Conventional economics would portend that the blunt instrument of 131 interest rate rises since May 2022 would be more than enough to squeeze the life out of the consumer and send the economy into a tailspin. Yet, this would be an oversimplification that fails to account for the complexities and nuances of an economy that supports the aspirations and dreams of over 272 million people.

Despite the headwinds of high interest rates and inflationary pressures, the domestic economy continues to hold up better than expected, recording GDP growth of 1.5%3 over the year to December. Timelier datapoints, including the latest unemployment figures for February (which fell from 4.1% to 3.7%4), suggests that this modest growth trend has continued over the first few months of 2024.

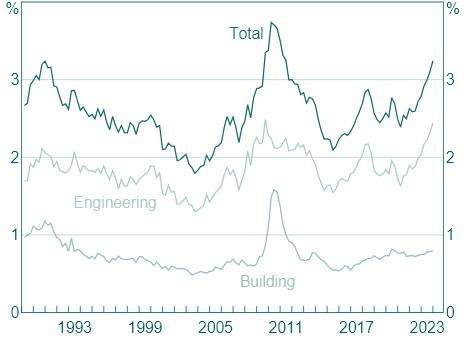

Clues as to why the economy is not yet contracting are littered across the landscape. Traversing across the city and sprawling suburbs of Sydney reveals a series of complex road and rail infrastructure projects that are a testament to the marvel of engineering and human endeavour. Similarly, other large scale construction projects across the country continue at pace. In Western Australia, the green energy transition supports a swathe of mining construction projects in addition to the more traditional Liquified natural gas (LNG) projects.

Public Construction Work (Percentage of Nominal GDP)

Source: ABS, RBA Chart Pack5

With less fanfare, but no less importance, has been the evolution of the NDIS industry which now helps improve the lives of thousands of Australians and supports over 320,000 workers6 as well as the businesses

1 ‘Cash Rate Target’, Reserve Bank of Australia, https://www.rba.gov.au/statistics/cash-rate/,(accessed 25 March 2024).

2 ‘Population clock and pyramid’, ABS, https://www.abs.gov.au/statistics/people/population/population-clockpyramid, (accessed 14 March 2024).

3 ‘Australian National Accounts: National Income, Expenditure and Product’, ABS, https://www.abs.gov.au/statistics/economy/national-accounts/australian-national-accounts-national-incomeexpenditure-and-product/latest-release, (accessed 8 March 2024).

4 ‘Labour Force, Australia’, ABS, https://www.abs.gov.au/statistics/labour/employment-andunemployment/labour-force-australia/feb-2024, (accessed 22 March 2024).

5 ‘The Australian Economy and Financial Markets’, Reserve Bank of Australia, March 2024, p.15, https://www.rba.gov.au/chart-pack/pdf/chart-pack.pdf?v=2024-04-02-15-57-33, (accessed 22 March 2024).

6 ‘Building a more responsive and supportive workforce’, NDIS Review, 15 May 2023, https://www.ndisreview.gov.au/resources/paper/building-more-responsive-and-supportive-workforce, (accessed 25 March 2024).

that are interlinked. Further, in response to the closed borders and labour shortages experienced during the pandemic, the government allowed an influx of new migrants, which has also been supportive of growth, albeit with unintended consequences (worsening the housing crisis).

Against this backdrop, it is impossible to ignore the looming headwinds that continue to threaten the outlook.

Some economists continue to believe that inflation remains a key risk, but we do not subscribe to this view While it is true that services inflation remains elevated as insurance premiums soar and the limited supply of housing continues to put upward pressure on rents. We have however seen a moderation outside these areas as household incomes continue to be eroded. We would argue a material reason that services inflation is elevated is because landlords have been passing on rent increases to cover their higher mortgage costs and this pressure should abate once the RBA starts to cut. In our view, monthly employment datapoints can be unreliable and so to suggest that there could be any reignition of wages inflation due to a tight labour market is highly unlikely given that both job vacancies and hours worked are still both decreasing.

We have also seen a significant deceleration in goods inflation courtesy of China’s extraordinary overinvestment in many manufactured goods (EV’s, steel, semi-conductors, solar panels, etc) that has helped export disinflation across the world. It has been estimated that by the end of next year, China will have built enough solar and battery capacity to quadruple the entire global supply of these products7. It already has enough capacity to meet global EV demand three times over.

The real risk then remains the evolution of China’s economy. Not only have China’s authorities made significant policy errors in recent years by curbing private sector investment and innovation, but this has been compounded by the implosion in China’s property sector. This sector remains in turmoil following the collapse of Evergrande and other large developers. With property prices falling in China8 after years of massive overinvestment, it is difficult to see this sector improving anytime soon.

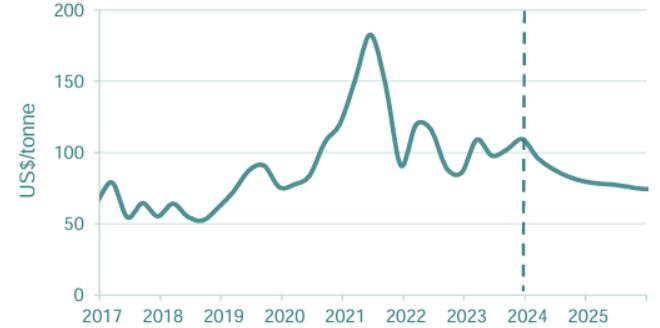

The significance of this cannot be understated. Failing large scale government stimulus, which will only exacerbate its structural debt problems, China’s economy is likely to continue to slow. These structural problems are a by-product of heavily indebted local government authorities and state-owned enterprises that overinvested in unproductive property and infrastructure assets to keep GDP growth on target. A decline in dwelling construction is now inevitable, which will reduce demand for steel and in turn, iron ore, Australia’s biggest export commodity. Moreover, iron ore supply is set to surge9 in 2025 as new mines in the African region of Simandou become operational.

With export revenues set to fall, mining profits and mining services profits are also likely to decelerate, reducing government revenues. This comes at a time when heavily indebted households have experienced a sharp decline in disposable income and have near exhausted their savings buffers.

7 A. Evans-Pritchard, ‘China is stealing growth by dumping its vase excess on the world’, The Telegraph (12 January 2024), https://news.yahoo.com/china-relentless-quest-growth-toxic-060000998.html,(accessed 25 March 2024).

8 C. Li, ‘China Home Prices Slide, Increasing Pressure on Beijing’, Wall Street Journal (23 February 2024), https://www.wsj.com/economy/housing/chinas-new-home-prices-fell-at-faster-pace-in-january-a99dafb4, (accessed 25 March 2024).

9 T. Treadgold, ‘Profit Collapse Looms For BHP, Rio Tinto and Fortescue’, Forbes (26 February 2024), https://www.forbes.com/sites/timtreadgold/2024/02/26/profit-collapse-looms-for-bhp-rio-tinto-andfortescue/?sh=564610b9918f, (accessed 25 March 2024).

Source: Office of the Chief Economist, Resources and energy quarterly10

It follows then that the sizeable headwinds facing the Australian economy should drag on growth unless we see the RBA reverse course and begin cutting rates

The Australian economy is likely to continue softening for the rest of the year as disposable incomes remain challenged by high interest rates and cost of living pressures. These impacts will be compounded by a likely decline in the price of Australia’s largest export commodity, iron ore, as China continues to come to terms with the implosion in its property sector. This fall could reduce exports, decease profits from the mining sector and reduce government tax revenues, all of which are likely to exacerbate the downturn unless the RBA starts to cut interest rates soon.

10 ‘Resources and Energy quarterly’, Office of The Chief Economist, March 2024, p. 43, https://www.industry.gov.au/sites/default/files/2024-03/resources-and-energy-quarterly-march-2024.pdf, (accessed 24 March 2024).

Source: Bloomberg

By Martin FowlerPartner | CIO, Pitcher Partners Sydney Wealth Management

p +61 2 8236 7776

e martin.fowler@pitcher.com.au

The global economy looks positioned to continue improving in 2024 after a difficult year navigating the challenge of higher interest rates and other commodity price shocks that contributed to anaemic economic expansion. With inflation normalising more towards pre-COVID levels across the developed world, the stage is set for rate cuts by central banks which should support economic growth returning towards trend levels

United States

The United States economy surprised on the upside last year thanks to a surge in government spending (up 4% for the year). Consensus forecasts expect growth to step down from 2.5% in 2023 to 2.1% this year. Government spending looks set to be a material support in 2024 with President Biden signing a $US1.2tn bill in late March11 Provided US politicians continue to find a compromise on government debt, this injection will remain a net positive for US growth in the near term.

US Federal Budget Deficit as percentage of GDP (Feb-04 to Feb-24)

Source: Bloomberg

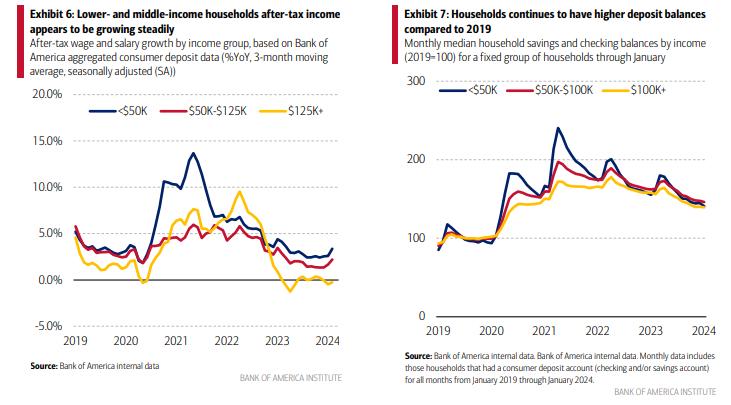

Household balance sheets also remain in good health with savings still tracking materially above 2019 levels. Although we expect some moderation in wage growth, it is likely to remain firm overall given resilience in the labour market. Unemployment is tracking at 3.9%, only mildly above its low point of 3.5% in March last year. This backdrop should remain supportive of household spending (consensus estimates expect 1.9% growth).

11 ‘President Biden signs $1.2 trillion US spending bill’, Reuters (24 March 2024), https://www.reuters.com/world/us/us-congress-averts-government-shutdown-passing-12-trillion-bill-2024-0323/, (accessed 28 March 2024).

On the inflation front it appears that the underlying trend of deceleration remains intact. After stripping out volatile components such as food, energy and the cost of shelter, inflation is tracking at only 2.2% growth for the year and indicates that much of the inflationary excess in other categories has now passed. This subdued growth in core inflation lends itself to the case that the Federal Reserve (Fed) has grounds to ease policy settings later in 2024.

Source: Bloomberg

Notwithstanding, recent comments by Fed Chairman Jerome Powell stated that the Fed requires more time to be confident that inflation will be contained around the 2% target level but more importantly, that the Committee members are not far from this conclusion. The latest update in projections from the Committee in late March corroborate this with three rate cuts anticipated by the end of 2024.

The US appears primed for a period of slower but still positive growth with inflation continuing to moderate. While there are pockets of weakness emerging in the labour market, these are not yet immediately

12 ‘Consumer Checkpoint: No underlying leaps in February’, Bank of America Institute (11 March 2024), https://institute.bankofamerica.com/content/dam/bank-of-america-institute/economic-insights/consumercheckpoint-march-2024.pdf, (accessed 28 March 2024).

concerning but instead an area we continue to monitor as a means of assessing the damage inflicted by the Fed’s rate hikes to date. We remain positive on the US outlook and do not anticipate material recession risks.

The picture in Europe continues to be difficult but there are promising signs. Leading indicators including the Markit PMI surveys are showing signs of stabilisation for the region after flirting with negative growth in 2023. The Services sector in particular, is an area of resilience although manufacturing remains challenged due to a mix of weak demand and rising competition from overseas such as Chinese electric vehicle (EV) imports These travails have impacted Germany in particular as the country, Europe’s largest economy, is experiencing a material demand shortfall. There is little prospect of government spending to bridge the gap with the country suffering from self-afflicted deficit restrictions that have already prompted spending cutbacks13. These constraints will limit any prospective recovery in the near term until the economy sufficiently adjusts to the weaker spending environment.

European policymakers are also beginning to acknowledge the competitive threat presented by China’s upskilling in manufacturing, with concerns of low-cost goods flooding the market for cars (up almost 37% in 2023), biodiesel14 amongst other examples. China is also flagging its willingness to retaliate with its own tariffs against European exports albeit starting small with an investigation into European dumping of brandy exports15. The widening trade imbalance could eventually lead to increased protectionism to the detriment of Europe given its reliance on Chinese exports. This may pose a headwind to growth as well as higher inflation (higher import prices) if the two are unable to find a compromise

On the inflation front the weaker demand outlook has seen material easing of price pressures with headline inflation sliding to 2.6% growth and expected to remain contained in the near term with consensus forecasts expecting 2.4% growth in 2024 overall. Barring additional shocks to energy markets we would anticipate inflation to maintain the current trajectory towards the ECB’s long-term target of 2%. A potential risk to this view is the persistence of elevated inflation in some segments of the services sector (mainly higher wage growth) which could lead to inflation remaining at a higher average level in the near term. We can see this in the chart below via the core inflation rate which has remained stubbornly higher than the headline rate, the latter benefiting notably from lower commodity prices, particularly energy costs.

13 H. Von Der Burchard, ‘German parliament approves 2024 budget, but further troubles loom’, Politico (2 February 2024), https://www.politico.eu/article/german-parliament-approves-budget-for-2024-but-financialwoes-continue/, (accessed 27 March 2024).

14 S. G. Caroll, ‘EU confirms probe into cheap Chinese biodiesel decimating EU industry’, Euractiv, https://www.euractiv.com/section/biofuels/news/eu-confirms-probe-into-cheap-chinese-biodiesel-decimatingeu-industry/, (accessed 26 March 2024).

15 M. G. Jones, ‘China to investigate EU brandy imports in new anti-dumping probe’, Euronews (5 January 2024), https://www.euronews.com/my-europe/2024/01/05/china-to-investigate-eu-brandy-imports-in-new-antidumping-probe, (accessed 26 March 2024).

Source: Bloomberg

The downward trajectory of inflation has seen firmer guidance from policymakers. While the ECB left its benchmark deposit rate at 4% in March, it updated its projections that see inflation hitting 2% in 2025. Comments from Spanish central bank governor Pablo Hernadez supports the prospect of the ECB beginning to cut rates from June this year16. Given the sensitivity of financing costs to variable interest rates this could become a material tailwind for the economy.

In summary the Eurozone has continued down its anaemic growth path. This has had a silver lining where easing supply constraints coupled with weaker demand have supported a return of inflation towards target levels. This should support ECB cuts in the second half of this year and act as a tailwind for an improvement in the broader economy

The Chinese growth story continues to face challenges to start 2024. The property sector is front and centre in this regard with real estate investment for the first two months in 2024 down 9% on the prior period. Authorities have, however, provided government subsidies and supported increased lending by financial institutions to drive renewed investment spending in both manufacturing and infrastructure which were up 9.4% and 6.3% respectively over the same period.

The government has set an ambitious growth target of approximately 5% for 2024 which will be a more difficult exercise given a lack of any material government stimulus.

The consumer remains a point of potential concern. Retail sales were up 5.5% for the first two months to start 2024 but the outlook remains subdued and the bounce, relative to other countries exiting COVID lockdowns, has been vastly more muted. We do not see signs of this changing in the near term with authorities reluctant to announce major stimulus initiatives.

Chinese consumer inflation data offers another data point for assessing consumer health. Growth for the year to February of 0.7% is subdued relative to Western countries and highlights the weakness of domestic demand relative to available supply from Chinese businesses. With producer prices falling, Chinese firms

16 ‘ECB could start rate cuts in June, De Cos says’, Reuters (17 March 2024), https://www.reuters.com/markets/rates-bonds/ecb-could-start-rate-cuts-june-de-cos-says-2024-0317/#:~:text=MADRID%2C%20March%2017%20(Reuters),an%20interview%20published%20on%20Sunday, (accessed 28 March 2024).

continue to see deflationary conditions. This means that China is reliant on export markets to offset the paucity of demand at home.

We are beginning to see a rising groundswell of opposition from overseas governments that have become increasingly concerned about China effectively dumping exports on global markets. This is notable in a range of sectors including steel with the country seeing a rapid surge in production last year with over 90 million tonnes exported, the highest level since 201617 .

Source: GMK Center

Investigations underway by Europe and Brazil18 as well as US warnings19 on the issue highlight its breadth. If we see any meaningful uplift in trade barriers as a result of these concerns it may reduce Chinese exports and have a negative knock-on effect for economic growth given the lack of other international markets that are capable of absorbing this surplus production.

In summary China is struggling with a demand deficit at home for the excess capacity it has built up in a range of sectors including manufacturing, automotives and more. It has effectively increased its reliance on external demand via exports to find a market for this excess supply. The willingness of the rest of the world to tolerate this scenario is increasingly coming into question. Rising trade barriers could pose a near-term risk for the country. Meanwhile the lack of meaningful stimulus domestically suggests that this year’s growth ambitions may also disappoint.

17 V. Kolisnichenko, ‘China exported 90.3 million tons of steel products in 2023’, GMK Center (15 January 2024), https://gmk.center/en/news/china-exported-90-3-million-tons-of-steel-products-in-2023/, (accessed 28 March 2024).

18 ‘Brazil launches China anti-dumping probes after imports soar’, Financial Times (16 March 2024), https://www.ft.com/content/8703874e-44cb-4197-8dca-c7b555da8aef, (accessed 28 March 2024).

19 ‘US warns China against dumping goods on global markets’, Financial Times (18 February 2024), https://www.ft.com/content/96dc71be-b795-47dc-a1cc-cccc7aa6a481, (accessed 28 March 2024).

Growth conditions globally appear to be improving on balance with the US continuing to grow at a healthy, albeit slower pace, while Europe emerges from a troubled 2023 experience. Inflation appears to be retreating globally due to a combination of weaker demand induced by higher interest rates and an easing in supply chain pressures. These factors coupled with the likely support of lower interest rates lead us to take a cautiously optimistic view on the global economic outlook. We expect 2024 to be a year of consolidation before seeing further improvement in 2025.

Source: Bloomberg

By Cameron CurkoHead of Macroeconomics & Strategy, Pitcher Partners Sydney Wealth Management

p +61 2 9228 2415

e cameron.curko@pitcher.com.au

The S&P/ASX 200 Total Return Index returned 5.3% over the three months and 14.4% over the year to 31 March 2024

S&P/ASX 200 Accumulation Index cumulative return (Mar-23 to Mar-24)

Source: S&P Global, Bloomberg

Recommendation: Maintain underweight.

The Australian market has rallied sharply to start 2024. This has been driven by investors frontrunning expected interest rates cuts by the Reserve Bank that are expected to underpin stronger credit growth (bank positive), stronger household spending (retail positive) and stronger real estate prices (A-REIT positive). In our view this shift has led to valuations becoming stretched particularly for segments such as the banking and retail sectors. With labour slack increasing and consumer demand anaemic in volume terms, the reality of a weakening economy present material headwinds to the outlook.

Taken together we need a material improvement in economic fundamentals to support current valuations. Our negative outlook on major sectors, confirmed further by recent economic data, leads us to maintain our underweight positioning.

Source: Bloomberg; Long-Term average Forward P/E calculated from Aug-05 to Mar-24

NB: Dividend Yield price move calculated after converting yield into Price to Dividend ratios.

Pricing at a sector level has become further stretched over the March quarter. Both Banks and retail require over 20% corrections to see share prices closer in line to their long-term average valuation. Resources have remained a notable exception thanks to the decline in iron ore prices driving the share prices of majors such as BHP lower over the quarter. A-REITs offer a more nuanced case with this sector heavily influenced by the valuation of major component Goodman Group (GMG). As shown below when we exclude GMG the overall sector is trading at a slight discount.

Source: Bloomberg, PPWM calculations; Long-Term average Forward P/E calculated from Aug-05 to Mar-24

Our outlook for some of the major sectors of the S&P/ASX 200 is as follows:

Recommendation: Maintain underweight.

The banking sector outlook remains problematic. In recent months a surge in offshore buying has supported a material uptick in bank share prices. This buying activity has led to sector valuations becoming stretched particularly in sector leader Commonwealth Bank, which ranks amongst the most expensive in the world. Current share prices imply a far stronger growth outlook than the macroeconomic backdrop or competitive landscape warrant and do not offer a sufficient margin of safety at present.

Credit growth has improved recently as households adjusted to a higher interest rate environment. The looming prospect of higher unemployment as the economy slows is not consistent with a period of strong credit growth and consequently, we believe it will soften in the near term. This reduces the aggregate supply of loans that banks can make lowering the industry’s potential for both revenue and profit growth.

Source: Bloomberg

Delving into business fundamentals we are not seeing expectations of a material uplift in profitability with net interest margins expected to be largely stable over the next few years. This arguably overlooks the risk of a slower growth environment triggering a renewal of competitive pressure in loan pricing. Recent reports in the AFR20 suggest bank discounting could be resuming which would pose a downside risk to profits as lenders sacrifice margin to ensure growth in their overall lending activity.

20 ‘Aggressive discounting threatens new front in “mortgage war”’, Australian Financial Review (8 March 2024), https://www.afr.com/companies/financial-services/aggressive-discounting-threatens-new-front-inmortgage-war-20240307-p5fao0, (accessed 19 March 2024).

Source: Bloomberg

Finally, we note that expense growth is expected to remain steady in the near term with consensus cost-toincome (the ratio of operating costs relative to income) showing some improvement into 2026-27. With sizeable efficiency gains already having been made in recent years, the potential for further cost-cutting to improve earnings becomes more difficult.

In summary many of the key factors governing bank fortunes such as valuation, top line growth and profit margins are under pressure. The outlook for the sector remains negative in the near term and accordingly we keep our positioning underweight.

Recommendation: Downgrade to underweight

The outlook for Australian resource stocks hinges on the strength of iron ore given it makes up the vast majority of profits from the largest players namely Rio Tinto, BHP and Fortescue. In that context our concerns have shifted appreciably since the end of 2023.

On the demand side of the ledger, we continue to see signs of current and emerging weakness. Property investment remains anaemic in China. The country did make a notable pivot towards producing steel for export last year with 2023 a near record of over 1 billion tonnes of steel being produced. That is not sustainable given the notable pushback from European and other national authorities as their local steel industries lobby for heightened tariffs on Chinese steel. In addition, the backdrop for steel demand has softened into 2023 with the Markit Steel Users PMI, a survey of major steel users globally, persisting in negative territory flagging still weak demand conditions most notably in North America and Europe.

Finally, despite several opportunities to do so, the latest being the Party’s National Congress, Chinese authorities are still yet to propose any material government stimulus initiatives that would support iron ore prices through, for example, renewed spending on infrastructure or property investment.

On the supply side we have seen the majors continue to increase their production volumes in recent reporting periods. In addition, Rio’s major joint-venture with a Chinese consortium, a mega mine in Simandou, Africa is set to begin production from 2025. This site is both high quality and high quantity in its scope with the prospective addition of over 5% to current iron ore production globally once it reaches full production. The consortium members are state-owned enterprises with an incentive to produce iron ore at capacity given the country’s reliance on the commodity as a key ingredient for steel production. This would likely see, barring

operational mishaps, an increased supply of high-quality ore being brought to the market which coupled with a subdued demand outlook threatens to see prices settle at a lower level.

Chinese growth targets also appear ambitious given weak domestic demand. Real-time data (shown below) shows that iron ore inventories have climbed sharply over recent months. This inventory overhang is likely to put downward pressure on the price in the short run.

China port inventories vs iron ore price (Dec-11 to Mar-24)

Source: Bloomberg

Although valuations in the sector are undemanding, the risk of downward earnings revisions cannot be ruled out.

In summary the combination of subdued demand coupled with increased supply is a net negative for the major miners as reduced prices leads to material declines in profitability. Consequently, we downgrade our outlook to underweight.

Recommendation: Maintain underweight.

Australian retail stocks surprised on the upside during the March quarter, enjoying strong outperformance against the broader market. Key to this was a number of stocks exceeding somewhat pessimistic consensus forecasts. Leading electronic goods retail JB Hi-Fi for example was one of the outperformers, even though earnings declined 20% in the first half of FY24. Earnings are expected to continue to decline in the second half with profits not expected to resume growing until FY26.

At a macro level the backdrop also remains challenging. The CommBank HSI Index, a timely indicator of for household spending continues to track at an annualised growth rate of 3.5%. This is consistent with close to flat volume growth in household spending after allowing for inflation. In addition, many household budgets are being eroded by inflation in non-discretionary categories such as insurance and education. Taken together this points to increasingly less scope for discretionary spending.

Annual growth in household consumption versus spending intentions (Mar-20 to Mar-24)

CommBank Household Spending Intentions Index

Sources: CommBank, ABS

Real Household consumption

To adopt a positive stance to the sector as the market has done requires forming two views we believe are overly generous. One is that the RBA will accommodate the economy with material interest rate cuts that will unlock increased spending together with the recently passed income tax changes. Second is that the labour market will remain tight and with high employment levels households will retain the security to maintain their spending at what are still historic highs. On the former we believe the pace of rate hikes may be more measured than current market pricing implies given the long lag before inflation reaches target levels. The outlook for employment remains poor with aggregate hours worked continuing to decline in recent months and job vacancies down over 12% for the year implying weakening demand for labour.

Finally, valuations for the sector are tracking at elevated levels given the still depressed earnings outlook in the near term. Accordingly, we maintain our underweight stance towards the sector.

Recommendation: Maintain neutral

The A-REIT sector continues to trade at a more reasonable value outside of index heavyweight Goodman Group. Goodman Group derives a substantial source of its earnings from property development and asset management rather than outright real estate ownership. This makes it quite distinct from the broader A-REIT market. The attractive rates of earnings growth (high single digits) coupled with high returns on capital at present as it benefits from developing sites for data centres have triggered a material rerating in the stock’s prospects and valuation. Outside of Goodman, most A-REITs are trading at material discounts to their underlying property values.

Prices on assets in the broader industrial sector outside of Goodman have also held up better than expected. This is because a deficit of supply in key markets such as Sydney and Melbourne has given industrial asset owners the ability to pass on material rental increases and more than offset pressures from higher interest rates.

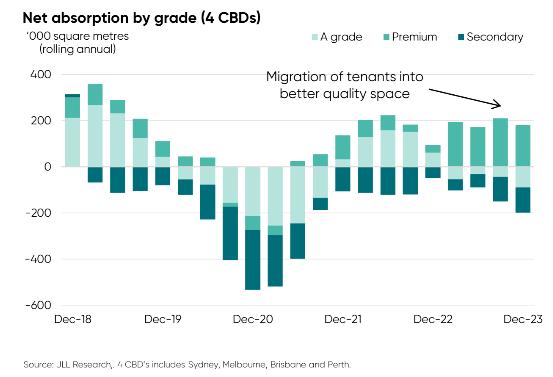

Commercial real estate cap rates by sector (Sep-10 to Feb-24)

Source: Bloomberg

Meanwhile, conditions in the office sector remain challenging, although some bright spots are emerging. The recent reporting season highlighted a clear preference by tenants for higher quality, premium office properties. Conversely, vacancies continue to rise for inferior sites. Certain operators such as Dexus are materially overweight with these prime sites and given the evidence of continued demand, are well placed for a gradual recovery over the medium term.

Dexus occupancy vs broader office market

Source: Dexus HY24 Results Presentation21

21 ‘Dexus HY24 Results presentation’, (14 February 2024), https://dataapi.marketindex.com.au/api/v1/announcements/XASX:DXS:2A1504715/pdf/inline/hy24-results-

Lastly, in the retail sector, demand for traditional “bricks and mortar” locations has held up well. Major landlords such as Westfield operator Scentre Group have benefited from increased foot traffic and the increased transformation of its locations into “experiences” that consumers are willing to seek out. This has flowed through into material pricing power with both Scentre and Vicinity enjoying notably positive leasing spreads as tenants are willing to pay a higher price to access prime locations and reach potential customers. This dynamic, like the industrial sector, has helped support valuations. Nevertheless, demand may become increasingly challenged as the consumer faces notable pressures from higher interest rates and, potentially, higher unemployment.

In conclusion, underlying demand in the AREIT sector remains healthy outside of office (in aggregate) with both retail and industrial landlord tenants having sufficient demand to sustain higher rental costs. Financing costs remain a near-term drag on both earnings and valuations. To warrant an overweight upgrade would require more sustained, higher transactions in the office sector which has not yet been forthcoming. Rate cuts may be an inflection point in that regard and we are closely monitoring to see if that will occur. Another potential concern lies in the support from underlying tenants to sustain higher rental costs. If the economy deteriorates, the ability for landlords to pass through higher rents will diminish. On balance, we believe a neutral sector weighting remains appropriate.

By Cameron Curko Head of Macroeconomics & Strategy, Pitcher Partners Sydney Wealth Managementp +61 2 9228 2415

e cameron.curko@pitcher.com.au presentation?_gl=1*ag3mz9*_ga*MjgxODUyNTU3LjE3MTEyNTgzMTU.*_ga_R504V9JPBH*MTcxMTI1ODMx NS4xLjEuMTcxMTI4Njg1MS41MS4wLjA

The MSCI World (excluding Australia) Net Total Return Index (AUD) returned 14.1% over the past three months and 28.7% over the year to 31 March 2024. A notable contributor to this return was the decline in the Australian dollar with the MSCI World (excluding Australia) Net Total Return Index (hedged to AUD) returning 25% for the year to March, a differential of 3.7%.

MSCI World excluding Australia Net Total Return Index (Mar-23 to Mar-24)

Source: MSCI, Bloomberg

Recent strength on global markets has been largely driven by the two major themes of artificial intelligence and innovations in healthcare.

The artificial intelligence (AI) arms race continues apace with major technology names such as Amazon and Microsoft embarking on an acceleration in capital spending to acquire the latest AI chips that their end customers are demanding. This has translated into a surge in demand for Nvidia chip designs and a virtuous circle has emerged where major tech names need to spend more on investing for the future. Meanwhile Nvidia benefits with its chip leadership seeing all of the major technology firms emerge as key customers. This is not without its risk due to the level of customer concentration. A broader wellspring of demand outside major technology businesses will be critical to ensuring the current drive for AI spending remains sustainable.

In the healthcare sector, weight loss drugs continue to be another key factor with leaders Novo Nordisk and Eli Lilly continuing to see material share price appreciation. Limited supply coupled with unprecedented demand are supercharging the earnings of these businesses. Intellectual property protection over their GLP-1 formulations is also critical in protecting their franchises. Competitive alternatives are beginning to emerge however. Viking Pharmaceuticals for example made headlines with the development of a new formulation which it is now seeking final regulatory approvals to mass produce. We would expect these efforts to intensify given the profits on offer and eventually this should see the current era of supernormal earnings and earnings growth begin to subside. However in the interim, this trend does appear to be sustainable with the expansion

of potential customers22 and a still limited supply backdrop enabling leading producers Novo Nordisk and Eli Lilly to continue reaping the rewards of higher pricing.

Finally, recession risk now appears an afterthought with markets turning away from defensive names to favour businesses with the ability to grow at a material rate. This has been supported by the expectation that central banks will cut rates in the second half of this year. The current period of ebullience has seen valuations become stretched.

In the US, operating earnings for S&P 500 companies are currently expected to now rise by 9% in 2024 (compared to 10.3% growth last quarter) and then rise by 12.4% and 8.4% in 2025 and 2026 respectively.

Assuming conventional long-term multiples, we estimate that the US sharemarket (as measured by the S&P 500 Index) is overvalued by almost 25.7% in the near-term and by a slightly lower 9.4% in the medium-term.

2024

Source: Bloomberg consensus estimates for 2023, 2024 and 2025 as of 31 March 2024

22 ‘Wegovy to be covered by US Medicare for heart disease patients’, Reuters (23 March 2024), https://www.reuters.com/business/healthcare-pharmaceuticals/wegovy-be-covered-by-us-medicare-heartdisease-patients-2024-03-21/,(accessed 29 March 2024).

Source: Bloomberg. Data as at 31 March 2024

Recommendation: Maintain neutral weighting

In summary, the outlook remains mixed. The current tailwinds that have propelled equity markets over the last 12 months, being AI and weight loss drugs, and the looming prospect of lower interest rates, remain in place. These positive attributes need to be counterbalanced however with valuations, particularly in the US, that screen expensive suggesting share prices need to correct to be more reasonably valued. As we believe risks are evenly balanced, we maintain our neutral positioning.

By Cameron Curko Head of Macroeconomics & Strategy, Pitcher Partners Sydney Wealth Managementp +61 2 9228 2415

e cameron.curko@pitcher.com.au

Jordan Kennedy Partner, Pitcher Partners Sydney Wealth Management

p +61 2 9228 2423

e jordan.kennedy@pitcher.com.au

Charlie Viola Partner | Managing Director, Pitcher Partners Sydney Wealth Management

p +61 2 8236 7798

e charlie.viola@pitcher.com.au

Andrew Wilson Principal, Pitcher Partners Sydney Wealth Management

p +61 2 9228 2455

e a.wilson@pitcher.com.au

Martin Fowler Partner | CIO, Pitcher Partners

Sydney Wealth Management

p +61 2 8236 7776

e martin.fowler@pitcher.com.au

Cameron Curko Head of Macroeconomics & Strategy, Pitcher Partners Sydney Wealth Management

+61 2 9228 9173

p

e cameron.curko@pitcher.com.au