Sam Bryden

KiwiSaver recently turned 18. While this isn’t quite the epic personal milestone it has been for generations of New Zealanders, it nevertheless reflects a growing maturity that has been marked by significant learnings and recent subsequent changes.

When KiwiSaver was launched back in 2007, Kiwis generally viewed the investment market with at best a distant curiosity – many preferring the bricks and mortar of residential property as their own personal retirement savings vehicle. Fast forward to today and while we still haven’t fallen out of love with property, over 700,000 Kiwis now invest directly in stocks or funds through online platforms and the overall pot of KiwiSaver funds under management has surged past $120B.

Kiwis are becoming ever more engaged in, knowledgeable about and comfortable with investment market dynamics and volatility. This growing familiarity has encouraged successive Governments to introduce a number of enhancements aimed at accelerating individual KiwiSaver balance growth. Most notably this has included opening up the option to make 10% employee contributions in 2019; changing the default setting from ‘conservative’ to ‘balanced’ in 2021; and just this year increasing the minimum compulsory contribution rate to 3.5% from 2026 and then 4% by April 2028. These have all been positive moves. However, for the majority of KiwiSaver members – those with 20-plus years of earning ahead of them – the default balanced setting simply does not go far enough to match their retirement savings ambition. And according to the country’s leading financial advisers, most Kiwis should therefore be going a step further and switching their settings to ‘aggressive.’

Without knowledge or experience, the jump from balanced to aggressive can feel like a leap of faith. But for those KiwiSaver members who have been playing close

attention to the market and have seen its long-term resilience through cycles to continue to deliver growth over time, there’s a growing appreciation that with time on their side, there’s no need for defensive assets within their retirement portfolio.

Switching from balanced to aggressive doesn’t mean throwing caution to the wind. Nor does it mean putting all your eggs in one single-sector basket. It simply requires better choices and greater diversification to be available within the high-growth sub sector of KiwiSaver.

Last month we responded to this need by adding two aggressive funds to our multi-manager GoalsGetter KiwiSaver Scheme mix: a new high-growth fund of our own and Milford’s Aggressive Fund, which now sit alongside the Generate Focused Growth Fund we started with.

The Milford fund, which has a 95% allocation to growth assets, predominantly through international equities, has returned 10.55% p.a. before tax since inception in 2019. Meanwhile the new Amova High Growth Fund, which is actively managed by our vastly experienced Head of External Managers, Alan Clarke, goes a step further with allocations of 67% international equities, 24% Australasian equities and 7% listed property. It has just 2% allocated to cash.

While I’d love for us to take all the credit for this product evolution, it’s genuinely the result of collaboration with financial advisers who are seeking the tools to support their clients’ retirement goals.

Notwithstanding individual circumstance and risk profile, once a client has bought their first home, advisers have told us that they are now generally advocating for them to have their KiwiSaver investment entirely in aggressive funds right through until at least their early to mid-fifties. This is because throughout this time in your life, you’ll be focused on long-term outcomes and have time to keep going through investment cycles.

The reason the GoalsGetter scheme appeals to advisers to support this switch, is that it offers two layers of risk protection through diversification: firstly through the diversified funds themselves, and then the ability to hedge on the performance of all three. Indeed, this is how one adviser described the diversified approach:

“For clients with balances of over $500K still seeking exposure to high growth, I’d go so far as to say this is an essential risk mitigation strategy.”

As you’ll see if you check out the advert opposite, the Nikko AM brand – which powers the GoalsGetter platform – has now changed to Amova. We’re fortunate to be part of this truly global network, and through it can apply the rigour and strategies associated with the company’s institutional investment heritage to our retail and KiwiSaver products here.

All the funds available through our GoalsGetter KiwiSaver scheme have been hand-picked and pre-vetted by our investment experts to derisk the selection process for direct customers and/or advisers as they curate personalised diversified portfolios for their clients.

This evolution of our KiwiSaver Scheme is very much in line with the GoalsGetter philosophy of connecting individual investors, either directly or through their financial adviser, with expert strategies tailored to their savings ambition. If you haven’t already, check out our website or download the GoalsGetter app to have this expertise and service at your fingertips.

Sam Bryden is Head of Distribution for Amova NZ, part of the global Asset Management company formerly known as Nikko AM which has over US$260B in funds under management. A

KiwiSaver is looming as a big election issue next year. ASSET assembled a group of six key industry players to discuss the state of the national savings team and found out what enhancements they would like to see.

Edward Glennie shares his journey.

All

AIA

Hear from six KiwiSaver leaders.

Two Kiwi MDRT members reveal some of their secrets.

Edward Glennie shares his journey from Generate to Hobson Wealth to becoming an adviser.

SOC gets big international award, Smart changes, Booster recruits from FMA and more.

ASSET went to the Beehive for the annual Booster conference.

David van Schaardenburg delves into KiwiSaver on its 18th year.

New insurance law means changes to benefit definitions. This is why.

Find out how hundreds of funds are performing

What advisers have been reading on Good Returns in the past month.

How to update your mailing address

Make sure you don't miss an issue by changing your address.

Go to: tarawera.co.nz/coa

Welcome to the final issue of ASSET for the year.

This is our bumper KiwiSaver issue featuring our annual Round Table. There is a clear view that changes need to be made to KiwiSaver - indeed it was the theme a year ago.

Unfortunately, and this is a failing of government very little has changed in a year.

This is best illustrated by our question where we ask participants to rate KiwiSaver out of 10.

The scores are little changed from a year ago.

Post our Round Table, National announced that it plans to campaign on increasing contribution rates to 12% over time. While the policy has had mixed reactions, it’s a step forward after what it proposed in the previous election.

What was good to see this month was the Retirement Commission’s three-yearly review of New Zealand’s retirement savings settings. It had 12 recommendations with many relating

Head office and advertising

1448A Hinemoa Street, Rotorua

PO Box 2011, Rotorua

0274377527

philip@tarawera.co.nz

Publisher

Philip Macalister

Photography

Steph Creagh

Staff

Writer

Ksenia Stepanova, Jenny Ruth

Design

Michelle Veysey

to KiwiSaver specifically. The KiwiSaver recommendations are sensible, but will the government adopt them?

You’d like to think so. While Commerce Minister Scott Simpson welcomed the report, his following comments didn’t seem to show he was in any rush or was going to advocate for changes with his ministerial peers.

The greatest win for KiwiSaver and retirement settings would be a return to an accord between political parties. But it’s probably wishful thinking. The previous administration scored some cross-party agreement on various issues around building and climate change, but the current coalition government has pulled out of them.

For the good of the country and New Zealanders we need more cross-party agreements and KiwiSaver is one area where agreement is sorely needed. NZ Superannuation is another – but the prospects of agreement here is, sadly, wishful thinking.

Coming up we will publish some interesting research on how much

Contributors

Russell Hutchinson, David Van Schaardenburg, Steve Wright

Subscriptions P: 0274 377 527

E: subscriptions@tarawera.co.nz

Disclaimer

KiwiSaver is worth to the financial advice sector. Without giving too much away I can say it is significant and will continue to grow.

I draw some comparisons to mortgage advice where the majority of home loans are originated by advisers and borrowers get a better deal.

With KiwiSaver advisers are playing a bigger role, particularly in the transfer market, plus the evidence is clear that advised members have higher balances than those without advice.

Thanks to those companies who have supported ASSET this year and to readers who often express how much they enjoy the mag.

Wishing you all a wonderful Christmas and a prosperous New Year.

Philip Macalister Publisher

All articles in ASSET are for information purposes only, the content is intended to be of a general nature, does not take into account any person’s specific circumstances, and is not financial, legal, or other advice. It is recommended you seek advice from a suitable expert before taking any action in relation to anything contained in this magazine. ASSET is published by Tarawera Publishing Ltd (TPL). TPL also publishes online money management magazine Good Returns GoodReturns.co.nz and TMM – The Mortgage Mag. All contents of ASSET Magazine are copyright Tarawera Publishing Ltd. Any reproduction without prior written permission is strictly prohibited. ISSN 1175-9585

Health insurance premium increases are hurting New Zealand customers and insurers are asking the government to help find solutions, AIA New Zealand chief executive Nick Stanhope says.

New Zealand's health insurance inflation is among the highest in the Asia-Pacific region. Stanhope says the affordability pressures require fresh thinking from both insurers and policymakers, potentially including smarter products, better understanding of health trends,

and Australian-style tax deductibility for health insurance.

AIA NZ has met with Health Minister Simeon Brown twice this year - first one-on-one in June, then in August as part of the FSC's CEO Forum. "I was very impressed with Minister Brown," Stanhope said. "I think he was thoughtful, listened to what we had to say and took notes. We're looking at the types of illnesses people are getting, age groups, etc. We're asking the government to focus on areas where there is high-cost inflation and to get to the root of it."

AIA has also raised fringe benefit tax on group health schemes with the government. Currently employers who provide healthcare to staff face a 49% penalty on top of the premium they pay.

Stanhope has met with Revenue Minister Simon Watts and Prime Minister Christopher Luxon to discuss the issue.

The Australian model offers a useful

comparison. Tax deductibility there has created significant capital investment in hospitals and a stronger public-private healthcare relationship. Insurers have taken different approaches. All major insurers have raised premiums, nib introduced co-pays on some diagnostics, and AIA has rolled out lower-cost options with fewer benefits, including a $10,000 excess option and specific cancer care products.

Stanhope says the biggest issue is still rising claim numbers, particularly as wait times in the public system have stretched to six to 12 months.

For advisers, Stanhope says one approach that's worked well for clients considering cancelling policies is encouraging them to get a health check first. "If you're going to do it, know your health," he says. “Some advisers have had clients getting those health checks and finding they have cancerous lesions, or something else they’ve been unaware of.”

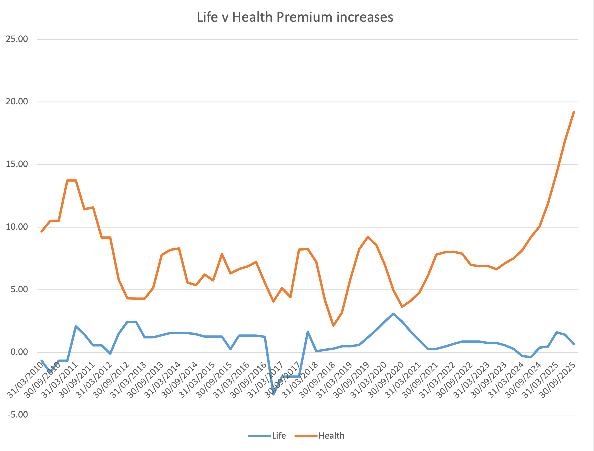

The Reserve Bank’s Financial Stability Report shows life and health insurance going in wildly different directions on profitability and premiums.

The Reserve Bank has released its latest Financial Stability Report, and it shows that New Zealand's health insurers are under a lot of strain, while life and general insurers are slowly improving.

As a result, premiums in health insurance have skyrocketed while life premiums have remained relatively stable.

Here's what's happening in each sector.

A health insurance crisis

The report noted that health insurers have lost almost 40% of their financial reserves over two years. They're still meeting legal requirements, but they're losing money every quarter.

The main problem is rising medical costs. Until 2022, price increases were normal and manageable - but in 2023, insurers were reporting quarterly losses.

New Zealand's public hospitals became overwhelmed, pushing more people into private healthcare. Insurance companies hadn't planned for this surge in claims.

Additionally, new medical technologies now cost more, supply chains are under pressure, and healthcare workers are demanding higher wages. All these factors have pushed claims costs even higher.

By 2024, insurance companies responded with massive premium increases - about 19% in a single year. The biggest jumps came in late 2024 when insurers came out with "material repricing," which means significant changes to their entire pricing structure.

Despite these huge premium increases, health

Source: RBNZ

insurers are still losing money. There's a delay between announcing higher prices and collecting that money as policies renew throughout the year.

Life insurers are making money again after several difficult years, but profits remain low. Returns don't match what investors could earn elsewhere.

Solvency margins in the life insurance sector have remained “well above” regulatory requirements, but the Reserve Bank noted that they have trended lower in recent years.

Life insurers have responded by paying bigger dividends to shareholders and keeping smaller cash reserves.

Some technical accounting changes make life insurers look weaker than they actually are. The Reserve Bank says their financial positions are still adequate despite the subdued figures on paper.

The Reserve Bank is intensifying its supervision of the insurance sector. Health insurers will now be included in its stress-testing programme, and will be put through scenarios where the pressures mentioned above continue to escalate.

The Reserve Bank will also be engaging with health insurers to ensure that responses support both the long-term sustainability of the sector and the resilience of households and the broader financial system.

Both the life and health sectors were mentioned as part of a broader look at the insurance industry.

The report noted that general insurers have largely maintained strong profits, supported by premium increases following the severe weather of 2023. Overall, health is the outlier in more serious stress, with health insurers still making losses. A

Stephen O'Connor has been awarded the FPSB 2025 Noel Maye Award for Outstanding Contribution to the Profession.

The award, presented by the Financial Planning Standards Board at its global meeting in Chicago, recognises individuals who have made a lasting impact on financial planning and CFP certification worldwide.

Since attaining his CFP designation in 1996, O'Connor has served in leadership roles with New Zealand's professional associations and held significant positions within FPSB, including chair of both the board of directors and council.

Lisa Turnbull has been appointed chief executive of Smart, replacing Anna Scott who left to head up Mercers.

Turnbull has led NZX subsidiary NZX Wealth Technologies since 2017, growing the investment platform from start-up to a key business within the NZX Group, with annual recurring revenue reaching $11.9 million by June 2025.

NZX chief financial and corporate officer Graham Law said Turnbull is a chartered accountant with a background in funds management, finance, strategic development and investment platforms. "Lisa is the ideal person to lead Smart and ensure more New Zealanders build their

wealth by investing in Smart's extensive range of products."

Smart has also appointed James Wesley to a newly created role of chief sales and marketing officer. Wesley, formerly chief executive of Nikko Asset Management Americas, begins in November.

NZX chief information officer Robert Douglas has been appointed acting chief executive of NZX Wealth Technologies, with head of capital market and digital technology Daniel Juchnowicz stepping into the CIO role on an acting basis.

Paul Darwell has joined Insync Funds Management, bringing more than 35 years of experience in trading and managing derivative risk across equity, interest rate and foreign exchange markets.

Most recently Darwell served as

director of fixed income and currency trading at CBA. His prior experience includes senior roles at Macquarie Bank and Citigroup, where he spent 12 years leading derivatives and trading teams.

Chief investment officer Monik Kotecha welcomed Darwell to the team.

“His deep experience across derivatives and structured risk management enhances our ability to continue delivering strong, risk-adjusted outcomes for our investors,” Kotecha said.

“Paul’s appointment reflects our ongoing commitment to building a team capable of navigating the ever-evolving global market landscape with discipline and foresight.”

Andrew Wilson has joined the Guardians, which manages the $85 billion New Zealand Superannuation Fund.

Wilson worked at the Reserve Bank of New Zealand, Bank of England and Rothschild Asset Management before spending more than 25 years with Goldman Sachs Asset Management in the United Kingdom. He served as both head of fixed income, currency and money markets and CEO of Goldman Sachs Asset Management International.

Christine Zhou will take over from Aaron Baker as MDRT New Zealand's North Island chair, and Joel McLachlan will replace Paula Jones as South Island chair.

Zhou is a director and financial adviser at Maxicare Financial Services in Auckland. A multi-year MDRT member, she brings extensive experience in personal insurance and KiwiSaver advice, working in both English and Mandarin. She has recently expanded into mortgage services and is known for helping migrant families navigate New Zealand's financial system.

McLachlan, who runs AdviceKiwi, has added the MDRT role to his recent appointment to the Woodend-Sefton Community Board at Waimakariri District Council.

Diana Gordon has joined Booster as senior portfolio manager in the investment management team.

Gordon's most recent role was head of investment management at the Financial Markets Authority. Her career has spanned roles at Kiwi Wealth in New Zealand and international positions

managing fixed interest funds in New York and London.

Chief executive Di Papadopoulos said Booster was excited to welcome someone of Gordon's breadth and depth of experience. "Delivery of outcomes like these takes talent and dedication. We're delighted to be adding Diana's experience and capabilities to the Booster team."

Gordon said Booster's ability to combine innovation and purpose was a key factor in her joining the company.

The Reserve Bank of New Zealand has appointed Rodger Finlay as its new chairman, and and added former KiwiWealth chief executive Rhiannon McKinnon to the board.

McKinnon has managed complex financial operations, including hedging programmes, bond issuance, and M&A transactions. She has held senior executive and board roles, including CEO of Kiwi Wealth, founder of executive coaching firm Cassiobury, and board member of the NZ Film Commission, CFA Society of NZ, and Dress for Success Wellington.

McKinnon is a Chartered Financial Analyst (CFA) and holds an MA from the University of Cambridge.

“Mrs McKinnon is an experienced financial professional with a strong background in leadership and strategy. We welcome her appointment to the RBNZ board and look forward to the contribution she will bring towards delivering on the strategic objectives,” Finlay says.

Finlay will serve as chairman until the end of his current term, June 30, 2027.

McKinnon will serve for a five-year term.

Finlay was appointed to the RBNZ Transition Board in October 2021, the RBNZ board on July 1, 2022, and was elevated to deputy chairman from February 1, 2023.

Former Apex NZ and Co-operative Bank executive Gareth Fleming has taken on the the role of managing director of Raise Investments.

Raise is the licensed entity behind the Bitcoin ETF PIE. Besides taking over the helm he has acquired a 50% stake in Raise.

Raise was established last September and bought the Vault fund from Vinnie Gardiner.

Vault launched in October 2021 and currently has about $38 million in funds under management. A

Powered by

Booster held its annual conference in the Banquet Hall at the Beehive at the start of November.

The theme this year was: Future Ready: Thriving in a shifting Landscape.

We show the data in a “risk return” char t for the ten the trade- off between return (vertical axis) and volatility how much the value of the investments fluctuate.

MJW has compared the 10-year performance of KiwiSaver funds in its latest annual report on the sector.

groups over this period.

large amount of different investment funds across many providers, the analysis has been largest seventeen providers by assets. Between them, these providers accounted for billion, or 94% of the entire system.

Also, interesting is that there is a reasonable spread of performance in each of the four groups; growth, balanced, moderate and conservative.

The graph has the flagship diversified funds, categorised based on their funds’ strategic weighting to growth assets.

• Growth: 66-85% growth assets.

As one would expect, there is a positive relationship between risk and return.

Conservative funds have been more stable but have realised lower returns.

Milford features at the top of its respective peer

Growth: 66-85% growth assets.

MJW says that due to the large amount of different investment funds across many providers, the analysis has been limited to largest 17 providers by assets. Between them, these providers accounted for $116 billion, or 94% of the entire system.

• Balanced: 50-65% growth assets.

• Moderate: 30-49% growth assets.

not shown all the funds available from each provider. Instead, we show the flagship funds, categorised based on the funds’ strategic weighting to growth assets. 1

• Conservative: 15-29% growth assets. Also, performance is shown after deductions for fund charges but before tax.

(after costs, before tax)

Balanced: 50-65% growth assets.

Moderate: 30-4 9% growth assets.

onservative : 15-29% growth assets.

Performance is shown after deductions for fund charges but before tax. Full details of this survey are included in Appendix B.

the data in a “risk return” char t for the ten years ended 31 March 2025. This chart shows off between return (vertical axis) and volatility (horizontal axis). Volatility is a measure of the value of the investments fluctuate.

would expect, there is a positive relationship between risk and return. Conservative funds more stable but have realised lower returns.

ten years ended 31 March 202 5. This chart shows volatility (horizontal axis). Volatility is a measure of relationship between risk and return. Conservative funds

ASSET assembled key industry leaders to talk about the health of the investment scheme, and what might be next as it closes in on 20 years.

BY PHILIP MACALISTER

KiwiSaver is generally doing fine. Maybe even great. But it could be better.

That’s the general view of the KiwiSaver leaders ASSET brought together for this year’s round-table discussion about the retirement savings scheme.

Now in its 18th year, KiwiSaver has about 3.4 members, and more than $130 billion under management. But with growth in numbers stalling as it nears its third decade, is the scheme getting tired?

Fiona Mackenzie, managing director of ANZ funds management represented the country’s biggest KiwiSaver provider. She said it was unfair to describe the scheme as tired – but said it was maturing into its goal of helping improve New Zealanders’ financial wellbeing as a long-term vehicle.

“I know there’s lot of debate and media focus on new things KiwiSaver could or could not do,” she said. “But at the end of the day… I think steady is actually a good part of the brand.”

Helen Skinner, head of distribution and sustainability at Kernel Wealth, said superannuation “isn’t meant to be sexy”.

“Actually it’s about dependency, it’s about the long-term and the maturity of the scheme.”

But she said there were younger people taking an interest in the scheme. Younger

advisers were coming into the market and connecting with a cohort their own age. “The Reddit community does think KiwiSaver is really interesting.

Ana-Marie Lockyer, chief executive of Pie Funds, agreed perceptions had improved significantly compared to when she first entered the industry. “I can remember when I was invited to work in the KiwiSaver space a very long time ago and my initial reaction was ‘I don’t want to work in the boring superannuation industry.’ I’m pleased to have been proven wrong.”

She said any impression the scheme was tired was probably related to a lack of differentiation.

“From a providers’ point of view, sometimes if feels there’s a lack of engagement from members. There could be a bit of fatigue at play, but that’s not necessarily a bad thing - it comes with the long-term proposition. I prefer to see it as an opportunity. It’s up to us to spark that interest and engagement and at the same time help people understand the role of KiwiSaver and what it’s meant to be achieving.”

Fisher Funds general manager of KiwiSaver David Boyle said the fact the percentage of the population in KiwiSaver was falling slightly just reflected

demographics.

“When KiwiSaver first started, everyone who was my age or older just signed up. It was a no brainer and the incentives were really attractive. Now that many of that cohort are retired they’re leaving the KiwiSaver scheme, cashing up so to speak and the new joiners are lower by number and there this has an impact on the total membership.

“There will come a time when [numbers] are going to be flat or even going a little bit back,” Boyle said.

Chris Wilson, co-chief executive of Harbour Asset Management, said there was less incentive for parents and grandparents to start their children early with the scheme, now there is now $1000 kickstart incentive.

He said what mattered was how engaged the 16 to 65 age group was.

People who are self-employed or outside the workforce are often contributing at lower rates, or not at all. There are also concerns about women being left behind if they take on the bulk of child-rearing and leave the workforce.

”Who is not in KiwiSaver, who is not being supported, who is KiwiSaver not working for? The people being left behind should be the key focus.”

Boyle said overall KiwiSaver contribution

rates remained too low. About 30% of eligible members are not actively contributing, a level which has not changed much over many years.

Mackenzie said ANZ continues to try a number of ways to increase engagement with KiwiSaver.

“We’re leverage our customer data and to identify where are the pockets where we can influence change to deliver improved customer outcomes over time.”

Skinner agreed the number of noncontributors was a worry but she said it partly due to the economic environment. “Most of those people are still focused on making sure they’re paying their bills. It’s a budget not a KiwiSaver question.”

Mackenzie said the way KiwiSaver is hard linked to wages and salaries risks increasing the divide between the poor and well-off. But she said just trying to increase the percentage of members contributing can be a sensitive subject to try to address.

“We’ve got to be careful about this because again listening to calls with our members, simply encouraging a member to start contributing again [after a pause]…. particularly as a bank when we can see their overall financial profile, can sound incredibly tone deaf. You’ve got to be really careful with these conversations and meet our customers where they are currently.

“Most providers are doing a really good job trying to encourage people to think about contributions if they are in a position where they can. Without spamming inboxes with their “thou shalt contribute” It’s a careful line we’ve got to walk.”

Lockyer said total remuneration packages should be banned and employer and employee contributions decoupled so that if people could not afford to contribute themselves, they could still have something being saved for their future.

Lockyer said this was something the

Government could have targeted when it announced changes to the scheme as part of its Budget earlier this year. “I would have personally liked to have seen them reallocate the government contribution to lower-income people which would help address some of the inequities in the system.”

There was widespread concern among participants about the prospect of ongoing small changes that could dent public confidence in the scheme without meaningfully improving outcomes.

But all acknowledged that bigger changes were likely to be needed.

Lockyer said she was surprised at the varying opinions that followed the news that contribution rates were increasing and the member tax credit being cut.

“We could have walked out of that Budget with KiwiSaver not even mentioned but the Minister of Finance was very clear. She said KiwiSaver is a key part of the superannuation conversation and needs to sit alongside NZ Super. Neither scheme on its own is going to be enough to support New Zealanders in a comfortable retirement. As of today, there's almost a million New Zealanders over the age of 65. That's a big number to be supported by NZ Super alone.

“So the Government’s said we're going to start a programme of change with KiwiSaver. It’s not perfect and these are just the first steps, but I applaud the fact they’ve recognised KiwiSaver is part of the solution, signalled more change is to come and they’re moving quickly.”

Boyle said the move to require contributions for 16- and 17-year-olds was welcome.

“I think the key is certainty for New Zealanders. I think that’s lacking a little bit around what is KiwiSaver going to be without being used as a bit of a political football from time to time or being dipped into … I thnk it’s a framework that the industry as much as government needs to work together to develop.

“We’ve got to be respectful and protect

‘I think the big challenge is achieving cross-party agreement, and that’s a massive challenge for the industry: to get in a room and talk to each of the parties.’

Fiona McKenzie

the brand as well. Make sure what’s on the tin is actually delivered inside it. I think having a higher level of certainty and encouragement for those that need support.”

Mackenzie was particularly worried about “tinkering”.

“New Zealand as a country has a very low hurdle when it comes to regulatory change, it's part of New Zealand's fabric. We are very quick to tinker with regulation or legislation which doesn’t always drive desired changes.”

She said changes should be made outside the political cycle, with sufficient warning so that people particularly employers, know what is coming. The three-year election cycle risked little being achieved.

“I think the big challenge is achieving cross-party agreement, and that’s a massive challenge for the industry: to get in a room and talk to each of the parties. The problem is they don’t want to go cross-party until they actually spend a year thinking about it, but by then you’re already too far through the three-year term and it’s almost too late.”

The participants were split on whether compulsion was an appropriate next step in KiwiSaver’s evolution.

Lockyer said the scheme should be made compulsory, with a transition programme to smooth the way to get

‘The people being left behind should be the key focus’

Chris Wilson

there.

Mackenzie supported it, too, but said contribution rates would need to start lower for people being forced in. Wilson said there needed to be cross-house support.

Boyle said Australia had managed it because the “moons aligned” and the employers, unions and government agreed on the path forward.

But Mackenzie said it should be doable in New Zealand as long as it was wellplanned. “Well-signalled without the risk of tinkering and flopping backwards and forwards… I think the industry has a massive role to play with employers if we’re able to come together and come up with a plan.”

She said KiwiSaver had left New Zealanders in a better position than they would have been without it.

“Research, which comes from Australia admittedly, found people were roughly split 50% savers by natural style versus 50% spenders.

“The savers likely would have been savers but for spenders this nudge, the set and forget of KiwiSaver… it does its dollar cost averaging over a long period of time. A lot of those spender-type people would not be where they are now without KiwSaver.”

Stuart Williams, managing director of Amova Asset Management, said New

Zealanders generally liked the idea of making their own choices. But he said issues around the affordability of aged care and superannuation were coming into the spotlight now. “There’s a very thin wedge potentially right now … we might all agree has or had to come at some point. The people who can afford to pay should pay otherwise we have even greater problem coming… I think that’s probably where the government is moving in the right direction.”

Participants were asked how they would rate KiwiSaver out of 10. They fell into two camps: About six, and eight.

Boyle said he rated it seven last year and was sticking with that.

“Could do better, you know.

“A lot of the fundamental things haven’t necessarily improved. Contribution rates… it doesn’t matter how well we provide a service or what fees we charge or what returns we gain if we’re not regularly contributing, Kiwi’s retirement nest eggs won’t be sufficient for an enjoyable retirement. That has to be improved.”

Mackenzie said she tends to err on the positive side so would give the scheme an eight. ‘

“Given it’s not mandatory, the fact total KiwiSaver balances have got to this level is quite extraordinary. The strong brand and

how simple it is are real positives.”

Lockyer said she rated it a six last year and retained that view. “I don’t think we can ever get to an eight until there’s some sort of long-term plan around KiwiSaver.”

But Williams said he thought it deserved an eight. “I think we should be a bit more optimistic about it. We can make some small changes and it will get better than where we are currently.”

Skinner said she thought it was a six. “I’m thinking about the members that are in at the moment and if the we think that a third of them roughly aren’t contributing… we’re not doing well for everybody.”

Wilson said a six felt right. “There are good building blocks but we’ve just probably got a few too many gaps.”

Lockyer said the goalposts would move as the scheme matured.

KiwiSaver schemes’ investments in private assets has been a topic of conversation this year as the Government looked at how it might ease the path for providers.

Lockyer said Pie Funds’ KiwiSaver scheme already invested in private assets through an allocation to Icehouse Ventures.

She said she had been converted to the idea. “I spoke at a private capital conference last week. The last time I’d

spoken there was 15 years ago and back then my view was ‘no, private assets don’t sit with KiwiSaver, there’s too many issues such as liquidity and pricing.’

“15 years on and I’m now 100 percent supportive. We’ve got such a small percentage of private assets in New Zealand versus what happens internationally and it’s awesome to be able to support some of that growth in early stage development in New Zealand.”

Williams said he agreed but was worried about the net-of-fees contribution. “I have a fundamental issue that the different asset classes return X or Y need to be correct and accurate, that we need to be excellent custodian of adequate net of fees returns..

“If that happens then that’s fine. Capturing an illiquidity premium is a great idea if you’ve got the mechanisms to do so. It’s a massive point of interest for Amova Group.”

Skinner said it was concerning when an entire market was talking about a single asset type. “Here and offshore it’s the flavour of the month. When you think about the illiquidity premium from an investment perspective I think that’s shrinking, . To access that premium you need to be of a certain size. Regardless, I think it’s an investment decision. You have to balance the cost of it, the return, and the liquidity.”

Wilson said people talked about it because of the dearth IPOs and opportunities to invest. “If we want exposure to great companies in these areas we need to think about the access points of those companies.

“I think where we would all get concerned is if the Government comes in and starts talking about private assets being a solution for a funding issue.’

Mackenzie said governments around the

world were talking about pension assets as a way to solve infrastructure deficits. “This is not unique to New Zealand, it’s a global thing.”

She said it would be important for managers to have the investment and governance expertise to make it work. “I think for us it’s probably investing in small sizes so you don’t need some of the more extreme stuff like members being gated.

“It’s not an instant solution for infrastructure deficits because to Chris’s point we are meant to be professional investors on behalf of of our members, not being picked up and put down by various interest groups.”

Trends such as the capital required to invest in Artificial Intelligence, from the necessary infrastructure all the way through to computing power, are driving the rise of private markets globally as a much, much bigger force in global capital markets.”

Skinner said investments that went sour could be bad for KiwiSaver’s reputation but that did not only apply to unlisted assets. “Some investments in NZX are not very liquid either.

“Even the ASX we look at them and go sheesh they are massive but they are getting concerned about a lack of listings.”

Financial advisers were seen as an important part of the KiwiSaver universe.

Williams said Amova had decided to pay advisers upfront for providing advice on their GoalsGetter Scheme.

“We basically decide it takes an amount of time for an adviser to sit down with the client, to spend time with them to understand investing. We are prepared to pay for that upfront investment of time, to reimbursement for the task.

“When you look at it you think to yourself ‘how much time are you going to spend with a client to understand their needs, what do you pay a professional adviser? What do you pay your doctor, what do you pay whatever adviser you want to talk to’…”

He said advisers did not have to allocate their clients to Amova funds to qualify.

“It is basically an open forum as long as you use as least two funds within the multi manager scheme and none of them have to be ours.”

Skinner said Kernel charge low fees and so facilitate an adviser fee that is charged to clients, and fully transparent.

Boyle said the country still did not have enough financial advisers to support the New Zealanders who needed advice.

“It’s about accessibility and affordability and how can they get a really good lite advice proposition that doesn’t create a lot of cost to deliver and access?

“If you get some of those elements in place then there’s a really good trajectory to a better financial outcome. I think financial advisers generally are really important. Not just around the growth but to support those clients particularly when they are getting nearer to actually wanting to use that money.”

Mackenzie said there was advice “with a capital A” which had a legal definition and which was not easily scalable. “But there’s a whole lot that we’re doing for our members around the nudge and guide, and advise. At those moments that matter, ‘you just bought your first home, have you managed to restart KiwiSaver contributions so you are back on track for life after 65?

“Because we certainly have in the past seen cases where members have taken the first home withdrawal and gone off the grid a little bit. But again time is their

‘Diversifying their business services and getting their level five investment qualification is a no brainer. ’

David Boyle

biggest advantage so nudge, guide advise is how we think about it.”

She said some investors who were “digital natives” did not want to talk to a human adviser and were happier using digital tools.

“We’ve invested in our digital features because some members do not want to speak to a person. However there are many other members, based on our call data, who want the reassurance of speaking with someone when they need help.”

Skinner said it was likely that advisers would be able to help clients who had not been through a market cycle before understand what was happening if investment returns were volatile.

“Talking to and working with advisers, those that haven't been through an event…they tend to have a higher risk profile. I think that’s natural.. And are we getting to a point where another event might be triggered?”

Boyle said insurance and mortgage advisers are part of the advice solution. “Diversifying their business services and getting their level five investment qualification is a no brainer. Mortgage brokers play a great role getting their clients into their first home. To me it makes sense they can make sure their KiwiSaver gets back on track and well positioned for their retirement years.

Lockyer said she agreed there was a spectrum of advice.

She said it was notable that Australia had banned commission on advice for superannuation. “The more people who can access advice to help them make good decisions, the better. As long as what we’re seeing is in the members’ best interests - as opposed to being commission-driven - then the right conversations are happening.

“I’m not sure there is a huge amount of oversight today around what is driving increased churn in the adviser space. I think that’s something we should probably keep an eye on as an industry.

“We don’t play in the advice space but we’re heading in that direction. You’ve got to consider the different remuneration models because there’s absolutely value in advice – the question is who pays: providers or clients?

“At the end of the day the client ultimately pays for it whether it’s paid by the client or to their adviser, but good advice allows for better decisions.”

Williams said it was “remarkably simple. “If you want ongoing advice there has to be a way to pay for this. .. the models we are familiar with look pretty logical.’

Mackenzie said it was the value for

‘The advisers are creating decumulation products through their portfolios. I think this is more a question of access to advice at different forks of a person’s investment journey’

Helen Skinner

money that mattered. “Are we delivering to our members investment returns net of reasonable fees, and are we genuinely offering the a service?”

Williams said people were likely to pay more attention to fees in the near future. “All the broker books are basically being swamped with money coming out of banks because they’re not getting [the interest rate returns].”

“We don’t want the same problem we had in 2021, when that happened,” Boyle said. “That’s where the advice matters, making sure they’re motivated for the right reasons and not just chasing a return.”

New Zealand does not have some of the decumulation products that are common in other countries, such as annuities.

But the providers were not convinced that this was necessarily a problem.

“I don’t think we need a product,” Boyle said. “We just need providers to provide a really good service and experience around how to decumulate. We talk about accumulating so much but for those who are getting close to or in retirement, or turning 65 his year, how much thought have they given to what they want to do with that money?

“So it’s about preparation.”

He said the Retirement Commission’s Retirement Navigator tools which showed rules of thumb for decumulation were a good option. “But we’ve got to bring that to life ourselves and make it personalised for our investors.”

Skinner said the role was being filled by the advice channel. “The advisers are creating decumulation products through their portfolios. I think this is more a question of access to advice at different forks of a person’s investment journey.”

Lockyer said she used to assume that decumulation products would be needed but now thought the opposite.

“People are retiring at 65 or later, but they’ve still got at 20 years of living left. KiwiSaver fulfils that need at low cost because people have the ability to use it as an income stream next to NZ Super.

“But the biggest thing is we can’t just let people access all their savings at 65 without the tools and knowledge on how to make it last for the rest of their life.

For example, the common wisdom is you should switch to lower risk, incomeproducing assets once you retire, but the reality is if you want to make your savings last 20 years or more, you need to retain some exposure to growth assets.”

Mackenzie said there would be a lot of technology developed in the next 10 years that would help provide solutions. A

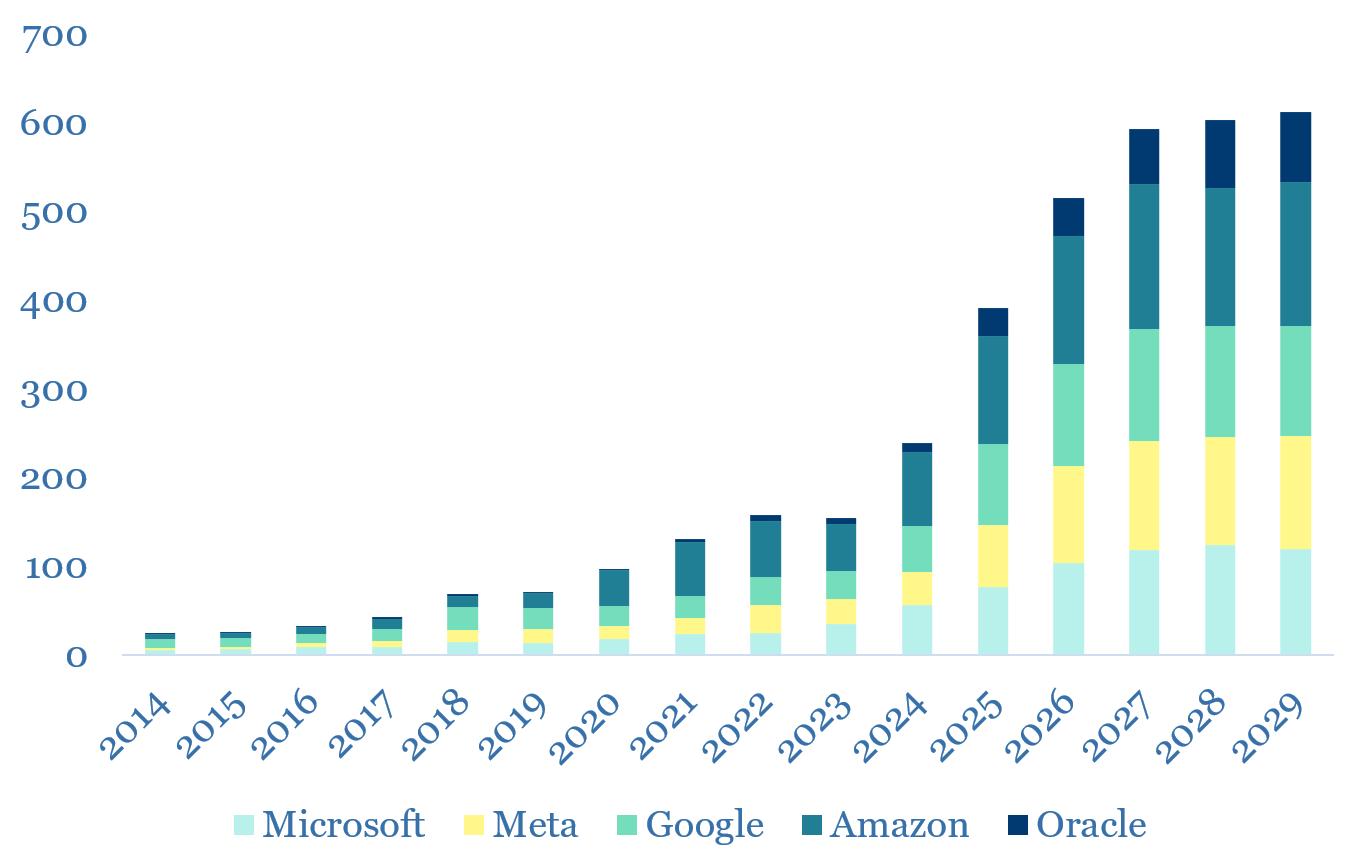

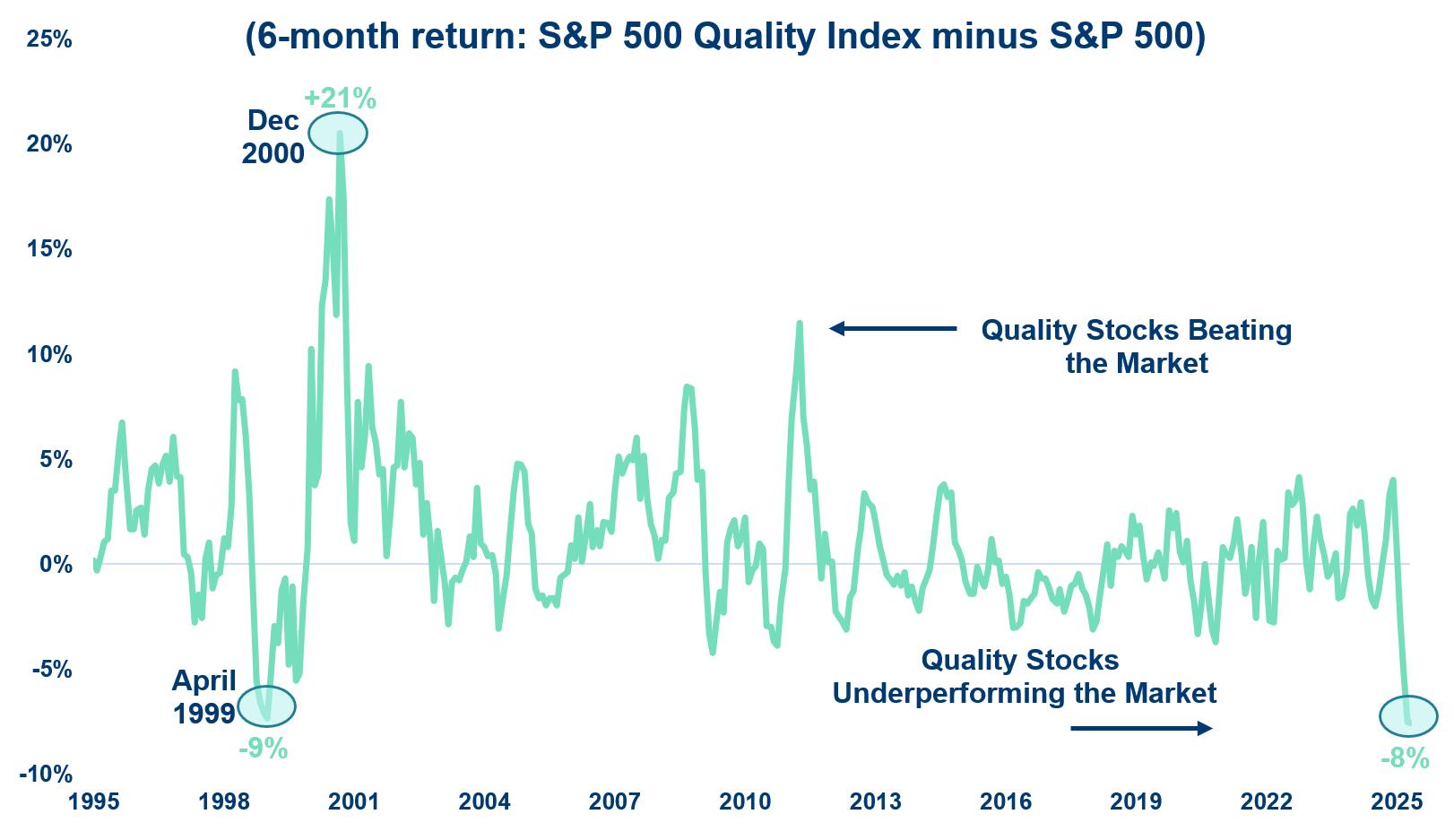

AI-fuelled exuberance has lifted technology’s share of the market beyond the dot-com peak and left benchmarks increasingly driven by a handful of mega-cap stocks trading on rich valuations. Caution is warranted.

Caution warranted amid market euphoria

There’s no denying that markets are roaring. Artificial intelligence stocks have been surging, unprofitable tech firms are back in vogue, and speculative pockets have re-emerged with an energy not seen in years. From quantum-computing start-ups to loss-making software names, investors seem happy to pay any price for the promise of exponential growth. Retail investor favourites like Palantir and Tesla now trade on valuations north of 200 times earnings – levels rarely seen outside of the dotcom bubble. Cryptocurrencies and meme-stocks have also been attracting a wave of speculative flows. Have investors forgotten the lessons from 2021 & 2022?

Debt markets, too, are exuberant, and we’ve seen record-high corporate bond issuance. ChatGPT owner, OpenAI, has said it has over US$1 trillion of financial obligations to help build 30 gigawatts of data-center infrastructure over the next few years. That’s a big commitment given the company only generates around $15 billion in annual revenue currently. That kind of ratio says much about the current mood — optimism bordering on exuberance. It may be a vote of confidence in the future of AI, but it also reflects a willingness among investors to suspend disbelief, at least for now.

Significant long-term potential, but does the math work for today’s investors

This isn’t to say we are sceptical on the potential of AI. We see it as a game changer for business and personal productivity – much like the internet was.

Source: Bloomberg

It will no doubt transform society and the economy in ways we can’t currently imagine. But that doesn’t mean it will lead to easy rewards for investors. As we saw in the early 2000s, many of the early dotcom names didn’t survive, and many of the big internet winners weren’t even listed on the share market in the late 1990s (eg. Alphabet, Netflix, Meta, Uber).

Market analysts forecast that c.US$34 trillion will be spent on building out AI infrastructure over the next five years. But if this doesn’t happen, or if it happens more slowly than expected, the valuations of semiconductor, datacentre and other AI-beneficiary stocks could be recalibrated downwards abruptly.

Even if all this infrastructure is developed, which it likely will be at some

point, it is still far from certain that it will ultimately deliver an acceptable return on investment. Estimates suggest that over US$2 trillion of new industry revenue would be required to justify this investment by 2030 – more than the current revenue of Alphabet, Amazon, Meta and Microsoft combined. We’re not saying it’s impossible – but a lot must go right for investors to be adequately rewarded.

In the dotcom bubble of the 1990s hundreds of billions of dollars was spent on the buildout of fibre-optic cable networks. This resulted in significant overbuild, a sharp decline in pricing, and the bankruptcy of once high-flyers like Global Crossing in the early 2000s.

Source: Bloomberg

While this excitement is occurring in the AI sphere - quality companies – those with strong balance sheets, durable earnings, and consistent returns on capital — have been left behind. By some measures, high-quality stocks (like Visa, Costco and Coca-Cola) have lagged the market by the most in twenty-five years. The last time this happened was during the late-1990s tech bubble, when investors similarly crowded into a handful of growth names and ignored fundamentals. The pattern is familiar: valuation discipline erodes, story stocks dominate headlines, and prudent investing starts to look outdated — until it doesn’t.

A handful of firms have powered much of the market’s gains recently. In fact, since the launch of ChatGPT in November 2022, ~75% of markets gains have been driven by AI related stocks. While not necessarily a problem in isolation, concentration is higher than at any point in modern market history – and it is a risk factor to watch.

The top ten US companies1, eight of which are mega-cap tech companies, now account for more than a third of the S&P 500’s total market capitalisation, and in many global benchmarks, the story is similar. This kind of dominance creates fragility. When market leadership narrows, breadth declines, and the fortunes of investors become increasingly tied to a small cluster of names.

As the chart below shows, the Tech sector’s share of the S&P 500 Index has recently hit an all-time high. If those companies continue to deliver on lofty earnings expectations, the rally

can persist. But if growth disappoints — or if rising competition, or regulation, or capacity bottlenecks slow the leaders — the unwind could be sharp.

The lesson: this isn’t the time to buy the index blindly. It’s a time to be selective, to understand not just what you own but why you own it.

To use an American saying, no one knows exactly which inning we’re in. Bubbles rarely announce themselves, and exuberance can endure far longer than logic would suggest. As prior market cycles reminds us, markets can stay irrationally strong well past traditional valuation limits.

The late 1990s dotcom mania carried on for years before bursting. In the last 6 months of the bubble alone, the Nasdaq Composite doubled in valued.

While this cycle could have further to run — particularly if AI continues to deliver tangible productivity gains — investors should resist the temptation to believe that momentum will protect them indefinitely. The higher valuations climb, and the narrower leadership becomes, the greater the importance of investment discipline.

As stewards of capital, an investors job isn’t to predict the precise top but to ensure portfolios can withstand the inevitable correction that follows periods of irrational exuberance. Pick carefully. Avoid the more speculative names, those trading on stratospheric valuations, and those yet to turn a profit or prove their business model. A

1Nvidia, Apple, Microsoft, Amazon, Alphabet, Meta, Tesla, Broadcom, JP Morgan, Berkshire Hathaway

Source: Bloomberg

Becoming an adviser right before the first lockdown meant Louise Grinstead focused heavily on social media presence – a strategy that continues to bear fruit.

BY KSENIA STEPANOVA

Louise Grinstead first landed in New Zealand on ANZAC Day as a backpacker - and didn’t take long to decide this was home.

Now, as director and insurance adviser at The Insurance Team, she's using social media and a passion for health to build a thriving practice, after starting at one of the toughest possible times.

Speaking at the recent MDRT roadshow in Auckland and Christchurch, Grinstead shared how she became an adviser in March 2020, contracted for several years, and then launched The Insurance Team as a business owner. Right in the midst of the Covid lockdowns.

"I'm newly self-employed, new to the industry, and I can't go out and do anything," Grinstead recalls of her early time as an adviser.

"That was an incentive to work harder, and so we spent lots of time on socials, getting online to look for clients."

"Even though it was a challenging time,

we worked through it, and it actually worked out."

Called to insurance

Before becoming an adviser, Grinstead had landed a role at ASB in Napier, where she quickly realised insurance was her calling.

She became an insurance manager at the bank before making the leap to advice, with a desire to protect people.

“Everyone wants money, but nobody wants to think about 'what if' and 'what next'," she says.

A lot of Grinstead’s success since comes down to her strong social media presence.

At a time where everyone is online, a strong and visible brand is everything for an adviser.

Her content strategy has a dual focus: approachable and fun, but also informative and not afraid to tackle serious topics.

"Insurance is an important subject, but

it's not always the most fun subject to talk about,” Grinstead explains.

“Social media platforms are great for showcasing who you are. I like to speak in plain terms, make fun posts, and get clients to think about their health, their family and their future."

Social media posting doesn’t come naturally to everyone, but her advice for other advisers is to just be authentic and consistent. And don’t hesitate to bring in outside expertise where it makes sense.

"The way of the world is now online. Get on the platforms that suit you, make engaging content, but also make sure you put calls to action on there to get people to call you or come through your website.

“You can engage specialists in their fields to help you put it all together - SEO specialists, for example.

“You need to be authentically yourself, and you need to commit, and consistently post to help yourself and your brand."

MDRT adviser Navroop Randhawa got the call overseas: her client had died. A month earlier, she'd talked him out of cancelling his cover.

BY KSENIA STEPANOVA

For Navroop Randhawa, insurance adviser at BIMA, one phone call several years ago put her work into sharp perspective.

She was attending a conference overseas when she received the news: a client had passed away.

Just a month earlier, that same client had called wanting to cancel his cover due to high costs. As the sole breadwinner for his family, he was struggling with expenses.

Randhawa had convinced him otherwise, explaining how critical the protection was and suggesting they review the policy later; it had been in place for only eight months.

Just 38 years old, he died at his workplace.

"The family didn't know how they were going to arrange the funeral costs," Randhawa recalls.

She immediately contacted their insurer

about a claim, and ensured the money reached the family's account so they could perform their rites properly.

"The text I received from them made me so satisfied - and made me realise just how important independent advice is,” she says.

“If he hadn't received that advice to keep the cover for a longer term and review it later, that cover would have been cancelled, and the family would not have received that support at the right time."

"It's not easy losing loved ones,” she adds. “But we can help people during a difficult time to ensure they at least don't have a financial crisis.

“This story has made me more connected to my job, and has made me think about how to do my job more efficiently in the longer run."

Growth through MDRT

Speaking at the recent MDRT roadshow, Randhawa credited the organisation with

helping her develop both personally and professionally.

She goes into each day knowing that there’s a family and a story behind every claim, and that her work truly matters.

"MDRT helped me to present myself with excellence and discipline," she said.

"I started to focus not on what I needed to achieve, but on what I needed to become to achieve it. I would say that dreams and goals do come true when you follow the right advice."

Randhawa also notes that advisers owe it to their clients to constantly look for ways to be more efficient.

These days, she uses AI tools like meeting trackers to speed things up, and encourages other advisers to get on the technology bandwagon.

"Technology will never replace great advisers,” she said. “But advisers will be replaced by the ones who use it.” A

Edward Glennie, adviser at Genesis Advice, is enjoying the opportunities a new direction is offering – but asks whether the industry is giving enough thought to wider succession plans.

Aan employee-shareholder of Hobson Wealth, its acquisition by Forsyth Barr in 2023 was good news for Edward Glennie.

But as an investment strategist who was not required in the new structure, it meant a change of direction was needed.

Glennie had been at Hobson Wealth for seven years, following a stint as a senior portfolio manager at Generate KiwiSaver, and a long period working in Hong Kong, including time as head of Asian research at Lighthouse Investment Partners.

While pondering a career change, a coach suggested he was likely to succeed in his own business.

Glennie figured he enjoyed client interaction and had useful skills - and feedback confirmed he was good at communicating and explaining things.

He had spent his time at Hobson Wealth working largely with advisers, providing portfolio research and other support.

“I effectively was dealing a lot with clients, and probably the more sophisticated, larger clients like the charities and what have you.

“I thought, ‘Why don't I go ahead and just do the papers?’

“So I did my Level 5 certification at the beginning of last year.”

By the end of the year he had made a decision to join Wealthpoint – in part because the fathers of two school friends were still working in the network as

senior advisers, proving that a long and enjoyable career was possible.

He was then introduced to David Lowe, one of the principals at Genesis Advice, a founding Wealthpoint member.

“There was an opportunity to come in, be the first investment person coming into what was investments but also insurance.”

A bird in the hand

Glennie started by focusing on the firm’s legacy clients.

“The baseline was, ‘Hey, we've got all these clients that we touch either from insurance needs or investment over the years, and advisers have come and gone… why don't you come and try to engage with the clients that we've got. But if you bring in any other clients, they can be your clients.’”

The arrangement gave him confidence that he would have a base to start from, and to which he could add value.

He was also able to move into KiwiSaver advice, building on Wealthpoint’s relationships with a number of providers.

“You’re joining something that was already established, but you're building up; it's sort of a co-op within a co-op.

“So you're starting from zero effectively, and you're building up a business within a business. And that's exciting.

“And gradually now, 11 months on, it's building on itself.”

Glennie says his business has grown

to 500 clients and $30 million of funds under management in less than 12 months.

Stroke of luck

In his second week on the job, another adviser asked whether he wanted to buy his KiwiSaver book.

“I sort of couldn't believe my luck… I started on the first of October; on the first of November, I essentially had nearly 400 clients to get out there and introduce myself to.

‘How can I help you? You're in the right fund…’

“That was a great windfall, just to be able to hit the ground running.

“But also I found, at the stage where I am in career, I tend to now know people who are in professional jobs, and they've actually got quite big KiwiSaver balances.

“So you can reach out to people that you know, and really add value.

“They already have a provider, but you're able to say, ‘Hey, look, I can be your adviser there, help navigate, make sure you're in the right funds where you are. If it makes sense to move you, we'd consider that.’

“You can really add value to people.”

Background a bonus

Glennie says his experience with Generate and other KiwiSaver providers earlier in his career is a point of difference - as is his investment knowledge, which

allows him to give customised updates on what’s happening to clients’ investments.

“That’s been quite rewarding, given my investment background.

“The other nice thing is now these days, pretty much everybody you speak to has got a KiwiSaver… they're just not optimising it in the same way that they probably should, which means then you can help them.

“And then through that, you then get investment leads, you might help someone on the KiwiSaver and you go and meet them and they've actually got an investment fund, money sitting in the bank.

“That can also be an opportunity to help them, and you build out that side as well.”

Having been in in the industry for a length of time, Glennie says he is able to bring experience of market cycles to help clients navigate volatility.

“I've seen the tech wreck, I've seen the GFC, I've seen Covid, I've seen the temper tantrum in the Fed many years ago… being able to look through that a little bit is where I can demonstrate my value to clients, and even just being able to do some analysis for them.

“Because often when they're thinking of the change, by the time they actually get to the point where they want to change something, the market's already bottomed, and is on the up.

“A lot of my job is just coaching them through that.

“Trying to make them make the right choices at that right time.

“Even though I've only recently become an adviser, because I've worked through markets for 25 years, you can really add value.”

Glennie says he expects to have many years ahead of him in the industry.

“I’ve always enjoyed markets. I really enjoy the people interaction side of it. And knowing that you can help people.

“The good thing with KiwiSaver is you've got long lead times.”

He says that’s also why he likes to have a mix of clients of different ages.

“I have clients that are over 65 who can actually access the money.

“But part of that education is just because you can access it [should you?]… people are living a lot longer; in my mind they’re not taking enough risk.

“The textbooks say you've got to get more conservative coming into either retirement or you're buying a house because you don't want the volatility with the asset that you've got.

“But actually, if you're not going to be able to buy another house for two more years, because prices aren't where you want them to be, you're missing out on that potential to grow that capital for the two years.

‘There are a lot of older advisers who don't really want to give up, because they've built these businesses up… But you've got to let the next person have a go.’

Edward Glennie

“Look at this year: the market sort of dive-bombed and has rallied back to record highs again.

“If you'd gone to cash in the beginning of April, and stayed there, because you got nervous… it's always challenging to get back into the market, because you just can't pick it.

“People are moving away from default funds and balanced into more growth funds.

“But with living a lot longer, you want your money to be working… not just in a conservative fund the day you hit 65 because that's what your age says.”

As an example, Glennie cites the story of a client who rang him recently – a man working in McDonalds who will be turning 65 in October.

“He hasn't got a large amount, but he wants to be able to access it the day he's going to retire.

“The day he hits 65, he's going to take his money out.

“And I was trying to say to him, ‘Look, that's fine. But even if we structure it such that you have an extra $100 a week, or $50 a week, and you can have it for this many years after…’”

Glennie says he enjoys the art of engaging with people, figuring out how best to relate to them.

“It's about getting a message across, I suppose, in a way they can understand.

“And look, that's something I enjoy doing.”

However, Glennie says the industry has some questions to tackle in regards

to how it brings in the next generation of advisers.

“In the advice space, coordinating succession plans can be something that's a challenge.”

Existing advisers usually value their relationships with clients highly, but, he says, if they could bring people in earlier, “on that pathway together”, it would help the newer advisers to understand the clients they would eventually take over.

“It is hard to start from scratch.

“I'm lucky because I had obviously worked at a firm, and, as a shareholder, I was able to monetise that to some degree. But it's not easy starting from nothing.”

He also advocates making sure new advisers are well trained – especially the younger ones – and have opportunities to gain experience.

“You’ve got to have a little bit of maturity.

“You can't go to someone to manage their money if you haven't really seen the cycles, and you don't really understand the investment.

“I think you want to get people into it, but it takes time to build up.

“And that's where someone like a Generate has been really good about bringing advisers in, in-house and training and what have you.

“They see the value of having [well-] advised clients.

“It’s tricky. There are a lot of older advisers who don't really want to give up, because they've built these businesses up. They enjoy the client interaction.

“But you've got to let the next person have a go.

“So I'll be quite mindful, when we get to that point; you want to make sure that you give someone an opportunity coming in as well.”

Glennie says he was at a conference where a speaker said a typical adviser coming in would often not last more than two years.

“I went up to him afterwards and said, ‘I didn’t like what you said, I’m not even a year here’.

“He said, ‘You’re different, don’t worry’.”

But it remains challenging for people coming into the industry and building something new, he says.

“I met a guy in his 30s who is really passionate about wanting to build his own firm.

“I’m a bit more agnostic about that; to me, it’s about the relationship with a client and it doesn’t necessarily matter who’s behind me, as long as the systems and compliance are in place, but he is very much about building something. That’s quite challenging.

“It’s not necessarily an easy industry to just come into… you’re always beholden to the market, which is another challenge.

“But there are tailwinds there. What to do with your capital or your KiwiSaver… people do need advice.” A

Now 18 years old, KiwiSaver is still experiencing highs and lows - achievements and struggles – just like any young adult. David van Schaardenburg looks at the latest statistics on our national savings scheme.

BY DAVID VAN SCHAARDENBURG

Eighteen years of KiwiSaver and the scheme continues to mature and become more sophisticated – albeit with sudden changes of mood between euphoria and gloom, as expected with any new adult.

Here’s the good news, according to key statistics:

$123 billion in size at March 31; up 10% with around half that growth from investment returns; and the average balanced fund is returning near 5% over the financial year.

KiwiSaver is now the #1 financial asset for NZ households. Contributions are up 8.8%, with most of that growth coming from rising member contributions.

KiwiSaver is being used in the way intended: withdrawals are up 16%, with over 50% of these being for retirement lifestyle and 30% for first-home purchases.

And retirees appear to being prudent in how they withdraw, with over 65s reducing the dollar level exited from KiwiSaver by 1.3% compared to 2024and gradually decumulating as opposed to total account closure.

Similarly, with a flattening out of the property market, the sum withdrawn for first-home purchases has bounced - being 22% above the prior peak year of 2022.

KiwiSaver members are getting more savvy in terms of aligning the long timeframe between the present and their likely date of commencing drawing down on their KiwiSaver account.

We see this in the proportion of KiwiSaver balances allocated to the ‘growth’ category expanding in percentage terms from round 25% market share at March 2021 to 48% in 2025.

While the FMA (Financial Markets Authority) report does not comment on the role of financial advisers, the combination of increased account sizes and relative financial importance is hopefully driving more New Zealanders to seek professional financial advice, leading to better quality decisions with respect to their KiwiSaver accounts.

Since March this year, the average KiwiSaver fund has had around a 10% return over the six months to 30 September, and, based on financial market trends during October, most KiwiSaver balances will have increased further.

In the absence of a market shock, I expect KiwiSaver to have total funds under management of over $140 billion by 31 March 2026.

On the other hand, while 65% of the working-age population (three million Kiwis) have a KiwiSaver account, 30% of these, or 900,000, are not contributing.

This will create a divide between those who have meaningful KiwiSaver balances to fund retirement lifestyles and a big chunk of the population who will have modest balances, defeating the primary aim of KiwiSaver, which was to reduce the social reliance on state-funded superannuation.

Hardship withdrawals are up 68% on the previous year – reflecting, one can presume, the weak economy and rising un- and under-employment.

‘It’s not hard: if you want people to lock their savings away for long periods, they need an incentive’

Investment-management fees are up 10% to $868m, in line with growth in funds under management.

Fees as a proportion of assets have not declined in the last two years, despite KiwiSaver FUM rising by $30b, or 32%, in that time frame.

I suspect this is in part due to the rising allocation to growth funds - which are typically more expensive - offsetting the market share increase of low-fee providers like Simplicity.

However, a broader failure of the potential benefit of true competition, and of the FMA’s vision of value for money, is clearly occurring between some of the largest KiwiSaver providers.

Why is it that Simplicity and Kernel can deliver passive-investment-based KiwiSaver funds for a 0.25% fee per annum, while two large mainstreet banks, a former large life insurer and the subsidiary of a listed company, who also manage their KiwiSaver using low-cost passive investing, have their KiwiSaver fund fees range from 0.6% to 0.79% per annum (balanced fund option used as the fee example)?

It’s extraordinary to see such price difference between suppliers of a commodity item in the investment management world – a bit like choosing to buy 91 petrol at a full-service petrol station for $6.90/litre, instead of driving down the road five minutes to, say, an

NPD (Nelson Petroleum Distributors) station, and getting the same product for $2.30/litre.

Collectively these four providers manage $36.7 billion in KiwiSaver funds, equating to a 27% market share.

Broadly adding up, their excess fees above Simplicity’s total around $141 million per annum based on their funds under management per Morningstar’s KiwiSaver report as at 30 September 2025.

Three of these four are New Zealand subsidiaries of Australian companies whose shareholders enjoy the benefit of such excess charging.

We definitely need a ‘Gaspy’ for KiwiSaver, because, despite best efforts, the Sorted app appears to have yet to put sufficient light on excess fee-charging in KiwiSaver.

National continues its track record of reducing Government support for longterm household savings into financial assets– a strategy that has proven so important to the longer-term growth in domestic capital markets and economies for our Trans-Tasman friends, as well as the US and many European countries.

As the supposed political party with higher levels of economic competence, you’d think they’d be putting in place more - not less - support for growth in KiwiSaver (read long-term savings) balances.

So no surprise to see their reduced Government contributions, which will reduce KiwiSaver membership levels irrespective of increased minimum contribution rates.

It’s not hard: if you want people to lock their savings away for long periods, they need an incentive.

On the other hand the incumbent Government has made promises to their support base to free up withdrawals for a range of business activities.

They have also led more discussion on the use of KiwiSaver to invest on illiquid assets such as infrastructure, private equity, and so on.

Take a look across the ditch at AusSuper private equity problems, and APRA’s review of illiquid assets in superannuation schemes, to see how complex this issue can become. A

David van Schaardenburg is independent of any fund manager and is CEO of the Ignite Adviser Network, whose FAPs provide advice to over 15,000 investment clients including their KiwiSaver savings.

In order for an insurance policy to be fair, how it works has to be clear. It can be complex, but not ambiguous.

BY RUSSELL HUTCHINSON

In order to be fairer to customers, insurers will need to be clearer about defining how their contracts work.

To illustrate, consider a promise to pay for non-Pharmac medicines for noncancer disorders as example - and this one is real: what if we don't tell the client what kinds of disorders are considered, we don't tell them what threshold the disorder needs to pass to be considered, we don't tell them what evidence will be required, and we won't tell them any limitations or exclusions, and we won't tell them how much will be paid?

Although I'm reluctant to describe this feature as 'unfair', equally I cannot in good conscience describe it as reliable, or predictable.

Put another way, how much would you pay for such a vague promise?

If insurance fails to improve much on the unpredictability of the uninsured state, what good is it?

So, predictability = some terms and guidance that would enable the customer to plan.

I think this is what's at the heart of a well designed and constructed insurancebenefit definition.

A well-designed benefit definition isn’t simply a contractual artefact. It’s a promise that can be understood, anticipated, and – crucially - relied upon.

And while the structure of a policy document may vary from insurer to insurer (and in some cases from product to product), the underlying conceptual building blocks of a benefit remain remarkably consistent.

Strip away layout, formatting and crossreferencing, and what you are really left with is a cluster of ideas which explain what the benefit is for, when it applies, and how it will behave at claim time.

Raison d’être

The first of these elements is purpose

The purpose of a life or health policy is not always universally obvious, even when treated as such.

Purpose matters, because it grounds the customer’s expectations.

A life benefit exists to protect dependants from financial loss; a trauma benefit exists to provide immediate financial support after a serious medical event or diagnosis; an income protection

benefit replaces a portion of earnings during incapacity to meet commitments.

Purpose is not just conceptual scaffolding, it’s the anchor that keeps the contractual promise aligned with the real-world risk it is supposed to address; it often, but not always, connects the cover to the principle of indemnity.

If a feature does not connect strongly to purpose – it is likely to be weak.

Benefits also depend on a set of contractual preconditions: who is insured, at what stage of life the cover applies, whether waiting periods are over, whether the policy is in force.

These are the policy-wide eligibility rules; they operate at a level higher than a specific feature.

Conceptually, they matter just as much as the event trigger.

They define the environment in which the promise operates.

Next comes the trigger event or contingency which activates the insurer’s obligation to pay.

This is the beating heart of the benefit definition.