GrowwIPO:CompleteInvestmentAnalysis

A comprehensive analysis of India's most anticipated fintech IPO, examining Groww's business model, financial performance, and market potential for retail and institutional investors.

A comprehensive analysis of India's most anticipated fintech IPO, examining Groww's business model, financial performance, and market potential for retail and institutional investors.

Groww is India's leading fintech platform that democratized investing for millions of users. Founded in 2016 by four former Flipkart employees, the company transformed from a simple mutual fund platform into a comprehensive financial services ecosystem.

With over 40 million registered users, Groww has become the go-to investment platform for millennials and Gen Z investors across India.

Four Flipkart veterans launch Groww with a

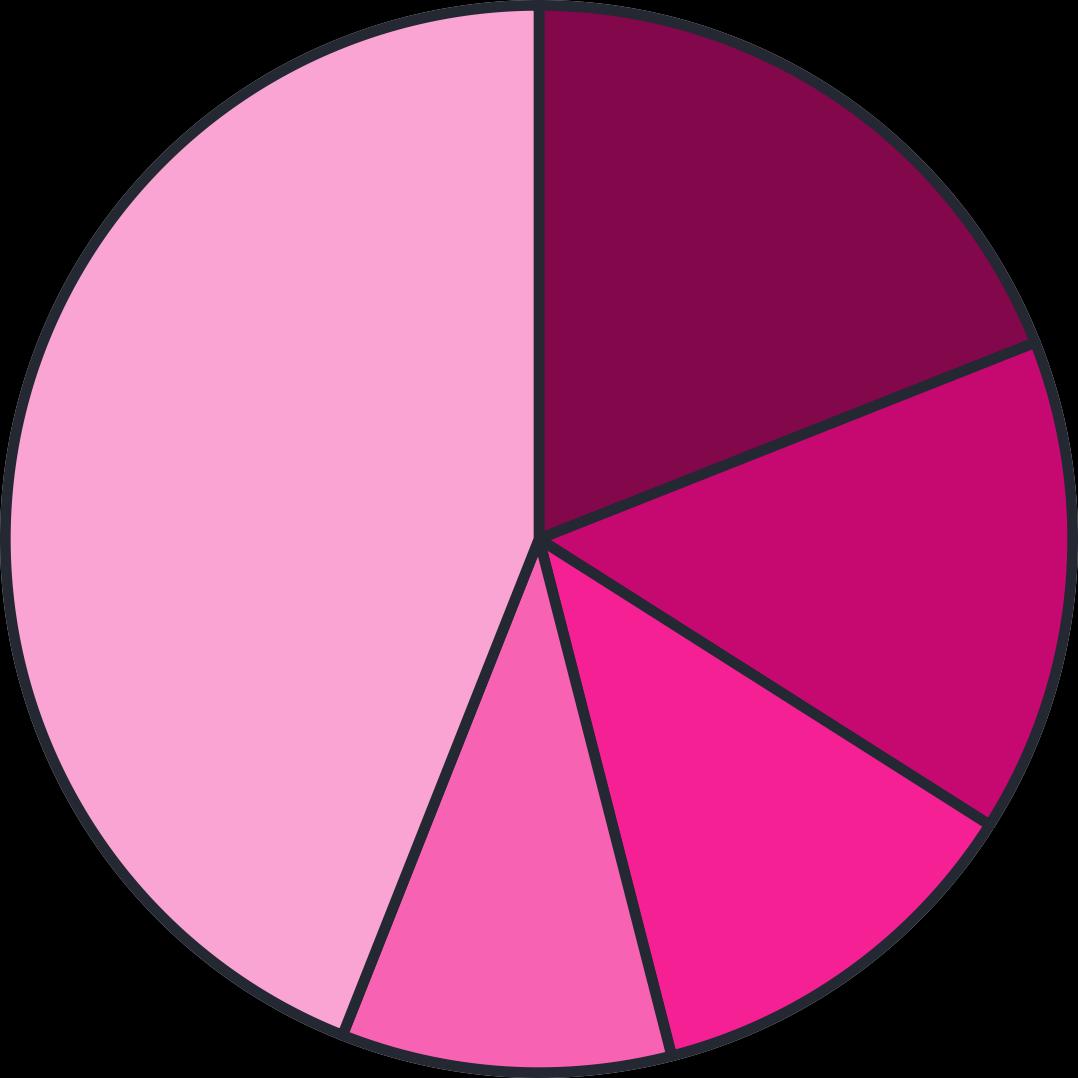

Groww operates a freemium brokerage model, acquiring customers through zero-commission products and monetizing through diverse revenue streams.

Flat ¹20 or 0.05% per order for equity and F&O tradingtransparent pricing that attracts retail investors

Commissions from Asset Management Companies for directing mutual fund investments - recurring income stream Premium subscriptions, digital gold, fixed deposits, and advanced trading tools for serious investors

Earnings from idle funds in user accounts and margin funding for leveraged trading positions

$150,000,000,000.00

$100,000,000,000.00

$50,000,000,000.00

$0.00

Groww's financial trajectory showcases explosive growth, with revenue increasing over 4,300% from FY20 to FY23. The company moved toward profitability in FY23, narrowing losses significantly while maintaining rapid expansion.

250% RevenueGrowth

Groww has rapidly gained market share in India's competitive discount broking space, positioning itself as the second-largest player behind Zerodha.

Over 80% of users under 35 years old, capturing the next generation of wealth creators in India

One-stop-shop offering mutual funds, stocks, IPOs, US equities, and digital gold investments

Fastest-growing platform in the sector, rapidly closing the gap with market leaders

IntenseCompetition

Frequent price wars and innovation pressure from established players like Zerodha and emerging fintech competitors

Heavy spending on digital marketing and referrals to attract new users may delay sustained profitability

SEBI frequently updates rules on margins, disclosures, and fee structures that can impact revenues overnight

Business heavily reliant on retail investor sentiment - bear markets could significantly reduce trading activity

RiskAssessment: While Groww shows strong fundamentals, investors should carefully weigh these risks against potential returns before participating in the IPO.

The GrowwIPO combines fresh issue and Offer for Sale components, targeting a valuation of $4.5-5 billion. Fresh capital will fund technology upgrades and strategic acquisitions.

Early investors like Sequoia Capital and Ribbit Capital will partially exit through the OFS component, providing liquidity while maintaining strategic involvement.

DRHP filing, regulatory approvals, and roadshows for institutional investors

3-day subscription period with separate quotas for retail, HNI, and institutional investors

PriceBandSetting

Final valuation determination and price discovery process with anchor investors

BSE and NSE listing followed by secondary market trading commencement

The IPO positions Groww for its next growth phase, with clear strategies for expansion and market leadership consolidation.

Expansion into insurance, lending, and wealth management for high-net-worth individuals to increase revenue per user significantly

Potential expansion beyond US markets, allowing Indian users to invest globally and tap into diaspora markets

Robo-advisory services using machine learning for personalized investment recommendations and portfolio management

IPO capital enabling acquisitions of wealth-tech firms to rapidly acquire new technologies and customer bases

Massive 40+ million user base with strong millennial appeal

Diversified revenue streams reducing single-point-of-failure risks

Strong financial backing from global investors

Proven ability to scale rapidly in competitive markets

Clear path to sustained profitability demonstrated in FY23

Groww represents India's fintech maturation, fundamentally changing how a generation invests. The company's trajectory from startup to IPO candidate demonstrates exceptional execution in a challenging market.

The Groww IPO offers exposure to India's digital transformation in financial services, backed by strong fundamentals and clear growth strategies.

Consider the regulatory risks and market volatility. Wait for post-listing price stabilization before entry with small allocation.

Strong IPO candidate given user growth, market position, and expansion opportunities. Suitable for long-term wealth creation.

Compelling opportunity to participate in India's fintech revolution with a market-leading platform and proven business model.

"Groww's IPO symbolizes the maturation of India's fintech ecosystem and represents a pivotal investment opportunity for those seeking exposure to the country's digital financial transformation."