6 minute read

Australian equities

Overview

The S&P/ASX 200 Total Return Index returned 3.5% over the three months and 0.1% over the year to 31 March 2023

S&P/ASX 200 Accumulation Index cumulative return (Mar-22 to Mar-23)

Outlook

Recommendation: Maintain underweight

Source: S&P, Bloomberg

Australian equities are facing a period of significant uncertainty amid a weak global and domestic economic backdrop. Initial signs of weakness were prevalent in the recent corporate reporting season (1HFY23). With a handful of exceptions such as energy, healthcare and utilities, most other sectors disappointed earnings expectations. A slowdown in global industrial production and limited stimulus from China is likely to reduce demand for resources and other cyclical sectors such as industrial businesses. Bank margins face challenges from heightened competition (reducing profitability) and weak consumer demand as interest rate hikes bite. Consumer sentiment remains weak, which bodes poorly for the retail sector which has enjoyed the benefit of strong government stimulus in recent years.

Given these conditions, we believe there is further scope for earnings downgrades and heightened risk for further price corrections as economic activity slows. In conclusion, we continue to recommend investors retain an underweight exposure to Australian equities.

Sector view

Our outlook for some of the major sectors of the S&P/ASX 200 is as follows: Banks

Recommendation: Maintain underweight

We believe the downside risks continue to outweigh potential upside factors and we retain an underweight position on the banking sector.

Our credit growth outlook remains negative. New mortgage loans (excluding refinancing) are down over 35% for the year to January. To attract customers in a weak market, lenders must be willing to sacrifice margin in the form of lower rates or cashback and other incentives. This has the impact of lowering net interest margins and was a focus in the latest reporting result by Commonwealth Bank. The rising concern on this front saw CBA shares underperform in February as a result.

Credit quality still appears strong, but we have likely seen the bottom in arrears. S&P figures (see below chart) highlights the uptick in mortgage stress for mortgage-backed securities (RMBS) that they cover. In our view, bad debts are likely to increase over the next 12 months as heavily indebted households and corporates struggle to meet repayments.

SPIN RMBS arrears rate (Jan-03 to Jan-23)

Source: S&P Global as of January 2023

The picture for bank operating efficiency matters more outside of turning points where rising credit risk and declining net interest margins are not as prominent factors as they are in the present day

Resources

Recommendation: Maintain underweight.

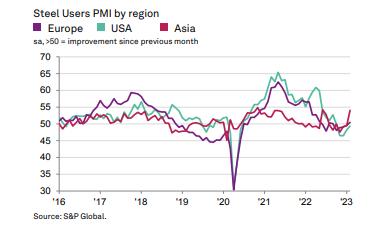

Iron ore prices continue to be supported by the ending of pandemic restrictions in China (up 4.2% quarter-todate). We saw confirmation of this in the latest S&P Steel Users PMI with the Asia region seeing a sharp uptick in February with the overall global PMI returning to expansion for the first time since October.

Source: S&P Global

11 S&P Global Steel Users PMI, S&P Global, 7 March 2023: https://www.pmi.spglobal.com/Public/Home/PressRelease/c5506b9fab1b4d53a22b14d686832880, , (accessed 23 March 2023).

Despite the reopening bounce in activity, Authorities in China have guided towards a lower-than-expected economic growth target for 2023. In addition, they have been at pains to avoid adding significant stimulus, which could limit commodity price upside

Demand destruction due to rate hikes in the US and elsewhere, as well as soaring energy prices in Europe, remain an ongoing concern for growth as discussed earlier with forecasts for the broader global economy remaining anaemic in 2023, a decidedly negative prospect for resource demand. The bounce back anticipated for China remains an inadequate offset in our view. A material step change in stimulus may impact our outlook but this has not eventuated to date.

If we look to the medium-term outlook for iron ore below both market (forward) pricing and consensus forecasts are anticipating declines of between 25% and 39% from current spot prices. If we take 2022 underlying earnings as a starting point, and assume operating expenses and production are similar, then this could imply a decline of up to 40% in underlying profitability for a business such as Rio Tinto where iron ore accounts for the vast majority of underlying earnings (over 84% for FY22 before excluded items)12. Share prices for the sector are not necessarily accounting for this risk given current valuations.

Iron ore price (62% FE grade), US$/MT

Source: Bloomberg as of 22 March 2023

Taken together, we believe the significant headwinds to global growth continue to outweigh the “China reopening” narrative given the lack of additional stimulus there. The subdued medium-term outlook also gives us pause given current valuations. Accordingly, we maintain our resource sector underweight.

Retail Recommendation: Maintain underweight

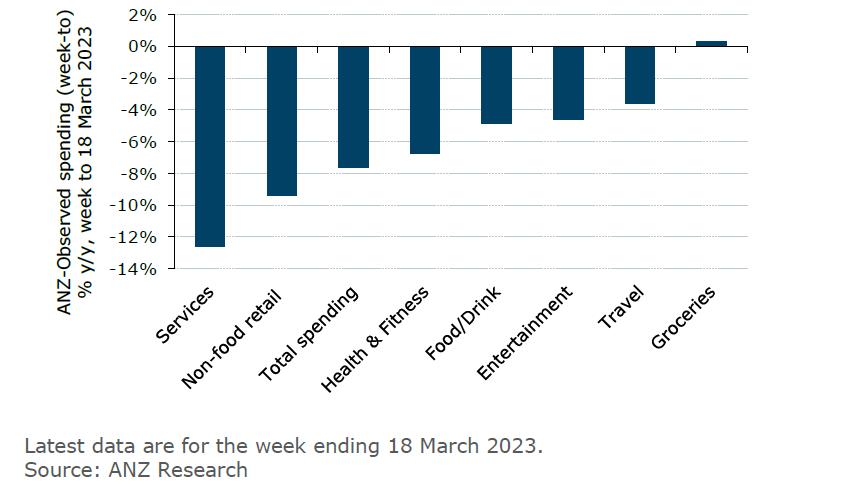

Spending has shifted firmly from goods to services with the latter growing at 28.1% for the year to January 2023 versus 8.7% for goods consumption (both in nominal terms) The outlook in more recent weeks has softened however with much of the spending over November to January seemingly tied to travel and holiday related services but has since receded. ANZ research note credit card spending is flagging sizeable declines in discretionary categories as shown below whilst essentials e.g. groceries have held up comparably better. 12 Rio Tinto Annual Report 2022, page 65: https://newswire.iguana2.com/af5f4d73c1a54a33/rio.asx/3A613229/RIO_Rio_Tinto_2022_full_year_results

Household spending year-on-year change for week to 18 March 2023

Consumer sentiment has remained soft and a more refined measure of spending intentions (based on credit card data) has also weakened markedly. The CommBank HSI is correlated with real consumption spending (a measure that strips out price impacts to assess underlying demand). Current levels as of late February suggest a material softening during the March quarter after correctly identifying the weakness in the December quarter (reported in early March)

Annual growth in real household spending versus Spending Intentions Index (Sep-18 to Mar-23)

Source: Bloomberg

Lastly, if we look at business performance in the listed consumer discretionary sector, we note a number of firms reported strong results for the December 2022 half. The outlook however was decidedly less clear with several noting that the peak in sales had likely been reached13, with most flagging a tougher environment going forward.

Overall, we believe meaningful drags on consumer spending are now arising. This will bode poorly for the retail sector after recent years of above-average profits (boosted by government stimulus programs) with a return to pre-pandemic profitability likely to be accompanied by further share price weakness.

Australian Real Estate Investment Trusts (AREITs) Recommendation:

Maintain underweight.

The AREIT universe underperformed the broader market in the March quarter One driver was the impact of rising interest rates for sector profitability. While many REITs are at least partially hedged against rising

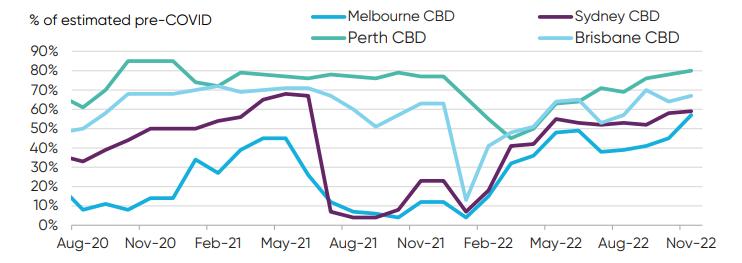

13 JB Hi-Fi says discounts on the way as sales slow, AFR, 13 February 2023: https://www.afr.com/companies/retail/jb-hi-fi-saysdiscounts-on-the-way-as-sales-slow-20230212-p5cjwt interest rates, over time they have to refinance and effectively pay these higher rates as loans mature, and financing needs to be replenished. In addition, some are financed with floating rate debt that reprices more instantaneously and has an immediate impact on profitability in a rising rate environment. We saw this risk crystallise during the latest reporting period with some REITs seeing strong rental growth almost entirely offset by higher financing costs. In addition, many REITs in the low inflation environment opted for fixed rate rental escalation as opposed to inflation indexing. This means that rents have lagged rising input and financing costs In some segments demand also remains weak, most notably in the office market with physical occupancy improving but still well below pre-pandemic levels by 20% or more. This casts doubt on profitability as the net income generated by certain sectors may be permanently impaired.

Office physical occupancy in the four major CBDs relative to pre-COVID levels

Source: Dexus HY23 Results Presentation14

The sector continues to trade at a material discount to net asset value (assets less liabilities) with only five of the 24 firms trading at a premium. At face value this suggests an opportunity on valuation grounds to invest today and wait for the discount to gradually close and enjoy the capital appreciation that would result.

That view presupposes that the valuations underpinning book values are reasonable. We think that there is room for doubt with capitalisation (or “cap”) rates still trading at record lows for some sectors, particularly industrial property as shown below The valuation correction has only just begun for AREITs. Many businesses only noted minor expansion in cap rates if at all in the latest reporting season update during February. In their defence the transactions market has arguably justified this perspective with valuations largely ignoring the backdrop of higher financing costs. (The 10-year bond yield at 4.05% is sitting far above its recent low point of 0.61% in March 2020). In that environment office and industrial heavyweight Dexus (ASX: DXS) only saw a 0.16% expansion in its portfolio cap rate. We don’t believe these anomalies can persist and expect property valuations to fall further as cap rates adjust.

14 HY23 Results presentation, Dexus, 14 February 2023: https://newswire.iguana2.com/af5f4d73c1a54a33/dxs.asx/2A1430463/DXS_HY23_Results_presentation

Source: Bloomberg

A-REITs enjoyed a strong start to the year, outperforming the market in January but have since declined with the rise in market volatility due to the banking crisis overseas. We believe the sector remains challenged given the above factors and would need to see a sustained decline in interest rates or further fall in asset values to improve our view on the sector Accordingly, we maintain our underweight outlook.

By Cameron Curko, Head of Macroeconomics

Strategy | Pitcher Partners