This Benefits Enrollment Guide highlights recent plan design changes and is intended to fully comply with the requirement under the Employee Retirement Income Security Act as a Summary of Material Modifications and should be kept with your most recent Summary Plan Description.

If you (and / or your dependents) have Medicare or will become eligible for Medicare in the next months, a Federal law gives you more choices about your prescription drug coverage. Please see guide for more details.

At Quanta, we believe that healthy living encompasses many aspects of overall wellbeing – from your physical and mental health to protecting the people and things you care about most to securing your financial future into retirement.

That’s why it’s so important for us to offer a comprehensive and competitive benefits program to our Quanta family members. You perform at the highest level on behalf of Quanta every day; we believe the benefits available to you should improve your quality of life.

I encourage you to take time to carefully review the 2025 Employee Benefits Guide so that you can make the best choices for you and your family. These benefits are designed to give you and your family access to a variety of resources to maintain and improve your total health.

Thank you for choosing to be part of the Quanta family. Your contributions make a difference.

Stay safe and be well. Live PWRfully!

Earl C. “Duke” Austin, Jr. President & CEO

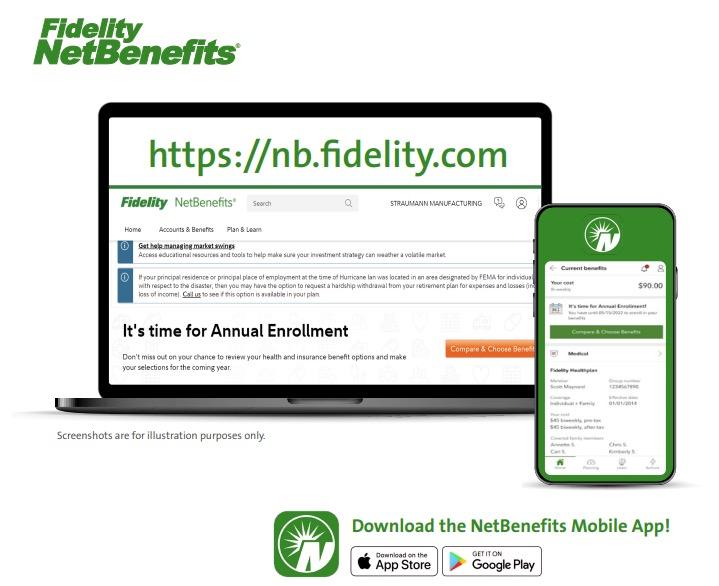

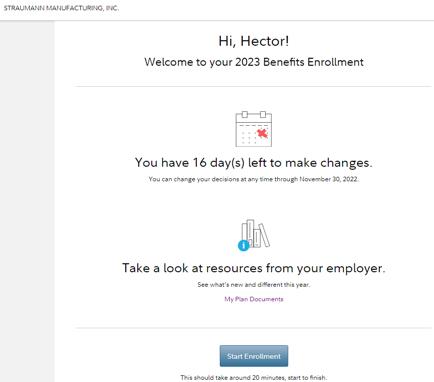

Navigate to https://nb.fidelity.com and enter your login credentials (the same user ID and password you use to access your Quanta 401(k) account.

You just register as new user

You can access the Quanta Enrollment Guide directly from NetBenefits.

Plan Summary documents are also available in the same location, should you need a deeper dive into your benefits.

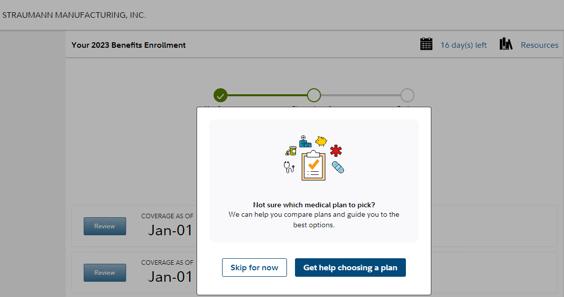

Fidelity NetBenefits Decision Support Tool can help by asking you questions about your expected medical and pharmacy needs.

The Decision Support Tool will consider your cost of the plan and the plan details to recommend a lowest cost option. This tool will pop up as you start your enrollment.

From the NetBenefits landing page, click the orange Compare & Choose Benefits button.

This will launch the enrollment information page, click the Start Enrollment button.

Welcome to your 2025 Benefits Enrollment

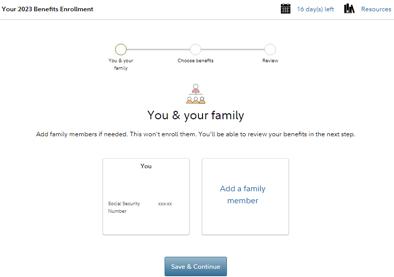

Start by adding any eligible family members you wish to cover.

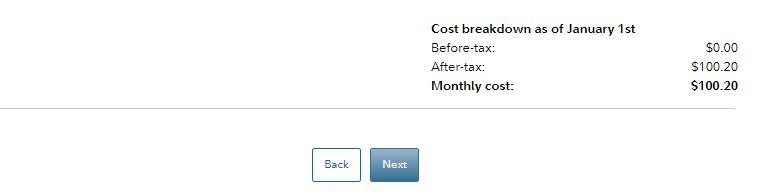

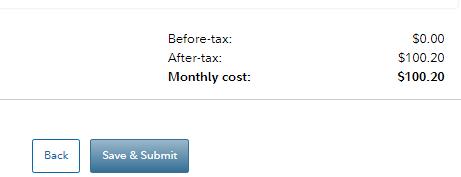

Follow the flow, reviewing the benefits you wish to select, and NetBenefits will guide you through your benefits elections. Once you have made your choices, just save and submit your selections.

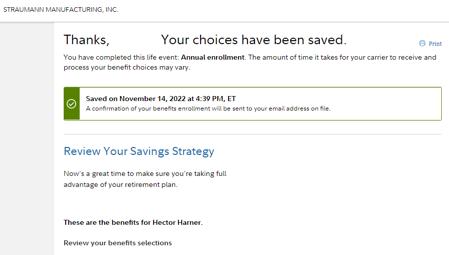

Once you have saved and submitted your selections you will receive the confirmation screen and the annual enrollment survey.

This is also a great time to review your 401(k) contributions and your beneficiaries.

PHONE: 800.835.5095

Monday – Friday

7:30 a.m. – 7:30 p.m. CST

Language Line can service over 200 languages

The Quanta Benefits Center offers assistance to employees with managing their health care benefits, including:

Understanding your benefits

Help with mid-year benefit changes

Confirming eligibility

COBRA questions

Ordering ID cards

Additionally, the Quanta Benefits Center offers Participant Advocacy Services.

A dedicated team of case managers will handle your inquiries to supplement your experience by providing benefits education including:

■ Education to help understand your benefits

■ Help with navigating the health care system

■ Research specific conditions and how they are covered

■ Coordinate with carriers on your behalf

■ Provide case management support for eligibility and enrollment determination.

■ Provide end-to-end research of your claims and appeals for health and welfare benefits under established claims & appeals process.

■ Provides in depth and detailed review of facts and circumstances of claims to include review of calls, work items, literature, SPDs and Plan Documents to facilitate client review.

Employees

■ Full-time working an average of 30 hours per week. Excludes temporary, contract, and collective bargaining employees.

■ Eligible employees must enroll within 30 days from their eligibility period, or they will not have the opportunity to enroll for coverage until the next Annual Enrollment period.

Dependents

■ Your legal spouse (excludes common law)

■ Your child up to the end of the month in which they turn 26

A “child” is defined as:

■ Your natural born child ■ Stepchild

■ Legally adopted child

■ A child (not listed above):

1 Whose primary residence is your household; and

2 To whom you have been designated as the primary caregiver, as set forth in a court order of guardianship or conservatorship or a custody agreement entered into pursuant applicable state custody laws; and

3 Who is dependent upon you for more than one-half of his support as defined by the Internal Revenue Code of the United States.

If both parents of a child work for Quanta and are covered for benefits under our plans, either parent, but not both, may cover the child as a dependent.

You may continue covering an eligible dependent child after age 26 if they:

■ Are totally and continuously disabled and incapable of self-sustaining employment by reason of mental or physical disability; and

■ Meet the definition of a dependent by the Internal Revenue Service; and

■ Were covered as an eligible family member under this plan immediately prior to their 26th birthday; and

■ Met the clinical definition of totally and continuously disabled before age 26 and continue to meet the clinical definition through subsequent periodic reassessments.

You will need to provide documentation for each dependent you wish to cover under the benefit plans. Your dependent will not be covered until the verification is received and approved. Verification documents are only required for newly covered dependents.

As part of annual enrollment, we recommend all employees take the opportunity to review their covered dependents and update any beneficiary information for your life benefits.

For mid-year changes, you have 30 days from the date of a qualifying life event to request a change to your coverage. Benefit changes made as a result of a family status change must be consistent with the event. Proof of family status change is required under the benefit plan.

Marriage

Divorce

Birth/Adoption/Placement of a child

Employee and/or dependents gain other group coverage

Employee and/or dependents lose other group coverage

■ Add dependent(s) to existing coverage including spouse’s children

■ Drop former spouse from all coverage

■ Add new dependent to existing coverage and changes to FSA

■ Drop dependents

■ Drop benefits

■ Add self and/or spouse and dependents

DEPENDENT OF THE PARTICIPANT (EMPLOYEE, OR INDIVIDUAL ENROLLED)

Spouse

ELIGIBILITY

Spouse as recognized by law

■ Copy of marriage certificate AND

■ If adding children copy of birth certificate

■ Copy of final divorce decree

■ Copy of birth certificate OR

■ Proof of birth letter from hospital OR

■ Copy of adoption or placement agreement

■ Proof of other group coverage for each individual being dropped

■ Proof of loss of group coverage AND

■ Marriage certificate and birth certificate(s) for newly added dependents

■ Government-issued marriage certificate AND

■ Current federal tax return OR

■ Proof of joint ownership issued within last six months OR one of the following:

• Most recent tax return

• Car insurance

• Household utility bill

• Bank statement

• Mortgage

• Renter’s lease

• Credit card statement

■ Government-issued marriage certificate only (if married in the last 12 months)

Biological Child

Adopted Child

Stepchild

Child of Managing Conservator

Foster Child

Legal Guardian

Natural born child

Child is eligible at time of adoption or placement

Child is eligible at time of adoption or placement

Child is identified in the managing conservatorship granted to the participant

Child must not have other governmental insurance

Child is under the protection or in the custody of the participant

■ Government-issued birth certificate

■ Adoption certificate OR

■ Adoption Placement Agreement AND

■ Petition for adoption

■ Government-issued marriage certificate OR

■ Government-issued birth certificate AND

■ Current federal tax return OR

■ Proof of joint custody issued within last six months

■ Managing conservatorship court document signed by a judge

■ Placement order AND

■ Affidavit of foster child

■ Court order signed by a judge appointing participant as the child’s guardian (documentation of legal custody) AND

■ Government-issued birth certificate

The three medical plans that Quanta offers have the same expansive provider network through BlueCross BlueShield (BCBS) with the same contracted service fees. In all plan options, your premium deductions will be on a pre-tax basis, and you have an option to enroll in an additional tax savings health reimbursement plan to help you save on eligible medical expenses.

You pay less out-of-pocket expenses if you use the physicians, hospitals, and other health care providers that participate in the BCBS network. You don’t need referrals or authorizations for most services, and you receive the highest level of benefits when you use in-network providers.

With the PPO option, you have copays for items such as doctor visits and prescriptions where you only pay a portion of the full cost and the plan pays the rest. Your portion of the expense is applied to your annual deductible and out-of-pocket maximum amount. Copays are only applied to your out-ofpocket maximum, not your deductible.

With the High Deductible Health Plan (HDHP) options, you are responsible for the full cost of your medical services and prescriptions until you reach your deductible, and then the plan will pay 100 percent of eligible expenses for the remainder of the calendar year. Keep in mind that your full cost will also include the BCBS in-network discounts.

Under all three plans, preventive care is covered at no cost to you when you utilize an in-network provider.

BEFORE YOU GO

The amount you must pay for covered services before your insurance begins paying its portion/coinsurance.

Your percentage of the cost of a covered service. If your service is $100 and your coinsurance is 20% (and you’ve met your deductible but not your out-of-pocket maximum), your payment would be $20.

The fixed amount you pay for healthcare services at the time you receive them.

The most you will pay during the plan year before your insurance begins to pay 100% of the allowed amount.

Network: Blue Choice PPO Pharmacy: Balanced Drug List

Please scan the codes above to view the 2025 SBC’s for each medical plan. You can also view and download copies of the SBC’s in your Fidelity account at https://nb.fidelity.com

$500

$1,500

$2,400 individual

$7,200 family Includes deductible, coinsurance and copays, including prescription copays

$30 copay

$40 copay

$20 copay

$30/$40 copay

Flexible Spending Account (FSA)

$0 Quanta contribution

$20 copay

$50 copay

Savings Account (HSA) $500 individual $1,000 dependent coverage Quanta contribution

Health Savings Account (HSA)

$500 individual $1,000 dependent coverage Quanta contribution

after

Pay 100% for each 90-day supply until deductible has been met, then covered 100% for remainder of calendar year

Pay 100% for each 90-day supply until deductible has been met, then covered 100% for remainder of calendar year

Provider’s responsibility

The Quanta medical plans have an embedded individual deductible that applies to all family coverage tiers (includes EE+Spouse, EE+Child and Family tiers). An embedded deductible is more desirable than a non-embedded deductible because it allows the plan to begin paying benefits for an individual family member who has met the individual deductible even though the full family deductible has not yet been satisfied. Once the full family deductible has been met by any combination of other covered family members, the Plan will pay benefits for all covered family members for the remainder of the plan year.

The IRS requires minimum annual deductibles (updated annually) for a HDHP to be HSA compatible. The requirements apply to individual embedded deductibles. An HSA compatible HDHP is not permitted to pay claims for a covered member prior to the minimum annual deductible being satisfied. For 2025, the minimum deductible set by the IRS for HSA compatible family HDHP coverage is $3,300.

This is how it works if you enroll in the $3K HDHP with family coverage. This is how the embedded individual deductible works in Quanta’s HDHP when you enroll in family coverage (includes EE+Spouse, EE+Child and Family tiers):

■ Your spouse receives treatment that cost $6,000.

■ Under the $3K HDHP, your spouse is responsible for $3,300 which can be paid from your HSA;

■ Your spouse’s individual embedded deductible has been satisfied and the Plan will begin to pay 100% of your spouse’s covered expenses for the rest of the plan year.

■ The remaining family deductible amount of $2,700 ($6,000-$3,300) can be satisfied by any combination of other covered family members (not your spouse). Once the full family deductible has been satisfied, the Plan will pay 100% of all family member’s covered expenses for the rest of the plan year.

Quanta participates in the BCBS preferred drug list. The preferred drug list is regularly updated based on the recommendations of the U.S. Food and Drug Administration (FDA). Approved drugs are chosen based on safety, uniqueness, and cost effectiveness.

Advantages of Using the Preferred Prescription Drug List

Medications on the preferred prescription drug list will typically cost less than non-preferred drugs. You have benefits for most covered medications that are not on the preferred drug list, but you may pay more out of pocket. The preferred drug list is a reference for your doctor when prescribing medications. We recommend you print this list and take it with you to your doctor visits. However, it is solely up to you and your physician to determine the medication that is best for you. The list can be found at www.BCBSTX.com, the Balanced Drug List.*

* Not all drugs listed in the Balanced Drug List are covered by the Plan. Please contact BCBS to confirm coverage.

Mail your prescription or have your doctor fax or e-scribe it to Express Scripts.

■ Ask your doctor for a prescription for a 90-day supply of each of your long-term medicines. Or ask your doctor to e-scribe your order to Express Scripts Pharmacy, or contact the Patient Care Contact Center at 833.715.0942.

■ To print a New Prescription Order Form, go to www.express-scripts.com/rx. From there, scroll down to the Prescription Drug Forms section.

■ Mail your prescription, completed order form, and payment.

BCBS has arranged for Accredo to support members who require specialty medication and help them manage their therapy. Specialty medications are generally prescribed to treat chronic, complex medical conditions, such as multiple sclerosis, hepatitis C, and rheumatoid arthritis. Specialty drugs often require careful adherence to a treatment plan and have special handling or storage requirements and may not be stocked by retail pharmacies.

Express Scripts delivers up to a 90-day supply of long-term medicines for the cost of a two-month supply for PPO members. This can reduce what you pay out of pocket and includes free standard shipping.

Express Scripts will call or email when your prescription is received, when it ships, and when it is due for a refill.

Refill dates are shown on each prescription label. You can choose to have Express Scripts remind you by phone or email when a refill is due. Choose the reminder option that best suits you.

■ Online: Visit www.BCBSTX.com to refill a prescription or renew an expired prescription and click on the ‘My Coverage’ tab, then ‘Prescription Drugs’ on the left. Then click ‘Express Scripts Pharmacy.’

■ Mail: Complete and mail the Refill Prescription Order Form sent with your order. Remember to allow time for your refill order to be received and processed.

If you have any questions regarding the preferred prescription drug list, call the customer service number on the back of your ID card, 24 hours a day, 7 days a week, or visit www.BCBS.com. For mail delivery, visit www.ESRX.com/bcbstx.

■ Phone: Call the automated refill system at 877.357.7463.

BCBS offers Virtual Primary Care, in collaboration with Teladoc Health, as part of our benefit plan.

Primary care is an important part of managing your health. Whether you’re getting an annual checkup, learning how to manage a health condition, or simply committing to making better day-to-day health decisions, BCBS members and their eligible dependents can now visit a primary care provider from the comfort of home with the Virtual Primary Care benefit.

Make your Virtual Primary Care appointment by:

■ Downloading the Teladoc app

■ Visiting teladoc.com/bcbstx

■ Calling 800-TELADOC (835-2362)

With Virtual Primary Care, BCBS members can:

■ Choose a primary care provider who takes the time to get to know you, your health history and needs.

■ Schedule annual checkups and ongoing care when it’s convenient for you.

■ Get referrals to in-person and in-network specialists, ongoing support from a dedicated care team and a custom care plan with clear next steps.

BCBS members get access to:

■ General Medical: Diagnosis and treatment by board-certified doctors for cold/flu, allergies, sinus infections and more, with prescriptions (if necessary) sent to your local pharmacy.

■ Behavioral Health: Support for depression, anxiety, stress and more from a therapist or psychiatrist available by appointment 7 days a week.

■ Dermatology: Upload photos through the secure portal and get custom treatment plans for skin issues such as eczema and psoriasis.

Visit TeladocHealth.com

Call 1-800-835-2362 | Download the app

Complete medical history prior to request

Choose a provider based on specialty, availability, language and gender

Keep the same provider throughout the course of care

SELECT A DATE AND TIME

Request appointment at least 60 hours in advance

Can schedule recurring appointments

Appointments available Monday through Friday, 7 a.m.- 6 p.m., and Saturdays, 7 a.m.-12 p.m., excluding federal holidays.

Speak with provider by phone or video session

Receive annual exam, preventive care, diagnosis and treatment for health concerns, manage chronic conditions, and receive referral to in-network specialists, when needed

Refer members to additional virtual care services when needed

Be contacted to schedule future appointments, if necessary

Follow up through secure online message center

Receive outreach to evaluate care and get additional guidance

The Quanta benefit programs offer a balance between access, affordability and quality to ensure that you and your family have the tools necessary to manage, maintain or improve your health. The following programs will help you and your family achieve your goals:

Our highest-touch holistic, concierge care management solution utilizing human-led advocacy and proven outcomes to drive greater cost savings, unrivaled health care expertise and an unmatched member experience.

■ 24/7 Personal Concierge

■ Integrated Advocacy

■ Flexible Cost Controls

■ Productive Outreach & Specialized Navigation

Wondr is a skills-based digital weight loss program that teaches you how to enjoy the foods you love to improve your overall health. To register, or for more information, go to wondrhealth.com/quantaservices.

Complete exercise therapy sessions anytime and anywhere, including the comfort of your own home. The 15-minute sessions improve strength and flexibility around the back or joint, thus alleviating pain. Call 855.902.2777, visit www.HingeHealth. com, or write help@HingeHealth.com.

Ovia Health apps feature health trackers and provide videos, tips, coaching, and more. Ovia Fertility, Ovia Pregnancy, and Ovia Parenting apps can be downloaded from the Apple App Store or Google Play Store. During sign-up, make sure you choose “I have Ovia Health as a benefit.” Then select BCBSTX as your health plan and enter your

employer’s name. Maternity specialists will help you by phone from early pregnancy until six weeks after delivery if your pregnancy is high-risk.

When you join Teladoc, you’ll get a new type of glucose meter that lets you know when your levels are too high or too low. It’ll ask you if you need more test strips. In fact, you’ll get unlimited test strips sent to your home whenever you need them. Plus, you’ll get online and live coaching from certified diabetes educators who can answer your questions about nutrition and lifestyle changes.

Based on your plan, you may not have to pay any out-of-pocket costs. If you are eligible for this benefit, Teladoc will send you information about how to sign up.

Online education and support from a live coach can teach you to manage your weight and stress for better heart health. You’ll have expert guidance to help you talk with your doctor about your blood pressure medications. A connected blood pressure monitor can help you remember to check your numbers and stay on track.

Based on your plan, you may not have to pay any out-of-pocket costs.

If you are eligible for this benefit, Teladoc will send you information about how to sign up.

Learn to Live is an online resource that can help. Programs are based on therapy techniques with a track record of helping people feel better. Learn to Live is confidential, accessible anywhere and available at no added cost to you and your family. Choose the program for you by taking a quick assessment today.

Did you know that prices for the same quality medical services can differ by thousands of dollars within the same health plan network? Member Rewards offers cash rewards when a lower-cost, quality provider is selected from several options.

Description

Blue365 is just one more advantage you have by being a BlueCross BlueShield of Texas (BCBSTX) member. With this program, you may save money on health and wellness products and services from top retailers that are not covered by insurance. There are no claims to file and no referrals or pre-authorizations.

Once you sign up for Blue365 at www.Blue365Deals.com/bcbstx, weekly “Featured Deals” will be emailed to you. These deals offer special savings for a short period of time.

Below are some of the ongoing deals offered through Blue365.

EyeMed & Davis Vision

You can save on eye exams, eyeglasses, contact lenses, and accessories.

TruHearing®, Beltone™ & American Hearing Benefits

You could get savings on hearing tests, evaluations, and hearing aids. Discounts may also be available for your immediate family members.

Dental SolutionsM

You may receive a dental discount card that provides access to discounts of up to 50% at more than 70,000 dentists and more than 254,000 locations.

Fitbit®

You’ll get a 20% discount on Fitbit devices plus free shipping.

Jenny Craig®, Sun Basket & Nutrisystem®

You may save on healthy meals, membership fees (where applicable), nutritional products, and services.

Reebok & SKECHERS®

Get 20% of select models of Reebok and get 30% of plus free shipping for your online SKECHERS orders.

Search online via Provider Finder® or call your BVA to find a reward eligible location for your procedure.

■ Compare costs and quality for numerous procedures

■ Estimate out-of-pocket costs

■ Earn cash while shopping for care

■ Save money and make the most eficient use of your health care benefits

■ Consider treatment decisions with your doctors

Receive a procedure or service at a Member Rewards eligible location.

After your claim is paid and the location is verified as reward eligible, a check will be mailed directly to your home. You can earn a cash reward of $25 up to $500.

InVite® Health

InVite Health offers quality vitamins and supplements, educational resources, and a team of health care experts for guidance to select the correct product at the best value.

eMindful

Get a 25% discount on any of eMindful’s live streaming or recorded premium courses.

Livekick

Action-packed 30-minute sessions that you can do from home, your gym, or your hotel while traveling. Get a free two-week trial and 20% of a monthly plan on any Live Online Personal Training.

If you enroll in an HDHP with an HSA, you receive significant tax and savings advantages over traditional health care plan options — regardless of whether you’re a low, medium, or high user of health care services. Here’s why:

Tax savings: When used for qualified medical expenses, HSAs offer a triple tax savings because contributions, any investment earnings, and distributions are federal tax free for qualified expenses.

Growth potential: You have the opportunity to invest your contributions in a wide array of investment options — including stocks, bonds, and mutual funds — for potential growth of your account over time.

Flexibility: Any unused balance in your account will automatically carry over from year to year so you can begin to build your savings for future qualified medical expenses.

Portability: Your HSA always belongs to you, even if you change jobs or become unemployed, or change your medical coverage.

Distributions from an HSA that are used to pay for qualified medical expenses for you, your spouse, and dependents are tax free provided they meet the IRS definition of a qualified medical expense. The good news is that a lot of expenses qualify for payment or reimbursement, such as:

■ Health plan deductibles and coinsurance

■ Most medical care and services

■ Dental and vision care

■ Prescription drugs and insulin

■ Medicare premiums (if age 65 or older)

For any health care account, if audited, the IRS requires that you substantiate your medical expenses.

For more information about HSAs and qualified medical expenses, refer to IRS Publications 969 and 502 at www.IRS.gov or consult a tax professional.

If you do not open your HSA, you will not be able to receive the employer contribution. If you and your spouse both work for Quanta and you each enroll in an HDHP, you will receive a contribution into your HSA of $500 each. The contributions combined will not exceed the Quanta family contribution of $1,000.

Annual HSA Contributions

EMPLOYEE & EMPLOYER CONTRIBUTION MEDICAL PLAN

HDHP 3,000 – 5,000

Benefits effective January 1 – June 30

HDHP 3,000 – 5,000

Benefits effective July 1 – December 31

Employee Only

Employee & Spouse

Employee & Child(ren)

Employee & Family

Employee Only

Employee & Spouse

Employee & Child(ren)

Employee & Family

* This IRS limit is a combination of employer and employee contributions, and if you are 55 or older, you can contribute an additional $1,000.

Before deciding to enroll in an HDHP, please review these important rules regarding the HSA:

■ You have no other non-HDHP coverage, including TRICARE.

■ You or your covered spouse do not participate in a Health Care FSA.

■ You are not enrolled in any part of Medicare.

■ You are not claimed as a dependent on someone else’s tax return.

■ Before age 65, you must use the money on qualifying medical expenses or you’ll pay taxes and a penalty.

■ After age 65, you would still have to pay taxes on non-qualified expenses, but you would not be subject to the penalty.

■ Any eligible expenses incurred before your HSA account is opened are not eligible for reimbursement through this account.

Prior to opening your HSA, you must be enrolled in an HDHP and have elected the HSA option during enrollment. You’ll get information on investment choices, payment options, and ongoing support to help you build and manage your savings.

You will receive an email from Fidelity providing you instructions for completing your HSA online setup at Fidelity NetBenefits® at https://nb.fidelity.com and click ‘Open’ next to Health Savings Account.

If you do not have online access, call 800.544.3716 and a Fidelity representative will mail you an application.

Representatives are available Monday through Friday from 8:30 a.m. to 8:00 p.m., ET.

NEED HELP? Not sure about an HSA? Open the QR code on the right to watch a short video on what an HSA is.

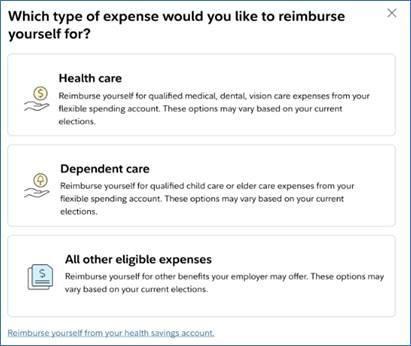

If you have not elected an HDHP, you may participate in the Health Care FSA. The FSA allows you to set aside a portion of your salary, pre-tax. You may use these funds to pay for eligible medical, dental, and vision expenses for you, your spouse, and your eligible dependents, as long as they are claimed as dependents.

Be conservative in your estimate. The IRS has a ‘use it or lose it’ rule which states that you lose any unused balance in your account at the end of the plan year over $500. Any carryover amount up to $500 must be used during the following calendar year or it will be forfeited.

For medical care purchases made on your Fidelity FSA Debit Card, the IRS requires that the expense be verified. Some of those purchases can be verified electronically right at the point of purchase, so there’s no need for additional substantiation. They include:

■ Copays in doctors’ offices

■ Copays in pharmacies

All requests for reimbursement of expenses incurred during the calendar year must be filed within 90 days of the following year.

A Dependent Care FSA plan allows you to set aside pre-taxed contributions to reimburse yourself for dependent care expenses, such as child day care. You may participate in the reimbursement benefit even if you do not enroll in any other Quanta benefit. As an IRS-regulated tax savings program, there are certain requirements that you need to be aware of:

■ Be conservative. If you do not use the money in your account within the plan year, you lose it.

■ Once the plan year has started, you cannot change your election unless you have a qualified event detailed on page 8, or one of the following:

• If you change day care providers

• When your child turns age 13

• If the cost of qualified day care expenses increase or decrease

■ Registration fees cannot be reimbursed until the services are actually incurred.

■ You will be required to report your dependent care provider’s Tax ID or SSN on IRS Form 2441 when you file your federal income tax return.

■ Remember to hang on to your receipts and documentation.

are made based on the current balance in your account. Reimbursement Paid For the date the expense is incurred, not billing date. Eligible Expenses

Expenses must be for dependent children under age 13 who you claim on your taxes, or a disabled spouse or disabled dependent of any age. You and your spouse must be employed, or your spouse must be a full-time student or looking for work.

Administered by UnitedHealthcare

Vision

UnitedHealthcare (UHC) is our plan provider for vision services. Benefits include a comprehensive exam, eyeglasses or contact lenses, and discounts on:

Laser eye surgery

Purchasing contact lenses online

Hearing Aid Discounts

Frames, lenses, etc.

Safety glasses

As a UHC Vision plan member, you can purchase high quality, digital hearing aids at meaningful savings over retail cost through UHC Hearing.

Visit www.MyUHCVision.com or call 1.855.523.9355, TTY 711.

SERVICE

Exam

Eyeglass Frames For frames that exceed the allowance, an additional 30% discount may be applied to the overage.

Eyeglass Lenses

Contact Lenses Instead of Eyeglasses

Contact lenses not on the formulary list are referred to as Non-Formulary. A copy of the list can be found at www.MyUHCVision.com Children’s & Maternity Eye Care

Tints, standard scratch-resistant coating, ultraviolet coating, standard progressive lenses, polycarbonate lenses for adults, polycarbonate lenses for dependent children (up to age 19) Formulary Contact Lenses

If you choose disposable contacts, up to 6 boxes are included when obtained from an in-network provider.

Non-Formulary Contact Lenses

Necessary Contact Lenses

age 0 to 12 and

Contact UHC Customer Service Center

PHONE: 800.638.3120

WEBSITE: www.MyUHCVision.com

Monday – Friday 7:00 a.m. – 10:00 p.m. CST Saturday 8:00 a.m. – 5:30 p.m. CST

Provider locator, benefit information, eligibility ■ Toll-free, 24 hours a day, 7 days a week

NOTE: For details on out-of-network reimbursement levels, visit the QR code to the right.

retail frame allowance

in full

fitting/evaluation fees, contact lenses, and up to two follow-up visits are covered in full after copay.

Our dental PPO plan allows you the freedom to have the dentist of your choice and allows for two preventive care visits per calendar year. The Quanta plan is administered through MetLife® Preferred Dental Program. It also includes comprehensive restorative care and orthodontia benefits.

Finding a network dentist is easy at www.MetLife.com/ mybenefits, or by calling MetLife at 800.942.0854. Choose from thousands of participating general dentists and specialists nationwide. Eligible benefits are paid subject to reasonable and customary charges for out- of-network dentists. Advantages of using a network dental provider are:

■ Lower out-of-pocket costs as much as 15% to 45%

■ Choices from one of the largest provider networks

■ Less paperwork

Predetermination of services is suggested when dental work in excess of $250 is anticipated.

ID cards can be found on the MetLife website, or QR code, as a card will not be mailed to you.

If you go to a non-network provider, you may be billed the balance for any amounts above the plan’s reasonable and customary payment levels.

Search ‘MetLife’ in the iTunes App Store or Google Play to download the app.

Then use your MetLife login information to access these features. It’s available 24 hours a day, 7 days a week.

■ Find a dentist

■ View your claims

■ View your ID card

$2,000

$50 Individual / $150

Exams, X-rays, cleanings, fluoride treatments,* sealants*

Fillings, endodontics (root canals), repairs, simple extractions, non-surgical periodontics, palliative care

Inlays, onlays, crowns, prosthetics, oral surgery, surgical periodontics, implants, general anesthesia

Adults and children are eligible; $1,700 lifetime limit

Administered by MetLife

STD provides you with income protection if you become disabled from a covered injury, sickness, or pregnancy.

Please review the benefit summary located in the pocket of this guide for more information.

LTD provides you with long-term income protection if you become disabled from a covered injury or sickness. The LTD benefits will pay a percentage of your monthly salary up to a maximum monthly benefit.

Please review the benefit summary located in the pocket of this guide for more information.

The maximum benefit period will vary depending on your age at the time of disability as determined by the plan. The LTD benefits will continue until you recover or you reach normal retirement age, whichever comes first.

Quanta’s disability insurance features include:

■ Return-to-work incentives: You can receive assistance in returning to the workforce and valuable transition support, when appropriate.

■ Rehabilitation incentive: You can increase the amount of your disability benefit by as much as 10% when you participate in a MetLife-approved rehabilitation program.

■ Family care benefit: You can get reimbursed for expenses, such as child care for eligible family members, if you participate in a MetLife-approved rehabilitation program.

■ Moving expense benefit: You may be reimbursed for moving expenses to a new residence if the move is recommended as part of a MetLife-approved rehabilitation program.

■ Online service solutions: At www.MetLife.com/mybenefits, you can obtain secure self-service capabilities such as checking the status of STD/LTD claim, viewing claim details, and finding out more information about disability coverage.

AGE LIMITS: Please review QR code for details on age limits.

Quanta offers life and accident insurance to provide financial protection when you or your family may need it most.

Do you know who your beneficiaries are for your Quanta benefits? It’s important to update your beneficiaries from time to time to ensure they reflect your current wishes. Log on to your Fidelity NetBenefits to complete beneficiary elections.

Open the QR code on the right to learn more about life insurance and the importance of beneficiaries.

You now have access to Travel Assistance, a special travel service administered by AXA Assistance USA, Inc., through an arrangement with MetLife. This 24-hour network of emergency medical, travel, legal, and financial resources offers valuable protection for you and your family when you travel more than 100 miles from home. With just one call, employees and their families have access to qualified professionals trained to manage any travel emergency. This program is paid for by Quanta and is available to you free of charge.

Administered by MetLife

Accident insurance provides a financial cushion by helping you pay for out-of-pocket costs. It provides you with a lump-sum payment — when you or your family need it most. The extra money can help you with other household expenses like your mortgage, car payments, or child care, which may be hard to cover due to lost or reduced income.

And, best of all, the payment is made directly to you and is in addition to any other insurance you may have.

Hospital indemnity insurance provides you with a lump-sum payment. An amount is usually paid for a hospital admission and a per-day amount for your entire hospital stay.

Best of all, the payment is made directly to you and is in addition to any other insurance you may have.

This plan provides benefits for hospitalization due to accidents and sicknesses, like:

Critical illness insurance is coverage that can help cover the extra expenses associated with a serious illness. When a serious illness happens to you or a covered dependent, this coverage provides you with a lump-sum payment.

Types of

Are Covered Under This Plan?

■ Full benefit cancer

■ Coronary artery bypass graft

■ Partial benefit cancer ■ Alzheimer’s disease

■ Heart attack

■ Stroke

■ Kidney failure

■ Major organ transplant

■ Plus 22 additional conditions

Administered by UNUM

Benefits for the long haul

Thanks to modern medicine, people are now living longer and surviving very serious health problems. But that can mean long term treatment in a nursing home or assisted living facility. And the same care that saves your life can devastate your savings.

You may be surprised to learn that this care isn’t covered by health or other insurance policies. Or that waiting for “later” to buy a long term care policy may make things worse. In fact, the younger you are, the less expensive this coverage is.

By adding a Long Term Care Rider to your Life Insurance policy, you can help protect your savings from being drained by this expensive care. Most importantly, this coverage allows you to use the benefit whether you receive care at home, or in a long term care facility, an assisted living facility, an adult day care, or a nursing home.

$15,000 or $30,000 100% of the employee’s initial benefit

Coverage is guaranteed, provided the employee is actively at work.

Coverage is guaranteed, provided the employee is actively at work and the spouse is not subject to a medical restriction as set forth on the enrollment form and the Certificate.

You and your dependents can also receive $50 each year, if you complete your annual wellness exam and submit to MetLife.

Here is an example of how this LTC rider can help you finance a period of long term care. This illustration is based on an insured individual who has a $25,000 Life Insurance policy.*

- Employer-selected

LTC pays 6% monthly benefit for either LTC facility benefit or assisted living facility benefit.

Payments reduce the death benefit until exhausted (approximately 16 months).

- Employee-selected

This rider restores 100% of the policy’s specified amount (face amount), death benefit and cash value.

more information:

$1,500 per month

$25,000 death benefit

A Statement of Health (SOH) is a short medical questionnaire used by the carrier to determine if requested coverage will be approved for an individual. Acceptance of an SOH will be determined by MetLife in accordance with its guidelines governing medical underwriting.

You may complete an SOH online during the annual enrollment process by clicking on the icon at the end of your enrollment prior to the final approval button, or in the tabs on your enrollment home page. You may also obtain SOH form by calling the Quanta Benefits Center at 800.835.5095

Note: EEs have 90 days to provide/submit EOI.

EVENT

Newly eligible for benefits and requesting up to Guarantee Issue Amount

Newly eligible for benefits and requesting amount above Guarantee Issue Amount

Annual enrollment and employee did not previously elect voluntary life coverage

Annual enrollment and employee wants to increase voluntary life coverage

* Employee must be enrolled in Voluntary Life benefit for dependent to be enrolled. ** Dependent Voluntary Life insurance is contingent on the approval of employee’s Voluntary Life insurance. If the employee’s coverage is not approved, the dependent will not be enrolled in elected coverage.

■ Administered by Norton

LifeLock with Norton

Everyday activities like online shopping, banking, and even browsing can expose your personal information, making you more vulnerable to cybercrime. LifeLock with Norton plans combine leading identity theft protection and device security against online threats, viruses, ransomware, and malware, at home and on-the-go. These plans canhelp you protect your identity, your devices, and your online privacy, in an always connected world. You have 24/7 live member support.

NOTE: Please review QR code for details on full policy coverage.

Administered by Magellan

As a vital part of Quanta’s commitment to helping employees maintain an optimum quality of life, we have partnered with Magellan Health to offer a confidential Employee Assistance Program (EAP). An EAP helps you and your household members address your personal concerns. Counselors can assist you to deal with problems such as:

■ Grief and loss

■ Health and

emotional wellness

■ Family and relationships

■ Financial wellness

If you are a member of BCBS, the EAP will help you find a counselor in network to assist with any continuation of care that may be needed.

■ The EAP is available to you at no cost.

■ The EAP is available 24 hours a day, 7 days a week.

■ Any information you share is confidential and private. Quanta does not have access to this information.

■ The EAP program offers seminars, coaching support, and online self-review tools during and after work hours.

■ You have access to five (5) in-person counseling sessions (per issue) per year.

It’s quick and easy to get started. The EAP will connect you with the right resources or professionals to help you with your questions, challenges, or needs.

IMPORTANT: Please review QR code for details on the employee assistance program.

If you have a legal or financial issue and you are not sure where to turn for help, check out our EAP. A variety of legal and financial consultation services are available to you and your household members. Get legal information on civil or consumer issues, personal or family issues, real estate, will preparation, estate planning, and more.

Your EAP program also offers online tools and resources and up to a 60-minute telephone consultation with a financial counselor for financial issues such as budgeting, debt consolidation, loans, mortgage assistance, retirement, saving for college, IRS matters, and other financial topics.

Financial consultants have extensive experience advising everyone — from those struggling with student loans, to those planning for retirement — on a range of financial issues.

■ Flexible coverage with up to 80% reimbursement and freedom to visit any U.S. licensed vet

■ Available optional Preventive Care coverage

■ 24/7 access to Telehealth Concierge Services

■ Access to discounts and offers on pet care

Please review QR code for details on pet insurance benefits.

Coverage Details

■ Exam fees ■ Hospital stays/surgeries

■ Medications ■ X-rays and diagnostic tests

NOTE: To enroll, visit www.metlife.com/getpetquote or call 1-800-GET-MET8.

1. Select and enroll in the coverage that’s best for you and your pet.

2. Download our mobile app.

3. Take your pet to the vet.

4. Pay the bill and send it with your claim documents to us via our mobile app, online portal, email, fax, or mail.

5. Receive reimbursement by check or direct deposit if the claim expense is covered under the policy.

Enjoy discounts, rewards, and perks on thousands of the brands you love in a variety of categories:

■ Travel ■ Entertainment & Tickets

■ Auto ■ Restaurants

■ Electronics ■ Beauty & Spa

■ Apparel ■ Sports & Outdoors

■ SmartRewards complements existing recognition programs and allows you to redeem rewards within the gift card outlet.

Administered by Farmers Group Select

Insurance That Can Be Customized to Fit One’s Needs

Everyone has different needs at different stages of life. Through Farmers GroupSelect, you are offered a wide range of products and services — providing the flexibility to choose what’s right for you.

■ Auto ■ Flood

■ Home ■ Condo

■ RV ■ Landlord’s rental dwelling

■ Renter’s ■ Personal excess liability protection

Industry-leading Features That Give You Confidence

Farmers GroupSelect advantages can help put things right for you:

■ Replacement cost coverages for home and new vehicles helps rebuild at today’s cost or repair/replace a new vehicle in case of a total loss.

■ Replacement costs for special parts help with repair or replacement of certain parts, regardless of their wear and tear at the time of the accident.

■ Safe driving benefit rewards with $50 for every year of claim-free driving for up to five years. You can use that money to help pay for your deductibles.

Login to website at pwrdiscounts.benefithub.com/app/home and use code VT2GSK to access account.

NOTE: To enroll, visit www.farmers. com/landing/groupselect/getquote or call 1.844.920.3880.

Quanta Cares was created to assist members of the Quanta family impacted by hurricanes, tornadoes, wildfires, and other natural disasters. It is through the generosity of employees like you, across our organization, that makes Quanta Cares possible.

If you or a coworker are in need of relief, please email QuantaCares@QuantaServices.com for a grant application.

The Quanta Cares Committee reviews all applications and makes every attempt to help applicants with recovery.

Make a Donation

If you would like to make a tax-deductible donation, please send a check payable to Quanta Cares to:

Quanta Services, Inc. Attn: Quanta Cares 2727 North Loop West, Houston, TX 77008

You may also donate through your paycheck by making an election at www.NetBenefits.com Adjustments to your donation may be made as often as you would like.

Thank you — we appreciate your support.

There is no waiting period to enroll in the Quanta Services, Inc., 401(k) Savings Plan (“Plan”) as long as you are 18 years of age. Eligible employees may enroll and make changes at any time throughout the year. You become eligible for matching contributions when you make deferral contributions. Quanta Services makes matching contributions to plan participants in an amount equal to 100% of the first 3% of your eligible compensation and 50% of the next 3% of your eligible compensation.

You can enroll in the Plan or update your Plan elections by visiting Fidelity’s NetBenefits® website at https://nb.fidelity.com, or by calling the Fidelity Retirement Benefits Line at 800.835.5095 to speak with a phone representative, Monday through Friday, 8:30 a.m. to 8:30 p.m., EST.

Plan Tools & Features

On NetBenefits®, you can:

■ Designate your Plan ■ Make investment beneficiary election changes

■ Change your

■ Research investments contribution rate

■ Request Plan literature

You can also access the following planning tools:

■ The Library: Use this tab on Fidelity NetBenefits® and access checklists, calculators and tools, workshops, and videos provided by Fidelity that can help you make smarter choices about your benefits and your money.

■ Mobile App: Download the NetBenefits® mobile app from your device’s app store, and get access to all your Fidelity workplace accounts anytime, anywhere.

■ Portfolio Review is an online tool that helps you identify your savings goals, analyzes your current investment mix, and suggests an investment mix to help you better align your portfolio with your goals.

■ The Automatic Increase Program (AIP) is an optional participant- elected service that helps you keep pace with your goals by automatically increasing your contribution amount each year. All you have to do is pick the amount and date of your increase. Even a small increase of 1% or 2% per year can potentially help you reach your goals.

How much can I contribute?

Through automatic payroll deduction, you may contribute up to 75% of your eligible pay on a pre-tax or Roth (after-tax) basis.

When is my enrollment effective?

Your enrollment becomes effective once you elect a deferral percentage, which initiates deductions of your contribution from your pay. These salary deductions will generally begin after we receive your enrollment information, or as soon as administratively practicable (approximately one to two paychecks).

What are my investment options?

The Plan offers a wide variety of investment fund options and includes a Roth 401(k) feature. You can elect to contribute in both a pre-tax and post-tax basis. You can review the Plan’s fund lineup by logging on to Fidelity at https://nb.fidelity.com or by calling 800.835.5095

Can I take a loan from my account?

Although your Plan account is intended for your retirement, you may borrow from your account for any reason.

Can I make withdrawals?

Withdrawals from the Plan are generally permitted when you terminate your employment, retire, reach age 59 1⁄2, or become permanently disabled, as defined by our Plan. Refer to the Summary Plan Description or call Fidelity for more details.

How do I designate my Plan beneficiary?

From the NetBenefits® home page, click ‘Your Profile,’ then click ‘Beneficiaries’ and follow the steps to designate your beneficiary.

NOTE: Please review QR code for details on the 401 (k) savings plan highlights.

Quanta Benefits Center: 800.835.5095 https://nb.fidelity.com

877.269.1182

877.357.7463 www.BCBSTX.com www.ESRX.com/bcbstx

800.835.2362 www.teladoc.com/BCBSTX

800.327.2189 www.MagellanHealth.com

Suicide Prevention Lifeline Text 988 hello@headway.co www.headway.co

800.942.0854 www.MetLife.com/mybenefits

Life/AD&DL: 800.638.6420 STD/LTD: 800.300.4296

833.470.3490 www.MetLife.com/mybenefits

Customer Service: 800.638.3120

Provider Location: 800.839.3242 www.MyUHCVision.com

800.835.5095 https://nb.fidelity.com

800.544.3716 https://nb.fidelity.com

800.835.5095 https://nb.fidelity.com

800.543.3562 www.lifelock.com