JULY/AUGUST 2025

JULY/AUGUST 2025

Pact CEO Paul Turton on his recipe for subscription success

Chobani’s Arthur Karuletwa on modernising the system

Fighting fungus with fungus

On the cusp of a solution to coffee’s biggest threat

The rise of robot baristas

Will androids replace humans behind the bar?

30 Beyond the café

10 A tough Pact to follow Pact Coffee CEO Paul Turton on bouncing back from COVID and the importance of fair pricing.

“The commodity market is the evil of the industry. It doesn’t work – it’s anachronistic. At some point, the coffee market will retreat and then how will farmers be treated?”

Paul Turton CEO, PACT COFFEE

14 Saving farming’s future

The average age of global coffee farmers is now above 50, with intervention needed to prevent the sector aging out.

18 Fighting fungus with fungus

Coffee leaf rust is threatening coffee harvests worldwide, but science is heading back to the disease’s source in search of a solution.

24 Regions on the rise: Indonesia

GCR spotlights one of the world’s biggest producers and why its farming sector is primed to continue its boom.

More than 11 million people wake up in hotels each morning. How is coffee helping to elevate the customer experience?

38 Can sustainability fix the supply chain?

Chobani’s Arthur Karuletwa had a vende a against coffee, and he’s using it to do good across the industry.

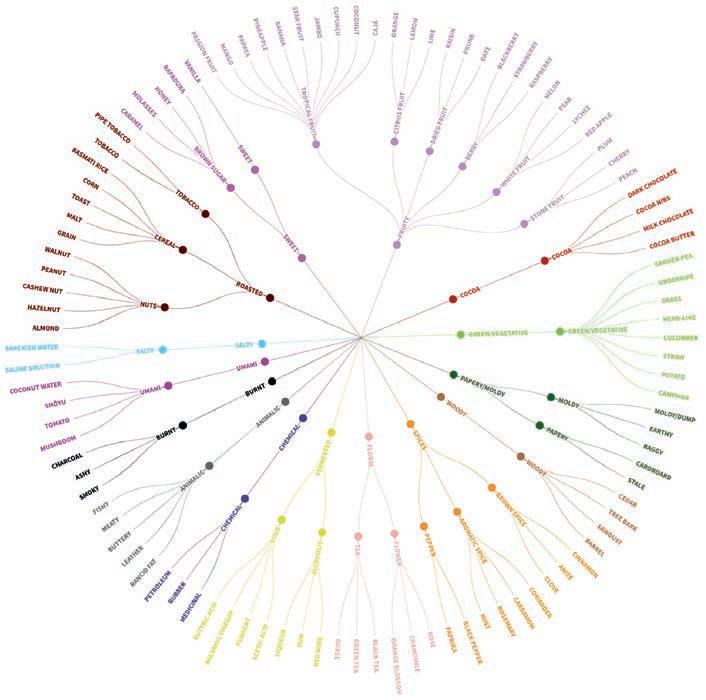

42 Robusta roule e

As interest in Robusta continues to rise, a new flavour wheel has been developed to evaluate the oftenunder-appreciated species.

45 Rise of the robot barista

As android baristas become more common across the globe, where does the traditional barista fit in with this technological revolution?

48 Jumping the Q

Sweeping changes are coming to the Specialty Coffee Association’s Q Grader program.

22 Barista bootcamp

Eversys brought together 12 new Brand Ambassadors for a three-day bootcamp at its Swiss HQ.

28 Arabian insights

SEB Professional reveals why modern coffee culture is rising so rapidly in the Middle East.

34 Good for the Soul

Schaerer is preparing to release a new feature to improve accessibility to its Coffee Soul machines around the world.

36 A gracious Host

The countdown to Host Milano 2025 is on, but what makes the flagship tradeshow a can’t-miss event?

50 From origin with love

Latin America’s single-origin producers received plenty of interest at MICE2025, and they’re already preparing to return next year.

58 Venice canal coffee

One café in Venice has given a new meaning to ‘a taste of Italy’.

04 Editor’s note 06 News in brief

Marketplace 56 Diary dashboard

he rise of social media over the past decade has seen co ee trends accelerate at a pace I’ve never witnessed before. From canned cold brew to strawberry matcha lattes, mushroom co ee to premium decaf, just as one trend is catapulted into the limelight it’s swi ly overtaken by another.

But what happens when the fashion zzles out? Is it game over for that product or are trends not really that important a er all?

In this issue’s cover story, we explore the success of Pact Co ee in the United Kingdom, a direct-to-consumer subscription-based roaster that’s de ed the odds. While many other subscription platforms failed to bounce back a er the post-lockdown subscriber slump, ve years on the company is set for doubledigit growth in 2025.

CEO Paul Turton tells Global Co ee Report how Pact has managed to buck the trend and continued to grow the brand in the subscription space. He also reveals how the roaster has prospered despite volatility in the global green-bean market, and why communication is key to product price rises.

While trends may not be the be all and end all in terms of success, one that has recently swept the market is the introduction of pop-up cafés operated by robot baristas.

e android evolution of the traditional vending machine, which is gaining momentum in Asia and beyond, is popping up in public spaces such as

shopping centres, university campuses, and o ces. Amid the rising popularity of such venues, we ask Chinese Barista Champion Simon Sun if the robot baristas are a threat to the profession and if we’ll all soon be ordering our morning at white from a barista plugged into the mains.

Another area of the industry that could soon be seeking help from a mechanical labour force is origin. According to Co ee Consultant Gerd Mueller-Pfei er, the aging population of co ee farmers is one of the biggest challenges the sector will face over the coming years.

It’s estimated the average age of co ee farmers around the world is about 55, with that number rising to 60 in Africa. While co ee is o en a generational occupation, many younger people are seeking alternative careers in urban areas that o er better nancial opportunities. In this edition, we explore the extent of the issue and some of the programs in place to avoid an international labour crisis.

Of course, there’s lots more to dive into, including an overview of Indonesia’s rapidly growing producing sector, the rise of premium co ee experiences in hotels, and the introduction of a Robusta avour wheel.

Enjoy the issue. GCR

Kathryn Lewis Editor, Global Coffee Report

CHIEF OPERATING OFFICER

Christine Clancy christine.clancy@primecreative.com.au

PUBLISHER

Sarah Baker sarah.baker@primecreative.com.au

MANAGING EDITOR

Myles Hume myles.hume@primecreative.com.au

EDITOR

Kathryn Lewis kathryn.lewis@primecreative.com.au

JOURNALISTS

Georgia Smith georgia.smith@primecreative.com.au

Daniel Woods

daniel.woods@primecreative.com.au

ART DIRECTOR/DESIGN

Daz Woolley daz.woolley@primecreative.com.au

HEAD OF DESIGN

Blake Storey blake.storey@primecreative.com.au

BUSINESS DEVELOPMENT AND SALES MANAGER

Charlotte Murphy charlotte.murphy@primecreative.com.au

CLIENT SUCCESS

Cailtin Pillay caitlin.pillay@primecreative.com.au

PHOTOGRAPHY

David McConaghy

HEAD OFFICE

Prime Creative Pty Ltd 379 Docklands Drive, Docklands, Victoria 3008 p: +61 3 9690 8766 enquiries@primecreative.com.au gcrmag.com

SUBSCRIPTIONS

+61 3 9690 8766 subscriptions@primecreative.com.au

Global Co ee Report Magazine is available by subscription from the publisher. e rights of refusal are reserved by the publisher.

ARTICLES

All articles submitted for publication become the property of the publisher. e Editor reserves the right to adjust any article to conform with the magazine format.

COPYRIGHT

Global Co ee Report is owned and published by Prime Creative Media. All material in Global Co ee Report Magazine is copyright and no part may be reproduced or copied in any form or by any means (graphic, electronic or mechanical including information and retrieval systems) without written permission of the publisher. e Editor welcomes contributions but reserves the right to accept or reject any material. While every e ort has been made to ensure the accuracy of information Prime Creative Media will not accept responsibility for errors or omissions or for any consequences arising from reliance on information published. e opinions expressed in Global Co ee Report are not necessarily the opinions of, or endorsed by the publisher unless otherwise stated.

Did you know that most customers enjoy chatting with the barista?*) They are even willing to pay more if the service is friendly and welcoming. The low height of our Mytico coffee machine facilitates contact between barista and customer, ensuring perfect coffee drinks and additional sales.

*) Allegra Project Cafe Scandinavia 2023

Chobani and La Colombe Coffee Roasters’ Arthur Karuletwa is on a mission to use sustainability and traceability to make the global coffee supply chain more equitable for all that operate within it.

Karuletwa, who was born in Rwanda, witnessed the country’s genocide against the Tutsi in 1994, and has been pursuing this mission for more than 20 years at every level of the supply chain.

Through his work not only with La Colombe, but also his vocal desire to ensure fair compensation for coffee producers through the Apple TV series Omnivore and La Mazocco documentary Rise of Espresso, Karuletwa uses coffee as a bridge for reconciliation and a tool for fighting poverty to further educate and inspire action in the improvement of equity in the global coffee industry.

See page 38.

Coffee farming as a profession is at risk of ageing out according to Founder of International Coffee Consulting Gerd Mueller-Pfeiffer. He is urging the industry to align on the seriousness of the issue and more strongly a empt to prevent young people from leaving coffee production.

The average age of coffee farmers in mass producing nations sits somewhere between 50 and 60, with traditional family succession planning beginning to fail where it had previously been a bedrock of the industry.

US$38.8 billion

The projected revenue of the Middle East’s coffee industry by 2030.

Expocacer (Cooperativa dos Cafeicultores do Cerrado) in the Brazilian producing region of Cerrado Mineiro says it is seeing strong success with a pair of key programs it has implemented to address the issue, Expocacer Teens and Elas no Café. However, the global cultural nature of coffee farming means it will be difficult to replicate these programs around the world.

See page 14.

A group of researchers in Brazil are on the brink of a promising and sustainable solution to managing coffee leaf rust (CLR), a fungal disease estimated to cause billions of dollars of economic damage to the industry each year.

CLR infects the leaves of coffee plants and hinders their ability to produce cherries. After first being identified in Africa in the 19th century, it has now spread to all coffee producing countries.

The research team, initially led by Professor Robert Barreto, has travelled the world to zone in on 10 promising fungal

38

isolates they believe have the potential to help manage CLR and protect coffee plants from the disease. Despite their success, difficulties in obtaining funding could see the project grind to a halt at its current critical late stage.

See page 18.

The Specialty Coffee Association (SCA) has announced sweeping changes to its Q Grader program, making the most significant alterations to its delivery since it was established more than 20 years ago.

The impending change, due to come into effect in October 2025, has been a ributed to the SCA’s desire to more closely align the program with its Coffee Value Assessment (CVA), which was introduced in 2022 following years of development.

With high-production nations including Brazil, Colombia, and Indonesia all recently signing Memorandums of Understanding

to implement the CVA in their own national operations, the SCA hopes the evolved Q Grader program will allow producers to speak the same “quality language” as one another in order to create be er communication, prices, and alignment across coffee’s international value chain.

See page 48.

Zalkifli Hasan, Indonesia’s Coordinating Minister for Food Aff airs, has publicly stated his ambition to see the country’s coffee production capabilities increase to surpass that of the world’s second-leading producer, and fellow regional production titan,Vietnam. Indonesia’s coffee production for 2024/25 stands at 10.9 million 60-kilogram bags, almost 20 million bags behind Vietnam, which is expected to have a lower harvest yield than average due

Can the coffee industry help secure farming’s future by bringing young people back to production? Image: Nexa/stock.adobe.com.

to ongoing climate challenges.

With a steadily growing economy, increasing consumer interest in local products, a booming specialty coffee scene, and a farming network with potential to further increase crop yield, Indonesia looks to be establishing a position where it could significantly improve its coffee production outcomes. However, the three-to-four year cycle of coffee tree growth could prove a limiting factor in seeing immediate results. See page 24.

The Middle East is one of the world’s fastest-growing coffee consumer regions, yet coffee culture has been ingrained in the region for centuries. The local market is projected to reach a revenue of US$38.8 billion by 2030, with a compound annual growth rate of 4.6 per cent from 2024.

Saudi Arabia has special significance in the growing region, according to SEB

Professional Vice President APAC/MEA/ Russia Claudio Maschie o, who says its location within the broader region makes Saudi Arabia an ideal trading hub within MEA.

“These factors, combined with growing demand for specialty coffee, high levels of investment in the sector, and government initiatives to promote local coffee cultivation, are making Saudi Arabia a key player in the global market,” he says.

See page 28.

Once restricted to the lobbies of innovationloving tech companies and high-traffic public spaces, robot baristas are now becoming more commonplace in areas typically held by barista-run cafés. Asia is quickly establishing itself as the hub for this latest consumer-facing

506,974 kilograms

The amount of coffee roasted by Pact Coffee in 2024/25.

automation innovation in the coffee sector, with products such as Singapore’s Ella and China’s COFE+. The capability of these robots, and others being developed around the world, continues to rapidly expand.

Is there room for both robot and traditional baristas to operate in the café market, or are android baristas on the verge of changing the profession and café culture for good?

See page 45.

Delegations from embassies and businesses representing a host of Latin American coffee producers have praised Melbourne International Coffee Expo (MICE2025) for helping create business opportunities for their countries, with Costa Rican delegate Gonzalo Quesada saying the event culminated in 86 leads for local businesses.

Representatives from Costa Rica, Ecuador, El Salvador, and Guatemala all a ended MICE2025 with the LatinAmerican Business Council, with the latest edition of the event seeing El Salvador return to MICE in an official capacity for the first time in a decade.

After the successful introduction of the

Roasters Playground in 2025, the focus on single-origin producers is set to take another step forward at MICE2026, with MICE Events Director Siobhan Rocks detailing plans to introduce Trip to Origin as a feature for next year’s event.

Trip to Origin will shine a light on the first step in the coffee value chain, and celebrate coffee farms and farmers while educating event a endees and providing a platform for green bean traders, dedicated embassies, and coffee producers to make new business contacts and partnerships.

See page 50.

Pact Coffee was an early adopter of the coffee subscription model. Since it was established in 2012, it’s grown to become one of Europe’s largest coffee subscription services under the leadership of CEO Paul Turton, and has thrived despite the post-pandemic downturn in interest in subscription services.

The company hasn’t been immune to the rising green bean prices that have plagued the coffee industry, and previously communicated its intention to increase

prices of most bags by £1 to its customers to compensate for the rising costs. Now, despite those challenges, it is on track to achieve 15 per cent growth in 2025.

Turton believes Pact’s desire to pay a premium for its beans has made it mostly immune to price rises. He says Pact pays farmers, on average, 48 per cent more than the Fairtrade base, and sources 60 per cent of its beans from women or gender equity groups, and 34 per cent from ruralpoor farms – all while roasting 506,974 kilograms of coffee in 2024/25.

See page 10.

Eversys has hosted its inaugural Shotmasters Bootcamp at its Swiss headquarters in Sierre to further grow its connection with customers and communities in some of the more than 100 countries in which its machines are distributed.

The selected Brand Ambassadors, also known as Shotmasters, embarked on a three-day regime involving training, cupping, and creative programming led by 2017 World Barista Champion and Eversys Global Ambassador Dale Harris.

Eversys Marketing Director Miranda Caldwell says the Shotmasters were selected from a variety of hospitality and foodservice backgrounds to represent the business’ individual target markets and introduce the company to a more diverse range of perspectives.

See page 22.

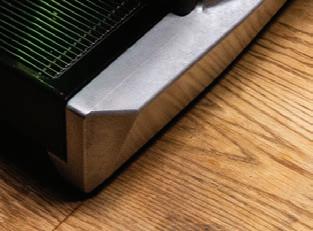

Automatic coffee machine manufacturer Schaerer is embarking on a journey to make quality coffee more accessible to more people ahead of the global launch of its Easy Access function.

Designed to allow its Coffee Soul machines to be accessed by people using wheelchairs, the function involves the installation of a module that features a series of control bu ons in front of the machine’s drip tray.

A variation of the Easy Access function was released in Schaerer’s United States market in 2023, but the company is now set to make the retrofi able module available worldwide in October 2025.

Schaerer Global Product Manager Xiaoya Tan says the business has already received extensive interest in the Easy Access function from a range of offices and

convenience stores around Europe, and believes the function will also find success in hospitals and other healthcare se ings.

See page 34.

The countdown to one of the world’s most popular foodservice and hospitality events, Host Milano 2025, is on.

With more than 2100 exhibitors from 50 countries and 180,000 professional visitors from 166 nations a ending Host Milano 2023, this year’s event is set to be another massive coming together of the international Hospitality, Restaurant and Catering (HoReCa) sectors.

Coffee is, once again, set to play a key role in the event, and Exhibition Director Francesca Cavallo says the Salone Internazionale de Caffè (SIC) section of the tradeshow has been revamped to take its place at the heart of the exhibition over twin-level pavilions.

The World Barista Championship, hosted by the Specialty Coffee Association, is also returning to Milan as part of the event. Cavallo says hosting the international competition underscores Host Milano’s commitment to the global coffee community.

See page 36.

While many coffee companies have struggled to get subscription services off the ground, Pact Coffee has bucked the trend. With double-digit growth predicted for the next year, CEO Paul Turton reveals how the roaster has continued to gain momentum post-COVID and the subsequent subscription drop-off.

HERE ARE FEW companies that experienced business growth during the COVID-19 pandemic, yet for the select few already in the subscription market, having their customer base stuck at home was an opportunity for expansion.

As many struggled to shi to the new, smaller way of life during lockdowns, one of the simple joys during the period of con nement was receiving everyday luxuries such as roasted co ee, baked goods, and beauty products by post. For those who could a ord it, retail therapy lived up to its moniker. In the United States (US), for example, between March and May 2020, the retail subscription service market saw growth rates of up to 145 per cent. And this wasn’t just a solution for consumers. For retail and some hospitality services, delivering goods direct to the customers who could no longer visit their venues or their customers’ venues was a method of generating revenue. In the global co ee industry, this shi saw many roasters pivoting from B2B wholesale to B2C subscription models.

In July 2020, it was estimated that one in 10 people in the United Kingdom (UK) had subscribed to a food or drink service, with

co ee among the most popular products. Roasters of all shapes and sizes across the world launched subscription schemes and many commentators predicted the consumer preference for getting products delivered direct to their doors would outlive the pandemic.

And yet, as soon as people regained their freedom, the appetite for the subscription

services started to decline. Many co ee companies tried to keep this new revenue stream alive, but most failed to reverse the decline – except for a select few, such as Pact Co ee in the UK. One of the reasons for its continued success? It didn’t pivot.

“Pact Co ee started as a subscription service and then established a roastery. Whereas many roasters entered the

subscription market in response to COVID-19, we’d been in the industry since 2012,” Pact Co ee CEO Paul Turton tells Global Co ee Report

“Part of our success was that, in the specialty sector, we were the rst in. Our Founder Stephen Rapoport started the business from his kitchen, fed up with the problematic co ee industry. Being the early adopter de nitely helped us.”

Today, around 60 per cent of roasters in the UK o er subscription schemes, with a large proportion of those companies entering the market during the rst lockdown. For most of those roasters, subscriptions now make up a minor percentage of their revenue, yet Pact’s more than 45,000 active subscribers account for 65 per cent of its business.

“ e technology we use has been another major factor in our success. When everyone entered the subscription market in 2020, most of them launched on the Shopify platform, which does a good job but doesn’t o er the tailoring that’s needed,” Turton says.

“Our technology allows us to o er our customers several key things: the ability to change frequency to suit their schedule as well as pause their subscription at any time; a very easy method to cancel, which

is hugely important to build trust; and the option to click an ASAP button and get co ee delivered the next day, whatever point in their subscription cycle.”

e online retail platform Pact uses is bespoke, with a support team working on the site and with customers every day to keep the business ticking over.

“Subscription services are hard – it’s not a license to print money. A lot of B2B providers are disinvesting because they haven’t cracked it,” he says. “Numbers spiked massively during COVID and then they dropped o . We did experience a tail o too, but we’re once again in that growth cycle.”

Since taking over as CEO in 2017, Turton has tripled the company’s annual turnover from £5 million (US$6.64 million) to £15 million (US$19.92 million). With a background in big businesses such as O ce Depot in the US and Hays PLC in the UK, stepping into the role he wanted to utilise his leadership, sales, and marketing experience in a smaller, more innovative setting.

“I wanted to truly make something my own and take the reins of a more entrepreneurial setup,” Turton says.

“As soon as I met the team, I could feel the energy in the room – it was completely di erent from my 20-year corporate experience where more o en than not people didn’t want to be there. Everyone was very passionate about the project. Stephen had given his heart and soul to the business and it was time for him to pass that on.”

In the eight years that have passed, Turton has helped build on the original subscription business by introducing a B2B wing of the operation, which is evenly split between o ce and corporate settings and the hospitality sector such as cafés, restaurants, and bars. In 2023, Pact also entered the grocery market, with its product rst introduced to high-end supermarket Waitrose.

“It’s funny because supermarkets were our original enemy – they were the main market we were going up against. But we’d been watching Waitrose’s progress over some time and what persuaded us to partner with them was their care and consideration for the products they choose to stock,” he says.

“ ey care for the producers and they’re there for growth. We’ve been in Waitrose for 18 months now and gone from strength-to-strength. Since then, we’ve also

partnered with other luxury grocers such as Ocado, Whole Foods, and Abel & Cole.”

While expanding into grocery and B2B has accelerated Pact’s growth, the lion’s share of its revenue is still generated by subscriptions. As of May 2025, it had 45,000 regular subscribers in the UK, 30,000 of which had bought more than 20 bags of co ee from the brand. So how did Pact bounce back a er the post-COVID slump?

“Some of it was having a rock-solid proposition. From the beginning of the business, we have focused on freshness and our process means customers never receive a bag of co ee that’s more than seven days old. Generally, it’s roasted on day one and delivered by day three,” Turton says.

“We also cracked many of the retention challenges. In the early days, we were heavily discounting the rst bag and nding a lot of people didn’t stick with us past that. Now, we encourage new customers with free gi s instead, such as a V60, cafetiere, or Clever Dripper. A free gi works well because it gets the customer familiar with the proposition.”

Another string to the team’s bow has been the use of intuitive technology. Pact’s web team developed a Co ee Picker tool that helps customers select co ees that suit their preferences, which uses customer feedback as well as user data to generate suggestions.

“We normally send new customers a crowd-pleasing blend we know they’ll love rst, before starting to introduce them to more fruity and oral beans,” he says.

“Our menu is always changing and our customers typically have the opportunity to choose from more than 200 co ees over a year. It’s important to us to cater to both the co ee connoisseurs as well as mainstream audiences who are only just being introduced to specialty co ee.”

Green beans and cost increases

While the co ee industry has experienced one of its most challenging years due to high co ee prices, supply and demand issues, and shi s in consumer buying habits, Pact Co ee is on track to achieve 15 per cent growth in 2025.

“We made some important changes to protect the integrity of what we do – including a price increase of £1 on most bags – and the result has been overwhelmingly positive, with 99 per cent of customers choosing to stay with us. It’s a testament to the strength of our customer base and the value they place on quality, ethics, and transparency,” Turton says.

“We have been crystal clear with our

“Subscription services are hard – it’s not a license to print money. A lot of B2B providers are disinvesting because they haven’t cracked it.”

Paul Turton CEO, PACT COFFEE

communication that farmer welfare remains essential to our business.”

Forming direct-trade relationships and ensuring co ee farmers receive fair payment for their crop has been a pillar of the brand since day one. In the 2024/25 period, as per the company’s impact report, Pact roasted 506,974 kilograms of co ee. It paid farmers, on average, 48 per cent more than the Fairtrade base. What’s more, 60 per cent of the beans were sourced from women or gender equity groups, and 34 per cent from rural-poor farms.

“We work directly with 200 farms across the globe and can pay a premium for the co ee we source. We manage our supply chain from farm to cup and this model allows us to cut out the middleman and make a good margin while still paying farmers well,” he says.

According to Turton, this model of paying a premium means Pact hasn’t been impacted as greatly by market volatility as many other roasters.

“While the commodity market has been going crazy, we’ve been able to cope because we were already paying more for the co ee and we don’t have to deal with so many constituent parts along the supply chain,” he says.

“ e spike at the start of 2025 did give us a headache, but nothing more than a headache because we’ve been paying well over commodity rates for a long time and so the shi was less seismic for us.

“ e commodity market is the evil of the industry. It doesn’t work – it’s anachronistic. At some point, the co ee market will retreat and then how will the farmers be treated? We’re deeply worried about the impact it will have on them.”

ough Pact is currently competing for the title of Europe’s biggest co ee

subscription service with Dutch company e Co eevine, an international setup that curates beans from di erent specialty roasters, Turton says there are no plans for European expansion just yet.

“ ere’s still plenty of room for growth in the UK – not just in direct-to-consumer but also in B2B and grocery,” he says.

“Unfortunately, some co ee companies will be struggling due to green bean prices. I think we’ll see more price increases across the board and we may see some roasters cease to exist, so there may be more market share there.

“Our proposition is really robust and we’re in a strong position to take more share in all of our chosen markets.”

As interest in specialty co ee in the region continues to grow, the CEO believes there’s opportunity for high-end o erings to overtake popular products such as capsules.

“Over the next few years, I think specialty will grow faster than any other part of co ee. Pods have stagnated and that’s opening the market for high-end roast and ground products like ours. I believe we’re in the right space,” he says.

“I’m incredibly proud of what our team have achieved so far and what’s to come.

ey are a very stable, talented, and knowledgeable group that have stayed true to the foundations of the brand. We’re positive and optimistic about the future.” GCR

Coffee farming is traditionally a job passed down generations, but that’s changing. Can this emerging challenge be turned into new opportunities?

ILLIONS OF DOLLARS, millions of people, and dozens of countries rely on the co ee value chain to provide economic stimulus, jobs and wages, and a point of national pride. It’s a pillar of international trade and one of a handful of key sectors in which the whole world can unite around a common means.

For all the positives the broader co ee industry can provide those who work and live in it, it would be foolish to ignore the issues that currently lie just below the surface. e continuing impact of climate change and rising green-bean prices are creating mass volatility within the production sector, while work to improve labour practice concerns remains ongoing. ere is one o en-overlooked issue that remains at large though. And if le unaddressed, its impacts have the potential to trickle through the entire co ee value chain from farm to cup.

Around the world, co ee farming as a profession is currently facing an age crisis. It’s a profession that has typically been passed down from generation to generation, but the average age of the co ee farmer is rising.

ose traditional family succession plans are hitting a wall, with fewer young people electing to pursue the careers of their parents. Should this issue continue, the already stressed global co ee markets will only be stretched thinner.

According to former Nestlé Executive and Founder of International Co ee Consulting Gerd Mueller-Pfei er, the average age of a co ee farmer in some of the world’s major co ee producers sits between 50 and 60 years of age.

He says this rapidly emerging challenge is only set to become a harder prospect to tackle as years go by.

“Co ee isn’t just a crop, it’s a generational

livelihood,” says Mueller-Pfei er.

“Many co ee farmers around the world are small holders. Since there is no formal pension system they rely on their land until they physically can’t work anymore.

“ e problem is there are not enough young people positioned to take over, and when that happens, you’re not just losing farmers, you’re losing the entire ecosystem of co ee knowledge and supply. is challenge will intensify in the future, because the pipeline is drying up in co ee production.”

Co ee production, much like many agriculture and trade professions around the world, is seeing a reduction of young people entering the industry. Rapid digitalisation has improved the ability for young people to grasp opportunities in new and emerging regions and elds.

With these new opportunities comes the challenge to established industries to innovate. In co ee production, this has presented itself through the issues it now faces in continuing family succession. e average age of the co ee farmer in Uganda, according to Mueller-Pfei er, is 55. In Colombia, it’s 56.

In Ethiopia less than ve per cent of co ee farm landowners are under the age of 35, and in Vietnam, which has a young national median age of 33.1, fewer than 10 per cent of farmers are under 35.

“Young people from co ee farming families are leaving rural areas for cities. In Colombia, no one wants to harvest co ee on the mountains when they can go to Bogotá and try to be an in uencer,” says Mueller-Pfei er.

“People are chasing education or simply a di erent lifestyle from their parents. Farming is o en seen as low income, which it is. e International Co ee Association estimates 5 million out of 12.5 million co ee farmers are living below the poverty line.

“More than 95 per cent of farmers have less than ve hectares of cultivated land, and there is not enough value in the system. It’s labour intensive, and climate risk in uences how much money you might make. Without real

investment, modernisation, or incentive, we will continue to push towards this demographic cli .

“ is isn’t a tap you can turn back on quickly once it runs dry. It’s a real issue.”

Pause for positivity

ankfully, this international issue isn’t being swept under the carpet, with major industry players monitoring and addressing the generational shi s with a number of initiatives.

As the world’s largest producer of co ee, the fruitfulness of Brazil’s co ee harvests have the potential to shape the industry. Should this succession issue become dire in the Arabica production powerhouse that is the Minas Gerais region, the results could be near irreparable.

Expocacer (Cooperativa dos Cafeicultores do Cerrado) operates in the northwest reaches of Minas Gerais, in the Cerrado Mineiro region, to promote socio-environmental initiatives to both improve the co ee produced and the lives of producers.

Executive Director of Expocacer Simão Pedro de Lima says family succession, in Cerrado Mineiro at least, is not currently a major issue.

“In this region, there is a culture focused on family succession. Few producers do

not have succession planning and we do not perceive major di culties regarding the presence of children in the family succession of the business,” says de Lima.

While Expocacer runs various programs to improve the co ee industry in Cerrado Mineiro, de Lima points to the ongoing success of two key initiatives in promoting continuing family succession: ‘Elas no Café’ and ‘Expocacer Teens’.

“ e Elas no Café program strengthens the socioeconomic sustainability of co ee production by more actively integrating women into production and management processes. It has a direct impact on co ee productivity and quality, since trained and valued women tend to invest more in sustainable and innovative practices,” he says.

“It enriches the cooperative’s human capital, promoting diversity and new perspectives in strategic decisions, and it also works to prepare new leaders, increase family engagement, diversify property management perspectives, preserve family identities and rural values, and create greater stability in the succession process.

“When all family members – men and women – are prepared and have their role recognised, succession occurs more harmoniously. It is an initiative that strengthens the present and guarantees the

quality and future of family co ee farming in the Cerrado Miniero region.”

Where Elas no Café focuses on promoting fair, innovative, and inclusive co ee farming, Expocacer Teens looks to further involve the children of cooperative members to foster an interest in agribusiness.

“Expocacer Teens works as a school for successors. rough technical visits, educational activities, interactions with industry professionals, and cooperative experiences, young people understand and develop the skills to take on the role of managers of rural properties in the future with greater preparation, strategic vision, and socio-environmental responsibility,” says de Lima.

“When young people realise there are opportunities for development and innovation in the countryside, it becomes more attractive to remain in the co ee industry. e program directly contributes to reducing the loss of talent from rural areas to cities, promoting a healthy renewal sector.

“By being included in the agribusiness universe from an early age, young people bring new ideas, open space for more sustainable technologies and practices, and strengthen the competitiveness of regional co ee farming. Expocacer Teens is more than an educational program – it is a

strategic investment in the future of co ee farming in the Cerrado Mineiro region.”

Opportunity, but not solution e Expocacer programs demonstrate that high-producing regions can successfully guard against the potential co ee farmer age crisis, and continued investment across the many facets of co ee production could hold a key to the global co ee industry avoiding the brunt of the issue.

Since the turn of the century, Vietnam’s co ee farming sector has evolved from a relatively small player to global superpower.

Although this process has taken decades, it shows the power of targeted, long-term investment to progress co ee production.

With high-potential, small producing regions around the world preparing to boost their own production, could we soon see another shi in global market share?

Co ee was likely introduced to Vietnam in the 1850s by French missionaries, however, it took until the 1970s for the government to see it as a path to greater economic stability.

Following the political and cultural clashes that plagued the nation through mid-1900s, the Vietnamese government started to invest in its co ee sector.

As a result, today Vietnam accounts for 17 per cent of global co ee production and is

the engine room of Asia’s burgeoning co ee production industry.

Although it has taken the better part of half a century for Vietnam’s co ee industry to reach its current heights, Mueller-Pfei er says it is a prime example of how long-term government planning and investment can turn the fortunes of a country’s production.

“In the 1980s Vietnam was a relatively small producer of co ee, but a er years of government intervention and nancing it has become the second-largest co ee producer in the world,” says Mueller-Pfei er.

“Now, I see more opportunities presenting in countries like Uganda, Myanmar, Laos, and even China, but it takes time to transform the co ee production of a nation. ere is an opening for more climate resilient nations to grow their co ee production, but it takes years to form the generational knowledge required, and it’s di cult to grow without serious investment and coordination.

“I’m optimistic, de nitely ‘glass half full’, but that opportunity presents a lot of risks and is the collective task of us all.”

While Expocacer’s programs are nding strong success in Cerrado Mineiro, de Lima says there is no one approach that will work to continue promoting family succession all over the world.

“Although co ee farming is almost global in scope, each country has its own culture,

politics, and economic structure. It is not possible to have a model of practices that is universal,” he says.

“Co ee farming is a ected by the internal economic factors of each country.

ere are countries where co ee farming is developed as an economic factor for subsistence, others where it developed by the growers themselves, and others where it is developed at large scale.

“It is necessary to understand the macroand micro-structures to nd the best way to continue the activity for the future.”

Within the litany of issues currently threatening co ee farming, there is one common denominator that can help revitalise the industry: creating a care factor.

Without the care of national governments, not-for-pro ts and the world’s largest co ee brands, it will be near impossible to action the change needed.

Changes seen in co ee production over the generations must be identi ed and addressed, according to de Lima.

“Over time, co ee farming has come to be

“When young people realise there are opportunities for development and innovation in the countryside, it becomes more a ractive to remain in the coffee industry.”

Simão Pedro de Lima EXECUTIVE DIRECTOR, EXPOCACER

seen as an economic activity that involves much more than production. e co ee segment demands management, technical, nancial, and strategic planning knowledge. ese characteristics have changed the way co ee farming is understood,” he says.

“Working to reduce unpredictability, mitigate climate e ects, labour relations, environmental balance, commercial issues, and all other risk factors requires a strong

structure on each property, and wellstructured properties reinforce the macrostructure of co ee farming.” is complex issue can be distilled down to one primary driver through which to focus key decision-making processes, according to Mueller-Pfei er. Creating purpose for the farmer.

He says if the positive stories of young role models are shared and farming becomes more bankable as a business, progress will be made in overcoming this challenge.

“Without any serious push, if we don’t see any impact at scale in the next ve to 10 years and we as a society don’t do anything, I guarantee in 20 to 25 years we will run into incredibly serious co ee supply issues,” he says.

“We now have a generation that has been growing up digitalised, and that generation doesn’t want to be le isolated in rural areas. Now, you can create a lot of purpose-driven things to re-engage them and meet the rising global demand for farmers.”

“It’s a di cult challenge facing the industry and it cannot be solved in 12 to 18 months, but I believe we can do it.” GCR

A group of researchers in Brazil are on the brink of a promising sustainable solution to one of the coffee industry’s biggest threats, yet funding issues could see their research cease if no one steps in to progress the project.

HE COFFEE INDUSTRY has overcome many challenges during its long history, from promoting regenerative farming practices to prevent soil degradation to introducing new approaches to reduce deforestation. Yet, one of its biggest threats remains at large.

It’s estimated that co ee leaf rust, also known as Hemileia vastatrix or CLR, a fungal disease that infects the leaves of co ee plants and hinders their ability to produce cherries, causes billions of dollars of economic damage to the industry each year. For farmers whose crops are impacted by the disease, this results in lost revenue and compromised quality and supply. In some cases, growers abandon the co ee trees and seek income from alternative crops or even attempt to migrate to other regions or countries.

e disease was rst identi ed in Africa in the mid-19th century and has since spread to all co ee-producing countries. It’s largely dispersed through wind currents and rain splashes. Animals and humans can also transport the fungus to new leaves and play a role in spreading the disease

from tree to tree and farm to farm.

Symptoms of CLR include yellow spots on the upper side of the leaf that darken to brown as they become necrotic and the plant tissues collapse. More evident is the orange, rust-coloured sporulation on the underside, which inspired the name for the disease. e co ee production of an infected tree can be reduced by up to 50 per cent, and some may eventually die due to the loss of leaves and inability to photosynthesise.

While the issue has plighted the industry for centuries, in the past few decades there have been several major outbreaks, including in Hawaii in 2020 which marked the rst incident in what was thought to be one of the last co ee-producing regions to be free of the disease. Other notable outbreaks include in Colombia between 2008 and 2011, which saw the country’s co ee production reduced by almost a third, and the ‘Big Rust’ outbreak in Latin America, which started in 2012 and is said to be the most serious epidemic since the one Sri Lanka endured in the 1880s.

Among the scienti c community, it is

widely acknowledged that climate change could be contributing to these recent outbreaks. Changing rainfall patterns and rising temperatures are thought to favour the worsening severity of the disease. For decades, one of the solutions to CLR has been growing Arabica co ee at higher elevations as the fungus requires warm environments, yet rising temperatures means even these greater altitudes are now warm enough to sustain it.

Over the years, many solutions have been put forward to control CLR. Traditional practices include maintaining healthy plants, removing weeds that may compete with the plant for nutrients, removing weak or diseased trees, and pruning to reduce humidity around the leaves. However, the most common treatment involves spraying crops with fungicides, a method that mycologist Professor Robert Barreto of the Federal University of Viçosa (UFV) in Brazil says may result in unwanted residues in the harvested product and negative environmental impacts.

“A lot of farmers are relying on fungicides and pesticides in general, but we know this

results in residues, both on the cherries and in the soil. e industry doesn’t want to hear about residues anymore and in some major consuming regions we’re seeing increasing restrictions, such as in Europe,” says Prof Barreto.

A more natural solution that has been relied upon is planting resistant varieties of co ee. First identi ed in the 1980s, several varieties have been championed for their resistance to CLR, including the so-called Timor hybrids and Timor hybrid derived cultivars, such as Lempira. However, according to Prof Barreto, reliance on one or few resistant varieties has proven to be a risky method of crop management.

“ ere was a major CLR outbreak in Honduras in 2017. About 45 per cent of co ee grown in the country was Lempira, which was favoured for its high productivity and resistance to CLR. But this resistance broke down and as a result the losses in the country were huge – it was a nightmare,” he says.

“Breeding has provided good bene ts in the ght against the disease and the

“Relying on resistance alone is a problem, as is continuing to move plantations up to higher altitudes.”

Prof Robert Barreto FEDERAL UNIVERSITY OF VIÇOSA (UFV ) IN BRAZIL

research in nding resistant varieties continues. However, relying on resistance alone is a problem, as is continuing to move plantations up to higher altitudes – eventually co ee farmers will run out of mountain.”

Over the past decade, Prof Barreto and his team at UFV have been working on a di erent solution that uses the power of nature to control CLR. Using his

background in fungi and fungal taxonomy, his team has explored the use of fungi as biological control agents to reduce the impact of the disease.

e research team are based in the university’s Department of Plant Pathology in Minas Gerais, Brazil’s largest co eeproducing region, which was established as one of Brazil’s responses to the CLR crisis a er it was found in the country during the 1970s.

“Up until around 10 years ago, my work focused on the use of fungi as tools for the biological control of weeds,” he says.

“Following the outbreaks of CLR in Central America in 2006, the United States (US) was very concerned about the collapse of the co ee industry and the possibility of massive migration of farmer families across Mexico into the US. At the time, colleagues based in the Centre for Agriculture and Bioscience International (CABI) suggested the rust crisis might o er the opportunity for an entirely novel approach to tackle CLR.

“An emergency CLR summit was

organised by PROMECAFE and took place at their headquarters in Guatemala City, where I presented the suggestion of using classical biological control against CLR. at’s where this research project really began.”

Every organism has natural enemies that help promote balance in nature. e use of these natural enemies to control undesirable and o en invasive species is called biological control. e modern biopesticide approach provides products to control pests in agriculture, but the earlier approach, called classic biological control (CBC), has been in use for more than 100 years.

CBC is applied biology at play and is far from an exact science. One of the most notorious examples of the method’s failure was the introduction of cane toads to control the cane beetle in Australia in the 1930s, which saw the toad quickly

adapt to the environment and become an invasive pest.

Because of incidents such as this strict protocols now surround CBC, but Prof Barreto believes a mistrust of the method remains.

researchers started their search for natural enemies of CLR alongside African research partners. e team journeyed to the wild co ee forests of Ethiopia, Kenya, and Cameroon on the hunt for CLRghting fungi.

His team have hypothesised a natural enemy of CLR may have been “le behind” in Africa as the CLR fungus spread to the rest of the world, and CBC could have a role to play in managing the disease.

“CLR is an exotic pathogen, and the classical biological rule is to nd a coevolved natural enemy from the centre of origin and then collect it, study it, clarify whether it’s reliable and safe to use, and introduce it to the diseased populations to reestablish the equilibrium,” says Prof Barreto.

With initial research funding from World Co ee Research (WCR), in 2015 Prof Barreto and a team of Brazil-based

“It was a fascinating experience. We visited forests where co ee still grows spontaneously – some of the old trees towered above our heads,” says Prof Barreto.

“It was in these forests we found a diversity of things we’d never seen before. e Trichoderma genus of fungi is considered one of the stars in the eld of biological control agents, and in Africa we identi ed and collected 16 di erent Trichoderma species either growing directly on CLR lesions or naturally growing as symbionts inside healthy co ee plants.

“Our conjecture was that these might behave as bodyguards for the co ee plants,

protecting them from CLR as well as other aggressors”

e team also visited parts of South America, particularly areas where co ee occurs spontaneously inside forest fragments and abandoned plantations nature has reclaimed. ey were surprised to nd these searches resulted in complete absence of Trichoderma, the total opposite to the observations in Africa.

“ e discovery of the novel Trichoderma in Africa may explain why Africa has not experienced as aggressive CLR epidemics as other regions,” says Prof Barreto.

From this collection phase of the project, the team assembled a list of about 1500 isolates. An elimination process brought that number down to 600 of the most interesting pathogens and fungi, which were then tested under controlled conditions in the laboratory, and then in greenhouses, to see if they had an impact on CLR. Now, a er ten years of hard work, that list has been whittled down to 10 promising fungal isolates.

“ ere are some very exciting isolates in the nal group. For example, we found that a species of Cordyceps belonging to a group that includes many insect pathogens, is e ective against CLR and greatly reduced the disease in infected plants,” says Prof Barreto.

In controlled tests, several other fungal isolates, including Aspergillus, Calonectria, Clonostachys, Fusarium, and Trichoderma, reduced CLR severity by up to 90 per cent.

The field trial hurdle

e decade-long body of research has now reached the small eld-trial stage, in the hopes the best lab and greenhouse results can be repeated in realworld situations. From here, the research has the potential to be turned into a series of viable products that can be deployed on farms across Brazil and beyond. However, the project has hit a roadblock: it’s run out of funding.

“It is becoming increasingly di cult to obtain funding for research such as this. Traditionally, grants would be acquired from the public sector, but unfortunately the tide has changed,” says Prof Barreto.

“We have found several very promising isolates that we believe can help manage CLR. It is now the time for the industry to step in and fund this research as this is hugely important to the whole co eeproduction chain and a signi cant market for the biocontrol industry as well.”

“This is a vital turning point for the coffee sector. Across major origins, producers face rising pressure to reduce chemical inputs due to increasing environmental concerns.”

Hanna Neuschwander SENIOR ADVISOR, WORLD COFFEE RESEARCH

Hanna Neuschwander, Senior Advisor at WCR, which was involved in the initial stages of the project, believes continuation of the work stands to bene t the entire industry.

“ is is a vital turning point for the co ee sector. Across major origins – from Central and South America to Africa – producers face rising pressure to reduce chemical inputs due to environmental concerns and increasingly strict residue regulations,” she says.

“A cost-e ective, naturally derived solution to CLR ts perfectly into

a broader push for sustainability, especially when combined with existing breeding programs and integrated pest management approaches. ese fungal ‘bodyguards’ could signi cantly reduce reliance on synthetic fungicides, stabilise yields, and preserve the ecological balance on co ee farms.

“ ese products could be a key resource for the industry but bringing them to market requires continued screening of additional isolates, establishing rigorous safety protocols, and making these biocontrol products broadly available to farmers.”

Although he retired last year, Prof Barreto is still very much involved in keeping the project alive.

“It is time for the whole project to be taken over by someone else. e potential of what we’ve found to date is so great that the industry should be interested and inspired to get involved,” he says.

“ is is an urgent issue and decisionmakers need to think outside the box. e concern of the co ee industry with the path towards a sustainable future for co ee needs to be directly linked with action towards the innovation in the natural management of weeds, pests and diseases.

“Without their support, academia can only advance slowly. ese projects take time and won’t provide an instant solution, but what we have found is very exciting and should be continued to be explored. e potential is very clear.” GCR

In March 2025, Eversys hosted the inaugural Shotmasters Bootcamp at its Swiss headquarters. Indonesian Barista Champion Yessylia Violin shares her experience and what it means to be a Shotmaster.

S AN INTERNATIONAL brand with its super-automatic espresso machines distributed in more than 100 countries, connection is a key component of what brings Eversys together. Being able to connect with people that use its machines and unique co ee communities all over the world is a central pillar of the brand’s ethos and success.

at’s why connection was the perfect theme for the company’s inaugural Shotmasters Bootcamp.

Hosted at Eversys’ headquarters in Switzerland in March 2025, the rst ever bootcamp saw 12 new Brand Ambassadors – also called Shotmasters – from all corners of the globe descend on Sierre for three days of training, cupping, and creative programming led by Global Ambassador and 2017 World Barista Champion Dale Harris.

Ultimately, the event served as a crash course in how to best use Eversys’ intelligent machinery while sharing ideas, knowledge, and experience with other Shotmasters.

“We’ve had an amazing group of Global Ambassadors for several years, but we

wanted to connect more closely with our regional audiences and people in new markets. Introducing a larger and more varied group of Brand Ambassadors around the world allows us to show up in our communities,” says Miranda Caldwell, Eversys Marketing Director.

“As well as having boots on the ground, our ambassadors help us to understand the

unique needs of their market.”

e brand’s pool of ambassadors now includes hospitality professionals from Australia, France, China, Greece, Indonesia, Japan, South Africa, South Korea, Spain, Switzerland, the United Arab Emirates, and the United Kingdom.

With so many talented individuals dispersed across the international hospitality industry, how does a company go about selecting just 12 to represent an iconic brand like Eversys?

“Funnily enough, it’s largely about feeling. We look at our individual target markets to see what’s going on there and then reach out to some of the key players. We want people who are aligned with Eversys, our products, and our community, but also those who think outside of the box,” says Caldwell.

“We also look for people with di erent perspectives. For example, our Brand Ambassador for France is a restaurant consultant who works with top chefs. He has a di erent perspective and adds diversity to the group, which is also a goal of ours. e co ee industry can be quite young and male dominant, so it

was important to have a range of genders and ages.”

Yessylia Violin, Roastery Manager of Common Grounds Co ee Roastery and 2022 Indonesian Barista Champion, was one of the new faces to take part in the Bootcamp.

“I was excited to be asked to be an Eversys Brand Ambassador. I had worked with the brand previously at a tradeshow in Indonesia and was intrigued by the capabilities of its espresso machines,” says Violin.

“I wanted to see exactly how the machines work, discover what kind of espresso they could create, and question some of the assumptions people have about super-automatic machines. Attending the bootcamp meant, as a group, we could answer these questions and share ideas.”

Drawing on his experience with the machines, especially the Cameo collection, Harris hosted in-depth tutorials on the equipment and how to produce the nest possible cup.

e aim of these tutorials was to help the Shotmasters get to know the machines – inside and out – so they could take the knowledge back home and share it with their local co ee communities.

“We wanted the ambassadors to get to know each other and get comfortable with the machines – kind of like a summer camp experience. We asked everyone to bring co ee, either their own or from their home country, which was a great way to get the conversation owing,” says Caldwell.

“ ere were also discussion sessions in which everyone shared ideas and insights from their markets, which was hugely valuable to us. It was fascinating to learn how we could better serve our co ee communities around the world.”

For Violin, this shared space of connection was one of the highlights of the experience. With some of hospitality’s top minds all in the one place, she says it was important to engage with people of diverse professional backgrounds to share tips and tricks of the trade.

“Most people had a co ee background, but there were a few people who were in sales and others from restaurant and hospitality settings. It’s great to be able to chat to people who know di erent things about and have di erent perspectives on co ee – someone might be really knowledgeable about water whereas someone else might know a lot about processing,” she says.

“Before this experience, I didn’t know how the machine actually worked and how exactly it extracted the coffee. Seeing the factory and ge ing to know the machines in the Shotmaster sessions was really valuable.”

Yessylia Violin

ROASTERY MANAGER, COMMON GROUNDS COFFEE ROASTERY

“It was also interesting hearing about the cultural di erences in each market, as well as the reception of super-automatic equipment like Eversys’ machines.”

e Shotmasters also received a tour of the Eversys factory to watch the machines being manufactured. is tour was vital for developing a deeper understanding of how to use the machines even more e ectively, according to the Barista Champion.

“One of the most surprising things was most of the people working in the factory were women, many of them having previously made watches. e intricacy of their work was fascinating – there are many ne details and small parts to assemble,” says Violin.

“Before this experience, I didn’t know how the machine actually worked from

the inside and how exactly it extracted the co ee. Seeing the factory and getting to know the machines in the Shotmaster sessions was really valuable.”

By the end of the three-day experience, the knowledge gained by Violin and the other Shotmasters about Eversys’ super-automatic machines was ready to be taken back home to their local co ee communities.

“I knew it was a high-quality machine, but I didn’t expect it to produce a very beautiful espresso – as good as a traditional machine or even better,” she says.

“One of the biggest operational issues at cafés is consistently producing a great shot. You can dial it in and get it perfect, but you then need to keep on reproducing that standard with di erent people throughout the day.

“With a traditional machine, there are many variables that can prevent that from happening, using a super-automatic machine minimises the chances of them occurring.”

Co ee as an industry is always on the cusp of the next great innovation, whether that be in the creation of new machines, roasting styles, signature drinks, or anything else along the value chain.

According to Violin, there is still some apprehension around investing in the new era of super-automatic machines in Indonesia – but those wheels of innovation are starting to turn.

“Some people are still a bit afraid of the investment in this type of technology as they are o en more expensive than traditional machines. However, I’m already seeing a big change in perspective. Café operators can see the bene ts in terms of consistency and extraction,” she says.

“ ere’s a common misconception that super automatics produce shots with less viscosity than traditional machines, but I discovered at the bootcamp that notion just isn’t true. I’m excited to prove people wrong with Eversys’ machines and introduce more baristas to the potential of this technology.

“Representing a brand and getting people to connect with their products is now much more than giving out cups of co ee at a tradeshow. We want to provide more tailored experiences, like hosting workshops with customers to make sure they’re getting the most out of their equipment.” GCR

Indonesia is already one of the four largest coffee producers in the world, but could the rise of specialty coffee, a booming consumer culture, and improvement in farming methods prime it for steeper growth?

NDONESIA is already one of the world’s major co ee producers, but if recent comments from the country’s Coordinating Minister for Food A airs Zulki i Hasan are anything to go by, co ee production in the archipelago nation could be set to soar.

During the World of Co ee Asia event in Jakarta in May 2025, Hasan stated his desire to see Indonesia’s co ee production surpass that of its northern neighbour, Vietnam.

Currently the world’s second-largest producer of co ee, Vietnam is enduring a di cult farming year, with drought issues tempering future harvest expectations.

Despite this year’s expected smaller harvest, growth of the Vietnamese co ee farming sector over the past 40 years is an example of how producers – backed by government support, sustainable and

“There is this amazing balance of coffee producing and coffee consuming in an economy that is super dynamic and growing so fast.”

Shae Macnamara FOUNDER, EXPAT. ROASTERS

industrial progress, and quality products – can disrupt the industry and emerge as a new superpower.

With Indonesia’s government likely to

bolster its production sector, alongside an already established industry and untapped farming potential, the question quickly becomes not if Indonesia can increase its global production share, but how?

The perfect storm

Historically, co ee from Indonesia has typically taken the form of commercial Arabica beans grown around the Sumatra region, but that’s changing – and fast. e consumer shi towards specialty co ee is growing in scope around the country, while farmland that previously chopped and changed between crops is starting to take a longer-term view of the potential of co ee.

Outside the traditional growing regions of Sumatra, Java, and Sulawesi, farmlands in areas like Bali and Flores are increasingly

producing high-quality and specialty co ee, according to Expat. Roasters Founder Shae Macnamara.

While the opportunities in the Indonesian co ee value chain are beginning to capture more attention, Macnamara was an early admirer of the archipelago’s potential.

A er founding the business in 2016, Expat now services more than 700 wholesale partners – with plans to grow that to 1000 by the end of 2025 – and operates cafés across Indonesia with new locations, including a rst international site in Malaysia, launching soon.

Macnamara says the marriage between Indonesia’s co ee production potential and interest in its consumer scene have created an environment ripe for development.

“Right now, there is this amazing balance of co ee producing and co ee consuming in an economy that is super dynamic and growing fast,” says Macnamara.

“Mix that with a huge population that has a high percentage of Muslims who can’t drink alcohol and an emerging specialty co ee industry, I think it’s the perfect storm of it all coming together.”

at perfect storm was on display at this year’s World of Co ee Asia.

“I’ve travelled the world and been part of these types of events for a long time, but I’ve never seen the sort of excitement that was at a show like what was just in

Jakarta,” Macnamara says.

“ e Brewers Cup Final announcement felt like a rock concert. e energy in the room was electric, with the crowd yelling, jumping around, and banging on the chairs. It was incredible.

“I’ve competed, judged, coached, and spectated at these competitions for 25 years, but I have never felt anything like that. It was amazing.”

The task at hand

Tanamera Co ee has been active in Indonesia’s wholesale and specialty co ee markets for more than a decade, and started with a dream of growing Indonesian specialty co ee’s fame in the international landscape.

e team at Tanamera work closely with farmers to improve the quality of co ee and strength of yield coming from both Indonesia’s established and emerging regions. Co-Founder Ian Criddle says the country’s environment means the perhectare yield will struggle to rival some of the other large producers.

Indonesia produced approximately six per cent of the world’s co ee harvest in 2024/25 according to the United States Department of Agriculture, equivalent to 10.9 million 60-kilogram bags. at gure is behind only Colombia (seven per cent), Vietnam (17 per cent), and Brazil (38 per cent).

Due to its sprawling chain of islands, the country spans more than 1.9 million square kilometres, with not even a quarter of that being land. On that land, volcanoes and mountains extend up to the clouds, and thick, heavy forest covers the regional territories.

“Our lowest yield of plantations is probably Flores, which is around 300 kilograms of green beans per hectare,” says Criddle. “ e highest is up in Sumatra, which is circa 1200 kilograms per hectare.

“If you look at Brazil as a country, the national average is 2500 kilograms per hectare. Because all our co ee plantations are grown on the slopes of the volcanoes, it’s like a jungle – it’s up and down. Brazil is, generally, more like a at vineyard at lower altitudes.”

Per-hectare yield is far from the only

method to ascertain growth in co ee production, though.

Koro Roasters is a relatively new player in the Indonesian scene e name draws inspiration from the Italian word ‘coro’, meaning ‘choir’ or ‘collaboration’, while also creating a connection to co ee roasting –‘kopi’ being the Indonesian word for co ee.

Founder Alain Scialoja is a former robotics engineer who has found his calling in co ee. He says Indonesia is already, in part, achieving that lo y goal set by Minister Hasan.

“Indonesia actually surpasses Vietnam in several important metrics already, it has more land dedicated to co ee production, it produces more Arabica co ee, and it has a much stronger domestic market,” says Scialoja.

“Where Vietnam leads signi cantly is total production volume. at di erence primarily comes from Vietnam’s Robusta sector, which it has developed through a

highly centralised, export-focused approach with intensive farming methods.”

Scialoja believes Indonesia won’t be able to match Vietnam’s co ee sector in terms of pure yield, but sustainable growth in production will continue to help the nation boost its co ee standings internationally.

“I believe Indonesia can certainly grow its production sustainably, perhaps by 50 per cent or more over the next decade, but rather than focusing solely on outproducing Vietnam in volume, I see more value in becoming the leader in sustainable, highquality, traceable co ee that commands premium prices,” he says.

“Indonesia could overtake Vietnam in value terms by focusing on its competitive advantages: incredible diversity of origins, unique processing methods, and rich cultural heritage. What’s more, this approach would more greatly bene t smallholder farmers than a pure volume play.”

With co ee so susceptible to climate change, and markets around the world feeling the impacts of droughts, oods, and rising temperatures, fostering a more sustainable industry is paramount to not only co ee’s continued progress but also its survival.

is desire to improve sustainability trickles through the entire supply chain, with roasters like Expat, Koro, and Tanamera all playing their own roles in promoting sustainable practices.

Over the past decade, Tanamera has placed massive importance on its relationships with farmers across Indonesia and seeks to help them implement modern and sustainable practices.

John Lee, Director of Tanamera Co ee, oversees the business’ quality control and bean sourcing, which sees him travel between smallholder farms around the country to help improve farming practices.

“I spend a lot of time in our farming areas from Sumatra to Flores to maintain good relationships with our farmers. Even if it’s small, we always want to keep investing in our farming areas, work with farmers, and invest in machinery and education,” says Lee.

“At Tanamera we’re crop to cup, from the very beginning on the farm to the very end serving your cup of co ee. We have the customer interface, we have the experience with what people want internationally, and what people want in Indonesia for specialty grade co ee. ere are apparently two million co ee farmers across Indonesia, and we can communicate all of our customer feedback with them.

“Some of them have small holdings, and some are essential processing. We help them improve their yields and the quality of the plantations to get the gains in the co ee quality.”

Criddle says the best approach to introducing new sustainable practices is to make them tangible to the farmer.

“It’s all interlinked,” he says. “John spends a lot of time with the farmers and repeats things over and over again so we can start to see tangible results. Every year, if you’re getting someone to change they have to be able to see that change.

“It’s doing things out of harvest, like pruning and weeding around trees and fertilising to get the yields up – that’s tangible to the farmer and they can see the di erence it makes.”

Koro, on the other hand, makes a point of seeking out producers already

implementing sustainable practices.

Scialoja says the most e ective frameworks recognise what farmers are already doing right.

“Indonesia has a unique opportunity to lead in the sustainability space because so many of its co ee farms are already inherently sustainable,” he says.

“ ey’re small-scale, diverse, and o en organic by default. e challenge is documenting these practices in ways global markets recognise without imposing excessive burdens on farmers.

“By building on Indonesia’s existing sustainable farming traditions while selectively adopting appropriate technologies, we can create a model that balances productivity, sustainability, and farmer livelihoods.”

The coffee connection

e Indonesian co ee scene, regardless of whether it reaches Minister Hasan’s aspirations, is still primed to continue its upward trend for both producer and consumer.

Its uniquely fanatical co ee culture is only growing – borne out of a connection that threads its way from farmer to cup.

“One of the things that attracted me to do something here was the fact the baristas and the people who are serving co ee have got an attachment to the co ee itself,” says Macnamara. “It’s their communities that are growing co ee.

“When I rst started here, I would ask someone the type of co ee they used and

“Indonesia has a unique opportunity to lead in the sustainability space because so many of its coffee farms are already inherently sustainable.”

Alain Scialoja FOUNDER, KORO ROASTERS

they would say usually say Arabica, but they would then say it’s from Sumatra and go on to call out the regions in those areas it was grown.

“Coming from Australia, they would say it’s Campos, Toby’s Estate, ST. ALi, or Grinders. In Australia, the roaster would give the education around the beans. Cafés are not partnered with the farmer, they’re partnered with the roaster.

“In Indonesia, there’s an incredible connection to origin that most places around the world don’t have, and I think that’s because of the proximities to the farming regions and the understanding people have of the farming.”

Macnamara says the opportunities in the industry are tangible, and it’s only a matter of time before the rest of the world catches on to Indonesia’s burgeoning co ee sector.

“ ere’s a xed potential to what is happening here. With co ee prices being higher, more people are holding co ee at the moment and not switching to other crops, and that’s exciting. We’re hoping that education around holding co ee crops for longer is going to start impacting the producing areas even more,” he says.

“ e advancements in co ee farming that are processing new varietals, all within a consuming and growing economy, it’s a great situation to be in.

“We want to keep Indonesian co ee in Indonesia, but I think you’ll soon be seeing it on many more menus all around the world.” GCR

By 2030, the coffee sector in the Middle East and Africa (MEA) is expected to reach a projected revenue of US$38.3 billion. Image: Chaudhary Umair/stock.adobe.com.

With a new showroom in Saudi Arabia and an office in Dubai due to open in late 2025, SEB Professional explores the unrelenting rise of the Middle Eastern coffee market.

HE GATHERING of people to enjoy a cup of freshly brewed co ee has been a part of Middle Eastern culture for centuries. In the 1400s, Yemini mystics believed drinking co ee induced spiritual intoxication, while during the Ottoman Empire co ee houses were social hubs where debates took place and business deals were struck.

While co ee culture has long been ingrained in the region’s rich cultural fabric, over the past few years the Middle Eastern co ee market has seen dramatic growth – with more predicted over the next halfdecade. According to the latest statistics from Horizon Grand View Research, by 2030 the co ee sector in the Middle East and Africa (MEA) is expected to reach a projected revenue of US$38.3 billion, with a compound annual growth rate of 4.6 per cent from 2024.

Claudio Maschietto, Vice President APAC/MEA/Russia at SEB Professional, says while the whole region is one of the fastest growing markets in the world, Saudi Arabia is of particular signi cance.

“Not only does the country have a rich co ee culture, but its strategic location also makes it an excellent hub for co ee trade within the MEA,” says Maschietto.

“ ese factors, combined with growing demand for specialty co ee, high levels of investment in the sector, and government initiatives to promote local co ee cultivation, are making Saudi Arabia a key player in the global co ee market.”

As part of the Government’s Vision 2030 program, the country aims to boost tourism by attracting visitors with authentic Saudi co ee experiences and related activities. It’s also supporting the local co ee cultivation sector, with the Ministry of Environment, Water and Agriculture launching a series of programs to enhance the production, manufacturing, and marketing of Arabica co ee.

As such, in 2024 the Saudi Sip of Excellence Competition was established through a partnership between Saudi Co ee Company and the Alliance for Co ee Excellence. e opening ceremony of the second edition in 2025 was attended by His Royal Highness Prince Muhammad bin Abdulaziz bin Muhammad bin Abdulaziz, Deputy Governor of the Jazan Region.

“ e growth of the co ee industry is supporting local farmers and encouraging sustainable farming practices, especially in regions such as Jazan, which are renowned

for co ee cultivation,” says Maschietto.

In response to the growth of the local market and the demand for intelligent automated technology, SEB Professional has teamed up with the local distribution partner Co ee Culture, which will open a dedicated showroom in Jeddah. e new hub is due to open in late 2025 and aims to establish the brand as a centre of innovation for catering and co ee in Saudi Arabia.