Super Newsletter

Understanding Division 296 – the facts and strategic considerations

The senate will meet later this month to reconsider the Division 296 – Superannuation (Better Targeted Superannuation Concessions) Impositions Bill which seeks to introduce additional tax on “earnings” for individuals with Superannuation balances that exceed $3million. It is anticipated that the Bill could be finalised in its current form, so let’s consider how it may be applied.

The provisions contain three crucial elements to determine the additional tax that applies to an individual, summarised below:

Is your total superannuation member balance at 30 June 2026 (or any later 30 June) > $3million?

IMPORTANTLY, if your balance is under $3million at 30 June 2026, Division 296 will not apply!

The calculation method evidences that the tax will not be applied to all “earnings” but the proportion that is attributed to the excess above $3million. The unique proposition with this tax is that “earnings” captures the after-tax movement in value for affected individuals in the relevant year.This is a diversion from what we understand of taxation of ordinary and statutory income (i.e. capital gains). Nevertheless, in its simplest form, Division 296 can never be an additional flat 15%, as it is levied on the after-tax increase in a member’s balance.

The below table summaries the highest possible effective tax rate on superannuation earnings based on current taxation rules and the proposed bill:

It’s important to understand that the new tax on unrealised gains will not apply to any increases in your member balance that occurred prior to 30 June 2025. Each year, your superannuation balance is valued at market rates as of 30 June, and the value at 30 June 2025 will effectively serve as the starting point (“high-water mark”) for calculating future “earnings” under Division 296. Because of this, ensuring that all assets are accurately valued as of 30 June 2025 should be a priority for SMSF trustees. To illustrate this further, let’s look at the next example.

Example 2

Bill has an unlisted shareholding that is sold during FY26 resulting in a significant capital gain. He is concerned that the capital gain will be subject to Division 296 taxes.Let’s consider two scenarios where the shares have the following attributes:

These effective tax rates will apply to the proportion of income above $3million.Let’s consider an example.

Example 1

Bill has a member balance of $4.5million at 30 June 2026. He made concessional contributions of $30,000 and took a minimum pension drawing of $100,000. His balance at 30 June 2025 was $4,280,000.

Bill will be subject to Division 296 as his balance exceeds $3m at 30 June 2026.

His proportion is 33 33% (($4,500,000$3,000,000)/$4,500,000).

Earnings are calculated at $294,500 ($4,500,000 + $100,000 – $25,500 – $4,280,000) Note that concessional contributions are subtracted at 85% of the gross value to allow for taxes paid.

Division 296 payable is $294,500 x 33 33% x 15% = $14,723. This represents additional taxes of 4.99% on the “earnings” for that year.

These two scenarios illustrate the importance of the market valuation at 30 June 2025, as the movement in value between 30 June 2025 and the eventual sale, results in additional taxes of $5,000.

Unlisted assets are often difficult to value, but a sale to a third party within 3–6 months of 30 June usually gives the most likely estimate. Obtaining support for value of unlisted assets at 30 June 2025 and thereafter will be imperative in managing and predicting Division 296 outcomes Where material superannuation balances are supported by unlisted assets, SMSF trustees should consider obtaining valuations for these assets, particularly when member balances exceed $3million. Note that the ATO has already indicated that SMSF valuations for 2025 will be under particular scrutiny.

Several additional considerations emerge when navigating the Division 296 provisions, each unique to the individual’s circumstances Key factors include:

Age and access: Can members access their superannuation? Are there personal circumstances that might affect strategy?

Restructuring costs: Are there potential capital gains tax or stamp duty implications if assets are moved?

Family group tax rate: What is the current average tax rate for the family group, and how would changes affect annual obligations?

Member profile: Are balances in pension or accumulation phase, and what are the proportions of taxable versus tax-free components?

Nature of investments: Do the assets experience significant fluctuations in value, are there lockup periods, or can assets be easily sold or transferred?

Valuations at 30 June 2025: Is there a risk of exceeding the cap due to highwater mark valuations? The ATO has highlighted a focus on valuations, prompting auditors to increase their level of scrutiny

Estate and legacy planning: Is the super fund essential to broader estate plans? Would any changes require updates to wills or other estate documents?

Our own modelling, like that of many others, has been undertaken to better understand the effects of Division 296 across a range of scenarios. While it’s not possible to account for every individual circumstance, the analysis consistently shows that when funds have already accumulated in superannuation, keeping investments within the super environment generally offers a better outcome—even after factoring in the impact of Division 296 and potential non-dependent tax considerations. In effect, the taxes imposed on nondependents of SMSFs and the ‘catch-up’ tax on franking credits function as terminal taxes, leading to similar overall results. Importantly, holding investments personally tends to deliver a less favourable result compared to retaining them within an SMSF structure

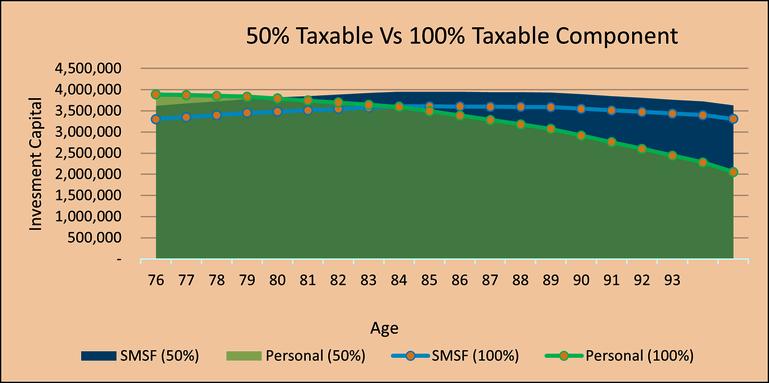

The below graph illustrates the outcomes of investing personally or via superannuation, assuming a 5% return, equivalent annual minimum pension drawing, zero restructure costs, personal tax rate of 47% and the super entitlements having a 50% or 100% taxable member component.

There is a tipping point where the taxes paid on personal investments outweigh any benefits gained from avoiding non-dependent taxes and Division 296 within superannuation. This breakeven typically occurs after 6 to 8 years meaning that if funds remain invested through an SMSF for more than 6 years (with a 50% taxable component) or more than 8 years (with a 100% taxable component), the outcome is generally more advantageous. It’s important to remember, though, that this assumes no significant restructuring costs like capital gains tax or stamp duty. If these costs are substantial, they must be carefully considered before restructuring a superannuation portfolio, as funds withdrawn from super can only be returned using any available contribution caps

While each individual’s circumstances will ultimately shape the optimal course of action, the evidence indicates that, barring significant restructuring costs, retaining investments within the superannuation system, remains generally advantageous over the medium to long term. The interplay of Division 296 and non-dependent taxes highlights the importance of a holistic approach to any superannuation review. Accordingly, careful analysis and ongoing review are imperative to ensure strategies remain aligned with evolving tax frameworks, regulatory scrutiny, and personal objectives. As the landscape continues to shift, proactive planning and professional advice will be key to securing the most favourable outcomes