VIEWPOINT

LGPS IN FOCUS: BUILDING BRIGHTER COMMUNITIES

MOMENTUM IN PENSIONS AND GROWTH

SPOTLIGHT ON SOCIAL FACTORS

THE MOTABILITY PENSION SCHEME

COMBATTING CYBER THREATS

MOMENTUM IN PENSIONS AND GROWTH

SPOTLIGHT ON SOCIAL FACTORS

THE MOTABILITY PENSION SCHEME

COMBATTING CYBER THREATS

JOIN A PLSA LOCAL GROUP to keep up to date with the latest developments in pensions, share your experience and network with pension professionals in your local region. Each Group welcomes members from all sections of the pension industry.

Local Groups are run by volunteer PLSA members who hold regular meetings, from panel discussions to debates, and specialist updates by industry experts and the PLSA Policy & Advocacy Team. Some groups also hold annual one-day seminars and social activities.

04 CEO VIEWPOINT

11

BRINGING OUR MEMBERS TOGETHER IN PERSON AND ONLINE

18 SPOTLIGHT ON SOCIAL FACTORS

25 VISION FOR THE FUTURE

12 CASE STUDY: THE MOTABILITY SCHEME

19 IN PERSON: ROBERT BRANAGH, CEO LPFA 29

CLIMATE DISCLOSURES: ACTIONS INTO WORDS

PLSA Team:

Maggie Williams, Editor

Tel: 07876 823 716

Email: maggie.j.williams@ googlemail.com

Twitter: @mrsmaggiew

Edward Bogira

Tel: +44 (0)20 7601 1733

Email: edward.bogira@plsa.co.uk

Eleanor Carric

Tel: +44(0) 7601 1718

Email: eleanor.carric@plsa.co.uk

20 PENSIONS AND GROWTH POLICY UPDATE WHAT’S HAPPENING AT THE LGPS CONFERENCE? 08

CHANGING RETIREMENT DECISION-MAKING IN DC LEGAL UPDATE 06 TAKING THE LEAD ON PENSIONS ADEQUACY AND ENGAGEMENT

CYBER THREATS: A 21ST CENTURY RISK

17 LGPS CASE STUDIES: WORK IN PROGRESS

22

INTRODUCING OUR NEW MEMBER PLATFORM 10 A COLD CLIMATE FOR RESPONSIBLE INVESTING? 14 31

32

Design arc-cs ltd

www.arc-cs.com

Advertising

Adrian Messina

Tel: +44 (0)20 7601 1722

Email: adrian.messina@plsa.co.uk

Karim Uddin

Tel: +44 (0)20 7601 1735

Email: karim.uddin@plsa.co.uk

ISSN 2398-7626

© Pensions and Lifetime Savings Association 2024. All rights reserved.

Published by the Pensions and Lifetime Savings Association, a company registered in England and Wales. Comany number 1130269. 3rd floor, Queen Elizabeth House, 4 St Dunstan’s Hill, London EC3R 8AD

The views expressed in this publication are not necessarily the views of the Pensions and Lifetime Savings Association.

Julian Mund, Chief Executive of the PLSA, welcomes a new member benefit intended to do exactly that.

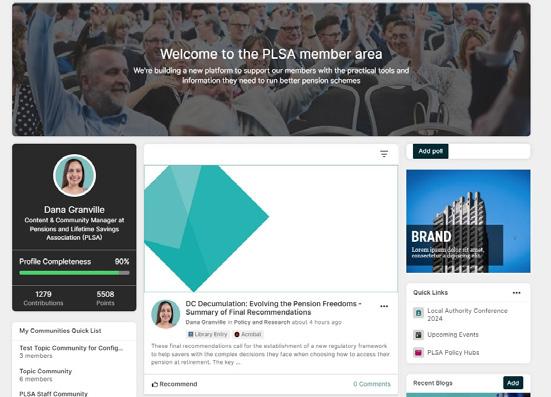

elcome to the second edition of Viewpoint for 2024, which – as well as covering the latest pensions news – reveals a very exciting development for members: the launch of the new member area of the PLSA website.

“Technology is best when it brings people together,” the social media entrepreneur Matt Mullenweg once said, and this is the intention with our new digital enhancement to member benefits.

In an industry tasked with securing people’s financial futures, pulling together is essential if we are to best meet the changing needs of today’s savers. And this sense of community is central to our new offering.

Now – as well as through our showstopping events – we’re giving members the ability to connect and interact with the PLSA community all year round.

The new digital space is your one-stopshop for exclusive member resources including practical guides, reports, live Q&As, videos, networking and discussion. Members can chat about the latest topics in pensions, as well as having PLSA policy experts on hand to answer all your burning questions.

We’ve seen time and again through our policy and advocacy work how collaborating with members achieves tangible results. The enhanced communication possible in the new member area will strengthen our ability to amplify your voice to policymakers

and regulators, and reinforce our collective mission to help everyone achieve a better income in retirement.

This could be through your involvement in our work looking at how pension funds can invest more in UK growth, or in defining our vision for 2035 – both covered in this issue of Viewpoint

Or it could be through talking to other professionals facing similar operational issues, whether that’s in DC, DB, Master Trust schemes, the LGPS, or pension providers.

This new benefit will be open and accessible to all PLSA members once it’s live, but we’ll be inviting members in groups over the initial weeks after launch so we can highlight content relevant to you and provide technical support to members who need it.

In this edition, we focus on the local authority pensions community and take a deep dive into some of the unique challenges facing the sector ahead of our Local Authority Conference taking place in June.

We hope many of you will join us to hear from keynote speakers Lewis Goodall, LBC Presenter and Co-Presenter of The News Agents podcast; and Susie Dent, Lexicographer from Countdown, as the after-dinner speaker.

Topics on the agenda will include the current government’s vision for the LGPS, the implications of the general election, the long-term future from the scheme’s perspective, the recruitment and retention challenge, pensions dashboards, the Retirement Living Standards, and plenty more.

Embracing technology is just one of the ways we’re growing as an association. This year we’re looking at a range of societal issues, including the application of AI, the necessity of taking climate action, and the huge benefits of promoting and delivering equity, diversity and inclusion (EDI).

We’ve partnered with Climate Action for Associations (CAFA), which is an organisation that brings membership bodies like ours together to tackle the climate change emergency, harnessing the collective power and influence of the membership sector to accelerate the transition to net zero.

We’re also working with Powered by Diversity to strengthen our EDI strategy. This includes internal training, an EDI organisational health check, leadership alignment, reviewing the employee base in terms of EDI, and the identification of gaps.

These themes, as well as the changes we’re seeing in the pensions, investment and savings industry, will feed into our review of the PLSA strategy as the current one draws to a close at the end of this year. We’ll bring you more on future plans in due course.

For now, I’ll leave you with a reminder to look out for your email invitation to the new and exclusive member area. I’m excited to see how this latest enhancement of membership benefits will serve our community. The pensions sector is evolving, and we are ready.

Best wishes,

Julian Mund

Julian Mund

Our trusteeship courses have been expertly crafted to support trustees of all levels through high quality pensions education and training. Enhance your trustee skills and gain the knowledge you need with dates available throughout 2024.

TRUSTEESHIP - PART 1: THE THEORY

4 June I 12 September

Gain a comprehensive understanding of your role, what is expected of you and how to apply good scheme governance.

TRUSTEESHIP - PART 2: THE PRACTICE

2 July I 5 November

Apply your knowledge and skills in boardroom simulations and gain first-hand experience on how to approach the issues you will face in your role.

TRUSTEESHIP - PART 3: THE EXPERT

20 November

Further enhance and refine your skills to become an expert in your role.

TMark Smith, Head of Media Relations, surveys our recent efforts to achieve better outcomes for savers.

he PLSA’s mission is to help everyone achieve a better income in retirement. To that end, we are highlighting to policymakers the severity of the pension adequacy challenge, and lobbying for workable and realistic reforms to improve outcomes with the utmost priority.

The PLSA has twice looked at this problem in great detail, first with the Hitting the Target report in 2018, and then again last year with Five Steps to Better Pensions. These reports have served to advance the conversation and evidence available.

While the government acknowledged in its own 2017 review of automatic enrolment that reform is necessary, and has since passed some of the necessary legislation, it is yet to set out a roadmap for when it will remove the auto-enrolment lower earnings limit, lower the qualifying age to 18, and increase minimum contributions.

Nor is there any guarantee that whoever wins the next election will prioritise pension adequacy.

Without policy intervention, we must ask ourselves as an industry – as schemes, as trustees, as employers and as an industry association – are we doing enough to address the adequacy problem? What can we do, in the absence of forthcoming policy reform, to help savers get better retirement outcomes?

Improving automatic enrolment and circumventing savers’ inertia over putting money from their pay away for the future remains the most effective way to achieve higher retirement incomes. If our policy recommendations were adopted, our modelling shows that, by the end of a full working life, the annual retirement income generated from the workplace pensions of a median earning man would increase from £6,200 to around £9,100, and from £5,700 to £8,300 for women i.e. there would be an increase of more than 45%.

Last year, we along with 10 other organisations signed the PLSA’s charter to demonstrate consensus support for automatic enrolment reform.

WITH A GENERAL ELECTION LOOMING, THE PLSA IS WORKING HARD ON YOUR BEHALF TO ENSURE THAT PARLIAMENTARIANS OF ALL STRIPES UNDERSTAND THE IMPORTANCE OF THESE REFORMS

we concluded that traditional approaches have only had limited success, and what was needed was an eye-catching new strategy. Making use of unexpected collaborations with celebrities, the campaign has released a grime track about pensions with rapper Big Zuu, and has taken the nation on a nostalgic journey back to the 80s and 90s with children’s television legend Timmy Mallett to encourage people to think about previous jobs and pension pots.

It is estimated that, in each year, up to 3 million savers were inspired to go and pay their pension some attention as a direct result of the campaign.

Around 100 pension schemes currently hold either PQM or PQM Plus, with over half a million employees actively saving in these schemes. Pension schemes which hold PQM are from a wide range of sectors, including financial services, charities, retail, pharmaceuticals and engineering, and include household names like BMW, Heineken, Manchester United and Nationwide.

The ‘Building a Consensus for Better Pensions’ charter calls for major reforms to improve pensions outcomes including setting clear objectives for the UK retirement savings system; protecting the value of the State Pension; bringing excluded groups within the scope of automatic enrolment; and supporting future policies that improve guidance and communications and promote improved outcomes for pension savers.

This new pensions charter brings together voices from across the pensions industry, as well as employer and consumer representative groups, who are lobbying for positive change.

With a general election looming, the PLSA is working hard on your behalf to ensure that parliamentarians of all stripes understand the importance of these reforms and the far-reaching support there is for them.

The joint ABI and PLSA Pay Your Pension Some Attention campaign will return this year to boost the nation’s awareness of its pensions. The initiative arose in 2022 from the industry’s recognition that more should be done to address the fact that over half the public struggle to find their pension information and only 20% are confident they are saving enough for retirement.

With the backing of some of the bestknown brands in the pensions industry,

Elsewhere, the PLSA continues to provide independently researched updates for the Retirement Living Standards, used widely by pension schemes, financial services providers and other saver-facing bodies. The latest research reflects the price rises that households have faced, particularly for food and household energy. It also highlights the increasing importance people place on spending time with family and friends out of the home, as people’s priorities have changed following the pandemic.

The Standards serve as an important tool to help savers engage with the type of spending they think they will need in retirement, and to help them plan for it.

Although policy intervention is needed to improve the default arrangements for automatic enrolment, many employers have grasped the nettle in offering enhanced contribution levels already.

The PLSA’s Pension Quality Mark (PQM) champions these organisations, recognising excellence in employer provision and higher total contributions.

To meet the PQM Standards, an employer must commit to offer all employees a contribution of 12%, with at least 6% from the employer. In addition, schemes must be well-run, understand their members, and act in the best interests of those members. This includes choosing a suitable default investment strategy, appropriate communications, delivering value for money, and listening to member feedback. Employers offering 15% contributions can also qualify for a PQM Plus accreditation.

The best and most responsible employers recognise that financially secure employees are happy employees. The Pension Quality Mark highlights those schemes that are really pushing to boost contributions and help savers achieve a better level of income in retirement, and encourages others to join them.

Another example of the industry working to achieve higher contribution levels is seen in the Living Pension Employer Standard.

The industry has also long shared experience and best practice on the best auto-enrolment structures, such as employer matching and auto-escalation. The industry has participated in trials, such as with the self-employed, to try and address the issue of chronic undersaving among certain groups.

In terms of saver outcomes, the case for auto-enrolment reform is universally accepted. But, with a challenging economy and a squeeze on corporate and household finances, some question whether now is the right time to implement a timetable for change. All of us with an interest in helping people achieve a better income in retirement must work to demonstrate that it is.

TRADITIONAL APPROACHES HAVE ONLY HAD LIMITED SUCCESS, AND WHAT WAS NEEDED WAS AN EYE-CATCHING NEW STRATEGY

This summer, from 11 to 13 June, the PLSA is once again bringing the LGPS community together at its annual Local Authority Conference.

This is an ideal chance for LGPS fund members to connect, discuss and learn as we tackle the unique challenges and opportunities for a scheme like no other. Our 2024 programme has been built on feedback from our members. We feature the themes and topics that you want to see covered and the issues that matter most to you.

You’ll find plenty on this topic in strategic sessions discussing the current state and future of the LGPS, and the outlook for 2035.

The next destination: the LGPS in 2035

As consolidation accelerates, today’s challenges are overcome, and tomorrow’s opportunities are realised, where will we be in 2035? We discuss what we’ve learned from recent developments and how to secure the best future for the LGPS.

Speakers include:

• Rachel Elwell, Chief Executive Officer, Border to Coast

• Euan Miller, Managing Director, West Yorkshire Pension Fund

• Jon Richards, Assistant General Secretary, UNISON

The conference has a great range of formal and informal opportunities to meet new contacts and refresh your professional connections. Our welcome drinks reception and dinner on the first day of the conference is a chance to unwind with colleagues and peers; and the second night features the conference gala dinner with food, drinks and entertainment.

There’s also time to enjoy the Cotswold scenery with our ‘Walk and Talk’ on the morning of the second day: join James Walsh, Head of Membership Engagement, to discover the wildlife and natural beauty in our lakeside setting.

And, of course, every coffee break, lunch and breakout time is another chance to make new links with more than 300 delegates from across the LGPS.

Political and regulatory landscapes are always a vital consideration for the LGPS, and never more so than in an election year.

The elections are nigh – outlook for UK politics

With a General Election taking place in the next few weeks, how will the UK political scene change? Hear the analysis from a well-versed commentator.

• Lewis Goodall, LBC Presenter and Copresenter of The News Agents podcast

Talent management, recruitment challenges and resource allocation are a focus for LGPS members. All are crucial to the long-term sustainability of

the LGPS, so we have invited speakers and panels to discuss some of the key challenges.

Talent management: dealing with recruitment, retention and resourcing challenges

In an interactive session, LGPS funds outline examples of best practice for dealing with the three Rs. These issues continue to plague the LGPS as well as the broader workforce in the UK. In search of remedies, we explore the ideas, policies and practices that work – as well as those that don’t.

Speakers include:

• Paula Brack, Chief HR Officer, Railpen

• Laura Colliss, Pension Fund Manager, North East of Scotland Pension Fund

• Sian Kunert, Head of Pensions, East Sussex Pension Fund

With sessions on topics including transport investment, litigation, private credit and impact investing, there are plenty of opportunities to get ahead of the latest investment thinking.

Localising returns: the strategic value of place-based impact investing for the LGPS

Hear how the LGPS can drive growth and sustainability in local economies by embracing place-based impact investing. Through illustrative case studies, we will highlight the dual goals of financial returns and social impact and bring these concepts to life.

Speakers include

• Mark Gross, Partner and Head of Development Capital, Downing

• Charlotte O’Leary, Chief Executive Officer, Pensions for Purpose

• George Graham, Director, South Yorkshire Pensions Authority

Laura Colliss, Pension Fund Manager, North East of Scotland Pension Fund, and speaker on our Talent management: dealing with recruitment, retention and resourcing challenges panel gives us some insights into why this topic is crucial for the LGPS.

• Why is recruitment, retention and resourcing a challenge for the LGPS – and for pension schemes in general?

Given most LGPS are included in their administering authority’s recruitment policies, and the lack of resources within those authorities, the ability to recruit and retain is one of the biggest challenges facing the LGPS. These challenges start from the initial approval to recruit, the ability to advertise appropriately, structural barriers and available remuneration packages. It is therefore difficult to recruit applicants at the correct level of ability, knowledge and experience.

• What do you think will be the most desirable skills for pension schemes in the next two to three years, and how can schemes prepare for those needs?

The LGPS is an extremely complex scheme requiring skills across

multiple disciplines. Experienced senior positions are some of the most challenging to fill. Funds need to be proactive in recruiting junior-level positions and have a training programme in place to develop the skills to deliver senior positions in the future while also creating a flexibility within the workforce. Having a training and development programme for people is essential for the future of the LGPS.

• What can schemes do better when it comes to recruitment and retention practices, and do you have any examples of good practice?

Schemes should seek separation from the administering authority’s recruitment policies to provide greater flexibility and an effective recruitment programme for the scheme.

Greater use of graduates and modern apprenticeships can provide funds with the appropriate resources for the future, and having a training and development programme and the opportunity to instil a positive culture can deliver loyalty and support retention within the scheme.

Find out more about the programme for the Local Authority Conference here: www.plsa.co.uk/Events/ Conferences/LocalAuthority-Conference

interviews with industry leaders, designed to keep you up to date with everything going on in pensions.

Keeping informed and connected is vital in the rapidly evolving world of pensions. That’s why we’re thrilled to announce the launch of our new online member area: it’s a significant upgrade to PLSA member benefits, crafted to enhance your membership experience.

The new member area is where you can find everything needed to make the most of your PLSA membership throughout the year. It’s your key to unlock a wealth of exclusive member-only content and a world of potential discussions with fellow PLSA members.

• Home to our exclusive resources and benefits. Access a curated selection of articles, policy analysis and summaries, Made Simple Guides, event recordings, practical checklists, live Q&As, and

• Your ready-made PLSA community. Network and connect with professionals all year round in our online communities.

• Discussion forums. You can now start or join a discussion with other members or PLSA experts.

This new benefit will be open and accessible to all PLSA members, but we are inviting members in groups over the initial weeks after launch so we can highlight content relevant to you and provide technical support to members who need it.

If you’re keen to get started now, log in using the account details that you use to book PLSA events or pay your annual

Connect with the PLSA community

• Join an exclusive community of professionals from across the PLSA’s membership.

• Network year-round to connect, share experiences, and collaborate wherever you are.

Centralised hub of content

• Access a comprehensive library of resources, support materials and knowledge.

• From the latest regulatory updates to in-depth analyses of market trends, and from policy insight to

practical support tools, we provide a holistic view of the pensions landscape.

• Access content at your level, tailored to your specific interests and requirements, including best practice, practical support, and detailed explorations of complex topics.

Continue the conversation

• Keep the exchange of ideas flowing beyond our events with a continuous space for discussion, allowing you to share perspectives and solve challenges together.

subscription, or reset your password. It’s that simple.

If you don’t have an account, click ‘LOGIN’ and then ‘Create Account’, which will take you to the sign-up process. You can also navigate directly to the member area with the URL https:// members.plsa.co.uk/. Clicking ‘Member Login’ on the banner will take you through the same process.

Creating an account also means you’re now one step closer to booking our industry-leading conferences, forums, webinars and training – so check out our calendar of events.

The member area is already stocked with a wealth of exclusive content, and we’ll be constantly providing you with more. Our communities will also offer you the chance to tell us directly about what further support and resources we can provide for you.

If you have any questions or feedback about the member area, contact us at communityteam@plsa.co.uk.

• Discuss the big issues and share perspectives beyond PLSA events, at your convenience.

• Join the voice of workplace pensions online. Content partnership opportunities for industry leaders

• We’re developing a range of opportunities for commercial partners to contribute and gain brand visibility.

James Walsh, Head of Membership Engagement, explains why networking is so important to our members.

My colleagues tell me this edition of Viewpoint will appear shortly before our Local Authority Conference in the Cotswolds, so that immediately had me casting my mind back to last year’s ‘LA’ Conference and what I most remembered about it.

The image that came to mind is the one below – a group of cheery delegates joining me and my Membership colleague Helen Lamb for a pre-breakfast ‘walk and talk’ stroll around the lake next to the hotel. (Strictly speaking, it’s a workedout gravel pit, but that descriptor doesn’t really do justice to what is now rather a nice spot.)

The previous year we had advertised this occasion as a ‘birdwatching walk’ because that’s something I like to do, but we found that, while our members were quite tolerant of me pointing out the local wildlife, what they really wanted to do was chat to each other – hence the ‘walk and talk’ billing on which we’ve now settled.

In a way, that is the point of so many of the PLSA’s conferences and events – at their heart they are about bringing people together so they can make new connections, refresh existing ones and exchange thoughts. Even if it’s just sharing the mutual pain over GMPs or McCloud, it’s cathartic to do so with fellow sufferers. And of course, as the classicists among you know, ‘confero’ is Latin for ‘bring together’, after all. So that’s what our events do.

It’s no accident that ‘networking’ is consistently cited as the main reason for attending our events. Yes, the

programmes and content are a key part of the mix, but it’s meeting and connecting that are most delegates’ prime motivations.

Of course, as event organisers, we could take the view that all we need to do is put people in a room with a supply of coffee/ wine/other refreshments and let them get on with it – and that’s fine, up to a point. But what makes the networking more effective is when we bring together people with more in common than just working in pensions, such as the type of scheme they run or the role they have.

In recent years we have set up several ‘Networks’ along these lines – one for CEOs of large schemes, one for CIO equivalents and one for chairs of trustee boards. More recently, we have added Networks for university-based schemes, water companies, local authority funds and churches and charities. We get each group together for online calls or over breakfast or dinner at a conference. We know this model works and I can only see us doing more of it.

As I write, we are taking a major step forward in the way we facilitate networking, with the launch of our online member area and community.

This is an important new string to the PLSA’s bow, giving our members opportunities to connect with each other from the comfort and convenience of their own laptop or mobile.

My Membership team colleagues and I are excited by the potential to let the kind of groups mentioned above connect online as well as in person, and I would like to think that – in due course – we will have a multiplicity of groups and sub-groups on the new platform, all allowing members with specific common interests to interact with their peers.

Realistically, though, we have to walk before we can run, so the focus now is simply on getting you all logged in, engaging with the content and using it to communicate with your peers. The extra bells and whistles will come later.

It’s been a huge amount of work by my colleagues in our Marketing, Communications and IT teams, but ultimately the new platform will be shaped by you – our members – as we see which topics and features prove most popular. As ever, I encourage you to give us your feedback.

I look forward to you getting involved as the PLSA develops this new way of bringing our members together.

Motability Foundation helps around 100,000 disabled people a year make the journeys that they want. We award grants to charities and organisations that provide different forms of transport, or make transport accessible. Alongside that, we continue to carry out research that will help support disabled people to be mobile, such as accessibility on a range of types of transport including planes and trains as well as cars.

We currently have 267 employees, who are all based in one location – we’ve just acquired our building, which is foundational to future stability and growth for us.

Our pension scheme is a defined contribution (DC) arrangement, and we offer salary exchange, meaning that our employees can exchange part of their salary in return for the pension benefit, which helps employees pay less tax and National Insurance. It also provides us as an employer with tax relief that helps to support the scheme. We work with an external pension provider, Aviva, but all of the payroll management and salary

Mona Lalloo, HR Reward Partner, Motability Foundation tells Maggie Williams about an exceptional DC pension scheme that has achieved the PLSA’s Pension Quality Mark.

exchange is carried out in-house by my team.

Communications are really important to us and we develop a lot of internal messaging about the scheme. Aviva help us to develop those materials, and we aim to post information for members every month. That could include wider issues beyond pensions such as financial guidance, or webinars run by Aviva that members can join. We’re also working on introducing one-to-one sessions this year through Aviva.

We have an annual pensions window where members can choose if they would like to contribute more into their pension – or reduce or stop contributions. As a company we automatically pay all

employees a 10% employer contribution. If employees want to contribute further, we will match up to an additional 5%. That is quite an incentive to join us and stay. The cost of living has been difficult for many of our employees, so being able to know that they are building their pension through employer contributions, even if they aren’t able to contribute themselves, is a great comfort factor.

We offer the scheme to our staff to help our employees have a comfortable retirement and I think that is our responsibility as an employer. A good quality pension scheme is important for both younger and older workers. Those who are closer to retirement might appreciate the pension contributions more immediately, and it’s tempting when you’re younger not to see how valuable a pension is. That’s why we try and add tools such as webinars and financial education to our communications, to help engage employees and encourage them to look at their longer-term finances as well as their day-to-day goals.

Employees can also access Aviva’s pension app. This allows them to see their pension and how much they have in their pot. During 2023, we saw an increase in registration on the app from 52% to 61%, which is very positive. We’ve also worked on making sure people

have nominated beneficiaries and that their requests are up to date, which is another way of helping people to engage, especially if they are getting closer to retirement.

The PLSA’s Pension Quality Mark (PQM) accreditation recognises that we offer a high quality DC pension scheme, and the independent verification proves that to our employees. It’s also reassuring for us to know we are meeting the PQM’s requirements in terms of our pension scheme. We offer good employee benefits across the board, and our pension

scheme is one of the best benefits we have. Not every employer offers the generous scheme that we have and we’re proud that we can offer this to employees.

For the future, we want to encourage more employees to contribute to the scheme. We’re planning to run a 20-minute free session to help employees understand how the pension works, signpost the Aviva scheme, and also use the PLSA’s Retirement Living Standards to help people think about and plan for the future. We can help employees understand that the value of the pension will go up and down over time, but it is about saving for the long term.

EWhat do changing attitudes to climate-aware investing in the US mean for UK pension schemes? Pádraig Floyd investigates.

SG (environmental, social and governance) based investment strategies are no longer the preserve of those with a set of ethical benchmarks that won’t be compromised. They have become normalised as institutional investors increasingly identify ESG risks as having a material impact upon their investment portfolios.

Yet despite the march of ESG, particularly over the past five years, it has been adopted as part of a battlecry of those who would seek to close it down.

Political pressure from Republican legislators and regulators in the US has contributed to deterring five of the world’s largest asset managers from the Climate 100+ investor coalition. Invesco walked away, following the lead of JP Morgan, State Street, Pimco and part of BlackRock, claiming its “clients’ interests in this area are better served through our existing investor-led and client-centric issuer engagement approach.”

IF PEOPLE ARE LEANING MORE HEAVILY INTO FOSSIL FUELS – INVESTMENTS IN FRACKING IN THE US FOR EXAMPLE –THEN THAT MAY BECOME A CONVERSATION ABOUT WHETHER YOU STILL WANT TO BE DOING BUSINESS WITH THAT MANAGER

It’s long been said in economic terms that when the US sneezes, we in the UK and Europe catch a cold. What might be the consequences of these asset managers getting cold feet for ESG strategies for UK schemes over the long term?

Some commentators have raised concerns about these managers pulling back from the public ESG debate. Even if the same level of ESG is available in segregated mandates or even products, there will be reduced transparency to avoid attracting flak from ESG critics –and any reduction in transparency must raise concerns about governance.

Jennifer O’Neill, Partner in Aon’s responsible investment group, says looking at it globally, different jurisdictions will clearly have different regulations and different market norms.

Climate change is a standout priority for investors in Europe, the UK and outside, apart from in the US. In the US, climate change is significantly further down the agenda, with socioeconomic issues and social issues taking precedence. What that tells you is that investors are thinking differently, operating in a different market environment, under different regulations and jurisdictional

TAKING CARE OF ESG CONSIDERATIONS ISN’T ABOUT ALL THE ‘GOOD’ THINGS. WE WANT TO PROTECT THE VALUE OF OUR ASSETS AND MANAGE THE RISKS. AND THESE ARE REAL RISKS

mandates, and asset managers are reacting accordingly.

“Typically, we see asset managers having a global policy on responsible investment issues with different local implementations, for regulation and for requirements in those different jurisdictions,” says O’Neill. “Navigating through that in an environment which is becoming more bifurcated is a challenge, so we tend to find more differentiation in strategies that those managers are offering.”

This results in a proliferation of different strategies with different implementation rules, mandates and objectives, says O’Neill, depending on where those investors are ultimately located.

Joe Dabrowski, Deputy Director of Policy at the PLSA, agrees that there are a lot of differences, but the US is a large market, particularly for big US asset managers, so they have become more circumspect in relation to the public ESG debate.

Of course, Europe is also a large market, and any schemes concerned about this change in policy must determine if it will have any meaningful impact on the investment strategy.

“Lots of asset owners will not invest with people who support lobby groups that are anti-climate change action, for instance,” says Dabrowski. “If people are leaning more heavily into fossil fuels – investments in fracking in the

US for example – then that may become a conversation about whether you still want to be doing business with that manager.”

Dabrowski says that if strategies adopt more ESG-sceptic components, that will reduce choice for UK investors.

“But it also creates an opportunity for fund managers based in the UK and Europe to fully reflect those customer needs – and there is a lot of capital in these markets. So I think people will rise to meet that challenge of opportunity as it presents itself,” he adds.Paul Black, Independent Trustee with the Pi Partnership, says that while Europe as a whole is more invested in ESG ambitions – particularly around climate change – there are a whole range of

objectives being pursued by different investors.

“Taking care of ESG considerations isn’t about all the ‘good’ things. We want to protect the value of our assets and manage the risks. And these are real risks.”

If a fund was prevented from taking account of these risks, it would be “madness” said Black, but he doesn’t think that is a likely outcome.

Just because asset managers have backed away from a public forum doesn’t mean they have abandoned ESG or dropped it from their investment strategies. However, it’s not something that can be taken on trust.

“The first thing we need to do is start asking questions and getting some transparency,” says Black.

While there is nothing to separate the two candidates for the US presidential election at time of writing, it is likely that a Trump win would lead to further challenges to the ESG debate politically, legally and through regulation.

A Biden win might mean the exact reverse, but if schemes are concerned about these five big managers being absent from the discussion table, start asking questions now, Dabrowski advises. “It’s worth having the conversation early,” he says, “even if it’s an incomplete conversation.”

If the US government was to withdraw from the Paris Accords again, what would that mean for asset managers? It extends further, Dabrowski explains, because schemes need to know if managers are simply biding their time to see which way the political wind is blowing – but in the long term, do these managers remain committed over the next 4, 10, or 20 years?

Richard Tomlinson, Chief Investment Officer of the Local Pensions Partnership Investments, agrees with O’Neill’s assertion that business is conducted differently in different jurisdictions. However, he can see the potential, should the political and regulatory situation in the US make it more difficult for managers to offer ESG products, for asset management houses to split their businesses.

“Absolutely,” says Tomlinson. “If I was the CEO of those businesses, that would definitely be on my radar for discussion.”

Like Black, he believes things will likely balance out, as the vast majority of investors want to see change with their investment returns, with extreme ethical investment mandates making up a very small subset of the whole. “It’s really about understanding what’s been excluded, engagement and looking for

Three Local Authority pension funds explained at the PLSA’s Investment Conference 2024 how they are boosting support for local residents, industry and infrastructure across the country.

From a West Midlands Pension Fund perspective, there is a new energy around illiquid assets, and we’ve been investing in illiquids for over 25 years. We consider a broad opportunity set across property, private debt and infrastructure.

As a pension fund, we have provided support in the form of debt financing for an ownership scheme developed in partnership with our host authority, City of Wolverhampton Council and the West Midlands Combined Authority. In terms of place, the project was about regenerating land, making a positive change to climate transition, and building community.

For the people in the area where the 100 homes were built, it provided an opportunity to live in new energy-efficient homes, benefitting from solar panels and electric charging points, available at an affordable point through a series of rents which then gave the option to buy.

From an investment point of view, the scheme provides us with secured debt and positive social impact. We made sure in the discussions around the design that key controls such as those ensuring the management of tenant risk were in place,

while ensuring our priorities in terms of responsible investment were integrated into the property management agreements. We could achieve a dual objective as this was built by and for our local region.

Assistant

Director,LGPS Senior Officer, Surrey County Council

We have a very mature public markets allocation and pooling has given us further opportunities, enabling us to build our capability and design products that really meet our investment strategy. Our alternatives allocation is around 25% now and this allows us to have diversification including access to real assets.

We don’t have a local bias in how we allocate, which is due both to internal capability and capacity constraints and also to challenges in the existing local government governance model. However, through the Border to Coast asset pool, we were able to collaborate with our 10 Border to Coast partner funds to develop a UK opportunities product that can encompass local opportunities across the diverse regions of the partners while providing a level of due diligence we could not deliver in isolation.

London Pensions Fund Authority (LPFA)

According to the LPFA’s recent Investing in the UK report, the Fund has around £1 billion – or 13% of the Fund – invested in over 250 infrastructure and real estate opportunities across the UK. The research was produced to help the Fund understand the role that its investments are playing in the future development of the country. The research showed that, among other things, the LPFA is invested in 23 school operators providing educational facilities for more than 141,000 school children; the Fund’s commercial real estate investments support more than 19,000 jobs; its renewable investments power more than 1.4 million homes; and its investments in health and care facilities provide more than 14,000 beds.

Most of the LPFA’s investment in housing – of great interest to policymakers given its scarcity in many locations – is in London and the Southeast, and is made though the London Fund, a collaboration with LCIV and LPPI. The London Fund provides the LPFA with a double bottom line: a return on its investment and an investment in opportunities that have a positive impact on London.

An example of this is the London Fund investment in DOOR (Delancey and Oxford Residential), a dedicated residential investment vehicle and part owner of Get Living, the UK’s leading build-to-rent operator of large-scale residential neighbourhoods. DOOR in London includes more than 3,000 homes under management, 1,126 homes under construction, and a further 3,000 in the secured pipeline, with an overall target of 12,000 homes within the next five years. Get Living provides long-term tenancies and resident-only break clauses, giving residents security of tenure.

RGeorge Dollner, Policy Lead, explains how the PLSA has been exploring the ‘S’ of ESG with its members.

esponsible investment is a PLSA priority for 2024. Throughout 2024 we’ll be engaging with a wide range of issues, but so far this year we’ve been particularly focused on helping members to consider the importance of social factors in their investment decisions.

Social factors are one strand of ‘ESG’. They cover a wide range of topics such as modern slavery, health and safety, working conditions and remuneration, and they present enormous opportunity. In an ideal world, ‘E’, ‘S’ and ‘G’ would be considered holistically and the objective should be to ensure that consideration is given to how action is taken to address inequalities or inequities that exist within an organisation’s sphere of influence. Social factors investment can provide strong returns, but returns may lie on a longer time horizon – and for now we think it’s right that trustees dedicate additional effort and attention to it.

Social factors are a vital part of ‘ESG’, but it has been evident that in recent years, environmental factors have dominated the discussion. This is largely because working towards net zero has been on the government’s agenda, and rigorous reporting requirements exist. It’s also clear that there’s a perceived simplicity in comprehension and action around the ‘E’ compared to the ‘S’ in ESG. We know that many of our members are doing fantastic work in relation to social factors to invest with impact while

meeting their fiduciary duty to maximise member returns. However, as public scrutiny grows over the social policies and investment approaches of pension schemes, trustees will need to continue to adapt to play a more active role in social factor investment.

So far this year, we’ve been engaged in two key pieces of work to support the discussion around social factors:

We’ve been an active member of the taskforce since its establishment in February 2023 following the DWP’s consultation on consideration of social risks and opportunities by occupational pension schemes. The Taskforce is focused on raising awareness of, and developing a common understanding of, social risks and opportunities which can be addressed by pension scheme trustees, industry and policymakers. This culminated in the publication of a guide in March which seeks to provide key stakeholders with the tools they need to engage with social factors more effectively.

We’d encourage all our members to engage with the guide, which includes several useful tools including:

• A Quick Start Guide for pension trustees

• Recommendations for the pensions industry, government and regulators

• A data sources directory

• An effective stewardship, investment and advice services guide

• Case studies of examples in practice.

To support the work of the Taskforce, we launched Putting the Spotlight on Social Factors – Best Practice Case Studies at our Investment Conference in February. This publication provides members with tangible examples to provide support when navigating the challenges and opportunities that social factors present. We understand there are a plethora of competing priorities for our members. These case studies demonstrate best practice across the investment cycle, from helping to highlight how to approach investing with impact, through to specific examples that demonstrate what opportunities are available. Through making changes to investment and stewardship strategies, the pensions industry can play a leading role in investing with impact.

The pensions industry has an important role to play in considering social factors within its investments. Through consideration of the Taskforce on Social Factors guidance, and our case studies, we’re confident that our members will feel well supported to navigate the challenges and opportunities that social factors present. Keeping social factors at the forefront of investors’ thinking, and making changes to investment and stewardship approaches accordingly, is vital to ensure that we support pension scheme members as effectively as possible.

Robert Branagh, Chief Executive Officer of the London Pensions Fund Authority, shares his thoughts on key LGPS topics.

There are lots of positives around scale and economies of scale in the LGPS. We’d like to see more consolidation, but collaboration is the first stepping stone.

For example, there are eight investment pools and we are starting to see them work together. My pool, the Local Pensions Partnership Investments (LPPI), is working with the London CIV pool to build products for some London boroughs. That collaborative approach enables Londoners in particular to benefit, but also gives us financial returns.

Other pools are planning collaboration with the idea of getting enough scale into the system so that we can make decent-sized investments and move the dial, which is interesting in the context of the government’s Mansion House agenda and levelling up. There is investment going into real assets such as infrastructure, and scale is making that easier. That includes some projects which are in line with responsible investing, and I think that’s been a big driver.

I think most people in the LGPS would say that they do not want the government to tell them where to invest or how to invest. However, as we’ve mentioned above, there are already really good examples throughout the

whole of the LGPS of funds investing in real assets and infrastructure. It’s happening and most people are on board.

The risk comes if the government starts to mandate where you have to invest that money. The recent pooling consultation was interesting, with most people being positive, but with a note of caution about fiduciary responsibilities, which are paramount.

There are some real issues around engagement more broadly in pensions. I’m a trustee of a DC master trust, and in that context, although auto-enrolment has been a fantastic success, there are issues around engagement and understanding. Many people don’t appreciate that money comes out of their pay and becomes a pot.

But as an open DB scheme, the LGPS is different from DC. We’re actively looking at how we can incorporate the PLSA’s Retirement Living Standards and more guidance to help people prepare for retirement, understand what happens in retirement and what benefits you might get from the scheme. A lot of engagement goes towards getting members ready for that latter part of their lives.

Signposting and messaging is vital. Many LGPS employees have found the cost-of-living crisis very difficult. The risk is that people then leave the pension scheme because they can’t afford to contribute. We have a mechanism called 50/50 where you can halve your

contributions and you’ll still accrue half benefits. That is a fantastic way of helping in the short term, enabling members to remain in the pension and continuing to contribute to something hopefully substantive when they retire.

There are lots of positives in the LGPS. Funds are looking through a whole different set of lenses about member outcomes, but also keeping pace with good investment returns. We’re seeing economies of scale, and these will provide benefits for members. At the last valuation in England and Wales, LGPS funds were in surplus. So, in terms of financial stability, doing interesting things, responsible investment and scale, there is a lot of good news.

One of the brilliant things about this industry is there are enough people who really care about members and employers. We have exceptional examples of best practice that need to have more light shone on them. The whole industry is committed to its members and employers – so we need to make sure that we’re sharing those examples, keep talking, collaborate and in time perhaps consolidate more.

This interview is taken from a video with Robert recorded at the Investment Conference 2024.

OSenior Policy Adviser Krista D’Alessandro, Senior Policy Adviser, shares the latest on a key PLSA policy initiative.

ver the past 15 years the UK has been on a path of relative economic decline, with both productivity and growth measuring at half the rate seen across other advanced economies. More recently, in just the past few years, the government has set its sights on pension funds to play a bigger role in reversing this decline.

There have been several recent announcements from the Chancellor

calling on pension funds to provide additional capital to support UK economic growth, especially through increased direct investment in infrastructure, private markets and venture capital. These are detailed in the timeline below.

The pensions and growth agenda has been a key priority for the PLSA, and we’ve been closely engaged with government and industry stakeholders every step of the way. In June 2023

OVER THE PAST 15 YEARS THE UK HAS BEEN ON A PATH OF RELATIVE ECONOMIC DECLINE, WITH BOTH PRODUCTIVITY AND GROWTH MEASURING AT HALF THE RATE SEEN ACROSS OTHER ADVANCED ECONOMIES.

we published our initial pensions and growth report, A Paper by the PLSA on Supporting Pension Scheme Investment in UK Growth.

In October of the same year, we built on this initial analysis in our PLSA Policy Position on Pensions and Growth paper, which factored in our views following the swath of government consultations released with the Chancellor’s Mansion House speech.

Most recently – earlier this year and just ahead of the Chancellor’s Spring Budget – we released a joint statement with the ABI, Four Measures to Boost UK Growth through Greater Pension Investment.

9 DECEMBER 2022

The Chancellor’s Edinburgh Reforms set out several announcements aimed at driving growth and competitiveness in the UK financial services sector, including its plans to issue new guidance on LGPS asset pooling and its aim to increase the pace of DC scheme consolidation.

Regulation must make it as simple as possible to invest in illiquids where it is in the interest of savers.

Representing the full breadth of the UK pensions industry, the release of our joint statement with the ABI in February detailed four key areas where more action is needed to effectively promote UK growth. These are:

1. Ensuring better adequacy in DC pensions and a bigger pool of investable capital – Most private sector pensions are DC, but low contributions risk retirement shortfalls.

2. Making regulations work better for investment and savers –

3. Increasing investment opportunities – Developing an effective pipeline of assets with good risk reward profiles for pension schemes to invest in UK growth.

4. Continuing to focus on consolidation – Ensuring that consolidation takes place in the best interests of members.

As the focus on pensions and growth isn’t going away, the PLSA will continue to promote our key recommendations to government. With some projecting a Labour Party win in the upcoming

election, we’ll work closely with party leadership on strategies to increase pension fund investment in UK growth, namely through the development of a growth fund.

We’ll also continue to influence consolidation developments across DC, DB and LGPS schemes, campaign for the adoption of automatic enrolment increases from 8% to 12% across the next decade, push for regulator alignment regarding rules to implement the Value for Money framework, and examine further potential tax relief options.

10 JULY 2023

The Chancellor’s ‘Mansion House Reforms’ detailed the government’s goal to promote greater investment in illiquid assets, to stimulate growth in the UK economy and to secure greater returns for pension savers.

• The ‘Mansion House Compact’ – launched during the Chancellor’s speech – announced the commitment of nine of the UK’s largest DC pension providers to allocate at least 5% of their assets to unlisted equities by 2030. Two additional providers also joined, totalling 11 signatories.

22 NOVEMBER 2023

The Chancellor’s Autumn Statement included announcements supporting key PLSA asks related to pensions and growth, like generating a pipeline of assets, allowing flexibilities to DB regulations, introducing certain fiscal incentives, improving the consolidation process, increasing pensions contributions, and allowing for other changes to automatic enrolment.

6 MARCH 2024

The Chancellor’s Spring Budget detailed several additional measures aimed at promoting UK growth, including progressing the work of the Mansion House Compact, announcing the winners of the LIFTS initiative, introducing a consultation on the Private Intermittent Securities and Capital Exchange System (PISCES) and another on UK ISA and British Savings Bonds, and detailing plans to deliver the sale of part of the government’s NatWest shareholding to retail investors.

Helping defined contribution savers to make more reports.

Recent research by consultants Hymans Robertson, Designing decumulation defaults in DC pensions –remember the member found that 75% of DC pension savers over 55 want to receive their pension income automatically when they reach retirement, as they are not sure how to use their savings.

That resonates with current research and initiatives from the PLSA, including our decumulation policy work and the Retirement Living Standards, which help savers think in a practical way about the kind of lifestyle they might lead in retirement.

Ruari Grant, Policy Lead for DC at the PLSA, says: “Decumulation – accessing money from a DC pension – has been referred to as the nastiest, trickiest problem in finance, and that’s because members have so many different options over how they access their money.

“As DB declines and people are increasingly reliant on DC for their retirement savings, we’re going to have more and more people who have to make really complex decisions about how they manage longevity risk, inflation risk and the investment risk over the period of what could be a 30-year retirement or more. Support with those decisions will be of absolute, paramount importance for those savers.

“We’ve been advocating for pension schemes to provide more help for them both in terms of communications and engagement to help them understand

people a general figure that they can

those options and help with those options themselves, to ensure they are available. Depending on what kind of scheme a member is in, different options, or a complete lack of options, may be the case for them.

“We were really pleased with the progress made by the previous government which looked to bring in legislation requiring trustees of pension schemes to offer certain product solutions for their members. If this is continued by the next government, members of all schemes - regardless of what type of scheme it is - will have the option to access their savings, in a manner that’s suitable for them and with good value products. We’ll continue to work closely with government after the election on ways to improve retirement options and support for scheme members.’’

The PLSA’s Retirement Living Standards are based on three possible levels, and illustrate what a range of goods and services costs for each level. By giving

understand, they can then develop their own personal targets based on individual circumstances and aspirations, and start to plan.

The Retirement Living Standards were updated in early 2024 with the latest research reflecting the price rises that households have faced through the costof-living crisis, particularly in food and energy use. The changes also highlight shifts in the UK public’s expectations, such as the importance people place on spending time with family and friends out of the home after retirement.

Workplace, private and State Pensions – as well as other types of savings –could all be used to meet the different income levels. But every individual will be different, both in terms of their expectations and the potential sources of retirement income they have to spend. Tax efficiency, using the right products in the right order, and responding to changing circumstances during the course of retirement will all shape and reshape our retirement plans, as our case study shows.

Stephen Coates, Head of Proposition at Mercer Workplace Savings, explains how an innovative approach to digital advice is helping members with retirement decisions.

As we move deeper into a defined contribution (DC) world, the certainties defined benefit (DB) schemes offered are becoming a thing of the past. But when you explore statistics about where people go for pensions information, it’s often to their older relatives, many of whom haven’t had to navigate the world of DC pensions.

For DC, the situation is very different. Savers get to 55 or 60 years old, and a combination of auto-enrolment and potentially low engagement with pension savings could lead to a big shock.

When it comes to decision-making, pension scheme members typically have access to guidance and advice.

The FCA’s ongoing Advice Guidance Boundary Review acknowledges that guidance hasn’t quite worked and many people are still making poor decisions at retirement. In our Master Trust we are seeing five times as many savers accessing lump sums at age 55 than at 60 to 65, and the FCA tells us that over 40% of people using drawdown are taking out more than 8% a year. You don’t need to be an actuary to calculate that their pension savings are not going to last very long.

Mercer wanted to address some of these serious DC member problems at retirement. Following a procurement exercise, we’ve been working with Hub Financial Solutions since June 2022, to deliver affordable, accessible financial advice.

Destination Retirement is a digital FCA-regulated financial advice service. It guides members through a series of steps to support their retirement planning, from understanding what they may need in retirement through to how they can use their various pots of money in combination to afford life after work.

It’s important to look beyond the restricted view of someone’s current company pension scheme, as that doesn’t tell the whole story and can even be dispiriting. There are many other factors that play a part in good pension planning, such as other workplace pensions, savings, property and partner income. By bringing everything together, suddenly the picture can look much brighter.

Taking into account the holistic financial picture, Destination Retirement runs millions of calculations to work out the most taxefficient way to use different pots of money. The headline is that, by using pots in the right order at the right time, we’re seeing people save on average 25% in tax liability alone.

The service helps people plan and configure a retirement solution that gives them enough money to live off, enables them to execute that solution, and gives them a route to accessing their savings. It also provides ongoing support, so if your situation changes, you can rerun the calculations and reconfigure the outcomes to meet your needs.

This approach shows members what could be possible for their retirement if they think about assets beyond their current pension. Over 50% of the pots being modelled in Destination Retirement are non-pension pots.

Seeing the bigger picture of all your different savings pots and assets in one place can change people’s perspective considerably – you’ll make a very different decision with £500,000 than, say, £20,000 in your current pension.

Mercer uses the PLSA’s Retirement Living Standards (RLS) as a benchmark approach for anyone who wants to get started quickly to get a rough idea of their situation and what their expectations are. The RLS can be used as a starting point for cash flow modelling and to determine roughly what level of income someone will need when they retire.

The PLSA’s 2024 policy priorities identify areas of regulatory projects that it will prioritise in 2024, categorised under seven broad themes. Two of those themes directly relate to providing savers with a better retirement.

Better DC: The PLSA will advocate for an efficient and effective DC pensions landscape that operates in line with PLSA member views and in the interests of savers. Specifically, the DC work programme includes promoting improved pension adequacy, an effective value-for-money framework, supporting proposals to provide savers with more help at retirement, and developing solutions to the proliferation of small pots.

Engagement: On the theme of engagement, the PLSA will work on initiatives like the Pensions Dashboards, the Advice/Guidance Boundary and the Retirement Living Standards, which are aimed at promoting saver understanding and confidence with pensions.

Designed to recognise and celebrate high quality defined contribution (DC) pension schemes, and help savers get better outcomes in retirement.

PQM standards go beyond the minimum regulatory requirements, recognising workplace schemes that have good contribution levels, good governance, and encourage employees to save for their future.

Find out more, visit www.pensionqualitymark.org.uk

Maria Espadinha, Policy Lead, explains how the PLSA is developing a blueprint of what the pensions sector will look like in 10 years’ time, with a focus on the LGPS.

As we approach a general election, the PLSA believes it is imperative to draw up a vision of how it expects the pensions sector to look a decade from now, setting out its ‘Vision for 2035’.

The project, which was approved by the PLSA Policy Board in December, started from a strong base by examining the policy positions which have been produced by the PLSA over the years.

Reports such as Five Steps To Better Pensions, which suggests a framework to improve adequacy; Hitting the Target, which sets out a series of recommendations for improving the retirement outcomes for millions of future retirees; and the DB Taskforce, which undertook a review of the challenges in the sector and suggested a number of recommendations, are some of the policies considered.

The PLSA will be drawing from the expertise of members to set our vision for the future, starting by consulting on key topics and themes that should be addressed in this project.

We received fairly consistent feedback across membership groups about the general direction of travel in the sector. As a starting point, we are looking at big themes which will be of utmost importance in a decade from now.

The future of auto-enrolment and how it will evolve, the role of AI services and how they will impact savers and their choices, the progress of consolidation in the sector and what shape it will have

taken during this 10-year period, are some of the key issues currently on the table.

The Vision for 2035 working group will be looking at these topics from a cross-cutting perspective, identifying how these will impact all areas of the pensions sector relevant to our members. For the Local Government Pension Scheme (LGPS), areas such as consolidation, investment, and savers and engagement will undoubtedly be of extreme importance.

At a time when the sector is waiting for further guidance on pooling of assets, there is no need for a crystal ball to see this will be a reality for local authority funds in 10 years’ time. However, and as always, the devil is in the detail, and the PLSA will advocate for further pooling of assets in an efficient and well-governed manner. Consolidation in the LGPS, and in fact in any area of pensions, only makes sense when there is a clear rationale of improvement in value for money for savers.

Depending on the model preferred by the government for pools, the PLSA is also expecting changes in the structure and number of existing pools – currently eight – in England and Wales. The former local government minister at the Department for Levelling Up, Housing & Communities, Simon Hoare, has been vocal about his intentions of having more consolidation in this sector. At the same time, it is unclear how far Labour’s focus on decentralising power to regions might

alter local authority structures in the future. In any case, considering that pools’ current structures were all in line with the initial guidance on this matter, it is imperative that changes take into account all existing models and that government works with pools and their fund partners to reach consensus. Only then can further mergers of pools be considered.

With more than 7 million members today, the LGPS is a cornerstone for future UK retirees. With the expectation of this number increasing in the next decade, engagement efforts will continue to be front of mind, hopefully improved by the pensions dashboards, which will be a game-changer in this area.

Some of the challenges the pensions sector faces today will still remain an issue in 10 years’ time, but it is the PLSA’s intention that, by working with its members and for its members, savers’ chances of having a better income in retirement will be improved.

WE ARE LOOKING AT BIG THEMES WHICH WILL BE OF UTMOST IMPORTANCE IN A DECADE FROM NOW.

THE MEMBER BACKING PENSIONS AND LIFETIME SAVINGS ASSOCIATION Spring 2024

THE DWP HAS NOW RELEASED A FINAL CONNECTION TIMETABLE IN GUIDANCE, WHICH SCHEMES WILL NEED TO CONSIDER. THE FINAL CONNECTION DEADLINE FOR ALL SCHEMES IS 31 OCTOBER 2026. IT’S IMPORTANT FOR SCHEMES OF EVERY TYPE TO GET READY FOR PENSIONS DASHBOARDS. THE PLSA HAS PREPARED THIS SUMMARY CHECKLIST OF ACTIONS SCHEMES SHOULD TAKE NOW.

1. YOUR DASHBOARDS STAGING DEADLINE(S)

2. YOUR KNOWLEDGE & UNDERSTANDING

3. YOUR COMPLIANCE PROJECT PLAN

4. YOUR CONNECTION(S) TO THE ECOSYSTEM

5. YOUR CONTRACTS & OTHER DOCUMENTS

In March 2024, after a previous delay, the DWP released final connection guidance setting out a staged timetable for connection with the deadline for larger pension schemes to complete connection by the end of April 2025, and a final connection deadline of 31 October 2026 for all schemes. See the table on the next page for the deadline dates.

Get familiar with the requirements. Keep visiting the PLSA Pensions Dashboards Hub and the Pensions Dashboards Programme (PDP) website, in particular the PDP Data Providers Hub Always watch out for dashboards information coming soon from Pensions dashboards: initial guidance | The Pensions Regulator.

Make a detailed plan for your scheme’s compliance with the dashboards regulations: define the work required, secure a budget and appropriate resources, and put in place appropriate project governance controls to ensure delivery.

Meet with all your administrators, pension providers and/or AVC providers to understand their plans to connect your scheme to the dashboards ecosystem. Consider if you should review alternative Integrated Service Provider (ISP) options.

Update your administration and other relevant service contracts to include dashboards connection services. Consider other documentation changes needed, such as your data privacy notices. It is quite likely you will need to take advice.

6. YOUR MEMBER RECORD DIGITISATION Ask your administrator(s) and/or provider(s) to confirm that none of your member records are held in non-digital format, or if they are, by when they will have loaded them on to the main administration system.

7. YOUR PERSONAL DATA ACCURACY AND MATCHING

8. YOUR PENSION INCOME DATA AVAILABILITY

9. YOUR SUPPORT FOR MEMBERS’ NEXT STEPS

10. YOUR MESSAGES TO YOUR MEMBERS

Ask your administrator(s) and/or provider(s) what steps they are continually taking to review the accuracy (not just presence) of the Surnames, Dates of Birth and National Insurance Numbers on all your deferred and active member records. Also confirm which elements of personal data they plan to compare against incoming Find requests, per the PASA Data Matching Convention Guidance

Ask your administrator(s) and/or provider(s) to report on the completeness of pension income data, on all deferred and active member records, to meet the dashboards data requirements. Where it is incomplete, commission calculation automation work to be done well in advance of your scheme’s staging deadline(s).

After using a pensions dashboard, what will your members do next? For example, if many wish to contact your administrator for definitive retirement quotations, what will be the most cost efficient way for them to do that? Discuss with your administrator(s) how they plan to support increased demand.

Plan what you will tell your members about pensions dashboards, and consider how your various existing scheme communications will need to change.

While the timetable is not mandatory, given that it is being published to ease the connection journey DWP would encourage trustees or managers and pension scheme providers to follow the dates in this guidance unless there are exceptional circumstances which prevent them from doing so.

To note: “number of relevant members at reference date” should be calculated as:

• for trustees or managers of occupational pension schemes subject to the 2022 Regulations: number of relevant members per scheme (active members, deferred members, and pension credit members) at the scheme year end date in the period between 1 April 2023 and 31 March 2024.

• for pension scheme providers subject to FCA Rules: the number of pots in accumulation across all the relevant pension schemes the provider operates (personal and stakeholder pensions, retirement annuity contracts, pension buy-out contracts and Freestanding AVCs) at the scheme year end date in the period between 1 April 2023 and 31 March 2024.

1(g)

2(a) FCA-regulated operators of a personal pension scheme, stakeholder pension scheme, a retirement annuity contract, a pension buy-out contract including a ‘section 32’ buy-out policy[footnote 4](#_edn4) or an FSAVC

2(f)

2(g) relevant

All schemes and providers in scope are legally required to be connected to the pensions dashboards ecosystem and be ready to respond to requests for pensions information by 31 October 2026 at the latest.

The PLSA is here to help you prepare for pensions dashboards.

• The PLSA plays an active role in the Pensions Dashboards Programme (PDP). Keep following all the latest

at the PLSA Pensions Dashboards Hub and the PDP website

• If you have any questions or comments about dashboards, please contact Ruari.Grant@plsa.co.uk (PLSA Policy Lead: DC).

Mark Hill, The Pensions Regulator’s Climate and Sustainability Lead, explains how the climate disclosure regime is already driving trustee action on climate risk.

Climate change poses risks and opportunities to all pension schemes.

That’s why, since 2022, the requirement to publish an annual climate-related financial disclosure report (also known as a TCFD report) has been extended to schemes with more than £1 billion in assets under management (AUM). This requirement has applied since 2021 for schemes with more than £5 billion in AUM and authorised defined contribution (DC) master trusts.

The purpose of these regulations is to drive trustees to act on climate risks and opportunities. The reporting regime can drive improvements on climate risk management across the pensions sector.

In April, we published our second review of schemes’ climate-related disclosure reports following the regime being widened to apply to more schemes.

We reviewed a representative sample of reports, from schemes including defined benefit, hybrid, single-employer DC and a DC master trust. We looked at reports from schemes with more than £5 billion AUM and schemes with between £1 billion and £5 billion AUM.

The aim of our review is to help trustees and their advisers to identify good practice, focusing on maximising the opportunities and mitigating the risks climate change presents.

It found many examples of good strategic decision-making, such as updating DC default lifestyle strategies to include sustainable funds and encouraging fund managers to engage with top carbon dioxide emitters.

By publishing our review, we hope trustees will see what good looks like –and, in turn, improve their management of climate-related risks and opportunities. Even though they are not yet in scope for disclosures, trustees of smaller schemes would also benefit by reading our report to help their strategic decision-making.

Our review also addresses the climate change scenario modelling typically used by trustees. Industry commentators and reports have argued that many scenario models significantly understate climate risk and the key model limitations, judgements and assumptions are not yet well understood.

It is essential that trustees feel confident to question and challenge their advisers and the output from climate scenario analysis they commission.

Nearly all the reports we reviewed included a ‘hot house world’ scenario –one assuming no transition, temperature rises well over 2°C, and severe physical impacts. The results showed a very wide range of assessment of the severity of the financial impact for this scenario, ranging from a reduction in pot size at retirement of more than 30%, through to very modest impacts. Four reports for defined benefit schemes actually showed a positive impact under this scenario because liabilities fell more than assets.

It is important that trustees understand what is included, and not included, in their modelling. There are ongoing industry initiatives in relation to the improvement of scenario analysis, and trustees may wish to ask their advisers about the emerging and latest developments in the market.

While not a legal requirement on trustees, transition planning is likely to be integral to achieving the UK’s netzero ambitions – and it’s important for the effective management of material climate-related financial risks and opportunities.

So, we were pleased that our April review showed more than 60% of the reports in our sample had some form of net-zero goal with a target date of 2050 or earlier.

We would encourage those trustees building their capacity in transition planning to visit the Transition Plan Taskforce’s website and familiarise themselves with this developing area.

Transition planning is not the only developing area trustees and their advisers ought to get to grips with.

While climate reporting should be becoming business as usual for schemes in scope, environmental, social and governance disclosure reporting requirements look set to continue to expand as practices around wider sustainability factors – such as nature and social issues – develop.

While some have argued the disclosure regime means an increased burden for schemes with uncertain benefit, we have shown how it is highlighting examples of real-world change in risk and opportunity management in savers’ interests.

The disclosure regime is here to stay. We should be glad that it is.

The PLSA’s 2024 Investment Conference brought together great networking, major investment themes and top class speakers in Edinburgh.

Pensions is a world of big numbers. Our members and their partners work in the millions, billions and even trillions every day. At this year’s Investment Conference, at Edinburgh International Conference Centre, we were dealing with big numbers too.

strong governance and having a clear objective for achieving their members’ outcomes needed to sit at the heart of all decision-making.