The Eddy Awards

The Eddy Awards

Winning entries showcased creativity in effort to inform and persuade employees

By MA R GA RI DA CO RR E I A and CA R YL ANNE F R ANC I A401(k) serial loan takers. Pre-retirees unaware of the risk of being overly concentrated in equities. Young workers overwhelmed by student loan debt.

These are some of the groups that employers attempted to reach through work-

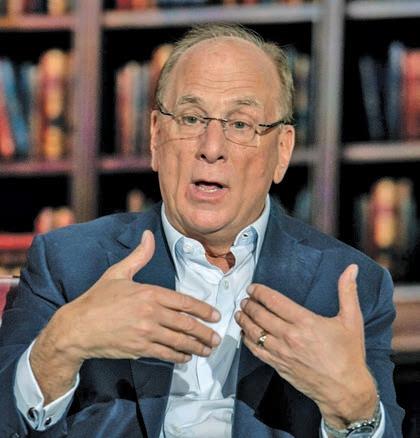

By DOUGLAS APPELLBlackRock Chairman and CEO Larry Fink’s latest annual letter to CEOs and clients called for the nancial equivalent of a moonshot to avert a looming U.S. retirement crisis.

“Maybe once a decade, the U.S. faces a problem so big and urgent that government and corporate leaders stop business as usual. They step out of their silos and sit

place retirement-plan educational campaigns that won Eddy Awards from Pensions & Investments this year.

At a ceremony held March 12 in Orlando, Fla., as part of its annual Dened Contribution East conference, P&I recognized 44 campaigns from employers in the private, public and nonpro t sectors and their service providers for their verve, creativity and singleminded focus on helping workers achieve

around the same table and nd a solution,” said Fink in his annual letter, released March 26.

“We need to do something similar for the retirement crisis,” Fink said. “America needs an organized, high-level effort to ensure that future generations can live out their nal years with dignity,” he added. Fink, whose views on industry trends carry added weight against the backdrop of

a digni ed retirement. Awards were given in ve categories: conversions/403(b) consolidations; nancial wellness; ongoing investment education, pre-retirement preparation and special projects.

This year’s top winners looked to address a wide swath of issues, ranging from debt reduction to the importance of naming 401(k) bene ciaries and the ben-

In the autumn of 2022, John L. Bowman, president of the Chartered Alternative Investment Analyst Association, met in a coffee shop in Singapore with Swee Chiang Chiam, managing director and head of total portfolio policy and allocation at Singapore sovereign wealth fund GIC, to discuss total portfolio approach, an alternative to traditional forms of strategic asset allocation, or SAA.

Over coffee, Bowman and Chiam discussed how a number of large institutional asset owners in New Zealand, Canada, Australia and Singapore — including GIC — had embraced total portfolio approach, or TPA, which “improves upon many of the long-entrenched practices of SAA when constructing their portfolios.”

That meeting would eventually lead to CAIA creating its seminal report “Innovation Unleashed: The Rise of Total Portfolio Approach” on March 19.

Essentially, Bowman noted, TPA eschews the traditional concepts of asset allocation and passive benchmarks in favor of picking the best investment ideas for the portfolio designed to meet a total return goal consistent with the fund’s actual purpose. TPA may be described as “one uni ed means of assessing

I EWED by JENN I FE R ABLAN

CalPERS CEO Marcie Frost, hailed as one of the most inuential women in institutional investing, talked to Pensions & Investments about America’s largest public pension system’s ongoing CIO search and its recent asset allocation increase to private equity and private credit — the darlings of the nancial market. The Sacramento-based pension fund has been searching for a new CIO to replace Nicole Musicco, who stepped down at the end of September. An announcement is expected any day now.

Alternatives

Quantitative managers are looking into arti cial intelligence and large language models, but so far many are skeptical.

Page 4

Special Report: Private Markets

Real estate debt may provide respectable returns, but the asset class also has signi cant drawbacks. Page 16

Private equity’s drops in valuations and distributions might start to impact pacing models for investors. Page 16

Lawmakers are concerned about private equity’s effects on the healthcare industry, and possible national security issues.

Page 17

Recent real estate investment darlings multifamily and warehouses could be in for a tough time. Page 19

According to Bain global private equity deal value plunged by 37% in 2023, while exit value dropped by 44%. There’s reason for optimism in 2024, however. Page 19

Washington

Auto IRA programs would help, say industry groups and experts, but the path to passing such legislation is unclear. Page 6

P&I still accepting late money manager surveys

Pensions & Investments is accepting late responses to the annual money managers survey. Firms managing U.S. institutional, tax-exempt assets are eligible to participate. Results will run June 10.

To request a survey or obtain further information, please contact Anthony Scuderi at ascuderi@pionline.com or 212-210-0140, or visit www.pionline. com/section/surveys

In the 18 months since IFM Investors was able to lure the high-pro le Luba Nikulina away from her 17-year career at Willis Towers Watson, it’s fair to say she’s built something of a super team.

Nikulina was brought in as the rst chief strategy of cer for the Australian superannuation fundowned infrastructure specialist in September 2022, tasked with developing the manager’s global strategy.

As chief strategy of cer, the idea “was to work on the evolution of IFM’s strategy — the organization that has 30 years of history, very strong credentials in infrastructure investing in particular, and quite a signi cant size of AUM with $150 billion,” Nikulina said in an exclusive interview. “But at the same time, it’s almost like the world’s best hidden secret in that it’s not actually that well-known outside Australia. My mission and objective at the time of joining was ... transforming the organization from an Australian asset manager with global ambitions to a global investment rm with a proud Australian heritage. This is what I’m essentially doing at the moment — quite a few of the new joiners are based in the Northern Hemisphere, and we are leveraging all the capabilities in Australia,” she said.

David Neal, CEO at IFM, said in an email that Nikulina hit the ground running for the fast-growing rm. “Stepping into the newly created role of chief strategy ofcer, Luba has been given a clear mandate to design and execute

ply with the Texas Government Code Section 809, known popularly as the anti-ESG law.

Texas Comptroller Glenn Hegar in August 2022 included BlackRock on a list of 10 nancial companies he determined “boycott energy companies” as a result of that law.

By ROB KOZLOWSKITexas Permanent School Fund, Austin, terminated BlackRock from approximately $8.5 billion in assets as part of the state's push to punish ESG investing.

The $52.3 billion endowment informed BlackRock of the terminations in two March 19 letters from CEO/CIO Robert Borden, emailed by a spokeswoman.

The terminations affect a BlackRock international equity portfolio and an emerging markets equity separate account called the Navarro 1.

In a post on X (formerly Twitter), Aaron Kinsey, chairman of the state’s board of education who is also a member of the Permanent School Fund board of directors, said the relationship was terminated in order to com-

In a March 19 statement, BlackRock said: “Today’s unilateral and arbitrary decision by Board of Education Chair Aaron Kinsey jeopardizes Texas schools and the families who have bene ted from BlackRock’s consistent long-term outperformance for the Texas Permanent School Fund. The decision ignores our $120 billion investment in Texas public energy companies and de es expert advice. As a duciary, politics should never outweigh performance, especially for taxpayers.”

The termination of BlackRock from the

active emerging markets equity portfolio came just over a month after its board eliminated the emerging markets equity target allocation.

The endowment’s board of directors approved by a 5-1 vote the elimination of the asset class and other asset allocation changes at its Feb. 1 meeting, a webcast of the meeting shows.

Other changes included the elimination of targets of 2% each to commodities and emerging markets debt, and long Treasuries and the creation of new targets of 8% to private credit and 4% to bank loans.

In a March 19 news release, Tom Maynard, chairman of the Texas Permanent School Fund, said, “Companies pushing anti-Texas policies and woke indoctrination have no place in Texas public education, whether in the classroom or as investments in Texas Permanent School Fund. We will continue to defend our Texas values while generating more resources to support the school children of Texas.”

At Pensions & Investments we are committed to serving our audience where they want to engage with us and that continues to include our print publication (the newspaper), our website and newsletters, as well as a variety of live events and webinars that deliver thought leadership and best practices from industry experts. Our newsroom is committed to delivering thoughtful, analytical and accurate journalism to our readers daily. As a news publication serving the institutional investing industry, we are breaking news and providing the latest updates throughout each week. As such, we are focused on a digital- rst publishing approach in our

newsroom to deliver information in a timely fashion. While we will continue to deliver the print publication 18 times annually, we will be removing some of our regularly published features in print, but you’ll still be able to nd them all on www.pionline.com

As of our April 1, 2024, issue, we will no longer be publishing our monthly ESG roundup, monthly DC roundup, or At Deadline breaking news. All of these stories can be read on our website and are curated in our weekly ESG Digest, weekly DC Digest and P&I Daily newsletters. Additionally, we will no longer publish a

curation of Searches & Hires in the print publication. These mandates, searches and hires are all posted to our website as they are sourced and are part of our P&I Daily news subscription. You can sign up for our newsletters and get information about our various subscription offerings at www.pionline.com/ subscribe

We hope you will continue to engage with Pensions & Investments across all of our platforms, and I welcome your feedback on our continued evolution. It is our honor to have served this industry for 50 years and we look forward to the next 50 and beyond. n

After suffering through the long dominance of growth stocks, the value manager is seeing in ows

By DOUGLAS APPELLMehdi Mahmud took the helm of First Eagle Investment Management in 2016 with a mission: to diversify the value equity boutique’s business with strategies capable of delivering equity-like returns by other means.Now, after a prolonged period of dominance for U.S. megacap growth stocks that left value managers struggling to retain clients, Mahmud, in an interview, said First Eagle looks to be turning a corner.

Last year was the rm's second year in a row of positive net ows following heavy out ows over the three preceding years, something "I’m particularly proud of,” said Mahmud, who left his perch as chairman and CEO of Jennison Associates in early 2016 to become First Eagle’s

president and CEO.

The industry veteran was brought in by Blackstone and Corsair Capital Partners, after their 2015 purchase of a majority stake in First Eagle from TA Associates and First Eagle's family owners, to diversify and institutionalize a money management rm that, for all its strengths, had remained narrowly focused on value equities and the wealth management space.

New York-based First Eagle reported $130.8 billion of assets under management as of Dec. 31.

Net in ows for 2023 came to about $200 million — “not a lot,” conceded Mahmud, but signicant nonetheless against the backdrop of a quick resumption of market dominance last year by megacap growth stocks following a sell-off in 2022 sparked by the start of a U.S. rate hiking cycle.By contrast, a number of value equity managers have suffered through ve years of negative ows, he noted.

DIVERSIFIED: Mehdi Mahmud said the move into private credit and municipal bonds helped drive First Eagle’s turnaround.

Mahmud credited First Eagle’s diversi cation strategy — including its move into private credit six years ago and last year’s push

The departure of four major money managers from the world’s largest investor-led initiative focused on climate change is worrying some European pension fund executives, who also reiterated their commitment to the cause.

Over the past six weeks, four of the top 20 money managers by assets under management left Climate Action 100+, an investor-led climate change-related engagement initiative with more than 700 signatories representing more than $68 trillion in total assets. They were State Street Global Advisors ($4.13 trillion), J.P. Morgan Asset

Management ($3.1 trillion), PIMCO ($1.86 trillion) and Invesco ($1.63 trillion). Also, BlackRock, the world’s largest money manager with $10 trillion in AUM, shifted its relationship with CA100+ to its international business.

Representatives at some of Europe’s largest pension funds told P&I that while the departures are disappointing, there remains an urgent need to focus on the impacts of climate change and to engage with the heaviest emitters.

“The departure of two major asset managers, J.P. Morgan Asset Management and State Street Global Advisors, from Climate Action 100+ and

SEE DEPARTURES ON PAGE 21 SEE

Aggressive monetary tightening by central banks, sti ed consumer spending and risks relating to the tightening U.S. money supply call for a cautious stance in the coming months, said Joe McDonnell, CIO at Border to Coast Pensions Partnership.

“We have only recently turned more cautious on the backdrop of a very strong performance in risk assets as markets are entrenched in this perfect Goldilocks scenario,” he said in emailed answers to questions from Pensions & Investments

“However, we continue to see downside risks to global growth as tighter liquidity begins to weigh more heavily on both consumer and corporate spending.”

And that’s certainly the case in Europe, which McDonnell said is “arguably already in a form of recession, especially in the more manufacturing-based economies such as Germany.”

The Leeds, England-based pool for 11 local authority pension funds that have a total about £60 billion ($77.1 billion) in assets, was responsible for £40.3 billion in assets as of March 31, 2023, invested across equities, debt and private markets for more than 1 million participants.

Markets are primarily occupied with interest rates, but the U.S. money supply amid Federal Reserve tightening is another risk on the horizon, he said. Al-

The S&P 500 continues to reach new highs as recession fears fade and optimism grows about the Federal Reserve cutting short-term interest rates. With nearly all companies reporting quarterly results, sales and earnings growth have been solid, and most have exceeded analyst expectations. Analysts expect certain sectors to hold back earnings growth at the start of this year but have a more optimistic outlook for the second half.

Beating estimates: With 496 companies reporting fourth-quarter results, 74% have beaten operating earning estimates. That’s in line with the 73% average going back to the start of 2013.

Results improve: The S&P 500 generated an aggregate 6.2% year-overyear sales growth and a 7% increase in operating earnings, with an operating margin of 11.1%. Consumer staples, information technology and healthcare had the largest sales growth.

Sales and earnings growth

Second-half pickup: Analysts expect earnings growth to accelerate in the second half, with the S&P 500 earnings per share to grow 3.7% and 7.1% in the rst and second quarters, respectively. They project this will accelerate to 20.5% and 19.9% in Q3 and Q4.

Earnings growth estimates

What recession? The number of companies citing “recession” in their latest earnings calls fell to 47, vs. 237 in the second quarter of 2022. At the start of the pandemic, 210 companies mentioned “recession.”

Companies citing “recession” on earnings calls

By

LYDIA TOMKIW

By

LYDIA TOMKIW

Quantitative money managers are exploring how to apply generative arti cial intelligence and large language models in their day-to-day work, but many are skeptical about AI’s uses in the investment process to generate alpha.

Instead, mundane tasks are proving more fruitful, said panelists and

attendees at the Quant Strats conference held in New York on March 12.

The idea of AI completely taking over and the human touch becoming irrelevant is doubtful, said Stacie Mintz, head of quantitative equity at PGIM Quantitative Solutions.

“Human beings still create the models, so even though we use models for stock selections and portfolio construction, the humans are the ones creating and evolving the models,” she said.

Investors will always be faced with situations and geopolitical risks where models need thoughtful adjustments, Mintz added.

“Really with any new technology, you need to understand what the potential pitfalls are, and as investors we are always going to come into situations that we’ve never seen before, so Covid is a great example,” she said.

AI needs human supervision, argued Tim Liu, a senior researcher at Neo Ivy Capital, a quantitative hedge fund.

“In my view, AI has some potential, but it’s not the key for everything,” he said.

Liu said it would take 100% condence that generative AI can replicate humans for it revolutionize investment decision-making and replace humans. “I don’t see the day coming any time soon,” he added.

A true leap could come if something closer to arti cial general intelligence – a eld of AI that is attempting to create software with human cognitive abilities so it can solve unfamiliar tasks – develops, said Gordon Ritter, CIO of Ritter Alpha, an investment advisor that runs systematic absolute-return strategies.

Currently, quants need to be cautious around using AI to generate trading models, said Michael Weinberg, an adjunct professor of nance and economics at the Columbia Business School, and special advisor to the Tokyo University of Science endowment.

Pension funds are rethinking their impact on participants’ lives, especially with an aging population. They’re exploring innovative approaches to retirement,

the crucial role pensions play. Recent studies highlight how pensions benefit society

“You have to be uber careful that you’re not over tting or looking at spurious correlations or relationships,” he said. “It could be that that the AI or LLM nds a relationship where certain stocks or industries or markets outperform or underperform while something else happens, but that could be entirely coincidental, not causal.”

Weinberg uses a checklist with over 80 different data points to ascertain what alternatives managers are really doing with arti cial intelligence.

For now, generative AI is great at automating routine tasks, he added.

Many quants are seeing applications and productivity gains outside of the investing process.

“[Y]ou can automate a lot of the simpler stuff, like docs and legal… and operations. I think there is tremendous and obvious cost savings and productivity that can be enhanced on in the middle and back of ce,” said Milind Sharma, CEO at hedge fund QuantZ Capital Management.

Yesim Tokat-Acikel, a managing director and portfolio manager at Principal Asset Management, said she is nding generative AI use cases experimenting with automating and writing responses for requests for proposals, creating initial drafts of documents and commentary.

Using a large language model that costs $30 a month is helpful for automation work and debugging code and can replace some work that was previously done by entry-level quants or software engineers, said Revant Nayar, CIO at hedge fund FMI Technologies.

But for alpha generation, generative AI shouldn’t have an impact, Nayar said. It’s an “extreme statement” he said, but with everyone having access to models, a consensus opinion will take hold. The best quants will be able to think of things LLMs have not, he added.

Enacting federal legislation that builds on state automatic IRA programs would bolster retirement savings in America, industry groups and experts said, but the path to passing

such legislation is unclear.

In February, Rep. Richard Neal, D-Mass., reintroduced the Automatic IRA Act of 2024, which would require businesses with 10 or more employees not currently offering a retirement plan to automatically enroll their workers in IRAs or 401(k)type plans.

“My plan here and the goal is to enhance retirement savings for people at the lower end of (the) economic spectrum and/or those who are in

a workplace where a retirement plan is not offered,” said Neal, ranking member of the House Ways and Means Committee, in a Pensions & Investments interview last month.

Speci cally, the bill requires that covered employers set up a 401(k)type plan or facilitate auto IRAs, with both default contribution rates starting at 6%. The bill is intended to “build on, expand upon, and protect the growing state-facilitated automatic IRA retirement saving programs,” according to a bill summary from the Ways and Means Committee Democrats.

As of Jan. 1, 19 states have enacted state-facilitated retirement programs, 15 of which are auto IRA programs, according to Georgetown University’s Center for Retirement Initiatives.

“We're seeing more and more states moving forward with these requirements anyway, so isn't it better to have some sort of federal, uniform solution than having 50 different states doing 50 different things?” said Melissa Kahn, managing director of retirement policy for the dened contribution team at State Street Global Advisors.

Douglas Magnolia, chief customer of cer and president of state savings at Vestwell, a record-keeping platform powering auto IRA programs in Oregon, Maryland and Connecticut, among others, also highlighted the growth of state-sponsored retirement programs, noting that such programs “are proving to everybody that (they work).”

“If this bill kind of helps cement those programs for those states and then creates an option, seemingly nationally, for people to be able to do that, I don't know how that's a bad thing,” Magnolia said.

However, Republicans did not support Neal’s bill in the past over concerns of a “mandate,” and sources noted that the bill may struggle to garner support, especially in an election year, when Congress is less likely to pass legislation.

“Realistically, I think that it's great that (Neal) reintroduced (this bill.) I think the conversation needs to continue,” Kahn said. “I think this is probably a topic for next year when we have a new Congress, depending on who the administration is.”

Despite the progress that’s been made, the retirement system is still not where it needs to be, according to Kahn.

“Now that we're in a world where de ned bene t plans are really a dinosaur, I think that we need to gure out how to make sure that people can plan and pay for their own retirement,” she said, which can be through de ned contribution plans or IRAs, as the bill calls for.

Applying to plan years beginning after Dec. 31, 2026, the bill stipulates that employers with 10 or more workers must set up 401(k)-type plans or facilitate auto IRAs, both with automatic enrollment and a default contribution rate of 6%.

For 401(k)-type plans, the contribution rate would automatically increase by 1 percentage point each

Governance, implementation, specialist manager access, market complexity, lack of expertise or bandwidth: a host of reasons are behind the diversity in types of institutions and the growth in scale of capital pools that are engaging OCIOs, or outsourced chief investment officers. With allocators focused on alpha-generating sources of return as they look ahead to the next decade — particularly via alternatives and private markets — OCIOs are bringing their discretionary expertise and specialized relationships with asset managers to the forefront. Many OCIOs are delivering flexible and custom mandates, tailored to specific allocator segments and even specific institutions’ needs within each segment, which is further encouraging industry growth. OCIO performance measurement, value-added services and education, and innovative methods of accessing asset managers are all top of mind for asset owners as they partner with OCIOs today.

Our panel of OCIO experts shares the latest in types of mandates, current priorities for different allocator types, and the greater efficiencies being delivered through new data and technology that, while significant, will not replace the more nuanced collaborative relationship.

Read all the articles and access exclusive sponsor content online:

pionline.com/ocio-report2024

Sponsored by:

How did a physicist with a background in hard sciences and space research end up in asset management?

George N. Patterson, managing director and the CIO for PGIM's Quantitative Solutions group, began his career three decades ago at a place one does not normally associate with portfolio management and nance — NASA.

After securing physics degrees from both the Massachusetts Institute of Technology and Boston University, Patterson went to work at NASA's Jet Propulsion Laboratory in Pasadena, Calif. for about two years as a technical staff member.

“It was great working at JPL and I enjoyed the research, but at some point I decided that I didn't want to spend my whole career in a government lab and wanted to use my analytical skills somewhere else,” he said. “After some soul-searching, I thought about becoming an actuary. However, I crossed paths with members of Barclays Global Investors at a research luncheon and ended up working there in various capacities for more than a decade. While more traditional asset management rms looked at me as if I had three eyes in my head during the interview process, BGI didn't. BGI researchers had diverse backgrounds including nance, economics, math, physics and computer science. For me, it was the

perfect t.”

Patterson eventually rose to become a portfolio manager at BGI on the market-neutral team despite his nontraditional background.

At both NASA and Barclays, Patterson said, rigorous research is required — the main difference is at one place one is studying space and planetary science, while the other is focused on analyzing markets and asset pricing.

Following his 10-year tenure at Barclays, Patterson has held senior positions at Menta Capital, BMO Global Asset Management and Axioma Inc., before joining PGIM in October 2017.

Patterson said he expects to see more people with science, tech, mathematics and physics backgrounds enter asset management — particularly at quant shops where their knowledge and analytical skills would t in very well.

However, Patterson pointed out a crucial difference between studying space and studying markets: “There are no equations of motion in nancial markets, and you need to take a statistical viewpoint,” he said. “But in physics, the fundamental laws never change. You never have a bad year for gravity or quantum mechanics, it's always the same.”

On that basis, he thinks the nancial markets are more interesting.

PALASH GHOSHThe SPARK Institute and LIMRA have joined forces to ght nancial fraud within the retirement services industry, seeking to enhance consumer education as well to develop best-practices guidelines for fraud prevention.

“The evolving landscape of nancial fraud demands a proactive and collaborative response from the industry,” Tim Rouse, executive director of the SPARK Institute, said in a Feb. 28 news release. “Our partnership with LIMRA will strengthen the industry's collective defenses, protect the interests of our members and ensure the long-term security of retirement assets for the millions of American workers that depend on us.”

The SPARK Institute represents service providers, investment managers, banks, mutual fund companies, insurance companies, third-party administrators, trade clearing rms, and bene ts

Tara Roth isn’t trying to replace the patriarchy with a matriarchy, but the president of the Goldhirsh Foundation does hope that naming an all-female investment committee will turn heads.

“What I want is parity,” Roth said. “But I think sometimes you need to put something in front of someone’s face and jostle a little bit the conventional wisdom and thinking.”

The approximately $60 million foundation named Shana Barghouti, co-chief investment of cer at ReMY Investors; Natasha Case, cofounder of Coolhaus Ice Cream; Celestine Schnugg, founding managing partner of Boom Capital; and Ruth Wernig, former chief investment of cer of The California Endowment, to its investment committee last week. The team takes over from an all-male investment committee that served for 10 years and has ful lled its mandate, she said.

The new committee is part of a broader shift for the Goldhirsch Foundation’s endowment that supports the organization’s broad mission of maximizing human potential and wellness with a large portion of its grantmaking taking place in

consultants. LIMRA is an insurance industry research organization.

According to the news release, the collaboration features four fraud- ghting strategies: A fraud prevention benchmarking study that will be created during the rst half of 2024 to “provide industry participants with valuable insights into the current state of fraud prevention practices” and to serve “as a foundation for identifying best practices, gaps in existing strategies and areas for improvement within the sector.”

Educational resources targeting plan sponsors and participants. “By enhancing awareness and understanding of emerging fraud threats, this initiative aims to empower

individuals and organizations to proactively safeguard against fraudulent activities.”

The use of industry platforms to share fraud incident and fraud threat intelligence information. This “will enable organizations to stay ahead of evolving fraud tactics and enhance their collective ability to detect and prevent fraudulent activities.”

An annual nancial services fraud and data security summit to “bring together industry experts, thought leaders and other key stakeholders to share insights, discuss emerging trends and collaborate on innovative solutions to more effectively combat fraud.”

— ROBERT STEYERLos Angeles. In 2023, the foundation’s investing became 100% mission-aligned, Roth said.

Roth hopes that others will follow the foundation’s lead, but says the decision to name an all-women committee was not a diversity, equity and inclusion play.

“This is about nding excellent people with speci c expertise in different functional and organizational arenas,” she said.

In fact, Roth has eschewed environmental, social and governance investing labels and thinks there is a much more expansive way of looking at investing with values and intentions.

With all-male investment committees being the norm for so long, Roth argues that in order to survive and thrive, the foundation needs to think differently.

“It's a little bit about stepping back and looking at the framework of, 'just because that's the way business has been done,' does not mean that that's the way business should proceed to be done,” she said.

LYDIA TOMKIWSovereign wealth funds are doing more to address climate change in their portfolios, according to a survey released March 14 by the International Forum of Sovereign Wealth Funds and the One Planet Sovereign Wealth Fund Network.

“Since 2020, the survey results have revealed sovereign wealth funds’ rapid progress in making their portfolios more resilient to the impact of climate change by measuring and monitoring their climate impact and looking to mitigate it,” the survey report said.

The 34 respondents to the fourth annual survey of IFSWF and OPSWF members represent 40% of the world’s 95 sovereign wealth funds, and 90% of the roughly $7 trillion in assets under management, according to IFSWF’s database.

The latest survey found more than one third of them carbon footprinting their portfolios in 2023, up from 18.5% in 2022. All but three of them see addressing the effects of climate change as

consistent with their investment mandate, with 68% saying it would improve long-term returns.

The percentage of sovereign wealth funds with a speci c mandate to address climate change increased to 29% from 14% in 2022.

Last year also brought another surge in sovereign wealth funds adopting climate change analytical tools, “showing how government investors were taking action and materially changing their processes, policies and portfolios,” the report said.

The latest look also found sovereign wealth funds expanding beyond unlisted assets like private equity and real estate to listed markets including xed income and hedge funds. While private equity is still the preferred asset class for sovereign wealth funds’ climate change strategy, with 66.7% of respondents following that strategy, 53% now select listed equities for climate-related themes, up from 33.3% in 2022, the report said.

Pooled employer plans are gaining traction across the defined contribution industry as a solution that can deliver a high-quality retirement program to employees with lower overall costs, a broader range of plan features and more robust compliance processes — versus managing a standalone DC plan. PEPs today are seeing more innovation and flexibility in approach, leading all types of DC plans to examine them more closely. This Guide covers:

Japan’s venture and private markets ecosystems are ready for U.S. institutions

As Japan anticipates a shift in monetary policy through potential interest rate hikes, the spotlight is intensifying not only on its public equity market but also on its less-explored venture and growth capital sectors. The upcoming policy pivot is expected to reinvigorate the Japanese public equity market, but amid a backdrop of strong corporate earnings and strategic central bank maneuvers, private markets also stand to bene t. U.S. institutional investors and consultants, who are increasingly allocating a larger share of capital to private markets, are assessing the Japanese startup industry given it presents an attractive combination of innovative growth opportunities, macroeconomic resilience, and it is viewed as a potential safe haven from geopolitical issues affecting other countries.

of either early stage or buyout funds. Thus, there is a signi cant gap in the middle-market, particularly with regards to managers focused on growth capital opportunities. Some Japanese deep tech startups are in the post-proof-ofconcept phase, as such they are often signi cantly undervalued compared to their peers in other developed economies. This discrepancy presents a strategic opportunity for investors to enter the market at favorable valuations.

The Japanese government is actively working to improve the venture capital landscape, as demonstrated by an ambitious plan to boost startup investments to approximately ¥10 trillion ($68 billion) by 2027. This effort re ects a strong commitment to fostering a vibrant entrepreneurial ecosystem.

For U.S. investors, Japan’s venture and growth capital market has historically been an underexplored area for allocations. This is no surprise when Japan’s burgeoning venture ecosystem is compared with that of the U.S. and China: total startup funding in Japan currently amounts to only about $6 billion. However, this is 10 times what it was in 2013.

As a result of this ongoing maturation, Japan’s startup industry has carved out a leading position and competitive edge in certain deep technology sectors, such as robotics. Some Japanese deep tech companies, which are focused on providing tech solutions based on substantial scienti c and/or engineering challenges, are ripe for global growth yet require signi cant amounts of capital if they are to scale to a size where they can compete meaningfully on the global stage.

The Japanese private markets industry is notably barbelled, containing mostly a mixture

Beyond the bustling metropolis of Tokyo, regional hubs like Fukuoka are emerging as key players in Japan’s venture scene, buoyed by their strategic locations (Fukuoka is a port city with access to Singapore, Seoul, Taiwan and Hong Kong) and encouraged by the historical successes of corporate behemoths such as Toyota and Nintendo, which hail from outside the capital. This geographic diversi cation within Japan enriches the venture capital landscape, offering a broader spectrum of investment opportunities than most investors are currently aware.

global business acumen into Japanese startups, enhancing their appeal to international investors. This cross-pollination of expertise is pivotal in elevating the credibility and global reach of Japanese startups, making them more enticing investment targets.

U.S. institutional investors, known for their strong demand for private markets, are increasingly recognizing Japan’s venture capital ecosystem as a burgeoning subasset class offering both diversi cation and the potential for attractive returns. This interest signi es a strategic pivot towards exploring new avenues within the private markets asset class, where Japan’s unique positioning and innovative sectors present an untapped opportunity for growth and investment.

As Japan’s venture ecosystem continues to mature, it beckons as a strategic opportunity for U.S. institutions looking to diversify their portfolios.

A key tailwind for the space is the in ux of global professionals from investment banking and private equity into the Japanese venture ecosystem. This net brain gain is injecting

A key metric for investors, the distribution to paid-in capital ratio (or DPI), indicates a healthy Japanese market capable of delivering robust returns, competitive with those in the U.S. and China. Japan has begun to overcome previous challenges of aligning investment sizes with startup needs, making the market increasingly accessible to foreign capital. As Japan’s venture ecosystem continues to mature, it beckons as a strategic opportunity for U.S. institutions looking to diversify their portfolios and capitalize on deep tech innovation in the region. This

OTHER VIEWS JEREMY KATZEFF

In the hunt for greater yields, diversi cation and returns, traditional asset managers are increasingly setting their sights on acquiring private markets specialists — particularly those with proven expertise in navigating complex and hard-to-access areas like infrastructure.

Take BlackRock's acquisition of Global Infrastructure Partners in January, for instance, which once again makes BlackRock the agent of change in the asset management industry. Once the $12.5 billion deal closes — slated for this summer — BlackRock will become the world's second-largest manager of private infrastructure assets, controlling an estimated $150 billion in infrastructure holdings ranging from the U.S. lique ed natural gas export market to airports in England and Australia.

While the deal is by no means the rst of its kind, signs are already emerging that it will accelerate the consolidation drive playing out in the asset management space. Indeed, last month, Europe's largest asset manager, Amundi, struck a multibillion-euro deal to acquire private markets specialist Alpha Associates, becoming the latest mainstream investment group to target the fast-growing alternatives space. And there can be little doubt over the growth opportunity posed by private markets. According to data provider Preqin, the overall private capital industry is forecast to grow to about $18 trillion by 2027 — a considerable leap

from about $10 trillion in 2021.

Of course, no one is suggesting that this foray into private markets is without risk. There have been countless analyses on the dangers presented by longer lock-up periods, for example. However, there has been far too little attention paid by market participants to the various operational complexities sure to emerge as the work ows surrounding public and private investing converge — particularly surrounding data management. And in the increasingly competitive and data-dependent landscape of investment management, asset managers can ill afford to overlook this element as they seek out private market fund acquisitions. It is paramount asset managers consider the investment process for private markets investment — namely due diligence, investment and valuation — through a data lens.

New batch of challenges

Performing due diligence on prospective investments — be it a business or infrastructure project — is one of the most data-intensive processes for investors, particularly those operating in private markets. Due to the nature of private markets, which as the name suggests are private, much of the key information required to build a good understanding of a prospect is not typically available in the public domain. Asset managers must request and organize the data themselves — much of which arrives in unstandardized formats.

It is paramount asset managers consider the investment process for private markets investment — namely due diligence, investment and valuation — through a data lens.

The sheer volume and variety of data required to complete effective due diligence exacerbates the challenge from a resource-allocation perspective. While market data providers have created speci c due-diligence offerings to combat this — some of which specialize in private markets — rms must carefully consider how these may interact with their existing data operating models, especially if they are mainly geared towards public investments.

Once due diligence is complete and a term sheet is signed, rms then face the challenge of keeping track of the capital committed, along with the capital drawn against that investment. As rms integrate private market assets into their wider investment portfolio, this will become increasingly complex. Most of the time, private market capital calls arrive via emailed PDF attachments, or even, in some cases, via fax which is hard to believe in 2024. For rms trying to track both public and private capital calls, sifting through and unifying this data will require signi cant legwork.

The task of accurately valuing assets presents another data dilemma, for several key reasons. Private assets are not markedto-market as often as public investments, so they can be subjective and dif cult to determine. Consider, for instance, the complexity of valuing a major infrastructure project such as the development of a new airport. Such projects typically possess long lifespans with highly diverse and convoluted cash ow patterns. Accurately forecasting future cash ows — which is fundamental to asset valuation — over such extended periods can be extremely tough, requiring careful analysis of factors like economic trends, regulation, maintenance costs and potential risks. Of course, all of these factors rely on effectively analyzing and managing a vast variety of data. For most traditional asset managers, the types of data they may have to scrutinize will be entirely new, and subsequently present a fresh set of challenges.

These examples highlight relative luxuries of investment data for public markets. It serves as a reminder to go into private markets deals with eyes wide open. If a private market business acquisition is to be a success, the parent company must be able to integrate and utilize the data from the new company. An inability to integrate could add signi cant costs after the acquisition if the complex data puzzle is assembled haphazardly.

While the opportunity posed by alternative assets is compelling, asset managers should ensure they possess the necessary data infrastructure to accommodate a set of assets that behaves very differently from the likes of publicly traded stocks and bonds. Indeed, if they are to successfully capitalize on the opportunities on offer in the private markets arena, data must be at the heart of the strategy going into a deal — not a mere afterthought. n

This content represents the views of the author. It was submitted and edited under Pensions & Investments guidelines but is not a product of P&I’s editorial team.

To mitigate climate risks, the global economy needs to decarbonize to reach net zero by 2050. Large scale and rapid decarbonization of the major emitting sectors (power, buildings, transportation, etc.) will require huge numbers of wind turbines, solar panels, electric vehicles and storage batteries that will require water, energy, rare earth elements and critical metals to produce, creating more emissions from production. The decarbonization pathway is likely to be bumpy and dirty.

Some asset owners started to shift their attention from the complexity of decarbonizing the economy to decarbonizing portfolios. Decarbonizing portfolios often involves shifting to securities with lower carbon emissions, and it may involve divesting from entire sectors. This approach is marketed as a way to make portfolios more resilient to climate change risks. However, simply having exposure to companies with lower carbon emissions is not equivalent to reducing the portfolio's exposure to climate risk. Whether a company has higher or lower relative carbon emissions today tells us little about how vulnerable or resilient their business model will be to climate-related

risks in the future. Portfolio decarbonization alone isn't enough to mitigate against climate risks.

The dislocations and inef ciencies that will come from decarbonizing the economy can present investment managers with opportunities to outperform the market. Investors can generate excess returns if they skillfully use information about climate-related costs and opportunities as part of their overall investment process, balancing climate-related factors with other risks and opportunities. Such strategies may include

investments in carbon-intensive securities where active managers have considered the physical and transition risks from climate change. There's no free or perfect "hedge" to protect portfolios from complex climate risk.

Some asset owners have confusingly blurred the line between their efforts to decarbonize the portfolio and efforts to decarbonize the real global economy. Asset owners shouldn't kid themselves into thinking these are equivalent. Selling carbon-intensive securities in the secondary market doesn't mean the securities will emit fewer greenhouse gases. It just means that someone else will own those securities. Some (but not all) investors seek an environmental impact alongside nancial returns (otherwise known as "impact" investors), and they should use their capital and stewardship to in uence the behavior of companies — that is, providing additional capital or engagement to help companies innovate and develop climate solutions faster, or to reduce emissions. There are investment strategies that do this, and they tend to look very different from simple portfolio decarbonization. For example, buying stock in a large, publicly traded electric vehicle (EV) company — even if you

buy a lot — is unlikely to change the number of EVs on the road. To help decarbonize the real economy, an investor can provide venture capital nancing to an EV startup to accelerate both its growth and the adoption of EVs. Portfolio decarbonization isn't the same as decarbonizing the economy.

Too many investors are decarbonizing portfolios for the wrong reasons, while some conventional investors (purely return seeking) avoid sustainable-themed investments, thinking they cannot make money. The narrative on climate change and investing has been oversimpli ed so much that many investors are behaving in ways counter to their goals. Instead of naively assuming all investments with low carbon emissions support climate objectives, or none generate strong returns, investors are better served by careful analysis of how each investment accomplishes their objectives. Decarbonizing the economy presents opportunities for both conventional and impact investors. n

This content represents the views of the author. It was submitted and edited under Pensions & Investments guidelines but is not a product of P&I’s editorial team.

CONTINUED FROM PAGE 1

e ts of saving on a Roth or after-tax basis.

Some campaigns were comprehensive, multimedia initiatives. Others were fashioned as long-term nancial wellness “challenges” or events that urged participants to take actions to improve their retirement readiness. Still others took highly innovative approaches, such as using birthdays and job promotions as “fresh start” triggers to nudge participants to reset their retirement goals.

Descriptions of some of the top-winning campaigns are organized by category below:

Two of the top three P&I Eddy Award winners in the nancial wellness category tackled ways in which to help plan participants reduce their debt.

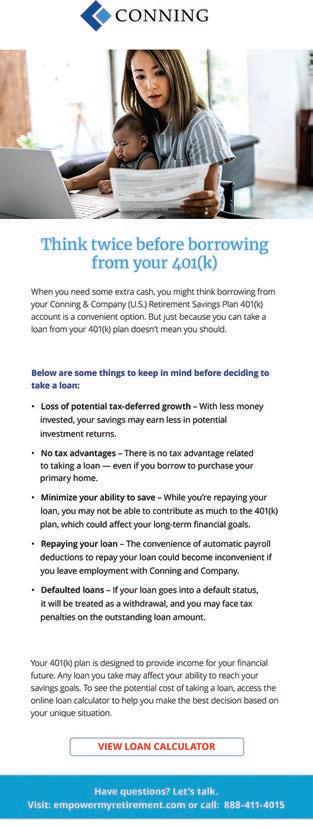

Global investment management rm Conning & Co. (record keeper Empower), for example, grabbed rst place for corporate plans with less than 1,000 participants for a campaign focused on participants it identi ed as “serial loan takers” — those who soon or immediately after paying off a loan against their 401(k) accounts take another loan.

“We wanted them to be aware of the downside to doing that,” said Greg Nickett, vice president of Human Resources at Conning, of participants who perpetually borrow from their 401(k) accounts.

The campaign consisted of a simple communication that cautioned the serial loan takers to “think twice before borrowing from their 401(k),” emphasizing the drawbacks of doing so.

“While you’re repaying your loan, you may not be able to contribute as much to the 401(k) plan, which could affect your long-term nancial goals,” Conning reminded loan takers in its $143 million 401(k) plan.

The targeted messaging worked. In 2022, the number of new loans dropped to nine, down 50% from 19 in 2021. The total loan amounts also fell, plunging to $224,000 from $443,000.

Participants clearly got the message, Nickett said. “You don’t want to be out of the market because you took a loan when there’s a rally,” he said.

The University of Colorado (TIAA-CREF) was also recognized for a campaign around the related issue of student loans, nabbing a rstplace Eddy Award for public plans with more than 5,000 participants. The public university employed Savi, a web-based service that helps borrowers navigate the federal government’s Public Service Loan Forgiveness Program for

individuals employed in the public sector and nonpro t organizations.

“It seemed like this would be a really good bene t for our employees,” said RyAnne Scott, director of Communications and Outreach, Employee Services, at the University of Colorado, noting that its faculty and staff struggled with student loan debt.

“It would save them money and encourage them to value their work at the university more,” she said.

The university’s “Conquer Your Debt” promotional campaign featured a webpage, employee portal, webinars, posters and email communications, using video game imagery to reinforce the idea that Savi could help participants reduce their student debt. The university offers both a $4.2 billion 401(a) plan and a $1.4 billion 403(b) plan.

As a result of the campaign, borrowers lowered their debt by an average of $168 a month,

Financial wellness winners: Conning & Co. (top left) warned employees of the dangers of taking excessive loans out on their 401(k)s, while the University of Colorado (above) emplored employees to ‘Conquer Your Debt.’ At left, Brakebush Brothers encouraged employees to take part in the company’s wellness challenge.

with the average forgiveness per borrower totaling $73,061.

In one case, an employee received $513,000 in forgiveness, “the highest forgiveness amount they’ve ever seen at Savi,” Scott said.

Brakebush Brothers (Francis) tackled a different issue with its July Wellness Challenge campaign, which tied for rst place with Alliant Energy (Empower) for corporate plans with 1,000 to 5,000 participants. The Wisconsin-based processor of chicken products wanted to engage more participants in the company-paid one-on-one nancial advice services it provided its workforce through retirement

plan consulting rm Francis.

While many workers met one-on-one with the nancial advisers, they tended to be the same workers year over year, said Alexandra Allen, corporate manager of Wellness at Brakebush.

“We were trying to capture people who maybe never have tried Francis,” she said.

As part of the July Wellness Challenge campaign, participants in the company’s $117 million 401(k) plan were required to meet with Francis nancial advisers and update their 401(k) and life insurance bene ciary elections. They also had to complete 15 voluntary, easyto-complete tasks, such as saying thank you to a co-worker or not eating junk food for a day.

As a result of the month-long effort, Brakebush boosted the number of participants who updated their bene ciary elections, with 27% of challenge participants ful lling the task.

The company also saw a strong uptick in the number of participants meeting with a nancial planner. For the 12-month period ended Aug. 31, 2023, 237 participants met with Francis advisers, up 34% from 177 the year before.

Those who met with planners reported an overwhelming positive experience, Allen said, adding that those who completed a satisfaction survey gave Francis high scores.

More than 4 in 5 (83%) indicated that the advice helped their nancial wellness with the remaining reporting that “it’s too soon to tell,” Allen said.

Top Eddy Award-winning campaigns in the ongoing investment education category covered everything from motivating participants to contribute more to their retirement savings accounts to educating them about changes to their workplace savings plans.

Industrial equipment supplier Applied Industrial Technologies (Principal Financial Group), a rst-place winner for corporate plans with more than 1,000 participants, for example, was recognized for using “fresh start framing” to encourage the participants in its $720 million 401(k) plan to save more in the plan and to at least save enough to maximize the company’s matching contribution.

The company matches 50% of a participant’s contribution, up to 6% of pay, for a total maximum contribution of 3%.

The company’s used participants’ birthdays and pay raises and promotions as triggers or “fresh start dates” to nudge participants to save more.

“What we’re trying to do is have people maximize the match and have them save for retirement so that they are able to retire with 80% of their income,” said Kurt Loring, Applied’s chief human resources of cer. “We

CORPORATE

Fewer than 1,000 participants

First Place

Conning & Company

Service provider: Empower

CORPORATE

1,000 to 5,000 participants

First Place (tie)

Brakebush Brothers

Service provider: Francis

First Place (tie)

Alliant Energy

Service provider: Empower

CORPORATE

More than 5,000 participants

First Place

Polaris, Inc.

Service provider: Compass Financial

Partners & Fidelity

were trying to nd points of time or moments where individuals might to open to that conversation.”

Loring added that the targeted Happy Birthday notes made participants feel special.

“It’s not some random email that showed up,” he said. “It says Happy Birthday.”

The automatic Happy Birthday messages provided age-based guidance on how much they should have saved for retirement at their age. Individuals in their early 50s, for instance, received a message saying they should have saved 6.5 times their income by the time they’re 55.

The fresh start nudges were aimed at individuals who were saving less than 10% — the amount experts deemed necessary to hit an 80% income replacement in retirement — or had recently decreased their deferral rates or hadn’t updated them in a while.

Another top winner in the ongoing investment education category — construction specialty contractor Grazzini Brothers & Co. (Francis) — developed a campaign to educate participants about changes to the company’s $15 million 401(k) plan following the switch to a new record keeper. In addition to adding a target-date fund to the investment lineup, the company introduced a Roth 401(k) option and made nancial consultants available to participants.

“Because of all those big changes, I de nitely wanted to make sure that our employees knew what was going on,” said Amanda Eiynk, director of administration at Grazzini Brothers.

The company, which took rst place for corporate plans with fewer than 1,000 participants, developed a week-long program that focused on plan changes, with each day dedicated to different topics.

“I heard a lot of good feedback from employees both in person and anonymously that it was an enjoyable week,” Eiynk said of the 401(k) Week program. “It wasn’t overwhelming.”

One day was dedicated to the bene ts of saving on a Roth or after-tax basis. Because the company’s employee population is younger than it used to be, Grazzini Brothers thought it would be helpful to offer the workforce a Roth 401(k) option.

“We’ve had a lot of people start to retire, and so we’re bringing a lot more younger people in to ll those holes,” Eiynk said.

As a result of the campaign, 33% of participants are saving with Roth dollars, considerably more than the national average of 12%, Eiynk said.

The top Eddy-winning plan sponsors in the pre-retirement preparation category ad-

14

Second Place

Avangrid

Service provider: Fidelity Investments

PUBLIC

More than 5,000 participants

First Place

University of Colorado

Service provider: TIAA

GENERIC

First Place

T. Rowe Price

Second Place

Francis LLC

CORPORATE

Fewer than 1,000 participants

First Place

Grazzini Brothers & Company

Service provider: Francis

CORPORATE

More than 1,000 participants

First Place

Applied Industrial Technologies

Service provider: Principal Financial Group

Second Place

Fidelity National Financial

Service provider: Principal Financial Group

Third Place

Dematic Corp.

Service provider: Principal Financial Group

PUBLIC

More than 5,000 participants

First Place

Commonwealth of

Massachusetts

Service provider: Empower

GENERIC

First Place

J.P. Morgan Asset Management

Consolidations

CORPORATE

More than 5,000 participants

First Place

Westinghouse Electric

Service provider: Voya Financial

PUBLIC

More than 5,000 participants

First Place (tie)

Chicago Public Schools

Service provider: Corebridge Financial

First Place (tie)

Colorado State University

Service provider: Innovest Portfolio Solutions

CORPORATE

More than 5,000 participants

First Place (tie)

Southeastern Freight Lines

Service provider: T. Rowe Price

First Place (tie)

ADP TotalSource

Service provider: Voya Financial

PUBLIC

More than 5,000 participants

First Place

Commonwealth of Massachusetts

Service provider: Empower

CORPORATE

1,000 to 5,000 participants

First Place (tie)

EBSCO Industries

Service provider: Principal Financial Group

First Place (tie)

EBSCO Industries

Service provider: Principal Financial Group

Second Place

Trek Bicycle Corporation

Service provider: Transamerica

Third Place

Ryan Speciality

Service provider: Empower

CORPORATE

More than 5,000 participants

First Place

SLB

Service provider: Segal Benz

Second Place

ProHealth Care

Service provider: Transamerica

Third Place

Southeastern Freight Lines

Service provider: T. Rowe Price

NOT FOR PROFIT/OTHER

1,000 to 5,000 participants

First Place

Northern Arizona Healthcare Service provider: Transamerica

NOT FOR PROFIT/OTHER

More than 5,000 participants

First Place

Northwell Health Service provider: Transamerica

Second Place (tie)

The University of Texas at Dallas

Second Place (tie)

Savannah River Nuclear Solutions

Service provider: Transamerica

Third Place (tie)

University of Pittsburgh Service provider: TIAA

Third Place (tie)

Medical College of Wisconsin Service provider: Transamerica

Third Place (tie)

SEIU 775 Benefits Group

Service provider: Capital Group

PUBLIC

1,000 to 5,000 participants

First Place

San Joaquin County

Service provider: Nationwide Retirement Solutions

PUBLIC

More than 5,000 participants

First Place

County of Los Angeles

Service provider: Empower

Second Place (tie)

Missouri State Employees’ Retirement System

Second Place (tie)

Missouri State Employees’ Retirement System

Third Place (tie)

Maryland Teachers and State Employees Supplemental Retirement Plans

Service provider: Nationwide Retirement Solutions

Third Place (tie)

Encompass Health

Service provider: Schwab Retirement Plan Services

Third Place (tie) Employees Retirement System of Texas

Service provider: Empower

GENERIC

First Place

Lincoln Financial Group

Second Place (tie)

T. Rowe Price

Second Place (tie)

T. Rowe Price

CONTINUED FROM PAGE 13

dressed a common issue affecting them all — the ever-growing number of pre-retirees dominating their workforces.

Trucking company Southeastern Freight Lines (T. Rowe Price), for example, won rst place for corporate plans with more than 5,000 participants for its “Put Your Future in Motion” campaign, an initiative directed at 401(k) plan participants over the age of 50.

“We’re a large family-owned business, but we have a lot of long-term associates,” said Alvin Shaver, director of compensation and bene ts at Southeastern Freight Lines. “We’ve got a lot of folks who invest their lives here.”

In keeping with the company’s core tenet to “value each other completely,” Southeastern Freight wanted to provide its pre-retirees with the resources to meet their retirement needs, he said.

As part of the campaign, the company developed a workshop to help participants in its $1 billion 401(k) plan visualize their retirement and provided them with a series of communications to assess their retirement readiness, including a workbook, brochure and an on-demand webinar about Social Security.

The company took great care to ensure that the visuals were speci c to Southeastern Freight employees, using bold pictures of company’s distinctive red and black trucks.

“Don’t just put any old truck because our folks know those from a mile away,” Shaver requested of its long-time record keeper T. Rowe Price.

The goal of the campaign was to encourage participants to meet with Empower’s retirement plan advisers for guidance on investment allocations and draw-down strategies and to engage them in retirement readiness reviews.

As a result of the campaign, the at-risk population dropped 6.3% to 18,740, Lynch said.

When Colorado State University opened a de ned contribution plan in 1993, it had three different plans administered by three different record keepers and provided 25 different in-

ket and technology could deliver for its participants, said David Pribozie, senior human resources consultant, global retirement, at the Cranberry Township, Pa.-based business. Its search for a new record keeper was prompted by a need to be more ef cient and to ful ll its “ duciary obligation.”

The outcome was a more contemporary investment lineup that provides employees with “good value and good service,” he added. Westinghouse Electric tried to incorporate the best options that were in each of the prior plans. For example, target-date funds — which were previously available to participants who were in the company’s two smaller plans only — are

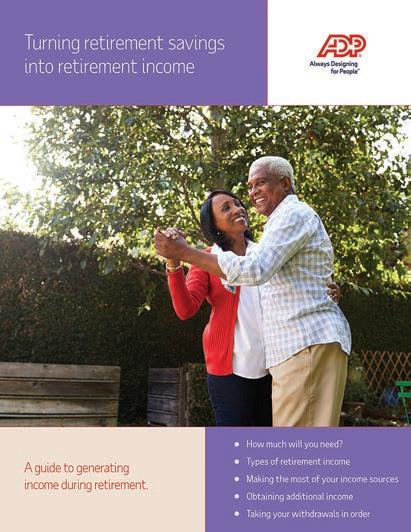

ADP TotalSource (Voya Financial), the provider of an $8.02 billion 401(k) multiple employer plan to some 6,300 employers, was also recognized for a multimedia campaign focused on pre-retirees.

“One of our largest age bands were those 50 plus,” said Melissa Pignatiello, health and wellness executive of 401(k) MEP Service, Support and New Business at ADP TotalSource, of the plan’s participants. “We had to really focus on this group.”

The multimedia “Smooth Sailing into Retirement” campaign, which tied for a rstplace Eddy Award with Southeastern Freight Lines, featured a retirement planning guide website, a retirement income brochure, a Social Security guidance tool as well as webinars on Social Security, healthcare in retirement and estate planning. It also included complimentary one-on-one meetings with Voya retirement advisers.

“We want to encourage participants to think about planning and the steps that they could take to better prepare themselves,” Pignatiello said.

The Commonwealth of Massachusetts (Empower), another winner of a top award in the pre-retirement preparation category, public plans, more than 5,000 participants, focused on an even more narrow segment of the pre-retiree population: those identi ed as being at risk because their account balances had more than a 75% exposure to equities.

Of the 82,660 participants in Commonwealth’s $12 billion 457 plan, about 20,000 were at risk, said David Lynch, executive director of De ned Contribution Plans at the Commonwealth of Massachusetts.

vestment options.

When the land-grant higher education institution conducted its rst major comprehensive review in 2020, the plan still maintained the same set up, but the “construct de nitely had changed a lot,” said Teri Suhr, chief total rewards of cer at the university. Its investment options had grown to over 300, which made the study dif cult and also gave participants “analysis paralysis” when choosing investments, she added.

With consultation from Innovest Portfolio Solutions, the Fort Collins, Colo.-based university had a committee consisting of faculty and administrative professionals select Fidelity Investments as its new, sole record keeper and narrowed down its investment menu to 20 options.

Since the new plan went into effect in June 2023, the university has seen a 37% increase in participation and — jointly with Innovest — has won rst place among public plans with more than 5,000 participants in the conversations/403(b) consolidations category.

When it converted its retirement plans, the university had a total of $2 billion in assets.

Following an acquisition in 2016, Westinghouse Electric Co. also had three plans administered by three record keepers, but it consolidated them into a single plan under one, new record keeper, Voya Financial, with nine core investment options. The move won the nuclear power company and Voya rst place among corporate plans with more than 5,000 participants in the category.

With the consolidation, Westinghouse Electric wanted to see what innovations in the mar-

Westinghouse Electric crafted three sets of communications materials — including newsletters and mailers — since “everything was a little bit different depending on the plan” the recipient was coming from, Pribozie said. Because it has employees working from across the U.S., Colorado State University reached out to participants through emails and postcards as well as live webinars and individual in-person meetings, Suhr said.

now available to all participants. Prior to the consolidation, the company’s bigger plan had 13 core investment options with no target-date funds.

When it converted its plans, Westinghouse Electric had a total of $1.7 billion in assets.

In addition to consolidating their plans, Colorado State University and Westinghouse Electric had to communicate the change to their participants.

While plan sponsors may nd the scale of these projects daunting, when the opportunity to convert or consolidate presents itself, it’s good to “take the leap,” Pribozie said. After all, they will “ultimately nd very cooperative partners and record keepers that will support” them, he added.

A helping hand: Southeastern Freight Lines (top left) and ADP TotalSource (top center), both winners for pre-retirement preparation campaigns, asked employees many of them over 50 to take a close look their retirement readiness. Westinghouse (top right) trumpeted new options in the company’s newly consolidated retirement plan. Special projects winner San Joaquin County (far left) used an interactive, 3-D courtyard to disseminate retirement information, while ProHealth Care (near left), another special projects winner, sought to lessen the information overload new hires experienced while going through the rm’s onboarding process.

While planning for retirement is important, it might not be fun and alluring for plan participants.

But for municipal employees in San Joaquin County (Nationwide Retirement Solutions), they turned out to engage and immerse themselves in retirement planning through an interactive, virtual experience.

The Stockton, Calif.-based municipality wanted its employees to be better acquainted with the resources and nancial tools offered by Nationwide Retirement Solutions, its new service provider. The two teamed up to create a colorful, 3-D courtyard — complete with a garden and smoothie shack — where users could click on buttons to access education videos, a quiz and information on how to schedule one-on-one meetings with a retirement specialist.

Through a link or QR code, employees could visit the space at any time from their computer or phone, and from the of ce or from home. Each visitor of the courtyard — which saw 61% engagement among all 5,060 county employees — engaged with at least six of the 10 available activities.

Nationwide “pulled out all the stops” when it came to the quality, giving participants a change from “the type of communication they

tend to see from the county government,” said Jennifer Goodman, director of human resources for the municipality.

San Joaquin and Nationwide jointly won rst place among public plans with between 1,000 to 5,000 participants in the special projects category. The municipality’s retirement plan had $543 million in assets as of Dec. 31.

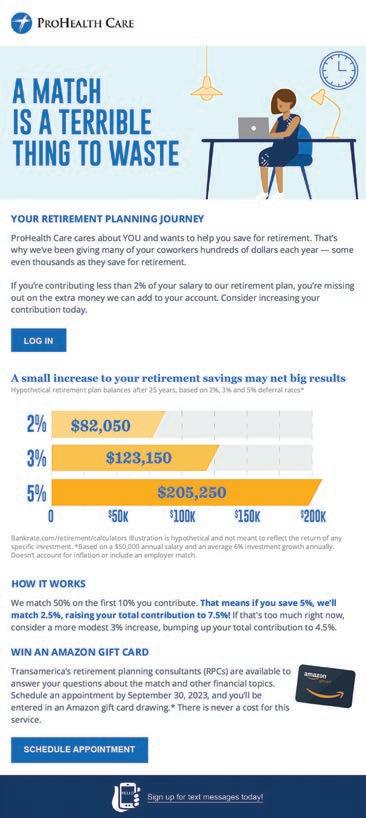

Other winners in the category turned to targeted communication campaigns to get employees engaged. In the case of ProHealth Care (Transamerica), it paid close attention to its new, Generation Z-aged employees.

As part of a multiyear approach for increasing its minimum savings rate from 2%, the Waukesha, Wis.-based company wanted to encourage the 30% of its 5,700 employees who were contributing at most 2% to increase their deferral rate.

This rate “is not quite enough to create a comfortable and stress-free retirement,” said Stephanie Barenz, compensation and bene ts analyst at ProHealth.

After 30 days of work, new employees are automatically enrolled into the retirement plan. But Barenz noted that given that they may experience an “information overload” while going through the onboarding process, they may not realize they’re in the plan or be aware of the tools and resources provided to them to prepare for retirement.

For Gen-Z employees in particular, she said they might be going into ProHealth with little nancial literacy knowledge, so this could also be their rst time participating in a 401(k) plan.

To make sure its employees know they’re in the plan and realize that the 2% rate is not enough for a secure retirement, ProHealth sent monthly emails with different subject lines, graphics and informational videos. As a result, the company saw nearly 500 people increase their deferral rate, with 298 exceeding 7% — 165 of them maintaining an average rate of 11%.

The company — which operates medical facilities such as urgent care centers — had over $616 million in assets in its retirement plan as of March 22.

Additionally, ProHealth saw a 67% spike in the number of individuals who actively participated in group meetings with a retirement planning consultant at Transamerica.

From this campaign, Barenz said “employees really do have a hunger for learning this,” adding that “just because this is a group of people that maybe is not as engaged, (that) doesn’t mean that they don’t have questions.”

ProHealth (Transamerica) — which won second place among corporate plans with more than 5,000 employees — gave participants who met with a retirement planning consultant the chance to win an Amazon.com gift card. It was one of several entries in the category that used incentives to promote participation.

Northern Arizona Healthcare (Transamerica) turned its 401(k) plan into a safe harbor plan, increased its contribution rate upon auto-enrollment to 5% from 4% and increased its employer match to 100% on the rst 5% of eligible pay. The hospital system, which won rst place among not-for-pro t/other plans with between 1,000 and 5,000 participants, communicated these changes to participants through a custom website and an email campaign.

The platform provided information and resources, notably highlighting the ability to schedule one-on-one appointments with a retirement planning consultant at Transamerica. Those who met with the consultant could earn 500 points in its employee wellness program. After employees reach a certain number of points, Northern Arizona will invest in their health savings account and lower the premium for participants in a high-deductible plan.

“If you give somebody a present and you don’t tell them that you gave it to them, then they’re not going to know that they can go open it,” said Mary Porter, human resources information services and bene ts administrator at the hospital system.

P&I reporters were on the ground in Orlando, Fla., March 10-12, for P&I’s annual DC East conference, which brought together top plan sponsors and industry experts. What follows is a roundup of key panels.

A key to encouraging millennials and GenZers to save more for retirement is for nancial experts to ask them what they want rather than tell them what they need, according to Anne Lester, a former head of retirement solutions for J.P. Morgan and author of “Your Best Financial Life.”

“Are you listening to people,” asked Lester, noting that younger investors process information differently than older investors. “We need to meet them where they are.”

Communication must be targeted to their needs, said Lester, adding that these younger employees have been targeted individually by advertisements from a young age.

GenZers and millennials have three major concerns about saving: they don’t think they can afford a house; they don’t think they will get much from Social Security; and they don’t trust institutions.

Don’t make young savers feel that they are stupid or lazy, she said. Instead, encourage them to establish an emergency savings fund.

“We can help them feel better about the progress they are making,” she said.

Robert SteyerRetirement expert J. Mark Iwry walked plan sponsors through several key provisions in SECURE 2.0, a comprehensive retirement security bill signed into law in December 2022.

Iwry, former senior adviser to the secretary of the Treasury and deputy assistant secretary for retirement and health policy and currently a visiting scholar at University of Pennsylvania’s Wharton School and non-resident senior fellow at the Brookings Institution, started off his discussion by highlighting one of the law’s most widely discussed provisions: one that requires catch-up contributions for DC participants to be Roth contributions if they earn $145,000 or more per year.

After industry pushback, the IRS in August announced a two-year transition period for sponsors to implement the law, pushing back its effective date to early 2026.

Currently, participants who are 50 and older can have their catch-up provisions subject to the traditional plan funded with pretax money or the Roth plan funded with after-tax money depending on a sponsor’s rules.

As part of its August announcement, the IRS said the Treasury Department and the IRS “plan to issue future guidance to help taxpayers.” They asked for public comments about the Roth catch-up provision that were due in October.

Iwry said plan sponsors need to hear additional answers from Treasury by the early fall in order to have enough time to effectively implement the provision.

“I’m betting that they will meet that target because they get it,” Iwry said. “The last thing they want to do is give another deferral.”

On SECURE 2.0’s “saver’s credit,” Iwry said the provision will provide certain workers with a better incentive to save for retirement and give plan sponsors more assets to oversee.

Under the provision, beginning in 2027, low- and middle-income workers who contribute to a workplace retirement savings plan or individual retirement account will be

eligible for a 50% match on up to $2,000 they put into their accounts, courtesy of the federal government.

For individuals making less than $20,500, that translates into $1,000 if they manage to set aside $2,000. For couples earning less than $41,000, the match can go as high as $2,000 if they put $4,000 in. The matches will be deposited directly into their retirement accounts.

“It doesn’t have any relation to the employer match and the government will put it into your plan if you and your record keeper agree,” Iwry explained. “You can decline to take these; I hope you won’t.”

Brian CroceIn early 2023, International Paper added a stand-alone private real estate fund to two 401(k) plans, which is a mixture of 75% private real estate and 25% real estate investment trusts.