EMPLOYEE BENEFITS GUIDE

March 1, 2023 –

February 29, 2024

March 1, 2023 –

February 29, 2024

Preventive Care

Eligibility

Medical Plans

Flexible Spending Accounts

Dental Insurance

crucial to our success. That’s why we provide you with an protect you and your family now and into the future.

Vision Insurance

Life Insurance

Supplemental Life Insurance

Disability Insurance

plans offered to you and your family It contains general overview. For complete details regarding each benefit plan documents as the information contained herein is for illustrative specific Summary Plan Description and Summaries of Benefits specific plan documents will prevail.

Employee Assistance Program

Hearing Discounts

ID Theft

Will Preparation

At Commdex, we know that our employees are crucial to our success. That’s why we provide you with an excellent, diverse benefits package that helps protect you and your family now and into the future.

This Benefits Guide outlines the health and welfare plans offered to your family. It contains general information and is meant to provide a brief overview. For complete details regarding each benefit plan offered, please refer to the individual plan documents as the information contained herein is for illustrative purposes. In the case of a discrepancy the plan specific documents will prevail over this benefits guide.

Your health is a work in progress that needs your consistent attention and support Each choice you make for yourself, and your family is part of an ever-changing picture Taking steps to improve your health such as going for annual physicals and living a healthy lifestyle can make a positive impact on your well-being

It’s up to you to take responsibility and get involved, and we are pleased to offer programs that will support your efforts and help you reach your goals.

Preventive care includes services like checkups, screenings and immunizations that can help you stay healthy and may help you avoid or delay health problems Many serious conditions such as heart disease, cancer and diabetes are preventable and treatable if caught early. It’s important for everyone to get the preventive care they need. Some examples of preventive care services are:

o Blood pressure, diabetes and cholesterol tests

o Certain cancer screenings, such as mammograms and colonoscopies without prior diagnosis

o Counseling, screenings and vaccines to help ensure healthy pregnancies

o Regular well-baby and well-child visits

Some immunizations and vaccinations are also considered preventive care services

Standard immunizations recommended by the Centers for Disease Control (CDC) Include: hepatitis A and B, diphtheria, polio, pneumonia, measles, mumps, rubella, tetanus and influenza although these may be subject to age and/or frequency restrictions.

Understanding What’s Covered

If a service is considered preventive care, it will be covered at 100% as long as you stay in the insurance carrier’s network. If it’s not, it may still be covered subject to a copay, deductible or coinsurance The Affordable Care Act (ACA) requires that services considered preventive care be covered by your health plan at 100% in-network, without a copay, deductible or coinsurance To get specifics about your plan’s preventive care coverage, call the customer service number on your member ID card You may want to ask your doctor if the services you’re receiving at a preventive care visit (such as an annual checkup) are all considered standard preventive care.

If any service performed at an annual checkup is as a result of a prior diagnosed condition, the office visit may not be processed as preventive, and you may be responsible for a copay, coinsurance or deductible To learn more about the ACA or preventive care and coverage, visit www.healthcare.gov.

Who is Eligible to Join the Employee Benefit Plan?

You and your dependents are eligible to join the health and welfare benefit plans if you are a full-time employee regularly scheduled to work 30 hours per week or more You must be enrolled in the plan to add dependent coverage

Who is an Eligible Dependent?

• Your legal spouse

• Your dependent child under the maximum age specified in the carriers’ plan documents including:

Natural child

Adopted child

Stepchild

Child for whom you have been appointed as the legal guardian

*Your child’s spouse and a child for whom you are not the legal guardian of are not eligible.

The dependent maximum age limit is up to age 26. The dependent does not need to be a full-time student; does not need to be an eligible dependent on the parent’s tax return; is not required to live with you; and may be unmarried or married

Once the dependent reaches age 26, coverage will terminate. Some policies may terminate on the last day of the birth month Other policies may terminate on the birthday

A totally disabled child who is physically or mentally disabled prior to age 26 may remain on the medical policy if the child is primarily dependent on the enrolled member for support and maintenance

Your employee benefits become effective on the first day of the month following 30 days of full-time employment with Commdex.

Each year during the annual Open Enrollment Period, you are given the opportunity to make changes to your current benefit elections To find out when the annual Open Enrollment Period occurs, contact Human Resources.

You are allowed to make certain changes to your current benefit elections during the plan year if you experience an IRS-approved qualifying event The change to your benefit elections must be consistent with and on account of the change in life status

IRS-approved qualifying life status changes include:

• Marriage, divorce or legal separation

• Birth or adoption of a child or placement of a child for adoption

• Death of a dependent

• Change in employment status, including loss or gain of employment, for your spouse or a dependent

• Change in work schedule, including switching between full-time and part-time status, by you, your spouse or a dependent

• Change in residence or work site for you, your spouse or a dependent that results in a change of eligibility

• If you or your dependents lose eligibility for Medicaid or the Children’s Health Insurance Program (CHIP) coverage

• If you or your dependents become eligible for a state’s premium assistance subsidy under Medicaid or CHIP

If you have a qualifying even, you must notify the company and make your desired changes within 31 days of the event. You have 60 days to make changes due to a Medicare or CHIP event.

If you do not notify the company during that time, you and/or your dependents must wait until the next annual open enrollment period to make a change in your benefit elections.

Please note, loss of coverage due to nonpayment or voluntary termination of other coverage outside a spouse’s or parent’s open enrollment is not an IRS-approved qualifying life event, and you do not qualify for a special enrollment period.

*Emergency room visits are for emergencies only. Non-emergency use of emergency room may result in denied claim. To search for providers, visit www.myuhc.com. You will search using the Choice Plus Network. Your plan runs on a calendar year, so your deductible and out-of-pocket max reset every January 1st

Commdex offers employees the opportunity to participate in the Healthcare Flexible Spending Account (FSA) and Dependent Care FSA. These programs may provide you with significant tax advantages as they allow you to pay for eligible out-of-pocket expenses with pre-tax dollars through payroll deductions. It is very important that you estimate your annual expenses as accurately as possible because the plan’s balance does not rollover from year-to-year.

Our FSA administrator is Infinisource Enrollees will receive a debit card with which you can make qualified FSA purchases You may also pay upfront and get reimbursed by submitting reimbursement, proof of purchase, and dates of service You may easily file a claim and manage your account through your personalized iSolved online portal https://infinconsumer.lh1ondemand.com/Login.aspx or via the iFlex App. To register your account, your login and password will be your lowercase first initial, last name, and last four digits of your Social Security Number. You will then be prompted to change your password.

You may defer up to $3,050 to your Healthcare FSA to fund eligible out-of-pocket healthcare expenses. The following list provides examples of expenses eligible for reimbursement under the IRS guidelines:

• Non-covered medical expenses that qualify under Section 217 of the IRS code

• Deductibles

• Office visit copays

• Prescription medication

• Over-the-counter medications (require physician prescription)

• Hearing and dental expenses not covered by insurance

Examples of non-eligible expenses include cosmetic surgery, electrolysis, toiletries, vitamins, health club dues.

You may defer up to $5,000 (single or married filing jointly) or up to $2,500 (married filing separately) to your Dependent Care FSA to fund eligible out-of-pocket expenses for childcare and eldercare. To be eligible for reimbursement, expenses must meet the following criteria established by the IRS:

▪ The person cared for must be under age 13, or if older, physically or mentally incapable of self-care

▪ Day care must be necessary in order for you and your spouse to work

▪ The person cared for must be claimed as a dependent on your federal tax return and must reside in your home at least eight hours per day

▪ Payment for care cannot be made to anyone you claim as a dependent on your income tax return, to your spouse or to a child under age 19.

▪ If care is provided by a center that cares for more than six individuals, it must be licensed.

For a complete list of eligible medical and dependent care expenses, you may access publications #502 (healthcare) and #503 (dependent care) on the web at www.irs.gov.

Staying healthy includes obtaining quality dental care for you and your family Our dental benefits, administered by Mutual of Omaha, provide a wide range of dental services including preventive care, fillings, and x-rays.

You have the freedom of choice to utilize in-network or out-of-network providers For a list of in-network providers, visit www.MutualofOmaha.com/dental. When you visit an in-network dentist, your out-of-pocket expenses are lower In-network dentists will file the claim for you and services are paid at the Mutual

None

-Basic Services:

-Major Services:

-Orthodontic Services:

12 Months

12 Months

12 Months

*Late Entrant: Anyone that enrolls after their initial eligibility period (new hires).

Oral Exams, Cleanings, Bitewing X-rays, Full mouth X-rays, Fluoride up to age 19, Sealants up to age 14, Space Maintainers up to age 14

Periodontal Maintenance, Fillings, Simple Extractions, Oral Surgery, Endodontics, Periodontics, Denture repair, Bridge repair, Crown repair, Inlays & Onlays repair, Surgical Extractions,

Inlays,

Your eyes deserve the best care to keep them healthy year after year. Regular eye examinations may determine your need for corrective eyewear and may also detect general health problems in their earliest stages. Vision benefits are administered by Mutual of Omaha.

For a list of in-network providers, visit www.MutualofOmaha.com/vision. When you visit an in-network vision provider, your out-of-pocket expenses are lower.

Eligible employees may elect coverage for themselves, a spouse and eligible dependent children. Dependent children are covered up to age 26, regardless of student status.

Frames $130 allowance plus 20% off balance over allowance $58 allowance Lenses Single Vision Bifocal Trifocal Lenticular

Standard Progressive (add on to bifocal copay) Premium Progressive (add on to bifocal copay) Tier 1 Tier 2 Tier 3 Tier 4

copay $25 copay $25 copay

copay

copay

copay $95 copay $110 copay $65 copay plus 80% of charge less $120 allowance

$20 allowance $36 allowance $64 allowance $64 allowance $36 allowance $36 allowance $36 allowance $36 allowance $36 allowance

Contact Lenses Fitting & Evaluation

Standard Contact Lens Fit & Follow-up

Premium Contact Lens Fit & Follow-up

Conventional Lenses

Disposable Lenses Medically Necessary Lenses

Frequency Exam Lenses (Contacts OR Eyeglass) Frames

$39 allowance $40 allowance $130 allowance plus 15% off balance over $130 $130 allowance Covered 100%

Not Covered Not Covered $89 allowance $104 allowance $210 allowance

Once every 12 months

Once every 12 months

Once ever 24 months

Members can also receive 40% off an additional complete pair of eyeglasses and conventional contact lenses.

Members are also eligible 15% off retail price or Lasik or 5% off promotional price.

Commdex provides a Company Paid Life and Accidental Death & Dismemberment (AD&D) benefit through Mutual of Omaha. As a full-time eligible employee, you have a death benefit of $25,000 with a matching AD&D benefit. Benefit reduces to 65% at age 65, 50% at age 70.

• Be sure you name a beneficiary when you enroll in Life and AD&D benefits.

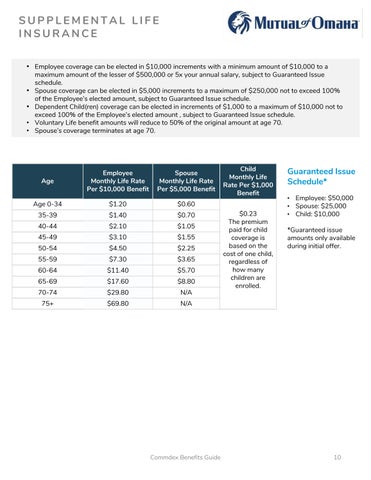

• Employee coverage can be elected in $10,000 increments with a minimum amount of $10,000 to a maximum amount of the lesser of $500,000 or 5x your annual salary, subject to Guaranteed Issue schedule.

• Spouse coverage can be elected in $5,000 increments to a maximum of $250,000 not to exceed 100% of the Employee’s elected amount, subject to Guaranteed Issue schedule.

• Dependent Child(ren) coverage can be elected in increments of $1,000 to a maximum of $10,000 not to exceed 100% of the Employee’s elected amount , subject to Guaranteed Issue schedule.

• Voluntary Life benefit amounts will reduce to 50% of the original amount at age 70.

• Spouse’s coverage terminates at age 70

• Employee: $50,000

• Spouse: $25,000

• Child: $10,000

The premium paid for child coverage is based on the cost of one child, regardless of how many children are enrolled.

*Guaranteed issue amounts only available during initial offer.

Disability coverage provides the financial security of knowing that you will continue to receive income if you are unable to work due to illness or injury.

Even a few weeks away from work can make it difficult to manage household expenses. Employee Paid Short-Term Disability is available to you through Mutual of Omaha. This coverage will pay up to 60% of your weekly salary up to a maximum of $1,000 per week for non work-related injuries or illnesses so you can focus on getting better and worry less about keeping up with your bills. Benefits begin on the 8th day of disability for an accident or illness. Benefits are payable up to a maximum of 13 weeks.

Serious illnesses or accidents can come out of nowhere. They can interrupt your life and your ability to work for months even years. Long-Term Disability coverage is available to you through Mutual of Omaha. This benefit pays 60% of your monthly earnings in the event of a disability after 90 days for injury or illness up to a maximum monthly benefit of $6,000 per month. The Long-Term Disability benefit pays up to your Social Security Normal Retirement Age (SSNRA).

*Neither disability policies provide benefits for a pre-existing conditions within the first year-to-two years of the policy. Review your policy for details. A pre-existing condition is any condition for which you received medical treatment, consultation, care or services including diagnostic measures, or took prescribed drugs or medicines prior to your effective date of coverage. Please refer to the plan certificate for the pre-existing guidelines.

**If you waive these policies as a new hire and decide to enroll later, you are considered a late entrant and will be required to complete a health questionnaire called Evidence of Insurability. Your health status will be reviewed and approval is not guaranteed.

Commdex contributes to the cost of coverage for all eligible employees. For an additional premium employees can add dependent coverage. Please refer to the chart below for your Semi-Monthly payroll deductions.

Find the lowest price on prescriptions right from your phone or iPad.

Our free, easy-to-use mobile apps feature:

• Instant access to the lowest prices for prescription drugs at more than 75,000 pharmacies

• Coupons and savings tips that can cut your prescription costs by 50% or more

• Side effects, pharmacy hours and locations, pill images, and much more!

Lowest Rx Prices, Every Day

SAVINGS IS EASY

Same Medication Lower Price.

The right to COBRA continuation coverage was created by a federal law, the Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) COBRA continuation coverage can become available to you and other members of your family when group health coverage would otherwise end For more information about your rights and obligations under the Plan and under federal law, you should review the Plan’s Summary Plan Description or contact the Plan Administrator For additional information regarding COBRA qualifying events, how coverage is provided and actions required to participate in COBRA coverage, please see your Human Resources department.

Newborns’ and Mothers’ Health Protection Act

The group health coverage provided complies with the Newborns’ and Mothers’ Health Protection Act of 1996 Under this law group health plans and health insurance issuers generally may not, under federal law, restrict benefits for any hospital length of stay in connection with childbirth for the mother or newborn to less than 48 hours following a vaginal delivery, or less than 96 hours following a cesarean section. However, Federal law generally does not prohibit the mother’s or newborn’s attending provider, after consulting with the mother, from discharging the mother or her newborn earlier than 48 hours (or 96 hours as applicable ) In any case, plans and issuers may not, under federal law, require that a provider obtain authorization from the plan or the insurance issuer for prescribing a length of stay not in excess of 48 hours (or 96 hours)

Premium Assistance under Medical and CHIP

If you or your children are eligible for Medicaid or CHIP (Children’s Health Insurance Program) and you are eligible for health coverage from your employer, your State may have a premium assistance program that can help you pay for coverage. These States use funds from their Medicaid or CHIP programs to help people who are eligible for employersponsored health coverage but need assistance in paying their health premiums. If you or your dependents are already enrolled in Medicaid or CHIP you can contact your State Medicaid or CHIP office to find out if premium assistance is available If you or your dependents are NOT currently enrolled in Medicaid or CHIP, and you think you or any of your dependents might be eligible for either of these programs, you can contact your State Medicaid or CHIP office or dial 1877-KIDS NOW or www.insurekidsnow.gov to find out how to apply If you qualify, you can ask the State if it has a program that might help you pay the premiums for an employer-sponsored plan Please see Human Resources for a list of state Medicaid or CHIP offices to find out more about premium assistance .

An Eligible Person and/or Dependent may also be able to enroll during a special enrollment period A special enrollment period is not available to an Eligible Person and his or her dependents if coverage under the prior plan was terminated for cause, or because premiums were not paid on a timely basis

An Eligible Person and/or Dependent does not need to elect COBRA continuation coverage to preserve special enrollment rights. Special enrollment is available to an Eligible Person and/or Dependent even if COBRA is elected. Please be aware that most special enrollment events require action within 30 days of the event Please see Human Resources for a list of special enrollment opportunities and procedures

If you have had or are going to have a mastectomy , you may be entitled to certain benefits under the Women’s Health and Cancer Rights Act of 1998 (WHCRA) For individuals receiving mastectomy-related benefits, coverage will be provided in a manner determined in consultation with the attending physician and the patient, for: All stages of reconstruction of the breast on which the mastectomy has been performed; Surgery and reconstruction of the other breast to produce a symmetrical appearance; and Prostheses and treatment of physical complications of the mastectomy, including lymphedemas These benefits will be provided subject to deductibles and coinsurance applicable to other medical and surgical benefits provided under this plan If you would like more information on WHCRA benefits, call your plan administrator

The Genetic Information Nondiscrimination Act (GINA) prohibits health benefit plans from discriminating on the basis of genetic information in regards to eligibility, premium and contributions This generally also means that private employers with more than 15 employees, its health plan or “business associate” of the employer, cannot collect or use genetic information, (including family medical history information). The once exception would be that a minimum amount of genetic testing results make be used to make a determination regarding a claim.

You should know that GINA is treated as protected health information (PHI) under HIPAA. The plan must provide that an employer cannot request or require that you reveal whether or not you have had genetic testing; nor can your employer require that you participate in a genetic test An employer cannot use any genetic information to set contribution rates or premiums

Since key parts of the health care law took effect in 2014, there is a new way to buy health insurance: the Health Insurance Marketplace To assist you as you evaluate options for you and your family, this notice provides some basic information about the new Marketplace and employment based health coverage offered by your employer

If your employer offers health coverage that meets the “minimum value” plan standard, you will not be eligible for a tax credit through the Marketplace and may wish to enroll in your employer’s health plan The “minimum value” plan standard is set by the Affordable Care Act. Your health plans offered by Commdex are ACA compliant plans (surpassing the “minimum value” standard), thus you would not be eligible for the tax credit offered to those who do not have access to such a plan.

NOTE: If you purchase a health plan through the marketplace instead of accepting health coverage offered by your employer, then you will lose the employer contribution to the employer offered coverage Also, this employer contribution, as well as your employee contribution to employer offered coverage, is excluded from income for Federal and State income tax purposed

The Uniformed Services Employment and Reemployment Rights Act of 1994 (USERRA) established requirements that employers must meet for certain employees who are involved in the uniformed services In addition to the rights that you have under COBRA, you (the employee) are entitled under USERRA lo continue the coverage that you (and your covered dependents, if any) had under the Commdex plan.

You Have Rights Under Both COBRA and USERRA. Your rights under COBRA and USERRA are similar but not identical Any election that you make pursuant to COBRA will also be an election under USERRA, and COBRA and USERRA will both apply with respect to the continuation coverage elected If COBRA and USERRA give you different rights or protections, the law that provides the greater benefit will apply The administrative policies and procedures described in the attached COBRA Election Notice also apply to USERRA coverage, unless compliance with the procedures is precluded by military necessity or is otherwise impossible or unreasonable under the circumstances.

"Uniformed services" means the Armed Forces, the Army National Guard, and the Air National Guard when an individual is engaged in active duty for training, inactive duty training, or full-time National Guard duty (i e , pursuant to orders issued under federal law), the commissioned corps of the Public Health Service, and any other category of persons designated by the President in time of war or national emergency.

"Service in the uniformed services" or "service" means the performance of duty on a voluntary or involuntary basis in the uniformed services under competent authority, including active duty, active and inactive duty for training, National Guard duty under federal statute, a period for which a person is absent from employment for an examination to determine his or her fitness to perform any of these duties, and a period for which a person is absent from employment to perform certain funeral honors duty . It also includes certain service by intermittent disaster response appointees of the National Disaster Medical System.

Duration of USERRA Coverage

General Rule: 24 -Month Maximum When a covered employee takes a leave for service in the uniformed services, USERRA coverage for the employee (and covered dependents for whom coverage is elected) can continue until up to 24 months from the date on which the employee's leave for uniformed service began However, USERRA coverage will end earlier if one of the following events takes place:

A premium payment is not made within the required time; You fail to return to work or to apply for reemployment within the time required under USERRA (see below) following the completion of your service in the uniformed services; You lose your rights under USERRA as a result of a dishonorable discharge or other conduct specified in USERRA

This Notice of Privacy Practices (the "Notice") describes the legal obligations of Commdex, (the "Plan") and your legal rights regarding your protected health information held by the Plan under the Health Insurance Portability and Accountability Act of 1996 (HIPAA) and the Health Information Technology for Economic and Clinical Health Act (HITECH Act) Among other things, this Notice describes how your protected health information may be used or disclosed to carry out treatment, payment, or health care operations, or for any other purposes that are permitted or required by law. We are required to provide this Notice of Privacy Practices to you pursuant to HIPAA.

The HIPAA Privacy Rule protects only certain medical information known as "protected health information " Generally, protected health information is health information, including demographic information, collected from you or created or received by a health care provider, a health care clearinghouse, a health plan, or your employer on behalf of a group health plan, from which it is possible to individually identify you and that relates to:

• Your past, present, or future physical or mental health or condition;

• The provision of health care to you; or

• The past, present, or future payment for the provision of health care to you.

If you have any questions about this Notice or about our privacy practices, please contact your Human Resources department. The full privacy notice is available with your Human Resources Department.

This guide provides a summary of you employee benefits rights and regulations as determined by Federal and State Laws. Information included in this guide includes the following:

Special Open Enrollment Rights

Children’s Health Insurance Program (CHIP) Premium Assistance

General Notice of the Cobra Continuations Rights

Affordable Care Act (ACA) – Insurance Mandate

Health Insurance Marketplace Coverage Options and Your Group Health Coverage

Affordable Care Act (ACA) – Preventive Services for Non-grandfathered Plans Newborns’ and Mothers’ Health Protection Act of 1996

Break Time for Nursing Mothers Under the Fair Labor Standards Acts (FLSA) Women’s Health & Cancer Rights Act

The Generic Information Nondiscrimination Act of 2008 (GINA)

HIPAA Privacy Rules

This notice is being provided to ensure that you understand your right to apply for group health insurance coverage. A special enrollment period is a time outside of the annual open enrollment period during which you and your family have a right to sign up for health coverage. In the Marketplace, you qualify for a special enrollment period 60 days following certain life events that involve a change in family status (for example, marriage or birth of a child) or loss of other health coverage Job-based plans must provide a special enrollment period of 30 days Some events will require additional documentation to be submitted with the application at the time of enrollment You should read this notice even if you plan to waive coverage at this time

If you have a new dependent as a result of a marriage, birth, adoption, or placement for adoption, you may be able to enroll yourself and your dependents However, you must request enrollment within 30 days after the marriage, birth, or placement for adoption

If you are declining coverage for yourself or your dependents (including your spouse) because of other health insurance or group health plan coverage, you may be able to enroll yourself and your dependents in this plan if you or your dependents lose eligibility for that other coverage (or if the employer stops contributing toward your or your dependents’ other coverage) However, you must request enrollment within 30 days after your or your dependents’ other coverage ends (or after the employer stops contributing toward the other coverage).

If you or your dependents lose eligibility for coverage under Medicaid or the Children’s Health Insurance Program (CHIP) or become eligible for a premium assistance subsidy under Medicaid or CHIP, you may be able to enroll yourself and your dependents. You must request enrollment within 60 days of the loss of Medicaid or CHIP coverage or the determination of eligibility for a premium assistance subsidy.

To request special enrollment or obtain more information, please contact HR.

To assist you as you evaluate options for you and your family, this notice provides some basic information about the Marketplace and employment-based health coverage offered by your employer.

The Marketplace is designed to help you find health insurance that meets your needs and fits your budget. The Marketplace offers “one-stop shopping” to find and compare private health insurance options You may also be eligible for a new kind of tax credit that lowers your monthly premium right away Open enrollment for health insurance coverage through the Marketplace runs from November 1st through December 15th for coverage starting as early as January 1st.

You may quality to save money and lower your monthly premium, but only if our employer does not offer coverage, or offers coverage that doesn’t meet certain standards The savings on your premium that you’re eligible for depends on your household income

Yes If you have an offer of health coverage from your employer that meets certain standards, you will not be eligible for a tax credit through the Marketplace and may wish to enroll in your employer’s health plan However, you may be eligible for a tax credit that lowers your monthly premium, or a reduction in certain cost-sharing if your employer does not offer coverage to you at all or does not offer coverage that meets certain standards If the cost of a plan from your employer that would cover you (and not any other members of your family) is more than 9.5% of your household income for the year, or if the coverage your employer provides does not meet the “minimum value” standard set by the Affordable Care Act, you may be eligible for a tax credit.

If you purchase a health plan through the Marketplace instead of accepting health coverage by your employer, then you may lose the employer contribution (if any) to the employer-offered coverage Also, this employer contribution – as well as your employee contribution to employer-offered coverage – is often excluded from income for Federal and State income tax purposes Your payments for coverage through the Marketplace are made on an alter-tax basis.

For more information about your coverage offered by your employer, please check your summary plan description or contact Human Resources

The Marketplace can help you evaluate your coverage options, including your eligibility for coverage through the Marketplace and its cost. Please visit www.healthcare.gov for more information, including an online application for health insurance coverage and contact information for a Health Insurance Marketplace in your area.

PART B: INFORMATION ABOUT HEALTH COVERAGE OFFERED BY YOUR EMPLOYER

This section contains information about any health coverage offered by your employer. If you decide to complete an application for coverage in the Marketplace, you will be asked to provide this information This information is numbered to correspond to the Marketplace application

Here is some basic information about health coverage offered by this employer: As your employer, we offer a health plan to:

All employees. Eligible employees are:

Active full-time employees working 30 or more hours a week

Some employees. Eligible employees are:

With respect to dependents:

We do offer coverage. Eligible dependents are:

Spouses and children up to age 26

We do not offer coverage

If checked, this coverage meets the minimum value standard and the cost of this coverage to you is intended to be affordable, based on employee wages.

** Even if your employer intends your coverage to be affordable, you may still be eligible for a premium discount through Marketplace The Marketplace will use your household income, along with other factors, to determine whether you may be eligible for a premium discount If for example, your wages vary from week to week (perhaps you are an hourly employee or you work on a commission basis), if you are newly employed mid-year, or if you have other income losses, you may still qualify for a premium discount

If you decide to shop for coverage in the Marketplace, Healthcare.gov will guide you through the process Here’s the employer information you’ll enter when you visit to find out if you can get a tax credit to lower your monthly premiums

3. Employer Name Commdex, LLC 4. Employer Identification Number (EIN) 61-1380792Please read this notice carefully and keep it where you can find it. This notice has information about your current prescription drug coverage with Commdex and about your options under Medicare’s prescription drug coverage. This information can help you decide whether or not you want to join a Medicare drug plan. If you are considering joining, you should compare your current coverage, including which drugs are covered at what cost, with the coverage and costs of the plans offering Medicare prescription drug coverage in your area Information about where you can get help to make decisions about your prescription drug coverage is at the end of this notice

There are two important things you need to know about your current coverage and Medicare’s prescription drug coverage:

• Medicare prescription drug coverage became available in 2006 to everyone with Medicare. You can get this coverage if you join a Medicare Prescription Drug Plan or join a Medicare Advantage Plan (like an HMO or PPO) that offers prescription drug coverage All Medicare drug plans provide at least a standard level of coverage set by Medicare. Some plans may also offer more coverage for a higher monthly premium

• Commdex has determined that the prescription drug coverage offered by the Your Carriers’ plans are, on average for all plan participants, expected to pay out as much as standard Medicare prescription drug coverage pays and is therefore considered Creditable Coverage Because your existing coverage is Creditable Coverage, you can keep this coverage and not pay a higher premium (a penalty) if you later decide to join a Medicare drug plan

You can join a Medicare drug plan when you first become eligible for Medicare and each year from October 15 th to December 7th. However, if you lose your current creditable prescription drug coverage, through no fault of your own, you will also be eligible for a two (2) month Special Enrollment Period (SEP) to join a Medicare drug plan

If you decide to join a Medicare drug plan, your current Commdex coverage will not be affected Please review prescription drug coverage plan provisions/options under the certificate booklet provided by Your Carrier. See pages 7- 9 of the CMS Disclosure of Creditable Coverage To Medicare Part D Eligible Individuals Guidance which outlines the prescription drug plan provisions/ options that Medicare eligible individuals may have available to them when they become eligible for Medicare Part D. If you do decide to join a Medicare drug plan and drop your current Commdex coverage, be aware that you and your dependents may not be able to get this coverage back

You should also know that if you drop or lose your current coverage with Commdex and don’t join a Medicare drug plan within 63 continuous days after your current coverage ends, you may pay a higher premium (a penalty) to join a Medicare drug plan later If you go 63 continuous days or longer without creditable prescription drug coverage, your monthly premium may go up by at least 1% of the Medicare base beneficiary premium per month for every month that you did not have that coverage. For example, if you go nineteen months without creditable coverage, your premium may consistently be at least 19% higher than the Medicare base beneficiary premium You may have to pay this higher premium (a penalty) as long as you have Medicare prescription drug coverage In addition, you may have to wait until the following October to join.

For more information about this notice or your current prescription drug coverage, contact your carrier.

NOTE: You’ll get this notice each year. You will also get it before the next period you can join a Medicare drug plan, and if this coverage through Commdex changes You also may request a copy of this notice at any time

More detailed information about Medicare plans that offer prescription drug coverage is in the “Medicare & You” handbook You’ll get a copy of the handbook in the mail every year from Medicare You may also be contacted directly by Medicare drug plans For more information about Medicare prescription drug coverage Visit www.medicare.gov Call your State Health Insurance Assistance Program (see the inside back cover of your copy of the “Medicare & You” handbook for their telephone number) for personalized help Call 1-800-MEDICARE (1-800-6334227) TTY users should call 1-877-486- 2048 If you have limited income and resources, extra help paying for Medicare prescription drug coverage is available For information about this extra help, visit Social Security on the web at www.socialsecurity.gov, or call them at 1-800-772-1213 (TTY 1-800-325-0778)

Remember: Keep this Creditable Coverage notice If you decide to join one of the Medicare drug plans, you may be required to provide a copy of this notice when you join to show whether or not you have maintained creditable coverage and, therefore, whether or not you are required to pay a higher premium (a penalty)

Health insurance terminology can be confusing As a result, understanding your benefits and what you may owe out of pocket can be difficult. In order to make sure you are using your coverage effectively, it is important to understand some key insurance terms.

You can purchase either group or individual health insurance Group health insurance is typically acquired through your employer and covers many people

Individual insurance, on the other hand, is usually purchased by an individual or a family and is not tied to a job.

To better understand your health insurance, be aware of the following terms:

Participant

There are a few different participants involved in health insurance One is the “provider”, or a clinic, hospital, doctor lab, health care practitioner or pharmacy The ”insurer” or the “carrier” is the insurance company providing coverage The “policyholder” is the individual or entity who purchased the coverage, and the “insured” is the person with the coverage”.

Premium

The amount of money charged by an insurance company for coverage. Rates are typically paid annually or in smaller payments over the course of the year (for example monthly)

Deductible

The amount you owe for health care services each year before your insurance company begins to pay Your deductible may not apply to all services, such as preventive care

Copayment

The fixed amount that you pay for a covered health care service That amount can vary by the type of covered health care service (for example, a doctor’s office visit or a specialist, urgent care or emergency room visit)

Coinsurance

The percentage of a medial bill that you pay (for example, 20 percent) and the percentage that the health plan pays (for example, 80 percent). You pay coinsurance plus any deductible you owe for a covered health service

20% 80% You Pay Health Plan Pays

Out-of-pocket maximum (OOPM)

The most you should have to pay for health care during a year, excluding the monthly premium After you reach the annual OOPM, your plan begins to pay 100 percent of the allowed amount for covered health services