The Reserve at Lake Keowee Market Report

Looking back three years to January 2020, I recall a few friends being sicker than they have ever been in their life and the duration of the illness lasting significantly longer than usual. A couple months later we all learned about COVID and our lifestyle dramatically changed. I’m grateful that in the grand scheme of everything, it was much easier living here than in most places in the country.

I think it is safe to say that no one could have predicted how the ongoing pandemic would impact the real estate market. As you know, there was an unprecedented surge in sales, prices and new construction in our area. This resulted in an extraordinarily strong seller’s market here as well as in most areas of the country. Nationally sales have slowed and it wasn’t a sustainable market given the high rate of sales of 2021. The Institute of Luxury Home Marketing noted “Despite the decline in the number of transactions over the last few months, there are no critical signs of distress in the luxury market. Low inventory levels are containing the ability for buyers to low-ball offers and home values continue to remain stable.”

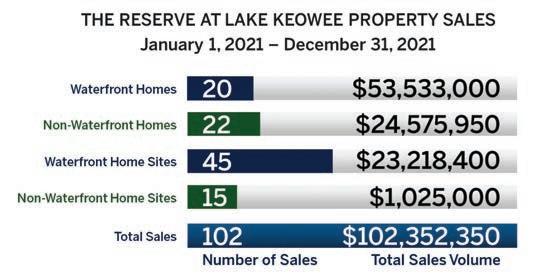

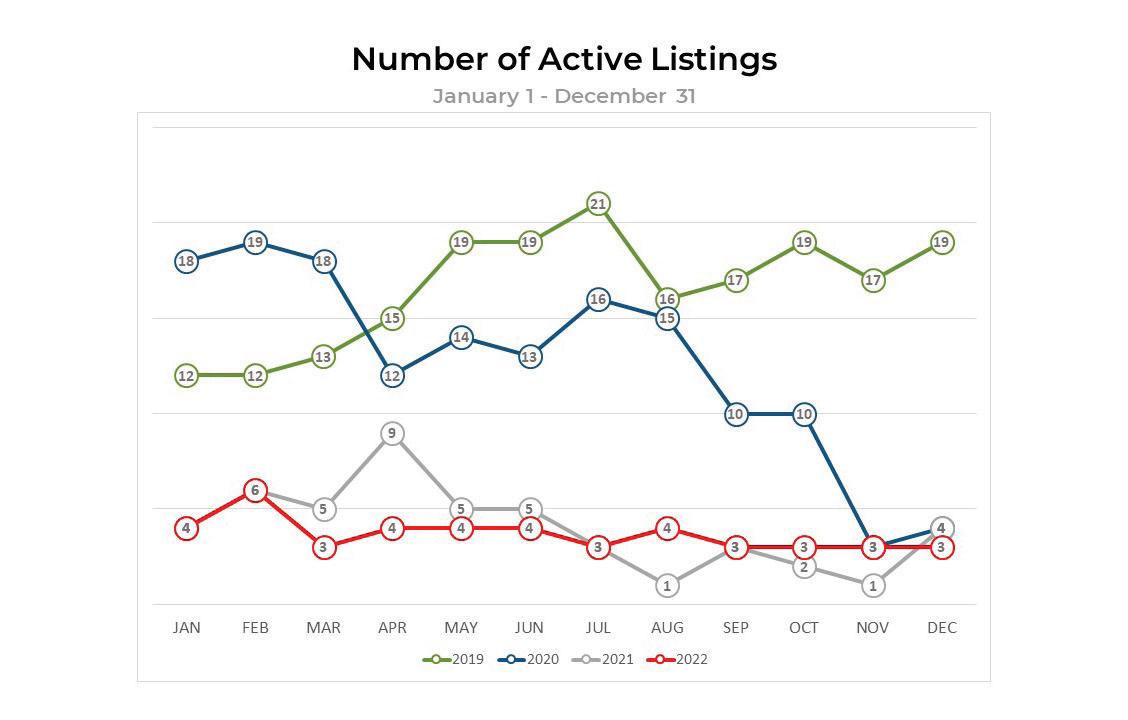

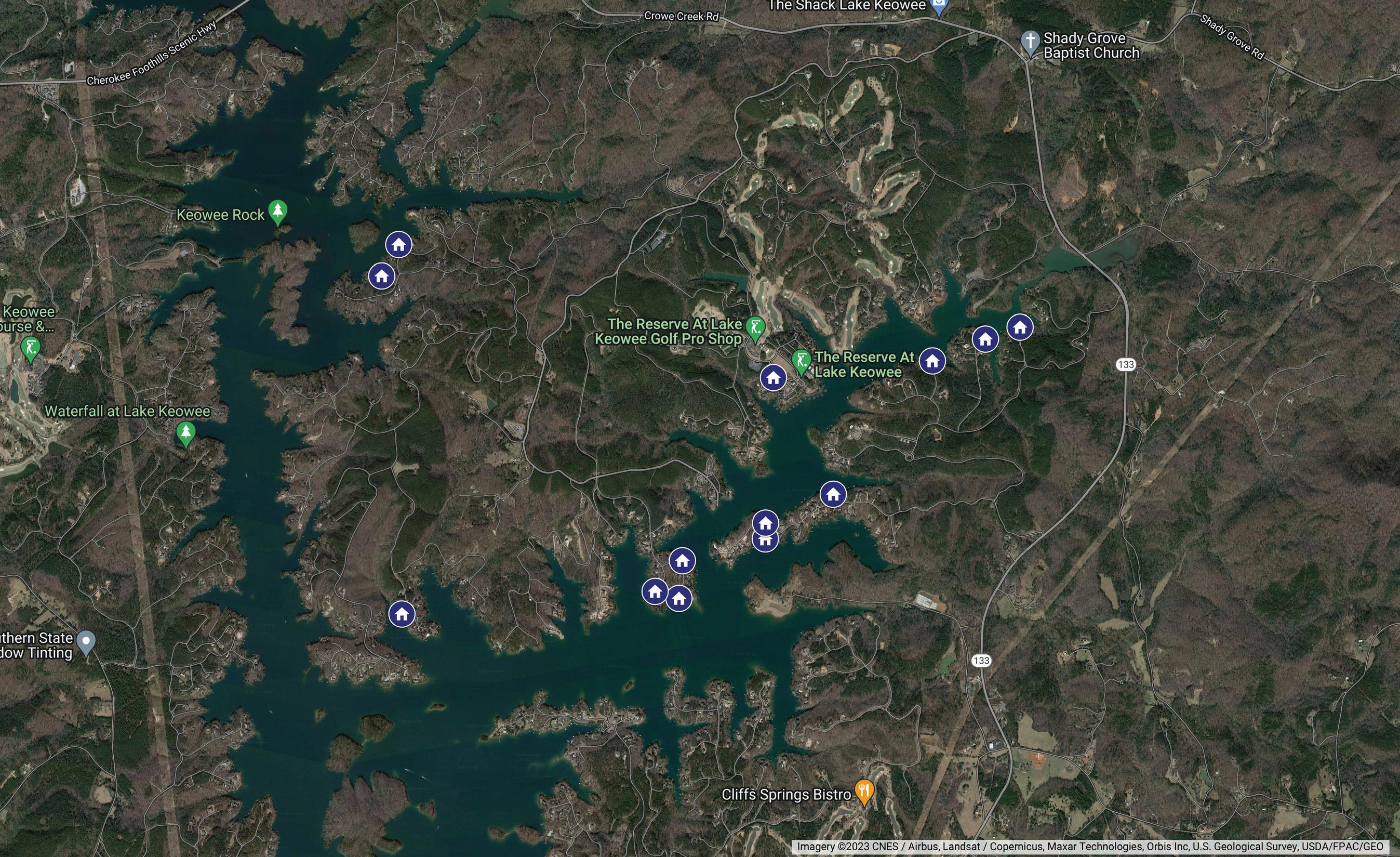

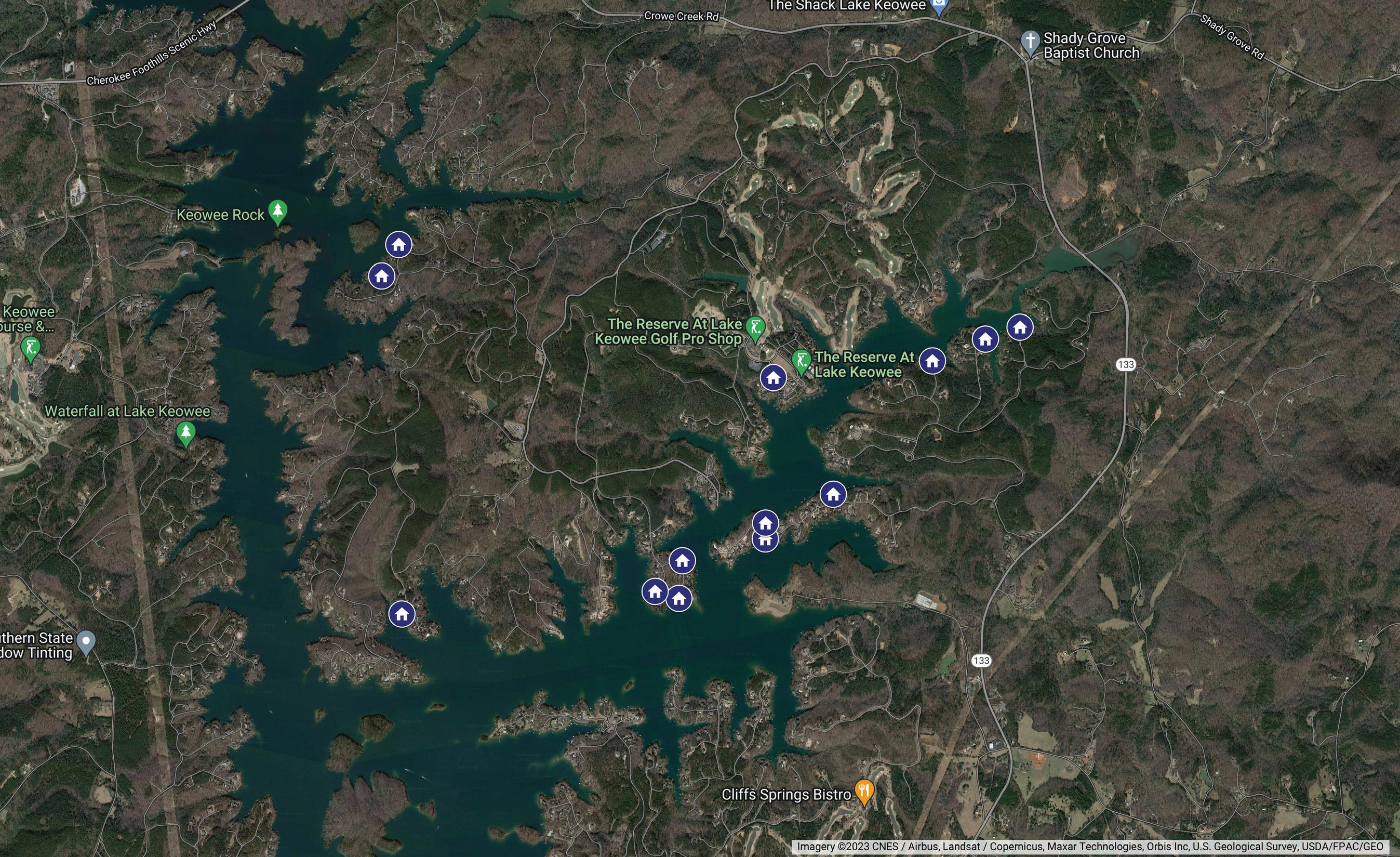

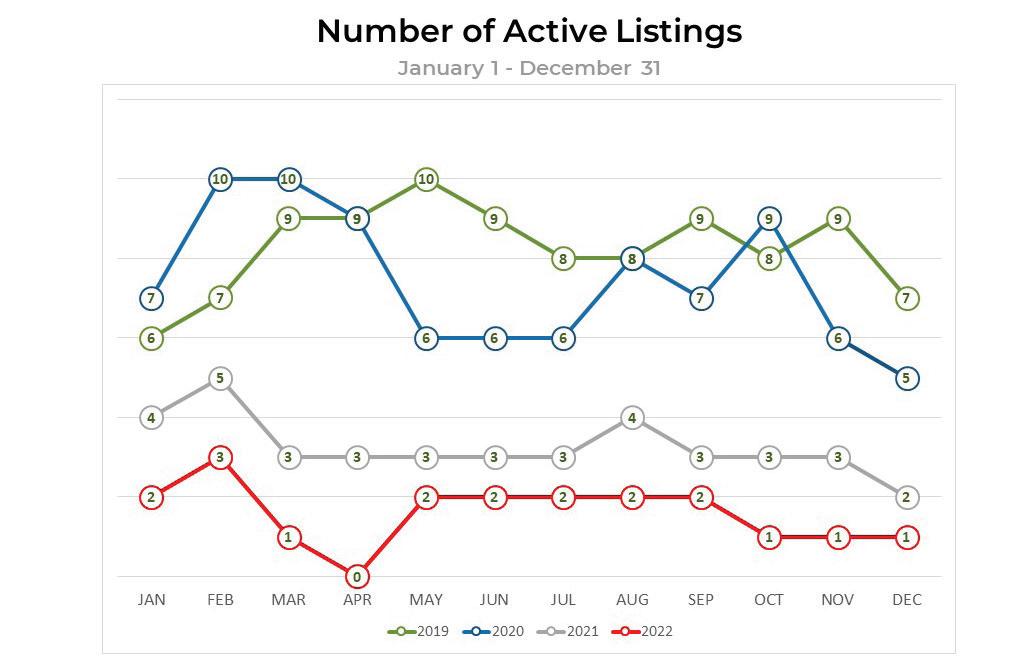

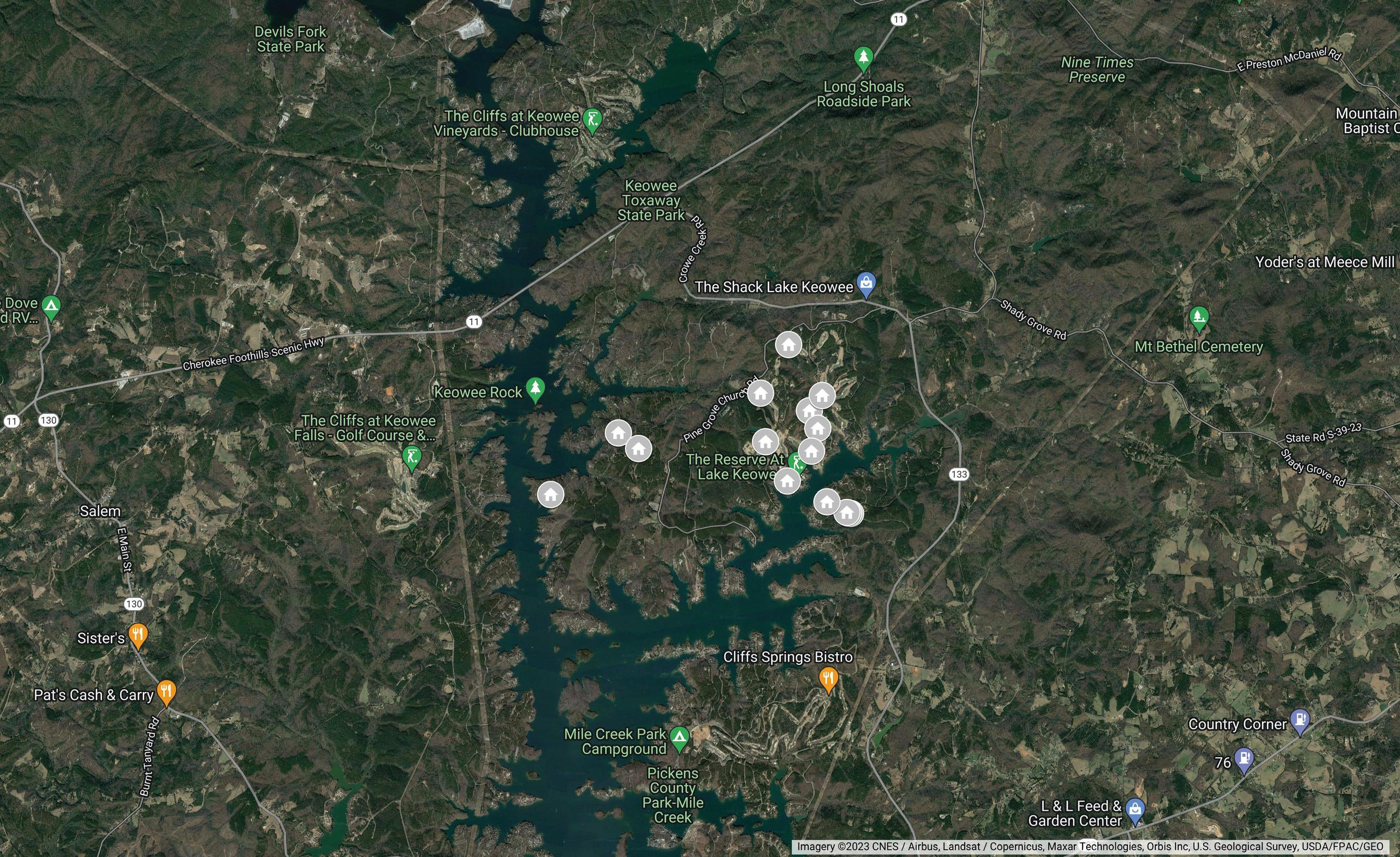

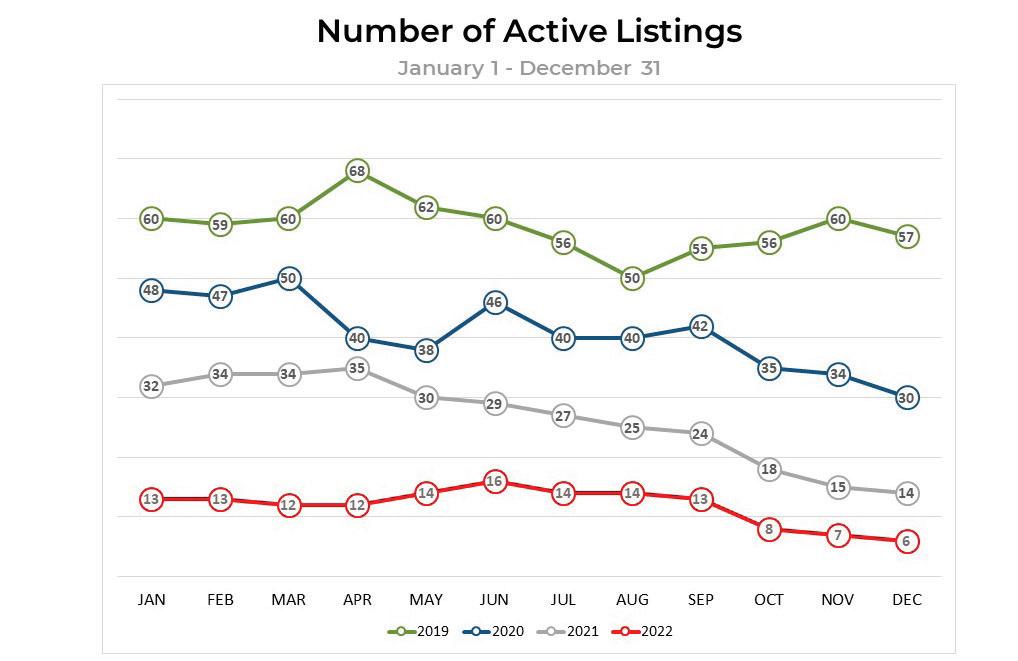

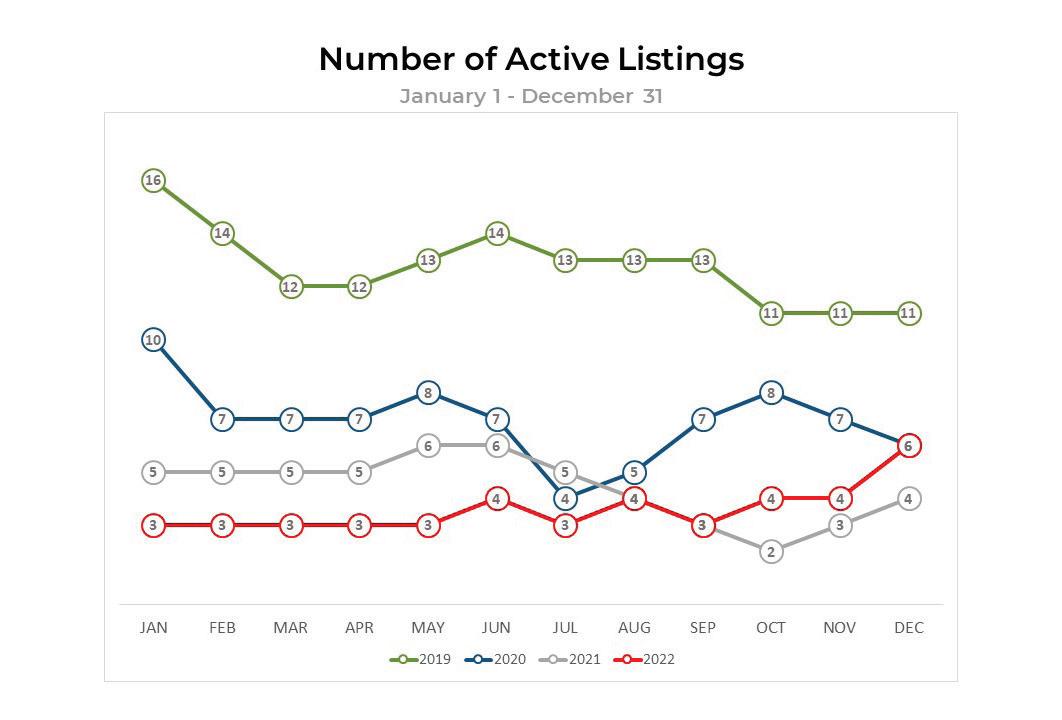

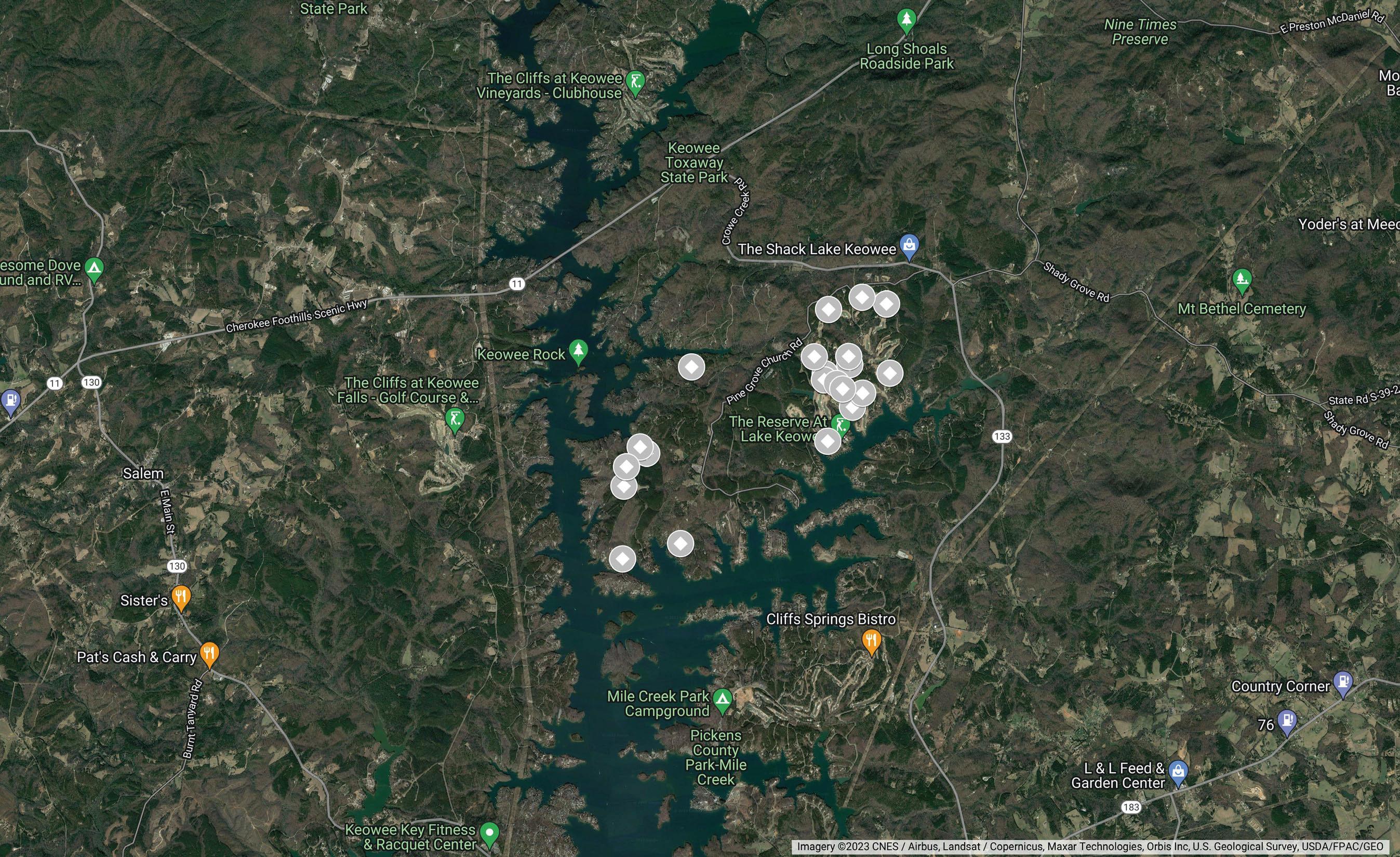

Sales have slowed at RLK throughout 2022, as 66% of the total sales in the year were in the first 6 months. For comparison purposes, The Cliffs sales were evenly split between the first and second half of the year. Compared to 2021, the RLK number of sales in 2022 was down 31% and the dollar amount down 30%. At the three Cliffs communities on the lake, the number of transactions was down -36% and the dollar amount up 6%. This is due to: low inventory levels (The Cliffs have 14 homes listed and RLK 7), higher interest rates, uncertainty in the stock

market, buyers’ return to a normal mindset (vs the feeding frenzy of 2020-2021), and, to some extent, the fluctuation in the ownership status at RLK.

Following the initial change in ownership in 2022, RLK management subcontracted its real estate sales effort to a small, real estate company in Travelers Rest, SC. While that arrangement is expected to change, no official announcement has been made.

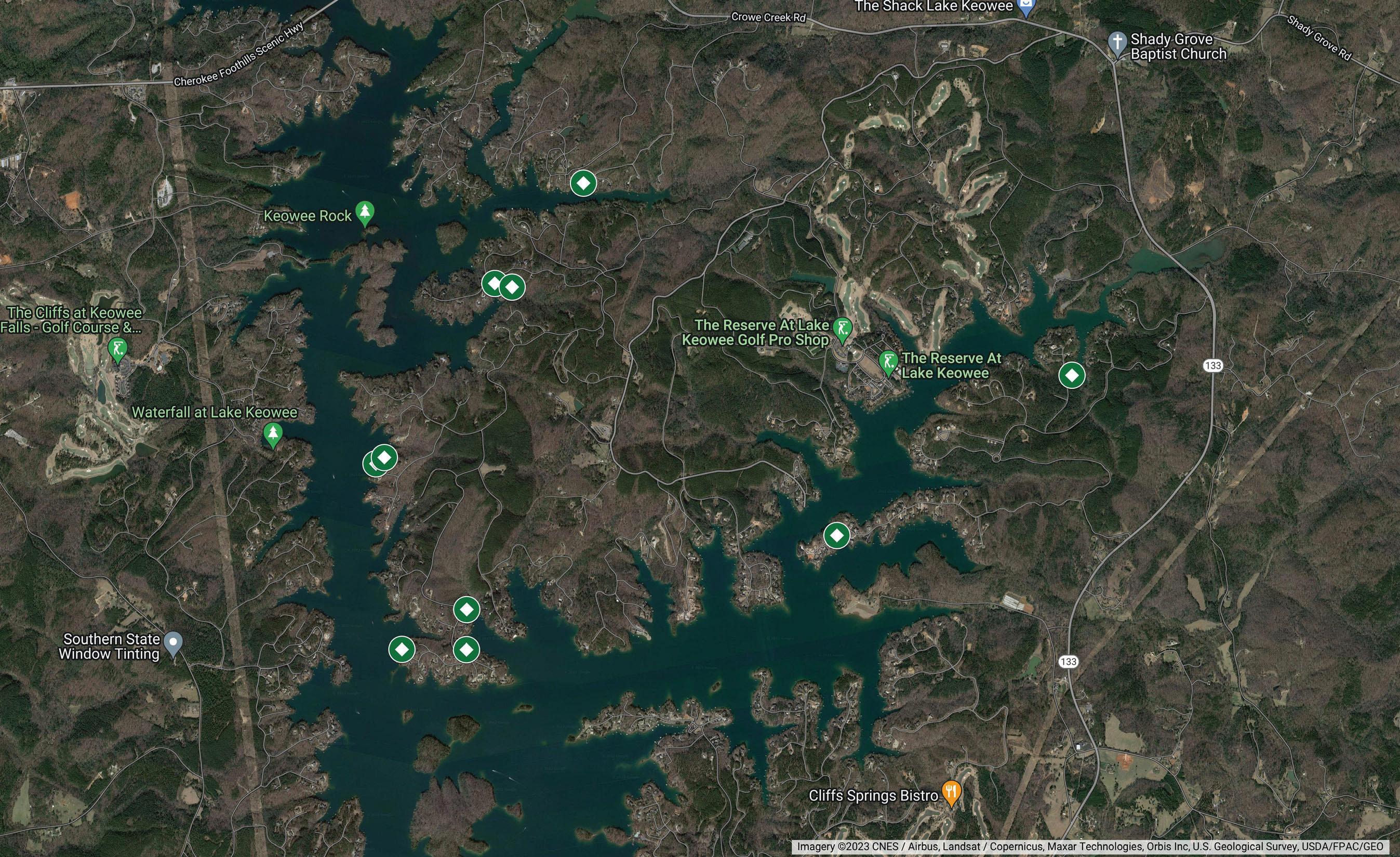

Joan Herlong & Associates Sotheby’s International Realty is the largest affiliate in the Upstate. We have two offices: Clemson/Lakes office in Patrick Square with a focused attention on RLK and in downtown Greenville.

If you are looking for additional details of real estate statistics in RLK and The Cliffs, please visit www.prominentkeoweeproperties.com.

Forecast for 2023:

• Real estate market continues a return to normalcy

• Continued tight inventory of homes in RLK and Lake Keowee area

• Flat to a modest increase in home prices

• Interest rates hikes to curb inflation will slow in 2023

• Mortgage rates to remain flat

• Soft landing to the US economy provided the interest rate hikes continue to curb inflation and also slow wage growth which should help relax the tight labor market

Read Sotheby’s International Realty 2023 Luxury Outlook.

If you would like to discuss the real estate market in The Reserve in relation to your priorities, please contact me.

Happy New Year! I hope you had a relaxing holiday and wish you the best for 2023!

• The median sales prices is up 100% over the last three years.

• Price per square foot has topped $600 for the first time.

• Sales price to list price ratios are decreasing. To compete in this market, sellers are agreeing to more concessions. It is imperative that these homes be expertly presented and professionally marketed to attract highest offers.

Cliffs Comparison

12/31/22 Reserve Cliffs

>4.5m 0200/Seller’s $4.25m-$4.5m0200/Seller’s $4.0m -$4.25m000 –$3.75m-$4.0m000 –$3.5m-$3.75m000 –$3.25m-$3.5m22012/Buyer’s $3.0m-$3.25m01 00/Seller’s $2.75m-$3.0m100 –$2.5m-$2.75m0200/Seller’s $2.25m-$2.5m000 –$2.0m-$2.25m01 00/Seller’s $1.75m-2.0m0300/Seller’s <$1.75m 000 –Total 3 13 03/Seller’s

Median Sale Price per Sq. Ft. $606$560 Median Days on the Market 38 74

12/31/20214

The months of supply calculates how many months it would take to sell a property given the current sales pace, inventory level and no new properties are offered for sale. The industry standard is that 6 months of supply is a balanced/ neutral market, 5 months or less is a seller’s market and 7 months or more a buyer’s market.

>1.8m 3409/Buyer’s $1.7m-$1.8m0300/Seller’s $1.6m -$1.7m1 1 012/Buyer’s $1.5m-$1.6m01 00/Seller’s $1.4m-$1.5m000 –$1.3m-$1.4m000 –$1.2m-$1.3m01 00/Seller’s $1.1m-$1.2m0200/Seller’s $1.0m-$1.1m000 –$900k-$1.0m01 00/Seller’s $800k-$900k00 10/Seller’s $700k-800k0200/Seller’s <$700k 000 –Total 41513/Seller’s

On 12/31/2132112/Seller’s

The months of supply calculates how many months it would take to sell a property given the current sales pace, inventory level and no new properties are offered for sale. The industry standard is that 6 months of supply is a balanced/ neutral market, 5 months or less is a seller’s market and 7 months or more a buyer’s market.

• 75% decline in sales from 2021 to 2022 reflects the fact that there are a limited number of developer or re-sale waterfront home sites available.

• Sales prices have decline more than 10% suggests that the most desirable home sites have been purchased, homes built, or future construction is planned.

• The median days on the market statistic has increased over the past two years, also suggesting a slower market for these home sites.

>1.2m 000 –$1.1m-$1.2m01 00/Seller’s $1.0m -$1.1m000 –$900k-$1.0m000 –$800k-$900k00 10/Seller’s $700k-$800k10 112/Buyer’s $600k-$700k01 0 0 $500k-$600k2308/Buyer’s $400k-$500k01 00/Seller’s $300k-$400k0200/Seller’s $200k-$300k1206/Balanced <$200k 1 1 012/Buyer’s Total 51125/Seller’s

On 12/31/21 13 4513/Seller’s

The months of supply calculates how many months it would take to sell a property given the current sales pace, inventory level and no new properties are offered for sale. The industry standard is that 6 months of supply is a balanced/ neutral market, 5 months or less is a seller’s market and 7 months or more a buyer’s market.

• A seller’s market with 4 months of supply is misleading because 75% of sales occurred in the <$50k price band. • Average days on the market has doubled since 2021.

Cliffs Comparison

The months of supply calculates how many months it would take to sell a property given the current sales pace, inventory level and no new properties are offered for sale. The industry standard is that 6 months of supply is a balanced/ neutral market, 5 months or less is a seller’s market and 7 months or more a buyer’s market.

• We leverage our brand’s heritage and sophistication.

• Connect with affluent consumers who share our vision.

• Go above and beyond to meet clients’ needs.

• Offer the only true, worldwide luxury real estate network.

• Partner with leading media to obtain the best exposure.

• Provide unparalleled reach to qualified buyers and sellers.

• Showcase every listing with the highest quality production.

• Utilize the latest technology for even greater impact.

• Deliver a singular client experience. Doing

more is our distinction.