ASteven Pacitti Editor utech-polyurethane

s contests go, you’d be hard pushed to find many as one-sided as this year’s women’s singles final at Wimbledon — sorry, Amanda Anisimova! That’s unless you’re looking at a chart illustrating where the world’s castor oil capacity is produced, because India is way ahead of the competition.

The country’s castor oil dominance gives it a foundational advantage in the bio-based polyurethane economy. But raw material abundance is not enough. To become a global centre of excellence in sustainable PU, India must build a strong regulatory and incentive framework, and scalable industrial capacity. These were among the findings of a webinar we hosted alongside our partners at Media Fusion in July that tackled the issues of future-ready PU, artificial intelligence, chemistry and sustainability, and brought together several experts from across the value chain. It served as a taster for our upcoming UTECH shows in India and the Middle East.

As IAL Consultants project manager Philipp Propst explained, the global share of eco-friendly polyols is expected to grow from 2% today to 34% by 2034, with polyols for flexible foams leading the charge. By contrast, eco-friendly isocyanates are only expected to reach 13% within the next decade. China is investing aggressively in eco-friendly PU, while Europe is setting the regulatory pace. But India’s opportunity lies in becoming a trusted supplier of bio-based alternatives.

Castor oil is abundant in locations such as Gujarat and Rajasthan, and it’s also incredibly versatile, forming the backbone of many bio-based polyols used in applications including flexible foams, coatings, flooring and adhesives. Its potential goes way beyond a niche. And what is particularly beneficial about castor oil is that – in stark contrast to palm oil – it is not found in forest environments. This keeps it clear of the EU Deforestation Regulation, a big advantage in today’s regulated global trade environment.

While the foundations of supply are very much intact, companies including Manali Petrochemicals, Expanded Polymer Systems and BASF India have already shown that industrial-scale commercialisation of bio-based polyols is possible. However, a synergistic e ort among government policy, industrial R&D and global market linkages is needed to turn potential into long-term success.

As Joe Marcinko, principal scientist and president at US-based Polymer Synergies, said during the webinar, if every flexible foam manufacturer wanted to use a bio-based polyol, there simply isn’t enough in the world. Cost is also an issue, and lack of supply plays a big role here. That is why progressive government initiatives are crucial — a good example being the BioE3 Policy, a framework for investment into biomanufacturing. Future-thinking legislation would enable producers and systems houses time to adjust production lines and remain competitive.

Add to that a need for a long-term track record, with studies that prove bio-based alternatives perform well over a prolonged period, and the current limitations in India become clear. The country could become a key supplier of sustainable PU in the future, but whether — and when — it gets there will depend on how it hones its long-term strategy.

continue to spearhead anti-dumping actions against imports

22 Interview The opportunities and challenges facing the domestic industry

24 Technical centres How international manufacturers are embedding themselves in India's domestic market

2 Comment Why India has a foundational advantage in the bio-based polyurethane economy 14 Data Geared up for

VOLUME 42, NO. 4 ISSN 1754-1352 (USPS 012611)

Published in March, May, July, September and December by Crain Communications, Crain Communications Ltd, Urethanes Technology International, Postal address: 11 Ironmonger Lane, London, EC2V 8EY Tel: +44 20 3287 5935

Website: www.UTECH-polyurethane.com

KC Crain, CEO

Chris Taylor, vice president and general manager, Global Polymer Group

LEADERSHIP

Chairman: Keith E Crain

Vice Chairman: Mary Kay Crain

President: KC Crain

Senior Executive Vice President: Chris Taylor Vice President and General Manager, Global Polymer Group: Chris Crain Chief Operating O cer Veebha Mehta

EDITORIAL STAFF:

Editor: Steven Pacitti Tel: +44 (0)7539 857175 Email: steven.pacitti@crain.com

Associate Editor: Sarah Houlton Email: sarah@owlmedia.co.uk

Art Director: Amy Steinhauser Email: asteinhauser@crain.com

Special Projects Editor Jordan Vitick Email: jvitick@crain.com

NORTH AMERICAN OFFICES (Editorial): Don Loepp, Tel: +1 313 446 6767 Email: dloepp@crain.com

INTERNATIONAL CORRESPONDENTS: EASTERN EUROPE: Jarosław Adamowski Email: ajaroslaw@gmail.com

MIDDLE EAST: Hanieh Khakpour Email: hanie.khakpoor@gmail.com

NORDIC/BALTIC: John Weston Email: john.weston.writing@gmail.com

INDIA: Satnam Singh Tel: +91 9811 018353 Email: Satnamsingh14@hotmail.com

Marketing Manager: Steve Faba Tel: +1 313 261 9001 Email: steve.faba@crain.com

Trade Show Sales Coordinator: Lindsay Crawford Tel: +1 (313) 446-5869 Email: lcrawford@crain.com

NORTH/SOUTH AMERICA, UK, OPEN AREAS: Advertising director: Matthew Barber Tel: +44 7739 302081 Email: mabarber@crain.com

NORTHERN EUROPE: Arthur Schavemaker Tel: +31 547 275005, Fax: +31 547 271831 Email: arthur@kenter.nl

SOUTHERN EUROPE: Fabio Potesta Tel/fax: +39 010 570 4948, Fax: +39 010 553 0088 Email: info@mediapointsrl.it

CHINA: Winnie Song, Tel: +86 13810 173625 Email: songwei@wkexpo.com

AFRICA, INDIA, MIDDLE EAST: Taher Patrawala Tel: +971 4 297 0512 Email: taher@mediafusionme.com

KOREA: Min Pyo Tel: +82 31 211 2073 Email: minpyo@hotmail.com

Media Services Director: Sam Abdallah Tel: +1 313 446 0400 Email: sabdallah@crain.com

SUBSCRIPTION DETAILS: £100 Basic Digital; £110 Print; £170 Premium (full access to our website, one year of print issues mailed to you, frequent email news alerts). Four weeks’ notice required for change of address. Note: Subscription payments may be made using all standard credit and debit cards at: UTECH-polyurethane.com/subscribe, where you will find more information about subscription options.

Subscriptions (abonnement) enquiries correspondence: Circulation Dept, Urethanes Technology International, 1155 Gratiot Ave. Detroit, MI 48207, United States. Tel: +1 313 446 0450 Email: customerservice@utech-polyurethane.com Print: Latitude Group Ltd www.latitudenorth.co.uk , Dorset, UK © 2025 Crain Communications Ltd.

13-15 November 2025

NESCO Bombay Exhibition Centre (BEC), Mumbai, India

UTECH India – Sustainable Polyurethane & Foam (ISPUF) Expo 2025 is the leading platform for brands and emerging players in the sustainable polyurethane and foam sector in India. This event offers unmatched opportunities for manufacturers, suppliers, and buyers of PU and foam products to connect with providers of raw materials, components, machinery, and advanced technologies.

New Delhi – Indian polyol suppliers are ramping up capacities to meet surging domestic demand. Despite this, only 15% of polyether polyol demand is serviced from within the country.

The size of India’s polyol market is estimated to be approximately 450kT of polyether polyol and 95kT of polyester polyol annually, according to the Indian Polyurethane Association (IPUA). However, expectations are that this will expand at a CAGR of 8% to reach 2MT by the year 2045, driven by rapid urbanisation and infrastructure development, and growing automotive and construction sectors. Polyether polyol is a critical raw material in foam and CASE applications.

“A major challenge is the low domestic production of key raw materials,” said Sunil Minocha, IPUA’s secretary general. “Local supply chains should boost the growth of the polyol sector as it seeks investment from global players in setting up a manufacturing footprint in India.”

One of the major challenges facing the sector is the lack of availability of propylene oxide in the country. India relies on imports of this feedstock for the production of polyether polyol.

“Propylene oxide must be imported, but as a reactive and flammable cargo, very few ports and vessels can handle it,” said Mahesh Gopalasamudram, deputy CEO of Jindal Poly Films and the former COO at Sheela Foam. “The biggest impediment for domestic growth will be availability of this key raw material.”

He believes that India’s aspirations for self-su ciency could ultimately lead to one of the larger petrochemical companies producing propylene oxide in the country. “India, being a supply-driven economy, will increase local consumption in applications including propylene glycol, dipropylene glycol and polyols,” he said.

The Indian polyols market is estimated to be valued

at around $2.5bn to 3bn. However, price volatility in the international market and tightening emission controls remain a challenge for domestic producers.

“Import dependency and price volatility of raw materials like propylene oxide, ethylene oxide and isocyanates, environmental regulations concerning manufacturing emissions, and competition from imports, especially from China, are major challenges for the industry,” added Keshav Goyal, executive director at Shakun Industries. “There is a need for technological advancements to produce bio-based and high-performance polyols.”

To bridge the demand-supply gap, several companies are reported to be evaluating a possible entry into polyol/ isocyanate production in India, but o cial announcements are still awaited. Meanwhile, major domestic producers like Manali Petrochemicals and Expanded Polymer Systems are investing in the expansion of their capacities by developing greenfield projects as well as installing additional lines. Both companies are primary domestic producers of polyether and polyester polyols.

Manali Petrochemicals, for example, is investing in a sys-

Bengaluru – Footwear manufacturer VKC Group has introduced a range of TPU-based footwear under the Go Plant.D brand. The shoes are designed for circularity and will be sold via an e-commerce business model with a “recycle, renew and resell” focus.

The zero-waste footwear is made via TPU moulding, followed by assembly. The shoes can then be sold back to the company for recycling at end-of-life. The company said that while sustainable products usually have high prices, these shoes will be launched at a more a ord-

able price to appeal to the mass market.

“To promote sustainability, the Go Plant.D range will follow the 3 Rs model where the product and material can be reused, refurbished and recycled,” said MD Abdul Razak. “It will be 100% recycled and reused. The expected life is about six to eight months, and post-use, it can be returned to the company for recycling.” Returns can be made via a courier, or at designated company-owned outlets.

More than 80% of VKC Group’s footwear production is based on TPU. Production

of the latest range started at a new site near Kozhikode at the end of May. “We are investing more than INR 400 million ($4.7m) in the site, which will have the capacity to produce 10,000 pairs each day,” Razak said.

Elsewhere, as part of its overseas expansion plans, the company opened a PU footwear site in Dar es Salaam, Tanzania, about a year ago. It also has a site in Colombo, Sri Lanka. “The Tanzanian site opened at the beginning of 2024 and has the capacity to produce 5,000 pairs per day,” Razak said. “It

tems house in Saykha (Gujarat) that will produce 30kT of formulated polyol per year, with commercial production expected to start in 2027. Expanded Polymer Systems is also expanding its polyols capacity with the installation of a third line at its Dahej (Gujarat) site.

Another Indian company, Shakun Industries, has expanded its polyols capacity to 6kT/year at its Dadri site in the North Indian state of Uttar Pradesh. Despite capacity building by domestic producers, there remains a huge gap in supply and demand. Makesh Bhuta, chairman of Expanded Polymer Systems, explained that there will always be the challenge of heavy dumping of low-cost materials from countries such as China.

CASE and rigid foams are also areas with growth potential in India as their proportion of the overall PU market is much lower than in more developed countries.

IPUA’s Minocha added that biopolyols present a good opportunity in India, as work has already commenced in that area. He urges global players to partner in India for this research. Re-polyol is another area of opportunity where India can provide an economical base for research.

provides a foothold in the African market, which has huge potential to grow.” VKC operates a total of 16 footwear sites. The other 14 are in India.

New Delhi – The rapid growth of the Indian domestic airline sector means there is a huge opportunity for PU upholstery, according to Poonam Bhardwaj, global business head at Vandana Aircraft Services. She was speaking at the Aircraft Interiors India show in New Delhi.

“The growth potential is huge as more than 1000 aircraft are going to be inducted in various airlines in the next five years, opening a big market opportunity for enhanced aircraft interiors with PU upholstery,” Bhardwaj said.

India now has the world’s third-largest domestic airline market, after the US and China. Commercial carriers currently operate more than 800 planes, according to the country’s Directorate General of Civil Aviation. This is set to expand, as three major Indian carriers have ordered more than 1100 aircraft in the past 18 months: Air India ordered 470 planes, with private carriers Indigo and Akasa Air ordering a further 500 and 150, respectively.

Gurugram-based Vandana specialises in refurbishment and maintenance services. It operates sites in Delhi and Neemrana, where it manufactures PU-based seat covers, armrests and headrests, and

Bhardwaj: lightweighting advantages

panel trims. These have applications in both commercial and private aircraft.

“The application of PU is increasing as it is more durable, safe, provides optimal comfort with soft touch, minimises noise and vibrations, is easy to clean and maintain, allows customisation, and is lightweight,” Bhardwaj said.

“We always stock 15,00020,000m of PU in a variety of colours and textures to compliment diverse aircraft interior designs,” she said. The Neemrana plant was built to cater to the growing demand from the Indian aviation sector.

The company is also working on a military-grade PU product for the country’s armed forces.

Pune – Italian machinery maker Cannon is hoping to double Indian sales of its A-Prima high-pressure dosing line this year. It has already sold 10 of the systems since it initiated production in Chakan, Pune, in mid-2023.

The company's sales and marketing corporate director, Pierre Termoz, recently outlined plans to expand the machinery range at Chakan, including the production of what he called “more complicated machines”, but he added that this would be market driven. “We do not want

Mumbai – The Sustainable Castor Association has set a target of bringing nearly a third of India’s castor farming under its Sustainable Castor Caring for Environmental & Social Standards (SuCCESS) code by 2030. The code aims to make castor farming more sustainable while improving farmer income levels.

With certified castor farmer numbers surging from 1000 to 15,000 during the past decade, the association has launched an ambitious programme that includes scaleup of farming implementation projects, digitalisation of the SuCCESS code, and a study of labour practices.

Castor oil derived from castor beans and its derivatives are used extensively in the industrial manufacture of biobased polyurethanes. The Indian states of Gujarat and Rajasthan are the major castor growing regions.

An independent study conducted in 2022 by Thinkthrough Consultants found that farmers adopting the SuCCESS code enjoyed 30% higher income than those who were not certified. A

life cycle assessment study conducted by Sphera International in 2024 also highlighted that castor farming according to the code resulted in a 30% reduction in all major impact categories.

In 2016, a baseline study of more than 1000 castor farmers found that castor is favoured for its high profitability and low input cost. This same study was the foundation for the Pragati Project – a collaboration by Arkema, BASF, Jayant Agro and Solidaridad – to create the world’s first sustainable castor farming and supply chain codes.

Under the SuCCESS code, about 15,000 farmers have been trained, audited and certified, and more than 150,000t of certified castor seeds have been cumulatively cultivated.

"Over 16,000 hectares are farmed in accordance with the SuCCESS sustainable castor code,” said Sanjay Sailas, general manager of the association. “Certified farmers are now increasing their land dedicated to castor farming as it is seen as a profitable crop."

to move fast as expansion in local production requires an understanding of the market and designing products as per the requirement of the market,” he said.

The A-Prime high-pressure PU dosing unit features 100L tanks with level control and automatic refilling, heat exchangers, recycle stream distributors and filters for pump protection.

“The critical component comes from Italy,” Termoz said. “The machine has a localisation level of 30%, with 70% sourced from our manu-

facturing base in Europe.”

Commenting on the competitive nature of the Indian market, Termoz explained that the machine is priced 30% higher than competing machines in India. However, he pointed to higher levels

of quality, reliability, servicing and the availability of spares.

The Cannon Indikos site, which is in the western Indian state of Maharashtra, produces technology to support reactive polymer processing, including polyurethanes and composite products. The Indian venture also o ers complete turnkey solutions for a full range of PU, epoxy and carbon fibre-reinforced polymer technologies, from chemical storage to metering, injection and beyond.

Gurugram – Kingspan Jindal is expanding its Pithampur site in the central Indian state of Madhya Pradesh. The Indo-Irish JV, which specialises in insulated sandwich panels, is developing both vertically and horizontally, growing the site in terms of capacity and product portfolio.

In an exclusive interview with Urethanes Technology International, MD Saurabh Jindal said: “We are expanding our production capabilities for all three verticals we are presently working in. We have additionally acquired five acres of land, adding to the existing 10 acres of land at Pithampur.”

Kingspan Jindal operates two sites across Nalagarh (Himachal Pradesh) and Pithampur (Madhya Pradesh). The latter currently operates a single line, with a second to be installed during the expansion to double capacity.

“Upcoming line capacity is about 250,000m2/month,” Jindal said. “Currently, the plant is functional on one line with 80% capacity utilisation and can produce typically between 300,000 and 350,000m2/ month. Once the additional line becomes functional, capacity would be doubled to 600,000m2/month.”

The company is also mulling over new vertical opportunities. These include opening up a retail network and expanding its portfolio of insulation boards for residences, ceilings and portable housing.

The Indian JV generated revenues of INR6bn ($69.7m) last year and is growing at a rate of 20% year on year. Business is divided into three verticals: insulated sandwich panels, clean room partitions and architectural building envelope. This includes parabolic roofs as well as facades. The insulation panel business focuses on sectors such as cold storage, industrial buildings, warehouses, poultry and slaughterhouses.

“We are investing about INR1.5bn in the ongoing expansion, and the expanded plant would likely commence

commercial production by March 2026,” he said.

The two Indian sites o er a wide range of insulation panel products to the domestic market and caters for the subcontinental markets of Bangladesh, Nepal, Bhutan, Maldives, Mauritius, Seychelles and Sri Lanka. Commenting on the potential of the regional markets, Jindal said: “Sri Lanka and Bangladesh are promising markets with a lot of potential to grow, but China is o ering us sti competition in these markets. We hope to gradually increase our footprints in these markets.”

The Gurugram-headquartered company conducts about 700 projects of various sizes per year, with the average project size in the 50006000m2 range. “We are doing around 3m m2/year, so divided by 5000m2, it is around 600 to 700 projects in a year.”

Among the landmark projects carried out by Kingspan Jindal is Bharat Mandapam,

regarded as one of the largest convention centres in India, located in the middle of capital New Delhi. “We have been engaged in doing cladding for a semiconductor site for Micron Technology in Sanand (Gujarat), besides the data centres of Microsoft and Google. We are also doing a lot of work for FMCG companies like Nestle and Coca-Cola.”

India’s insulation panel market is experiencing solid growth, and Kingspan Jindal controls 20% of the market. The vertical business is growing at more than 20% CAGR. “The total insulation panel market size in India is valued at about INR25bn annually or equal to 15m m2,” he said.

The clean-room segment is also growing at a rapid pace on the back of Indian government Production Linked Incentive (PLI) schemes. There is specific allocation under PLI for the pharmaceutical and electronic sectors to encourage cleanroom development. In the

Jindal: Expanding production capacity

past, the clean-room market was restricted to two sectors – pharmaceutical and automotive – but now it is expanding rapidly to the electronics sector with companies like Foxconn, ATL batteries, Veris and Tata investing in clean room.

In the clean-room sector, the partition wall market is close to INR30bn/year. “The clean room is segmentised further as there are di erent classes of clean rooms. The entire ducting and HVAC business in clean room will be another INR25bn to 30bn annually,” Jindal said.

Kingspan Jindal sources chemical feedstocks like MDI, isocyanate, polyols and catalysts from the likes of BASF, Dow, Covestro, Huntsman and Wanhua. “We source chemicals from them, but we do our own blending and mixing to create recipes in-house.”

Kingspan Jindal is a JV between Kingspan and Jindal Mectec. Kingspan holds the majority stake, while Jindal Mectec has management control.

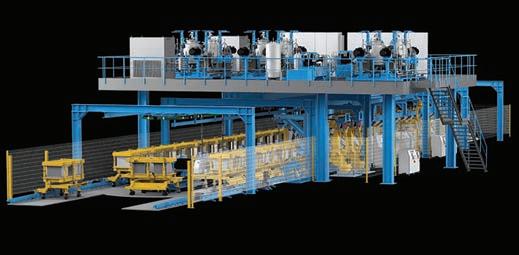

Kanchipuram – Shaya Polymers is investing in machinery from Laader Berg for a cutting-edge foaming line at its site in Kanchipuram, about 70km from Chennai, as it investigates expansion into new foam-based verticals. The investment will integrate advanced foam production into the company’s existing manufacturing facilities.

Shaya specialises in technical foam for products such as furniture, mattresses and high-end automotive components. It will install a Multimax foaming machine from Laader Berg at the site. This can produce a diverse range of foams, including standard, HR, hypersoft, visco and FR foams.

“We are investing INR500m in an ongoing expansion project, covering the procurement of advanced machinery, infrastructure upgrades and capacity enhancements,” said Ram Sai Yelamanchili, chairman and MD of Shaya Polymers. “This significant investment will support the installation of the new Laader Berg produc-

tion line and overall facility improvements to boost production capabilities.

With the Laader Berg production line becoming operational in Q3 of the 2025 fiscal year, Shaya Polymers' total manufacturing capacity increases multi-fold. This significant expansion will provide a strong competitive edge, enabling it to strengthen market presence across various sectors.

Shaya Polymers produces specialised automotive-grade PU foams used in critical vehicle components. These high-performance foams are

supplied to leading Tier 1 automotive suppliers that incorporate them into vehicles manufactured by major automakers. The company's foam solutions currently feature in several popular vehicle models across di erent segments.

While Shaya Polymers' Tamil Nadu facility primarily serves the domestic market, the company is actively preparing for international expansion.

“Following the commissioning of the new Laader Berg production line, Shaya Polymers plans to begin exporting to key overseas markets, including the Middle East and Southeast Asia,” Yelamanchili said. “The enhanced production capacity from the expansion will enable the company to meet both growing domestic demand and explore new opportunities.”

He explained that the company is also planning to expand into customised moulded foams and is exploring PU foam solutions for specialised packaging applications. It is also evaluating opportunities in specialty foam segments to

diversify its product portfolio.

“These new verticals complement the existing business while addressing emerging market needs,” he said.

Meanwhile, the company has also started a collaboration this year with Pioneer Coldstore & Cladding (PCC), which is regarded as an industry leader in insulated panels and cladding. The partnership combines Pioneer’s panel manufacturing prowess with Shaya’s expertise in PU chemistry, setting the stage for breakthrough innovations. The “ZED” rated PCC o ers a wide range of external and internal cladding solutions to designers, and the Chennai-based company has installed capacity to produce more than 200,000m2 insulated panels per month. These panels are produced with pentane as the blowing agent.

At the start of this year, Shaya Polymers acquired ICOL Chemicals. The business offers adhesive for a range of applications in footwear manufacturing, furniture production and automotive sectors.

Gujarat – Manali Petrochemicals is investing in a systems house based in the Indian state of Gujarat and ramping up glycol capacities at its existing site in Chennai. The company is also doubling its propylene glycol capacity and was hoping to commission this plant by the end of July.

“The expansion in Western India involves setting up a systems house at Saykha in the Bharuch district of Gujarat,” said COO Shivaram Narayanan. “The proposed systems house will produce 30kT a year of formulated polyol, targeting automotive, footwear and energy-ecient sectors.”

The land acquisition for

the proposed greenfield expansion has already been completed, and construction will start by the end of the year, with commercial production set to commence in early 2027.

Manali plans to invest INR1.3bn ($15.2m) in the

Gujarat expansion, according to a filing with the stock exchange. It will serve the country’s northern, western and eastern markets as well as the export market.

The considerable transportation costs of supplying from its southerly Chennai site to other parts of the country had made the company’s products less competitive.

“There are no margins left in the flexible slabstock polyol (FSP) business mainly due to competitive pricing attributed to imported FSP entering the domestic market, leading to negative pricing impacting our profitability,” Narayanan said. Manali is the only producer of FSP in India.

Manali is also hiking glycol capacity at its main Chennai site. The company aspires to become India’s major producer of propylene oxide, propylene glycol and polyols by 2030.

“We are doubling propylene glycol capacity from the existing 22kT/year to 44kT at Chennai,” Narayanan said. “The additional capacity will be available for commercial production by the first quarter of fiscal 2025-26.”

The expanded capacity of propylene glycol will serve the food, beverage and pharmaceutical sectors. Manali is part of the Singapore-headquartered $2bn-plus AM international group.

Tamil Nadu – Momentive Performance Materials is exploring plans to establish a site in Mexico as part of its ‘In the region, for the region’ strategy.

VP Nalian, the company’s president and general manager of the performance additives business, told Urethanes Technology International that expanding into Mexico is part of its “footprint strategy”, although the idea remains at a very early stage. “This is part of a larger strategy of building our supply chain in the region, with 80% catering for the local market,” Nalian said.

Besides Germany, Italy, Brazil and its home in the US, Momentive currently has a footprint across Japan, Korea, China, India, Thailand and the UK.

The company is currently investing $35m in a new facility in Rayong, Thailand, which would likely be commissioned in July. This would be Momentive’s seventh global site for the supply of PU additives and its second in Thailand. It would enable Momentive to build a more robust and flexible supply chain for its customer base in the region.

In India, Momentive is embarking on a second phase of expansion. This will allow the

company to double its capacity from 15kT/year to 30kT/year.

The company’s previous significant investment in the region was a $25m spend in 2014.

“We are a speciality chemicals and material company, and we have to secure certain regulatory approvals,” said Balaji B, Momentive’s South Asia segment leader for PU slab. “We got all the required per-

mits for expansion, and gradually we've been adding asset capacity in alignment to those permits.” About 20-30% of its Indian production is exported to Africa and the Middle East.

India is a strong market for flexible slabstock, and Momentive has been rolling out new products in the region. These include the medium potent silicone surfactant Niax Silicone

L-540AP, which is said to o er broad processing latitude for conventional foam from low to high densities, including both pure and filled foams.

“We have also introduced medium-potent FR silicone L-645, designed to reduce the flammability of flexible PU foams,” said Gabriel Kiss, global segment technology leader for PU slab. “By using this grade slabstock foam, producers might save 10-20% liquid flame retardant and still maintain good FR properties.”

The company has also launched Geocell catalyst D-25 for foam processing. This high-gelling metal catalyst is designed to replace stannous octoate in the production of flexible PU foam and will help foam meet certification requirements of Certipur and Ikea, among others.

Momentive is focused on three major areas: e-commerce, products that adhere to regulatory framework, and sustainability. “On the specialty application side, the focus is on e-mobility, moulded seats, electronics, noise, vibration, harshness and battery,” said Thuan D Nguyen, the company’s senior global business director for PU slabstock additives.

Noida – Cardolite is planning to expand the capacity of its Indian site in Mangalore. The company, headquartered in Pennsylvania, US, uses cashew nutshell liquid (CNSL) to manufacture specialty chemicals, including polyols.

“We are doubling the capacity to 100,000MT/ year, adding an additional 50,000MT/year to the current capacity,” said Shailendra Bhatkhande, Cardolite’s VP for global operations.

The company has two CNSL-based manufacturing sites. As well as the plant in Mangalore, it has a second in Zhuhai in China’s Guangdong province. The Mangalore site was commissioned in 2013.

Cardanol is distilled from CNSL and is the primary building block for Cardolite polyols and derivatives. Bhatkhande said the long aliphatic sidechain of cardanol adds valuable intrinsic benefits to foams made using these polyols.

“We are also introducing a new bio-based product vertical having application in PUbased footwear, coatings etc in early 2026,” he said.

The company declined to share details of the size of the investment in the Mangalore

expansion. However, it did say that it was being funded through internal accruals.

The site is in Mangalore’s special economic zone. About 85% of its production is expanded to the US, Europe, Middle East and SE Asia, with the remainder consumed by the market at home in India.

“The shipments to the US market are expected to be exposed to the proposed new tari regime, which is under 90-day pause,” Bhatkhande said. “Hopefully, something positive emerged out of the new BTA under negotiation between both countries.”

Currently, the Cardolite India business is growing at an annual rate of 15%.

Hyderabad – Shree Malani Group has expanded the production capacity of its site in Bhubaneswar by 50%. The facility is located in the eastern province of Odisha. The expansion project started in 2023, and was completed in 2024.

It has added 7500m2 to the site. Equipment includes a 60m looper, cutting equipment, storage and handling systems, and metering lines.

“The expansion will cater to the growing demand in the eastern part of the country and overall in sync with the growth that India is going through, including in technical foams and the automotive industry,” said Avinash Daga, technical director at Shree Malani Foams.

The company said the site is the largest foam plant in eastern India. It also supplies the states of Chhattisgarh, Bihar, Jharkhand, West Bengal, Sikkim, Assam, and other north-east states.

Shree Malani Foams operates two foam-based mattress manufacturing facilities. As well as the Bhubaneswar plant, which was first commissioned in 2021, it has one of India’s largest integrated

plants, located in Hyderabad.

Elsewhere, the company has cut its CO2 emissions by a total of about 1.6kT in 2023 and 2024. The reduction in 2023 was 1.3kT, with a further 300T eliminated in 2024.

“We have installed a rooftop solar power plant,” said Daga. The company is also now us-

ing 100% biodiesel for steam generation, further cutting its greenhouse gas emissions.

In addition, this year it is converting its diesel-fuelled generators from high-speed diesel to biodiesel. It aims to cut a further 250T of CO2 emissions in 2025, which it said will move it to 97% on the Sustainability

The Telanagana-based mattress producer declined to give a timeline for achieving carbon neutrality. “We continue working towards achieving carbon neutrality over a period of time,” Daga said. Carbon neutrality: Shree Malani continues to progress sustainably

Development Index. It is also focusing on the use of more sustainable raw materials.

European PU companies with a long-term Indian presence are keen to expand their footprints, on the back of growing international trade volatility, supply chain challenges and ongoing tari uncertainty. These include Italian company Coim, which operates a site in Bahadurgarh in the north Indian state of Haryana. It sees potential for an important investment in the country in the coming year.

India is also emerging as an interesting market for Hennecke, with several installations lined up for the months ahead. Hennecke has held a dominant Indian market share in continuous slabstock machinery for almost two decades, is growing by double digits annually, and operates a sales-service o ce in Hyderabad, the capital of the south Indian state of Telangana. Machinery is supplied from the company’s locations in Singapore, China and Germany.

“The volatility in tari s poses a challenge, and Hennecke

thinks deeper on the India market, where it has a leadership position as a foam machinery supplier,” said MD Rolf Tripper. “India is a key growing market for us. Discussions are at management level to further hike our involvement in India, but no final decision has been taken. We are evaluating various options, and it is too early to comment.”

The company will soon be installing a Multiflex line at Shakti Foams, which marks its 25th continuous slabstock machine on the subcontinent. The line features the latest in material-saving, high-pressure technology. Furthermore, the liquid-laydown system, combined with flat-top system, is claimed to ensure a particularly homogeneous foam structure along with high raw material e ciency.

Hennecke is also increasing its commitment to the moulded foam sector, with two WKH foam moulding plants to be installed in India this year. These systems allow for the

fully automated manufacture of moulded foam parts such as seats, backrests and headrests. They are specifically designed for demanding applications in the automotive industry where damping, insulation, sensory experience and appearance are key.

Norwegian foaming machinery producer Laader Berg is bullish about the Indian market after its home country of Norway signed a historic trade deal with India last year. Norway and the other three European Free Trade Association (EFTA) countries – Iceland, Liechtenstein and Switzerland – reached an agreement envisaging zero tari s on almost all exports to India.

“The Free Trade Agreement (FTA) could be a great advantage for us at a time when the ongoing tari war poses a seri-

ous challenge to international trade,” said MD Per Henning Vaagen.

Laader Berg currently sells between one and three lines a year in India. “The FTA will provide us an opportunity to grow in India, where foam consumption is comparatively low at 0.2kg per person compared with Europe’s 1.7kg, which indicates potential for growth in this market,” he said. “India has all the growth indicators like fastest-growing GDP, a growing middle class, a stable political system and a homogenous market.”

Currently, Laader Berg supplies foaming lines under the Multimax Pro, Maxfoam 5025, and Maxfoam compact brands to the Indian market. It also recently sold a Multimax Pro to Chennai-based foaming company Shaya Polymers.

Dahej – UAE-headquartered Pearl Polyurethane Systems is increasing its presence in India by setting up a systems house in Dahej in the western state of Gujarat. Dahej is a key industrial and port city, with a major chemical and petrochemical industry presence. The company declined to share financial information on the investment.

Slated for startup at the end of the year, the Dahej systems house will add polyol formulation capacity for sectors including construction, transportation, refrigeration automotive and footwear. The site will also produce pre-polymers for CASE applications during this first phase.

“Our business is growing significantly, and expansion is in line to meet surging

commitments in India,” CEO Martin Kruczinna said. “We have expanded in the UAE, and opened a new production site in Hi Chi Minh City in Vietnam last October. The India expansion is to be near to our customers with a local production base.”

A second phase is also being planned in Dahej. During the next two or three years, Kruczinna said, the aim is to backward-integrate into the production of polyester polyol. The facility is expected to become one of the company’s biggest operations over the coming few years. Read more about this on page 26.

Pearl continues to expand its footprint across the Middle East and North Africa region. Its new systems house in Ain-Sokhna, Egypt, opened

in late May and is the company’s sixth site. It also opened sales o ces in Melbourne, Australia, and Santiago, Chile, in July 2024.

Group also operates three sites in the UAE, and one each in Saudi Arabia and Vietnam. It has sales o ces in multiple locations.

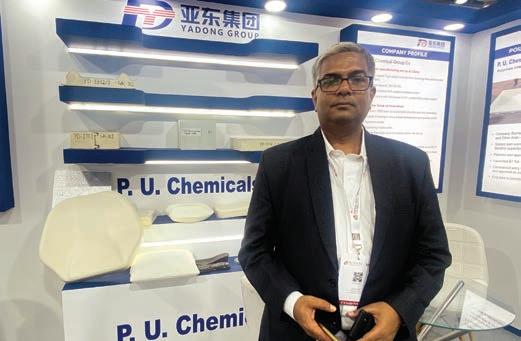

Maharashtra – China’s Yadong Group (Hebei Yadong Chemical Group) is investing in a systems house in the Thane district of Maharashtra via its Indian subsidiary PU Chemicals. The Bhiwandi site, about 50km from Mumbai, will produce blended polyols for flexible foam.

The move comes as Indian imports of polyether polyols and flexible polyols from China jumped significantly in the first quarter of 2023, rising to 120%.

India has imposed an anti-dumping duty on polyether polyol imports from China to protect the domestic industry.

“The Bhiwandi system house will become functional in the next two to three months, and we are now awaiting final government approval for starting commercial production,” Arvind Jha, business head for Asia-Pacific at PU Chemicals, told Urethanes Technology International. “Ini-

tially the systems house will produce 1kT of blended polyol for flexible foam per month.”

Yadong Group’s Indian arm has achieved double-digit volume growth since 2019 and has successfully implemented a cyclopentane-based preblended system for flexible foam in India and the wider subcontinent. It also operates

four warehouses in Delhi, Chennai, Kerala and Bhiwandi.

“India is emerging as one of the biggest markets for polyurethane,” Jha said. “Volumes and applications of PU are growing in India, with the former expected to double over the next five to six years.”

PU Chemicals currently imports finished product from

China to sell in India, and while the upcoming systems house will produce blended polyols for flexible foam, polyols for rigid foam will continue to be supplied from Hebei in China until the Bhiwandi site is upgraded within the next six months. The company said shipments from China currently take more than 30 days to arrive at the Indian port.

Yadong Group operates across six product categories: polyether polyols for rigid foams, flexible foams, high resilience foams, CASE, mining safety and polyol systems. Applications include home appliances, footwear, automotive, houseware and furniture sectors.

The Hebei site produces 200kT of polyether polyol. The group operates two research centres in China, one located at its headquarters in Shijiazhuang and the second in the Shanghai free trade zone.

Tamil Nadu – Indian mattress firm Duroflex has opened its seventh site in Kelamangalam, Hosur, in the southern state of Tamil Nadu.

Commercial production started in May 2025, and the company said the plant will enable it to better meet future demand with greater speed, e ciency and consistency.

Mathew Thomas, Duroflex president and business head, said Hosur o ered a strategic advantage with robust infrastructure, an industry-friendly environment and strong connectivity to major markets in southern India.

“Its proximity to Bengaluru ensures logistical e ciency and access to a broad talent pool, while Tamil Nadu’s deep-rooted manufacturing ecosystem provides the right conditions for streamlined and scalable operations,” he said. “The region aligns well with our long-term growth plans, making it an ideal base for expansion.”

Headquartered in the capital

city of the south India state of Karnataka, Duroflex operates seven manufacturing sites across India. It has a cumulative annual capacity of more than 1 million mattresses.

The plant is equipped with a combination of locally sourced and imported machinery to ensure high-quality, e cient production. “We’ve partnered with international and domestic brands such as Elektroteks, Dolphin Pack and AS Enterprises,” Thomas said. “This hybrid approach enables it to maintain global manufacturing standards while leveraging India's robust industrial capabilities.”

State-of-the-art infrastructure and integrated operations mean the Hosur site will become “one of the most modern and streamlined facilities in this category in India,” he said. It brings multiple manufacturing processes under one roof, ensuring end-to-end e ciency, enhanced quality control and faster turnaround times.

Commenting on future expansion, Thomas said: “We’re

already present across all major markets in India and continue to expand into emerging pockets where there is strong consumer presence.”

Exports have always been an integral part of Duroflex’s business strategy, he said, with clients across North America, Europe, the Middle East and Southeast Asia. “While our focus remains on scaling within India’s high-growth market, we continue to engage with global partners through select

institutional channels,” he said. With plans for an initial public o ering by the end of 2026, the company estimates the Indian mattress market to have been worth around INR19bn in 2024, projected to grow at a CAGR of 7% to reach INR330bn by 2033. PU foam mattresses dominate with nearly 58% market share, and flexible PU foam is expected to grow at a strong CAGR of 10% through 2030.

Duroflex continues to focus on sustainability and, for the past three years, all its premium mattresses have featured fabric made from 40% recycled PET yarn, helping it to divert more than 2 million plastics bottles from ending up in ocean beds. Additionally, the company regularly runs mattress and furniture exchange programmes, encouraging responsible disposal and the prevention of old mattresses from reaching landfill. These initiatives, Duroflex said, reflect a long-term commitment to reducing environmental impact.

New Delhi – As PU foam manufacturing continues to evolve, e cient space utilisation, workflow optimisation, material integrity and cost e ciency are critical to maintaining smooth operations.

AS Enterprises (ASE) has designed a rack storage system to address these challenges by providing structured, high-capacity storage that enhances operational e ciency while significantly reducing material wastage and improving overall cost-effectiveness. The role of rack storage in PU foam production involves handling large foam blocks that require proper curing, storage and accessibility for further processing.

“Without an e cient storage system, manufacturers often face challenges such

as space constraints, product deformation and workflow disruptions – all of which impact productivity and quality,” said CEO Anurag Purie.

ASE’s system delivers a customised, high-capacity solution, allowing manufacturers to streamline oper-

Rack ‘em up: storage system for foam manufacturers

ations, minimise material wastage and maximise available space e ectively. The system helps manufacturers achieve substantial savings, particularly due to front skin preservation and lesser overall wastages, ensuring better resource utilisation.

The system is designed for high-capacity foam block management, featuring a heavy-duty storage rack capable of accommodating blocks of 20, 30 or 60m, ensuring optimal space management. A long feeding conveyor with a lift-and-shift mechanism enables seamless movement, facilitating e cient placement within the racks and ensuring easy retrieval of foam blocks.

“Built on a robust heavy-duty steel structure, these racks o er durability and precision, supporting foam blocks up to 1.4m in height. Ventilation and airflow management are strategically integrated, ensuring proper curing conditions, reducing moisture retention, and preventing deformation,” Purie said.

Jaipur – Scientists at Manipal University Jaipur have looked at the potential of integrating phase change materials (PCMs) into mattress foam to improve its heat dissipation characteristics.

By systematically varying the levels of PCM, the foam’s density and airflow optimisation strategies, they looked for the most e ective combination for thermal comfort and temperature regulation.

PCMs can regulate mattress temperature by absorbing and releasing heat, they said. This helps provide consistent comfort, particularly in extreme climates in the absence of air conditioning.

Eight di erent PU foam configurations were investigated. Two di erent types of foam were studied, both with and without PCMs: a 32kg/ m3 high-density foam and an 18kg/m3 low-density foam. These four combinations were all tested with ventilation holes.

The PCM used in the study, sodium carbonate decahydrate (SCD), was packed into aluminium pouches and placed on top of each foam layer within the testing chamber. SCD was chosen because of its high latent heat and thermal stability.

In all, 12 thermocouples were placed at the top, mid-

dle and bottom layers of each mattress, plus another at ambient temperature. These allowed temperature variations to be monitored continuously. The heat was generated by three 40W incandescent lightbulbs, as this gave a similar heat output to the human body’s release rate.

The high-density foam mattress with no PCM showed a moderate increase in temperature, with limited thermal regulation. The PCM-free, low-density form performed a little better. Incorporating PCMs gave significant improvements in thermal regulation, with the best results seen with the low-density foam.

In the versions with ventilation holes, some improvement was seen in thermal performance across the board. However, their ability to enhance thermal regulation was limited. Again, the version with low-density foam and PCMs gave the best results.

Ultimately, they determined that the low-density PU foam mattress with PCMs looked most promising in terms of improving thermo-regulatory performance. This, they suggested, makes it a viable option for those looking for a cooler mattress.

The work has been published in the journal Discover Applied Sciences

Secunderabad – In an attempt to overcome the challenge of heat generation in foam and memory foam mattresses, especially in summer, Centuary Mattresses has introduced Q-Gel mattresses. The new range utilises the natural cooling and heat management properties of copper.

“Q-Gel stands for our innovative mattress collection developed by harnessing copper's natural cooling and antimicrobial/antiviral properties to create a truly innovative mattress technology,” said Uttam Malani, executive director of Centuary Mattresses, which is part of Shree Malani Group.

The Telangana-based mattress producer claims most brands, even larger ones, seem to readily ignore the problems connected with a foam or memory foam mattress, which gave Centuary an opportunity to innovate and lead. The company’s proprietary CuSense (or copper sense) technology brings the magic of copper crystals infused in memory foam to

ensure a cool sleeping experience, while ensuring adequate orthopaedic relief to the body.

“We've infused solid copper particles into conventional PU foams and also memory foam to combine copper's natural cooling and antimicrobial benefits with the plush softness of memory foam, so while the foam maintains its shape adaptability, the copper gels work in dissipating the heat away from the surface where the body is in contact with the mattress,” he said.

foams are used to guarantee they are free from harmful odours and emissions. Also, the use of natural materials helps the product score highly on health and hygiene parameters.

The company said the Q-Gel mattress collection, inspired by nature, is built to excel on all three fundamental parameters that any good mattress should exhibit: comfort, support and surface feel. Certipur

The group produces all of its mattresses and mattress components in-house. The Q-Gel collection is produced at two of its strategically located manufacturing sites in Hyderabad (Telangana) and

Bhubaneshwar (Odisha).

“The Q-Gel collection already contributes more than 10% of Centuary's domestic market revenues, and with more products being added to this segment, it should easily account for nearly 20% of the sales in the year to come,” he said.

The Q-Gel series starts at a thickness of 15cm.

The mattresses are categorised in the premium to luxury end of the market.

India’s polyurethane sector accelerated to a 9.2% growth rate in 2024, driven by robust end-use industries and supportive policy tailwinds. From adhesives to foams, manufacturers are scaling up capacity, innovating with bio-based chemistries and low-VOC systems, and positioning India as a leader in Asia’s PU landscape.

Flexible foam (50%) remains the backbone, majorly used in bedding, furniture and automotive seating. Production climbed 10% in 2024 as retail and hospitality demand surged. Rigid foam (22%) – notably sandwich panels for cold chain and prefab buildings – grew 11%, aided by new plants and government cold storage schemes.

Elastomers (21%), largely for footwear soles, rose 7% on the back of export orders and premium shoe trends, and adhesives and sealants (4%), coatings (2%) and binders (1%) are smaller but fast-growing niches, each advancing between 8–9% last year.

Production of PU adhesives and sealants in India has increased significantly due to the country's infrastructure and manufacturing boom, with a nearly 10% increase last year. This expansion is due to projects in rail, road and renewable energy as well as the completion of Phase III of Henkel's Kurkumbh plant. PU adhesives now account for the majority of bonding solutions in the automotive segment.

Thermoplastic polyurethane (TPU) elastomer is still mostly imported despite its growth, although new domestic investments in compounding and filmmaking have been made possible by recent antidumping duties on Chinese TPU.

Most segments sustained – or even accelerated – their 2023 gains. Flexible foam, coatings and rigid foam contin-

ued double-digit expansion, while adhesives and binders maintained high single-digit growth.

Elastomers saw an uptick in 2024 after a modest 4% rise in 2023, reflecting renewed investment in footwear and industrial seals.

Over 2021-2024, adhesives and sealants and flexible foam logged the strongest CAGRs (~10–13%), with rigid foam close behind. Despite slower base growth, elastomers and coatings are expected to rebound, reaching 8-9% annual growth by 2025. This steady trajectory underscores India’s ongoing infrastructure build-out, housing schemes (PMAY), and expanding automotive, packaging and footwear exports.

Data in this article is extracted from the latest edition of IAL’s Polyurethane Chemicals and Products in Asia-Pacific , published in June 2025. For more information contact ial@brggroup.com.

More charts are available in the online version of this article published on utech-polyurethane.com.

15-17 September 2025

UTECH MEFPU is the region’s only dedicated technical Foam and Polyurethane exhibition and conference.

UTECH MEFPU has proved to be an ideal platform for leading brands as well as emerging players from the technical foam and polyurethane sectors to showcase their innovations and new technologies to their potential business partners from across the globe.

For more

and to book, contact Matt Barber on +44 7739 302081 mabarber@crain.com

The Indian PU sector is ready for a breakthrough, but problems still exist, reports Eugene Gerden

India’s polyurethane sector is steadily growing because of sharp improvements in the country’s economy and the ongoing implementation of large-scale construction and infrastructure projects. A significant percentage of them were suspended during the Covid pandemic. India was particularly badly a ected, and the PU industry was paralysed between 2020 and 2021 – but completion of these building projects is now expected in the coming years.

India’s PU industry has since returned to pre-pandemic performance levels, helped in no small amount by supplies of cheap Russian oil, which helped ensure annual economic growth of up to 8% annually during the period 2023-24. The

bulk of this oil was redirected to the Indian market from the west after the refusal of companies there to buy Russian oil, leading to discounts of up to 50%. Such strong economic advantages have helped India position itself as potentially one of the world’s third-largest economies within the next two years. It is currently fourth.

According to the Indian Polyurethane Association, the PU sector has registered double-digit growth over the past five years, and the outlook is positive for at least the next decade. India is expected to become the second-largest PU market in Asia-Pacific during the coming years.

Valuing it at $3bn, research company Mordor Intelligence forecasts growth of 7-9% annually in light of strong demand from building and construction, and rising demand from the bedding, carpet and cushioning industries. Demand for PU is currently estimated at 565kT, but the industry is still heavily dependent on imports as current domestic production is about 150kT.

Prior to 2024, domestic production and

consumption of PU was relatively small compared with other Asian countries, largely as a result of the high costs of production and raw materials. The positive oil trend helped to reverse that somewhat.

Domestic PU consumption in India is far below other emerging nations, estimated at 400g per capita compared with 1.2kg in most developed countries. Analysts expect the construction sector to be the main driver for change in this case.

One significant player in the domestic market is Dow, which operates a technology centre to enable close collaboration with local customers and has high hopes for the market in the years ahead. BASF has also strengthened its presence in the Indian PU market in recent years.

According to Beverley Tan, regional manager for communications at BASF, the PU market in India is growing at 5% per year between 2023 and 2028, making it one of the fastest-growing countries in Asia. “Construction, appliances, transportation and footwear form the main applications, and we expect them to grow with the market,” she said.

Since 2014, BASF has had two PU production sites in India, located in Thane (Maharashatra) and Dahej (Gujarat). It broke ground at the end of February on a new plant to increase Cellasto microcellular PU (MCU) capacity in Dahej. This plant will feature a mould line in its first stage and is expected to be operational by the second half of 2026. Acknowledging the increasingly important role of local R&D, BASF launched a PU application development laboratory in Mumbai last year.

“The inauguration of the laboratory shows our commitment to enhancing local production and capabilities,” said Andy Postlethwaite, SVP for performance materials Asia-Pacific at BASF. “With this Made-in-India-for-India strategy, we increase our speed-to-market and stay close to our customers, enabling us to shorten our delivery time in terms of products, solutions and technical service.”

India’s construction sector is expected to reach $1.4tn in value terms by 2047, according to Shailesh Kumar Agarwal, executive director of the Building Materials and Technology Promotion Council, which is part of the Indian Ministry of Housing and Urban A airs. One of the Indian government’s priorities is to switch to low-carbon building materials, which includes a more active use of PU.

The latter is of strategic importance for the construction sector, Deloitte’s executive director Vivek Mittal said in a recent interview with the Indian Mojo4industry business paper. “Construction contributes about 40% of carbon emissions in the country, and PU can facilitate long-term energy conservation,” he said.

Aniruddha Nakhawa, honorary secre-

tary of the Builders Association of India, agrees with this sentiment and even sees PU as partially replacing cement in the sector. “While it won’t completely replace cement, it is an alternative in various forms: replacing traditional walls with drywall, roofing, and as a waterproofing compound for sealing terraces and construction joints,” he added. Analysts expect construction companies to become increasingly aware of the benefits of PU and to utilise it more in the coming years.

One of India’s largest PU systems houses, Rymbal, demonstrated solid results in the domestic market last year and expects further improvements this year. Its director and co-founder, Neeraj Garg, cited a significant gap in per capita consumption.

“Rymbal posted sales growth of approximately 55% in 2024,” Garg said. “Year-on-year growth for the first two months of 2025 was more than 100%. We are expanding our capacity by 25% and have an aggressive expansion plan for the coming years.” He claimed that PU demand in India will continue to grow on the back of rising disposable income, but he warned of continuing dependency on an import-based supply chain.

Garg sees price volatility and supply chain disruptions as two of the major factors challenging domestic producers in recent years. However, he views next-generation PU materials that are lighter in weight, recyclable and bio-based as a “mega-trend”.

Some analysts, however, view logisti-

cal issues and inadequate infrastructure as key stumbling blocks in a more active growth of the domestic PU market. There is also concern about the pressure on India from the US in the form of tari s on Indian goods, as well as pressure from the Trump administration for the country to reduce its purchase of Russian oil.

Philipp Propst, Project Manager, IAL Consultants

Steven Pacitti., Editor, UTECH

K S Shivanand (Shiva) – Vice President,

As India strives for self-reliance, domestic producers continue to spearhead anti-dumping actions against imports. Could the latest high-stakes trade cases reshape the country’s PU supply chain and manufacturing strategy? Steven Pacitti finds out

Economic growth, infrastructure expansion and petrochemical developments are propelling India towards becoming the second-largest polyurethane market in Asia-Pacific. But the country continues to face something of a supply dilemma on the back of its heavy reliance on imported MDI, TDI and polyols.

After long-serving Prime Minister Narendra Modi referenced the importance of “self-reliance” when he came to power more than a decade ago, the Hindi phrase “Atmanirbhar Bharat Abhiyan” (Self-Reliant India) has served as an umbrella concept for the government’s vision for India. Commerce and industry minister Piyush Goyal continued to bang the drum for

domestic manufacturing in June when he called on industry to ramp up their manufacturing capabilities, diversify supply chains and reduce import dependency. It is a sentiment shared by the chair of the Indian Polyurethane Association (IPUA), Harneet Kochar, who believes in the development of India’s PU sector as the country undergoes its own development and a transition away from imports.

To put this into context, the Oil Price Information Service (OPIS) reported in 2023 that close to 60% of the global polyether polyols capacity resides in north-east and south-east Asia, but the Indian subcontinent’s share stood at just 1%. Today, nearly 80% of India’s imports come from China, Singapore, Thailand, Saudi Arabia and South Korea. Facing intense compe-

Harbouring ambitions:

Manali Petrochemicals’ filing is a sunset review of duties applied to Chinese and Thai companies

tition from these exporting countries, India’s domestic producers have submitted several requests to the Ministry of Trade and Commerce over the last two decades for anti-dumping investigations.

“In the past, the Indian Trade Authority – the Directorate General of Trade Remedies (DGTR) – has conducted various anti-dumping investigations against dumped imports entering into India from Korea, China, Brazil, Thailand, the EU, USA, Singapore, Japan, Australia, Saudi Arabia and the UAE,” Harsh Mittal, a senior associate specialising in international trade remedies and WTO laws for India-based Lumiere Law Partners, told Urethanes Technology International. “The recommendations of the DGTR were accepted in almost all the occasions, except one or two, and anti-dumping duties have been imposed against imports of flexible slabstock polyol (FSP) originating in or exported from these countries.”

A representative from a US PU manufacturer who asked to remain anonymous commented that such cases are very

Getty Images / Jorisvo

rarely brought unless there is a strong likelihood of the case being successful. He said that it is both costly and time-consuming for the party making the filing, and this discourages frivolous actions from being taken.

“In the US, the mattress industry has succeeded in winning cases against multiple countries, including China,” he said. “There has been a case filed by MDI producers in the US against Chinese producers (specifically Wanhua) recently. In the US, cases can only be brought if there is a significant percentage of the providers in the industry who are harmed, meaning one company cannot bring the case alone.”

Given that Manali Petrochemicals is the sole producer of FSP in India, the case dynamics are perhaps somewhat di erent to what is the norm in the US. DGTR published an initiation notification in March 2023 of an anti-dumping investigation concerning imports of FSP originating in or exported from China and Thailand. The application was filed by Manali Petrochemicals, which alleged that injury is being caused to the domestic industry by dumped FSP imports of the product under consideration. FSP is used to make PU foams that are widely used in upholstery, mattresses, pillows, transport seating and packaging.

India’s capacity for FSP is estimated at about 50kT/year, but it is operating at about two-thirds capacity (with the remainder unused), DGTR said in May 2024. This implies that polyol imports result from lower pricing rather than a gap between supply and demand. At the same time, DGTR recommended imposing anti-dumping duties on suppliers of FSP from China and Thailand, with Wanhua Chemical set to attract a duty of $534/T and other Chinese producers to be levied with $608/T. Thai producers were set to face a duty of $480/T, apart from GC Polyols, whose products would be rated at $470/T.

A statement from the DGTR claimed that aggressive dumping, price undercutting and price underselling meant the domestic industry could not use its capacity at optimum levels, which also led to further capacity not being added. Interestingly, while this was the second time that Thailand had come under anti-dumping investigation, this was the first for mainland China, which overtook Singapore in 2022 to become the top flexible polyols exporter to India.

Several anti-dumping investigations have been launched against flexible polyol imports into India over the past decade. A 2015 anti-dumping investigation into FSP imports resulted in duties of between approximately $45/T and $153/T imposed on exports from Singapore, while a 2017 investigation resulted in duties

of $135.40/T imposed on imports from Thailand. In 2019, an investigation into material exported from Saudi Arabia and the UAE resulted in duties of between $101.81/T and $235.02/T.

Following the 2023 investigation instigated by Manali Petrochemicals to prove dumping and harm by Chinese and Thai companies, the 2025 filing is a “sunset review”. This is a legal check to renew duties or, in some cases, allow them to expire.

“The DGTR has initiated the investigation on the basis of a duly substantiated application filed by Manali Petrochemicals alleging that revocation of current anti-dumping duty would lead to continuation or recurrence of dumping and injury to Indian domestic producers,” Mittal said.

Alluding to the 2017 duties imposed on imports from Thailand, Amit Randev, a trade lawyer and policy consultant at the Centre for WTO Studies at the Indian Institute of Foreign Trade (IIFT) in New Delhi, pointed out that they were later withdrawn in December 2021. He was speaking in a personal capacity. “Those earlier measures initially led to a drop in imports, but over time import volumes often recovered,” he said. “This was largely due to price advantages o ered by foreign suppliers and the fact that India’s domestic production capacity was not sucient to meet rising demand.”

While Randev points to preliminary evidence to support the imposition of anti-dumping duties in the most recent case, he warns that the long-term e ectiveness of such duties might be limited. “Given the growing demand for polyols in India, imports are likely to continue playing a significant role in the market, even if duties are imposed,” he said.

According to McKinsey data in 2021, India imported 297kT of polyols in 2019, with the overall size of the market between 350kT and 360kT. In late 2024, Manali Petrochemicals announced it

Continued on page 20

Continued from page 19

was investing in new polyester polyols and propylene glycol projects in the west of the country, initially targeting 30kT/year of formulated polyols for automotive, footwear and energy-e ciency sectors. It is also expanding its polyester polyol capacity with one 4.15kT/ year plant already complete and another under construction.

Speaking to Urethanes Technology International at the time of the investment announcement, COO Shivaram Narayanan said: “There are no margins left in the FSP business mainly due to competitive pricing attributed to imported FSP entering the domestic market, leading to negative pricing impacting our profitability.”

Indian producers of rigid PU chemicals clearly have insu cient capacity and wish to get protection from imports. As an association, IPUA can help with by representing them in the anti-dumping cases and discussions with government.

“We continue to advocate that the government approach should be to assist the industry to grow by helping them with zero tari imports of equipment and upstream raw materials,” said IPUA chairman Harneet Kochar. “That would spur investment in capacities. Ironically, the case to set up large-scale plants is assuming that

tari s will assist to safeguard their interests and viability.”

Randev explained that Manali Petrochemicals demonstrated clear evidence of dumping above the minimum 2% threshold required under Indian law. “The key triggering factors included dramatic increases in import volumes from China and Thailand, both in absolute terms and relative to domestic production, with Chinese imports rising exponentially,” he said. “The investigation was further justified by evidence that subject imports were priced below Manali’s production costs and even below raw material costs, creating an unsustainable competitive environment. Manali has also produced evidence of material injury to the domestic industry through declining market share, reduced capacity utilisation and financial losses, establishing the necessary causal link between dumped imports and injury required under Indian anti-dumping laws.”

Earlier this year, the company claimed that both margin and revenue continued to be “a ected by imported materials at cheaper prices”. It said that cost and operational e ciencies had to led to a reduction in losses in its third quarter.

While the Indian government has consistently promoted the Make in India

initiative, Harsh Mittal points out that it’s important to highlight the objective of anti-dumping measures is not to curb imports. Rather, it is to ensure a level playing field for all producers and suppliers, both domestic and international.

“Trade remedy is not a protection but a tool to provide a level playing field to domestic manufacturers in the case of unfair trade practices adopted by foreign producers or exporters,” he said. “Therefore, the imposition of anti-dumping duty is a company-specific phenomenon based on their pricing strategies. The duties are allowed as per the WTO General Agreement on Tari s and Trade agreement.”

Amit Randev personally believes the case could set a strong precedent not only for India’s chemical and petrochemical sectors but also for producers in other countries that compete with China or Thailand. “If India proves dumping and imposes anti-dumping duties, it shows a clear pattern of unfair trade by these countries,” he said.

“Other nations’ producers could use India’s findings as evidence to support their own anti-dumping cases against Chinese or Thai imports. This could make it easier for them to argue that these exporters have a history of dumping. Overall, it signals that trade remedies are a practical way to protect domestic industries from

unfair competition.”

The risk of retaliatory measures from China or Thailand is relatively low as anti-dumping duties are legitimate trade remedy measures permitted under WTO rules, rather than protectionist barriers. Both China and Thailand are WTO members and regularly use similar trade remedy measures themselves, with China recently imposing anti-dumping duties on Indian exports of the insecticide cypermethrin. “India’s approach emphasises levelling the playing field rather than protectionism, allowing continued imports at fair prices,” he said.

Chinese and Thai exporters can raise several defences against Manali’s dumping allegations, based on legitimate cost di erences and market factors. Randev explained that they can argue that price di erences reflect higher domestic taxes, logistics costs, transportation expenses or shorter supply chains, rather than actual dumping practices. They might also claim no causal link between their imports and domestic industry injury.

“They might attribute Manali’s diculties to macroeconomic factors, raw material cost fluctuations or internal management issues unrelated to import competition,” Randev said. “They can challenge the injury calculations by providing alternative data on market conditions, demand patterns or the domestic industry’s performance. Additionally, exporters might argue that their pricing reflects legitimate competitive advantages such as economies of scale, more ecient production processes or access to cheaper raw materials, which constitute fair trade practices rather than dumping.”

In a sunset review like this latest investigation, the Indian authority normally extends the duty earlier levied through original investigation. “However, in situations where dumping and injury margins are re-determined, the Indian authority

“Given the growing demand for polyols in India, imports are likely to continue playing a significant role in the market, even if duties are imposed”

Amit Randev, Centre for WTO Studies at the Indian Institute for Foreign Trade

follows lesser duty rule principle to accord duty rates to the participating and non-participating foreign producers or exporters,” Mittal said.

Generally, DGTR concludes its original investigations within nine to 12 months, unless an extension of up to six months is granted by the Central Government. In the case of a sunset review, the authority will complete the investigation at least three months prior to the expiry of the duty in force. Even if the DGTR recommends duties, however, the Ministry of Finance makes the final decision to accept, change or reject them.

“In the present case, the possible outcome could either be an extension of existing anti-dumping duty for a further period of five years, or revocation of duty or re-quantification of existing duties,” he said. “This investigation is still underway.”

For Amit Randev, with such complete reliance on Manali for domestic polyol supply, India’s self-reliance in this key input depends heavily on the company’s ability to compete and expand. “Imposing anti-dumping duties would give Manali the breathing space to use its 50kT capacity more e ectively and possibly invest in further growth,” he said. “This aligns with government policies that o er tax incentives and other support to boost chemical manufacturing.”

If Manali succeeds and expands, Randev said, it could inspire other domestic producers to invest. However, the overall impact will depend on whether these protections are strong enough to overcome cost disadvantages and if India’s growing demand can be met by local production.

The spokesman for the US PU producer cited above expects India to rule in favour of Manali, as the country has a history of ruling in favour of local producers in a variety of cases. He believes that Manali sees the imported prices of polyol and is convinced that they are being sold below the cost of production, which is a threat to its own profitability.

Recent data shows that India issued final findings in 13 anti-dumping cases in March 2025, with 12 targeting China, indicating increased vigilance against Chinese dumping. Each anti-dumping investigation into the polyol industry revealed sys-

tematic underpricing by foreign suppliers, Randev said, resulting in the imposition of duties. However, the measures often had only temporary e ects: when duties were imposed on one country, imports tended to shift to other low-cost suppliers or recover as market dynamics evolved.

“For example, after duties on Singapore and Thailand, import volumes from previously targeted countries often rebounded within a few years,” he said. “This recurring pattern demonstrates that dumping is not an isolated event, but a persistent challenge for the Indian polyol industry, with foreign exports consistently leveraging cost advantages to undercut domestic producers. The e ectiveness of anti-dumping duties has been limited by India’s growing demand and the global competitiveness of major exporting countries, making dumping a structural issue in the sector.”

The latest case, Randev explained, reflects India’s evolving approach to using trade remedies more strategically to support domestic manufacturing and counter unfair trade practices, particularly from China. “Over recent years, the procedural concerning trade remedial measures are being streamlined in India, making it easier for domestic industries, especially micro, small and medium enterprises to access trade remedy measures,” he said. “A few notable reforms, including anti-circumvention provisions, the DGTR online filing platforms SETU, and simplified application procedures suggest India is making trade remedies more accessible and e ective.”

This trend is likely to continue as India seeks to reduce import dependence and build domestic manufacturing capacity across critical sectors. However, authorities must balance protection with avoiding excessive use that could harm downstream industries or increase input costs for other manufacturers.

“The success of this polyol case might encourage more frequent use of trade remedies, but each case will still require substantial evidence of dumping, injury and causality,” he said.

Mittal, too, thinks that it is encouraging to see Indian producers expanding their capacities to meet domestic demand. Importantly, this aligns with the broader vision of building a self-reliant India.

Steven Pacitti and Satnam Singh ask the chairman of the Indian Polyurethane Association about the opportunities and challenges facing the domestic PU industry