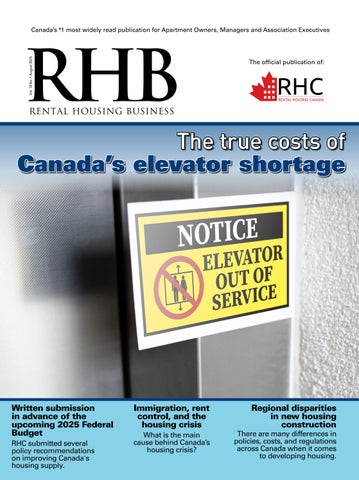

The true costs of Canada’s elevator shortage

By the time this issue reaches you (either via Canada Post or digitally), I will have visited and returned from London and Paris. I took the family on vacation, visiting two of the most beautiful cities in Europe. I’ve never been to either city, so it was a unique experience for all three of us. I created rough itineraries for each day, but other than planning to see the Louvre (I bought tickets in advance), most of our time was spent exploring the beautiful sights, doing some shopping (a must for my daughter and wife), and eating some amazing food. We did most of our touring by foot.

This issue of RHB Magazine features an examination of Canada’s elevator shortage in the multifamily housing industry. It costs three times more to install an elevator in a mid-rise building in Canada when compared to a similar building in Europe (my six-storey hotel in Paris had a three-person elevator). Topics covered in the article include the design divide, policy and regulatory gaps, reasons for higher elevator costs, potential solutions to this problem, and reevaluating Canada’s national housing strategy.

The second article describes the regional disparities in new housing construction across Canada. We examine the discrepancies between cities and provinces with respect to home building, zoning differences, home building costs, surety bonds and CMHC’s MLI Select program, and one potential solution to building more housing. The third article discusses the relationship between immigration levels, rent control, and the housing shortage.

Don't forget to read RHC’s newsletter, National Outlook, as well as the Regional Association Voice. FRPO provides an update on the homebuilding situation in Ontario. Yardi Canada wraps up this issue with a discussion of how to market effectively to reach today’s renters. Make sure to check out the digital edition of the magazine, which features content not found in these pages.

We enjoy hearing from our readers, and we want to support twoway communication. If you have any comments or questions, send them to david@rentalhousingbusiness.ca. I look forward to your emails.

Publisher Nishant Rai nishant@rentalhousingbusiness.ca

Editorial

David Gargaro

david@rentalhousingbusiness.ca

Creative Director / Designer

Scott Clark

National Director, Sales and Marketing

Melissa Valentini

melissa@rentalhousingbusiness.ca

Sales Executive

Justin Kreslin

justink@rentalhousingbusiness.ca

Office Manager

Geeta Lokhram

Principal

Marc Côté

marc@rentalhousingbusiness.ca

Subscriptions

One year $49.99 Cdn

Two years $79.99 Cdn

Single copy sales $9.99 Cdn

Opinions expressed in articles are those of the authors and do not necessarily reflect the views and opinions of the RHC Board or management. RHC and RHB Inc. accept no liability for information contained herein. All rights reserved. Contents may not be reproduced without the written permission from the publisher. P.O. Box 696, Maple, ON L6A 1S7 416-236-7473

Produced in Canada

the issue!

David Gargaro Senior Editor

All contents copyright © RHB Inc. Canadian Publications Mail Product Sales Agreement No. 42652516

your Laundry from your Phone!day.

our laundry payment solution that allows residents to pay using a mobile app.

More than just app payment, the mobile app makes the chore of laundry easier for residents. Depending on your specific tech bundle, you can select different modules for:

• Remote Monitoring

• Cycle Countdowns & Alerts

• Service Requests

• Laundry Education

• Refund Management

The ultimate benefit of a modern, digital laundry room is convenience with a variety of tools at your residents’ fingertips.

For more information contact us at:

Full-Service Laundry Room Management! Let us take the hassle out of laundry for your Multifamily, Campus or Hospitality property, with no upfront costs.

From machine and parts sales to installation and service, we’ve got you covered.

This issue of National Outlook provides an advocacy update from Rental Housing Canada (RHC). It also includes an overview of RHC's written submission to the Liberal government on policy updates and summaries of two recent CMHC reports.

RHC has moved to scale up outreach and engagement with the new federal Liberal government. We are encouraging the government to move forward on recently announced policies that will help to promote much needed rental housing development. We also submitted recommendations to the federal Liberal government on policy directives to implement that would help to address the housing situation. See pages 35-39 to read more about what RHC had to say on these issues.

The Canada Mortgage and Housing Corporation (CMHC) recently released two new housing reports. On July 24, CMHC put out the summer update of its 2025 Housing Market Outlook, which explores trends, supply, and other key issues in Canada’s major markets. The update finds Canada’s housing market is still in a period of adjustment. The combination of weaker economic growth, reduced population inflows, and ongoing trade- related uncertainty is creating a softer market environment. Earlier in the month, on July 8, CMHC published the mid-year Rental Market Update report, which provides an update on rental market conditions across Canada. It builds on insights

from the 2024 Rental Market Report, using alternative data sources, and includes insights obtained through market intelligence from industry experts. See pages 39-41 to read the highlights of both reports.

If you are not already a direct member of Rental Housing Canada, please consider joining RHC as a Direct Rental Housing Provider Member or a Suppliers Council Member.

Visit www.rentalhousingcanada.ca today.

Tony Irwin President and CEO, RHC and

FRPO

35. RHC has scaled up outreach to the new Liberal government in its efforts to advocate for the rental housing industry.

38. RHC wrote a number of policy recommendations for the federal government that if implemented would help to increase housing supply while ensuring affordability.

40. CMHC recently released two new housing reports: the 2025 Housing Market Outlook, which explores trends, supply, and other key issues in Canada’s major markets, and the mid-year Rental Market Update report, which provides an update on rental market conditions across Canada.

To subscribe to RHC’s e-Newsletter, please send your email address to admin@rentalhousingcanada.ca.

Rental Housing Canada (RHC) (formerly the Canadian Federation of Apartment Associations (CFAA)) is the leading national voice for Canada’s rental housing sector representing owners, managers and builders of nearly one million residential rental units across Canada.

RHC advocates for policies that enable our members to grow, invest, manage and build purpose built rental housing which provides quality rental homes for more than 10 million Canadians. For more information about RHC itself, see www.rentalhousingcanada.ca or telephone 613-235-0101.

Corporation des Propriétaires Immobiliers du Québec (CORPIQ) www.corpiq.com P: 514-748-1921

Eastern Ontario Landlord Organization (EOLO) www.eolo.ca P: 613-235-9792

Federation of Rental-housing Providers of Ontario (FRPO) www.frpo.org P: 416-385-1100, 1-877-688-1960

Greater Toronto Apartment Association (GTAA) www.gtaaonline.com P: 416-385-3435

Hamilton & District Apartment Association (HDAA) www.hamiltonapartmentassociation.ca P: 905-632-4435

Investment Property Owners Association of Nova Scotia (IPOANS) www.ipoans.ns.ca P: 902-425-3572

LandlordBC www.landlordbc.ca P: 1-604-733-9440

Vancouver Office P: 604-733-9440

Victoria Office P: 250-382-6324

London Property Management Association (LPMA) www.lpma.ca P: 519-672-6999

New Brunswick Apartment Owners Association (NBAOA) www.nbaoa.ca jbrealsetate@nb.aibn.com

Manufactured Home Park Owners Alliance of British Columbia (MHPOA) www.mhpo.com P: 1-877-222-4560

Professional Property Managers’ Association (of Manitoba) (PPMA) www.ppmamanitoba.com

P: 204-957-1224

Saskatchewan Landlord Association Inc. (SKLA) www.skla.ca P: 306-653-7149

Waterloo Regional Apartment Management Association (WRAMA) www.wrama.com P: 519-748-0703

Garage & Balcony Assessment & Restoration

Building Cladding Design, Assessment & Remediation

Roofing System Design, Assessment & Remediation

Building Condition Assessments

Capital Planning

Building Renewal

Energy Audits and Modelling

Largest Primary Rental Markets by Unit Count in Eastern Canada

1 Halifax, NS - 59,725

2 Moncton, NB - 16,825

3 Saint John, NB - 10,726

4 Fredericton, NB - 10,255

5 Chartlottetown, PEI - 6,462

6 St. John’s, NL - 4,322

By David Gargaro

In addition to having an affordable housing crisis, Canada has an elevator shortage. This problem is more pronounced for residents of high-rise condos and rental properties, especially when they must wait 15 minutes or more for an elevator… or worse, take the stairs. Across Canada, many multifamily residential buildings have the bare minimum of elevator capacity—just two elevators for 20 or more floors. When one elevator is out of service, the other one bears the full load, which leads to long waits, crowding, and frustration.

Compare this to the standard in many European countries. On average, there are more elevators per building, and they are faster, smaller, and have more responsive systems that support density and efficiency. In Canadian buildings, elevators are often an afterthought; they’re necessary but an expensive part of construction. In Europe, they’re an essential part of the building’s vertical infrastructure.

Having an elevator is about more than comfort: it affects the accessibility, reliability, and livability of multifamily housing.

Even though Canada is an urbanized nation, there are about four elevators for every 1,000 people. While we are slightly better off than the U.S., we are well behind most European nations. Switzerland, which has half the population of Ontario, has four times as many elevators. Greece has 10 times as many elevators as Canada on a per capita basis.

In Canada, one elevator will serve an average of more than 100 apartments. In Europe, the ratio is about 30. Most European jurisdictions allow construction of “point access block” apartment buildings, which are lower, squatter, and configured around one winding staircase. Europe tends to take a proactive approach to elevators. In Germany, the Netherlands, and Sweden, many buildings have a relatively high elevator-to-unit ratio, which reduces wait times and mitigates service disruptions. Many European mid-rise buildings (i.e., six to eight storeys) have at least one elevator, even if not required by law. In Canada, buildings below seven storeys may not have even one elevator.

High-rise buildings in Europe are designed with redundancy in mind. They will have three or four elevators serving fewer units than a comparable Canadian multi-unit building. The difference is due not only to design culture but also regulations and expectations of convenience and accessibility.

Why does Canada have fewer elevators?

Canada’s lack of elevators is due to outdated building codes, cost-driven design, and a regulatory landscape based on compliance rather than performance. Many Canadian developers focus on the bottom line due to lower margins. As a result, they include the minimum number of elevators required under provincial building codes; this often means two elevators for buildings above six storeys. Adding a third or fourth elevator is a luxury rather than a necessity, and will detract from the number of units for sale or rent.

“Elevators take up a lot of space in a building,” said Phil Staite, President, Quality Allied Elevator. “Residential buildings would prefer to maximize the rentable space of sellable space. Many new residential buildings are under-elevated for the building population. Traffic studies detailing the floor space and building population should be part of the Ontario Building Code to regulate the number of elevators required in a building.”

In Europe, public and municipal housing projects often set a higher standard. However, Canadian

building norms rarely require developers to include extra elevator capacity. Municipal planning departments do not evaluate elevator wait times or redundancy. Elevator planning becomes an exercise in checking the requirement off the list rather than a thoughtful part of designing a building to elevate the resident experience.

“Most residential buildings constructed today are under-elevated,” said Staite. “Also, a lot of buildings that were constructed for one family per apartment have multiple generations living in the same space, significantly increasing the building population, putting even more stress on the elevators. The elevators travel much more than designed, which leads to components wearing out faster. Elevators may be out of service because components have prematurely worn, putting even more stress on the remaining elevators and the cycle continues.”

Canada’s outdated building codes exacerbate the issue with the lack of elevators. Elevator requirements have not evolved at the same pace as the country’s shift toward building taller and denser residential developments. Canadian regulations do not make elevator redundancy a significant concern, even when new towers house hundreds of residents. Building code regulations focus on meeting minimum safety and accessibility standards rather than achieving optimal performance.

The key issue is that Canada’s elevator codes rely heavily on the codes written for and by U.S. building authorities. U.S. elevator codes (and therefore Canadian elevator codes) regulate numerous issues, including how elevators are designed, built, maintained, and tested. As a result, they also define what companies can and cannot sell elevators within the North American market. North America’s elevator codes are different from European elevator codes; most of the world follows the latter. The U.S. makes up just 5 per cent of the global elevator market, and yet it has fewer elevators than Spain (which has less than half the number of multifamily residential buildings).

“Canada has a harmonized Elevator Safety Code with the United States,” said Staite. “Each province has its own authority having jurisdiction (AHJ) and choses which version of the code they want to adopt and if there are areas of the code they do not want to adopt. Ontario’s AHJ, the Technical Standards and Safety Authority (TSSA), is an early adopter. This adds many costs to both new and existing elevators.”

Europe operates on a different standard. Some countries include vertical transportation modeling in the building approval process. Their policies

In 2024, the Center for Building in North America (a thinktank in Brooklyn) published a comprehensive report on how to make elevators more affordable and accessible for the U.S. market. The full report and its summary are available here: https://www.centerforbuilding.org/reports.

The report suggests that Canadian and American regulators should consider changing certain attitudes.

• First, regulators must holistically consider safety and accessibility. There is an inverse relationship between elevator cost and access: whatever increases the cost of elevators comes at the expense of increasing accessibility in buildings. Stricter safety requirements mean those who depend on them will end up being deprived of those measures due to higher costs. Therefore, regulators should take a bigger picture approach when doing a costbenefit analysis of safety and accessibility.

• Second, regulators must pay more attention to international best practices. While the elevator industry has become more global, North American regulations are becoming less so. Canadian and U.S. regulators should give more credence to practices approved outside of North America, especially when elevators are more affordable and accessible in those markets.

To follow are the report’s summarized recommendations, which can be applied to Canadian elevators.

1. Allow 1.1 m × 1.4 m European wheelchair elevators (without a wheelchair turning radius or accommodation for a stretcher) in small new apartment buildings, at risk of having no elevators at all (or never being built).

2. Allow additional relief on wheelchair turning radii in elevator cabins in larger buildings where developers provide a higher ratio of elevators to apartments.

3. Require elevator cabins to accommodate stretchers only for high-rise buildings (where the highest occupied floor or roof is more than 75 ft above the lowest level of fire department vehicle access).

4. Require elevators in multifamily buildings above three or four stories, in conjunction with cost- and size-reducing reforms.

Technical codes and standards

5. Do not allow jurisdictions to deviate from the latest ASME A17.1/CSA B44 elevator safety code.

6. Harmonize the A17.1/B44 code with the global European standard.

7. Roll back elevator hoistway opening protection requirements for most buildings.

8. Roll back visual communication requirements for most buildings.

9. Allow elevator mechanic licenses to be seamlessly transferred between states.

10. Create legal immigration pathways for construction workers.

11. Develop more technical and vocational programs in public high schools to train workers for the construction industry.

For over 30 years, Quality Allied Elevator has created practical solutions for all your elevator service, maintenance and modernizations.

We are dedicated to our customers and pride ourselves in customer communication

evaluate wait times, peak traffic hours, and operational resilience during outages. Canada does not have this type of holistic framework. Municipalities could help to drive change by incorporating elevator performance metrics into site plan approvals or incentives. However, there are no clear provincial standards or funding incentives that would encourage cities to make these changes. As a result, city councils are reluctant to demand more from developers who face high development charges and approval delays.

Cost is the most common concern for developers when designing buildings. The same goes for determining whether to add another elevator. Installing an elevator shaft can range from $150,000 to $250,000, depending on the building type and elevator system. This is a significant expense when projects already face rising land prices, development charges, and interest rates. It should be noted that the North American elevator industry is dominated by four multinational corporations: Otis, Schindler, Kone, and ThyssenKrupp. As with any industry, fewer competitors mean higher prices and fewer options for companies that need elevators. And when you’re forced to use proprietary technology and receive service from approved contractors, prices go up even more.

Canada has a cost problem regarding elevator installation when compared to European counterparts. It is at least three times more expensive to install an elevator in a new mid-rise building in Canada compared to a similar building in western Europe. Ongoing expenses, such as service contracts, repairs, modernizations, and periodic inspections, also cost more in Canada than they do in Europe.

Due to the high cost of elevators in Canada, some smaller buildings have no elevators at all, which limits accessibility. Larger buildings also tend to have fewer elevators than they should, which means longer wait times and more disruption when one car is out of service. There is more small-scale infill growth occurring in Canada, as smaller rental and condo buildings are becoming more viable due to pending reforms to singlestair and land use regulations. However, the high cost of elevators is becoming a greater barrier to the development of more affordable, accessible homes.

Three main factors drive up the cost of Canada’s elevators:

1. Larger elevator cabins

Elevator cars in Canada and the U.S. tend to be about twice as large as European elevators, due

to regulations requiring the accommodation of people in wheelchairs and medical emergencies (including a 7-foot stretcher). In Europe, mid-rise multifamily buildings only require elevators to be large enough to accommodate a wheelchair plus a person standing behind it (stretchers are not required in mid-rise buildings). Larger elevators cost more and take up more space, which limits how many elevators can be installed in buildings. If North America were to allow European-sized elevators in mid-rise buildings, they would cost from 13 to 44 per cent less.

2. Availability of skilled labour

There is a skills shortage in North America’s elevator industry, which increases labour and manufacturing costs. North America’s main elevator union (the International Union of Elevator Constructors) makes it difficult for workers to enter the field. The North American immigration system also makes it challenging for foreign trained workers to enter the skilled trades. Conversely, the European Union allows free movement of workers across borders, which enables European firms to hire experienced elevator professionals as needed. Both the U.S. and Canada have relatively weaker technical and vocational educational systems at the high school level, which reduces the pool of native-born workers. This forces North American companies to outsource manufacturing and repair, which is more expensive.

3. Strict technical codes and standards

Most of the world has harmonized with dominant European elevator standards. The U.S. and Canada use the ASME A17.1/CSA B44 elevator safety codes, which differ from Europe’s EN 81 family of codes that have been adopted into the ISO 8100 global standard. Many parts must be separately certified to comply with both sets of standards; some elevator manufacturers choose not to spend the money to do so. Canada’s elevator regulations limit what elevators and equipment they can use in buildings; fewer elevator options results in higher purchasing and maintenance costs. For example, China’s WECO is one of the world’s largest manufacturers of detectors (i.e., they prevent the doors from slamming shut on people entering and exiting the elevator). They sell 20 different product series in Europe, but only six models in Canada.

“In Italy, you get a lot of smaller elevators, some as small as 200 kilograms or 500 pounds, and about 30 inches deep, which is good for one or two people,” said Rob Isabelle, P.Eng., Chief Operating Officer, KJA Consultants Inc. “They cost less and they’re easier to install. Those do not exist in Canada. Minimum capacity is 900 kilograms or 2100 pounds, and they cost three times as much.”

The cost of elevator installation is not the only consideration. Adding a third elevator to a highrise building could reduce wear and tear on the other two elevators. This would decrease longterm equipment maintenance costs. Having more elevators also means less crowding, reduced downtime, and improved tenant satisfaction, which are key factors for improving retention in competitive rental markets.

“An elevator in a properly elevated building would stop about 600 to 800 times per day,” said Isabelle. “If it’s under-elevated, you could have 1000 to 1200 stops per day. The more stops you have, the quicker it’s going to wear out and the sooner you must replace it.”

When a building with two elevators has an outage, the system is halved. If the building has three elevators, losing one elevator leaves two in operation. This means shorter wait times, fewer complaints, and lower long-term service costs. Investing in a third or fourth elevator is an upfront expense that could yield savings and operational benefits over the building’s lifetime.

“It’s cheaper to add an elevator during the development stage. If you are one elevator short, the existing units will be excessively busy, accelerating wear and tear and increasing tenant frustration, possibly lowering rents," added Isabelle. “Spending $400,000 upfront could yield an extra two to three million dollars over a 30-year period.”

Some Canadian municipalities are exploring alternatives to the typically Canadian approach to elevator design. Langford, BC is piloting the use of compact European elevator systems that cost less than current models to install and maintain. These systems have smaller footprints and are designed for lighter use, which makes them easier to retrofit in mid-rise and low-rise buildings. The District of Saanich voted to send a resolution to call on the province to legalize smaller and less expensive European-style elevators in low- and mid-rise buildings where an elevator would not typically be installed.

Elevator technology has advanced, improving responsiveness and efficiency. For example, destination dispatch optimizes travel by grouping riders by floor, while predictive maintenance tools are making elevators smarter, faster, and more resilient. These systems are more commonly used in commercial buildings; however, they could be adapted for residential use, especially in high-density urban areas that tend to experience elevator bottlenecks.

Building owners and developers are also revisiting space allocation. Developers have rejected the idea of adding elevators in the past because it meant losing one or more revenue-generating units. However, removing units can make the rest of the building more livable, as well as more valuable, over the long term. This becomes more integral in markets that depend on tenant satisfaction and reviews to maintain a property’s reputation.

Canada plans to build approximately five million new homes by 2030. Most of those will include mid- and high-rise buildings. However, current housing policy does not consider the infrastructure inside those buildings, including elevators. As population density increases, policy developers should consider treating elevator capacity as core infrastructure, much like plumbing, heating, and electrical requirements. Elevators are not a convenience, particularly in multifamily buildings. They are essential for addressing accessibility, enabling people to age in place, and ensuring equitable urban living. When elevators break down, or when residents are required to wait more than ten minutes to use them, it undermines the building’s functionality and residents’ dignity.

Adding more elevators will not solve the housing crisis. However, ignoring their value risks creating functionally inadequate buildings. Consider what is happening today with so many condos that were built based on return on investment rather than meeting families’ needs. People may appreciate energy-efficient buildings with numerous amenities, but they won’t want to live there if they must constantly wait for the elevator.

If Canada wants to build more high-density, affordable, and livable housing, we must think vertically. This does not mean adding more floors but finding ways to move people more efficiently within those spaces. Elevators are essential to achieving this goal; right now, we’re not meeting the challenge.

Fortunately, solutions to this problem exist. Canada can learn from European models by adjusting building codes, incentivizing developers to pursue better vertical design, and integrating existing and emerging technologies. By prioritizing livability alongside affordability, we can build more and better housing. And we can finally stop waiting as long for the next elevator.

HD Supply Offers Maintenance, Repair & Operations products and services. Everything you need. All in one place.

Flexible delivery options, from next-day to scheduled drop-offs at your site.

Save time and money with customizable e-Procurement solutions built for your business needs.

Whether it’s routine maintenance and repairs, property upgrades, or suite turn renovations, our dedicated team is committed to delivering a seamless experience every step of the way.

Thousands of products in stock every day, plus access to thousands more we can source on your behalf. Essential categories available, including:

Trade credit, job quotes & bulk pricing options available. • Appliances • Plumbing • Tools • Flooring • Paint & Sundries • Cleaning & Janitorial

• Grounds Maintenance • Fire Safety

• Hardware

• Electrical

• Cabinetry

• HVAC

• Lighting

• Personal Protective Equipment

• And MORE!

Plus, Exclusive Brands that deliver quality, style & value.

By David Gargaro

Canada is facing a severe housing crisis. In 2022, the Canada Mortgage and Housing Corporation (CMHC) stated we would need to build 5.8 million new homes by 2030 to get housing back to more affordable levels. We are currently on pace to build 2.3 million new housing units in this time, which means another 3.5 million housing units (or 500,000 additional homes per year) will be needed to meet this goal.

The federal government has pledged to double national home building by 2035. Based on the current rate at which homes are being built, this is unrealistic. Ontario is the primary reason why Canada won’t meet its housing development goals. In the first half of 2025, Ontario’s housing starts fell by 25 per cent compared to last year, while the rest of Canada had a 17 per cent increase over the same period.

Canada’s inability to meet its housing goals is not the fault of one province or due to one key obstacle. Local policies, costs, and regulations have created deep regional disparities in housing development, adding to the challenges facing developers in getting more housing built.

Alberta is experiencing a surge in new housing starts. According to Bank of Montreal data, over the first six months of 2025, Alberta had 27,902 new housing starts, an increase of 30 per cent compared to 2024. This puts it on pace for nearly 59,000 new housing starts, which would be a new record and nearly equal Ontario’s capacity. Calgary, Edmonton, Lethbridge, and Red Deer have seen significant increases in housing starts. The province also leads the country in housing construction, representing about one quarter of all Canadian housing starts.

Conversely, over the first six months of 2025, Ontario had only 27,368 new housing starts, a

25 per cent decline from 2024 and a 35 per cent decline from 2023. There were more housing starts in the first six months of 2020 (33,588), even though COVID-19 had shut down much of the industry. From 2022 to 2024, Ontario averaged 86,650 new housing starts per year, which is just more than half the 150,000 starts required to meet Premier Doug Ford’s target of 1.5 million new homes by 2031. Some cities (like Ottawa) are seeing significant growth, while others are experiencing significant declines. For example, new housing starts in Toronto have dropped by 44 per cent, while Guelph has declined by 76 per cent compared to last year.

Some provinces and municipalities make it easier for developers to get shovels in the ground for new housing projects. Let’s compare Toronto and Edmonton to understand the differences.

Ontario has strict provincial and municipal zoning bylaws and design requirements. In some cases, land zoned for residential use may only allow single-family homes. Some zoning restrictions force developers to either build single-family homes or condo towers. This means “middle ground” developments (such as fourplexes and sixplexes) cannot be built. Even though Toronto has voted to permit these developments, city council has repeatedly stopped them from going ahead. These types of properties can add density and reduce costs for buyers, addressing a gap in the housing market. Many municipalities (particularly Toronto) have onerous permit approval processes, which increases the time and cost required to get projects built.

Compare this with cities in Alberta. Edmonton is one of the fastest cities in Canada with respect to approving new housing developments. The city’s zoning regulations are less restrictive, which means a more streamlined development process and lower costs. Calgary and Edmonton have more available greenfield land (i.e., previously undeveloped land in rural or urban fringes). This supports the development of a broader mix of housing types, including ground-related homes, which tend to be more affordable.

Approval timelines vary widely across Canadian municipalities. In 2022, it took an average time of seven months to get a development approved. In Toronto, the average approval timeline was 32 months, or almost three years. This backlog is due to a combination of stacked municipal and provincial development fees, zoning bylaws, building codes, official plans, and design guidelines.

Taxes, development charges, municipal levies, and other fees continue to increase the costs of building new homes. Housing is taxed at double the rate of the rest of the economy. Government taxes and fees can equal one third of the total cost of a new home, which is more than the cost of the land and more than 50 per cent of hard construction costs. Multifamily developers must increase rents to cover these costs, which makes it more difficult for tenants to find housing that meets their income levels.

The federal government is trying to address the costs associated with building different types of housing projects. It has pledged $35 billion to finance new affordable and middle-income housing projects. The federal government has stated it will halve development charges for multifamily housing by providing municipalities with financial support on hard infrastructure costs (e.g., water, sewer, electrical). However, the provinces have allowed municipalities to add charges for soft infrastructure that should be funded through general revenues (rather than on the backs of developers, homebuyers, and tenants). One way to make the provinces take a hard line with municipalities is to force them to lower housing taxes to qualify for federal funding of local infrastructure.

Comparing development charges in Edmonton and Toronto demonstrates the vast differences in the cost to build homes in these two cities. According to a 2022 municipal benchmarking study from the Canadian Home Builder’s Association (CHBA) and the Altus Group, development charges cost $6,599 per high-rise unit in Edmonton versus $99,894 per high-rise unit in Toronto (that’s a $93,000 difference). Toronto’s development fees have also increased by more than 900 per cent since 2010. In 2024, Altus Group published a guide on residential construction costs for high-rise buildings in Canadian cities. Costs ranged from $295 to $345 per square foot in Edmonton, compared to $340 to $425 per square foot in Toronto.

Taxes increase the costs of developments and decrease developers’ margins, resulting in less return on investment and higher risk of return. According to a 2024 report by the Canadian Centre for Economic Analysis (CANCEA), developer margins have decreased from 14 per cent to 10.7 per cent in Ontario. Government taxes on new Ontario homes include income tax (8.1 per cent), corporate taxes (2.5 per cent), sales taxes (10.8 per cent), production taxes (12.3 per cent), and transfer taxes (1.8 per cent). These “taxes on taxes” increase new home development costs, raising the cost to purchase or rent a home while reducing the financial feasibility of new home building projects.

High interest rates are another barrier to building multifamily housing. On July 30, the Bank of Canada announced it would be holding its policy interest rate at 2.75 per cent. Some analysts see this as a stabilizing move, particularly in the face of U.S. tariffs. However, many housing and mortgage experts argue it falls short. According to the Canadian Mortgage Brokers Association of Ontario (CMBA Ontario), holding rates stable will

make it more difficult for homeowners to purchase homes. Keeping the interest rate stable will also delay or cancel projects for developers seeking more affordable financing options.

CMHC’s MLI Select, a mortgage loan insurance program for multifamily buildings, supports the development, acquisition, and refinancing of multi-unit residential properties that meet specific criteria. It enables developers to access high-leverage financing, extended amortization periods, and low-cost capital. The program uses a point system to calculate the level of available insurance incentives.

On November 15, 2024, CMHC changed the MLI Select program with respect to how it enforces the requirement for surety bonds, creating new challenges for developers. While bonding was technically required before the change, the requirement for surety bonds was rarely enforced when developers acted as general contractors. CMHC determined the developer’s financial stake and oversight reduced the perceived construction risk. Projects could proceed without securing formal bonds.

CMHC is now enforcing the surety bonding requirement for almost every project, even if the developer manages construction internally. Many developers have been caught off guard by the change, often discovering the requirement later in the financing or planning stages. Securing a bond requires time, financial vetting, and underwriting, which can be a challenge for smaller or lessestablished builders.

“For those unfamiliar with the qualification process or the level of financial disclosure required, the shift has been significant,” said Slava Kolmatskyy, Vice President, Surety, NFP Canada. “Projects structured as new corporations, often with minimal assets, face added hurdles. The learning curve is steep, leading to delays, higher costs, and, in some cases, risk to the project’s viability. Without the bond, CMHC funding is withheld, putting early investments in jeopardy.”

Rental property owners can overcome regional development obstacles by building new units on existing land. Intensification accelerates building timelines, makes use of in-place infrastructure, adds density to the property, and supports reinvestment into the existing buildings.

In 2019, Beaux Properties built a 32-storey, 420unit condominium development on a surplus parking lot of a AAA property in midtown Toronto. The goal was to unlock dormant land value, as well as add value to the existing apartment building through proper site integration and improvements. They worked with an architect, consultants, and condo developer to move the process forward.

“Start with a business plan and carefully consider your goals for the site,” said Jason Birnboim, President, Beaux Properties International Inc. “Maximizing the profit on paper should not be your number one objective if you can’t realistically achieve it. Today there are far more sites available for development than demand for new product. Only consider such an endeavour if you can afford to wait out the market cycle.”

Hazelview Investments began with a 1970s-built tower in midtown Toronto and an underutilized surface parking lot. This two-phase, purposebuilt rental development resulted in the addition of 500 new rental homes. Building on pre-zoned land reduced entitlement risk and lowered soft costs tied to land acquisition and approvals. This enabled them to redirect capital into high-quality design, sustainability features, and resident-first programming, as well as reinvest in the existing buildings.

“For property owners looking to replicate this approach, our advice is simple: start by looking inward,” said Michael Williams, Managing Partner, Head of Development, Hazelview Investments.

“Many sites, especially older rental communities, hold untapped potential. By integrating ownership thinking, smart design, and collaboration with municipalities, we can collectively scale housing without waiting years for rezoning.”

Canada’s housing crisis is a complex national issue shaped by deeply entrenched regional and municipal disparities. Alberta and other provinces have been able to accelerate homebuilding through streamlined zoning, lower costs, and supportive policies. However, some provinces (such as Ontario) are struggling under the weight of red tape, high development charges, and prohibitive taxes. Federal efforts to encourage multifamily property development and affordability are being undercut by provincial and municipal policies that drive up costs and delay progress. To close the housing gap and meet federal housing targets, all levels of government must align on a unified strategy that cuts red tape, lowers financial barriers, and treats homebuilding as an urgent national priority.

By David Gargaro

Canada’s immigration policy has often been targeted as a key reason for Canada’s housing crisis. Until recently, home prices and rental rates had climbed to unprecedented levels. The argument is simple: more immigrants mean more competition for housing, especially rentals, which drives up prices and puts pressure on supply. However, this explanation may be ignoring a more complex truth: local policies, such as rent control, play a more significant role in what’s happening in the housing markets, especially in provinces with the worst housing shortages.

Up until last year, Canada had ramped up immigration levels to address labour shortages, promote economic growth, and offset an aging population. In 2023 and 2024, the country welcomed 471,808 and 483,591 permanent residents, respectively. Housing supply has not kept pace with these numbers, which has led some experts to correlate population growth and housing inflation.

According to federal data, immigration plays a role in rising housing demand. However, the impact is relatively modest. A report commissioned by Immigration, Refugees and Citizenship Canada (IRCC) estimated that, from 2006 to 2021, immigration was responsible for about 11 per cent of the increase in housing prices across all municipalities with populations of more than 1,000 residents. The effect is greater in large urban centres (i.e., more than 100,000 residents). Newcomers were responsible for 21 per cent of median value home increases and 13 per cent of median rent increases. The stated every 1 per cent increase in new immigrants led to a 0.375 per cent increase in home values and a 0.086 per cent increase in rents.

However, immigration did not uniformly impact housing prices across Canada. There were statistically significant increases in BC and Ontario, where most immigrants tend to

settle. Although Alberta and Saskatchewan also experienced substantial increases in immigration levels, there were minimal changes in home values. Other factors, including local economic conditions and housing policies, seem to be more impactful on housing prices and rents.

According to one real estate industry executive, Alberta has more than enough supply, particularly newer, more expensive purpose-built rentals. In fact, vacancy rates are higher in this part of the rental housing market. However, although average rents have dropped, Alberta needs more affordable housing. To help address this imbalance, different levels of government should step in to provide more rental supports to help fill increase occupancy rates.

Rent control appears to be more strongly tied to increasing rental prices than immigration. Ontario and BC, which have strict rent control laws, reported some of the highest year-over-year rent increases in Canada. In theory, rent control should protect tenants from unaffordable rent increases. However, rent control may discourage the construction of new rental units, which can limit mobility within the market.

Rent control policies vary across Canada. Ontario caps annual rent increases for most units at or below the inflation rate. BC allows rental property owners to make slightly higher adjustments but

restricts how much rents can be increased for current tenants. Rent control legislation does not always apply to newer units or those built after a certain year. This creates a two-tiered rental market that protects older units and enables newer ones to be priced at market rate. Rental property owners have less incentive to maintain or upgrade older units if they cannot recoup their investments by charging market-rate rents. As a result, rental housing supply declines, demand increases, and rents for existing inventory rise.

According to the data, provinces with stricter rent control measures have experienced steeper rent hikes. Interprovincial migration patterns have shown residents moving away from these regions to find more affordable living.

Neither immigration nor rent control alone are responsible for the housing affordability crisis. Together, they may be making the problem worse. High immigration levels increase the need for new housing supply, especially in Toronto and Vancouver. At the same time, restrictive rent policies limit developers’ ability to respond to that demand. Since the housing market supply is low, adding more newcomers without increasing the rental housing supply (while also disincentivizing development) will prevent supply from meeting demand.

One solution is to remove constraints on supply. Creating new construction incentives would allow developers to get the financial assurances required to build more affordable housing stock. Streamlining zoning and permitting, especially for multifamily rental housing, would help to address the supply gap exposed (but not caused) by higher immigration levels. For example, Edmonton is the first Canadian city to use AI-powered technology to auto-review homebuilders’ applications, which has helped to reduce permit approvals from 20 days to one day.

If Canada wants growth through immigration, it must adapt its housing policies to match. Blaming immigration for Canada’s housing crisis is easy but does not address the challenges of supply, affordability, and regulation. Provinces with rent control must determine whether their policies are helping tenants or preventing the development of new housing. Immigration targets must also be tied to realistic housing goals and planning tools at all levels of government to ensure supply can meet demand.

By Tony Irwin, President and CEO, RHC and FRPO

Since the House of Commons adjourned for the summer, Rental Housing Canada (RHC) has moved quickly to scale up outreach and engagement with the new Liberal government. We continue to emphasize that collaboration with the rental housing industry, which supports more supply and a balanced operating environment, is critical to a healthy rental market.

During the federal election campaign this past spring, the Liberals pledged to cut municipal development charges in half for multi-unit residential housing and to reintroduce the Multi-Unit Rental Building (MURB) program, a tax incentive that spurred tens of thousands of rental housing units across the country in the 1970s. RHC is encouraging the government to move forward on both of these policies to encourage much needed rental housing development.

RHC has met or is scheduled to meet with the Prime Minister’s Office, senior staff to the Minister of Housing & Infrastructure and Minister of Finance, and a number of MPs including Jennifer McKelvie, Parliamentary Assistant to the Minister of Housing and former Deputy Mayor of Toronto. We continue to advocate for:

• The permanent elimination of the GST on new rental construction

• The introduction of a capital gains deferral similar to the 1031 exchange in the United States

• Streamlining and modernizing Canada Mortgage and Housing Corporation (CMHC) programs to reduce red tape and ensure funding is accessible and responsive to market needs

• Increasing funding available through the Apartment Construction Loan Program Looking ahead to the federal budget this fall, RHC is actively engaging with the Office of the Minister of Finance and National Revenue, and the Standing Committee on Finance (FINA). RHC has met with staff from Hon. Karina Gould’s office, Chair of the Finance Committee, to highlight RHC’s key budget priorities. We have also met with Committee member MP Jake Sawatzky, who welcomed feedback from our B.C. members on stalled developments and acknowledged the impact of tariffs on the industry.

RHC’s fall Hill Day will take place in Ottawa on November 4-5. RHC remains committed to building relationships with MPs from all parties and providing ongoing and reliable insights for our members.

RHC was pleased to see the Liberal Party commit to a number of forward-thinking actions on housing such as halving development charges over five years and reintroducing the Multiple Unit Rental Building (MURB) cost allowance. We urge the government to implement these important policies as soon as possible.

To continue in a policy direction that achieves greater supply while ensuring affordability, RHC encourages the government to adopt the recommendations outlined below. RHC thanks the Department of Finance for the opportunity to participate in the 2025 Budget Consultations and looks forward to engaging with the office further.

The 2025 Liberal Party Platform includes a commitment to reduce municipal development charges by half for multi-unit residential housing over a five-year period, in partnership with provinces and territories to ensure municipalities remain financially whole.

In Ontario, development charges have increased by over 900% since 2004, averaging 14.3% growth per year compared to a 2% annual increase in property taxes. These rising charges, combined with additional fees, taxes, regulatory barriers, slow approval processes, and declining rents, have made it increasingly difficult for purpose-built rental projects to meet investor expectations and lender requirements.

The 2025 Liberal Platform costing stated the program would begin in the 2025-26 and estimated the program would require $6 billion in annual spending. This initiative is designed to be revenue neutral for municipalities, with reduced revenues offset by increased federal investment in housing-related infrastructure such as water, power lines, and wastewater systems.

RHC calls on the Government of Canada to undertake the following:

• At minimum, halve municipal development charges for five years through a coordinated approach to infrastructure funding programs, as promised in the 2025 Liberal Party Platform

In 2024, the federal government introduced the Accelerated Capital Cost Allowance (CCA) to stimulate investment in new purpose-built rental (PBR) housing. This measure allowed builders to claim a larger first-year tax deduction for depreciation, thereby encouraging new rental housing construction.

RHC calls on the government to make this crucial program fully permanent. Additionally, the government has also indicated interest in reintroducing a tax incentive similar to the Multi-Unit Rental Building (MURB) program from the 1970s, which was highly effective in increasing the supply of rental housing. Addressing this technical barrier and aligning the incentive with a modernized MURB program would significantly improve the effectiveness of these measures and support new rental housing development.

RHC calls on the Government of Canada to undertake the following:

• Make the accelerated CCA permanent to provide certainty for rental housing providers

• Coordinate this change with the introduction of a modernized Multi-Unit Rebate (MURB) federal tax tool to further incentivize equity investment in purpose-built rental, as promised in the 2025 Liberal Party Platform

RHC recognizes that the Government of Canada has delayed the implementation date for the two-thirds capital gains increase from June 25, 2024, to January 1, 2026. However, rising interest rates, combined with double-digit increases in insurance, property taxes, utilities, and maintenance, far exceed what rental housing providers can recoup through rents. The increase should be officially abandoned, so focus can shift to finding a more suitable alternative.

Unlike the United States, Canada does not allow real estate investors to defer capital gains taxes when reinvesting in another property. Under Section 1031 of the U.S. Internal Revenue Code, proceeds from the sale of an investment property can be reinvested into property of equal or greater value. This provides a sustained source of investment for new housing and incentivizes continued growth of housing stock.

RHC calls on the Government of Canada to undertake the following:

• Direct the Canada Revenue Agency to review Section 1031 exemptions (like-kind exchanges) used in the U.S. to defer capital gains taxes for PBR projects

• Introduce a similar or equivalent program for Canadian developers, provided the proceeds are reinvested in new housing construction

Enhance and extend the GST/HST rebate for rental construction:

When the GST was introduced in 1991, Parliament ensured that renters would not be directly taxed on residential housing by shifting the tax liability to rental housing providers. RHC applauded the government’s initiative to incentivize new builds through the removal of GST on new purpose-built rentals through Bill C-56.

However, the sunset provisions for the rebate require construction to begin before December 31, 2030 and end before December 31, 2035. Given the extent and severity of the housing crisis in Canada, RHC encourages further action on this by making the rebate permanently available, so long as the GST savings are reinvested into new builds. This would further incentivize purpose-built rentals, accelerating Canada’s response to the housing shortage.

RHC calls on the Government of Canada to undertake the following:

• Work with the provinces to eliminate their tax on purpose-built rental housing, ensuring federalprovincial alignment on housing growth

• Eliminate the sunset clause and make the GST/HST rebate for PBR construction permanent to provide long-term market stability for ongoing development

• Work with the provinces to eliminate their tax on purpose-built rental housing, ensuring federalprovincial alignment on housing growth

PBR developments are multi-year projects, which require careful financial planning. The Apartment Construction Loan Program is a government initiative that offers low-interest, long-term loans to developers for building new rental apartment buildings. This program plays an important role in addressing the shortage of rental housing by making it more financially feasible for builders to start new projects.

CMHC funding approval often requires developers to submit two-year financial plans, which is difficult to calculate given the current uncertainty. Government risks hindering progress if it does not reconsider the impacts of its policies on the development pipeline.

Additionally, CMHC funding is often difficult to access. Many RHC members have described MLI Select as a “loan of last resort” due to its onerous requirements, which require applicants to submit a two-

year project budget as part of their application. To ensure rental housing programs are properly funded, accessible, and easier to navigate, RHC urges the government to streamline its approach.

RHC calls on the Government of Canada to undertake the following:

• Direct CMHC to conduct a thorough program review to ensure funding seamlessly integrates with the needs of rental housing providers

• The review should focus on:

o Streamlining application processes

o Improving accessibility

o Removing unnecessary submission requirements

o Ensuring programs are fully funded and available

• Reduce the affordability requirements in the MLI Select program to increase utilization of the program for both new construction and refinancing

• Increase funding through the Apartment Construction Loan Program (ACLP)

Solving the housing crisis cannot be done with investment and economic measures alone. One of the greatest barriers to new construction today is critical construction labour shortage. In fact, the growing construction labour shortage was cited by the CMHC as one of three factors contributing to longer construction times. Employment in the construction industry amounts to 8% of total employment in Canada. However, the share of construction workers among new immigrants and temporary foreign workers varies between 2% and 3%.

RHC calls on the Government of Canada to undertake the following:

• Adjust immigration and non-permanent-resident (NPR) programs to address workforce shortages in construction and trades

On July 24, 2025, the Canada Mortgage and Housing Corporation (CMHC) released the summer update to its 2025 Housing Market Outlook, which explores trends, supply, and other key issues in Canada’s major markets. The update finds Canada’s housing market is still in a period of adjustment. The combination of weaker economic growth, reduced population inflows, and ongoing trade- related uncertainty is creating a softer market environment.

Canada’s housing market has slowed since January, with many buyers and developers adopting a “wait and see” approach amid weak economic growth and ongoing trade uncertainty. Resale activity has declined, particularly in Ontario, British Columbia, and Alberta, while Quebec has shown more resilience due to stronger market momentum and buyer confidence. Overall, current conditions are tracking closer to the low-end scenario of the Housing Market Outlook, signaling increased downside risks.

Home prices are slipping in areas with weaker demand and more listings. The national average home price is expected to fall by about 2% in 2025, with larger declines in Ontario and BC due to reduced investor interest and elevated prices. A recovery is anticipated in 2026 as confidence and economic fundamentals improve, though new construction will likely be slower to respond due to ongoing financing challenges and developer caution.

Multi-unit construction remains historically high but varies by region. Activity will stay strong in Atlantic Canada, the Prairies, and Quebec, while dropping sharply in Ontario and BC, where high costs and low investor confidence are delaying or canceling many condo projects. Unsold inventory is rising, and developers are increasingly converting condos to rentals, adding further risk for buyers.

Low-rise construction is facing similar pressures, particularly in Ontario. However, Quebec, Manitoba, and Alberta are expected to see modest gains. Semi-detached and row housing types are proving more resilient in parts of BC.

Rental market conditions are gradually easing. New rental and condo completions are pushing up vacancy rates in major cities. Although rents are still rising, the pace has slowed due to softer demand from slower household formation, lower immigration, and weaker job markets.

Affordability remains a major challenge, especially in expensive markets. Despite modest rate cuts, mortgage costs remain high as spreads return to historical norms. Tariffs on building materials are keeping construction costs elevated, discouraging new supply and pricing many buyers out of the market.

Overall, Canada’s housing sector is undergoing a period of adjustment. Slower growth, tighter credit, and reduced population inflows are weighing on demand in 2025. However, as trade tensions ease and borrowing conditions improve, the market is expected to stabilize and return to a more balanced path by 2026.

Forecast summary: Rental markets

Vacancy rates (%) City

Sources: CREA, CMHC

Sources: CREA, CMHC

On July 8, CMHC published the mid-year Rental Market Update report, which provides an update on rental market conditions across Canada building. It builds on insights from the 2024 Rental Market Report, using alternative data sources, and includes insights obtained through market intelligence from industry experts. Highlights:

• Since October 2024, advertised rents are declining due to increased supply, while rents for occupied dwellings continue to rise at a slower pace than a year ago.

• Sluggish job markets and decelerating migration are creating challenging environments for landlords and property managers.

• Purpose-built rental supply is growing. CMHC construction financing programs and products supported an estimated 88% of Canada’s new purpose-built rental apartment starts in 2024.

• Vacancy rates are expected to rise in most major markets this year.

• Despite easing rent growth and increasing supply, rental affordability isn’t improving, especially in Vancouver and Toronto, as turnover rents are driving increases. Calgary, however, has shown a slight improvement.

Figure 1: Year-over-year change in asking rents for a 2-bedroom purpose-built rental apartment

change

(Q1 2024 vs. Q1 2023)

Year-over-year change

(Q1 2025 vs. Q1 2024)

2: Year-over-year change in rents for a 2-bedroom occupied rental unit

change

(Q1 2024 vs. Q1 2023)

Year-over-year change

(Q1 2025 vs. Q1 2024)

As we near the end of summer, I’m energized by the spirit of collaboration that continues to drive FRPO’s work and our sector forward. With the Ontario election now firmly in our rearview mirror, the PC government has a renewed focus on Ontario’s housing challenges. FRPO continues to work closely with key decision-makers to ensure professional rental housing providers remain central to the solution.

FRPO members recently met with Attorney General Doug Downey to discuss ongoing improvements to Landlord and Tenant Board (LTB) processes, and to share member input regarding Bill 10, which are important steps toward ensuring a fair, efficient, and balanced system for both providers and residents. In addition, FRPO’s Board had the opportunity to meet with Minister of Municipal Affairs and Housing Rob Flack to discuss Bill 17, which aims to accelerate building and streamline approvals across Ontario.

These regular meetings reflect our ongoing commitment to building and strengthening relationships with government at every level. As Ontario’s leadership sets to work on delivering much-needed housing, FRPO will continue to be an active, constructive partner, ensuring our members’ perspectives are heard and advocating for policies that are practical, effective, and focused on real solutions.

FRPO will continue to encourage all levels of government to prioritize and incentivize the construction of purpose-built rental housing by speeding up approvals, cutting red tape, and reducing government fees and charges to level the playing field.

Together, by fostering strong partnerships and amplifying our collective voice, I’m confident we can make real progress, delivering more homes, protecting tenants, and building a thriving, resilient rental housing market for all Ontarians.

As always, I want to thank our members for their continued dedication and professionalism. Your willingness to share your stories and insights helps us champion the value and excellence of Ontario’s rental housing sector. Don’t hesitate to reach out to us. We look forward to hearing from you.

Enjoy the rest of your summer!

Tony Irwin, President and CEO, FRPO and RHC

Ontario’s homebuilding rate falls by 25 per cent

According to data from the Canadian Mortgage and Housing Corporation (CMHC), homebuilding in Ontario has fallen in first half of 2025 compared to prior years. Over the first six months of 2025, Ontario has begun building only 27,368 new homes, which is a 25 per cent drop compared to the same six-month period in 2024 and 35 per cent below the first half of 2023. Ontario had more housing starts in the first half of 2020 (33,588), even though they were taking place during the COVID-19 pandemic. From 2022 to 2024, Ontario averaged only 86,650 housing starts each year, which is far less than the 150,000 starts per year required to meet the Ford government’s target 1.5 million new homes by 2031.

There are significant variances in homebuilding trends across Ontario’s municipalities. Ottawa recorded 5,150 housing starts in the first half of 2025, which is an 82 per cent increase compared to the same period last year. However, Guelph started only 46 new homes in the first half of the year, which is a 76 per cent drop from the same period in 2024. Toronto recorded only 12,575 housing starts in the first half of this year, which is a 44 per cent decline from the same period in 2024. Given its size, Toronto’s poor performance is especially consequential.

Ontario’s rate of building homes is behind other parts of the country. The rest of Canada saw a 17 per cent increase in the first half of 2025. In absolute numbers, 9,003 fewer homes were built in Ontario relative to last year while 12,921 more homes were added in the rest of the country.

Several cities meet provincially designated housing targets

The Ontario government has made several announcements of funding for several cities for met or exceeded their provincially designated housing targets through the second round of the Building Faster Fund. Announced in August

2023, the Building Faster Fund will provide $1.2 billion in new annual funding for three years to municipalities that are on target to meet provincial housing targets by 2031. Municipalities that reach 80 per cent of their annual target each year will become eligible for funding based on their share of the overall goal of 1.5 million homes. Municipalities that exceed their target will receive a bonus on top of their allocation.

To follow are some of the announced awards:

• August 1: The City of North Bay will receive $400,000 for breaking ground on 398 new homes in 2024, which is 480 per cent of its 2024 housing target.

• July 31: The City of Greater Sudbury will receive $1,520,000 for breaking ground on 840 new homes in 2024, which is 265 per cent of its 2024 housing target.

• July 30: Sault Ste. Marie will receive $600,000 for breaking ground on 189 new homes in 2024, which is 151 per cent of its 2024 housing target.

• July 22: Haldimand County will receive $991,984 for breaking ground on 310 new homes in 2024, which is 89 per cent of its 2024 housing target.

• July 10: The City of Kingston will receive $3,200,000 for breaking ground on 966 new homes in 2024, which is 145 per cent of its 2024 housing target.

From January to June 2025, Ontario saw 9,125 rental starts, an increase of 26.5 per cent compared to the same period in 2024. After 2023, this is the second-highest level of rental starts on record for this time of the year.

On June 30, the Ontario government announced it is capping rent increases for 2026 at 2.1 per cent. This cap is based on Ontario’s Consumer Price Index (CPI), a measure of inflation calculated by Statistics Canada using data that reflects economic conditions over the past year.

“Our government knows tariffs and economic uncertainty are creating challenges for many people in Ontario, including renters, which is why we are capping rent increases for 2026 at 2.1 per cent,” said Rob Flack, Minister of Municipal Affairs and Housing. “This cap is the lowest in four years, which demonstrates our commitment to protecting tenants across our province as we continue searching for ways to keep costs down across the province.”

On July 28, the federal government announced it will be committing $81.5 million in low interest loans through CMHC’s Apartment Construction Loan Program (ACLP) to support the development of 159 new affordable rental units in Toronto’s Bedford Park area, located at 3101 Bathurst Street. Dubbed Vivant on Bedford Park, the nine storey mid-rise development will be built by Medallion Corporation and designed by Arcadis, will provide modern, energy efficient homes for individuals and families, and is expected to be completed by the fall of 2027.

Housing Minister Gregor Robertson stated the project will boost rental housing supply in Toronto, with 27 per cent of the units geared toward residents below Toronto’s median household income. The project is part of Canada’s National Housing Strategy, which aims to finance hundreds of thousands of new rental units through the ACLP and similar programs.

July 22, 2025

Another year, another incredible golf tourney! On July 22, FRPO held our Annual Golf Tournament at Lionhead Golf Club. As usual, the event was sold out, and we raised $100,000 for Interval House. See you next year!

July 29, 2025 - Interval House: New Virtual Counselling Services webinar

Interval House, Canada's first shelter for abused women and their children, announced the launch of a new offering: Virtual Counselling Services (VCS). VCS provide counselling to victims of intimate partner abuse from across Ontario virtually. Webinar attendees learned more about the organization and the VCS program, and how they can help spread awareness to those in the communities they manage.

This year's Women in Rental Housing Luncheon took place on Thursday, August 21 at the Old Mill in Toronto. This event was sponsored by Wyse Meter Solutions and brought together women in the industry to network, learn, and share their experiences. The topic for the luncheon was “Beyond the Land Acknowledgement, Transforming Tomorrow.”

This event featured Cher Obediah as the guest speaker. She is Ojibway and Mohawk, Turtle Clan from Six Nation of the Grand River Territory with roots in Alderville First Nation. She is a multidisciplinary creative as a filmmaker, speaker, author, and artist. Cher is a heart-centred creative empowering others to shine their brightest light. She's a visionary who believes self-knowledge is a catalyst for healing and collective change. With a background in theatre, television, and film she lends her energy to projects that focus on holistic health, Indigenous culture, domestic violence, youth driven initiatives and content that inspires others to recognize their worth. Other speakers included:

• Kellie Spearman, JLL Canada

• Liza Bauer, Concert Properties

• Nicole Alvarez, Minto Properties

• Belinda Black, Tricon Residential

• Rachel Roenspies, QuadReal

FRPO is the largest association in Ontario representing those who own, manage, build and finance residential rental properties.

For membership inquiries please contact Lynzi Michal, Director, Membership & Marketing

Federation of Rental-housing Providers of Ontario

801-67 Yonge Street, Toronto, Ontario M5E 1J8 416-309-8744

lmichal@frpo.org www.frpo.org

Since MetCap Living established itself as a leader in property management, we have routinely been asked one, simple question; “Can you help us run our property more effectively?” And, for well over thirty years, the answer has remained — Yes, we can! Our managers are seasoned professionals, experienced in every detail of the day to day operations and maintenance of multi-unit rental properties. From marketing, leasing, finance and accounting, to actual physical, on-site management, we oversee everything.

Guaranteed vacancy reduction, revenue growth and net profitability — when you’re ready to discuss a better option; we’ll be there. You can count on it.

Kazi Shahnewaz Director,

Business Development

Office: 416.340.1600 x504

C. 647.887.5676

k.m.shahnewaz@metcap.com

www.metcap.com

EOLO discusses property tax decreases, solid waste charges, and new water, sewer, and stormwater rates. pg. 49

RHPNS discusses Halifax Water rate hike, rent cap policy, and misinformation campaigns. pg. 53

LPMA discusses how housing providers are often ‘stuck’ when trying to balance tenants’ rights. pg. 57

HDAA discusses the Safe Apartment Buildings By-law, a Jamesville development, as well as past and future events. pg. 61

Check out the digital version of RHB Magazine for news from ARLA and RHSK .

EOLO has been working on the multi-residential tax policy issue in the City of Ottawa since our inception as an association in 1990. We have worked with tenants, experts, and City Councillors of all political views. Finally, with Council’s adoption of a four-year plan beginning in 2025, we should see a multi-residential tax ratio of 1.0. This will mean that tenants will pay the same property tax rates on their dwellings as homeowners. (Homeowners pay their taxes directly to the City, and tenants pay their taxes through the rent they pay their landlords, which their landlords pay to the City.) This is a tremendous victory for tenants, multi-residential landlords, and property tax fairness in Ottawa!

- John Dickie, Chair, Eastern Ontario Landlord Organization

In Ottawa, in 2024, tenants paid municipal property taxes at a rate 41 per cent higher than the rate homeowners paid, through a tax ratio of 1.41 (rounded). This disparity is unfair on its face. Numerous studies have found the disparity to be unjustified. The Province recognized the fair rate for tenants was the same as the rate for homeowners when it set the education tax at the same rate for both. The Province also set the target for municipalities at a nearly equal tax rate when it set the band of fairness (i.e., the target) for the multi-residential tax ratio at between 1.0 and 1.1.

From the inception of rent control in 1975, it has operated on a “cost pass-through system.” Under that system, landlords have been allowed to apply for above-guideline rent increases to recover unusual increases in property taxes. In 1997, when the provincial government reformed property taxes to make the tax discrepancies visible, it also provided for all but very minor tax decreases to be passed through to tenants automatically, without the need for any action by tenants.

In Ottawa in 2025, City Council faced a choice. If Council had made no adjustment to the multiresidential tax ratio, landlords would have been able to apply to raise rents above the guideline to recover the extraordinary property tax increase,

along with the increase in the solid waste charge that took effect on January 1, 2025. That would have increased many tenants’ rents, and reduced affordability.

Alternately, Council had the ability to adopt the recommendation of the staff report, and by doing that, eliminate the above-guideline rent increase, and produce a modest rent reduction for tens of thousands of tenants.

Geoff Younghusband of Osgoode Properties, and John Dickie, EOLO Chair, spoke at the Finance and Economic Development Committee on April 1, 2025 to urge Councillors to adopt the recommendation of the staff report, which called for a decrease in the multi-residential tax ratio to trigger modest rent reductions, and thus improve rental affordability.

On April 16, 2025, City Council voted to approve the proposed four-year plan to reduce the multiresidential tax ratio to 1.3 in 2025, to 1.2 in 2026, to 1.1 in 2027, and to 1.0 in 2028. (City Finance staff is to review the situation if there is a province-wide reassessment before the City reaches 1.0.)

The tax ratio reductions will trigger tax decreases from year to year. Those tax decreases will trigger automatic rent reductions at December 31 of each year from 2025 to 2028.

The decrease in the ratio is especially valuable in 2025 because it will avoid an increase in City taxes and charges, which was going to be about 7 per cent for most apartment buildings, and higher than that for some buildings, especially buildings with relatively low rents.

Here is how that will work. For virtually all properties, the annual property tax bill is calculated by multiplying the property’s assessed value by the City’s tax rate for the particular type of property. The assessed value is the fair market value at a certain date as determined by the Municipal Property Assessment Corporation (MPAC).

Currently, the property tax rate for multi-residential property is higher than the property tax rate for residential property. Residential property is property where people live, with one to six units on the “roll number.” Multi-residential property is property where people live with seven or more residential units on the roll number. (However, as an exception, recently built property of seven units or more is in the new multi-residential class and taxed at the lower residential rate.)

Unless they are adjacent and all on a single legal property owned by one owner, single-family homes, duplexes, and triplexes are residential properties. Residential condominiums are also residential properties because each unit has a separate title (and roll number), even though they may be parts of one building.

The City’s plan is to reduce the tax rate on multi-residential property, including apartments, in four annual steps, until it is equal to the tax rate on residential properties, like single-family homes, duplexes, and triplexes.

Under the Residential Tenancies Act (RTA), a property tax decrease of more than 2.49 per cent must be passed through to the tenants through an automatic rent reduction. To make sure tenants are aware of their right to a rent reduction, the City will issue a notice of rent reduction to all rental units in multi-residential buildings.

The notices will likely be issued in the Fall, specifying a percentage reduction in the rent. Unfortunately for everyone, that reduction is likely to be higher than the final reduction. The reduction given in the City’s notice will be based on an estimate, set by the RTA, of the ratio of the property taxes to the rent.

Past experience has shown the RTA estimate is significantly higher than the ratio that currently applies in Ottawa. While it has been doing it slowly, Ottawa has been moving toward an equal tax rate for many years, whereas the RTA ratio has not been adjusted.

Landlords are entitled to apply to the Landlord and Tenant Board (LTB) to correct the rent reduction so it matches the dollar tax decrease they have received. As an example, the City may issue a notice of a 4 per cent rent reduction. The taxes on the building may have decreased by $2,000 per year, which is 2 per cent of the revenue, while the reduction set out in the City’s notice would push the total rent revenue down by $4,000. Understandably, the property owner will want to correct that.

In the past, the LTB has processed those applications in writing, which may help avoid excessive delays.