2823N.DodgeBlvd. Tucson,AZ85716

Title Security Agency is officially becoming First American Title. Despite the name change, you can expect the same excellent service and familiar faces at your closings.

Our partnership with First American Title brings you the best of both worlds:

LOCAL EXPERTISE AND FORTUNE 500 RESOURCES.

Same great team

Same local knowledge

Same convenient locations

Same great service

Fortune® 500 company

Multicultural materials

Economic team, market data, and trends

Leading technology in a changing market

Our industry is navigating a challenging market. Our alignment with a seasoned industry leader, with over 130 years of experience, provides valuable resources and expert guidance as we adapt.

Thank you for your continued trust in us!

We truly appreciate your business and look forward to seeing you at the closing table soon.

THE BEST OF BOTH WORLDS

24-DID-0071-F1_CP-AZL_01

NEWS! FIRST AMERICAN - SOUTHERN ARIZONA ADMIN OFFICE 520.885.1600 tsa-administration@firstam.com First American Title Insurance Company, and the operating divisions thereof, make no express or implied warranty respecting the information presented and assume no responsibility for errors or omissions. First American, the eagle logo, First American Title, and firstam.com are registered trademarks or trademarks of First American Financial Corporation and/or its affiliates. ©2024 First American Financial Corporation and/or its affiliates. All rights reserved. NYSE: FAF

EXCITING

WIRE FRAUD ALERT THINK DIFFERENTLY

Email-based, real estate fraud schemes are on the rise. One common scenario is altering wiring instructions with the intention of rerouting funds.

Keeping this in mind, First American Title is changing the way we receive payment information. It is imperative that we are familiar with the people in our transactions.

RELYING ON EMAIL

ALONE

IS NO LONGER AN OPTION.

YOU SHOULD BE AWARE OF PRECAUTIONS IN THE REAL ESTATE CLOSING PROCESS

DO NOT TRUST EMAILED INSTRUCTIONS

Fraudsters often use email to send falsified wire instructions to unsuspecting victims. Please warn your buyers and sellers to only follow wire instructions they receive personally from First American Title.

Additionally, we will not accept disbursement instructions for seller or buyer funds via email OR from any third party (attorney, real estate agent, etc).

ALTERNATIVE INSTRUCTIONS?

If your buyer or seller receives alternative wiring instructions that appear to be from First American Title, make sure they contact their escrow officer at a trusted phone number for confirmation.

Know that our wiring instructions do not change so any communication is suspect. Our banking institution is First American Trust.

IN SHORT – wire instructions will not be accepted by email. New wire instructions must be hand-carried or uploaded to the First American Secure Portal.

Thank you for joining First American Title in fostering a secure real estate transaction process. Have questions or concerns? Please contact our office or your escrow officer.

For more information please contact your First American representative. www.firstam.com

01100180621

First American Title Insurance Company, and the operating divisions thereof, make no express or implied warranty respecting the information presented and assume no responsibility for errors or omissions. First American, the eagle logo, First American Title, and firstam.com are registered trademarks or trademarks of First American Financial Corporation and/or its affiliates. ©2023 First American Financial Corporation and/or its affiliates. All rights reserved. NYSE: FAF

LIMITATION OF LIABILITY FOR INFORMATIONAL REPORTS

IMPORTANT -- PLEASE READ CAREFULLY:

This report is not an insured product or service or a representation of the condition of title to real property. It is not an abstract, legal opinion, opinion of title, title insurance commitment or preliminary report, or any form of Title Insurance or Guaranty. This report is issued exclusively for the benefit of the Applicant therefor and may not be used or relied upon by any other person. This report may not be reproduced in any manner without First Americans prior written consent. First American does not represent or warrant that the information herein is complete or free from error, and the information herein is provided without any warranties of any kind, as-is, and with all faults. As a material part of the consideration given in exchange for the issuance of this report, recipient agrees that First Americans sole liability for any loss or damage caused by an error or omission due to inaccurate information or negligence in preparing this report shall be limited to the fee charged for the report. Recipient accepts this report with this limitation and agrees that First American would not have issued this report but for the limitation of liability described above. First American makes no representation or warranty as to the legality or propriety of recipient's use of the information herein.

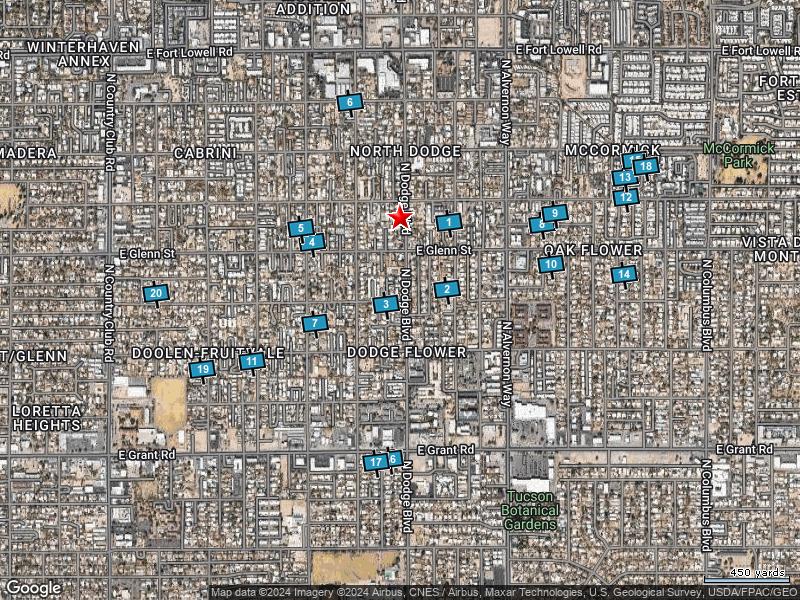

Subject Property

2823 N Dodge Blvd

Tucson AZ 85716

APN: 111-06-1490

Data Provided By:

First American Title Ins Co

© 2024 CoreLogic. All rights reserved

Data Provided By:

Disclaimer

This REiSource report is provided "as is" without warranty of any kind, either express or implied, including without limitations any warrantees of merchantability or fitness for a particular purpose. There is no representation of warranty that this information is complete or free from error, and the provider does not assume, and expressly disclaims, any liability to any person or entity for loss or damage caused by errors or omissions in this REiSource report without a title insurance policy.

The information contained in the REiSource report is delivered from your Title Company, who reminds you that you have the right as a consumer to compare fees and serviced levels for Title, Escrow, and all other services associated with property ownership, and to select providers accordingly. Your home is the largest investment you will make in your lifetime and you should demand the very best.

First

American Title Ins Co

© 2024 CoreLogic. All rights reserved

Subject Property : 2823 N Dodge Blvd Tucson AZ 85716

Owner Information

Owner Name : Goode Joel Richard

Mailing Address : 5042 N Marlin Canyon Pl, Tucson AZ 85750-6089 C058

Owner Occupied Indicator : A

Location Information

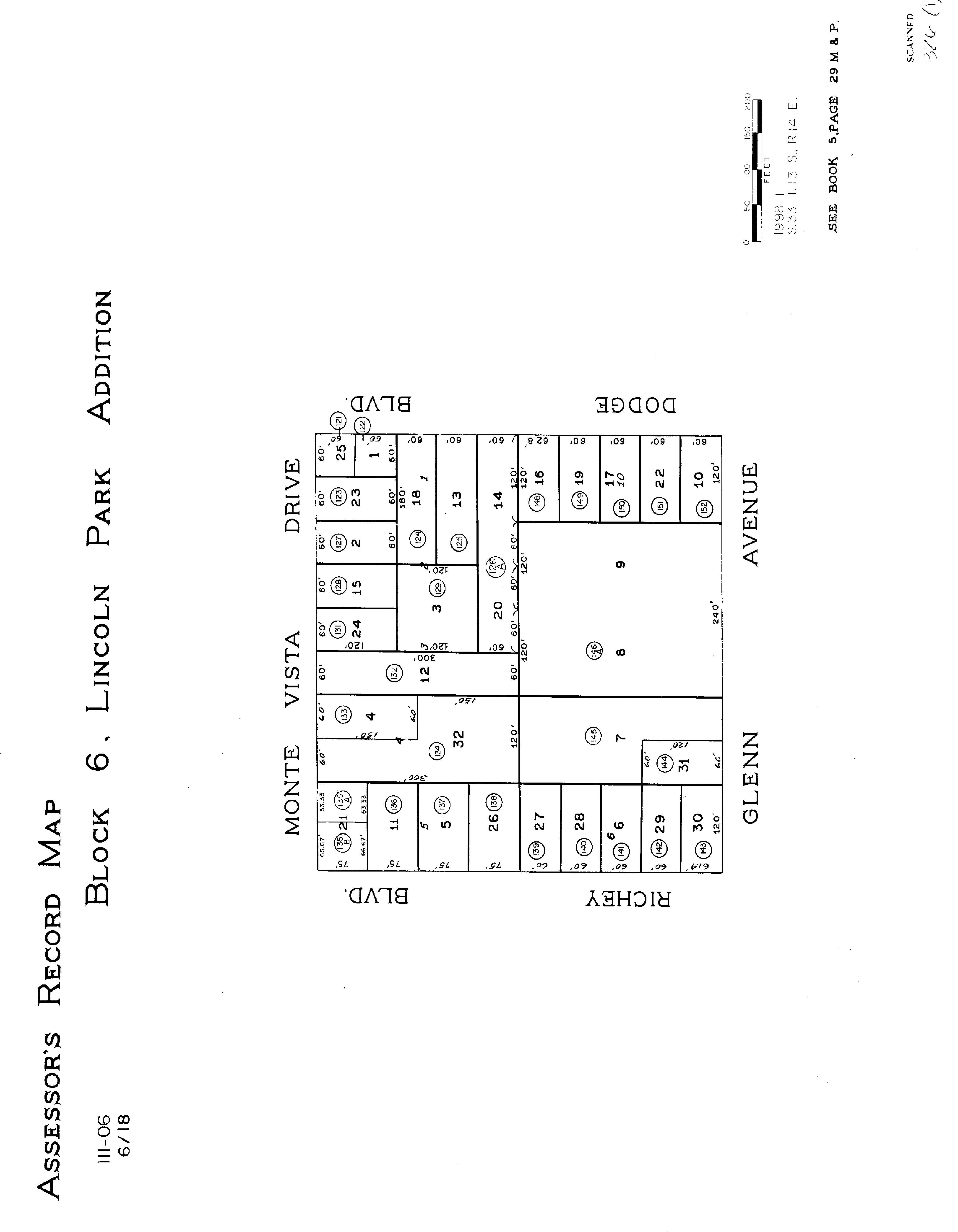

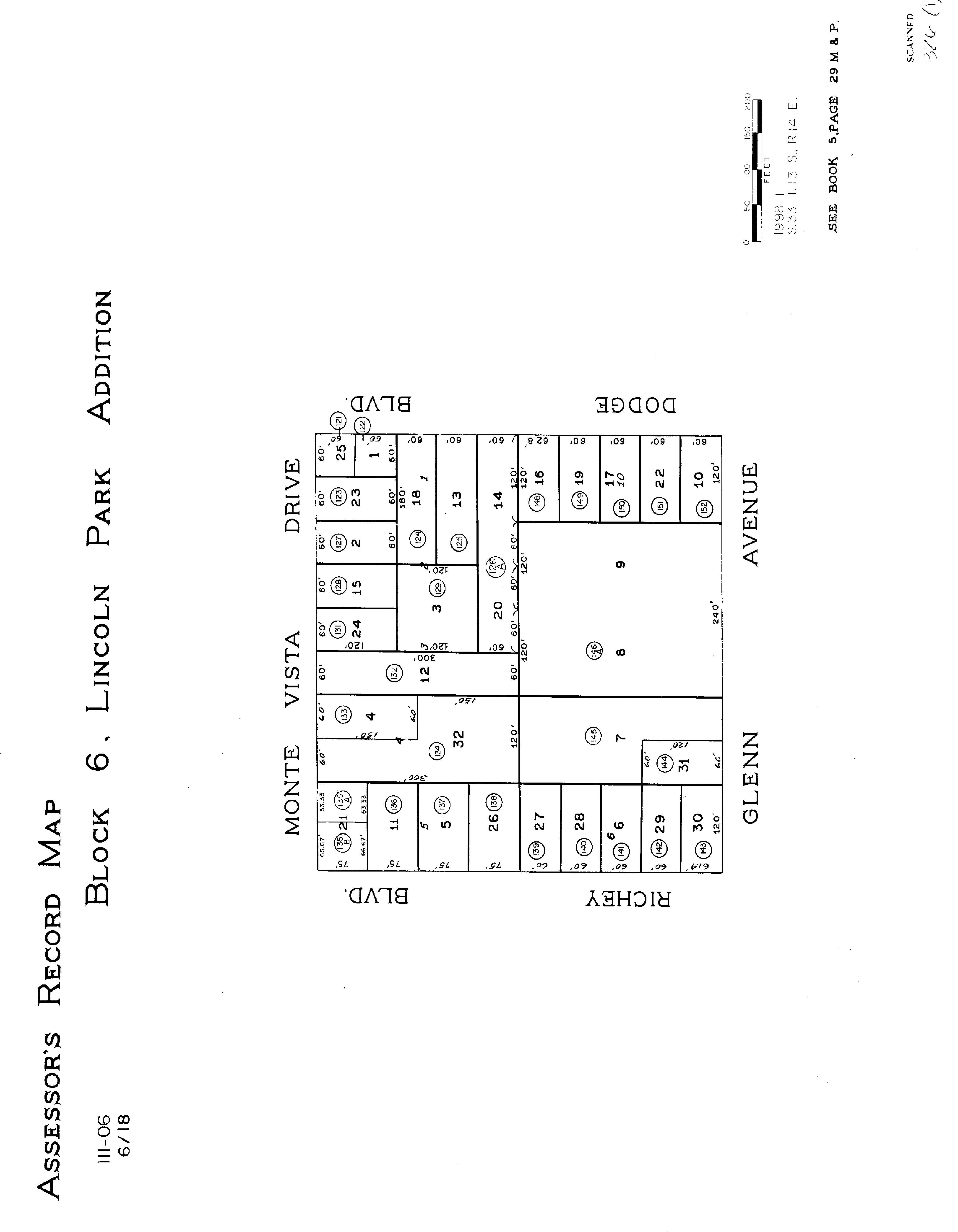

Legal Description : Lincoln Park N60' S240' Lot 10 Blk 6

County : Pima, Az

Census Tract / Block : 28.02 / 2

Township-Range- Sect : 13S-14E-33

Legal Book/Page : 5-29

Legal Lot : 10

Legal Block : 6

Owner Transfer Information

Recording/Sale Date : 05/06/2021 / 04/26/2021

Document # : 1260251

Last Market Sale Information

Recording/Sale Date : 01/30/2017 / 01/19/2017

Sale Price : $90,500

Document # : 300015

Title Company : Stewart Title & Tr/tucson

Seller Name : Higgins Christine L & Joseph T

Prior Sale Information

Prior Rec/Sale Date : 04/13/2005 / 04/08/2005

Prior Sale Price : $155,000

Prior Doc Number : 12530-1836

Prior Deed Type : Warranty Deed

Market Area : 40

APN : 111-06-1490

Subdivision : Lincoln Park

Map Reference : 33-13S-14E

School District : Tucson Unified

Munic/Township : Tucson Unified

Deed Type : Warranty Deed

Deed Type : Warranty Deed

Price Per SqFt : $63.64

Prior Lender : Corstar Fin'l Inc

Prior 1st Mtg Amt/Type : $124,000 / Conv

Prior 1st Mtg Rate/Type : / Fixed Rate Loan

Customer Name : Lisa Mrazek Customer Company Name : First American Title Insurance Company Prepared On : 02/23/2024 © 2024 CoreLogic. All rights reserved

Property Characteristics

Gross Area : 1,422

Living Area : 1,422

Total Rooms : 7

Year Built / Eff : 1945

# of Stories : 1

Property Information

Land Use : Sfr

County Use : Single Fam Resurban Subd

Tax Information

Total Value : $157,139

Total Taxable Value : $12,538

Assessed Year : 2023

Tax Year : 2023

Parking Type : None Patio Type : Covered Patio

Roof Material : Asphalt Air Cond : Evap Cooler

Heat Type : Wall Furnace Quality : Fair

Cooling Type : Wall Furnace Condition : Average

Exterior wall : Stucco

Zoning : R-2

Lot Acres : 0.17

Property Tax : $1,655.02

Tax Rate Area : 0150

Market Value : $157,139

Current Assessed Year : 2024

Bath Fixtures : 6

Lot Size : 7,200

State Use : Single Fam Resurban Subd

Current Year Total Value : $18,890

Current Year Improvement Value :

$18,840

Current Year Land Value : $50

Customer Name : Lisa Mrazek Customer Company Name : First American Title Insurance Company Prepared On : 02/23/2024 © 2024 CoreLogic. All rights reserved

Sales Analysis Criteria Subject Property Low High Average Sale Price $90,500 $140,000 $357,500 $268,304 Bldg/Living Area 1422 1226 1556 1353 Price Per Square Foot $63.64 $96 $280 $198.90 Year Built 1945 1941 2003 1961 Lot Size 7,200 3,449 11,401 7,631 Bedrooms Bathrooms 2 1 3 2 Stories 1 1 2 1 Total Assessed Value $157,139 $140,538 $223,131 $181,848 Distance From Subject 0 0.13 0.64 0.44 Customer Name : Lisa Mrazek Customer Company Name : First American Title Insurance Company Prepared On : 02/23/2024 © 2024 CoreLogic. All rights reserved

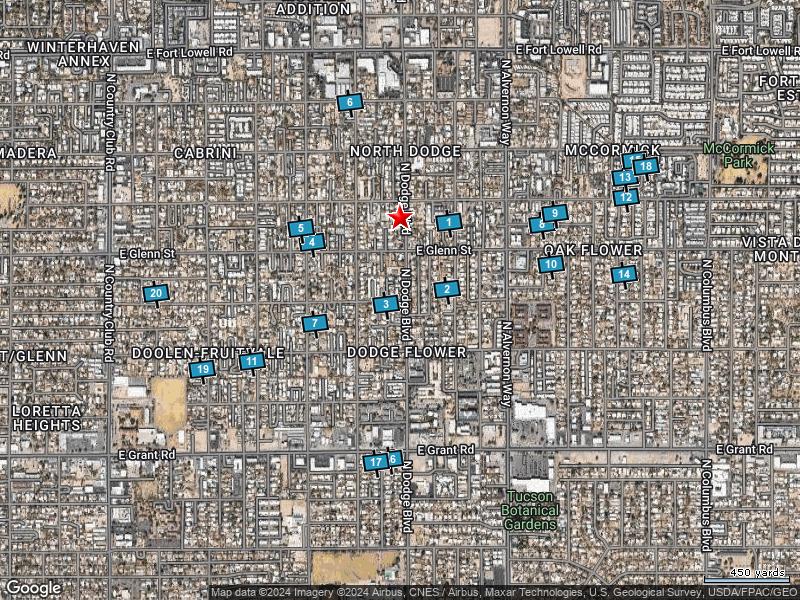

Map Customer Name : Lisa Mrazek Customer Company Name : First American Title Insurance Company Prepared On : 02/23/2024 © 2024 CoreLogic. All rights reserved

Details of Comparables

Subject Property: 2823 N Dodge Blvd Tucson Az 85716

Owner Name: Goode Joel Richard / APN / Alternate APN: 111-06-1490 / Deed Type: Warranty Deed

Subdivision / Tract: Lincoln Park / Lot Size: 7,200

Land Use: Sfr

Year Built / Eff: 1945 / Rec. Date / Price: 01/30/2017 / $90,500 Living Area: 1,422

Document #: 300015

#1 2813 N Winstel Blvd Tucson Az 85716

# of units:

Bedrooms: Pool:

Bath(F/H): /

Owner Name: Echlin Jillian C /Echlin Seth M

APN / Alternate APN: 111-06-1820 / Deed Type: Warranty Deed

Land Use: Sfr

Subdivision / Tract: Lincoln Park / Lot Size: 7,800 Year Built / Eff: 1947 / Rec. Date / Price: 11/02/2023 / $258,589 Living Area: 1,556

Document #: 3060493

#2 2661 N Winstel Blvd Tucson Az 85716

/

Owner Name: Saenz Andrew / APN / Alternate APN: 111-08-2110 / Deed Type: Warranty Deed

Subdivision / Tract: Catalina Farms

Annex / Lot Size: 10,321

Rec. Date / Price: 02/02/2024 / $140,000

Document #: 330531

#3 2638 N Chrysler Ave Tucson Az 85716

Living Area: 1,232

Land Use: Sfr

Year Built / Eff: 1958 /

# of units:

Bedrooms: Pool:

/

Owner Name: Carter Webb Llc / APN / Alternate APN: 111-08-1570 / Deed Type: Warranty Deed

Subdivision / Tract: Grantland Acres / Lot Size: 6,211

Land Use: Sfr

Year Built / Eff: 1960 / Rec. Date / Price: 11/28/2023 / $180,000 Living Area: 1,226 # of units:

Document #: 3320287

#4 2760 N Palo Verde Ave Tucson Az 85716

Bedrooms: Pool:

/

Owner Name: Barron Daniel /Doan Jennifer

APN / Alternate APN: 111-08-0360 / Deed Type: Warranty Deed

Subdivision / Tract: Grantland Acres / Lot Size: 9,000

Land Use: Sfr

Year Built / Eff: 1951 / Rec. Date / Price: 08/09/2023 / $300,000

Document #: 2210271

Living Area: 1,314

Bath(F/H): / Customer

Total Tax Value: $157,139

# of units:

Value:

Bedrooms: Pool: Total Tax

$175,300 Bath(F/H):

Total Tax Value: $167,429 Bath(F/H):

Total Tax Value: $174,361 Bath(F/H):

# of units:

Bedrooms: Pool: Total Tax Value: $168,755

Name : Lisa Mrazek

Company Name : First American Title Insurance Company Prepared On : 02/23/2024 © 2024 CoreLogic. All rights reserved

Customer

#5 2801 N Palo Verde Ave Tucson Az 85716

Owner Name: Modern Concepts By Del Sol / APN / Alternate APN: 111-06-289D / Deed Type: Warranty Deed

Subdivision / Tract: Granada Park / Lot Size: 11,401

Land Use: Sfr

Year Built / Eff: 1941 / Rec. Date / Price: 11/20/2023 / $220,000

Document #: 3240358

#6 3043 N Richey Blvd Tucson Az 85716

Living Area: 1,260

Bedrooms:

Bath(F/H): /

Owner Name: Martinez Jesse /Martinez Jaime M

# of units:

Pool:

APN / Alternate APN: 111-05-171B / Deed Type: Special Warranty Deed Land Use: Sfr

Subdivision / Tract: Farmington / Lot Size: 7,200 Year Built / Eff: 1949 /

Rec. Date / Price: 03/07/2023 / $250,000 Living Area: 1,333

Document #: 660353

#7 2614 N Palo Verde Ave Tucson Az 85716

Bedrooms:

/

Owner Name: Budish Jared K / APN / Alternate APN: 111-08-0690 / Deed Type: Warranty Deed

# of units:

Land Use: Sfr

Subdivision / Tract: Grantland Acres / Lot Size: 9,000 Year Built / Eff: 1946 / Rec. Date / Price: 06/16/2023 / $265,000 Living Area: 1,352

# of units:

Document #: 1670261

#8 3949 E Glenn St Tucson Az 85712

Bedrooms:

/

Owner Name: Yang Chengyin / APN / Alternate APN: 110-06-1370 / Deed Type: Special Warranty Deed Land Use: Sfr

Subdivision / Tract: / Lot Size: 8,276 Year Built / Eff: 1955 / Rec. Date / Price: 07/21/2023 / $258,000 Living Area: 1,262

Document #: 2020508

Total Tax Value: $162,391

#9 4002 E Hayhurst Ln Tucson Az 85712

Bedrooms:

Bath(F/H): /

Owner Name: Flip With Integrity Llc / APN / Alternate APN: 110-06-1220 / Deed Type: Warranty Deed

# of units:

Pool:

Land Use: Sfr

Subdivision / Tract: / Lot Size: 6,970 Year Built / Eff: 1956 /

Rec. Date / Price: 05/19/2023 / $144,000 Living Area: 1,493

Document #: 1390163

Total Tax Value: $160,318

Bedrooms:

Bath(F/H): /

#10 2720 N Montezuma Ave Tucson Az 85712

Owner Name: Mcgregor Camden /Estrada Jessica

APN / Alternate APN: 110-07-2800 / Deed Type: Warranty Deed

Subdivision / Tract: Los Nidos / Lot Size: 10,326

# of units:

Pool:

Land Use: Sfr

Year Built / Eff: 1948 / Rec. Date / Price: 05/05/2023 / $312,000

Document #: 1250506

Total Tax Value: $178,016

Living Area: 1,420

Bedrooms:

# of units:

Pool:

Bath(F/H): / Customer

Total Tax Value: $168,543

Value:

Pool: Total Tax

$140,538 Bath(F/H):

Pool: Total Tax Value: $184,264 Bath(F/H):

Name : Lisa Mrazek

Company Name : First American Title Insurance Company Prepared On : 02/23/2024 © 2024 CoreLogic. All rights reserved

Customer

#11 2531 N Sparkman Blvd Tucson Az 85716

Owner Name: Zamora Alejandro / APN / Alternate APN: 111-07-0370 / Deed Type: Warranty Deed

Land Use: Sfr

Subdivision / Tract: Fruitvale / Lot Size: 6,000 Year Built / Eff: 1955 / Rec. Date / Price: 05/02/2023 / $269,000 Living Area: 1,392 # of units:

Document #: 1220218

#12 2850 N Walnut Ave Tucson Az 85712

/

Owner Name: Arizona Sunshine Estates Ll / APN / Alternate APN: 110-06-2020 / Deed Type: Warranty Deed Land Use: Sfr

Subdivision / Tract: Glenn Vista / Lot Size: 10,273 Year Built / Eff: 1961 / Rec. Date / Price: 01/10/2024 / $265,000 Living Area: 1,320 # of units:

Document #: 100299

#13 2988 N Cardell Cir Tucson Az 85712

Owner Name: Liu Tao /Ji Lin

/

APN / Alternate APN: 110-06-4880 / Deed Type: Warranty Deed Land Use: Sfr

Subdivision / Tract: Monte Vista / Lot Size: 5,436 Year Built / Eff: 2000 / Rec. Date /

Document #: 1770448

#14 2706 N Walnut Ave Tucson Az 85712

Bedrooms:

Owner Name: Meisch Charles G / APN / Alternate APN: 110-07-0370 / Deed Type: Warranty Deed

Document #: 1790488

#15 2981 N Cardell Cir Tucson Az 85712

Bedrooms:

Bath(F/H): /

Owner Name: Huber Kayla / APN / Alternate APN: 110-06-533A / Deed Type: Warranty Deed Land Use: Sfr

/ Tract: Monte Vista / Lot Size: 3,486

Built / Eff: 2003 /

Date / Price: 08/16/2023 / $324,000 Living Area: 1,542 # of units:

Document #: 2280321

Total Tax Value: $223,131

#16 2328 N Chrysler Dr Tucson Az 85716

Bath(F/H): /

Owner Name: Ducey Lance /Ducey Isabella Y

APN / Alternate APN: 122-16-0300 / Deed Type: Warranty Deed Land Use: Sfr

Subdivision / Tract: Palo Verde Add / Lot Size: 7,209 Year Built / Eff: 1959 / Rec. Date / Price: 04/11/2023 / $250,000 Living Area: 1,320 # of

Document #: 1010158

Bedrooms: Pool:

Bath(F/H): /

Bedrooms: Pool: Total Tax Value: $173,620 Bath(F/H):

Bedrooms: Pool: Total Tax Value: $181,262 Bath(F/H):

#

Price: 06/26/2023 / $340,000 Living Area: 1,430

of units:

Pool:

Tax Value:

Total

$218,583 Bath(F/H): /

Year

Rec.

Land Use: Sfr Subdivision / Tract: Catalina Farms / Lot Size: 6,797

Built / Eff: 1972 /

Date / Price: 06/28/2023 / $310,000 Living Area: 1,241 # of units:

Pool:

Total Tax Value: $186,700

Subdivision

Year

Rec.

Bedrooms: Pool:

units:

Total Tax Value: $193,489

Name : Lisa Mrazek

Company Name : First American Title Insurance Company Prepared On : 02/23/2024 © 2024 CoreLogic. All rights reserved

Customer

Customer

#17 2325 N Chrysler Dr Tucson Az 85716

Owner Name: Mahony James M O Livin / APN / Alternate APN: 122-16-0150 / Deed Type: Warranty Deed

Subdivision / Tract: Palo Verde Amd / Lot Size: 7,619

Land Use: Sfr

Year Built / Eff: 1959 / Rec. Date / Price: 10/25/2023 / $350,000 Living Area: 1,260

Document #: 2980586

#18 2918 N Cardell Cir Tucson Az 85712

Bedrooms:

/

Owner Name: Miller Mona L / APN / Alternate APN: 110-06-5220 / Deed Type: Warranty Deed

Subdivision / Tract: Monte Vista / Lot Size: 3,449

Rec. Date / Price: 03/15/2023 / $318,000 Living Area: 1,542

Document #: 740447

#19 2519 N Edith Blvd Tucson Az 85716

# of units:

Pool

Land Use: Sfr

Year Built / Eff: 2002 /

# of units:

/

Owner Name: Duggan A B & K Living Trust / APN / Alternate APN: 111-07-353B / Deed Type: Warranty Deed

Subdivision / Tract: / Lot Size: 7,015

/

3480520 Bedrooms:

/

Land Use: Sfr

Built / Eff: 1941 /

#20 3150 E Bermuda St Tucson Az 85716

Owner Name: Happy Home Az Rentals Llc / APN / Alternate APN: 111-07-2330 / Deed Type: Warranty Deed Land Use: Sfr Subdivision / Tract: Almartin Add / Lot Size: 8,827

/

Bedrooms:

Pool:

Total Tax Value: $213,712 Bath(F/H):

Tax Value: $221,997 Bath(F/H):

Bedrooms: Pool: Total

Rec.

Pool: Total Tax Value:

Bath(F/H):

Year

Date / Price: 12/14/2023

$357,500 Living Area: 1,277 # of units: Document #:

$160,502

Year Built / Eff: 1947 / Rec. Date / Price: 06/19/2023

$255,000 Living Area: 1,280 # of units: Document #: 1700068

Pool:

Tax Value:

Customer Name : Lisa Mrazek Customer Company Name : First American Title Insurance Company Prepared On : 02/23/2024 © 2024 CoreLogic. All rights reserved

Total

$184,046 Bath(F/H): /

Subject Property : 2823 N Dodge Blvd Tucson AZ 85716 Customer Name : Lisa Mrazek Customer Company Name : First American Title Insurance Company Prepared On : 02/23/2024 © 2024 CoreLogic. All rights reserved

Customer Name : Lisa Mrazek Customer Company Name : First American Title Insurance Company Prepared On : 02/23/2024 © 2024 CoreLogic. All rights reserved

2784 N DODGE BLVD Distance 0.07 Miles

Owner Name : Langworthy Daniel

Sale Date : 09/22/2016

Total Value : $228,051

Bed / Bath : / 2

Land Use : Sfr

Stories : 1

Subdivision : Glenn View

Recording Date : 09/28/2016

Sale Price : $189,300

Property Tax : $2,011.25

Lot Acres : 0.24

Living Area : 1,654

Yr Blt / Eff Yr Blt : 1952 / APN : 111-08-2750

2774 N DODGE BLVD Distance 0.09 Miles

Owner Name : O Brien Andree N

Sale Date : 09/19/2018

Total Value : $180,882

Bed / Bath : / 2

Land Use : Sfr

Stories : 1

Subdivision : Glenn View

Recording Date : 08/21/2018

Sale Price : $155,000

Property Tax : $1,511.95

Lot Acres : 0.18

Living Area : 1,116

Yr Blt / Eff Yr Blt : 1953 / APN : 111-08-2760

2785 N BAXTER AVE

Owner Name : Rucker Dale Franklin

Sale Date : 10/10/2014

Total Value : $158,778

Bed / Bath : / 2

Land Use : Sfr

Stories : 1

Distance 0.09 Miles

Subdivision : Glenn View

Recording Date : 10/14/2014

Sale Price : $109,000

Property Tax : $1,408.14

Lot Acres : 0.24

Living Area : 1,104

Yr Blt / Eff Yr Blt : 1953 / APN : 111-08-2960

2766 N DODGE BLVD

Owner Name : Segura Richard

Sale Date : 04/00/2004

Total Value : $137,657

Bed / Bath : / 2

Land Use : Sfr

Stories : 1

Distance 0.1 Miles

Subdivision : Glenn View

Recording Date : 04/01/2004

Sale Price : $125,000

Property Tax : $1,227.08

Lot Acres : 0.18

Living Area : 912

Yr Blt / Eff Yr Blt : 1953 / APN : 111-08-2770 Customer

Name : Lisa Mrazek Customer Company Name : First American Title Insurance Company Prepared On : 02/23/2024 © 2024 CoreLogic. All rights reserved

2775 N BAXTER AVE

Owner Name : Browning Vincent A

Total Value : $208,719

Bed / Bath : / 2

Land Use : Sfr

Distance 0.1 Miles

Subdivision : Glenn View

Sale Price : $61,000

Property Tax : $1,806.32

Lot Acres : 0.17

Stories : 1 Living Area : 1,762

Yr Blt / Eff Yr Blt : 1955 / APN : 111-08-2950

2767 N BAXTER AVE

Distance 0.11 Miles

Owner Name : Mc Reynolds Jeffrey Subdivision : Glenn View

Sale Date : 02/15/2017

Total Value : $216,415

Recording Date : 02/15/2017

Sale Price : $179,000

Bed / Bath : / 2 Property Tax : $1,749

Land Use : Sfr

Stories : 1

Lot Acres : 0.17

Living Area : 1,773

Yr Blt / Eff Yr Blt : 1953 / APN : 111-08-2940

2784 N BAXTER AVE

Owner Name : Yee Francisco Javier

Sale Date : 11/17/2021

Total Value : $166,440

Bed / Bath : / 2

Land Use : Sfr

Stories : 1

Distance 0.11 Miles

Subdivision : Glenn View

Recording Date : 11/23/2021

Sale Price : $220,000

Property Tax : $1,473.97

Lot Acres : 0.22

Living Area : 1,332

Yr Blt / Eff Yr Blt : 1953 / APN : 111-08-2970

2758 N DODGE BLVD

Owner Name : Zane Josephine E

Sale Date : 04/23/2002

Total Value : $153,139

Bed / Bath : / 2

Land Use : Sfr

Stories : 1

Yr Blt / Eff Yr Blt : 1953 /

Distance 0.11 Miles

Subdivision : Glenn View

Recording Date : 05/15/2002

Property Tax : $1,364.53

Lot Acres : 0.17

Living Area : 1,104

APN : 111-08-2780

Name : Lisa Mrazek Customer Company Name : First American Title Insurance Company Prepared On : 02/23/2024 © 2024 CoreLogic. All rights reserved

Customer

2731 N DODGE BLVD

Owner Name : Olivarria Vanessa L

Sale Date : 08/13/2015

Total Value : $201,129

Land Use : Duplex

Stories : 1

Yr Blt / Eff Yr Blt : 1950 / 1950

Subdivision : Grantland Acres

2774 N BAXTER AVE

Owner Name : Hamilton

Total Value : $198,956

Bed / Bath : / 2

Land Use : Sfr

Stories : 1

Distance 0.12 Miles

Recording Date : 08/21/2015

Sale Price : $149,950

Property Tax : $1,725.25

Lot Acres : 0.15

Living Area : 1,722

APN : 111-08-024A

Distance 0.12 Miles

Subdivision : Glenn View

Recording Date : 10/03/1990

Property Tax : $1,638.49

Lot Acres : 0.16

Living Area : 1,552

Yr Blt / Eff Yr Blt : 1956 / APN : 111-08-2980

Customer Name : Lisa Mrazek Customer Company Name : First American Title Insurance Company Prepared On : 02/23/2024 © 2024 CoreLogic. All rights reserved

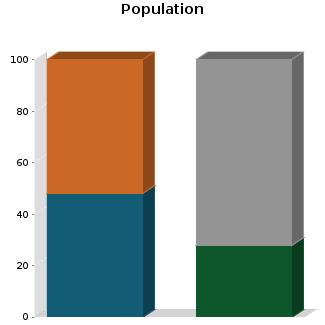

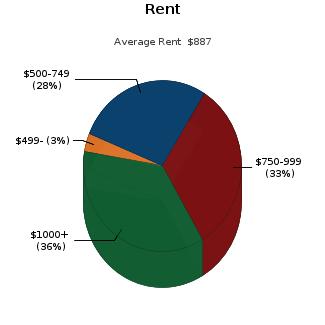

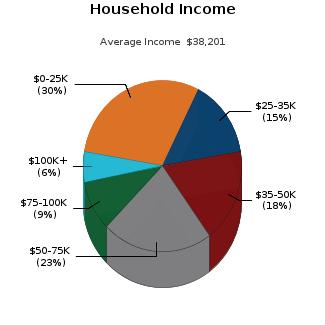

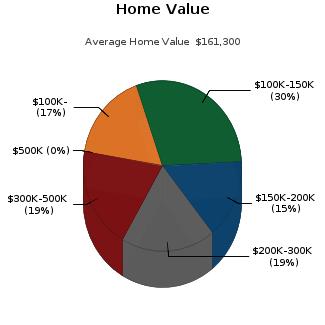

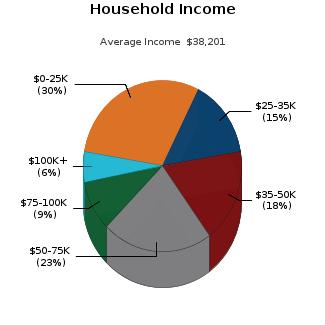

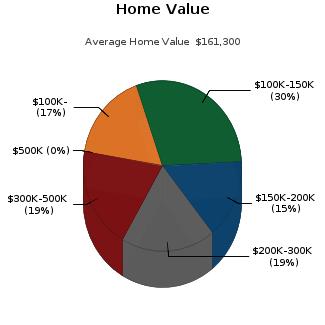

Census Tract / block: 28.02 / 2 Year: 2020 Household Population Population by Age Count: 4,227 0 - 11 Estimate Current Year: 4,445 12 - 17 Estimate in 5 Years: 5,433 18 - 24 8.97% Growth Last 5 Years: 1.32% 25 - 64 61.72% Growth Last 10 Years: -84.85% 65 - 74 10.03% 75+ Household Size Household Income Current Year: 2,138 0 - $25,000 29.65% Average Current Year: 1.95 $25,000 - $35,000 14.83% Estimate in 5 Years: 3,252 $35,000 - $50,000 17.73% Growth Last 5 Years: 6.55% $50,000 - $75,000 22.5% Growth Last 10 Years: 6.51% $75,000 - $100,000 9.49% Male Population: 47.91% Above $100,000 5.8% Female Population: 52.09% Average Household Income: $38,201 Married People: 27.8% Unmarried People: 72.2% Housing Median Mortgage Payments Home Values Under $300: 10.64% Below $100,000: 16.88% $300 - $799: 44.4% $100,000 - $150,000: 29.54% $800 - $1,999: 44.95% $150,000 - $200,000: 15.05% Over $2,000: 0% $200,000 - $300,000: 19.08% Median Home Value: $161,300 $300,000 - $500,000: 19.45% Unit Occupied Owner: 25.49% Above $500,000: 0% Median Mortgage: $580 Customer Name : Lisa Mrazek Customer Company Name : First American Title Insurance Company Prepared On : 02/23/2024 © 2024 CoreLogic. All rights reserved

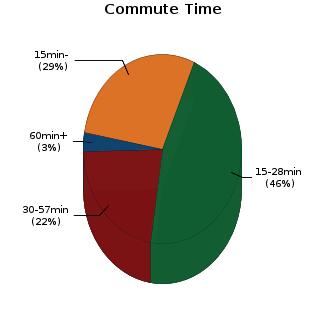

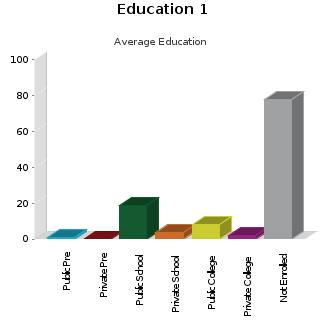

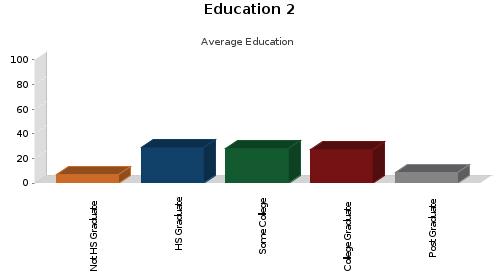

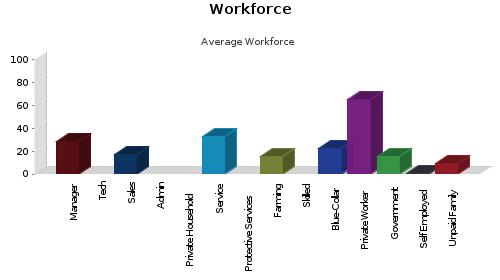

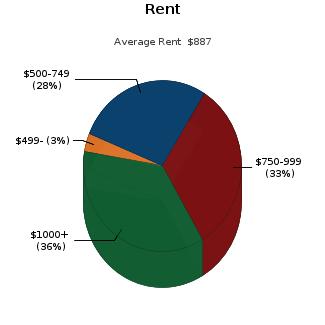

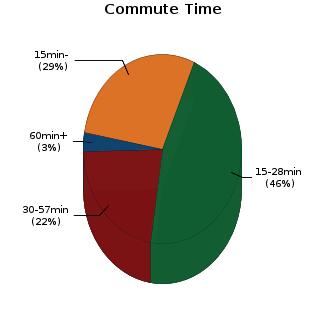

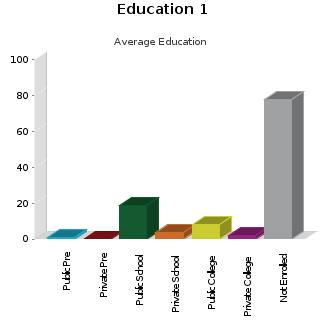

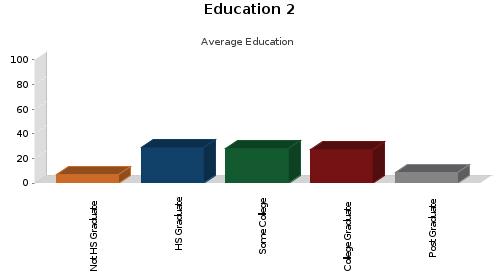

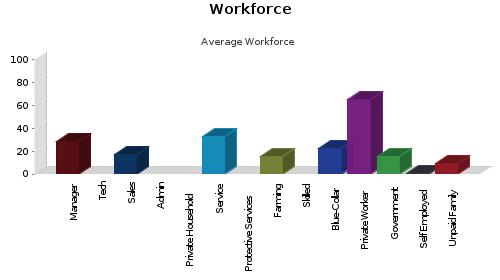

Rent Payments Year Built Unit Occupied Renter: 74.51% 1999 - 2000 Median Gross Rent: $887 1995 - 1998 Less Than $499 3.42% 1990 - 1994 $500 - $749 27.71% 1980 - 1989 14.46% $750 - $999 32.69% 1970 - 1979 25.85% $1000 and Over 36.18% 1900 - 1969 42.01% Education Enrollment Public Pre-Primary School: 0.8% Not Enrolled in School: 77.66% Private Pre-Primary School: 0% Not A High School Graduate: 6.93% Public School: 18.84% Graduate Of High School: 29.13% Private School: 3.51% Attended Some College: 28.15% Public College: 7.87% College Graduate: 27% Private College: 1.83% Graduate Degree: 8.78% Workforce Occupation: Manager/Prof: 28.17% Private Worker: 65.08% Technical: Government Worker: 15.45% Sales: 16.84% Self Employed Worker: 0.37% Administrative: Unpaid Family Worker: 9.02% Private House Hold: Farming: 15.68% Service: 32.52% Skilled: Protective Services: Blue-Collar: 22.48% Commute Time Less Than 15 Min: 28.74% 15 min - 28 min: 45.99% 30 min - 57 min: 22.13% Over 60 min: 3.14% Customer Name : Lisa Mrazek Customer Company Name : First American Title Insurance Company Prepared On : 02/23/2024 © 2024 CoreLogic. All rights reserved

Customer Name : Lisa Mrazek Customer Company Name : First American Title Insurance Company Prepared On : 02/23/2024 © 2024 CoreLogic. All rights reserved

Customer Name : Lisa Mrazek Customer Company Name : First American Title Insurance Company Prepared On : 02/23/2024 © 2024 CoreLogic. All rights reserved

Customer Name : Lisa Mrazek Customer Company Name : First American Title Insurance Company Prepared On : 02/23/2024 © 2024 CoreLogic. All rights reserved

Arizona Schools For detailed information and statistics on Arizona schools please go to https://azreportcards.azed.gov/ First American Title Insurance Company, and the operating divisions thereof, make no express or implied warranty respecting the information presented and assume no responsibility for errors or omissions. First American, the eagle logo, First American Title, and firstam.com are registered trademarks or trademarks of First American Financial Corporation and/or its affiliates. ©2021 First American Financial Corporation and/or its affiliates. All rights reserved. NYSE: FAF 05117910421

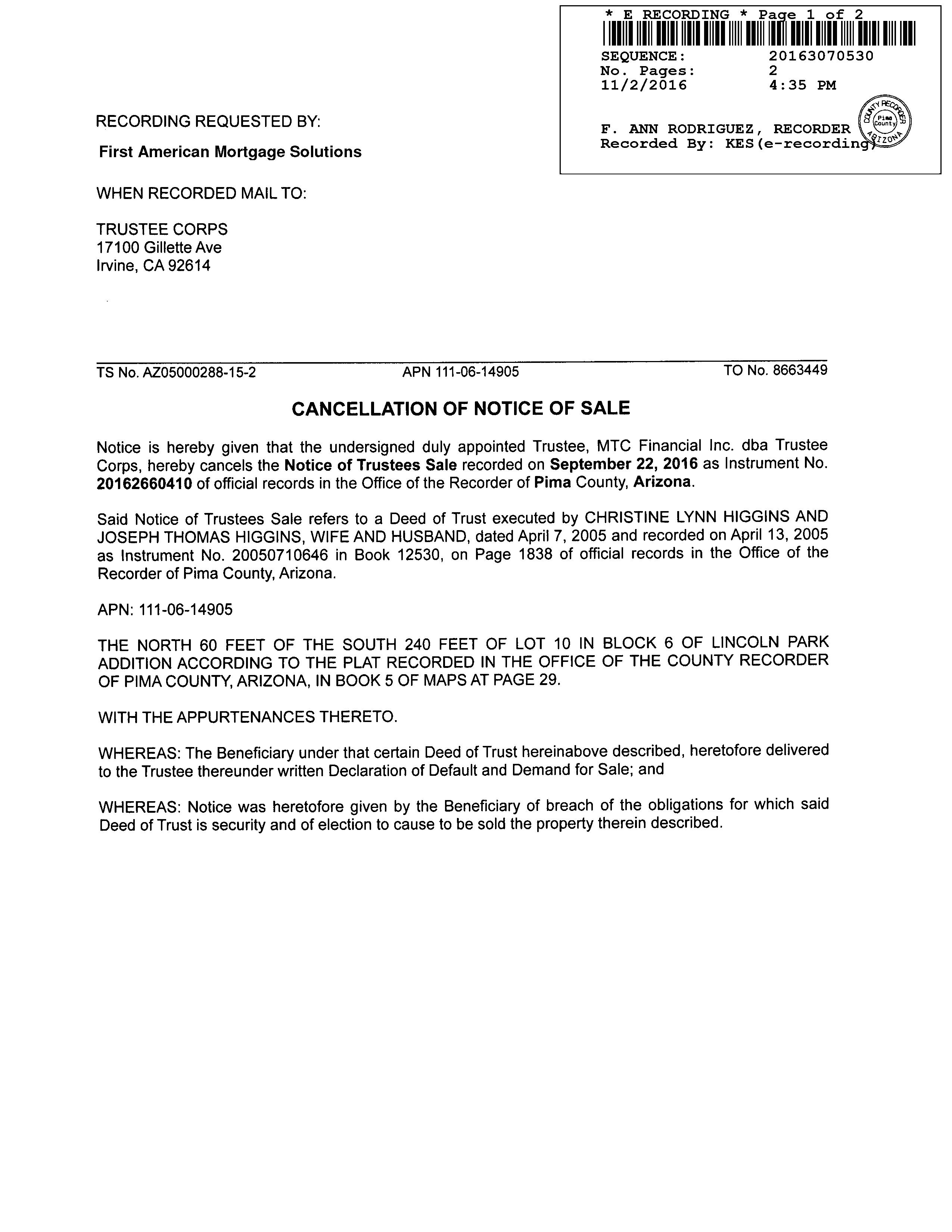

COUNTY

05249570321 TUCSON INT'L AIRPORT Air Force WSilverbellRd SSantaRitaRd N M t L emmon Hwy ESascoRd NF38 W Avra Valley Rd E Grand Va ey Dr NAguirre R d N L u c k e R d N W e n t z R d N Wa terman Mounta i n R d N Anway Rd W El Tiro Rd N Trico Rd W Tucker Rd W Rudas l Rd W Manvi e Rd SSanJoaquinRd WBopp Rd W Snyder H l Rd S M a r s e a r R d W Park Rd W Hermans Rd W Hermans Rd W Guy St W Bush Rd S G a v e y R d N C a e R i n c o n a d o S W m o R d S Shaw Rd S Sierrita Mountain Rd S K o b R d W TwinButtes Rd W Mcgee Ranch Rd S E s t a n c a D r EDesertDove E Hemlock Dr N Bea r C a n y o n R d W E Camino Del Cerro E Fairmount St S Swan Rd NFrontageRd W Emigh Rd W Fort Lowe Rd N P u m p S t a t ion dR E Nona Rd Ch efButteRd Lo al Ave N Trico Rd S Cattle Tank Rd Evalyn Rd SOwlHead R a n c h Rd GasLineRd S P ec a n R d N T r c o R d W Bayard Rd S S a n d a r o R d W i l l owSpri n gsRd N Dove Mountain Blvd SHelvetiaRd WAnamax Mine Rd W G a c i a R a n hc R d Road424 WRagged Top Rd W Ruby Star Dr WBritten RanchRd W Pima Mine Rd S Mcgee Ranch R d E Edw n Rd SGuildRd 8 0 NKINNEYRD S PICACHO HWY E BAUMGARTNER RD N S A N D A R I O R D N ANWAY RD W VALENCIA RD W MOORE RD W INA RD N 1 S T A V E E SUNRISE DR E SNYDER RD NSILVERBELLRD N S O L D I E R T R L E RIVER RD E PRINCE RD E SPEEDWAY BLVD S FREEMAN RD E 22ND ST E 22ND ST W IRVINGTON RD S N O G A L E S H W Y W VALENCIA RD SMISSIONRD W SPEEDWAY BLVD S O L D S P A N I S H T RL W NARANJA DR W TWIN PEAKS RD W PICTURE ROCKS RD W MANVILLE RD SKINNEYRD W MILE WIDE RD E SAHUARITA RD N TRICO RD S S A N D A R O R D PARK LINK DR S OLD N O G ALES HW Y S H O U G H T O N R D S L A C A N A D A DR W HELMET PEAK RD WAJOHWY N S W A N R D S KOLB RD S HOUGHTON RD W TANGERINE RD E GRANT RD S H O U G H T O N R D 9 5 WAJOHWY E VALENCIA RD NORACLE R D I10 I-19 77 77 77 86 86 286 10 19 10 10 Corona de Tucson Casas Adobes Catalina Green Valley Oracle Picture Rocks Three Points Vail Summit Tanque Verde Tucson Sahuarita Red Rock Saddlebrooke Marana Oro Valley Rillito Summerhaven Willow Canyon Oracle Junction Cortaro Continental Littletown 20 30 13 15 51 39 12 01 01 08 10 16 11 06

map is provided for general location only. Please contact school districts for actual street boundaries SCHOOL DISTRICTS 15 AJO UNIFIED 111 N. Well Road, Ajo, AZ 85321 520.387.5618 51 ALTAR VALLEY ELEMENTARY 10105 S. Sasabe Road, Tucson, AZ 85736 520.822.1484 10 AMPHITHEATER UNIFIED 701 W. Wetmore, Tucson, AZ 85705 520.696.5000 16 CATALINA FOOTHILS UNIFIED 2101 E. River Road, Tucson, AZ 85718 520.209.7500 39 CONTINENTAL ELEMENTARY 1991 E. Whitehouse Canyon, Green Valley, AZ 85614 520.625.4581 08 FLOWING WELLS UNIFIED 1556 W. Prince Road, Tucson, AZ 85705 520.696.8800 06 MARANA UNIFIED 11279 W. Grier Road, Marana, AZ 85653 520.682.3243 11 PIMA COUNTY JTED 2855 W. Master Pieces Dr, Tucson, AZ 85741 520.352.5833 30 SAHUARITA UNIFIED 350 W. Sahuarita Road, Sahuarita, AZ 85629 520.625.3502 12 SUNNYSIDE UNIFIED 2238 E. Ginter Road, Tucson, AZ 85706 520.545.2000 13 TANQUE VERDE UNIFIED 2300 N. Tanque Verde Loop, Tucson, AZ 85749 520.749.5751 01 TUCSON UNIFIED 1010 E. 10th Street, Tucson, AZ 85717 520.225.6000 20 VAIL UNIFIED 10701 E. Mary Ann Cleveland Way, Tucson, AZ 85747 520.879.2000 First American Title Insurance Company, and the operating divisions thereof, make no express or implied warranty respecting the information presented and assume no responsibility for errors or omissions. First American, the eagle logo, First American Title, and firstam.com are registered trademarks or trademarks of First American Financial Corporation and/or its affiliates. ©2021 First American Financial Corporation and/or its affiliates. All rights reserved. NYSE: FAF

PIMA

School District Information This

PARCEL: 111-06-1490

SEARCH PARAMETERS

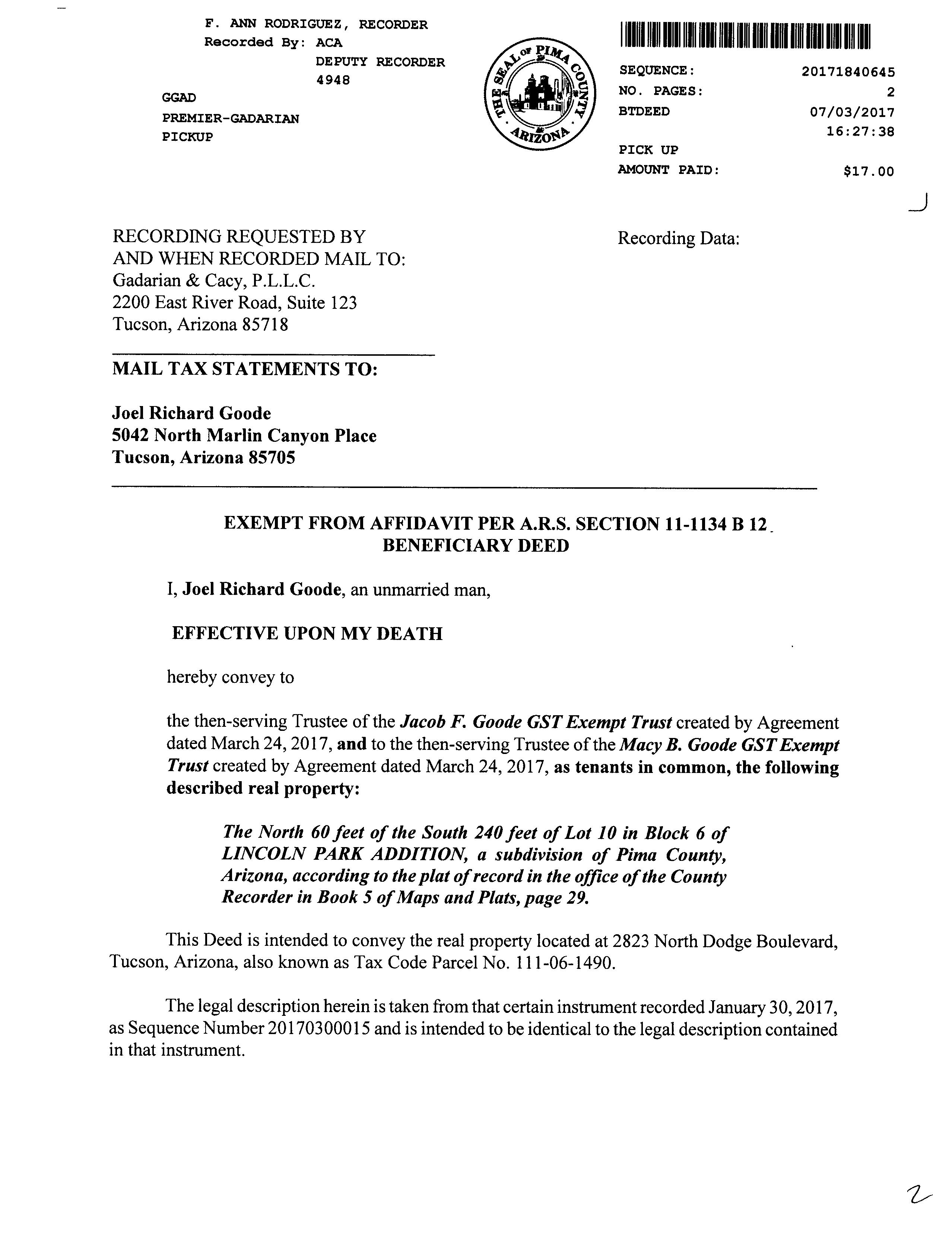

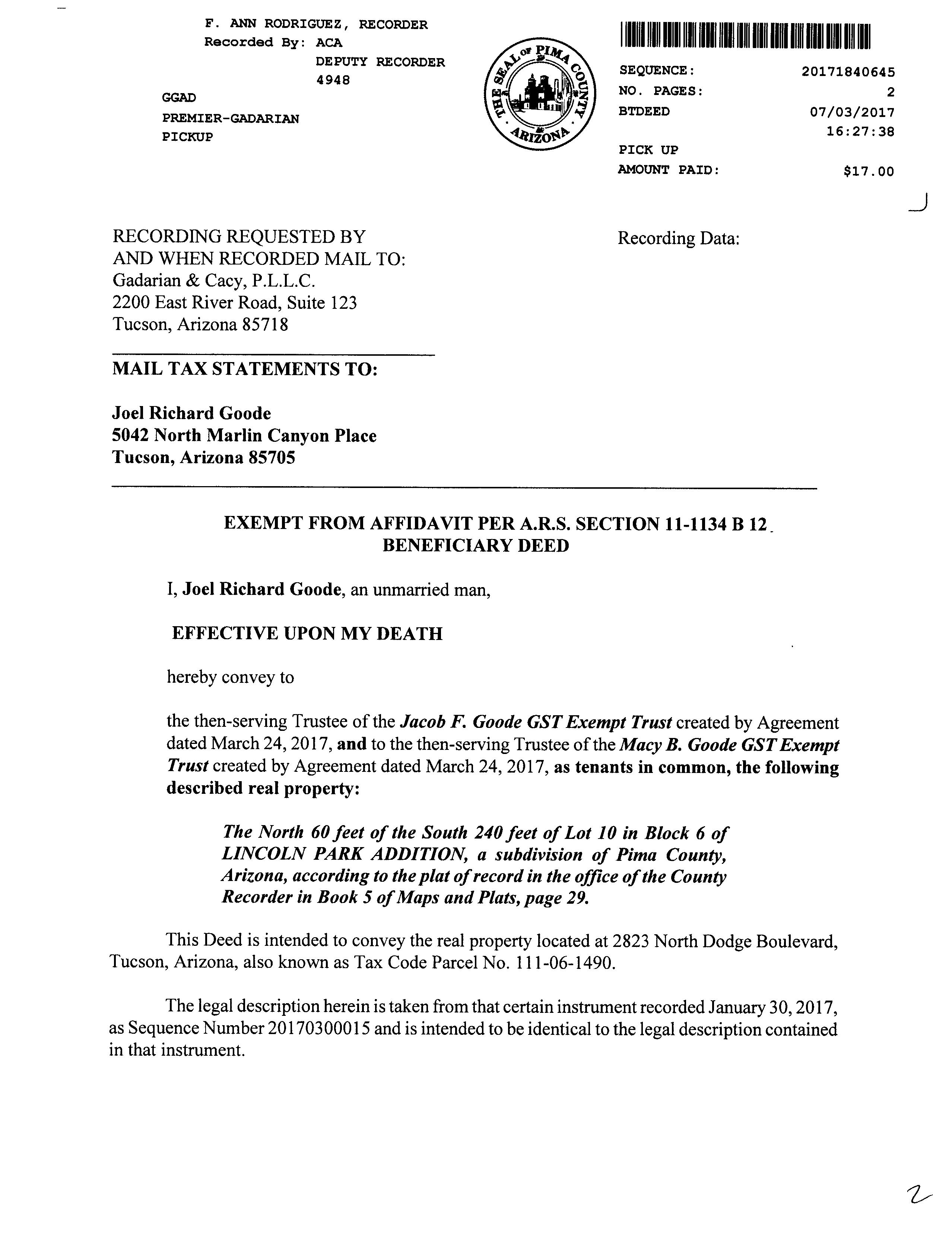

PARCEL: 111-06-1490 INSTRUMENT REC DATE

OWNER: GOODE JOEL RICHARD 2017 300015 01/30/2017

SITUS: 2823 N DODGE BL TUC

MAIL: 5042 N MARLIN CANYON PL TUCSON, AZ 85750

PLAT: LOT 00010 BLOCK 006

LEGAL: LINCOLN PARK N60' S240' LOT 10 BLK 6

+ FIRST AMERICAN TITLE, FC0, LMRA PIMA, AZ 02/23/2024 12:59PM RL13 INVESTIGATIVE SEARCH RESULTS PAGE 1 OF 1

CURRENT TAXES INFORMATION THROUGH 01/28/2024 LAND IMPR EXEMPT RATE AREA SPECIAL DISTRICTS PRIMARY 12,538 0 0 10.8979 0150 SECONDARY 50 15,664 0 2.3020 2023 TOTAL TAX BILLED 1,655.02

TAX AMT TAX DUE INTEREST DATE PAID TOTAL DUE FIRST HALF 827.51 827.51 44.13 871.64 SECOND HALF 827.51 827.51 0.00 827.51 TOTAL CURRENT TAXES DUE 02/24 1,699.15 03/24 1,710.19 (ESTIMATED) IMPROVEMENTS RESIDENTIAL PHYSICAL CONDITION BELOW AVE BLDG SQFT 1,422 FULL CASH VALUE 157,139 YEAR BUILT 1945 LAND USE 01 31 NUMBER OF STORIES 1.0 LOT SIZE 7,200 SQ FT STORIES HEIGHT 0 SCHOOL DISTRICT 0150 EXTERIOR WALLS STUCCO LAND FULL CASH VALUE 502 GRADE MATERIALS IMPR FULL CASH VALUE 156,637 SALES SALE DATE SALE AMOUNT INSTRUMENT TYPE SELLER NAME VALIDITY 01/30/2017 90,500 2017 300015 WD HIGGINS CHRISTINE LYNN & J 04/13/2005 155,000 12530 1836 WD BIANCHI VINCENT/DENISE 07/20/2001 100,500 11595 6102 JD HILLMAN ESTERMARIE / 06/18/1993 64,600 9566 2882 WD DENTON INVESTMENTS INC 12/27/1991 55,000 9194 448 QD DENTON PROPERTIES I 05/10/1989 62,000 8534 519 JD DENTON PROPERTIES I 02/17/1988 1,000 8224 1349 WD DENTON H D ADDITIONAL PROPERTY INFORMATION STANDARD LAND USE: SFR END SEARCH

2023

Page 1 of 2 02/23/2024 2:04 PM

Page 2 of 2 02/23/2024 2:04 PM

Page 1 of 1 02/23/2024 2:04 PM

Page 1 of 2 02/23/2024 2:04 PM

Page 2 of 2 02/23/2024 2:04 PM

We are providing the requested information without CC&Rs.

Unfortunately, we are unable to confirm CC&Rs at this time, possibly because:

The property is too complex to obtain CC&Rs without a complete title examination

The property is sectional, whereas there are no “standard” subdivision‐type restrictions

A recorded plat may not exist

The recorded plat may be older, with limited information available, or

Recorded CC&Rs may not exist.

Once escrow is opened, the property will be thoroughly examined. CC&Rs and other matters that may “run with the land” will be disclosed in Schedule B of the Commitment for Title Insurance.

If you have questions, or need additional information at this time, please contact your First American Account Manager or Escrow Officer.

to the Title & Escrow Process in Arizona Home Seller’s Guide

Southwest Gas 1.877.860.6020 www.swgas.com Cox 602.277.1000 www.cox.com Direct TV 1.888.777.2454 www.directv.com Dish Network 1.800.823.4929 www.dishnetwork.com CenturyLink 800.366.8201 www.centurylink.com AT&T 1.800.222.0300 www.att.com Verizon 1.877.300.4498 www.connecttoverizon.com Salt River Project 602.236.8888 www.srpnet.com APS 602.371.7171 www.aps.com Your Escrow Number Your New Address City/State/Zip Real Estate Agent Name Email Assistant Email Company Phone Address Fax Insurance Previous Company Phone Previous Agent Policy No. New Company Phone New Agent Policy No. Home Warranty Company Policy No. First American Title Escrow Officer Email Escrow Assistant Email Address Phone City/State/Zip Fax 02 Quick Reference 03 Welcome 04 Benefits of Using a REALTOR ® 05 Key Professionals 06 Preparing Your Home for Sale 07 Staging Your Home for Show 09 Terms You Should Know 10 The Life of an Escrow 11 Closing Costs: Who Pays What 12 The Escrow Process 14 Understanding Title Insurance 16 Consider This 17 Closing Your Escrow 18 Planning Your Move Q uick Reference Table of Contents Utilities and Services

Count on First American Title

Welcome to the home-selling process. Throughout this process, you can count on First American Title to guide you smoothly through your transaction and provide expert answers to your questions. We are happy to serve you.

First American Title’s professionals are proud to provide the title insurance that assures people’s home ownership. Backed by First American Title Insurance Company, your transaction will be expertly completed in accordance with state-specific underwriting standards and state and federal regulatory requirements.

First American Title has a direct office or agent near you, offering convenient locations throughout Arizona. We also have an extensive network of offices and agents throughout the United States, and internationally.

First American Title is the principal subsidiary of First American Financial Corporation, and one of the largest suppliers of title insurance services in the nation. With roots dating back to 1889, we’ve served families for generations.

First American Financial Corporation offers more than title insurance and escrow services through its subsidiaries. Our subsidiaries also provide property data, title plant records and images, home warranties, property and casualty insurance, and banking, trust and advisory services.

AZ Sellers Guide | 3

On Us For Service

On Us For Stability

On Us For Convenience

On Us To Meet Your Needs

Count

Count

Count

Count

Benefits of using a Professional REALTOR ®

Before you make the decision to try to sell your home alone, consider the benefits a REALTOR ® can provide that you may not be aware of.

A

REALTOR ® :

› Understands market conditions and has access to information not available to the average homeowner.

› Can advertise effectively for the best results.

› Knows how to price your home realistically, to give you the highest price possible within your time frame.

› Is experienced in creating demand for homes and how to show them to advantage.

› Knows how to screen potential buyers and eliminate those who can’t qualify or are looking for bargain-basement prices.

› Knows how to go toe-to-toe in negotiations.

› Is always “on-call,” answering the phone at all hours, and showing homes evenings and weekends.

› Can remain objective when presenting offers and counter-offers on your behalf.

› Maintains errors-and-omissions insurance.

› Will listen to your needs, respect your opinions and allow you to make your own decisions.

› Can help protect your rights, particularly important with the increasingly complicated real estate laws and regulations.

› Is experienced with resolving problems to facilitate a successful closing on your home.

Only you can determine whether you should attempt to sell your home—probably your largest investment—all alone. Talk with a REALTOR® before you decide. You may find working with a professional is a lot less expensive and much more beneficial than you ever imagined!

FOR SALE BY OWNER

Many people believe they can save a considerable amount of money by selling their homes themselves. It may seem like a good idea at the time, but while you may be willing to take on the task, are you qualified? The following are some questions to help you realistically assess what’s involved.

Do you...

- have the knowledge, patience, and sales skills needed to sell your home?

- know how to determine your home’s current market value?

- know how to determine whether or not a buyer can qualify for a loan?

- understand the steps of an escrow and what’s required of you and the buyer?

- need to hire a real estate attorney? If so, do you know what the cost will be and how much liability they will assume in the transaction?

- know how to advertise effectively and what the costs will be?

- understand the various types of loans buyers may choose and the advantages and disadvantages for the seller?

- have arrangements with an escrow and title company, home warranty company, pest-control service and lender to assist you with the transaction?

Are you...

- aware of conditions in the marketplace today that affect value and length of time to sell?

- concerned about having strangers walking through your home?

- familiar enough with real estate regulations to prepare a binding sales contract? Counter-offers?

- aware that every time you leave your home, you are taking it off the market until you return?

- aware that prospective buyers and bargain hunters will expect you to lower your cost because there’s no REALTOR® involved?

- prepared to give up your evenings and weekends to show your home to potential buyers and “just-looking” time wasters?

AZ Sellers Guide | 4

Key Professionals Involved in Your Transaction

REALTOR ®

A REALTOR ® is a licensed real estate agent and a member of the National Association of REALTORS,® a real estate trade association. REALTORS ® also belong to their state and local Association of REALTORS.®

REAL ESTATE AGENT

A real estate agent is licensed by the state to represent parties in the transfer of property. Every REALTOR ® is a real estate agent, but not every real estate agent has the professional designation of a REALTOR.®

LISTING AGENT

A key role of the listing agent or broker is to form a legal relationship with the homeowner to sell the property and place the property in the Multiple Listing Service.

BUYER'S AGENT

A key role of the buyer’s agent or broker is to work with the buyer to locate a suitable property and negotiate a successful home purchase.

MULTIPLE LISTING SERVICE (MLS)

The MLS is a database of properties listed for sale by REALTORS ® who are members of the local Association of REALTORS.® Information on an MLS property is available to thousands of REALTORS ®

TITLE COMPANY

These are the people who carry out the title search and examination, work with you to eliminate the title exceptions you are not willing to take subject to, and provide the policy of title insurance regarding title to the real property.

ESCROW OFFICER

An escrow officer leads the facilitation of your escrow, including escrow instructions preparation, document preparation, funds disbursement, and more.

AZ Sellers Guide | 5

PREPARING FOR SALE YOUR HOME

Mow and edge the lawn regularly, and trim the shrubs.

Make your entry inviting: Paint your front door and buy a new front door mat.

Paint or replace the mailbox, if needed.

If screens or windows are damaged, replace or repair them.

Repair or replace worn shutters and other exterior trim.

Make sure the front steps are clear and hazard-free. Make sure the doorbell works properly and has a pleasant sound.

Ensure that all exterior lights are working.

Check stucco walls for cracks and discoloration.

Remove any oil and rust stains from the driveway and garage.

Clean and organize the garage, and ensure the door is in good working order.

Shampoo carpeting or replace if worn. Clean tile floors, particularly the caulking.

Brighten the appearance inside by painting walls, cleaning windows and window coverings, and removing sunscreens.

Repair leaky faucets and caulking in bathtubs and showers.

Repair or replace loose knobs on doors and cabinets. If doors stick or squeak, fix them.

Make sure toilet seats look new and are firmly attached.

First impressions have a major impact on potential buyers. Try to imagine what potential buyers will see when they approach your house for the first time and walk through each room. Ask your REALTOR ® for advice; they know the marketplace and what helps a home sell. Here are some tips to present your home in a positive manner:

Repair or replace loud ventilating fans.

Replace worn shower curtains.

Rearrange furniture to make rooms appear larger. If possible, remove and/or store excess furniture, and avoid extension cords in plain view.

Remove clutter throughout the house. Organize and clean out closets.

Clean household appliances and make sure they work properly.

Air conditioners/heaters, evaporative coolers, hot water heater should be clean, working and inspected if necessary. Replace filters.

Check the pool and/or spa equipment and pumps. Make sure all are working properly and that the pool and/or spa are kept clean.

Inspect fences, gates and latches. Repair or replace as needed.

AZ Sellers Guide | 6

Staging your home for Show

To make the best impression, keep your home clean, neat, uncluttered and in good repair. Please review this list prior to each showing:

Keep everything clean. A messy or dirty home will cause prospective buyers to notice every flaw.

Clear all clutter from counter tops.

Let the light in. Raise shades, open blinds, pull back the curtains and turn on the lights.

Get rid of odors such as tobacco, pets, cooking, etc., but don’t overdo air fresheners or potpourri. Fresh baked bread and cinnamon can make a positive impact.

Send pets away or secure them away from the house, and be sure to clean up after them.

Close the windows to eliminate street noise.

If possible you, your pets, and your children should be gone while your home is being shown.

Clean trash cans and put them out of sight.

If you must be present while your home is shown, keep noise down. Turn off the TV and radio. Soft, instrumental music is fine, but avoid vocals.

Keep the garage door closed and the driveway clear. Park autos and campers away from your home during showings

Hang clean attractive guest towels in the bathrooms.

Check that sink and tub are scrubbed and unstained.

Make beds with attractive spreads.

Stash or throw out newspapers, magazines, junk mail.

AZ Sellers Guide | 7

AZ Sellers Guide | 8

Terms You Should Know

Appraisal

An estimate of value of property resulting from analysis of facts about the property; an opinion of value.

Annual Percentage Rate (APR)

The borrower’s costs of the loan term expressed as a rate. This is not their interest rate.

Beneficiary

The recipient of benefits, often from a deed of trust; usually the lender.

Closing Disclosure (CD)

Closing Disclosure form designed to provide disclosures that will be helpful to borrowers in understanding all of the costs of the transaction. This form will be given to the consumer three (3) business days before closing.

Close of Escrow

Generally the date the buyer becomes the legal owner and title insurance becomes effective.

Comparable Sales

Sales that have similar characteristics as the subject real property, used for analysis in the appraisal. Commonly called “comps.”

Consummation

Occurs when the borrower becomes contractually obligated to the creditor on the loan, not, for example, when the borrower becomes contractually obligated to a seller on a real estate transaction. The point in time when a borrower becomes contractually obligated to the creditor on the loan depends on applicable State law. Consummation is not the same as close of escrow or settlement.

Deed of Trust

An instrument used in many states in place of a mortgage.

Deed Restrictions

Limitations in the deed to a parcel of real property that dictate certain uses that may or may not be made of the real property.

Disbursement Date

The date the amounts are to be disbursed to a buyer and seller in a purchase transaction or the date funds are to be paid to the borrower or a third party in a transaction that is not a purchase transaction.

Earnest Money Deposit

Down payment made by a purchaser of real property as evidence of good faith; a deposit or partial payment.

Easement

A right, privilege or interest limited to a specific purpose that one party has in the land of another.

Endorsement

As to a title insurance policy, a rider or attachment forming a part of the insurance policy expanding or limiting coverage.

Hazard Insurance

Real estate insurance protecting against fire, some natural causes, vandalism, etc., depending upon the policy. Buyer often adds liability insurance and extended coverage for personal property.

Impounds

A trust type of account established by lenders for the accumulation of borrower’s funds to meet periodic payments of taxes, mortgage insurance premiums and/or future insurance policy premiums, required to protect their security.

Legal Description

A description of land recognized by law, based on government surveys, spelling out the exact boundaries of the entire parcel of land. It should so thoroughly identify a parcel of land that it cannot be confused with any other.

Lien

A form of encumbrance that usually makes a specific parcel of real property the security for the payment of a debt or discharge of an obligation. For example, judgments, taxes, mortgages, deeds of trust.

Loan Estimate (LE)

Form designed to provide disclosures that will be helpful to borrowers in understanding the key features, costs and risks of the mortgage loan for which they are applying. Initial disclosure to be given to the borrower three (3) business days after application.

Mortgage

The instrument by which real property is pledged as security for repayment of a loan.

PITI

A payment that includes Principal, Interest, Taxes, and Insurance.

Power of Attorney

A written instrument whereby a principal gives authority to an agent. The agent acting under such a grant is sometimes called an “Attorney-in-Fact.”

Recording

Filing documents affecting real property with the appropriate government agency as a matter of public record.

Settlement statement

Provides a complete breakdown of costs involved in a real estate transaction.

TRID

TILA-RESPA Integrated Disclosures

AZ Sellers Guide | 9

The Life Of An Escrow

THE BUYER

Chooses a Real Estate Agent

Gets pre-approval letter from Lender and provides to Real Estate Agent.

Makes offer to purchase. Upon acceptance, opens escrow and deposits earnest money.

Finalizes loan application with Lender. Receives a Loan Estimate from Lender.

Completes and returns opening package from First American Title.

Schedules inspections and evaluates findings.

Reviews title commitment/ preliminary report.

Provides all requested paperwork to Lender (bank statements, tax returns, etc.) All invoices and final approvals should be to the lender no later than 10 days prior to loan consummation.

Lender (or Escrow Officer) prepares CD and delivers to Buyer at least 3 days prior to loan consummation.

Escrow officer or real estate agent contacts the buyer to schedule signing appointment.

Buyer consummates loan, executes settlement documents, & deposits funds via wire transfer.

Documents are recorded and the keys are delivered!

THE SELLER

Chooses a Real Estate Agent

Accepts Buyer’s offer to purchase.

Completes and returns opening package from First American Title, including information such as forwarding address, payoff lender contact information and loan numbers.

Orders any work for inspections and/or repairs to be done as required by the purchase agreement.

Escrow officer or real estate agent contacts the seller to schedule signing appointment.

Documents are recorded and all proceeds from sale are received.

THE ESCROW OFFICER

Upon receipt of order and earnest money deposit, orders title examination.

Requests necessary information from buyers and sellers via opening packages.

Reviews title commitment / preliminary report.

Upon receipt of opening packages, orders demands for payoffs. Contacts buyer or seller when additional information is required for the title commitment/ preliminary report.

All demands, invoices, and fees must be collected and sent to lender at least 10 days prior to loan consummation.

Coordinates with lender on the preparation of the CD.

Reviews all documents, demands, and instructions and prepares settlement statements and any other required documents.

Schedules signing appointment and informs buyer of funds due at settlement.

Once loan is consummated, sends funding package to lender for review.

Prepares recording instructions and submits docs for recording.

Documents are recorded and funds are disbursed. Issues final settlement statement.

THE LENDER

Accepts Buyer’s application and begins the qualification process. Provides Buyer with Loan Estimate.

Orders and reviews title commitment / preliminary report, property appraisal, credit report, employment and funds verification.

Collects information such as title commitment / preliminary report, appraisal, credit report, employment and funds verification. Reviews and requests additional information for final loan approval.

Underwriting reviews loan package for approval.

Coordinates with Escrow Officer on the preparation of the Closing Disclosure, which is delivered to Buyer at least 3 days prior to loan consummation.

Delivers loan documents to escrow.

Upon review of signed loan documents, authorizes loan funding.

AZ Sellers Guide | 10

Closing Costs: Who Pays What

AZ Sellers Guide | 11 CASH FHA VA CONV 1. Downpayment BUYER BUYER BUYER BUYER 2. Termite (Wood Infestation) Inspection (negotiable except on VA) SELLER 3. Property Inspection (if requested by buyer) BUYER BUYER BUYER BUYER 4. Property Repairs, if any (negotiable) SELLER SELLER SELLER SELLER 5. New Loan Origination Fee (negotiable) BUYER BUYER BUYER 6. Discount Points (negotiable) BUYER BUYER BUYER 7. Credit Report BUYER BUYER BUYER 8. Appraisal or Extension Fee (negotiable) BUYER BUYER BUYER 9. Existing Loan Payoff SELLER SELLER SELLER SELLER 10. Existing Loan Payoff Demand SELLER SELLER SELLER SELLER 11. Loan Prepayment Penalty (if any) SELLER SELLER SELLER SELLER 12. Next Month’s PITI Payment BUYER BUYER BUYER 13. Prepaid Interest (approx. 30 days) BUYER BUYER BUYER 14. Reserve Account Balance (Credit seller / Charge buyer) PRORATE PRORATE PRORATE 15. FHA MIP, VA Funding Fee, PMI Premium BUYER BUYER BUYER 16. Assessments payoff or proration (sewer, paving, etc.) SELLER 17. Taxes PRORATE PRORATE PRORATE PRORATE 18. Tax Impounds BUYER BUYER BUYER 19. Tax Service Contract SELLER SELLER BUYER 20. Fire/Hazard Insurance BUYER BUYER BUYER BUYER 21 Flood Insurance BUYER BUYER BUYER 22. Homeowners Association (HOA) Transfer Fee BUYER or SELLER BUYER or SELLER BUYER or SELLER BUYER or SELLER 23. HOA/Disclosure Fee SELLER SELLER SELLER SELLER 24 Current HOA Payment PRORATE PRORATE PRORATE PRORATE 25. Next Month’s HOA Payment BUYER BUYER BUYER BUYER 26. Home Warranty Premium (negotiable) BUYER or SELLER BUYER or SELLER BUYER or SELLER BUYER or SELLER 27. REALTORS®’ Commissions SELLER SELLER SELLER SELLER 28. EAGLE Homeowners Title Policy SELLER SELLER SELLER SELLER 29. Lenders Title Policy and Endorsements BUYER BUYER BUYER 30. Escrow Fee (NOTE: Charge seller on VA Loan) SPLIT SPLIT SELLER SPLIT 31. Recording Fees (Flat rate) SPLIT SPLIT SPLIT SPLIT 32. Reconveyance/Satisfaction Fee SELLER SELLER SELLER SPLIT 33. Courier/Express Mail Fees SPLIT SPLIT SELLER SPLIT THIS CHART INDICATES WHO CUSTOMARILY PAYS WHAT COSTS Note: Prorated items will appear on Closing Statement as charges for one and credits for the other.

The Escrow Process

WHAT IS AN ESCROW?

The escrow is the process of having a neutral party manage the exchange of money for real property. The escrow holder is known as an escrow or settlement officer or agent. The buyer deposits funds and the seller deposits a deed with the escrow holder along with all of the other documents required to remove all "contingencies" (conditions and approvals) in the purchase agreement prior to closing.

HOW IS AN ESCROW OPENED?

Once a purchase agreement is signed by all necessary parties, the agent representing the party who will pay the fee selects an escrow holder and the buyer's earnest money deposit and contract are submitted to the escrow holder. From this point, the escrow holder will follow the mutual written instructions of the buyer and seller, maintaining a neutral stance to ensure that neither party has an unfair advantage over the other. The escrow holder also follows the instructions of the Buyer's new lender, the seller's existing lender, and both parties' agents. The escrow holder ensures the transparency of the transaction, while carefully maintaining the privacy of the consumers.

AZ Sellers Guide | 12

Your Escrow Professional May:

Open escrow and deposit good faith funds into an escrow account

Conduct a title search to determine the ownership and title status of the real property

Review the title commitment and begin the process of working with you and the title officer to eliminate the title exceptions the buyer and the buyer’s new lender are not willing to take subject to. This includes ordering a payoff demand from your existing lender.

Coordinate with the buyer’s lender on the preparation of the Closing Disclosure (CD)

Prorate fees, such as real property taxes, per the contract and prepare the settlement statement

Set separate appointments allowing the buyer and seller to sign documents and deposit funds

Review documents and ensure all conditions are fulfilled and certain legal requirements are met

Request funds from buyer and buyer’s new lender

When all funds are deposited and conditions met, record documents with the County Recorder to transfer the real property to the buyer

After recording is confirmed, close escrow and disburse funds, including proceeds, loan payoffs, tax payments, and more

Prepare and send final documents to all parties

AZ Sellers Guide | 13

Understanding Title Insurance

The Title Industry & Title Insurance in Brief

Prior to the development of the title industry in the late 1800s, a home-buyer received a grantor’s warranty, attorney’s title opinion, or abstractor’s certificate as assurance of home ownership. The buyer relied on the financial integrity of the grantor, attorney, or abstractor for protection. Today, home-buyers look primarily to title insurance to provide this protection.

Title insurance companies are regulated by state statute. They are required to post financial guarantees to ensure that any claims will be paid in a timely fashion. They also must maintain their own “title plants” which house duplicates of recorded deeds, mortgages, plats, and other pertinent county property records.

WHAT IS TITLE INSURANCE?

Title insurance provides coverage for certain losses due to defects in the title that, for the most part, occurred prior to your ownership. Title insurance protects against defects such as prior fraud or forgery that might go undetected until after closing and possibly jeopardize your ownership and investment.

WHY IS TITLE INSURANCE NEEDED?

Title insurance insures buyers against the risk that they did not acquire marketable title from the seller. It is primarily designed to reduce risk or loss caused by defects in title from the past. A loan policy of title insurance protects the interest of the mortgage lender, while an owner’s policy protects the equity of you, the buyer, for as long as you or your heirs (in certain policies) own the real property.

WHEN IS THE PREMIUM DUE?

You pay for your owner’s title insurance policy only once, at the close of escrow. Who pays for the owner’s policy and loan policy varies depending on local customs.

AZ Sellers Guide | 14

Compare First American’s Eagle Policy® for Owners

Protection from:

1 Someone else owns an interest in your title

2 A document is not properly signed

3 Forgery, fraud, duress in the chain of title

4 Defective recording of any document

5 There are restrictive covenants

6 There is a lien on your title because there is:

a) a deed of trust

b) a judgement, tax, or special assessment

c) a charge by a homeowner’s association

7 Title is unmarketable

8 Mechanics lien

9 Forced removal of a structure because it:

a) extends on another property and/or easement

b) violates a restriction in Schedule B

c) violates an existing zoning law*

10 Cannot use the land for a Single-Family Residence because the use violates a restriction in Schedule B or a zoning ordinance

11 Unrecorded lien by a homeowners association

13

14

15

16

17

19

Compare First American’s Eagle Policy® for Owners

21 Post-policy prescriptive easement

22 Covenant violation resulting in your title reverting to a previous owner

23 Violation of building setback regulations

24 Discriminatory covenants

Other benefits:

25 Pays rent for substitute land or facilities

26 Rights under unrecorded leases

27 Plain language statements of policy coverage and restrictions

28 Compliance with Subdivision Map Act

29 Coverage for boundary wall or fence encroachment*

30 Added ownership coverage leads to enhanced marketability

31 Insurance coverage for a lifetime

32 Post-policy inflation coverage with automatic increase in value up to 150% over five years

33 Post-policy Living Trust coverage

* Deductible and maximum limits apply. Not available to investors on 1- to 4-unit residential properties. Coverage may vary based on an individual policy.

As with any insurance contract, the insuring provisions express the coverage afforded by the title insurance policy and there are exceptions, exclusions and conditions to coverage that limit or narrow the coverage afforded by the policy. Also, some coverage may not be available in a particular area or transaction due to legal, regulatory, or underwriting considerations. Please contact a First American representative for further information. The services described above are typical basic services. The services provided to you may be different due to the specifics of your transaction or the location of the real property involved.

AZ Sellers Guide | 15

EAGLE ALTA Standard or CLTA

12 Unrecorded easements

Building

permit violations*

Restrictive covenant violations

Post-policy forgery

Post-policy encroachment

Post-policy damage from extraction of minerals or water

Lack of vehicular and pedestrian access

18

Map not consistent with legal description

Post-policy adverse possession

20

EAGLE ALTA Standard or CLTA

Consider This

One escrow transaction could involve more than 20 individuals, including real estate agents, buyers, sellers, attorneys, escrow officer, escrow technician, title officer, loan officer, loan processor, loan underwriter, home inspector, termite inspector, insurance agent, home warranty representative, contractor, roofer, plumber, pool service, and so on. And often, one transaction depends on another.

When you consider the number of people involved, you can imagine the opportunities for delays and mishaps. Your experienced escrow team can’t prevent unforeseen problems from arising; however, they can help smooth out the process.

AZ Sellers Guide | 16

Closing Your Escrow

THE CLOSING DISCLOSURE

Once the loan is approved and all invoices and paperwork have been provided, the lender and escrow officer will collaborate on the preparation of the Closing Disclosure (CD). In order to close on time, all paperwork and invoices should be submitted at least 10 days prior to the expected close of escrow date. The borrower must receive the CD at least three days* prior to consummation of the loan (typically the signing date). The escrow officer will also prepare an estimated settlement statement and inform the buyer of the balance of the down payment and closing costs needed to close escrow. *For purposes of the Closing Disclosure“business day” is defined as every day except Sundays and Federal legal holidays.

THE CLOSING OR SIGNING APPOINTMENT

The escrow holder will contact you or your agent to schedule a closing or signing appointment. In some states, this is the "close of escrow." In some others, the close of escrow is either the day the documents record or that funds are disbursed. Ask your escrow holder if you would like clarification about your state's laws.

You will have a chance to review the settlement statement and supporting documentation. This is your opportunity to ask questions and clarify terms. You should review the settlement statement carefully and report discrepancies to the escrow officer. This includes any payments that may have been missed. You are responsible for all charges incurred even if overlooked by the escrow holder, so it's better to bring these to their attention before closing.

The escrow holder is obligated by law to have the designated amount of money before releasing any funds. If you have questions or foresee a problem, let your escrow holder know immediately.

DON'T FORGET YOUR IDENTIFICATION

You will need valid identification with your photo I.D. on it when you sign documents that need to be notarized (such as a deed). A driver's license is preferred. You will also be asked to provide your social security number for tax reporting purposes, and a forwarding address.

WHAT HAPPENS NEXT?

If the buyer is obtaining a new loan, the buyer’s signed loan documents will be returned to the lender for review. The escrow holder will ensure that all contract conditions have been met and will ask the lender to "fund the loan."

If the loan documents are satisfactory, the lender will send funds directly to the escrow holder. When the loan funds are received, the escrow holder will verify that all necessary funds are in. Escrow funds will be disbursed to the seller and other appropriate payees. Then, the REALTOR® will present the keys to the property to the buyer.

AZ Sellers Guide | 17

Planning your move

SIX WEEKS BEFORE:

Create an inventory sheet of items to move.

Research moving options You’ll need to decide if yours is a do-it-yourself move or if you’ll be using a moving company.

Request moving quotes Solicit moving quotes from as many moving companies and movers as possible. There can be a large difference between rates and services within moving companies.

Discard unnecessary items Moving is a great time for ridding yourself of unnecessary items. Have a yard sale or donate unnecessary items to charity.

Packing materials. Gather moving boxes and packing materials for your move.

Contact insurance companies. (Life, Health, Fire, Auto) You’ll need to contact your insurance agent to cancel/transfer your insurance policy. Do not cancel your insurance policy until you have and closed escrow on the sale.

Seek employer benefits. If your move is work-related, your employer may provide funding for moving expenses. Your human resources rep should have information on this policy.

Changing Schools. If changing schools, contact new school for registration process.

FOUR WEEKS BEFORE:

Contact utility companies Set utility turnoff date, seek refunds and deposits and notify them of your new address.

Obtain your medical records. Contact your doctors, physicians, dentists and other medical specialists who may currently be retaining any of your family’s medical records. obtain these records or make plans for them to be delivered to your new medical facilities.

Note food inventory levels Check your cupboards, refrigerator and freezer to use up as much of your perishable food as possible.

Service small engines for your move by extracting gas and oil from the machines. This will reduce the chance to catch fire during your move.

Protect jewelry and valuables. Transfer jewelry and valuables to safety deposit box so they can not be lost or stolen during your move.

Borrowed and rented items. Return items which you may have borrowed or rented. Collect items borrowed to others.

ONE WEEK BEFORE:

Plan your itinerary. Make plans to spend the entire day at the house or at least until the movers are on their way. Someone will need to be around to make decisions. Make plans for kids and pets to be at the sitters for the day.

Change of address. Visit USPS for change of address form.

Bank accounts Notify bank of address change. Make sure to have a money order for paying the moving company if you are transferring or closing accounts.

Service automobiles If automobiles will be driven long distances, you’ll want to have them serviced for a trouble-free drive.

Cancel services. Notify any remaining service providers (newspapers, lawn services, etc) of your move.

Start packing. Begin packing for your new location.

Travel items. Set aside items you’ll need while traveling and those needed until your new home is established. Make sure these are not packed in the moving truck!

Scan your furniture. Check furniture for scratches and dents before so you can compare notes with your mover on moving day.

Prepare Floor Plan. Prepare floor plan for your new home. This will help avoid confusion for you and your movers.

MOVING DAY:

Review the house. Once the house is empty, check the entire house (closets, the attic, basement, etc) to ensure no items are left or no home issues exist.

Sign the bill of lading. Once your satisfied with the mover’s packing your items into the truck, sign the bill of lading. If possible, accompany your mover while the moving truck is being weighed.

Double check with your mover. Make sure your mover has the new address and your contact information should they have any questions during your move.

Vacate your home. Make sure utilities are off, doors and windows are locked and notify your real estate agent you’ve left the property.

AZ Sellers Guide | 18

Your Notes:

AZ Sellers Guide | 19

Your Notes:

AZ Sellers Guide | 20

Your Notes:

AZ Sellers Guide | 21

1

623.299.3644

13940

2

623.537.1608

20241

E

3

623.551.3265

39508

NE

4

480.515

N

5

480.575.6609

7202

NE

6

480.551.0480

6263

7

480.563.9034

18291

SE

8

480.777.0051

2121

SW

9

10

11

SE

12

6877

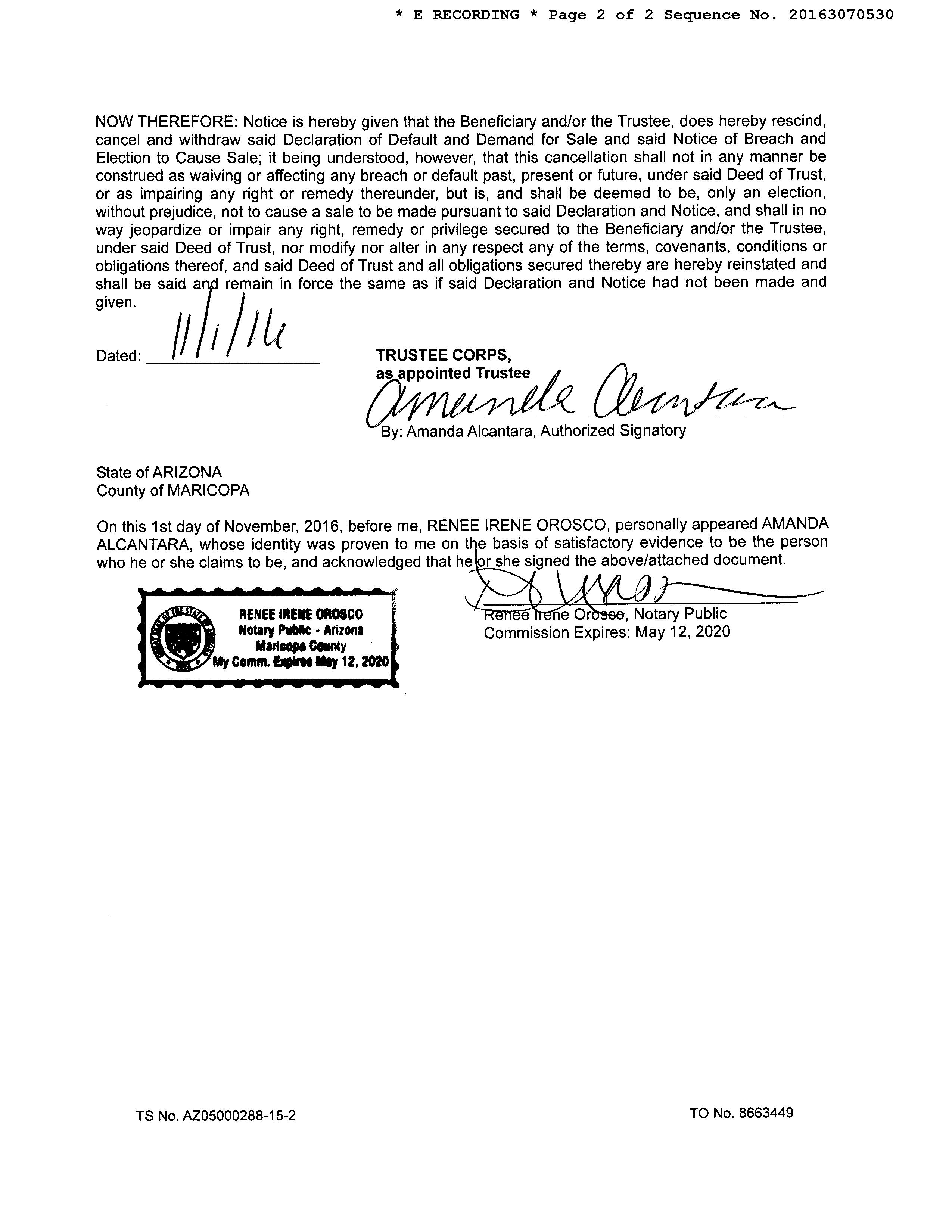

First American Title Branch Locator

1 4 3 2 6 12 10 5 8 7 11 9 CRISMON SIGNAL BUTTE GOLDFIELD OLDWESTHWY SKINGSRANCH

Central Arizona

SUN CITY WES

T

W. Meeker Blvd, #119

Sun City West, AZ 85375

Meeker

N of

Blvd W of R.H. Johnson

THE LEGENDS

N. 67th Ave, #A-2

Glendale, AZ 85308

side 67th Ave/N of 101

ANTHEM

Mountain Dr, #128

N. Daisy

Anthem, AZ 85086

corner Daisy Mtn Dr/Gavilan Peak Pkwy

TATUM RIDGE

4369

Blvd, #A150

11211 N Tatum

Phoenix, AZ 85028

of Shea, E side of Tatum

CAREFREE

E. Carefree Dr, Bldg 1, #1

AZ

Carefree,

85377

corner of Tom Darlington/Carefree Dr.

SCOTTSDALE FORUM

N. Scottsdale Rd, #110 Scottsdale, AZ 85250 E Side Scottsdale/S of Lincoln

DC CROSSING

N. Pima Rd, #145

Scottsdale, AZ 85255

corner of Pima/Legacy

CHANDLER PORTICO

W. Chandler Blvd., #215

AZ

Chandler,

85224

Corner Chandler Blvd./Dobson Rd.

GILBERT SAN TAN

E. Williams Field Rd. #101 Gilbert, AZ

corner of Williams Field Rd./Val Vista Rd.

480.777.0614 1528

85295 NW

MESA

S. Stapley Dr, #123 Mesa, AZ

N of Baseline / W of Stapley

480.401.3738 1630

85204

RED MOUNTAIN

N. Recker Rd, #103 Mesa,

480.534.3599 1135

AZ 85205

corner

Recker & Brown

of

GOLD CANYON

480.288.0883

South Kings Ranch Rd, #5 Gold Canyon, AZ 85118

of 60/South Side Kings Ranch Rd.

Sellers Guide | 22

E

AZ

05110280223 For more information please contact your First American representative. www.firstam.com First American Title Insurance Company, and the operating divisions thereof, make no express or implied warranty respecting the information presented and assume no responsibility for errors or omissions. First American, the eagle logo, First American Title, and firstam.com are registered trademarks or trademarks of First American Financial Corporation and/or its affiliates. ©2023 First American Financial Corporation and/or its affiliates. All rights reserved. NYSE: FAF