2 minute read

International equities

Overview

The MSCI World (excluding Australia) Net Total Return Index (AUD) returned 9.2% over the past three months and 4.3% over the year to 31 March 2023

MSCI World excluding Australia Net Total Return Index (Mar-22 to Mar-23)

Outlook

Source: MSCI, Bloomberg

The outlook for international equities remains challenging.

On the positive side, valuations remain favourable, particularly outside the US, with major markets trading at discounts of over 10% to their long-term average price-earnings multiples. Normally such discounts provide attractive opportunities to accumulate equities. In addition, the reopening of China has spurred expectations of stronger global demand supporting firms providing natural resources and reliant on Chinese demand e.g., luxury goods. The recent US banking sector crisis and spill over into Europe may also see central banks pause their rate hikes to assess the damage and avoid compounding it.

However, there are several counterarguments that give us pause.

First, monetary policy remains unsupportive. Central banks have shown an unrelenting commitment to combat inflation, particularly in the US and Europe. This suggests that current interest rate levels may persist until we see broad-based economic weakness, such as significant job losses. The longer this scenario persists the greater the risk of lower asset prices as investors move capital to safer options such as cash.

We also harbour concerns that the outlook for slowing economic growth is not adequately reflected in earnings forecasts. The US is still predicted to grow profits approximately 5.9% per annum over the next three years to 2025. This remains difficult to reconcile with the below-average growth outlook. If earnings disappoint further, as would seem likely over coming quarters, then the risk of further market weakness in the short term is high.

Lastly the geopolitical environment continues to be unstable. The war in Ukraine shows no signs of abating, posing ongoing challenges for the global supply of energy and food. Further, the probability of China invading Taiwan in the next few years continues to rise.

On balance, we believe the case for being underweight global equities continues to be justified and maintain our underweight position.

Valuations

In the United States, operating earnings for S&P 500 companies are currently expected to decline by 0.8% in 2023, and then rise by 9.9% and 9% in 2024 and 2025 respectively. Assuming conventional long-term multiples, we estimate that the United States sharemarket (as measured by the S&P 500 Index) is overvalued by 8.8% in the near-term and undervalued by almost 7% in the medium-term.

Source: Bloomberg consensus estimates for 2023, 2024 and 2025 as of 29 March 2023

Over the March quarter we continued to observe rising share prices even as earnings expectations declined Two factors have been key. First, the deceleration of US inflation saw the “bad news is good news” narrative persist whereby investors are anticipating the Fed to halt or even cut rates sooner than previously anticipated to offset weaker economic growth. Second, the positive economic data emerging out of China saw a pickup in optimism for commodities and consequently resource stocks in anticipation of stronger Chinese demand.

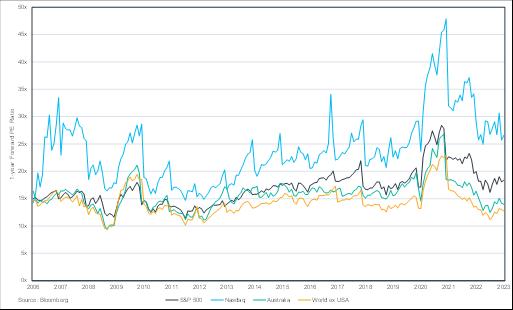

12-month Forward Price-Earnings Ratios for major markets (Mar-06 to Mar-23)

Source: Bloomberg; Data as at 29 March 2023

Consistent with the above, forward Price-to-Earnings (P/E) multiples for markets around the world are below longer-term averages as follows:

Source: Bloomberg. Data as at 29 March 2023.

Conclusion

Recommendation: Maintain underweight

In spite of more attractive valuations, we believe consensus earnings forecasts remain overly optimistic. We expect earnings expectations to be downgraded in coming months as global growth slows materially given challenges posed by inflation, the US banking crisis and rising interest rates. For these reasons we remain underweight.

By Cameron Curko, Head of Macroeconomics & Strategy | Pitcher Partners Sydney Wealth

Management +61 2 9228 2415 cameron.curko@pitcher.com.au