What’s the GO with RO?

GRAPE PRICES under pressure

GROUNDED IN SUSTAINABILITY

The lowdown on healthy soil

MARCH 2023 2023 ANNUAL THEME: INNOVATION | ISSUE THEME: VINEYARD FOCUS

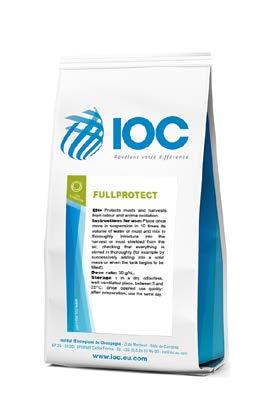

FULLCOLOR FULLPROTECT ESSENTIAL ANTIOXIDANT

• Specially formulated product containing tannins and yeast polysaccharides.

• This blend maximises and stabilises the colour of red wine while giving a rounder, approachable palate.

• 100% natural product.

• Blend of specific yeast derivatives and antioxidant gallic tannin.

• These work synergistically to protect from oxidative reactions.

• FullProtect enhances aromatics and improves longevity while also enhancing mouthfeel.

• Pure Gall nut tannin.

• Protects musts and wines from oxidation in difficult conditions.

• Improves aromatics and colour.

• Early addition to grapes, must or juice will significantly influence the quality of your resulting wine.

YOUR VINTAGE 2023 TOOLBOX

NEW

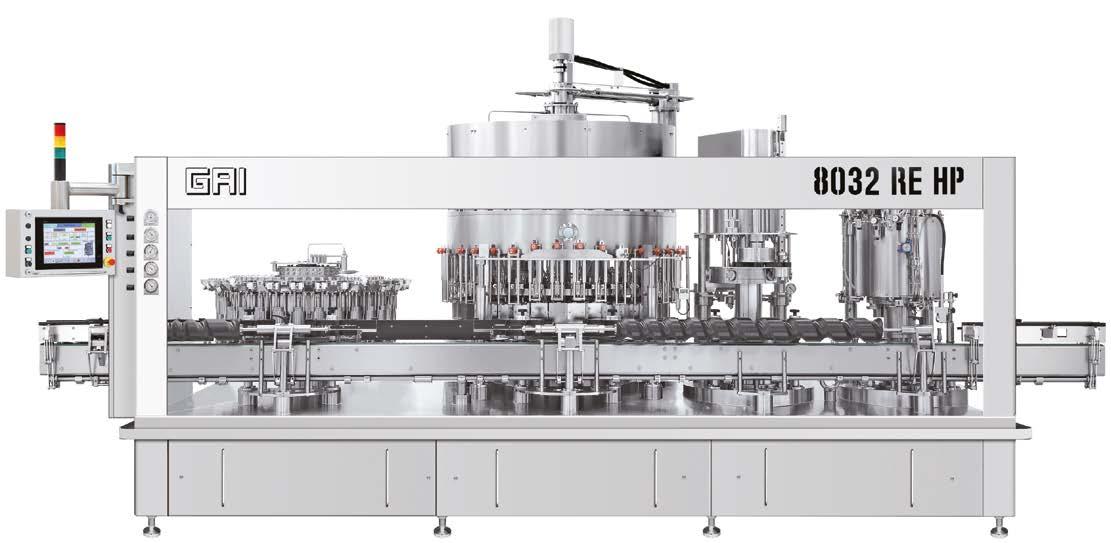

The JUCLAS Crossflow respects the organoleptic and structural characteristics of your wine, yet has the ability to process significant volumes on a daily basis. It has the ability to filter juice, sparkling wine and still wines pre-bottling.

FILTER HOUSINGS

Our filter housings utilise new technological filtration media to ensure quality filtration with a minimal impact on wine. These housings are rated for absolute filtration and are made of AISI 304 stainless steel.

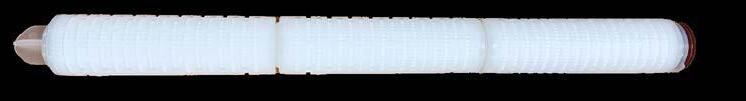

FILTER CARTRIDGES

Our range of filter cartridges includes a wide variety of formats and lengths for existing and new applications. These cartridges are ideal for use with our Alteco filter housings.

Victoria 59 Banbury Road, Reservoir 03 9462 4777 South Australia 16 Burdon St, Dudley Park 08 8365 0044 New South Wales 2/40 Bradmill Ave, Rutherford 02 4932 4511 Western Australia Unit 5, 1 Ostler Drive, Vasse 08 9755 4433 Tasmania 9 Swanston Park Drive, Waverley 03 6722 5050 New Zealand 3 Estuary Place, Richmond, Nelson +64 9 4412 262 Email us at sales@winequip.com.au WWW.WINEQUIP.COM.AU

FILTRATION OPTIONS FOR ALL PRODUCERS

CROSSFLOW

4 Grapegrower & Winemaker www.winetitles.com.au March 2023 – Issue 710 41 65 86

The March 2023 issue

Winemaker

on

with a look at aspects of soil health in particular.

the

COVER:

of Grapegrower &

focusses

the vineyard,

Pictured on

cover

is Kym Kalleske of Kalleske Wines in the Barossa.

MARCH 2023 ISSUE 710 contents REGULARS 7 Winetitles Insights 8 What’s Online 8 In This Issue 12 International briefs 46 Ask the AWRI 89 Producer Profile: Chris Scott 91 Calendar 91 Looking Back 92 Marketplace Classifieds NEWS 9 WISA appoints new executive chair 10 Shaky Bridge Wines names Mike Kush as winemaker and GM 11 Tahbilk honours James Halliday AM with cellar building dedication GRAPEGROWING 14 FEATURE Stressors and facilitators to adoption of sustainable viticulture 20 FEATURE Understanding, measuring and ameliorating soil composition in vineyards 32 Growers beware of infected grafted vines 34 Fungicide resistance: effective management practices for healthy vines and budgets 41 Chenin Blanc Uncorked WINEMAKING 47 Taylors Wines boasts clear benefits of water filtration system 53 FEATURE Reverse osmosis and value adding 56 Amphorae in vogue 61 Behind the Top Drops: Dal Zotto Col Fondo Prosecco 65 Young Gun: Tash Arthur

Photo is courtesy of Wine Australia.

BUSINESS & TECHNOLOGY

70 FEATURE Renewed growth in wine and viticulture degrees provides industry optimism

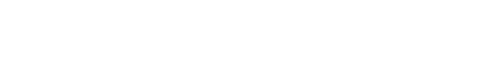

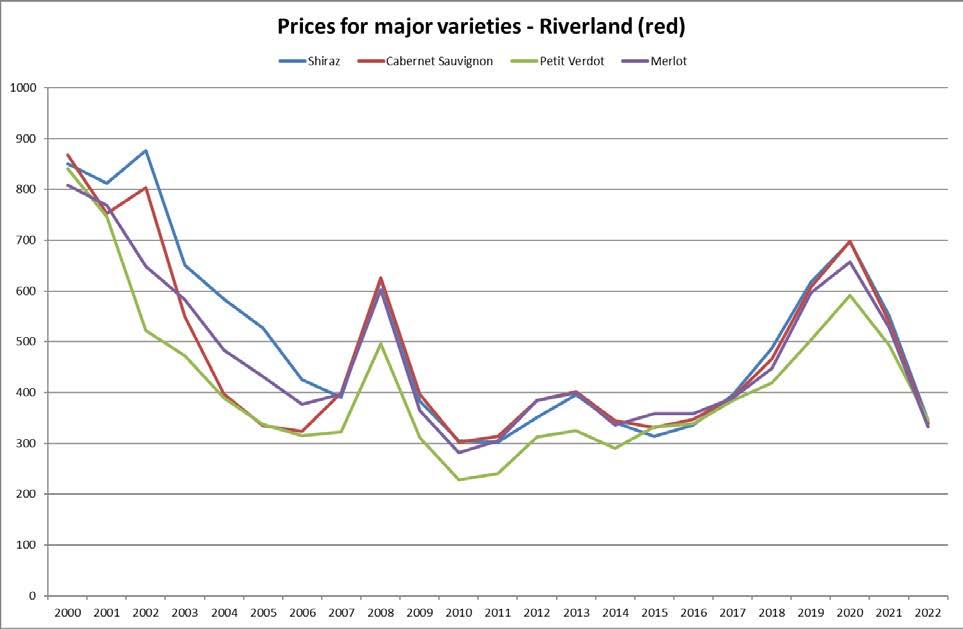

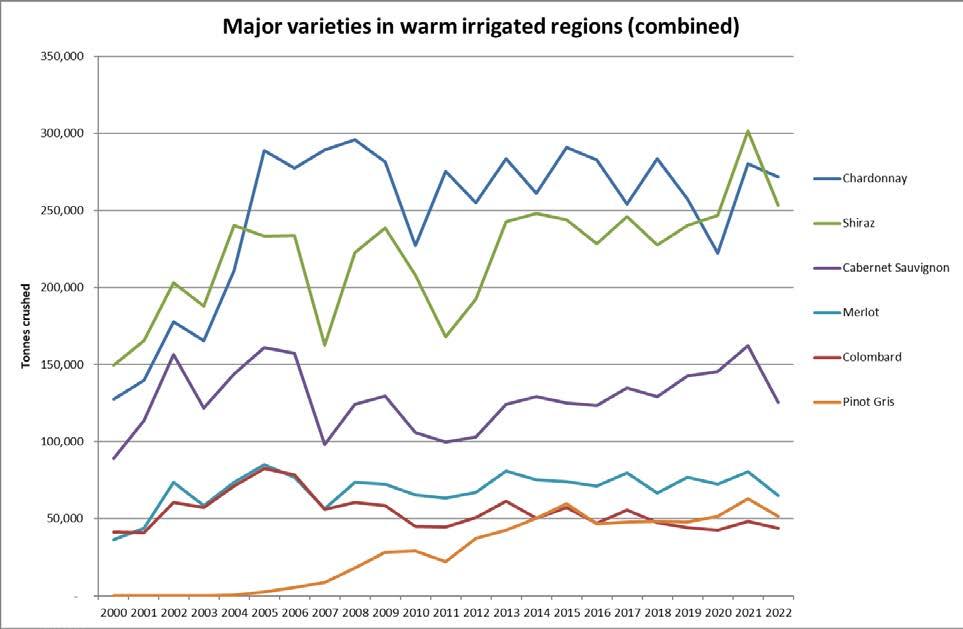

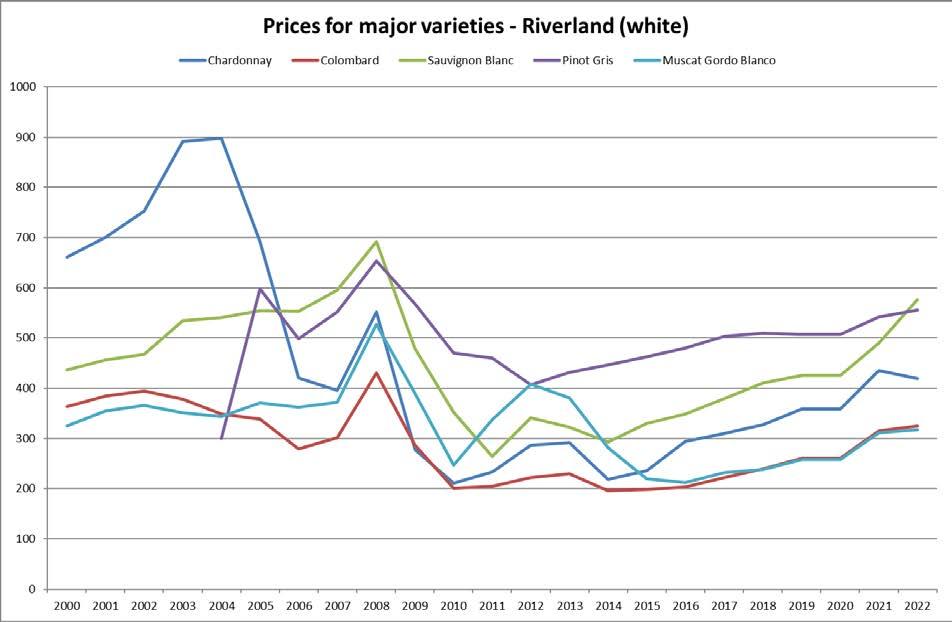

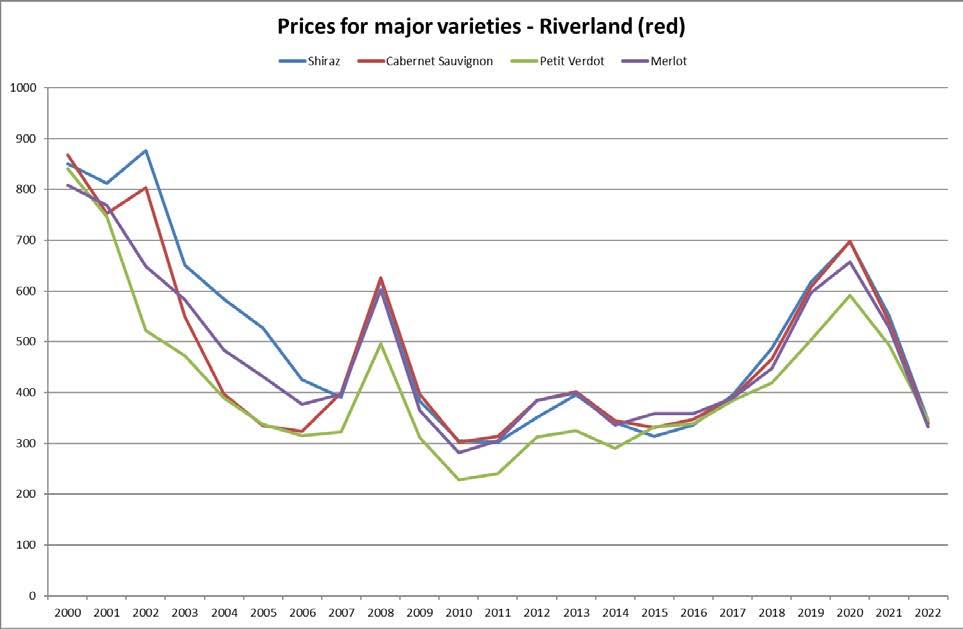

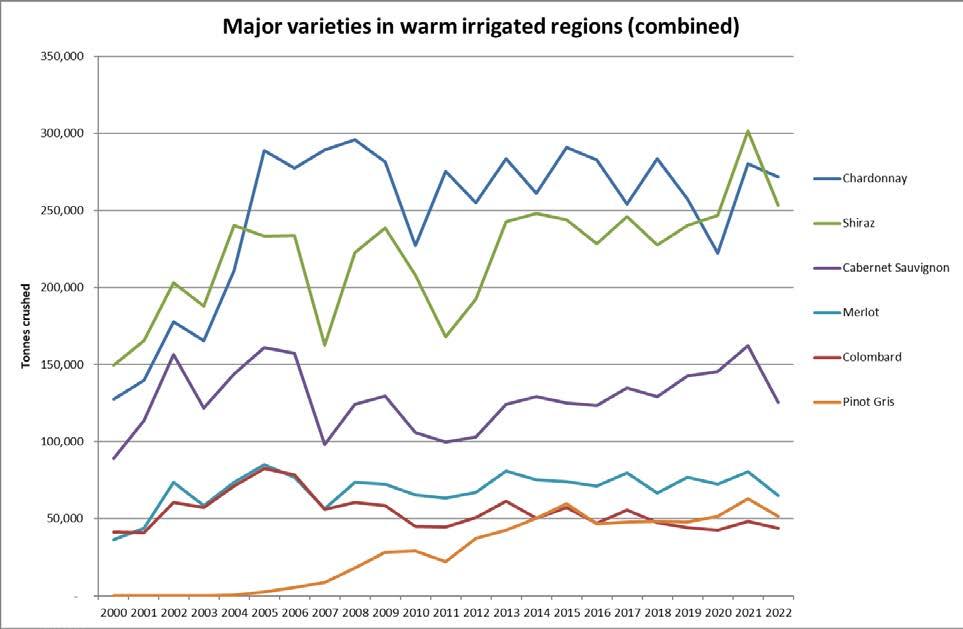

74 Grape price pressures add to growers’ woes

79 Endeavour Group appoints new chief financial officer

SALES & MARKETING

80 FEATURE A glass act

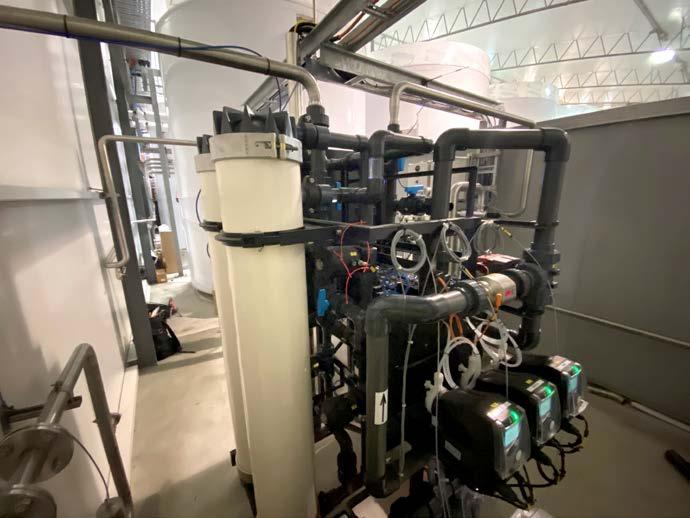

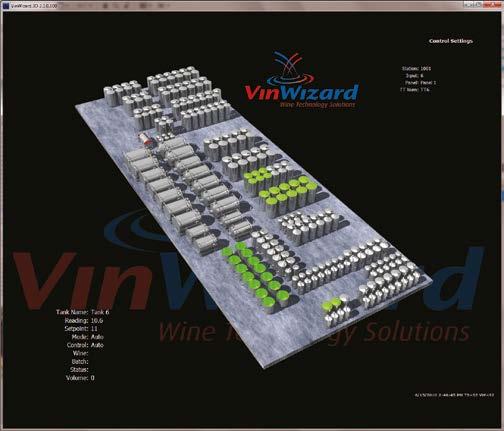

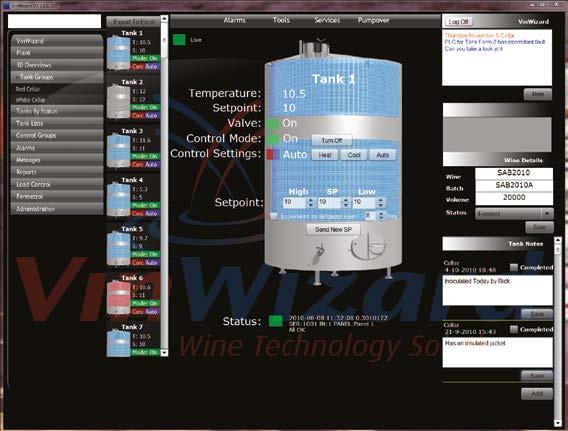

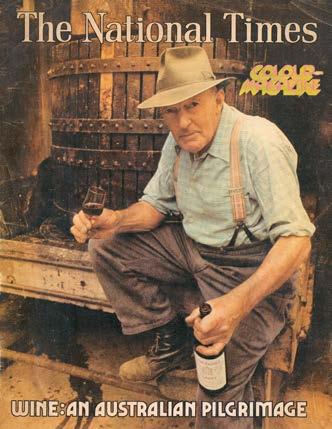

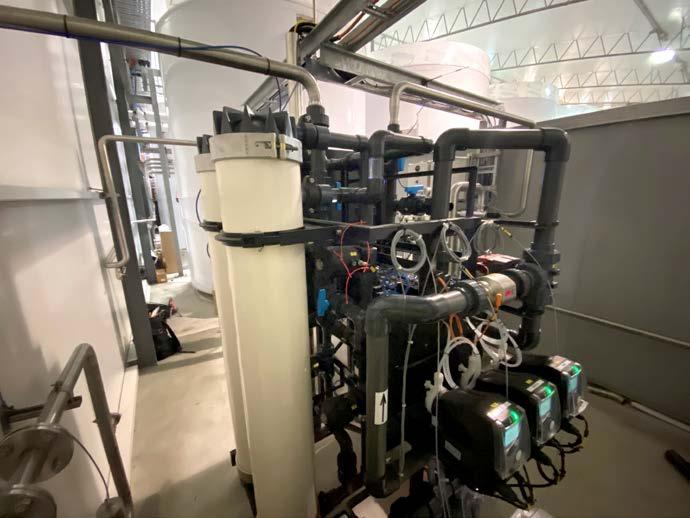

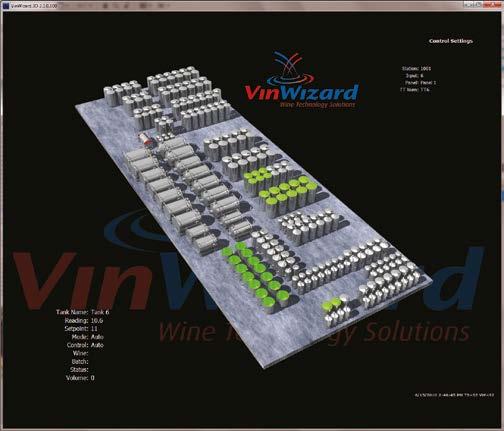

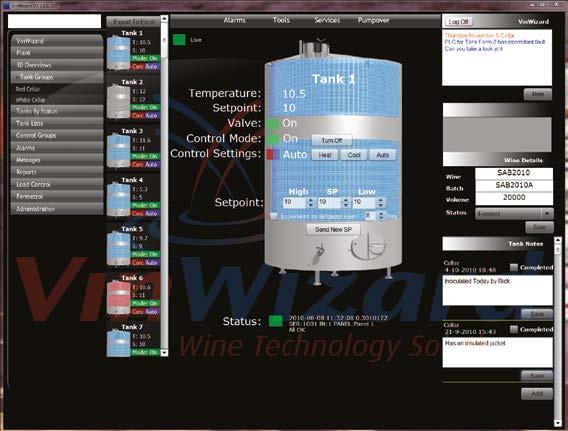

84 The flow of Australia’s rich wine history revealed in forthcoming publication

Hans Mick Editor

Hans Mick Editor

Welcome to the March issue of the Grapegrower & Winemaker which has a focus on the vineyard. Speaking of vine rows and fruit, we hear that vintage has been running late in several, though not all, Australian wine regions. However, those that have begun picking fruit have reported excellent quality for the grapes coming off the vines. Vintage 2023 brings with it a continuation of challenges and will raise hard questions regarding the future for individual operators and the industry as a whole. It’s likely to be a pivotal point that could determine the viability and potential longevity of many – but the grape and wine sector has successfully navigated downturns and shocks to the system before, and there’s always the chance that 2023 may surprise us all by offering some unexpected optimism.

Staying grounded for the time being, we explore important aspects of soil health. Firstly, we look closely at the attributes of soil for the adoption of sustainable viticulture (page 14). Then we turn to vineyard wheel traffic and compaction of soil to better understand its composition. We present trial data related to this from page 20. Dr Richard Smart informs us about his concerns about trunk disease and, specifically, the threat posed by infected grafted vines (page 32). With wet conditions having had such an effect on the past growing season for many, writer Simone Madden-Grey provides an overview of effective management practices for Botrytis, powdery mildew and downy mildew with an eye on improving efficiencies and costs (page 34). We also profile South Africa’s favourite variety, Chenin Blanc, in our regular Uncorked feature (page 41).

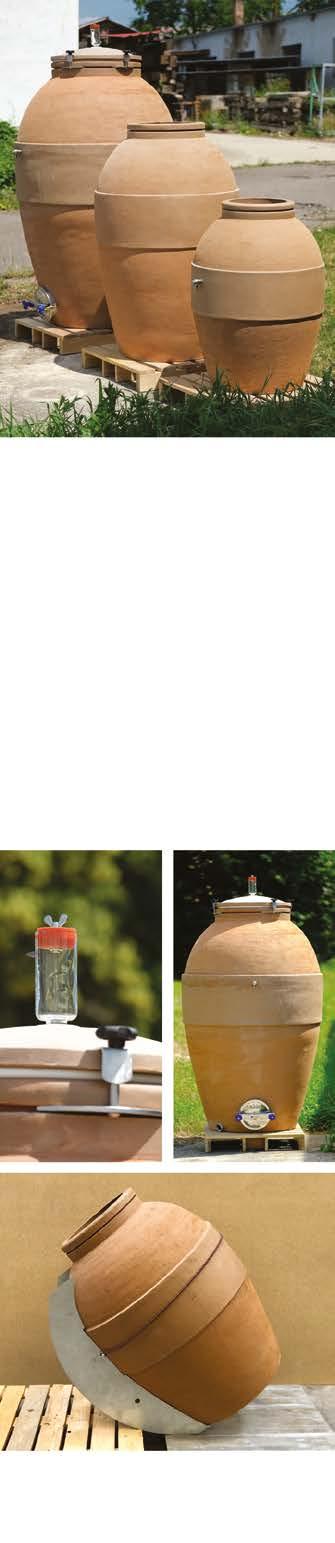

Heading into the winery, Sonya Logan

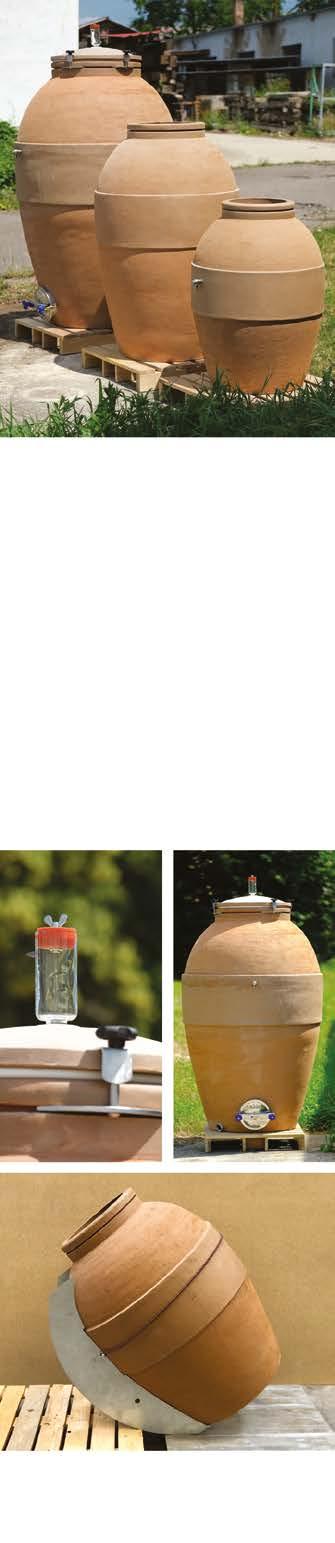

examines the technology behind an advanced new water filtration system installed and successfully utilised at Taylors Wines in the Clare Valley (page 47). Meantime, winemaker Paul Le Lacheur uncovers the current status of reverse osmosis in wine filtration (page 53). We head to the other end of the technological scale to uncover a new revival of amphorae, a simple, ancient winemaking tool that’s risen again from the dust like an awakened mummy. Read more about its benefits for modern winemakers from page 56. For Behind the Top Drops we find out the backstory of Dal Zotto Col Fondo Prosecco (page 61), while we meet this month’s Young Gun, Margaret River’s Tash Arthur who’s blazing a renewed trail for fortified wines (page 65).

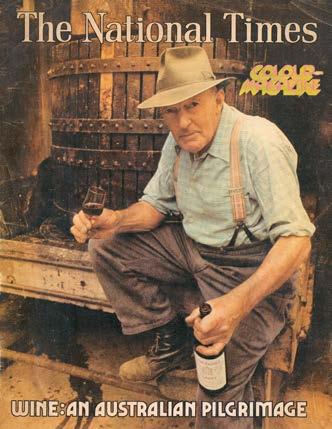

One of those challenges for growers mentioned earlier has been the increasing pressure on grape prices. There are, of course, well-understood reasons behind this and so we unpack the current state of fruit pricing across several Australian regions (page 74). We also delve into the present state of the education and training sector for viticulture and oenology (page 70). And we ask author Andrew Caillard MW to tell us how his massive (!) forthcoming set on the history of Aussie wine came to be (page 84).

There’s a lot more inside too – I hope you enjoy the read!

March – Issue 710 www.winetitles.com.au Grapegrower & Winemaker 5 89 61 EQDC Find us @winetitles

linkedin.com/company/winetitles-pty-ltd

E @winetitlesmedia D @winetitles Q @winetitlesmedia C

ABOUT Grapegrower & Winemaker

The Australian & New Zealand Grapegrower & Winemaker is a practical, solution-based journal published monthly for the wine & viticulture industry. Packed with grapegrowing and winemaking advice, it also features articles related to business, technology, sales and marketing. It profiles industry professionals, wineries, plus wine and grape varieties and much more.

NATIONAL JOURNAL OF THE WINE INDUSTRY SINCE 1963

Publisher and Chief Executive: Hartley Higgins

General Manager: Robyn Haworth

Editor: Hans Mick h.mick@winetitles.com.au

Associate Editor: Sonya Logan s.logan@winetitles.com.au

Editorial Advisory Board

Denis Gastin, Dr Steve Goodman, Dr Terry Lee, Paul van der Lee, Bob Campbell MW, Prof Dennis Taylor, Dr Mary Retallack and Corrina Wright

Editorial: Harrison Davies h.davies@winetitles.com.au

Advertising Sales: Louise Reid sales@grapeandwine.com.au

Production Sudapa Rattanonda

Creative Services Sudapa Rattanonda

Circulation: subs@winetitles.com.au

Winetitles Media

ABN 85 085 551 980 630 Regency Road, Broadview, South Australia 5083

Phone: (08) 8369 9500 Fax: (08) 8369 9501 info@winetitles.com.au www.winetitles.com.au

E @winetitlesmedia

D @winetitles

Q @winetitlesmedia

C linkedin.com/company/winetitles-pty-ltd

Printing by Lane Print Group, Adelaide ISSN 1446-8212

Printed on FSC Certified Paper, manufactured under the Environmental Management System ISO 14001, using vegetable-based inks from renewable resources.

Grapegrower & Winemaker subscribers represent all industry categories including grape growers, propagationists, wine makers, cellar door, managers, marketers, engineers, suppliers and educators.

Subscribe from as little as $57.75* for 12 issues!

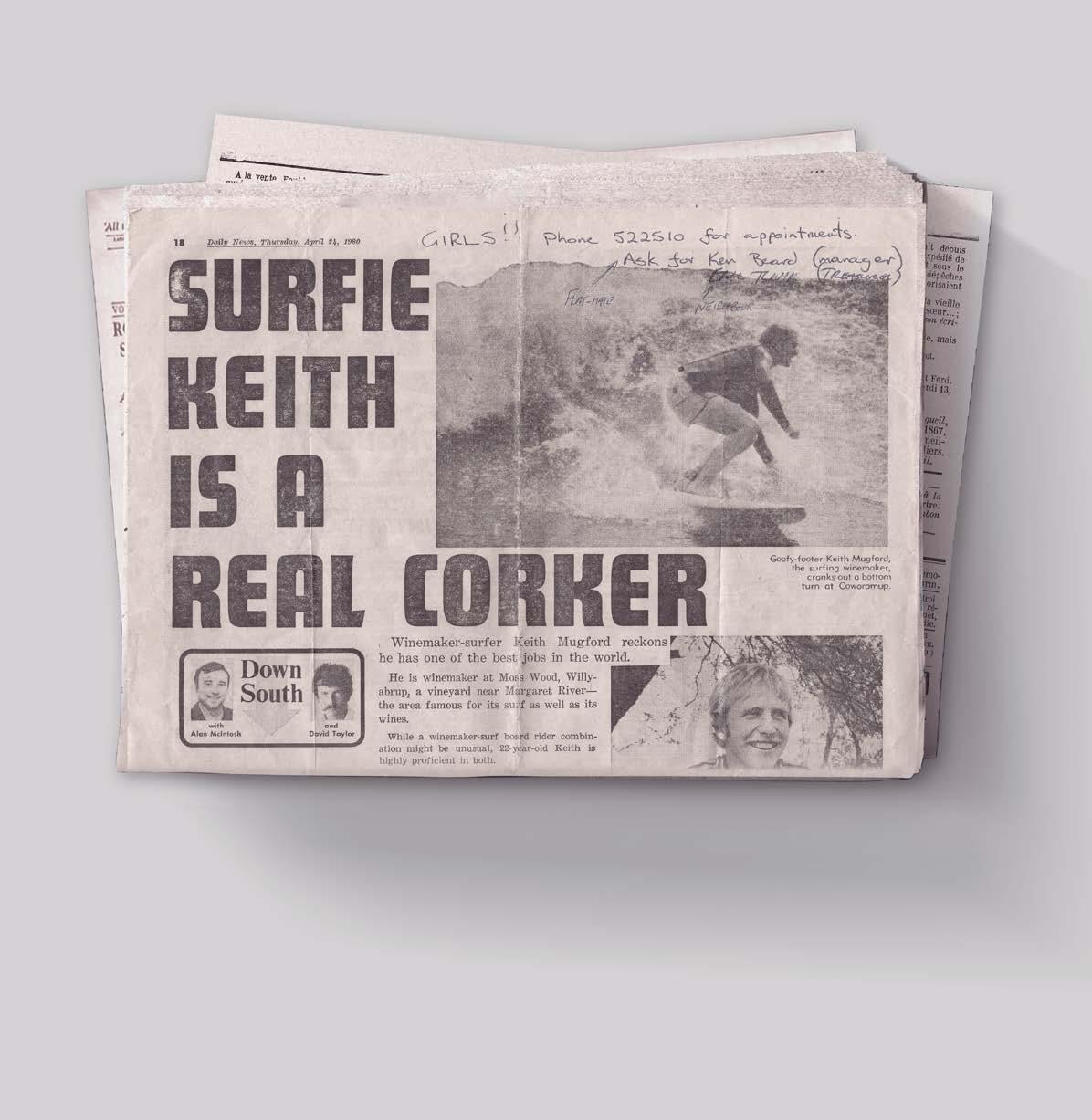

© Contents copyright Winetitles Media 2022 All Rights Reserved.

Print Post Approved PP100004140

Articles published in this issue of Grapegrower & Winemaker may also appear in full or as extracts on our website.

Subscription Prices

Australia:

1 year (12 issues) $83.95 (inc. GST)

2 years (24 issues) $157.50 (inc. GST)

New Zealand, Asia & Pacific:

1 year (12 issues) $119.70 (AUD)

2 years (24 issues) $227.85 (AUD)

All other countries:

1 year (12 issues) $189 (AUD)

2 years (24 issues) $366.45 (AUD)

Students (Aus only):

1 year (12 issues) $68 (inc. GST)

SUBSCRIBE TODAY

or phone

www.winetitles.com.au/gwm

+ 61 8 8369 9500

It’s essential reading for wine industry

I find the whole magazine interesting and it’s always very helpful to all areas of our business. I love reading it every month!

Jacob Stein

“ Available in PRINT & DIGITAL *based on 12 month digital subscription

Director & Chief Winemaker, Robert Stein Winery

Compiled from data supplied by Wine Australia, our regular Winetitles Insights reports feature industry sales and production insights to keep growers and winemakers informed on the latest trends.

AUSTRALIAN WINE EXPORTS - year ended December 2022

AUSTRALIAN WINE EXPORTS - year ended December 2022

Annual export tracker

Monthly export tracker

The value of Australian wine exports decreased by 4% to $1.9 billion and volume increased by 1% to 623 million litres in the year ended December 2022.

Increases in the value of exports to Canada, Thailand, Malaysia and Japan were offset by decreases to the other top 10 destinations.

Annual export tracker

AUSTRALIAN WINE EXPORTS - year ended December 2022

AUSTRALIAN WINE EXPORTS - year ended December 2022

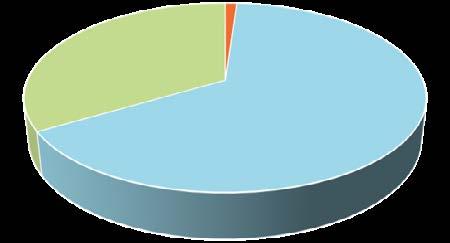

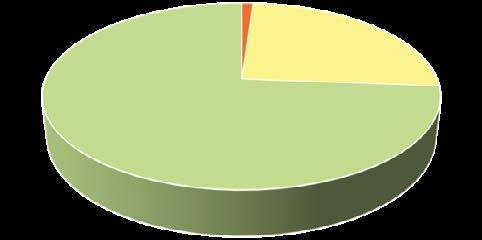

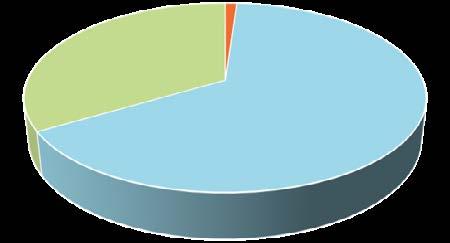

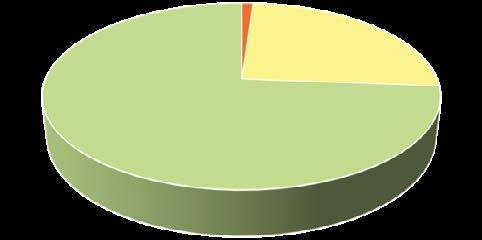

SHARE OF EXPORTS BY CONTAINER TYPE

Annual export tracker

Monthly export tracker

SHARE OF EXPORTS BY CONTAINER TYPE

SHARE OF EXPORTS BY CONTAINER TYPE

Monthly export tracker

The value of packaged exports decreased by 3 per cent to $1.5 billion and volume decreased by 9 per cent to 216 million litres. Unpackaged wine exports decreased by 6 per cent in value to $488 million and increased by 6.5 per cent in volume to 407 million litres. The average value of unpackaged wine decreased by 12 per cent to $1.20 per litre FOB.

Monthly export tracker

Monthly export tracker

The top five markets by value in the year ended December 2022 were:

• US, down 3 per cent to $390 million

• UK, down 18 per cent to $373 million

• Canada, up 14.5 per cent to $188 million

• Hong Kong, down 13 per cent to $167 million, and

• Singapore, down 20 per cent to $132 million.

EXPORTS BY PRICE POINT AND YEAR ON YEAR CHANGE EXPORTS BY TOP 10 DESTINATIONS AND YEAR ON YEAR CHANGE

EXPORTS BY PRICE POINT AND YEAR ON YEAR CHANGE EXPORTS BY TOP 10 DESTINATIONS AND YEAR ON YEAR CHANGE

EXPORTS BY PRICE POINT AND YEAR ON YEAR CHANGE

EXPORTS BY PRICE POINT AND YEAR ON YEAR CHANGE

EXPORTS BY PRICE POINT AND YEAR ON YEAR CHANGE

COMMENTARY

EXPORTS BY TOP 10 DESTINATIONS AND YEAR ON YEAR CHANGE

EXPORTS BY TOP 10 DESTINATIONS AND YEAR ON YEAR CHANGE

BY TOP 10 DESTINATIONS AND YEAR ON YEAR

The value of Australian wine exports decreased by 4% to $1.9 billion and volume increased by 1% to 623 million litres in the year ended December 2022. Increases in the value of exports to Canada, Thailand, Malaysia and Japan were offset by decreases to the other top 10 destin ations.

The value of packaged exports decreased by 3 per cent to $1.5 billion and volume decreased by 9 per cent to 216 million litre s. Unpackaged wine exports decreased by 6 per cent in value to $488 million and increased by 6.5 per cent in volume to 407 million litres. The average v alue of unpackaged wine decreased by 12 per cent to $1.20 per litre FOB.

The top five markets by value in the year ended December 2022 were:

•US, down 3 per cent to $390 million

•UK, down 18 per cent to $373 million

•Canada, up 14.5

•Hong Kong, down 13 per cent to $167 million, and

•Singapore, down 20 per cent to $132 million.

Source: Wine Australia

COMMENTARY

COMMENTARY

The value of Australian wine exports decreased by 4% to $1.9 billion and volume increased by 1% to 623 million litres in the year ended December 2022. Increases in the value of exports to Canada, Thailand, Malaysia and Japan were offset by decreases to the other top 10 destin ations.

The value of Australian wine exports decreased by 4% to $1.9 billion and volume increased by 1% to 623 million litres in the year ended December 2022. Increases in the value of exports to Canada, Thailand, Malaysia and Japan were offset by decreases to the other top 10 destin ations.

year ended December

Wine Australia providing insights on Australian Wine

$0.0 $0.4 $0.8 $1.2 $1.6 $2.0 $2.4 $2.8 $3.2 $3.6 $4.0 0 100 200 300 400 500 600 700 800 900 Jan-2019 Apr-2019 Jul-2019 Oct-2019 Jan-2020 Apr-2020 Jul-2020 Oct-2020 Jan-2021 Apr-2021 Jul-2021 Oct-2021 Jan-2022 Apr-2022 Jul-2022 Oct-2022 $A (BILLIONS) LITRES (MILLIONS) ROLLING ANNUAL (YEAR ENDING)

Export volume Export value 0 5 10 15 20 25 30 35 40 0 1 2 3 4 5 6 7 8 Jul Aug Sep Oct Nov Dec CUMULATIVE EXPORTS (MILLION CASES) MONTHLY EXPORTS (MILLION CASES)

Mth 2021 Mth 2022 Cum 21 Cum 22 ▲ 2.7% to $623 m ▼ 5.9% to $0 m $500 m $1,000 m $10.00 and above $2.49 and under YE December 2021 YE December 2022 ▼ -3.3% ▼ -17.7% ▼ -5.4% $390 m $373 m $51 m $44 m $0 m $100 m $200 m $300 m $400 m $500 m USA South Korea YE December 2021 YE December 2022 Alternative Packaging 1% Bulk Wine 65% Glass Bottle 34% Volume Alternative Packaging 1% Value EXPORTS BY TOP 10 DESTINATIONS AND YEAR ON YEAR CHANGE volume increased by 1% to 623 million litres in the year ended December 2022. were offset by decreases to the other top 10 destin ations. volume decreased by 9 per cent to 216 million litre s. Unpackaged wine exports 0 5 10 15 20 25 30 35 40 0 1 2 3 4 5 6 7 8 Jul Aug Sep Oct Nov Dec CUMULATIVE EXPORTS (MILLION CASES) MONTHLY EXPORTS (MILLION CASES)

Mth 2021 Mth 2022 Cum 21 Cum 22 m ▼ -3.3% ▼ -17.7% ▼ -5.4% $390 m $373 m $44 m $0 m $100 m $200 m $300 m $400 m $500 m USA UK Canada HK Singapore NZ Thailand Malaysia Japan South Korea YE December 2021 YE December 2022 Alternative Packaging Volume AUSTRALIAN WINE EXPORTS - year ended December 2022 SHARE OF EXPORTS BY CONTAINER TYPE

COMMENTARY The

Australian wine exports

2022. $0.0 $0.4 $0.8 $1.2 $1.6 $2.0 $2.4 $2.8 $3.2 $3.6 $4.0 0 100 200 300 400 500 600 700 800 900 Jan-2019 Apr-2019 Jul-2019 Oct-2019 Jan-2020 Apr-2020 Jul-2020 Oct-2020 Jan-2021 Apr-2021 Jul-2021 Oct-2021 Jan-2022 Apr-2022 Jul-2022 Oct-2022 $A (BILLIONS) LITRES (MILLIONS) ROLLING ANNUAL (YEAR ENDING) Annual export tracker Export volume Export value 0 1 2 3 4 5 6 7 8 Jul Aug Sep Oct Nov Dec MONTHLY EXPORTS (MILLION CASES) Monthly export tracker Mth 2021 Mth 2022 Cum 21 Cum 22 ▲ 2.7% to $623 m ▼ -11.8% to $531 m 5.9% to $457 m $0 m $500 m $1,000 m $10.00 and above $7.50 to $9.99 $5.00 to $7.49 $2.50 to $4.99 $2.49 and under YE December 2021 YE December 2022 ▼ -3.3% ▲ 14.5% ▼ -12.8% ▼ -20% ▼ -9.5% ▲ 118% ▲ 77.6% ▲ 7.7% ▼ -5.4% $390 m $373 m $188 m $167 m $132 m $95 m $62 m $61 m $51 m $44 m $0 m $100 m $200 m $300 m $400 m USA UK Canada HK Singapore NZ Thailand Malaysia Japan South Korea YE December 2021 YE December 2022 Alternative Packaging 1% Bulk Wine 65% Volume Alternative Packaging 1% Bulk Wine 25% Glass Bottle 74% Value AUSTRALIAN WINE EXPORTS - year ended December 2022 EXPORTS BY CONTAINER TYPE BY PRICE POINT AND YEAR ON YEAR CHANGE EXPORTS BY TOP 10 DESTINATIONS AND YEAR ON YEAR CHANGE COMMENTARY of Australian wine exports decreased by 4% to $1.9 billion and volume increased by 1% to 623 million litres in the year ended December 2022. $0.0 $0.4 $0.8 $1.2 $1.6 $2.0 $2.4 $2.8 $3.2 $3.6 $4.0 Apr-2019 Jul-2019 Oct-2019 Jan-2020 Apr-2020 Jul-2020 Oct-2020 Jan-2021 Apr-2021 Jul-2021 Oct-2021 Jan-2022 Apr-2022 Jul-2022 Oct-2022 $A (BILLIONS) ROLLING ANNUAL (YEAR ENDING)

EXPORTS

value of

decreased by 4% to $1.9 billion and volume increased by 1% to 623 million litres in the

Export volume Export value 0 5 10 15 20 25 30 35 40 0 1 2 3 4 5 6 7 8 Jul Aug Sep Oct Nov Dec CUMULATIVE EXPORTS (MILLION CASES) MONTHLY EXPORTS (MILLION CASES)

Mth 2021 Mth 2022 Cum 21 Cum 22 ▲ 2.7% to $623 m ▲ 5.9% to $120 m ▼ -1.7% to $214 m $0 m $500 m $1,000 m above $9.99 $7.49 $4.99 under YE December 2021 YE December 2022 ▼ -3.3% ▼ -17.7% ▲ 14.5% ▼ -12.8% ▼ -20% ▼ -9.5% ▲ 118% ▲ 77.6% ▲ 7.7% ▼ -5.4% $390 m $373 m $188 m $167 m $132 m $95 m $62 m $61 m $51 m $44 m $0 m $100 m $200 m $300 m $400 m $500 m USA UK Canada HK Singapore NZ Thailand Malaysia Japan South Korea YE December 2021 YE December 2022 Alternative Packaging 1% Bulk Wine 65% Glass Bottle 34% Volume Alternative Packaging 1% Bulk Wine 25% Glass Bottle 74% Value

$0.0 $0.4 $0.8 $1.2 $1.6 $2.0 $2.4 $2.8 $3.2 $3.6 $4.0 0 100 200 300 400 500 600 700 800 900 Jan-2019 Apr-2019 Jul-2019 Oct-2019 Jan-2020 Apr-2020 Jul-2020 Oct-2020 Jan-2021 Apr-2021 Jul-2021 Oct-2021 Jan-2022 Apr-2022 Jul-2022 Oct-2022 $A (BILLIONS) LITRES (MILLIONS) ROLLING ANNUAL (YEAR ENDING)

Export volume Export value 0 5 10 15 20 25 30 35 40 0 1 2 3 4 5 6 7 8 Jul Aug Sep Oct Nov Dec CUMULATIVE EXPORTS (MILLION CASES) MONTHLY EXPORTS (MILLION CASES)

Mth 2021 Mth 2022 Cum 21 Cum 22 ▲ 2.7% to $623 m ▲ 5.9% to $120 m ▼ -1.7% to $214 m ▼ -11.8% to $531 m ▼ -5.9% to $457 m $0 m $500 m $1,000 m $10.00 and above $7.50 to $9.99 $5.00 to $7.49 $2.50 to $4.99 $2.49 and under YE December 2021 YE December 2022 ▼ -3.3% ▼ -17.7% ▲ 14.5% ▼ -12.8% ▼ -20% ▼ -9.5% ▲ 118% ▲ 77.6% ▲ 7.7% ▼ -5.4% $390 m $373 m $188 m $167 m $132 m $95 m $62 m $61 m $51 m $44 m $0 m $100 m $200 m $300 m $400 m $500 m USA UK Canada HK Singapore NZ Thailand Malaysia Japan South Korea YE December 2021 YE December 2022 Alternative Packaging 1% Bulk Wine 65% Glass Bottle 34% Volume Alternative Packaging 1% Bulk Wine 25% Glass Bottle 74% Value

$0.0 $0.4 $0.8 $1.2 $1.6 $2.0 $2.4 $2.8 $3.2 $3.6 $4.0 0 100 200 300 400 500 600 700 800 900 Jan-2019 Apr-2019 Jul-2019 Oct-2019 Jan-2020 Apr-2020 Jul-2020 Oct-2020 Jan-2021 Apr-2021 Jul-2021 Oct-2021 Jan-2022 Apr-2022 Jul-2022 Oct-2022 $A (BILLIONS) LITRES (MILLIONS) ROLLING ANNUAL (YEAR ENDING) Annual export tracker Export volume Export value 0 5 10 15 20 25 30 35 40 0 1 2 3 4 5 6 7 8 Jul Aug Sep Oct Nov Dec CUMULATIVE EXPORTS (MILLION CASES) MONTHLY EXPORTS (MILLION CASES)

Mth 2021 Mth 2022 Cum 21 Cum 22 ▲ 2.7% to $623 m ▲ 5.9% to $120 m ▼ -1.7% to $214 m ▼ -11.8% to $531 m ▼ -5.9% to $457 m $0 m $500 m $1,000 m $10.00 and above $7.50 to $9.99 $5.00 to $7.49 $2.50 to $4.99 $2.49 and under YE December 2021 YE December 2022 ▼ -3.3% ▼ -17.7% ▲ 14.5% ▼ -12.8% ▼ -20% ▼ -9.5% ▲ 118% ▲ 77.6% ▲ 7.7% ▼ -5.4% $390 m $373 m $188 m $167 m $132 m $95 m $62 m $61 m $51 m $44 m $0 m $100 m $200 m $300 m $400 m $500 m USA UK Canada HK Singapore NZ Thailand Malaysia Japan South Korea YE December 2021 YE December 2022 Alternative Packaging 1% Bulk Wine 65% Glass Bottle 34% Volume Alternative Packaging 1% Bulk Wine 25% Glass Bottle 74% Value SHARE OF EXPORTS BY CONTAINER TYPE Commentary

what’s ONLINE

Growing popularity of cans helps drive Orora growth

Sustainable packaging provider Orora has reported its first-half results, with a strong performance delivering increases to sales revenue, up 13.9 per cent to $2.26 billion, EBIT up 7.3% to $165.8m and statutory net profit after tax, up 7.8% to $108.1m. Orora operates in multiple markets and strong earnings growth in North America, and a “robust earnings performance” in Australasia helping the company to this strong result. Source: The Shout

NZ vineyards devastated by Cyclone Gabrielle

Vineyards in the key growing regions of Hawke’s Bay and Gisborne have been devastated by flooding caused by Cyclone Gabrielle. NZ Prime Minister Chris Hipkins said: “The severity and the damage that we are seeing has not been experienced in a generation.” It is only the third time a national state of emergency has been declared in New Zealand. Many vines were completely submerged during the cyclone, just weeks before the start of the grape harvest. Source: Drinks Digest

Trials cloning Margaret River

Cabernet Sauvignon

A south west WA winery has cloned one of Margaret River’s most famous red wine varietals in the name of future-proofing the industry against climate challenges. The industry-funded trial has resulted in 14 different clones of Cabernet Sauvignon being grown on a plot of land in the heart of the renowned wine region. The genetic qualities of the plant were carefully selected from Australian and overseas sources to create the clones, which have been propagated and built as part of the ongoing trial.

Source: ABC News

In this issue

“The problem arises due to the use of infected rootstock cuttings. This is not surprising since probably most rootstock cuttings are grown in Australian source areas with shoots from mother vines sprawled on the ground. This is known to cause infection of the shoots which leads to infected cuttings.”

- Richard Smart, page 32

“As soon as we went to the ultra-filtered water supply, everything seemed to improve. We’ve got a [wine] crossflow filter which started washing itself better. The performance of all our [wine] filtration media improved. Our [wine] filtration costs went down, manual handling went down, the amount of environmental waste we were sending to landfill went down.”

- Adam Eggins, page 47

“Like last year, there is strong demand, particularly for the Chardonnay, Sauvignon Blanc and icon reds. More vineyards in the region are now contracting their fruit for a number of years, reducing the grapes for sale on the bulk market. In 2022 the average price per tonne in Margaret River for Cabernet Sauvignon increased 3% to $1,965 and Shiraz increased 8% to $1,419.”

- Amanda Whiteland, page 74

“We are also drawing on help from our wider friends and colleagues from the wine industry and beyond to help with various elements of the project. This has included sending the unedited manuscript to a handful of trusted industry friends, academics and historians for their feedback.”

- Andrew Caillard MW, page 84

8 Grapegrower & Winemaker www.winetitles.com.au March 2023 – Issue 710 Daily Wine News is a snapshot of wine business, research and marketing content gleaned from local and international wine media sources, with a focus on Australian news and content.

BSI

WISA appoints new executive officer

Wine Industry Suppliers Association Inc. (WISA) have appointed Cameron Hills to the position of executive officer.

Following the recent departure of Shirley Fraser from the role, WISA chair Tim Stead was enthusiastic to see what Hills will bring to the position.

“The Management Committee was sad to see Shirley leave the association after having such an enormous impact on the strategic direction, industry relationships and membership engagement of WISA, but we are ready to welcome Cameron and the breadth of experience he will bring to the role,” Stead said.

“Cameron is an experienced EO in the wine industry and beyond. His background is well suited to the role, but equally, his experience outside of the wine industry will bring new ideas and help shape the next era of WISA.”

Hills was most recently employed in a senior role at Royal Agricultural

& Horticultural Society of SA and previously held several executive roles in the wine industry. He has a passion for wine and the people of the wine industry which is evident in his career.

“I am both honoured and excited to have been selected to work with the Wine Industry Suppliers Association,” Hills said.

“The body has demonstrated clear industry leadership and is motivated to build on its progress with a host of future opportunities. I am enthused to be playing a part in the ongoing success of the association and the wine industry.

“I am looking forward to meeting the members of Wine Industry Suppliers Association as well as the affiliated professional organisations that share the association’s values.” Hills was scheduled to commence in the role at WISA on 27 February.

Freshcare Programs for the Wine Industry

We deliver audits that meet the requirements of the Freshcare Australian Wine Industry Standards of Sustainable

March – Issue 710 www.winetitles.com.au Grapegrower & Winemaker 9 news

is a leading food safety certification provider with extensive auditing capacity and the capability to conduct integrated audits for a wide range of food safety standards.

Practice in both Viticulture and Winery that were developed specifically to support the Australian

Industry. Contact us today to begin the Freshcare certification process. W: bsigroup.com/en-au E: info.aus@bsigroup.com P: 1300 730 134 2303_Grapegrower and Winemaker Ad_b.indd 1 3/02/2023 11:25:51 AM

Wine

Cameron Hills

Shaky Bridge Wines names Mike Kush as winemaker and GM

Central Otago based Shaky Bridge has announced Mike Kush as winemaker and general manager to lead the winery and reaffirm its commitment to producing best-in-class Pinot Noir reflecting the best of the region and Alexandra basin.

“We are one of the original wineries in Central Otago with my parents Gill and the late Bill Grant planting some of the first vines in the region back in 1973,” said Dave Grant, owner and winemaker at Shaky Bridge.

“Mike, with his range of experiences, passion for the region and commitment to quality, is the perfect person to come on board and lead the winery. He knows the best wines in the world with one foot in the old world and one foot in the new world, and has a vision for where Central Otago and Pinot Noir from the region can go.”

Originally from Chicago in the US, Kush began his winemaking career in Sonoma County and has worked for wineries worldwide, including in New Zealand, Burgundy, Mosel, Argentina, Portugal and South Africa.

He is also the winemaker and owner of Chasing Harvest wines, producing wines in New Zealand and Douro, Portugal.

Kush is a candidate for the Masters of Wine, currently in Stage 2, having passed the four day theory examination and looking to pass the 36-wine blind-tasting practical exam this June. He also teaches Wine Business for Sonoma State University’s Wine Business Institute.

State of UK on-premise sales

On-premise sales have, and continue to be, a reliable resource for wineries to bolster income. The ultimate goal of producers is to find their way on to more menus, meaning more sales.

Wine Business Solutions has released its 2023 study into on-premise sales in the UK as a resource for Australian wine businesses.

The case study is valuable to the Australian industry because around 19% of wine is consumed in the on-premise segment in the UK. Interestingly, 19% is the number in both the US and Australia, when those markets are operating under ‘normal’ conditions demonstrating, perhaps, the extent to which restaurant culture has become globalised.

“We keep hearing that restaurants in the UK are doing it tough. Cost of living pressure is impacting consumer spending. But you wouldn’t necessarily know that given what Brits are spending on wine in the on-premise,” Wine Business Solutions principal Peter McAtamney said.

“According to Wine Business Solutions’ Wine On-Premise UK 2023, the average price of a bottle of wine sold in the UK on-premise is now £44, up 9% and in line with inflation. No real surprise there.”

McAtamney identified rosé and sparkling wine styles as moving trends in the UK, all showing signs of growth throughout the on-premise sector and mirroring trends in Australia and the US. White and red wines both saw price increases to match inflation.

“The average price of a glass of white wine, however, is up by 18% to £8.11 and red is up 19% to £8.36 indicating where the UK on-trade are looking to build back their margins on the back of ‘break out’ style demand,” McAtamney said.

“We saw it in sales figures in off-premise last year and we see it now in UK on-premise listings, Champagne listings are up by 45% on a year ago after having dropped 10% year-on-year to the start of 2022.

“After seemingly having come to the end of its run, rosé listings are up 55% year-

“Although I’ve travelled and worked all over the wine world, I’m here in Central Otago because I believe it can produce truly world-class Pinot Noir,” said Kush. “I’m also very passionate about Alexandra. With its unique soils and being a cooler corner of Central Otago, it

on-year with Provence driving growth.”

Distribution for Australian products in the UK is still in flux, as the country is still the biggest international consumer of Australian wine, however the Australian industry has found a new competitor in what has historically been a very friendly market.

Somewhat mirroring the ‘shop local’ trends in Australia, British origin wines saw a significant increase of on-premise listings in the Wine Business Solutions report.

“One category outshone them all, however, and that was British wine. Listings are up by over 100% year-onyear. This now means that, for the first time, WBS has enough data to make a statistically reliable assessment of British wine as a category,” McAtamney said.

“British sparkling wine is now a bigger category than Cava in the UK on-premise, something that would have been inconceivable a decade ago and which highlights the difference between having a strategy that is driven by value

10 Grapegrower & Winemaker www.winetitles.com.au March 2023 – Issue 710 news

Mike Kush and Dave Grant from Shaky Bridge Winery

Tahbilk honours James Halliday AM with cellar building dedication

Tahbilk has announced a new member of their Estate ‘family’. Building on a long-held tradition of dedication, fourth generation board member and former CEO, Alister Purbrick, unveiled a cellar on the historic estate dedicated to Australian wine writer James Halliday AM.

A walk around the Estate will reveal many plaques on buildings, honouring longtime, loyal staff members or signifying building openings by Prime Ministers, Federal Ministers and State Premiers. And last month, James Halliday himself was present on the Estate to witness the unveiling of the James Halliday Cellar, in view of family members, staff and colleagues from the wine media fraternity.

“Tahbilk and the Purbrick family have long been friends of mine, and I am humbled by this dedication, even if it suggests I am near the end of my useful life,” Halliday said with his typical self-deprecating and sometimes dark humour.

“My family has agreed that naming one of our buildings after James is so appropriate and a small token of our gratitude for his support of our great

industry, Tahbilk and my family over many years,” Alister Purbrick, who unveiled the plaque with Halliday present, said.

“In keeping with our Estate tradition, we believe that naming a cellar for James provides lasting recognition of his enormous contribution to the wine landscape in Australia and beyond.

“His wine ratings are followed by a global audience of consumers and industry and are an unquestioned measure of wine quality and we look forward to welcoming James back to the Estate to visit any time.”

An Australian wine writer, critic, winemaker, judge and globally recognised authority on all things wine, James Halliday AM is one of the pioneers

of Australian wine writing, along with his friend and former colleague Len Evans, who had the Estate’s museum named after him during Tahbilk’s 135th anniversary celebrations in 1995.

Since 1979 Halliday has written and co-authored more than 40 books on wine and contributed to international publications including The Oxford Companion to Wine

Creator of the best-selling, annual Halliday Wine Companion and its associated rating system, James’ eponymous website houses over 100,000 tasting notes covering thousands of wineries and has become by far Australia’s most comprehensive wine resource.

Grapegrower & Winemaker 11 MEET THE

WEEDING

& NEW FISCHER TORNADO Fischer FKT-420 RSO CANE RAKE sales@fischeraustralis.com.au FITS 12 UNIQUE UNDERVINE MANAGEMENT DEVICES

FISCHER FLEX1 FLEX2

SYSTEM

(LR) Hayley Purbrick, James Halliday AM, Alister Purbrick and Mark Purbrick.

Portuguese winemakers call for urgent action over bottle prices

Wine producers in Portugal are calling for urgent action from the government over the rapidly soaring cost of glass bottles, reported the Drinks Business. The National Association of Traders and Exporters of Wines and Spirits (ANCEVE) has asked government officials for “urgent intervention” over escalating glass bottle prices, which according to local reports, are “dramatically” damaging the Portuguese winemaking industry.

France’s Agriculture Minister reveals support plan for wine industry

Vitisphere reported that a meeting eagerly awaited by the entire French wine industry took place last month with Agriculture Minister Marc Fesneau. Although there was plenty of talk, it wasn’t just idle talk. The minister confirmed to industry representatives that he agreed to provide funding for short-term distillation measures along with possible funding for structural vine pulls in regions that needed it.

Wildfires in Chile rip through historic vineyards and destroy wineries

Wildfires have destroyed wineries and scorched vineyards in south-central Chile after temperatures reached a record 40°C in mid-February. According to Decanter, more than 20 people died after the wildfires burned down hundreds of homes with three regions – Araucanía, Biobío and Ñuble – declaring a state of emergency. Leoncio Fernández, owner of Leoncio Wines in the Itata Valley, said he was left ‘speechless’ by the destruction to his winery. Another producer, Altos del Valle in the Bío Bío Valley, reported that its winery had been completely destroyed.

California crushed 3.35m tons of winegrapes in 2022

In its preliminary crush report, the California Agricultural Statistics Service says 3.35 million tons of winegrapes were crushed in 2022, down nearly seven per cent compared to 2021 when 3.6 million tons of winegrapes were crushed in California, and around 1.5% less than the total for 2020. It was the third below average California winegrape crop in a row. The 3.35 million ton total is in line with industry expectations and is down slightly from the grape crop forecast of 3.5 million tons that was issued by CASS last August, according to Wine Business

Ireland’s plan for alcohol labels reaches the WTO

Ireland has notified the World Trade Organisation (WTO) of its draft regulations on the labelling of alcoholic beverages. Meininger’s reported that the Assembly of European Winegrowing Regions (AREV) has criticised Ireland’s push for alcohol labelling at a national level and calls for a clear counter-position by the EU. AREV claims that Ireland “is disregarding the EU agreement” by regulating the labelling of alcoholic beverages at a national level and wants to put up warning labels “similar to those on tobacco”.

Japan legalises selfcheckout alcohol sales

Last month, Japanese Minister of Digital Affairs Taro Kono announced that stores would be permitted to sell alcohol and tobacco through self-checkout registers, without a clerk checking the customer’s ID, reported the Drinks Business. Before this new development, if a customer wished to purchase alcohol at a self-checkout in Japan, the store clerk would prompt them to press a button confirming that they are 20-years-old or older (the legal age for the purchase of tobacco or alcohol), they may also have asked to see some form of identification

12 Grapegrower & Winemaker www.winetitles.com.au March 2023 – Issue 710 international briefs

Might alcohol follow tobacco?

By Richard Smart¹

By Richard Smart¹

Irecently came across modified (2023) guidelines for alcohol consumption in Canada (see www.ccsa.ca). For moderate risk the recommended intake was three to six standard drinks per week, which I found surprisingly low. The guidelines further suggest a low risk for consumption of two drinks a week or less, and increasingly high for seven drinks a week or more. A standard drink is 340ml of beer or a glass of 12% wine, 140 ml. The guidelines were updated from 2011.

Australia has also recently reviewed guidelines in 2020. These are for adults to reduce the risk of harm from alcoholrelated disease: healthy men and women should drink no more than 10 standard drinks a week, and no more than four a day.

I wondered if what is considered as a safe consumption level is now decreasing because of better health statistics and analyses. I further pondered if this tendency may lead to alcohol receiving more government attention, as did tobacco use after health warnings in the 1950s?

Some reactions

Cancer is the leading cause of death in

Canada. However, the fact that alcohol is a carcinogen that can cause at least seven types of cancer is often unknown or overlooked. The most recent available data show that the use of alcohol causes nearly 7,000 cases of cancer deaths each year in Canada, with most cases being breast or colon cancer, followed by cancers of the rectum, mouth and throat, liver, esophagus and larynx. According to the Canadian Cancer Society, drinking less alcohol is among the top 10 behaviours to reduce cancer risk.

The Canadian press (CBC) responded to the recent guidelines announcement, including statements that 25% of drinkers do not know that alcohol can cause cancer. Specialists say that health benefits have been largely debunked but they continue to circulate causing confusion and misunderstanding. The Canadian discussion, as might be expected, involved warning labels on alcohol containers.

Interestingly, in January 2023 the Irish Government declared its intention of warning labels on alcohol containers (“Drinking alcohol causes Liver disease” and “There is a direct link between alcohol and fatal cancers”). Wine is the

second favourite beverage, with those of Chile, Spain and Australia preferred. There have been protests by Italy, Spain and six other EU member states.

In February 2021 the European Commission launched “Europe’s Beating Cancer Plan”, focusing on prevention including alcohol policy solutions. This plan contains a target of 10% reduction in per capita alcohol use by 2025. One measure of the plan involves health warning labelling. In the EU in 2016, cancer was the most common cause of alcohol-related deaths at 29%. Will label health warnings on alcohol become common in Europe? Some argue so.

Conclusion

I have no pretense as to expertise in this area of public health and alcohol. I was however concerned when reading the new Canadian guidelines, and wondering how such guidelines might affect the Australian grape and wine sector in the future. For those interested in the possible tobacco parallel, the history of tobacco use in Australia is interesting reading, see www.tobaccoinaustralia. org.au.

March – Issue 710 www.winetitles.com.au Grapegrower & Winemaker 13 my view

LETTER TO THE

Will alcohol labels follow the example set by tobacco health warnings?

¹Smart Viticulture, Glenroy, Vic. E: vinedoctor@smartvit.com.au

EDITOR

Stressors and facilitators to adoption of sustainable viticulture

A focus on soil health

Suzy Y Rogiers¹, Darren Fahey¹, Maggie Jarrett¹, Matt Adkins¹, and Tintu Baby²

It is impossible to have a healthy and sound society without a proper respect for the soil (P. Maurin)

Our soils are critical for food and fibre production. Soil is not only important for productivity but also provides ecosystem services. Soils hold 25% of our planet’s biodiversity. A healthy soil is able to capture and hold water, to provide an oxygen and nutrient rich environment, to suppress diseases and pests, to neutralise toxins, and to store carbon.

through farming practices. Australian soils are typically low in organic matter and nutrients and are susceptible to erosion.

Soil health is a critical component of the vigneron’s management program. Following careful consideration of genetic material (cultivar, clone and rootstocks) and vineyard architecture at the time of vineyard establishment, the soil health indicators listed in Table 1 can form the basis of an annual vineyard health check, along with canopy and vineyard floor health assessments. Implementing practices that boost soil health is not only good for vines but also good for the surrounding environment, biodiversity, and encourages long-term sustainability for the industry. Appropriate management will reduce the loss of soil through wind or water erosion, slow carbon loss and acidification, improve water infiltration, and reduce the need for pest and weed control.

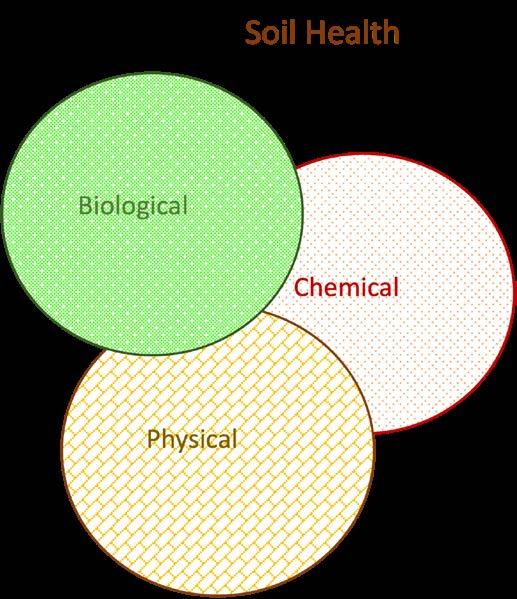

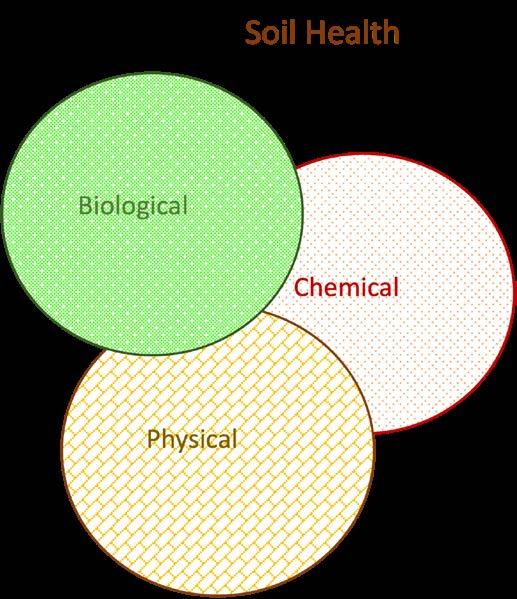

The soil is composed of physical, chemical and biological properties. There are a number of specific indicators that can provide useful information on the health of a vineyard soil (See Table 1 on page 18). Some of these are attributes of the parent material and difficult to manipulate, while others are malleable

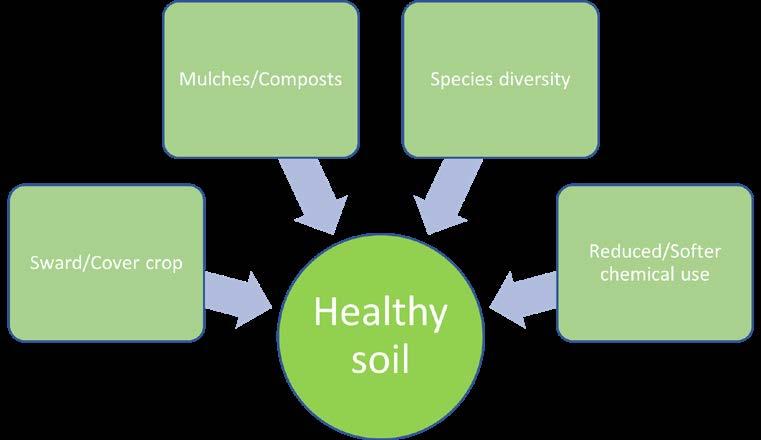

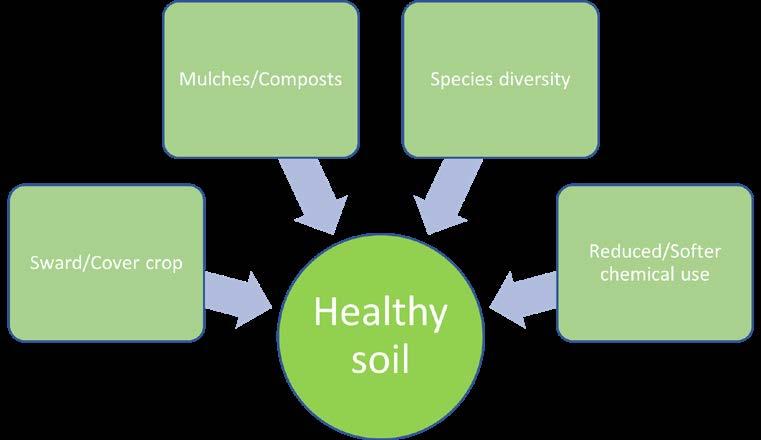

Soil health can be encouraged through appropriate vineyard floor management. The application of mulch undervine can reduce evaporation. However, the chemical composition of mulch and compost will need to be considered to avoid excess levels of potassium and other inorganic elements. The predicted increase in severe temperatures and heatwaves will have a significant influence on vine functioning and fruit quality directly and indirectly through soil and sward/cover crop influences. Allowing volunteer species to grow across the mid-row or planting a cover crop can improve organic matter. Establishing a year-around groundcover both undervine and mid-row can reduce synthetically derived inputs. However, groundcover height will need to be considered to alleviate competition and for disease management. Sheep may be used

14 Grapegrower & Winemaker www.winetitles.com.au March 2023 – Issue 710 grapegrowing

Fertilisers & Soil Health Sustainability

¹NSW Department of Primary Industries, Orange, NSW ²Gulbali Institute, Charles Sturt University, Wagga Wagga, NSW

Appropriate management will reduce the loss of soil through wind or water erosion, slow carbon loss and acidification, improve water infiltration, and reduce the need for pest and weed control.

to manage these areas during dormancy and even longer periods into the season. In dry regions, this mid-row area can be mown to alleviate competition for water. During wet years, a groundcover will reduce water erosion and the degradation of the surrounding water

quality. High species diversity in and around the vineyard will encourage natural predators such as arthropods and insectivorous birds for pests and diseases. Likewise, reducing herbicide use for the control of weeds will improve biodiversity. The rising costs of fertilisers

and their carbon footprint has created additional incentives to select specific floor management strategies.

Soil protection, restoration and maintenance has been a focus for several decades but recently it has become a

March – Issue 710 www.winetitles.com.au Grapegrower & Winemaker 15 Insecticides, Fungicides, Wetting Agents, Surfactants, Plant Growth Regulators, Herbicides, Disinfectants, Foliar Fertilisers KENDON The Farmer’s Mate Since 1950 Owned by an Aussie Farmer for Aussie Farmers Available at Your Local AG Distributor For chemicals that work, switch to Kendon in the BIG BLUE DRUM.

high potash liquid foliar fertilizer with chelated trace elements.

HIGH K Foliar Fertilizer Boost Your BRIX A

Distributor

Available at Your Local AG

5L,

Pack Sizes: 500ml, 1L,

20L, 200L, 1000L

topic of national significance. How can we encourage the adoption of some of these sustainable solutions so that our healthy soils continue to contribute to productivity, environmental sustainability and economic growth? The likelihood of practice change is dependent on the balance between stressors and facilitators.

Stressors Facilitators

Long-term viability

Cost

Complexity

Confidence

From an economic standpoint, practice change is more likely if financial viability can be assured through increased yield and quality, and/or lower costs of production, and/or increased premiums. None of these factors are guaranteed. The application of sustainable practices

Environmental & social governance

Policies and incentives

Knowledgecapabilityand

can be costly in the short-term, with a lag-time in reaping the on-farm benefits. Nonetheless, it is expected that longterm, quality should increase, and yield should stabilise and be more resilient to environmental stressors such as extreme weather events. A recent survey by our group found that long-term viability was

one major motivator for practice change. A second motivator was ‘doing the right thing’. However responsible agriculture is highly context dependent. Current farm finances, time commitment and skills can outweigh these motivators. While most growers want to protect and improve their soils, the stressors of their immediate situation can tip the balance in favour of the status quo.

Programs and incentives

In view of this, government programs and incentives may be required to facilitate and promote change. The NSW Government is developing a Sustainable Farming Program to improve both natural assets and agricultural productivity. Farmers can opt-in to an accreditation program to improve biodiversity and soil carbon whilst maintaining productivity. Certification may open markets relating to economic, environmental and social (ESG) values. Likewise, Sustainable Winegrowing Australia (SWA) is aimed at moving individuals and industry to a certification to demonstrate better practice and continual improvement in sustainability. Market access is a strong driver for change. The perception of our wine industry’s dedication to

16 Grapegrower & Winemaker www.winetitles.com.au March 2023 – Issue 710

grapegrowing

The predicted increase in severe temperatures and heatwaves will have a significant influence on vine functioning and fruit quality directly and indirectly through soil and sward/cover crop influences.

Extend your roots well beyond their natural range with EndoPrime® . With high performing mycorrhizae strains and a bio stimulant included, EndoPrime vastly increases the foraging ability of your roots while boosting crop productivity.

Goes where roots can’t.

KEY AREAS ENDOPRIME HAS BEEN SHOWN TO IMPACT:

• Crop yield

• Root and shoot biomass

• N, P, K and trace element uptake

• Water uptake during moisture stress

• Improved soil structure

• Plant performance in variable soil environments

• Soil health

• Australian Organic Certified

• Compatible with drip irrigation systems

www.sumitomo-chem.com.au ® EndoPrime is the registered trademark of Sumitomo Chemical Australia.

Table 1: Indicators for Vineyard Soil Health

BIOLOGICAL

Soil organic matter (SOM) - The benefits of SOM are numerous. It is suggested that once organic matter has been addressed the other indicators listed below are more likely to fall into place. For instance, SOM facilitates root growth through lowered bulk density and thus vines are more likely to find new sources of nutrients.

Soil biological quantity and diversity - Soils contain an array of insects, worms and microorganisms. Microbes are the powerhouse of biological processes in the soil and release nutrients from crop residues

Pests and diseases under control.

CHEMICAL

Nutrients - Grapevines, like all plants, require adequate quantities of the essential nutrients to achieve their full potential. Nutrients in deficient or excess quantities can be harmful to growth and development.

pH - The soil’s pH is a measure of the hydrogen ions in the soil solution and influences the availability of nutrients. Soils with a pH less than 5.5 (5.0 CaCl2) can be detrimental to nutrient uptake and may cause aluminium toxicity.

Cation Exchange CapacityCEC is a measure of the negative charges within the soil that can adsorb cations such as Ca2+, Mg2+ and K+. CEC influences soil structure stability and nutrient availability.

Electrical conductivity (EC)High salt stunts plant growth. Salinity can be an issue if irrigation water has a high EC.

Toxins - The application of foliar products may alter the chemistry of the soil once they are washed to the vineyard floor by rain. Some may increase the water repelling nature of the soil.

PHYSICAL

Aggregation - the aggregation of soil particles improves soil structure affecting aeration, permeability and nutrient cycling

Porosity - A soil with good porosity allows vine roots to penetrate into new regions and seek out nutrient, oxygen and water sources.

Bulk Density - Soils with high bulk density may deter this root exploration. Subsurface compaction leads to greater bulk denisty

Moisture - Water infiltration, retention and drainage affect soil moisture

18 Grapegrower & Winemaker www.winetitles.com.au March 2023 – Issue 710 grapegrowing

1 1 1 2 3 4 2 3 4 5 2 3

environmental governance by importing countries and their consumers is critical to ensuring markets. New Zealand’s FTA with Europe includes the need for ‘efficient use of natural resources and agricultural inputs, including reducing use and risk of agrichemicals’. Australia has committed to net zero targets and there will be a need to reduce fertiliser use in the coming years. Improving soil health and changing management practices will enable this transition.

Knowledge and capability are two significant barriers to change. Raising stakeholder awareness of the critical role soils play for our ESG wellbeing is a starting point. From a wine industry perspective, building a region-specific knowledge package on how to conserve and improve soil health will increase grower confidence to try new strategies. This can only be achieved through research. The sharing of expertise and knowledge through successful reallife demonstration sites, workshops or online portals and networks will

facilitate information transfer, improve confidence and drive practice change. This is well illustrated in the National EcoVineyards Program which aims to increase the land area dedicated to enhancing functional diversity and to increase the use of cover cops and soil remediation practices. It provides regional-specific options, an online information portal and demonstration vineyards across nine regions.

Soil health is significant to addressing key challenges such as climate change and food security. For the viticulture industry, a healthy soil will support plant resilience, improve productivity and environmental outcomes. The stressors and facilitators to practice change are complex and context dependent, and it is likely that the rate of change will be spread along a spectrum. That said, awareness and willingness to protect our soils will go a long way to encourage the long-term viability of the viticulture industry.

HERBICIDE

THE ORGANIC CHOICE FOR FAST WEED CONTROL

Beloukha is a non-selective, bio-degradable, broad-spectrum, foliar applied herbicide that acts exclusively on contact, attaching and destroying the cell membrane of the plant epidermis causing rapid tissue dehydration.

Features

680g/L Nonanoic Acid

Rate: 6 – 8L of product/100L of water

Applied in 200 to 300L of water/Hectare

Fast acting with visible effects on green plant tissue

Derived from natural occurring substances sourced from Sunflowers

Biodegradable

Many use patterns

Extra use patterns

Available in 1L, 5L, 20L, 200L & 1000L packs

Benefits

Highest load Nonanoic Acid on the market

Lower use rates per treated hectare

Rate range to give more flexibility

More treated hectares per spray vat

Less time wasted filling spray tank with water

Lower rates of product per hectare

Most weeds show effects within hours of applications

Derived from plants to kill weeds

Breaks down into carbon dioxide and water

Orchards

Paths, driveways, around sheds, gardens, amenity horticulture areas, protected cropping situations, around nursery stock

Spot spraying in lawns and turf

A pack size for every situation

For more information please call: 1800 777 068 or email: info@grochem.com.au grochem.com

March – Issue 710 www.winetitles.com.au Grapegrower & Winemaker 19

While most growers want to protect and improve their soils, the stressors of their immediate situation can tip the balance in favour of the status quo.

®

Understanding, measuring and ameliorating soil compaction in vineyards

By Tony Proffitt¹ and Lee Haselgrove²

Due to the way that many vineyards have been managed since planting, there is generally some degree of wheel traffic compaction within 0.5-1m of the vines. If we assume that there is minimal root activity past the wheel compaction zone, the potential soil volume available to vines planted at a row spacing of 3m is reduced to about a third. At narrower row spacings where the same wheel base tractors are used, the potential soil volume is reduced even further. Since roots are vital for grapevine growth and production, an inadequate root system, and in particular a lack of feeder roots, could severely limit a vine’s ability to access soil water and nutrient reserves.

Significant work has, and continues to be done, on managing and improving overall soil health in vineyards across the country. However, in recent years there has been an emphasis on soil biology and less on soil physical and chemical constraints to vine growth. One of the main reasons for this is that, as an industry, we know a considerable amount about soil physical and chemical constraints and how they can be managed.

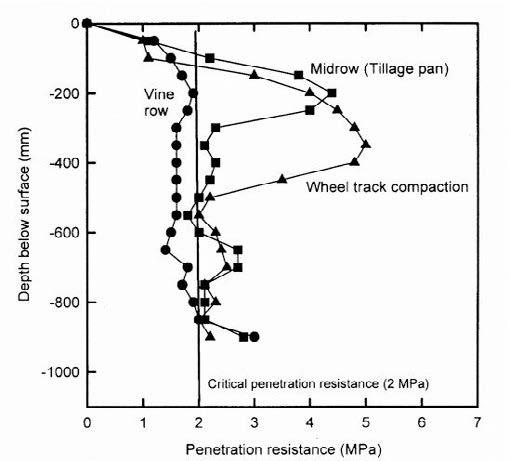

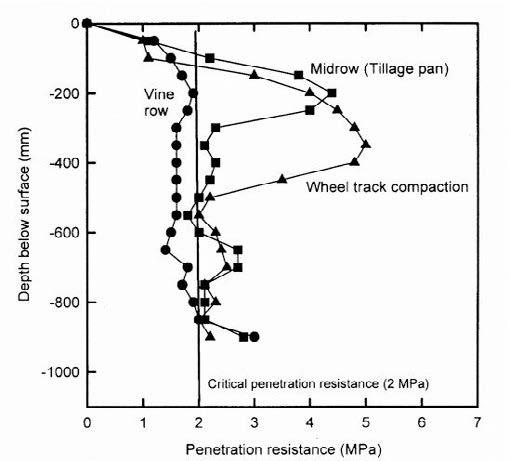

Soil compaction studies in vineyards are not new. In the mid-1990s, Philip Myburgh travelled extensively with researchers and industry leaders to many Australian grape growing regions. The main conclusions (detailed in Mybugh et al. 1996) were as follows:

• Poor vine performance (yield and/ or fruit quality) was associated with restricted root development.

• The restriction to root development was generally caused by hard, dense layers, with the degree of soil hardness (strength) being measured

using a soil penetrometer.

• Root growth was restricted if the soil had a strength/penetration resistance <2 MPa measured at/close to field capacity water content.

As many vineyards in Western Australia are now over 20 years old, it is appropriate to revisit the topic of soil compaction by extending existing knowledge to the upcoming generation of grapegrowers and viticulturists. This was done by measuring soil strength at a number of vineyards and extending the results and associated information at a workshop run by a number of presenters with expertise in soil physics, root physiology and practical experience in ameliorating compacted soils through deep ripping. This article forms the basis of the material presented.

What is soil compaction?

Soil compaction is the process whereby the application of a load results in an increase in bulk density and an associated reduction in air-filled porosity and continuity of pore space as a result of an increase in particle-to-particle contact.

What causes soil compaction to occur?

In vineyards, soil compaction is commonly associated with the load and sliding forces of vehicular traffic and trailers, tillage implements, and animal hooves (where grazing animals are part of the management system). When applied to firm, dry or slightly moist soil, the stresses will generally be resisted by the soil without any significant structural changes. However, when applied to soft, moist and malleable soil, compression and/or smearing often occurs.

The way in which a soil reacts to the application of a load depends on its texture, moisture content, bulk density, and the weight, shape and contact area of the pressure source. Soil particle and aggregate size distribution have a marked influence on the compactability of a soil. For example, the more broadly graded the soil, the more closely it is able to pack because of the ability of the smaller grains to fit in the spaces between larger grains.

Vehicular traffic

Compaction is often found within wheel tracks in the midrow area with the distance between the compaction zone and vine row dependant on row width and vehicle characteristics. Most vineyard tractors have wheels with 1.71.8m centres.

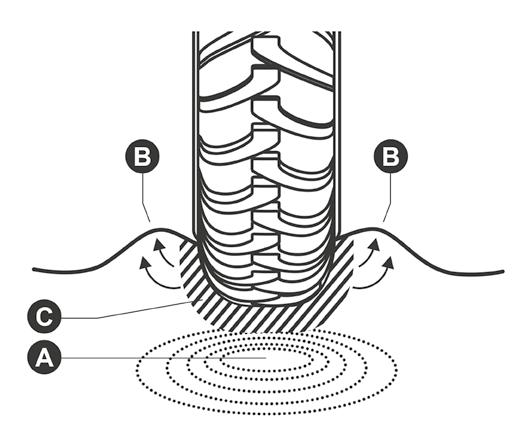

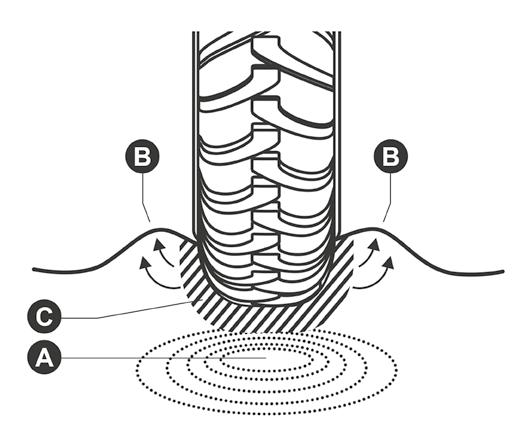

The passage of a wheel across soil is accompanied by a number of processes (Figure 1). In zone A there is a concentration of downward and shearing stresses from the applied load and compaction occurs with an intensity and distribution which is dependent on the applied pressure, the shape of the load, and the distribution of soil strength below the surface. Soil movement without appreciable compaction occurs in zone B. This results in a rise of the soil surface on either side of the wheel rut, with the amount of movement dependent on both the strength and compactability of the soil. The soil immediately under the wheel, zone C, is subject to very high intense shearing action especially when there is severe wheel-slip. As a result, there is a considerable amount of puddling and smearing, resulting in the destruction of soil structure.

grapegrowing 20 Grapegrower & Winemaker www.winetitles.com.au March 2023 – Issue 710

¹AHA

²Mure

Fertilisers & Soil Health

Viticulture, Dunsborough, WA

Viticulture, Dunsborough, WA

Tillage

Compacted layers within the upper 30cm of the soil profile (tillage pans) can be pronounced in the midrow area as a result of regular cultivation/tillage operations.

Animals

Animal hooves can exert a load on a soil, with the amount of deformation being dependant on soil texture and density, moisture content, organic matter, and sward strength. When animals walk, only two hooves are generally in contact with the ground at any one time which effectively doubles the applied load.

What problems are associated with soil compaction?

The effect of compaction on a soil is to change its structure, which directly affects its physical properties and indirectly affects both its chemical and biological properties. The reduction in macro-porosity can induce waterlogging, thereby creating soil aeration deficits which can impact on vine growth, as well as reducing infiltration and increasing the risk of erosion. Compaction can also increase the resistance of the soil to root penetration, thereby affecting the vine’s rooting distribution which can have an impact on canopy growth and productivity by limiting access to soil water and nutrient reserves. Passioura and Stirzaker (1993) concluded that when vine roots sense restricted or difficult conditions in the soil, they send signals (the so-called feed-forward response) to the shoots with the aim of slowing growth before the water supply nears depletion.

What is the structure and function of the root system?

Structural roots are 6-10mm in diameter and generally reach a depth of 30cm or more. The smaller permanent roots are 2-6mm in diameter and arise from the structural roots by

Ocloc V repairs broken wooden trellis posts

Quick inexpensive x for broken wooden posts

Keeps existing posts in the ground acting as a secure repair

1/4 the cost of traditional post replacement

Single pass repair

No wire or frost line removal required

No broken posts to graveyard or land ll

Environmentally responsible, low carbon footprint , carbon o set

Galfan or Galvaspan coated high tensile steel

Flexible, strong and durable

Australian made & owned

100% Carbon o set

“The Ocloc repair system is a great low cost strong x for what has been a very, expensive problem, until now.”

- Richard Leask, Leask Agri

“We've been using Ocloc V for a number of years 1/4 the cost of traditional post replacement, a complete 'game changer' & no brainer”

- Darren Sheer Burge Of Barossa.

“As organic growers we have found Ocloc, revolutionary, easy to install, strong and inexpensive"

- Hamish Stevenson Cape Ja a

produc ts are supplied 100% carbon o set

Nigel Cat t 0 418 832 967

nigel@ocloc com au ww w.ocloc.com. au

March – Issue 710 www.winetitles.com.au Grapegrower & Winemaker 21

Figure 1: Diagram showing the principal zones (A, B, C) of soil reaction to the passage of a wheel (adapted from Soane, 1970).

• • • • • • • • • • •

either horizontally (called ‘spreaders’) or downwards (called ‘sinkers’). Branching of these roots produces the fibrous ‘feeder’ roots which are relatively shortlived and are continually being replaced. Feeder roots make up the major portion of the root mass and are predominantly found in the upper 20-50cm of the soil. Each young root has a root tip and proximal to the tip is the ‘zone of elongation’ followed by the ‘zone of absorption’. The latter is about 100mm long, whitish in colour, covered in root hairs and is the zone where much of the soil water and minerals are absorbed. Root length, density, degree of branching and horizontal and vertical distribution is influenced by soil properties, type of irrigation system, cultivation practice and rootstock genotype.

How do you diagnose soil compaction?

There are several quantitative methods of assessing the ‘compaction status’ of a soil. These include the measurement of dry bulk density, porosity, and penetration resistance. The penetrometer is generally considered to be the easiest method for use in vineyards since it is rapid, thereby allowing a large number of readings to be taken to account for site variability. It is simply a device for measuring the force on the end of a shaft inserted into the soil to simulate a growing root (Figure 2). However, penetrometers are sensitive to changes in soil condition and are of limited use in rocky or gravelly soils. It is particularly important to ensure penetrometer measurements are taken at similar soil moisture conditions (preferably at or close to field capacity).

Following the extensive survey of soil conditions in vineyards across southeastern and Western Australia, Myburg et al . (1996) found that poor vine performance could often be traced back to a limited root system caused by soil compaction. Figure 3 is a typical example of their findings.

What visual observations can be made?

Visual observations of soil horizons and rooting distribution are useful to confirm penetrometer findings. For example, compaction will often show restricted root growth. In order to make these observations, soil pits should be excavated with one edge about 30cm away from the vine row and the width extending out to the centre of the midrow. They should be at least 1m in depth (Figure 4). Roots on both sides of the soil pit should be carefully exposed to assess the direction, density and depth of growth. Root densities on both sides of the soil pit should be compared and the fine feeder roots checked to determine if they are alive or dead.

22 Grapegrower & Winemaker www.winetitles.com.au March 2023 – Issue 710 grapegrowing

In vineyards, soil compaction is commonly associated with the load and sliding forces of vehicular traffic and trailers, tillage implements, and animal hooves…

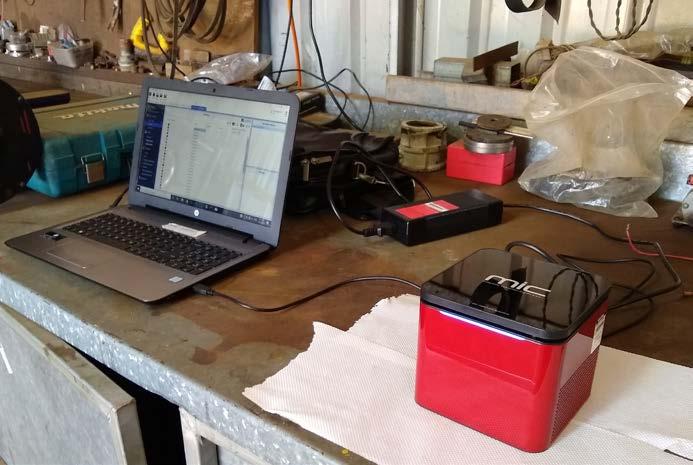

Figure 2: Cone penetrometer. The cone on the end of the rod is inserted and pushed into the soil at a steady rate. The applied force is recorded (kPa or MPa) electronically by a data logger, via a strain gauge (photo courtesy of RIMIK).

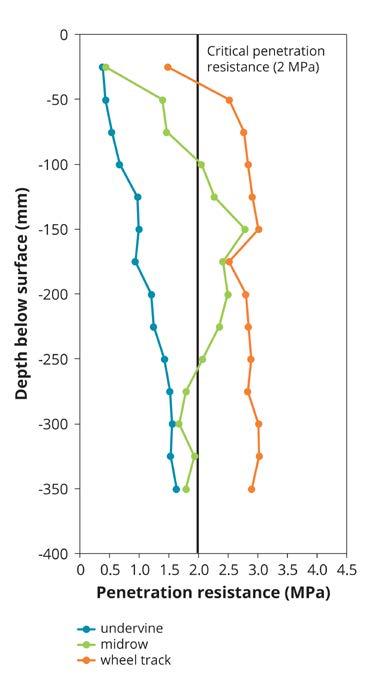

Figure 3: Penetration resistance in a vineyard showing low (<2 MPa) penetration resistance values within the vine row due to ripping before planting and higher penetration resistance values at 200 mm depth within the midrow where a tillage pan has formed, and at 400 mm depth within the wheel track (Cass et al. 1997).

Figure 4: A sandy gravel clay loam soil profile dug adjacent to a vine row in the Margaret River region. Horizon depths, and the presence/absence of impeding layers and roots should be recorded.

What are the management options to reduce or remove compaction?

Before embarking on a program of amelioration, a grower should be sure that there is a vine performance problem associated with soil compaction. If this situation is confirmed, then there are a number of options.

• Minimise the number of machinery operations that need to be performed, particularly on soils of inherently low strength. Alternating rows in which machinery movement occurs can be a beneficial option.

• Use the lightest machinery with low ground-pressure tyres when performing vineyard operations. This includes towed implements such as fungicide sprayers which in recent years have become very large (e.g. 4000L capacity).

• Use machinery with multiple axles rather than single axles as this will spread the load.

• Restrict compaction to the smallest possible zone within the vineyard block. Take advantage of over-the-row machinery where wheels travel along the middle of the row and GPS guidance systems.

• Restrict vehicle and animal traffic during wet periods when the soil is fragile. The timing of management operations in relation to soil moisture conditions is a critical factor.

• Reduce or eliminate soil tillage within the midrow by using permanent cover crop swards or replacing tillage equipment with rolling equipment.

• Increase the organic matter content of the soil through the use of cover crops, mulch and compost. The greater the organic matter content, the lower the maximum soil bulk density and the higher the optimum moisture content.

• Improve surface drainage through the use of slotted drainage pipes and maintaining vegetative growth in the midrow.

• Consider carrying out amelioration practices such as deep ripping and adding soil amendments to the rip line.

Remedial tillage through deep ripping

The aim of remedial tillage is to stimulate new root growth into parts of the soil that currently do not support roots as a result of physical or chemical restrictions. Deep ripping is the process by which the structure of the subsoil (below 10cm) is fractured, thereby potentially increasing the effective root depth and available soil water storage. Deep ripping also assists in the placement of amendments such as lime, gypsum and compost, as well as improving drainage. It is therefore a management technique that can be used to ameliorate soils which have naturally compacted zones or which have become compacted due to tillage and trafficking. The need for and depth of deep ripping should be based on the presence and depth of impeding layers, and should only be performed at the optimal soil moisture content (i.e. not too wet when the soil could smear as the tine passes and not too dry when the soil could be too powdery and not shatter). There are generally two

The mini greenhouse for vines!

• Pre-assembled and ready to use, NO tools required.

• UV stable long life durable polyethylene, reusable and recyclable at end of life.

• Does NOT split or pop open.

• Translucent for vine inspection.

• Life expectancy 5 years.

• Trains vine straight to the cordon wire.

• For a perfect fit every time, all SnapMax have extra length for ground-wire variation.

For further information: Australia: 03 9555 5500 info@globalgreen.com.au globalgreen.com.au

March – Issue 710 www.winetitles.com.au Grapegrower & Winemaker 23

GENUINE SnapMax SnapMax Vineguards

year when optimum moisture conditions may be met, particularly with clay soils; (i) autumn after sufficient rainfall and preferably before the second flush of root growth which occurs after harvest and (ii) late spring after sufficient drying but preferably not too late so that it coincides with the first flush of root growth around flowering and berry set. Note that deep ripping may not be suitable in established vineyards with shallow soils overlying rock since excessive rock fragments will be brought to the surface. In this case, mounding the vine row might be an alternative strategy to increase soil volume and rooting density.

Recommendations

• The optimal soil water content for deep ripping is when a handful of soil can be remoulded to form a coherent ball that will just crumble when a slight pressure is applied with a finger. This is the so-called ‘plastic limit’.

• The choice of machinery set-up and ripper blade is important. The conventional tool for ripping is the wingless tyne which is often considered to be ineffective in clay subsoils because of its limited capacity to disrupt soil laterally. However, where there is weathered rock and/or cemented layers, it is often the tool of choice. Winged tynes

are preferred where clay is present in the subsoil because they create a larger zone of disruption. However, they have a greater draft and hence a greater tractor power requirement.

• Ideally, two tynes should be used and positioned so that they are in the middle of the compacted zones (e.g. wheel tracks). The rake angle is critical when using winged tynes and should be 20° from horizontal at its working depth (Cass et al. 1998, 2003). Tynes with a greater rake angle will compact the soil adjacent to and below the rip line, while tynes with a lower rake angle will not lift and shatter the subsoil (Cass et al 1998, 2003). It is recommended that the speed of travel while ripping is kept to below 5km/hr (Cass et al 1998, 2003).

• The power of the tractor and/or depth of ripping should be set to minimise wheel slippage in order to prevent further soil structural damage.

• The addition of lime, gypsum and/or compost to ripped soil is likely

24 Grapegrower & Winemaker www.winetitles.com.au March 2023 – Issue 710 grapegrowing

The reduction in macro-porosity can induce waterlogging, thereby creating soil aeration deficits which can impact on vine growth, as well as reducing infiltration and increasing the risk of erosion.

• to prolong the benefits of ripping because the newly-created pores in both the topsoil and subsoil will be more stable with these amendments.

• The long-term benefits of ripping will depend on the nature of the soil as well as post-ripping soil management practices. It is advisable to restrict heavy machinery completely in the first year after ripping, and limit traffic when the soil is very wet in subsequent years. Deep ripping may be required every few years.

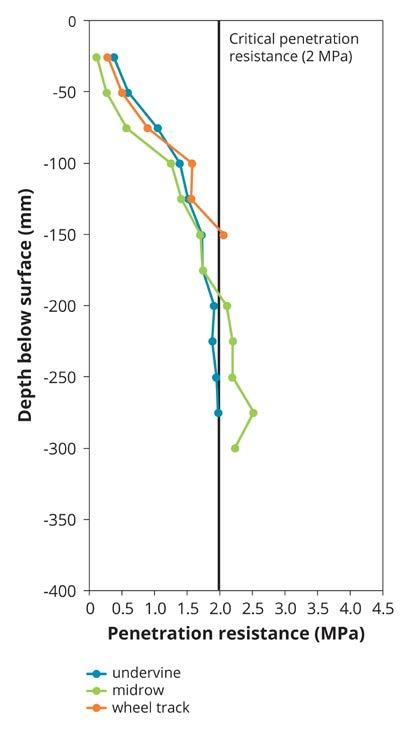

Case studies from the Margaret River region

Equipment and methods

Soil penetrometer (RIMIK CP200) readings were taken at three vineyards on the 27 June 2022. The vineyards selected had been deep ripped in different years (2022, 2021 and 2016) which enabled the study to investigate how long the potential soil benefits lasted. Approximately 343 mm of rain had fallen since 1st April and therefore

the soil was considered to be sufficiently wet for a penetrometer to be used. At each vineyard, readings were collected in three non-adjacent unripped rows (the control rows) and three non-adjacent ripped rows (the ameliorated rows) of a block of vines. Measures were made at two different locations within each row, thereby resulting in six replicate sets of penetrometer readings for both the control and ameliorated rows.

At each measurement position, penetrometer readings were made (i) along the vine row (200-300mm from a vine trunk), (ii) within the wheel track (1m in from the centre point between adjacent rows) and (iii) at the centre of the midrow. The penetrometer was set to record at 25mm intervals to a maximum depth of 400mm. Note that it was not possible to reach the full 400mm depth at all measurement locations due to either high soil strength and/or the presence of stones/gravel. Penetration resistance data presented for each depth increment are mean values determined from the available data.

Due to the sensitivity of penetration resistance to soil water content, it was important to record topsoil (1020cm) moisture content at the time measurements were made. Three soil samples were collected from a single panel in each control and ameliorated row. Samples were weighed and ovendried (105°C for 24 hours) in order to determine the mean gravimetric water content (GWC). Additional soil samples were collected on 4 August 2022 after a further 245mm of rain to determine water content and bulk density (BD) values. Mean volumetric water contents (VWC) (expressed as v/v, %) were determined using the following formula:

VWC = GWC x BD (g/cm3) x 100

Rainfall between the two sampling dates brought the soil profile at each vineyard site close to what was considered to be field capacity. The results indicated that at the time penetration resistance readings were made, the topsoil water content was about 77% of field capacity.

INFIELD GRAPE SORTER

• MOG levels verified from 0.02% (premium) to 0.4% (high volume) Increase winery throughput

MOG0

• No MOG related expenses at the winery

• Increase grape harvest weight

• Decrease juice loss through harvester fans

• Models to suit any grape harvester - any vineyard

• No grape maceration

• No loss of harvesting speed

• Easy to set up, operate and maintain

• 34% reduction in Cineole compound

• up to 10% increase in yield for the grower, with reduced harvester fan speed

March – Issue 710 www.winetitles.com.au Grapegrower & Winemaker 25

aussiewinegroup.com.au Q @aussiewinegroup e: matt@aussiewinegroup.com.au ph: +61 419 959 330

Wine Australia Verified Trial Vintage 22

”

“

The AWG Infield Grape Sorter has been a fantastic investment for Watkins Family Wine - With this technology we no longer need to upgrade to a new harvester, saving the company a huge amount in capital expenses, while also decreasing our overheads costs at the winery

Mark Evans - Vineyard Manager Watkins Family Wine

Ameliorated rows: Ripped in 2022 (the current year) with a Yeomans 3 tyne plough. Tynes were spaced to rip the wheel tracks (1.8m centres) and centre of the midrow to a depth of about 350mm. The mid-row was then powerharrowed and seeded.

Site details and results

26 Grapegrower & Winemaker www.winetitles.com.au March 2023 – Issue 710 grapegrowing

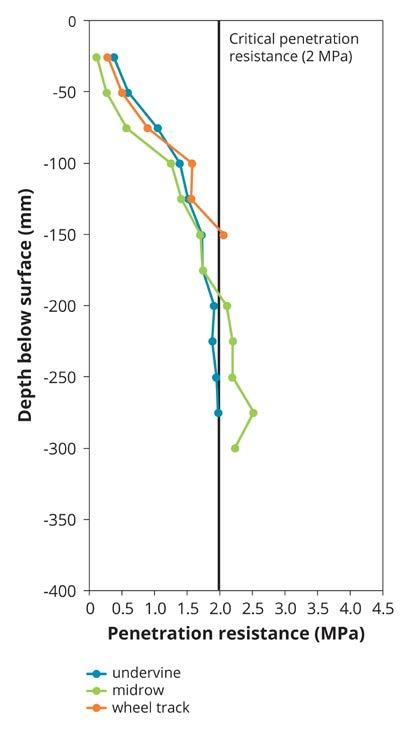

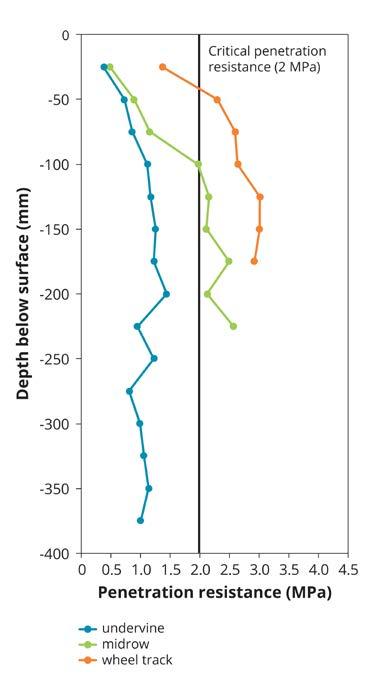

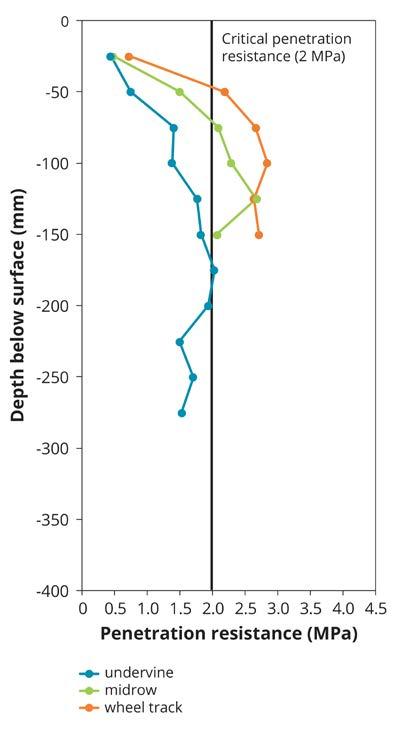

Figure 5a: Vineyard 1. Control rows showing soil penetration resistance values undervine, within the wheel tracks and at the centre of the midrow. Soil strengths >2 MPa limit vine root growth.

Figure 5b: Vineyard 1. Ameliorated rows showing soil penetration resistance values undervine, within the wheel tracks and at the centre of the midrow. Soil strengths >2 MPa limit vine root growth.

Figure 5a

Block Year planted 1983 Variety Chardonnay Row width (m) 3.6 Soil type Gravel loam

Figure 5b

VINEYARD 1

Deep ripping also assists in the placement of amendments such as lime, gypsum and compost, as well as improving drainage.

Ameliorated block: Ripped in 2021 with an AgSoilworks Vibrosoiler.

There were 2 tynes spaced to rip the wheel tracks (1.8m centres) to a depth of about 500mm.

The midrow was then power-harrowed, seeded and rolled.

VINEYARD 2

Site details and results

March – Issue 710 www.winetitles.com.au Grapegrower & Winemaker 27

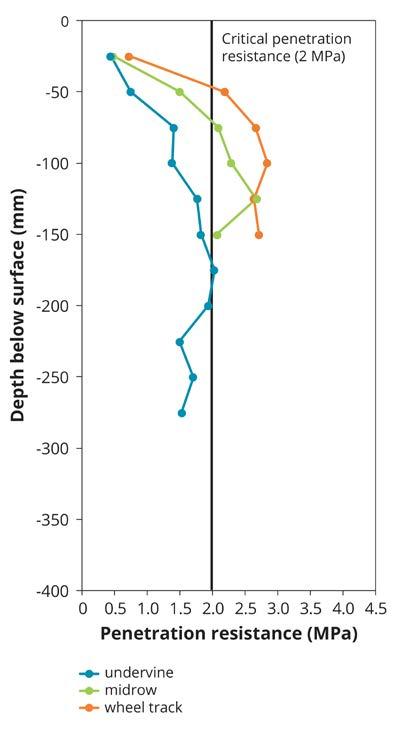

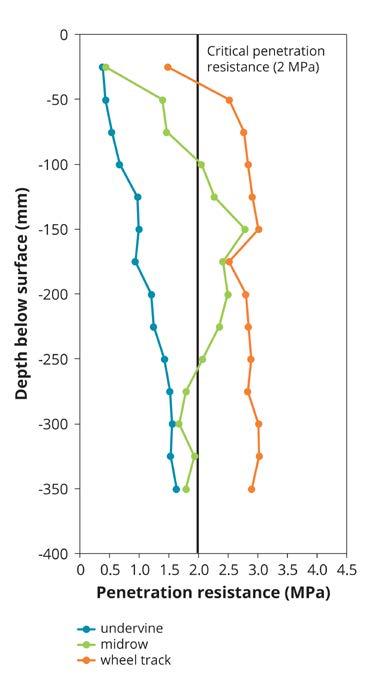

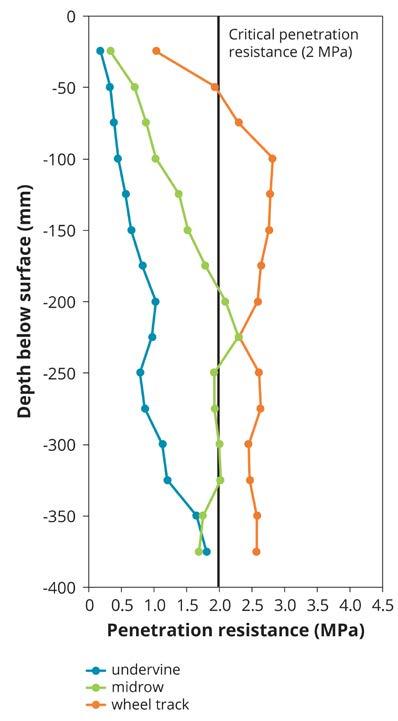

Figure 6a

Figure 6b

Figure 6a: Vineyard 2. Control rows showing soil penetration resistance values undervine, within the wheel tracks and at the centre of the midrow. Soil strengths >2 MPa limit vine root growth.

Block Year planted 2003 Variety Cabernet Franc Row width (m) 3.0 Soil type Clay loam

Figure 6b: Vineyard 2. Ameliorated rows showing soil penetration resistance values undervine, within the wheel tracks and at the centre of the midrow. Soil strengths >2 MPa limit vine root growth.

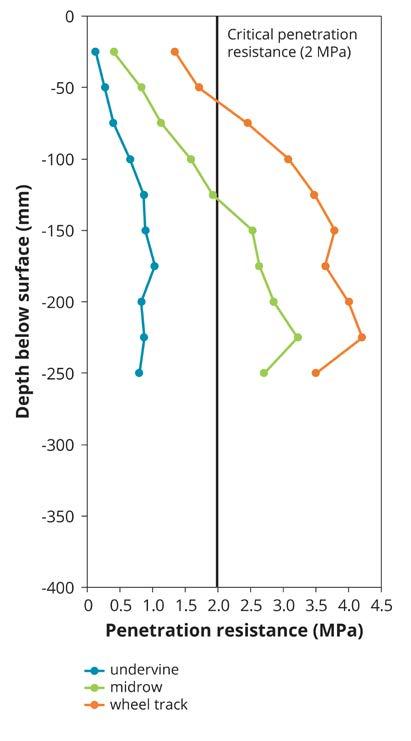

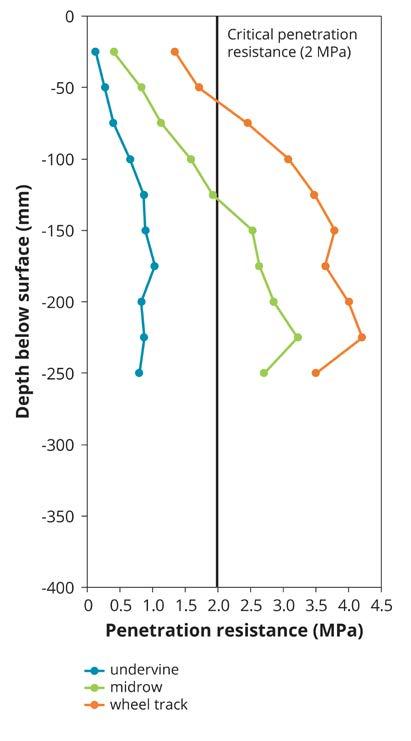

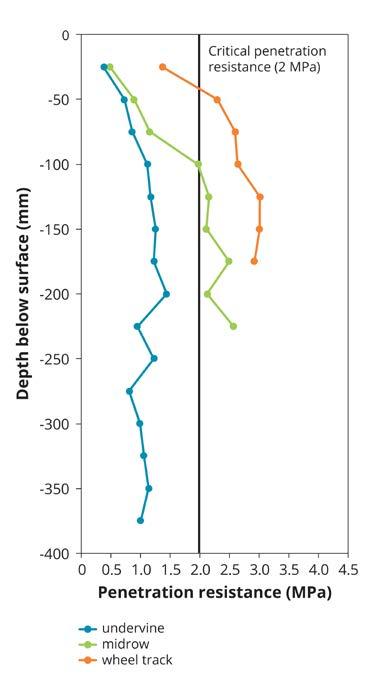

Ameliorated rows: Ripped in 2016 with an AgSoilworks Vibrosoiler. There were 2 tynes spaced to rip the wheel tracks (1.8m centres to a depth of about 500mm. The midrow was then power-harrowed and seeded. The block was replanted in 2017.

The results are discussed with the acknowledgement that data is incomplete in some cases due to limitations of the penetrometer in gravelly/stony soils. Such soils are characteristic of the Margaret River region.

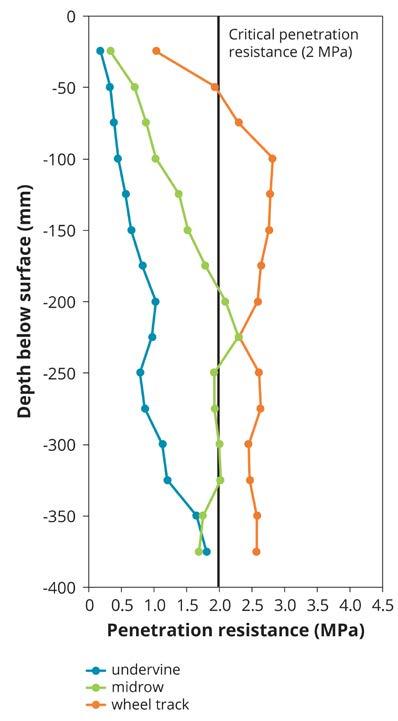

Within both the control and ameliorated rows at each vineyard, soil strength values undervine were generally ≤2 MPa (Figures 5-7). This suggests that the physical properties of the soil within the vine rows are in good condition, presumably due to continuous vine

root and soil biological activity since the initial soil preparation and planting operations. In the control rows at each vineyard, the highest soil strength values at all recorded measurement depths were within the wheel tracks, with values >2 MPa being recorded at about 50mm depth and continuing down the profile (Figures 5a-7a). While midrow soil strength in the control rows was consistently lower than that recorded within the wheel tracks, soil strength was consistently higher than that recorded undervine.