with wood and disney : The Advisors to Ambitious Entrepreneurs

Wood and Disney are a tech savvy firm of chartered accountants who bridge the gap between numbers and dreams by using our skills with numbers and multiplying this with our experience in business to make a real difference to our clients’ lives with jargon-free, pragmatic and best practice business advice.

The most successful people focus first on accumulating business assets before they can reap the benefits of that success personally. Those business assets may be intellectual property, tangible assets, the best team, the best systems or perhaps the most important thing for long term survival, CASH. Recessions occur regularly every decade or so, but the survival rate of small businesses is staggeringly poor with less than 28% still being in business after ten years.

So, when we talk about Building Awesome Futures our vision is:

To defy the norm of business failure statistics and help 100% of our clients not only survive more than 10 years but also create a genuine asset to pass on to another generation

Over the past four decades we have created a process called Your Journey to Freedom® with over 500 tried and tested resources and tools. This process is a best practice process for established businesses where the owner has either reached a plateau or has exploded with growth and is fearful of losing control.

Wood and Disney

Lodge Park, Lodge Lane, Langham, Colchester, CO4 5NE

01206 233170

www.woodanddisney.co.uk

www.yj2f.co.uk

AWARM (hopefully!) welcome to our spring issue – one which (hopefully!) reflects the seasonal theme of regeneration and new life.

It’s easy to get worn down by the tide of pessimism emanating from the national media, understandable though much of it is. However, here at BusinessTime in Essex, we prefer to maintain a mood of realistic optimism. If we’d have believed the doom-mongers, we wouldn’t have got past our first issue because, so many people told me, print was dead – but here we are publishing our 35th issue in our ninth year, and another bumper 80-pager at that.

So, the following pages are designed to keep you up-to-date with the latest news and views concerning the Essex business scene. I’m so fortunate to have such an amazing group of contributors who share their knowledge and thoughts with you via our pages. It makes my job pulling it all together relatively

Devolution, hybrid working, a new Essex business board, cyber security and a six-page ‘survive and prosper’ feature (starting on page 66) are just some of the subjects tackled in this issue so, sit back, grab yourself a cuppa and catch up with all that’s happening on the vibrant Essex business scene.

Talking of prospering, we have teamed up with Colchester-based Contigo Associates to offer BusinessTime in Essex readers a deal which is not to be missed – see page 18 for details.

I really hope you enjoy reading this issue. Don’t forget, it’s very easy to be part of our next issue which will hit desks on June 1 - have a quick look at page 36 to see how. In the meantime, enjoy spring!

BusinessTime in Essex Colchester-based PJR Communications. Publishing Editor

Peter Richardson 01206 843225 or 07778 067614

peter@pjrcomms.co.uk Sales

Vivienne Richardson 01206 843225

Designed and Produced by Print Acumen Ltd 0345 340 3915

Mailed out by

The DS Group 01255 221322

Publishing Editor

To advertise or feature in the next issue of BusinessTime in Essex, contact Peter or Vivienne as detailed above.

CHELMSFORD-BASED R&D tax consultancy RDA has extended its suite of services into intellectual property (IP).

Launched in January this year, RDA’s new IP-services arm will offer companies valuable support in developing patent and trademark applications, copyright and design rights, as well as trade secrets and confidential information.

And as one of the nation’s leading independent R&D-focused tax agents, RDA

will bring its deep expertise to delivering clients tax relief on their IP-related turnover through the government’s valuable Patent Box scheme.

RDA’s founder and managing director, Kevin Auchoybur, said: “Moving into this area is a natural progression for our company and for our clients. With every R&D tax-relief claim we support, we see a wealth of protectable IP.

“Expanding RDA’s offering into this area will help our clients identify, protect and leverage their IP, as well as helping direct their R&D strategies in future.”

Leading RDA’s new IP division will be Alec Griffiths, an IP specialist with more than a decade’s experience in supporting businesses through their design, copyright, trademark and patent journey.

He said: “RDA and IP are the perfect fit. And as our analysis piece in this edition shows, there is so much we can do to guide innovative businesses beyond the expert support in R&D tax relief that has made RDA’s name.

“I look forward to helping any Business Time in Essex readers who would like to learn more about developing and protecting their intangible assets.”

RDA’s proud association with motorsport is shifting gears to the very top of the range, with Tom Gamble winning a prestigious seat in the 007 Valkyrie AMR-LMH hypercar in the world’s elite sportscar series. Gamble, a former British Racing Drivers’ Club Young Driver of the Year, has benefited from RDA sponsorship since 2019. And now he has caught the eye of one of the biggest teams in sportscar racing.

The Heart of Racing is the Brackley-based American team whose association with Aston Martin dates back to 2020, running the Vantage AMR GT3 Evo in last year’s WEC series and the Vantage AMR the previous year.

This season the 007 Valkyrie hypercar will –uniquely – be running not only in the WEC but also the IMSA WeatherTec SportsCar Championship. That is not all that is unusual about the car.

Its monster 6.5-litre, V12 engine is a variant of the Aston Martin road vehicle of the same Valkyrie name and a flashback to the Audi R10 that became the first V12 engine to win the 24 Hours of Le Mans race in 2006.

Aston Martin are hoping the improved efficiency of the Cosworth engine can outlast the hybrids being run by most of the WEC field.

It is perhaps something of a gamble, although the same cannot be said of Heart of Racing team principal Ian James’s decision to turn to Gamble to help Aston Martin dominate the sportscar division.

“I rate him very highly as a natural talent and he deserves a chance in the spotlight at the highest level of sportscar racing,” said James. Gamble’s year with Heart of Racing began with enormous promise, collecting a podium finish at the IMSA season-opening 24 Hours of Daytona in January. It is form the team is expected to carry through the entire season, with high hopes it will land a first title for Aston Martin since 1959 in the centrepiece Le Mans race.

Team RDA will be there in force to cheer him on through every turn, because for RDA and Gamble, it has always been about how they develop together.

by Iain McNab, Head of Policy at Essex Chambers of Commerce

MANY readers will have heard the d-word (for devolution) bandied about for some time – and you will be hearing it a lot more following a Government announcement on February 5 that Essex is one of six places to be included in a priority programme to deliver a devolution deal.

In our case this would cover the entire county. The announcement has been warmly welcomed by the leaders of all three upper tier authorities: Essex, Southend and Thurrock.

Devolution is being linked, as set out in a recent Government White Paper, with a process of local government reform (LGR) which will run roughly in parallel. The result, if all goes to plan, will be a very different-looking governance model in Essex to what we have now: a mayoral strategic authority and a few unitary councils (perhaps four or five) replacing the existing county council, two unitary authorities and 12 district councils. Southend and Thurrock, although already unitary authorities, will not stay as they are but will be merged into larger entities.

This article aims to explain the likely changes and why we at the Chambers of Commerce believe it will be good for residents and business alike and should be supported.

Devolution is about devolving powers away from central government to local areas so control and decision-making over some issues is exercised locally. So far, a particular model - an elected mayor working with a strategic authority - has been rolled out mainly to metropolitan areas, most notably and for longest in London but more recently to Greater Manchester and other places. We have become used to quite powerful mayors having a national profile and being powerful voices for their areas. This could be the case for Essex in future.

What will be devolved to local areas under devolution deals?

The key areas in which powers would be devolved are:

• transport and local infrastructure

• skills and employment support

• housing and strategic planning

• economic development and regeneration

• environment and climate change

• health, wellbeing and public service reform

• public safety.

Devolution would likely bring with it a long-term investment fund allocated by the Government. Greater Essex will have more control over its own funding, creating greater flexibility to target resources where they are needed most - in trade, inward investment, skills development, infrastructure

or sector-specific growth. We’d expect to see efficiencies, economies of scale and so on.

The Mayoral Strategic Authority will have a mandate to develop a new Local Growth Plan, essentially an Essex version of the UK’s industrial strategy. From a business perspective we believe this, harnessed to a wider economic strategy, would help set a clear sense of direction for the Essex economy. Business influence would be exerted through the new Greater Essex Business Board, which has recently been established.

A Strategic Plan for Greater Essex would also need to be put in place, setting out strategic growth locations and providing a framework within which to plan for the pattern, scale and design of quality places for the next 30 years. This would include provision for new communities, affordable housing, employment space, necessary infrastructure and the conservation of green space and our historic environment.

Devolution could happen without LGR and vice versa, but they have been linked by the Government with a view to them being tackled concurrently. We believe this is sensible. Much of the rest of the country has already replaced the two-tier system with a single tier i.e. unitary authorities, which combine the powers of counties and districts. Essex, and a few other places, have not yet, but many people think that 15 local authorities is too many – and a simplified structure should be easier for business to engage with.

The next step is for Essex to submit outline proposals for reform by March 2025. Discussions are underway around the county on what the future might look like. It will mean existing local authorities joining together in a new configuration. In the north-east of Essex Colchester, Braintree and Tendring have already stated their ambition to join and form a new unitary authority. This could be a good fit as their combined population is around 500,000, which appears to be the Government’s preferred size for new unitaries. This would imply that Essex (population around two million) could have four similarly sized unitary authorities. However, it’s unlikely to be this straightforward – for example, some will think five smaller authorities would be the right number if projected housing growth is considered.

At the Chambers, we support the principle of the reform of local government but recognise it will be a very challenging project politically to carry through, especially given the timescales envisaged. We are neutral on the geography for now but look forward to the publication of proposals for consultation, at which point we will want to be sure they look right for business as well as residents.

This is a very brief overview but if you want to find out more or have comments, please feel free to contact Iain McNab at iainmcnab@ essexchambers.co.uk

BUSINESS leaders have been selected to join an influential new board which will champion the economy of Greater Essex.

The Greater Essex Business Board brings together key businesses, influential and inspiring business leaders and will act as the voice of the private sector in Greater Essex.

Through an open recruitment process, 20 business leaders have been appointed to join the new board.

Membership reflects the economy of the area, different sizes of business, the geographical local economies and different perspectives of the business community. The board will help shape economic policy in Greater Essex.

The board will be chaired by Julia Gregory, who brings a wealth of knowledge and experience to the role. This has been built up during a 30 plus year career working across the private and public sectors, primarily in the real estate development sector.

As an active real estate and infrastructure leader in Essex and other nationally significant roles, Julia has supported delivery of key projects.

This includes delivery of a new garden city at Ebbsfleet and supporting growth aspirations during her time at Stansted and Gatwick airports.

As a Chairperson and Non-Executive Director, she currently leads the strategic direction of various companies. In 2023, Julia was recognised by the National Businesswomen Awards for a lifetime achievement award.

Julia said: “This group of business representatives is fantastic, we have real richness of experience and expertise and representation of a cross section of the economy in Greater Essex. Board members come from a variety of sectors - from ports, logistics and advanced manufacturing to construction and aviation - all have their role to play in supporting the economy.

“By coming together behind a common purpose; to encourage and support growth, we hope to make Essex stand out and compete for investment and grab the attention of policy makers to deliver new jobs and grow the economy in Greater Essex. Business is well placed to do this, together with our local authority partners.”

Working in partnership, Essex County Council, Southend-on-Sea City Council and Thurrock Council led an open recruitment process for the board. Appointments were made by a selection panel of Members from each authority.

The Greater Essex Business Board’s members are:

• Alan Shaoul, DP World

• Alison Hartley, Teledyne

• Andrea Cunningham, Metal Culture

• Ann Scott, Federation of Small Businesses

• Bolaji Sofoluwe, ETK Group

• Christopher Lines, Leonardo

• Denise Rossiter, Essex Chambers of Commerce

• Edwin Strang, Industrial Chemicals

• Eoin Lyons, SS&C Financial Services

• Jacqui Dallimore, Roslin Beach Hotel and Chair of Southend Tourism Partnership

• Lara Fox, Objective IT

• Mike Hardaker, MAG/Stansted Airport

• Ryan Liversage, Morgan Sindall

• Rupert Wood, Almcor

• Steve Beel, Freeport East

• Trevor Scott, Simarco

• Tim Price, Park City Consulting Ltd

• Professor Mohammad Ali, Anglia Ruskin University

• Dr Rob Singh, University of Essex By business, for business, with business, Members will play a key role in attracting

Julia Gregory

investment, influencing job growth, advising on infrastructure and skills priorities, and overseeing future Government programmes.

The board’s work will compliment that of organisations such as the Essex Chamber of Commerce, which will be a key collaborator in areas such as skills.

Councillor Louise McKinlay, Essex County Council Deputy Leader and Cabinet Member for Communities, Economic Growth and Prosperity, said: “The creation of the Greater Essex Business Board will support our region’s economy to reach its full potential. The board will help to set economic direction by advising, advocating and lobbying for the interests of businesses across the area.

“I am hugely impressed by the collective experience and knowledge amongst its members, and we look forward to working closely with the board going forward.”

Councillor Daniel Cowan, Leader of Southend-on-Sea City Council, said: “I am pleased to see the new members and chair appointed for the Greater Essex Business Board. I am looking forward to working with the new board to drive investment and growth at this important time for our area.”

Councillor Lee Watson, Cabinet Member for Good Growth at Thurrock Council, said: “The Greater Essex Business Board will play an important role in helping our region’s economy grow and prosper. I’m looking forward to working with the chair and the new board to ensure this growth delivers real benefits for Thurrock and for our residents.”

Members of the board are appointed on a yearly basis. The board will meet four times a year.

Find out more about the Greater Essex Business Board at: https://www.essex.gov.uk/ business/greater-essex-business-board.

UK businesses must brace themselves for looming employment law changes that will impact them this year.

While major reforms from the Employment Rights Bill are set to take effect in 2026, this year still brings significant legal shifts that require immediate attention and a need to prepare for the further reforms on the horizon.

The rise in the National Minimum Wage and National Living Wage, which comes into effect in April, is aimed at narrowing the pay gap across age groups, with the minimum wage for 18 to 20-yearolds rising by 16.3% to £10.00 per hour. The National Living Wage for those aged 21 and over will jump to £12.21 per hour. This means reviewing salary structures, ensuring payroll compliance and considering potential ripple effects such as pay compression (which may require adjustments to broader wage scales). Failure to comply could lead to significant financial penalties, reputational damage and, in more serious cases, potential criminal liability.

Beyond wages, 2025 also introduces new rights for working parents. The Neonatal Care (Leave and Pay) Act 2023, which takes effect in April, grants parents up to 12 weeks of additional leave and statutory pay if their newborn requires neonatal care. This will require businesses to update to parental leave policies and payroll systems.

Employers will also need to accommodate a new right under the Paternity Leave (Bereavement) Act 2024, which removes the existing 26-week service requirement for bereaved partners and could extend paternity leave to as much as 52 weeks.

These reforms underscore the growing legislative focus on familyfriendly workplace policies and the need for businesses to support employees during difficult personal circumstances.

While most of the Employment Rights Bill’s 28 proposed reforms will not be implemented until 2026, consultations on several key measures start this year. Among the most transformative proposals are the introduction of a ‘day one’ right to protection from unfair dismissal, in effect, eliminating the current two-year qualifying period.

The Bill also proposes tighter restrictions on the controversial ‘fire and rehire’ tactics used by some employers during restructuring, as well as the requirement for businesses to offer guaranteed hours to zero-hours and low-hours employees.

Strengthened protections against thirdparty harassment and enhanced rights to request flexible working are also in the pipeline.

While these changes are not immediate, businesses should begin reviewing their policies and workplace practices to ensure they remain ahead of compliance requirements.

Ola McGhee, Associate in the Company Commercial team at leading regional legal firm, Tees, urges business leaders to brace themselves for a wealth of changing legislation.

Several key employment tribunal cases in 2025 could further shape the legal landscape. One of the most closely watched is For Women Scotland Ltd v The Scottish Ministers, which could redefine the legal definition of a "woman" under the Equality Act 2010 and influence employer policies around gender identity and workplace equality. Another pivotal case, Augustine v Data Cars Ltd, examines whether a part-time worker must prove their employment status was the sole cause of less favourable treatment to succeed in a discrimination claim. Meanwhile, Higgs v Farmor’s School addresses the growing issue of balancing employees’ rights to express personal beliefs on social media against protections for other groups under anti-discrimination laws. The retail sector will also be closely watching Thandi and Others v Next Retail Ltd, a case dealing with equal pay claims between store-based and warehouse employees, which could set a precedent for similar disputes across the industry.

Beyond legal changes, 2025 is set to be a year of significant workplace evolution.

Diversity, Equity, and Inclusion (DE&I) remains high on the agenda, with a particular focus on better supporting neurodiverse employees.

Increasing use of Artificial Intelligence (AI) in recruitment, performance management, and decision-making presents both opportunities and risks. Many employment laws are yet to catch up with AI-driven workplace practices, making it crucial for businesses to develop ethical AI governance strategies.

Reviewing employment contracts, updating policies, and ensuring that payroll systems are aligned with new wage requirements are immediate priorities. Additionally, engaging with employment law experts can provide valuable insights into upcoming consultations and tribunal cases, helping businesses stay ahead of regulatory changes.

Training is another critical area of focus. Ensuring managers and HR teams understand the implications of the new laws will help foster a fair and legally compliant workplace culture. Good communication is also key, as clarity on rights and entitlements can help prevent misunderstandings and disputes and promote an engaged workforce.

Looking further ahead, businesses must prepare for the 2026 reforms outlined in the Employment Rights Bill. This means considering how a day-one right to protection from unfair dismissal will impact hiring and HR strategies, reviewing current redundancy and consultation procedures, and assessing how guaranteed hours contracts could affect workforce planning. The restrictions on fire and rehire practices may also require companies to rethink their approach to restructuring and employment contract changes.

By taking a proactive approach to 2025’s employment law changes, businesses can avoid potential legal pitfalls, maintain good employee relations and position themselves for long-term success. In an era of evolving workplace expectations and regulatory scrutiny, those who stay ahead of the curve will be best placed to thrive.

For further information, go to www.teeslaw.com/work-life/ employment-law

If you were a driver, a cyclist or motorcyclist or even a pedestrian in the 1920s and 1930s, you really were taking your life into your hands. At the time there were two million cars on the road – today there are 20 times that many.

According to the Department of Transport’s historical road-safety statistics, for every 409 cars there were on the road in 1926, there was a road-traffic fatality. This number hit a peacetime peak at a staggering one in 272 in 1934.

Compare that with today and it is chalk and cheese. Despite the proliferation of cars on the roads – amounting to 334 billion vehicle miles travelled – there were in fact fewer collisions overall in 2023 than in 1926.

As you can see from the chart above, road safety began to improve in the 1930s. (And, understandably, briefly worsened again in the early 1940s with the breakout of World War Two, when cars had to drive in darkness without headlights.)

The improvement was no coincidence. It was in 1930 that the UK government introduced the Road Traffic Act “to make provision for the protection of third parties against risks arising out of the use of motor vehicles”.

It was only a first step, but it worked – as the general trend towards road safety demonstrates. And the very same principle has applied in everything from air travel to restaurants to healthcare to construction sites: it is a safety-first story.

Regulation has clearly helped in activities where the public are potentially at risk. And in those sectors where risks are permitted to persist unchecked, damage can be done.

Regrettably, this has proven to be the case in one vital professional service in particular. The HM Revenue and Customs (HMRC) Research & Development (R&D) Tax Credits are a lifeline

for innovative companies developing new products and processes.

But they have been subject to cynical abuse by some participants in the tax-advice sector. According to HMRC’s most recent error-and-fraud estimates, as much as £1.3 billion of the total £7.6 billion awarded in 2021 to 2022 could have been to fraudulent or erroneous claims.

It is clear HMRC has its sights set on certain firms it believes to be responsible for this staggering drain on the exchequer’s resources. One East Anglia business was raided by HMRC enforcement officers last September. It has reportedly ceased trading, with another

nine related companies that traded from the same address having reportedly been wound up.

For Kevin Auchoybur, founder and managing director of the Chelmsford-

based R&D tax consultancy RDA, enough is enough.

“The corrupt practices of some rogue tax agents have placed their clients at tremendous risk,” said Mr Auchoybur. “Illegally claimed tax

relief requires repayment, along with penalties and interest.

“We at RDA have been appalled by the actions of some agents and we are determined to improve the standards in the industry,” he added. “It turns out that several other reputable firms are of a like mind, and we have got together to set up a standards body that will sort this out once and for all.”

The new body will introduce a code of conduct and formal governance processes that ensure all prospective members must undergo stringent vetting before being allowed to join. Mr Auchoybur reports that this adheres closely to the regulatory best practice operating in other sectors, ensuring members’ clients have proper recourse in the event of any alleged malpractice.

He adds that this will include a fit and proper persons test for all beneficial owners, officers and managers, restrictions on certain commercial practices and a formal complaints procedure for clients to seek redress.

“This inevitably has the effect of putting off genuine claimants from putting in for the relief – or perhaps even undertaking R&D in the first place. And that is not a good outlook for generating muchneeded growth in the UK economy.”

Understandably, Mr Auchoybur’s solution is based on the one that improved safety on Britain’s roads: regulation of his industry. But unlike for the Road Traffic Act, this is not something any statutory body is currently prepared to undertake. So, he has gone about it himself.

He also explained these matters will be rigorously enforced by an independent compliance expert and referred to an adjudicatory panel when required. “We are very confident that the benefits of joining a formal body that separates the wheat from the chaff will be very attractive to the respectable actors in our industry,” added Mr Auchoybur.

“It will also iron out any creases in their practices by ensuring they are both closely scrutinised and that they adopt the code of conduct into their own protocols. The threat of formal disciplinary sanctions including fines or membership being rescinded will, we believe, ensure ongoing compliance.

“We’re very excited about what this means for the future of our industry and R&D tax reliefs in general.”

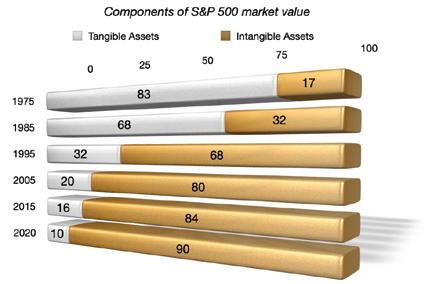

According to research conducted in 2020 by Ocean Tomo, an intellectual property (IP) focused merchant bank in the US, there has been a dramatic shift in how the world’s biggest companies are valued.

In 1975, it discovered, intangible assets made up only 17% of their market value. Forty-five years later, it was tangible assets that constituted only 10%, with intangibles accounting for the other 90%. (See chart below.)

Long gone are the days where a business’ value was predominantly derived from its tangible assets – intangible assets have already taken their crown as the biggest value driver in business. Leading the charge in this economic shift is IP.

IP covers a broad spectrum of intangible assets, from brand identity through to technological advancements. Contrary to what some may say, ALL businesses have IP. They just do not recognise it. If you do not recognise it, you cannot protect it, and if you cannot protect it, it will not add value.

Most businesses do not recognise or protect the IP they generate, leaving them vulnerable to IP theft and financial loss – they effectively ‘donate’ their IP to their competitors.

• Increased Competitive Advantage – Exclusive rights to innovations, brands, and creative works prevent competitors from copying or profiting from a business’s unique assets.

• Revenue Generation – IP can be monetised through licensing, franchising, or direct sales, providing additional income streams.

Although slightly lower in the UK, at around 70% rather than the 90% in the US, intangibles are still the predominant driver of a business’s value. Transitioning away from traditional, physical assets in the knowledge-based economy means understanding and leveraging your IP becomes less a luxury and more a necessity.

IP is the crucial asset that distinguishes a business from its competitors. Recognising and protecting your IP brings several benefits, such as:

Tax Reduction – UK companies that own UK or European patents could be eligible for a tax reduction on profits relating to their patents through accessing the UK Patent Box scheme.

Risk Mitigation

– Securing IP rights protects businesses from infringement lawsuits and unauthorised use by others.

• Increased Business Valuation – Investors and potential buyers view strong IP portfolios as indicators of long-term growth and stability.

• Failing to recognise and protect IP can result in lost opportunities, legal battles, and reputational damage. Companies that actively manage their IP assets ensure they maintain control over their innovation, growth and future.

IP rights such as patents, designs, trademarks, copyrights and trade secrets are valuable tools in safeguarding the intangible assets within your business. These assets are often more valuable than physical assets, such as inventory, real estate and the like, however, they are considerably more difficult to identify.

How you manage your IP, and therefore the bulk of your intangible assets, is referred to as an IP strategy. The term might seem daunting, or like legalese designed to confuse, but an IP strategy is just a component of your business strategy.

The strength of your IP strategy often correlates to the value of your intangible assets, and as we’ve pointed out, the value of your business - no business ever decreased in value by developing a robust IP strategy!

Developing a strong one involves several key steps. First comes an IP Audit & Identification – Businesses must assess their existing assets, including inventions, branding elements, and proprietary knowledge, to determine what qualifies for IP protection.

Is your business fit for the Age of IP?

RDA’s senior IP and patent expert, Alec Griffiths, can help you find out. Alec is a commercially and strategically focused IP manager with a strong track record in aligning IP with business strategy.

His domestic and international clients receive advice on protection, commercial exploitation, and risk mitigation through the innovation life cycle, from ideation to market launch. He provides essential support in innovation-based tax-relief regimes, infringement risks, portfolio management and alignment strategies.

He helps clients deliver a structured methodology and company-wide strategic initiatives, informed by business objectives and market realities to overcome all the technological, financial and strategic hurdles in exploiting IP. If you would like to learn more from Alec, give him a call on the number below.

infringement will safeguard your business interests.

Then it is about securing IP rights by filing patents, registering trademarks, and protecting copyrights and trade secrets to ensure exclusive ownership and legal protection. Next is monitoring & enforcement; regularly tracking IP usage and enforcing your rights against

Another important step to understand the landscape. Knowledge of competitor IP provides valuable insight into competitor and market direction. It also offers opportunities to avoid confrontation and maximise the efficiency of resource use within your own business by not reinventing the wheel.

Finally comes strategic monetisation. Through licensing, your business can maximise the value of its IP assets, not least with tax relief from the HMRC Patent Box scheme. In short, by implementing a proactive IP strategy, companies can strengthen their market position, attract investment, and unlock new revenue opportunities.

What’s the most crucial asset in your business?

It’s not just your technology, your products,

It’s your people. Without engaged and

What’s the impact on your bottom line?

It’s real, measurable and damaging for your but it doesn’t have to be this way.

EMPLOYEES are often the best people to identify problems and come up with new ideas. They interact daily with products, services, and customers, so they know what works and what doesn’t.

By involving employees in developing business strategies, companies can benefit from fresh insights that improve the company’s direction. Set up regular brainstorming sessions with employees from different levels and departments to share ideas on improving products, services, or processes, and create an opendoor policy where employees feel comfortable sharing their thoughts, whether it’s through meetings or suggestion boxes.

By involving employees in these ways, businesses encourage innovation and ensure strategies are based on real, on-the-ground feedback. When employees feel their input matters, they are more likely to be engaged and motivated.

As businesses evolve, employees need to grow with them. Companies that help their employees develop new skills will have a workforce ready to meet future challenges. Involving employees in business development not only helps the company but also boosts personal growth.

Offer training and development progammes that align with the business’s goals and strategy, and encourage employees to participate in cross-departmental projects where they can develop new skills and learn more about the business.

Providing employees with the tools and opportunities to grow will make them feel valued

and supported. This also helps businesses retain top talent and reduces turnover costs.

Business development isn’t a solo effort; it’s a team effort. When employees work together on strategy, they bring different perspectives and skills to the table. This helps create better solutions and strengthens relationships across departments.

Create cross-functional teams to work on specific projects or challenges, allowing employees to collaborate with colleagues they don’t usually work with. Hold regular team-building exercises that promote communication, trust, and collaboration between departments.

By fostering teamwork, businesses not only improve their strategies but also build a stronger company culture where employees feel more connected to each other and the organisation’s goals.

Today’s employees, especially younger generations, want to feel their work has meaning. By involving employees in strategy development, companies show they value their contributions, which can lead to higher job satisfaction and loyalty.

Regularly update employees on the company’s goals, progress, and how their work contributes to those goals. Offer opportunities for employees to take ownership of projects or initiatives, giving them a sense of responsibility and accomplishment. When employees see their impact on the company’s success, they are more likely to stay committed and stay with the company long-term.

Involving employees in business development helps to create a culture where communication flows freely between management and staff. When employees feel they can

speak up, they are more likely to share useful ideas and feedback, leading to better decision-making.

Hold regular ‘town hall’ meetings where leadership updates employees on company goals, performance, and upcoming changes. Allow employees to ask questions and provide feedback. Use surveys or suggestion tools to gather input from employees on key decisions or strategies. A transparent communication culture helps align employees with the company’s mission and ensures that everyone is working towards the same goals.

In today’s fast-moving business world, companies need to stay ahead to succeed. One key way to achieve this is by involving employees in both their own development and the creation of business strategies. When businesses include employees in these processes, it leads to better strategies, a more engaged workforce, and longterm success. Tony Kerley, director at Colchester-based Contigo Associates Ltd, explores why involving employees is important and suggests practical steps for organisations to follow.

To immediately begin involving employees in business development, businesses can take the following steps:

• host a strategy workshop: organise a session where employees from various departments can brainstorm ideas and suggest improvements to the business strategy

• create a feedback loop: set up a system where employees can easily provide feedback on current strategies and suggest changes. This could be through regular surveys or suggestion platforms

• provide learning opportunities: offer training or workshops focused on skills employees will need to contribute to business development. Include leadership skills, strategic thinking, or industry-specific knowledge

• recognise contributions: make sure to recognise and reward employees for their contributions to business strategy development, whether through formal recognition or incentives

• promote cross-department collaboration: actively encourage employees to collaborate with colleagues from other departments on business development projects. This promotes new ideas and a shared understanding of the company’s goals.

Involving employees in business development is a winwin for both the organisation and its workforce. It leads to better business strategies, fosters innovation, and helps retain talented staff. By creating opportunities for employees to contribute to strategy development, businesses create a culture of collaboration, learning, and engagement that drives longterm success.

Implementing these simple but effective steps – such as setting up brainstorming sessions, offering learning opportunities, and promoting open communication – can make a significant difference in how businesses develop and execute their strategies. These actions not only help develop more relevant and effective strategies but also contribute to a more motivated and committed workforce.

BusinessTime in Essex has linked up with Contigo Associates Ltd to offer this fantastic opportunity to supercharge your business towards unparalleled success.

Join us for an exclusive free morning business breakfast with Tony Kerley FCIPD, FInstLM, FIoL, Managing Director of Contigo Associates. This dynamic session will equip you with the essential strategies to fuel growth and achieve lasting success.

The event takes place at the Colchester Innovation Centre at the University of Essex on Friday May 2, starting at 8.00am and finishing at 10am.

This inspiring interactive session is designed for small business owners and entrepreneurs ready to elevate their game. Walk away with actionable insights centred on four transformational pillars for success.

Let’s accelerate your business journey, together.

1. Purpose-driven vision

Create a compelling, clear vision that answers your “why?” and drives every decision. Position your business to stand out, resonate deeply with customers, and inspire employees.

2. Market mastery

Pinpoint your ideal customers, define your unique edge and master the art of efficient marketing and sales. Automate where possible to free up time and scale faster.

3. Unstoppable teams

Build, lead and nurture a high-performing team. Harness frameworks like Tuckman’s Model and principles from Lencioni, John Adair and Ken Blanchard to foster a culture of trust, collaboration and productivity.

4. Sustainable growth strategies

Align operations, finances, and strategy to scale seamlessly. Navigate risks, anticipate trends and implement processes that ensure sustainable growth for years to come.

Agenda at a glance:

8:00 am – welcome breakfast and networking

8:15 am – keynote by Tony Kerley: Driving for Growth

9:00 am – interactive discussion & Q&A

9:30 am – exclusive offers and wrap-up

Exclusive benefits for attendees: Receive special discounts on Contigo Associates’ renowned consultancy and leadership services, including:

• 1-2-1 executive coaching

• bespoke leadership and management

• business strategy development

• tailored team-building solutions.

Power-up your business with expert guidance and tools designed to help you thrive. Don’t miss out! Secure your spot now, as there are only 20 free spaces available.

THE thought of dragging yourself out of bed on a damp, cold January Monday morning is hard enough under normal circumstances – so imagine how much more unpleasant it became upon reading the morning headlines on the BBC news website and discovering I hadn’t actually done any proper work for the past 35 years.

Yes, according to Lord Rose, former boss of Marks and Spencer and Asda, working from home is creating a generation who are ‘not doing proper work’.

So, building one of the area’s most respected media relations consultancies and then creating from scratch the UK’s leading regional B2B magazine, all whilst working very happily from home, clearly couldn’t have really happened – just a Bobby Ewing dream sequence obviously (one for the oldies there).

Clearly the whole working from home debate shows no sign of abating. With large companies including Amazon, Boots and JP Morgan now requiring their head office staff to be in every day, Lord Rose added further fuel to the debate by telling BBC Panorama that home working was part of the UK economy's ‘general decline’ and employees' productivity was suffering.

Now everyone has at least one hobby horse, and hybrid working is mine. In fact, I tell a lie – I actually have two hobby horses but, in hindsight, I now believe they are intertwined. The other is the sad demise of LinkedIn during the past year or two, to the point it is now dominated - from where I view it anyway - by a small but alarmingly active (as in at least one post a day) band of people bearing their souls and seeking sympathy on issues I wouldn’t really want to read on Facebook, let alone LinkedIn. And those that aren’t indulging in such matters are instead conducing puerile surveys in the hope, no doubt, it will boost

their LinkedIn profile. There’s one woman who must comment on every other post on LinkedIn. How she finds the time to run her own business is beyond me.

My theory is (and I stress without any authoritative research of any kind, just gut feel) that most of the people living their lives on LinkedIn are people who perhaps used to work in an office and now work mostly from home – and who sadly struggle coming to terms with the more isolated working environment. Anyway, I digress – back to the home working debate or, perhaps we should more accurately say, hybrid working debate, for hybrid working is surely the hub of this whole debate.

There is a percentage of people who, either by the nature of their job or personal circumstances, need to work in ‘the office’. There is a percentage who can work highly effectively and happily without stepping foot in ‘the office’ ever again. Both these groups should be left to go their own way. It’s the fairly large percentage in the middle the debate should focus on.

The easy, dare I say lazy, answer is to dictate everyone must work in the office full-time. But this is an awful waste of an opportunity Covid afforded us to review working practices in line with 21st century conditions. The advantages of working from home two or three days a week are manifold: less congestion on roads, less pollution of the atmosphere, better worklife balance, happier staff leading to better staff retention and, many argue, greater staff productivity. This latter issue really seems to divide opinion. Resolve this and the picture probably becomes clearer as, at the end of the day, most bosses are more interested in productivity than the other aforementioned benefits.

In the winter issue of BusinessTime in Essex, we ran a fantastic article by Jessica Douglas, Head of People and Corporate Services at Colchester City Council, who argued articulately and forcefully for flexible working being a win-win for employee and employer.

She stated that employee productivity at the council had actually risen with the introduction of flexible working. If you haven’t yet read it, please do, as it’s a great example of how hybrid working can and should work.

With the current Government keen to pursue more flexible working options, as evidenced by its Employment Rights Bill introduced in the autumn, it is clearly going to be an interesting year or two ahead. It would appear that sooner rather than later, businesses will have a lot of the choice taken away from them and will be forced to recognise the right of their employees, where appropriate, to work part of the time away from the office. The challenge will be for HR leaders to recognise this inescapable fact and set the wheels in motion for a smooth transition, being mindful both of legislation and common sense.

In the next couple of pages, we take a look at what could lie ahead…

TWO prominent business leaders, Lord Alan Sugar and Asda boss Lord Rose, spoke recently about hybrid working, expressing opinions strongly in favour of a back-to-theoffice approach for most workers and, in Asda’s case, changing company policy to enforce a three-day week minimum office time.

This had a mixed response in the media, with very strong views on both sides of the argument. But, what is better for our health?

Firstly, we need to look at the concept of health, as it often means different things to different people. ‘Health is the absence of disease or infirmity’ was the western definition of health until 1948. This defined health in a negative sense - by the absence of, rather than a positive state.

In 1948, the World Health Organisation established a more positive definition: ‘health is a state of complete physical, mental and social well-being and not merely the

absence of disease or infirmity.’ In this way, both internal and external factors are considered, health is defined as a resource for living.

From a workforce perspective, few would argue that a cohesive workforce requires at least some face-to-face time. In an article for Entrepreneur, David Nilssen argues that hybrid work can create a divided workforce, leading to challenges with inclusivity, productivity, scheduling, and company culture. Writing for Harvard Business Review, Mark Mortensen highlights that hybrid work environments can sometimes become toxic. He points out that the varied contexts in which employees work can lead to disrespect, noninclusivity and other negative behaviours.

On the plus side, and from the perspective of individual health, articles from Psychology Today and The Stanford Report suggest there are many benefits to hybrid work, the key highlights are shown below.

Krekel et al, writing in the Global Happiness and Wellbeing Policy report 2019, showed the health and wellbeing of employees is linked to increased productivity.

Hybrid working offers several health benefits, supported by various studies and reports.

Improved physical health: hybrid workers tend to exercise more, sleep longer and eat better. A study by IWG found hybrid workers exercise for almost 90 minutes more a week, get an extra 71 hours of sleep a year, and have healthier eating habits.

Alix Sheppard, Director at Colchester-based public health consultancy, Health Talks, examines the health benefits of hybrid working.

Better mental health: the same study revealed 66% of hybrid workers reported improved mental well-being due to additional personal time. This extra time allows for better work-life balance, reducing stress and burnout.

Enhanced employee well-being: hybrid work arrangements can lead to a more engaged and productive workforce. Employees have more control over their schedules, which can lead to higher job satisfaction and lower turnover rates.

Reduced commute stress: by reducing the number of days employees need to commute,

hybrid working can decrease the stress and time associated with daily travel. This can lead to a more relaxed and focused work environment.

Healthier lifestyle choices: with more time at home, employees can prepare healthier meals and have more opportunities for physical activities like walking or running.

As employers, we should individually consider the needs of the business and carefully balance these with the needs of our workforce. Hybrid working, when managed effectively, can facilitate a flexible, productive, and satisfied workforce.

FLEXIBLE working is not only about where you work of course – it’s also about when you work.

Marketing agency, VerriBerri, was one of the first Essex businesses to implement the four-day working week structure and is encouraging more companies to follow suit.

As a forward-thinking agency, the company has always thought outside the box when it comes to employee wellbeing. Initially skeptical about remote working due to the highly collaborative nature of the business, the firm instead explored alternative ways to enhance flexibility while maintaining productivity. The concept of a four-day workweek was first proposed by senior management in 2018 but was initially trialed for three months before making a long-term commitment.

Under the new way of working, employees transitioned to an 8am-6pm schedule across four days, ensuring salaries remained unchanged. The transition during the trial period was seamless and the benefits were almost immediate. Employees embraced the change, reporting

higher job satisfaction, increased motivation and improved work-life balance. The four-day week was therefore extended into a full-time routine for members of the team who wanted to opt into it. There are some team members who prefer a more traditional 9-5 still, which the business also accommodates.

Employee days off are staggered so at least one team member from each department is always available. This approach eliminated service disruptions and, in fact, clients responded positively to the new system. Many appreciate working with a company that values employee welfare, are interested in how it works and have even considered implementing it themselves as a result.

Staggering days off and having longer days not only ensures VerriBerri’s office is open five days a week, but has extended the businesses opening to 8am-6pm, which has also been a positive for clients.

Assistant Director, Amy Spooner, said: “We immediately noticed that staff were happier, more motivated and more energised after a

three-day weekend. In our line of work, creativity is so important and this allows the team time to explore other creative avenues. Some of our staff have been able to start new business ventures, establish side hustles and pursue passion projects with their day off, transferring their skills to their work here at VerriBerri.”

Beyond enhanced creativity, staff retention has also increased which management puts down to an increase in employee satisfaction and welfare, but also because staff feel valued and appreciate the flexibility, so want to stay loyal to the business.

There are key policies in place to ensure fairness and consistency; for example, employees can’t swap their designated day off and if additional time off is needed, they must request annual leave. This structure ensures operational stability while maintaining the integrity of the four-day workweek model.

VerriBerri has recently been accredited by Four Day Week Foundation. Having seen the benefits first hand, they are an example of how successful the four-day week can be for both employee welfare and business performance.

PRIOR to the pandemic, for most organisations, the idea that someone worked exclusively remotely or even partly remotely was relatively rare in many sectors but certainly not unheard of.

The technology existed (and has had significant investment and improvement since), but for various reasons, there was resistance - even if the role could be carried out effectively remotely.

When the pandemic hit, organisations that had resisted remote working put in place remote working arrangements and mandated remote working - there was no choice! For most organisations and individuals, the choice was binary: remote work or no work. Many adapted - and adapted well.

According to (or derived from) statistics collated by the Office of National Statistics, in the period October to December 2019, homeworking in the UK was at 4.7 million. By January to March 2022, that had risen to 9.9 million people. In terms of percentages, in May 2020, 33% of the working population worked from home only. This dropped significantly to 16% by December 2024, whilst hybrid working rose from 8% to 25% in the same period, and those attending the workplace rose from 29% to 41%.

Some of this will be workforce demand with individuals benefitting from working remotely, for example, to suit their personal preferences and circumstances and to achieve a better work-life balance. Others believe, and I agree, some are more effective

when working remotely without the interruptions a workplace environment sometimes brings. Others may have been driven by organisational inertia, with companies hesitant to force employees back into the office for fear of uproar. How many organisation leaders have truly reflected on their business postpandemic with a laser focus to understand what worked, what didn’t and what could be improved?

Businesses absolutely should review operating practices regularly. Things change, often rapidly, and what worked yesterday may not be suitable for today, let alone the future. An organisation’s location of work strategy requires regular review - should it mandate a workplace-only, remote-only, or hybrid approach?

The starting point for every organisation is the roles that make it up. Focus on the role, not the individual carrying it out, and consider each one separately. What are the duties of each role? Where can those duties practically be carried out? Where are they most effectively performed? Be realistic, and don’t fall into the trap of assuming that the way things have always been done is the best way. Generally speaking, organisations that remain static don’t succeedeven leading brands, such as Coke, change their design and recipe!

If some duties require workplace presence and others can be (effectively or otherwise) carried out remotely, can some or all of the duties be organised or planned to be done at certain times on certain days so that a hybrid strategy could be effective?

If you sketch it out, you might draw two circles: one for duties

Julie Temple, Partner, Head of BLHR and Employment Team at Birkett Long, offers advice to businesses looking to formulate a hybrid working strategy.

that require workplace presence and the other for duties that can be (effectively or otherwise) performed remotely. In some cases, there will be an overlap between the two circles. The size of each circle and the overlap will vary depending on the role. Since this approach focuses on individual roles rather than a global approach across the entire organisation, the results will differ from role to role - and that’s expected. There might just be one circle!

Of course, dealing with roles within an organisation in complete isolation is shortsighted and likely unsustainable. Roles interact with other roles, and this must be factored into the location of work strategy. This means identifying interactions across roles, teams, departments and, in some cases, locations. Organisations then need to ask -,again, for each interaction - how and where it can be carried out and how effective each approach is. Can these interactions be planned and organised to support an effective hybrid approach?

A role-focused system centred on the roles within the organisation is essential for developing a location of work strategy. However, this must be balanced with the needs of the individuals who perform these roles. This is where legal risks arise.

Changes in work location could lead to breach of contract claims, discrimination claims based on location, lack of flexibility, or issues arising from flexible working requests. Minimising these risks requires a balance between what the organisation needs from a role (already identified) and what can practically be achieved, compared to what is effective and acceptable to the organisation - a balance that should withstand scrutiny.

There is no one-size-fits-all answer, and neither should there be. Each role is different, each person is different and organisations should strive for equity (considering roles and circumstances individually) rather than equality (treating every role and individual the same regardless of circumstances). If you are in doubt, seek specialist legal advice.

More than ever before image is everything. That’s why when it comes to your business it really does pay to invest in excellent photography.

In the digital era, content is king! Websites and social channels all demand images that stand out, will intrigue people to know more about your business, people

and products. This is something you simply cannot get with a stock image. It’s also a skill. If you wonder why your competitors are getting more engagement and followers, look at their content. Are they producing more dynamic images and film? Are they better storytellers? Often, the winners aren’t those with an award-winning new product, just an ability to excite audiences through the power of pictures.

Cameras on mobile phones can be a real asset, but without an experienced pair of hands behind the lens, they can also be a company’s downfall. Often, you’ll find the file size is too small, the lighting and camera angle poor. When you have a great image, you want it to really work for you. It needs to engage not only online but also provide a great visual for large-scale exhibition stands, direct mailers, brochures and annual reports.

Every picture tells a story

Carl Allen, Director at Colchester-based Big Wave PR, stresses the importance of not cutting corners when it comes to getting your image spot-on.

Our in-house photographer understands the editorial needs of a press image and our photos have gained column inches in The Times, The Guardian, amongst many other trade and local titles.

At Big Wave PR, much of our work involves getting our clients on TV or in the press. In the media, pictures sell stories. A great photo can be the difference between a ‘news in brief’ to a page spread; the return on investment is so worthwhile.

To hire Big Wave PR for photography, PR, social media or event management , email: hello@wearebigwavepr.co.uk, or call Carl on: 01206 231807 –www.wearebigwavepr.co.uk.

Tell us more about your role at Scrutton Bland.

As an Audit Partner, I head up the corporate team at our Colchester office. We’re a team of around 15, all with lots of different experiences, from school leavers to established senior managers. Together we work with businesses across a wide range of sectors, from owner-managed SMEs to national and international companies based in Essex.

What’s your career history so far?

I’ve worked in audit and accounting for my entire career, having started as a graduate trainee more than 30 years ago. I’ve worked my way up to Audit Partner and then on to Managing Partner of BDO’s Cambridge office, having been part of the team that had successfully set up the Cambridge office from scratch.

Finance wasn’t necessarily the career route I planned to take, as I studied languages at university. But I’ve carried this through my career as a reminder of how those from non-finance backgrounds can bring different perspectives

to the industry, with a wide range of problem-solving skills and the ability to think ‘outside the box’.

What are your career highlights?

There have been plenty, but some of those that stand out are an audit client who went public in the US – a huge piece of work that I was very proud to be involved with. Similarly, a UK life sciences company I worked with was a really interesting and fun project. And the biggest challenges?

Rapidly expanding our team from 16 to 45 people in just three years was a challenge, but one I thoroughly enjoyed. We built up an international team made up of more than 12 different nationalities. Despite the occasionally leftfield problems that come with managing a large team, we consistently came out top in staff satisfaction surveys.

What would you tell someone at the beginning of their career that you wish you’d known?

Looking back now, I’d say to always have a clear understanding of what you contribute to both

your role and to the business. I think we’re all guilty of not reflecting on our achievements and accomplishments enough. Getting and giving recognition, and rewarding positive contributions is incredibly important. What do you enjoy most about your role?

Piers Harrison joined Scrutton Bland as a Corporate Partner in the Audit team in September 2024 and is based in the Colchester office. With years of experience in the industry, he took some time out this month to share more about his role at the firm, his career highlights, and the opportunities he’s most looking forward to as he works with businesses across Essex.

100% the people. Both the team I work with - I love being amongst a group of engaged and motivated individuals and helping them to develop and progressand the clients I build relationships with. Seeing businesses thrive and succeed, and learning from individuals across a diverse range of industries and businesses is both fascinating and motivating. What do you enjoy most outside of work?

Well, having spent the past 20 years bringing up a family, and all that goes with it, I suddenly have a lot more time on my hands as both kids are now at university. So, perhaps the golf course is calling me once again? Although having not played regularly for quite some time, I may need to get some practice rounds in!

Any sector specialisms?

The joy of audit is it covers each and every industry, but I particularly enjoy working with manufacturing and distribution companies, tech and life sciences, US businesses, and private equity backed businesses.

Having not long joined the business, I’m still very much enjoying the opportunity to get to know our clients and their various industries in depth. I’m

always keen to hear from Essex businesses who’ve recently taken external investment, or from those looking to expand nationally or internationally, to offer audit advice and support. So, please do get in touch or connect on LinkedIn, I’d love to hear from you.

Tell us a bit more about audit services at Scrutton Bland

A thorough external audit helps you to make informed decisions about your business. Whether legally required or not, it allows specialists to take a detailed look at your business to verify your financial statements, keep you compliant and reveal ways to improve your systems and controls.

At Scrutton Bland, our audit services are designed to give you clarity, confidence and compliance, offering certainty of your current financial situation and showcasing where opportunities lie to improve your systems and processes. Along with a better understanding of how to satisfy stakeholders and potential investors, an audit puts you in a strong position if you need to access credit – as well as the knowledge you’re working in accordance with HMRC’s regulations and avoiding possible fines and penalties.

To find out more about audit services across Essex, speak to the team on 01206 838400, or visit www.scruttonbland.co.uk

INNOVATIONS that seemed futuristic just a few years ago are now integral to daily operations. For businesses, this rapid change presents both unprecedented opportunities and formidable challenges.

Staying competitive isn't just about keeping up; it's about anticipating and leveraging technology to drive growth, efficiency and innovation. For small and medium-sized businesses across Essex, there's an imperative to invest sensibly to avoid being marginalised by larger competitors.

This article delves into the key business challenges posed by technological evolution and underscores the importance of robust technology infrastructures across critical areas.

Digital transformation is no longer a choice but a necessity. Companies that fail to adapt, risk obsolescence as competitors leverage technology to enhance efficiency and innovation. A recent report from McKinsey highlights both analytical and generative AI can significantly improve innovation outcomes, including increased market fit and reduced time to market.

Organisations should begin by conducting a thorough assessment of their current digital capabilities. This involves evaluating existing technologies, employee skill levels and the overall digital culture. Identifying gaps in these areas is

crucial for developing targeted strategies to build necessary competencies.

Investing in employee training is paramount. A study published in arXiv emphasises the importance of organisational learning and knowledge development in advancing digital transformation, particularly for small and medium-sized enterprises. By fostering a culture of continuous learning, businesses can equip their workforce with the skills needed to utilise new technologies effectively.

Executive leadership plays a critical role in championing digital initiatives. Leaders must articulate a clear vision for digital transformation and allocate resources to support this transition. Business leaders need to adopt dynamic engagement models to drive successful digital transformations.

AI and automation are at the forefront of the digital revolution. Businesses can leverage AI to streamline operations, enhance customer experiences and drive innovation. For instance, AI can assist in product development by accelerating design processes and optimising testing phases, leading to faster time-to-market and improved product performance.

As technology advances, employees may experience a fear of becoming obsolete (FOBO). To mitigate this, companies should implement structured upskilling initiatives and promote a culture that embraces technological change. Encouraging collaboration between senior employees and techsavvy colleagues through reverse mentoring can also

Chris Hodson, Programme Director at Pitman Training in Essex, explores the key business challenges posed by technological evolution.

facilitate adaptation to new technologies.

The challenges presented by technological evolution are significant, but they are surmountable with the right knowledge and approach. Robust technology isn't just a support function—it's a strategic asset that can propel your business forward.

By focusing on critical areas such as cloud computing, AI, collaboration tools, data analytics, and cybersecurity, and by developing strategic planning and change management skills, you can navigate the digital landscape effectively.

Many businesses are finding benefit in appointing a digital systems champion who acts as a catalyst for transformation. It's an investment in your leadership capabilities and your organisation's future success.

Discover the unparalleled charm of Hylands House and the contemporary elegance of the Grand Pavilion, set amidst breathtaking parkland. If you’re in search of a truly remarkable venue for your business events, look no further.

• Company Away Days

• Go Ape Team Building

• Exhibitions & Trade Fairs

• Filming & Photography

• Hybrid Meetings

• Awards Ceremonies & Dinners

ROM April 6 2025, the thresholds determining whether a company requires a statutory audit in the UK are set to increase.

This change is aimed at reducing regulatory burdens on small and medium-sized businesses. While this will exempt more companies from mandatory audits, it is essential for business owners and finance leads to understand the implications and plan accordingly.

The Government has decided to increase the audit thresholds as part of broader efforts to support business growth and ease financial and administrative obligations. By raising the thresholds, the Government aims to reduce costs for SMEs, allowing them to focus on expansion and investment.

Currently, companies must undergo a statutory audit if they meet two of the following three criteria: annual turnover of more than £10.2 million, gross assets exceeding £5.1 million and more than 50 employees.

From April 6, these thresholds will increase to annual turnover of £15 million, gross assets exceeding £7.5 million and more than 50 employees.

Companies exceeding two of these new criteria will still require an audit, but many

that previously needed one will no longer be obligated.

The new thresholds will impact businesses currently just above the existing audit criteria. Those that now fall below the new limits may no longer need an audit. However, some businesses, including regulated entities such as those authorised by the Financial Conduct Authority (FCA), will not be affected by the changes and must still comply with existing audit requirements. This includes insurance brokers, which may require a client money audit rather than a full statutory audit.

Additionally, charities have separate audit thresholds, and these changes do not apply to them. Trustees and finance teams in charities should ensure they continue to meet their specific audit requirements.

For businesses close to the current thresholds, it is possible an audit may be required for just one year before falling below the new limits. This is because the changes apply to accounting periods starting on or after April 6 2025. If a company is growing and expects to exceed the current limits before the new ones take effect, they may need to consider whether changing their financial yearend could help them manage this transition.

Furthermore, businesses below the new thresholds should still assess whether an audit is beneficial. Many lenders, investors, and stakeholders require audited financial statements,

Michael Greene, Partner Streets Whittles Chartered Accountants which has offices in Colchester and West Mersea, explains the upcoming changes to audit thresholds.

even when not legally mandated. External assurance can enhance credibility, strengthen governance, and improve financial oversight.

If a company is no longer required to have a statutory audit, other financial assurance options can provide value, such as assurance reviews (a lighter-touch review) agreed-upon procedures (specific financial checks tailored to stakeholder requirements) and internal audits.

With the threshold increase approaching, business owners and finance leaders should review their audit obligations now. Engaging with an auditor early will help assess whether an audit is still needed, what alternative services may be beneficial and how to manage the transition.

THE route looks a little different now we have a Labour government in charge. Its first budget, last October, brings big changes, including employer National Insurance rates rising to 15%, boosts to capital gains tax rates, a 4% bump to the state pension and VAT added to private school fees.

Sluggish growth is likely to continue throughout 2025, with global GDP predicted to grow less than 3%. Landlords face a 2% hike in stamp duty for second homes, while first-time buyer relief remains unchanged. On the bright side, house sales are up 29% from last year (according to Rightmove), and mortgage rates should ease in 2025.

Supply chain issues in 2025 will see many businesses shifting gear to local suppliers due to climate and political challenges. AI and tech are helping automate and optimise processes, and growing consumer and regulatory demands will push companies to adopt more sustainable supply chain practices.

With disruptions ongoing, businesses would be wise to reassess their insurance policies to ensure sufficient cover, as they steer towards the new landscape of localised sourcing and sustainable operations.

In the autumn Budget, the UK raised its windfall tax on oil and gas profits to fund clean energy initiatives such as carbon capture, nuclear and green hydrogen. Gas and electricity prices are set to rise through the early part of this year, but long-term investments aim to stabilise costs, whilst increasing climate events raise risks and widen the protection gap when it comes to insurance.

As a result, businesses might need to change course to make sure their business interruption insurance adequately covers these risks and to adopt proactive strategies on route to a robust UK energy infrastructure.

The UK’s food self-sufficiency is at a critical low due to the convergent bumpy roads of Brexit, labour shortages, nature loss and extreme weather, with climate change posing

long-term risks to domestic food production. These challenges increase insurance risks in areas such as business interruption, agriculture and product recalls.

Businesses should reassess their insurance coverage to address their specific risks when it comes to an uncertain food supply terrain and ensure their resilience as they drive into the future.

Construction costs have been on a shaky path for a while, and are set to rise further in 2025, due to stricter environmental regulations which plan to offer long-term savings in the future through sustainable practices. A skills shortage also threatens short-term progress and rising insurance costs may lead to higher premiums, meaning construction firms must make sure their policies cover changes in materials, timelines or project scopes to mitigate potential disruptions and financial dents.

New EU CO2 standards will continue to drive demand for electric vehicles this year. While EVs are currently exempt from Vehicle Excise Duty (VED), this ends in April 2025, raising costs for many drivers. The luxury car market, meanwhile, fuelled by demand for premium electric options, is set to grow significantly, and overall, car insurance premiums continue to rise, due to inflation-driven repair costs, advanced vehicle technology and a rise in fraudulent claims, bringing headaches for drivers.

Looking at the current skyline of commercial property, the demand for rental properties has

As businesses, we have already embarked on our professional journeys of 2025, hopefully with a full tank and sturdy wheels, but what is the view ahead for small and medium businesses in the UK this year? Where are the bumps in the road and what will be the major landmarks? Matthew Collins, Director at Chelmsfordbased Ascend Broking Group, examines some notable signposts on the UK economic landscape to look out for and navigate in 2025.

surged and renting remains more affordable than buying (despite the continued rise in rents), but there are changes in view. Starting this year, all leased commercial properties must have a valid EPC, and new leases will need a rating of C or higher.

Increased demand is driving applications to convert commercial properties into residential units, offering landlords opportunities but also regulatory challenges. Insurance rates for properties have risen since 2017, and costs to repair and maintain property remain high. Crucially, many SMEs lack accurate rebuild valuations for their premises, requiring a review of insurance coverage to avoid underinsurance and coming off badly in a claim.

The wider backdrop to any business’s journey through 2025 is the current geopolitical climate, shaped by conflicts such as Ukraine, tensions in the Middle East, USChina trade friction and significant elections in the US, Taiwan, and the UK. These factors continue to drive uncertainty in the global economy, affecting the UK economy with inflation, market volatility and disrupted supply chains, and challenging the insurance market's risk assessment and pricing models.

All signals considered, it could be a bumpy ride for UK businesses this year, but the more we understand what lies on the road ahead, the better we can equip ourselves for any eventuality. With forethought and a good roadmap in hand, there’s no reason not to thrive, wherever 2025’s route may take us.

THE East of England is a thriving region of innovation and enterprise, home to businesses that are driving growth across a wide range of sectors.

At Anglia Ruskin University (ARU), we just don’t work with businesses but rather for businesses, by assuring access to cutting-edge research, fresh ideas and new skills.

A Knowledge Transfer Partnership (KTP) offers a unique opportunity by connecting your business with academic expertise and talented graduates. So, what is a KTP?

A KTP is a dynamic, three-way collaboration between: