Clean energy grows up

As Australia’s largest supplier and extruder of aluminium, Capral is committed to supporting the nation’s energy transition with high quality, locally produced aluminium extrusions purpose-built for energy and renewable energy projects. Our state-of-the-art manufacturing facilities deliver precision engineered solutions for solar, wind, transmission, storage, and supporting infrastructure, designed to perform in demanding Australian conditions.

Choosing Capral means dependable local supply, reduced lead times and the confidence that comes from working with an Australian manufacturer invested in long term capability, skills, and production.

When you need Australian made aluminium for energy and renewables, Capral can do.

Celebrating 90 years of Australian manufacturing

From the editor

The first phase of Australia’s energy transition was defined by ambition and scale. The next phase is shaping up to be defined by something less visible, but far more decisive: Execution.

This issue of ecogeneration puts hydrogen at its centre, not as a promise, but as a proving ground. Hydrogen will not become mainstream because the industry wants it to. It will earn its place only if projects can be designed, built and operated with repeatable performance, acceptable safety margins and credible economics. That future will be built by engineering discipline, digital rigour and teams that know how to move fast without gambling capital on avoidable project failure – a reality explored in our feature with LEAP Australia.

South Australia offers a clear view of this next phase in action. New independent analysis shows the state is closing in on a 60 per cent emissions cut by 2030, while the recent financial close for Carmody’s Hill Wind Farm shows how progress is made one hard, practical step at a time.

Across this edition, the theme of ‘invisible work’ keeps surfacing. Specialised Energy Solutions makes the case that training, culture and long-term thinking matter as much as megawatts. MegaWatt Power shows how service capability is becoming the real differentiator in a high-tech solar market. Meanwhile, EcoFlow is quietly building resilient, intelligent power systems at scale, while SOFAR Solar is evolving from inverter supplier to full-stack energy partner.

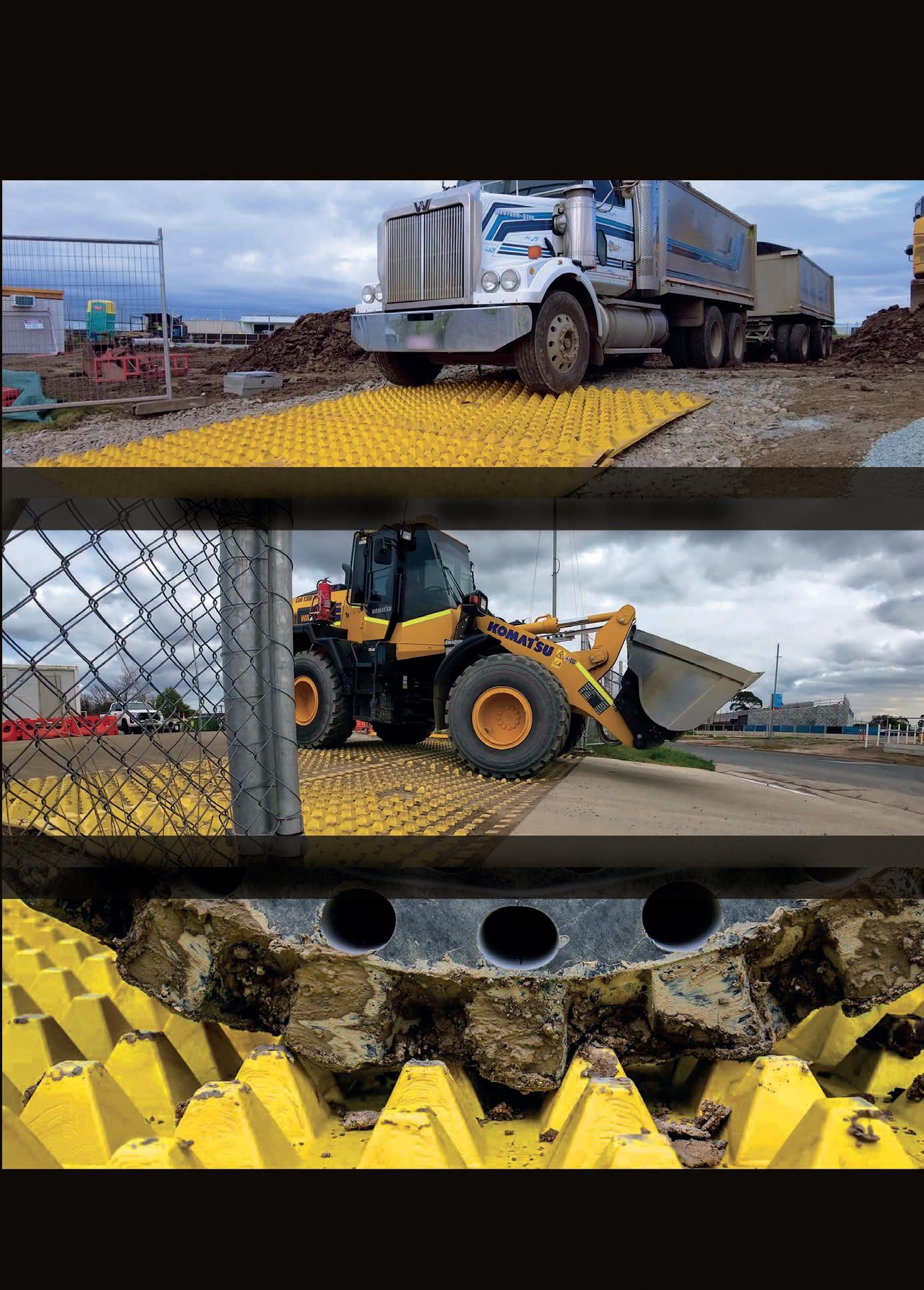

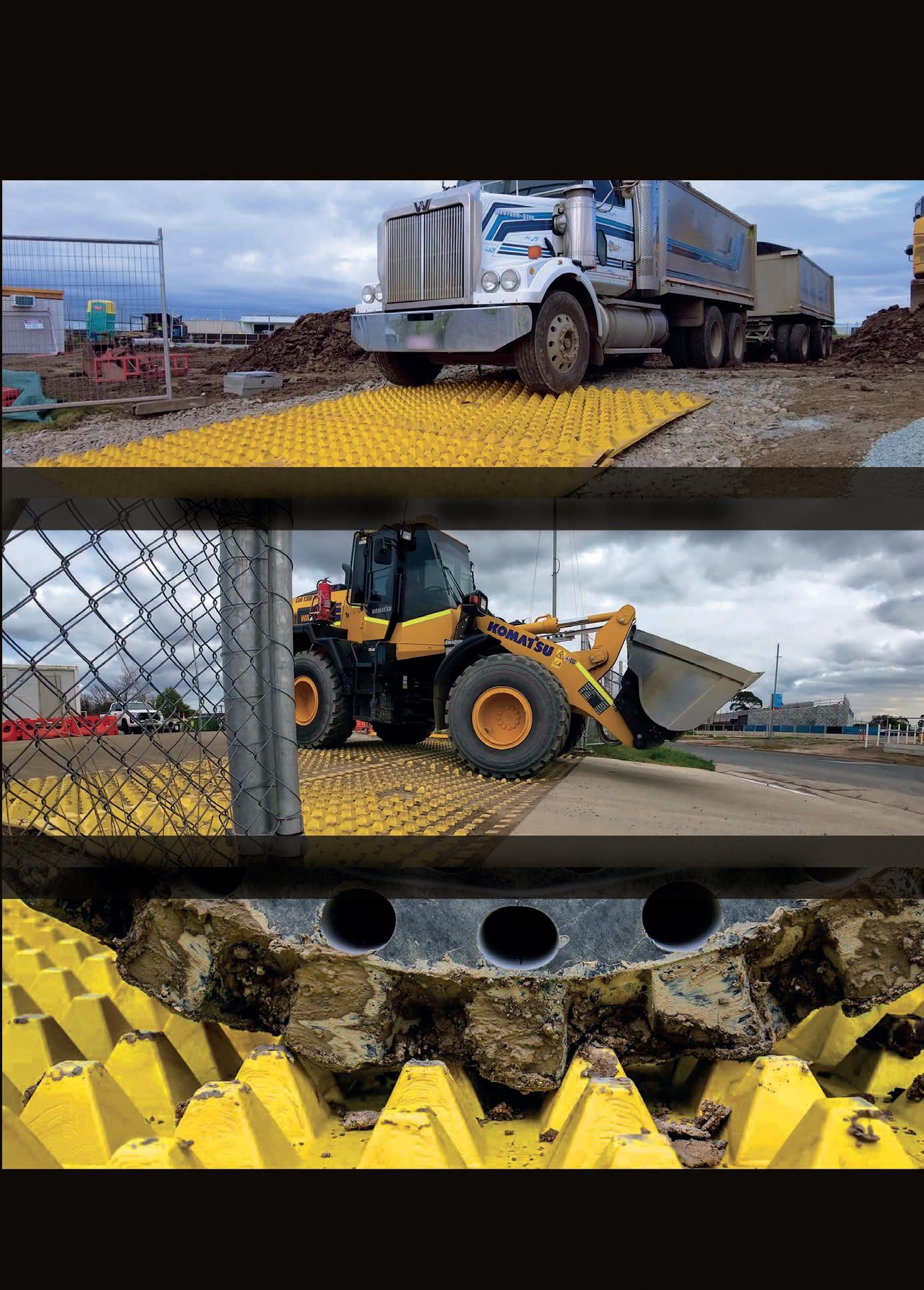

On the ground, JWA Composite Matting reveals how something as prosaic as track-out control is becoming a serious emissions lever. Capral Aluminium shows how local manufacturing is underpinning Australia’s first commercial-scale photovoltaic-thermal project. And as Australia’s battery market matures, FOX ESS and others are helping shift storage from consumer gadgetry to long-life infrastructure, alongside a broader move toward higher-power, whole-of-home systems.

Whether it is hydrogen, battery storage, solar or renewable heat, the next phase will not be won by announcements, but by the people, systems and standards that make clean energy work at scale.

Lavinia Hulley ecogeneration Editor

ecogeneration acknowledges the Cammeraygal people, traditional custodians of the land on which this publication is produced, and we pay our respects to their elders past and present. We extend that respect to all Aboriginal and Torres Strait Islander people today.

Chief Executive Officer: Christine Clancy

Chairman: John Murphy

Editor: Lavinia Hulley lavinia.hulley@primecreative.com.au

Business Development Manager: Nick Lovering , +61 414 217 190 nick.lovering@primecreative.com.au

Client Success Manager: Karyssa Arendt karyssa.arendt@primecreative.com.au

Head of Design: Blake Storey

Designer : Apostolos Topatsis

Subscriptions : T: +61 3 9690 8766 subscriptions@primecreative.com.au

Published by: PRIME CREATIVE MEDIA PTY LTD

ABN: 51 127 239 212 379 Docklands Drive

Melbourne VIC 3008, Australia T: +61 3 9690 8766 www.primecreativemedia.com.au

www.ecogeneration.com.au

Cover image: Capral Aluminium Ltd

ecogeneration is printed on Lumi paper which is PEFC-certified and manufactured in an ISO 14001-certified mill. Lumi paper also contains premium white waste paper, reducing matter going into landfill. This magazine is available to interested parties throughout Australia and overseas. The magazine is also available by subscription. The publisher welcomes editorial contributions from interested parties, however, the publisher and the Editorial Board accept no responsibility for the content of these contributions and the views contained therein are not necessarily those of the publisher or of the Editorial Board. The publisher and the Editorial Board do not accept responsibility for any claims made by advertisers. Unless explicitly stated otherwise in writing, by providing editorial material to Prime Creative Media, including text and images, you are providing permission for that material to be subsequently used by Prime Creative Media, whole or in part, edited or unchanged, alone or in combination with other material in any publication or format in print or online or howsoever distributed, whether produced by Prime Creative Media and its agents and associates or another party to who Prime Creative Media has provided permission.

Average net distribution 6616 Period ending September 2021

South Australia sets the pace on net zero

New independent analysis shows South Australia is closing in on a 60 per cent emissions cut by 2030, as the state doubles down on high-renewables power, climate risk planning and turning decarbonisation into an economic advantage.

South Australia is on track to cut net greenhouse gas emissions by at least 60 per cent by 2030 and reach net zero by 2050, according to new independent analysis that also points to opportunities to strengthen the state’s renewable energy leadership and low-emissions economy.

A report by the Commonwealth Scientific and Industrial Research (CSIRO) confirms the state has reduced net emissions by 55 per cent compared to 2005 levels, based on 202223 data. In the electricity sector, renewables supplied 69.7 per cent of South Australia’s net generation in 2023-24, reinforcing the state’s position as one of the world’s most advanced high-renewables power systems.

The findings come alongside the release of South Australia’s first Statewide Climate Change Risk and Opportunity Assessment, prepared by Deloitte, which provides a longterm view of climate risks and economic opportunities out to 2030, 2050 and 2090.

The assessment draws on input from more than 100 organisations spanning government, industry, research and community sectors, intended to inform future adaptation planning, infrastructure, investment, and economic development.

It identifies 11 priority risk areas that will require increased action over the next five years; including, water security, agriculture,

transport, emergency services, insurance, coastal systems, biodiversity and health.

According to the assessment, average temperatures in South Australia have already risen by around one degree since 1960. If global emissions remain high, the report projects an increase of between 1.3 and 2.2 degrees by 2050, with extreme weather events such as bushfires and heatwaves.

At the same time, the assessment highlights significant opportunities for South Australia to further expand its leadership in renewable energy, accelerate the net zero transition, grow its circular economy, and develop new low-emissions industries, skills and jobs.

The findings arrive as the state moves to strengthen its climate governance framework. Amendments to the Climate Change and Greenhouse Emissions Reduction Act, passed in March 2025, have expanded requirements for government agencies around climate risk assessment, planning and action.

One of the most significant policy commitments is South Australia’s target to achieve 100 per cent net renewable electricity generation by 2027 – brought forward by three years in a move that positions the state at the forefront of global power system decarbonisation.

The climate risk assessment also underlines the importance of South Australia’s new Biodiversity Act. This was implemented after the assessment and is intended to strengthen ecosystem resilience in the face of climate pressures.

Martin Haese, the South Australia Premier’s Climate Change Council Chair, shares that the assessment wil play a central role in guiding future decision-making across government, business and the research sector.

“This first statewide climate change assessment will help catalyse action to tackle the challenges we face under a changing climate,” he says.

“While there is much we are already doing, there is much more we will need to do.”

He said the assessment was not only about managing risks, but also about identifying economic opportunities linked to the energy transition and climate-resilient growth.

Lucy Hood, South Australia’s Minister for Climate, Environment and Water, says the state’s climate and energy agenda will shift into turning decarbonisation into an economic advantage.

“South Australia is a global leader in renewable energy and climate mitigation, and we are determined to meet our ambitious targets,” she says.

The statewide assessment will be reviewed every five years to track progress and emerging risks. To keep up momentum, these findings are shared across industry, research organisations and communities.

For the energy sector, the report reinforces South Australia’s role as a testbed for high-renewables power systems, longduration storage, grid stability technologies, and new low-emissions industries.

Within Australia’s energy transition, South Australia appears to be the clear leader across states for effectively building a climate-resilient, low-carbon economy around its power system.

View of South Australia farmlands.

Image: Mariangela/Stock.Adobe.com

Carmody’s Hill Wind Farm reaches financial close

After clearing a series of technical, commercial and regulatory hurdles, a 256-megawatt wind project in South Australia is now in its construction phase.

Aula Energy’s 256 megawatt (MW)

Carmody’s Hill Wind Farm in South Australia’s mid-north has reached financial close, marking a major achievement for the ~$900 million project and clearing the way for construction to begin in early 2026.

The milestone follows Aula Energy’s long-term power purchase agreement (PPA) with Snowy Hydro, under which Snowy will contract 120 MW of the wind farm’s output over 15 years – the equivalent to around 47 per cent of the project’s expected generation.

Located near Georgetown, the Carmody’s Hill Wind Farm will comprise 42 turbines delivering up to 256 MW of capacity, supported by a new 275 kilovolt (kV) transmission line connection. Once operational in 2028, the project is expected to generate enough clean energy to power more than 195,000 homes and support up to 200 jobs during construction.

The project has also secured support through the Australian Government’s Capacity Investment Scheme (CIS) Tender Four and has received approval for its negotiated generator performance standards from ElectraNet and the Australian Energy Market Operator (AEMO).

Chad Hymas, Chief Executive Officer at Aula Energy, shares that the financial close of Carmody’s Hill represents a significant leap forward for both the company and South Australia’s energy transition.

“Closing two major wind projects in consecutive years is a clear demonstration of our team’s dedication to building Australia’s clean energy future,” he says.

“From Boulder Creek to Carmody’s Hill, Aula Energy is proving that even in challenging market conditions, we can deliver and make a difference to the sector. As a new leader in Australia’s clean energy transition, we have built deep expertise and have a long-term commitment to create shared value for all.”

Aula Energy achieved financial close on its flagship Boulder Creek Wind Farm in

Central Queensland (co-owned with CS Energy) in September 2024. Carmody’s Hill recent financial close marks the company’s second major project to reach this milestone since its inception in 2023.

“Securing this PPA with Snowy Hydro is a major step forward for Carmody’s Hill Wind Farm,” Hymas says.

“Snowy Hydro’s leadership in the energy market reflects their position as a key customer driving change as we work towards a more sustainable energy system.”

Hymas adds that Aula Energy, as a long-term owner and operator of renewable energy assets, will continue to work closely with customers as market and demand profiles evolve over time.

Dennis Barnes, Chief Executive Officer at Snowy Hydro, shares that the agreement reinforces the strategic importance of South Australia in the national energy transition.

“This agreement with Aula Energy reflects our confidence in the quality and strategic importance of Carmody’s Hill Wind Farm and the South Australian market,” he says.

“Our unmatched mix of on demand power and pumped hydro energy storage is what makes renewables work, enabling three times the clean wind and solar to come online.”

Barnes says the new contract also supports Snowy Hydro’s growing retail business, which now serves more than 1.6 million customers.

“This new contract enhances our role as an integrated generator and retailer,

supporting the continued growth of Snowy’s

Renewable Project Services before Aula Energy assumed sole ownership at financial close. With financing now secured, the company has confirmed support from delivery partners GE Vernova, DT Infrastructure, GHD, Aurecon and ElectraNet.

“With finance secured and the support of our delivery partners, we’re ready to deliver a project that creates long-term value for the local communities, the traditional owners, the Nukunu People, shareholders, and the sector,” Hymas says.

The project has been shaped by extensive community consultation and is expected to deliver long-term economic and social benefits to the Georgetown, Gulnare, Caltowie, Bundaleer, Washpool, Gladstone and Nukunu communities.

As part of this commitment, the project will establish a Community Benefit Fund to support local initiatives with environmental, social and net zero objectives throughout construction and operations.

“Aula Energy extends its appreciation to local communities for their valuable input throughout the development phase,” Hymas says.

“Community feedback has helped shape this project, and we’re grateful for the strong engagement. We look forward to continuing this partnership as construction continues now and in the future.”

The site for Carmody’s Hill Wind Farm Project, based in the mid-north region of South Australia on the traditional land of the Nukunu Peoples.

News in brief

NEW TECHNOLOGY, NEW PROJECTS, NEW IDEAS

Renewables still win on cost

The Clean Energy Council welcomed the release of the 2025-26 GenCost report, confirming that renewables (backed by storage and flexible firming) remain the lowest-cost pathway to replace Australia’s ageing coal fleet.

The latest analysis from the Commonwealth Scientific and Industrial Research Organisation found that the average cost of renewable electricity is on track to reach approximately $91 per megawatt-hour (MWh) when new transmission is included, or about $81 per MWh for wholesale generation costs.

Jackie Trad, Chief Executive Officer at the Clean Energy Council, shared that the modelling shows Australia can retire coal while maintaining affordability and reliability for households and businesses.

“By assessing costs at a whole-of-system level, GenCost again finds renewables-led systems consistently outperform alternatives,” she said.

“It confirms new coal would deliver electricity at least double the cost of solar and wind. The cheapest system for Australia is built on renewables backed by storage and firming.”

The report also showed electricity costs in 2050 under the least-cost pathway remain broadly in line with recent historical levels. This is the case even as demand

grows and coal exits the system, with batteries and other flexible technologies playing a central role in reliability.

Importantly, higher-cost options such as

increased overall system costs, compared with a renewables-first approach. Indicative figures showed solar at $52-$88/MWh and onshore wind at $78-$129/MWh, well below

Eraring extension affirms urgency for renewables

Origin Energy’s decision to extend the life of the Eraring coal-fired power station until 2029 underscores the urgency of accelerating investment in renewable energy, storage and transmission, according to the Clean Energy Council.

Jackie Trad, Chief Executive Officer at the Clean Energy Council, publicly shared that the extension reflects the need to manage the transition in an orderly way, but warned that Australia’s ageing coal fleet is becoming unreliable and costly, with unplanned outages driving price volatility across the National Electricity Market.

The average age of coal generators is now 38 years, close to the historical retirement age of 44. Recent failures, including another outage at Queensland’s Callide C power plant, have again highlighted the risks of continued reliance on ageing assets.

In the 12 months to October 2025, an

average 24 per cent of coal-fired generation was unavailable in New South Wales (NSW) and Queensland, contributing to wholesale price spikes.

In one month alone, prices in NSW surged from around $70/megawatthours (MWh) to $220/MWh following a wave of unplanned outages.

The Clean Energy Council shared that every new renewables, storage and transmission project reduces exposure to this volatility. They also welcomed Origin’s continued investment in large-scale batteries at Eraring, making a point that storage is already playing a growing role in supporting system reliability as coal exits the grid.

Momentum in energy storage continues to build, with nearly 1.2 gigawatts of new projects reaching financial close in the most recent quarter.

Jackie Trad, Chief Executive Officer at the Clean Energy Council (CEC).

Solar power and onshore wind remain the lowest-cost pathway for replacing Australia’s coal fleet. Image: Zhengzaishanchu/Stock.Adobe.com Image:

Less wind, more solar and storage

being recalibrated, and for solar installers, the direction of travel is becoming clearer.

In its latest draft Integrated System Plan (ISP), the Australian Energy Market Operator (AEMO) has downgraded expectations for new wind farms and transmission, while lifting forecasts for large-scale solar, batteries and household energy technologies. The shift reflects falling solar and battery costs, alongside mounting delivery

distance infrastructure.

AEMO has cut its forecast for new wind capacity by 2030 from 42.6 gigawatts (GW) to 26 GW, following no wind projects in construction for 2025. Planned transmission has also been reduced from around 10,000 kilometres (km) to closer to 6000 km by 2050, but major projects like HumeLink and VNI West remain in development. By contrast, utility-scale solar is now forecasted to reach 32 GW by 2030,

From rooftop to resource

The Federal Government has announced a $24.7 million investment over three years to establish a national pilot scheme for recycling end-of-life solar panels, including up to 100 collection sites across Australia.

The program aims to reduce landfill and recover valuable materials such as copper, silver and aluminium, and ultimately strengthen Australia’s circular economy for clean energy technologies.

The initiative comes as Australia continues to lead the world in rooftop solar uptake, with more than one in three homes now equipped with photovoltaic systems. While this has delivered major emissions and cost benefits, the growing volume of ageing and decommissioned panels is creating a significant waste challenge.

The pilot responds to the Productivity Commission’s latest circular economy

expected to deliver 27 GW of dispatchable capacity.

The biggest shift is at household level. By 2050, AEMO expects 87 GW of rooftop solar and 27 GW of home batteries, with coordinated household systems playing a critical role in reliability.

For installers, this shows the opportunity is no longer just in selling systems, but in building, integrating and managing the foundations of Australia’s future grid.

report, which identified solar panels as a high value but high-risk waste stream and called for a coordinated national recycling scheme. Currently, only around 17 per cent of panels in Australia are recycled, with most stockpiled, sent to landfill or exported.

The Federal Government recently estimateed that lifting recycling rates could unlock up to $7.3 billion in economic and environmental benefits.

Treasurer Jim Chalmers shared that better resource recovery would improve productivity and reduce costs, while Climate Change and Energy Minister Chris Bowen sees the scheme as a way of supporting Australia to maximise the longterm value of its solar rollout.

The Federal Government says it will work with across the country’s states and territories to develop a nationally consistent, long-term recycling framework beyond the pilot phase.

As solar energy uptake surges, so does the need for responsible recycling of panels. Image: Bilanol/Stock.Adobe.com

The Australian Energy Market Operator’s latest report lifts its forecasts for large-scale solar, batteries and household energy technologies.

Inside the invisible work that will decide hydrogen’s future

LEAP Australia shares why bankable hydrogen projects require reliable engineering, digital innovation and proven technical pathways.

The hydrogen sector is entering its commercial reality check. The projects that proceed will be those that can clear Front-End Engineering Design reviews, procurement, construction and commissioning – and still deliver on cost, efficiency and risk.

For LEAP Australia, the difference comes down to what its engineers call “engineering certainty.” By that, they mean the ability to make confident decisions using digital engineering and simulation to understand

how complex hydrogen systems will behave, long before anyone pours concrete or orders equipment.

“Hydrogen plants are inherently multidisciplinary; made up of electrochemistry, power electronics, fluids, heat transfer, structures. None of these elements can be treated in isolation of each other,” says Lewis Clark, Engineering Manager at LEAP Australia.

“The way we see our customers succeed is by connecting the physics. You take

outputs from one domain and feed them into another. Electronics losses become thermal loads, thermal loads become mechanical stresses, and from there, you can build a picture you can trust.”

That picture matters because the hydrogen value chain is not a single technology challenge. It is a systems challenge, where small design decisions compound into major cost and safety consequences across production, storage, distribution and utilisation.

“Simulation plays a role across the whole lifecycle, from production, storage, transport and then utilisation of hydrogen by end users. Pick any part of the process and it’s going to involve multiple physics: Fluid mechanics, mechanical, often electromagnetics. It’s all interconnected,” Clark says.

Hydrogen value chain

Hydrogen has promising potential as a clean alternative to fossil fuels, particularly in hard-to-abate sectors. But the pathway to scale is constrained by persistent barriers: Process inefficiencies, scale-up costs, safety risks, and durability issues.

Across the industry, investment has leaned heavily into hydrogen production – and for good reason. Electrolysis can produce hydrogen without carbon emissions, but it is electricity-intensive, and electrolyser components are exposed to punishing operating conditions over long periods. Meanwhile, moving hydrogen safely and cost-effectively introduces a new set of challenges: Compression energy penalties, leakage risks, materials compatibility, and the complexity of pipelines and tanks not originally designed for hydrogen’s small molecules and high-pressure requirements.

That is why LEAP Australia’s proven view is not that engineering simulation is ‘nice to have,’ but that it is foundational

Robust digital engineering, multidisciplinary solutions, and industry collaboration can turn hydrogen’s potential into economically viability in Australia’s energy transition.

Image: Ansys

infrastructure for hydrogen development.

“It’s just not feasible these days to take a build-and-test approach as your primary method. You cannot hit time-to-market and budget if you’re committing to a physical prototype as your best guess and only finding out months later where the design breaks down. The virtual testing we provide clients lets them explore hundreds, even thousands, of configurations before they commit to a final design,” Clark says.

In practice, that can look like modelling electrochemistry and flow behaviour inside an electrolyser, then iterating design parameters to lift efficiency and durability before a single component is manufactured.

“You can configure your electrolyser geometry and inputs, and the simulation will report hydrogen yield, efficiency, power consumption,” Clark says.

“No one gets it right the first time. Simulation lets you parameterise the model, vary flow rates and geometry, and use optimisation tools to iterate until you hit your targets.”

Engineering commercial viability

Hydrogen’s future will ultimately be decided as much by economics as by physics – a point LEAP’s team hears repeatedly from industrial customers weighing early hydrogen pathways against lower-cost incumbent fuels.

Derik Cloete, Territory Manager at LEAP Australia, shares that the industry cannot rely on ambition alone.

“The solution can be physically viable yet commercially irrational if operating costs remain too high. The economics has to make sense,” he says.

Clark agrees and argues simulation is one of the few levers developers can pull immediately to improve both engineering performance and cost confidence.

“A lot of the value is risk mitigation. This means being able to say to your stakeholders: This is the design I’m confident in, because we’ve tested it virtually across the operating envelope,” he says.

“It is not just time and cost – simulations can provide unparalleled technical insights. Physical tests might tell you what goes in and what comes out, but simulation can show you what is happening inside the device, and why something performs well or not.”

That internal visibility becomes critical in hydrogen systems, where temperature gradients, pressure drops, material degradation and transient events can drive unexpected failures.

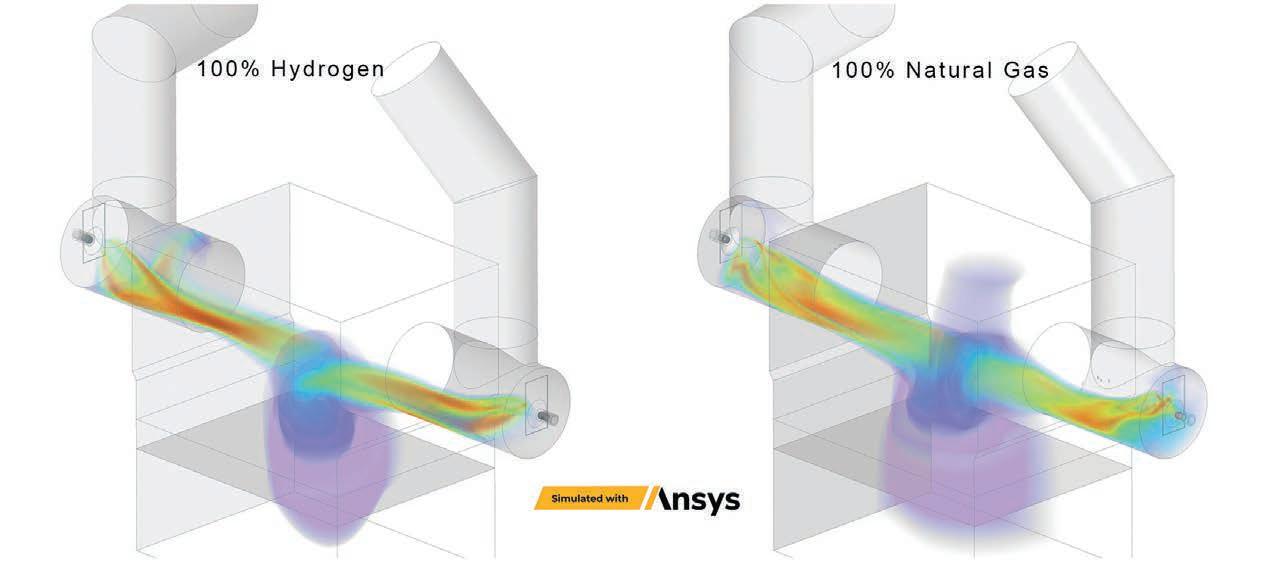

High-temperature hydrogen complexity

Case Study: Hadean Energy

One Australian company confronting that complexity headon is Hadean Energy, a Commonwealth Scientific and Industrial Research Organisation spin-out commercialising tubular solid oxide electrolysis technology to produce green hydrogen and syngas for industrial users.

Solid oxide electrolysis operates at higher temperatures, unlocking exceptional electrical efficiency and enabling direct integration with industrial heat and steam sources. But these conditions present technical challenges, from thermal management and mechanical stress to materials behaviour and electrochemistry.

Chris Rowland, Chief Executive Officer at Hadean Energy, explains that: “Simulation allows our team to explore cell, stack, and systemlevel designs virtually before we build hardware, optimising for thermal management, durability, and integrating with industrial heat sources. We have achieved this while reducing our development time, costs and technical risks.”

Hadean Energy has already demonstrated its approach in realworld conditions: Its first pilot system completed more than 1000 hours of operation in a trial at BlueScope Steel’s Port Kembla Steelworks, validating the technology in an industrial setting.

Over the next few years, Hadean aims to move from pilot to early commercial deployment, including a 250-kilowatt green hydrogen demonstration project with a tier one industrial partner supplying hydrogen directly into an operating industrial process. This will be a stepping stone toward commercial-scale systems for steel, chemicals, e-fuels and materials processing.

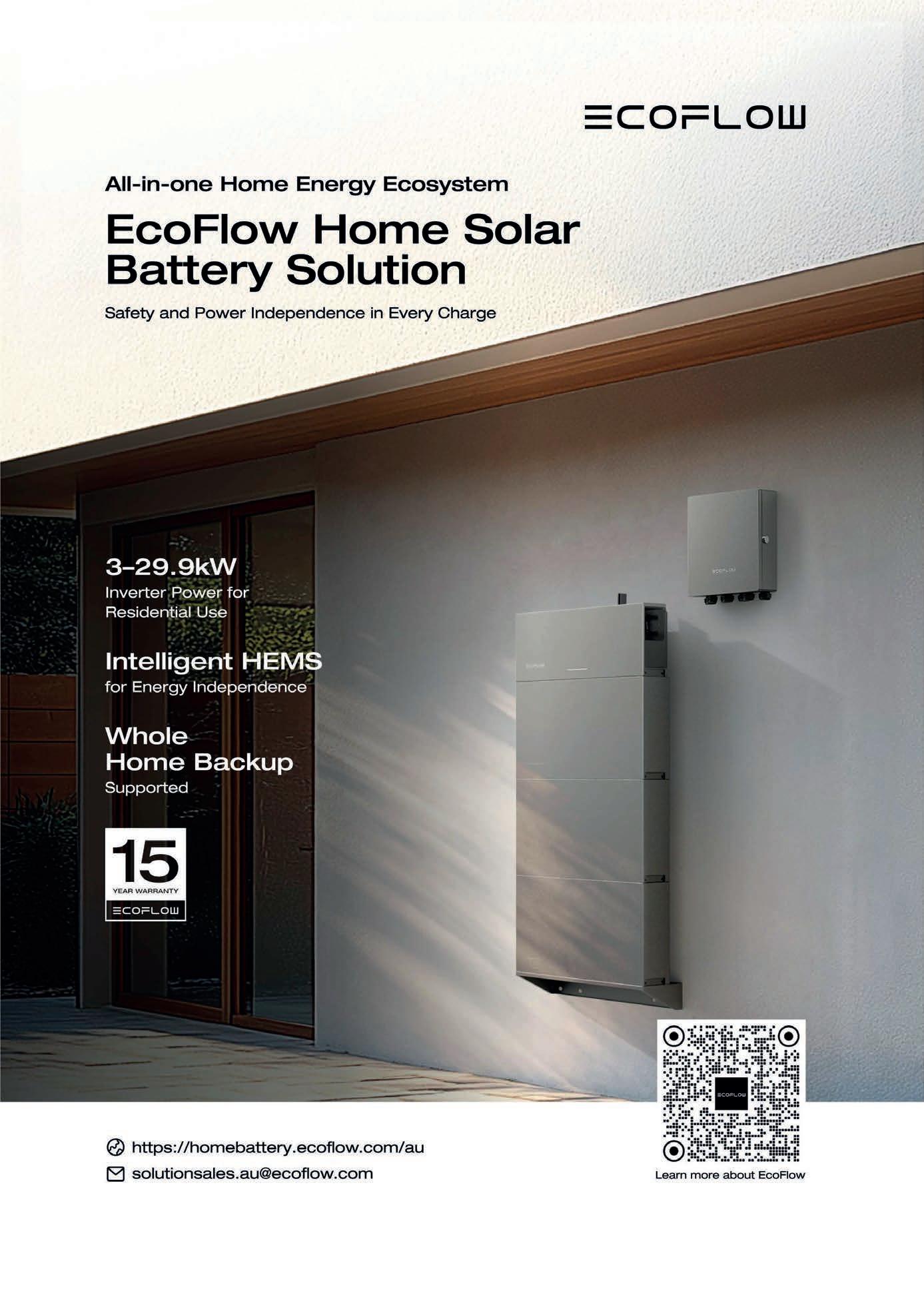

Case Study: FCT Combustion

FCT Combustion in Adelaide has over 40 years’ experience in high-temperature combustion, with a local team spanning engineering, research and development, and modelling/ simulation.

As the hydrogen supply chain matures, FCT has seen increasing interest from industry looking to transition from fossil fuels to hydrogen- ready burners suitable for high-temperature rotary kilns and calciners, along with fuel integration, controls and safety systems.

Renata Favvali, Computational Fluid Dynamics (CFD) Specialist at FCT explains that: “Engineering simulation plays a central role in de - risking these transitions. Our advanced CFD and thermo -fluid simulations accurately predict flame behaviour, heat transfer and system efficiencies. On recent retrofit projects we have significantly reduced our design iterations and the need for physical prototypes, compressing our engineering cycle by weeks and converging on a final configuration (after assessment of mixing, aerodynamics, thermal profile and process integration) with full confidence.”

The simulation advantage LEAP positions itself as a practical bridge between advanced simulation platforms and on-the-ground engineering teams trying to deliver real equipment and projects.

Clark highlighted that LEAP’s differentiator from other companies in the hydrogen sector is that they can support customers locally.

“LEAP has the largest team of local engineers dedicated to helping customers solve such challenging simulation problems. We can be onsite, we’re in the same time zone, and we can work alongside teams as they iterate,” Clark says.

Cloete adds that hydrogen projects rarely require just one type of physics model – and few providers cover the full stack.

“There are companies who specialise in different domains such as fluid dynamics,

that traceability becomes a risk-control mechanism, and increasingly, a prerequisite for investor confidence and project finance.

structural integrity, control systems and electrochemistry. But there are very few companies that cover all the physics required across hydrogen applications,” Cloete says.

For hydrogen innovators, particularly startups, that breadth matters. Hydrogen hardware development is capital intensive, and physical prototyping can quickly consume budget and time.

Hydrogen plants typically involve multiple partners, vendors and engineering disciplines. In that environment, digital engineering is as much about collaboration and governance as it is about modelling.

Filip Kuttner, Group Sales Manager at LEAP Australia, framed digital engineering as maintaining a digital thread.

“This means capturing decisions from requirements through preliminary and detailed design, prototyping and trials, so teams can trace why a change was made and where to go back if optimisation is needed,” he says.

For large, complex hydrogen projects,

The next phase

The next phase of hydrogen will reward the quiet work.

Hydrogen will not become mainstream because the industry wants it to. It will become mainstream if projects can be designed, built and operated with repeatable performance, acceptable safety margins and credible economic, and engineering teams that can move faster without gambling

capital on avoidable failures.

“It’s almost like a living organism. The amount of detail and the interconnections are enormous. But that is exactly why simulation matters. It lets you see the physics, iterate intelligently, and build confidence across production, storage, transport and end use,” Clark says.

As the hydrogen sector continues to search for the most commercially viable pathways, LEAP believes the winners will be the organisations that turn ambition into engineering certainty – and then practically prove it to the world.

Volume rendering of 3D temperature comparing 100 per cent hydrogen and 100 per cent natural gas.

CSIRO-developed solid oxide electrolysis system.

The Hadean Energy team at their pilot plant at BlueScope Steel’s Port Kembla Steelworks.

Images: Hadean Energy

Global Hydrogen Review: From ambition to implementation

After years of big promises and pilot projects, hydrogen is starting to look less like a future bet and more like an emerging industrial reality.

The Global Hydrogen Review 2025 by the International Energy Agency (IEA) shows steady progress across production, policy and technology as the sector moves into a new phase of development.

Published under the Clean Energy Ministerial Hydrogen Initiative, the annual report tracks global hydrogen supply and demand, as well as developments across infrastructure, investment and innovation.

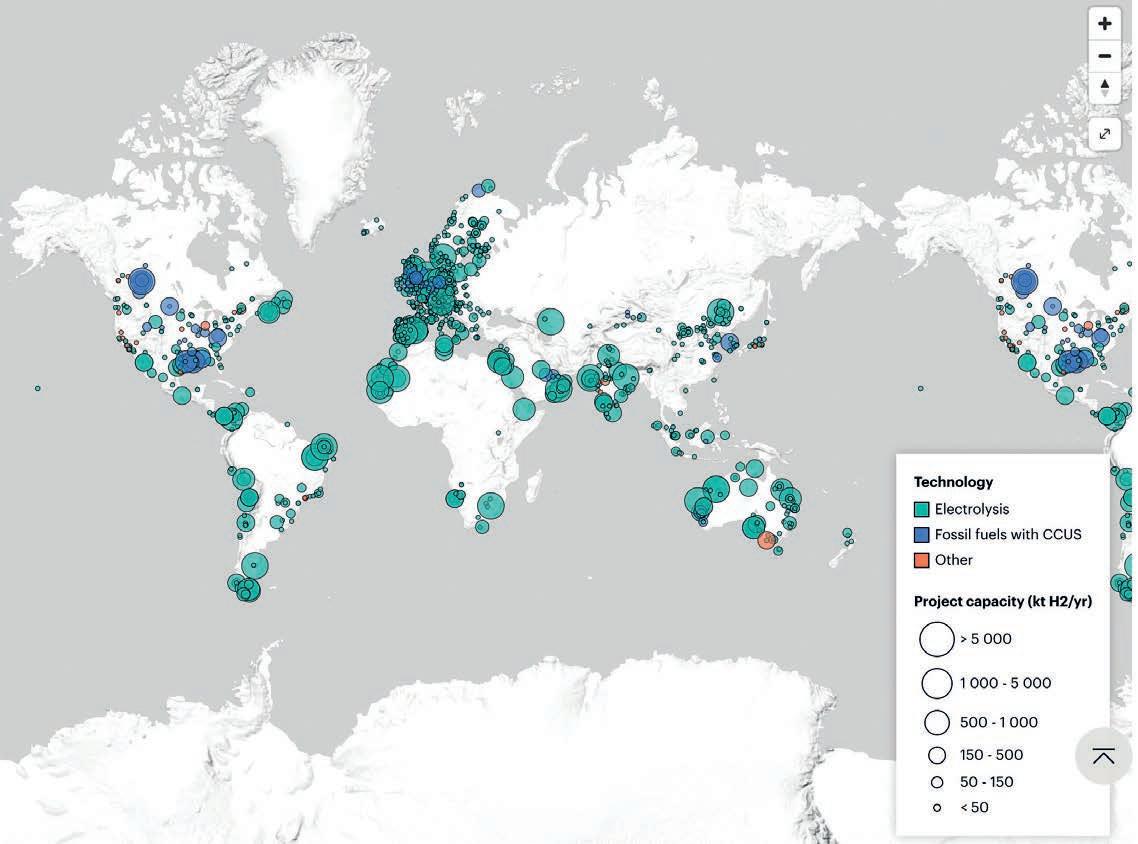

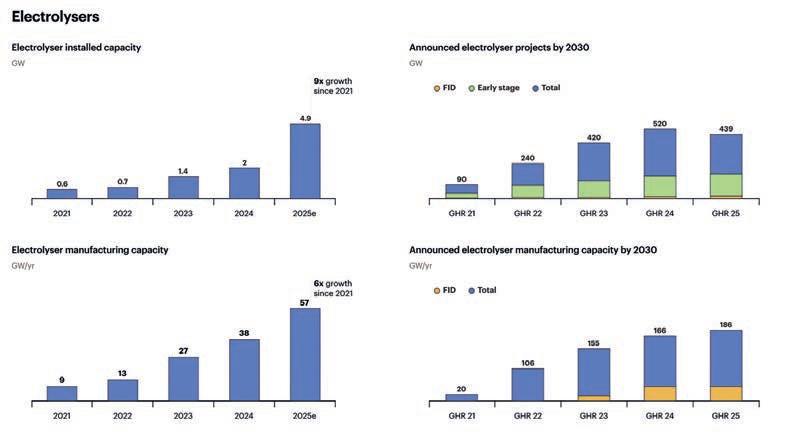

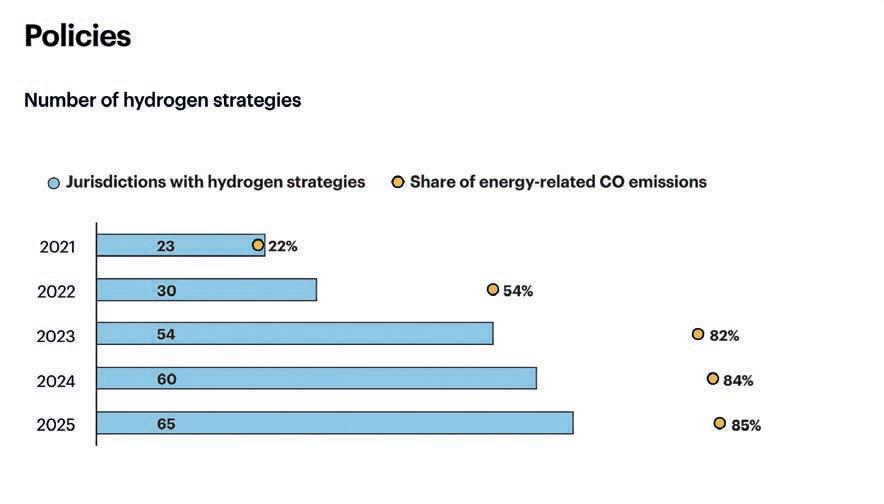

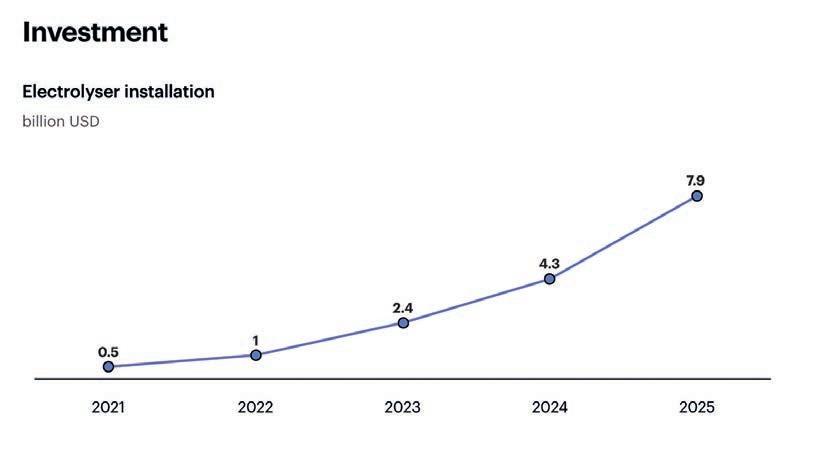

Globally, hydrogen demand reached almost 100 million tonnes in 2024. This growth aligns with broader energy use, while more than 200 low-emissions hydrogen projects have now reached final investment decision globally (up from just a handful of demonstrations in 2021). Innovation across the value chain is also accelerating, with a record number of technologies moving closer to commercial readiness.

Overall, the IEA’s findings point to a

sector shifting from early ambition to largescale implementation, following a familiar pattern seen in other major clean energy sources’ transitions.

Hydrogen’s role in today’s energy system

Hydrogen already plays a critical role in the global energy and industrial system, particularly in refining and chemical production. In 2024, demand growth was

Images: International Energy Agency

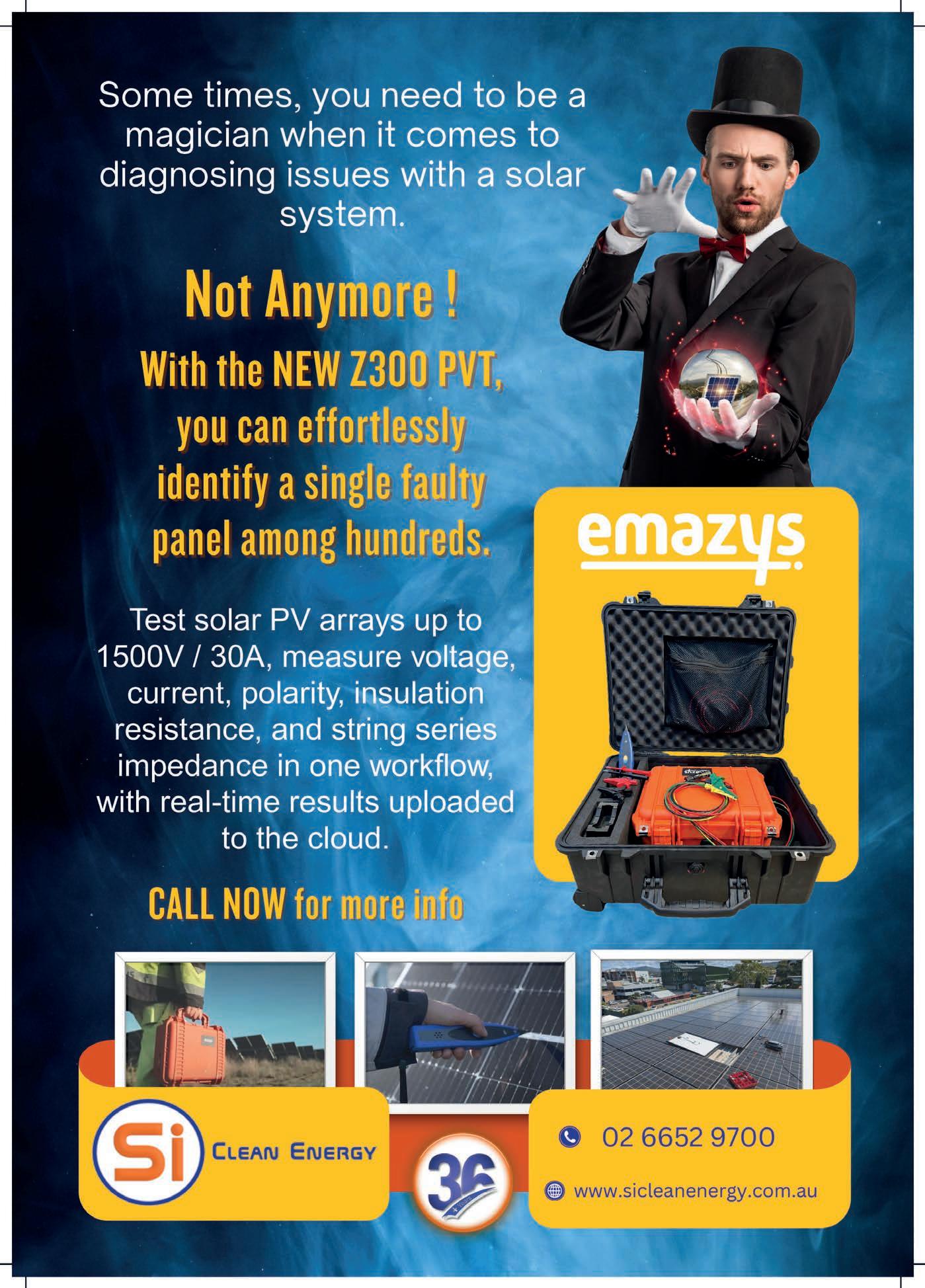

The map features projects set to produce low-emissions hydrogen.

driven mainly by these traditional uses, reflecting the essential role hydrogen plays in modern economies.

Supply today remains dominated by fossil fuels, with hydrogen production in 2024 consuming around 290 billion cubic metres of natural gas and 90 million tonnes of coal equivalent. Low-emissions hydrogen production grew by around 10 per cent last year and is expected to reach one million tonnes in 2025.

While this still represents a small share of total production, the IEA notes that early growth phases for new energy technologies are typically gradual before accelerating as markets, supply chains and infrastructure develop.

Importantly, the report highlights that the most immediate and scalable opportunity for emissions reductions lies in decarbonising existing hydrogen uses – particularly in refining, ammonia and chemicals – while new applications such as shipping, steel and power generation continue to develop.

Project development gains depth

One of the most encouraging trends identified in this year’s review is the growing maturity of the global project pipeline.

Although some early-stage projects have been delayed or refined as developers reassess timing and market conditions, the number of projects reaching final investment decision continues to rise. Since 2020, more than 200 low-emissions hydrogen production projects have now passed this key milestone, signalling increasing confidence among investors and policymakers.

Based on projects that are already operational, the IEA expects low-emissions hydrogen production to reach 4.2 million tonnes per year by 2030. This equates to around five times today’s level. This would lift low-emissions hydrogen’s share of global

around four per cent by the end of the decade.

In addition, a new assessment in this year’s review finds that a further six million tonnes per year of announced projects could realistically be operating by 2030, provided that supportive policies continue to be implemented and demand creation measures gain traction.

The IEA notes that this type of stepwise progress – combining steady investment decisions with ongoing project refinement –mirrors the early growth trajectories seen in other clean energy technologies such as solar photovoltaic (PV) and battery storage.

Costs are improving, with regional differences

The cost of producing low-emissions hydrogen remains one of the central considerations for the sector’s expansion, and the review finds that progress continues, but at different speeds across regions.

Recent changes in energy and equipment markets includes lower natural gas prices and higher input costs for electrolysers. This has influenced near-term project economics. However, the IEA expects the cost gap between low-emissions hydrogen and conventional production to narrow toward

scale effects and policy frameworks.

In China, renewable hydrogen could become cost-competitive by the end of the decade thanks to low equipment costs and favourable financing conditions. In Europe, higher carbon prices and strong renewable resources are expected to continue improving competitiveness. In regions with lower natural gas prices, such as the United States and the Middle East, hydrogen produced with carbon capture is expected to play an important role in the near term.

These regional variations underline the importance of diverse technology pathways and market-specific strategies as the global hydrogen industry develops.

Electrolyser manufacturing scales up

Electrolyser deployment and manufacturing capacity expanded significantly again in 2024. Global installed water electrolysis capacity reached two gigawatts (GW), with more than one GW added in 2025 to date.

China continues to lead this expansion, accounting for around 65 per cent of installed and committed capacity and nearly 60 per cent of global manufacturing capacity. The rapid growth of manufacturing

All graphs contain Data from the International Energy Agency (2025).

Graphs: International Energy Agency (2025)

global supply chain and drive learning effects across the industry.

At the same time, the review notes that electrolyser manufacturers outside China are navigating a challenging period as markets adjust and scale develops. Over time, the IEA expects continued innovation, international expansion and industry consolidation to strengthen the global manufacturing base and improve performance and reliability. When total project costs like engineering, construction and local installation are considered, the difference between Chinese and non-Chinese equipment is narrower in overseas markets than headline equipment prices suggest, highlighting the importance of local project development ecosystems.

Building markets for clean hydrogen Alongside supply, the creation of sustainable demand remains a key focus for policymakers and industry.

In 2024, new hydrogen offtake agreements totalled 1.7 million tonnes per year, with activity concentrated in refining, chemicals and shipping. While this was slightly

earlier agreements were finalised, enabling investment decisions on production facilities in several regions.

Policy frameworks to support demand are continuing to take shape. Europe is implementing sectoral targets under its Renewable Energy Directive, while India, Japan and Korea have launched major programs focused on priority sectors such as fertilisers, refining and power generation. The new International Maritime Organisation Net Zero Framework is also expected to support the uptake of lowemissions fuels in shipping over time.

The IEA notes that translating these policy frameworks into clear, bankable market signals will be an important next step in supporting the next wave of investment.

Ports and shipping pose opportunities

Shipping is identified as one of the most promising early markets for hydrogen-based fuels, particularly methanol and ammonia.

As of mid-2025, more than 60 methanol-powered vessels are already in

operation, with nearly 300 more on order. Ensuring that fuel supply and bunkering infrastructure develops in parallel is now a

The review finds that around 80 ports worldwide already have strong capabilities in handling chemical fuels, positioning them well to adopt hydrogen-based alternatives. More than 30 major ports could each access at least 100,000 tonnes per year of low-emissions hydrogen supply from announced projects within 400 kilometres, creating clear focal points for early infrastructure investment.

Southeast Asia’s growing role

A special chapter in this year’s Review examines Southeast Asia, where hydrogen demand reached four million tonnes in 2024, led by Indonesia, Malaysia, Vietnam and Singapore.

The region’s pipeline of low-emissions hydrogen projects could reach 480,000 tonnes per year by 2030, with a strong focus on ammonia production and exports. While many projects are still at early stages, several large-scale developments like the 240 megawatt electrolyser project in Vietnam highlight the region’s growing role in the global hydrogen economy.

The IEA identifies fertilisers, steel and maritime bunkering as particularly promising early applications, supported by the region’s strong industrial base and strategic shipping position.

Key recommendations for growth

The IEA concludes that the hydrogen sector is now entering a phase of practical, cumulative growth, supported by improving technologies, expanding policy frameworks and increasing investment certainty.

To build on this momentum, the agency recommends:

Continuing targeted support for nearterm projects in existing markets

Accelerating demand creation in priority sectors

Fast-tracking infrastructure in industrial and port hubs

Strengthening public finance mechanisms to reduce early technology risk

Supporting emerging economies in developing hydrogen-based value chains.

For project-level data on low-emissions hydrogen production worldwide based on the Global Hydrogen Review, visit the IEA Hydrogen Tracker.

Maritime shipping transition shows hydrogen’s promise and limits

The hydrogen sector continues to grow despite barriers, according to award-winning report series ‘Fuel for Thought.’

With maritime shipping responsible for around three per cent of global emissions and new measures from the International Maritime Organization, the European Commission and FuelEU Maritime, the industry is being forced to rethink its most fundamental input – fuel.

Against this backdrop, Lloyd’s Register (LR) has released the latest instalment in its award-winning Fuel for Thought series, turning its attention to hydrogen and its potential role in shipping’s energy transition. Published in January 2025, Fuel for Thought: Hydrogen offers a clear-eyed assessment of both the opportunities and the obstacles facing one of the most talked-about fuels in the decarbonisation debate.

LR’s broader Fuel for Thought program examines alternative fuel pathways; including, methanol, ammonia, biofuels and electrification. The series reflects a growing recognition that no single fuel will provide a universal solution. Instead, shipping’s future is likely to be shaped by a mix of technologies and use cases, constrained by cost, infrastructure and operational realities.

A sector searching for scalable solutions

Alternative fuels have moved rapidly from niche concept to strategic necessity in maritime transport. Environmental regulation is tightening, but so too is scrutiny from investors and customers who are increasingly demanding credible decarbonisation pathways. At the same time, shipowners are urged to balance emissions reduction with operational realities such as vessel range, payload capacity, safety and fuel availability.

Today’s menu of marine fuel options is broad and still evolving. It includes Liquefied Natural Gas and Liquefied Petroleum Gas

emissions.

as transitional fuels, biofuels that can often be blended with existing marine fuels, and emerging zero or near-zero-emissions options, such as hydrogen, ammonia, methanol and battery-electric systems. Even nuclear propulsion occasionally features in long-term discussions for specific vessel classes.

Each comes with trade-offs. Ammonia, for example, offers high energy density and zero carbon at the point of use, but presents significant toxicity and infrastructure challenges. Biofuels can deliver near-term emissions reductions using existing engines, but face constraints around sustainable feedstock supply. Batteries are well suited to

Maritime shipping is responsible for around three per cent of global

Images:

Lloyd’s Register

short-sea shipping but remain impractical for long-distance routes.

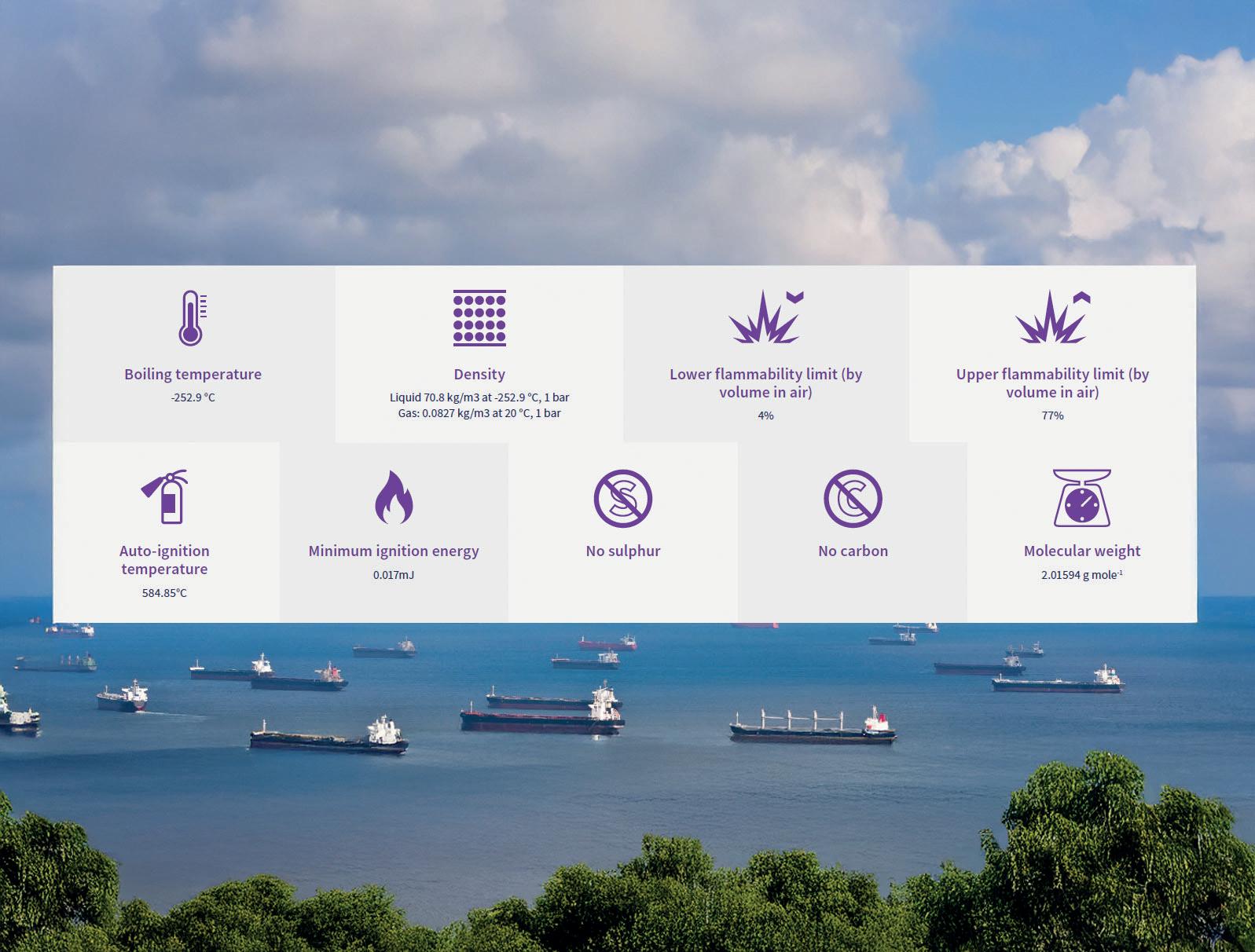

Hydrogen occupies a unique position in this mix. When produced using renewable electricity and used in fuel cells, green hydrogen can deliver zero tank-to-wake emissions. It is also a critical building block for e-fuels, such as ammonia and methanol, giving it strategic importance beyond its direct use onboard ships.

Hydrogen under the microscope

LR’s new report examines hydrogen from production and supply through to onboard use, highlighting both its promise and the reasons it remains a challenging option for most vessel types.

On the positive side, hydrogen’s climate credentials are compelling. In fuel cell applications, it produces only water as an exhaust product. It is also highly versatile, with potential to serve as a direct fuel, a feedstock for synthetic fuels, or a form of energy storage linked to renewable power systems.

But the physical realities of hydrogen are hard to ignore. Its low volumetric energy density means far larger storage volumes are required compared with conventional marine fuels. In liquid form, hydrogen must be stored at around –253 degrees Celsius (°C), introducing complexity and energy penalties. These factors translate directly into lost cargo space, higher costs and more complicated vessel designs.

Safety is another critical consideration. Hydrogen has a wide flammability range, low-ignition energy and can cause embrittlement in certain materials. Managing these risks requires rigorous engineering standards, specialised systems and enhanced crew training.

LR’s own rules for ships using lowflashpoint fuels, including its hydrogen requirements set out in Appendix LR3, provide a framework for addressing these issues. The guidance covers fuel cells, composite cylinders, liquid hydrogen systems and bunkering arrangements, reflecting the depth of technical change required to support hydrogen at sea.

The missing pieces: Infrastructure and supply

Perhaps the biggest barrier to hydrogen’s wider adoption is not onboard technology, but what happens onshore. Despite growing interest and a wave of national hydrogen strategies, low-emissions hydrogen still accounts for less than one per cent of global production, according to the International Energy Agency.

The award-winning ‘Fuel for Thought’ series has turned its attention to hydrogen.

Significant investment is needed across the entire value chain – from production, transport, storage and bunkering. For shipping, the challenge is compounded by the need for reliable, standardised refuelling infrastructure in ports around the world.

Competition for green hydrogen will also be intense. Heavy industry, chemicals, fertilisers, power generation and long-haul transport are all targeting the same limited supply. This makes robust certification schemes and transparent lifecycle assessments essential to ensure that maritime decarbonisation efforts deliver genuine climate benefits.

Under FuelEU Maritime, renewable fuels of non-biological origin (including green hydrogen) benefit from a two-times multiplier until 2033, potentially accelerating early uptake as production scales. But for now, cost remains a major hurdle.

Reflecting this reality, hydrogen-capable vessels still represent less than 0.5 per cent of the global orderbook, despite growing regulatory and industry interest.

Where hydrogen makes sense

While the report is cautious about hydrogen’s near-term role in deep-sea shipping, it identifies clear opportunities in

shorter routes and specialist applications. Ferries, tugs and coastal vessels – where regular bunkering cycles reduce storage constraints – are seen as the most viable early adopters.

Fuel cell technologies particularly show promise in these segments, supported by improving cost trajectories and advances in durability. Hybrid configurations and ‘hydrogen-ready’ designs also offer shipowners a way to future-proof assets without committing fully to a single fuel pathway.

Padmini Mellacheruvu, Lead Technical Specialist in Cryogenic and Compressed Fuel Systems at LR, shared that hydrogen has an important role to play, but warned the pathway to scale will be complex.

“Progress will depend on early investment, careful planning and a clear focus on safety,” she said.

“Our latest Fuel for Thought report brings clarity to both the potential of hydrogen and the substantial work still required to enable its safe, scalable and commercially viable use.”

Wider energy transition

The hydrogen report, as part of LR’s wider

the rapidly evolving alternative fuels landscape. The overarching message is that the shipping transition will not be defined by a single winner, but by a portfolio of solutions tailored to different routes, vessel types and regional conditions.

Dr Maximilian Kuhn, Advisor to Hydrogen Europe and Liaison to the International Maritime Organization, said hydrogen should be seen as a driver of systemic change rather than a standalone answer.

“Its versatility, scalability and compatibility with renewable energy sources put it in a unique position to address the complex challenges of maritime decarbonisation,” he said.

“Yet the path forward is not without obstacles: infrastructure, regulation, safety and cost remain critical hurdles.”

For Australia, with its vast renewable resources and ambitions to become a clean energy and hydrogen export powerhouse, these developments will be closely watched. While the initial focus has been on land-based industry and exports, the maritime sector will

The properties table provides an assessment of hydrogen as a marine fuel.

RAPID DEPLOYMENT Ready in under 30 minutes

DURABLE & SUSTAINABLE Designed for 10+ years in the eld

From mining to megawatts

With skills shortages emerging, Specialised Energy Solutions is betting that technical training, culture and long-term thinking will be as critical as megawatts and megaprojects.

When Australia talks about the energy transition, the focus is usually on megawatts, transmission lines and technology. But on the ground, the success or failure of the transition increasingly comes down to something far more prosaic: Whether there are enough skilled people who actually know how to install, integrate, commission and maintain the equipment.

For Aaron Mulhall, Founder and Chief Executive Officer of Specialised Energy Solutions (SES), that reality is not theoretical. It is the daily operating environment of a business that has quietly grown from a handful of people in 2022 to nearly 100 today, working across almost every state across Australia’s most complex renewable energy projects.

“We’re not a business built around hype. We’re built around delivery, around people, and around being able to support this equipment for the next 20 to 30 years,” Mulhall says.

Coal to renewables

Mulhall’s path into renewables is not a conventional one. He is an electrician by trade, having completed his apprenticeship in the mining industry, working underground in coal.

From there, he moved to operational roles across multiple mine sites before being exposed to the early stages of the energy transition around seven years ago.

“I did some work with a large European company and that was really my first deep look at how far ahead Europe was in terms of technology. That opened my eyes to what was coming to Australia,” Mulhall says.

That experience also exposed him to a different way of thinking about projects – not just construction – but lifecycle management, commissioning and long-term operational performance.

In 2022, Mulhall launched SES, initially with a very narrow and technical focus: Supporting global technology providers as they brought advanced equipment into the Australian market.

“When we started, it was basically just me,” he says.

“By the back end of 2022, we might have had seven or eight people. The original idea wasn’t to build a huge company. It was to sit in a very specific niche around integration and commissioning.”

However, that niche turned out to be much larger, and more critical, than first expected.

Bridging the gap

Australia’s renewable sector is heavily reliant on overseas technology, particularly from Europe and China. But what often gets underestimated is how different Australian regulatory environments are compared to other markets.

“Australia is much more rigorous,” Mulhall says.

“The approval processes, the compliance,

the installation standards – they’re all tighter. That’s a good thing, but it does mean overseas manufacturers can’t just land equipment here and expect it to be installed the same way it is elsewhere.”

SES has positioned itself as the on-theground bridge between global Original Equipment Manufacturers (OEMs) and Australian conditions. This means not just installing equipment, but helping manufacturers understand how their products need to be adapted, integrated and supported locally.

“We sit at the table with corporate and engineering teams, but we can also talk about the physical realities of installing the equipment. The logistics, the site conditions, the workforce – all of that matters if you want these projects to succeed,” Mulhall says.

Today, SES works across solar, wind, battery storage, substations and hybrid projects, supporting multinational clients with installation, commissioning and long-term service agreements. While Mulhall cannot name specific customers for privacy reasons, he shares that most of the company’s major clients are large international firms.

“We see ourselves as an extension of OEMs,” he says.

OEMs are companies that design and build the actual physical parts (turbines, inverters, batteries) or integrated systems (microgrids, solar farms) for renewable energy projects.

SES team working on a large-scale battery energy storage project, supporting Australia’s energy transition and long-term energy security.

“If their equipment succeeds in Australia, we succeed. That’s how we’ve built our partnerships.”

Systems and culture, not slogans

SES’s workforce growth has been rapid by any standard: From single digits in 2022, to around 25 in 2023, roughly 60 in 2024, to approaching 100 in 2025.

But Mulhall is quick to push back on the idea that growth itself was ever the goal.

“The business was never meant to grow this big, this fast. It happened because the market needed what we were doing,” he says.

What he is far more proud of than headcount is high retention.

“We’re on site, we set expectations early, and we build teams that don’t want to let each other down. That’s the culture we breed,” Mulhall says.

That culture is backed up by a very deliberate financial strategy.

“Every dollar this company has ever made has gone back into the business. Into people, into equipment, into vehicles, into tooling, into systems. I’m playing a long game. I’ve got 30 years to build this properly,” Mulhall says.

Decades-long view

That long-term mindset is central to how SES positions itself in the market. Rather than thinking in terms of projects, Mulhall thinks in terms of asset lifecycles.

“The equipment being installed today should still be supported in 20 or 30 years. That’s how we build continuity of work for our people and real value for clients,” he says.

It’s also why SES has been building long-term service agreements alongside its construction and commissioning work.

“We don’t want to just show up, build something, and disappear. We want to be there for the operations and maintenance phase as well,” Mulhall says.

For Mulhall, that continuity is personal.

“I’ve got a young family. A lot of the people working for us do too. We’re all in the same boat,” he says.

“If we can give our people consistent work and long-term security, that matters.”

Technical capability

Without enough skilled people to commission, operate and maintain complex renewable assets, the risks for the development of the renewable energy sector extends well beyond project delays to underperforming assets, increased fault rates, safety incidents, and long-term reliability challenges.

“You can build capacity quickly. But capability takes time. If we don’t invest in people now, we’ll feel it five to ten years down the track when assets start to age and there aren’t enough technicians who truly understand how they work,” Mulhall says.

When asked what worries him the most about Australia’s 82 per cent renewables target, Mulhall doesn’t talk about approvals or capital. He talks about skills.

“An emerging industry barrier is technical capability,” Mulhall says.

“There are plenty of electricians who can pull cables. But fault-finding, commissioning, high-voltage switching – that’s a different level of skill.”

He believes the real crunch will come once assets are operational, not in construction.

“If we don’t have enough people who really understand the complex systems required to deliver for our growing customers, operations will become the constraint,” Mulhall says.

SES has responded by making training a core part of its operating model. The company currently employs seven apprentices and puts all its tradespeople through OEM-specific training, high-voltage operations and switching courses.

“We give them exposure to equipment they would never see in residential or commercial electrical work. By the time they finish their trade, they’re confident not just

in general electrical work, but in high-end technical systems,” Mulhall says.

Three of SES’s apprentices came from residential and commercial backgrounds and are now being trained on utility-scale infrastructure.

“They’re learning things they just wouldn’t get exposed to anywhere else,” he says.

Mining meets renewables

Mulhall credits much of SES’s operational discipline to his mining background.

“Mining is heavily safety-driven and process-driven,” he says.

“There are decades and decades of hardearned lessons in that industry. Bringing that thinking into renewables gave us a big head start.”

That includes everything from safety systems to documentation, training pathways and quality assurance.

“Renewables is a younger industry. It’s scaling incredibly fast, but it hasn’t had 100 years to build its systems yet. That’s where we’ve tried to bring some structure,” Mulhall says.

Aaron Mulhall, Founder and Chief Executive Officer, Specialised Energy Solutions.

Not a typical CEO story

Despite founding and leading the business, Mulhall is almost uncomfortable talking about himself.

“I’d rather people know the business and the team first, and find out who I am afterwards. This isn’t about me.”

He still spends time onsite, works directly with teams, and sees himself as a tradesman first and a CEO second.

“I like being able to talk to engineers at a high level, but also to talk about how the equipment actually gets installed,” he says.

His ambition for SES is not to become a corporate giant, but to become a longterm, trusted delivery partner across the sector.

As Mulhall puts it: “You can have all the technology in the world. But if you don’t have the people who know how to install it, run it and fix it, it doesn’t matter.”

“We need to make this a career people can stay in for decades. That means training, progression, exposure to different technologies, and a work environment that’s safe and sustainable.”

For SES, this translates into continued investment in apprenticeships, OEMspecific training, and long-term service agreements. This ensures that as Australia’s renewable fleet expands, the workforce grows alongside it.

The unseen work behind Australia’s most reliable solar assets

In a high-tech solar era, Mega Watt Power shows how technical service is the real differentiator.

For more than a decade, Australia’s solar conversation has been dominated by hardware: Bigger panels, smarter inverters, higher-density batteries, faster deployment.

Yet behind every system that performs reliably year after year is something far less visible and far more critical: The people who service it.

For Mega Watt Power, this reality has shaped the business from its earliest days. Long before ‘solar inverter’ became industry vocabulary, and long before renewable energy became a national success story, the company’s over 30 year track record began with a single off-grid system on a riverbank outside Dorrigo in regional New South Wales.

“Our journey began in 1989 with a single 12-volt battery, a 42-watt solar panel, and a very determined need to keep the lights on,” says Peter Bulanyi, Founder and Managing Director at Mega Watt Power.

It was a modest beginning, but one that set the tone for what would follow.

“Our business was built not just on technology, but on responsibility, technical honesty and long-term service,” Bulanyi says.

Expertise meets accountability

Today’s solar and storage systems are sophisticated parts of infrastructure. Modern renewable energy plants rely on multi-mode inverters, advanced battery platforms, rapid shutdown systems, real-time monitoring and continuously evolving firmware.

Australia now depends on residential, commercial and utility-scale PV and BESS assets operating with tight performance targets and little tolerance for downtime.

Technology has accelerated rapidly, but the importance of technical services has not changed.

Mega Watt Power occupies a unique position in the Australian market because

it combines decades of hands-on field experience with the backing of its longstanding engineering and servicing arm and technical partner founded by Bulanyi and his wife Lee in 1989.

While Mega Watt Power focuses on installation, project delivery and ongoing maintenance, Si Clean Energy works quietly in the background, providing deep technical capability that many site operators never directly see: Electronics repair, calibration, spare parts, engineering support, and advanced diagnostics.

“It’s not one business sitting above the other, it’s two parts working as one,” Bulanyi says.

The electronics laboratory at Si Clean Energy supports calibration services, component-level electronics repairs, sales

and servicing of solar test instruments, and specialist services for pyranometers and weather stations. An experienced engineering team underpins field services, enabling rapid fault identification and resolution when systems don’t behave as expected.

“When something goes wrong, the last thing customers want is to be told to log a ticket overseas,” Bulanyi says.

“They want someone who understands the system, the site, the climate and the conditions – and who can actually be there.”

Technical services as defining difference

Solar has entered a new phase of maturity. Batteries are no longer niche. Hybrid systems are becoming standard.

Mega Watt Power inverter integration at Kiamal Solar Farm in Victoria.

Commercial and utility-scale clients expect real-time visibility, rapid response and clear accountability well beyond commissioning day.

This shift is exposing a reality the industry does not always acknowledge.

“Products don’t keep systems running –people do,” Bulanyi says.

For Mega Watt Power, technical service is not an afterthought or a support line. It is the core of how the business operates. The company’s technicians live in the regions where the systems operate. They understand the effects of humidity, heat, coastal corrosion, power quality and the environmental variables that glossy brochures rarely capture.

As a result, problems are often resolved within hours rather than weeks. Firmware updates and diagnostics are handled locally, not offshore. Responsibility is shared rather than passed along supply chains.

Technical services are the daily order of work. Mega Watt Power provides IV (current-voltage) curve testing in the field, while Si Clean Energy as an authorised Fluke distributor supplies testing equipment, technical training and result analysis for plant operators and subcontractors performing their own testing.

Many manufacturers of inverters and power electronics also outsource servicing and maintenance to Mega Watt Power, trusting the team to perform component-

level repairs inside equipment, deliver firmware upgrades and carry out remote diagnostics via plant Supervisory Control and Data Acquisition (SCADA) systems.

This combination of field capability and engineering depth is what gives customers confidence over the long term – and what has earned the company a reputation for reliability across Australia.

A philosophy built over decades

What has sustained the business for more than 30 years is not scale or market share, but a belief that solar companies must remain human at their core.

“Solar is technology, yes. But it’s also people’s homes, their livelihoods, their businesses and their power plants. If we don’t care about the people, the technology doesn’t matter,” Bulanyi says.

That philosophy influences how technicians are trained, how teams are built and why the company has remained proudly regional. Many staff members have stayed with the business for a decade or more, drawn by an environment that values capability, accountability and trust.

Although Mega Watt Power’s roots are firmly planted in Coffs Harbour, New South Wales, its work now spans the country. The team has supported solar farms, commercial installations and long-term maintenance programs across all mainland states, bringing the same consistency and care they

deliver in their home region.

Major project experience includes the electrical construction of the 167-megawatt Stage One Wandoan Solar Farm, integration of more than five gigawatts of central inverters across Australia, utility-scale Battery Energy Storage System (BESS) commissioning and maintenance, power transformer testing and substation services. It is a portfolio built quietly, job by job, rather than through marketing fanfare.

Investing in skills

As Australia moves deeper into electrification – spanning batteries, electric vehicle (EV) charging, home energy management and commercial storage – the demand for skilled technical service will only increase.

Systems are becoming more integrated. Customers are more informed. Expectations around uptime, response times and accountability are rising.

Mega Watt Power is preparing for that future by investing in people. The company currently supports seven apprentices within its technical team and provides ongoing professional development opportunities across the organisation.

“There’s new technology coming that goes beyond anything we’ve previously imagined. Our job is to be ready to deliver it – and to maintain it properly,” Bulanyi says.

That preparation is already evident on the ground. While Bulanyi now spends less time on the tools day-to-day, he remains closely involved in complex and cutting-edge projects, particularly during commissioning phases where experience and judgement matter most.

“When things are truly new, that’s when you want your most experienced people involved. That’s where risk is highest, and where good technical service makes the biggest difference,” he says.

Local hands, national footprint

Mega Watt Power’s vision is straightforward: Continue delivering advanced energy systems without losing sight of the values that shaped the business from its earliest days.

“Local hands, national capability, real responsibility. That’s our service model that doesn’t disappear once the system is switched on,” Bulanyi says.

“It may not be the flashiest story in Australia’s renewable energy sector, but it is one of the most important. As the industry continues to scale, it will be technical service – quiet, skilled and accountable – that ultimately keeps Australia powered.”

Vena Energy is the developer and owner driving the planning, financing and delivery of Wandoan South Solar Stage One.

Large-scale agri-solar project advances

The Blind Creek Solar Farm and Battery Project in New South Wales is set to supply enough electricity to power more than 120,000 homes while supporting agricultural production.

Octopus Australia recently appointed GHD to deliver construction management services for the Blind Creek Solar Farm and Battery near Bungendore, New South Wales.

Under the appointment, GHD will act as construction manager across the delivery phase of the project, providing full-time site supervision alongside project management, contract administration, planning and

scheduling, cost control, reporting and gridconnection support.

The role builds on an established working relationship between GHD and Octopus Australia, following previous engagements at

Blind Creek is a farmerled, utility-scale renewable energy project founded by local landholders and energy specialists.

the Fulham Solar Farm and Battery project, where GHD provided both construction management and owner’s engineering services. Octopus Australia is an energy fund manager and developer with a renewable energy portfolio and development pipeline exceeding $15 billion across wind, solar and battery storage.

Blind Creek is a farmer-led, utility-scale renewable energy project founded by local landholders and renewable energy specialists. The development co-locates large-scale solar generation and battery storage with ongoing sheep grazing, positioning the site as a leading example of agri-solar development in Australia. The project was recognised with the Clean Energy Council’s 2022 Community Engagement Award for its benefitsharing approach and integration with agricultural operations.

At roughly three times the size of the Fulham project, Blind Creek represents a significant expansion of Octopus Australia’s operating portfolio. Once complete, the solar farm and battery are expected to deliver 300

megawatts (MW) of renewable generation capacity, with a 243 MW / 486 megawatthour battery system. At full output, the project is expected to be capable of supplying enough electricity to power more than

120,000 homes for 24 hours, with emissions abatement equivalent to removing around 200,000 cars from the road.

GHD’s Delivery Phase Services team will lead the construction management scope, drawing on specialist expertise from across the company’s Australian operations.

Craig Palmer, General Manager of Delivery Phase Services at GHD, said the appointment reflected the strength of the partnership between the two organisations and the value of continuity across major renewable projects.

“Establishing a unified management team across Octopus Australia’s Fulham and Blind Creek projects has enabled effective knowledge transfer and consistency in delivery,” Palmer said.

“By tailoring our organisational structure to prioritise quality, safety and flexible resourcing, we’ve been able to minimise costs and maximise value. We’re looking forward to bringing GHD’s major project delivery experience and technical capability to this landmark renewable energy development.”

Specialised Energy Solutions

National Project Footprint

Craig Palmer, General Manager of Delivery Phase Services at GHD.

The next phase of high-performance energy storage

Australia’s storage market is moving beyond early adoption into a phase of higher power, larger systems and whole-of-home capability, reshaping what installers and households now expect from batteries.

Australia’s first wave of battery uptake was driven by early adopters, rising power bills and demand for backup power. The market is now shifting toward systems that can support fully electrified homes, electric vehicles and higher peak loads, while remaining practical for installers to deploy and support.

Rising electricity prices, accelerating electrification and growing expectations around resilience are changing what is expected from energy storage. Batteries are no longer an add-on to rooftop solar. They are becoming part of how buildings manage supply, reliability and load.

Against this backdrop, Growatt has released its SPM 8000-10000TL-HU hybrid inverter to the Australian market, targeting higher-power residential and light commercial systems.

High-power homes

Australian homes are using more electricity, more often. Air conditioning, induction cooking, pool pumps and electric vehicles (EV) are becoming common, reshaping the load profiles that solar and storage systems must support.

This is where the SPM series 8 kilowatt (kW) to 10 kW output range is relevant. Rather than being designed for partial load coverage, the system is intended to support multiple high-demand appliances operating at the same time.

In practice, this allows households to run more of their home on solar and storage during peak periods and maintain closerto-normal operation during outages, rather than limiting use to essential loads only.

Storage systems expand

Alongside higher inverter power, the Australian market is also moving toward larger battery capacities. Time-of-use

tariffs, evening demand and a desire to reduce grid dependence are pushing many households and small businesses beyond the 5-10 kilowatt-hour (kWh) systems that dominated early installations.

The SPM 8000-10000TL-HU supports battery capacities from 5 kWh to 100 kWh, allowing systems to be sized for current use and expanded later.

This matters for households planning to add an EV, electrified heating or increase

overall electricity use. The ability to expand storage without replacing core equipment reduces long-term cost and disruption.

A recent Victorian installation combining a 10 kW single-particle model (SPM) inverter with 50 kWh of battery storage reflects a broader trend: System sizes that once looked commercial are now appearing at the upper end of the residential market.

Backup capability remains a key consideration, particularly in regional and

Growatt’s 10 kilowatt Single-Particle Model + 50 kilowatt-hour Advanced

Power Battery System installed in Victoria.

Images: Growatt

semi-rural areas where grid reliability can be less predictable.

In grid-connected operation, the SPM series supports a 63 Amp (A) bypass load capacity, allowing household loads to be supplied directly by the grid under high current demand. This makes whole-home backup configurations more feasible than partial or selective coverage.

When the grid is unavailable, the system switches to off-grid operation with a

maximum output current of 43.5 A, keeping essential loads operating. This move from minimal backup to continuity of operation is becoming more common as storage systems become more capable.

A more mature storage market

The SPM 8000–10000TL-HU is not just another product release. It reflects a broader shift in what the storage market now demands.

Systems are increasingly being judged on whether they can deliver usable power (not just nominal capacity), scale as household energy use grows, support whole-home backup, integrate into everyday operation, and remain practical for installers to deploy and support.

In this context, storage is increasingly being treated as part of building infrastructure rather than an add-on.

While customers focus on performance and resilience, installers are facing labour shortages, tighter margins and growing system complexity.

To address this, Growatt has paired the SPM series with its ShineTools app, which supports one-click system setup and diagnostics. The aim is to reduce commissioning time, manual configuration and error rates.

Shorter commissioning times also mean systems can be brought online faster and with fewer follow-up visits.

Growatt’s local presence

Growatt has expanded its Australian presence over recent years, supported by local partnerships, technical support and a growing installed base across both solar and storage. As the market moves from early adoption to mainstream deployment, the company is increasingly associated with scalable system designs and established supply chains.

Installer feedback suggests that products that balance functionality with ease of use are gaining traction, while end users are placing more emphasis on reliability, system transparency and clear upgrade pathways.

A central part of Growatt’s approach in Australia has been adapting products to local grid rules, standards and installer practice, rather than relying solely on global specifications. Changes in scalability, backup behaviour and commissioning workflows reflect local use cases and operating conditions.

As Australia’s energy system becomes more distributed and more variable, this kind of localisation is becoming more important. High-performance storage will continue to play a growing role in emissions reduction and how households and businesses manage cost, reliability and exposure to the grid.

The first phase of Australia’s battery market was about adoption, the next phase is about capability, scale and system integration.

Site Installation of Growatt’s SPM-HU Hybrid Inverter.

How EcoFlow is reshaping Australian energy