AILWAY G E SERVING THE RAILWAY INDUSTRY SINCE 1856 WWW.RAILWAYAGE.COM JANUARY 2023 2023 PASSENGER RAIL OUTLOOK Amtrak at the Crossroads TIMEOUT FOR TECH Correlation vs. Causation RAILROADER OF THE YEAR BNSF’s Katie Farmer ‘Railroading is a Momentum Business’ 2023

CONGRATULATIONS Mrs. Katie Farmer 2023 RAILROADER OF THE YEAR Rail Grinding | Ballast Maintenance | Friction Management | Material Handling | Track Inspection Services www.Loram.com

Railway Age, USPS 449-130, is published monthly by the Simmons-Boardman Publishing Corporation, 1809 Capitol Avenue, Omaha, NE 68102. Tel. (212) 620-7200. Vol. 224, No. 1. Subscriptions: Railway Age is sent without obligation to professionals working in the railroad industry in the United States, Canada, and Mexico. However, the publisher reserves the right to limit the number of copies. Subscriptions should be requested on company letterhead. Subscription pricing to others for Print and/or Digital versions: $100.00 per year/$151.00 for two years in the U.S., Canada, and Mexico; $139.00 per year/$197.00 for two years, foreign. Single Copies: $36.00 per copy in the U.S., Canada, and Mexico/$128.00 foreign All subscriptions payable in advance. COPYRIGHT© 2022 Simmons-Boardman Publishing Corporation. All rights reserved. Contents may not be reproduced without permission. For reprint information contact PARS International Corp., 102 W. 38th Street, 6th floor, New York, N.Y. 10018, Tel.: 212-221-9595; Fax: 212-221-9195. Periodicals postage paid at New York, N.Y., and additional mailing offices. Canada Post Cust.#7204564; Agreement #41094515. Bleuchip International, PO Box 25542, London, ON N6C 6B2. Address all subscriptions, change of address forms and correspondence concerning

Dept., Railway Age, PO Box 239 Lincolnshire IL 60069-0239 USA; railwayage@omeda.com; or call +1 (402) 346-4740;

+1 (847) 291-4816.

to

January 2023 // Railway Age 1 railwayage.com

subscriptions

FAX

Printed at Cummings Printing, Hooksett, N.H. ISSN 0033-8826 (print); 2161-511X (digital). FEATURES 8 28 32 36 39 Railroader of the Year Katie Farmer, BNSF 2023 Passenger Rail Outlook Amtrak at the Crossroads Notch 8 to the Golden Run Right Decisions, Right Time Timeout for Tech Thirteenth in a Series MxV Rail R&D Truck Hunting Track Effects COMMENTARY 2 44 From the Editor Financial Edge DEPARTMENTS 4 6 7 41 42 42 43 Industry Indicators Industry Outlook Market People Professional Directory Classifieds Advertising Index COVER PHOTO 2023 Railroader of the Year Katie Farmer. BNSF photo JANUARY 2023 28 AILWAY GE Amtrak

Subscription

New Year’s Evolution

ew Year’s resolutions are, mostly, as my late Uncle Alberto used to say, “a bunch of malarkey.” What’s the point in pledging once a year to change something that perhaps you should have changed a long time ago, or in starting to behave differently than what people are accustomed to, on Jan. 1, year after year? The only constant in life is change, right? And if you really think about it, life is more about adapting than about changing.

So is railroading, which Katie Farmer, our 2023 Railroader of the Year, calls “a momentum business.” Keeping the momentum going involves adaptation. Perhaps a better word is “evolution,” something the rail industry, both management and labor, needs to wholly embrace.

Railroading as a momentum business “applies more broadly to the whole supply chain,” Katie told me in our interview for this month’s cover story (p. 8). “When one part of the supply chain struggles, we all struggle. When volume fluctuates, we adapt to that variability, and that’s not new for us. The difference is the pandemic impacted the entire global supply chain, which, as you know, is a complex system of connections among ports, railroads, trucks and our customers.”

Moving through the pandemic, BNSF “saw consumers shift from services to goods, more freight went into the supply chain,” Katie noted. “Unfortunately, labor left the workforce, and it did create a series of disruptions. It created a series of shortages— chassis drivers, labor to support distribution center unloading. All of this slowed overall velocity. That caused shipments to back up in rail facilities and at the ports. ... We have strong momentum in restoring the service

Ncustomers have come to expect and that we frankly expect from ourselves There are, however, some good things that have come out of the supply chain challenges. There is increased collaboration, information sharing and accountability across the supply chain. But there is more to be done. The supply chain continues to evolve. We have to evolve as an industry in order to remain competitive. It’s imperative that we find ways to continue to collaborate and work more closely, not only across the supply chain, but also with our customers.”

In my humble opinion, the evolution Katie refers to involves “creative destruction,” defined as “the dismantling of established practices to make way for innovation and improved production. It is most often used to describe disruptive technologies.”

Austrian economist Joseph Schumpeter coined the term in 1942. He characterized creative destruction as “the process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.”

In the 19th century, the railroads were the biggest form of creative destruction. In the 21st century, creative destruction is driven largely by disruptive technologies like artificial intelligence and machine learning, made possible by microprocessors infinitely more powerful than the room-sized mainframes that got us to the moon in 1969.

Another thing about evolution: It’s difficult, even painful—but well worth the effort. Realistically, we have very little choice. So let’s all make adaptation our New Year’s evolution—but not just one day a year.

WILLIAM C. VANTUONO Editor-in-Chief

Railway Age, descended from the American Rail-Road Journal (1832) and the Western Railroad Gazette (1856) and published under its present name since 1876, is indexed by the Business Periodicals Index and the Engineering Index Service. Name registered in U.S. Patent Office and Trade Mark Office in Canada. Now indexed in ABI/Inform.

Change of address should reach us six weeks in advance of next issue date. Send both old and new addresses with address label to Subscription Department, Railway Age, PO Box 239, Lincolnshire IL 60069-0239 USA, or call (US, Canada and International) +1 (402) 346-4740, Fax +1 (847) 291-4816, e-mail railwayage@omeda.com. Post Office will not forward copies unless you provide extra postage.

POSTMASTER: Send changes of address to: Railway Age, PO Box 239, Lincolnshire, IL 60069-0239, USA.

Photocopy rights: Where necessary, permission is granted by the copyright owner for the libraries and others registered with the Copyright Clearance Center (CCC) to photocopy articles herein for the flat fee of $2.00 per copy of each article. Payment should be sent directly to CCC. Copying for other than personal or internal reference use without the express permission of Simmons-Boardman Publishing Corp. is prohibited. Address requests for permission on bulk orders to the Circulation Director. Railway Age welcomes the submission of unsolicited manuscripts and photographs. However, the publishers will not be responsible for safekeeping or return of such material.

Member of:

SUBSCRIPTIONS: 1 (402) 346-4740

EDITORIAL AND EXECUTIVE OFFICES

Simmons-Boardman Publishing Corp. 1809 Capitol Avenue Omaha, NE 68102 (212) 620-7200 www.railwayage.com

ARTHUR J. McGINNIS, Jr. President and Chairman

JONATHAN CHALON Publisher jchalon@sbpub.com

WILLIAM C. VANTUONO

Editor-in-Chief wvantuono@sbpub.com

MARYBETH LUCZAK Executive Editor mluczak@sbpub.com

CAROLINA WORRELL Senior Editor cworrell@sbpub.com

DAVID C. LESTER

Engineering Editor/Railway Track & Structures Editor-in-Chief dlester@sbpub.com

HEATHER ERVIN

Ports and Intermodal Editor/Marine Log Editor-in-Chief hervin@sbpub.com

Contributing Editors

David Peter Alan, Jim Blaze, Nick Blenkey, Sonia Bot, Peter Diekmeyer, Alfred E. Fazio, Don Itzkoff, Bruce Kelly, Ron Lindsey, David Nahass, Jason H. Seidl, David Thomas, John Thompson, Frank N. Wilner, Tony Zenga

INTERNATIONAL OFFICES 46 Killigrew Street, Falmouth, Cornwall TR11 3PP, United Kingdom 011-44-1326-313945

International Editors

Kevin Smith ks@railjournal.co.uk

David Burroughs dburroughs@railjournal.co.uk

David Briginshaw db@railjournal.co.uk Robert Preston rp@railjournal.co.uk Simon Artymiuk sa@railjournal.com

CUSTOMER SERVICE: RAILWAYAGE@OMEDA.COM , OR CALL 1 (402) 346-4740

Reprints: PARS International Corp. 253 West 35th Street 7th Floor New York, NY 10001 212-221-9595; fax 212-221-9195 curt.ciesinski@parsintl.com

2 Railway Age // January 2023 railwayage.com FROM THE EDITOR

GE

AILWAY

Art Director: Nicole D’antona Graphic Designer: Hillary Coleman Corporate Production Director: Mary Conyers Production Director: Eduardo Castaner Marketing Director: Erica Hayes Conference Director: Michelle Zolkos Circulation Director: Joann Binz

THE OKONITE COMPANY Okonite Cables...A higher Standard! 102 Hilltop Road, Ramsey, New Jersey 07446 201.825.0300 www.okonite.com OurPremierVitalCircuitSignalCablesare EscortedbySuperiorCustomerService OKONITE Ourformulatokeepyourbusinessontrackisourfleetof6 manufacturingplants,5servicecentersand23localsalesoffices. Ourmultipleplantcapabilityprovidesmanufacturingflexibilityaswe supportyourneedswithourdirectsalesforceandapplication engineeringstaff.Okonitehasbeensettingthestandardsince 1878...andalways100%builtintheU.S.A. We’re Here ForYou!

‘GIVE ME A ONE-HANDED ECONOMIST’ –

HARRY TRUMAN

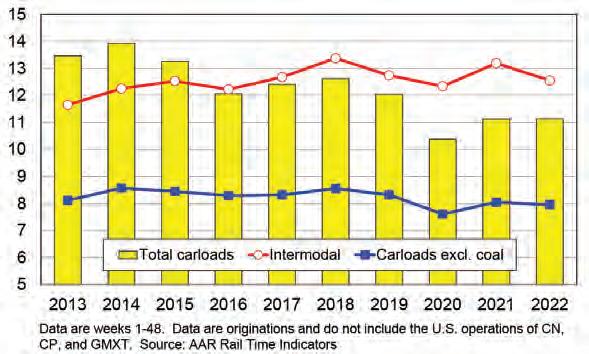

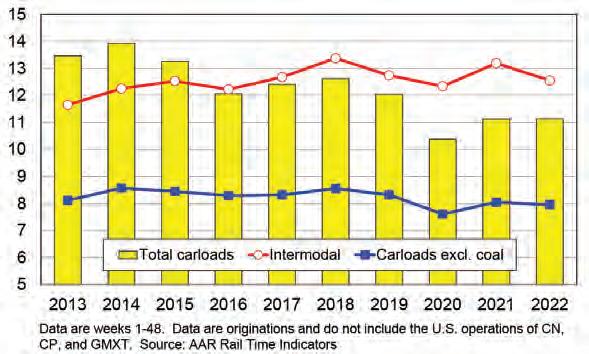

“Harry Truman famously said, ‘Give me a one-handed economist. All my economists say, ‘On the one hand ...’, then ‘but on the other...’ Economic indicators released over the past 30 days suggest that ‘on the one hand, on the other hand’ is often the best an economist can do,” the Association of American Railroads commented last month. “Total U.S. rail carloads in November were down 0.9% from last year, but the weekly average for the month (232,547) was slightly higher than the weekly average so far in 2022 (231,961). In November, eight of the 20 carload categories we track had gains. Crushed stone and sand led the way (up 9.2%), followed by motor vehicles and parts (up 8.3%), carloads not elsewhere classified (up 10.0%), and metallic ores (up 8.0%). Carloads of coal, the single highest volume carload commodity, were up 0.5%. U.S. intermodal originations, which are not included in carloads, fell 5.4% in November— their ninth straight decline and 15th in the past 16 months. Year-to-date intermodal was down 4.8%.”

Grain 123,351127,108 -3.0% Farm Products excl. Grain 3,689 3,988-7.5% Grain Mill Products 47,29047,682-0.8% Food Products 32,87031,6273.9%

Chemicals 152,519170,127-10.3%

Petroleum & Petroleum Products50,01450,237-0.4%

Coal 333,128331,4120.5%

Primary Forest Products 5,2205,0443.5%

Lumber & Wood Products 14,19215,859-10.5%

Pulp & Paper Products 25,76927,762-7.2%

Metallic Ores 28,12226,0438.0%

Coke 17,247 16,835 2.4%

Primary Metal Products 38,89740,489-3.9%

Iron & Steel Scrap 18,85820,226-6.8%

Motor Vehicles & Parts 70,21364,8418.3%

Crushed Stone, Sand & Gravel 103,16194,4359.2%

Nonmetallic Minerals 14,99616,146 -7.1% Stone, Clay & Glass Products 36,54038,422-4.9% Waste & Nonferrous Scrap 18,24419,053-4.2%

All Other Carloads 28,41625,837 10.0%

TOTAL U.S. CARLOADS 1,162,736 1,173,173 -0.9%

CANADIAN RAILROADS

TOTAL CANADIAN CARLOADS 410,211 369,17011.1%

COMBINED U.S./CANADA RR 1,572,947 1,542,343 2.0%

4 Railway Age // January 2023 railwayage.com

Indicators

Industry

Source: Rail Time Indicators, Association of American Railroads Intermodal MAJOR U.S. RAILROADS BY COMMODITY NOV. ’22NOV. ’21% CHANGE Trailers 74,095109,373-32.3% Containers 1,156,196 1,191,025 -2.9% TOTAL UNITS 1,230,2911,300,398 -5.4% CANADIAN RAILROADS Trailers 0 0 Containers 328,643299,2299.8% TOTAL UNITS 328,643299,2299.8% COMBINED U.S./CANADA RR Trailers 74,095109,373-32.3% Containers 1,484,839 1,490,254 -0.4% TOTAL COMBINED UNITS 1,558,934 1,599,627 -2.5% FIVE WEEKS ENDING DECEMBER 3, 2022 Railroad employment, Class I linehaul carriers, NOVEMBER 2022 (% change from november 2021) Transportation (train and engine) 49,934

Executives, Officials and Staff Assistants 8,030

Professional and Administrative

Maintenance-of-Way and Structures 28,429

Maintenance of Equipment and Stores 17,774

Transportation (other than train & engine)

Source: Surface Transportation Board TOTAL EMPLOYEES: 118,944 % CHANGE FROM NOVEMBER 2021: +4.38% TRAFFIC ORIGINATED CARLOADS MAJOR U.S. RAILROADS BY COMMODITY NOV. ’22NOV. ’21% CHANGE

(+6.29%)

(+10.29%)

9,998 (+2.47%)

(+1.31%)

(+3.15%)

4,779 (+2.80%)

WEEKS ENDING DECEMBER 3, 2022

FIVE

January 2023 // Railway Age 5 railwayage.com TOTAL U.S. Carloads and intermodal units, 2013-2022 (in millions, year-to-date through NOVEMBER 2022, SIX-WEEK MOVING AVERAGE) TOTAL U.S./Canadian CARLOADS, NOVEMBER 2022 VS. NOVEMBER 2021 1,572,9471,542,343 NOVEMBER 2022 NOVEMBER 2021 Copyright © 2023 All rights reserved. Short Line And Regional Traffic Index CARLOADS BY COMMODITY ORIGINATED NOV. ’22 ORIGINATED NOV. ’21 % CHANGE Chemicals 52,835

Coal

Crushed Stone, Sand & Gravel

Food & Kindred Products

Grain

Grain Mill Products

Lumber & Wood Products

Metallic Ores

Metals & Products

Motor Vehicles & Equipment

Nonmetallic Minerals

Petroleum Products

Pulp, Paper & Allied Products

Stone, Clay & Glass Products

Trailers / Containers

Waste & Scrap Materials

All Other Carloads

AILWAY GE Visit http: //bi t.ly/rai l jobs To place a job posting, contact: Jerome Marullo 732-887-5562 jmarullo@sbpub.com ARE YOU A RAILROAD OR SUPPLIER SEARCHING FOR JOB CANDIDATES? RA_JobBoard_1/3Vertical.indd 1 7/27/21 3:02 PM

50,592 4.4%

20,937 15,12638.4%

27,078 24,825 9.1%

12,360 11,513 7.4%

31,039 30,205 2.8%

8,056 7,607 5.9%

9,010 9,439 -4.5%

2,622 3,224-18.7%

18,220 17,180 6.1%

9,217 7,29426.4%

3,042 2,46623.4%

2,076 1,965 5.6%

16,093 16,638-3.3%

14,889 14,178 5.0%

41,573 45,777-9.2%

11,740 11,171 5.1%

70,689 68,254 3.6%

Industry Outlook

“I encourage the Class I railroads to accept the opportunity afforded by the new rule and sign up for the arbitration program they clearly prefer,” Oberman said. “However, if they do not, in my view, FORR also provides a strong rate relief mechanism, and its availability would also streamline rate review processes in small rate cases. To be clear, regardless of some differences of opinion about the most preferable way forward, all Board Members are committed to ensuring review of rate challenges are practical and affordable.”

STB Adopts ‘Smaller Rate Dispute’ Rules

The Surface Transportation Board (STB) on Dec. 19 adopted two final rules establishing new “rate reasonableness procedures” it says “provide two streamlined approaches for shippers and railroads to resolve smaller rate disputes.” The Association of American Railroads (AAR) is calling STB’s actions “fatally flawed.”

The two rulings are Final Offer Rate Review (FORR) and Joint Petition for Rulemaking to Establish a Voluntary Arbitration Program for Small Rate Disputes (Arbitration Final Rule).

The Board’s two Republican Members, Patrick Fuchs and Vice Chairman Michelle Schultz, dissented on FORR. Though all five Members concurred on the Arbitration Final Rule, Fuchs did so with separate expression; Schultz commented with separate expression.

STB describes FORR, effective 60 days from date of publication in the Federal Register, as “a voluntary arbitration program and an entirely new procedure for rate challenges.” The final rule establishing the Voluntary Arbitration Program is effective 30 days from the date of publication in the Federal Register

“Either rate review mechanism will substantially improve shippers’ access to rate reasonableness reviews for smaller rate disputes,” STB said, adding that the Voluntary Arbitration Program will become operative “only if all seven Class I carriers commit to participating in the program for five years and do so within 50 days of the date of publication of the final rule in the Federal Register,” and that “if all Class I carriers do so, they will be exempt from the FORR procedure.”

Both review mechanisms are limited to rate disputes worth up to $4 million in relief over two years. Under the new FORR procedure, if STB finds a rate to be unreasonable, it “will decide the rate by selecting either the complainant’s or the defendant’s final offer, subject to an expedited procedural schedule that adheres to firm deadlines. Under the arbitration program, Class I rail carriers would commit for a period of five years to arbitrate rate disputes, under a similarly expedited schedule.”

STB “has taken great strides in its long-term quest to make the adjudication of smaller rate disputes more accessible, reasonable and less time-consuming,” said Chairman Martin J. Oberman, pointing to “the leadership of former Chairman Ann Begeman in establishing the Rate Reform Task Force in 2018, whose thorough effort led to the ideas incorporated in these two new procedures.”

“The two rules attempt to strike a balance between the competing interests of various stakeholders,” Oberman said. “While much of the shipper community has expressed a preference for FORR and the railroad community pursued a voluntary arbitration program in lieu of FORR, both rules have much in common. They both offer relief under similar timeframes, allow for flexibility to use different methodologies, and have the same monetary limits. I am confident that either program will provide shippers with access to more meaningful rate relief than was previously available to them. ... Experience has shown that the Board’s prior efforts to provide rate review methods suitable for smaller disputes have been rarely used by shippers.”

In September 2019, STB issued a Notice of Proposed Rulemaking and sought public comment on its proposal for the new FORR procedure. “Subsequently, five Class I railroads filed a joint petition urging the Board to exempt them from the FORR procedure, promising in return to agree to resolve rate challenges through binding arbitration, a methodology in which the carriers had previously refused to participate for many years,” STB noted. “The Board reviewed that petition and explored whether establishing a voluntary arbitration program would provide a practical alternative dispute resolution mechanism to address smaller rate disputes. In November 2021, following this effort, the Board advanced rulemakings in both FORR and the establishment of a Voluntary Arbitration Program.”

The STB “issued a fatally flawed final rule in its Final Offer Rate Review proceeding, and at the same time issued a proposal for new STB arbitration rules,” the AAR said. “Unfortunately, the arbitration proposal ignores key principles that could otherwise make STB-sponsored arbitration of small rate disputes a viable option. AAR and its members are closely reviewing the decisions to determine next steps, but it is clear that our primary concerns remain.

“FORR, the rule modeled on baseball-style arbitration, flatly exceeds the agency’s authority. In a case filed under the new rule, the agency would do no independent analysis or engage in any reasoned decision-making, but instead would simply choose the ‘final offer’ rate proposed either by the shipper or by the railroad.

“With respect to the arbitration procedures for small rate cases that a group of Class I railroads had proposed, the Board’s decision falls short of including substantive provisions that were critical to one or more railroads. But at the same time, the rule effectively requires all Class I railroads to agree to participate in order for the procedure to be available as an option for any railroad.”

6 Railway Age // January 2023 railwayage.com

STB

STB Chairman Martin J. Oberman

NJT Seeks HBLR O&M Contractor

New Jersey Transit (NJT) has initiated a procurement process for an O&M (Operations and Maintenance) contractor for the 20.6-mile, 24-station Hudson-Bergen Light Rail (HBLR) system, which has operated under the initial DBOM (Design-Build-Operate-Maintain) contract held by 21st Century Rail Corporation—comprising AECOM, 70%, and Itochu Rail Car/Kinkisharyo USA, 30%—since its inception in 2000. “As that contract gets set to expire in the coming years, NJT is evaluating all options on how best to continue delivering high-quality operation and maintenance of the system,” the agency said. HBLR connects terminals at Tonnelle Avenue in North Bergen, Hoboken Terminal (NJT’s commuter rail hub that also serves PATH trains), 22nd Street in Bayonne and West Side Avenue in Jersey City. The system was implemented in phases.

WORLDWIDE

QUBE, an Australian-based logistics service provider, announced last month that it acquired 12 new GT46 locomotives from Progress Rail, a Caterpillar Company, to be used for Qube’s new interstate service between Melbourne and Sydney. The locomotives will be delivered in New South Wales, commencing in August 2023. Qube’s service launched in November 2022, initially providing three weekly round trips. It is the first interstate service to be handled under automation at the Qube Moorebank IMEX Terminal in Sydney.

NORTH AMERICA

The CALIFORNIA HIGH-SPEED RAIL AUTHORITY (CHSRA) has awarded Edmonton, Alberta, Canada-based engineering firm Stantec a $41 million contract to design the 33.9-mile Merced to Madera extension, the key junction that will connect the 500-mile-long project between the Bay Area and Los Angeles. The contract, which is expected to be delivered over approximately two years, will include finalizing the project configuration, advancing design work to refine costs and travel-time enhancements, and mapping right-of-way needs and utility relocations. The project will be partially funded by $25 million in federal funding from the U.S. Department of Transportation (USDOT) under the Rebuilding American Infrastructure with Sustainability and Equity (RAISE) discretionary grant program.

AMTRAK will seek a “Delivery Partner” for replacement of the nearly 150-year-old Baltimore & Potomac (B&P) tunnel in Baltimore, Md. The Delivery Partner model, “America’s Railroad” said, involves a private partner taking on “substantial risk-sharing, impacting overall project outcomes.” The

B&P Tunnel Replacement Program, conducted by Amtrak and the Maryland Department of Transportation Maryland Transit Administration (MDOT MTA), will build a new tunnel to be used solely for passenger rail service. Named the Frederick Douglass Tunnel—for the 19th century Maryland-born abolitionist leader—it will include two new tubes, serving MARC commuter rail and Amtrak riders. Currently, trains travel at around 30 mph through the two-track, 1.4-mile B&P Tunnel that connects Baltimore’s Penn Station with Washington and Virginia; two separate single-track tubes would enable speeds up to 100 mph. The program will also modernize a four-mile section of the Northeast Corridor; work includes new roadway and railroad bridges, new rail systems and track, and a new ADA-accessible West Baltimore MARC station. The existing B&P Tunnel will be dedicated to freight rail service. According to Amtrak, more than 24 companies responded to its recent Request for Information (RFI) that invited feedback on the Delivery Partner model. Solicitation for the Delivery Partner is expected to launch this month.

January 2023 // Railway Age 7 railwayage.com Market

Wikimedia Commons/ Hudconja

‘RAILROADING IS A

MOMENTUM BUSINESS’

KATIE FARMER

PRESIDENT AND CEO, BNSF

BY WILLIAM C. VANTUONO, EDITOR-IN-CHIEF

BY WILLIAM C. VANTUONO, EDITOR-IN-CHIEF

BNSF

Railway Age ’s 2023 Railroader of the Year Award, the 60th annual, goes to a groundbreaking North American rail industry leader: BNSF President and Chief Executive Officer Katie M. Farmer.

Katie Farmer permanently changed the industry for the better by becoming the first female chief executive of a Class I railroad. She took the throttle of North America’s largest railroad, in terms of both route-miles and revenue, during unprecedented times, in the midst of a global pandemic. She has continued to press forward during a challenging, postpandemic period, dealing with global supply chain and service problems, as well as a difficult labor market, focusing on building a better BNSF.

Katie knows her railroad inside and out. She’s held leadership positions in every major function of the company,

overseeing a 32,500-route-mile network that spans 28 states and touches three Canadian provinces. She has been working with her team to shape the legacy of BNSF, which has seen industryleading growth. In late 2020, when she was named as the railroad’s next chief executive, she told Railway Age how proud she was of the men and women of BNSF—railroaders who ‘know how to do hard’—and looked forward to continuing BNSF’s success.

Katie was appointed BNSF President and CEO in January 2021. She has been with BNSF for more than 30 years, previously serving as Executive Vice President Operations since September 2018, where she oversaw the entire Operations organization. Farmer received a bachelor’s and master’s degree from Texas Christian University. Upon graduation, she began her career with BNSF predecessor Burlington Northern in 1992 as a

management trainee in Fort Worth, Tex., following an internship in the Engineering department between her junior and senior years in college.

Katie Farmer is the ninth person from BNSF or one of its predecessor railroads named Railroader of the Year in the award’s six-decade history: Louis W. Menk, Northern Pacific (1967); John S. Reed, Atchison, Topeka & Santa Fe (1970); Lawrence Cena, AT&SF (1981); Darius W. Gaskins, Jr., Burlington Northern (1988); Robert D. Krebs, AT&SF, and Gerald Grinstein, BN (1996); Matthew K. Rose, BNSF (2010); and her immediate predecessor, Carl R. Ice, BNSF (2016).

RAILWAY AGE: Congratulations on being named Railroader of the Year. You are the first female CEO of a Class I railroad. This award goes back 60 years, and you are the first woman to be named Railroader of the Year.

10 Railway Age // January 2023 railwayage.com

Bruce Kelly

KATIE FARMER: Thank you, Bill. It’s an honor to be included with leaders who have had an impact on the industry, including my predecessors. But I really do think it’s important to acknowledge that BNSF is not great because of one person’s work, but because of all our 35,000 employees. They’re due the credit for BNSF’s success.

RAILWAY AGE: You joined Burlington Northern right out of college as a management trainee. How did you find your way to railroading and what was it about BN that attracted you? Did you ever imagine yourself as a long-term railroad employee?

KATIE FARMER: I was drawn to Burlington Northern because of the importance of what we do. Really, the relevance of railroading and freight railroads that are the backbone of the U.S. economy. They move everything from energy to heat our

homes to the clothes that we wear. If you look at the importance of what we do just at BNSF alone, we move, for example, a quarter of the grain and grain products in this country. We saw this again with great clarity during the pandemic. We moved a lot of PPE and medical supplies that the nation needed. I’m really proud of that. At BNSF, we take a lot of pride in knowing that we’re helping so many companies across this country, and helping to strengthen the competitiveness of the United States.

If I could go back and ask my 20-yearold self, did I plan on being a long-term railroader? I’m not sure of the answer to that. But what I am sure of is that railroading is a high calling. And what we do matters. The relevance and the importance is a key reason why people, I think, make a career of railroading, much like myself.

RAILWAY AGE: These days when there are so many career choices, so

many career paths, and younger people don’t tend to stay in one place for a very long time, why should a young person come to work for a railroad? What’s the attraction? What’s the incentive?

KATIE FARMER: I believe doing something that matters appeals to people of all ages, to know that what you are doing is a part of something larger than yourself that contributes to society. One of the things I say to young people as they’re looking at this industry is, the U.S. economy doesn’t function without rail and what it provides for the supply chain. To be a part of that every day, to know that what we’re doing and working on together really makes a difference. If you look back at our company, we’re a combination of predecessor railroads over the past 170 years—what we do is as relevant today as it was 170 years ago.

We’ve accomplished that because we’ve innovated, we’ve evolved, we’ve Bruce Kelly

12 Railway Age // January 2023 railwayage.com

BNSF.com

BNSF proudly congratulates KATIE FARMER for being named the 2023 Railroader of the Year.

stayed relevant. The one thing that’s never changed over all those 170 years is the difference we make and the relevancy of the rail industry. I would add that the other thing I think really appeals to young people starting out their career is the breadth and diversity of experiences you can have at a railroad. A lot of people don’t realize that. I think we need to do a better job telling our story about all the different careers you can have just within the rail industry, whether it’s finance, marketing, operations, engineering— you name it.

One of our challenges is communicating that relevancy and the importance of the rail industry to young people, because it’s not natural, per se, for people to think about it. We’re kind of unsung heroes. Although the past several years we’ve been at the forefront, we’re not typically something that young people might naturally think

of gravitating toward. For young people coming out of school thinking about what they want to do, it’s very different than when I was coming out of school. I was looking at, frankly, how do I pay my bills? This generation really thinks about how they can make a difference, waking up every day doing something that motivates and excites them. That’s a bit of a shift. If we tell our story correctly, there aren’t many companies that you can say have been around for 170 years and make such a big difference in this country and the world. That’s why I’ve stayed in this career for 30 years. I get excited every harvest, every UPS peak season. Those are tangible things where you can see how we make a difference.

RAILWAY AGE: When you were named to succeed Carl Ice as CEO of North America’s biggest Class I, and as the first woman ever in that position, how

was that experience for you personally?

KATIE FARMER: Carl, and Matt Rose before him, really did an incredible job positioning BNSF to be successful well into the future. Who I am as a leader has been shaped by our culture. I’ve been a part of this company’s leadership team for more than a decade and have helped shape our direction. From day one, I’ve said my focus as a CEO is to continue to lead BNSF on a journey to fulfill our vision by really positioning us to succeed during all business cycles. At any given time or in any given year, we see fluctuations in our business, decreases or increases in our volume across all the various markets we serve.

To be successful, we know that we must always stay focused on growth. One thing truly consistent about BNSF is our focus on growth. We need a bias for growth to be successful in growing with our customers. We really have to be

14 Railway Age // January 2023 railwayage.com

Bruce Kelly

C M Y CM MY CY CMY K

herzog.com • 816.233.9001 •

nimble and agile enough to reinvest in our business and have capacity so we can say “yes” to our customers. We’re in business for our customers. That was the focus in our past when we became a combined company, and it’ll be the focus of who we are going forward. One thing I have learned is that it’s critically important we continue talking about that journey every day. It remains a part of our culture. It’s just who BNSF is, and it’s who we will be as we move into the future.

RAILWAY AGE: You’ve been with BNSF for 30-plus years, and you’ve had numerous roles in your career. What are the accomplishments you’re most proud of, those you believe have had the most impact for your company?

KATIE FARMER: Even though I’ve been here 30 years, I certainly hope our greatest accomplishments are yet to come. One area I am really focused on is ensuring that others have access to the same opportunities to develop that I’ve been given over my career. Our culture

them to do what’s right and we invest in their professional development. I look forward to continuing to ensure that those opportunities continue to exist for future generations.

I would also say there are a couple of recent accomplishments of which I’m particularly proud of our team—last year’s agreement with J.B. Hunt, our largest service provider and our partner. It’s a big leap forward for our intermodal product, a commitment to bring additional capacity to the marketplace while continuing to evolve our joint service product. It’s going to ensure that customers have a more seamless experience in the future with BNSF and J.B. Hunt’s intermodal product. And it’s going to be a big differentiator for us in the marketplace and facilitate our continued growth for years to come.

Also, while it’s not yet complete and yet to be approved by the Surface Transportation Board, bringing back Montana Rail Link into the BNSF network is something that all of us at BNSF will be proud of. Having been a former Burlington North-

efforts, and provided the STB approves the lease termination, the MRL will become the MRL Subdivision of our Montana Division. It’s really a fitting tribute to the history of both these great railroads.

RAILWAY AGE: Operationally and growth-wise, that seems to be a very good strategic move on BNSF’s part.

KATIE FARMER: Absolutely. We are excited for the opportunities that it presents for our customers to have a more seamless product. And we have added a second main line on our new Lake Pend Oreille Bridge at Sandpoint, Idaho. This opens up capacity and will allow us to continue to offer more consistent service for our customers, both along the Northern Transcon and our Central Corridor, as well. It’s an incredible project, the work that [BNSF Vice President Engineering] John Cech and his team have done and many others is remarkable. It has been a multi-year cross-functional effort with lots of support from lots of folks, and it’s going to be great for our customers.

Also, Barstow InterBarstow International Gateway is going to be

railwayage.com 2023 RAILROADER

OF THE YEAR

“We talk about our people as our differentiator. We hire the best, keep them engaged, empower them to do what’s right and invest in their professional development.”

WVCORAILROAD.COM | 541-484-9621 | SALES@WVCORAILROAD.COM COMPLETE SERVICE THAT KNOWS NO END. Running a railroad means demanding schedules, harsh conditions, and countless details. WVCO is committed to the highest level of service. With class-leading products like FastPatch®, innovations like reusable totes, equipment, and maintenance, we’re with you every step of the way to make your job easier. SERVICE THAT KEEPS EVERYTHING RUNNING SMOOTHLY.

RAILROADER OF THE YEAR

the largest intermodal facility in North America when fully built out. It will sit on more than 4,500 acres. It is going to be a state-of-the art integrated rail facility in Southern California consisting of a rail yard, an intermodal facility, and warehouses for transloading freight from international to domestic containers. The facility will allow direct transfer from containers through the ports of Long Beach and Los Angeles, through the Alameda Corridor and onto BNSF’s main line up to Barstow. Once the containers reach Barstow, they’ll be processed at the facility. We’ll use clean energy-powered cargo handling equipment, and then we’ll build and stage trains moving east via our Southern Transcon.

We’re excited about this. We think it really will help maximize rail and distribution efficiency across the entire U.S. supply chain. It will reduce truck traffic and freeway congestion. It’ll have a critical role in the competitiveness of the West Coast, improving the fluidity of our network. The people of Barstow have been great supporters of it. It’s another example of our bias for growth, a clear example of investment in capacity that will help us continue to reinvent ourselves, adapt and offer a more

seamless product for our customers.

RAILWAY AGE: So, it’s a “BIG” part of your growth strategy? That’s a great name.

KATIE FARMER: Well said! We’re still testing the name, so we’ll see if it sticks.

RAILWAY AGE: The past few years have been difficult for the industry. The past year has been especially challenging. The rail industry in general now has a lot of work to do in mending relationships with employees and regaining customer confidence. What are the next steps? What will be your approach? What do you think the industry in general has to do differently going forward?

KATIE FARMER: We’ve all faced challenges during the past few years as we have navigated our way through the pandemic, the great resignation, supply chain challenges, and certainly the most recent bargaining round. Let me start with our people. As I said earlier, our people are our differentiator. BNSF is great because of the hard work and commitment day in and day out of our 35,000 people who deliver on our promise to our customers. None of what we accomplish happens without them. We recognize that railroading is tough,

essential work that BNSF team members do safely every day. And we have always supported and provided fair compensation and benefits for our employees. While the new agreement has the highest wage increases in decades and best-inclass healthcare, we recognize there’s more to be done to further address our employees’ work-life balance concerns.

We hear and recognize the deeply felt concerns regarding quality of life. And I fully intend to work collaboratively with our employees and the unions to find the right balance. We have started those discussions. At the end of the day, we want BNSF to be not only a great place to work, but also a great place to have a career for everyone who works here. It has been a challenging couple of years, but we’re a 170-year-old company, and we have seen our share of challenges. Short-term challenges don’t erase what we have, what all of us have built together at BNSF. We’ll continue to work with our people. We’ll continue to work with their unions to create opportunities to enhance rail careers, to promote safety, to support environmentally friendly and efficient transportation. We’re going to continue to do the things we need to do to strengthen the backbone of the

18 Railway Age // January 2023 railwayage.com

2023

“We hear and recognize the deeply felt concerns regarding quality of life. I fully intend to work collaboratively with our employees and the unions to find the right balance.”

Your track is talking Are you listening?

ultrasonic rail testing uses high pitched waves to identify defects in the rail.

track inspection service provides

report of the location, characteristics and urgency of defects. pandrol.com

Pandrol’s

A full

an exhaustive

Hi-Rail Grapple Truck Mecalac Hi-Rail Mini-Excavator Track Tools HydraSkid 248 CONTACT US. LET’S TALK BUSINESS. 800.962.2902 quotes@RELAMinc.com RELAMinc.com RELAM, Inc. 7695 Bond Street Glenwillow, Ohio 44139 YOUR FLEET IS OUR BUSINESS. We also have the equipment you forget about and the equipment you don’t know you’re missing. Leasing with RELAM powers your fleet with the best of the standards, the stuff you need in a pinch, and the innovations in productivity. RELAM HAS THE EQUIPMENT YOU NEED. Scan to visit our website

2023 RAILROADER OF THE YEAR

U.S. economy. So, we’ll continue those discussions and evolve as we always have over the years.

Turning to the supply chain, we often say railroading is a momentum business. This applies more broadly to the whole supply chain. When one part of the supply chain struggles, we all struggle. When volume fluctuates, we adapt to that variability, and that’s not new for us. The difference is the pandemic impacted the entire global supply chain, which, as you know, is a complex system of connections among ports, railroads, trucks and our customers.

As we were moving through the pandemic and we saw consumers shift from services to goods, more freight went into the supply chain. And unfortunately, labor left the workforce, and it did create a series of disruptions. It created a series of shortages—chassis drivers, labor to support distribution center unloading. All of this slowed overall velocity. That caused shipments to back up in rail facilities

and at the ports. We take a lot of pride at BNSF in delivering customers safe, efficient, consistent and reliable service. And we faced some challenges this past year. However, I would tell you that we have made significant progress. Service is close to pre-pandemic levels. We have strong momentum in restoring the service customers have come to expect and that we, frankly, expect from ourselves.

There are, however, some good things that have come out of the supply chain challenges. There is increased collaboration, information sharing and accountability across the supply chain. But there is more to be done. The supply chain continues to evolve. We have to evolve as an industry in order to remain competitive. It’s imperative that we find ways to continue to collaborate and work more closely, not only across the supply chain, but also with our customers.

RAILWAY AGE: That’s a good shortterm outlook. What is your long-term

outlook for the industry? What do BNSF and the industry need to do to be competitive, to be relevant as supply chains evolve? How does BNSF plan to leverage technology?

KATIE FARMER: The rail industry is really focused on implementing new technologies and delivering better and more consistent service. Those are the key drivers. That’s how we increase the value proposition for rail and the supply chain. Driving sustainable and profitable business growth requires the right capabilities, strategy and mindset. As I mentioned earlier, the heart of how we operate is around growth. But we are also keenly aware that to be successful, we must continue to evolve with the supply chain.

When you look at all of our predecessor companies, if BNSF moved the same commodities today and operated in the same way as our predecessors, we’d be out of business. So being agile in the marketplace, being nimble and able to pivot to new opportunities with our

20 Railway Age // January 2023 railwayage.com

VISIT RWY.COM/BATTERYTEST TODAY! 525 9th Street S, Delano, MN 55328 | 763.972.2200 | sales@rwy.com Products • SMC • Cell Monitor • Load Bank • Current Coil AUTOMATED BATTERY TESTING WITH AC POWER CONNECTED RECO’s Automated 30 Day Battery Testing System provides the ability to test your batteries without disconnecting AC power. The system is equipped with 2 dry relay contacts for voltage, temperature or current alarm, independent of the battery charger system and user programmable. • Retrofit into other battery charger systems with the use of the Event Recorder display unit. AUTOMATED BATTERY TESTING SYSTEM Data Collected • Current • Voltage • % of Battery Charge • Time to Empty • Alerted of a Bad Battery Cell

TRACK on for

tomorrow

Some see steel tracks. We see safer connections — trusted pathways maintained by our high performance, American-engineered technology. Because wherever they lead, at the end of the line, everything is riding on quality. plasseramerican.com

HIGH CAPACITY | PRECISION | RELIABILITY

RAILROADER OF THE YEAR

customers is how we stay relevant. And we are also continually focused on improving the experience of our customers, both in the transit of their goods and overall making it easier to do business with us. Customers now don’t just require consistent and reliable service. They also want tools, transparency, the ability to track shipments throughout the supply chain.

We need to continue to focus on integrating more deeply into our customers’ supply chains and their processes and making it easier to do business with us—creating value so that BNSF remains the customers’ transportation provider of choice for the long term. So, growth is how we think about the long term. We don’t just focus on growth as an annual objective or for a specific market opportunity. Again, this has been the key to our success over time. We’re committed to having the capacity, equipment and people that allow us to

new business opportunities. That’s really what’s critical to our success.

BIG is just one in a long line of investments toward growth and to better align with our customers. If you look back, we

supply chain, sustainably lowering transportation costs, reducing fuel costs, lowering carbon emissions. This has been our focus for years. We pioneered the Logistics Park concept back in 1993 with our facility in North Fort Worth at Alliance. In 2002, we opened Logistics Park Chicago, and we’ve seen continuous expansion at both of those facilities since their inception. And then in 2013, we opened Logistics Park Kansas City in Edgerton, Kans., to serve the growing Midwest market.

RAILWAY AGE: Years ago, Railway Age ran a cover story titled with a quote from Rob Krebs: “Grow or Die.” Would you call it a mantra?

have our Logistics Park strategy, which uses our intermodal hub as a centerpiece to locate distribution centers nearby. That

KATIE FARMER: It’s foundational to who we are at BNSF. It’s in our DNA. We clearly recognize that we are in business to help our customers succeed. And the way we do that is positioning ourselves to be able to say “yes” when they bring us an opportunity and have the capacity and investment to be

2023

“We’re committed to having capacity, equipment and people that allow us to grow with our customers.”

CONGRATULATIONS

PRESIDENT AND CEO, BNSF RAILWAY FROM

2023 RAILROADER OF THE YEAR

RAILWAY AGE: Over the years, capital investment at BNSF has always been strong. To my knowledge, it has really never let up, even though the economy is cyclical. You need to continue investing in capital to maintain not only a state of good repair, but also to be prepared for growth, to be ready for it, able to handle it.

KATIE FARMER: I agree 100%. We clearly recognize that we have to take care of our infrastructure every year, regardless of what happens in the economy. And then we have to think ahead. To your point, what that means is you have to continue to invest to be in a position to have the capacity when those markets bring you opportunities.

RAILWAY AGE: Let’s talk a bit about technology and sustainability advancements. What is BNSF doing in both spaces?

KATIE FARMER: We employ and create advanced technology to continually

improve safety, efficiency, service reliability, consistency and the customer experience. Those are the lenses that we look at when evaluating investment in technology. One of the areas we’re looking at is the pursuit of energy efficiency. It’s one of our top priorities as we look to reduce our environmental impact. More than 90% of our emissions come from our locomotives. We look at locomotive technology to improve our fuel efficiency. We have the largest number of the newest and cleanest locomotives in North America. We have idle reduction systems on most of our line haul locomotive fleet, and we are testing higher blends of biodiesel and renewable diesel. We are partnering in the development of zeroemissions locomotives, and that includes battery-electric, as well as hydrogen to reduce our environmental impact and helps us increase fuel efficiency, as well as lower operational costs—a win for the environment, our customers and the operation. A battery-electric locomotive

uses about half of the energy of a diesel locomotive. Ultimately, they’ll be able to do the same work.

We continue to look for opportunities to lead in piloting zero-emissions technologies, whether it be on our locomotives or in our intermodal facilities, with batteryelectric yard trucks or electric cranes, which we’re already using. All of these technologies are helping to reduce emissions in the communities in which we operate. We’re continuing to evolve and innovate, and we understand that technology is a big part of our future if we’re going to meet the demands of our customers, our employees and communities, as well as our environmental responsibility.

RAILWAY AGE: There’s a lot going on in the industry in terms of leveraging technologies like artificial intelligence, machine learning. I remember doing stories on reading hot bearings, something BNSF was doing years ago. This seems to have taken an almost exponential leap.

24 Railway Age // January 2023 railwayage.com

Over four decades of renting quality trucks, construction equipment, and hi-rail units PHILADELPHIA 800.969.6200 | DENVER 800.713.2677 | DANELLA.COM/RENTALS R ENTA L SY STEM S, INC. CONGRATULATES KATIE FARMER RAILROADER OF THE YEAR

WHEN

TrinityRail

® is North America’s leading railcar equipment and services provider. With a comprehensive platform of leasing, manufacturing, maintenance and professional services, you can rely on TrinityRail to fully deliver trusted expertise, innovative solutions and supply chain optimization. Learn more at TrinityRail.com.

YOUR BUSINESS RELIES ON RAIL, RELY ON US.

26 Railway Age // January 2023 railwayage.com 2023 RAILROADER OF THE YEAR

The Bi-directional “Gate Gard” from Western-Cullen-Hayes, Inc •Economical •Easy-install, low maintenance •Accomodates Arms to 40’ Long The Bi-directional “Gate Gard” with Swing Away Adaper allows for a gate arm to pivot in either direction when struck by a vehicle, returning the gate arm to its position without the damaging rebound other spring loaded adapters generate. Permits the gate arm to be replaced or repaired parallel to the road, keeping maintainers safely out of traffic. WESTERN-CULLEN-HAYES, INC. 2700 W. 36th Place • Chicago, IL 60632 (773) 254-9600 • Fax (773) 254-1110 Web Site: www.wch.com E-mail:wch@wch.com WE SIFT THROUGH THE NEWS SO YOU DON’T HAVE TO ROUND-UP RAILWA RAIL GROUP NEWS From Railway Age, RT&S and IRJ https://railwayage.com/newsletters RA_RailGroupNews_Fourth_Sift_2022.indd 1 1/10/22 12:44 PM

Bruce Kelly

2023 RAILROADER OF THE YEAR

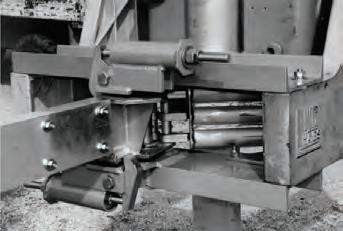

KATIE FARMER: We are employing machine vision and automated track inspection using autonomous geometry cars. Look across the spectrum of our business, and we have exciting things happening with technology. We’ll continue to invest in anything we can do to make our railroad safer, more efficient, and to provide a better product for our customers.

RAILWAY AGE: Employing and investing in state-of-the-art technology should make our old “bricks and mortar” industry attractive to young people. Here’s a big industry that moves goods on tracks with trains. But we employ modern technologies and will continue to advance them, so here’s an opportunity for you, the young person, to develop your skills and contribute to that.

KATIE FARMER: Absolutely. That goes back to continuing to tell our story and communicating with people looking to make a career in the rail

industry. The idea that you can come to a 170-year-old company and work on cutting-edge technology is a story we must continue to tell to make sure we attract the best and the brightest.

RAILWAY AGE: With all the scrutiny the industry has been facing from the Surface Transportation Board, I have found BNSF to be very transparent. The data you folks provide, the minutia.

KATIE FARMER: This gets back to the consistency of who we are at BNSF. We’ll continue to provide our service metrics to the STB. What you’re seeing in those metrics goes back to what I mentioned earlier: We’ve had challenges, but we have great momentum, and we’re seeing service that is moving toward prepandemic levels.

RAILWAY AGE: Closing thoughts?

KATIE FARMER: Just that I really appreciate this honor, and I do accept it on behalf of all the employees at BNSF.

January 2023 // Railway Age 27 railwayage.com

AMTRAK AT THE CROSSROADS

BY DAVID PETER ALAN, CONTRIBUTING EDITOR

“

It was the best of times; it was the worst of times.” So goes the opening of A Tale of Two Cities, Charles Dickens’s 1859 saga of the French Revolution. Amtrak and its riders have experienced the best of times in some respects, along with the worst of times in others, during the half-century since “America’s Railroad” was founded in 1971, but Amtrak’s prospects stand in stark contrast today.

The present could be “the best of times” for Amtrak, at least on the capital

side. Because of the Bipartisan Infrastructure Law (BIL, also known as the Infrastructure Investment and Jobs Act, IIJA), there is federal money available for capital improvements on lines where Amtrak runs. It includes money for projects along the Northeast Corridor (NEC), as well as other places on Amtrak’s National Network.

For the first time in decades, Amtrak is talking about starting service on new lines. None would be new long-distance trains, much to the consternation of some civic leaders and many rider-advocates.

Still, Amtrak’s ConnectUS plan calls for dozens of new lines to start service by 2035. However likely or unlikely any of these new starts might be, Amtrak is finally talking about expansion. These are corridor-length routes, and most of the money would come from the states through which the trains would run, at least after Amtrak financial support expires after the first few years of operation.

Amtrak tends to play its proverbial cards close to its proverbial vest, but there are signs of enthusiasm about the proposed new routes. Railway Age has Amtrak

28 Railway Age // January 2023 railwayage.com

Presently it could be the best of times. The future is not as clear.

provided extensive coverage of the slugfest at the STB about Amtrak’s proposal to run two new passenger roundtrips daily between New Orleans and Mobile. During a public hearing last February, advocates made enthusiastic statements in support of the proposed service. So did Amtrak President Stephen Gardner, whose own statement was as strong as those from the advocates. It was refreshing to hear Gardner’s favorable and forceful statement, and advocates hope there will be more.

On the rails themselves, times are not good for Amtrak. The long-distance

PASSENGER RAIL OUTLOOK

network has stayed skeletal throughout Amtrak’s history, and it is just beginning to recover from the effects of the COVID19 pandemic. Its future remains uncertain. State-supported trains and corridors outside the Northeast are also experiencing difficulties, and at this writing, not every route is running its full schedule. Operations on the NEC and its branches are doing better, but Amtrak’s NEC and the National Network in the rest of the country seem to be at odds.

Amtrak is divided into three components: the long-distance network, statesupported trains and corridors, and the NEC and its branches. Each has its problems, and those problems sometimes vary with the line of concern.

THE LONG-DISTANCE NETWORK

Amtrak’s network of long-distance trains is the same size today that it was in 1971: 14 routes (not counting the Auto-Train). There has been no net growth over the half-century, while service was slashed to the lowest level in Amtrak’s history in 2020 and 2021. The network has only recently recovered to its pre-COVID level of operation, but can it stay there?

After service on 12 of the 14-train network was slashed from daily to tri-weekly (the other two have operated on tri-weekly schedules for decades), Amtrak restored daily service as Congress had mandated, but only for eight months. Amtrak claimed that the 2022 cuts were temporary and would last for only two months, but it took nearly nine months to restore it fully. Amtrak has drawn fire for organizational changes that made it more difficult to recall or hire the employees needed to restore full operation after the original cuts in October 2020.

To make matters worse, there is a shortage of equipment. Once-mighty trains like the Capitol Limited and the Texas Eagle have run with consists as short as four cars. Other trains have run with consists shorter than usual, including during summer 2022. In the meantime, equipment sits at the Amtrak shops in Beech Grove, Ind., out of service. Some of that equipment was damaged in wrecks, and may have to sit there until litigation resulting from those wrecks is over, but other equipment is not being used to

transport riders and earn revenue.

It will be years, with the exception of locomotives, before there is new equipment for the long-distance trains. The existing Superliner fleet is up to 40 years old, as are the Amfleet II single-level cars used on long-distance trains between New York and Chicago, New Orleans, and Miami. There is talk of ordering replacement cars during the latter part of this decade, but the question remains how long the existing equipment can hold out.

In the meantime, advocates are pushing for new long-distance trains, most notably restoring service in southern Montana and across the mid-line of North Dakota on the historic Northern Pacific (a BNSF line) route of the North Coast Limited , which lasted until 1979. There is also an effort to restore the Pioneer (historically the City of Portland ) on the UP through Wyoming, Idaho and Oregon along the Columbia River, which came off in 1997. These are good ideas, but funding would not fit nearly into the scheme established by the Passenger Rail Investment and Improvement Act of 2008 (PRIIA), and there is barely enough equipment to run the trains operating today.

STATE-SUPPORTED TRAINS AND CORRIDORS

Amtrak’s ConnectUS plan for 2035 does not contemplate adding long-distance trains, but medium-distance routes and corridors that would be sponsored by the states. Amtrak would contribute some of the costs during the first few years of operation, after which the states would be on their own. There is a lot of talk, and some politicians have mentioned taking the money available under the BIL, but the experience under the Obama Administration’s High-Speed Intercity Passenger Rail (HSIPR) program demonstrates that a chunk of money might not be enough to get a train going. Republican governors in Ohio, Wisconsin and Florida rejected the grants, so the money went elsewhere.

While it appears that some new routes will be added by 2035, it seems unlikely that there will be many. Some states have been feeling the financial pinch since the pandemic struck, and the dust has not settled yet. While officials in many cities and advocates want to see new trains,

January 2023 // Railway Age 29 railwayage.com

Amtrak’s ConnectUS plan calls for dozens of new lines to start service by 2035.

PASSENGER RAIL OUTLOOK

rural interests generally oppose them, and those are the interests who call the shots in many states between the coasts. We might see five, or maybe even 10, new routes operating by 2035, but this writer would be pleasantly shocked if there are more.

It is not even clear that Amtrak could operate new routes after they are funded and capital improvements are completed. The proposed route between New Orleans and Mobile is a test case, and the recently announced settlement between Amtrak and CSX and NS means that there will be some line improvements, and that the trains will run eventually. When they actually start remains to be seen.

Elsewhere, though, it is unclear whether Amtrak can reliably operate the schedule it advertises. For the past several months, at least one daily round trip on most Midwest routes has been canceled for weeks, or even a few months, at a time. That means one daily round trip instead of two, or two instead of three. Whatever the reason, that state of affairs cannot inspire confidence among local or state officials who will have to chip in for the cost of new routes.

In New York state, the Adirondack between New York and Montreal has not run for almost three years. There is very little bus service north of Albany, and most of the communities that the train served have none. Officials like Sen. Chuck Schumer (D-N.Y.) have expressed their displeasure, but Amtrak’s answer seems to be “maybe next year,” the ongoing lament of Cubs, Red Sox or Mets fans.

So, the future of the corridors running today is not great, which makes the prospect for many new state-supported trains and corridors in the next 12 years far-fetched. The prognosis is guarded, at best.

THE NEC

There is no doubt that the NEC, and its

branches, will continue to host plenty of trains. Most of them are not Amtrak, but are operated by commuter/regional railroads New Jersey Transit, Metro-North, Long Island Rail Road, SEPTA, MARC and MBTA. Rider advocates elsewhere in the country have criticized Amtrak for unduly emphasizing the NEC, while service deteriorates elsewhere. They have excoriated Amtrak for appointing a Board composed mostly of Northeasterners and giving substantial bonuses to senior managers while service suffers in many parts of the nation.

The BIL has allocated more money for the national network than for the NEC during each of its five years of funding authority. Still, the difference in needs may exceed the difference in funding, especially since Amtrak is still not operating several trains outside the NEC that are part of the “normal” schedule.

Some capital projects along the NEC are necessary to keep the railroad going for the long haul, like updating the Baltimore Tunnel or replacing some old bridges. The Gateway Program enhancing New YorkNew Jersey service gained momentum once Joe Biden took office. The issue boils down to how much infrastructure does Amtrak really need, and how much would benefit peak-hour riders on the commuter regional trains that use the NEC. It appears that the transit agencies using the NEC need to sit down with Amtrak and take a fresh look at the anticipated needs of future riders and how to meet those needs affordably and effectively.

IT’S MOSTLY ABOUT POLITICS

On Amtrak, the NEC is strong, because the region is full of “blue” states, and Democrats reliably vote for funding for Amtrak and the commuter/regional railroads. Elsewhere in the nation, there

are corridors (defined as three or more round trips daily) only in “blue” or “purple” states. There is not a single corridor in a state where Republicans dominate. There are only three daily round trips on state-supported routes in “red” states: the Heartland Flyer in Texas and Oklahoma, and the two Missouri River Runner round trips between St. Louis and Kansas City. In the recent past, though, there has been only one daily round trip on the route, either because Missouri cut funding or because Amtrak canceled one of them for several weeks at a time. Sen. Roger Wicker (R-Miss.) has been strong in backing the proposed Gulf Coast trains through his state. When they start, there will be five daily round trips in red states, still a tiny percentage of Amtrak’s medium-distance runs.

The position of Amtrak’s statesupported routes is precarious, and that of the long-distance routes is even more so. Some advocates suggest that Amtrak should start acting less like an airline. The choice of the name “Airo” for the new Siemens trainsets that will run on the NEC and other corridor-length routes suggests the influence of airline managers and practices at Amtrak. The public’s love affair with air travel is diminishing. Amtrak competes with the airlines, especially along the NEC, but is it emphasizing rail’s superiority to air travel in the region?

Whether advocates outside the region like it or not, the NEC will survive somehow, even if Amtrak were to dissolve and the system is operated under the Northeast Corridor Commission or some other interstate agency, or even a private-sector corporation (both have been proposed).

That is not true elsewhere, and Republicans will be the key, especially in the next Congress. Long-distance trains run through the states they represent, even if corridor and local trains do not. If Amtrak were to alter its course and start emphasizing, improving and expanding the long-distance network immediately, some Republicans might get on the bandwagon to support those constituents who want to keep their trains and get more.

30 Railway Age // January 2023 railwayage.com

“Amtrak and its riders have experienced the best of times in some respects, along with the worst of times in others.”

RIGHT DECISIONS, RIGHT TIME, RIGHT AUTHORITY

PART 2: THE BUSINESS ENVIRONMENT AS A SERVICE PLATFORM

BY SONIA BOT, SHEPPARD NARKIER AND DAVID SHERR

BY SONIA BOT, SHEPPARD NARKIER AND DAVID SHERR

This is Part 2 of a three-part series based upon our new book, Dynamic Multi-Level Decisioning Architecture: Making the Right Decisions, at the Right Time, with the Right Authority for Sustained Competitiveness and Relevance. It’s about how all industries, including the rail industry, its partners and adjacent competitors, are evolving in the throes of digital disruption and other external forces, and emphasizes the role all employees play in decision-making at all levels of an organization. Decision-making needs to flow better upwards and downwards, tying the boardroom to the railroad yards, transloading facilities, tracks—the whole rail network and transportation ecosystem.

The Business Environment as a Service (BEaaS) platform can be viewed as enacting the end product of our decisioning

architecture. It’s what stakeholders and users can see, touch and experience—a natural digital meeting place for buyers and sellers of products and services. What makes this environment special is that stakeholders can be on any side of the market. It will make sense for some niche players to be providers to a larger provider who consumes a customized offering to provide a richer service that neither provider could offer by themselves.

An example is transloading, where several rail freight ecosystem participants such as rail, trucking and marine operators; shippers (senders and receivers); and trade financiers. The ecosystem comes together in a neutral digital meeting place, all with the incentive and accountability to make sure they benefit from smooth operations.

BEaaS is a platform that supports onboarding, updating, discovery and

orchestration of sets of industry-related services, which are mostly supplied by ecosystem partners. It creates a marketplace where newer services are less expensive to start up and maintain because the basic digital infrastructure is in place. The platform enables services to be changed faster and more frequently, a necessity in an age of constant disruption.

A good example is a dynamic railcar allocation model using a variable number of cars for specific roles based upon realtime assessment of incoming loads at key transfer points. This could greatly improve fuel efficiency and make better use of car utilization. It should enable railroads to be more quickly responsive to unexpected events with better flexibility.

The foundation of any IT service is provided through messaging, data delivery, service discovery and maintenance. The

32 Railway Age // January 2023 railwayage.com

NOTCH 8 TO THE GOLDEN RUN

goal is to easily integrate these services from different providers to deliver value faster with less startup investment exposure. In the case of any type of machine learning such as for digital twins, it is possible to have statistically aligned synthetic data available for secure model test runs, allowing for faster modeling and experimentation.

Another example would be railcar and locomotive maintenance in which, because of real-time feedback, a set of services and parts were projected in real-time to a service center in advance of train arrival. This would save time and improve service. A platform like this has enormous competitive advantages.

Things wear out in the universe even without use. Nicola Tesla’s insight painted a big picture when he said, “If you want to find a secret of the universe, think in terms of energy, frequency and vibration.” Energy, frequency and vibration put substantial stress on moving parts of rail freight equipment and infrastructure. There are ancillary assets—signals and switches, power lines that will need period repair. And last but not least, labor. Timely and proper maintenance underpins the performance of PSR, which improves vastly in a smoothly running system. That’s why decisioning on maintenance is critical.

WHAT IS DECISIONING?

Decisioning is becoming a mainstream business term. It is decision management for design automation, AI, machine learning and secure digital twin technologies. A decisioning architecture with the convergence of Operational Technology (OT) and Information Technology (IT) as the cornerstone enables making the right decisions, at the right time, with the right authority and scope.

It starts with how people assess value, which is in the eyes of the beholder. Each person has a value lens based on their role, the implied scope of their decision-making and the risk/reward calculation they make. For example, a brakeman would ask, “Could I lose my job, my life, or be injured?” A CEO would ask, “Could I cause a massive operational failure at a critical time that devastates my company and my reputation?” Both have very legitimate concerns. The difference centers on the impact scope and timeframe.

Another key aspect is the time in which a decision must be made. A brakeman might

NOTCH 8 TO THE GOLDEN RUN

have less than a minute, a railroad manager less than five minutes, and a logistics dispatcher a day. The C-suite might only have less than a month for a critical matter. Also, we need to consider the impact scope if a decision is not made. On a railroad, it could be massive. The principle is to limit the downside of not acting. A decisioning architecture defines meaningful components at certain levels of detail, then describes how these components interact with each other.

OT-IT CONVERGENCE

OT is often referred to as the “non-carpeted areas” of IT. Both involve computing, networking and storage technologies. OT is a category of computing and communication systems to manage, monitor and control operations with a focus on the physical devices and the operating processes they use.

IT focuses on business support and business enablement by using technology to collect, manipulate, analyze and generate insights from data.

In its most basic form, OT-IT convergence connects OT and IT systems, allowing them to share data. The goal is to use this connectivity to enhance the value these systems deliver. For example, consider an IT system connecting to a shipping container’s OT system for perishables. When the temperature crosses a buffer threshold, an alert is sent, and proper corrective action can be taken before the shipment spoils.

OT-IT convergence is driven by top-level business objectives, which are continuously managed and governed under an overarching executive-level authority. Common processes are the foundation engine while standard technologies and people competencies are the fuel. The payload is the knowledge that travels through the processes in the two worlds of OT and IT. And this knowledge can be refined to uncover latent needs and business value. The software connects, transports and shares the data throughout the converged system. IoT (Internet of Things) plays a substantial role.

SECURE DIGITAL TWINS

A digital twin is an intelligent agent, a virtual representation that serves as the real-time digital counterpart of a physical object or process. We build them with intelligent agent tools. Digital twins mediate data and information between OT and

the counterpart, IT; ergo the convergence happens. They are built by gathering data and information about anything you want to make it a copy of, and then recreating it in a digital space.

As an intelligent agent, a digital twin is out of sight, but certainly not unfelt. They are centrally situated in our decisioning architecture. The digital twin uses AI and machine learning, mostly to simulate the effects that change in a design process or conditions would have, all without subjecting the real-world object to those same changes. For example, suppose a management team is wondering if changing the maintenance schedule of the fleet of railcars and locomotives as well as other vehicles would positively or negatively affect the delivery of freight at their sites in the collective supply chain.

The same can be said of passenger routes and running these trains close to schedule for a great rider experience. If a digital twin of these operations is in place, then simply change the schedule there and find out without necessarily disrupting and putting the ongoing operations at risk.

The use cases in our book explore the example of how secure digital twins can assist in extracting value from supply chain business operations by being the nexus of OT-IT convergence for the physical asset. We start with key business processes, drilling down to keeping assets in working order so that goods and processes flow

January 2023 // Railway Age 33 railwayage.com

NOTCH 8 TO THE GOLDEN RUN

smoothly and efficiently.

Real-time or near real-time input is becoming a greater part of managerial understanding that will change approaches to operational tactics and overall strategy. Digital disruption and IoT are driving this change. Inexpensive, user-friendly sensors and advances in network access are making this possible. This technology is pervasive and will intentionally remain low-cost due to economies of scale. But they are more susceptible to hacking by entities outside firewalls.

Low-cost sensors, distributed data and diverse network traffic provide opportunities for system compromises at all levels of an organization. We need to design around this constraint, and this is where secure digital twins come into the picture. Secure digital twins have several layers of built-in protection. Data is scrubbed well before it is placed in repositories and has strong role-based access controls. Since sensors are devices that will have a simple digital twin model, sensor data needs to be carefully orchestrated.

Secure digital twins provide levels of predictability regarding how an operating device will respond to varying stress points from simple wear and tear to a significant breakdown. They can predict the need for maintenance well before the physical component fails. They can predict wear and tear impact on the operating mode of the entire machine, in real-time. If structured properly, they can work with an operations dashboard to alert of impending changes or even send the data to an operational control component to change an operating mode in real-time. This move toward greater autonomy is a game changer in terms of safer, more effective and more efficient operations.

THE BEAAS PLATFORM

The BEaaS has decisioning architecture to support decision-maker actions. It’s an architecture with tools to develop multi-tenant SaaS (Software as a Service) instances that are consistent with that architecture. And it’s interoperable with any IaaS (Infrastructure as a Service) offerings. Security and privacy are table stakes for a BEaaS platform.

As OT converges with IT, the digital twin is the IT connection to the OT device. It’s an actual image of an intelligent agent that not only discovers insights but also can act upon them (autonomy). It continually updates the state of the device through the stream of

sensor data, exclusively mediating messages among IT services. The OT device is one of the very few cases where something is hard-coded due to sensor limitations. The digital twin notifies a device of state change requests and contains and runs analytic measures of the device’s behavior.

The secure digital twin operates in a “cloaked network,” providing digital and some physical security and privacy levels. BEaaS security digitally certifies private and secured digital twins. As well, the digital twin “knows” any instruments used by the device to promote physical security. This is called physical surveillance. Regulators dictate operational safety surveillance. Operators act; regulators surveil. These regulators can be inside the enterprise and/ or outside the enterprise, in government agencies like OSHA, FRA, NHTSA or nonprofit industry groups.

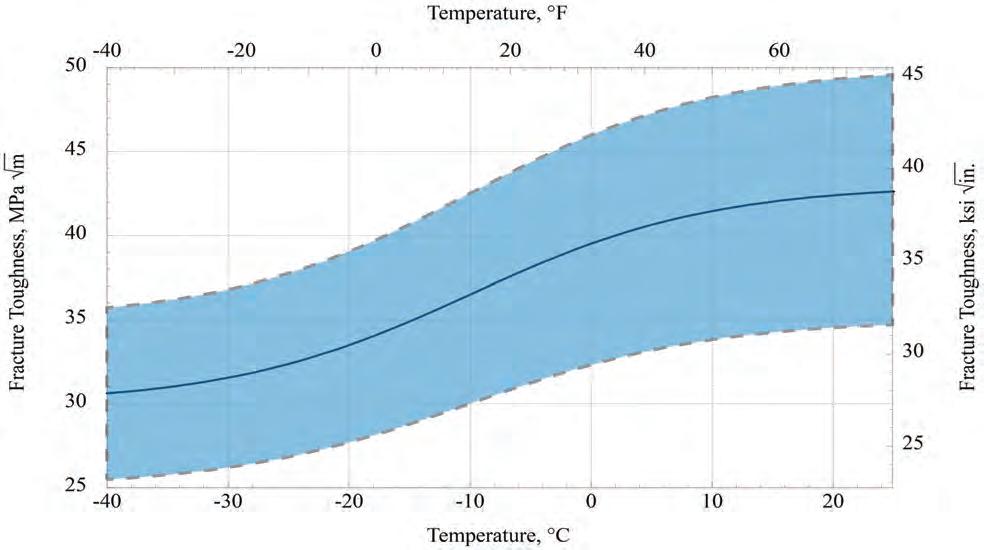

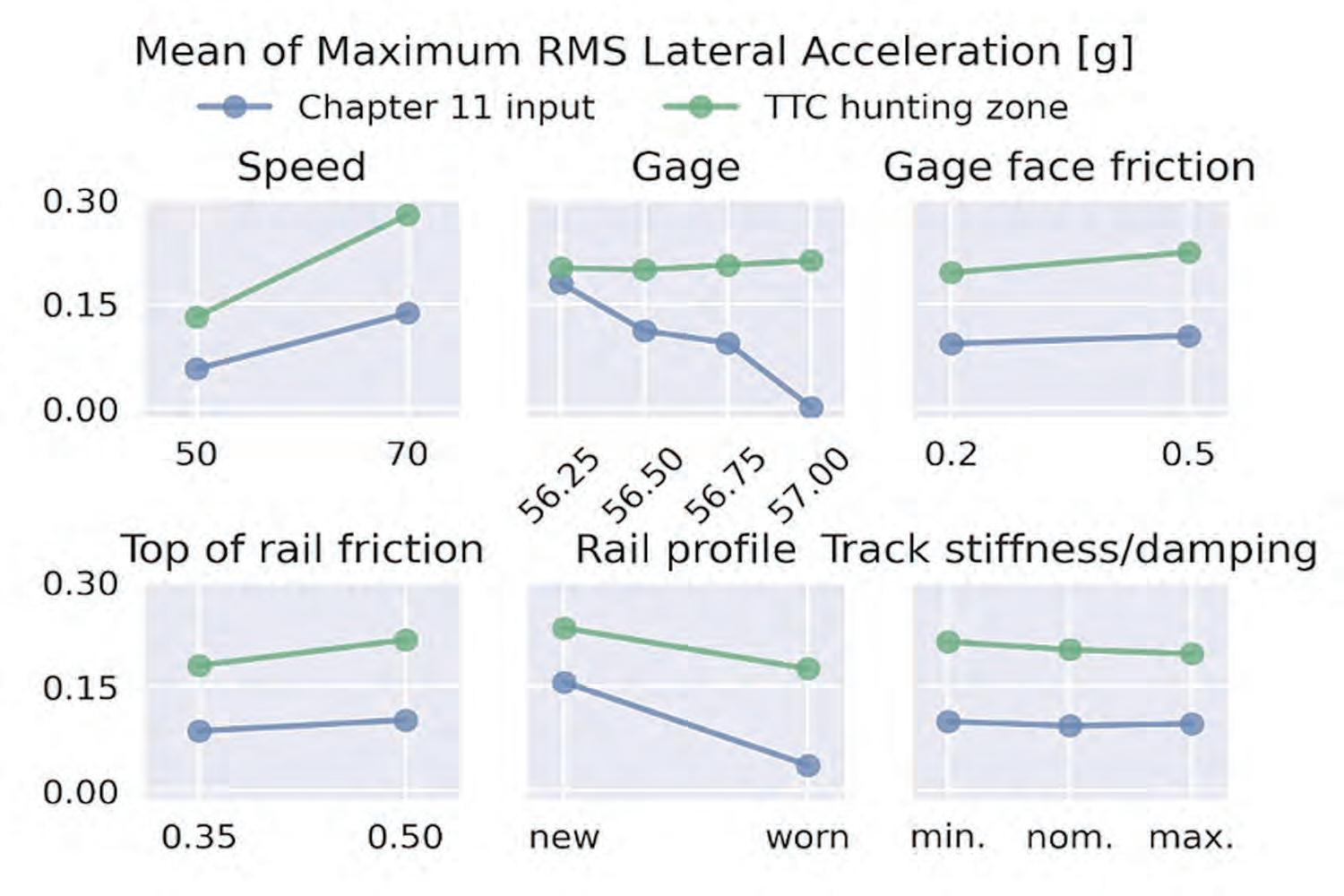

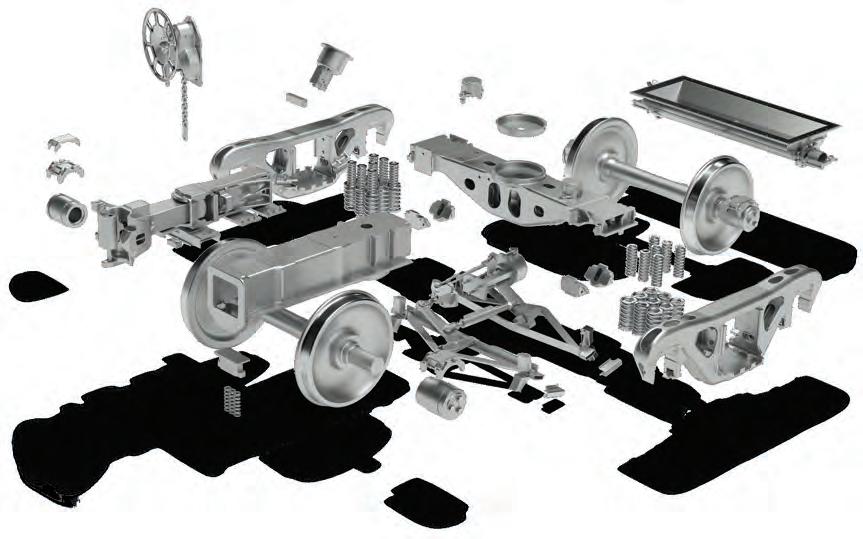

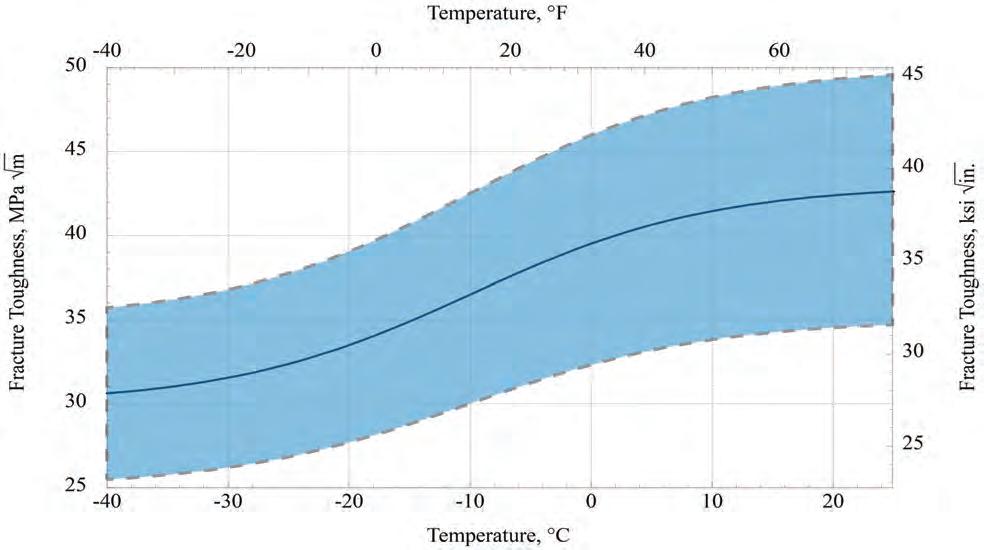

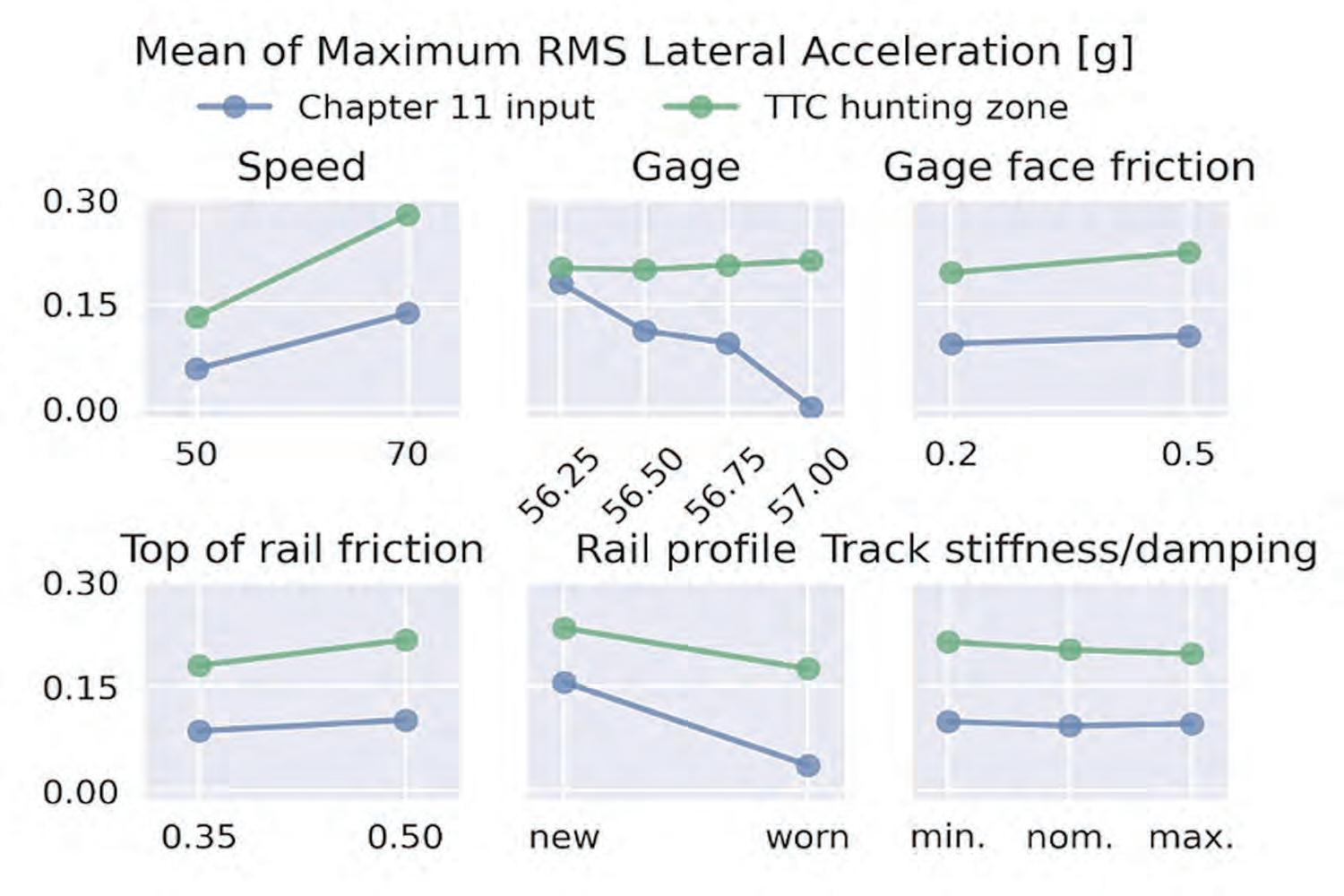

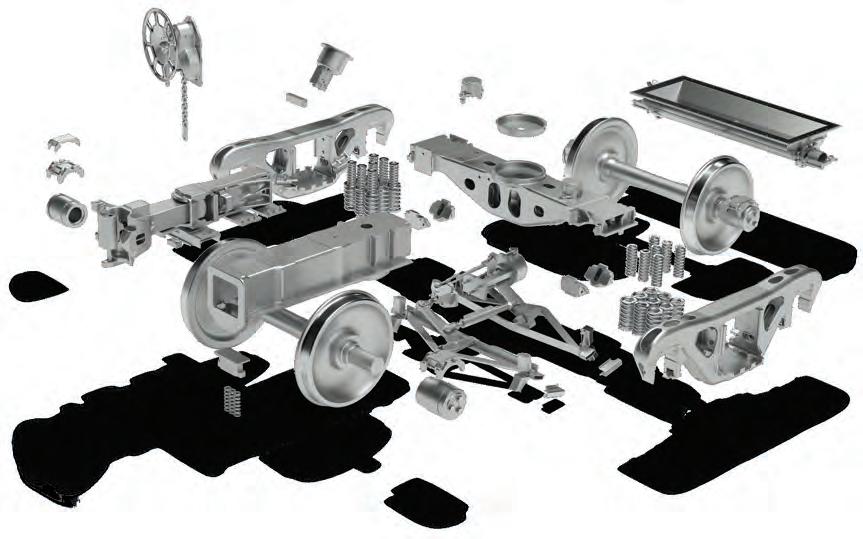

People typically make investment decisions based on incomplete and aged information, while market, technological, economic, regulatory, weather, environmental, and other forces and events around us continue to change, at faster rates. Ambiguity tends to increase. The continuous influence of external forces adds another layer of complexity. We find that most decision-makers don’t really understand the technical debt and overall enterprise drag that already exists in their span of influence and control, especially in systems with an abundance of legacy, whether it’s technology, processes, skillsets, policies, regulations, products or services.