The south suburbs may be the epicenter of Cook County’s rising property tax burden, but with so many government entities, it will be hard to nd a single solution that satis es everyone I PAGE 15

Black and Latino restaurant owners in Chicago are learning how to survive and thrive in an eat-or-be-eaten business transformed by the COVID pandemic I PAGE 11

Sizing up a startup? Check

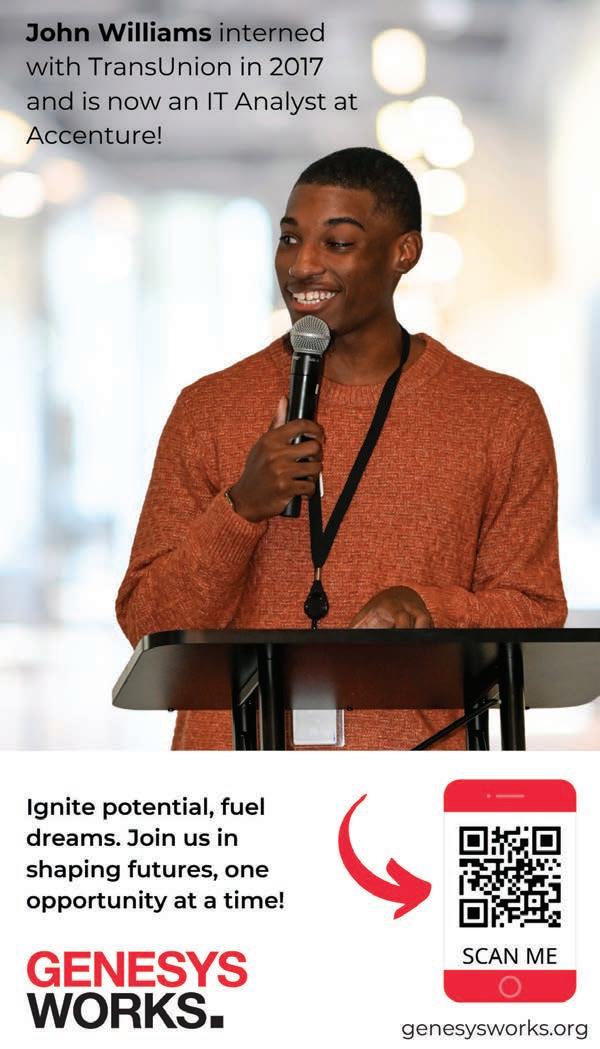

e corporate world has its own unique rules, language, and rituals. Mastering these subtleties is crucial for navigating and thriving in this environment while staying true to your authentic self, voice, and values.

In October, Crain’s featured the initial installments of Part 2 in my series, "50 Career Insights for Gen Z and Millennials." is column delved into strategies for thriving within organizational landscapes — an often unfamiliar and daunting terrain for many young professionals.

Now, I’m excited to share three new, critical insights that are essential for anyone starting their journey in the corporate world.

You won’t change a corporation

Michael Fassnacht is former CEO of World Business Chicago and is now chief growth o cer at Clayco in Chicago.

In my experience, creating

meaningful change within any organization is an incredibly difficult and challenging endeavor, regardless of one's position, even as a CEO. Every organization has a unique origin story, intrinsic values, ingrained behavioral patterns, and spoken and unspoken norms. These elements, combined with organizational muscle memory and other factors, create inherent resistance to change.

There are two crucial caveats: The higher one's position, the more power they have to instigate change, and the larger the organization, the more daunting the task becomes. I do not suggest that young profes-

sionals remain passive in the face of unprofessional or disrespectful behavior. It is just that they should speak up with full recognition of the constraints on their ability to effect genuine change within the organization.

Your well-being is up to you

For many young professionals, the pressure to perform well and the desire to be positively perceived by peers and superiors are paramount. This concern is natural in any business environment, especially in the early stages of one's career. However, the pursuit of professional success should not come at the expense of emotional well-being. Relentlessly chasing status can lead to unproductive stress and self-doubt, undermining your emotional health.

From my own experiences, I've learned the importance of protecting your emotional well-being from the influence of the company and its leadership.

While dedication and excellence in work are admirable, it's crucial to ensure that personal happiness and emotional health remain independent of the corporate environment. Achieving this balance can be challenging, but continuously reminding yourself of this "emotional independence" is critical to achieving balance, happiness, and ultimately, greater success.

Don’t let a job keep you up at night

Early in my career, I didn’t just face a few stressful weeks — I found myself stuck in a cycle of sleepless nights, with only brief moments of emotional balance. This experience led me to adopt a simple yet profound rule: If my job causes me to lose sleep for more than five consecutive nights, it’s time to seriously consider leaving. Over the past 25 years, I've stuck to this principle, and it has proven invaluable in helping me maintain emo-

tional balance even in the most challenging professional circumstances.

I can’t emphasize this enough. Prolonged sleep loss due to work-related stress is a clear signal that something is deeply wrong — a red flag that shouldn’t be ignored. It’s often not about placing blame on either the employer or oneself but recognizing that the combination of factors has created an unhealthy dynamic.

Entering the corporate world can feel intimidating, particularly in the early stages of one’s career. However, developing a mindset that blends curiosity with discernment is essential for long-term success.

Like any domain, the corporate world has its own unique rules, language, and rituals. Mastering these subtleties is crucial for navigating and thriving in this environment while staying true to your authentic self, voice, and values.

There were 51,984 fans packed into Comiskey Park to see the White Sox sweep a Bat Day doubleheader from the still despised Yankees on June 4, 1972.

And over the years I’ve probably run into 250,000 folks who say they were there.

Credit the Dick Allen Effect. He was an electrifying presence on a baseball eld; no one went to the beer stand when No. 15 was scheduled to hit. And though his tenure here was brief — three seasons, 348 games — the things he did with that 40-ounce war club in his hands are so vividly recalled that they must have been witnessed rsthand.

Bat Day 1972 is a classic example. e largest Comiskey Park crowd in 18 years had been treated to a tidy 6-1 Sox victory in Game 1. Tom Bradley went the distance for his sixth win, the late Bill Melton hit a home run, and Carlos May and Mike Andrews drove in two runs apiece. Allen was 2-for-4 with a double.

Allen had played in each of the team’s 41 games to that point, so manager Chuck Tanner told him to take a break and skip Game 2 “unless we need you.”

Sure enough, the Sox trailed 4-2 in the ninth inning when Tanner sent a batboy to the clubhouse to “ask Dick if he wants to hit.”

“Chili Dog MVP” authors David Fletcher and John Owens have Allen sitting down to a Sunday dinner of chili dogs when the batboy arrived. A cold beer on a warm day might have been on the menu as well.

“Who’s pitching?” he asked the kid.

“Sparky Lyle.”

“Tell Chuck I’ll be right out.”

Melton had walked and Andrews had singled, so Allen came to the plate as the potential winning run when he was announced as a pinch-hitter for shortstop Rich Morales. Allen’s subsequent departure from the Sox would be acrimonious. He simply left and went home in September 1974, citing general disillusionment, and missed out on 34 games total that season. He had no relationship with the team thereafter, until the Sox extended an olive branch by inviting him back in 2012 to acknowledge the 40th anniversary of his MVP season, one that might have saved baseball on the South Side.

Allen’s memory of June 4 was as sharp as those 250,000 eyewitnesses’.

“With Sparky Lyle, you knew you were going to get a slider,” he told me. “At 1-and-1 he threw me one, and I hit it out of the ballpark.”

Allen’s eyes gleamed as he recounted the moment. e reaction was felt from Bridgeport to Belvidere to Bourbonnais.

e Sox would hang around in the division race for most of the season before the Oakland A’s pulled away, on their way to the rst of three straight World Series titles. A broken leg would limit Allen to 72 games in 1973, and his ba ing departure brought an abrupt end to a magical run in 1974.

But over those 348 games, Allen did things Sox fans had never seen before, providing them with memories they retain to this day.

“It’s about time,” was the bittersweet reaction to Sunday’s news that Allen, four years after his death, had been elevated to Hall of Fame status by a “modern era” Veterans Committee charged with checking

the work of the occasionally prissy voting members of the Baseball Writers' Association.

Dave Parker was also a bene ciary of the committee’s revisionist process. A physically imposing ve-tool wonder, Parker had been recognized as baseball’s best player for the better part of a decade before injuries and a center-stage role in the tawdry Pittsburgh drug trials took a jackhammer to his reputation.

But no one can deny the power and beauty of what Parker and Allen did on the eld.

Allen’s four-teams-in-four-years sojourn re ected a penchant for going his own way. at probably hurt him in the eyes of the writer/voters, who tend to prefer a more clean-cut model of hero.

“He didn’t have the numbers” also was frequently cited, in reference to Allen’s failure to approach 3,000 hits or 500 home runs, which all but guaranteed Hall of Fame stature until Rafael Palmeiro and Alex Rodriguez got there through chemistry.

Numbers known only to Bill James and his fellow seamheads 30

years ago — on base plus slugging, runs created, wins above replacement and etc. — are now widely accepted as a better measure of a player’s true value. And by that measure, Dick Allen holds his own with Henry Aaron, Willie McCovey, Billy Williams and the other Hall of Famers of his generation.

So he’s a Hall of Famer himself. And it is about time.

Crain’s contributor Dan McGrath is president of Leo High School in Chicago and a former Chicago Tribune sports editor.

Following heavy pushback from neighbors in the area, Nitti Development has also switched from a plan to build rental homes on the 33-acre site off Meacham Road to all for-sale housing I

Ahomebuilder’s new plan for a Schaumburg farm property that the Loeber family of car dealers has owned since the 1940s cuts the proposed density by two-thirds from a plan that met heavy resistance earlier this year.

Nitti Development’s revamped plan for the 33acre parcel o Meacham Road also switches to all for-sale housing from rental.

“We heard what the community was saying,” said Joe Nitti, who heads the homebuilding rm with his brother, Nico.

Crain’s reported in August that Nitti Develop-

By Dennis Rodkin

ment’s plan for 352 rental units in 32 buildings faced strong opposition, particularly from residents of large-lot single-family homes that border the site. Nitti later withdrew the proposal. Now Nitti wants to build 122 homes, or roughly one-third of the old plan. e brothers previewed the new proposal for Crain’s on Dec. 4 ahead of ling an application with village o cials in Schaumburg in early 2025. At an informal meeting on the new concept, the Nittis said, village o cials

See LOEBER on Page 26

Nitti wants to build 122 homes, or roughly one-third of the old plan.

It may come with several drawbacks for workers and consumers though

By Katherine Davis

e possibility of Walgreens Boots Alliance being sold to a New York private-equity rm may present the struggling pharmacy chain with the privacy and leniency needed to execute on a turnaround strategy, but there’s no guarantee it would work and it may come with several drawbacks for workers and consumers.

e potential deal, rst reported on Dec. 10 by the Wall Street Journal, would have Deer eldbased Walgreens sell itself to Sycamore Partners, a privateequity rm usually investing in consumer and retail businesses. For Walgreens, the deal could provide a path to stability — maybe even pro tability — and perhaps avoid a slow spiral to bankruptcy.

If Sycamore is indeed entertaining a Walgreens acquisition, it is likely examining how many pharmacies to close, which unpro table initiatives need to be axed and who among the company’s leaders could be replaced, says James Schrager, an entrepreneurship and strategic management professor at the University of Chicago’s Booth School of Business.

“ e quest for pro tability is really the quest to survive,” Schrager says. “Private equity

adds value by being able to do things that are harder to do in a public market transition.”

Walgreens has been in turnaround mode for a while, however. Like its competitors, Walgreens has been hit with industrywide challenges including online retail competition and pricing pressure from pharmacy bene t managers, but a series of missed opportunities and a money-losing health care strategy that loaded up the company with debt have also taken a toll. Walgreens reported an $8.6 billion net loss in its 2024 scal year and is in the process of closing hundreds of stores.

Even still, Sycamore’s reported interest in Walgreens signals it views the company’s shares as undervalued or has identi ed a possible path to pro tability. While Walgreens badly needs an e ective turnaround plan, privateequity ownership and the costcutting tactics that would come with it could further shrink Walgreens’ footprint and sta , and possibly deteriorate access to necessary pharmacy services.

Walgreens and other pharmacy chains have already been criticized for closing underperforming stores in low-income neighborhoods and towns, moves that can sometimes create or worsen so-called pharmacy deserts, areas where residents have limited access to a pharmacy.

“We are very wary of Sycamore Partners’ possible purchasing of Walgreens,” says Matthew Parr, communications director at the

See WALGREENS on Page 27

By

One of the country’s largest cannabis operators is abandoning its Michigan grow operations.

Chicago-based PharmaCann told employees Monday it would shutter its 207,000-square-foot LivWell Michigan cultivation site in Warren, laying o at least 170. Todd Lince, president of Teamsters Local Union No. 337, con rmed the news to Crain’s Detroit Business. e Teamsters had just organized the PharmaCann-owned operations in early November.

“ ey told us they just can’t be competitive in Michigan …” Lince said. “We knew they were having nancial troubles. But this doesn’t have anything to do with us organizing; we didn’t even have a contract yet."

Lince said the employees will be terminated by the end of January and the union will work with PharmaCann to get the employees a severance package.

Representatives from PharmaCann and its attorneys did not respond to several requests for comment. It’s also unclear whether the closure of its cultivation and dispensary in Warren

will lead to closures of its two other Michigan LivWell dispensaries in Cheboygan and Sault Ste. Marie.

e PharmaCann closure plan comes only weeks after competitor Fluresh LLC, doing business as Tend.Harvest.Cultivate. announced it was closing down its $46 million, 105,000-square-foot grow facility in Adrian, Mich., at the end of November.

e company, doing business as Tend.Harvest.Cultivate, couldn’t make the economics of the operation work as the

See LIVWELL on Page 26

By Ally Marotti

Planting Hope, a Chicagobased sesame milk company that last year acquired assets of Argo Tea, has filed to liquidate through bankruptcy.

e roughly eight-year-old sustainable food and beverage company led for Chapter 7 bankruptcy protection in Chicago federal bankruptcy court late last month. e court ling estimates Planting Hope’s assets to be below $50,000 and its liabilities to be between $10 million and $50 million. e ling comes about 16 months after Planting Hope acquired assets of Chicago-based Argo Tea and laid out plans to breathe new life into the brand, which operated 50 cafes at its height.

Neither Planting Hope cofounder Julia Stamberger nor an attorney representing the company immediately responded to a request for comment.

Its sesame milk, for example, used sesame seed pulp that was pressed for oil and otherwise would have been discarded. Sesame is pest-resistant, helps soil and requires much less water than the almonds used in almond milk. The company also made Right Rice, a protein- and fiber-rich product that replaces emissions-heavy white rice.

The company had acquired some of Argo Tea’s assets out of bankruptcy, including licenses for Argo’s eight remaining cafes. Planting Hope did not plan to operate the cafes — they were all on college campuses and managed by food-service operators. But the company did put its sesame milk barista blend on Argo Tea menus. The idea was to add sustainable products into Argo’s offerings and target college students.

Stamberger told Crain’s last year that she also wanted to ex-

The court ling estimates Planting Hope’s assets to be below $50,000 and its liabilities to be between $10 million and $50 million.

e bankruptcy ling indicates Stamberger left the company in June. It also says revenue had been slumping, from $12.2 million in 2022 to $9.9 million last year. It notched $925,000 this year before the bankruptcy ling late last month.

Planting Hope focused on sustainable and natural foods.

pand into Chicago again, targeting managed locations such as hospitals.

“We’ve got a great . . . bakedin test bed through these eight cafes where we will refine what is the new Argo. Once we have that dialed in, yes, absolutely, let’s expand,” she said at the time. “We want to see more

Argo back in Chicago.”

Two boyhood friends from Armenia opened the first Argo Tea cafe in Chicago in 2003. They opened company-operated and licensed locations over the next two decades. The company also launched a line of ready-to-drink teas that were sold across the country in Walgreens and other convenience stores. Stamberger told Crain’s last year that Argo’s ready-todrink tea products would be phased out.

Caribou Coffee invested in Argo Tea in 2016 and began opening tri-branded stores with Einstein Bros. Bagels. Then in January 2020, Golden Fleece Beverages paid $1.6 million to buy Argo’s debt from Caribou. A month later, Golden

Fleece bought the rest of Argo’s assets in a public auction with a credit bid of $9 million.

Golden Fleece was formed strictly to purchase Argo’s debt in early 2020, and its co-founder was former Walgreens CEO Greg Wasson. Golden Fleece began exiting cafe ownership and operation, instead focusing on the licensed cafes and readyto-drink teas. When COVID hit, Golden Fleece closed all its retail operations, selling some, shuttering others and transferring some company-owned shops to licensees.

In October 2021, Golden Fleece filed for Chapter 11 bankruptcy protection and set about reorganizing the company. Argo was in financial trouble from a previous battle with

The ling comes more than a year after Planting Hope, a Chicago-based sesame milk company, acquired some of the brand’s assets A lighter regulatory hand by the incoming Trump administration will likely assist a broader-based rally next year

a landlord, according to court documents from that bankruptcy filing, and the pandemic did not help the situation. The bankruptcy case stretched into 2022.

Planting Hope came across the potential Argo deal through a mutual shareholder, Stamberger told Crain’s last year. Rather than pay cash, Planting Hope entered into an agreement with Argo shareholders in which they nanced a loan of up to $1 million for working capital. After the loan was funded, shareholders were to receive a revenue share on Argo products and intellectual property, according to a news release announcing the deal. Planting Hope also assumed some debt.

By Mark Weinraub

The U.S. stock market rally will continue in 2025 with robust corporate profits and a strong economic outlook supporting further gains, Northern Trust predicts in its outlook for the new year.

The expected rally will likely be broader-based than the tech-driven gains of 2024, with an assist from a lighter regulatory hand by the incoming Trump administration, said Anwiti Bahuguna, chief investment officer of global asset allocation for Northern Trust Asset Management, which has $1.3 trillion in assets under management for the Chicagoheadquartered bank.

“We have started seeing a sharp broadening out of market performance because sectors like nancials absolutely love

less regulation,” Bahuguna said. Smaller-cap stocks also stand to benefit as fewer restrictions mean lower expenses.

The S&P 500 has rallied nearly 29% so far in 2024, buoyed by a resilient U.S. economy and easing inflation. Interest rate cuts at the tail end of the year added to the strength. The closely watched index has risen 5% since Donald Trump’s election on Nov. 5.

The market is strong enough to withstand some of Trump’s key campaign promises, such as tariffs on imported goods and mass deportations that would thin the pool of labor, Bahuguna said.

“I think he is serious about doing some of the things he has said,” she added. “I think the magnitude of what he's proposing matters. I think if the tariff rate is still in that sort of ap -

proximately 10% range, there is enough fundamental support with the economy that it will still be OK.”

She also downplayed concerns about deportations, saying

they would be too costly to enact.

A further round of interest rate cuts in 2025, which will allow for strong capital from companies taking advantage of

the cheaper cost of capital, also will contribute to expected stock market gains.

“From a monetary policy perspective, even if they cut four to five times and not six to seven times, it does not matter as long as they are not raising rates anymore,” Bahuguna said.

But if Trump goes too far with some of his policies, he threatens to reignite inflation. Concerns about prices could cause the U.S. Federal Reserve to reverse course and begin raising rates again, removing the underpinnings of the stock market strength.

“If it is high because we have restrictive supply-side policies on immigration and tari s, those are bad in ationary numbers because then growth takes a hit,” Bahuguna said. “All your risk assets will be dead wrong in our allocation in that scenario.”

In another proof that history has an ironic streak, Cook County Board President Toni Preckwinkle is setting out to do what's needed doing for decades: xing what's broken in Cook County's property assessment system.

e technicalities of placing a value on a piece of real estate and then determining how much its owners should be taxed are hardly a dry-as-dirt subject around here: e outcomes of the process determine how much money will ow to government co ers and, in many cases lately, whether property owners can a ord to maintain or even keep their holdings. And the assessment system itself — an ouroboros of complex calculations followed by equally arduous appeals — has spawned a thriving legal trade which has, in turn, been the wellspring of some of the state's most malignant political corruption.

Into that swamp wades Preckwinkle. She's determined to bring sense to the system, and the ironic part, in case you're wondering, is that one of the targets of her e orts is the work of Fritz Kaegi, the Cook County assessor who was elected to clean up the mess left behind by one of Preckwinkle's close associates, the ethically challenged former assessor Joe Berrios.

But perhaps it's churlish to recall such things when a Cook County politician is

nally ready to do what needs doing on behalf of taxpayers. Preckwinkle deserves kudos for recognizing the system is broken and exercising her responsibility as the county's top elected o cial to repair it.

As Crain's Danny Ecker reported Dec. 12, Preckwinkle hired a third-party consultant to examine how Kaegi and his de facto nemesis, the Cook County Board of Review, value commercial properties for tax purposes. At the heart of the consultants' recommendations: e assessor and the appeals board need to start sharing more data, consulting with each other about it and using a more uniform approach to deciding how much commercial buildings countywide are worth.

It's a push county o cials hope will help make local property taxes more predictable than they have been. Commercial property investors consistently gripe about the wild uncertainty infecting the assessment system. e status quo harms taxpayers and scares o new investment from the Chicago area, real estate rms say.

Under the current system, as Ecker explains, the assessor's o ce initially estimates what commercial properties are worth via a so-called mass appraisal approach, using broad, market data-based assumptions about property types to come up with valuations. Property owners can

appeal those rst-pass estimates directly to the assessor, often providing detailed information about a building's income and expenses, vacancy and other circumstances. Under Kaegi, those appeals generally haven't led to big valuation swings.

If property owners are still not satis ed, they can turn to the Board of Review, an elected three-member panel. at group uses a di erent approach to valuation and sometimes receives even more propertylevel details from owners who appeal, and has proved to be commercial landlords' tax savior in the Kaegi era. e board awarded so many big reductions in recent years that the local property tax burden has shifted slightly in favor of commercial landlords and against homeowners, even though Kaegi's initial assessments signaled the opposite would happen.

Landlords lament the big gap between where commercial assessments start and nish and the costly appeal process they must go through to get what they deem to be more realistic valuations. Josh Myers, the consultant Preckwinkle hired, echoed that in the study, noting the di erences in how Kaegi's o ce and the Board of Review arrive at values that don't meet assessment industry standards and hurt property owners.

" e process is appeals-driven in many

aspects," Myers told Crain's, adding his report focuses on how the assessor's o ce and Board of Review "could work more collaboratively to create more transparency and hopefully bring more predictability to the system. And in the long run, hopefully to lower appeals as a result."

Myers' recommendations boil down to a series of common-sense steps, including better sharing of information between the assessor and the review board, the creation of a centralized database where all relevant details on a property can be stored and retrieved, and regular meetings between both o ces. But perhaps the most important recommendation is embracing a uni ed valuation approach: e assessor should conduct an annual study of capitalization rates — estimated rstyear returns for a theoretical buyer relative to a property's value — and reach an agreement with the Board of Review on how to use them in valuations. Di erences in how the two bodies determine and account for cap rates "have led to signi cant confusion among stakeholders," the Myers report says. at it took an outside consultant to arrive at these conclusions is lamentable, but now, at least, Preckwinkle is armed with a third-party report she can leverage to drive necessary reform.

We are fortunate to have had some well-reported analysis from Crain’s Chicago Business on my agency’s valuation of downtown hotel properties. I wanted to add some more color to the conversation.

Crain’s readers know that my o ce recently revalued downtown hotels, including those on the Mag Mile. We valued the small number of luxury hotels at about $486,000 per hotel room, and the much larger group of hotels in the next quality tier (“upper upscale”) at about $225,000 per hotel room.

For example, in the upper upscale tier next down from luxury, there have been a dozen recent transactions. Buyers paid about $250,000 per hotel room.

My o ce’s estimate of $225,000 per room for this tier is also lower than the $308,000 per room average of the 16 publicly traded hotel real estate investment trusts, or REITs, that collectively own hotel rooms at a slightly lower-quality tier.

to Lodging Analytics Research & Consulting — a source pointed to by the Illinois Hotel & Lodging Association — EBITDA margins (which should re ect all operating costs) in Chicago hotels in 2024 are 19.5%, just short of their 2019 level of 19.9% and up from about zero during the last reassessment.

It is true that these values are up signicantly since hotels were last reassessed in 2021. ese assessments were done as of January 2024, when hotel room rates, occupancy, margins and valuation multiples were up signi cantly compared to three years ago.

How fair are these valuations? Actual recent purchases by well-informed buyers and sellers are the ultimate acid test. Opinions will di er when few transactions are available, but in fact there have been a high number of transactions in downtown Chicago high-end hotels since the onset of the pandemic.

ere are fewer transactions to work with in the luxury category. e most recent and most noteworthy sale was the St. Regis, which was purchased for $490,000 per room in May 2023. is surpasses the $425,000 paid per room for the W City Center in 2019. is compares with our valuation of these properties at $486,000 per room. is estimate re ects industry-standard sources for revenue per available room, occupancy, margins and valuation multiples. e transactions mentioned here re ect strong recovery in fundamentals. Overall Chicago hotel revenue per available room in 2023 was $101.44, up from $99.50 in 2019, re ecting more than full recovery. What about costs and margins? According

We welcome additional data and evidence that hotels can provide, both before we send out assessments and as part of the ongoing appeals process. As we’ve advocated for years in Spring eld, our assessment system will work better if the state passes a law that provides for anonymized reporting of average rental rates, costs and occupancy. A law providing for a more granular and updated snapshot of physical descriptions of commercial properties would also help.

My agency’s analysts’ work is available to peruse on our website. Crain’s readers can compare valuations for each downtown hotel, how they were derived and debate their accuracy. ey can do this for any hotel in Cook County, and have been able to for the last four years.

e same cannot be said for the Cook County Board of Review, which handles appeals after my o ce has nished its work. Board of Review Commissioner

George Cardenas recently opined on these pages, arguing for “a ‘do-no-harm’ approach” to assessments of downtown hotels. is suggestion is meaningless — by law, assessments in Illinois must be in line with market values. A consistent, uniform methodology supported by robust data, such as the one I’ve described above, is the only way forward.

Unfortunately, the Board of Review’s methods are obscure, opaque and troubling for the taxpayer. The public does not have access to the assumptions guiding their decisions, so there is no way to know if these decisions are guided by market conditions. The agency does not publish benchmarks that demonstrate it is maintaining the valuation uniformity required under the Illinois Constitution.

In addition to establishing and publishing these benchmarks, the Board of Review should set and publicize a quality standard for appraisals under its rules to ensure appraisals submitted as evidence meet the Uniform Standards of Professional Appraisal Practice standard required by nancial institutions. ese are standards the Assessor’s Ofce follows. Taxpayers should expect the same from the Board of Review.

Picture this: A recruiter for a major global corporation posts an executive role on LinkedIn late Friday, logs o and heads into the weekend. By Monday morning, she’s staring at over 400 applications. When asked how many were truly relevant, her answer was unsettling: “Maybe 14.” is isn’t just a tech glitch or an over-eager response rate: It’s emblematic of a disturbing trend overtaking the hiring landscape. Platforms like Monster and CareerBuilder were pioneers in digital hiring, designed to connect employers and candidates eciently. LinkedIn’s evolution from a professional networking hub to the primary venue for job postings accelerated this trend. But now, LinkedIn and similar platforms are being undermined by bots, fraudulent pro les and listings, and spam applications. A once-straightforward hiring process has devolved into an ava-

The distortion and degradation of a hiring process, known to be relatively reliable in the past, suggests that many are being left out.

lanche of instant, irrelevant submissions, leaving companies to wade through hundreds — sometimes thousands — of bogus applications.

Reports are widespread. A recent job post attracted 1,800 resumes in two days, a number once thought to signal a wave of discontented job seekers. But behind this surge lies the reality of AI-powered bots, which generate automatic submissions and swamp recruiters. Some companies, overwhelmed by volume, now review only the rst 50 resumes, discarding the rest without a second glance. Genuine candidates — real people actively seeking opportunities — are rendered invisible under this bot onslaught.

In a recently published article from Barron's, reporter Karishma Vanjani writes, “Before the pandemic, over 80% of the jobs listed monthly were lled within six months of the posting. But the rate steadily declined in recent years, with the latest data from April showing that an average job posting has only a 41% probability of resulting in a new hire in the following six months.”

e majority of companies invested heavily in applicant tracking systems, expecting technology to simplify and streamline the hiring process. Instead, they’re now forced to defend against a growing issue: the exploitation of a system meant to lter talent, not drown it. We posit that the fundamental job posting apparatus is broken and compromised.

Cybersecurity expert Robert Kirtley, director of cybersecurity at Chicago-based iDiscovery Solutions, warns that AI can not only mimic job descriptions but can also clone them to auto-generate resumes. Worse, this wave of bot activity may not be a mere accident. In some cases, competitors could potentially manipulate hiring pipelines by ooding postings to hinder recruitment e orts. Kirtley highlights that this isn’t merely a technical nuisance — it’s a cyber threat, a theft of

company data, a misuse of company resources and an invasion into HR’s fundamental function. is bot-generated deluge forces HR teams to waste hours sifting through irrelevant applications, distorting a process meant to connect people with real opportunities.

e broader implications are grave. is widespread manipulation obstructs genuine economic mobility and job access, turning a vital employment ecosystem into a clogged, ine ective

system. And given the downgraded job numbers, economist Claudia Sahm o ers this: “I worry most about the drop in the hiring rate now — not so much about it being recessionary but about the lost potential.” e distortion and degradation of a hiring process, known to be relatively reliable in the past, suggests that many are being left out, their personal search for the right opportunity sidelined by a twisted use of AI.

Isn’t it time we confront this

problem? e misuse of AI in hiring threatens the integrity of the American labor market, and it’s up to us to demand a solution.

Recognize an attorney involved in significant litigation and trial proceedings.

Emily Rogalski and her colleagues are analyzing a form of dementia that af icts younger people

By Jon Asplund

e science of aging often speaks of "Alzheimer's disease and other dementias," with the devastating e ects of late-onset Alzheimer's and its severe memory loss being the most common and well-known dementia.

However, among the several kinds of thinking disruptions that encompass dementia, there is another frustrating, progressive neurodegenerative disease that often a icts younger people, where they have all their memories and all their intellect, but can't get the words they want to speak to come out of their mouths.

Newly published research out of the University of Chicago tackles this di erent kind of dementia, called primary progressive aphasia, or PPA, o ering new treatment options and new understanding of the disease and the havoc it wreaks on its victims and their families.

Two new papers coming out of UChicago's Healthy Aging & Alzheimer's Research Care, or HAARC, Center provide a way to benchmark the health-related quality of life of PPA patients and o er up a plan for clinical trials of a telehealth-based treatment for

the dementia.

UChicago professor of neurology Emily Rogalski said that the approach to research shown in these rst HAARC-led papers can pave the way for other Alzheimer's and dementia research.

“We see our approach as a potential model,” Rogalski said. “We think the framework we have can be adapted and used to support advocacy and interventions for multiple di erent dementia syndromes and conditions.”

HAARC was established in 2023 with Rogalski at the helm. She previously was a longtime researcher on aging at Northwestern University and a 2017 Crain's 40 Under 40 alum.

PPA su erers gradually lose their ability to express themselves, usually beginning in middle age, creating problems with employment,nancial hardships and stress on family life, she said. But the dementia is frequently overlooked by medical professionals, especially among people with lower socioeconomic status, she said.

“ ese individuals are at a di erent life stage from late-onset Alzheimer’s dementia patients,” Rogalski said. “ ey're often still in the prime of their working career;

they may have young children in the home.”

“PPA is a relatively rare dementia,” she said. " ere hasn't been as much study of it because it can be di cult to assemble large groups of people to look at."

Without a large group of patients in one area, HAARC worked with other medical centers to better understand how PPA a ects daily living, UChicago said in a press release, using the Health Utilities Index standardized tool that measures various aspects of well-being, including physical abilities, emotional health and cognitive functions.

Researchers showed in the journal Translational Research & Clinical Interventions that PPA has a moderate to severe negative im-

pact on patients’ health-related quality of life, and greater language impairment in individuals with PPA was linked to a lower quality of life, particularly a ecting domains such as hearing, sensation, cognition and speech.

“It was important to con rm that the HUI, a commonly used health measure across diseases, was capturing the essence of these patients’ primary impairment,” Rogalski said in the release.

e second study, in the Journal of the Alzheimer's Association, described the feasibility of delivering speech-language therapy for PPA via telemedicine.

e study reported the successful enrollment of 95 participant pairs — each comprising a PPA patient and their primary caregiver

— from four countries, demonstrating that remote recruitment and video chat intervention are viable options for overcoming geographic and socioeconomic barriers to treatment.

“We found a way to deliver care that creates a little bit more of an equal playing eld,” Rogalski said in the release. “Persons with PPA don't have to be living next to a major academic medical center or specialty center to get in touch with an expert and receive treatment.”

Rogalski said she has been working on video chat as a useful intervention for about 10 years, well before the boom in telehealth. Before Zoom and telehealth applications, PPA patients were talking to clinicians via FaceTime and Skype.

By Ally Marotti

Next year, Yuengling will sell its beer in Illinois for the rst time.

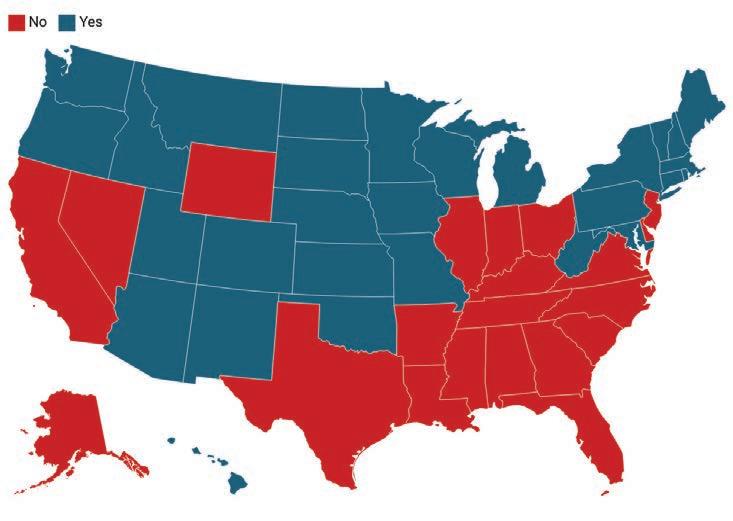

e 195-year-old brewery in Pottsville, Pa., takes a slow, methodical approach to distribution. Its beers are available only in 27 states. (Illinois will be the 28th.) It expanded last year into Kansas, Missouri and Oklahoma. In a news release announcing the upcoming Illinois sales, executives said there was more demand to be lled in the Midwest.

“For years we have seen an overwhelming desire for our portfolio from our most loyal fans in Illinois that have been eagerly awaiting the brand’s arrival,” Wendy Yuengling, chief administrative o cer and sixth-generation family member, said in the release. “We are incredibly proud to announce our expansion into a great beer market such as Illinois in the new year.”

Yuengling’s beers — which include its traditional lager, light lager, golden pilsner, black and tan, and Flight by Yuengling — will rst be available on draft at restaurants and bars in late January. Bottle and can distribution to bars, restaurants and stores will follow.

In a list of states that sell the most beer by volume, Illinois ranks seventh, according to data from Bump Williams Consulting, which focuses on the beverage industry.

Yuengling is “very deliberate in their expansion e orts and focus, with Illinois being a previously untapped market for them,” said Brian Krueger, vice president of business development and portfolio strategies at Bump Williams Consulting, said in an email. Yuengling has been family

owned and operated since 1829. e beer is produced at two breweries in Pottsville and one in Tampa, Fla. A separate joint venture called e Yuengling Co. was established with Molson Coors Beverage in 2020 to expand production and distribution westward. e Yuengling sold in Illinois will be produced and shipped from a few locations, a spokesperson said. ose include facilities in Pennsylvania, Milwaukee and Fort Worth, Texas.

Startup success is often gauged by metrics like growth, revenue and market traction. Yet one of the most critical, and frequently overlooked, determinants of a startup's success is the founder. At the early stages of a startup, the founder is the single most important factor in uencing success. However, traditional venture diligence rarely delves into understanding the founder on a human level. is omission leaves a critical gap in how startups are assessed and supported. Founders are not machines; they are individuals with vulnerabilities, emotions and limitations, all of which directly impact their ability to lead, build and innovate.

Entrepreneurship is an inherently high-stakes endeavor, demanding resilience, emotional regulation and the ability to navigate ambiguity — all of which are just as important as functional expertise. Despite this, venture diligence remains predominantly focused on the business opportunity: market potential, competitive advantages and the team's functional expertise. Rarely do investment memos explore

founder motivation, emotional health or capacity for sustained grit, even though these qualities correlate strongly with startup success. Recognizing this gap, integrating founder diligence into venture diligence cycles can o er a more holistic view of a startup's potential.

Evaluating a founder extends beyond assessing their professional skills; it requires delving into the deeper motivations, emotional triggers and behavioral patterns that shape their actions. Founders may be driven by various internal desires, such as a need for validation, a pursuit of power and status or a strong inclination to be liked. By asking targeted questions to uncover these underlying behavioral patterns, investors can gain critical insights into a founder's capacity to navigate the unique challenges of entrepreneurship. For example, asking questions that evaluate a founder's willingness to reconsider long-held beliefs can reveal an openness to growth and change. Understanding the role

that feedback and recognition play in sustaining motivation can reveal key insights into a founder's leadership style, decision-making processes and their ability to maintain resilience during challenges.

Equally important is assessing emotional intelligence. How does the founder demonstrate empathy in their interactions? Research shows that empathetic leaders are better equipped to build loyal and high-performing teams. Founders who can forge connections based on trust and understanding often foster stronger organizational cultures, which is a key ingredient for long-term success.

Founder diligence doesn't end in the data room; it's a gift that keeps on giving. By understanding the emotional and psychological pro le of a founder, investors can tailor post-investment support to their speci c needs. For instance, a founder with a strong need for validation may be more likely to subconsciously prioritize

vanity metrics over the true drivers of a business or surround themselves with "yes" team members who a rm their decisions. is can inadvertently foster a culture of homogeneous thinking and discourage critical analysis. An investor who recognizes this tendency can ask targeted questions during check-ins to help the founder identify and address these challenges. By improving the founder's self-awareness, the investor can play a pivotal role in mitigating these pitfalls, ultimately accelerating the startup's success. Such personalized support helps founders build the stamina needed to navigate the turbulence of entrepreneurship. When founders feel supported as humans — not just as CEOs — they are more likely to lead with con dence, make better decisions and cultivate healthier team dynamics.

Ultimately, founder diligence disrupts traditional portfolio management in truly meaningful ways. By considering both the business opportunity and the human element, investors can foster an environment where more startups have a chance to succeed.

Visit our website for our locations across Chicagoland morettisrestaurants.com

Moretti’s was founded in Chicago and is 100% family-owned and exclusive to the Chicago area. The original Moretti’s is on the northwest side of Chicago. Ten other locations serve the north and west metro area. Moretti’s original family recipes range from traditional to the latest delicious trends. All ingredients are fresh, and everything is handcrafted to order.

101 CLUB

101 E Erie St, Chicago, IL 60611 312-667-6800 • 101club.com/101-room

Ale Breuer, a former founder turned investor with a background in venture capital and startup coaching, works as adjunct professor of entrepreneurship at the University of Chicago Booth School of Business and helps student entrepreneurs through the school’s Polsky Center for Entrepreneurship & Innovation.

is holistic approach doesn't just yield better business outcomes. It accelerates innovation and elevates the entrepreneurial ecosystem to an unmatched level.

Experience the newly opened 101 Club American Grill on the 20th oor, featuring stunning views and a sophisticated mid-century design. Savor impeccably prepared American favorites like steaks, chops, fresh seafood and upscale comfort food. Elevate your next gathering with 101 Club’s private and semi-private event spaces — perfect for beautiful weddings, corporate meetings and holiday parties up to 300 guests.

Black and Latino restaurant owners in Chicago are learning how to survive and thrive in an eat-or-be-eaten business transformed by the COVID pandemic |

Sergio Reyes is stressed. He’s preparing to reopen his Pilsen restaurant after a four-year hiatus. He’s in a dispute with the city of Chicago over the placement of a bar on the new patio. Attorney and architecture fees are eating into his capital to buy food and liquor.

“ at’s what’s keeping me up at night,” Reyes says, “along with creating menus, hiring sta , getting the right people to work with us and having them understand the culture of our restaurant.”

Just like Carmy Berzatto, the ambitious chef-owner in the Emmy Award-winning TV series “ e Bear,” Reyes needs to get the restaurant open as soon as possible to start generating sales.

Opening a restaurant is a daunting undertaking for any entrepreneur. Banks generally don’t favor lending for restaurants because of the high failure rate. It’s particularly di cult, however, for Black and Latino owners whose families most often don’t have extra funds to spare.

ey go to great lengths to land the capi-

By Judith Crown

tal needed to buy a building or rent space, build out the restaurant and acquire equipment. e buildout alone can easily cost $300,000 or more depending on the size and format.

“Our demographic doesn’t have a history of generational wealth,” says Sam Sanchez, president of ird Coast Hospitality Group and a member of the Illinois Restaurant Association's executive board. “You mortgage your house. And

See HURDLES on Page 12

SPONSORS

Opening a restaurant is a daunting undertaking for any entrepreneur. Banks generally don’t favor lending for restaurants because of the high failure rate.

From Page 11

then you reach out to your parents and ask, ‘Hey, can you get a loan on your house?’ ”

ere are plenty of other hurdles along the way. A poor location or an unhelpful landlord can sabotage an owner. Mistakes by a contractor can be costly if you have to go back and replace the electrical or ventilating systems. Not passing city inspection usually means waiting another month to open the business. en there’s getting the word out that you’re open.

In addition to that come rising costs: higher property taxes, phasing out the tip credit for employees and mandated paid leave. Tighter pro ts mean it’s more difcult to expand. “ e small entrepreneur has less cash ow than he did 30 years ago, and that cash ow isn’t available to open more restaurants,” Sanchez says. Independent operators o ering tacos and other Mexican food face threats from deep-pocketed competitors coming into the Chicago market. Tacombi, an upscale taqueria backed by Shake Shack founder Danny Meyer, opened in the West Loop last year.

Still, Black and Hispanic restaurant owners are resourceful. Fortyone percent of restaurant rms are minority owned, compared to 30% of overall private-sector businesses, according to the National Restaurant Association, with 14% of restaurants Hispanic owned and 9% African American owned. ese entrepreneurs often work for years as sous chefs and save their funds. ey seek Small Business Administration loans and government grants or launch crowdfunding campaigns.

Some restaurateurs are able to build out their own spaces — it helps if a partner has contracting experience. Many start small, perhaps with a food truck, or working out of a ghost kitchen for catering or delivery. When entrepreneurs open full-service restaurants, they often opt for smaller, less-expensive spaces since the COVID pandemic shifted a lot of activity to pickup and delivery.

Owners also have to make dicult choices. Robert Cardenas, partner at La Mejikana in Pilsen, says he was evicted from his apartment because he was investing all his money into building out the restaurant space in 2017 and 2018. “ at’s how hard it is for business owners in general, but especially Latinos, to get access to funding, where I had to choose between opening my business and my place of living,” he says. Cardenas says he sold his car and moved into his former college roommate’s basement. “He gets free tacos whenever he comes,” Cardenas adds. He and his partner, Julio Moreno, are now working to open a second location with a seafood menu.

Is he just asking for more trouble? “Me gusta la mala vida,” he says, which translates

More restaurants have opened than closed in predominantly Black or Hispanic neighborhoods in Chicago in the last two years. Of course, Black and Hispanic entrepreneurs operate restaurants throughout the city, not just in these neighborhoods. Across the Chicago metro area, 2,761 restaurants opened while 1,784 closed.

as, “I like the bad life.”

Finding a safe location Reyes worked for years at his mother-in-law’s taqueria in Bensenville — he rose from washing dishes to running the kitchen. His savings and help from his mother-in-law enabled him to acquire a building in Pilsen to open a restaurant, DeColores Galeria y Sabores, which opened in 2009 and subsequently won Michelin Bib Gourmand recognition.

When the pandemic hit, Reyes was operating DeColores and three other locations, and working seven days a week. Everything closed, but Reyes appreciated the break and the chance to spend more time with family. An SBA loan currently is providing the $450,000 cost of upgrading the kitchen and building a patio at DeColores, along with working capital. e expanded space should accommodate more than 150 customers.

Entrepreneurs starting a restaurant invariably try to get bank loans and are almost always disappointed. When Soul & Smoke co-founder and executive chef D’Andre Carter was planning to buy the Evanston building that housed his kitchen, banks wouldn’t consider loans to cover the $1.4 million cost of the building.

“ ey were o ering $20,000,” Carter recalls. “I was asking these guys, ‘What’s up with this 20-grand thing?’ e rent we were paying at the time was more than what our monthly mortgage payment would be.” Carter was nally able to secure a loan through a mortgage broker and First Women’s Bank in Chicago, a mission-driven lender. Once a restaurant establishes and proves itself over three years, banks may be more accommodating, experts say. For example, Uncle Remus Saucy Fried Chicken had a track record dating to 1969, but banks wouldn’t provide a loan for a location in Bronzeville, says CEO Charmaine Rickette. She eventually won nancing for the $600,000 buildout from the Chicago Community Loan Fund, a nonpro t community development nancial institution.

Still, Rickette was paying $16,000 a month for rent and the construction loan, “and you’re not open yet,” she says. “I’m taking money from the Madison store (in Austin) to catch up. It’s like a hamster wheel, let me jump o .” e Bronzeville location opened in 2015. e business was originally started in the Austin neighborhood by Rickette’s father, Gus, and a friend. It also operates a location in Broadview and a food truck called “Big Saucy.” Entrepreneur Taylor Mason launched a crowdfunding campaign to raise capital for the buildout of Taylor’s Tacos in the Little Italy neighborhood, which she owns with partner and wife Maya Mason. Grants from Grubhub and the Chicago Blackhawks Foundation also helped fund the $100,000

which required electrical upgrades because the system was not up to code in the older building. Choosing a safe location is paramount, Taylor Mason says. Her ca-

tering business started in 2018 at e Hatchery food incubator in Gar eld Park. A few years in, the pair started to move into a space in Bridgeport but did not receive a warm reception in the neighborhood, which Mason attributes to the business being Black and lesbian owned.

“You know something is o when people on the street and neighborhood businesses keep inquiring, ‘Where are you from?’ and ‘What’s your business?’ ” she recalls. ey moved out after a drunk driver crashed into the space. e pair settled into its current Taylor Street location last year, which operates primarily as a catering business but is open to the public on Tuesdays.

A friendly and exible landlord is key for success in a rental, experts say. “What can bring you down to your knees is not having a favorable lease,” says Chicago restaurant consultant Doug Roth, who was a partner in former popular Michigan Avenue restaurants Bistro 110 and Blackhawk Lodge. Irene Acosta and her partner and husband, Miguel Hernandez, opened their Pilsen brunch restaurant Pochos last year after losing their lease in nearby McKinley Park. e old space needed upgrading and a kitchen expansion, but the landlord wouldn’t o er the eight- to 10-year lease the pair required, Acosta says.

ey found a promising space on 18th Street that needed work. Happily, the landlord’s family was a fan of the restaurant. “ ey were willing to share the cost of construction — without that I don’t know what we would have done,” Acosta says. “We’re not technically partners, but it certainly feels like we’re in a partnership.”

Beware the generation gap

Navigating the permit and inspection process is a particularly painful point, as depicted in the FX TV show “ e Bear” when a Chicago inspector shows up to the restaurant and nds oil-soaked rags in a vent, a pack of cigarettes close to the stove and cracks in the building's foundation.

Unless the owner's a whiz at drywall and plumbing, the restaurateur depends on a contractor. And some contractors, whether incompetent or inexperienced, don’t know building codes, says Malcolm Crawford, executive director of the Austin African American Business Networking Association, who is driving to spur development along Chicago Avenue in the Austin neighborhood. Maybe the contractor doesn’t know the need for a higher level of electrical service to support equipment. Or, maybe he made an error that caused the restaurant to fail an inspection.

“Not only does (the contractor) fail you, but you’ve got to get back in line and schedule your next inspection, which might not be for another one or two months,” Crawford says.

But knowledge is power, says Rickette of Uncle Remus Saucy Fried Chicken. When the chain’s location at Central Avenue and Madison Street was being remodeled in 2022, the contractor made an error and wrapped the ventilation in insulation before inspection. e contractor could have quickly removed the wrapping, but the inspector took a hard line. He refused to wait and complete the inspection, she recalls.

“I called the alderman, who called the building commissioner,” she recalls. “ ey sent another inspector pretty quickly. But you have to be entrenched in the community to know (how to do) that.”

One skill that took Rickette a while to master was how to block employees from stealing. She quips that when she was growing up, “the employees were richer than we were at one point, because they were stealing most of (the money).”

Rickette assumed operations from her father in the 1990s, but it still took years to uncover the schemes. In one instance, an employee pocketed cash from a customer while recording the transaction as a credit card sale. She wrote checks occasionally and one re-

The Emmy Award-winning television series captures the ups and downs of the restaurant industry, especially the need to persist

By Judith Crown

Chicago restaurant owners relish that the hit TV show “ e Bear” showcases the city’s restaurant scene. It portrays the glamour of the business, but also the relentless pressure and grind.

cipient used the routing and account numbers on the check to make a car payment, she says. Technology has enabled more checks and balances to make the deceptions nearly impossible, Rickette adds.

e pandemic changed the attitude of many workers who wanted to create a better work-life balance. At Uncle Remus, workers used to stay for 10, 15 or 20 years, Rickette says. Now an average employee might make it to six months.

“I have people that interview, and we onboard them,” Rickette says. “ en they don’t show up, or they come late, or come and leave and never come back.”

Mason of Taylor's Tacos sees a generation gap between herself, as a 36-year-old millennial, and Gen Z employees. A common hiring practice in the restaurant industry is staging, where an applicant works without pay for a trial period to see how they t in. It’s comparable to an unpaid internship. But prospective employees are pushing back.

You really have to see how they move about the kitchen but these days people are refusing, demanding that they be paid for the time, she says. Mason is holding rm to the industry practice.

She says new employees often feel entitled — for example, asking for a break after two hours. “Dude, you should have eaten before you got here,” Mason tells them. Or the new hires brush o being late, basically saying it doesn’t matter as long as they arrive. She says she feels they have her over a barrel because they know the search and hiring process to replace them is time consuming and tedious.

Restaurateurs note that it’s di cult to maintain a satisfying work-life balance, as ownership is usually an all-consuming 24/7 undertaking. Rickette says she has no plans to open additional restaurants in the city but hopes to sell a license for satellite locations at O’Hare International Airport.

“I want to make money in my sleep,” she says.

ey don’t necessarily spend hours binging the series. Why would they want to relive the stress they encounter every day in the kitchen?

“It gave me high anxiety when I was watching it,” says Sergio Reyes, who is working to reopen his Pilsen restaurant known as DeColores. “I can't believe we're about to get back into this business, but it's what I know how to do.”

e Emmy Award-winning FX series follows protagonist Carmen “Carmy” Berzatto, a ne-dining chef who returns home to Chicago to run his late brother’s failing Italian beef sandwich shop. Carmy’s goal is to transform the shop into a mecca of ne dining. Along the way, kitchen chaos ensues and tensions are among Carmy and the sta .

Chicago restaurateurs say the situations are exaggerated for maximum television drama. “We're not that violent in the kitchen,” says Sam Sanchez, president of ird Coast Hospitality Group and a member of the Illinois Restaurant Association's executive board. “Yeah, there’s disagreement, people that quit and

get red. But they’re not screaming and throwing things around.”

On the other hand, the show portrays the camaraderie of the kitchen, or “back of the house,” which appeals to Robert Cardenas, partner at La Mejikana in Pilsen, who is opening a second location. “It's shoulder to shoulder in the trenches with your team,” he says. “It's controlled chaos, but you're doing it together.”

" e Bear" accurately portrays the panic that sets in when the line cooks can’t keep up with the orders owing in. “We’ve been there when the tickets are pouring in,” Cardenas says. “I tell the server, ‘Please stop taking orders.’ ” e perfectionist side of Carmy — he insists on changing the entire menu every day — is neither realistic nor good business, says restaurant consultant Doug Roth. Business success depends on a disciplined structure for expenses and optimizing the cost of food, Roth says. “What happens if you’ve got leftover Dover sole?” he says. “Dover sole is a high-priced sh. And suddenly you don't want to serve Dover sole the next day?"

Turning the menu over daily also means you’re not establishing a set of signature dishes that customers will associate with the restaurant, he adds.

What “ e Bear” really nails, Roth says, is the need to persist and push through obstacles. You’re going to eat crow for a while, he adds, until you make it.

For decades, Chicago's rich and vibrant culinary traditions have been celebrated throughout the South Side, including Chinatown and Little Village and from Bronzeville to Pullman. e neighborhoods of Avalon Park, Auburn Gresham, Chatham and Greater Grand Crossing, collectively known as Greater Chatham, are the focus of the Greater Chatham Initiative (GCI).

City, Tropical Island Jerk Chicken, Dat Donut and Justice of the Pies, are just a slice of the Greater Chatham food and dining options. ese enterprises are community and corridor anchors, neighborhood amenities, destination nodes and centers of sustainable employment. ese establishments feed Greater Chatham’s 122,000 residents and 30,000 workers.

Greater Chatham has 300 Black American, Caribbean and West African food businesses, which attract more than 2 million residents, workers and visitors annually who spend over $84 million, according to the Bureau of Labor Statistics and other consumer spending sources.

Restaurant visitors are Greater Chatham residents and patrons who come from as far away as Schaumburg and the border states of Michigan and Indiana. ese diners are attracted to the dishes and delights of foods served in Black restaurants in Black communities.

O erings from restaurants and retailers, including Lem’s Bar-BQ, Brown Sugar Bakery, Soul Veg

A 2019 "Assessing Chicago’s Small Business Ecosystem" report details that Greater Chatham is one of the jewels in the larger crown of the South Side restaurant entrepreneurial ecosystem, where half of Chicago's South Side businesses were food-related with $284 million in restaurant sales.

During the COVID pandemic, entire swaths of Chicago-area communities faced challenges. Because many restaurants did not have an online presence, sales su ered.

GCI kicked o FoodLab Chicago, a food-based business support program, in 2019 and stepped into action by assisting restaurants in creating online presences. Greater Chatham’s enterprises

survived and, out of this crisis, GCI created Soul Delivered, an affordable restaurant and catering food-delivery partner.

Only 18% of restaurants know how to appropriately price their plates, according to FoodLab Chicago statistics, so it o ers a complete restaurant business curricu-

lum, including plate costing, menu engineering and storytelling.

FoodLab Chicago’s motto is that if every plate is pro table, then that restaurateur will be pro table. FoodLab Chicago has assisted 85 businesses since March 2020. Food entrepreneurs

need access to capital to thrive. Twenty-three FoodLab Chicago members have obtained $7.8 million in loans and grants between 2020 and 2023.

Restaurants are one component of the South Side's abundance of businesses, and Greater Chatham o ers plenty of options.

My passion for all cultures and cuisines fueled an intense desire to get into the food service industry — in uenced, I would add, by my Latina identity. is passion has allowed me to travel and sample di erent foods and observe how they were prepared. I dreamed of preparing and serving dishes that would delight the palate and satisfy the soul with wholesome, nourishing meals.

urban eatery that would serve my community nutritious hot food at affordable prices.

Originally, I worked as a licensed practical nurse at a Veterans Administration hospital, so helping others in need is something I happily embraced. From that experience, I learned that I could take my passion for nursing in a di erent direction while building on my passion for soul food by providing nutritious meals to customers who also appreciate soul food.

Using my savings, I followed my dream of becoming an entrepreneur by self- nancing and opening a community restaurant strategically based in Chicago's Austin community. I named it Chef Daddy’s and designed it to be a unique

Oftentimes, entrepreneurs that look like me have a di cult time seeking and securing nancing, but my work as a nurse allowed me to save enough money to start my business. I opened the doors in 2015 and hired exclusively from the Austin community. is decision ensures that my team re ects the community we serve and allows me the possibility to provide opportunities to individuals who may have faced barriers themselves.

By focusing on the Austin community, Chef Daddy’s is committed to serving culturally prepared nutritious foods at a ordable costs with meals starting at $6.99. We serve many seniors in the community as well and others who typically may not have, for various reasons, healthy food options. It gives them the ability to choose healthier options rather than fast food.

Our food not only meets but exceeds expectations while creating a welcoming space that

makes everyone feel at home. Our focus on quality and genuine connections has been key to building and maintaining trust and a sense of community. Despite the ups and downs, as a restaurant owner, I derive joy from seeing our customers share meals with loved ones. e pride

that comes from witnessing my team’s growth allows me to share a piece of the culture with others, making it all worthwhile. Maintaining customer loyalty is another challenge that requires constant e ort and adaptability.

We know our customers in Austin appreciate the respect we show

for the community and those we serve.

For me, owning a restaurant is more than just cooking food that people like. It allows my sta and me to elevate a culture and show that a successful, independently owned restaurant is possible in Austin.

COOK COUNTY PROPERTY TAXES

The south suburbs may be the epicenter of Cook County’s rising property tax burden, but with so many government entities, it will be hard to nd a single solution that satis es everyone | By

When Mayor Brandon Johnson announced an earlier version of a city budget that included plans — that went back on a campaign promise — to raise Chicago property taxes, resistance was high.

Discontent about property tax increases persists not only among Chicagoans, but also among Cook County residents and property owners nationwide. Relief is what everyone wants, as seen by the rate at which municipalities put property tax-related referendums and legislation on the ballots in 2024, says Rita Je erson, a

policy analyst for the Institute of Taxation & Economic Policy, or ITEP.

Illinois ranked 21st in overall state tax burden in 2022, the most recent year for which gures were available, according to data from the U.S. Census Bureau and the Bureau of Economic Analysis compiled by the Federation of Tax Administrators. Yet the state had the second-highest e ective rate on owner-occupied properties in 2022, behind New Jersey, according to the

See TAXES on Page 16 CRAIN’S

Margaret Littman

Discontent about property tax increases persists not only among Chicagoans, but also among Cook County residents and property owners nationwide.

From Page 15

nonpro t Tax Foundation.

“Cook County and Illinois have governments that are too reliant on property tax revenue,” says Ralph Martire, executive director of the Center for Tax & Budget Accountability.

While property tax discontent isn’t new, large jumps in assessed values and tax bills are what’s driving it now. But it’s not just the increases. It’s the decreasing ability to pay those taxes, many say. Everyone has an opinion about property taxes. But not everyone has a solution. And solutions are what’s needed.

e pressure placed on residents by recent increases in assessed property values and tax bills is acute in some municipalities. As south suburban Harvey resident Glynis James-Watson detailed for Crain’s earlier this year, her property tax bill jumped from less than $2,000 in 2022 to more than $9,000 in 2023.

According to the ITEP, families with an income of less than $26,700 pay the most in property taxes — 5.1% of their income — while those who have an income of more than $749,400 pay just 2% of their income in property taxes.

Collection rates, determined by the percentage of property owners who pay their tax bill, decreased in 2024 to 95%, according to the Cook County Treasurer’s O ce. e south suburbs had the lowest collection rate at 92%. Countywide, property tax delinquency this year reached its highest rate in a decade.

Of all the county municipalities, Ford Heights had the lowest collection rate at 31.38%. Of the $4.39 million billed, just $1.38 million was collected. at means the chronically impoverished village, marked by entire blocks of vacant buildings and with only 1,509 taxable properties, has to cut services or nd additional revenue to the tune of $3.01 million.

In nearby Harvey, where the collection rate was 52.19%, some business owners who failed to pay their taxes have had access to their properties physically blocked by order of the mayor and were denied business licenses. Critics point out that business owners who don’t have access to their facilities will have di culty generating revenue to pay back taxes.

e Cook County Treasurer’s O ce is tasked with issuing property tax bills in two installments: the rst due in March and the second in August. e Cook County Assessor’s O ce assesses the value of property every three years based on geographical area — the northern and northwestern suburbs, the city of Chicago, and the southern and southwestern suburbs. e Cook County Board of Review then evaluates and adjusts property assessments and recommends any exemptions.

South suburban Ford Heights and Harvey are littered with abandoned residential and commercial buildings. Developing these properties to get them back on the tax rolls is one way to ease the tax burden of homeowners in these areas.

Part of the complication in reducing the area’s reliance on property taxes is that the Cook County property tax system, called “byzantine” by some, has a dizzying number of government entities and agencies involved. In Cook County, agencies that receive funds from property taxes include park districts, public libraries, county

forest preserves and the Metropolitan Water Reclamation District of Greater Chicago.

“Do we really need 17 governmental bodies?” asks 1st District Cook County Board of Review Commissioner George Cardenas, suggesting a consolidation is needed.

No one expects how local governments operate to change

anytime soon. That would take herculean efforts and upset a baked-in status quo. But some solutions that could bring relief to different subsets of taxpayers could ease some of the pain. These proposals would require cooperation among city, county and state leaders to truly make a difference. Most experts say changes on the county level

alone would not be significant enough to make a meaningful difference. Here are seven ways that could help relieve the irksome property tax burdens in Cook County.

1. Create circuit breakers Many homeowners are at real risk of losing their homes, as well as mom-and-pop business

Comparing assessments frequency and property tax exemptions

County Homeowner exemptions offered

Cook County, Ill. (Every three years)

Most homeowners are eligible for an exemption if they own and occupy their property as their principal place of residence. Once the exemption is applied, the county assessor’s of ce automatically renews it each year. The homeowner exemption provides property tax savings by reducing the equalized assessed value.

A property tax circuit breaker reduces property taxes that exceed a certain percentage of someone’s income. Circuit breaker programs take into account a property owner or renter’s ability to pay when calculating property tax bills.

Los Angeles County, Calif. (Annually)

Harris County, Texas (Annually)

Maricopa County, Arizona (Annually)

San Diego County, Calif. (Annually)

A homeowner can apply for exemption of $7,000 from the home’s assessed value if it was the principal residence on Jan. 1.

The state tax code requires school districts to provide a $100,000 exemption on a residence homestead and any taxing unit to adopt a local option residence homestead exemption of up to 20% of a property’s appraised value.

Personal exemptions are offered to eligible widows, widowers, totally disabled residents or disabled veterans with an honorable discharge. The exemption reduces the assessed limited property, which is the taxable amount due and up to $4,476.

The homeowner tax exemption program allows homeowners to claim a $7,000 exemption from the full value of a property used as the homeowner’s primary residence. Other programs are applicable to properties owned by disabled veterans, religious organizations, public schools, colleges and cemeteries.

owners, as property values and assessments increase in many areas while personal incomes do not. Twenty-nine U.S. states and the District of Columbia have circuit breakers, or credits that are designed to help homeowners — and sometimes renters — whose property taxes eat up a significant portion of their budgets. Each state sets up its circuit breaker differently, but is often designed to kick into effect when property taxes exceed a certain percentage of household income. Circuit breakers are different from homeowner exemp -

renters as well as homeowners, which is something the Center of Budget & Policy Priorities recommends. While renters do not receive tax bills in the mail, they typically experience rent increases as landlords pass those costs on to their tenants. Some are set up as direct credits on a property tax bill and others are a state refund, meaning residents need to be able to pay the bill in full in order to get the bene t.

e best circuit-breaker programs, Phillips says, allow for applications separate from tax returns. ose who wish to apply

According to the Institute of Taxation & Economic Policy, families with an income of less than $26,700 pay the most in property taxes — 5.1% of their income — while those who have an income of more than $749,400 pay just 2% of their income in property taxes.

tions and exemptions for senior citizens, veterans and those with disabilities that are offered in Illinois.

“One of the best proposals to keep people in their homes are circuit breakers,” says Anna Phillips, policy analyst at the Washington, D.C.-based Center of Budget & Policy Priorities. Circuit breakers protect local revenue, she says, so that residents still have access to the services that property taxes provide.

Many circuit breakers take into account a property owner’s age as well as their ability to pay. In some states, including Michigan and Minnesota, relief is provided to

when they le their taxes can, but those who do not le income tax returns also have easy access to the applications.

While there is a structure for a circuit breaker at the state level in Illinois, it has been unfunded since 2013. In July, the Cook County Assessor’s O ce called on the Chicago City Council, the county Board of Commissioners and the Illinois General Assembly to work together to address the issue. Some critics, however, complain that circuit breakers are Band-Aids that may provide relief for some homeowners, but they don’t solve systemic property tax problems.

2. Get vacant properties back on the tax roll

While property tax regressivity and complexity irk residents countywide, the issues in the south suburbs are particularly egregious. “We saw declining values in the south suburbs with the housing crisis (in 2008), and a lot of families that were really struggling. We were just starting to recover (when) COVID hit and so that really stymied the recovery,” says Kristi DeLaurentiis, executive director of the South Suburban Mayors & Managers Association.

During the COVID pandemic, people bought property in the south suburbs, lured by the appeal of single-family homes with more elbow room and low interest rates at the time. Then, housing prices increased as inflation and interest rates rose. And when 2023 assessments for the south suburbs came out, homeowners no longer had the benefit of the 10% COVID assessment reduction enacted in 2020. e median south suburban residential tax bill increased by 19.9%, the largest percentage increase in at least 29 years, according to data from the Cook County Treasurer’s O ce. In some cases, DeLaurentiis says, people saw bills that were nearly double their previous bill, an “untenable” situation, particularly given that bills arrived around July 2 and were due a month later. at’s not enough time to come up with the money to cover those kinds of increases.