September 2025

Forward

On 9 April, the Railway Industry Association (RIA) in partnership with the RIA Exports Leadership Group (RELG), the RIA SME Leadership Group and attending officials from the Department for Business and Trade (DBT), along with UK Export Finance (UKEF) and Innovate UK, held an SME Exports Workshop with over 90+ UK rail-related company representatives registering.

The aim of the workshop was to encourage UK rail SMEs to learn more about how to start exporting or to grow existing exports. This is especially important in today’s challenging market domestically or for the future, in order to help SMEs spread risk, become more resilient, and ensure they are not just reliant on individual markets or single clients.

Workshop delegates heard from and networked with fellow exporters, Tier 1 companies and Government representatives, who then took part in an interactive whiteboard session and answered four questions related to exports, the objective being to enable the organisers to acquire a greater understanding of both potential issues and what more could be done to assist UK SME exporters.

The findings of this interactive session, the company insights and thoughts have helped form a narrative to shape and support UK companies going forward.

SMEs that engage in exporting are more likely to experience growth, providing clear benefits not only to the UK economy but also to the broader UK supply chain. Highlighting the importance of exports, Business and Trade Secretary Jonathan Reynolds stated, “we know that when more small firms export, it leads to more jobs and higher wages and grows the economy.”1

The 10th edition of the UNIFE World Rail Market Study (2024)2 expects the global rail supply market to follow a positive growth trajectory through to the end of the decade. The market is projected to grow at an average annual rate of 3% in real terms, driven by continued investment in rail infrastructure, rolling stock, and services. By the period 2027–2029, the average annual market volume is forecast to reach €240.8 billion, excluding the effects of inflation. This outlook is based on an analysis of more than 10,000 planned rail project orders, including greenfield developments, asset replacements, and modernisation initiatives across major global regions.

The latest full figures published by DBT for 2023 show that UK rail exports amounted to over £1bn, comprising £454m of railway equipment exports and £613m of railway services exports3 (with figures due to be updated in October 2025). Rail-related exporters and their supply chains contribute 12,500 jobs to the UK economy each year.

1 Department for Business and Trade, 2024. Small businesses set to see a boost in exports and growth with new expert panel https://www.gov.uk/government/news/small-businesses-setto-see-a-boost-in-exports-and-growth-with-new-expert-panel

2 UNIFE – The European Rail Supply Industry Association ,2024. World Rail Market Study: Forecast 2023–2029. Presented at InnoTrans 2024. https://www.railtarget.eu/business/10th-world-railmarket-study-reports-27-annual-growth-and-positive-outlook-for-the-decade-9296.html

3 Office for National Statistics, 2024. Source: ONS trade in services and ONS country by commodity

To access the April Workshop event, each company had to answer a pre-event survey about their experiences of exporting, to provide data about the companies in attendance at the workshop, listed in Annex A.

This report, produced by RIA Exports, RELG and the RIA SME Leadership teams, summarises the insights from the Workshop, and includes thematic analysis, response counts, and executive recommendations based on these responses to the four questions, listed in Annex B

The aim is that Government, officials, and those organisations in a position to assist SMEs and UK exporters, consider the responses from UK rail SMEs and where possible, undertake recommendations and measures to improve the available support and services to empower the UK’s exporting railway community further.

RIA’s RELG Chair, and Associate Director, PriestmanGoode, Joy Grover:

“This membership consultation exercise is a call to action for the Government and those in a position to influence to give more support to companies who contribute to our export economy, SMEs, Tier 1 & 2 companies and OEMs [Original Equipment Manufacturers] in the UK rail industry. It particularly highlights the challenges faced by smaller UK rail companies who are considering exporting or aiming to increase their export income. It is essential to preserve our supply chain in the UK, not only for economic success, but also to ensure that when infrastructure projects are released in the UK, a domestic supply chain still exists to deliver them.”

Catherine Leech, RIA SME Group Chair, and Anturas Consulting MD, said: "SMEs form a critical part of the UK economy so it is in the interest of the UK to create an environment where SMEs can thrive both at home and abroad. The Workshop has provided invaluable insights into the how SMEs view the world of exporting and more particularly the struggles with pursing opportunities. As RIA SME Group Chair, I can reiterate that RIA and its SME members are committed to breaking down barriers and working across the sector to facilitate a stronger exporting community."

Neil Walker, Exports Director, Railway Industry Association, said: “It’s clear to see there is a growing appetite and wish to export among UK SMEs, who often need more support in sourcing help, information, rail related market intelligence or exporting activity available to them. Next steps, supporting our exporters, working with officials and supported by RELG to address these concerns is clearly an outcome we would want to take forward following this report.”

Executive Recommendations

This report is a starting point for RIA, industry and stakeholders, to work together to improve rail exports and the support available to UK exporters. In summary, it recommends:

• Better signposting of available exports support and related training;

• Better sharing of overseas market intelligence;

• To be aware of, and to utilise, UKEF [UK Export Finance] services to unlock financial support and access to procurement opportunities;

• Strong relationships to be created between Tier 1 companies and SMEs to support the railway industry’s ability to bring increased export value to the UK economy; and

• RIA, RELG, DBT, UKEF, DfT and Innovate UK to form a working group to provide solutions to the report’s recommendations, where practical.

Introduction

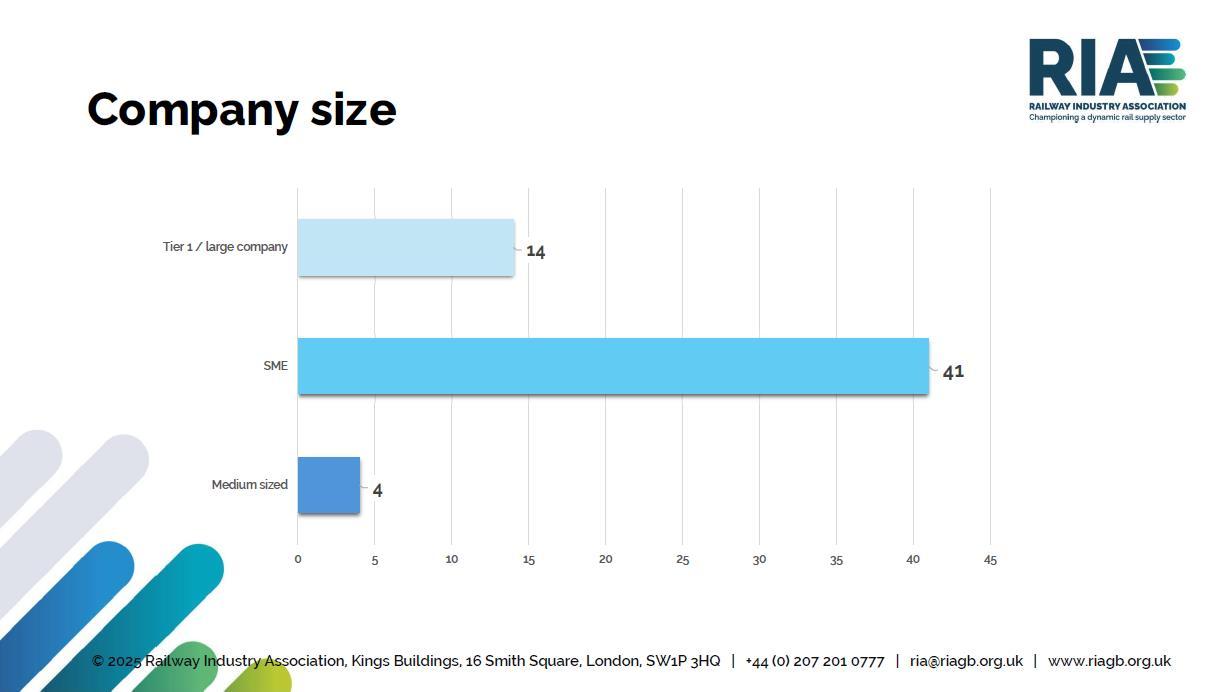

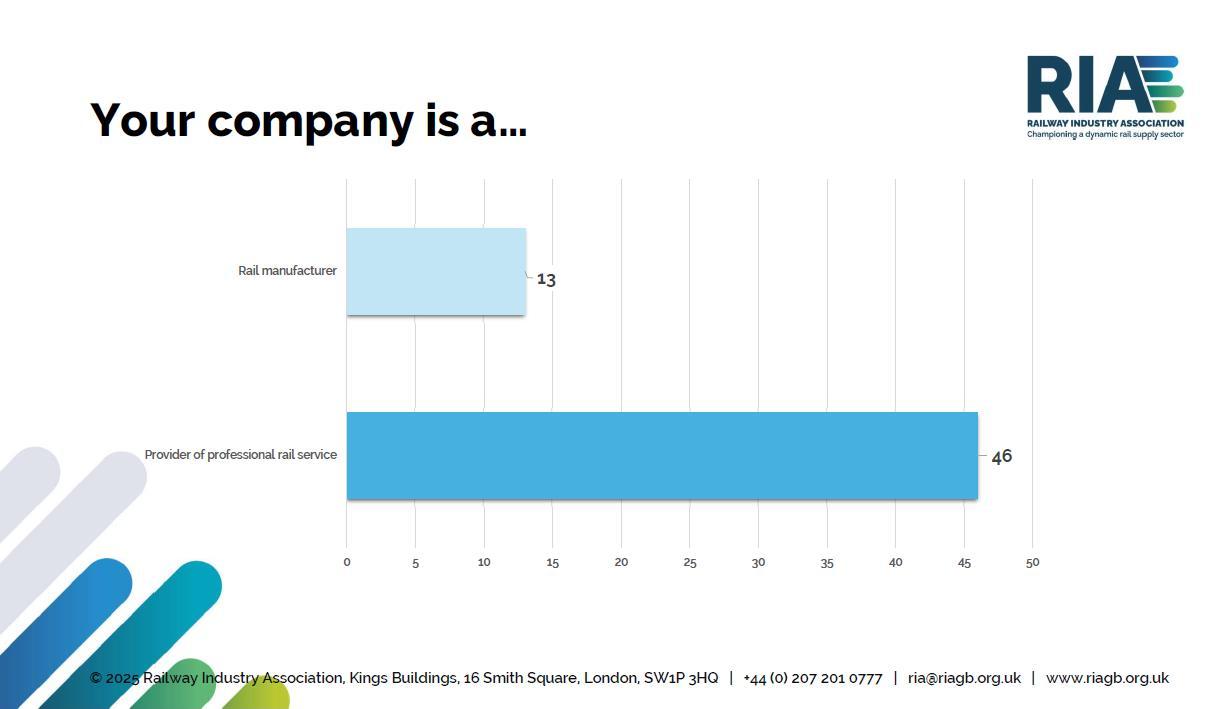

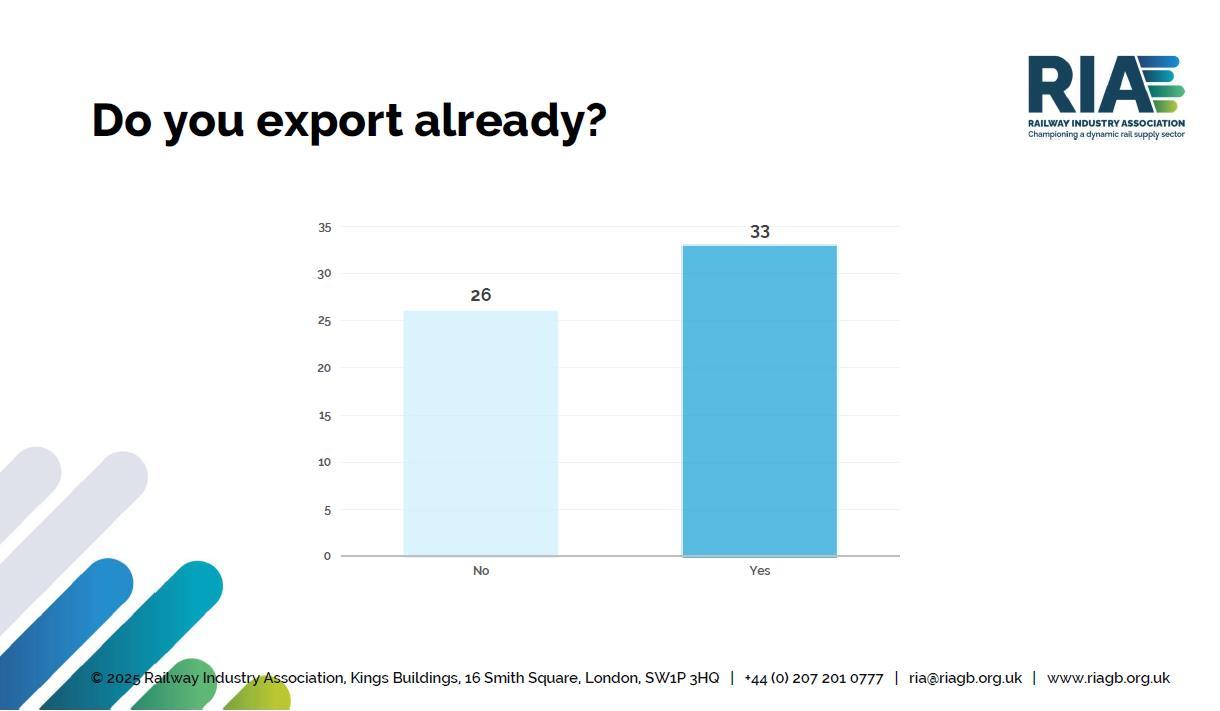

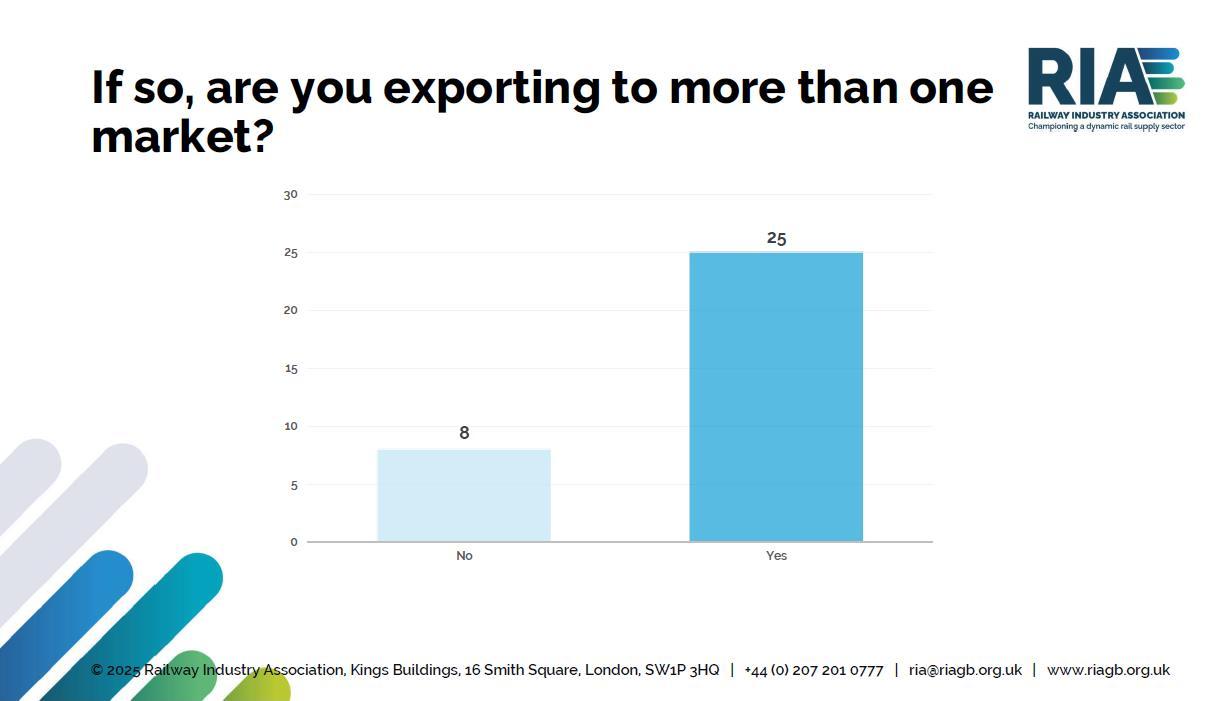

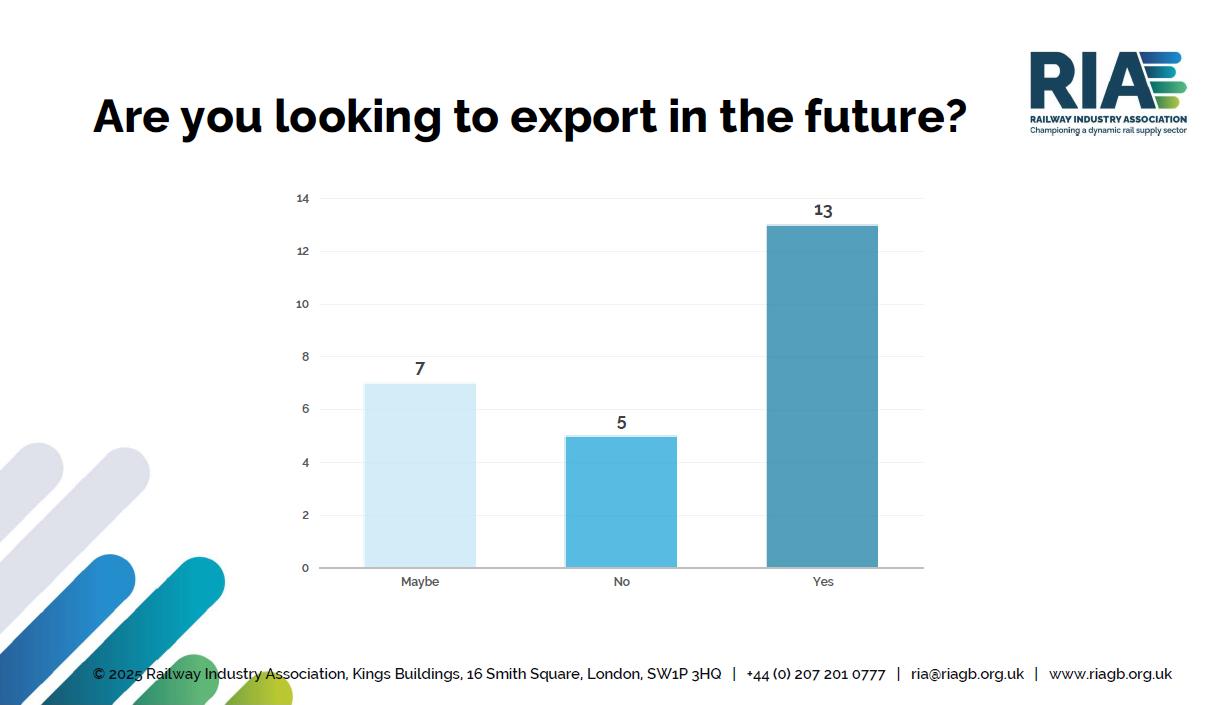

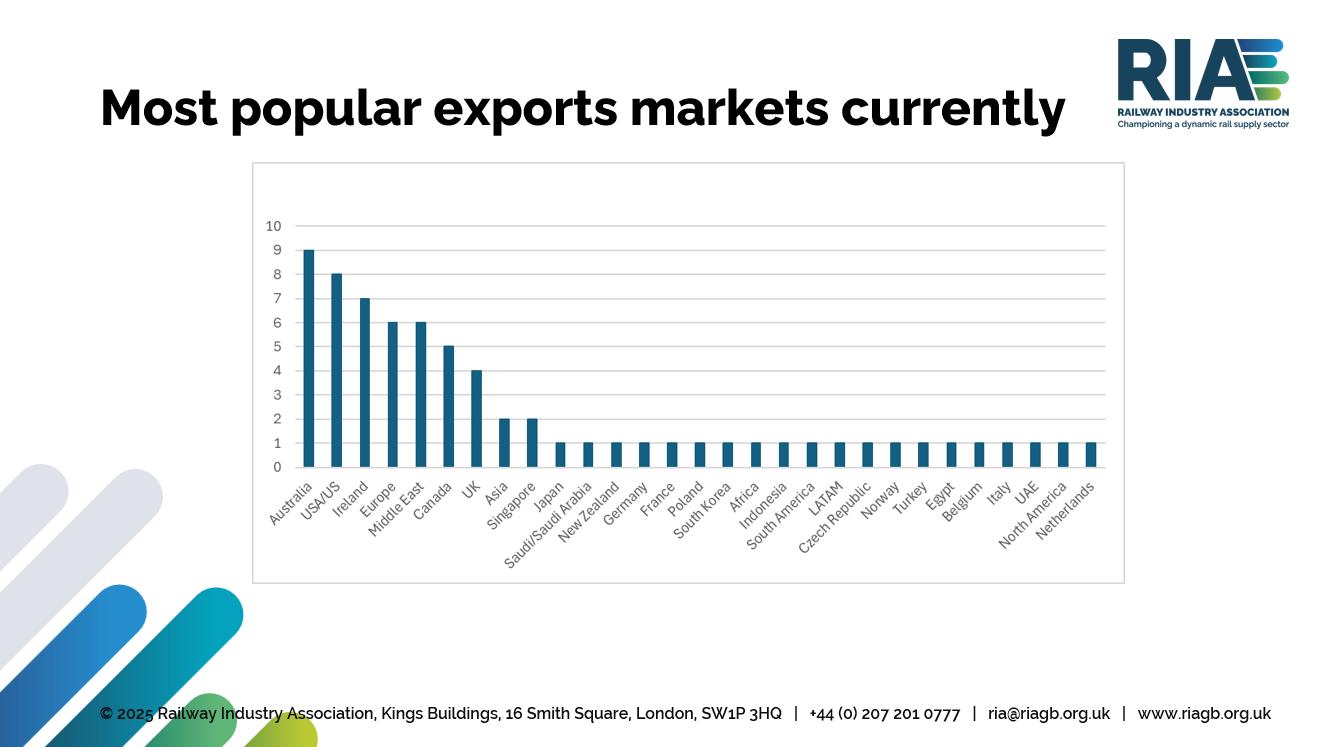

The SME Exports Workshop session was well attended with over 70% of attendees being SMEs. There was also a strong contingent of Tier 1 companies and larger businesses, which made up 24% of attendees The majority of businesses provide professional services (78%) while the remainder were in rail manufacturing (22%). Over half of the attendees currently export, and of those the majority currently export to more than one market.

The Workshop was split into two sessions. Session 1 allowed Government bodies and SMEs to engage with attendees and identify routes to market, funding options and share intelligence. Session 2 was a set of ‘sub workshops’, where four questions were posed and discussed. A facilitated discussion was held at each table with the aim of providing insights from the attendees to allow a set of recommendations to be developed. These recommendations have now been worked up to be used to allow RIA to support those in their membership who are on an exporting journey or wish to begin that journey.

This document is an overview of the points raised during the discussions and the highlevel recommendations in response to each question. The full responses are in Appendix B.

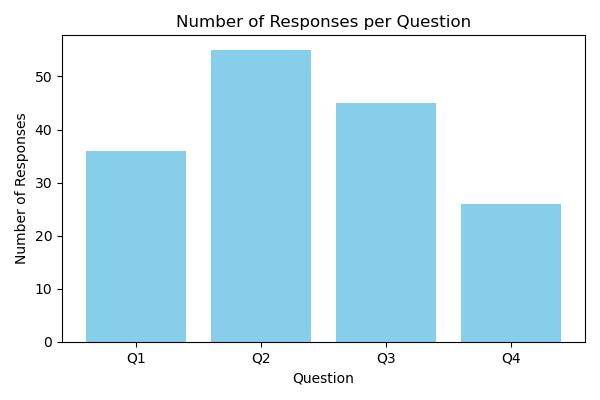

The level of engagement was high, with the graph below providing the number of responses to each question.

Question 1 - How can Tier 1 companies support exporting SMEs better?

The definition of Tier 1 companies for this report is the company contracted by the project client or EPC, which include, but is not limited to, original equipment manufacturers (OEMs), main contractors or major consultancy companies.

Summary

• Transparency and communications are key to building trust and aligning capabilities.

• Partnerships and networking with global clients can open new markets for SMEs.

• Tier 1s can support innovation and development through training and supplier programs.

• Strategic procurement and early identification of SME needs are essential.

• Promotion of UK SMEs and showcasing success stories enhances visibility.

Recommendations

• Encourage Tier 1 companies to appoint SME champions and promote UK supply chains.

• Facilitate trade missions and innovation challenges, encouraging Tier 1 companies to be involved where applicable.

• Improve visibility of their Tier 1 procurement pipelines.

• Support long-term relationships and early engagement funding.

• Tier 1 companies to be familiar with UKEF’s service offers and promotions and, where feasible, involve UK SMEs in meeting UK content requirements.

• The possibility of exports mentoring between Tier 1 companies and SMEs should be explored, with suggestions around how to achieve it to be discussed with stakeholders.

Question 2 - How can government, quangos, and trade associations support exporting SME’s better?

Summary

• There is a need to improve visibility and communication of support programmes.

• Funding, tax relief, and trade mission support are critical.

• Knowledge sharing through webinars and best practices is valuable.

• Local advisors and market intelligence help SMEs navigate new markets, but need consistent signposting

• Collaboration platforms and matchmaking events foster partnerships.

Recommendations

• Better signposting to the available resources, support and activity provided by Government and RIA This includes support provided by devolved governments.

• Increase visibility of routes to access funding or financial initiatives and reduce bureaucracy in their processes.

• Promote sector-specific market insights and local advisors.

• Organise matchmaking events and community platforms to connect both exports and those offering support.

Question 3 - What would make a fundamental change to allow you to export or export more?

Summary

• Training and education on export strategy and regulations are needed, or better promotion of what is available.

• Financial support and payment reliability are major concerns.

• Access to market intelligence and buyer introductions is crucial.

• Digital transformation and alternative sales channels are growing in importance.

• Policy support and trade agreements can unlock new opportunities.

Recommendations

• Provide better signposting to export training and strategy development support that is available, and to advertise specific and related training better.

• Continue to advocate for financial support for UK SMEs, enabling them to start exporting, and signpost to insurance-backed guarantee schemes and other financial safeguards offered by UK Export Finance or similar bodies.

• Facilitate access to market data and buyer networks. DBT to share their market rail reports when produced, via an in-person workshops to enable related networking.

• Support digital sales initiatives and policy advocacy.

Question 4 - Open discussion on trade barriers and export readiness

Summary

• Information gaps and lack of project visibility hinder export efforts.

• Execution challenges include market entry, tariffs, and cultural differences.

• More in-country support and education are needed.

• Strategic enablers include free trade agreements and certified exporter programmes.

Recommendations

• Improve access to, and promotion of, market data and project pipelines.

• Provide export readiness training and cultural education.

• Promote the value of rail exports, to ensure that rail continues to be a priority sector when considering Embassy support and in-country resources.

• Publicise exporter programmes and trade agreements.

Next Steps

• RIA will look to create a working group alongside RELG, DBT, UKEF, DfT and Innovate UK, to suggest solutions to the report’s recommendations, where practical.

• An Action Plan will then be developed with the stakeholders to provide possible solutions to issues raised, and to engage in rolling out solutions.

Other resources

• RIA Nations & Regions

• RIA’s Pre-Mission Webinars

Question 1 - How can Tier 1 companies support exporting SMEs better?

Anonymous Company Answers

• Honesty between SME & Tier 1 about capability

• How do Tier 1 buy 'procurement' category management approach?

• Connecting SME with global clients where a presence in market

• Promote 'British' built with UK SME content.

• Use UK SME supply base on global contracts/projects.

• SME visibility of Tier 1 & companies by country / SMEs shadowing Tier 1s

• Supplier development programme sharing product knowledge.

• SME fragmented relationship between tender delivery

• Sensible make-buy decisions

• Map of Tier 1 (UK) players working internationally

• Transparency of pipeline

• Developing a long-term relationship

• How do Tier 1 support SME to fund early engagement

• Better visual partnership to gain ideas.

• Wide market knowledge & 12+ months ahead

• Tier 1 to support innovation challenges.

• Tier 1 can support by building wide networks with the global market.

• Understand the value SME can add in specific projects.

• Tier 1 supply chain events - procurement process

• Promote Innovative SMEs to the wider global businesses.

• Identify 'gasps' in Tier 1 offers - product, innovation, resource.

• Share key target countries, are SMEs there already?

• SMEs attending trade missions with Tier 1

• Sponsorship of business lounges/receptions at global shows

• Access to domestic opportunities to better understand procurement routes.

• Tier 1 to promote UK SME supply chain.

• Connect UK successes to overseas Tier 1 colleagues - best practice.

• Use UKEF as UK supply chain.

• Earlier identification of opportunities

• Tier 1 to ID SMEs who are needed for main contract/project requirements.

• Appoint an SME champion / Be more imaginative with global bids.

• How do we as Tier 1 share market insight better to future work?

• Value add in training, marketing, development.

• Showcasing the existing support and key capability of supply chain

Question 2 - How can government, quangos, and trade associations support exporting SME’s better?

Anonymous Company Answers

• At events fly flag for SMEs

• How do we get on lists of GB services

• Giving more visibility workshops

• Be aware that other companies have similar issues sharing experiences.

• Understand who actually provides help, where to seek for support

• Understand how you can transfer skills within/between countries.

• RISK (reduce); not understanding the client, process, culture, the environment and

• commercial risk

• Access other organisations working in the country.

• Support with targeted trade missions and events such as InnoTrans.

• Hold more awareness sessions.

• Should we support quangos or invest directly to the UK market?

• Bring more senior people to stands.

• Share more insights.

• DBT hand holders - who are they?

• More funding

• Tell us what we as SMEs can do to help you help us.

• Do more online webinars.

• Recognise SMEs time and resource.

• Have more inward missions to UK so we don't have to spend money going there.

• Tax relief on first 3 years of exporting.

• Trade mission calendar visibility for better planning

• Exports newsletter once a week with everything

• Exports roadmap - where, what, and when?

• Everything in one comms

• DBT's digital export programme

• Don't sell valuable assets.

• Store knowledge and contacts; do not lose it.

• Reduce paperwork to processes, timing is key.

• Sector DBT gateways.

• In post at embassies, employ local long-term advisors.

• Marketing service to opportunities

• In market local knowledge

• Introductions, opening doors.

• Identify high value opportunities.

• Marketing & information

• Trade association partnering with government at events.

• Support for pavilions, money or on site added value services.

• Awareness - we need to see what is available.

• Introduce us to similar companies we can partner with

• Joint trade association knowledge, who is trade advisor in Australia, Canada etc?

• Information sign posting / Opening doors - trade missions.

• Better communication of activities as half of ten was unknown.

• A group / network web chat where you can post a question and get advice from other companies.

• Best practice sharing between SMEs, experiences, success stories, collective learning (RIA could support?)

• Rely on Tier 1 suppliers to support against risks.

• Better access to Tier 1s and understanding of possible opportunities and gaps to add value.

• Tier 1 actively reaching out to SMEs.

• Greater visibility of the funding routes and gov support

• RIA could organise a match making speed dating between SMEs and Tier 1s.

• Can other government departments have sector specialisation like DBT Rail Team?

• Partnership programmes between SMEs and Tier 1s

• Market insights, consumer trends, reports/data

• Build awareness of available resources regarding the community.

• Location map of areas where we could collaborate.

Question 3 - What would make a fundamental change to allow you to export or export more?

Anonymous Company Answers

• At events fly flag for SMEs

• Recognition trusted partner programme

• Greater understanding

• Access to market intel, more webinars

• Rail influencers - who are they?

• Export training

• Skilled workforce

• Knowing client/company payment, history

• Getting paid on time.

• Understand risk.

• Tax relief on international profits for 3-5 years.

• UK Export events

• Funding support

• Identify local partners.

• Reciprocal trade with trade partners

• Sign posting for market intel, confusing currently.

• Export strategy builds local domestic relationship.

• Understand the internal and external barriers to export.

• Introduce custom union with EU.

• Government committing to longer financial for events ahead of time (civil service +

• minister commitment)

• Know before you go.

• Lobby government for support to match other countries.

• Making sure SMEs are using all digital channels.

• By 2030: 70% of all sales by digital sales

• Route to market via alternative channels

• How can government departments create more collaborations?

• Route to growth in country

• Use published market data - country, value, segments.

• Skilling up for export including strategy.

• Finding support to fill the gaps for export plan

• Understand standards and regulations.

• UKEF intel

• UKEF - slow responses, not helpful

• More case studies

• Introductions to buyers at the right level

• Audience specific introductions

• Identify targets.

• Knowing the countries we can export to

• SME being specified in tech spec.

• Tier 1 to help more SMEs.

• Competitor analysis

• More collaboration with UK companies to support each other.

• Exporter club by territory

• 1 person to give advice (account manager)

• OEM's help bring SMEs in

• Trade Show funding

Question 4 - Open discussion on trade barriers and export readiness

Anonymous Company Answers

• Project visibility and point of entry.

• More market intelligence required.

• No overall supply chain coordination

• How to execute when there is a desire to export?

• Can RIA info be freely published on export? Justify to Board?

• Lack of info about the market

• List of current projects and dates would be a massive help.

• How can RIA help members be 'certified exporters'?

• How to be export ready? Have to go to do it in order to learn how to do it.

• More reliable returns

• Better and the right type of marketing for different countries and projects

• Knowledge of who to export to is needed.

• How do you educate senior leaders about exporting, especially around ROIs and timelines?

• Local requirements

• Local market dominance - difficult to break into markets.

• Tariffs

• More support needed in territory.

• Need more education and training on exports.

• Bring back TAP funding or a new version of it.

• More and stronger in-country support and information

• Better signposting

• Higher duties imposed when exporting to a country that has a company making a similar product.

• Cultural differences

• Currency risks

• Embassies are often not specialists, and it is difficult to get the answers needed as they don't know.

• Free trade agreements