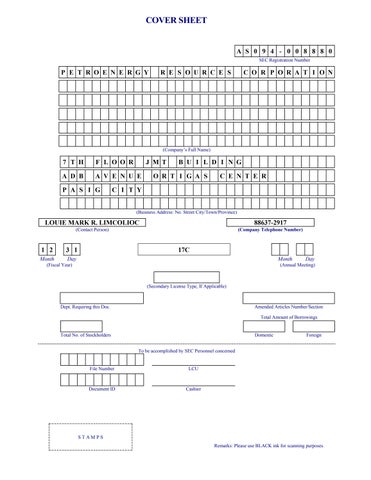

A S 0 9 4 - 0 0 8 8 8 0 SEC Registration Number P E T R O E N E R G Y R E S O U R C E S C O R P O R A T I O N (Company’s Full Name) 7 T H F L O O R J M T B U I L D I N G A D B A V E N U E O R T I G A S C E N T E R P A S I G C I T Y (Business Address: No. Street City/Town/Province) LOUIE MARK R. LIMCOLIOC 88637-2917 (Contact Person) (Company Telephone Number) 1 2 3 1 17C Month Day Month Day (Fiscal Year) (Annual Meeting) (Secondary License Type, If Applicable) Dept. Requiring this Doc. Amended Articles Number/Section Total Amount of Borrowings Total No. of Stockholders Domestic Foreign To be accomplished by SEC Personnel concerned File Number LCU Document ID Cashier

S T A M P S Remarks: Please use BLACK ink for scanning purposes.

COVERSHEET

April 24, 2023

PHILIPPINE STOCK EXCHANGE

9th Floor, Philippine Stock Exchange Tower 28th Street corner 5th Avenue, BGC Taguig City

Attention: Ms. Alexandra D. Tom Wong Officer-in-Charge, Disclosure Department

Subject: PetroEnergy Resources Corporation Acquisition of Common Shares

Gentlemen:

Tel: (+632) 8637-2917 Fax: (+632) 8634-6066 Visit: www.petroenergy.com.ph

Please see attached copy of the SEC Form 17C on acquisition of common shares.

Thank you.

Very truly yours,

Atty. Louie Mark . Limcolioc Assistant Corporate Secretary Compliance Officer 7F

JMT Building, ADB Avenue, Ortigas Center, Pasig City 1600, Metro Manila, Philippines

SECURITIES AND EXCHANGECOMMISSION SEC FORM 17-C

CURRENT REPORT UNDER SECTION 17 OF THE SECURITIES REGULATIONCODE AND

PetroEnergy Resources Corporation (PERC) signed a Share Purchase Agreement (SPA) with EEI Power Corporation (EEIPC) to acquire, upon fulfillment of all conditions therein, the latter’s common shares in PetroGreen Energy Corporation (PGEC) (213,675,516 shares), PetroSolar Corporation (6,993,800 shares) and PetroWind Energy Inc., (2,865,408 shares).

The move supports PERC’s plans to focus more on renewable energy and to increase its stake in existing and planned projects, taking advantage of the emerging opportunities in the industry.

PERC, through PGEC, now has 138 MW of RE operating capacity and has recently secured Php 1.8 Billion financing and major approvals for the expansion of its onshore wind project in Aklan.

SRC RULE 17.2(c) THEREUNDER 1. April 24, 2023 Date of Report (Date of earliest event reported) 2. SEC Identification Number: AS094-008880 3. BIR Tax Identification Number: 004-471-419-000 4. PETROENERGY RESOURCES CORPORATION Exact name of issuer as specified in its charter 5. Metro Manila, Philippines 6. (SEC Use Only) Province, country or other jurisdiction of incorporation Industry Classification Code: 7. 7F JMT BUILDING, ADB AVE., ORTIGAS CENTER, PASIG CITY 1605 Address of principal office Postal Code 8. (632) 86372917 Issuer's telephone number, including area code 9. N/A Former name or former address, if changed since last report 10. Securities registered pursuant to Sections 8 and 12 of the SRC or Sections 4 and 8 of the RSA Title of Each Class Number of Shares of Common Stock Outstanding and Amount of Debt Outstanding Common stock 568,711,842 shares 11. Indicate the item numbers reported herein: Item No. 9 – Other Events

SIGNATURES

Pursuant to the requirements of the Securities Regulation Code, the issuer has duly caused this report to be signed on behalf by the undersigned hereunto duly authorized.

PETROENEGY RESOURCES CORPORATION

Issuer By: Atty. Louie Mark Limcolioc Assistant Corporate Secretary/ Compliance Officer

Date: April 24, 2023

C03038-2023

SEC FORM 17-C

1. Date of Report (Date of earliest event reported) Apr 24, 2023 2. SEC Identification Number ASO94-08880 3. BIR Tax Identification No. 004-471-419-000 4. Exact name of issuer as specified in its charter PETROENERGY RESOURCES CORPORATION 5. Province, country or other jurisdiction of incorporation Metro Manila, Philippines 6. Industry Classification Code(SEC Use Only) 7. Address of principal office 7th Floor, JMT Building ADB Ave., Ortigas Center, Pasig City 1605 Postal Code 1605 8. Issuer's telephone number, including area code (632) 86372917 9. Former name or former address, if changed since last report -10. Securities registered pursuant to Sections 8 and 12 of the SRC or Sections 4 and 8 of the RSA Title of Each Class Number of Shares of Common Stock Outstanding and Amount of Debt Outstanding COMMON 568,711,842 11. Indicate the item numbers reported herein Item No. 9 TheExchangedoesnotwarrantandholdsnoresponsibilityfortheveracityofthefactsandrepresentationscontainedinallcorporate disclosures,includingfinancialreports.AlldatacontainedhereinarepreparedandsubmittedbythedisclosingpartytotheExchange,

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT UNDER SECTION 17 OF THE SECURITIES REGULATION CODE AND SRC RULE 17.2(c) THEREUNDER

andaredisseminatedsolelyforpurposesofinformation.Anyquestionsonthedatacontainedhereinshouldbeaddresseddirectlyto theCorporateInformationOfficerofthedisclosingparty.

PetroEnergy Resources Corporation

PERC

PSE Disclosure Form 4-2 - Acquisition/Disposition of Shares of Another Corporation

References:SRCRule17(SECForm17-C)and Section4.4oftheRevisedDisclosureRules

Subject of the Disclosure

Acquisition of Common Shares

Background/Description of the Disclosure

PetroEnergy Resources Corporation (PERC) signed a Share Purchase Agreement (SPA) with EEI Power Corporation (EEIPC) to acquire, upon fulfillment of all conditions therein, the latter’s 213,675,516 common shares in PetroGreen Energy Corporation (PGEC).

Date of Approval by Board of Directors

Apr 20, 2023

Rationale for the transaction including the benefits which are expected to be accrued to the Issuer as a result of the transaction

The support PERC’s plans to focus more on renewable energy and to increase its stake in existing and planned projects, taking advantage of the emerging opportunities in the industry. ;

Details of the acquisition or disposition

Date

Manner

Apr 24, 2023

Share sale through execution of a Share Purchase Agreement

Description of the company to be acquired or sold

PGEC is a joint venture corporation established between PERC, EPC and Kyuden International Corporation. After fulfillment of all conditions for the sale, EPC will no longer have any interest in PGEC.

The terms and conditions of the transaction

Number of shares to be acquired or disposed 213,675,516 Percentage to the total outstanding shares of the company subject of the transaction 7.5 Price per share 2.78

Nature and amount of consideration given or received

The consideration shall be paid in cash.

Principle followed in determining the amount of consideration

Based on fair market multiple valuation validated by a third-party appraisal report

Terms of payment

Payment in tranches with full payment expected by August 2023

Conditions precedent to closing of the transaction, if any

The usual conditions precedents (to closing) applicable in this kind of transaction.

Any other salient terms

None

N/A

Other Relevant Information

Filed on behalf by: Name

of the person(s) from whom the shares were acquired or to whom they were sold Name Nature of any material relationship with the Issuer, their directors/ officers, or any of their affiliates EEI POWER CORPORATION House of Investments is the majority shareholder of EEI Corporation, the parent of EEI Power Corporation, who is also the majority shareholder of PetroEnergy Resources Corporation.

Identity

if any

Effect(s) on the business, financial condition and operations of the Issuer,

Louie Mark Limcolioc Designation Asst. Corporate Secretary

C03039-2023

SEC FORM 17-C

1. Date of Report (Date of earliest event reported) Apr 24, 2023 2. SEC Identification Number ASO94-08880 3. BIR Tax Identification No. 004-471-419-000 4. Exact name of issuer as specified in its charter PETROENERGY RESOURCES CORPORATION 5. Province, country or other jurisdiction of incorporation Metro Manila, Philippines 6. Industry Classification Code(SEC Use Only) 7. Address of principal office 7th Floor, JMT Building ADB Ave., Ortigas Center, Pasig City 1605 Postal Code 1605 8. Issuer's telephone number, including area code (632) 86372917 9. Former name or former address, if changed since last report -10. Securities registered pursuant to Sections 8 and 12 of the SRC or Sections 4 and 8 of the RSA Title of Each Class Number of Shares of Common Stock Outstanding and Amount of Debt Outstanding COMMON 568,711,842 11. Indicate the item numbers reported herein Item No. 9 TheExchangedoesnotwarrantandholdsnoresponsibilityfortheveracityofthefactsandrepresentationscontainedinallcorporate disclosures,includingfinancialreports.AlldatacontainedhereinarepreparedandsubmittedbythedisclosingpartytotheExchange,

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT UNDER SECTION 17 OF THE SECURITIES REGULATION CODE AND SRC RULE 17.2(c) THEREUNDER

andaredisseminatedsolelyforpurposesofinformation.Anyquestionsonthedatacontainedhereinshouldbeaddresseddirectlyto theCorporateInformationOfficerofthedisclosingparty.

PetroEnergy Resources Corporation

PERC

PSE Disclosure Form 4-2 - Acquisition/Disposition of Shares of Another Corporation

References:SRCRule17(SECForm17-C)and Section4.4oftheRevisedDisclosureRules

Subject of the Disclosure

Acquisition of Common Shares

Background/Description of the Disclosure

PetroEnergy Resources Corporation (PERC) signed a Share Purchase Agreement (SPA) with EEI Power Corporation (EEIPC) to acquire, upon fulfillment of all conditions therein, the latter’s 6,993,800 common shares in PetroSolar Corporation.

Date of Approval by Board of Directors Apr 20, 2023

Rationale for the transaction including the benefits which are expected to be accrued to the Issuer as a result of the transaction

The support PERC's plans to focus more on renewable energy and to increase its stake in existing and planned projects, taking advantage of the emerging opportunities in the industry.

Details of the acquisition or disposition

Date Apr 24, 2023

Manner

Share sale through execution of a Share Purchase Agreement

Description of the company to be acquired or sold

PSC is a joint venture corporation established between PGEC and EPC. After fulfillment of all conditions for the sale, EPC will no longer have any interest in PSC.

The terms and conditions of the transaction

of shares to be acquired or disposed 6,993,800 Percentage to the total outstanding shares of the company subject of the transaction 44 Price per share 206.46

Number

Nature and amount of consideration given or received

The consideration shall be paid in cash.

Principle followed in determining the amount of consideration

Based on fair market multiple valuation validated by a third-party appraisal report

Terms of payment

Payment in tranches with full payment expected by August

Conditions precedent to closing of the transaction, if any

The usual conditions precedents (to closing) applicable in this kind of transaction.

Any other salient terms

None

Effect(s) on the business, financial condition and operations of the Issuer, if any

N/A

Other Relevant Information

Filed on behalf by: Name

Nature of any material relationship with the Issuer, their directors/ officers, or any of their affiliates EEI POWER CORPORATION House of Investments is the majority shareholder of EEI Corporation, the parent of EEI Power Corporation, who is also the majority shareholder of PetroEnergy Resources Corporation.

Identity of the person(s) from whom the shares were acquired or to whom they were sold Name

Louie

Designation Asst. Corporate Secretary

Mark Limcolioc

C03037-2023

SEC FORM 17-C

1. Date of Report (Date of earliest event reported) Apr 24, 2023 2. SEC Identification Number ASO94-08880 3. BIR Tax Identification No. 004-471-419-000 4. Exact name of issuer as specified in its charter PETROENERGY RESOURCES CORPORATION 5. Province, country or other jurisdiction of incorporation Metro Manila, Philippines 6. Industry Classification Code(SEC Use Only) 7. Address of principal office 7th Floor, JMT Building ADB Ave., Ortigas Center, Pasig City 1605 Postal Code 1605 8. Issuer's telephone number, including area code (632) 86372917 9. Former name or former address, if changed since last report -10. Securities registered pursuant to Sections 8 and 12 of the SRC or Sections 4 and 8 of the RSA Title of Each Class Number of Shares of Common Stock Outstanding and Amount of Debt Outstanding COMMON 568,711,842 11. Indicate the item numbers reported herein Item No. 9 TheExchangedoesnotwarrantandholdsnoresponsibilityfortheveracityofthefactsandrepresentationscontainedinallcorporate disclosures,includingfinancialreports.AlldatacontainedhereinarepreparedandsubmittedbythedisclosingpartytotheExchange,

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT UNDER SECTION 17 OF THE SECURITIES REGULATION CODE AND SRC RULE 17.2(c) THEREUNDER

andaredisseminatedsolelyforpurposesofinformation.Anyquestionsonthedatacontainedhereinshouldbeaddresseddirectlyto theCorporateInformationOfficerofthedisclosingparty.

PetroEnergy Resources Corporation

PERC

PSE Disclosure Form 4-2 - Acquisition/Disposition of Shares of Another Corporation

References:SRCRule17(SECForm17-C)and Section4.4oftheRevisedDisclosureRules

Subject of the Disclosure

Acquisition of Common Shares

Background/Description of the Disclosure

PetroEnergy Resources Corporation (PERC) signed a Share Purchase Agreement (SPA) with EEI Power Corporation (EEIPC) to acquire, upon fulfillment of all conditions therein, the latter’s 2,865,408 common shares in PetroWind Energy Inc.

Date of Approval by Board of Directors

Apr 20, 2023

Rationale for the transaction including the benefits which are expected to be accrued to the Issuer as a result of the transaction

The support PERC's plans to focus more on renewable energy and to increase its stake in existing and planned projects, taking advantage of the emerging opportunities in the industry.

Details of the acquisition or disposition

Date Apr 24, 2023

Manner

Share sale through execution of a Share Purchase Agreement

Description of the company to be acquired or sold

PWEI is a joint venture corporation established between PGEC, BCPG Wind Cooperatief U.A. and EPC. After fulfillment of all conditions for the sale, EPC will no longer have any interest in PWEI.

The terms and conditions of the transaction

Number of shares to be acquired or disposed 2,865,408 Percentage to the total outstanding shares of the company subject of the transaction 20 Price per share 227.38

Nature and amount of consideration given or received

The consideration shall be paid in cash.

Principle followed in determining the amount of consideration

Based on fair market

Terms of payment

Payment in tranches with full payment expected by August 2023

Conditions precedent to closing of the transaction, if any

The usual conditions precedents (to closing) applicable in this kind of transaction.

Any other salient terms

None

N/A

of the person(s) from whom the shares were acquired or to whom they were sold Name Nature of any material relationship with the Issuer, their directors/ officers, or any of their affiliates EEI POWER CORPORATION House of Investments is the majority shareholder of EEI Corporation, the parent of EEI Power Corporation, who is also the majority shareholder of PetroEnergy Resources Corporation.

on the business, financial condition and operations of the Issuer, if any

Identity

Effect(s)

Name Louie Mark Limcolioc Designation Asst. Corporate Secretary

Other Relevant InformationFiled on behalf by: