The purpose of this guide is to acquaint you with the benefits we offer and to serve as a reference source throughout the year. It is important to familiarize yourself with the various options and enroll in the plans that best meet your needs Barbour Orthopaedics is pleased to continue to offer a robust benefits package to our employees

All regular, full-time employees working a minimum of 30 hours per week are eligible to participate in all benefit plans . Eligible employees may participate in the benefit plans beginning on the 1st of month following 30 days Also eligible for coverage are:

• Your spouse

• Your children up to age 26 regardless of marital status, student status or employment status

Any elections made during Open Enrollment are considered final and cannot be changed unless a Qualifying change in status occurs . Qualifying change in status include, but are not limited to:

• Marriage, divorce, or legal separation

• Death of spouse or other dependent

• Birth or adoption of a child

• A spouse’s employment begins or ends

• A dependent’s eligibility status changes due to age, student status, marital status, or employment

• You or your spouse experience a change in work hours that affect benefit eligibility

• Relocation into or outside of your plans service

• Becoming eligible for Medicare or Medicaid during the year

If you experience a qualifying change in status, you must provide written notice to Human Resources within 30 days of the event .

HOSPITAL INDEMNITY NOTICE : This notice applies to the Cigna fixed indemnity coverage that appears on page 17 in this guide .

IMPORTANT : THIS NOTICE REFERS TO THE HOSPITAL INDEMNITY POLICY ONLY . The Hospital Indemnity policy on page 17 , is a fixed indemnity policy, NOT health insurance .

This fixed indemnity policy may pay you a limited dollar amount if you're sick or hospitalized . You're still responsible for paying the cost of your care

• The payment you get isn't based on the size of your medical bill

• There might be a limit on how much this policy will pay each year.

• This policy isn't a substitute for comprehensive health insurance .

• Since this policy isn't health insurance, it doesn't have to include most Federal consumer protections that apply to health insurance .

Looking for comprehensive health insurance?

• Visit HealthCare .gov or call 1-800 -318 -2596 (TTY : 1-855 -889 -4325 ) to find health coverage options .

• To find out if you can get health insurance through your job, or a family member's job, contact the employer .

Questions about this policy?

• For questions or complaints about this policy, contact your State Department of Insurance Find their number on the National Association of Insurance Commissioners' website (naic .org ) under "Insurance Departments . "

• If you have this policy through your job, or a family member's job, contact the employer

When you add dependents to your coverage, you may be required to provide the following information so please have them ready :

• Legal name

• Date of birth

• Social security number

Participating in Open Enrollment for 2026 benefits?

Go to the UKG portal on your desktop Navigate to Myself > Open Enrollment Follow the screen prompts to select your benefits, making sure to either enroll or decline each .

Enrolling in 2026 benefits as a new employee OR have a qualifying life event?

Go to the UKG portal on your desktop . Navigate to Myself > Life Events . Follow the screen prompts to select or change your benefits, making sure to either enroll or decline each

Via the UKG portal, you can :

• View all your benefit information

• Compare your benefit options

• Make your new-hire benefit elections

• Make your annual Open Enrollment benefit elections

• Make changes throughout the year (address update, dependent information, etc )

To access additional benefits information, please visit the Barbour Document Library on the company intranet site, www.bosmportal.com

• Extended family members, such as grandchildren, are not eligible for coverage unless you are their legal guardian, have adopted them, or claim them as a tax dependent .

• For more specific eligibility requirements, see the Dependent Eligibility section of the Summary Plan Document (SPD) for each specific benefit .

Important Reminders Regarding Your Medical Plan (refer to page 9 and 10 for details)

• Preventive Care is covered at 100 % if you stay in-network

• Save money by switching your medication to a generic .

• For minor emergencies visit the Urgent Care Centers .

• Make sure your doctor, and/or hospital is in-network before your visit.

Barbour Orthopaedics offers you and your dependents a choice of three medical benefit plans through Allied Benefits utilizing the First Health PPO Network . As a plan member you have access to many consumer education tools and value -added programs designed to help manage your family’s medical care - 24 hours a day, 7 days a week

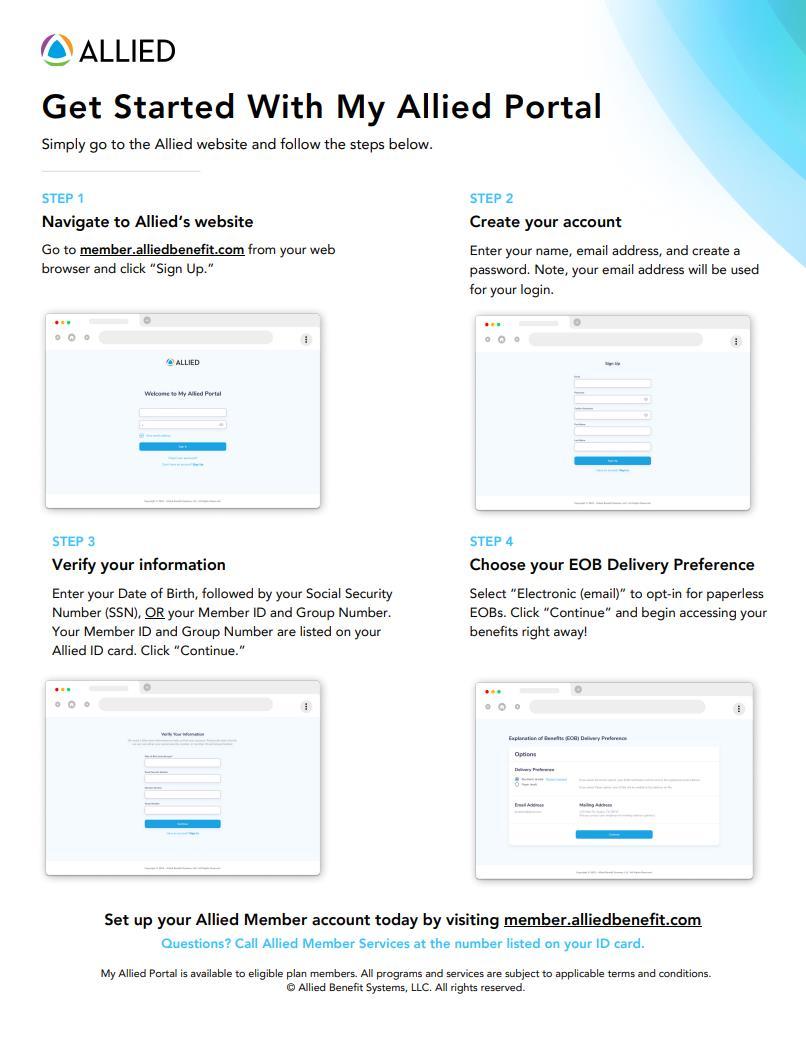

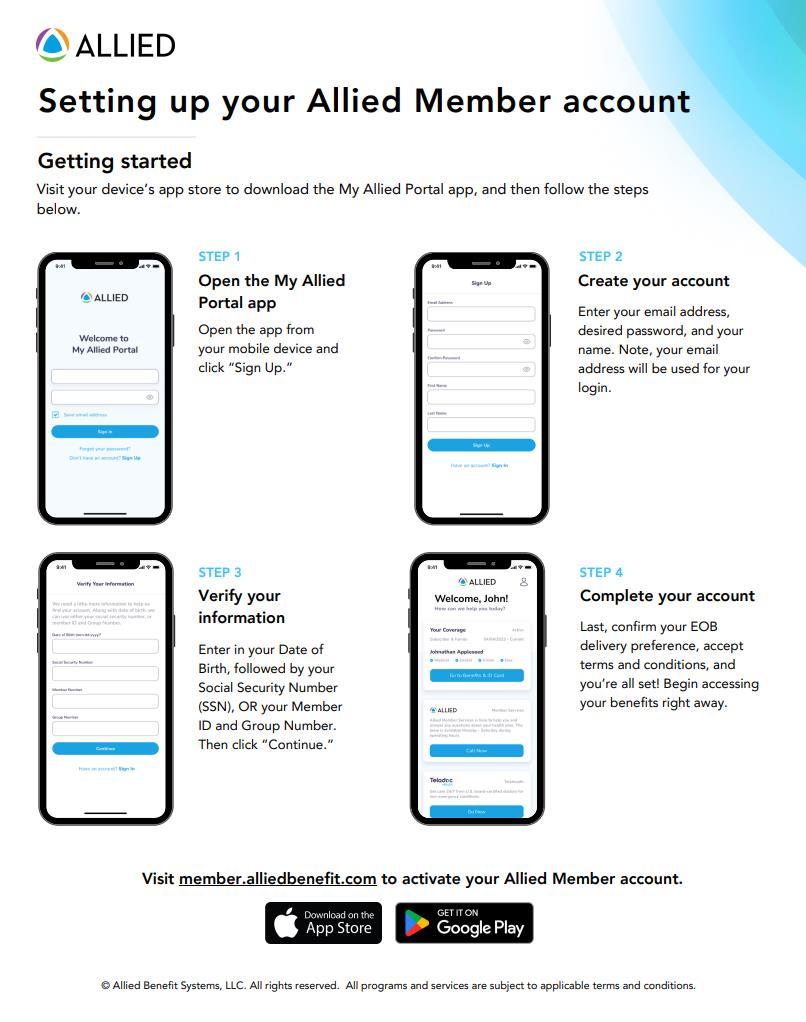

Once the plan year begins, you can call Allied at 800.621.0748 with any claims or benefit coverage questions. Visit www.member.alliedbenefit.com to establish an account or download the MyAllied App.

Once your account is established, you will be able to access information on your medical and prescription drug account, including, but not limited to, the following:

• View your benefits

• Find doctors, hospitals, and other healthcare providers

• Check your claims

• See how much you’ve spent on health care this year

• Get cost estimates for common medical services, tests and medicines

You have a choice of three medical plans : one High -Deductible Health Plan (HDHP) paired with a Health Savings Account (HSA) and two traditional PPO options that could be paired with a Flexible Spending Account (FSA) (see page 14) . These plans allow you to receive care from physicians and hospitals within the plan’s network, as well as outside the network for covered services .

To select the plan that best suits your family, consider the key differences between the plans, the cost of coverage (including payroll deductions) and how the plan covers services throughout the year.

To find a list of the medications that your plan covers, go to the My Allied Portal app or www.member.alliedbenefit.com .

You pay out -of-pocket for most medical and pharmacy expenses, except those with a copay, until you reach the deductible: Yourdeductible

• For the HDHP Plan, if you are enrolled in anything other than employee only coverage, your medical and pharmacy deductible is non-embedded (aggregate) This means that one or a combination of all covered members can satisfy the family deductible requirement for your plan option . Once the family deductible is satisfied, the plan will begin paying its share of eligible expenses for all members . You can pay for these expenses from your Health Savings Account (HSA) .

• For the traditional PPO Plans, you can pay for deducible, as well as your other out -of-pocket expenses, with your FSA.

Once your deductible is met, you and the plan share the cost of covered medical and pharmacy expenses The plan will pay a percentage of each eligible expense, and you will pay the rest; coinsurance . Yourcoinsurance

• Your deductible, copays, and the coinsurance apply toward the out-of-pocket maximum .

• For the HDHP and POS Plans, if you are enrolled in anything other than employee only coverage, your medical and pharmacy out-of-pocket maximum is embedded (not aggregate) . This means that if one covered member satisfies the individual out-of-pocket maximum for your plan option, that ONLY that individual’s eligible medical and pharmacy expenses are covered at 100 % for the balance of the plan year.

In-network preventive care is covered at 100 % (no cost to you) for both plans Preventive care is often received during an annual physical exam and included immunizations, lab tests, screenings, and other services intended to prevent illness or detect problems before you notice any symptoms .

Make smarter healthcare decisions by comparing costs and quality across providers . It promotes transparency, rewards cost -effective choices, and helps reduce out-of-pocket expenses, ensuring better value and more control over healthcare spending . Access the MyMedical Shopper feature by logging into your Allied Portal and clicking the “Find Care” function .

If you are enrolled in Barbour Orthopaedics medical plan, you and your eligible dependents will have access to Teledoc through Allied Benefits . Offering 24/7 access to doctors and therapists for physical and mental health needs, delivering fast, convenient, and affordable care from anywhere, without the need for in-person visits . Register for Teladoc by accessing Teladoc through your Allied Portal or going to www .teladochealth .com .

Telemedicine should be considered when your primary care doctor is unavailable, after-hours or on holidays for non-emergency needs .

Telemedicine can be used to treat many medical conditions such as : cold and flu symptoms • upper respiratory infections • allergies and sinus infections • ear and eye problems • skin conditions

Your Optimyl plan includes access to medical providers through the First Health network . This nationwide network offers discounted rates with a broad range of participating providers Choosing in-network providers helps lower your out-ofpocket costs .

Your Optimyl plan includes pharmacy benefits administered through CVS . These benefits offer access to a broad nationwide network of pharmacies, competitive tiered drug pricing to help you save on medications, and coverage for drugs listed on the CVS Formulary .

Your HSA allows you to take control of your healthcare spending and to save for qualified medical expenses on a tax -advantaged basis.

• Tax -advantaged – You may benefit from tax advantaged contributions, investment earnings and withdrawals for qualified medical expenses .

• Ownership – You own your account and the money in the account, even if your employer contributes to it.

• Long -term savings – Unused funds roll over from year -to-year The funds invested can help you to build financial security for retirement savings or to pay for unexpected medical expenses You may be able to access unused balances to supplement retirement income after age 65, subject to applicable income taxes .

• Investments – Once your HSA has a balance over the required threshold, you can elect to have excess funds directed into an HSA investment allocation of your choice

• Contribute Anytime : You, your employer, and your spouse and family members can contribute anytime, up to a yearly maximum .

2026Pre-taxAnnualHSAContributionLimits:

A total of $4,400 for individual coverage (including both employee and employer dollars) A total of $8,550 for family coverage (including both employee and employer dollars)

- If you are age 55 or older, you can contribute an additional $1,000 per year

Barbour Orthopaedics provides employees with a deposit to employee HSAs up to $600 per year (pro-rated based upon employee’s benefit start date). These are accrued bi-weekly if you remain an employee

To enroll online, complete the following steps :

1. Under the I Want To section, click “Enroll Now . ” 2. Click “Begin Your Enrollment Now . ”

3. Review your personal information, make any needed updates, and then click “Next ”

Note : If you are enrolling in an HSA, review the Summary of Accounts statement and agree to the terms and conditions . 4. For each eligible dependent, complete the required fields and then click “Add to List . ” After all dependents have been added or if you choose not to add any dependents, click “Next . ”

5. Check the box for each plan indicating you have read and understood the plan rules, and then click “Next . ”

6. Type your annual election for each plan in which you want to enroll and click “Next ” Note : Click “Calculate” if you want to see the estimated tax savings

7. Select a reimbursement method and then click “Next . ”

If you select a debit card

If an HSA debit card is not offered for your plan.

If you select direct deposit

You can still receive reimbursement via check or direct deposit for services you paid for out of pocket.

Select either direct deposit or check as your preferred reimbursement method.

1. Type your bank’s routing number and click “ Find Your Bank. ”

2. Complete the required fields and then click “ Next .”

3. Click “ Update Bank Account .”

Note: You will be prompted with a message indicating further action is needed to activate your bank account so you can receive reimbursements there.

8. Complete the required fields, click “Add Beneficiary” and then click “Next ”

9. Review your enrollment information, make any necessary updates and then click “Submit . ”

10. Read the Creation Authorization, check the required boxes to indicate you want to open an HSA in your name, and then click “Submit Enrollment . ”

The Flexible Spending Account (FSA) provides employees the opportunity to pay specific expenses with pre-tax dollars (limits shown below) and can be paired with either of the Traditional PPO Medical plans or set up without enrolling in a medical plan . These plans enable you to “redirect” part of your pay (before federal income tax or Social Security taxes are deducted) into a tax -advantage account .

You may also set aside money under the Dependent Care FSA to pay for eligible day care expenses for a dependent child(ren) up to age 13 or for an elderly parent . You may set aside up to $7,500 per year if you are single or married (filing joint tax returns); or up to $3,750 if married and filing separate returns .

After enrolling, you will receive a debit card with which you can make qualified FSA purchases You may also pay upfront and then get reimbursed by submitting reimbursement, proof of purchase, and dates of service . You may easily file a claim and manage your account through your personalized online portal.

How do I Sign Up?

Annual Maximum Contribution

Eligible Expenses

What Happens to Account Funds at the End of the Year?

How do I make changes to my election?

What is the deadline to file claims?

Follow the onscreen prompts in UKG

Up to $3,400 per employee

Qualified medical costs (copays, deductible, coinsurance), dental costs (ex: fillings, X -rays, orthodontia), and vision costs (ex: glasses, contact lenses, LASIK eye surgery)

$680 Carryover.

By IRS regulations, the account holder can “carryover” a $680 maximum to the following plan year

Up to $7,500 per year if you are single or married (filing joint tax returns); or up to $3,750 if married and filing separate returns.

Day care expenses for a dependent child(ren) up to age 13 or for an elderly parent. Workday childcare services, cost of care at a licensed daycare or care center, or before and after -school care.

Use it or lose it. By IRS regulations, the account holder loses any unclaimed money in the account at year end.

You can make changes to your election and/or contribution amount during Open Enrollment or with a qualifying event only. Make sure you budget and plan according to your projected medical, dental/vision and dependent care needs.

You have 90 days to file Health Care and Dependent Care FSA claims after 12/31/2026 to get reimbursed.

Barbour Orthopaedics offers you and your dependents a dental plan option that provides in-network and out-of-network benefits . Keep in mind, your savings is more substantial when visiting an innetwork provider . Out-of-network providers will bill you for the balance between their fee and what your dental plan pays .

To locate a network provider, please log on to Mycigna .com

Barbour Orthopaedics offers you and your dependents an option to enroll in a vision plan To receive the deepest discounts, choose an in-network eye doctor To locate a network provider, please log on to mycigna .com : Under

and

on "Visit Cigna

Barbour Orthopaedics covers the entire cost (100 % ) of these benefits for you, but you will be prompted to designate a beneficiary when making your elections . It is important to keep your beneficiary information up to date to ensure that your life insurance benefits will be allocated to the appropriate parties . In the event death occurs from an accident, both the life and AD&D benefit would be payable .

MGIS STD insurance would replace part of your income that you would lose due to an accident, pregnancy or illness . This benefit is 100 % paid by the employee

Voluntary Life insurance is an excellent opportunity for you to purchase group term life insurance on a payroll -deduction basis . This benefit is paid 100 % by the employee .

Current employees and eligible new hires can elect the Guaranteed Issue amount during the 2026 Open Enrollment without submitting an Evidence of Insurability (EOI) form

Barbour Orthopaedics covers the entire cost (100 % ) of these benefits for you. Your employer further protects your income with an LTD benefit that will pay after 91 days of disability up to Social Security normal Retirement Age . Please see benefit summary located in UKG for details Employees will automatically be enrolled in this coverage .

Increments of $10,000 to $500,000

Issue: $150,000

(Employee election required) Increments of $5,000 to $100,000 or 100% of Employee’s elections Guarantee Issue: $25,000

Up to $10,000 Guarantee Issue: $10,000

*Class 1,2, and 4 – Please refer to the supplement document for coverage

Age Reduction (based on Employee age)

65% at age 65, 40% at age 70, 20% at age 75

Note that we are no longer using AFLAC, but all eligible employees will have the opportunity to enroll in Cigna’s Supplemental Health plans An unexpected illness or injury can disrupt every facet of your life, including your physical, emotional and financial well-being . Regular expenses, big and small, can add up These voluntary benefits are designed to help strengthen your overall benefits package and provide additional protection for you and your family through fixed benefits paid directly to YOU . The Critical Illness and Accident plans contain a wellness benefit. This benefit will pay you $50 or $75 for completing certain wellness and preventive screenings ; ex, annual exam, pap smear, colonoscopy, flu shot . Details of the wellness and preventative screenings are available in the plan policy document

Key Features to Consider :

• Flexible . Use the money however you want. Pay for anything you need – medical deductibles, childcare, groceries, etc

• Supplement your medical plan. Benefits are paid in addition to other coverage you may have .

• Cost effective Your premium is conveniently deducted from your paycheck at a low group rate.

If you’re diagnosed with a covered critical illness, group critical illness insurance can help with your expenses, so you can concentrate on what’s most important, your treatment, care, and recovery Critical Illness Insurance is designed to help supplement the cost of an illness like heart attack, stroke, major organ failure, and more.

• Option to purchase up to $20,000 guaranteed issue on yourself, up to $10,000 on your spouse and up to $5,000 on any dependent children .

• Includes benefits for additional diagnosis of a different condition as well as recurrence of the same condition for some illnesses (diagnosis must be separated by at least 12 months - see policy for details) .

• Coverage is fully portable .

• There are no pre-existing limitations (Please note diagnosis must occur after the effective date).

• Includes $50 Wellness benefit

Critical Illness Benefit Example :

• Situation : Marco had a heart attack while raking leaves . He has a $20,000 Critical Illness policy .

• Critical Illness benefit paid directly to Marco : $20,000

No one plans on having an accident . If you are accidentally injured, accident insurance from Cigna can help you take care of out-of-pocket expenses and medical expenses

• Pays a fixed cash benefit directly to you in the event you need medical treatment due to an on or off the job accident, like an ankle sprain or arm fracture

• Includes $75 Wellness benefit

See Plan Summary for details .

Accidental Injury Benefit Example :

• Situation : Chloe broke her leg playing soccer . Chloe's covered benefits :

• Doctor's office visit - $100

• Broken leg - $2,000

• Diagnostic exam (X-ray) - $75

• Physical therapy sessions - $50 per visit for 10 visits

• Accidental Injury benefit paid directly to Chloe : $2,675

Hospital Indemnity Insurance pays a fixed cash benefit directly to you when you experience a covered hospital stay, for events like an in-patient procedure or childbirth

• Pays $1,000 for hospital admission (per year) plus $100 per day during your stay (up to 30 days per 90 days)

• Pays $1,000 for ICU admission (per year) plus $200 per day in the ICU (up to 30 days per 90 days) .

• There are no pre-existing limitations – even for pregnancy!(Please note hospitalization must occur after the effective date).

Care Benefit Example

• Situation : Susan was hospitalized in the ICU for5 days following a car accident . Susan’s covered benefits :

• ICU admission - $1,000

• Hospital stay - $200 per day

• Hospital Care benefit paid directly to Susan : $2,000

The Hospital Indemnity plan described here is the plan referred to on page 3 that clarifies this plan is not a health insurance plan .

See Plan Summaries for details .

Barbour Orthopaedics provides access to an Employee Assistance Program (EAP) through MGIS' partnership with ACI Specialty Benefits, an All One Health Company, at no cost to you!

• Up to 5 sessions to help manage stress, anxiety and depression, resolve conflict, improve relationships, overcome substance abuse and address any personal issues, with options for in-person, telephonic, or video counseling sessions .

• To help reach personal and professional goals, manage life transitions, overcome obstacles, strengthen relationships, and build balance .

• To help build financial wellness related to budgeting, buying a home, paying off debt, managing taxes, preventing identify theft, and saving for retirement or tuition.

• To help with a variety of personal legal matters including estate planning, wills, real estate, bankruptcy, divorce, custody, and more.

• To provide information and referrals when seeking childcare, adoption, special needs support, eldercare, housing, transportation, education, and pet care

• To help manage everyday tasks and give back time by providing information and referrals for home services, repairs, travel, entertainment, dining and personal services .

• To help navigate insurance, obtain doctor referrals, secure medical equipment or transportation, and plan for transitional care and discharge .

• Access your benefits 24/7/365 with online requests and chat options, and explore thousands of articles, webinars, podcasts and tools covering total well-being .

Q: What is a spousal surcharge?

A: A spousal surcharge is a charge that applies to employees whose covered spouse has access to medical coverage through his or her own employer but chooses to participate in the Barbour Orthopaedics plan The Spousal Surcharge is $400 per month

Q: My spouse is unemployed . Do I have to pay the surcharge?

A: No

Q: My spouse is self-employed and has no group coverage . Do I have to pay the surcharge?

A: No

Q: My spouse is retired and has coverage based on his/her retirement. Do I have the pay surcharge?

A: Both Yes and No

Yes ; If your spouse is eligible for Medicare or retiree benefits through his/her employer . No; If your spouse is not eligible for Medicare and has no other retiree benefits

Q: If my spouse has enrolled in medical benefits through his/her employer and is not covered on my medical plan . Do I have to pay the surcharge?

A: No

Q: If my spouse does not have a job during our company’s annual open enrollment, but starts working after I have elected to cover him/her under my employer, do I have to pay a surcharge?

A: Yes, the surcharge would start when your spouse is eligible for coverage at his/her new employer but chooses to stay on the Barbour health plan You need to notify Human Resources of this change . Please note that if your spouse becomes employed after the plan year begins, this is a family status change that will allow you to make new elections under the Barbour Orthopaedics health plan . For example, you could choose to terminate your spouse’s coverage under the Barbour plan, and he/she could become covered under his/her employer’s plan .

Q: Can I remove my spouse from my plan if his/her plan year has already begun?

A: You and your spouse can change your status during either of your annual enrollment periods In addition, changing your spouse’s coverage at your employer may trigger a family status change at his/her employer . Your employer considers changes during a spouse’s annual enrollment at their employer a qualifying event, but other companies’ policies may vary. Check with your spouse’s employer to see if Barbour Orthopaedics annual enrollment is considered a family status change

You may join the plan as an active participant after you meet these requirements :

• You are age 21 or older

• You have 3 months of service - New : Barbour reduced the eligibility period from 6 months to three months of service so employees can plan their retirement savings early .

• You are an eligible employee

• You are an eligible employee for purposes of 401 (k) elective deferral contributions unless you are any of the following :

o Represented by a bargaining unit that has bargained with us in good faith about retirement benefits

o A nonresident alien with no U S income or all such income is exempt from U S income tax

o A leased employee

o An independent contractor

Employee and Employer Contributions Employees can elect to defer up to 100 % of their compensation not to exceed $24,500 (2026 ) or $32,500 for those age 50 and older. Contributions can be made on a pre-tax or Roth basis .

Barbour Orthopaedics provides a match of 100 % up to 3% of compensation, and 50% on the next 2% of employee’s contribution

Vesting : All contributions are 100 % immediately vested . For questions, please contact :

• Kristen Manweiler :

o Kristen Manweiler@CannonFinancialStrategists com or 706 -548 -3422 ext 124

• Shane Allen:

o Shane .Allen@CannonFinancialStrategists .com or 706 -548 -3422 ext. 126

If you experience issues with your account, or need to reset password, please call 800 -547 -7754

If you have any questions about your benefits, please contact our team of service representatives from Sterling Seacrest Pritchard.

- Need help solving benefit related problem?

- Have a question about a benefit?

- Need further clarification on an insurance matter?

Contact your SSP representatives:

Joel Stern | Client Advisor jrstern@sspins.com

404 -832 -8652

Jen Rakestraw | Client Service Executive jrakestraw@sspins.com

678 -553 -8293

Abigail Rives| Client Service Assistant arives@sspins.com

404 -698 -4419

Have a question regarding a bill?

Believe that your claim has not been paid properly?

Please contact our claim advocate if you have a claim question: benefitclaims@sspins.com

BE SURE TO HAVE THE

Subscriber

Kristen Manweiler: Kristen.Manweiler@CannonFinancialStrategists.com 706 -548 -3422 ext. 124 Shane Allen : Shane.Allen@CannonFinancialStrategists.com 706 -548 -3422 ext. 126 www.principal.com | 800-547 -7754