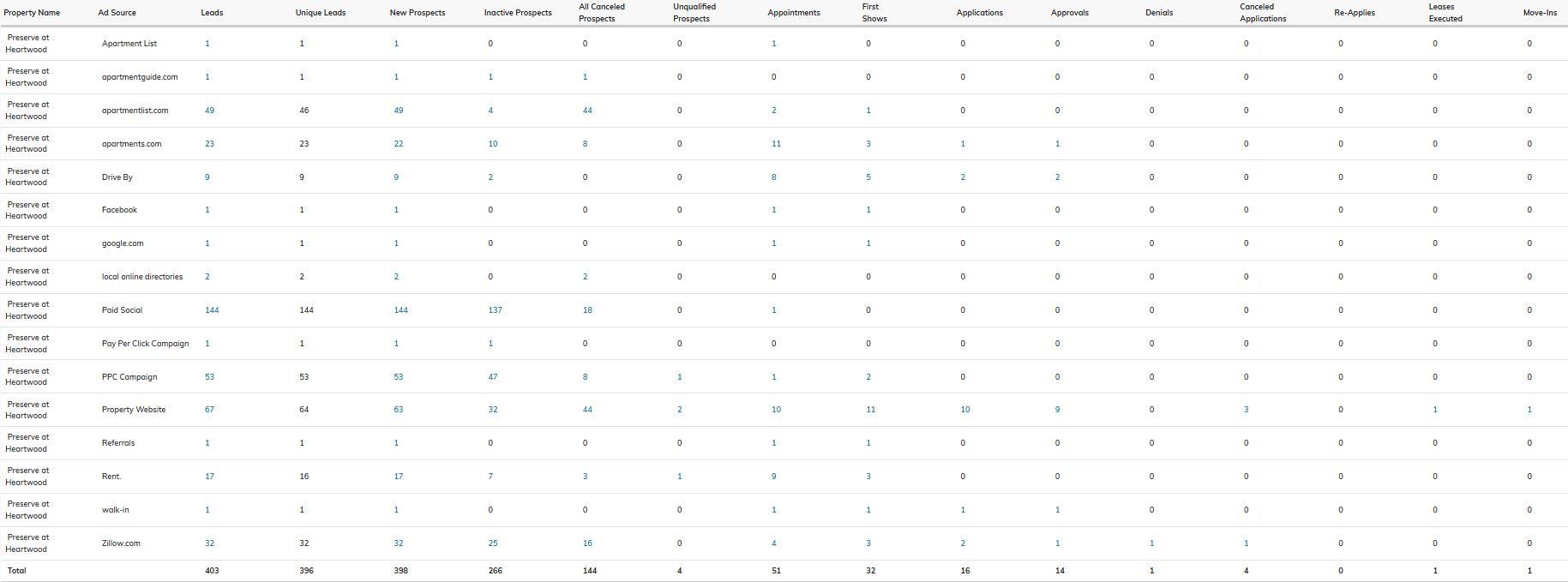

● Prospect to visit conversion rate of 7.9% was below the RAM benchmark of 20-30%.

● Visit to Lease (Approved Applications) conversion rate of 87.50% was extremely healthy and exceeded the RAM benchmark of 25-35%.

● Prospect to Lease (Approved Application) conversation rate of 3.48% was below the RAM benchmark of 7-10%.

October 1, 2024 - December 31, 2024

● As of 1/16/2025, Preserve at Heartwood is 4.64% leased and 2.32% occupied.

● As of 1/16/2025, the property has 285 available units.