As Australia’s largest supplier and extruder of aluminium, Capral is committed to supporting Australian manufacturing with high-quality, locally produced aluminium extrusions. Our stateof-the-art facilities provide precision-engineered solutions for industries nationwide, from construction, to transport, and marine.

Choosing Capral is an investment in reliable supply, shorter lead times, and a stronger Australian manufacturing sector.

When you need Australian-made aluminium, Capral can do.

manmonthly.com.au

CEO: John Murphy

Chief Operating Officer: Christine Clancy

Managing Editor: Mike Wheeler

Editor: Jack Lloyd jack.lloyd@primecreative.com.au

Design: Alejandro Molano

Head of Design: Blake Storey

Sales/Advertising: Emily Gorgievska Ph: 0432 083 392 emily.gorgievska@primecreative.com.au

Subscriptions

Published 11 times a year

Subscriptions $140.00 per annum (inc GST) Overseas prices apply Ph: (03) 9690 8766

Copyright Manufacturers’ Monthly is owned by Prime Creative Media and published by John Murphy.

All material in Manufacturers’ Monthly is copyright and no part may be reproduced or copied in any form or by any means (graphic, electronic or mechanical including information and retrieval systems) without written permission of the publisher. The Editor welcomes contributions but reserves the right to accept or reject any material. While every effort has been made to ensure the accuracy of information, Prime Creative Media will not accept responsibility for errors or omissions or for any consequences arising from reliance on information published.

The opinions expressed in Manufacturers’ Monthly are not necessarily the opinions of, or endorsed by the publisher unless otherwise stated.

© Copyright Prime Creative Media, 2024

Articles

All articles submitted for publication become the property of the publisher. The Editor reserves the right to adjust any article to conform with the magazine format.

Head Office

379 Docklands Drive Docklands VIC 3008 P: +61 3 9690 8766 enquiries@primecreative.com.au www.primecreative.com.au

Sydney Office Suite 11.01, 201 Miller St, North Sydney, NSW 2060

Printed by: The Precision Group

83-89 Freight Drive. Somerton Vic 3062 Ph: (03) 9794 8337

Welcome to the June edition of Manufacturers’ Monthly.

For this edition’s Manufacturer Focus, we explore Drone Shield’s innovative counter-UAS solutions that are proving vital amid evolving threats that emerge from drone technology. Then, there is coverage of Australian Manufacturing Week 2025 which featured cutting-edge technology and valuable networking opportunities. Rounding out the issue is a Decision Makers comment from Visy’s executive general manager of Packaging, Adrian Dalgleish, and an association comment from Ai Group’s Dr Jeff Wilson. Here, Wilson argues that targeted reforms are essential to lift underperforming industries that are holding back growth.

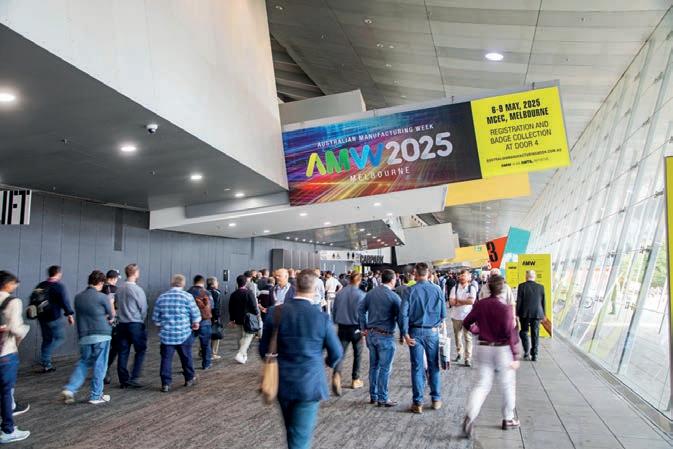

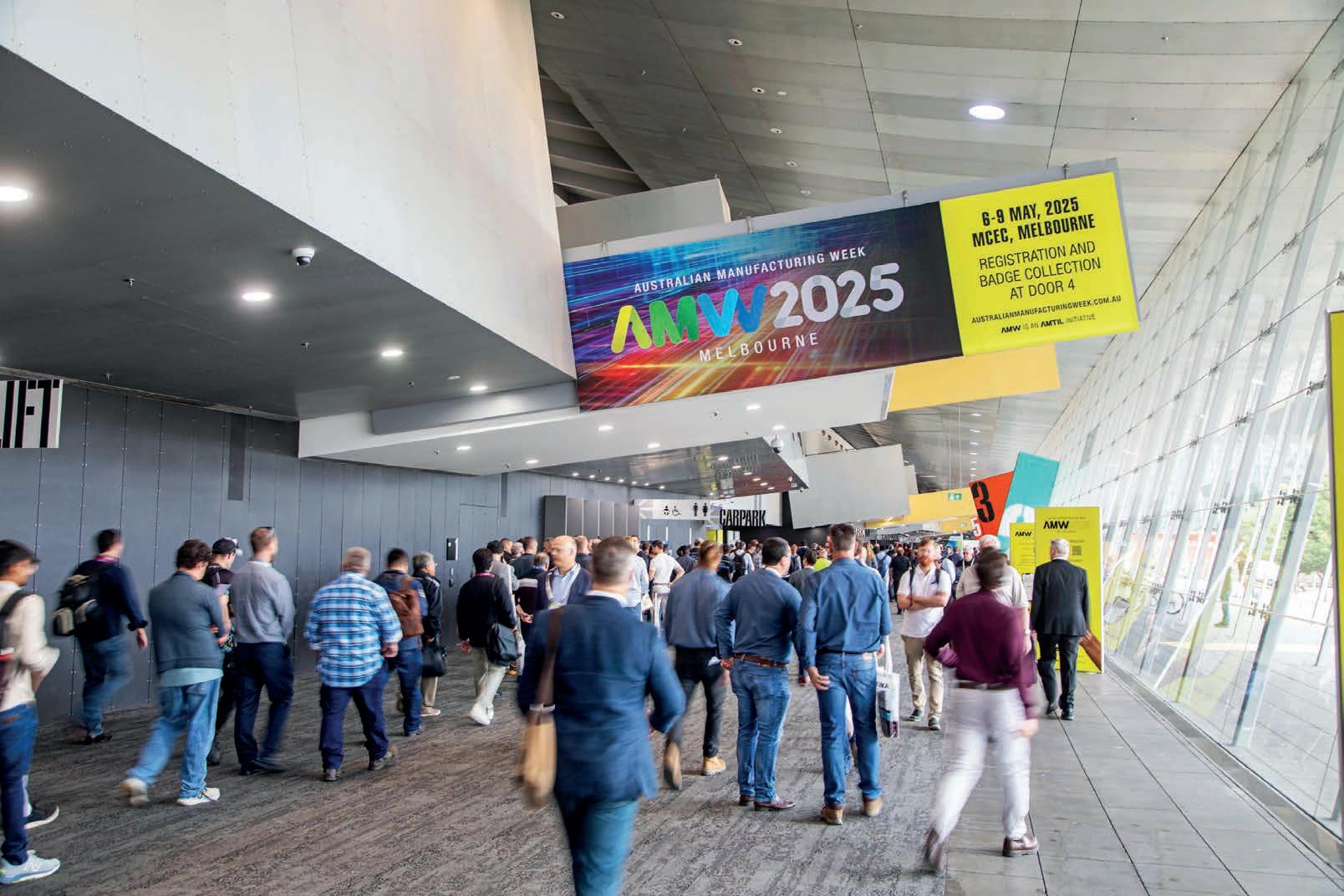

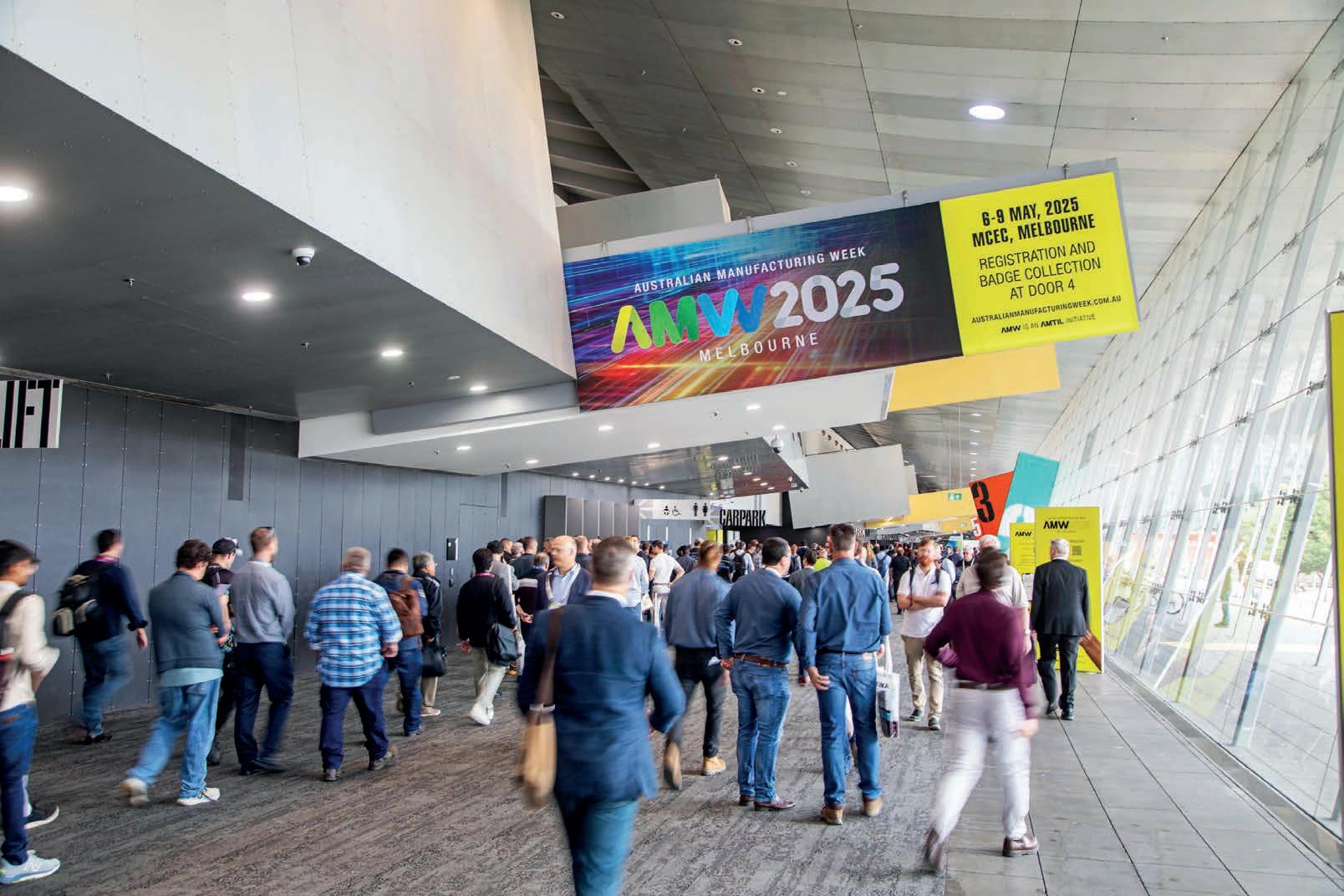

After a month that saw advancements across multiple manufacturing sectors, Australian-Made Week, the pivotal outcome of the 2025 Federal Election and Australian Manufacturing Week (AMW) 2025, the industry feels more energised than ever.

AMW’s record-breaking event brought more than 300 exhibitors and thousands of attendees together to celebrate manufacturing in Melbourne for four days. With technology showcases, networking opportunities and keynote addresses from government and industry leaders, the event proved a source of momentum as the industry continues down the path of strengthening sovereign capability.

To mark a successful month, this month’s edition of Manufacturers’ Monthly features an event recap, along with updates from many of the exhibitors and associations that took part. The theme of sovereign capability extends through to the Manufacturer Focus feature, which explores the local manufacturing of counter-drone technologies. Here, supply chain manager of DroneShield, Luke Ryan, speaks to the company’s product suite that combines radiofrequency sensing, AI, and electronic

warfare to detect and neutralise uncrewed aerial systems.

Next is June’s Engineering Focus piece that follows a Swinburne University-led international team developing scalable next-generation electrolysers. With potential to boost Australia’s clean energy manufacturing, the project focuses on improving catalyst design, electrode fabrication, and reducing CO₂ into valuable products. The team speaks to the roadmap that will hopefully help lay the groundwork for local production of advanced electrolysis technologies.

This emphasis on a sustainable future extends into a Decision Maker Column from Visy’s executive general manager of packaging, Adrian Dalgleish. Here, he talks to how the company is leading the charge with local innovation, circular manufacturing, and solutions designed to help customers meet expectations in the growing age of sustainability.

Additionally, this edition takes a clear look not only into the past but also into the future of a sector that has long been synonymous with manufacturing –metal and plastic production. This presence is kicked off by a recognisable name within the industry, Capral Aluminium, and

its decade-long partnership with PLP Australia.

This partnership has proven fruitful in delivering custom-engineered aluminium busbars for Project EnergyConnect, a major 900-kilometre interconnector uniting the electricity grids of NSW, SA and Victoria.

Also present within the sector is Minitab, whose statistical software solutions, while advanced, are helping traditional metal and plastic manufacturers to drive efficiency, improve product quality, reduce costs, and solve complex production issues.

This issue also spotlights an international affair, exploring the 50th anniversary of EMO 2025, an event that is set to bring together global leaders in metalworking and machine tools in Hannover this September.

We also hear from association partners such as Weld Australia, Southeast Melbourne Manufacturing Alliance (SEMMA), WorldSkills Australia and Ai Group.

As Australian manufacturing gains momentum, this issue captures the innovation driving the sector forward. From sovereign capability and clean energy breakthroughs to traditional strengths in metal and plastic production, the future of local industry remains on an upward trajectory.

From metal precision to plastic innovation, Minitab gives senior managers and engineers the tools to transform production lines. Identify inefficiencies, reduce scrap, and optimise processes to turn raw materials into exceptional products—backed by the power of data. You have data. We have solutions. Imagine the possibilities.

www.minitab.com

Despite having rigorous safety standards, Australia continues to allow imported infrastructure products to enter the market without inspection – thus undermining local manufacturing.

If a product is being sold in Australia, it should be safe, reliable, and compliant with Australian Standards. And yet, time and again, we are seeing products – from water heaters to wind towers – arrive on Australian shores without any local inspection, often with catastrophic consequences.

There is no question that Australian Standards are among the most rigorous in the world. But in too many cases, these standards are treated as optional because they are not legally enforceable. As a result, imported goods are often accepted on the basis of overseas paperwork alone, with no independent assessment or validation. The implications of this lax approach range from waste and inefficiency to genuine danger.

Take, for example, fabricated steel. Imported wind turbine towers are being erected across the country, often in regional farming areas, with no requirement for local weld inspection. These towers support 125-tonne generators and 80-metre blades, operating under enormous stress in some of Australia’s windiest environments. And yet, they are not inspected once they arrive. The results have been tragic: turbine collapses, blade failures, and widespread cracking.

These are not isolated incidents. They are warning signs of a systemic failure in how we manage the quality and safety of imported infrastructure. In any other sector, this level of risk would be unacceptable. Imagine the public outcry if highrise buildings were constructed using structural components that had never been inspected. And the problem isn’t limited to wind towers. Recent recalls of imported water heaters and heat pumps reveal systemic failures. Independent lab testing has confirmed dangerously low carbon content in the steel used in some imported models – up to 90 per cent lower than equivalent Australian-made units. When installed, these products have imploded, leaked flammable gases, or failed outright. Every household in Australia has a water heater. These are pressure vessels. If they fail, the consequences can be explosive.

Australia has a proud local manufacturer of water heaters in Dux, a regional manufacturer with more than 100 years of history and a proven track record. But despite this capability, imported heat pumps with substandard components are being installed in Australian homes under generous government rebate schemes – without any minimum performance standards. The risks associated with this are not hypothetical. We’ve already seen heat pumps implode during operation, with fragments scattered across residential areas. This is not just a consumer issue – it is a public safety issue. We’ve also seen road gantries collapse due to inferior imported components. In 2019, VicRoads was forced to conduct an audit of freeway gantries and signs to cover the entire Melbourne metropolitan network after an enormous Tullamarine Freeway sign suddenly fell and crushed a car travelling underneath it.

The amount of fabricated steel being imported from overseas and used for road infrastructure, including traffic signs, gantries and bridges, was increasing but often didn’t comply with Australian safety standards. In 2005, about 5 per cent of all fabricated steel was imported from abroad, but the quantity has soared to about 30 per cent in the last decade.

Transformers used in renewable energy projects, imported with minimal oversight, have required complete refurbishment within 12 months. In some mining projects, companies have resorted to placing teams of engineers in overseas factories to supervise fabrication, recognising the risk of failure if components are not closely monitored. When Australian engineers must travel overseas to ensure basic quality assurance, we should be asking why these products are being imported in the first place.

The rail sector has not been immune either. Offshore procurement of train carriages has led to costly rework, delays and defective units. In one example, trains had to be retrofitted and inspected locally after defects were identified. And yet, the trend continues. States continue to offshore contracts worth billions of dollars, undermining local industry and introducing unnecessary risk.

If it’s made in Australia, it must comply with Australian Standards. Local manufacturers know

this, and they build accordingly. If a water heater is made here, it must pass strict compliance checks. If VicRoads or Transport for NSW commissions a bridge or road, it is subject to local inspection throughout the build. So why is it that goods made offshore are not subject to the same scrutiny once they arrive?

The lack of enforcement is the root cause of this problem. Australian companies specify that components must meet local standards, but there is no mechanism to ensure that they do. The paperwork arrives, the product is delivered, and no one is held accountable until something goes wrong. This creates a dangerous precedent where the lowest bidder wins, regardless of quality, compliance or safety. In many cases, the true cost of these products is only revealed after they fail – when bridges require strengthening, turbines collapse, or household appliances explode. These

Weld Australia believes every product used in infrastructure, energy, and construction must be inspected upon arrival to Australia.

failures often require expensive remediation and can place lives at risk.

Compare this to other developed nations. In Europe, Japan, and Canada, compliance with standards is mandatory and enforced by accredited thirdparty inspectors. In fact, in Canada, such systems have been in place since 1947. These countries understand that safety cannot be left to chance or commercial interpretation. Their governments recognise the importance of high standards not only to protect public safety but to ensure long-term economic and environmental outcomes.

Our close neighbours and trading partners in southeast Asia do not always operate under such rigorous standards. Fabrication is typically undertaken to customer specifications, not to internationally recognised benchmarks. This means that unless Australian importers are checking every weld,

every material certificate, and every manufacturing process, there is no guarantee that these imports meet our standards.

At Weld Australia, we believe every product used in infrastructure, energy, and construction must be inspected upon arrival if it has been manufactured offshore. We must stop relying on foreign documentation and start validating safety and compliance on our own soil.

We are not suggesting that all imported goods are inferior. But we do argue that it is reckless to take quality on trust. Especially when that trust has been broken time and again.

That means implementing a national inspection regime for imported fabricated steel and other highrisk products. It means legislating that imported components used in public infrastructure projects

must meet Australian Standards. And it means holding importers accountable for the safety and reliability of the products they bring into this country.

A national inspection framework would not only reduce risk, it would create local jobs for inspectors, engineers, and quality assurance professionals. It would also level the playing field for Australian manufacturers, who are currently competing against cheaper offshore products with no equivalent compliance costs.

We must also revisit our procurement frameworks. Projects funded by Australian taxpayers should prioritise Australian-made components wherever possible. This is not protectionism; it is good policy. It supports local jobs, maintains sovereign capability, and ensures that our infrastructure is safe and built to last.

How many lives must be lost before the government takes action? Public safety is not negotiable. It is time we acted like it.

than $500 million, aimed at boosting Australia’s manufacturing and biotechnology sectors.

The Future Industries Institute (FII) will be central to both the Additive Manufacturing CRC (AMCRC) and the Solutions for Manufacturing Advanced Regenerative Therapies (SMART CRC). FII Industry Professor Colin Hall, a researcher in the AMCRC,

“Once limited to plastic prototype parts, 3D printing today includes metal, ceramic and composite materials that are on the cusp of full-scale adoption across Australia’s manufacturing sector,” he said. “Additive manufacturing offers significant advantages, boosting productivity, reducing waste and accelerating product development.”

The AMCRC is set to operate for seven years with

$57.5 million in Federal funding and $213 million in partner contributions from 73 industry partners and 14 research organisations. UniSA researchers will lead several streams, including sustainability, surface technologies and post-processing.

“By embedding environmental, social and governance principles, 3D printing can fuel innovation, drive business transformation and propel Australian businesses towards a more resilient future,” said Associate Professor Shruti Sardeshmukh, who will lead the Sustainable Manufacturing research theme.

Professor Allison Cowin will be a key researcher in the $238 million SMART CRC, which focuses on advancing regenerative medicine and therapies such as cell and gene treatments.

The CRC aims to fast-track a decade’s worth of projects to commercialisation, with $65 million in Federal support and $173 million in partner funding.

“The SMART CRC will accelerate the Australian regenerative therapy industry,” Cowin said. “It will catalyse, drive and coordinate a national effort, guiding industry growth in the cell and gene therapy sectors.”

Expected to create 1,500 skilled jobs and generate $4.5 billion in economic activity, the SMART CRC will help position Australia as a leader in diseasecuring technologies.

The Queensland Government has partnered with the North Queensland Cowboys to launch a campaign to inspire more women and girls to pursue careers in manufacturing, The initiative will use match day advertising and business development opportunities to highlight the achievements of manufacturing trailblazers and promote career pathways in one of Queensland’s biggest industries.

Minister for Manufacturing, Dale Last, said the partnership would help spread the word about the exciting opportunities in manufacturing.

“We’re spreading the word by teaming up with the North Queensland Cowboys, tapping into their enormous reach both on and off the field,” he said. “There are exciting career opportunities for women and girls designing and making products that solve real-world problems.

“The NRL has a growing fanbase of young women and we’ve jumped at the opportunity to partner with one of the league’s strongest and most trusted brands to share our message.”

The campaign will focus on regional areas like Townsville, where there’s already an established

Manufacturing Hub and a strong industry presence.

North Queensland Cowboys chief executive Jeff Reibel said the club was proud to support the initiative.

“Together the North Queensland Toyota Cowboys and the Queensland Government are putting women in manufacturing in the spotlight,” Reibel said. “The partnership will also support our NRLW team and NRL Cowboys House program. This is an exciting partnership that highlights our shared focus on initiatives that improve women’s economic opportunities.”

Manufacturing contributes nearly $27 billion to Queensland’s economy each year. Townsville is the State’s third-largest manufacturing hub, generating around $1.3 billion annually. Member for Townsville Adam Baillie said local manufacturers span diverse fields.

“From food and textile production to high-tech robotics or servicing the defence and aeronautical sectors – Queensland and Townsville manufacturers do it all,” Baillie said.

Member for Mundingburra Janelle Poole said

women remain under-represented in the sector.

“About 180,000 Queenslanders work in manufacturing – but only a quarter of them are women,” Poole said. “We want that number to grow because the result will be greater innovation and productivity.”

Member for Thuringowa, Natalie Marr, added the campaign underlines the Government’s focus on creating career pathways.

“The diversity of the sector means there is huge potential for North Queensland’s women and girls pursuing a career in the industry.”

Renewable gas, like biomethane, is being demonstrated and developed right here in New South Wales, and already being used successfully overseas.

Biomethane can help industry and manufacturing sectors to lower emissions without any operational changes.

If we look at the big picture we can find big opportunities, more solutions and more ways to support the energy transition for industry.

Defence has welcomed a milestone in the global

sustainment services. These contributions

The NSW Government has approved a $139 million warehousing estate in the Western Sydney Aerotropolis, supporting more than 600 jobs and driving economic growth around the new international airport.

Spanning 19.4 hectares, the Barings Luddenham Industrial Park will offer over 63,500 square metres of warehousing across seven buildings, ranging from 1,000 to 30,000 square metres.

“This investment is not just about warehouses, it’s about jobs, opportunity, and building a thriving future right here in the Aerotropolis,” said deputy premier and minister for Western Sydney Prue Car. “More than 600 jobs will be created through this development, and it’s just the beginning of what is to come.”

The site will include an onsite café, office spaces, open green areas, stormwater infrastructure, waterway rehabilitation and car parking. Construction will begin mid-2025, with the first warehouse set to open by December 2026.

be during construction and 250 will be ongoing roles located near the future Western Sydney International (Nancy-Bird Walton) Airport.

developments within the Aerotropolis, following the recent approvals of Bradfield City’s Central Park and the opening of its First

DroneShield’s supply chain manager, Luke Ryan, outlines how the company’s innovative counter-UAS solutions are proving vital amid evolving threats that emerge from drone technology. Jack Lloyd writes.

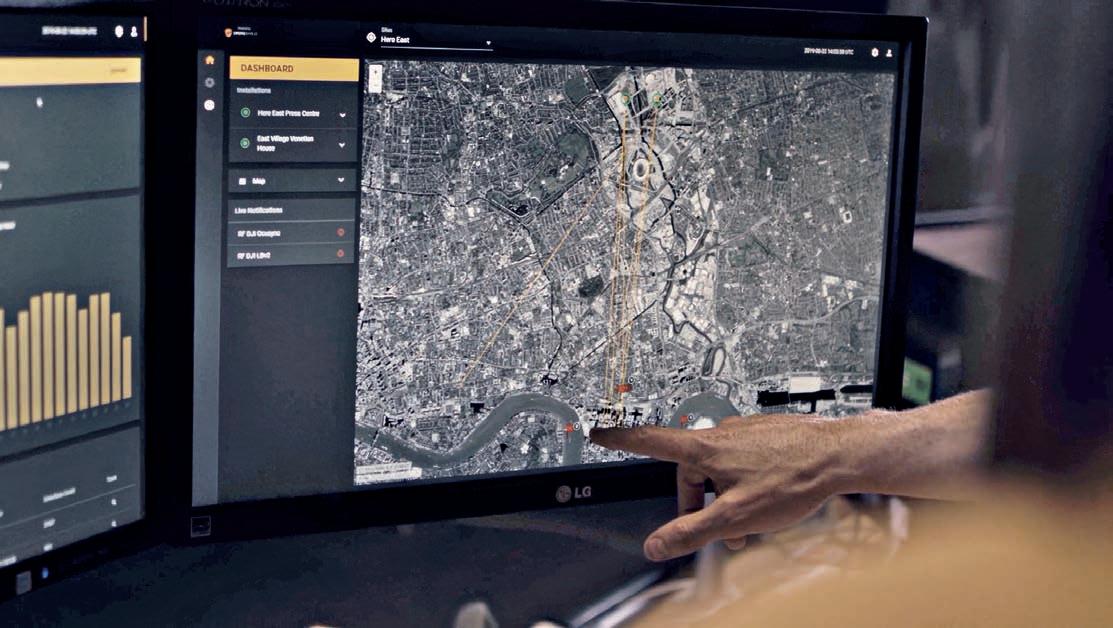

Founded in 2014, DroneShield has become a well-known name in the radio frequencybased (RF) detection and defeat of uncrewed aerial systems (UAS). Supply chain manager, Luke Ryan, attributes DroneShield’s rapid rise to its counter-UAS technology that is designed to detect, track, identify, and defeat systems like commercial drones and military-grade UAVs.

“DroneShield’s counter-UAS solutions focus on radio frequency sensing, artificial intelligence (AI), and machine learning,” he said. “At the core of our company is the C2 command and control software, integrated with a suite of detection and optional defeat solutions to address the growing threat of drones being used for nefarious purposes.”

These solutions have broad applications and can be used to defuse nefarious scenarios across a range of civil, law enforcement, government, and defence settings. This adaptability has seen the company establish what is now a global presence.

“Our handheld and fixed-site systems are deployed on active battlefronts, protecting critical infrastructure and airports, and are used for both private and government VIP protection,” said Ryan. “Examples of this include contraband smuggling into prisons, incursions into critical infrastructure such as corporate data centres, and, more recently, their widespread use on modern battlefronts like those in Ukraine.”

Behind a counter drone defence solution is a range of technology-based capabilities that are implemented within a suite of products that each serve a different purpose. Beginning with capabilities, Ryan noted the primary ability of DroneShield’s solutions as electronic warfare.

“These capabilities include identifying signals of interest (SOI) to enable threat identification and warning (I&W), threat geolocation, and support for the targeting cycle,” he said. “This provides intelligence to inform an electronic warfare response.”

This electronic warfare capability leverages AI, which prior to a counter-drone response, helps identify the makeup and location of a UAS.

“AI enhances our counter-drone capabilities by leveraging algorithms and machine learning to identify, track, and classify drones – enabling a swift response to potential threats,” said Ryan.

This use of AI extends to DroneShield’s capability known as SensorFusion, which can be deployed either on a single compute node or across multiple nodes.

“SensorFusion is a good one. Drone detection is moving toward a multi-sensor approach, and that approach only produces better results when paired with an intelligent software engine that can fuse the sensor outputs,” said Ryan.

The systems also feature edge computing capabilities, seamless product integration, training services, and a range of product offerings tailored to diverse operational needs.

DroneShield’s anechoic chamber is a foam-padded room designed to eliminate RF reflections and echoes for

Manufacturing a product suite to match advanced capabilities DroneShield’s product suite implements these capabilities for the detection, identification and disruption of enemy UAS units in different operational contexts. First, the company’s dismounted product offering includes the RF detection system, RfPatrol Mk2, and the RF defeat systems of the DroneGun Mk4 and DroneGun Tactical.

DroneShield’s DroneSentry-C2 command and control software integrates with a suite of detection and optional defeat solutions to counter UAS systems.

“The RFPatrol Mk2 is a versatile, passive, nonemitting portable UAS detection device. It offers the user situational awareness without distraction or complex operation, making it easy to use,” said Ryan. “The DroneGun Mk4 and DroneGun Tactical are both effective against a wide range of UAS types and models.

“They work by disrupting the control, navigation, and video signals of single or multiple drones simultaneously. While similar, the DroneGun Tactical

is slightly larger and designed for two-handed operation with long-range defeat capabilities.”

Ryan said the RfPatrol Mk2 and DroneGun Mk4 together form a handheld Immediate Response Kit (IRK), which – despite being independent products –form a portable counter-UAS solution.

“This allows for real-time detection and immediate response for efficient counter-drone defence,” he said.

Next are the products defined as ‘on-the-move,’

which centre around the DroneSentry-X Mk2 and extends to the Expeditionary Fixed Site (EFS) Kit. As opposed to being handheld, the DroneSentry-X Mk2 is a software-defined system that is suited for mobile operations or field-expedient pop-up and fixedsite protection.

“It’s designed to be deployed in harsh environments and can be mounted to standard vehicle roof racks on military vehicles, surface vessels, boats, RIBs, or unmanned mobile platforms,” said Ryan. “It’s a cost-effective solution with both detection and optional defeat capabilities built into a single, self-contained platform.

“It can also be deployed as a permanent or fixedsite install, say on a tripod, mast, or tower, and it supports both local and remote operations through software interaction.”

The DroneSentry-X Mk2 is enabled by a combination of AI-driven computer vision technology and a specialised DroneSentry-C2 software to achieve this. Ryan said that DroneSentry-C2 is interactable through a rugged tablet known as the DroneSentry-C2 Tactical.

“Optical sensors – like camera systems – can detect, verify, and track UAS threats in real time using DroneOptID, which is DroneShield’s AI-driven computer vision technology,” said Ryan. “This works hand in hand with our DroneSentry-C2 software, which allows users to check system statuses,

to threats with real-time recommendations.”

“DroneSentry-C2 Tactical provides an intuitive satellite map-based display, deployable to customerspecific devices.”

Confronting a global problem with a local supply chain

To maximise the quality and volume of these products, DroneShield is headquartered in Sydney’s CBD, where the company maintains an office space, a showroom and product assembly facilities within one building. The company also utilises off-site contract manufacturing facilities in both Sydney and Adelaide.

“One thing I’m proud of is that our products are inherently sovereign Australian,” said Ryan.

Yet, to address the global need for its products, DroneShield does have a global presence in numerous countries.

“We have a team in Warrenton, Virginia, as well as sales directors positioned across Europe, the Middle East and Latin America,” said Ryan.

With a rapidly growing target industry to address, Ryan said the company’s headcount within Australia has grown exponentially to reach around 300 personnel. He said that roughly 80 per cent of those employees are engineers, with the remaining 20 per cent covering operations and other roles. This headcount results in a product assembly capability that holds up despite the absence of

“Our current product assembly capacity for the dismounted is upwards of 250 units per month across the handheld products. That includes a mix of in-house product assembly and contract manufacturing,” said Ryan. “The DroneSentry-X Mk2 is assembled in-house here in the Sydney CBD, with a monthly capacity of up to 50 units, and growing. This model allows for easy growth as needed.”

Alongside in-house product assembly, Ryan said DroneShield has advanced its processes with RF testing and simulations.

“DroneShield uses specialised RF test and simulation equipment, such as spectrum analysers and vector network analysers (VNAs),” he said.

“We’re also proud of our walk-in anechoic chamber, which is a foam-padded room designed to eliminate RF reflections and echoes for safe, controlled product testing during product assembly.”

This emphasis on product testing extends to DroneShield’s Quality Assurance and Quality Control (QA/QC) measures. As an ISO 9001 certified organisation, Ryan said DroneShield has an endto-end process in place to ensure the delivery of quality products.

“Every component goes through incoming quality checks, then in-process QC during product assembly, and finally outgoing QC checks before dispatch to customers,” he said.

Additionally, the company has an emphasis on

assessments and manufacturing-specific WHS codes of practice.

“Safety starts with our anechoic testing chamber, ensuring the products function as intended,” said Ryan. “Our regulatory compliance is backed by ISO certification, internal audits, external audits, and ongoing real-time monitoring aligned with legislative updates.”

Staying one step ahead

With a product designed to address dynamic threats – and a capability that is seemingly matching its demand – Ryan said the defence communities’ response has been positive.

“These products are designed to protect people and critical infrastructure, not to cause harm,” he said. “We’ve got many repeat customers, and most are increasing their order volumes as awareness of the threat landscape grows.”

This success has not come without its challenges. Ryan said DroneShield’s greatest battle continues to be the rapid pace at which UAS technology is evolving.

“It’s a constant race. DroneShield’s edge lies in our ability to respond and adapt in real time – whether through quick-turn hardware redesigns or frequent software updates that optimise the performance of our deployed systems,” he said.

Despite the unpredictability, DroneShield’s pipeline

Ryan said that a part of this growth is targeting fastgrowing markets like Europe and the Asia-Pacific. Consequently, DroneShield will aim to scale up and thus meet demand in those regions.

“It’s difficult to predict precisely because the industry changes so rapidly, but I see DroneShield continuing to be the partner of choice for protection agencies worldwide,” said Ryan. “We’ll continue to evolve with the technology and remain an innovative leader.”

technically sophisticated systems is a clear mission to address emerging threats that are likely to play a “tremendously important” role in the future.

“I’d go so far as to say DroneShield is one of the most relevant technology companies on the planet right now,” he said. “We’ve never seen this level of drone activity – both commercial and nefarious –especially on modern battlefronts.

“DroneShield plays a critical role in responding to this challenge.”

delivering complete air and power solutions for

When performance matters, selecting the right industrial air and power solution backed by local support and new innovations is imperative.

The basis for achieving performance, reliability and efficiency in manufacturing environments is a direct result of having the right equipment, operated in the right manner.

However, it is often the elements regarded as ancillary tasks, such as scheduled maintenance and upgrades, which can ultimately determine the ongoing success of an operation. If a supply of compressed air or power is disrupted, entire manufacturing processes stop. With no product output, delayed schedules and resulting rectification, costs can begin to grow.

Therefore, choosing the right solution is not only about delivering the required performance outcomes but also ensuring you have the service and support available to keep things running at their optimum.

CAPS has delivered complete air and power solutions to Australian businesses for more than 45 years and is now packaging its service and support experience into CAPS Care.

Continuing its well-established industry services, CAPS Care features diagnostic and maintenance

programs that ensure your equipment runs smoothly throughout its operational life.

Always looking to deliver additional value for its customers, and now as part of the global Ingersoll Rand group, CAPS is sharing its enhanced support and assurances with customers. Scheduled air compressor maintenance, as well as using predictive analytics, helps prevent unexpected interruptions in production and CAPS Care provides clients with ongoing warranty, parts and service plans, ensuring the greatest value for managing their assets.

With 10 branches nationwide, CAPS’ team delivers service, advice, support and spare parts, with its 24/7 maintenance and breakdown service. With direct access to Ingersoll Rand’s global offering of innovative and mission-critical air, fluid, energy and medical technologies, CAPS can enhance an industry’s productivity and efficiency.

A CAPS Care program to suit

Compressed air, filtration and power generation are important elements in the operation of essential

utility services, manufacturing facilities, industrial complexes and commercial environments. To support the varied operations, four types of CAPS Care programs have been established to cater for different requirements.

Packaged care allows users to focus on maximising their operations while knowing their equipment is covered. With scheduled maintenance and predictive analytics, it helps prevent production disruptions and covers a company’s new equipment with total extended warranty coverage.

With extended air-end warranty for new Ingersoll Rand Equipment, Planned Care provides predictable maintenance, diagnostics, and detects early problems.

If a company believes it has the service capability but wants regular access to genuine OEM parts, then Parts Care can be set up as either automated shipments or a reminder plan.

To predict problems before they occur, Performance Care provides predictable

maintenance, diagnostics, and access to CAPS Insights for early problem detection.

CAPS’ national footprint means the team is working in the same time zones as its clients and are on hand to support customers through the entire process. This includes understanding their requirements, offering suggestions, providing advice and ultimately delivering the solutions and support they need.

CAPS has a range of products from partner brands such as Ingersoll Rand, AIRMAN, Mitsubishi Heavy Industries, Sauer, Pedro Gil, Bollfilter, Next Turbo Technologies, Oxywise and many more, as part of its designed solutions.

CAPS delivers complete solution designs, developed by its in-house engineering team and supported through its Australian ISO9001 accredited manufacturing facility. The custom-built systems are matched to clients’ requirements. This expertise also enables CAPS, where possible, to integrate new technology into existing installations, enhancing the operational performance and life of equipment and infrastructure.

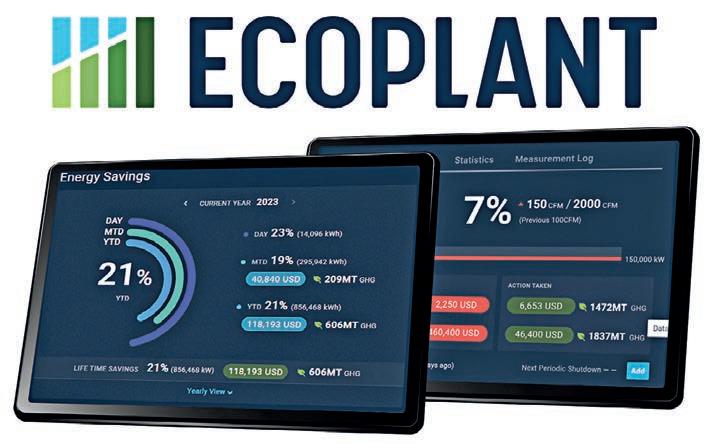

Optimising energy usage and minimising downtime are critical in today’s competitive manufacturing landscape. Ecoplant, an advanced dynamic controls platform, delivers real-time, actionable insights that can unlock annual savings for a company’s operations by enhancing the performance of its compressed air system.

Designed to identify inefficiencies and reduce costly downtime, Ecoplant leverages cloud-based monitoring and dynamic control technology to optimise energy use in real time. By integrating seamlessly with existing compressed air infrastructure, it delivers both immediate and longterm operational benefits.

As a fellow global Ingersoll Rand company, Ecoplant is part of a network committed to delivering efficient solutions tailored to local needs.

One of Ecoplant’s standout features is its compatibility with all major original equipment manufacturer compressed air systems. This flexibility means it can be integrated easily into existing setups, regardless of brand. Powered by advanced machine learning models, Ecoplant provides predictive maintenance insights and instant alerts for potential system failures, helping to ensure reliability and uninterrupted production.

Unlike traditional static systems, Ecoplant requires no upfront capital investment. There are no installation or maintenance fees, instead there is

a monthly subscription that includes all necessary hardware and support.

The platform’s intuitive dashboard delivers reporting and real-time analytics, giving a team the information they need to make proactive decisions. As production demands fluctuate, Ecoplant dynamically adjusts system controls to maintain peak efficiency, detect leaks early, and respond instantly to changes – no manual intervention is required.

Ecoplant also helps future-proof an operation. Its open architecture allows for seamless integration with new technologies as they emerge, ensuring a business remains agile and competitive in an evolving landscape.

Whether a company is looking for a reciprocating, rotary screw, oil-free rotary screw, portable diesel or centrifugal air compressor, CAPS’ flexible solutions are engineered around a client’s needs, with a commitment to delivering low-cost industrial air compressors that are built tough and engineered to the end user application.

The at-scale generation of nitrogen to support operational needs is a challenge for which CAPS Australia has efficient solutions. Experienced in delivering engineered nitrogen (N2) or oxygen (O 2) generation systems, CAPS can configure the equipment needed to support on-site demands.

Industrial, utility and commercial operations are reliant on uninterrupted power supplies. CAPS has proven itself in the delivery of reliable and cost-effective backup power solutions, with the equipment sizes and power outputs able to be customised to meet specific needs and operating environments.

At the heart of every diesel-powered generator, the engine dictates the reliability and efficiency of the generator. This is the sole reason why CAPS only sources from manufacturers who use the best engines, such as Kubota, Perkins, Isuzu, Volvo, Mitsubishi and Yanmar, each paired with alternators and controllers to help ensure operational continuity.

The AIRMAN range of industrial diesel-powered generators are the smart choice for a reliable source of energy. Airman is one of the world’s largest manufacturers of diesel compressors and generators. Designed, engineered and manufactured in Japan, the Airman range of portable power generators are renowned for their precision engineering, reliability and fuel efficiency.

Partnering with Mitsubishi Heavy Industries Engine System Asia (MHIES-A), the Mitsubishi Generator Series (MGS) delivers reliable performance, supplying power during emergencies and acting as a backup for critical operations. Meticulously crafted in Japan with globally recognised Mitsubishi Engines, Mitsubishi Turbochargers, advanced control systems and a top-quality brand of alternators, the MGS exemplifies quality and performance.

Utilising quality products with proven reliability, CAPS delivers global solutions, suited to Australian conditions, backed by local service.

Get in touch with the CAPS team to discuss compressed air and power generation requirements or discover how Ecoplant and CAPS Care can optimise an operation.

Contact the CAPS team on 1800 800 878 or visit www.caps.com.au

Walkinshaw Group representatives spoke to Manufacturers’ Monthly about the growth of its remanufacturing arm, which now depends on Objective3D additive technology for core operations.

As a major player within performance engineering and precision manufacturing, Walkinshaw Group has been at the forefront of automotive innovation in Australia for more than 35 years. While Walkinshaw Andretti United (WAU) is best known for its high-profile presence in racing and motorsport, with each year the broader Walkinshaw Group is increasingly focused on vehicle remanufacturing programs and industrial operations.

“The Walkinshaw Group, founded by Tom Walkinshaw, evolved from his racing team, Tom Walkinshaw Racing (TWR). In 1987, TWR partnered with Holden to form Holden Special Vehicles (HSV). That was really the beginning of Walkinshaw’s involvement in Australian motorsport and creating performance vehicles,” said CAD manager, Walkinshaw Group, Phil Georgiou. “Walkinshaw would order specific Holden Commodore variants direct from the GM production facility in South Australia and have them transported to Walkinshaw’s factory in Clayton Victoria.

“These vehicles would be partially disassembled and reassembled with specific Walkinshaw component upgrades including, front and rear fascia’s, side skirts, wheels/tyres, brake callipers, exhaust system, suspension, engine tuning and

interior trim components – to name a few.”

According to Georgiou, the company’s emphasis placed on re-manufacturing programs comes with developments including the departure of iconic automotive names, forcing Walkinshaw Group to adapt.

“When GM ceased manufacturing in Australia in 2017, Walkinshaw shifted its focus from performance upgrades, to remanufacturing programmes for some of the largest automotive Original Equipment Manufacturer (OEMs),” he said.

Now, the company’s remanufacturing arm is fully realised, with a capability of remanufacturing approximately 10,000 vehicles coming from its Melbourne facilities in collaboration with major OEMs. The remanufacturing program in Australia focuses on converting American-built vehicles –such as the RAM 1500, Chevrolet Silverado, and Toyota Tundra – from left-hand to right-hand drive, tailoring them for the local market and to meet Australian standards.

“Part of remanufacturing involves disassembling various subsystems of the vehicle, reusing many left-hand drive components, and generating brand new right-hand drive components for conversion,” said Georgiou.

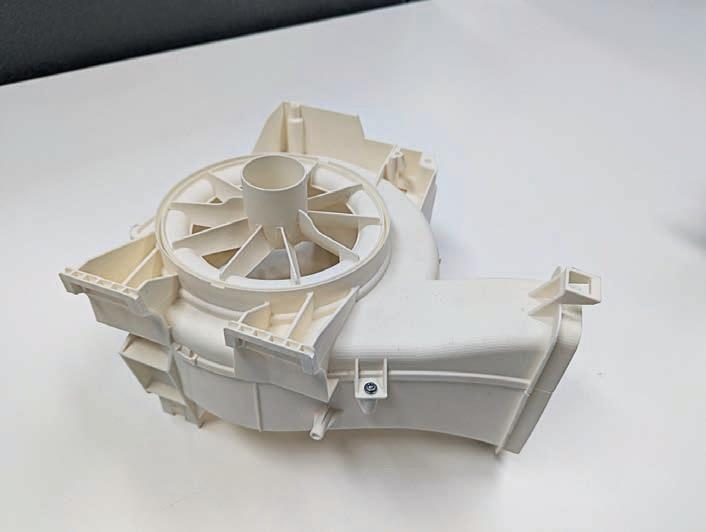

Within this vehicle remanufacturing program, additive manufacturing technologies play a crucial yet often hidden role. Recognising the technology’s importance across various operations, Walkinshaw expanded its capabilities in 2023 by forming a strategic partnership with Objective 3D, enabling access to cutting-edge Stratasys FDM 3D printing technology. This use of additive manufacturing for operations and relationship with Objective 3D dates back over 10 years.

“We’ve been working with Objective 3D as our supplier and support network. They’re the go-to for material procurement, servicing the machines, and helping us with any issues we’ve had with prints or STL files. They’ve been pretty instrumental for us,” said Georgiou.

“Our relationship with Objective3D goes back to around 2015. At that time, we had one of the earlier Stratasys 400MC machines,” said Andrew Thiel, CAD engineer, Walkinshaw Automotive Group.

The Walkinshaw team turned to Objective3D because of its reputation as a trusted provider of additive manufacturing solutions in Australia and New Zealand. It brings to the table more than 12 years of experience in offering advanced

3D printing technologies – from Carrum Downs, Victoria – that deliver rapid prototyping, custom manufacturing, and on-demand production services across industries including aerospace, healthcare, automotive, and education.

The 2023 partnership focused on the adoption of the Stratasys Fortus 450mc FDM 3D Printers –an upgrade on Walkinshaw’s previous Stratasys systems. Supplied and supported by Objective3D, these industrial-grade printers play an important role in accelerating product development and production across the organisation. From rapid prototyping and custom tooling, the technology is now embedded in Walkinshaw Group’s operations.

“All of our 3D printing is for the prototype or feasibility stage or conducting trial fitments on vehicles. The trial fitments check clearances, gaps and margins, design for assembly (DFA),” he said. “Engineers often request trial fits for new parts, which we design, print, and adjust based on fitment tests – forming a key part of our prototyping loop.

“It’s useful to be able to iterate like that. You can quickly 3D print something, check if it works, then go again.”

aimed at building upon the trust they already had in previous Stratasys 3D printing systems. The currently used Stratasys Fortus 450mc built upon this with the improved ability to swiftly produce high-quality prototype parts used across a range of applications.

heat-resistant parts we needed,” said Thiel. “We found this was especially true with the ULTEM material. That’s what we use for jigs and fixtures that need to handle high temperatures in the engine compartment, during the remanufacturing process.”

Georgiou said that many of these 3D printed parts are jigs and fixtures for left-hand drive components, which production can use to scribe lines onto the firewall and figure out where they need to be cut.

“We use 3D printed parts for reworking a lot of the left-hand drive components,” said Georgiou. “Once you’ve got just the shell of the vehicle – like the cabin – we cut out the firewall in certain areas and replace those with new pressed panels that accommodate things like the right-hand drive steering column, pedal box, HVAC plumbing, and wiper mechanisms.”

For what is now a vital process within the re-

“Every second counts not only on the track but also in the workshop,” said WAU team principal Bruce Stewart. “The high-performance standards of Stratasys industrial printers and materials means these parts also perform exceptionally well, despite the extreme heat, dirt, and vibration.”

Additionally, the Fortus 450mc has a capacity for more than two dozen materials – including those with flame-retardant properties, chemical resistance, and carbon-fibre reinforcement. By leveraging these advanced thermoplastics and specialty materials,

Walkinshaw Group ensures its printed parts meet standards.

“We found Stratasys machines particularly reliable and capable of producing the high-strength,

This level of material versatility is especially critical in Walkinshaw’s remanufacturing operations and has seen the Fortus 450mc form the centrepiece of a dedicated, temperature-controlled Smart Manufacturing Hub adjacent to the team’s vehicle assembly area.

This strategic partnership between Walkinshaw Group and Objective 3D has proven essential in advancing the company’s remanufacturing capabilities, enabling faster and more precise prototyping processes. By embedding Stratasys additive manufacturing technology into their operations, Walkinshaw Group continues to drive innovation and maintain its competitive edge in the automotive industry.

The decade-long relationship between PLP Australia and Capral Aluminium has proven to be an important piece of the puzzle that makes up one of the country’s largest energy infrastructure projects.

While partnerships are valuable across industries worldwide, strong collaboration between engineering expertise and high-quality materials is especially critical in the production of energy infrastructure. In Australia, one such standout collaboration exists between Preformed Line Products (PLP) and Capral Aluminium.

“PLP’s been working with Capral for over 10 years. They’re our preferred supplier of aluminium,” said general manager for sales and marketing at PLP Australia, Adam Talbott.

An energy infrastructure project spanning three Australian states Project EnergyConnect (PEC) is a 900-kilometre interconnector that unites the electricity grids of New South Wales, Victoria, and South Australia. These three states have united in a bid to provide energy security, improve grid resilience, and shift towards renewable energy.

“It runs 200 kilometres within South Australia and 700 within New South Wales,” said Talbot. “Its purpose is to connect South Australia, New South

Wales and Victoria so they can share energy. PLP has been proud to be involved from an early stage.”

“If there is a significant event that detrimentally impacts the power network, like what happened in South Australia a few years back, a connection like this will help redirect power from other states to the affected areas so that electricity can be restored quicker.”

PLP has been involved in the project since its design stage in 2020 and has supplied customengineered aluminium busbars from its Western Sydney facility to key PEC substations at Buronga, Dinawan, and Wagga Wagga. Busbars are custom designed components in substations that connect major electrical equipment.

“Every aspect of the busbars – from custom die sizes to palm placements – are fine-tuned in consultation with project contractors and clients. The more that we can help with the design and maximise busbar length, the less welds that are required on site. It saves time and effort and ensures that it all fits and connects,” said Talbot.

While PLP delivers busbars of up to 24 metres in length, they are joined on site to create lengths that

extend more than 200 metres.

“The Buronga site is one of the largest in the Southern Hemisphere. PLP Australia has delivered around 350 lengths of busbars to Buronga. That equates to around five kilometres,” said Talbott.

At the core of PLP’s operations is a material that is essential for energy infrastructure. Aluminium has high conductivity, is corrosion resistant, has good strength-to-weight ratio and is recyclable which makes it suitable for outdoor applications. The sustainability credentials of aluminium align with PEC’s low-emission criteria.

PLP depends on Capral to supply consistent quality aluminium extrusions and provide reliable delivery times to align with the PEC construction schedule.

“Our preferred supplier is Capral, particularly on large projects like this. They are local and have made a point of understanding our business and what is important to our clients,” said Adam Talbot.

”Capral’s ability to produce extrusions up to 13 metres long, enabled reduced welding time and

simplified installation, which helped to cut costs.”

Partnering closely with PLP from the project’s earliest stages, Capral has helped select suitable aluminium alloys and supported the engineering design process which gave PLP a competitive edge during tendering.

“We engaged with Capral to work through choosing the right alloys, particularly for the mechanical strength required within a substation. We also worked to ensure that we could put together a very competitive and compelling bid for the project,” said Talbot.

The mutual understanding between both businesses originates from what is a decade-long working relationship built on trust and reliability. Talbot said throughout all the dealings with Capral over this time period, the primary reason PLP continues to choose its offerings is the quality.

“We’ve never had an issue with Capral’s product – and when you’re dealing with projects of this scale and importance, reliability is everything. I enjoy working with them because if I’ve got questions, I can call and speak with someone straight away,” he added.

Once Capral’s aluminium bars arrive at PLP’s Sydney facility, they are cut, welded and assembled, custom-labelled for transport, and delivered ready for installation.

“Once arriving at PLP Glendenning, the Capral Aluminium tubes get unloaded and sent into our welding bay where they’ll be cut down to the required engineered length.”

This prepares PLP for transporting the aluminium products to PEC sites that are by no means ‘close-by’. Once delivered, the busbars are assembled in a manner that Talbot referred to as “like a Lego set”.

“It’s a long drive, around 1000 kilometres to get to the Buronga site from PLP at Glendenning in Sydney,” said Talbot. “All the components are labelled individually, so the guys on site know where they need to go and what needs to be welded together in accordance with the design drawing, and away you go.

“They’re packed very carefully to make sure that the 21-metre-long busbars are going to arrive safely and can be easily unpacked.

“Seeing their work energised on-site is a point of pride for the PLP team. It might just look like a tube of aluminium – but behind every busbar is months of planning, problem-solving and careful execution.”

The long-standing partnership between PLP and Capral exemplifies how collaboration between local manufacturing companies, engineering expertise and quality materials can power the nation’s most critical energy infrastructure.

EMO’s 2025 event in Germany takes place in September, bringing together metalworking and machine tool industry leaders from around the globe.

In 2025, EMO will celebrate its 50th anniversary when the international trade fair for metalworking production technology returns to the Hannover Exhibition Centre from September 22-26. The milestone will also be marked with an EMO World Tour, with presentations in cities like Prague, Paris, and Stockholm.

Under the motto Innovate Manufacturing , for half a century EMO has stood for innovation, internationality, inspiration, and the future of metalworking.

“EMO exists as a platform for dialogue between all the international players in the industry –manufacturers and users,” said executive director of EMO organiser, VDW, Dr. Markus Heering. “The trade fair is unique as visitors can find so much international expertise.

“EMO has become a global institution and a fixed

date in the trade fair calendar. It’s far more than just a trade fair. Being present is essential.”

Since 1977, organiser VDW has drawn from its experience in organising exhibitions for the global machine tool and metalworking sectors to ensure the event garners the presence of key figureheads in the industry.

“VDW based in Frankfurt am Main, Germany, has represented the interests of the German machine tool industry for more than 130 years,” said Heering. “Machine tools for the metalworking industry represent the key to modern industrial production.”

Heering said EMO Hannover represents the value chain of metalworking, including the global launch of start-up innovations and key technologies from experts in additive manufacturing, automation, digitalisation, artificial intelligence, and sustainability.

“Germany is the most important market in Europe, with most progress in metalworking technology often

invented in Germany,” he said. “Start-up companies in the field of production technologies introduce their innovations to establish their companies and find cooperation with new customers or business partners.”

Following the success of the 2023 event, which hosted over 1,800 exhibitors from 45 countries and attracted around 92,000 trade visitors from nearly 140 countries, VDW looks to further establish EMO as a critical platform for innovation and industry insight.

“VDW always has its finger on the pulse on the important topics in the industry to bring international experts to the trade fair and offer them a stage,” said Heering. “Focusing on promoting and expanding the dialogue and the network of exhibitors, visitors and industry experts is also a priority.”

For 2025, more than 1,400 exhibitors have already registered, with nearly three-quarters coming from outside Germany – including from Australia. Heering said these exhibitors will have the opportunity to forge meaningful business connections partnerships.

“It is not unusual for exhibitors to find cooperation partners for special projects at EMO, or for visitors to find new suppliers with whose help they can drive their business forward,” he said. “EMO organises matchmaking activities that bring together exhibitors and visitors with the same interests.”

For important visitor target groups – like aerospace, medicine and electronics – support is further strengthened by EMO’s promotional services.

“For example, we publish their product and company news on the EMO website, take them over to the EMO newsletter and promote them over the EMO social media channels,” Heering explained. “We built up landing pages where exhibitors can publish their news purposefully.”

Despite always reaching the broader metalworking sector, EMO 2025 focuses on automation, digitalisation, AI, and sustainability. According to Heering, these themes further reinforce EMO as a global innovation platform that advances key production trends.

“Industrial production is taking a major step

forward thanks to advances in the EMO focus areas, which are already mentioned. These advances can stimulate investments and boost demand for production technology,” he said.

Heering noted that automation will be front and centre in 2025 due to its proven benefits in boosting production efficiency and quality. This presence includes a Cobot Area that focuses closely on automation and collaborative robots and their potential applications.

“Automation solutions represent one of the main drivers for investments and are offered in many different forms by numerous EMO exhibitors,” he said. “They include grippers, machine vision, measuring systems, software, industrial electronics and feed systems.”

In addition to automation, EMO will explore sustainability and circular economy practices with exhibitors presenting solutions that reduce energy and material waste.

“The Sustainability Area at EMO 2025 will be the ideal meeting point to experience solutions for sustainable production,” said Heering. “Exhibitors will provide information on trends in energy efficiency, the integration of regenerative energies, recycling, and lifecycle concepts.”

It’s not just innovation that EMO fosters – the trade fair is also dedicated to skills and workforce development through support measures to

ensure that the mechanical engineering industry remains innovative and competitive. This ties into VDW’s Mechanical Engineering Youth Foundation, which promotes vocational careers and youth engagement programs.

“With an eye on the future and young talents, the

training is the basis for the success of the industry.”

Heering emphasised that despite the presence of other trade fairs, EMO remains the premier event for showcasing innovation, with exhibitors still timing major developments around its schedule. With global economic uncertainty ongoing, he hopes EMO 2025

With the reshaping of supply chains, RSM Australia’s Ross Dixon and Thomas Leslie outline how manufacturers can navigate uncertainty and seize opportunities heading into FY2026.

As we draw closer to 30 June, the uncertainty that has characterised the global business community throughout the year will persist beyond the end of the 2025 financial year.

Donald Trump’s start to his second term as President has resulted in volatility in the international share market and unpredictable foreign policy. Manufacturers, still grappling with the impacts of the

supply chain interruption in sight, this article will provide some key areas Australian manufacturers must focus on as they enter the 2026 financial year to reduce impact from global factors and put themselves in a position to benefit from new opportunities as they arise.

RSM Australia, part of the global network RSM International, offers tailored audit, tax, and consulting services to various industries,

tax advisory, and financial modelling, guiding manufacturers from growth and funding stages to business sale.

• Data analytics – giving insights into manufacturing chains, including business process improvement, customer growth, data management, and more.

• Transfer pricing – assisting manufacturers with international related party sales and supply chains. R&D – helping clients access potential R&D

digital ecosystem for manufacturers, including NetSuite and ERP solutions for those requiring more advanced platforms for cost accounting, inventory, and other manufacturing accounting needs.

• Management reporting – offering customised management reporting and dashboarding to provide better business oversight and insights for manufacturing business owners and managers.

In times of uncertainty, it is paramount that manufacturers have a complete understanding of their business. Starting from the conception and design process, knowing where their inputs are sourced, what staffing requirements the business requires, through to current customer needs, target markets and logistics with a solid understanding of the tax and accounting landscape from which the business operates.

Being aware of these factors is within the control of the business owner and having a thorough understanding of the business allows them to pivot in response to unexpected changes quickly or to take advantage of new opportunities as they arise in this ever-changing business landscape. Impacts of the current global and domestic landscape include:

• Currency fluctuations as global tensions weigh down on currencies.

• Impacts on freight as the international tariff wars continue to impact global shipping operations, which is especially important for Australian-based manufacturers given their geographical location.

• Cost of compliance and operations in the USA will continue to increase given the tariffs themselves, but also additional compliance costs associated with US enforcement of the new tariff regime.

• Potential price decreased as Australia becomes a “dumping ground” for excess stock that historically would be headed to the US.

Heading into the 2025 tax time there are important enacted and unenacted tax changes manufacturers must be aware of.

The Instant Asset Write-Off threshold –businesses with under $10m in aggregated turnover can choose to opt into the small business depreciation rules under 328-D, which will allow access to the Instant Asset Write-Off. This measure allows businesses to immediately deduct the cost of depreciating assets costing less than $20,000 (excluding GST) against their assessable income in that financial year. The $20,000 threshold is legislated for the 2025 financial year but reverts to the standard amount of $1,000 from 1 July 2025.

RSM believes that while an immediate tax deduction helps to reduce the income tax burden in the year the asset is purchased, it is important

to remember that when sold, the proceeds are subject to taxation as the asset has been depreciated and has no cost base.

Non-deductibility of General Interest Charges

– From 1 July 2025, General Interest Charges (GIC) and Shortfall Interest Charges (SIC) charged on ATO debts will no longer be tax-deductible. By removing the ability for businesses to deduct interest charged on their outstanding ATO debts, the cost of falling behind on ATO obligations increases. This measure applies to any outstanding ATO debts that are overdue and will apply regardless of if there is a payment plan over the debt or not. The current ATO GIC is 11.17 per cent per annum.

RSM emphasises that in addition to the removal of interest deductibility, the ATO has tightened its stance on the remission of overdue interest charges. It is crucial manufacturers treat ATO debt as seriously as any other form of finance to make sure they have robust cash flow planning measures in place to ensure ATO obligations are met on time. Businesses with inconsistent or seasonal cash flows should consider alternate financing options to pay ATO obligations as interest on normal business financing remains tax deductible.

Payday Super – From 1 July 2026, the Government has announced that among other changes, employee Superannuation Guarantee must be paid within seven days of paying the employee’s wages. This is a significant shift from the current timing, which only requires employers

to make payments of super four times a year, being 28 days after the end of each respective quarter. Also, the Superannuation Guarantee rate is increased from 11.5 per cent to 12 per cent from 1 July 2025.

RSM believes that employers should review their payroll processes and systems to ensure they are ready for the superannuation changes. Consideration should be given to the system’s employers use for their payroll, internal finance function improvement, changing pay run frequency and the cashflow impact the more regular superannuation payments will have on the business.

Amid the rising global economic uncertainty, the government encourages businesses domestically to invest in research and development through the R&D tax incentives scheme. The R&D tax offset helps subsidise the cost of investment into the development of new processes, products and technologies.

Given the result of the 2025 Federal election, Labor’s Future Made in Australia economic plan will continue to be at the forefront of the economic government’s agenda. The Future Made in Australia plan provides funding for investment into green energy manufacturing, critical minerals processing and renewables through funding various regimes.

Treotham Automation has unveiled igus’ new G4.42 glide-chain that poses improved performance and lower costs for long-travel indoor crane applications.

As a supplier of high-quality electrical components and products to a range of industrial markets, Treotham Automation has introduced the glide-chain G4.42 tailored for long-travel indoor crane applications. The system from motion plastics expert igus, is an energy chain designed to travel lengths of up to 30 metres for a variety of modern manufacturing factory operations.

“The G4.42 glide-chain is a fit for industries requiring reliability, extended travel distances, and robust performance under continuous motion, especially where low noise, fast installation, and ease of service are essential,” said national sales manager, Treotham, John Sharp. “With customers under massive pressure to reduce their costs, igus has developed a product that not only saves money but also has a long service life.”

Sharp said the system prompts lower operational costs, fewer unplanned downtimes, greater energy efficiency and sustainable automation compared to igus’ previous E2 and E4 range. This is a result of a simplified, lightweight design that includes extralarge sliding surfaces and cost-optimised side links on both sides.

“The 25 per cent weight reduction in the G4.42 offers a strategic upgrade, enhancing speed, efficiency, and ease of use without sacrificing reliability,” said Sharp. “Compared to standard chains with the same dimensions there is also a price advantage of 30 to 40 per cent.”

Increasing performance while reducing costs

Sharp emphasised the G4.42’s structure that improves durability and reduces friction is the combination of specialised materials and engineering innovation.

The use of tribologically optimised polymers offers low coefficient of friction, high wear resistance, high load-bearing capacity and resistance to dirt, moisture, and chemicals. This allows for lowered wear rates in long-distance sliding operations and minimal maintenance.

“For the material composition, igus uses proprietary engineered plastics, formulated with solid lubricants and fibres that enhance abrasion resistance and eliminate the need for external lubrication,” said Sharp.

Another key feature is the chain’s glide-optimised

underside design, which is shaped to reduce surface area contact and minimise sliding friction. This geometry allows for a stable gliding surface, thus reducing wear on both the chain and the guiding trough.

“This results in a smooth, quiet, and low-friction motion even at long lengths and under heavy loads,” said Sharp.

The G4.42 also features snap-open crossbars, less mechanical strain on components and noise dampening features.

“The easy-to-open crossbars simplify cable installation and inspection, reducing handling time and minimising the chance of stress on cables during assembly,” said Sharp. “It also incorporates vibration-absorbing link profiles and a quietglide design.”

According to Sharp, with the performance advantages of G4.42, comes surprisingly controlled costs. This makes it suitable for budget-conscious applications where reliability and durability can’t be compromised. This cost optimisation revolves around the chain’s side links.

“Their geometry is optimised for strength while reducing material usage, which keeps weight and material cost low,” said Sharp.

On top of this, the glider chain’s moulding process poses a competitive price point, making highperformance cable guidance accessible to more industries and projects.

“The injection moulding process used is highly efficient for mass production, helping to reduce manufacturing costs,” said Sharp.

To ensure these advantages are feasible, G4.42 has been tested in igus’ 4,000m² in-house lab for tensile strength, abrasion resistance, temperature resistance, noise levels and load-bearing capacity. All materials and design features are validated through real-world simulations for millions of cycles at different speeds and environmental conditions.

The chain’s durability is also backed by a fouryear guarantee.

“For users, this means greater long-term reliability, lower maintenance risk and stronger technical and financial justification,” said Sharp. “The four-year guarantee on the G4.42 not only surpasses typical industry warranty durations but also reflects igus’ leadership in quality assurance, testing, and material science.”

A product backed by experienced distribution Igus’ G4.42 is a product that is backed by Treotham Automation’s distribution network. With multiple warehouses and experienced staff, the company strives to provide customers with the highest quality products, service and technical support.

“Each company Treotham represents is an integral part of the automation process. Our international partners provide the industry’s highest standard of products worldwide,” said Sharp. “With offices nationwide, we offer a complete service to Australian and New Zealand customers by providing products and support locally at every level through experienced sales engineers and competent staff.”

Backed by testing, a four-year guarantee, and Treotham Automation’s trusted distribution network, the G4.42 is primed to empower industries in achieving smarter, leaner, and more reliable operations while controlling cost.

Sharp believes that igus G4.42 glide-chain is suitable for the many production environment requirements of major manufacturing sectors.

• Heavy machinery and construction equipment.

• Shipbuilding and offshore applications.

• General industrial automation.

• Aerospace and aircraft maintenance systems.

• Automotive manufacturing.

• Rail technology and transport systems.

• Warehousing and logistics automation.

Manufacturers’ Monthly explores how Minitab’s Statistical Software solutions are driving operational and quality outcomes in traditional metal and plastic manufacturing environments.

Software solutions provider, Minitab, has been increasing operational efficiency, enhancing product quality and reducing costs in industrial organisations for 50 years. The company has helped even the most traditional businesses – such as plastic and metal manufacturers – by utilising data analysis to drive decision-making.

“Developed in 1972, Minitab Statistical Software is now trusted by businesses around the world to deliver quality analytics and insights,” said analytics solutions design manager, Minitab Australia and New Zealand, Bass Masri.

Masri believes the company’s statistical quality analysis tools are embraced across a range of industries due to their proven effectiveness. He attests this to the company’s range of solutions that cater to different manufacturing verticals.

“Minitab provides a suite of improvement tools to enable manufacturers to analyse processes, identify key factors, optimise settings and monitor production,” he said.

Cutting through the complexity of metal manufacturing

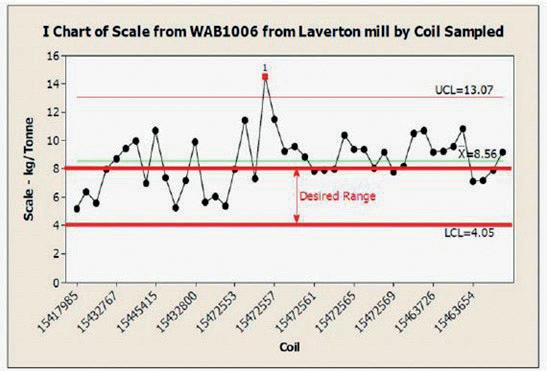

One manufacturing sector that stands to prosper from the advantages these solutions present is metal manufacturing. This potential was seen as Minitab helped OneSteel’s Laverton Rod Mill address an inherent issue in its steel manufacturing processes.

This issue surrounded excessive mill scale originating from the Laverton Rod Mill, presenting operational issues that impacted downstream processes at Geelong’s Wire Mill. To address this, Minitab provided solutions to identify issues surrounding the abrasive nature and uneven distribution of the scale.

“Minitab provided the statistical tools and graphical visualisations necessary for OneSteel to understand the factors contributing to excessive mill scale, evaluate the effectiveness of process changes, and ultimately reduce the issue,” said Masri. “This led to improved efficiency and cost savings at the Geelong Wire Mill.”

The process began with a comparative analysis using hypothesis testing to prove that there were differences in scale weights between different grades of steel rods.

“This helped them identify if certain steel types were more prone to excessive scale formation,” said Masri. “Box plots visually reinforced the findings, making it easier to see and communicate the variation in scale weights across different grades.”

After this, the team utilised a regression analysis to uncover the relationship between the laying head temperature and the weight of the mill scale to understand how a specific process parameter was influencing the scale formation.

“Scatterplots visually represented this relationship, making it clear how changes in head temperature correlated with changes in scale weight,” said Masri.

The Minitab team then evaluated process variation using a probability density function to analyse sampling data of scale weights and compare it to desired outcomes. Masri said that this helped quantify the variation and estimate the potential

• Measurement system analysis solutions ensure the accuracy and precision of measurement equipment.

• D esign of experiments solutions identify factors and optimise settings for manufacturing processes.

• Statistical process control solutions monitor and control processes to reduce variation and ensure consistency across production.

• C apability analysis solutions assess whether a process can consistently meet customer specifications.

• Quality improvement solutions identify and analyse defects, understand root causes and implement corrective actions.

• Predictive and preventive maintenance solutions identify potential equipment failures to prevent downtime.

savings from a potential reduction. Finally, Minitab assessed the impact of changes using its Statistical Software to analyse data before and after implementing process changes.

The changes implemented based on Minitab’s analysis had an impact on product quality and equipment longevity, according to Masri. This was highlighted through a reduction of head temperature, the optimisation of the cooling process, improvements based on steel grade and a focus on delay-causing rod grades.

“We reduced the laying head temperature and lowered the reform temperature on the cooling conveyor by 30 per cent,” said Masri. “Hypothesis testing and box plots revealed which steel grades formed more scale, prompting targeted adjustments. Pareto analysis identified the rod grades causing the most delays, helping us prioritise improvements and consider changes to reduce downstream issues.”

Masri said Minitab’s data-driven changes made steel manufacturing more efficient and costeffective, improving wire quality and extending equipment life.

Aside from immediate improvements, Masri said that there have been several long-term positives including a reduction in die consumption. The intervention also proved crucial to improving the mill’s yield, since a variation of just 1 kg of scale per tonne of rod was worth $75,000 in yield.

“By reducing the scale, the lifespan of these expensive dies increased, translating directly into lower operational costs due to fewer replacements and reduced downtime for die changes,” said Masri.

Additionally, much aligned with Minitab’s goals, its solutions have seen long-term benefits in lower housekeeping costs, increased production efficiency and higher product quality.

“Excessive scale caused $815,000 in housekeeping costs in 2008, so reducing it cut cleaning, waste, and possibly lubricant expenses,” Masri said. “Less rod wear also meant fewer die changes, boosting efficiency and throughput. Reducing surface defects from scale improved product quality, with fewer complaints, rejections, and greater customer satisfaction.”

By providing a cross-functional collaboration with a common platform for data analysis, visualisation and communication, Masri said Minitab was pleased with its effect on the overall operations at the steel mill.

Another long-tenured sector that Minitab has more than dipped its feet in is plastic manufacturing. This is seen through the company’s expertise in driving efficiency and quality within the injection moulding industry. The most pressing challenges within this vertical surround data management, efficiency, costs, product quality and regulatory compliance, equipment downtime and material variability. Masri said these are all issues Minitab as a solution provider was born to address.

“Industry experts have emphasised that Minitab plays a crucial role in enhancing process efficiency and reducing scrap rates by enabling a data-driven approach,” he said.