1 90 INFLATION DEFLATES OZ 72 NRI SUPERCHARGE INDIA MARKET 70 JAKARTA’S SOARING SATELLITE UNCERTAIN STEPPES IN MONGOLIA 100 ARCHETYPE’S EVOLUTIONARY ROAD 54 NISEKO SLALOMS BACK 82 USD10; SGD13; IDR135,000; MYR41; THB330 NO. 180 asiapropertyawards.com/newsroom

4

5

LUXURIOUS STAY IN NISEKO SURROUNDED BY THE NATURE

Andaru Collection Niseko is a luxury village living concept that blends modern Japanese and Balinese styles together. The villas are set against the magnificent backdrop of Mount Yotei and within the natural beauty of the renowned ski destination of Niseko, Hokkaido, Japan.

7

WWW.ANDARU.JP

8

9

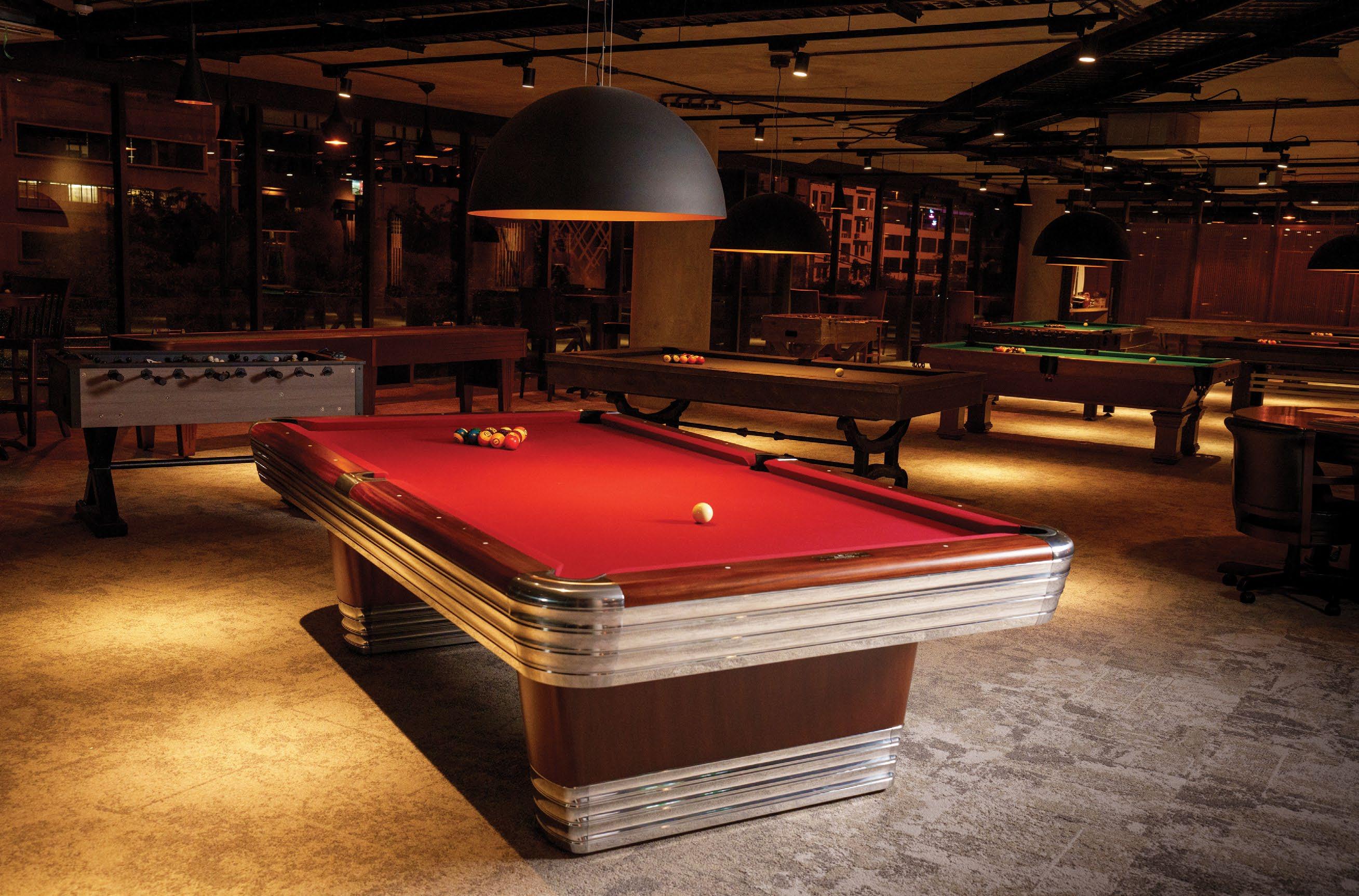

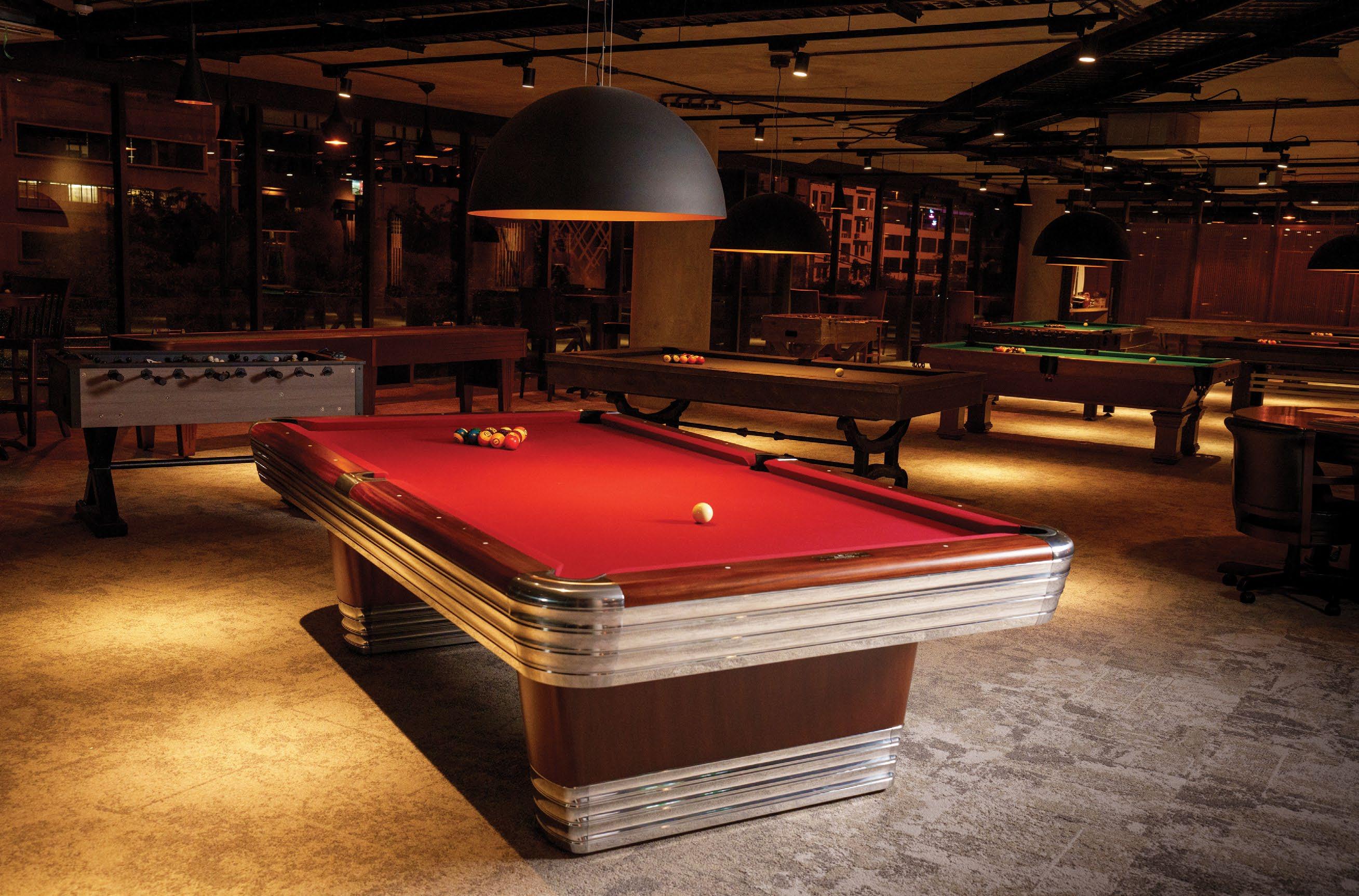

Solutions for distinguished lounges, games rooms, and activity centers in clubhouses, hotels, resorts, and private homes

Styles for Every Space

Architects, interior designers, hospitality operators, and home owners choose the heirloom quality and design of Brunswick and American Heritage activity rooms, games rooms, and furniture solutions.

Heirloom Quality From Brunswick Billiards Group

PRESTIGE HERITAGE DURABILITY

QUALITY CLASSIC STYLING CRAFTSMANSHIP Tel: +66 (0) 2185 1920-4

Join the region’s most exclusive real estate honours, celebrating 18 years of excellence in 2023 AsiaPropertyAwards.com SHINE BRIGHT LIKE A WINNER

ISSUE 180

Publisher

Jules Kay

Editor Duncan Forgan

Deputy Editor

Al Gerard de la Cruz

Senior Editor

Richard Allan Aquino

Digital Editor

Gynen Kyra Toriano

Editorial Contributors

Liam Aran Barnes, Bill Charles, Oliver Irvine, Steve Finch, George Styllis, Jonathan Evans

Head of Creative

Ausanee Dejtanasoontorn (Jane)

Senior Graphic Designer

Poramin Leelasatjarana (Min)

Digital Marketing Executive

Anawat Intagosee (Fair)

Media Relations & Marketing Services Manager

Nate Dacua

Media Relations & Marketing Services Executive

Piyachanok Raungpaka

Marketing Relations Manager

Tanattha Saengmorakot

Senior Product Lifecycle & Brand Manager

Marco Bagna-Dulyachinda

Director of Sales

Udomluk Suwan

Head of Regional Sales

Orathai Chirapornchai

Regional Manager of Event Sponsorship

Kanittha Srithongsuk

Solutions Manager (Australia)

Watcharaphon Chaisuk

Solutions Manager (Cambodia)

Phumet Puttasimma

Solutions Manager (Cambodia and Greater Niseko)

Nyan Zaw Aung

Senior Solutions Manager (China and India)

Huiqing Xia

Solutions Manager (China and Australia)

Kai Lok Kwok

Solutions Manager (India and Sri Lanka)

Monika Singh

Senior Account Manager (Indonesia)

Wulan Putri

Senior Account Manager (Indonesia)

Oky Prasetya

Asst. Manager (MY & CN) - Awards

Samuel Poon

Senior Solutions Manager (Philippines)

Marylourd Pique

Solutions Manager (Philippines)

Maria Elena Sta. Maria

Awards Manager (Singapore)

Alicia Loh

Senior Account Director (Thailand)

Kritchaorn Rattanapan

Senior Account Director (Thailand)

Rattanarat Srisangsuk

Head of Awards & Developer Business (Vietnam)

Nguyen Tran Minh Quan

Account Manager, Awards Sponsorship

Priyamani Srimokla

Distribution Manager

Rattanaphorn Pongprasert

General Enquiries

awards@propertyguru.com

Advertising Enquiries

petch@propertyguru.com

Distribution Enquiries

ying@propertyguru.com

PropertyGuru Property Report is published six times a year by

© 2023 by PropertyGuru Pte. Ltd. All rights reserved. No part of this publication may be reproduced without prior permission of the publisher KDN PPS 1662/10/2012 (022863)

16

17

36

Project Confidential: Health is wealth

Property seekers have their health needs catered for at KL Wellness City: Southeast Asia’s first township dedicated to wellness

44

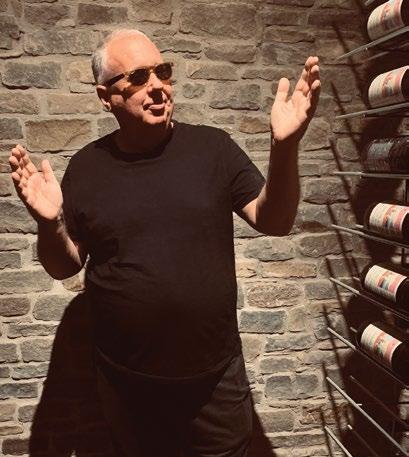

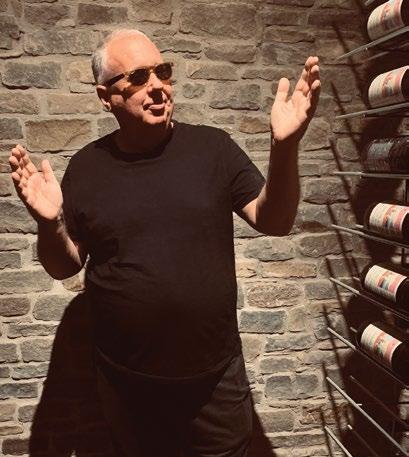

Interview: Nose for new frontiers

Bill Barnett retains a strong instinct for opportunities after a long tenure in Asia

32

Style

Conjure some haunting beauty for the spooky season

54

Design Focus: Evolutionary thinking

Archetype Group has overseen numerous transformative projects in Southeast Asia

18

Trends

your

haven 26 Gadgets

widgets make for great travel companions CONTENTS | Issue 180

30

Make

home’s most private space a

These

19

CONTENTS | Issue 180

70

Neighbourhood Watch: Depok

A hub for shopping and education near Jakarta, Depok is a much-coveted address for real estate investors

72

Special feature: Fruitful roots

With market conditions and regulatory changes working in their favour, NRI investors are supercharging India’s real estate scene

82 Destination: Niseko

The property sector in Greater Niseko is heading back onpiste as Japan regains lost momentum

90 Destination: Australia

Soaring mortgage payments and other factors are putting a dampener on the real estate investment scene

100 Dispatch: Uncertain steppes

Ulaanbaatar’s housing boom has exposed planning deficiencies within unprecedented growth

103 Dispatch: Back to basics

There are signs of life in Myanmar’s real estate sector, especially at the lower end of the residential market

20

21

The Golden Ratio of Living

Bringing harmony to everyday life, real estate developer Lofter Group introduces The Timeless Series, a bold new succession of projects that embody balance in Hong Kong living

In the tapestry of Hong Kong’s urban landscape, a timeless allure emerges.

Hong Kong, romanticised in the arts and real life for its dynamic energy and vibrant urban landscape, is home to a collection of residential buildings that defy the rapid pace of change. These buildings stand as silent witnesses to the city’s evolution.

Indeed, Hong Kong’s heritage buildings encapsulate its rich past and diverse architecture. Tenement houses, walk-ups, shophouses, colonial-era structures, and temples reflect how far the city has come.

These treasures embody a blend of Eastern and Western influences, offering insights into Hong Kong’s community life. Preserving such buildings is thereby crucial because they connect a modern metropolis to its roots.

Past, present, and future collide in the form of 181 Sai Yee Street, the first

venture by property developer Lofter Group into residential development. It is also the first in a series of residential developments by the company aptly called The Timeless Series.

Situated at the eponymous street in the bustling heart of Mong Kok, 181 Sai Yee Street is a sophisticated 21-storey residential development with a mix of uses. This architectural marvel welcomes a new chapter for the neighbourhood and takes it into an era of modernisation that is still grounded in the past.

Comprising 52 exquisite units, 181 Sai Yee Street has an extensive array of layouts, spanning from 240 square feet to 450 sq ft, tailored to suit the needs of young professionals and contemporary families.

The appreciation for Hong Kong’s cultural heritage and artistic richness comes as its citizens gain more wisdom. There are now around 3.52 million people aged 35 to 64 living

in Hong Kong. The youngest of this set, mostly born in the 1980s, display a reverential attitude towards arts and culture even as they seek equilibrium in their personal and professional spheres. A good portion of millennials, those born from 1981 to 1996, are known for their high household incomes in Hong Kong.

The design of 181 Sai Yee Street is notable for the harmonious fusion of materials, prominently displayed in the crescent-shaped balconies. They allude to the unique urban tapestry of Hong Kong while proudly showcasing its distinct identity.

At its core, The Timeless Series is not just about architecture. It is a symphony that harmonises form and function, environmental sustainability, smart living, and wellness concepts that ensure utmost comfort for residents.

The Timeless Series is an opportunity to put the concept of the “Golden

22 ADVERTORIAL

Ratio” of Living into practice. This concept encapsulates the essence of harmonious coexistence and life balance, mirroring the delicate harmony people seek in their daily lives.

In addition to 181 Sai Yee Street, Lofter Group has readied more exciting projects within The Timeless Series. They include the illustrious project known as No. 1-15 Ki Lung Street in Prince Edward, which brings an iconic 50-year-old tong lau (tenement building) back to life, as well as No. 2C-2D Boundary Street in Tai Kok Tsui; and Nos. 2-4A Ping Lan Street & Nos. 26-28 Ho King Street in Ap Lei Chau.

ADVERTORIAL

In addition to music, The Timeless Series also finds its way into the world of movies. Lofter Group has created the “Moonlight Treasure Box” (月光 寶盒), a thoughtful gift inspired by legendary film star Stephen Chow. Depicted as a time travel tool on film, this unique creation aligns with the concept of The Timeless Series, where old items transcend the limits of time.

With the same vision, Lofter Group collaborated with local NGOs to donate clothes and electric home appliances. These community engagement initiatives resonate with the essence of The Timeless Series—coexistence, inclusion, and sustainability.

Lofter Group’s exhibition, Old Hong Kong - Fusion- Art Concept Studio, celebrates the seamless blending of old and new in the city’s architecture, as witnessed by the Ki Lung Street development, and gives new life to cherished relics.

To showcase the spirit of Hong Kong culture, Lofter Group also sponsored 852FES, a prestigious music festival held at AsiaExpo. During the day, Lofter Group helped present the city’s world-famous street culture, ultimately tying into the essence of The Timeless Series as a harmonious integration of local elements.

All the projects under The Timeless Series will benefit from implementing the Golden Ratio, enriching the lives of all those who become part of this exceptional living experience. At its heart, The Timeless Series is more than just a vision of artistry in architecture; it is a celebration of the golden ratio that governs the balance between tradition and modernity in everyday life.

23

EDITOR’S NOTE

Issue 180

Given the challenges of living in the present, it can always be tempting to indulge in nostalgia. And our Emerging Markets issue always gives us the opportunity to do just that.

Although ostensibly a window into the future—an insight to the destinations around Southeast and South Asia that are primed for change—it also never fails to inspire wonderment at the evolution that has occurred in this region over the past couple of decades.

It was only just a few years ago that cities such as Ho Chi Minh City, Phnom Penh and Jakarta fell squarely into the up-and-comers category. Fast forward to the present and these destinations—and other former investment frontiers—are well and truly established.

Yet while the wild (and some might say more thrilling) days of yore when huge opportunities presented themselves to those with a high threshold for risk may be over, there remains scope for strong returns around Asia.

In South Asia for instance, NRI investment has supercharged the Indian market. Dhaka, meanwhile, is witnessing strong economic growth. Elsewhere in the region investors are eyeing secondary markets such as Depok just outside Jarkarta as well as familiar names like Hua Hin in Thailand.

In this issue we take a look at some of these trends via market analysis of Greater Niseko, South Asia, and Australia as well as interviews and profiles of long-term players in this fascinating—and oh-so dynamic—part of the world.

Duncan Forgan Property Report duncan@propertyguru.com

24

25

TOUR TRINKETS

As useful in the air as they are on land, these widgets make for great travel companions

JOURNEY JOULES

Nimble’s Champ Portable Charger uses high-density batteries, offering a 10,000mAh capacity (good for three days of power) in an ultra-compact package. This fastcharging gizmo is all housed in 72.5% post-consumer plastic, dramatically shrinking its carbon footprint compared to most competitors.

USD62.95, gonimble.com

26 DETAILS | Gadgets

C M Y CM MY CY CMY K

27

DETAILS | Gadgets

TRANSIT TECH

Say goodbye to excess baggage fees with Etekcity’s dependable, accurate luggage scale. The scale can weigh luggage up to 50 kilograms heavy. But the device itself is very light at just under five ounces. A true travel essential, it also has a temperature sensor.

USD11.98, etekcity.com

JET-SETTER JEWELS

Sometimes you prefer your own wireless headphones or earphones to the corded ones on the plane. Twelve South’s AirFly solves this predicament. A nifty wireless adapter, the AirFly can easily connect your audio devices to the in-flight entertainment system. The Duo version lets one more person connect to the same screen.

USD54.99, twelvesouth.com

ADVENTURE APPARATUS

Clothes all wrinkly in your luggage after landing? No sweat—Conair’s handheld travel garment steamer has an adjustable steam head, making it easy to cover all angles, evening out every crease. It heats up in just 35 seconds and has an easy-fill water tank.

USD59.99, conair.com

GLOBETROTTING GIZMO

Epicka’s all-in-one adapter stands ready to plug your devices wherever you are on earth. With retractable prongs enabling compatibility across more than 150 nations, the adapter has versatile ports to charge six devices all at once: including USB ports, USB-C ports, and a universal AC socket.

From USD22.99, epickatech.com

28

THE LIFE AFTER TOMORROW

NEW BEGINNING OF LIVING WITH ULTRAMODERN DESIGNS.

LET YOUR EVERYDAY LIFE AT KAVE AVA BE FULL OF COLORS AND JOY.

In a typical Kavean, our project designed with a concept of Futuristic. A spectacular modern along with color and lines of living in harmony with nature that connected both inside and outside, combined with the beginning of life. Ava Pod, 360 degrees ellipsoid, surrounded with enjoyment, including 2 storey The Gym Pod provided you a Panorama view, 3 pools 3 styles and also common areas with more than 48 facilities. Fulfill everyday lifestyle with Ava Concierge Service which ready to serve the Kavean.

DESIGN CONCEPT

“Simple arrangement for easy access, with the common area available at the floor area that can thoroughly connect with the garden outside the building. Indoor and outdoor common areas cover over 7,000 sq.m. with clear separation of interior working space.”

Factors in choosing residence

Convenient location, easy transportation to the institution

Nearby facilities, close to many restaurants and convenience stores

Clean and safe room and environment, friendly neighborhood

Factors for the student in choosing condominium

Higher standard of overall project supervision and safety

Attractive and interesting facilities within the project

More orderly and better society

29 KAVE AVA by ASSETWISE BEST AFFORDABLE CONDO DEVELOPMENT (BANGKOK) WINNER

assetwise.co.th 02 168 0000

WASHROOM WONDERS

Make your home’s most private space a haven

NAME IN VAIN

Room & Board’s freestanding Copenhagen vanity can be customised in a wide variety of wooden and MDF finishes. The 60-inch-wide cabinet, which has a steel base, can accommodate one basin and countertop space, with softclose birch plywood drawers and adjustable wooden shelves within.

From USD2,199, roomandboard.com

30 DETAILS | Trends

SUDSY SPOT

Pedestal bathroom sinks are back in style—as if they ever went away. Pottery Barn’s Saif sink looks especially elegant with its generously sized basin and square base, giving small washrooms a spacious feel.

USD301, potterybarn.com

FAIREST OF ALL

With its interactive touchscreen capabilities, the Hilo Smart Mirror is a hub for connectivity and entertainment, letting you access apps, social networks, and more as you primp for going out. Boasting built-in Wi-Fi and Bluetooth speakers, it’s a mirror that is nothing short of magic.

USD889, hilosmartmirror.com

RINSE AND RETREAT

Elevate your bathroom with the Jonàk Walnut Tall Cabinet. Crafted from FSC-certified solid walnut, it adds Scandinavian charm to any bathroom and discreetly stores towels, mats, and more. This versatile 180-centimetre-tall cabinet seamlessly complements existing furniture.

GBP649, tikamoon.co.uk

BATHING BUDDY

Standing up to shower can be a taxing chore for the elderly and sick. Enter the SUMGREEN shower seat, a hip-conforming chair made of eco-friendly bamboo with drainage holes. Sat on an aluminium frame that can be adjusted to various heights, the seat can accommodate 300-pound weights.

USD72.69, amazon.com

31

EERIE ESTATE

Conjure a hauntingly beautiful haven for the spooky season with these bewitching embellishments

TOMBSTONE TOAST

The Skeleton Wine Glass is a creep-tastic addition to your drinkware. The showstopping stems are handcrafted of zinc alloy, shaped into joyful bony figures and topped with sodalime glass. Each piece, which can hold up to 13 ounces of beverage, features handblown glass.

USD29.50, potterybarn.com

32 DETAILS | Style

HEAD OFF

Heads will turn to admire Department 56’s eye-catching model of Ichabod Crane’s cottage house in the legend of Sleepy Hollow. Just imagine the superstitious schoolmaster, who encounters the Headless Horseman, burning the midnight oil in this cute ornament perfect for the season of spooks.

USD150, department56.com

IN LOVE WITH FALL

River of Goods has created a beautiful Samhain décor in “Patch,” a tiffany table lamp designed like a pumpkin. See the warm light glow through handcut pieces of real stained glass. With an inline switch, the lamp is easy to turn on and off.

USD79.99, riverofgoods.com

CAULDRON COMFORT

Halloween dinner parties are as sumptuous as can be with the Curiosity salad plates, available in sets of four. The microwave-ready, dishwasher-safe plates, each with a diameter of 8.5 inches, sport moody designs and are made of durable stoneware.

USD52, westelm.com

DARK NIGHT

Make sure your front door means business this Halloween with the Midnight Raven Wreath. The inky blue, black, and purple leaves and tendrils may just sparkle in the moonlight. At the centre is a replica of a raven, standing sentinel below a black polyester fabric bow.

USD169, grandinroad.com

33

Dream Tropical Homes

It’s time to #StartLiving in The Residences at Sheraton Cebu Mactan Resort, a place in which to holiday, settle, or retire in one of the Philippines’ most scenic island destinations

Cebu continues to make its mark as a tourism hub as the Philippines opens its beautiful archipelago anew to international travellers. In 2022, the province ushered in over 544,000 foreign tourists and 2.21 million tourists, forging a way forward to recovery from the pandemic, according to official figures.

Cebu has also made a splash as a viable retirement destination where the cost of living is low enough for people of a certain age to seek better value for their money. Prospective retirees can easily establish themselves in the locale, with most Cebuanos able to communicate in English. Most goods and conveniences are within easy reach from Cebu, the capital of the same name being a historically important economic centre and port city.

The core lure of Cebu lies in its scenic beauty. The province has a nearly 514-kilometre-long coastline, harbouring pristine beaches coveted by snowbirds and lovers of tropical climes worldwide. Beaches on mainland Cebu and its surrounding isles have appeared time and again in bestof lists on international publications.

Award-winning Cebu homes

Travelers and retirees enter Cebu province through its historic gateway: the island of Mactan. Home to busy Mactan-Cebu International Airport, Mactan witnessed the arrival of the first Spanish explorers in the Philippines.

Centuries later, some of the world’s most recognisable hospitality brands have made their own expeditions to the island, no doubt attracted to its natural appeal and central location. In 2016, Mactan was chosen as the home of the first Sheraton-branded residences in Southeast Asia.

An award-winning development by AppleOne Mactan, The Residences at Sheraton Cebu Mactan Resort seamlessly integrates a holiday destination with luxurious residential spaces. The 44,000-square-metre property is conveniently set adjacent to Sheraton Cebu Mactan Resort, the first Marriott-branded resort in the Philippines.

A property development titan in Cebu, AppleOne developed such landmark projects in the province as AppleOne Equicom Tower, AppleOne Banawa Heights, and Mahi Center.

“Through our luxury developments, and our commitment to levelling Cebu to be at par with global standards, we hope to contribute to its allure as a smart city destination for tourists and locals,” says AppleOne vice-president for marketing Javier Marcalain.

Every day amounts to a beach holiday at The Residences at Sheraton Cebu Mactan Resort. The lay of the land reaches down to reveal a golden beach with exposed rocks, creating a scenic extension into the sea. The global architecture

34 ADVERTORIAL

ADVERTORIAL

firm Blink Design Group took inspiration from these aweinspiring littoral landscapes to deck the residential towers and villas in plush materials like natural stone, marble, luxurious fabrics, rattan, and wood.

The Residences at Sheraton Cebu Mactan Resort offer a choice of 154 homes, in one- to three-bedroom configurations, within a 22-storey main tower. The tower maintains a low density of units, with only up to six homes per wing.

The development also houses the exclusive Courtyard Villas at The Residences, made up of 36 villas in twobedroom homes and three-bedroom loft configurations. Every Courtyard Villa comes with its own private plunge pool while an expansive lagoon pool completes the premium resort experience for the community. Oversized windows give residents dramatic vistas of the private pools or cliffside panoramas of the sea.

#StartLiving your best, healthiest, most flavourful life

Everyday routines feel extra special at The Residences at Sheraton Cebu Mactan Resort. In these fabulous Cebuano homes, it’s never too late to #StartLiving.

Dining is not a mundane moment but an experiential activity—whether the dishes are prepared at the indulgent

restaurants of the resort or at home in the well-appointed kitchens of the Residences.

The Residences at Sheraton Cebu Mactan Resort cultivate a lifestyle of wellness with amenities like a fully fitted fitness centre, steam rooms, a yoga room, signature spa, and the residents-only Beach Club. Retirees and holiday homeowners can get in shape in the Residences’ naturally invigorating, beachside outdoor spaces.

With constant, easy access to the Sheraton Cebu Mactan Resort, residents get exclusive privileges like in-residence housekeeping and botanical services, laundry services, and the like.

With the full might of the AppleOne and Marriott brands behind it, The Residences at Sheraton Cebu Mactan Resort let you step into a world of refined elegance and serenity. Every corner of the property reflects your unique taste and desire for elevated living.

From the waterfront views that greet you every morning to the meticulously designed interiors that envelop you in comfort, this is the tropical sanctuary that you’ve always envisioned in Southeast Asia.

35

HEALTH IS WEALTH

36

BY AL GERARD DE LA CRUZ

37

As new fitness ideals of grip Malaysia, property seekers are catered for at KL Wellness City: Southeast Asia’s first township dedicated to wellness

How would doctors envision a city?

Obstetrician and gynaecologist Dato’ Dr. Colin Lee fielded that question quite well with KL Wellness City (KLWC) in Malaysia.

The renowned fertility specialist banded with fellow medical professionals to develop the township, the first dedicated to healthcare and wellness in Southeast Asia. The “360-degree wellness hub,” in Lee’s words, is masterplanned to“embrace the ageing nation,” referencing Malaysia’s rapidly greying populace.

Now under construction, the first phase of KLWC is anchored on The Nobel Healthcare Park, three towers of medical, wellness, business, and retail suites connected by link bridges to the 12-storey-high International Hospital @ KL Wellness City.

The thought of integrating an entire ecosystem of healthcare services came to Lee after developing another

hospital, Tropicana Medical Centre (now Thomson Hospital Kota Damansara), in 2008.

“There is a point of difference here because the people who build will be the people running the hospital and the city,” says Dato’ Sri Dr Vincent Tiew, executive director of branding, sales and marketing at the development company KL Wellness City Sdn Bhd. “We know exactly what are the weaknesses or areas that we should pay attention to in order to ensure we are operationally efficient and cost-effective.”

The dream from the get-go was to find land huge enough to fit the bill of “wellness real estate,” as defined by the Global Wellness Institute (GWI). By 2016, after years of negotiation with landowners, the developer had acquired seven individually titled parcels in Bukit Julil, an affluent suburb of Kuala Lumpur, to form the current site—a massive affair at 26.49 acres.

38

KLWC IS PURPOSEFULLY DESIGNED WITH A VISION OF A 360-DEGREE WELLNESS HUB CENTRED AROUND ITS TOWNSHIP, ENCOMPASSING ASPECTS OF MEDICAL CARE, HEALTH, WELLNESS, FITNESS, AND BUSINESS, COMPLETE WITH RESIDENTIAL, RETAIL, AND COMMERCIAL OFFERINGS

The developer approached architects experienced in medical and hospitality developments. As lead architect, Konzepte Asia Sdn Bhd ticked many of the developer’s boxes, and the admiration was mutual.

“When we first spoke to Colin, we got really excited because there was a sort of genuine sense and a very honest approach that he wanted to take,” says Konzepte partner Nicholas Ling, recalling his first discussions with the company in 2015. “That means it’s not just what we call ‘wellness-washing’ a project. A lot of developers do that. They put a swimming pool in their project, and they call it a ‘wellness project.’”

Ling, known for delivering projects like the Lady Cilento Children’s Hospital in Brisbane, dialogued with the city council, Dewan Bandaraya Kuala Lumpur (DBKL), during the master-planning process. The unprecedented nature of the project confounded the city hall at first, but its wellness framework spoke for itself. “Because of that, they gave us the density that we wanted,” says Ling, noting that the

township’s central park will ultimately be handed over to the city government.

The pandemic eventuated in nine months of intense design processes done virtually. Around this time, age-old ideas of natural cross-ventilation and longstanding building wellness standards reignited public interest.

The zeitgeist suited the conceptualisation of KLWC just fine. Ling made it clear that the built structures of KLWC should not be “air-con boxes.” The artifice of indoor climate control was traded, where possible, for passive cooling ways, shading techniques, and other practices of Malaysian tropical vernacular design.

People are generally made to encounter a garden or outdoor space before entering air-conditioned clinical spaces. “You could be, say, in the ICU, and there’ll be a pocket garden just outside of you,” says Ling.

39

WHILE MANY TOWERS IN MALAYSIA SIT ON TOP OF HUGE CAR PARKS, KL WELLNESS CITY BOASTS AN OPEN, SPACIOUS GROUND PLANE, WITH PEOPLE GREETED BY THE BUILDINGS THEMSELVES AND THEIR MAIN ENTRIES

A COMPLETE ECOSYSTEM FOR HEALTHCARE PRACTITIONERS AND PATIENTS ALIKE, THE NOBEL HEALTHCARE PARK CONTAINS HUNDREDS OF MEDICAL SUITES FOR SPECIALISTS TO SET UP THEIR PRACTICE, IN ADDITION TO WELLNESS, BUSINESS, AND RETAIL SUITES

40

SPECIAL CARE

The township development known as KL Wellness City (KLWC) is a pioneering fluke in that it is, in many ways, created by healthcare practitioners for healthcare practitioners.

The township’s appeal partly hinges on the inclusion of privately owned “medical suites” or clinics suited to a diverse range of specialists. The township also has an abundance of operating theatres and advanced, specialised equipment to help medical practitioners in their practice.

Equipped with 624 beds, scalable to a 1,000bed capacity, the tertiary hospital at KL Wellness City is open to—and needs—all kinds of specialists. In peopling the medical suites, the developer initially sought out doctors who need a hospital base or those whose business requires support for inpatient stay. The team also targeted general surgeons and other medical professionals who deal with multiple operations in a day—and thereby need equipment that they normally will not buy for themselves.

“It’s not often that existing hospitals in Malaysia, be it private or public, continuously upgrade or bring in new equipments,” says Dato’ Sri Dr Vincent Tiew, executive director of branding, sales and marketing for KLWC. “Equipment is expensive. You just don’t bring it in and buy a new one after seven years.”

All too often, these high-value assets become obsolete before they can be fully utilised and cost-effectively replaced by the hospital. These life-saving tools typically cost hospitals more than MYR30 million to MYR50 million.

At KLWC, the sheer size of its hospital enables economies of scale that facilitate equipment investments. The extensive bed capacity allows for efficient amortisation and the ability to serve a diverse populace, according to Nicholas Ling, partner at Konzepte Asia Sdn Bhd, the lead architect for the township. “It’s almost an ecosystem in that way,” he says.

41

WE STARTED WITH THIS IDEA OF ADAPTABILITY AND FLEXIBILITY, AND THAT’S HAND IN HAND WITH SUSTAINABILITY AS WELL. YOU DON’T WANT TO HAVE TO KNOCK THINGS DOWN. HEALTHCARE CHANGES OVER TIME

A SHOWROOM FOR THE WELLNESS SUITES, ENVISIONED AS SHORTTERM STAYS FOR PATIENTS AND HEALTHCARE TRAVELERS WHO MAY NEED FURTHER CONSULTATIONS OR PROCEDURES, AS WELL AS THEIR LOVED ONES

Such manoeuvres are necessary as the project guns for Green Building Index (GBI) certification, a balancing act between the developer’s eco-aspirations and patients’ need for a controlled, comfortable environment.

“In Malaysia particularly, a hospital that is GBI-certified is quite rare,” says Tiew. “It’s quite a big thumbs up for ourselves, a feather in our cap.”

The manoeuvres are also congruent with the scientific thinking at home with the project’s medically trained leaders. Access to natural environments, let alone views to them, are linked to good recovery outcomes, research says. Windows at the township possess a greater vertical tilt than usual, inspired by studies on the benefits of being able to see the ground from certain heights. The developer also eschewed enclosed corridors and winding spaces for navigable layouts that allow people to orientate themselves in the building.

“Hospitals are typically designed almost like rabbit warrens,” says Ling. “You come into the front door, and then you feel you’re going to get lost. The further you go in, the more stress you get because you worry you can’t get back to where you need to go. So, we’ve designed it from day one with the patient, the visitor at the centre.”

To the developer, it was imperative for architects to use building information modelling (BIM), preventing massive substantial variations and unnecessary wastage. The models keep the healthcare park and hospital on track for a 2025 completion.

“Right from the early stage, before the first pile cap was done, we were able to clearly see the whole design of each room and each floor itself,” says Tiew. “That’s seeing it like a doctor trying to do surgery.”

By early 2022, KLWC initiated piling and earthworks. The topography of the site gently inclines from one end to the other across approximately 15 metres. Its width covers several hundred metres, enabling the architects to place parking amenities either beneath ground level or a simulated ground floor.

The team strategically maximised the unique slope configuration according to height restrictions set by the Ministry of Health. The tallest of the healthcare park buildings rises only to 17 storeys, housing 512 wellness suites ideal for short-term stays by medical tourists and hospital inpatients who need monitoring after discharging.

42

CONFIGURED IN VARIOUS LAYOUTS, INCLUDING STUDIOS AND ONE-BEDROOM TYPES, THE WELLNESS SUITES ARE LIKENED TO SLEEK HOTEL ROOMS AND CONDOMINIUMS, BUT WITH BETTER, OPTIMISED DIMENSIONS FOR MAXIMUM ACCESSIBILITY TO PATIENTS AND HOSPITAL STAFF

In addition to 55 retail suites and 50,000 sq ft of business suites, the healthcare park houses 379 medical suites that doctors can privately own as clinics. Konzepte gave the suites, averaging around 650 sq ft in size, a modular design that expands to combine with adjoining units. Along with the hospital, the medical suites follow an open-plan layout, featuring columns at consistent, modular grids.

“We started with this idea of adaptability and flexibility, and that’s hand in hand with sustainability as well,” says Ling. “You don’t want to have to knock things down. Healthcare changes over time. The needs and requirements change.”

Several more healthcare centres and hospitals are expected to rise across the five as-yet-undeveloped parcels of the site. The future projects for seniors are particularly resonant since people aged 65 years and above now account for over 7% of the Malaysian populace.

But the needs of ageing people in Malaysia are not a monolith. In that light, the township has residential spaces tracking the full spectrum of retirement, old age, and decrepitude. These vary from senior living blocks for active agers to multi-generational condominiums for ageing-in-

place households to an assisted living tower for those that require 24-hour care.

“You will no longer see an old folks’ home that combines people who are old and frail with people who are healthy,” says Tiew. “We are going way beyond, 10 steps ahead of that in Malaysia. We are moving forward.”

With a projected development value of MYR11 billion, the city is expected to evolve with the needs of its inhabitants over time. Health may be wealth, but the math also makes sense.

“Everything here is so scientifically designed,” says Ling. “It’s not my opinion. It’s all based on empirical data and research down to the position of the windows. We wanted sustainability to be real, to be felt, to be seen, and to have actual outcomes. We wanted people to continue to thrive within the city, within our buildings, as long as they’re there.”

43

44

Nose for new frontiers

Bill Barnett retains a strong instinct for opportunities after witnessing the progress of Asia’s hospitality and real estate scene during a long tenure in the region

BY BILL CHARLES

45

46

BILL BARNETT SAYS THAT HUA HIN IS EVOLVING INTO ONE OF THAILAND’S MOST DESIRABLE INVESTMENT DESTINATIONS

We like to have sustainability at the table when we start designing things. What are the green areas? What’s the plan 10 years from now with electricity and water? How can we have more sustainable development?

While living in Hawaii some 30-odd years ago, Bill Barnett read a book about Michael Rockefeller that changed the trajectory of his life.

Rockefeller, an heir in the dynastic American family, famously disappeared near the Sepik River in Papua New Guinea in 1961.

As Barnett read about what had happened, he became convinced he needed to see the place for himself.

So, he picked up and moved there, finding a job in the country’s highlands region that marked the beginning of a new life and career in Asia.

47

Barnett later moved to the Philippines, arriving as President Ferdinand Marcos was toppled under the People Power Revolution, and eventually made his way to mainland Southeast Asia, where he became the first American hotel manager to work in post-war Vietnam in 1992.

“Yeah, it’s been an interesting time,” Barnett reflects. “As Asia grew, there were just so many new opportunities.”

His hotel work—he spent time up and down Vietnam, in Hong Kong, and elsewhere on the continent—led to a position in real estate at Laguna, the integrated community in Phuket in southern Thailand.

And then one day, Barnett decided to combine his experience in hotels and property development to form C9 Hotelworks (short for “Cloud 9”), a hospitality and real estate advisory group that today works across Asia Pacific and beyond.

“We’re typically the first group people contact when they have an idea for a new development project,” says Barnett, a native of California.

The Phuket-based company had projects last year in 11 countries, including as far away as Rwanda, performing market research and feasibility studies, in addition to “creating unique DNA for clients and a forward-looking view in the market,” Barnett says.

C9 Hotelworks is involved in everything from resorts and city hotels to ultra luxury private villas, all the way to glamping resorts, private islands, and branded residences in places like the Maldives.

When you look beyond traditional mainstream markets like Bangkok, Phuket and Bali, where do you see exciting things happening in real estate?

I always think it’s interesting to look within a short distance of capital areas where people are going. Khao

48

SUPPLY CHAIN DISRUPTION IN CHINA HAS PROMPTED DEVELOPERS TO SEEK OTHER SOURCING SOLUTIONS

Yai outside of Bangkok is one example where things are happening. And I think Hua Hin will continue to transform.

Hua Hin is interesting because the international school and infrastructure—the highway—have grown along with it. That’s creating a new market for people to live there full-time. It’s transforming from a holiday or retirement place into something where people want to live.

What are some unique trends you’re seeing in the region?

I think the co-living concept is interesting. We really like a company called Homa. Their model is to get a hotel license. Then they can rent long-term but they can also rent short-term. So, they’re able to effectively manage the yield. Unlike property developers that come in and sell the property, their model is meant to retain the asset to make it into a cash-flow machine.

Big demand generators for this model include places with international flights, international schools, hospitals,

resort areas—places where you have a lot of mid-tier management who want long-term accommodation. They want to rent. They want something a little better, which is maybe not just living in their own apartment, but it’s easy to move in and everything’s already there. You know: WiFi, drinking water, good gym, co-working space. It’s easy to come and go.

Co-living is interesting because you’re going to have a lot more people who want to be flexible. In Phuket, we see a lot of tech guys coming in and spending three to six months a year working here, and they want that kind of experience. They want to intermingle. They don’t want to rent long-term. They don’t want to rent a hotel room. It’s something in between.

With regard to property development, much has been said about the impact of supply chains, inflation, and the Ukraine war. What are some other major challenges you see right now?

I think you have to say what’s happening in China. Every

49

PHUKET REMAINS A SOUGHT-AFTER BASE FOR RUSSIANS AND OTHER NATIONALITIES

market sees that as a solution both for tourism and for property, and the economic reality is that the slowdown has been coming for a long time. The pandemic didn’t create the China problem. Nothing goes in straight lines forever.

So, the writing has been on the wall for this, but I think people are certainly struggling with it. We do a lot of projects that use prefabricated pieces from China. Now, with supply chain disruption in China, people are looking to Vietnam and other solutions. But you don’t know how much a project is going to cost because commodity prices are going up so quickly. Inflation is hurting the market. And currency is interesting—up and down. There’s a lot of uncertainty.

Russian buyers and renters are quite active in major Southeast Asian markets like Phuket and Bali. What do you see on the ground there?

We saw a great impact in Q1 and Q2, but we’ve seen a softening of that now. Those traditionally were buyers who

would come during high season. The question is: What’s going to happen after the ruble got devalued? Are there going to be more Russians who want to take their money out? It’s the same thing with Russians and Chinese: They want to bring their money out for investment. But when the currency is so low, is it better just to leave it there or not?

Fundamentally with Russians they’ve been investment buyers, but they’ve also been end-users of real estate, which is good. And they’re buying in cash, so even if the market softens out, it’d be a soft landing. The next high season is an unknown. I think it’ll be about the currency.

What other demographic changes do you see in the region?

We see a return of multigenerational living. That’s important for both domestic and foreign buyers. We’re seeing foreigners who bring their parents and grandparents to live with them.

50

HOTELS OFTEN FAIL TO SEE THE LONG-TERM BENEFITS OF INVESTING IN RENEWABLE ENERGY LIKE SOLAR

Pre-Covid in Thailand, we’d see people moving into condos—the detachment of the family compound. Now we’re seeing people gather again. The value system and lifestyles change. Also, people are working from home. They don’t need to be in the office all the time. So, they view their residences as places that also need dedicated working areas—which often means they need larger spaces. And I think that’s going to continue.

How does C9 Hotelworks try to improve sustainability in real estate development?

From a hotel perspective, owners often only see cost. The developer says, “No, I can’t afford it. It’s going to be more expensive.” But a hotel’s value is not how much it cost to build and the replacement value of the hotel. Valuation is based on discounted cash flow, meaning profit—the long-term profitability of the hotel. We like to have sustainability at the table when we start designing things. What are the green areas? What’s the plan 10 years from

now with electricity and water? How can we have more sustainable development?

The biggest costs for a hotel are staffing and energy. If you’re able to do a sustainable project at lower energy cost, your profit is more and your long-term valuation of the property is more. And I think it’s really important to get developers to understand that. Our intention is to influence developers to do this because it makes economic sense—but also for sustainability.

If you go to Singapore, it’s expected to do these things. You go to Europe and it’s expected to do the same. In the US, it’s expected. But it’s not expected to be done here. And so, I think we have a responsibility to encourage the market to start doing it here.

51

Embracing a Greener Future

Global networks HLB and Multilaw portend the prospects and challenges of ESG around the world

by Paul Ashburn

ESG or environmental, social, and governance has become a significant factor in the real estate sector, with stakeholders and investors increasingly prioritising sustainable practices.

Governments are implementing energy efficiency standards. Investors as well as tenants are insisting on more sustainable buildings. Energy-efficient properties are expected to have higher occupancy rates and lower vacancy rates while low-quality, inefficient buildings will require significant investment.

Real estate also plays a vital social role, positively impacting local communities and attracting consumers, thereby boosting the local economy. These considerations and other ESG factors are now shaping investment

decisions, development projects, and ongoing operations in the real estate sector, according to a global outlook published by HLB and Multilaw.

HLB, a global advisory and accounting network, and Multilaw, a global network of law firms, joined forces earlier in 2023 to co-author a report on how an increased focus on sustainability is shaping the real estate sector.

Drawing on the real estate expertise of both networks, the report finds that the importance of adopting more sustainable practices in the sector is high. It also reveals that economic challenges, such as rising construction costs, have made it difficult for investors and developers to meet ESG expectations.

Nevertheless, despite the challenging economic climate, real estate opportunities are plentiful, from the growing subletting business to the rising importance of proptech.

Technological innovations are playing a crucial role in making real estate more sustainable. Smart building technology, including sensors and IoT devices, helps monitor and reduce energy consumption while sustainable materials and construction practices minimise environmental impact. Virtual and augmented reality aid in visualising designs and improving sustainability.

Proptech also promotes the adoption of renewable energy sources like solar panels and energy storage systems. These innovations are driving the

52 ADVERTORIAL

There’s a lot of proptech being developed that is able to collect and measure data and report about sustainable practices to not only focus on your own sustainable practices, but also of your suppliers, too, to develop that whole supply chain that is sustainable

real estate industry towards a more sustainable future.

There’s a lot of proptech being developed that is able to collect and measure data and report about sustainable practices to not only focus on your own sustainable practices, but also of your suppliers, too, to develop that whole supply chain that is sustainable.

From a global perspective, ESG practices vary greatly across the world. Asia is seeing a marked increase in traction for green leases. They constitute an agreement between tenant and landlord to improve the property’s environmental performance through cuts in energy and water usage and reducing waste.

Meanwhile, the Middle East are viewing ESG as a top priority ahead

of the Conference of the Parties of the UNFCCC (COP28) summit in November 2023. The summit, which is the 28th United Nations Climate Change conference, is being hosted by the UAE. While climate concerns have been a big consideration in the region for several years, the summit has spurred an even greater commitment to creating sustainable buildings.

Africa is seeing sustainability rise as a megatrend that is forcing change. It seems likely that the African region will need to craft its own unique approach to the creation of sustainable buildings which is more in line with its GDP per capita.

ESG is also starting to take more precedence in Latin America (LATAM) and the Caribbean. Companies and governments are issuing many sustainability-linked bonds to create

ESG policies with genuine impact.

Investors and lenders across Europe are increasingly analysing the credentials of their investments through an ESG lens. This is challenging investors and governments as they juggle ESG policy, economic growth, and asset growth.

In contrast to Europe, the US is divided in opinions regarding climate change. Some of the country’s more prominent landlords are still sceptical of the view that higher rates result from sustainability or ESG features. Instead, they view the “newness” or novelty of these buildings as the cause of the rate increases.

In the coming years, the real estate sector will see a continual rise in advances that will pave the way for more sustainable practice. The capabilities of proptech to drive sustainability in real estate are exciting and promising.

By leveraging technology to monitor energy usage; using sustainable materials and practices; and adopting renewable energy sources, the real estate industry can make significant progress towards a more sustainable, greener future.

Paul is co-managing partner of HLB Thailand. In that position he shows that relationships with clients and colleagues are key to display the true value of HLB as a leading provider of professional services to clients carrying on business in Thailand. With over 30 years of experience providing professional services, including more than 20 years in Thailand, his international experience and inquisitive character allow him to view opportunities at hand and offer new ways to set up processes and to give room for new and better services to clients.

To download the report by HLB and Multilaw, visit www.hlb.global

53 ADVERTORIAL

Evolutionary thinking

Jean-Francois Chevance, director of design at Archetype Group, has overseen numerous transformative projects around Southeast Asia over the last 20 years

BY LIAM ARAN BARNES

BY LIAM ARAN BARNES

54

In the not-so-distant past, touching down in Siem Reap felt like arriving in a world frozen in time.

But it wasn’t the temple complex at Angkor, one of the world’s great cultural wonders, that transported air travellers to a bygone era upon arrival.

For years, Siem Reap’s dark, dingy airport welcomed visitors with the inescapable smell of mould and mildew. Outside the single-building terminal, befuddled tourists were confronted by rowdy tuk-tuk drivers and stifling tropical heat. This was the Cambodia of contemporary folklore—off limits to all but the most intrepid of travellers.

The situation improved with the construction of a new terminal in 2006. And nowadays, except for subtle nods to Angkorian architecture and ever-present tuk-tuks (now summoned via apps rather than shouting contests), arriving in Siem Reap largely resembles landing at any other provincial Asian airport.

The country’s tourism industry experienced another major boost this year when the brandnew Siem Reap Angkor International Airport began operations. Located 50 kilometres southeast of the city, the three-phase airport will initially serve around seven million passengers annually, with projections of accommodating 10 million by 2030 and 20 million by 2050.

Elaborating on the impact, Jean-Francois Chevance, director of design at Archetype Group, the firm behind the 700-hectare development’s blueprint, notes, “This is a project that will not only bolster tourism but will bring transformative change to the local community. It’s within the realm of large-scale master planning, especially of transport hubs, where we witness the greatest influence on communities.”

55

JEAN-FRANCOIS CHEVANCE BELIEVES THAT ARCHITECTURE CAN BRING TRANSFORMATIVE CHANGE FOR COMMUNITIES

Chevance is no stranger to transformative projects. His trajectory, once aimed at the sea, diverged as his fascination with architecture grew. Switching his course from becoming a naval officer, he attended the prestigious Paris Villemin School of Architecture and the Paris-la-Seine School of Architecture. After gaining invaluable experience in various firms across the French capital, his journey led him to Archetype in 2003.

Since then, Chevance’s responsibilities in the group have been both diverse and influential. Primarily working in Vietnam and Cambodia, he has dedicated over two decades to designing and managing projects in the emerging markets of Southeast Asia.

“The architecture and design landscape here has experienced a dynamic evolution over the years, with different countries embracing distinct architectural languages,” he says. “The education of students has improved significantly, and clients, having been exposed to global architectural trends, have become more discerning and demanding compared to two decades ago.”

Furthermore, Chevance takes on the role of mentor, instilling in junior architects a philosophy rooted in attentive listening. This entails not only comprehending clients’ visions but also guiding them to discover the essence of their projects. “It’s a twofold process—listening to their vision and helping them realise what they truly need.”

Chevance also underscores Archetype Group’s commitment to community upliftment in less advantaged regions. Projects such as the Paul Dubrule Hospitality School and the Kairos School in Ho Chi Minh City hold a particular place of pride, representing the positive impact design can have on local life.

Beyond his regional work, Chevance helms Archetype’s global hotel portfolio, overseeing properties across 18 countries for renowned

hospitality brands like Aman, Raffles, St. Regis, RitzCarlton, Mandarin Oriental, and Shangri-La. But what is evident from talking with Chevance, however, is that Archetype, launched out of Vietnam in 2002, remains committed to its vision of serving emerging markets.

“Architecture and design, particularly urban planning, play an outsized role in shaping cities and communities in emerging markets,” he says. “These markets are characterised by rapid growth and new infrastructural developments. The decisions we make as architects and designers have far-reaching consequences—both positive and negative—for the communities that inhabit these spaces.”

Across Southeast Asia, Archetype’s footprint now spans commercial, retail, residential, transportation, healthcare, and hospitality sectors. Impressive projects to date include South Quarter, a 7.9-hectare mixed-use development in Jakarta’s CBD, the fivestar Amanoi resort in Vietnam’s Nui Chua National Park, and Ho Chi Minh City’s high-rise Etown 6 Tower. Among these, the new Siem Reap Angkor International Airport stands out for Chevance.

“This project was a remarkable endeavour due to its grand scale and the challenge of merging an airport with resort-style aesthetics,” Chevance explains. “But the one that remains closest to my heart is the Belmont La Residence Angkor in Siem Reap. This marked my first role as the main designer from concept to construction, and its success means a great deal to me.”

It is fitting that, two decades since his initial venture in Siem Reap, Chevance’s influence continues to shape the city’s tourism landscape, with his fingerprints imprinted on another milestone as the international airport welcomes its first passengers this October.

57

Emerging markets are characteriSed by rapid growth and new infrastructural developments. The decisions we make as architects and designers have far-reaching consequences—both positive and negative—for the communities that inhabit these spaces

58

Amanoi Resort

Conceived in partnership with starchitect Jean-Michel Gathy’s Denniston Architects, Amanoi Resort has one of Vietnam’s most impressive locations. The 53-room retreat, Vietnam’s inaugural Aman property, is a world apart from civilisation, perched on a secluded cliff along the Nui Chua National Park’s coastline.

“Collaborating on the design of Amanoi alongside the esteemed Denniston firm truly highlights our capability to craft original luxurious and harmonious environments,” Chevance says.

Archetype’s role spanned from early concept design in 2008 to the resort’s grand opening in September 2013, and encompassed comprehensive engineering and architectural design, project management, and cost oversight.

59

Aman Nai Lert

Upon completion in 2024, the upcoming 36-storey structure will house a 52-suite hotel, approximately 50 residences, and a range of luxury leisure and entertainment amenities. This collaboration marks Archetype’s second with Gathy and Denniston, bringing together the prestigious Aman brand and Nai Lert Park Development in Thailand. Chevance remarks, “It’s an honour to collaborate once more with Denniston and Aman, contributing to an iconic addition to Bangkok’s hospitality and luxury residential scene.”

Nestled within the century-old tropical gardens of Nai Lert Park, the design takes inspiration from the park’s serenity and heritage while incorporating the elegance of the Aman brand. Amenity-wise, residents can enjoy a private Aman fitness centre, a yoga/pilates studio, and a children’s pool, as well as access to Aman Nai Lert Bangkok Hotel’s features, including the Holistic Wellness Centre, Nai Lert Butlers, and a range of dining services.

60

61

e.Town 6

Following the recent completion of e.Town Central in Ho Chi Minh City’s District 4, Archetype was commissioned to lead the design for e.Town 6, the latest endeavour by local developer REE Corporation. Situated in Tan Binh District’s thriving CBD, the expansive 36,780 square metres of premium-grade commercial space stands out for its sleek glass facade inspired by minimalist high-rises that blend with their surroundings.

“The client had lofty expectations for this project, set to house one of Ho Chi Minh City’s most iconic business communities,” explains Chevance. “We believe this edifice will stand as a testament to the remarkable growth of this dynamic area.”

Scheduled for lease availability in January 2024, the development also features state-ofthe-art facilities and is within easy reach of the city’s transport hubs and leading lifestyle amenities.

62

63

64

Mirai by Nirman

This 30-floor, 36,000-sqm contemporary office tower will be one of the most significant additions to Dhaka’s skyline upon completion. Situated in the heart of the city’s thriving Tejgaon business district, Mirai by Nirman, with 30,000-sqm of gross floor area, will offer international-grade office space with an emphasis on innovation and sustainability.

“We approached this landmark development for Dhaka with the idea of creating the optimal environment for productivity,” Chevance explains.

Featuring a double-glazed unitised façade and cutting-edge elevators with a destination control system, Mirai by Nirman promises an array of top-tier amenities, including a rooftop pool, an in-house gym, verdant gardens, and terraces. An upscale restaurant on the 13th floor will provide panoramic vistas of Dhaka’s dynamic cityscape and Hatirjheel Lake.

65

66

Orkide The Royal Condominium

With its shimmering gold exterior soaring into the sky above Phnom Penh, Orkide The Royal Condominium is eye-catching to say the least. Arguably more attention-grabbing than the exterior, however, is the first-of-its-kind manmade garden and beach pool that intersects with six towers, each comprising 18 floors.

Described by Chevance as “one of the most ambitious developments of this size to be built in the capital,” Orkide The Royal Condominium merges mixed-use high-rise offices and apartments.

Completed in 2022, the project boasts myriad amenities, complemented by the 51,000-sqm Royal Shopping Mall, hotel, and international supermarket. The encompassing 3.2-hectare Royal Garden, meanwhile, boasts more than 100 facilities, including a swimming pool, gym, steam and sauna rooms, walking tracks, and dedicated rooftop gardens for each tower.

67

68

South Quarter Residences

The South Quarter Residences, known as SQ Rés, aim to combine South Jakarta’s most desirable assets, lifestyle amenities and connectivity, with resort-style, eco-friendly residences.

Set across almost 8 hectares, the one-bedroom, two-bedroom, and dual-key luxury apartments are complemented by fitness-focused onsite amenities. These include the Zen lobby, wellness-focused jogging tracks, fitness and yoga studios, tropical pools, a spa, a beauty salon, and a children’s playground. A core aspect of SQ Rés is its emphasis on connectivity, and walkability. The complex is interconnected by sidewalks, footpaths, and elevated walkways, seamlessly linking residential towers with commercial, retail, and lifestyle venues.

“An urban oasis is a cliché, but we set out to create a breath of fresh air in the heart of the city for professional families, first-time buyers, and those seeking a meaningful urban experience,” Chevance explains.

69

Satellite of love

BY JONATHAN EVANS

A hub for shopping and education near Jakarta, Depok is becoming a much-coveted address for real estate investors 1 2 3

Cimanggis Golf Estate

A work in progress that’s scheduled for completion early next year, this neatly landscaped, eco-forward development is well placed to benefit from local transport links for venturing within and beyond Jakarta. The 660-unit gated community will feature an extensive indoor market and other retail outlets, while sporting facilities in the vicinity include the eponymous golf course, gym, basketball court, tennis court, and swimming pool. The estate itself uses smart features and digital systems in its advanced lighting techniques. Interior design from Pandega Desain Weharima veers towards the minimal, with beige and cream tones most prominent in the twostorey townhouses.

Shila at Sawangan

This project comprising 411 semi-detached and detached modern family houses has an uncommonly high proportion of forested and arboreal coverage (55%), lending the impression that this downtown locale is in a more remote place altogether. Shila at Sawangan has consequently proven a big hit with Depok dwellers who cherish tranquility and green space—even extending to the units themselves, which feature a garden between the ground-floor living room and bedroom. The wood, concrete and glass material combination helps ventilation to circulate and sunlight to flood living space, while add-ons like a double garage, dual kitchen, and private roof deck further entice punters.

Taman Mini Indonesia Indah

First dreamt up in 1975 by then president Suharto’s wife, “Beautiful Indonesia Mini Park” was an ambitious attempt at encapsulating all the country’s provinces— not just their architecture, but their inhabitants’ culture and clothing—in one theme park surrounding a lake. Over time, more amusements were added such as cable cars, museums, a cinema, and theatre. After the secession of East Timor in 2002 and eight more provinces were created (making the total 34), space had to be found for newcomers like Bangka-Belitung, West Sulawesi and West Papua. Somehow builders made room for numerous plant gardens, religious buildings, and children’s areas too. An epic undertaking if one considers the exhaustive construction involved, TMII embodies Indonesia’s ethnic and religious harmony, and remains among Greater Jakarta’s biggest tourist destinations even today.

70

A crowded city-within-a-city on the eastern side of Jakarta, Depok still has enough space for huge public attractions and sought-after upscale real estate. The last satellite city to be welded to the gigantic urban block that is Greater Jakarta, Depok was also the last to emerge when it seceded from Bogor in 1999. To outsiders, it might still be obscure. But it’s still among Indonesia’s top 10 most populous cities in its own right. Despite it being decimated in 1945 during the Indonesian National Revolution, rapid reconstruction allowed the city to flourish in the 80s and 90s, and Depok is now one of Jakarta’s most important hubs for shopping and education, home to numerous private language schools and universities. The city shuttles thousands of commuters daily, so its desirable new residences are becoming much-coveted addresses within the metropolis.

4 5 6

Ragunan Zoo

The oldest zoo in the country, this rainforest park was established in 1864 and is one of Greater Jakarta’s largest public spaces at 147 hectares. For a century, it sprawled across legendary painter Raden Saleh’s private land in Cikini in central Jakarta, before burgeoning resident numbers forced a relocation; it’s now home to 2,290 animals and 335 species. Ragunan is particularly strong in the bird department, while rare and endangered mammals such as the Bornean orangutan, babirusa (deerpig), Javan rusa deer, Komodo dragon, and Sumatran tiger complement the Indonesian creature quotient. In this crowded area of Greater Jakarta filled with infrastructure and malls, the zoo also provides muchneeded breathing space, with some 50,000 trees giving plenty of shade for walkers, joggers and visitors to reconnect with the natural world.

Dian Al-Mahri Mosque

Also known as the Golden Dome Mosque for obvious reasons, Depok’s most treasured and largest religious place of worship is also its most beautiful. Its minarets and solid-gold domes—their centrepiece resembling Agra, India’s Taj Mahal—tower above a building that’s capable of holding 20,000 worshippers. The six minarets are hexagonal, with small 24-karat golden domes at their tallest point that symbolise the Islamic pillars of faith. Ornate to the finish, the decorative interior features a series of chandeliers imported from Italy, with a relief above the imam’s residence also made of 18-karat gold. What’s most surprising—aside from the mosque’s staggering dimensions and lavishness—is that it dates back only 17 years, having originated in a successful land purchase by a Javan businesswoman in the early noughties.

Warung Kopi Nako

In Depok City, Jalan Margonda Raya is undisputed foodie central with a reputation for spicy dishes. This principal artery hosts most of the top restaurants, including an intriguing hospital-themed eatery where wait-staff are dressed as nurses. Warung Kopi Nako is far from outlandish, but the greenhouse-like structure does flaunt one of the city’s most spacious interiors—a pale colour scheme bathed in natural light— making a desirable backdrop to your coffee break. This café is heaven for the young caffeinated set, with the best-selling Ice Coffee Nako Durian mixing bitter espresso with the meat (not the syrup) from the pungent fruit. Other novelty flavours are available, like Chocopresso (coffee flavoured like chocolate), Japanese Monkey (banana, milk and matcha ice cream) and the self-explanatory Banana Milk Oreo.

71

FRUITFUL ROOTS

With market conditions as well as regulatory changes working in their favour, NRI investors are supercharging India’s real estate scene

BY LIAM ARAN BARNES

BY LIAM ARAN BARNES

72

73

From the bustling boroughs of New York to Sydney’s sundappled neighbourhoods, and the dazzling skylines of Dubai and Abu Dhabi, echoes of India’s rich cultural tapestry resonate far and wide.

This migratory saga, with roots dating back centuries to maritime expeditions to the Middle East, Southeast Asia, and Africa, has spanned generations. It culminated in waves of Indians dispersing across continents during the colonial and post-independence eras.

According to the latest UN estimates, about 18 million of the 281 million migrants worldwide are from India. Now, many of the world’s largest diaspora stand at a fresh crossroads, as the threads of heritage woven across time and space draw them back to their ancestral homeland—a journey buoyed by the allure of thriving real estate prospects.

74

Looking at India’s positive economic growth trajectory, the stage is set for a transformative era in NRI property investment, marked by sustainable gains and a deepening connection to their ROOTS

“There are so many objectives and motivations driving investments by non-resident Indians (NRIs),” says Sangeet Hemant Kumar, founder of SHK Global Ventures, a Mumbai-based real estate consultancy. “While some may invest with the intention of relocating or retiring in India, others see it as a financial investment opportunity or a way to maintain ties to their homeland.”

The sweeping economic reforms of the 1990s, marked by the liberalisation of foreign exchange and investment policies, dismantled the regulatory hurdles NRIs previously encountered when attempting to acquire property in India.

More recently, the landmark implementation of the Real Estate (Regulation and Development) Act, 2016 (RERA) brought about increased transparency and accountability to the sector, benefiting both domestic buyers and NRIs alike.

In the wake of the pandemic, the contribution of NRIs to premium real estate sales has reportedly surged, more than doubling to 20% of all transactions. A significant number of high net-worth individuals (HNWIs), many of them NRIs, meanwhile, plan to buy luxury real estate in the next two years, according to a recent survey by India Sotheby’s International Realty.

Indeed, most observers agree that current market conditions are highly favourable for overseas investors, particularly in the upper echelons of the market. The interplay of financial pragmatism with the promise of lucrative returns is a particularly powerful motivator, especially given the current strength of the dollar against the Indian rupee.

“Global NRIs are channelling resources, drawn from hubs like the Gulf Cooperation Council countries, the US, and the UK, leveraging the stability of these economies,”

75

DUBAI AND THE REST OF THE GULF COOPERATION COUNCIL (GCC) COUNTRIES ARE A MAJOR HUB FOR GLOBAL NRIS

explains Keval Valambhia, chief operating officer of CREDAI MCHI, a prominent real estate association. He adds that the vast majority of NRI investors continue to hail from these destinations, in addition to Australia, Canada, and Southeast Asia.

For NRIs, individual markets across the country hold their unique appeal. Major metropolitan areas like Delhi-NCR, Hyderabad, and Bengaluru continue to lead the pack. A recent joint survey by property consultancy firm Anarock and the Confederation of Indian Industry revealed that 60% of respondents are inclined to invest in one of these destinations.

Second-tier cities are also gaining attention due to lower property prices and the potential for higher returns as urbanisation and development expand. Coastal states such as Goa, Kerala, and Tamil Nadu, meanwhile, are experiencing

BENGALURU IN THE STATE OF KARNATAKA IS A FAVOURITE WITH NRI INVESTORS DUE TO ITS STRONG ECONOMIC PROSPECTS

heightened demand from those seeking rental income, vacation homes, and retirement properties.

“NRIs are increasingly open to newer products, such as holiday homes, student accommodations, and coliving properties,” says Ajai A Kapoor, CEO of Mumbai-based real estate firm 360 Degrees. “Overall, a balanced consideration of rental return and potential capital appreciation remains key.”

Another factor behind the post-pandemic NRI investment boom is the increasing role of technology in facilitating property purchases. The acceleration of virtual and augmented reality-driven tours during the lockdowns, for instance, made it easier than ever to search for and purchase properties from overseas.

76

Moreover, AI-powered algorithms have vastly improved data-driven property valuation and market analysis, while the emergence of secure long-distance transaction technology has fostered greater trust and convenience in remote financial dealings and document management.

In 2020, India became the world’s largest real-time payment market, boasting 25.5 billion annual transactions. The Unified Payment Interface, a smartphonebased system for instant fund transfers between bank accounts, has tie-ups with major NRI hubs such as Singapore, the US, Australia, Canada, Hong Kong, Oman, Qatar, Saudi Arabia, UAE, and the UK.

But beneath these economic drivers flows an emotional undercurrent. The vision of owning a piece of their homeland plays a pivotal role in NRIs’ decision-making process. Many prefer properties in their home states due to family connections.

THE COASTAL STATE OF GOA OFFERS PLENTY OF ALLURING OPTIONS FOR SECOND-HOME BUYERS

“Pride is certainly associated with these investments—a profound desire to be part of India’s ongoing growth story,” notes Kapoor. These investments not only stimulate markets, especially in smaller cities, but also promote economic growth by funding real estate and businesses. This, in turn, boosts infrastructure development, living standards, and foreign exchange reserves, contributing to the country’s financial stability.

In some instances though, NRI investments can exacerbate socioeconomic inequalities. High demand and real estate prices can widen the economic divide, making housing unaffordable for locals. Kumar emphasises that careful regulation and diversification of investment sectors are crucial to mitigate these challenges.

Despite the potential drawbacks, the prevailing sentiment is clear: NRI investment is a force for positive

77

ECONOMIC

GROWTH IN DHAKA, THE CAPITAL OF BANGLADESH, FAR OUTSTRIPS MANY OF ITS REGIONAL COUNTERPARTS

78

change. Experts believe that continued reforms, enhanced transparency, simplified regulatory processes, and supportive policies are needed to attract and retain NRI investments.

“With the nation’s economic growth trajectory, the stage is set for a transformative era in NRI property investment, marked by sustainable gains and a deepening connection to their roots,” Valambhia says.

In a world where horizons are increasingly blurred, technology diminishes distances, and cultures intermingle with ease, the recent surge in NRI investments is a testament to the significance of cultural ties. And as NRIs continue to invest in their homeland, these contributions not only bolster the economy but also reinforce the bridge between their past and the future of India’s real estate landscape.

Bangladesh gets a boost

Dhaka, like many burgeoning megacities in the Global South, frequently bears the stigma of being one of the most inhospitable cities on the planet.

In the 2023 edition of its annual global liveability index, the Economist Intelligence Unit, the research and analysis division of the Economist Group, ranked the Bangladeshi capital 166th out of 173 cities.

The city’s narrative is often dominated by images of overcrowding, slums, and substandard housing. With a population of 23 million, Dhaka often grapples with some of the most severe air pollution worldwide. To many observers, there appear to be few silver linings.

And yet the country’s economic growth continues to far outstrip its regional counterparts. Per capita, its GDP is already bigger than neighbouring India. In 2021, the International Monetary Fund (IMF) predicted Bangladesh’s gross domestic product would soon exceed that of Denmark or Singapore.

This bright outlook was however dimmed last year by the post-pandemic global economic slowdown that has wreaked havoc

79

in developing countries. The downturn was underscored in January when the IMF loaned the country USD4.7 billion.

Nonetheless, Bangladesh’s GDP is predicted to reach USD1 trillion by 2040 and real estate looks set to play a crucial role. According to the Bangladesh Bureau of Statistics, the sector contributed almost 8% to the economy in the last fiscal year. This marked a significant year-onyear increase, highlighting the sector’s expanding role. Increased urbanisation, rising income, and a growing middle class were cited as the key drivers by Alamgir Shamsul Alamin Kajal, president of the Real Estate and Housing Association of Bangladesh (REHAB).

“The government should prioritise the sector and formalise a sector-friendly policy in the next budget, considering the employment opportunities it generates,” adds Alamin. He also suggests that the government reduce the recently increased registration fee and offer

SINGAPORE’S PROXIMITY TO INDIA MAKES IT ANOTHER PREFERRED BASE FOR NRI

discounts to incentivise first-time buyers. In 2022, the prime minister endorsed the Detailed Action Plan, a comprehensive 20-year blueprint designed to enhance Dhaka’s liveability and modernity.

While this ambitious plan has sparked optimism, real estate experts voice concerns about potential decentralisation, which could inflate property prices by up to 50%, rendering apartments unaffordable for many.

On a more positive note, the plan reportedly encompasses the creation of 202 kilometres of new cycle lanes and 574 kilometres of waterways. It envisions the establishment of nearly 30 new parks, including reserves and conservation zones, along with an array of new educational institutions and healthcare facilities.

The question of whether this ambitious plan can effectively address Dhaka’s environmental and population challenges remains uncertain. Regardless, the

80

coming years will be crucial for shaping the future of one of the world’s most maligned cities.

Stormy conditions in Pakistan

Smoke and mirrors, rather than bricks and mortar, remain the foundations of Pakistan’s property market.

The sector is plagued with numerous issues, including overpricing, artificial growth, and various manipulations. In recent years, speculation and lack of transparency and regulation in the industry have resulted in significant asset-price bubbles, leading to a volatile market, while the lack of reliable data makes informed investment decisions almost impossible.

For the intrepid, there are opportunities to be had. Prominent developers, like Defence Housing Society and Bahria Town, are seen as reliable and trustworthy. Inevitably properties by these developers

PAKISTAN’S REAL ESTATE MARKET IS PLAGUED BY SEVERAL DIFFICULTIES, NOT LEAST THE NATION’S ONGOING POLITICAL TURMOIL

command much higher prices due to their perceived credibility.

A sharp decline in remittances from the country’s diaspora in recent years has also hit the market hard. According to Mohammad Hassan Bakhshi, former chairman of the Association of Builders and Developers, overseas Pakistanis on average invested USD10 billion in the property market before the pandemic.

But with the recent economic downturn and heightened political instability expected to continue, there are concerns many may permanently opt for safer ports amidst Pakistan’s ongoing storm.

81

COMING IN FROM THE COLD