How U.S. election could affect energy investing

Did 5 grad students just cook up a x for Chicago’s pension funding troubles? Pension Funds

By ROB KOZLOWSKI

A team of ve University of Chicago graduate students won a Harris School of Public Policy competition with a proposal of nine initiatives designed to save the city of Chicago between $200 million and $400 million a year to shore up its woefully underfunded pension funds.

The team of graduate students — Syed Ahmad, Anthony Beaupre, Liam Gluck, James Karsten and Greg Rudd — was awarded the $10,000 rst prize in the inaugural Harris Policy Innovation Challenge, which tasked graduate students to come up with solutions to the city of Chicago’s pension funding crisis.

The team was one of eight that competed in the challenge and one of three nalists that made presentations at an April 3 event at the school.

The nalist teams were judged by a panel that included Dominic Garcia, former CIO of the New Mexico Public Employees Retirement Association and current chief pension investment strategist at CBRE Investment Management.

In his presentation, Ahmad said the team generated 28 different ideas speci cally intended to increase funding and growth and decrease liabilities.

“The advantage of taking a simpli ed view like this is it makes diagnosing root

Uncertainty surrounds incentives linked to In ation Reduction Act

By BRIAN CROCE

Asset managers and consultants are closely watching how the U.S. presidential election could impact renewable energy investing.

Those with a focus on the sector are trying to discern whether politics around, and speci c economic incentives borne out of, the In ation Reduction Act and its myriad tax credits for clean energy will change after the November election.

”I think anybody that is going to sit there and wait until December to adjust their portfolio could really face some adverse outcomes because elections can change policy, and policy can change economics, and that can really change valuations and so forth for renewables,” said Tyler Rosenlicht, a senior vice president and portfolio manager for global listed infrastructure who also serves as head of natural resource equities at Cohen & Steers.

Rosenlicht said he and his colleagues are very focused on what could happen after the election between President Joe Biden and former President Donald J. Trump, who have vastly different views on renewable energy.

Cohen & Steers is positioning itself to ensure it comes out ahead after the election, Rosenlicht said, adding that is “why we come to work every day.”

“There are situations where if the IRA gets rolled back it’s a dramatically, dramatically negative outcome for the existing stock. There are situations where if the IRA gets rolled back it’s not a big deal or really good. So our day to day is spent trying to understand that range of outcomes and where the mispricings are.”

Cohen & Steers manages an $8.4 billion infrastructure portfolio.

Retirement

Tax incentives and state mandates driving surge in new 401(k) plans

Cerulli projecting a gain of 230,000 plans by 2028, raising hopes of closing ‘coverage gap’

By MARGARIDA CORREIA

The age of startup retirement savings plans may just be getting started.

Cerulli Associates, for one, anticipates a surge in 401(k) plans, projecting more than 900,000 by 2028, or roughly 230,000 more than there were in 2022.

“By the end of the decade, we could be looking at close to 1 million 401(k) plans,” said Shawn O’Brien, Cerulli’s director of retirement, during a March 21 webinar on the U.S. retirement market.

Record keepers for retirement

goal is to convert as many of the top-performing interns to full-time as we can.’

plans are also bullish. Guideline, a San Mateo, Calif.-based digital record keeper, for example, is seeing sharp growth in rst-time plans, signing up roughly 13,195 plans in 2023, more than double the 6,510 plans logged in 2020.

“We’re seeing continued rapid growth in new plan creation,” said Jeff Rosenberger, Guideline’s chief operating of cer. Other record keepers are also

Some

More on the energy transition:

n The election notwithstanding, investing in energy is going full speed ahead. Page 14

n Like ESG, energy transition investing means different thing to different people. Page 16

Fired employees detail concerns on Bridgewater Hedge Funds

Complaint over termination of execs airing dirty laundry

By LYDIA TOMKIW

Two former Bridgewater Associates executives allege their criticism of the giant hedge fund’s performance and transactions costs were part of why they were red, and the insiders’ complaint has raised fresh concerns among pension funds and other institutional investors.

Last year, Bridgewater’s agship Pure Alpha II fund lost 7.6% while its All Weather fund returned 10.6%.

Although Pure Alpha II notched one of its worst annual declines since its 1991 inception, the fund rebounded almost 16% in the rst quarter.

Bridgewater is currently managing approximately $120 billion in assets for 260 clients, according to a February presentation for the Alaska Permanent Fund Corp. Alaska Permanent remains a client and declined to comment.

Houston Police Of cers’ Pension System has terminated hedge fund giant Bridgewater Associates from two underperforming portfolios. The $7.5 billion pension fund’s board approved terminating its investments in Bridgewater Pure Alpha and Bridgewater Major Markets Fund at

SPECIAL REPORT THE ENERGY TRANSITION

SEE ELECTION ON PAGE 15 SOUND BITE

Danish funds eye defense assets

future. Page 3 BALYASNY’S

Page

THE INTERNATIONAL NEWSPAPER OF MONEY MANAGEMENT | A PRIL 15, 2024 | PIONLINE.COM | $16 AN ISSUE / $350 A YEAR

funds are raising allocations, noting that a safe society leads to a sustainable

HANNAH DINARDO: ‘Our

6

AT RISK: The tax credits contained in the IRA may not survive a second Trump presidency, some observers said.

SEE BRIDGEWATER ON PAGE 24 SEE STARTUP ON PAGE 26 SEE CHICAGO ON PAGE 27 MAN WITH A PLAN: Jonathan Halpert, owner and chief medical officer of Priority 1 Urgent Care, said tax credits and labor market dynamics factored into his decision to offer a workplace plan, but weren’t the only reason.

Rachel Jessen (Biden), Christian Monterrosa (Trump)/Bloomberg

Hedge Funds

Applicants for summer internships at some hedge funds are facing long odds, with some acceptance rates below 1%. Page 6

The stock market has changed, says Eminence Capital CIO Ricky Sandler — and his rm is changing with it. Page 18

Money Management

GMO’s Ben Inker is excited about the number of cheap stocks he sees in the markets a strong statement for the evenkeeled, value-centric manager. Page 4

Asset-management executive search rms

BraddockMatthews and David Barrett Partners have merged. Page 16

Polus Capital Management, born from the 2021 merger of Cairn Capital and Bybrook Capital, is thriving. Page 17

Awards

P&I and DCIIA have opened nominations for 2024’s Excellence & Innovation Awards, which recognize DC executives and their teams for projects that help participants prepare for retirement. Page 4

ETFs

Single-country ETFs that focus on Japan and India are gaining in ows from investors wary of concentration risk in U.S. Page 12

Regulation

SEC Commissioner Hester Peirce criticized the agency’s “dwindling” engagement with the public, saying it sti es discussion. Page 18

Alternatives

Jim Smigiel, CIO at SEI, thinks the booming private credit sector is no longer as attractive as it seems. Page 17

Private credit, while not a risk to nancial stability, could potentially worsen a future recession, said an IMF of cial. Page 18

Time is running out to submit a money managers survey

Pensions & Investments is still accepting late responses to the annual money managers survey. Firms managing U.S. institutional, tax-exempt assets are eligible to participate. Results will run June 10.

To request a survey or obtain further information, please contact Anthony Scuderi at ascuderi@pionline.co m or 212-210-0140, or visit www.pionline. com/section/surveys

of credit and markets says investors are making permanent allocations

By LYDIA TOMKIW

With interest rates likely to stay higher for longer, it’s a great time for investing in credit, said Christopher Sheldon, partner and cohead of credit and markets at KKR & Co.

And amid that favorable environment, institutional investors are moving from tactically allocating to private credit to creating permanent allocations, he said in an exclusive interview with Pensions & Investments

“We are going to have more dispersion in the market. Defaults will increase, but I don’t think they are going to spike,” Sheldon said. “And it’s a credit picking market. It’s about making sure you have scale, differentiated origination, making sure you have choices.” KKR has seen credit assets grow meaning-

fully over the last ve years to $219 billion as of Dec. 31 from $59 billion at end of March 2018. The assets under management include the rm’s acquisition of retirement and life insurance company Global Atlantic Financial Group and a joint venture it formed with FS Investments.

Credit accounts for approximately 40% of KKR’s total assets under management as of Dec. 31, according to the rm’s April 10 Investor Day presentation. KKR divides its credit business into leveraged credit, which accounts for $123 billion in AUM; private credit, which stands at $86 billion; and strategic investment at $9 billion.

asset-based nance strategies and bespoke capital solutions, he said.

With uncertainty around valuations and the nancing markets, companies are looking for bespoke capital solutions.

“They may not want traditional debt, but are willing to have some type of structure, whether it be a preferred, or actually an equity, but just with a lot of bells and whistles on it,” he said.

“The roots that we have in the ground today should fuel growth for the next decade,” Sheldon said.

Two areas where KKR has been busy are

Pensions & Investments has opened registration for the 2024 Best Places to Work in Money Management program.

Now in its 13th year, the program shines a light on top employers within the money management industry and how they are elevating their workplace culture, attracting talent and developing employees.

For the 2024 program, P&I has enlisted Workforce Research Group as its new research partner and will work together to identify great places to work. The Humble, Texas-headquartered independent research rm will engage with employers and employees to determine winners through a two-step assessment.

In the rst part, employers complete a questionnaire that covers topics such as population demographics, practices and organizational bene ts. In open-ended questions, employers may provide greater detail on their practices.

There are several market tailwinds favoring increased institutional credit allocations, Sheldon said. Higher rates for longer along with ongoing bank deleveraging and a pullback from noncore lending, record levels of private equity dry powder globally, and developing Asia-Paci c capital markets are all

SEC halts climate disclosure rule pending legal challenge

By BRIAN CROCE

The Securities and Exchange Commission said it will voluntarily halt implementation of its new public company climate disclosure rule while a federal court considers multiple legal challenges on a consolidated basis.

The SEC said in an April 4 ling that it “has determined to exercise its discretion to stay” the nal rule pending judicial review.

After the SEC nalized its rule March 6, nine lawsuits were led in six different circuits. A lottery was then held and determined that the challenges will be heard on a consolidated basis in the 8th U.S. Circuit Court of Appeals in St. Louis.

The rule in question will require public companies to disclose a host of cli-

In the second part, employees complete a survey designed to quantify their engagement and satisfaction with their rm. Employee responses will be anonymous.

The employee survey will account for 80% of a rm’s total score; the employer survey will carry a 20% weight.

To participate, rms must have at least 20 U.S.-based employees and have at least $100 million of discretionary, institutional assets under management or advisement. Participants must also be in business for at least one year.

mate-related information in their periodic reports and registration statements. That information includes material climate-related risks; activities to mitigate or adapt to such risks; information about the company’s board of directors’ oversight of climate-related risks; and information on any climate-related targets or goals that are material to the company’s business, results of operations or nancial condition.

The nal rule didn’t go as far as the March 2022 proposal on which it was based, but it still drew sharp pushback.

A bulk of the lawsuits, like those from energy companies, business groups and Republican attorneys general, make similar arguments, claiming that the SEC doesn’t have the authority to issue such a rule, that the rule is arbitrary and capricious under the Administrative Procedure Act, and also violates the First Amendment by effectively mandating discussions about climate change.

But the SEC also received a challenge

Participants must register to participate by June 7 and pay a nonrefundable $199 registration fee. Results will be published by P&I online and in its Dec. 9 print issue, which will include pro les and photos of the winners.

For further questions and more information on the program, please reach out to Julie Tatge, executive editor

Firms may register to participate in this year’s program at pionline.com/bptw2024 Frequently asked questions and answers, a timeline of the survey process, plus a sample survey are available there as well.

2 | April 15, 2024 Pensions & Investments

IN THIS ISSUE

of P&I, by email at jtatge@pionline. com. To contact Workforce Research Group, please send an email to answers@workforcerg.com or call (281) 602-5004. The program recognized a record 123 rms in 2023. A full list of last year’s winners as well as their pro les and related stories can be found at pionline. com/bptw2023 n

‘It’s

credit picking market’ – KKR’s Sheldon SEE CREDIT ON PAGE 25

a

Registration opens for P&I’s Best Places to Work program SEE CLIMATE ON PAGE 23 Alternatives

Washington Implementation of nal rule is stayed as appeals court considers 9 lawsuits

Awards Firm’s co-head

VOLUME 52, NUMBER 5 Keith E. Crain Chairman Mary Kay Crain , Vice Chairman KC Crain President & CEO Chris Crain , Senior Executive Vice President Bob Recchia , Chief Financial Officer G.D. Crain Jr. , Founder (1885-1973) Mrs. G.D. Crain Jr. , Chairman (1911-1996) Published by Crain Communications Inc. Chicago offices 130 E. Randolph St., Suite 3200, 60601 London offices 11 Ironmonger Lane, EC2V 8EY New York offices 685 Third Ave., 10th Floor, 10017 Address all subscription correspondence to Pensions & Investments, 1155 Gratiot Ave., Detroit, MI 48207-2732 or email customerservice@pionline.com. www.pionline.com Entire contents ©2024 Crain Communications Inc. All rights reserved. Pensions & Investments (ISSN 1050-4974) is published monthly in January, February, March, July, August and December, and semimonthly in April, May, June, September, October and November by Crain Communications Inc., 130 E. Randolph St., Suite 3200, Chicago, IL 60601. Periodicals postage paid at Chicago, IL, and at additional mailing offices. POSTMASTER: Send address changes to Pensions & Investments, Circulation Dept., 1155 Gratiot Avenue, Detroit, MI 48207-2912. $350 per year in the U.S. Printed in U.S.A. GO TIME: KKR’s Christopher Sheldon said the likelihood of higher for longer interest rates has fueled growth. HOT WATER: Many of the lawsuits are challenging the SEC’s authority to issue the rule, which the plantiffs said is arbitrary and capricious, and violates the First Amendment. JHVEPhoto

Danish funds mulling defense investments

Upping allocations to the sector seen as a way to support peace by funds following responsible investment policies

By SOPHIE BAKER

Danish pension funds are re ecting on how defense-related investments reconcile with their responsible investment policies, against a backdrop of signals from the European Commission and Danish government to help strengthen defense and security, and the war in Ukraine.

Some pension funds in the country have been upping their allocations to the defense sector, explaining that they’re increasing exposures in a quest to contribute to a peaceful and safe society and secure a sustainable future.

“Since the outbreak of the Ukrainian war, broad political support in Denmark and throughout the Western world for rebuilding defense capabilities has increased

signi cantly and many Western countries are now reaching or trying to reach” the 2% of GDP commitment to defense spending made by NATO heads of state and government in 2014, said Tom Vile Jensen, deputy director of Danish pension and insurance association F&P.

“This of course also impact(s) investors and has opened up new opportunities for pension funds as well,” such as the construction of new military buildings and facilities, nancing shipbuilding in cooperation with other private entities, and investing in global companies “which provide Denmark and other allies with material/ weaponry,” he added.

Last month, the EC proposed its rst European defense industrial strategy, which

New CalPERS CIO has funding ratio in his sights

By JENNIFER ABLAN

CalPERS has tapped Stephen Gilmore, the chief investment ofcer of sovereign wealth fund New Zealand Superannuation Fund, as its new chief investment of cer.

Gilmore has spent the last ve years as CIO of NZ Super Fund, which is owned by the New Zealand government and valued at more than NZ$73 billion ($43.5 billion). He is is expected to start at CalPERS, the nation’s largest public pension fund, in July.

Gilmore will succeed Nicole Musicco, who left the Sacramento-based California Public Employees’ Retirement System in September and became the second straight CIO to leave after only 18

months on the job.

“Stephen has worked in very public roles during his career for organizations where transparency and resiliency are essential,” said CalPERS Chief Executive Of cer Marcie Frost, in an April 2 news release. “He brings not only a wealth of investing knowledge to the job, but he also has the temperament to understand the needs of our members and public sector employers who depend on CalPERS to be a steady, long-term partner.”

As chief investment of cer for NZ Super Fund, CalPERS said Gilmore has overseen the world’s best-performing sovereign fund, with annual investment returns of

Japan’s government bond yields on the upswing

AT&T, Lockheed Martin suits facing hurdles, experts say

By ROB KOZLOWSKI

U.S. corporate retirement plan sponsors are full speed ahead on pension risk transfer transactions despite recent lawsuits that legal experts say face hurdles to avoiding early dismissals.

In March, two groups of AT&T retirees led separate lawsuits against the telecommunications giant and independent duciary State Street Global Advisors, alleging a violation of duciary duties related to a 2023 pension buyout transaction; and four Lockheed Martin Corp. retirees led a lawsuit against the defense company alleging similar violations related to two recent pension buyout transactions. What the lawsuits have in com-

mon is the two companies each purchased group annuity contracts from Athene Annuity and Life Co. and Athene Annuity & Life Assurance Co. of New York.

The AT&T purchase from the two Athene Holdings subsidiaries transferred $8.1 billion in U.S. pension plan liabilities and the responsibility of paying bene ts to about 96,000 AT&T retirees and bene ciaries, and the two Lockheed Martin purchases in 2022 and 2021 transferred a combined $9.2 billion in U.S. plan liabilities and the responsibility of paying bene ts to about 31,600 retirees and bene ciaries.

Each lawsuit alleges Athene is not safe.

Japan recently ended its negative interest-rate policy after a period during which other central banks hiked rates to combat in ation. Recently, Japan set a zero to 0.1% targeted short-term rate and loosened controls on 10-year yields. While economists expect Japan and the EU’s long-term yields to increase, they project them to fall in other developed countries, providing investors an opportunity to lock in higher yields.

Locking in yields: Government bond yields have risen over the past few years, with the U.S. 10-year yield the highest at 4.55% as of April 10. Japan’s 10-year yield is the lowest among those examined at 0.81%, but economists project they’ll keep climbing through the end of 2025 while yields in other countries, including the U.S., will drop. 10-year yield comparison**

Falling in ation: Japan’s consumer price index rose 3.3% last year, and economists expect it to slow to 2.3% this year. That’s much higher than the country’s 0.73% 10-year yield.

Economists also expect CPIs in the U.S., EU and the other countries to continue slowing.

Developed country CPI

De cit spending: A number of countries as well as the European Union have budget de cits, which some economists expect will impact long-term yields in the future. Last year, the U.S. de cit accounted for 6.5% of gross domestic product.

Deficit as % of GDP

Funds’ holdings: The median pension plan had 11% of its xed-income allocation in non-U.S. developed markets, based on the 22 de ned bene t plans that provided this information in P&I’s survey of the largest plan sponsors.

% of fixed income in nonU.S. developed markets

Pensions & Investments April 15, 2024 | 3

Investing

Pension Risk Transfer

SEE LAWSUITS ON PAGE 21

Anastasia Vlasova/Getty Images

GREEN LEADER: New CIO Stephen Gilmore said CalPERS’ leadership in sustainable investing was a big draw. INSTRUMENTS OF WAR: Ukrainian servicemen stand on patrol at a security checkpoint in Kyiv.

Pension Funds

SEE GILMORE ON PAGE 24 SEE DEFENSE ON PAGE 20

*As of March 25. **Year-end data unless otherwise noted. Sources: Bloomberg, U.S. Department of the Treasury, Pensions & Investments Compiled and designed by Larry Rothman and Gregg A. Runburg -18% -16% -14% -12% -10% -8% -6% -4% -2% 0% 2% 2026 2025 2024 2023 2022 2021 2020 2019 2018 2017 Japan Germany Canada France EU U.S.

-1.0% -0.5% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% U.S. EU France Canada Germany Japan 2019 2020 2021 2022 2023 *2024* 2024E 2025E 2019 2020 2021 2022 2023 2024E 2025E 2026E -1% 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% U.S. EU France Canada Germany Japan 90th percentile 75th percentile 50th percentile 25th percentile 10th percentile 1.9% 2.6% 11.0% 25.6% 50.6%

By

By

U.S. large-cap growth stocks have been hogging the investment limelight in recent years but Ben Inker, partner and co-head of asset allocation at Boston-based quant rm GMO, says his team has been looking elsewhere — and nding a lot to like just now.

“We are excited because there are

a lot of cheap stocks out there,” both at home and abroad — even as a relatively narrow group of mega-cap U.S. growth stocks keeps lifting the benchmark S&P 500 index to new highs this year, Inker said in an interview.

And it’s not just stocks. “You’d have to go back to 2000” to nd such a range of assets — including lowrisk bonds and the cash returns underlying liquid alternatives — paying investors this well for taking risk, Inker said.

It’s the rst time in a very long time that, when looking to add exposure now in attractive market seg-

ments such as European deep value stocks to GMO’s multiasset portfolios, “we’re faced with this problem of saying, oh, but we like everything in our portfolio so much already. It’s painful nding the thing to sell in order to buy this,” Inker said.

That kind of enthusiasm isn’t entirely expected of GMO, given the rm’s value-centric reputation for keeping animal spirits in check and irrational exuberance at bay, Inker concedes, asking rhetorically “how could GMO be talking about how excited we are when the market is making all-time highs?”

Jeremy Grantham, GMO’s found-

er, provided a possible explanation in a March 11 “viewpoint” analysis of the market moment, noting that the “current (arti cial intelligence) bubble…limited to a handful of stocks, is totally unprecedented, so looking at history books may have its limits.”

So, if the S&P 500 is substantially overvalued now, “we don’t have to own any of those stocks…and there’s a lot of other stocks that aren’t trading at those kinds of valuations,” Inker said.

U.S. value stocks, for example, are “as cheap versus the market as anything we have ever seen,” apart from

Entries are judged on innovation as well as excellence in execution.

Last year, P&I and DCIIA honored four individuals and one team for projects that sought to provide a guaranteed income solution, to offer a retirement-plan lifeline to smallbusiness employees and to pay a corporate match if employees paid off student debt or increased contributions to their 401(k) accounts.

Other winners implemented retirement plan design changes that made fees more transparent and equitable and gave employees or retirees a chance to select an investment usually available only to dened bene t plan participants.

The winners of the 2023 program can be found at www.pionline.com/ excellence-innovation-awards

P&I and DCIIA will review projects that were implemented on or after Jan. 1, 2023. Winners will be recognized at P&I’s West Coast Dened Contribution Conference, which will be held from Oct. 20 to Oct. 22 in Pasadena, Calif.

Entries for this year’s awards are due May 17. Participation in the program is free.

More information and the nomination form are available at pionline. com/excellenceinnovation2024

For questions or further help, please contact Julie Tatge, executive editor of P&I, at jtatge@pionline.com

Self-nominations are encouraged. The program will also accept nominations from colleagues and people outside the organization who are familiar with the work done by a dened contribution plan sponsor.

Only DC plan sponsors and their teams are eligible to win an award.

For plan sponsors looking to showcase communications excellence in de ned contribution campaigns, the 2025 Eddy Awards will open for nominations in September.

4 | April 15, 2024 Pensions & Investments

Money Management GMO says: ‘There are a lot of cheap stocks out there’ Quant rm’s Ben Inker is ‘excited’ by the range of well-paying assets SEE CHEAP ON PAGE 20 DOUGLAS APPELL

*Only asset owners and a limited number of consultants are invited to attend. All registration requests are subject to verification. P&I reserves the right to refuse any registrations not meeting our qualifications. The agenda for Canadian Pension Risk Strategies is not created, written or produced by the editors of Pensions & Investments and does not represent the views or opinions of the publication or its parent company, Crain Communications Inc. THANK YOU TO OUR SPONSORS SPONSORSHIP OPPORTUNITIES ARE AVAILABLE. Contact Kimba Jackson at kjackson@pionline.com | 978.317.5032 or Andy Jenkins at andy.jenkins@pionline.com | 703.725.6161 for more details and availability. REGISTRATION QUESTIONS? Please contact Kathleen Stevens at kstevens@pionline.com | 843.666.9849 REGISTER AT PIONLINE.COM/CRISK2024 May 14th | Toronto WHY YOU SHOULD JOIN US! 220B AUM Be present alongside participants overseeing $220B in assets under management. 20+ INDUSTRY EXPERT SPEAKERS 9 ENGAGING SESSIONS Rub shoulders with Canada’s leading corporate and public pension plans. Nominations now being accepted for 2024 Excellence & Innovation Awards Awards INDECISION TIME: Ben Inker says the big challenge is deciding what to sell. Pensions & Investments and the De ned Contribution Institutional Investment Association have opened nominations for this year’s Excellence & Innovation Awards program.

program seeks to recognize

Now in its 13th year, the

de ned contribution plan executives and their internal teams for well-executed, creative and groundbreaking projects that help participants prepare for retirement.

Megatrend investing? Talk to the pioneers. Sustainability Technology Health assetmanagement.pictet Marketing material All forms of investment involve risk. The value of investments and the income derived from them is not guaranteed and it can fall as well as rise and you may not get back the original amount invested. This material is for distribution to professional investors only and issued by Pictet Asset Management Inc., (Pictet AM Inc) which is registered as an SEC Investment Adviser.

Funds Summer intern applicants are learning a lesson on long odds

conference in recent months. It’s all part of an effort to recruit the next generation of employees amid the erce ght for talent — and this year's summer intern class is shaping up to be the most competitive ever.

Hedge fund rm co-founder and CIO Dmitry Balyasny visited three college campuses and gave a keynote address at the London School of Economics alternative investment

Navigating the Evolving Regulatory Landscape for Retirement Income Solutions and Beyond

An insightful discussion and update on current and upcoming regulatory changes impacting retirement income solutions. This session will bring you up to speed on the latest developments, including:

• Observations on the Department of Labor’s current challenges and priorities

• The continuing saga of the fiduciary rule

• In-plan annuities and other lifetime income products

Internships at top multistrategy hedge funds, including Balyasny Asset Management, Point72 Asset Management, Citadel and Millennium are among the hardest jobs to land on Wall Street with some accep-

• Developments in ERISA litigation (and non-ERISA litigation a ecting the regulatory landscape)

• Other Department of Labor regulatory updates

tance rates below 1%, sources said. The roles can come with ve- gure monthly pay and perks like trips and attending Mets baseball games.

“It’s incredibly competitive,” said Gary Goldstein, who started recruiting in 1979 and is the founder and CEO of Whitney Partners, an executive search rm. “There has been a shift away from going to the investment banks where that was a very hot segment of the market for a long time.”

There is a huge uptick in interest to snag these sought-after jobs on the buy side, Goldstein said. “There’s a real appetite for going into hedge funds.”

With summer only a few months away, Pensions & Investments spoke with Balyasny and Point72 about their programs. Millennium and Citadel provided information about their programs.

Balyasny: 40,000 applications

Balyasny will host approximately 100 interns this summer with many coming from quant-focused backgrounds. The rm received over 40,000 applications and accepted under 0.5%.

It was the highest application year on record and a 15% increase yearover-year, said Hannah Dinardo, head of campus recruiting at Balyasny. Balyasny himself visited Princeton University, the Massachusetts Institute of Technology and New York University. The majority of interns are rising seniors along with masters and Ph.D students.

“We are in search of top talent anywhere we can nd it,” Dinardo said.

THE 2024 DOL UPDATE

That means going through thousands of applications, without using AI, to nd candidates with a passion for the industry who have more than good GPAs, she adds. They are seeing applicants building trading bots and algorithmic strategies and pursuing certi cates and research.

“Times have changed, and it is very competitive for them,” she said. “We are really looking for the people who want to break into this industry.”

Most interns will start June 10 and work with the rm for 10 to 12 weeks. Pay ranges vary up to $25,000 a month and up to a $25,000 sign-on bonus for some groups of interns.

Interns focused on macro, commodities, technology and data management will go through customized week-long training groups with case studies and trading simulations and dive into areas ranging from options trading to swaps with the goal of bridging the gap between what is taught in school and market application, Dinardo said.

Every Thursday, interns will hear from people across the rm’s business. “It’s a way for them to better understand the hedge fund industry,” she said.

Balyasny expects around half of its interns to accept full-time roles.

“Our goal is to convert as many of the top-performing interns to full-time as we can,” Dinardo said. “It’s very intentional and strategic.”

The $21 billion in assets rm will start accepting applications in Au-

6 | April 15, 2024 Pensions & Investments

gust

September

rolling

Competition is erce for coveted slots that offer big pay packages, perks SEE INTERNS ON PAGE 21 LYDIA TOMKIW By REGISTRATION QUESTIONS? Please contact Kathleen Stevens kstevens@pionline.com | 843.666.9849. *Only asset owners and a limited number of consultants are invited to attend. All registration requests are subject to verification. P&I reserves the right to refuse any registrations not meeting our qualifications. The agenda for the Retirement Income Conference is not created, written, or produced by the editors of Pensions & Investments and does

represent the views or opinions of the publication or its parent company, Crain Communications Inc. RETIREMENT INCOME

18,

June 20,

YORK

and

on a

baHedge

not

June

CHICAGO

NEW

ASSOCIATE SPONSOR: SUPPORTING SPONSOR: MARKETING PARTNER: SPECIAL THANKS TO OUR SPONSORS LEAD SPONSORS:

Julie Stapel Morgan Lewis Bockius LLP

RI24 House Ad 3 40'.indd 1 4/8/2024 9:44:55 AM Gremlin/Getty Images

Elizabeth Goldberg Morgan Lewis Bockius LLP

FIXED INCOME STRATEGY

A COMPELLING MOMENT

Institutional allocators in fixed income are always scanning the horizon for signals on macroeconomic shifts and the next central bank moves. Even in the midst of the very positive resurgence of fixed income, they need to carefully navigate this transition period for interest rates and inflation so they can remain on track to achieve their long-term objectives. It’s an opportune time to reach for quality with reasonable risk exposure across several segments of fixed income, and stretch out on the credit spectrum into high-yield, emerging markets, and other sectors.

Our panel of fixed-income experts cuts through the market complexities to share what’s top of mind for the di erent types of institutional clients today. You’ll also learn what’s current in fixed-income indexing and the use of actively-managed ETFs, new developments in systematic indexing, and opportunistic segments –including private credit.

Read

pionline.com/fixed-income-report2024

Sponsored by:

The content of this supplement and webinar is not created, written or produced by the editors of Pensions & Investments and does not represent the views or opinions of the publication or its parent company, Crain Communications Inc. For information on participating in P&I Custom Content projects, please contact Julie Parten at julie.parten@pionline.com.

all the articles and access exclusive sponsor content online: WEBINAR REGISTRATION: pionline.com/fixed-income-webinar24 FREE WEBINAR Wed, Apr 17 | 2:00 PM ET PANELISTS: Nicholas Godec Senior Director, Head of Fixed Income Tradables S&P Dow Jones Indices MODERATOR: Howard Moore Associate Editor, Custom Content Pensions & Investments Henry Hughes Portfolio Manager Fixed Income Pensions Solutions Goldman Sachs Asset Management James Palmieri Managing Director, Senior Portfolio Manager and Head of Structured Credit for the Fundamental Active Fixed Income Team State Street Global Advisors ADVERTISING SUPPLEMENT FIXED INCOME STRATEGY A COMPELLING MOMENT

BIG

BUCKS

HSA assets grew 18.6%, hitting new high in 2023

Health savings account assets achieved a record last year of $123.3 billion, up 18.6% from the previous record of $104 billion in 2022, according to an annual survey by Devenir Group, an HSA research rm and investment consultant.

The investment component of the HSA assets rose to $46.4 billion, up 37.3% from the $33.8 billion in 2022, thanks to a strong stock market, according to a March 26 report describing the survey results.

Investments — as opposed to deposits — accounted for 44.6% of total HSA assets in 2023, according to Devenir, which conducted a survey in January of the 100 largest providers of HSAs. Survey responses are self-reported by the providers.

The number of HSA accounts reached 37.4 million last year, up 5% from 2022. Devenir also reported that about 2.9 million HSAs have “at least a portion of their HSA dollars invested” compared to almost 2.6 million accounts in 2022.

ROBERT STEYER

Coffey takes stage to offer advice and re ect on career

Hedge fund manager Greg Coffey has some advice for younger traders: “trade smaller and let trends run longer.”

Coffey, founder and CIO of Kirkoswald Asset Management, spoke at the Sohn Investment Conference held in New York April 3 and re ected on how he has changed as a trader over the years. He said that advice is something he follows now that he wishes he had done earlier in his career and that these days, “we no longer take big swings.”

Coffey, who started his career in 1994 and previously worked at GLG Partners and was also co-CIO of Moore Europe Capital Management, shot to prominence as a macro trader and was nicknamed the “Wizard of Oz.” He rarely gives interviews.

Asked on stage at the Lincoln Center when he started believing in himself, the Australian investor answered, “I don't know that anyone ever believes in themselves. I think that that's the key to this business is understanding that the markets are there to teach you how bad you are at your job.”

His risk appetite now is “signi cantly differ-

THE NEXT GENERATION

ent” to when he was younger and focused on being a “money maker.” Now, Coffey said, “my focus is more on risk management.” The key to running a macro hedge fund, Coffey said, is not being stopped out — exiting a position with a loss — and ensuring your size is never big enough to get near a stop/loss area.

Coffey came out of retirement and launched Kirkoswald, a macro hedge fund, in 2018.

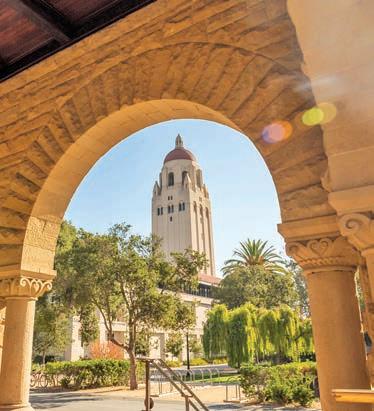

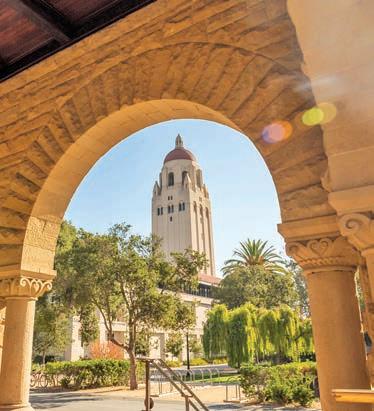

Stanford-CalPERS join forces to develop future investment pros

CELEBRATING A HALF-CENTURY ERISA 50th

Stanford University and CalPERS have teamed up to offer students a one-year program called the Long-Term Investing Fellowship designed to help them explore nance and investment careers at organizations such as public pension funds, university endowments, charitable foundations and sovereign funds.

Ashby H.B. Monk, executive and research director at the Stanford Research Initiative on Long-Term Investing, said he will direct the program, overseeing all aspects of selection and administration.

Noting it is a brand new fellowship, Monk said the

Anniversary Symposium seeking research paper submissions

The ERISA 50th Anniversary Symposium & Gala has issued a call for ERISA-related research papers, one of which will be presented at the Sept. 12 event in Washington celebrating the 50th anniversary of the signing of the Employee Retirement Security Act of 1974.

The invitation-only event at the National Building Museum in Washington is intended to celebrate the retirement security legislation signed by President Gerald Ford on Sept. 2, 1974. Hosting the event are 11 organizations including the American Council of Life Insurers, American Bene ts Council, American Retirement Association,

De ned Contribution Institutional Investment Association, Investment Company Institute, SPARK and the U.S. Chamber of Commerce.

The host committee is seeking ERISA-related research papers from individuals and organizations that “will further inform and enhance the dialogue around opportunities and challenges for employer-sponsored retirement and health plans,” according to an April 3 news release from the American Retirement Association.

One project will be presented at the symposium, others will be included in an ERISA 50th digital journal, and there will also be

opportunities for other research to be covered in webcasts leading up to the Sept. 12 event, the news release said.

The deadline for submitting a research topic is April 30, and the research must be completed by Aug. 15. The ERISA 50 Research Committee, which is chaired by Barb Marder, CEO of the Employee Bene t Research Institute, and consists of representatives from the host organizations, will review submissions.

Submissions should be made online at the Call for Papers website.

Questions should be directed to Marder at marder@ebri.org

Kirkoswald has approximately $8 billion in assets under management. Coffey has been in talks to acquire Emso Asset Management to create a $13 billion rm.

Amid audience laughter, Coffey said he was once asked what he would tell his younger self and he answered, “I don’t want to be anywhere near my younger self.”

— LYDIA

purpose of the program is twofold. “First, it will provide CalPERS and public pensions generally with a new and unique pipeline of highly talented candidates for employment,” he said. “Second, it will help to raise awareness among graduating students and recent graduates about this extraordinary world of long-term investing and offer them a new pathway to work for these organizations.”

A spokesperson for the $494.6 billion California Public Employees' Retirement System, Sacramento, said the ultimate goal of the program — a fully paid work experience — is to develop the next generation of institutional investors. Stanford will select and hire candidates in the spring of each year, the CalPERS spokesperson said. “Students will design a project, engage in an intensive apprenticeship at CalPERS, and return to Stanford to present

their ndings to the next group of incoming fellows,” he added.

The program is open to all graduating university students and recent graduates from around the world, not just Stanford students, Monk said.

Stanford and CalPERS, Monk added, have partnered on this project because both organizations “see it as part of their mission to develop this talent pipeline.”

This program will mark the rst partnership between these two organizations. Monk said the success of the program will be measured by how much it grows, “such as the four fellows this year growing to eight next year and 16 the year after that, with other pensions joining CalPERS leadership in this domain.”

By 2034, Monk said, he would love to place 100 of the world's best graduates at pension funds for a year-long fellowship.

— PALASH GHOSH

8 | April 15, 2024 Pensions & Investments

REPORTERS NOTEBOOK GETTING CANDID

TOMKIW

DIFFERENT FOCUS: Kirkoswald’s Greg Coffey, right, chats at the 2024 Sohn Investment Conference in New York.

Sean T. Smith

KOZLOWSKI

ROB

SEA CHANGE: President Gerald Ford prepares to sign the Employee Retirement Income Security Act of 1974.

Historical/Alamy

Everett Collection

Sandor F. Szabo

David Madison/Getty Images

SAVE THE DATE

Discover and celebrate the trailblazing women shaping the future of institutional investing!

Registration will open June 2024!

Learn more at pionline.com/IWII2024

Rob Kozlowski General assignment

Christopher Marchant International

CHRISTOPHER.MARCHANT@PIONLINE.COM

Kathie O’Donnell ETFs KATHIE.ODONNELL@PIONLINE.COM

Robert Steyer De ned contribution

Lydia Tomkiw Hedge funds LYDIA.TOMKIW@PIONLINE.COM

ART

Gregg A. Runburg Art director

DATA/RESEARCH

Aaron M. Cunningham Director of research and analytics

Larry Rothman Data editor LARRY.ROTHMAN@PIONLINE.COM

Anthony Scuderi Directory manager n n n

Julie Parten Senior VP-commercial operations

JULIE.PARTEN@PIONLINE.COM

Mike Palazuk VP-product MICHAEL.PALAZUK@ PIONLINE.COM SALES

Lauren DeRiggi Digital specialist/account manager LAUREN.DERIGGI@PIONLINE.COM

Judy Kelly New York JUDY.KELLY@PIONLINE.COM

Annika Mueller Midwest ANNIKA.MUELLER@PIONLINE.COM

Kimberly Jackson Director of conference sales

Andy Jenkins Account manager, conferences

ANDY.JENKINS@PIONLINE.COM

Steve Middleton EMEA SMIDDLETON@PIONLINE.COM

Thomas Markley Account executive

THOMAS.MARKLEY@PIONLINE.COM

Stacey George Manager of sales operations

STACEY.GEORGE@PIONLINE.COM

CUSTOM CONTENT/CONFERENCES/

MARKETING/CLIENT SERVICE

Gauri Goyal Senior director, content and programming

Diane Pastore Director of conference programming

Tammy Scholtes Director of conference programming

Joshua Scott Director of conference programming

JOSHUA.SCOTT@PIONLINE.COM

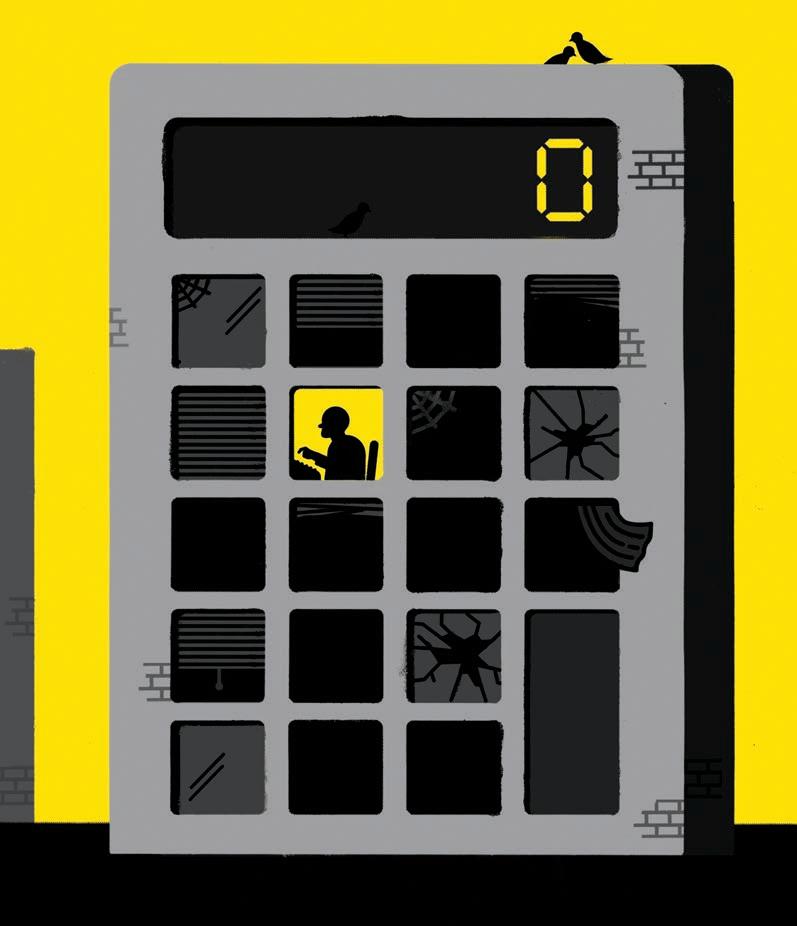

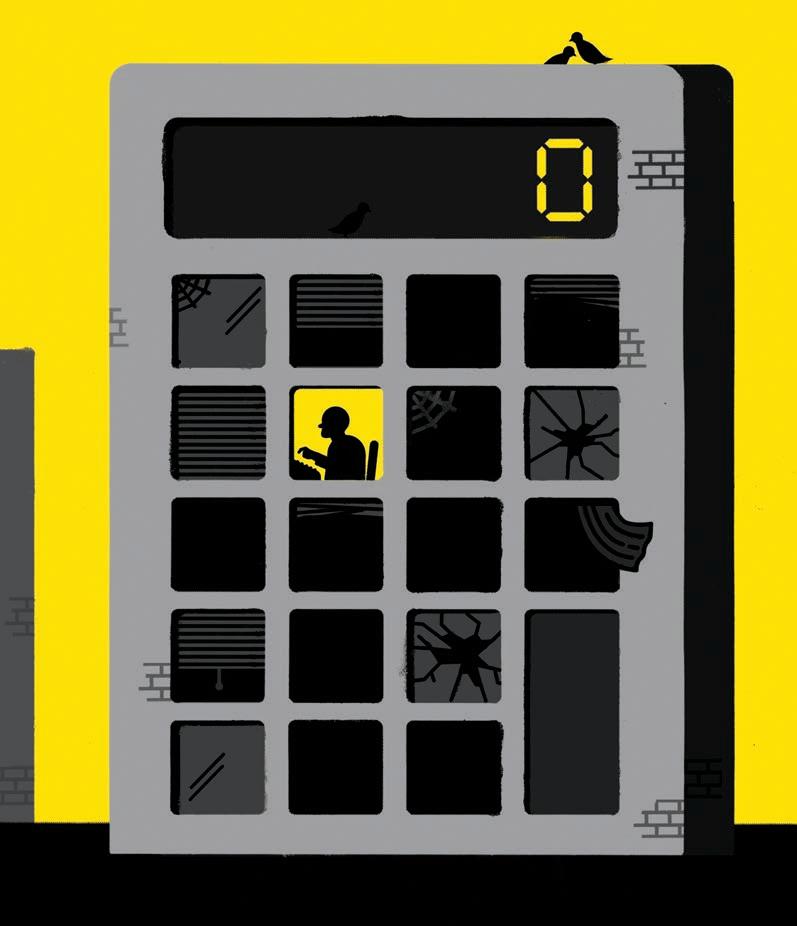

Howard Moore Associate editor,

With public exits more than 70% lower than the record highs of 2021, it’s understandable why everyone from venture capitalists to limited partner investors to entrepreneurs on the brink of generational wealth is turning to a crystal ball. But even before interest rates and valuations started going in a more rational direction after the funding glut of the recent past, the public exit was no longer the promised land it once was.

In fact, the public market is markedly failing to meet the needs of today’s high-growth businesses, creating a growing vacuum that private markets writ large are lling. While so many are focused on the IPO window being closed, we’re missing the more important point that the window is broken! And with the public markets no longer hospitable to their arrival, should small- and midcap companies be aiming for the public exit at all?

Today the positive storylines outside of the Magni cent Seven are few and far between, and M&A is an increasingly dif cult regulatory journey. Simply being a public company today is onerous, putting unnecessary strain on small- and midcap companies, in particular. For example, companies must contend with the high cost of compliance, extensive required governance including multiple independent board members, exorbitant directors and of cers liability insurance (or D&O insurance) and costly quarterly reporting and lings. A 2022 Cato Institute research brief found that regulatory costs represent more than 4% of a rm’s equity value on average and can exceed 10% of earnings for small-cap companies.

Sarbanes-Oxley, Regulation Fair Disclosure (FD) and labyrinthine rules around IPOs and being public also diminish the attractiveness of this path to liquidity.

Add to that the challenge of employee compensation schemes that have a short-term orientation and are devised by costly consultants, all of which impair public companies from focusing their executives and employees on long-term value creation. The result? The number of publicly listed companies traded on U.S. stock exchanges has dropped dramatically — more than 50% — since its peak in 1996 with 8,000; in 2023 there were only 3,700, according to the Center for Research in Security Prices. When taken in the context of the sharp rise in business creation during the last two decades of low interest rates, it is clear this market is not working as it should be, leaving retail investors and smaller institutions that don’t partake in the private markets out in the cold.

Today there stands $1.6 trillion of unrealized value from 2015 to 2019 vintage year startup investment, and this large and growing pool of companies are seeking a private capital partner to support them in the next phase of their growth journeys given the unattractiveness of the public alternative. With only 3% of venture-backed companies pro table at the end of 2023, many companies will need to raise capital in the next 12 months or will go out of business.

Despite a persistent bad rap fueled by an antiquated pop cultural portrayal of robber barons and liquidators, private markets have been critical to helping companies shoulder

Does this mean the end of the public company? No. Private equity depends on the public markets and vice versa — but we’re facing a historic imbalance that stands to negatively impact the American economy.

more risk and drive innovation — and provide much needed capital in a challenging environment. Despite declines across the board in deal volume, private equity in North America still showed up in 2023 and invested $693.5 billion. Globally, $3.9 trillion in dry powder stands ready to transact across all global private capital strategies, according to data from PwC and Preqin.

The same way that Dodd-Frank gave rise to a massive private credit market, the deterioration in the public market option has opened the door for private equity to step in and ll the void. As a result, private equity has also had to mature and evolve its craft, with each stage from venture capital to growth equity to buyout expanding its investment horizons, getting sharper about differentiation and introducing a panoply of value-add services to portfolio companies over the past decade that greatly enhance the outcomes for companies of all sizes and stages.

Today, private governance is winning out because small, agile boards with active investors tied closely with management are fundamentally more effective for higher-growth businesses. Long-term incentives for management and investors are far superior to options and restricted stock units (or RSUs) in a public context, which can be much shorter sighted, favoring near-term wins over sustainable growth that makes our economy stronger and more productive.

Does this mean the end of the public company? No. Private equity depends on the public markets and vice versa — but we’re facing a historic imbalance that stands to negatively impact the American economy.

The American capital markets are a vital competitive advantage for our economy and the envy of the world. We need the entire spectrum prospering to generate liquidity and spur commerce — that means a vibrant public market with lots of IPOs every year. And a growing private market at every stage of private equity, from venture capital to growth equity to buyout, working to realize the full value of the innovations it has driven.

To achieve this will require active collaboration among politicians, regulators, Wall Street bankers and investors. We need to take a hard look in the mirror to acknowledge these challenges and then work together to make measured, growth-positive decisions that encourage innovation and unlock better access to capital to foster a healthy economy that works from Main Street to Wall Street. No crystal balls required.

This content represents the views of the author. It was submitted and edited under Pensions & Investments guidelines but is not a product of P&I’s editorial team. 10 | April 15, 2024 Pensions & Investments OPINION TO CONTACT A P&I STAFFER Unless otherwise noted above, email us at firstinitiallastname@pionline.com or find phone numbers at pionline.com/staff KC Crain CEO Nikki Pirrello President & publisher n n n Jennifer Ablan Editor-in-chief/chief content of cer JENNIFER.ABLAN@PIONLINE.COM Julie Tatge Executive editor Kevin Olsen Managing editor Erin Arvedlund Enterprise editor ERIN.ARVEDLUND@PIONLINE.COM Gennady Kolker Audience development editor GENNADY.KOLKER@PIONLINE.COM John Fuller News editor JOHN.FULLER@PIONLINE.COM Sophie Baker International news editor Meaghan Offerman Associate editor MEAGHAN.OFFERMAN@PIONLINE.COM Colette Jordan Chief copy editor Ann Acum Editorial operations associate ANN.ACUM@PIONLINE.COM Caryl Anne Francia Editorial intern CARYL.FRANCIA@PIONLINE.COM Abigail Parrott Editorial intern ABIGAIL.PARROTT@PIONLINE.COM REPORTERS Douglas Appell Money management Hazel Bradford International

n

Margarida Correia De ned contribution Brian Croce Washington Courtney Degen Washington COURTNEY.DEGEN@PIONLINE.COM Palash Ghosh General assignment PALASH.GHOSH@PIONLINE.COM Arleen Jacobius Private equity/real estate Natalie Koh International NATALIE.KOH@PIONLINE.COM

content solutions HOWARD.MOORE@PIONLINE.COM

Lewis Associate project

conference

events manager

WorldPensionSummit

Assel Chanlatte Conference marketing manager Andy Jang Conference & events coordinator Alison Rivas Marketing & events specialist Kathleen Stevens Investor relations director Erin Northrop Associate marketing manager ERIN.NORTHROP@PIONLINE.COM Todd Van Luling Digital project specialist TODD.VANLULING@PIONLINE.COM Tetyana Saucedo Digital campaign manager Nicole Callaghan Digital campaign specialist NICOLE.CALLAGHAN@PIONLINE.COM SUBSCRIPTIONS/SITE LICENSES Ed Gorman Director, EMEA/international site licensing +44-(0)20-3823-9891 Erin Smith Sales manager, site licenses Jack Follansbee Account executive, site licenses JOHN.FOLLANSBEE@PIONLINE.COM REPRINTS Laura Picariello Sales manager 732-723-0569 LPICARIELLO@CRAIN.COM ADVERTISING PRODUCTION Sam Abdalla Media services manager (313) 446-0400 SABDALLAH@CRAIN.COM Subscription information - single copy sales: 877-812-1586

OTHER VIEWS BRAD BERNSTEIN

Corina

director Sarah Tumolo Senior

and

SARAH.TUMOLO@PIONLINE.COM Mirjam Guldemond Conference manager,

+31-6-2333-2464

The IPO window isn’t closed. It’s broken.

Brad Bernstein is a managing partner at FTV Capital. He is based in New York.

Yarek Waszul/The iSpot

Beyond compliance — where stewardship and regulation collide

Last month, the U.S. Securities and Exchange Commission issued its highly anticipated climate-related disclosure rules for U.S.-listed companies. With 4,500 unique letters and 18,000 form letters submitted during a yearlong consultation period, the proposed rules were intensely scrutinized. While the outcomes from the consultation are often portrayed in binary terms of whether they “strengthened” or “weakened” the initial requirements, this dichotomy is the wrong frame of analysis. A better approach would be to consider whether the requirements promote the introspection and dialogue that an issue like climate change demands.

performance. Given this, it’s surprising that in 886 pages, the word “science” is only mentioned 21 times, almost all in deliberating whether to require disclosure of targets certi ed by the Science Based Targets initiative (or SBTI). By contrast, “burden” is used 306 times — as in the burden of prospective reporting requirements.

with glee.

By giving companies options regarding what they can choose not to disclose with a vague materiality caveat, the SEC also gives companies various knots to tie themselves in. How does a company determine if something is material without rst assessing it?

It is timely then that the following day, the EU’s Copernicus Climate Change Service announced that February 2024 was the hottest on record, the ninth consecutive month to break the record for its time of year. Thus, the 12 months through February were also the hottest on record, more than 1.5 degrees Celsius above preindustrial levels. While it would take a decade of average temperature anomalies above 1.5°C to technically breach the goal set in the Paris Agreement, severe impacts caused by past carbon pollution are already being felt globally. Scientists also warn that the climate system is approaching tipping points that would result in irreversible and signi cant changes with far-reaching impacts on communities, companies, economies and other species.

The nal SEC rules (which have been temporarily halted while a federal court considers multiple legal challenges on a consolidated basis) aim to ensure investors have consistent, comparable and reliable disclosures and acknowledge that climate change can impact a company's operations and its current and future nancial

In Memoriam

Rightly, in the case of SBTI, the SEC argues companies should have the exibility to choose a framework and should not be required to disclose if they have set an SBTI target speci cally. Unfortunately, the SEC then missed the opportunity to ensure companies explain the scienti c (or any other) basis of targets and only requires disclosure of targets that “materially affected or is reasonably likely to materially affect the registrant’s business, results of operations, or nancial condition.” Given the signi cance of the economic and social transformations required to meet emission reduction goals, one might wonder whether a target that wasn’t worthy of disclosure would meet the need for rapid reductions.

In an effort to balance concerns around the originally prescriptive requirements, the rules have become confusingly circular. Companies must now disclose material risks to their strategy, business model, and outlook but not their supply chain or products. However, if the risks from suppliers or products could materially affect the business, they should disclose those risks. Yet, companies don’t need to disclose the emissions arising from them (scope 3) or what they plan to do about them. However, if they decide to do something about those risks and it materially affects the business, they should disclose their plans. While we might pity company executives navigating these directives, their lawyers and consultants will rub their hands

If a company nds climate change risks are not material, surely the reasons are of legitimate interest to their shareholders, given materiality relates to what shareholders need to make investment and voting decisions. While disclosures produced by following the rules may be “consistent, comparable, and reliable,” the deeper question is whether they are decision-useful for investors.

Bottom-up analysis necessitates understanding a company’s business model and the quality of its management team, franchise and nancials. Sustainability goes beyond operational environmental, social and governance factors. It sits at the heart of a company’s culture and the impact its products and services have on people and the planet across its entire value chain. What a company tells its investors (or not) is one indicator of quality and a legitimate area for shareholder engagement.

When climate-related disclosure requirements are distinct from climate science, they create a disconnect between a company’s compliance obligations and its place in the world. This is because supply chains, customers, employees and communities are essential in the decarbonization effort, and will also experience the negative effects of a changing climate. As stewards of clients’ capital, the role of investment managers is to understand and engage with company leaders on these issues. When disclosure obligations con ict with stewardship efforts, the risk is that companies may put up walls to prevent potential legal action, relying on the letter of the law as a shield from scrutiny.

Today, more than half the capital in U.S. stock markets is held in passive funds, and time horizons have collapsed, as evidenced by shorter average holding periods.

Ryan Selwood, Bregal Investments CIO, dies at 51

Ryan Selwood, chief investment of cer of Bregal Investments, has died at 51, according to a statement from the rm.“At the time of his passing, Ryan was in Portugal with Alain Carrier, CEO of Bregal Investments, and Delaney Brown, head of capital solutions for Bregal Investments,” according to an April 5 statement from the Bregal Investments management team. “Both are grieving the loss of their longtime friend

Ryan Selwood

and colleague.Bregal added in the statement that “Ryan was not only a respected leader at Bregal, but a prominent and longstanding member of the nancial services industry.” A spokesperson for Bregal con rmed that Selwood left behind a wife and two children.Further details of his passing or his potential successor were not available.

Since joining Bregal in March 2023, the statement added, “Ryan left an indelible mark on our organization

By giving companies options regarding what they can choose not to disclose with a vague materiality caveat, the SEC also gives companies various knots to tie themselves in .

Long-term, bottom-up, active investors who take the time to understand the nuances of companies and their business models are best placed to assess if a company can navigate and thrive in a net-zero carbon economy and whether it is resilient to increasingly severe climate impacts. A principles-based approach, which the SEC rejected, could have been designed to encourage companies to consider various issues and articulate what it means for their businesses, fostering more engagement with their stakeholders. While a prescriptive approach doesn’t preclude this, it can lead to a box-ticking mindset by companies.

It is unrealistic to believe that

disclosure requirements, no matter how prescriptive, will trigger the type of action required by companies that have so far neglected to act. After all, the SEC’s rst guidance on climate disclosure was issued in 2010 with limited effect. In the U.S., a range of investors have sought to engage with companies on these issues and, when unsuccessful, have turned to tools like shareholder resolutions to drive change. Yet, with some notable exceptions, most of the market has not supported these efforts. More recently, support has also declined among some large passive investors.

The SEC rules may fall short of promoting the introspection and dialogue needed by companies, but rather than criticize the rules on technical grounds, we must step back and recognize that disclosure is not a panacea for managing rapidly accelerating climate risks. Moreover, the failure is not a lack of disclosure regulation, but a lack of investor stewardship. The best lever asset managers have for supporting the transition to a net-zero carbon economy while protecting and growing client assets is to invest in and engage with high-quality companies that are driving climate solutions. n

and the individuals he worked with.”As reported, Selwood was Bregal's rst CIO, which was a newly created position when he joined the rm.

According to his biography on the Bregal website, prior to joining the rm, Selwood was a partner and chief development of cer at Carlyle. Prior to Carlyle, he spent more than 15 years at CPP Investments.The international private equity rm has more than €18 billion ($19.4 billion) of assets under management, according to the rm’s website. n

Pensions & Investments April 15, 2024 | 11

This content represents the views of the author. It was submitted and edited under Pensions & Investments guidelines but is not a product of P&I’s editorial team.

OTHER VIEWS PABLO BERRUTTI OPINION P&I HTML Reprints Share Pensions & Investments’ content with your social community We're excited to o er the next level of article reprints! A stand-alone HTML digital article that will never be placed behind a subscription paywall. The P&I HTML reprint can be licensed to post to your website, share on social media, used in email correspondence, presentations and so much more. Select from news articles (print and digital), rankings, opinion pieces, editorials, awards and more. Contact Laura Picariello at lpicariello@crain.com or 732.723.0569 for pricing and details

Pablo Berrutti is a senior investment specialist at Stewart Investors. He is based in Sydney.

EXCHANGE-TRADED FUNDS

Investors taking new look at single-country exposures

By ARI I. WEINBERG

What’s old is new again. Single-country funds, among the earliest niche products introduced to the exchange-traded fund market, have reemerged as tactical tools to overweight or underweight speci c economies across the world.

Since the end of 2022, U.S.-listed ETFs investing in Japan and India have added $10 billion and $7 billion of net in ows, respectively, while other single-country funds have experienced net out ows of $4 billion, including $2 billion from China ETFs alone, according to State Street Global Advisors.

“The distinct allocations to Japan and India equity exposures are supported by economic, fundamental and price momentum,” said Matthew Bartolini, head of SPDR Americas research at SSGA. “The last few years, non-U.S. equity exposures have been a hindrance on returns, but we nd investors are reviewing those allocations as they become more skeptical of concentration risk in the U.S.,” Bartolini said.

In recent months, market returns

in both Japan and India have validated ETF ows. For the year ended March 31, the MSCI India index was up 36.8% and MSCI Japan up 25.2%, while economic news in both countries continues to support the momentum story.

Gross domestic product growth in India closed the year at 8.4%, compared with 7.6% in the prior quarter. In Japan, the Bank of Japan’s end to negative interest rates in March was seen as a critical step in its ongoing push for monetary normalization.

Since the end of 2022, the $17.1 billion iShares MSCI Japan ETF has added $3.9 billion of net in ows and the $1.9 billion Franklin FTSE Japan ETF added $694 million of net inows, according to FactSet Research Systems.

Renewed interest in Japanese ETFs has also sparked ows back into currency-hedged offerings. For example, the $4.6 billion WisdomTree Japan Hedged Equity ETF added $1 billion in net ows in the rst quarter, compared with $511 million for all of 2023, according to FactSet, and the $49 million Franklin FTSE Japan Hedged ETF added

$14 million in the quarter, compared with just over $400,000 for the prior year. These ows have been rewarded with performance that more than doubled unhedged Japan indexes since the beginning of the year, but the history lesson of hedged currency ETF volatility nearly a decade ago still looms large for ETF investors.

“Our unhedged Japan fund appeals to most international investors who have stronger long-term views on the country's fundamentals, more so than layering a tactical view on the yen and currency impacts,” said Dina Ting, senior vice president and head of global index portfolio management at Franklin Templeton.

On India, Ting said that clients are exploring exposures that “reach further into the midcap range,” through the $913 million Franklin FTSE India ETF. The fund counts among its largest holders Israeli insurance companies Menora Mivtachim Holdings and Migdal Insurance and Financial Holdings, according to SEC lings.

More notably, the Tennessee Department of Treasury is the largest holder of both the $9.6 billion iShares MSCI India ETF and the $873 million iShares India 50 ETFs within a portfolio that includes 21 separate country or regional funds.

China outflows

Counter to assets owing to Japan and India single-country ETFs, interest in exposure to Chinese equities through both single-country funds and emerging markets funds has been waning. Since the end of 2022, the $4.9 billion iShares MSCI China ETF saw $1.6 billion of net out ows. Over the same time period, the $13 billion iShares MSCI Emerging Markets ex-China ETF added $8.5 billion of net in ows.

But just like picking stocks, picking country exposures is challenging.

“There's little evidence that investors can time their buys and sells well enough to make (single-country ETFs) work for them,” said Elisabeth Kashner, vice president and director of global fund analytics at FactSet.

“In most cases, the ETF fees and spreads complicate the job further, as most country funds cost 0.50% or more per year, with the exception of Franklin's 0.09% expense-ratio country suite,” said Kashner, “and spreads can be unexpectedly wide.”

Still, quants and stock pickers aren’t letting market dynamics impact their ETF product strategy.

Non-U.S. equity exposures are coming to the fast-rising actively managed ETF market. Recent launches include ETFs from Rayliant Global Advisors, Pacer Advisors, Hartford Funds Management Co. and Avantis from American Century Investments.

“The market wants disaggregated exposures to developed market companies,” said Andrew Skatoff, founder and chief investment of cer of Bancreek Capital Advisors. The rm launched a large-cap international equity ETF in March to follow its December 2023 launch of a U.S. large-cap product. n

12 | April 15, 2024 Pensions & Investments

Connect with us. Like us pionline.com/facebook Follow us pionline.com/linkedin Follow us @pensionsnews

LONG-TERM VIEWS: Franklin Templeton’s

Dina Ting said investors who are optimistic about Japan’s fundamentals are interested in the rm’s unhedged ETF.

ETFs that focus on Japan, India are gaining in ows from investors wary of concentration risk in U.S.

BY THE NUMBERS

Pension risk transfer activity

Total completed transactions (billions)

Pensions & Investments April 15, 2024 | 13

$0 $10 $20 $30 $40 $50 $60 $70 $80 $90 2024 2023 2022 2021 2020 Lump-sum acceptance Longevity swap Buyout Lump-sum offer Buy-in Other Total transactions: 75 Total transactions: 59 Total transactions: 14 Total transactions: 79 Total transactions: 91 78% 81% 84% 87% 90% 93% 96% 99% 102% 105% 108% 111% 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 100.0% 100.5% 101.0% 101.5% 102.0% 102.5% 103.0% 103.5% 104.0% 104.5% 105.0% 105.5% NISA Pension Funded Status index (left axis) Milliman Pension Buyout index (right axis) March: 108.4% February : 103.6% 0 4 8 12 16 20 24 28 32 36 40 44 48 ’24 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 5,000 5,500 6,000 0 7 14 21 28 35 42 49 56 63 70 77 84 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 0 20 40 60 80 100 120 140 160 180 200 220 240 Cyclically adjusted price-earnings ratio (left axis) S&P 500 real price (right axis) Real dividends (left axis) Real earnings (right axis) Trailing 12-month returns by asset class S&P 500 trades at rich valuation – CAPE ratio Sources: P&I Research Center; NISA Investment Advisors; Milliman; Bloomberg LP; Robert Shiller 2022 2023 2024 April May June July August September October November December January February March April May June July August September October November December January February March Real Estate 0.7% Cash 0.1% Cash 0.2% Cash 0.2% Cash 0.4% Cash 0.6% Cash 0.8% Cash 1.1% Cash 1.5% Cash 1.9% Cash 2.2% Cash 2.6% MSCI ACWI ex-U.S. 3.0% Cash 3.3% S&P 500 19.6% MSCI ACWI ex-U.S. 13.4% S&P 500 15.9% S&P 500 21.6% MSCI ACWI ex-U.S. 12.1% S&P 500 13.8% S&P 500 26.3% S&P 500 20.8% S&P 500 30.5% S&P 500 29.9% S&P 500 0.2% S&P 500 -0.3% BB U.S. Agg -10.3% S&P 500 -4.6% High Yield -10.6% High Yield -14.1% High Yield -11.8% High Yield -9.0% High Yield -11.2% Russell 2000 -3.4% High Yield -5.5% High Yield -3.3% Cash 2.9% S&P 500 2.9% MSCI ACWI ex-U.S. 12.7% S&P 500 13.0% MSCI ACWI ex-U.S. 11.9% MSCI ACWI ex-U.S. 20.4% MSCI EM 10.8% MSCI ACWI ex-U.S. 9.3% Russell 2000 16.9% High Yield 9.3% MSCI ACWI ex-U.S. 12.5% Russell 2000 19.7% Cash 0.1% Real Estate -5.2% S&P 500 -10.6% High Yield -8.0% S&P 500 -11.2% BB U.S. Agg -14.6% S&P 500 -14.6% S&P 500 -9.2% BB U.S. Agg -13.0% High Yield -5.2% Russell 2000 -6.0% BB U.S. Agg -4.8% S&P 500 2.7% High Yield 0.0% Russell 2000 12.3% MSCI EM 8.3% High Yield 7.2% MSCI EM 11.7% S&P 500 10.1% High Yield 8.7% MSCI ACWI ex-U.S. 15.6% MSCI ACWI ex-U.S. 5.9% High Yield 11.0% MSCI ACWI ex-U.S. 13.3% High Yield -5.2% High Yield -5.3% High Yield -12.8% BB U.S. Agg -9.1% BB U.S. Agg -11.5% S&P 500 -15.5% BB U.S. Agg -15.7% MSCI ACWI ex-U.S. -11.9% MSCI ACWI ex-U.S. -16.0% MSCI ACWI ex-U.S. -5.7% MSCI ACWI ex-U.S. -7.2% MSCI ACWI ex-U.S. -5.1% High Yield 1.2% MSCI ACWI ex-U.S. -1.4% High Yield 9.1% Russell 2000 7.9% Russell 2000 4.7% High Yield 10.3% High Yield 6.2% Cash 5.1% High Yield 13.4% Cash 5.3% Russell 2000 10.0% High Yield 11.2% BB U.S. Agg -8.5% BB U.S. Agg -8.2% Real Estate -13.5% Real Estate -9.8% Real Estate -16.6% Real Estate -22.4% Russell 2000 -18.5% BB U.S. Agg -12.8% S&P 500 -18.1% S&P 500 -8.2% S&P 500 -7.7% S&P 500 -7.7% BB U.S. Agg -0.4% BB U.S. Agg -2.1% Cash 3.7% High Yield 4.4% Cash 4.4% Russell 2000 8.9% Cash 4.9% MSCI EM 4.2% MSCI EM 9.8% Russell 2000 2.4% MSCI EM 8.7% MSCI EM 8.2% MSCI ACWI ex-U.S. -10.3% MSCI ACWI ex-U.S. -12.4% Global exU.S. xed income -18.8% Russell 2000 -14.3% Russell 2000 -17.9% Russell 2000 -23.5% Global exU.S. xed income -24.6% Russell 2000 -13.0% Global exU.S. xed income -18.7% BB U.S. Agg -8.4% BB U.S. Agg -9.7% MSCI EM -10.7% Russell 2000 -3.6% Russell 2000 -4.7% MSCI EM 1.7% Cash 4.1% MSCI EM 1.3% Cash 4.6% Global exU.S. xed income 2.6% Global exU.S. xed income 2.5% Real Estate 9.8% BB U.S. Agg 2.1% Cash 5.3% Real Estate 7.6% Global exU.S. xed income -15.5% Global exU.S. xed income -16.7% MSCI ACWI ex-U.S. -19.4% MSCI ACWI ex-U.S. -15.3% MSCI ACWI ex-U.S. -19.5% Global exU.S. xed income -24.8% MSCI ACWI ex-U.S. -24.7% Real Estate -16.9% MSCI EM -20.1% MSCI EM -12.1% Real Estate -14.4% Global exU.S. xed income -10.7% Global exU.S. xed income -3.9% Global exU.S. xed income -6.5% BB U.S. Agg -0.9% Global exU.S. xed income -2.5% Global exU.S. xed income 0.6% Global exU.S. xed income 3.4% BB U.S. Agg 0.4% BB U.S. Agg 1.2% Global exU.S. xed income 5.7% Global exU.S. xed income -0.2% BB U.S. Agg 3.3% Cash 5.3% Russell 2000 -16.9% Russell 2000 -16.9% Russell 2000 -25.2% Global exU.S. xed income -18.5% MSCI EM -21.8% MSCI ACWI ex-U.S. -25.2% Real Estate -24.7% MSCI EM -17.4% Russell 2000 -20.4% Real Estate -12.6% MSCI EM -15.3% Russell 2000 -11.6% MSCI EM -6.5% MSCI EM -8.5% Global exU.S. xed income -1.8% BB U.S. Agg -3.4% BB U.S. Agg -1.2% Real Estate 2.8% Real Estate -4.1% Real Estate -2.0% BB U.S. Agg 5.5% MSCI EM -2.9% Global exU.S. xed income 2.7% BB U.S. Agg 1.7% MSCI EM -18.3% MSCI EM -19.8% MSCI EM -25.3% MSCI EM -20.1% Global exU.S. xed income -22.0% MSCI EM -28.1% MSCI EM -31.0% Global exU.S. xed income -19.8% Real Estate -23.6% Global exU.S. xed income -14.2% Global exU.S. xed income -16.7% Real Estate -20.3% Real Estate -14.3% Real Estate -14.8% Real Estate -3.9% Real Estate -6.5% Real Estate -4.2% BB U.S. Agg 0.6% Russell 2000 -8.6% Russell 2000 -2.6% Cash 5.2% Real Estate -3.1% Real Estate 1.0% Global exU.S. xed income -0.7%

recent transactions (millions) Type Sponsor Date Assets ■ Epson U.K. April 8 $76 ■ Energizer Holdings April 3 $56 ■ De Beers Diamond Consortium April 2 $1,100 ■ Unisys April 1 $200 ■ FirstEnergy March 15 $700 ■ Scottish Widows March 13 $7,700 ■ Verizon Communications March 6 $5,900 ■ Ford Motor Co. of Canada Feb. 22 $686 ■ Centrus Energy Feb. 9 $187 ■ Shell USA Feb. 7 $4,900 ■ Huntington Ingalls Industries Feb. 1 $411 ■ Ball Corp. Jan. 26 $1,800

Lockheed Martin Jan. 24 $414 For details on all recent pension risk transfers, go to pionline.com/ pension-risk-transfer.

Corporate funding & buyout indexes Most

■

CAPE ratio and S&P 500 prices Real dividends and earnings

THE ENERGY TRANSITION

Transition projects gaining speed and winning investors

IEA records more than $1.7 trillion in clean energy investments in 2023, outpacing spend on fossil fuels

B y HAZEL BRADFORD

Energy transition investing may go by different names or strategies, but one thing is clear: The money is there, and the investing is poised for impressive growth.

Of the roughly $2.8 trillion invested in all types of energy in 2023, more than $1.7 trillion went to clean energy, according to the International Energy Agency. “For every $1 spent on fossil fuels, $1.7 is now spent on clean energy. Five years ago, the ratio was 1:1,” said the IEA, which counts renewable power, nuclear, grids, storage, low-emission fuels, ef ciency improvements and end-use renewables and electri cation in that group.

For investors, the energy transition includes energy markets and their supply chains, climate-related decarbonization strategies in other sectors like transportation and manufacturing, and opportunities addressing infrastructure needs and technological innovation. Investors also see a role for arti cial intelligence to help identify demand and supply, process improvements and more, industry sources said.

“We see a lot of opportunity with the energy transition,” said Chris Ireland, senior managing director, green eld investments and renewables, for Ontario Teachers’ Pension Plan, Toronto, with C$247.5 billion ($186.7 billion) as of Dec. 31.

“Most countries are either transforming their own energy systems or looking at building new businesses to help elsewhere. A huge amount of capital is needed for all of this,” he said.

Most investors are focusing on the energy transition in some way. Nuveen’s annual EQuilibrium Global Institutional Investor Survey released March 21 found that of the more than 800 global institutional investors overseeing $18 trillion in assets, a scant 7% did not plan to address it and a few contrarians were sticking with fossil fuels. Survey respondents included decision-makers at corporate as well as public pension funds, insurance companies, and endowments and foundations, as well as sovereign wealth funds and central banks.

On the ip side, 55% think they can “signicantly in uence” the energy transition’s rate of progress. More than half, 57%, already have or are seeking exposure to alternative energy, including renewables, nuclear and hydrogen power, and 51% want to allocate to new infrastructure projects, including new energy storage projects, grids and battery storage.

The rate of progress was mixed, with 9% considered rst movers, 23% just getting started and 19% meeting regulatory requirements, the Nuveen survey found.

There were also big regional differences, with corporate pension funds in the Asia-Paci c region showing more interest in nature-based solutions while pension funds in Germany favored carbon credit markets, and North American public pensions leaned to-

ward legacy infrastructure upgrades, Nuveen found.

Powering up