BENEFITS GUIDE

It’s Your Health. Get Involved

Your health is a work in progress that needs your consistent attention and support. Each choice you make for yourself and your family is part of an ever changing picture. Taking steps to improve your health such as going for annual physicals and living a healthy lifestyle can make a positive impact on your well being

It’s up to you to take responsibility and get involved, and we are pleased to offer programs that will support your efforts and help you reach goals.

Health Care Services

Preventive care includes services like checkups, screenings and immunizations that can help you stay healthy and may help you avoid or delay health problems Many serious conditions such as heart disease, cancer, and diabetes are preventable and treatable if caught early It’s important for everyone to get the preventive care they need. Some examples of preventive care services are:

o Blood pressure, diabetes, and cholesterol tests

o Certain cancer screenings, such as mammograms, colonoscopies

o Counseling, screenings and vaccines to help ensure healthy pregnancies

o Regular well baby and well child visits

Some immunizations and vaccinations are also considered preventive care services Standard immunizations recommended by the Centers for Disease Control (CDC) Include: hepatitis A and B, diphtheria, polio, pneumonia, measles, mumps, rubella, tetanus and influenza although these may be subject to age and/or frequency restrictions.

What’s Covered

Generally speaking, if a service is considered preventive care, it will be covered at 100%. If it’s not, it may still be covered subject to a copay, deductible or coinsurance. The Affordable Care Act (ACA) requires that services considered preventive care be covered by your health plan at 100% in network, without a copay, deductible or coinsurance . To get specifics about your plan’s preventive care coverage, call the customer service number on your member ID card You may want to ask your doctor if the services you’re receiving at a preventive care visit (such as an annual checkup) are all considered standard preventive care.

If any service performed at an annual checkup is as a result of a prior diagnosed condition, the office visit may not be processed as preventive and you may be responsible for a copay, coinsurance or deductible To learn more about the ACA or preventive care and coverage, visit www.healthcare.gov

You and your dependents are eligible to join the EspriGas benefit plans if you are a full time employee regularly scheduled to work 30+ hours per week. You must be enrolled in the plan to add dependent coverage.

• Your spouse to whom you are legally married

• Your domestic partner with whom you have shared a residence and financial obligations for 6 months or more

• Your dependent child under the maximum age specified in the Carriers’ plan documents including:

• Natural child

• Adopted child

• Stepchild

• Child for whom you have been appointed as the legal guardian

*Your child’s spouse and a child for whom you are not the legal guardian are not eligible.

The Dependent Maximum Age Limits is up to age 26. The dependent does not need to be a full time student; does not need to be an eligible dependent on parent’s tax return; is not required to live with you; and may be unmarried or married

Once the dependent reaches age 26, coverage will terminate on the last day of the birth month.

A totally disabled child who is physically or mentally disabled prior to age 26 may remain on the if the child is primarily dependent on the enrolled member for support and maintenance.

Your benefits become effective on your 1st day as a full time employee with EspriGas.

Each year during the annual Open Enrollment Period, you are given the opportunity to make changes to your current benefit elections To find out when the annual Open Enrollment Period occurs, contact Human Resources

You are allowed to make changes to your current benefit elections during the plan year if you experience an IRS approved qualifying change in life status . The change to your benefit elections must be consistent with and on account of the change in life status.

IRS approved qualifying life status changes include:

• Marriage, divorce or legal separation

• Birth or adoption of a child or placement of a child for adoption

• Death of a dependent

• Change in employment status, including loss or gain of employment, for your spouse or a dependent

• Change in work schedule, including switching between full time and part time status, by you, your spouse or a dependent

• Change in residence or work site for you, your spouse, or a dependent that results in a change of eligibility

• If you or your dependents lose eligibility for Medicaid or the Children’s Health Insurance Program (CHIP) coverage

• If you or your dependents become eligible for a state’s premium assistance subsidy under Medicaid or CHIP

If you have a life status change, you must notify the company within 60 days for changes in life status due to a Medicare or CHIP event and within 30 days of all other life events.

If you do not notify the company during that time, you and/or your dependents must wait until the next annual open enrollment period to make a change in your benefit elections.

Please note, loss of coverage due to non payment or voluntary termination of other coverage outside a spouse’s or parent’s open enrollment is not an IRS approved qualifying life event and you do not qualify for a special enrollment period.

Go to www employeenavigator com and click Login

• Returning users: Log in with the username and password you selected. Click Reset a forgotten password.

• First time users: Click on your Registration Link in the email sent to you by your admin or Register as a new user. Create an account and create your own username and password

• The EspriGas company identifier = ESGAS

After you login, click Let’s Begin to complete your enrollment and additional required tasks if applicable

After clicking Start Enrollment, you’ll need to complete some personal & dependent information before moving to your benefit elections.

Have dependent details handy. To enroll a dependent in coverage you will need their date of birth and Social Security number.

To enroll dependents in a benefit, click the checkbox next to the dependent’s name under Who am I enrolling?

Below your dependents you can view your available plans and the cost per pay To elect a benefit, click Select Plan underneath the plan cost

Click Save & Continue at the bottom of each screen to save your elections.

If you do not want a benefit, click Don’t want this benefit? at the bottom of the screen and select a reason from the drop down menu.

If you have elected benefits that require a beneficiary designation or completion of an Evidence of Insurability form, you will be prompted to add in those details

Review the benefits you selected on the enrollment summary page to make sure they are correct then click Sign & Agree to complete your enrollment

You can either print a summary of your elections for your records or login at any point during the year to view your summary online.

If you miss a step you’ll see Enrollment Not Complete in the progress bar with the incomplete steps highlighted. Click on any incomplete steps to complete them

You are finished You can go back to your homepage to view your elections and you can make changes until the enrollment window closes.

You can login to review your benefits 24/7!

IN –NETWORK Plan Highlights

$1,500 PPO Plan

$3,000 HSA Plan

Coinsurance 20% 10%

Calendar Year Deductible

Individual $1,500 $3,000 Family $3,000 $6,000

Out of Pocket Maximum

Individual $5,000 $5,000 Family $10,000 $10,000

Preventive Care $0 $0 TelaDoc $0 $10

Office Visit Copays

Primary Care Physician $30 Ded + 10% Specialist $75 Ded + 10%

Emergency Room Copay (In and Out of Network) $600 Ded + 10%

Urgent Care $100 Ded + 10%

Inpatient Hospital & Services Ded + 20% Ded + 10%

Outpatient Hospital & Services Ded + 20% Ded + 10%

Prescription Drugs

Tier 1 / Tier 2 / Tier 3 / Tier 4 $10/$40/$75/25% Ded + 10%

OUT-OF-NETWORK

Coinsurance 50% 50%

Calendar Year Deductible

Individual

Family

Out of Pocket Maximum Individual

COST PER PAYCHECK

Employee Only

Employee Spouse

Employee

Family

Above

$6,000

$10,500

$18,000

$81.33

To

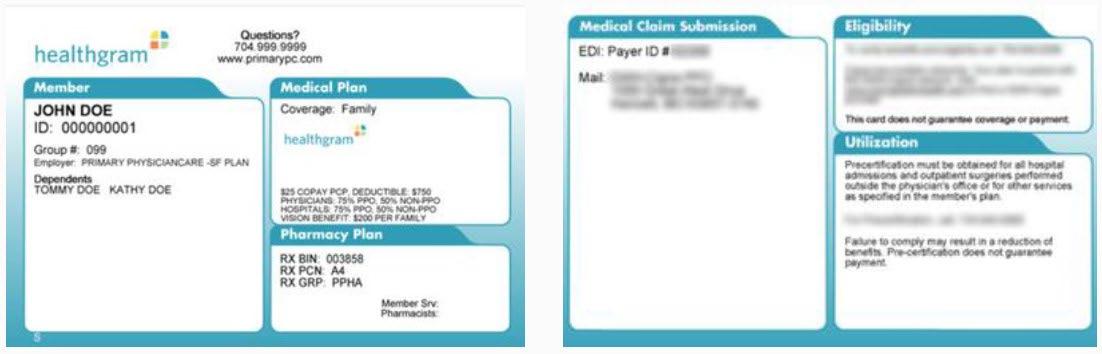

Your ID card details the

It

being mailed to the

address you

in Employee Navigator. Provide your new ID Card to your

1st.

Member support: 1-866-904-9081

after

Your

Your

To

You need help quickly to confirm that a local doctor is in network, or maybe you’ve developed a cough or been diagnosed with a condition and are not sure where to receive care. No matter how you enter the healthcare system, there are times when questions are met with even more questions, when what you need is answers.

Help is on the way.

Your employer has teamed up with Healthgram to bring you a solution . Healthgram Connect aligns you with a knowledgeable Health Advisor. Your Advisor, who is supported by a team of medical and benefits experts, is ready to answer any questions you have about your benefits or care. That means everything from network questions to appointment scheduling to billing!

Find the right doctor, hospital or facility for your specific needs

Resolve insurance- related issues from claims status inquiries to billing

Understand your benefits including all coverage questions and issues

Estimate medical costs and in some cases, help you earn money

Stay healthy with the help of alert reminders for upcoming screenings

$22.74

$33.94

EspriGas employees have the option to purchase Identity Protection through Allstate. Coverage includes identity monitoring, credit monitoring, full remediation and up to $1 million expense coverage and stolen funds reimbursement.

Employee Only $4.59 Family $8.28

Accident coverage provides lump sum benefits for common on/off job accidental injuries and related treatments. Benefits are payable for covered injures such as dislocations, fractures and burns; and treatments including ER visits, x rays and surgery.

Critical Illness is group specified disease insurance designed to help employees and their families maintain financial security during the lengthy, expensive recovery period of a serious medical event such as cancer, heart attack or stroke. Critical Illness provides a lump sum benefit if you or a covered family member are diagnosed with a critical illness.

See Employee Navigator for more details and pricing.

https://www.fidelity.com/

To be eligible for participation in the plan, you must be an active employee with 6 full months of service Once eligible, the Company will match your deferral contributions up to 3%, and then 50 cents on the dollar after, up to a 5% total match. You are welcome to transfer any funds into the plan prior to your payroll contribution eligibility date.

You are always 100% vested in your own employee Deferral Contributions and earnings in the Plan. Whole years of service with your Employer will be counted to compute your years of service for vesting purposes.

Years of Service Vesting Percentage less than 3 0 3 100.00

A Health Savings Account (HSA) is like a 401(k) for healthcare. It is a tax advantaged personal savings or investment account that you can use to save and pay for qualified health expenses, now or in the future.

Funds contributed to the HSA are not subject to federal income tax at the time of deposit.

Withdrawals for qualified medical expenses are also tax free.

HSA funds may be used to pay for qualified medical expenses at any time without federal tax liability or penalty.

HSAs are portable, which means you keep your HSA, even if you leave EspriGas or are unemployed.

Funds roll over and accumulate year to year if not spent.

1. You must have coverage under an HSA qualified HDHP there can be no secondary medical coverage in place

2. Once covered by a qualified HDHP, you may open an HSA and contribute up to the 2022 regulatory limits

3. Pre tax contributions to your HSA can continue until age 65 and you’re enrolled in Medicare Part A. If you are currently enrolled in Medicare, are currently being claimed as a dependent on another person’s tax return, or have coverage through Tricare or the Veteran’s Administration, you are not eligible to open an HSA

3. Once your HSA is established and you have a qualified expense you may:

• make a tax free withdrawal from your account to cover the costs, or

• pay out of your pocket and save your HSA for future qualified expenses

5. HSA money rolls over indefinitely so you may allow the money to accumulate for use in retirement!

Only IRS qualified healthcare expenses are eligible for reimbursement from an HSA. Any funds used for nonqualified expenses are taxable as income and subject to a 20% tax penalty.

Maximum contributions for calendar year 2023 are listed below. This amount includes employer contributions.

• $3,850 for Individual coverage

• $7,750 for Family coverage

• Additional $1,000 for “Catch Up” age 55 and older

For the 2022 2023 plan year, EspriGas will contribute a dollar for dollar match to the employee’s Health Savings Account up to $750.

Looking to MAX OUT your employer contribution? Based on the 2023 contribution limits:

Individual Coverage $3,850(max) $750(employer contribution)= $3,100/26= $119.23 contribution per pay

Family Coverage $7,750(max) $750(employer contribution)= $7,000/26= $269.23 contribution per pay

Examples of HSA eligible expenses are copays, deductibles, qualifying prescriptions, and qualifying medical equipment. A full description of qualified HSA expenditures can be found in IRS Publication 502 and is located on the web at www.irs.gov/pub/irs pdf/p502.pdf.

You may not enroll in the FSA if you are contributing to an HSA.

Provided by SurencyEspriGas offers employees the opportunity to participate in the Healthcare Flexible Spending Account (FSA) and Dependent Care FSA These programs may provide you with significant tax advantages as they allow you to pay for eligible out of pocket expenses with pre tax dollars through payroll deductions It is very important that you estimate your annual expenses as accurately as possible because the plan only allows for a $570 carryover maximum annually.

You may defer up to $2,850 to your Healthcare FSA to fund eligible out of pocket healthcare expenses. The following list provides examples of expenses eligible for reimbursement under the IRS guidelines:

• Non covered medical expenses that quality under Section 217 of the IRS code

• Deductibles

• Office visit copays

• Prescription medication

• Over the counter medications (require physician prescription)

• Hearing and dental expenses not covered by insurance

For a searchable list of FSA eligible expenses please visit: www.fsastore.com

Examples of non eligible expenses include cosmetic surgery, electrolysis, toiletries, vitamins, health club dues.

You may defer up to $5,000 to your Dependent Care FSA to fund eligible out of pocket expenses for childcare and eldercare To be eligible for reimbursement, expenses must meet the following criteria established by the IRS:

▪

The person cared for must be under age 13, or if older, physically or mentally incapable of self care.

▪ Day care must be necessary in order for you and your spouse to work

▪ The person cared for must be claimed as a dependent on your federal tax return and must reside in your home at least eight hours per day.

▪ Payment for care cannot be made to anyone you claim as a dependent on your income tax return, to your spouse or to a child under age 19.

▪ If care is provided by a center that cares for more than six individuals, it must be licensed.

For a complete list of eligible medical and dependent care expenses, you may access publications #502 (healthcare) and #503 (dependent care) on the web at www.irs.gov.

Don’t wait weeks for an appointment and skip the trip to urgent care. Teledoc connects you with the right care — right now.

No matter what you face the Teledoc doctors, therapists and specialists are available 24/7 to diagnose and treat many common medical conditions and provide guidance to move forward in treating a serious medical condition.

Teladoc doctors can treat and diagnose many common medical conditions, including:

• Cold and flu symptoms

• Allergies

• Ear Infections

• Pink Eye

• Respiratory Infections

• Sinus Problems

• Skin Problems, and More

When you use Teledoc to treat an injury, illness or to get the advice you need, the cost is simple with a $0 or $10 copay per visit (depending on your medical plan).

Most people download the app or get started online. You can also call 1 800 Teladoc. Then fill out a brief medical history like you would at a doctor’s office.

Employees and dependents enrolled in medical coverage will be automatically enrolled in the Vitality wellness program.

The Vitality program has all kinds of healthy activities to inspire you to be the healthiest you can be for yourself, your friends and your family. Along the way, celebrate your accomplishments by earning Vitality Points® for the rewards you deserve.

1. Register at PowerofVitality.com

2. Download the Vitality Today mobile app from your app store.

3. Take the Vitality Health Review.

Vitality Points translate into Vitality Bucks that can be spent in the Vitality Mall, redeemable for gift cards and other great rewards like fitness devices and movie tickets.

Vitality Bucks = Vitality Currency!

Get Rewarded by EspriGas

Employees reaching Gold status will receive a $800 wellness incentive bonus.

Bonuses will be paid quarterly to employees who have earned Gold following quarter end.

Employees who have achieved Silver or Gold in the 2021 2022 plan year will qualify for the first quarter bonus in 2023.

Employees enrolled in medical will also have access to the following benefits.

Vitality Wellness Program earn rewards by maintaining or improving well-being through nutrition, healthy activates and preventive education.

Husk (formerly GlobalFit) – discounted gym memberships nationwide. Use eligibility ID, P12608, when registering.

SmartMatch offers Medicare eligible employees alternative coverage options.

KisX Card assist in scheduling planned surgeries and diagnostics at pre negotiated prices with top providers. Procedures such as: ankle & foot, arthroscopy, ear, elbow, gastroenterology, general surgery, hip, knee, neck & throat, shoulder, spine, urology, wrist & hand, and more!

Before seeking In-Network Providers through the health plan, just call a KISx Card Nurse regarding your elective procedure. By choosing a KISx Card provider, you will always pay $0.

To learn more about Surgery and Imaging benefits that are available to you text “tmg” to 64554

EspriGas provides all Full Time employees a $50,000 Basic Life and Accidental Death & Dismemberment (AD&D) benefit Life insurance pays your named beneficiary in the event of your death AD&D insurance will provide a benefit to your beneficiary if your death is the result of an accident. This coverage is provided through Guardian at NO COST to employees.

Voluntary Life Insurance and AD&D Employees are offered the option to purchase additional life insurance through Guardian. Rates will vary based on age and the benefit you select. All rates can be found in your Employee Navigator portal.

Employee: Increments of $10,000 up to a maximum of $500,000 subject to medical eligibility. At your initial enrollment, you are eligible for up to a $100,000 with no medical questions asked.

Spouse: Increments of $5,000 up to a maximum of $150,000 (not to exceed 50% of employee’s amount). Subject to medical eligibility. At your initial enrollment, your spouse is eligible for up to a $20,000 with no medical questions ask.

Child(ren): Increments of $5,000 up to a maximum of $10,000. Coverage begins at 15 days.

Through Guardian all full time employees are provided short term disability at NO COST.

Benefit Amount: 60% of weekly salary up to a maximum of $1,500 for non work related accidents or sicknesses

Waiting Period: Benefits begin on day 8

Benefit Period: up to 24 weeks

Voluntary Long-Term Disability

Through Guardian all full time employees are offered long term disability . Rates will vary based on age and the benefit you select . All rates can be found in your Employee Navigator portal

Benefit Amount: 60% of monthly earnings up to a maximum of $6,000 for a covered accidents or sicknesses

Waiting Period: 180 days

Benefit Period: up to Social Security Normal Retirement Age (SSNRA)

Assistance Program offers services to help promote well

with family and personal issues online

and by phone at 1 800 386 7055.

Questions on your benefits or need assistance with Claims, contact Sterling Seacrest Pritchard:

Human Resources

Jennifer Norris

770 367 9725 jnorris@esprigas.com

Megan Montrois 770 635 2294 meganm@sspins.com

NEED HELP WITH A CLAIM? BE SURE TO HAVE THE FOLLOWING INFORMATION WHEN CALLING:

Subscriber ID #

Date of Service

Name of Patient Name of Doctor, Facility or Hospital Copy of Bill or Explanation of Benefits (EOB)

Kristie Mercer | Darlene Moorman 770 635 2293 | 770 635 0439 kmercer@sspins.com | dmoorman@sspins.com

THIS GUIDE This brochure summarizes the health care and income protection benefits that are available to EspriGas and their eligible dependents. Official plan documents, policies, and certificates of insurance contain the details, conditions, maximum benefit levels and restrictions on benefits. These documents govern your benefits program. If there is any conflict, the official documents prevail. These documents are available upon request through your Human Resources department. Information provided in this brochure is not a guarantee of benefits.

EspriGas , in accordance with HIPAA, protects your Protected Health Information (PHI). We will only discuss your PHI with medical providers and third party administrators when necessary to administer the plan that provides you your medical, dental and vision benefits or as mandated by law A copy of the Notice of Privacy is available upon request through your Human Resources department.

If you have had or are going to have a mastectomy, you may be entitled to certain benefits under the Women's Health and Cancer Rights Act of 1998 (WHCRA) For individuals receiving mastectomy related benefits, coverage will be provided in a manner determined in consultation with the attending physician and the patient for:

• All stages of reconstruction of the breast on which the mastectomy was performed;

• Surgery and reconstruction of the other breast to produce a symmetrical appearance;

• Prostheses; and

• Treatment of physical complications of the mastectomy, including lymphedema. These benefits will be provided subject to the same deductibles and coinsurance applicable to other medical and surgical benefits provided under this plan If you have any questions about your coverage, please contact your Human Resources department.

If you decline enrollment in your employer's health plan for you or your dependents (including your spouse) because of other health insurance or group health plan coverage, you or your dependents may be able to enroll in your employer's plan without waiting for the next open enrollment period if you:

• Lose other health insurance or group health plan coverage You must request enrollment within 30 days after the loss of other coverage.

• Gain a new dependent as a result of marriage, birth, adoption or placement for adoption. You must request (medical plan OR health plan) enrollment within 30 days after the marriage, birth, adoption or placement for adoption

• Lose Medicaid, or Children's Health Insurance Program (CHIP) coverage because you are no longer eligible. You must request medical plan enrollment within 60 days after the loss of such coverage.

The continuation required by Federal Law does not apply to any benefits for loss of life, dismemberment or loss of income . Federal law enables you or your dependent to continue health insurance if coverage would cease due to a reduction of your work hours or your termination of employment (other than gross misconduct) Federal law also enables your dependents to continue health insurance if their coverage ceases due to your health, divorce, or legal separation, or with respect to a dependent child, failure to continue to qualify as a dependent. Continuation must be elected in accordance with the rules of your Employer's group health plan(s) and is subject to federal law, regulations and interpretations

The continuation required by Federal Law does not apply to any benefits for loss of life, dismemberment or loss of income . Federal law enables you or your dependent to continue health insurance if coverage would cease due to a reduction of your work hours or your termination of employment (other than gross misconduct) . Federal law also enables your dependents to continue health insurance if their coverage ceases due to your health, divorce, or legal separation, or with respect to a dependent child, failure to continue to qualify as a dependent. Continuation must be elected in accordance with the rules of your Employer's group health plan(s) and is subject to federal law, regulations and interpretations

Federal law prohibits the plan from limiting a mother's or newborn's length of hospital stay to less than 48 hours for a normal delivery or 96 hours for a Cesarean delivery or from requiring the provider to obtain pre authorization for a stay of 48 or 96 hours, as appropriate. However, federal law generally does not prohibit the attending provider, after consultation with the mother, from discharging the mother or her newborn earlier than 48 hours for normal delivery or 96 hours for Cesarean delivery