As the holiday season approaches, we want to take a moment to wish you and your family a Merry Christmas and a Happy New Year! May this festive season bring you joy, warmth, and precious moments spent with loved ones.

We are incredibly grateful for your continued loyalty and support throughout the year. Whether you’ve been with LifeandHomes from the start or are a more recent reader, your engagement means the world to us. It’s because of you that we are able to continue bringing you valuable content, insights, and updates that matter.

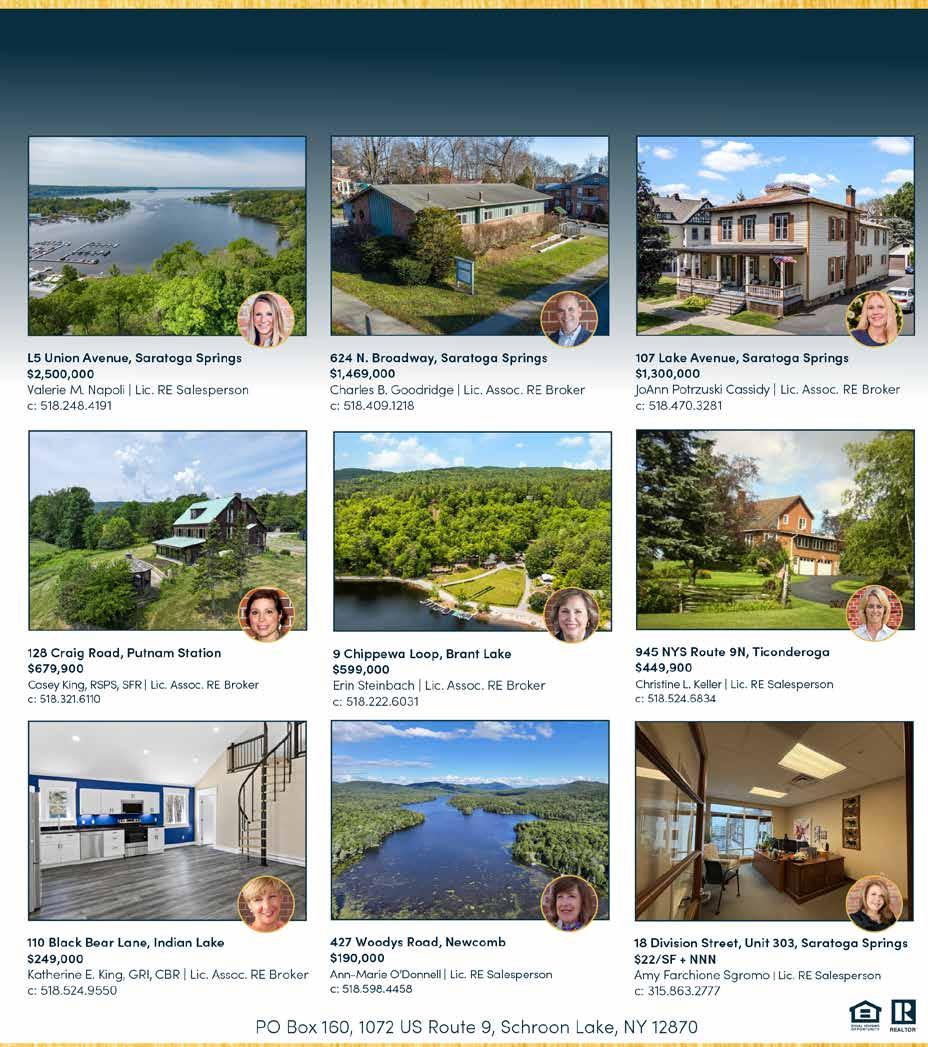

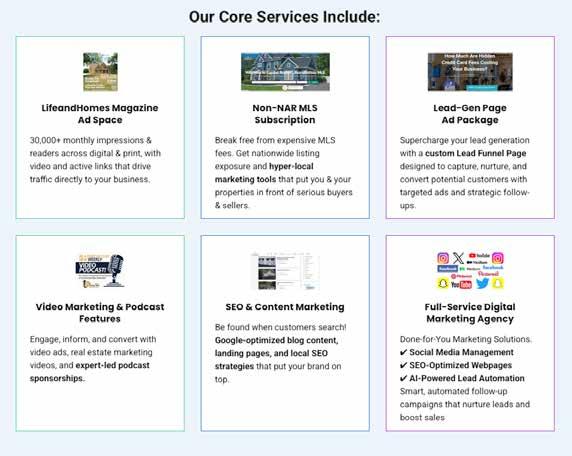

We also want to extend our heartfelt thanks to our advertisers. Their support makes this publication possible, and we are proud to work alongside local businesses and service providers who share in our commitment to serving our community. We encourage you to check out their services, as they are integral in helping us deliver quality services throughout the year.

Thank you for being part of our journey. From everyone at LifeandHomes, we wish you and yours a holiday season filled with peace, love, and all the good things life has to offer.

God Bless You and Yours

www.facebook.com/pages/Lifeandhomes.CapitalRegion Follow Us

www.LifeandHomes.com

Hippo's annual Housepower Report surveyed over 2,000 U.S. homeowners to uncover valuable insights, from the repairs impacting their financial well-being to their top home projects.

A significant 73% of homeowners expressed regret about their home purchase in 2024, primarily due to compromises on features, higherthan-expected mortgage rates, and unexpected maintenance issues. This is up from 63% in 2023, indicating a troubling year-over-year trend.

Regret # 1 - 42% regret compromising on features they really wanted.

Regret #2: - 34% of respondents regret paying a mortgage rate higher than they can comfortably afford.

Regret #3 - 29% feel regret after facing more unexpected issues and repairs than anticipated.

The 2024 Housepower Report survey was conducted by SurveyMonkey Audience for Hippo Insurance Services. (hippo.com/blog)

Did you know that one portable generator produces the same amount of carbon monoxide as hundreds of cars?

Carbon monoxide, also known as CO, is called the "Invisible Killer" because it's a colorless, odorless, poisonous gas. More than 200 people in the United States die every year from accidental non-fire-related CO poisoning associated with consumer products. More than 100 of those deaths are linked to portable

generators. Many Americans own portable generators to keep the power on after a storm.

• Never use portable generators inside homes or garages, even if doors and windows are open. Use generators outside only, at least 20 feet away from homes with exhaust facing away.

• Install battery-operated CO alarms or CO alarms with battery backup on every level of the home and outside sleeping areas. Interconnected CO alarms are best; when one sounds, they all sound.

• Know the symptoms of carbon monoxide poisoning: headache, dizziness, weakness, nausea, vomiting, sleepiness, and confusion. If you suspect CO poisoning, get outside to fresh air immediately, and then call 911. (cpsc.gov)

Tom Corley, author, speaker, and financial planner, interviewed 233 millionaires and revealed the five things that millionaires don’t waste their money on. Can you guess what they are?

1. Packaged and processed food - According to Tom Corley, many millionaires said they stopped buying low-quality, processed food when they could afford to. For better health and utilization of money, they put their cash towards organic, ethically-sourced, and high-quality produce and meat.

2. Fast fashion - Many of the ultra-rich prefer to invest in high-quality clothes that can stand the test of time. They opt for tailored or timeless pieces that are definitely more expensive but also of better quality. They feel it’s still less expensive than constantly replacing clothes from fast fashion brands that are cheap and wear out quickly.

3. Major repairs - They preferred to spend money on completely replacing things like old roofs, washing machines, dishwashers, refrigerators, furnaces, and even vehicles, rather than putting their hard-earned funds towards expensive repairs,” wrote Corley.

4. Garden tools and equipment - Millionaires opt for hired landscapers once they can afford to. This means they no longer spend money on outdoor tools and machines used for weeding, mowing, trimming, etc.

5. Lottery tickets - Instead of putting their money towards lottery tickets, they preferred to spend it on experiences. ( moneycontrol)

The average U.S. household generates 1,000 to 1,200 pounds of plastic waste annually.

A significant portion of this comes from soft plastics like bags, wrappers, and flexible packaging. To address the U.S. waste crisis, Clear Drop® launched the Soft Plastic Compactor (SPC) as a pre-recycling step to process soft plastics directly at home, transforming them into uniform blocks suitable for storage, transport, and guaranteed recycling.

SPC uses a patented plastic softening technology that has been rigorously tested and is safe for household use. It compresses waste about 10 times more efficiently than collecting soft plastics in bags and can store roughly a month's worth of waste. SPC runs quietly and efficiently, using roughly $0.52 per month in electricity costs for an average household.

The Soft Plastic Compactor (SPC) is now available for home use and the $50 monthly plan includes installment payments for the device, recycling pickup, and a full two-year warranty. Customers receive three prepaid mailers every quarterenough to recycle about one block per monthand can schedule pickups anytime. Learn more at onecleardrop.com (Newswire.com)

Every space has been thoughtfully refreshed while preserving its historic warmth. If you’re seeking elbow room, timeless country tranquility, and million-dollar views, this admired and lovingly cared-for property may just check all the boxes.

Gary Glebus Broker/Owner

Commercial Building, Main St, Ticonderoga, prime location, former floral shop, retired, high traffic flow, retail, office etc. $210,000!

Apts plus.

There is a convenient laundry area near the first floor bedrooms, and the open staircase leads to an oversized primary bedroom with an ensuite bath! If a fourth bedroom is needed, there is extra space in the walkout basement that also includes a family room and a workshop.

Jut as the residence is made for the comfort of people, the barn is constructed to pamper your horses. This 60x60 foot newly constructed building includes eight custom stalls, two of which are super stalls, made to accommodate two horses. There is a huge tack room and plenty of space for feed storage. Along side the barn are four partly sheltered paddocks that enter into a 200 x 120 foot riding ring. As a bonus, there is a 36 by 60 foot second floor on the barn for future expansion (classrooms or apartment maybe?)

Vehicle storage is provided by a one-stall under the house and a three-stall detached garage. The majority of the land is wooded and there are about two acres of meadow near the stable. A small stream provides year-round harmony.

Live the good life in this exceptional contemporary Log Home tucked away in a corner above the orchard on this nine and four-tenths-acre Horse Ranch!

Enjoy the view from the glass-walled living room with its cathedral ceiling and massive stone replace. Entertain in style from the adjoining kitchen/dining area with custom cabinets and built-in appliances. A wrap-around porch brings you outside for summer fun.

Call Bruce Ward today 315-796-4425

There are several types of costs and fees you pay when taking out a mortgage and purchasing a home. Some of these costs are directly related to the mortgage and others are part of homebuying or homeownership. Consider the costs directly related to the mortgage when you’re shopping for a loan.

You pay for mortgage and homeownership fees either up-front when you first take out the mortgage, or over time by paying them with your monthly mortgage payments. When choosing a mortgage, it’s important to consider both possibilities. A mortgage with a lower monthly payment may be the result of paying more costs at or before closing, or a mortgage may have a higher monthly payment because the principal amount of the loan is higher.

Upfront costs. In addition to your down payment, there are several different kinds of costs you must pay at closing.

• Origination and lender charges. These costs are charged by the lender for “originating,” or making you the loan. They are part of the price of borrowing money. Common charges are labeled origination fees, application fees, underwriting fees, processing fees, administrative fees, etc. Although the lender may itemize these costs differently, it’s the total amount that matters.

• Points. Points are a charge you pay upfront to the lender to lower the interest rate on your loan. Points are part of the price of borrowing money and are calculated as a percentage of the loan amount. You can choose whether or not to pay points.

Tip:If you don’t know how long you’ll stay in the home or when you’ll want to refinance and you have enough cash for closing and savings, you might not want to pay points to reduce your interest rate or take a higher interest rate to receive credits. If you are unsure, ask a loan officer to show you two different options (with and without points or credits) and to calculate the total costs over a few different possible timeframes. Choose the shortest amount of time, the longest amount of time, and the most likely amount of time you can see yourself keeping the loan.

• Third-party closing costs. These are charges for third-party services that are required to get a mortgage, such as appraisals and title insurance. You can shop separately for some of these services.

• Government fees. These fees may be required by your local government and charged in connection with the real estate transaction or mortgage. They generally will not vary based on who the lender is.

• Prepaid expenses and deposits. These expenses may be associated with your loan or with homeownership. Typically, you need to pay the interest on your loan between the time you close and the end of that month. It’s also common to pay the first year’s homeowner’s insurance premium and make initial deposits into an escrow account to cover future homeowner’s insurance and property taxes.

• Other homebuying expenses. These expenses may be associated with the purchase of a home but not required to get a mortgage. These may include home inspections, owners title insurance, or real estate agent fees.

Monthly costs. Your monthly payment will typically contain up to four elements:

• Principal. This is the money you borrowed and have to pay back. This is part of the cost of buying your home, but not a cost of borrowing money.

• Interest. This is the primary, but not the only, cost of borrowing money.

• Mortgage insurance. This is an additional cost of borrowing money, typically required for borrowers who make a down payment of less than 20%.

• Property taxes and homeowners’ insurance. These are costs of homeownership, not of borrowing money. They are usually bundled with your monthly payment and managed by the lender through an escrow account.

Tip: If your loan doesn’t include an escrow account, you will have to plan to pay these large expenses yourself. Be sure you budget for these extra costs and stay current on your taxes and insurance payments. If you fail to pay your property taxes, your state or local government may impose fines and penalties or place a tax lien on your home. You could also face foreclosure.

In addition, if you fail to pay your taxes or insurance, your lender may:

• Add the amounts to your loan balance

• Add an escrow account to your loan

• Purchase new homeowners insurance for you and bill you for it. This lender-purchased insurance, known as force-placed insurance, is typically more expensive than homeowners insurance you pay on your own.

In addition, you may pay for condominium or homeowner’s association dues. These costs are usually paid separately from your monthly payment.

Note, while property taxes and homeowners’ insurance are often paid with your mortgage, they’re really costs of homeownership. You would have to pay them with or without a mortgage. These costs are important in deciding how much you can afford. However, lenders don’t control these costs, so you shouldn’t make decisions about which lender to choose based on their estimates of these costs.

(consumerfinance.gov)

8520 Trenton Falls Prospect, Trenton $599,000 7 Bedrooms | 2 Full & 2 Half Baths | 2,520 Sq. Ft. Trenton Falls Log Home • Holland Patent Schools

and

Thoughtfully updated with modern comforts, this exceptional property features a spacious dining room and a large, modern eat-in kitchen, complete with a walk-in pantry perfect for all your storage needs. Enjoy the beauty of every season in the stunning three-season screened lounge, featuring a cozy gas stove that brings the outdoors in all year long.

The serene primary suite offers a true retreat, with expansive windows that frame breathtaking views right from your bed. Indulge in the luxurious Jacuzzi tub, and unwind by the suite’s own gas stove—making this private sanctuary the perfect place to relax and recharge. With 7 bedrooms, 2 full and 2 half bathrooms, and multiple gathering and family room areas, there’s space for everyone to live, work, and relax in comfort. A six-stall garage, horse barn, and private pond are nestled on acres of wooded seclusion—offering privacy and tranquility just minutes from the city. Steps away from the West Canada trail and gorge. Located in the highly sought-after Holland Patent School District, this extraordinary home is a rare find and a true lifestyle property.