Table of Contents About Us 4 Mission & Vision 8 RADD America 10 RAD Diversified REIT, Inc. 14 RAD Diversified OZ Fund, LP 16 Community Outreach 18 Executive Team 20 Timeline 6

About Us

RADD is a conglomeration of companies that share a common ethos: educate and empower investors to build generational wealth and a legacy to be proud of. Lead by Dutch Mendenhall and Amy Vaughn, RADD is comprised of a myriad of REITS and funds with offerings in Reg A+ and Reg D, an exclusive joint venture community for accredited investors, and an alternative investment education platform. With an emphasis on fractionalized ownership and “people first”, RADD has established itself as an industry leader in the alternative investment space.

2015

• Inner Circle started

• First fund

• 6 employees

• We did the deals and knew we could do the deals with you/for you

• Paid all cash

• We made investors money

$30M INVESTED (2018-2020)

• We put in the hours

• We grinded daily

• We kept doing deals

• We built teams

• We built processes and systems

• We made investors money

$67M INVESTED

$5M INVESTED $20M INVESTED 2020 2021 2019

$100M INVESTED

2022

• $5,000,000 in partnerships with Inner Circle members

• $30,000,000 in partnerships with Inner Circle members

• $67,000,000 from over 1,000 deals in partnership

• 50+ employees

• The Opportunity Zone Fund

• $100,000,000 total portfolio assets

• 276 properties acquired

• 110+ employees

• We pay entire rehab/construction costs for members

2016 2017 2018

$200M INVESTED

2022

• RADD America

• Crypto Fund

• Other Alternative Investments

2023

• 119 properties acquired as of June

• New business ventures

• 200 Million assets managed

• Hard money loans

• RADD Ventures (VC opportunities for Inner Circle Members)

• BOXABL REIT (future offering)

• Establishment/foundation of AIA

• Launch of Redefined American Dream education

• Golf Suites Partnership

• ERC Communities Partnership

• Acquisition of Golf Course/Country Club

2023 & Beyond

Create a Billion Dollars in Assets with Our Partners

Our Mission

RADD builds paths to generational wealth based on our unparalleled research and a forward-thinking mindset. We accomplish this by educating, empowering, and inspiring dedicated people and partnerships to reach beyond their financial goals to leave a long-lasting legacy. We thrive during the best and worst economic times through great alternative investments, talented people, the strongest relationships, and industryleading preparedness and planning.

Our Vision

To establish RADD as the leading nontraditional alternative investment company in America. We will make an impact by providing the best opportunities and research for alternative investments. We are not perfect, but you will know that we care, we are different, and we are transparent through clear, concise, and proactive communication. Our investors will not be merely a number to us, but a face and member of our Tribe. The partnership we establish will result in building your wealth and meeting your goals. We pride ourselves on ensuring you leave your legacy for future generations.

RADD America Regulation D and Regulation A+ offerings (coming soon) focus on the acquisition and revenue operations of all types of American land.

Right now, our team is on the road, scouring the country for the best RADD America parcels. When we find something we like, we run it through a rigorous due diligence process. If a property meets our due diligence standard, we negotiate a purchase price that will position RADD America for capital gains as the value appreciates and annual revenue increases.

This is not an offer; offers will be made only by means of the Regulation D documents available at www.raddiversified.com, either of which may be updated or amended from time-to-time with the most recent Offering Documents. The acquisition of any property identified in this communication is subject to various contingencies and may not be consummated. Past performance is not an indication of future results. Investing involves risk and may result in partial or total loss. Prospective investors should consider investment objectives, risks, charges, and expenses carefully and consult with a certified public accountant (CPA), tax advisor, or legal advisor before making any investment decision. REGULATION A: NO MONEY OR OTHER CONSIDERATION IS BEING SOLICITED, AND IF SENT IN RESPONSE, WILL NOT BE ACCEPTED. NO OFFER TO BUY THE SECURITIES CAN BE ACCEPTED AND NO PART OF THE PURCHASE PRICE CAN BE RECEIVED UNTIL THE OFFERING STATEMENT FILED BY THE COMPANY WITH THE SEC HAS BEEN QUALIFIED BY THE SEC. ANY SUCH OFFER MAY BE WITHDRAWN OR REVOKED, WITHOUT OBLIGATION OR COMMITMENT OF ANY KIND, AT ANY TIME BEFORE NOTICE OF ACCEPTANCE GIVEN AFTER THE DATE OF QUALIFICATION. AN INDICATION OF INTEREST INVOLVES NO OBLIGATION OR COMMITMENT OF ANY KIND. AN OFFERING STATEMENT REGARDING THIS OFFERING HAS BEEN FILED WITH THE SEC. YOU MAY OBTAIN A COPY OF THE PRELIMINARY OFFERING CIRCULAR THAT IS PART OF THAT OFFERING STATEMENT

raddamerica.com

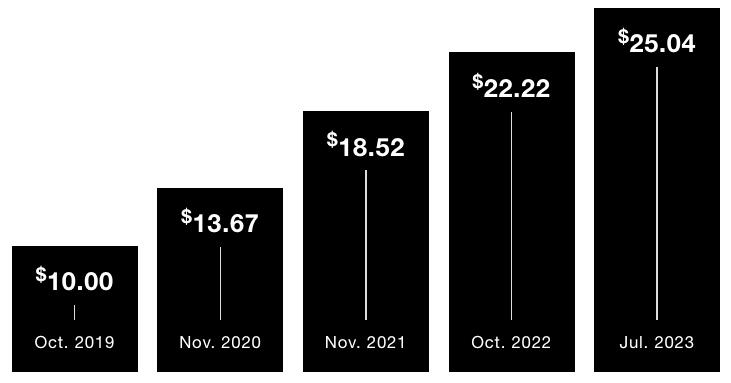

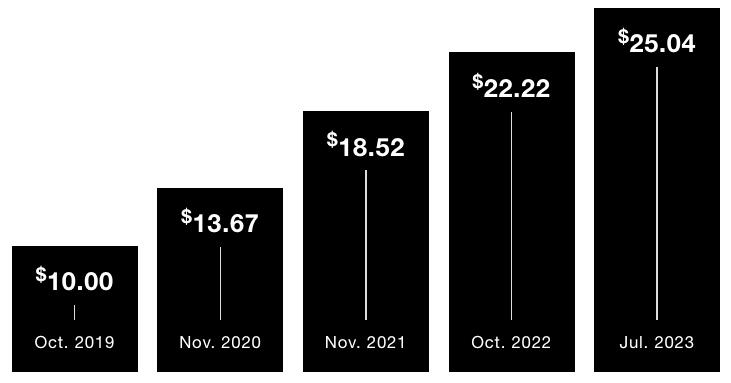

Initial share price: $10/share

Minimum investment: $10,000

Hedge Economic Turmoil

Real estate investments (and land investments, specifically) hold up well in times of crisis, inflation, or recession because land provides our basic needs: food, water, and shelter. Moreover, real estate that produces income creates a onetwo punch when inflation strikes price appreciation and a rise in income. Investments in income-producing properties like farmland, timberland, ranch land, and raw land can be used as bastions of safety and stability when the economy lurches, or the stock market fluctuates.

Build Wealth Through Fractional Ownership

American land investments have created many millionaires and even some mega-billionairescreating generational wealth and a legacy for those who crave it. As of 2021, Donald Bren, the wealthiest real estate billionaire in the U.S., had a net worth of $16.2 Billion. To put that in perspective, assuming it was all liquid, he could spend $17.08M a month for 79 years before running out of money.

Protect Our Great Nation

As of 2019, 2.7% of farmland, or 35.2 million acres in the U.S. is owned by foreign investors according to the USDA. These foreign entities range from billionaires abroad to countries like China. The number of foreign-controlled US farmland grows each year, begging the question of how much American soil is too much for foreigners to own.

When Americans invest in America, we, the people, win.

1

3

2

Weiser, Idaho Farm

OVERVIEW

Purchase Price $8,050,000 (12/2020)

Renovation Costs $1,100,000 (8-month rehab)

Appraised Value $24,500,000 (12/2022)

Exit Strategy Operate as income-producing farm

Held in RAD Diversified REIT

Profit 160 acres sold 8/2021 for $550,000

DESCRIPTION

2219 N Weiser River Rd, ID (“The Baker Farm”) is a 2,754-acre farm/ranch. The Property is a mixture of cropland and pasture. The renovation was completed in 8 months. Costs include approx. $250,000 in new pivot irrigation system and approx. $50,000 for farmhouse remodel. The highest and best use is the current agricultural use both as-vacant and as-improved.

raddiversified.com

Past performance is not indicative of future results, no investment is guaranteed regardless of its past performance.

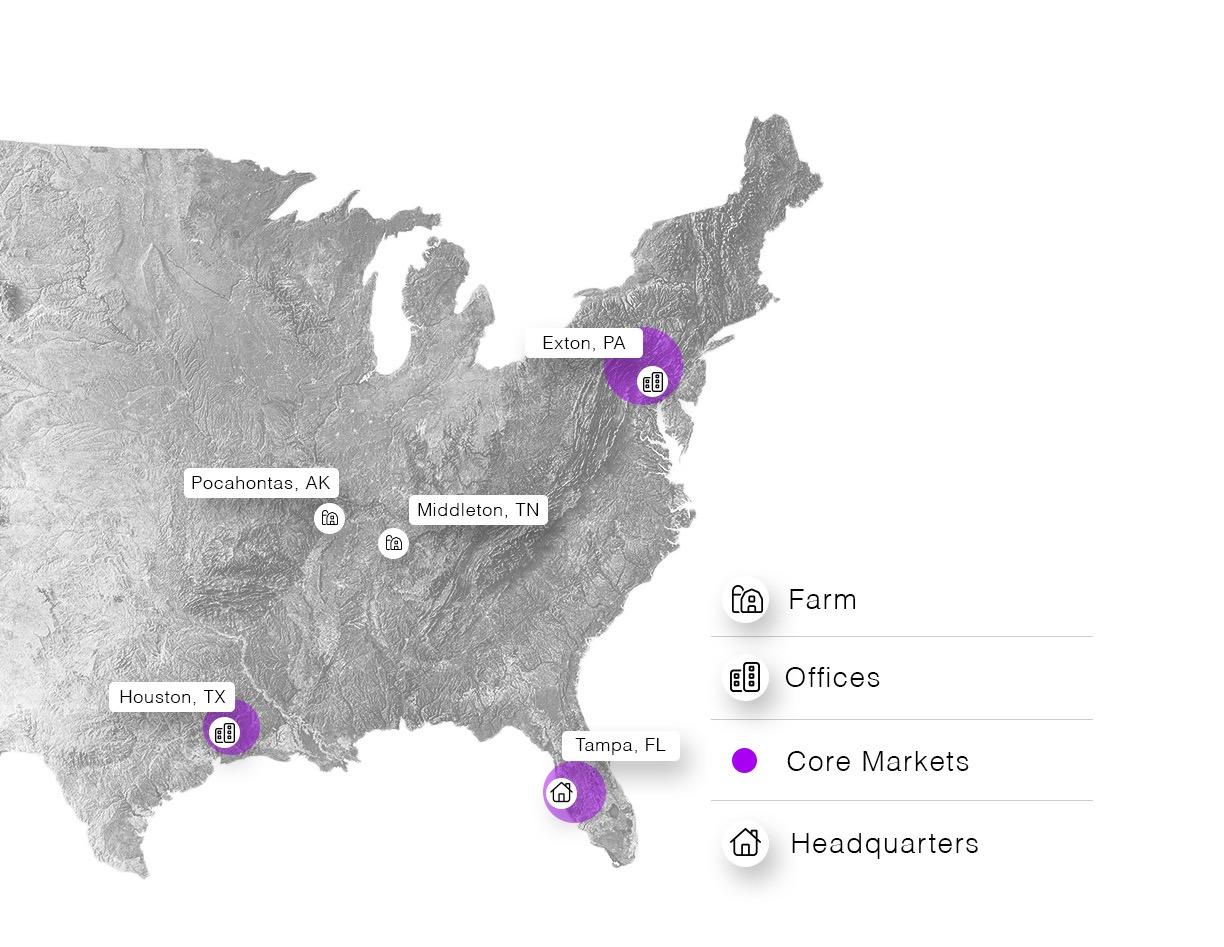

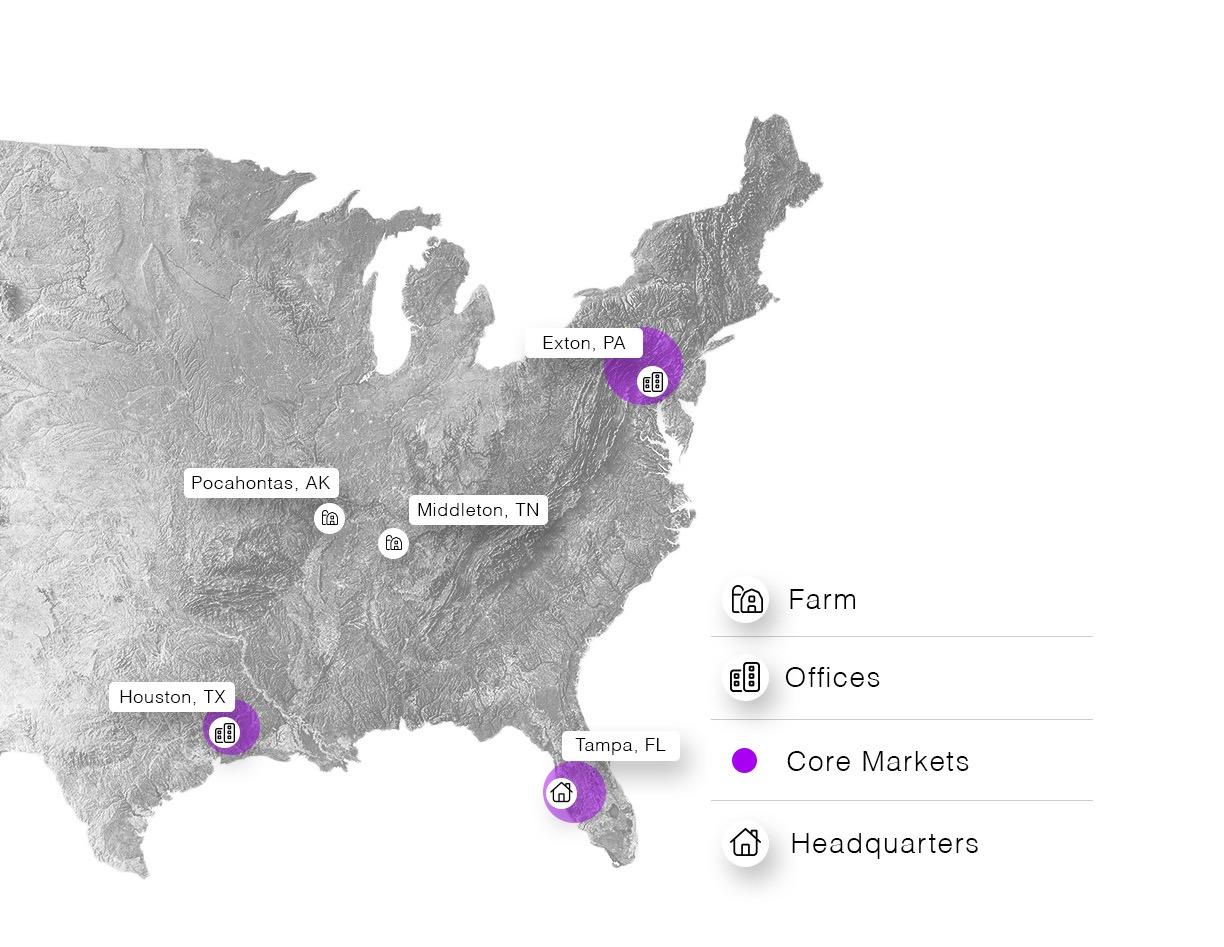

RAD Diversified REIT

RAD Diversified REIT offers investment partners the opportunity to invest in income producing farms and cash-flowing properties such as residential & multi-family properties with substantial value-add opportunities.

We have developed a vouched for, reliable system for investing in residential & multi -family properties in key real estate markets across the U.S. We offer investment partners the opportunity to invest in cash-flowing properties with substantial value-add opportunities.

Past performance is not indicative of future results, no investment is guaranteed regardless of its past performance.

This is not an offer; offers will be made only by means of the Regulation D documents available at www.raddiversified.com, either of which may be updated or amended from time-to-time with the most recent Offering Documents. The acquisition of any property identified in this communication is subject to various contingencies and may not be consummated. Past performance is not an indication of future results. Investing involves risk and may result in partial or total loss. Prospective investors should consider investment objectives, risks, charges, and expenses carefully and consult with a certified public accountant (CPA), tax advisor, or legal advisor before making any investment decision.

raddiversified.com

65th

Huckinston CT.

Almond ST.

TX Purchase Price $25,000 Loan Amount $205,650 Appraised Value (as of 3/31/2023) $375,000 Current Rent $2,400/month

Spring,

Baytown, TX Purchase Price $180,000 Loan Amount $146, 177 Appraised Value (as of 3/31/2023) $227,000 Current Rent $1,950/month

ST. NW Bradenton, FL Purchase Price (Cash) $272,5,00 Loan Amount No Loan Appraised Value (as of 3/31/2023) $405,000 Current Rent $2,300/month

QOZ Program Overview

The Qualified Opportunity Zone Program (“QOZ Program”) was created by the federal Tax Cuts and Jobs Act of 2017 and encourages long-term private sector investments in designated communities known as “Qualified Opportunity Zones” (“QOZs”). The QOZ Program offers potential tax benefits to investors and the potential to deliver positive social impact.

RAD Diversified OZ Fund, LP

RADD OZ Fund, LP seeks to provide investors the ability to participate in the QOZ Program, leveraging the combined RAD Diversified real estate platforms and extensive QOZ Program experience. RADD OZ Fund, LP plans to acquire, develop and/or redevelop a diversified portfolio of all types of real estate assets located in QOZs primarily in metropolitan areas within the U.S.

RADD OZ Fund Strategy

Portfolio Diversification

Construct a diversified portfolio of commercial, farmland, and residential real estate properties located in QOZs within U.S. metropolitan areas. Portfolio diversification seeks to reduce the risks associated with a single project.

Target Markets

Identify QOZs with economic drivers including efficient transit, job creation, and the potential for a live, work and play lifestyle. Focus on areas exhibiting positive demographic trends that are attracting institutional capital.

Target Assets

Primarily multifamily and mixed-use projects centered on single family housing, multifamily housing, farmland. Projects with potential for rent growth and property appreciation supported by market growth fundamentals.

Development Approach

Partner with local/regional developers with project or market value-add to complement expertise.

Investment Access and Discipline

Utilize the depth, breadth, and investment discipline of real estate platforms to identify, underwrite and structure quality investment opportunities.

The acquisition of any property identified in this communication is subject to various contingencies and may not be consummated. Past performance is not an indication of future results. Investing involves risk and may result in partial or total loss. Prospective investors should carefully consider investment objectives, risks, charges, and expenses and should consult with a tax, legal, and/or financial adviser before making any investment decision. For additional information, visit www.raddiversified.com/disclosures.

Community Outreach

We believe that people come first, and that giving back is a moral imperative. Through financial contributions, donations, and collaborations with vetted charitable organizations, RADD strives to impact our community in a positive, meaningful, and memorable way.

We focus our charitable giving on efforts that align with our company mission and values: support our nation’s children, the most vulnerable members of our community, and support our nation’s veterans to whom we owe a deep debt of gratitude for the freedoms we enjoy.

Special Operation

Wounded Warriors Task Force Dagger Special Operations Foundation

SOWW (Special Operations

Wounded Warriors) provides outdoor experiences and focused therapeutic retreats to a select group of both active duty and veteran U.S. Military Special Operations Warriors.

Task Force Dagger Special Operations Foundation is dedicated to wounded, ill, or injured U.S.Special Operations Warriors.

Joshua House

Joshua House provides safe haven for abused, neglected and abandoned children.

Dutch Mendenhall CEO & Founder

Dutch Mendenhall CEO & Founder

Dutch Mendenhall, Author of “Money Shackles”, President of the Alternative Investment Association, and CEO & Cofounder of RAD

Dutch Mendenhall, Author of “Money Shackles”, President of the Alternative Investment Association, and CEO & Cofounder of RAD

Diversified is a loving husband, father, patriotic American, and visionary. Dutch consistently uses his gifted foresight to deliver unmatched thought leadership and mentoring for the alternative investment industry and recently received the Legacy Patriot Award from Florida Congressman Cory Mills. His emphasis on legacy and impact as a philanthropist and a trailblazer has helped thousands earn millions in real estate revenue and live their Redefined American Dream™. Today, Dutch manages six real estate investment funds and helms the overall direction of RADD real estate strategy. His leadership style combines the data-driven ‘science’ of smart investing with the ‘art’ of dealmaking, resulting in formidable industry-leading performance.

Amy Vaughn Founder

Amy Vaughn, Cofounder of RAD Diversified and Vice President of AIA, is a loving mother, dedicated real estate investor, and prominent sales leader. With 20 years of experience, she continues to grow herself, her business, and her investors' portfolio. Amy fought to establish her reputation in a male-dominated industry and now oversees positive returns for investors, making her a sought-after consultant. She is a strong supporter of children and at-risk youth, working to redefine the American Dream. Amy also manages three real estate investment funds and believes in the power of positive thinking and taking action to manifest one's goals and make a difference. Her guiding principle is leaving a positive legacy that helps others and keeps the light shining.

raddamerica.com raddiversified.com

Your RADD Representative Phone • (833) 723 – 7348 Email • support@raddiversified.com For More Information Contact:

Dutch Mendenhall CEO & Founder

Dutch Mendenhall CEO & Founder

Dutch Mendenhall, Author of “Money Shackles”, President of the Alternative Investment Association, and CEO & Cofounder of RAD

Dutch Mendenhall, Author of “Money Shackles”, President of the Alternative Investment Association, and CEO & Cofounder of RAD