Sector Pulse

Warwick Face Partner

p +61 7 3222 8444

e wface@pitcherpartners.com.au

Kieran Wallis Partner

p +61 7 3222 8444

e kwallis@pitcherpartners.com.au

Listed retail businesses continue to trade at exceptional multiples despite a volatile reporting season, as major players experience steady sales momentum and seek consolidation to drive growth.

Pitcher Partners expect that M&A will continue to be a lever for sector participants looking to accelerate growth to supplement organic initiatives.

Industry Outlook:

• Despite global uncertainty, Australian retail sales are expected to grow in 2025, driven by easing inflation, potential rate cuts, and resilient consumer demand.

• Retail turnover (in Qld) rose 5.5% (YoY) to $7.85b in June 2025, the second-highest growth amongst all states, driven by strong sales in the food and househould goods category.

Deal Volumes:

• 514 transactions were reported globally in 2025 August LTM.

• 601 transactions globally in the comparable period to August 2024.

• 716 deals on a 10-year average basis.

Deal Values:

Disclosed ANZ values for 2025 August LTM totalled approx. $476m, versus a total transaction value of $3.8 billion (prior comparable period).

M&A Highlights over Last Twelve Months:

• March 2025: Dollarama’s acquisition of The Reject Shop brings together two value-driven retailers. Building on its success in Canada and Latin America, Dollarama sees Australia as a key growth opportunity in what it views as an underpenetrated market.

• June 2025: Private equity backed Amart acquired Freedom Furniture, forming a retail group with 120+ stores and ~$1 billion in sales, as it eyes a potential ASX listing next year.

Australia & New Zealand Retail

September | 2025

The ANZ retail sector has seen a wave of recent strategic M&A activity, driven by international expansion, domestic consolidation, and portfolio realignment.

Dollarama (Canada) acquired The Reject Shop in March, marking its entry into the Australian market and providing an established platform to scale its discount retail model. In the home furnishings category, Amart acquired competitor Freedom Furniture, expanding its store network and supply chain capacity. Meanwhile, Nova Hardware was acquired by Allegion plc, a US-listed security and hardware group, in a deal that gives Allegion a foothold in Australia’s trade and retail distribution network.

Premier Investments finalised the divestment of its Just Group apparel brands to Myer in exchange for newly issued Myer shares. This led to the in-specie distribution of Myer shares to shareholders of Premier Investments, with Premier’s Chairman, Solomon Lew, becoming Myer’s largest shareholder with a ~27% interest.

JB Hi-Fi acquired E&S Trading, a premium kitchen and appliance retailer, expanding its exposure to the high-end home segment and strengthening its multi-brand strategy.

To gain scale rapidly in a competitive landscape where margins are slim and brand loyalty is fleeting, many retailers are turning to acquisitions. A notable example is British e-commerce group THG’s proposed acquisition of Adore Beauty, a move aimed at entering the Australian beauty retail market, though the deal was ultimately rejected

In response to shifting consumer preferences and economic pressures, businesses are actively reshaping their portfolios to close gaps across geographies, channels, and product lines. The recent acquisition of Freedom Furniture by PE-backed Amart illustrates this trend, enabling Amart to consolidate market share and broaden its offering.

To sharpen operational focus and improve profitability, some companies are divesting non-core assets. Premier Investments’ decision to sell off its apparel brands is a recent example of this streamlining strategy aimed at reinforcing its core business.

As companies pivot to new initiatives, many are opting for private ownership to shield themselves from short-term market pressure. The recent privatisation of Nordstrom by its founding family reflects this approach, allowing the business to focus on long-term repositioning without public market scrutiny.

The current median EV/EBITDA multiple of listed ANZ Retail companies is 9.6x, up 24% on the 3-year average of 7.7x.

Investor confidence and earnings resilience remain strong, supported by steady retail sales growth since mid-2022.

Multiples for companies in the Home & Electronics category have expanded the most in the last three years. Investors are valuing the market share and dominance of key players such as JB HiFi and Nick Scali, despite the modest growth in earnings they reported during this period.

Aug-25 Market Movements

Many retailers have released their FY25 earnings at the date of this publication. Shown below are the top share gainers and losers across different sub-sectors for Aug-25 month-to-date.

M&A Overview: Over the past decade in ANZ, higher EV/EBIT multiples have generally been associated with larger revenue size. Deals with above-average revenue have recorded an average multiple of 14.7x, compared to 8.8x for those below the average. Higher margins do not meaningfully correlate with higher multiples. Deals with above-average margins recorded an average multiple of 7.3x, while those below the average had a multiple of 12.6x, indicating no significant correlation. Overall, Broadline Retail is the sub-group with significantly higher multiples compared to others. Within each sub-group, higher multiples are generally associated with larger scale, which aligns with the observations mentioned above.

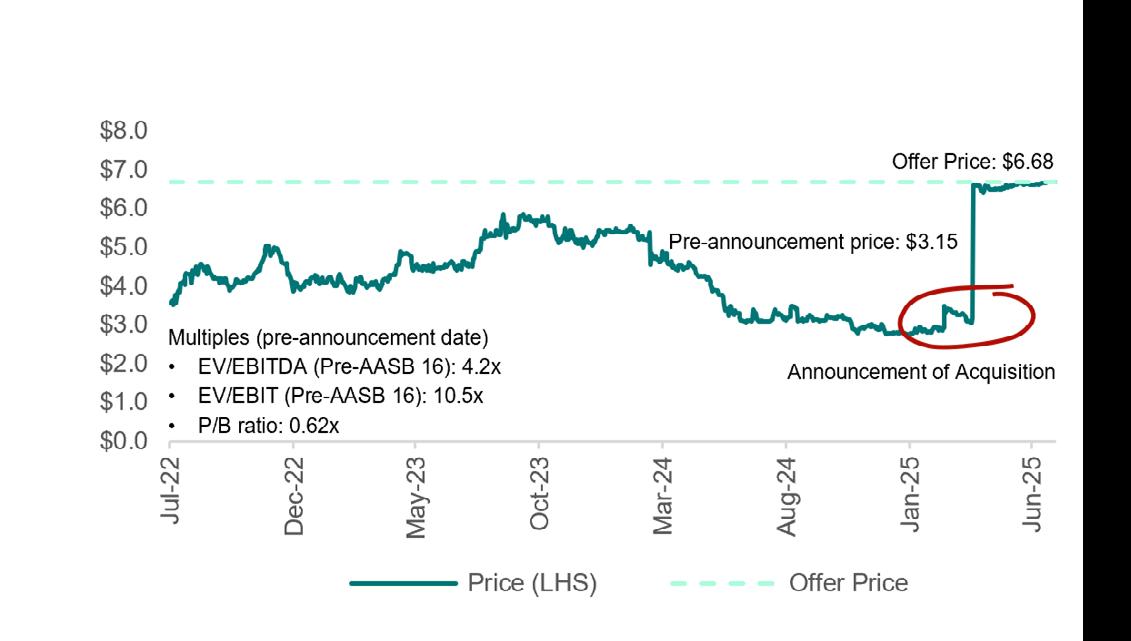

Dollarama announced its acquisition of The Reject Shop (“TRS”) on 27 March for $259 million ($6.68 per share). The offer price represented a 112% premium to the previous trading day’s closing price of $3.15.

Multiples:

EV/EBITDA (Pre-AASB 16): 8.9x

EV/EBIT (Pre-AASB 16): 22.2x

P/B ratio: 1.31x

Transaction Overview: Dollarama’s offered price implies an EV/EBIT multiple of 22.2x. Compared to transaction multiples in ANZ over the past decade, TRS’s multiple is significantly above the median and near the upper end of the range. The same holds when compared to ANZ-listed peers, where the multiple also ranks near the high end of the observed range. The offer represents a 112% premium, reflecting the prior discount caused by prolonged operational challenges and subdued earnings results.

• Scale is key: TRS was sold at a high-end EBIT multiple, supported by its above-average sales revenue relative to both past transactions and listed ANZ peers.

• Strategic market entry: For Dollarama, the acquisition provides a rare opportunity to enter an underpenetrated market with structural similarities to Canada. TRS’s national footprint and limited direct competition make it a strong strategic fit.

• Turnaround and synergy potential: Despite TRS’s recent margin pressure and operational challenges, its national presence offers a strong foundation for performance improvement. Dollarama likely sees potential to enhance profitability through supply chain synergies, improved merchandising, and format optimisation.