Week ending 09 August 2024

One of the most volatile on record: extreme shifts in short-term volatility across the week.

Week ending 09 August 2024

One of the most volatile on record: extreme shifts in short-term volatility across the week.

Increasing recession concerns in the US: unemployment rate reaches a three-year high.

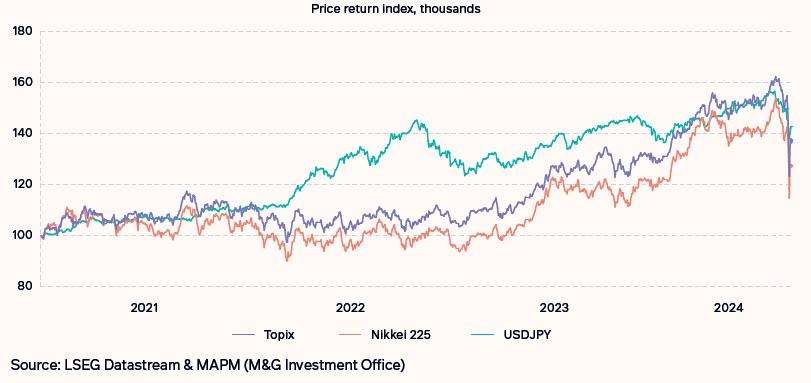

Market turbulence in Japan: stocks had their worst crash for almost 40 years.

Welcome to our weekly market update. Our focus is on providing clear, concise insights into stock and bond market movements and the broader economic landscape. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it. This is for your information only. It is not a recommendation or advice, if you’re unsure about anything please speak to your financial adviser.

This week saw some of the most significant shortterm volatility shifts on record. Concerns about a US recession, complications with the Japanese Yen and underwhelming stock earnings drove extreme market reactions. The narrative around rates changed from “higher for longer” to a series of significant cuts in a short period.

Data in the prior week’s contributed to increasing US recession concerns. In particular, the unemployment rate rose to a three-year high of 4.3%. However, other indicators still point to a resilient economic picture. An expansion in the labour force has driven the rise in unemployment, with demand for labour remaining solid.

A recent survey from the Federal Reserve indicated credit demand and supply improvements. Nonetheless, US labour market data is crucial for assessing the US economic path forward. If joblessness drifts higher over time, it could potentially reduce growth. In other regions, China’s exports unexpectedly slowed in July. Meanwhile, imports rose +7.2% year-on-year.

Central banks are warming to the idea of rate cuts. The Fed hinted that its first rate cut could come in September, markets now assign a 100% probability of a rate cut in September. Investors and central banks alike continue to focus on key data points that could provide insight into the relative health of economies, while corporate earnings will be in focus as well.

Market turbulence in Japan. Japanese stocks experienced their worst crash since 1987. The Yen soared, forcing investors to move quickly and unwind their carry trades –this involves borrowing in a

low-interest rate country to fund purchases elsewhere. Given Japan’s ultra-low interest rates compared to the rest of the world, the Yen carry trade has become one of the largest-ever iterations of this strategy. The Bank of Japan’s assurance that it won’t

raise rates as long as market volatility persists has helped restore some calm, but uncertainty remains. The economic conditions in the US and the Federal Reserve’s

responses will also impact Yen movements. If the dollar weakens due to the Fed implementing more aggressive rate cuts, the unwinding of the carry trade could continue.

With the latest updates seen across the globe, there’s continued evidence that maintaining a well-diversified, long-term thinking to your investment approach rather than reacting to market swings is key. By staying committed to carefully

considered plans, investors can navigate through periods of volatility and uncertainty.

Has provided the commentary within this document.

If you have any questions in relation to this document, please discuss them with your financial adviser.. – we look forward to hearing from you.

Principle Financial Services Ltd is an Appointed Representative of New Leaf Distribution Ltd. who are authorised and regulated by the Financial Conduct Authority. Number 460421. 01530

The Springboard Business Centre, Mantle Lane, Coalville, Leicestershire, LE67 3DW

www.principlefinancialservices.co.uk info@principlefinancialservices.co.uk shanefox@principlefinancialservices.co.uk samhagon@principlefinancialservices.co.uk

PLEASE

This guide is for general information and is not intended to address your personal and financial requirements and should not be deemed or treated as constituting financial advice. Nor does this guide constitute tax or legal advice and should not be relied upon as such. Tax treatment of investments and legal advice depends on the individual circumstances of each client and may be subject to change in the future. For further guidance on the matters discussed in this guide please speak to Shane Fox, who is a regulated financial adviser. Our services relate to certain investments whose prices are dependent on fluctuations in the financial markets beyond our control. Investments and the income from them may go down as well as up and you may get back less than the amount invested. Past performance cannot be used as a reliable prediction of future performance.