The complete market perspective for the rental housing industry

2025 2025

Welcome to the 2025 national edition of theANNUAL, an industry specific periodical that provides our readership with relevant, timely information and data based on a single-minded approach: “What does the apartment industry need to know?” With this basic philosophy as our focus, we turned to industry experts, association executives, government sources, and apartment owners & managers from coast to coast to provide you with the most complete and thorough industry resource.

Produced by RHB Inc – creators of RHB Magazine, RHBTV, RHB Newsreel, CREBTV, BoldTV, the video series - Real Estate Legends and Coast to Coast along with Perpetual Media Group (PMG), theANNUAL delivers a complete market perspective for the Canadian rental housing industry.

Producing a standalone resource guide with vital and practical industry information is an expansive undertaking. That’s why theANNUAL is the only resource of its kind that produces this level of in-depth analysis and forecasting for Canada’s rental housing industry. It takes a great deal of time, resources and industry knowledge to produce this type of comprehensive report that involves regional and national apartment owners and managers, and that also enables them to respond to market need, size and competition.

Here is some of what you’ll find in theANNUAL:

• CMHC’s State of the Industry Report, reviewing primary rental stock in 24 major centres, while outlining specific market conditions and performance markers.

• The Realty Check section gives us a look at realty transactions in Canada’s top primary markets, an analysis of 2024 and what to expect in 2025.

• Benjamin Tal’s economic update and forecast authored by John Dickie.

• An analyzation of in-place rents and what they mean to you. We also included the 2025 allowable rent increases from across Canada where applicable.

Publisher Nishant Rai

Associate Publisher Debbie Dollar-Seldon

Sales Executive Justin Kreslin

FOREWORD

• You’ll also find data from Yardi’s quarterly Canadian Apartment Industry Report. It includes their insight and analysis on the Canadian rental housing market.

• A vetted report of Canada’s top owners, managers and REITs. Although we shouldn’t be surprised after all these years of reporting on rental housing, we see a shakeup in the rankings and, as always, are pleased to see the year over year growth of our amazing industry.

RHB Inc. is Canada’s National Voice for the apartment industry. We work diligently to deliver the latest news and information that help industry professionals maintain a competitive advantage. That’s why so much effort is place on ensuring theANNUAL is the best resource guide that it can be to our industry. Our success is based upon the same family principles that define our industry. Therefore, we would like to acknowledge the following people and companies for their help gathering the information and data which enabled us to deliver this comprehensive guide:

John Dickie, EOLO; Benjamin Tal, CIBC World Markets; Canada Mortgage and Housing Corporation (CMHC); Yardi Canada.

We accept full responsibility for accurately delivering the news for the apartment industry. Therefore, we want to hear from you, the people who make us the strongest industry in Canada. Let us know what you think about what you’ve read in this edition of theANNUAL. Tell us what you want to read in the 2026 edition of theANNUAL – what matters most to you, what information will help you better in your business and what data and resources are critical to your decision-making.

All the best,

Nishant Rai

Nishant Rai Publisher

H&S Building Supplies Ltd. is one of Ontario’s leading wholesalers for property maintenance products, specializing in the multi-unit residential sector. With years of experience and a dedication to excellence, we provide reliable solutions for building operations. Our commitment to quality, service, and efficiency ensures that every order is handled with precision and care.

Trusted Advisors

Providing Expertise in Building Science and Structural Restoration

Garage & Balcony Assessment & Restoration

Building Cladding Design, Assessment & Remediation

Roofing System Design, Assessment & Remediation

Building Condition Assessments

Capital Planning

Building Renewal

Energy Audits and Modelling

East Coast Statistics

New Brunswick: AVR: 2.0%; 2BR: $1,285

Prince Edward Island: AVR: 0.8%; 2BR: $1,181

Nova Scotia: AVR: 2.0%; 2BR: $1,606

Newfoundland and Labrador: AVR: 1.8%; 2BR: $1,109

Number of Private Apartment Units

Apartment Vacancy Rates

Apartment Estimate of Percentage Change of

*In State of the Industry, the rent and vacancy figures stated reflect apartments within the Primary Rental Market.

Eastern Canada

*The vacancy and rent figures are as of October 2024

State of the Industry

St. John’s, NL

Charlottetown

RENTAL HOUSEHOLDS 6,462

TOTAL PRIMARY RENTAL HOUSEHOLDS

59,725

1st

TOTAL PRIMARY RENTAL HOUSEHOLDS

16,825

2nd

State of the Industry

Saint John, NB

Central Canada

*The vacancy and rent figures are as of October 2024

State of the Industry

Quebec City

St. John’s

St. John’s

114,092

30,607

Montréal

St. John’s

653,365

334,748

State of the Industry

78,463

St. John’s

John’s Hamilton K-C-W

Turnover Rate

State of the Industry

St. Catharines

15,838

18,380

Western Canada

*The vacancy and rent figures are as of October 2024

State of the Industry

Winnipeg

Saskatoon

73,270

St. John’s

St. John’s

State of the Industry

St. John’s

St. John’s

St. John’s

32,850

8,788

Realty Check

Foreword

In 2024, Canada’s multifamily real estate market— particularly in Ontario—entered a defining period of transition, marked by shifting investor expectations, recalibrated pricing models, and a renewed focus on operational fundamentals. Following years of market volatility, 2024 has brought clarity around core market dynamics, even as financing challenges and economic uncertainty persist.

The rental housing market continues to be underpinned by extremely strong fundamentals. Ontario alone added more than 500,000 new permanent and temporary residents this year, including a significant number of immigrants and international students. This rapid population growth has sharply increased demand for rental housing, while new housing supply—especially rental units—has not kept pace.

Rising construction costs, which have outpaced inflation, have made homeownership increasingly inaccessible for many, prolonging tenancy durations and contributing to record-low turnover rates. In key urban markets vacancy rates remain near zero, and average asking rents climbed throughout the year, with a slight decline in the latter part of the year.

With turnover down and tenants staying in place longer, the ability for investors to reset rents to market levels has become more limited—posing a challenge for value-add strategies. Investors are now placing greater emphasis on in-place income, debt assumptions, and asset-specific factors when underwriting deals.

While transaction volumes have not yet returned to pre-slowdown levels, momentum is gradually building. A notable re-engagement of capital has occurred in 2024, with investors who had been on the sidelines now looking to deploy funds in a more stable market. A significant share of this interest is directed at newer purpose-built rental buildings, particularly those completed after 2018 and exempt from Ontario’s rent control measures. These assets offer investors greater flexibility to adjust rents to market rates and capture future income growth.

At the same time, Ontario’s older multifamily stock continues to retain its appeal. Construction of new rental supply remains difficult due to cost and regulatory hurdles, which has helped existing assets hold value. In some cases, operating expenses have stabilized or even declined, enhancing overall asset performance.

There is also a growing pipeline of potential sellers—including fund managers reaching maturity, intergenerational owners planning transitions, and developers seeking to recycle capital. Many of these owners have delayed bringing assets to market, waiting for more favorable transaction conditions. That inventory is beginning to re-emerge, bringing with it the potential for increased deal flow in the months ahead.

Looking into 2025, there is cautious optimism that interest rates may begin to trend downward or at least stabilize. Bond yields appear to be settling into a more predictable range, which may help close the valuation gap between buyers and sellers. If this trend continues, it could signal a broader reopening of the transaction market and renewed liquidity.

Outlook for 2025

Looking ahead, 2025 is poised to be a year of cautious optimism. While a return to ultra-low interest rates is unlikely, many economists expect some rate relief over the course of the year. If bond yields stabilize and financing becomes more predictable, the bid-ask spread may continue to narrow—unlocking more transaction activity and bringing liquidity back to the market.

We also anticipate a re-emergence of sidelined capital. Both private and institutional investors have been patient, waiting for pricing clarity and more consistent macroeconomic signals. With a backlog of owners— ranging from funds nearing maturity to developers looking to recycle capital—the potential for increased deal volume in 2025 is significant. The key to market activation will be alignment: between buyer and seller expectations, financing conditions, and underlying asset performance.

Operational performance will remain a top priority in 2025. With turnover low and rent control still in place across much of the country, investors will need to drive value through hands-on management, cost efficiency, and tenant retention. Purpose-built rentals—especially those with flexibility around rents—will continue to attract outsized attention.

In short, 2024 set the stage for a more balanced, thoughtful investment environment. While not without its challenges, the year reaffirmed the strength of Canada’s multifamily market. As the country continues to grow and urbanize, rental housing remains a core need— and a compelling opportunity for investors with a longterm, fundamentals-first mindset.

SOLUTIONS YOU NEED WHEN AND WHERE

YOU NEED

Explore money saving contract-pricing and time-saving business tools that help you operate effi ciently, control costs, and keep your staff and those you serve safe.

IT

HD SUPPLY OFFERS a wide variety of essential and innovative products for all of your facility maintenance needs, including:

• Appliances Appliance Repair Parts

• Electrical

• Fabrication

• Hardware

• Health & Safety

• Housekeeping HD Supply Brand Exclusives

• HVAC

• Janitorial

• Lighting

• Paint & Sundries

• PPE Plumbing and Commercial Plumbing Products

• Seasonal Products

• Textiles

• Tools

We also offer a dedicated Special Orders Department to help with those hard-find-products.

ADDITIONAL SERVICES THAT WE OFFER

Take advantage of the various services we offer to help you manage your orders, improve your property, and make your job easier.

TRADE CREDIT

Take advantage of flexible credit limits, no third party provider and 30-day net terms by opening a credit account with HD Supply Canada, Inc.

E-PROCUREMENT SOLUTIONS

Keep your property compliant with our procurement tools.

RELIABLE COAST TO COAST DELIVERY

Direct ship and job site delivery options available. Enjoy free next-day delivery on stocked products to most locations.

APPLIANCE DELIVERY PROGRAM

Hassle-free, coast-to-coast and offers delivery, appliance placing, uncrating and move/haul away services.

HD SUPPLY INSTALLATION SERVICES

Whether it’s window coverings, PTAC units, appliances, or cabinet refacing, we’ve got you covered from start to finish.

PROGRAMS TAILORED TO THE NEEDS OF YOUR PROPERTY

We will build a custom catalogue for an easy way to help limit your spend to pre-selected products for consistency and maximum savings.

Ville-Marie

Location: Saint-Laurent $197,500,000

Location: St-Jerome

656

per Suite: $160,061

Location: Ville-Marie $107,000,000 Suites: 248

Luxer One Contactless Parcel Delivery Lockers

100% of packages accepted in every size and shape

Smart technology & design for easy-to-use experience

Unparalleled service, support teams available 24/7 for carriers, residents and communities

Indoor - Outdoor and refrigerated models available

Multiple revenue opportunities

6-8 delivery timeline

Why do property owners and managers prefer Luxer One?

Luxer One and Coinamatic have partnered together to provide over 15 years of experience in multifamily lockers as well as over 75 years of experience operating and serving this multi-family industry.

We strive to provide the best product, delivery and installation experience, and user experience to building residents, carriers and property managers alike!

We are not just a laundry company. Coinamatic is a provider of Smart Parcel lockers. Contact us today at (800) 361-2646 or info@coinamatic.com for more information

Location: Cote-Saint-Luc

Quebec City $35,650,000

Coquitlam

121

Saanich

Dollars & Cents

By John Dickie, based on an interview with Benjamin Tal, CIBC Deputy Chief Economist

Unlike the last several years, inflation is no longer a key concern. Aggregate mortgage costs are almost stable. The U.S. economy is not strong, even before the negative impact of tariffs, both American and Canadian. Which sectors and provinces will the tariffs affect the most? Where is the U.S. economy going?

40%

$200-$300 billion heading to other assets from Canadian GICs

Source: Statistics Canada , CIBC Source:

Outside of consumer spending, the US economy has been weak

Deviations from Pre-Pandemic Trend (2015-2019)

Consumption

GDP less Consumption and Inventories

In the U.S., job-to-job transitions have stalled out

Change in transition to unemployment (y/y %, 6m avg.)

The likely purpose and distribution of the economic effects of U. S. President Trump’s tariffs.

U.S. President Trump threatens high tariffs as a negotiating tool

“My inclination is that when we hear 60% tariffs on China, that’s the beginning of a maximalist negotiating position. That’s the way President Trump negotiates. I would be surprised if we ever hit that…”

Scott Bessent US Treasury Secretary

Dollars & Cents

Ontario and Quebec could bear 80% of the shock of higher tariffs due to their high direct exposure

Source: CIBC calculations

Trade uncertainty dented Canadian manufacturing capital spending in first half of Trump’s first term

Trump’s steel tariffs were painful and probably will be again

Exports of primary metal manufacturing to the US (Index, May 2018 = 100)

Tariffs levied (May 2018)

Tariffs lifted (May 2019)

Source: Statistics Canada, CIBC calculations

But America’s tariffs will hurt Americans, especially in states that usually vote Republican (“red states”)

China entering the WTO was a game changer for the U.S. economy

U. S. Re-globalization after the pandemic

US imports of goods (Index, June 2018 = 100, 12mma)

Rest of world China

Source: U.S. Federal Reserve Board, Bureau of Economic Analysis, CIBC

China exporting through South-East Asian countries (which are emerging markets or “EMs”)

US becoming slowly more reliant on emerging markets’ consumers, and less reliant on Canada and Europe

Sources: U.S. Census Bureau, CIBC

Key uncertainties that will drive the economy

The success of the next government

• in resolving the tariff dispute and other disputes with the U.S.

ABOUT THE SOURCE

• in building new infrastructure and diversifying Canada’s exports.

• in addressing housing costs and housing supply.

Benjamin Tal is the Deputy Chief Economist at CIBC World Markets. Well-known for his ground-breaking research on all major sectors of the real estate market, on credit markets, and on business economic conditions, Benjamin frequently sets key elements of the public policy agenda. He is also a big believer in the value of a strong

sector. As well, Benjamin has been the keynote speaker at many CFAA conferences over the years. CFAA thanks Benjamin for his support.

Rents – Allowable & Actual

Rent Increases for 2025 per province:

BRITISH COLUMBIA

Residential Tenancies – 3%

Manufactured Home Tenancies – 3% plus a proportional amount for the change in local government levies and regulated utility fees. Some increases above the guideline are available. MANITOBA

Residential Tenancies – 1.7%

ONTARIO

Residential Tenancies – 2.5%

Exemptions apply to buildings and additions first occupied after November 15, 2018. Some increases above the guideline are available for both residential tenancies and manufactured home sites.

MANITOBA

Some increases above the guideline are available. Exemptions apply for units renting for $1,640 or more per month (as of December 31,2024), and for buildings with an occupancy permit first issued after March 7, 2005, which are less than 20 years old.

PEI

Residential Tenancies – 2.3%

Manufactured Home Tenancies – 2.3%

NEW BRUNSWICK

Residential Tenancies – 3%

Manufactured Home Tenancies – 3%, and other restrictions apply.

NOVA SCOTIA

Residential Tenancies – 5%

Manufactured Home Tenancies – 5%

In Quebec, there is no exact equivalent to the guideline as it is used in BC, Ontario, Manitoba, PEI, and now Nova Scotia. The Quebec government does not set a rent increase that a landlord can charge without any specific approval. Instead, if tenants challenge the rent increase notice that the landlord gives them, the Tribunal administratif du Logement (the Quebec Rental Board) applies a set of standard cost increases to the specifics of each rental building. The calculation is based on actual increases in municipal taxes and insurance, and inflationary percentage increases applied to other costs such as heating and services. Alberta, Saskatchewan, Newfoundland and Labrador, do not limit rent increases.

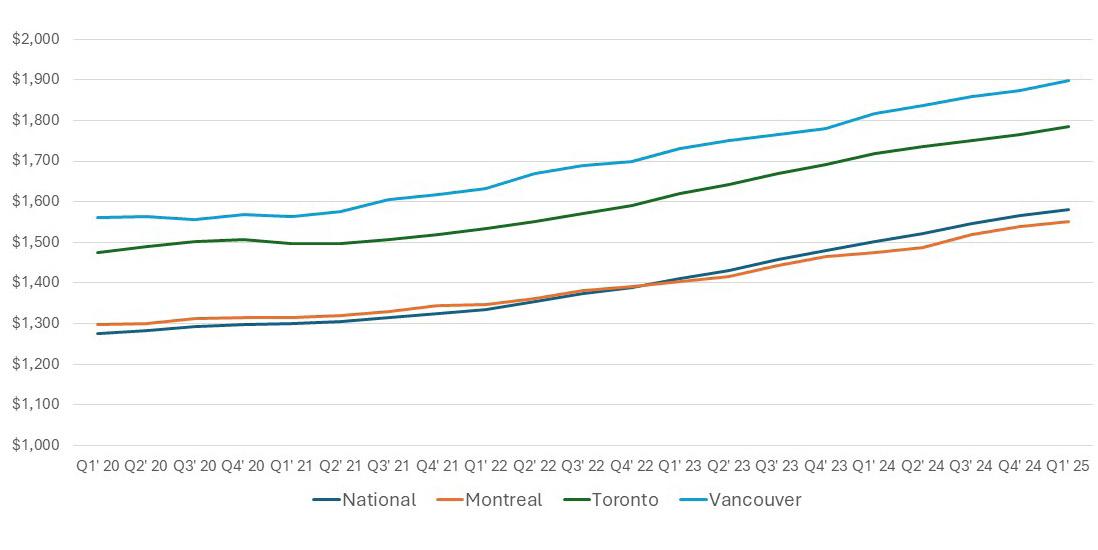

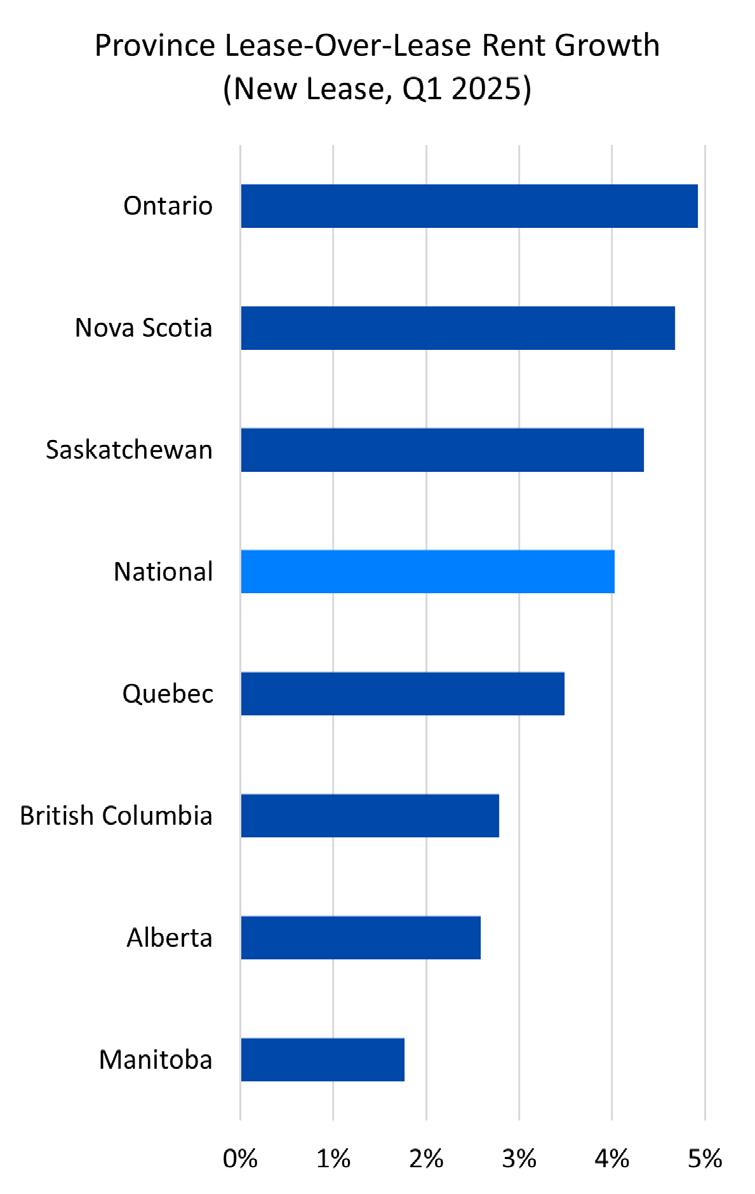

Rents – Allowable & Actual

Multifamily rents in Canada continue to increase but the growth rate is slowing. The average national in-place rent increased $17 in Q1 2025 to $1,582 and rose $79 over the last four quarters. In-place rent growth fell 50 basis points during the quarter to 5.3% and declined 120 basis points over the year. In-place rents represent an aggregation of all rents in a given Census Metropolitan Area (CMA), including those for new leases, renewals and existing leases. Rent increases are slowing as demand is softening from red-hot levels, with much of the growth coming from raising the rates on renewal units to bring them closer to market rents for new leases.

In-Place Rents

National & Major CMA Averages

Rents – Allowable & Actual

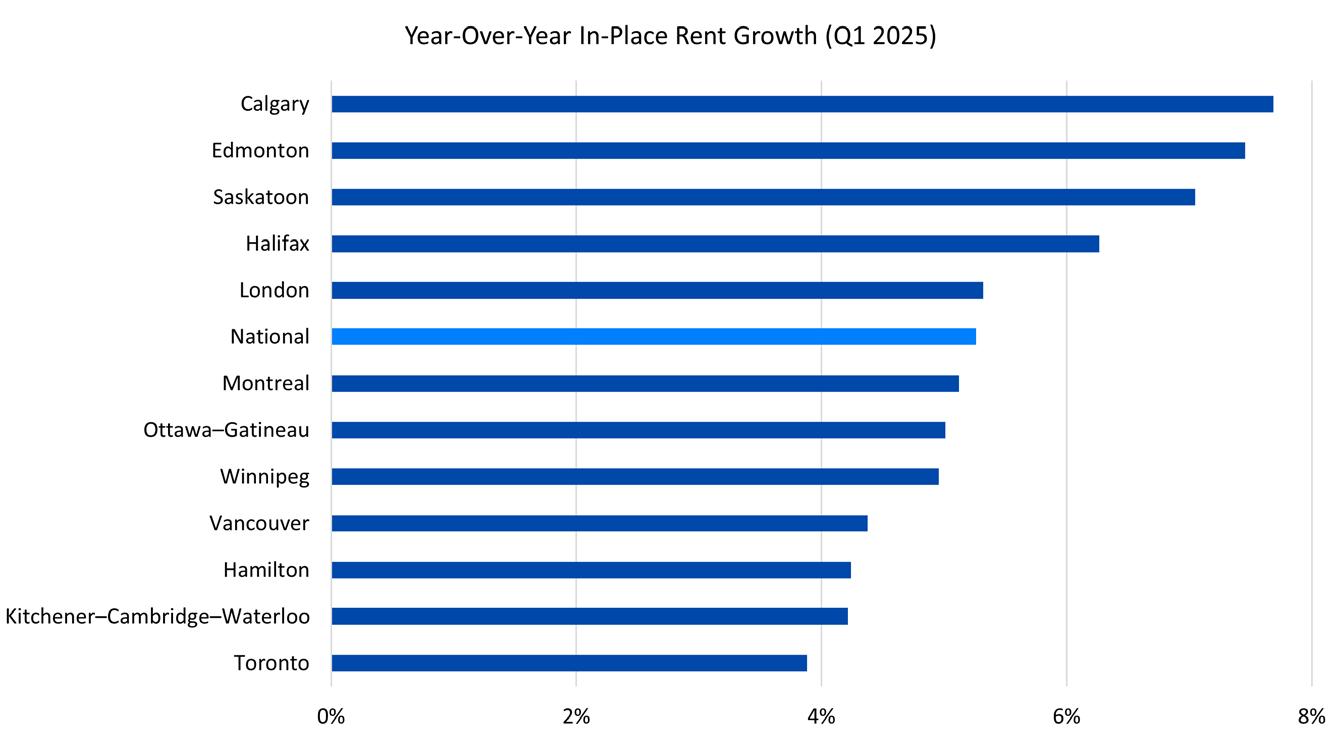

Year-Over-Year In-Place Rent Growth Rent Growth

Smaller Eastern CMA Averages

Conclusion

National & Major CMA Averages

Smaller Western CMA Averages

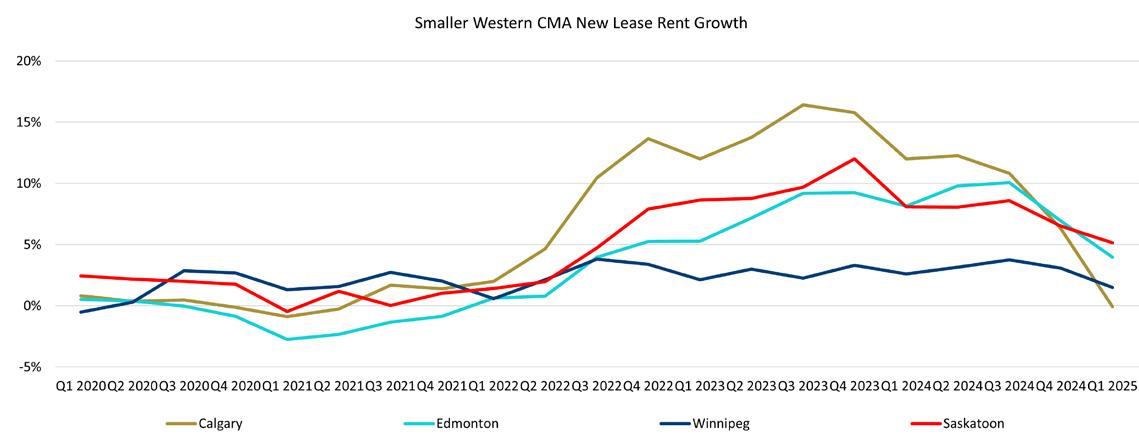

Despite recent cooling of rents, CMAs in Alberta and Saskatchewan led year-over-year rent growth in Q1 2025 because the numbers still reflect rapid growth during the first half of 2024. In-place rents rose 7.7% year-over-year in Calgary (up $117 to $1,641), 7.5% in Edmonton (up $104 to $1,494) and 7.0% in Saskatoon (up $97 to $1,476). Year-overyear growth was weakest in Ontario CMAs Toronto (3.9%), and Kitchener-Cambridge-Waterloo and Hamilton (4.2%).

For more insight into the Canadian multifamily market view the full report at Yardi.com/CNDMultifamilyReport

Canadian Apartment Industry Report

Canadian Multifamily Market: Momentum Slows, Uncertainty Builds

Which direction will the apartment market go following its years of exceptional growth? Canada’s multifamily sector is showing early signs of stabilization as vacancy rises and rent growth moderates. Supply continues to expand, but economic forces — from inflation to reduced immigration — may challenge the market’s resilience in 2025.

According to the Yardi® Canadian multifamily report, the sector remains fundamentally strong but is adjusting to a new phase, highlighted by the following national averages:

• A 5.3% year-over-year increase in in-place rents, bringing the national average to $1,582.

• A 4.0% rise in new lease-over-lease rents in Q1 2025, down 240 basis points from Q4 2024.

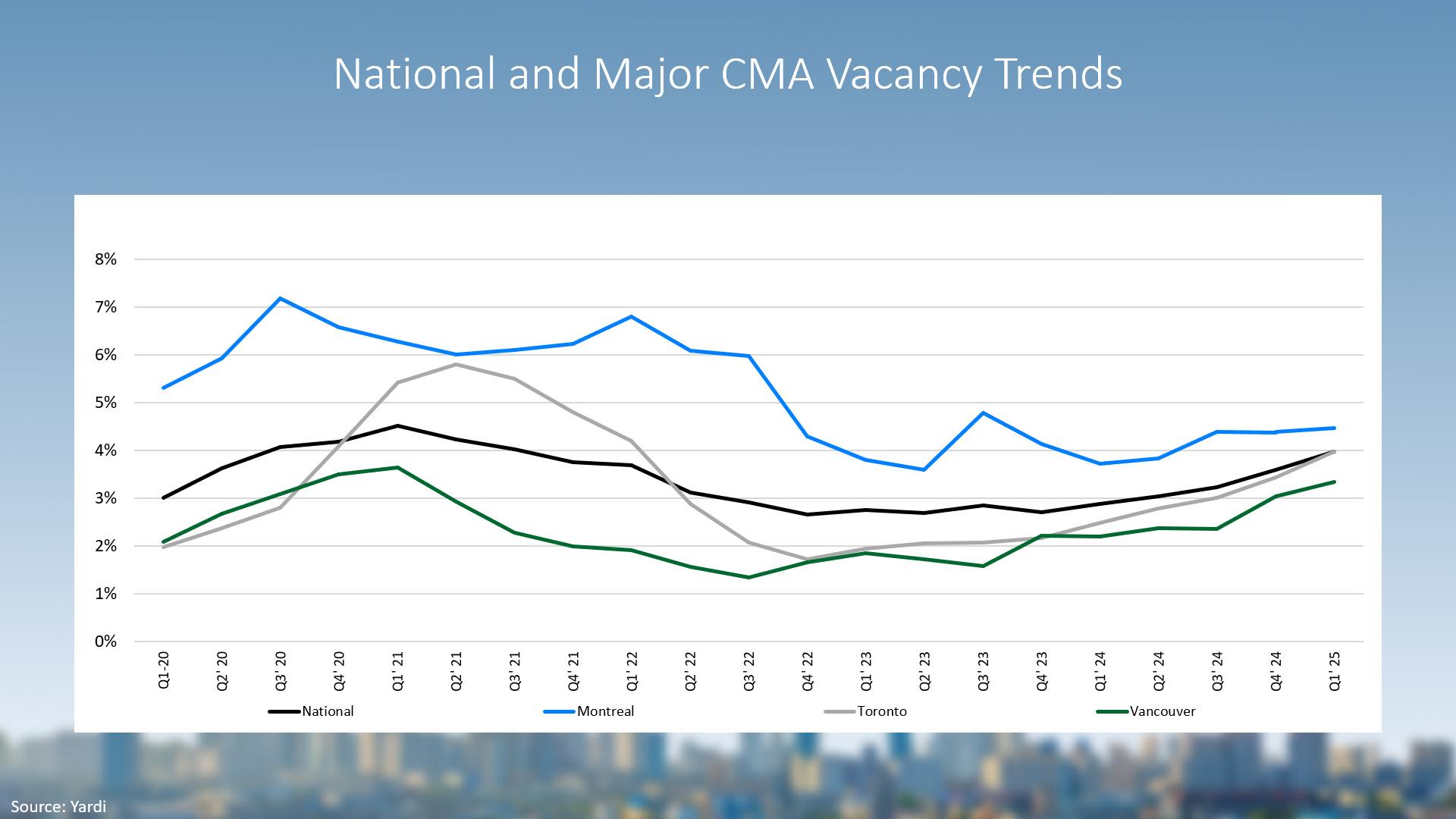

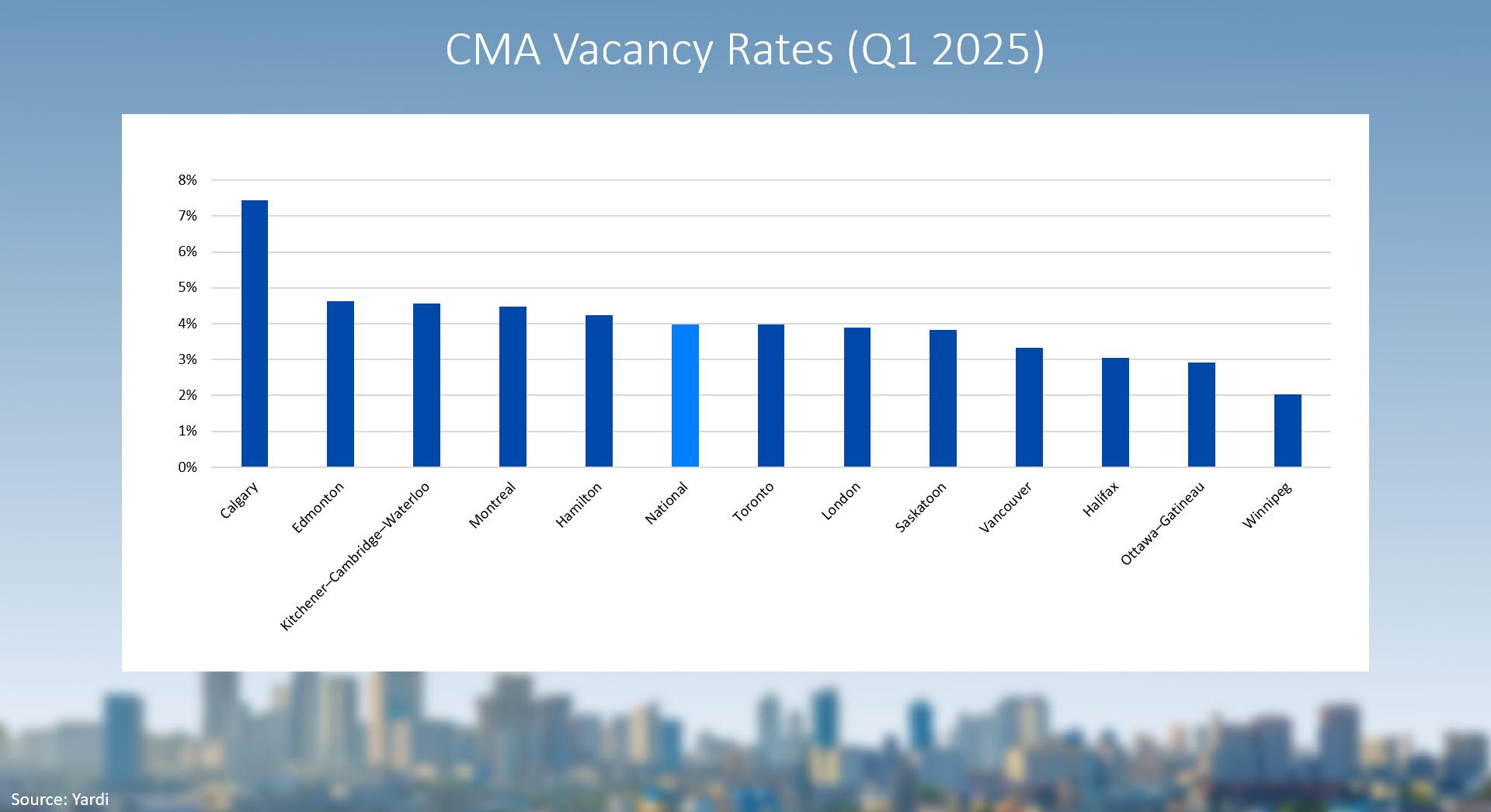

• A national average vacancy rate of 4.0%, the highest level since 2020.

• Bachelor unit vacancy reaching a 5.8% average, with Toronto (7.7%) and Calgary (7.1%) leading all Census Metropolitan Area (CMAs).

While demand for rentals remains healthy, affordability challenges and shifting demographics are creating new uncertainties. Slower population growth, elevated development costs and global economic pressures are setting the stage for a more measured pace of growth across the country.

Canadian Apartment Industry Report

Pressure points begin to emerge

Several indicators suggest the Canadian multifamily market is shifting gears. While demand remains steady, macroeconomic challenges are testing the sector’s resilience:

• A national economy under stress, with GDP growth expected to slow amid rising inflation and trade uncertainty.

• Unemployment ticking up to 6.7% in March 2025 following the loss of 33,000 jobs.

• U.S.-imposed tariffs impacting Canadian exports and weighing on business confidence.

• A planned reduction in immigration, with population growth falling to 1.8% in 2024 from 3.1% in 2023.

Despite these developments, the Yardi report suggests the market is recalibrating — not retreating. Rent growth is easing, vacancy is rising, but demand fundamentals remain largely intact.

Development catches up — for now

For years, Canada’s housing supply lagged behind demand. That gap is finally narrowing. Apartment completions reached 84,273 units in 2024, marking a 32.4% increase year-over-year. Alberta led with a 108.5% jump, outpacing Ontario and Quebec.

This new wave of supply is starting to rebalance overheated markets. In Calgary — a city that saw 12% rent growth in early 2024 — new lease rent growth turned negative by Q1 2025, falling to -0.1%. Similar slowdowns are visible in other growth-heavy CMAs like Kitchener-Cambridge-Waterloo.

Still, structural barriers persist. High construction costs, zoning delays and labour shortages continue to limit new housing across many regions.

Vacancy climbs, renter behaviour shifts

For the first time in years, national vacancy has meaningfully increased, hitting 4.0% in Q1 2025. Bachelor units led the rise at 5.8%, with vacancy in Toronto (7.7%) and Calgary (7.1%) outpacing the national average. Despite this, annual turnover remained low at 23.4%, a sign that renters are staying put in a high-cost environment.

Canadian Apartment Industry Report

A market in transition — not retreat

Multifamily remains a stabilizing force in Canada’s housing system. Federal and provincial governments continue to introduce incentives aimed at improving affordability and increasing construction, including the Housing Accelerator Fund and development charge exemptions.

While 2025 may bring more moderate growth, Canada’s multifamily outlook remains solid. With supply finally catching up in some regions and long-term demand supported by urbanization and rental affordability, the sector is poised for continued relevance — even as the pace of change slows.

Yardi® Canadian multifamily report

In-Place Rent Growth: The year-over-year percentage increase in average monthly rents for all occupied units, including new leases, renewals and continuing leases.

Lease-Over-Lease Rent Growth (New Leases): The change in rent between a new lease and the previous lease for the same unit. This metric reflects market-level pricing trends for vacant, re-leased units.

Vacancy Rate: The percentage of all rental units that are unoccupied and available for lease at a given time.

Turnover Rate: The percentage of renters who moved out of their units within the past 12 months.

Digital Prospects Per 100 Units: The number of prospective renters who first contacted a property through digital sources, scaled to a 100-unit benchmark. Digital sources include websites, online listings, classified ads, social media and ratings platforms.

Digital Prospect Conversion Rate: The percentage of digital prospects who ultimately signed a lease at the property they inquired about.

CMA (Census Metropolitan Area): A geographic area with a core urban population of at least 100,000, used for regional comparisons.

The data in this report includes 5,700 professionally managed properties representing over 499,000 private rental units across Canada.

Top 10

Top 10 Owners

Starlight Investments

Self-Managed: NO - asset managed Number of suites owned

Number of Employees: 360+

Operates in: BC, ON, QC, NS

Website: www.starlightinvest.com

**Apt: 55,000

55,000

QuadReal Property Group

Self-Managed: YES

Number of Employees: 480

Operates in: BC, AB, ON, QC, NB, NS

Website: www.quadreal.com

**Apt: 9,861 | TH: 231 | Mfg: 22,750 | SR: 301

Number of suites owned

33,143

Homestead Land Holdings

Self-Managed:

Operates in: AB, ON

Website: www.homestead.ca

**Apt: 26,928

Number of suites owned

26,928

Yes, we can!

Since MetCap Living established itself as a leader in property management, we have routinely been asked one, simple question; “Can you help us run our property more e ectively?” And, for well over thirty years, the answer has remained — Yes, we can! Our managers are seasoned professionals, experienced in every detail of the day to day operations and maintenance of multi-unit rental properties. From marketing, leasing, finance and accounting, to actual physical, on-site management, we oversee everything.

We concentrate on revenue growth, controlling expenses, and strategic capital investment in your property to maximize your profitability over the long term — when you’re ready to discuss a better option; we’ll be there. You can count on it.

Kazi Shahnewaz Director, Business Development

O ce. 416.340.1600 x504 Cell. 647.887.5676

k.m.shahnewaz@metcap.com www.metcap.com

Realstar Management

Self-Managed: YES

Number of Employees: 900

Operates in: BC, AB, SK, ON, QC, NS

Website: www.realstar.ca

**Apt: 23,000

Number of suites owned

23,000

Hazelview Investments

Self-Managed: YES

Number of Employees: 650+

Operates in: AB, SK, MB, ON, QC, NS

Website: www.hazelview.com

**Apt: 22,665

Number of suites owned

22,665

Mainstreet Equity Corp.

Self-Managed: YES

Number of Employees: 596

Operates in: BC, AB, SK, MB

Website: www.mainst.biz

**Apt: 17,017 | Condo: 50 | TH: 1,193 | Sr: 241

Number of suites owned

18,501

17,851

11,674

Park Property Management

11,245

Effort Trust

10,318

Top 10 Managers

Cogir

Number of Employees: 20,000*

Number of Suites Managed

Number of Suites Owned

Operates in: BC, AB, SK, MB, ON, QC, NS, 60,213 12,941

Website: www.cogir.net

**Apt: 22,143 | Sr: 37,570 | Student: 500

*includes senior residences staff

Tribe Management Inc.

Number of Employees: 286

Operates in: BC, AB, ON

Number of Suites Managed Number of Suites Owned

49,843 0 Website: www.tribemgmt.com

**Apt: 18,206 | Condo: 31,637

MetCap Living Management Inc.

Number of Employees: 507 Number of Suites Managed Number of Suites Owned

Operates in: BC, ON, QC, NB, NS

Website: www.metcap.com

**Apt: 20,606

20,606 0

We Market

Top 10 Managers

Greenwin Corp.

Number of Employees:

Operates in: ON

Website: www.greenwin.ca

**Apt: 20,529

20,529 2,336

Sterling Karamar

Number of Employees:

Operates in: ON 19,558 0 Website: www.sterlingkaramar.com

**Apt: 19,558

Operates in: ON 11,906 0 Website: www.briarlane.ca

**Apt: 11,906

Group

Berkley Property Management

Shelter Canadian Properties Limited

CAPREIT

Self-Managed: YES

Number of Employees: 999

Operates in: BC, AB, SK, ON, QC, NS, NB, PEI

Website: www.capreit.ca

**Apt: 44,188 | TH: 2,712

Boardwalk REIT

Self-Managed: YES

Number of Employees: 1,575

Operates in: BC, AB, SK, ON, QC

Website: www.bwalk.com

**Apt: 28,892 | TH: 5,368

Killam Apartment REIT

Self-Managed: YES

Number of Employees: 750

Operates in: BC, AB, ON, NB, NS, PEI, NL

Website: www.killamreit.com

**Apt: 18,569 | Mfg: 5,975

Number of suites owned

46,900

Number of suites owned

34,268

Number of suites owned

24,554

Centurion Asset Management Inc.

Self-Managed: YES

Number of Employees: 414

Operates in: BC, AB, SK, MB, ON, QC, NS

Website: www.centurion.ca

**Apt: 21,729

Number of suites owned

21,729

Skyline

Self-Managed: YES

Number of Employees: 991

Operates in: BC, AB, SK, MB, ON, QC, NB, NS

Website: www.skylineapartmentreit.ca

**Apt: 21,140

Number of suites owned

21,140

Avenue Living

Self-Managed: YES

Number of suites owned Number of Employees: 347

Operates in: AB, SK, MB

Website: www.avenuelivingam.com

**Apt: 16,427

16,427

Northview Residential REIT

Self-Managed: YES

Number of suites owned Number of Employees: 440

Operates in: BC, AB, SK, MB, ON, QC, NB, NS, NL, NWT, NU Website: www.rentnorthview.com

**Apt: 13,804

13,804

InterRent REIT

Self-Managed: YES

Number of suites owned Number of Employees: 484

Operates in: BC, ON, QC

Website: www.interrentreit.com

**Apt: 13,182

13,182

The Minto Group Inc.

Self-Managed: YES

Number of suites owned Number of Employees: 176

Operates in: BC, AB, ON, QC Website: www.mintoapartmentreit.com

**Apt: 7,598

7,598

Morguard North American Residential REIT

Self-Managed: YES

Number of suites owned Number of Employees: 175

Operates in: AB, ON Website: www.morguard.com

**Apt: 5,281

5,281

We’ll keep your systems top of mind, so you don’t have to!

With over 65 years of industry experience, our team is dedicated to ensuring optimal performance, resident comfort, and budget control.

Work with Enercare for reliable home services tailored to your property’s unique needs, with dedicated support from your Client Success Manager. We offer energy-efficient upgrades for multi-residential properties, servicing low, mid, and high-rise dwellings to enhance comfort and sustainability. Our expert team ensures seamless installations that meet manufacturer standards, regulations and safety codes, along with comprehensive maintenance and repair services for all systems, including:

Why choose the Enercare Advantage Program?

Enercare Advantage® offers a hassle-free, convenient solution for residents, eliminating concerns when it comes to upfront payments, costly repair service calls, and equipment replacement.* Below are additional benefits the Enercare Advantage® program provides to you and your residents:

Design

& Install

Industry leading products. NEW energy efficient equipment to offset your carbon footprint.

Quality installations done right the first time.

Service & Maintenance

HVAC maintenance to keep your equipment operating efficiently.* Service performed by fully licensed and insured technicians.

Added Benefit

Potential utility rebates on eligible equipment.

Invest in other improvement projects.

Potential welcome incentive on eligible equipment.

Ready to enhance your portfolio with reliable and energy efficient solutions? Email us at keyaccounts@enercare.ca or visit enercare.ca/support/propertymanagers

Honourable Mentions

Industry Events Tradeshow & Expo

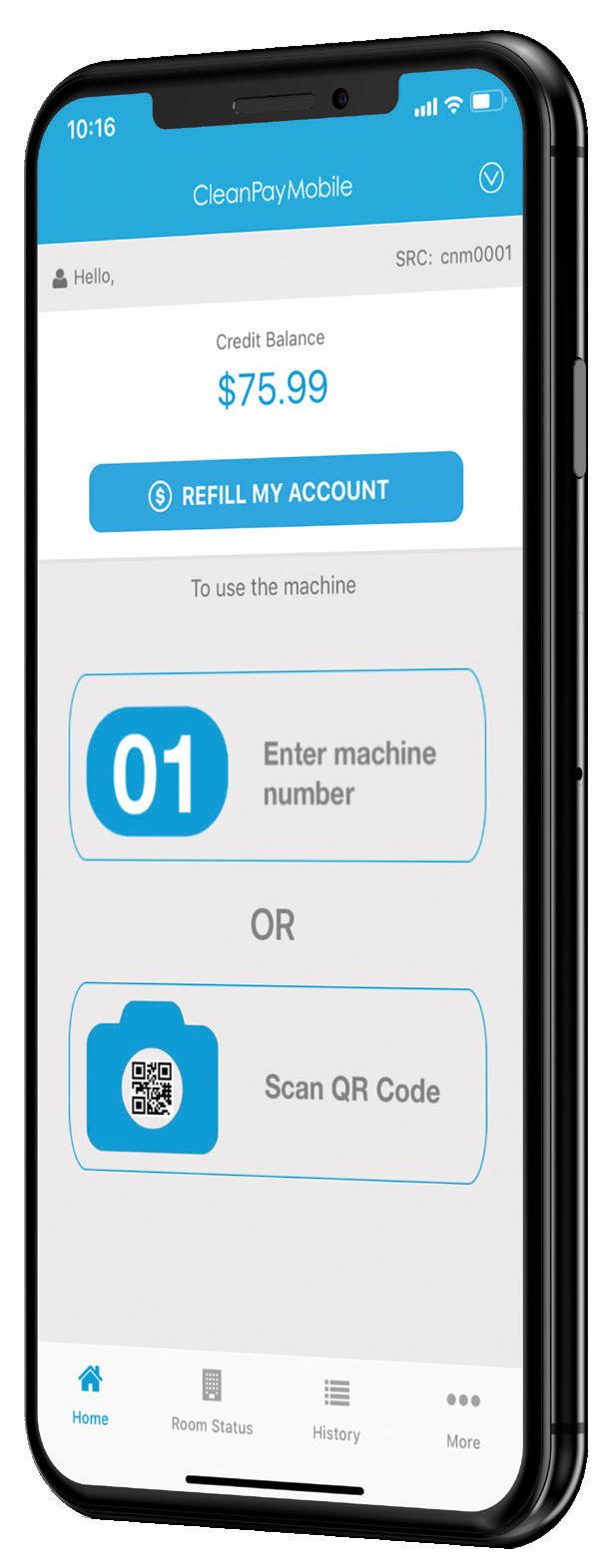

CP MOBILE APP DOWNLOAD THE APP

Do your Laundry from your Phone!

Experience our laundry payment solution that allows residents to pay using a mobile app. Let them pay how they want to pay!

Adding the convenience of mobile fosters resident loyalty, improves resident satisfaction and may increase usage by providing easy to use payment choices.

One App Does It All

More than just app payment, the Coinamatic CP mobile app makes the chore of laundry easier for residents. Depending on your specific tech bundle, you can select different modules for:

• Remote Monitoring

• Cycle Countdowns & Alerts

• Service Requests

• Laundry Education

• Refund Management

Enhanced User Experience

The ultimate benefit of a modern, digital laundry room is convenience with a variety of tools at your residents’ fingertips.

For more information contact us at:

I N C.

Canada’s One-Stop Source for the Rental Housing Industry