How Grubhub lost its edge in food delivery

An industry pioneer got out anked by Silicon Valley rivals, but it gave Chicago tech cred at an important time | By

John Pletz

wenty years after it was founded, Grubhub remains one of the most beloved names in Chicago tech — if not necessarily one of its most enduring companies.

Grubhub was a pioneer in enabling consumers to nd and order restaurant food online. e company went public a decade ago and in 2021 fetched a $7.3 billion price when it was acquired by European rival Just Eat Takeaway.com.

Now it’s being sold to New York-based private company Wonder in what looks like a re sale that values the company at just $650 million — a deal that includes just $150 million in cash. Grubhub’s local headcount is down to roughly 750 from a peak of

Private-equity dealmaking set to surge in January

ago, 31 deals for Chicago companies were made.

By Mark Weinraub

Lower interest rates and clarity about the political environment should make for a revved-up dealmaking environment in 2025 from private-equity rms ush with cash.

e slow exit activity of recent years has made private-equity investors impatient as they wait for returns on aging investments, which also should contribute to an acceleration in deal ows, said Keith Campbell, global privateequity lead at Chicago consulting rm West Monroe. e rm esti-

mated there was $2.62 trillion in dry powder for private-equity shops to deploy as of July.

“We have seen, within the last couple of months, our private-equity clients begin to prepare their portfolio companies for exiting next year,” Campbell told Crain's in an interview. “We now have a good prediction for 2025 that things will pick up.”

A slower-than-expected 2024, stemming from delays in interest rate cuts and disparities between

what sellers are asking for their companies compared to what buyers are willing to pay, has made rms even more excited for a pickup in activity in 2025.

“ e bankers are giddy,” Campbell said. “We see sell-side prep already for next year.”

Activity in the Chicago market has already begun to perk up, with 60 deals for Chicago companies made in the third quarter of 2024, the second highest of 16 cities surveyed by KPMG. A year

DAN MCGRATH

Getting the coaching thing right hasn’t been the Bears’ strength. PAGE

West Monroe’s clients are readying their portfolio companies to hit the market in early January, with some putting together nancial data for potential buyers, a move that is often not done until a bidder has entered the space.

“What should we be thinking of doing?” Campbell said. “What should we shore up? How do we tell that sell-side story to try to maximize valuation? ere really are a handful of things that owners and private-equity sponsors will do.”

e early prep could mean many deals will be consummat-

ed by the end of the rst quarter. Campbell also said privateequity rms were eager to employ arti cial intelligence tools to boost the value of companies they acquire. He said applications to boost revenue growth and rein in costs were already available and seen as critical to success.

“ e private-equity rms themselves have hired data scientists and are soliciting the help of consultants to tell them if they buy the company where the opportunity is,” he said. “A lot of them are deploying AI already into their portfolios. AI is where a lot of these

A CHICAGOAN TO KNOW

Dr. Michael Adkesson is leading an ambitious Next Century Plan at Brook eld Zoo. PAGE 8

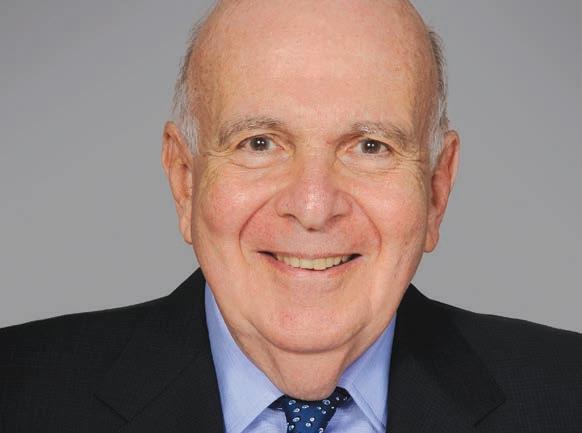

Keith Campbell

Coaching hasn’t been the Bears’ strength

For the rst time in their 104-year history, the Chicago Bears have red a coach midseason.

at’s a welcome break with tradition, if you buy into the plausible theory that the coach in question, Matt Eber us, had to go. He did. e botched handling of the nal half-minute of a 23-20 anksgiving Day loss to the Detroit Lions, and the look of bewilderment on the coach’s face as those 30 seconds ticked away, were reason enough.

Eber us also had priors, beginning with a 14-32 record for two-plus seasons, a six-game losing streak and an uncanny penchant for coming up short in the one-score games that separate the good from the bad in the NFL.

I type these words with no particular relish. Eber us had visited the school where I work a few times and came across as decent, down-to-earth and approachable. Kids can always spot a phony, but the verdict on Eber us was unanimous: genuinely good guy whom you could pull for to do well. But he didn’t, and the Bears did what they had to do to maybe too good a guy.

And as if to remind us that they’re still the Bears, they handled the ring as clumsily as they could, announcing it two hours after Eber us had held his weekly post-mortem with reporters and made one nal, futile attempt to explain the inexplicable, which probably made things worse. No one from the team’s brain trust (heh-heh) was available to take questions or elaborate on press-release statements or explain the thinking behind elevating to interim head coach a man with three games of coordinator experience to call upon. at will come. In the meantime, we’re free to speculate on what’s next. If you have followed this team, that’s a scary proposition, although the presence of a real quarterback makes the job more appealing than it otherwise might be.

Whether it was Dave Wannstedt, Dick Jauron, Lovie Smith, Marc Trestman, John Fox, Matt Nagy or Eber us, the Bears have not been able to get this coaching thing right since Mike Ditka stomped o into the sunset after 11 tumultuous but mostly successful seasons.

Maybe that’s because Jerry Angelo, Phil Emery, Ryan Pace and now Ryan Poles had a hand in the hires.

Of what we’ve seen, only Angelo would pass a course in Team

Building 101 — the Bears made four playo appearances in his 11 seasons and played in Super Bowl XLI under Smith.

Lovie didn’t distinguish himself in subsequent stops at Tampa Bay and the University of Illinois, but his 81-63 record is easily the best among the seven would-be Ditkas, and he was coming o a 10-6 season when he was dumped.

Too defensive-minded in an increasingly o ensive game, Emery o ered by way of explanation. His solution? Trestman. Mr. Incompetent, meet Mr. Inept.

Poor Eber us was still packing up his o ce when the usually credible Athletic put forth a list of 15 possible successors — boy, that narrows the eld.

e Sean McVay “tree” will be invoked as the process unfolds, as if the Rams’ coach were a majestic California redwood, branches shading and roots underpinning the pro game’s history. e man is 38 years old, but very much an archetype: young, pedigreed, o ensiveminded . . . the football version of eo Epstein, with former associates in high demand. Every team has to have one, even as 66-year-old Andy Reid, 62-year-old John Harbaugh and 60-year-old Sean Payton keep cranking out winners.

e Eber us denouement overshadowed another Bears-related item that had slipped back into the news for a minute: an acknowledgement that much is forgiven in Arlington Heights and the former racetrack property could be back in play as a stadium site.

It’s about time. ere could have been shovels in the ground if the Bears had made the commitment earlier.

Team President Kevin Warren is adept at using his full-bore ambition to get his way, but he misread the room in unveiling that lakefront Taj Mahal as his vision of the Bears’ new home. George Lucas’ Star Wars museum was a toolshed by comparison, but Friends of the Parks and fellow environmentalists succeeded in scuttling it — in their world, the lakefront remains free from commercial development.

Sam Zell estate puts riverfront of ce building up for sale

By Dan McGrath

A riverfront o ce building that late real estate mogul Sam Zell owned for nearly ve decades has gone up for sale as his estate looks to unload his properties more than a year after his death.

Zell's investment rm, Equity Group Investments, or EGI, has hired brokers from real estate services rm Eastdil Secured to seek a buyer for the 26-story building at 2 N. Riverside Plaza, according to sources familiar with the o ering. Zell, who died last year at age 81, originally bought the art deco building in the West Loop in 1975. ere is no speci c asking price for the 579,000-square-foot property, which served as the longtime home of the Chicago Daily News. But sources said bids are expected to be well short of the balance of a $65 million loan from lender Voya Financial that EGI borrowed against the property in 2016. at mortgage isn't scheduled to mature until 2036, according to Cook County property records.

A sale price below the outstanding debt would put 2 N. Riverside in the same bucket as many downtown o ce buildings that are mired in distress. e remote work movement fueled by the COVID-19 pandemic has pushed downtown ofce vacancy to a record high and combined with elevated interest rates to hammer o ce property values, wiping out massive chunks of equity for landlords and pushing many lenders to take painful nancial haircuts.

e pain has been especially acute for lower-tier, or Class B, ofce buildings with lots of vacancy, like 2 N. Riverside. Companies have

And against a backdrop of underperforming schools, underfunded pensions, decaying infrastructure and a perception that crime is everywhere, there’s not much appetite for public money going toward private stadiums for billionaire owners.

Especially owners who don’t demonstrate much aptitude.

predominantly cut back on workspace and ocked to the newest and most-updated buildings downtown as they look to inspire employees to work in person.

e Riverside building is just 54% leased, according to industry publication Real Estate Alert, which rst reported that the property was being marketed for sale. at's well below the 74% average for downtown o ce buildings. Equity Residential, a real estate investment trust previously led by Zell, is the tower's largest tenant.

e o ering comes as Zell's estate looks to sell o properties he personally owned amid a wideranging real estate portfolio. Another Zell-owned property, the 292unit Cobbler Square Lofts apartment complex in Old Town, is

More seats, more parking, more amenities, a dome . . . the new facility has to be built someplace where all that ts. Even the Bears should realize that.

Correction

◗ In Crain’s Notable Nonpro t Board Leaders that published in the Dec. 2 issue, Michael Monticello’s pro le should have noted that Catholic Charities of the Archdiocese of Chicago served a total of nearly 2 million people during his board leadership, not annually.

under contract to be sold to local investors for close to $90 million.

Spokesmen for EGI and Voya did not respond to requests for comment.

e Riverside building was the rst Chicago o ce tower built using air rights above train tracks when it was completed in 1929. e property stood out at the time for its expansive plaza adjacent to the tower and overlooking the river. Zell mulled plans over the years to develop another tower on that plaza. He hired an architecture rm in early 2008 to draw up plans for a new o ce tower on the site, but didn't pursue the project as the Great Recession set in.

Eastdil Secured brokers Bryan Rosenberg and David Caprile are marketing 2 N. Riverside for sale.

Dan McGrath

2 N. Riverside Plaza | COSTAR GROUP

Where Chicago ranks in tech workforce diversity

Brookings looked at the 100 largest U.S. metropolitan areas, analyzing jobs that it classi es as ‘highly digital’ |

Chicago is among the top one-third of large cities when it comes to the diversity of its tech-related workforce, according to a new Brookings Institution study.

Brookings looked at the 100 largest U.S. metropolitan areas, analyzing computer, engineering and management jobs that it classi es as “highly digital,” or involving intensive knowledge and use of computer technology, across all industries.

e data shows a Chicago digital workforce that is 35.9% female, in line with New York but slightly ahead of Los Angeles, Dallas and Houston. Hispanic people hold 11.7% of computer, engineering and

By John Pletz

Computer, engineering and management jobs with a tech focus play an outsized role in the economy.

@properties Christie’s to be acquired by Compass

Founded 24 years ago as a technology-driven upstart, the Chicago company grew to become the 8th-largest residential brokerage in the U.S.

By Dennis Rodkin

@properties, a real estate brokerage that launched in Chicago 24 years ago and grew to have international reach with the acquisition of the Christie’s real estate brand, is being acquired by New York-based Compass, the companies announced on Dec. 2.

e deal, terms of which were not disclosed, “is a very complementary union that respects our unique brands,” Mike Golden, co-CEO of @properties Christie’s, said in prepared comments in the press release announcing the sale. His coCEO and co-founder, ad Wong, told Crain’s they would not comment beyond the press release issued by Compass.

Terms of the deal were not disclosed by the rms, but Real Estate News reports the sale is a $444 million deal.

e sale should be nalized in 2025, according to the press release.

Since entering the Chicago market in 2017, Compass has grown its footprint here through a series of acquisitions, including signing the city’s top-selling real estate team, led by Je Lowe, and by attracting several bou-

tique brokerages with a technology package they were too small to a ord on their own.

Acquiring @properties Christie’s is Compass’s biggest gulp to date in the Chicago-area market. @properties Christie’s International Real Estate is the nation’s eighth-largest residential real estate brokerage by volume, according to RealTrends. It’s also

Terms of the deal were not disclosed by the rms, but Real Estate News reports the sale is a $444 million deal.

by far the largest in the Chicago area, with $14.4 billion in sales volume in 2022, the last year that RealTrends broke out its data expressly for Chicago. e brokerage with the next-biggest business, Coldwell Banker, had less than half the volume of @properties Christie’s that year.

Baird & Warner, ranked third in 2022 with $6.3 billion in sales

A look at MacKenzie Scott’s 2024 local donations so far

The billionaire philanthropist has given a total of $57 million to 24 organizations this year

By Brandon Dupré

Billionaire philanthropist MacKenzie Scott has given big sums to Chicago nonprofits since she went on her donation spree in 2020. Here's how 2024 is stacking up.

Scott and her philanthropic foundation, Yield Giving, have donated a total of $57 million to 24 Chicago nonpro ts so far in 2024, according to her website, which includes the $15 million donation to the a ordable housing lender Community Investment Corp. reported by Crain’s yesterday, her largest single donation in Chicago this year.

In 2023, Scott recorded $62

million in donations to Chicago nonpro ts, according to her foundation’s records. In 2022, she gave over $160 million and topped $146 million in 2021 and $147 million in 2020.

While this year’s numbers are short of the high-water mark of donations made in 2022, the 2024 gures are sure to grow as there appear to be delays between her donations and what is listed on the site’s database. It’s unclear how regularly the site is updated and how exhaustive the list is.

Some donation listings do not disclose an amount.

On its website, the foundation says: “Information in this database is updated periodically,

following consultation with the organizations themselves to afford them an opportunity to share it in the ways that best

serve their e orts.” Scott on Nov. 25 broke a record at the nonpro t Community Investment Corp. with her $15 mil-

lion donation, the largest single donation in the nonpro t’s 50year history and the second from the billionaire philanthropist. She awarded the nonpro t $8 million in 2020.

“We’re thrilled and incredibly grateful (for this donation),” said Stacie Young, president and CEO of CIC, which lends capital to businesses and rehabbers of multifamily housing in low- and moderate-income communities.

“It's really unusual that we would have this kind of latitude (with a donation or grant), and it has really enabled us to ll gaps in what we see are needs in the marketplace that we couldn't otherwise do,” Young said.

In typical Scott fashion, the donation is unrestricted, allowing

F REE PIK

MacKenzie Scott

Italian Village opens basement restaurant Sotto

The fourth generation now involved in the century-old, family owned business is looking to appeal to younger neighborhood customers

By Ally Marotti

e almost century-old Italian Village restaurant complex in the Loop debuting a new spot in the basement, as the fourth generation of the family business looks to attract a younger neighborhood crowd.

Sotto, which opened last week, replaces La Cantina Enoteca, one of three restaurants that comprised Italian Village until it shut down during the pandemic.

An Italian wine bar that opened in the mid-1950s, La Cantina Enoteca had wood paneling and drew locals on cold nights to its cozy basement locale, said Jonathan Capitanini, president of the Italian Village complex. It was a spot for locals to grab a drink, not a place to wine and dine a business client.

e Capitaninis are going for a similar ethos with Sotto. ey renovated the space and modernized the plumbing and lighting in the circa-1800s building. ey reused the wood paneling and kept the original bar, but will roll out new drink and food menus with Italian-inspired dishes. ey’ll turn o the oldschool Italian tunes and operas in lieu of di erent music.

“We dubbed it an ‘Italian bar with Chicago sensibility,’ ” Capitanini said. “ is non-stu y place where you can get great drinks, great food and just relax. e heart of the Loop is oftentimes not a place people relax.”

Operating a restaurant in the Loop has been fraught with challenges in recent years, as post-pandemic exible work schedules have fundamentally changed operators' business models. Loop restaurants once catered to business diners or the lunchtime crowd, who ocked downtown en masse during the

work week and often stuck around after 5 p.m. for happy hour or dinner. Now, Chicago’s average o ce occupancy hovers around half of what it was prepandemic, according to data from real estate technology rm Kastle Systems. Mondays and Fridays see even fewer commuters.

Capitanini, whose title at the restaurant also includes “head dishwasher,” is not worried about that. He sees the situation as an opportunity for the Loop to shift toward residential occupancy and garner more of a neighborhood vibe. Sotto is aimed toward that shift.

e restaurant will be closed Sundays and Mondays. Capitanini said Sotto’s mid-week clients will likely be o ce workers, while Friday and Saturday they could be someone else — maybe tourists from nearby hotels or suburbanites in to visit a museum or watch a show.

“I come to work every single day and I look at the parking lots, the people walking around, and they are my age,” said Capitanini, 28. “It is young people that are here because they actually want to be at work. To some extent, there are limitations.

“We just have to be aware of what the trends are and change with them.”

Opening under a legacy restaurant umbrella will certainly help Sotto weather the challenges, said James Gray, CEO of food and beverage consulting rm Calibrate Coaching. e Capitaninis will need to be clear in their messaging to consumers and market their story as the new generation coming in to win over new, younger customers.

“Being Italian Village, they probably have an upper hand,” said Gray. “If it was anybody else going into downtown to do that

and trying something similar, I don’t know that I’d be nearly as optimistic.”

Capitanini’s great-grandfather, Alfredo Capitanini, opened Italian Village’s rst restaurant, e Village, in 1927. He had immigrated from a town in Tuscany a few years before, landing jobs as a dishwasher and working his way up through line cook and chef positions. When he was able to open his own restaurant, he modeled it after his hometown, adorning the walls with murals of the Tuscan foothills. He bought the building at 71 W. Monroe St. in the mid-1940s, a move his great-grandson said helped keep the business alive during the COVID-19 pandemic.

The next generation opened La Cantina Enoteca in the basement of the building in 1955. Styled to make diners feel they were walking into a wine bar in Florence, it evolved into a

steakhouse later. The family opened a fine-dining option called Florentine Room on the top floor of the building in 1961, at a time when Italian food was not considered elevated cuisine. The third generation turned Florentine Room into Vivere in 1989 to modernize the restaurant.

Vivere and La Cantina both closed during the pandemic, a time of extreme tumult for the restaurant world. Chicago restaurants were forced to halt inperson dining for months. When they started reopening in 2021, they were hit with in ation. e cost of eating out is up about 30% since 2019, and some restaurants struggle to maintain customer loyalty.

e Village subsisted on a strong take-out business, holiday take-home dinners and other revenue streams. Vivere is now only available as an event or

private-dining space. Capitanini said there are plans to reopen Vivere in the next few years. Capitanini and his sister, 30year-old marketing manager Giovanna Capitanini, in recent years left other careers to enter the family business. She came on board about ve years ago; Jonathan Capitanini joined the business after the pandemic, following a career in consulting that included a stint at McKinsey and work in another restaurant group. e two opened a pop-up in the basement space called Bar Sotto about a year ago to test their new concept. e family deemed it a success, as nearby hotels sent guests and the long dark basement turned lively again. Bar Sotto will reopen adjacent to Sotto.

“We’re reaching a di erent type of guest, which was our goal in the end,” Giovanna Capitanini said.

Fresh off a James Beard win, Lula Cafe starts something new

By Jack Grieve

Lula Cafe owner Jason Hammel has taken over the old Mini Mott lease and turned the Logan Square restaurant at 3057 W. Logan Blvd. into a dynamic space for musical performances, speaker series, pop-up culinary events and more.

LouLou, as the new space is called, seats about 50 guests and feels like a cross between an art gallery and a "really tiny, little, intimate restaurant," Hammel said. e space debuted Dec. 3 with the inaugural edition of "From e Pass," a new speaker series hosted by Hammel. Celebrity chef Rick Bayless was the rst guest.

Hammel's goal with LouLou is to continue the community element of Lula Cafe while minimizing disruptions to its restaurant service. Lula Cafe, which opened in 1999, has long hosted special events like the ones Hammel has planned for LouLou. But the restaurant has become more popular in recent years — it was Chicago's only 2024 James Beard Award winner — and while Hammel celebrates the success, "it takes away from our ability to host smaller events," he said. " is gives us a way of accessing the deep community roots that we've had for the 25 years we've been in Chicago," Hammel said. "It's a very small, intimate, artistic space where we are going

to be doing a bunch of esoteric, interesting events."

Most LouLou events will be open to the public through tickets on Resy. Admission to the "From e Pass" night with Bayless is listed at $85.

Hammel said parts of Lula Cafe's menu will be available at certain events on a curated basis. Again using the Bayless talk as an example, LouLou will serve appetizers before the discussion and a bu et-style meal afterward.

LouLou may also become a brunch restaurant with regular weekend service not tied to any speci c event, though Hammel said that remains a ways down the road.

Sotto replaces La Cantina Enoteca, one of three restaurants that comprised Italian Village. | GIOVANNA CAPITANINI

LouLou from Lula Cafe | WADE HALL VIA LOULOU

CEO’s murder raises some troubling questions for insurers — and for us all

First, a stipulation: No consumer complaint should ever be settled at the point of a gun.

One would like to think this truth is self-evident. And yet, in the wake of the Dec. 4 murder of UnitedHealthcare CEO Brian Thompson, it seems necessary to restate the idea in the clearest possible terms, because the public reaction to the shooting — particularly on social media — has been almost as troubling as the crime itself.

We're still not exactly sure a beef with the health insurer is what motivated an unknown gunman to open fire on Thompson in broad daylight on a Mid -

of the book title "Delay, Deny, Defend," which describes tactics allegedly used by insurers to reject claims. And Thompson's wife, Paulette, told NBC News her husband had received threats and suggested they could have been related to a “lack of coverage.”

As the news of ompson's murder spread, social media expressions of shock, grief and sympathy were soon overtaken by a tsunami of venom directed at the industry in which he spent a nearly three-decade career. e commentary implying ompson somehow got what was coming to him doesn't bear repeating, but one Florida orthopedic surgeon succinctly captured the more civil essence of the discourse: " e fact that every doctor thought, 'I'm sure this is related to denying access to care' . . . shows how bad our system is."

There’s the unsettling realization that the Thompson shooting signals Americans’ growing acceptance of violence as a way to settle civil disputes.

town Manhattan sidewalk. But clues that emerged during the manhunt for the killer suggest it's possible. Bullet casings found at the scene outside the investor conference Thompson meant to attend were inscribed with words such as “delay” and “deny,” reminiscent

PERSONAL

VIEW

And that reality is what the insurance industry is grappling with now as its leaders, along with law enforcement and elected officials, search for answers in this case. To be sure, more regulation is hardly what's needed in the health insurance marketplace, but a more thoughtful and attentive application of the rules already in

place would be a step toward making the system work better for everyone. Industry figures show health care providers nationwide and their patients are dealing with more claims denials than ever, a trend that's forcing them to spend more on resources and staff dedicated to claims appeals. From 2022 to 2023, care denials from commercial and Medicare Advantage plans grew 20% and 55%, respectively, according to data from Chicago-based organizations the American Hospital Association and Syntellis Performance Solutions.

Just as a for-instance, an October report from the Senate's Permanent Subcommittee on Investigations shows many insurers have been using arti cialintelligence tools to deny claims from holders of Medicare Advantage plans. As reported in Quartz, the study found UnitedHealthcare's denial rate for postacute care — in other words, transitioning people out of hospitals and back into their homes — among Medicare Advantage patients rose 22.7% in 2022, up from 10.9% in 2020.

As Crain's Katherine Davis and Jon Asplund report, data on claims denial rates by specific insurance providers is unavailable. Although the Affordable Care Act permits regulators to require insurers to disclose information on

claims denials, the feds have so far not collected much of this data and have shared even less with the public, according to a 2023 ProPublica report.

And even as the reverberations of the Thompson case rocked the industry, word came that insurance giant Anthem Blue Cross Blue Shield had introduced a proposal earlier this month that would set time limits on insurance coverage for anesthesia, stating it would deny claims for procedures that went on longer than allowed. After facing backlash from physicians and elected officials, Anthem announced Dec. 5 that it was backing away from the plan.

The disconnect between what customers pay for health care coverage and what they and their care providers actually get in return is a widely recognized chasm, representing a monumental public-relations crisis the insurance industry must now reckon with.

For the rest of us, there's the unsettling realization that the Thompson shooting signals Americans' growing acceptance of violence as a way to settle civil disputes.

"Now the norms of violence are spreading into the commercial sector," as Robert Pape, director of the University of Chicago's project on security and threats, put it to The Guardian. "That's what I saw when I saw this."

Mapping the next steps toward the world’s energy transition

The University of Chicago recently did something extraordinary.

Recognizing the urgent need to accelerate the reduction of greenhouse gas emissions, the university opened a new, agship Institute for Climate & Sustainable Growth — the rst of its kind for Illinois’ top-ranked university.

In recognition, well-known names in politics, academia and energy ocked to the David Rubenstein Forum in downtown Chicago, including Gov. JB Pritzker; former U.S. Sen. Heidi Heitkamp, cofounder and chair of the One Country Project; U.S. Sen. Dick Durbin; and John Podesta, President Joe Biden’s senior adviser for International Climate Policy. I joined former Department of Energy Undersecretary for Science Paul Dabbar, and Shirley Meng, a world-leading researcher in energy storage technology, on a panel focused on the growth of battery storage technology and the demands on the grid from increased electri cation needs. ere was spirited debate and a shared commitment to driving action on climate change.

But now that the panels have concluded

and the launch celebration is behind us, how will this new institute do what it has committed: lead the way in developing solutions to the complex challenges of the world’s energy transition?

Despite an impressive push for startup funds, money won’t be the only answer. Even the laudable hiring of distinguished new faculty in elds ranging from climate economics and politics to geoengineering and materials science won’t do it. Not entirely.

If the institute is to be a success in its e orts to take on, in its own words, “the greatest challenge confronting the globe today,” it will need to link arms with a critical partner: its local energy company. Exelon, through our six local energy companies — including Commonwealth Edison, here in the Chicago area — is a leader in the energy transition. at transition is demanding transformational change across the entire energy system and the economy to achieve the net-zero carbon emissions experts tell us will help turn the tide on climate change.

E orts to decarbonize, achieve netzero or usher in new forms of renewable

energy all manifest at your car, home or business with critical infrastructure built and maintained by Exelon/ComEd. Our role as your energy company is to upgrade and operate an electric grid that can meet the needs of a clean energy future. e electron, if you will, starts and stops with us.

More is being required of the grid we know today — from dealing with greater and more frequent weather threats, to preparing for more electri cation of vehicles, more solar, wind and other energy resources, and accommodating the incredible surge in energy capacity needed to power data centers and the rise of articial intelligence.

We’re also focused on equity, making sure underserved and under-resourced communities — the ones most a ected by air pollution and other e ects of climate change — are not overlooked in the energy transformation.

Ultimately, the goal is not just a decarbonized energy system, but one that is also smarter, more reliable — a ordable and equitable.

But we can’t do it alone.

ough we have brilliant researchers in-house, we maximize our R&D impact by pursuing it in partnership with industry, national labs and universities. We are actively involved in research with many partners to test and scale emerging technologies needed for the energy transition. Locally, we have partnerships with Northwestern and the University of Illinois School of Engineering, for example, and Argonne National Laboratory in DuPage County, one of the most important research organizations in the country.

Although we are experts in our own right, utilities like Exelon/ComEd are not research organizations. We rely on the Ph.D.s, professors, researchers and specialists at universities and institutes — like the one just launched at the University of Chicago — who have deep scienti c knowledge and can test out nascent theories and cutting-edge technologies for us. But this is, and must be, a symbiotic relationship.

Universities and research institutes are doing groundbreaking conceptual work.

See ENERGY on Page 7

In a time of uncertainty, count on nonpro ts to keep innovating

One certain result of the recent elections is that there will be change. It’s just not clear what that change will be. For every sector of society — public, private and nonpro t — in organizations of all sizes, it is moments like this that put a spotlight on the importance of innovation.

Here in Chicago, we have had a front-row seat as the power of innovation has revealed itself as a key driver of the regional economy, and there is no question that the spirit of innovation will continue to thrive.

One sector that has received less attention as the region’s innovation economy has emerged is the nonpro t sector. But there, as well, the news is good. I believe the nonpro t sector in the Chicago region, because it is alive with innovation, is well-positioned to manage the challenges and opportunities that the coming years will bring.

at spirit of innovation in the sector was on full display recently at the 23rd annual Chicago Innovation Awards, which received more nonpro t nominees than any prior year. e winners demonstrate the impact of nonpro ts creating new solutions for unmet needs.

Here are a few examples:

◗ United Way of Metro Chicago won for 211 Metro Chicago, a free, 24/7, multilingual one-stop-shop helpline born out of the pandemic, when people were seeking essential services through what was previously a very fragmented system.

◗ Feeding America won for MealConnect, a mobile app that provides food banks, food pantries

ENERGY

From Page 6

e University of Chicago’s new institute will surely do the same. But research organizations need us to convey the practical applications — how the science and lab work apply to the utilities who will need to deploy it on behalf of customers.

As an example, Exelon is currently collaborating on a Department of Energy project led by MIT in partnership with Sandia National Labs and GTI Energy to develop a multilayer coating that can protect hard steels from material embrittlement in the presence of hydrogen. If successful, it will save utilities and customers money because we will be able to repurpose existing steel pipes, rather than having to replace them.

We have a tremendous need in our world to drastically slash carbon emissions, minimize our dependence on fossil fuels, keep up with the lightning-fast pace of new energy technologies and keep energy a ordable for all.

Universities and utilities must marry that need with practical solutions — solutions that only come when we work together.

Calvin Butler is president and CEO of Exelon, corporate parent of Commonwealth Edison. He serves on the board of governors of Argonne National Laboratory.

and food donors with real-time information and logistics management, increasing e ciency in the food rescue process nationwide.

◗ As DEI programs are being questioned, Chicago-area nonpro ts are working hard to demonstrate the value of ensuring that diverse voices have a seat at the table. Disability Lead is the only program in the U.S. that trains disabled people to take leadership roles and actively connects them to opportunities.

Proven in Chicago, they’re now expanding their model across the country.

◗ Chicago-region nonpro ts are focused on new technologies that have enormous promise but clearly will need guardrails. Spearheaded by Northwestern University and UL Research Institutes, the Center for Advancing the Safety of Machine Intelligence is a collaborative initiative designed to ensure that the proliferation of arti cial intelligence in all aspects of society is done ethically, safely and with the wellness of human beings as core principles.

◗ A remarkable example of government teaming up with the nonprof-

it sector is the Cook County Bureau of Economic Development’s win for its Manufacturing Reinvented program, which assists small local manufacturers with their highestpriority needs, such as workforce training, operational improvements and capital support. ese are just a few examples of our region’s innovators in the nonpro t sector that were celebrated earlier this month for their unique solutions that create value for others. ere are many others in this powerful sector.

Fred Rogers, host of the beloved

“Mr. Rogers’ Neighborhood,” famously said: “When I was a boy and I would see scary things in the news, my mother would say to me, ‘Look for the helpers. You will always nd people who are helping.’ “To put a twist on this good advice: In times of need, look for the innovators. ere are more than 13,000 nonpro t organizations in the city of Chicago ready to apply the Chicagostyle spirit of innovation in adjusting to whatever changes the coming years will bring.

Luke Tanen is president and CEO of Chicago Innovation.

Talent

Dr. Michael Adkesson of the Brook eld Zoo

Dr. Michael Adkesson is president and CEO of Brook eld Zoo Chicago, where he’s leading the organization’s ambitious 15-year Next Century Plan. Already completed is the $10 million renovation of the Seven Seas dolphin habitat. In progress is the $66 million Tropical Forests, scheduled to open next year with four new outdoor habitats for gorillas, orangutans and monkeys; a new Gorilla Conservation Center; and the new home to the King Conservation Leadership Academy for youth. Adkesson and his wife live in Lemont with their three children, ages 14, 11 and 2. I By

How did you get where you are?

At 8 years old, I joined the children’s “Zoo Crew” at Scovill Zoo in Decatur. It included classroom instruction and experience handling animals, and then we did chores such as cleaning the animal barn or skimming duckweed o a pond. I loved every minute, became a junior leader and then a part-time zookeeper.

A recent advance in veterinary medicine?

Brook eld Zoo is one of seven institutions working to develop the much-needed Zoo & Aquarium Radiology Database. Our goal is to amass more than 10,000 medical images of 500 species by 2025. Most unappreciated zoo animal?

Bats. ey get a bad rap, but from an evolutionary standpoint, their ability to echolocate and catch insects in mid- ight is magni cent. We would be drowning in mosquitos without them. And honestly, some of them are really cute. Our Rodrigues fruit bats have a very adorable, fuzzy face.

A hidden gem at Brook eld?

Swan Lake. People don’t venture out to that far western edge, but it’s a beautiful lake surrounded by a nature path that wanders through old-growth forest.

A memorable story about treating animals?

Four years ago we did a novel, one-sided hip replacement on a tiger here who had severe arthritis. Because tigers have so much force in their legs, she broke the implant, but our backup surgery was successful and it signi cantly reduced her pain. Free time fun?

My kids and I spend a lot of winter Saturdays building Lego sets and watching college basket ball. During the summer we go water skiing and wakeboarding at our cabin in Michigan. I love a good book, too.

What do you recommend?

“ e Alchemy of Air.” It de scribes the use of nitrogen for fertilizer, dating back to seabird guano in South America in the 1800s, and the conservation of birds to protect this resource. It then chronicles the discovery of

Laura Bianchi

nitrogen xation from air to produce fertilizer, which saved millions of people from starvation but was also used to make gunpowder and explosives that killed millions during two world wars.

A favorite quote?

“ e true meaning of life is to plant trees under whose shade you do not expect to sit.” When we planted numerous trees on our property, I told my kids to imagine that one day their grandkids might sit beneath them.

Sterling Bay proposes 39-story

Fulton Market apartment tower

The developer scrapped an 18-story of ce building it planned for Google, pivoting to a plan for a 573-unit residential high-rise

By Danny Ecker

Sterling Bay has scrapped plans for an o ce building across the street from Google's Fulton Market District home in favor of a 39-story apartment tower, adding to the drove of residential projects proposed in the trendy neighborhood.

e Chicago developer is seeking city approval for a 573unit apartment building at 350 N. Morgan St., according to a zoning application set to be introduced next week to the City Council. It's a pivot from the 18-story o ce building city ocials green-lighted in 2019 for the site, which Sterling Bay previously pitched with the address of 1000 W. Carroll Ave.

It's one of the largest proposed apartment buildings in the former meatpacking corridor, where developers over the past few years have built and rolled out plans for thousands of new rental units.

e once-gritty pocket of the West Loop has transformed over the past decade into a hotbed of o ces, trendy restaurants and hotels. And with more than 2,000 apartments now under construction or recently completed, according to data from Integra Realty Resources, Fulton Market is now evolving into a mixed-use district with a burgeoning population and some of the highest apartment rents in the city.

at landscape — combined with the remote work movement's assault on demand for workspace — made Sterling Bay's switch from o ces to apartments

a logical one. It's unclear, however, whether the developer would actually move forward with the project or just tee it up for someone else.

Sterling Bay earlier this year got the City Council to sign o on plans for a 390-unit apartment building at 370 N. Carpenter St. and a 559-unit apartment project at 345 N. Aberdeen St., two properties just steps from the vacant 350 N. Morgan site. But instead of forging ahead with either, the developer has hired brokers to seek buyers for both.

A spokeswoman for the developer did not immediately provide a comment on whether it would take the same approach at 350 N. Morgan. Sterling Bay has been looking to unload a series of properties in Fulton Market and near its stalled Lincoln Yards megaproject on the city's North Side as it navigates lingering fallout from the COVID-19 pandemic on its o ce portfolio and elevated interest rates hampering its ability to pay o maturing debt.

Best known for its o ce projects in Fulton Market like Google's Chicago o ce at 1000 W. Fulton St. and 333 N. Green St., Sterling Bay has dabbled in the corridor's residential boom. e developer landed nancing in early 2022 for a 282-unit apartment building at 160 N. Morgan St. just as interest rates were starting to spike, and completed that 30-story project last year.

e 350 N. Morgan tower would rise 434 feet and include a ve-story podium at its base, according to the zoning application. e building would comply

with the city's a ordable housing requirement ordinance by o ering 115 units, or 20% of the total project, at rates that are a ordable to households making an average of 60% of the area median income, the application said.

A Sterling Bay-led venture bought the 350 N. Morgan St. property just before the onset of the pandemic from Pioneer Wholesale Meat, one of the last remaining meat companies in Fulton Market that relocated to new facilities elsewhere in the city amid the neighborhood's changing character.

Sterling Bay had a deal around the same time to sell the site to Google and develop a new 18story building there for the company, part of a massive o ce expansion by the tech giant on the Near West Side, according to a lawsuit led in 2020 against the developer involving other Fulton Market properties.

But Sterling Bay's agreement with Google fell apart as the public health crisis upended the ofce sector, pushing Google and almost every company to evaluate their future o ce needs, the complaint said.

Sterling Bay razed the former Pioneer building on the property in 2022, and the site bounded by Morgan and Carpenter streets, Carroll Avenue and the Metra tracks running through the neighborhood has sat vacant since.

Google, meanwhile, has set its sights on a much larger o ce presence in the Loop, where it is transforming the James R. ompson Center into its future Chicago home.

The vacant development site at 350 N. Morgan St. | COSTAR GROUP

Engineering design rm Sargent & Lundy tapped to help build nuclear power plants in Ukraine

The rm will identify the best sites to convert into small modular reactors for cleaner energy and enhanced security

By Pawan Naidu

Sargent & Lundy, a Chicagobased engineering design rm, signed a deal to help increase Ukraine's nuclear capacity, joining U.S. e orts to support the Eastern European country amid conict with Russia.

e rm is partnering with ocials from the U.S. and Ukraine to transform coal- red power plants into small modular reactors, or SMRs, for cleaner energy and enhanced nuclear security. Sargent & Lundy will contribute engineering expertise to identify the best sites for conversion.

e e ort, known as Project Phoenix, is a response to the seizure of Ukrainian nuclear sites and the associated security concerns from those actions. “We are gravely concerned with the Russian Federation’s unlawful actions in Ukraine, including forcefully seizing control of nuclear facilities and other violent actions in connection with a number of nuclear facilities, nuclear and other radioactive material,” a U.S. State Department spokesperson told Crain’s.

President Joe Biden recently authorized Ukraine to use longrange missile strikes on Russia, according to CNN. e decision comes in the aftermath of attacks

on Ukraine's energy supply, which have reportedly caused severe damage to power plants used to power hospitals. “( e actions) have caused and continue to pose serious and direct threats to the safety and security of these facilities and their civilian personnel, signi cantly raising the risk of a nuclear acci-

Maple & Ash wants to open restaurants in four new cities next year

The owners of the beloved Gold Coast steakhouse will debut a new location in Miami in early 2025

By Jack Grieve

e owners of beloved Gold Coast steakhouse Maple & Ash are gearing up for national expansion. In addition to opening a new restaurant in Miami in early 2025, as Crain's reported in August, the team is now teasing three more cities where it hopes to expand next year.

Maple Hospitality Group has set its sights on Santa Barbara, Calif., Boston and New York City for future restaurants, likely in that order. e timeline is yet to be determined, but chef-partner Danny Grant said the goal is to open in 2025.

"It's been in the works for a long time, and now it's just getting to the point where all the dominoes are starting to fall in place and you'll start to see a lot of our new restaurants popping up around the country," Grant said. "We're ready to take the nation by storm."

Maple also plans to launch a private membership club going

"beyond the bounds of sit-down service" in January. "Membership will grant VIP access to all MHG restaurants, along with concierge services from the team’s top curators," the announcement read. " ink ve-star catering and staing for over-the-top events, airport transfer direct to their concepts, a helicopter experience through Miami, or wine trips to the South of France curated by the group's lauded sommeliers."

Partners Jim Lasky and Danny Grant have been eyeing expansion for years. e hospitality group had hoped to open a Maple & Ash in Miami in November 2022, but internal turmoil put those plans on pause when Lasky and former partner David Pisor had a falling out. Opening in Miami and eventually the other cities will not be the rst Maple & Ash ventures outside Illinois. A second restaurant in Scottsdale, Ariz., opened just before the COVID pandemic.

dent or incident, which endangers the population of Ukraine, neighboring states and the international community,” the State Department spokesperson said. e State Department says attacks and seizures of facilities have damaged Ukraine's energy infrastructure, a ecting its ability to generate power. In one of the

more severe examples, the occupation of the Zaporizhzhia nuclear power plant has led to the reduction in Ukrainian power generation capacity by 6 gigawatts, or enough energy to power 4.5 million homes.

e project with Sargent & Lundy and a consortium of U.S.-based rms will help the ongoing war

e ort and also falls under the U.S. government's FIRST initiative, which aims to help allied countries build SMRs to meet clean-energy needs.

“We believe that supporting Ukraine’s development of new technological capabilities in the clean-energy sector will create the foundation for a modernized and decarbonized energy architecture in Ukraine,” the State Department said.

Since 2022, Ukraine has generated 55% of its electricity from nuclear energy and 21% from coal. Coal also contributes to 42.5% of Ukraine's CO2 emissions, making it the largest source, according to Sargent & Lundy. e impact of the war with Russia, which began in February 2022, on Ukraine's energy production remains uncertain.

e rm has experience working with other countries in similar pursuits. Recently, Sargent & Lundy formed a joint venture with Fluor, AtkinsRéalis and Ansaldo Nucleare to focus on clean-energy initiatives in Romania, which involved the expansion of a nuclear power plant in the town of Cernavod. e rm is also pursuing clean-energy e orts in the Slovak Republic and the Republic of Slovenia.

our panel of electrical contractor and labor leaders for a

Chicago-based virtual care provider founded by Obama alums raises $25M

B Capital, CommonSpirit

By Jon Asplund

Synapticure, a Chicago-based virtual care company for neurodegenerative diseases founded by two Obama administration alums, has closed a $25 million funding round led by B Capital, with new investors including CommonSpirit Health, CVS Health Ventures, RA Capital Management and Nexus NeuroTech Ventures.

The company says its virtual platform addresses unmet needs of patients and caregivers living with Alzheimer's disease, related dementias, Parkinson's and other neurological diseases.

Neurodegenerative disease community advocates Brian Wallach, a former assistant U.S. attorney who is living with ALS, and his wife and caregiver, Sandra Abrevaya, a former executive at youth advocacy nonpro t rive Chicago, founded Synapticure in 2022. e two met working for Barack Obama's rst presidential campaign in 2008 and later served in various posts within his administration. eir patient and caregiver journey was chronicled in the Amazon Prime Video documentary "No Ordinary Campaign." ey also founded their own ALS advocacy nonpro t, I Am ALS.

B Capital and other new investors join existing investors Google Ventures, Optum Ventures and Rock Health Capital in the Series A funding, Synapticure said in a press release last month.

e company said it would use the funding to expand part-

Health and CVS joined the fundraising round for Brian Wallach and Sandra Abrevaya’s Synapticure

nerships with providers and payors, invest in further AIenabled analytics and clinical research on its platform, fasttrack clinical research, expand patient access to emerging treatments and clinical trials, and scale its national medical group by bringing on additional providers.

Synapticure said in the release it has been selected as a CMS Guide provider in all 50 states by the U.S. Centers for Medicare & Medicaid Services.

Additionally, it plans to operate a single, standardized clini-

cal operation across all 50 states with in-home research capacity, the release said, allowing it to enroll a diverse population of patients anywhere in the U.S. "Synapticure's mission to provide accessible, high-quality care for neurodegenerative diseases aligns closely with our focus on investing in transformative health care companies led by visionary founders," Adam Seabrook, partner at Manhattan Beach, Calif.-based B Capital, said in the release. "With the investor group's combined expertise and resources, we believe

this collaboration will continue to drive advancements in the treatment and care of patients living with Alzheimer's and related dementias, Parkinson's and beyond."

CommonSpirit, the Catholic health system with headquarters in Chicago, supports "innovation in health care both inside and outside the walls of our hospitals," Anu Anuradhika, vice president of strategic partnerships at CommonSpirit, said in the release. "We believe we go farther, faster when we work with partners who cham-

pion new models of care, and our patients bene t from it."

Synapticure currently serves several thousand patients providing comprehensive care and treatment for cognitive, neuromuscular and movement disorders, the release said.

"This investment will enable Synapticure to continue to democratize care for people and their families living with neurodegenerative diseases," Abrevaya said in the release. "As a caregiver for the last seven years, I've experienced firsthand how overwhelming it can be to carry the weight of someone else's well-being while navigating the complexities of care and treatment. For too long this struggle has been accepted as just another part of life, but Synapticure refuses to accept that. Synapticure is designed to not only make high-quality care accessible, but to ease the burden on patients and caregivers by providing immediate access to expert neurologists, comprehensive wraparound care, and caregiver support services. With the support of B Capital as well as both new and existing bluechip investors, I am proud Synapticure works to reach patients in any community across the U.S. living with one of these conditions so they can receive the expert, personalized specialty care they deserve."

e release notes neurodegenerative diseases a ect more than 10 million people across the United States, with demand expected to increase with the aging U.S. population.

Northwestern accelerates mental health efforts

The goal of the $8.6 million initiative is to increase access and provide earlier intervention in primary care settings

By Jon Asplund

An $8.6 million initiative backed by West Health promises to increase access to top evidence-based mental health services in primary care settings at Northwestern Medicine.

e initiative, a collaboration between Northwestern, senior heath nonpro t West Health and the Meadows Mental Health Policy Institute, will establish the Northwestern Medicine West Health Accelerator, Northwestern said in a press release.

e accelerator's aim is to provide earlier mental health intervention by putting comprehensive psychiatric services for primary care practices throughout Northwestern Medicine, the

release said.

e initiative builds on a project launched by the health system in 2018. Northwestern Medicine's Collaborative Behavioral Health Program integrates mental health care into primary care settings to "help manage population health across all generations, and scale and optimize equitable treatment for patients," according to Northwestern.

In the past six years, the program has been made available to patients across 75 di erent primary care locations within Northwestern Medicine's system, the release said. Recent expansion led to West Health collaborating with Northwestern and the Meadows Mental Health Policy Institute to

increase utilization of the program.

With the funding from West Health and development guidance from Meadows Institute, the health system touts the program as a potential model for others across the U.S. West Health, a San Diegobased nonprofit solely funded by philanthropists Gary and Mary West, is dedicated to lowering health care costs and enabling seniors to age in place. Meadows Mental Health Policy Institute, originally focused on behavioral health in Texas, is an independent and nonpartisan group that provides data-driven policy and program guidance and "works to shift the focus of new investments toward early

intervention for children and families, address the mental health crisis in our jails and emergency rooms and help all people with mental health needs recover and be well," the release said.

“ e integrated care model (of mental health and primary care) is a proven, e ective way to ensure people receive the treatment they need as early as possible," Andy Keller, president and CEO of Meadows Institute, said in the release.

“We believe in taking bold moves and this collaboration could be transformative,” Shelley Lyford, CEO and chair of West Health, said in a statement. “We will leverage the unique resources, technologies,

capabilities and expertise of each organization and design a robust evidenced-based care model that can be optimized across health systems and regions throughout the country.”

“Across the United States and Chicagoland, the demand for high-quality treatments for the most common mental health conditions continues to grow,” Dr. Sachin Patel, chair of the department of psychiatry and behavioral sciences at Northwestern Medicine, said in the release. “ is collaboration with West Health will help transform mental health care by delivering e cient, e ective and equitable behavioral health services to patients while expanding access to care.”

Brian Wallach, left, and Sandra Abrevaya

West Monroe expects health care orgs to start getting practical about AI in 2025

The Chicago-based digital services rm says implementation efforts will be more focused, measurable and useful going forward

By Jon Asplund

Health care organizations will prioritize arti cial intelligence projects that will make a big impact on their operations without compromising ethical standards in the coming year, according to West Monroe's 2025 Healthcare Outlook, which will be released this month.

"We believe that AI will continue to be a large driver of investment, but health care professionals will take a more conservative approach to it," said Larry Briski, health care sector lead at the Chicago-based digital services rm. "It is not (about) taking people out of the process, but how AI can make organizations more efcient and free people up" to work on more important and fullling aspects of their careers.

e outlook examines four trends, starting with responsible AI, along with using AI and data to revolutionize cost control, setting up cyberattack resiliency and advancing health equity.

Practicality

Rather than experimenting with

"AI for AI's sake," Briski said, health care organizations need to "look at AI as another tool to work more e ciently, implementing smaller projects business case by business case, not with a 'build it and they will come' mentality."

e report predicts that the need to train health care professionals to get the most out of articial intelligence will drive investments in workforce development, including AI literacy and technical training, to "create a culture of learning around these technologies."

Cost optimization

Tied to that is a growing need to further automate administrative tasks as cost pressures mount.

AI can be brought to bear on tasks like claims processing, customer service and billing to streamline operations, reduce manual workloads and focus sta on higher-value work, the report says.

"If you have the right underlying data capacity, your speed to market is much, much faster," Briski said. "Moving people and

Ravinia Brewing closing taproom, teases second act and unveils new name

By Jack Grieve

Ravinia Brewing is closing its Logan Square taproom and rebranding in Highland Park under a new name after settling a trademark dispute with Ravinia Festival.

e company is now called Steep Ravine Brewing. It will continue to operate its taproom in Highland Park, but will close the Chicago taproom at 2601 W. Diversey Ave on Dec. 14.

Steep Ravine will still use the Logan Square space to make beer, and co-owner Kris Walker told Crain's the company plans to unveil something new for the space in the coming weeks.

In explaining the decision to close the Chicago taproom, Walker cited broader challenges in the craft beer industry, including in ation. Many other breweries have struggled in recent years, even without costly legal battles like the one with Ravinia. Walker also said the rebrand gave him and his partners a unique opportunity to re-evaluate their vision for the Logan Square space.

processes off legacy systems toward more value-added operations can improve cost optimization and make employees feel they're using the skills they want to use."

Cybersecurity

It isn't enough to keep building walls against cyberattacks, which inevitably develop cracks and expose networks to widespread dis-

ruption, the report says. "With more and more breaches at hospitals and other organizations, we need to turn to resiliency," Briski said. "You need to build operational resiliency to continue to operate without some core network functions and know how to get operations back up and running as quickly as possible following an attack."

e work in 2025 will involve

implementing network segmentation to isolate critical systems, a measure to limit the impact of a cyberattack and protect sensitive data, according to the report. With cyber insurance requirements tightening, health care organizations need to be proactive if they want to "reduce costs and protect reputational trust, while upgrading legacy systems and securing vendor relationships to strengthen long-term stability and data protection," the report says.

Advancing health equity

West Monroe's outlook predicts both providers and payers will continue to concentrate on issues of health equity and how social determinants of health shape outcomes.

Briski points out that Medicare star ratings' new emphasis on health equity will make drastic changes necessary. Organizations can start by embedding equity into every aspect of care delivery, but they also need to be hyperlocal in how the data is used.

To make meaningful change, he said, requires using AI and population health data "in every area, by doctors, hospitals, health systems and insurance organizations to understand the health care gaps on a hyper-localized manner."

e Highland Park taproom will "undergo modest updates," the announcement said.

A new name has been expected since September when the beer maker and music festival reached a settlement agreement that included a stipulation that the brewery be rebranded. e taproom closing, however, was not expected.

It appears the parties are now on amicable terms. e festival "provided assistance for the rebranding," according to the announcement. Ravinia Festival

CEO Je Haydon wrote in a statement, " is announcement marks an exciting new chapter for Steep Ravine Brewing Company," and added, "We look forward to their continued success."

e Steep Ravine name is an ode to its agship beer, the Steep Ravine IPA. "Every time we thought of new names, we came back to our origins — our original home in the Ravinia District of Highland Park, and the steep ravines and stories that surround it," Managing Partner Je Hoobler wrote in the release.

How a Chicago meat supplier for restaurants is using AI

A new arti cial intelligence tool is helping Northwest Meat take orders from customers, ultimately cutting down on labor costs

By Ally Marotti

e owners and employees of Northwest Meat had a daily task that they dreaded for years: taking orders from their restaurant clients.

e orders would come in from dining spots throughout the city: Lonesome Rose in Logan Square and e Bellevue in the Gold Coast, as well as catering companies, pizza joints and taverns. An employee at one of those restaurants would place an order with Northwest Meat for their chicken breast or sirloin steak for the next day. en someone — usually co-owner Andrew Neva, his father or one of their o ce employees — would plug those orders into their own system, one by one, to be lled by their West Loop warehouse workers.

It was tedious. It took hours. It required intimate knowledge of the meat company’s 1,300 di erent products. And it usually happened in the evening — a time when few employees are keen to sit back down at their computer.

Recently, however, Northwest Meat started using arti cial intelligence to streamline that process. e technology reads the restaurants’ orders — which are placed via email, voicemail or through an app — and spits out a concise sales order that Neva hands over to his warehouse workers to be lled. ere is still a human element: Neva must check each order to make sure the AI didn’t misinterpret anything. But it cut a task that took three hours down to less than 60 minutes.

“ is is a no-brainer,” Neva said. “ is is going to make (our)

jobs easier. is is going to cut down on the tedious work.”

It has been two years since consumers became acquainted with generative arti cial intelligence, a type of AI that can produce content, through the introduction of ChatGPT. Since then, businesses and consumers alike have been toying around with its capabilities. Many laud its potential to boost productivity, and talk abounds about science ction-sounding solutions, like AI-powered, burgeripping robots. But where theory is becoming practice — particularly among small, family owned businesses in the hospitality industry — is right where Northwest Meat is deploying its new AI tool: in the mundane, daily tasks that eat up increasingly expensive employees’ time.

Labor optimization

“When you talk about AI, everybody’s mind immediately goes to these really futuristic usages,” said David Henkes, senior principal at market research rm Technomic. “But, frankly, what you’re seeing with this butcher is really what’s happening with AI. It’s being used as a labor optimization tool.”

Indeed, hourly wages for Northwest Meat’s union employees are up 23.5% since the COVID pandemic. At the same time, the company’s meat and shipping costs increased. Neva said he can only pass so many of those increases to his restaurant customers, which also have been pummeled with price hikes. Menu prices are up about 30% since 2019 nationwide, and restaurants, which have notoriously low margins, are always on the

hunt for places to cut back.

Finding workers has been an added challenge for Northwest Meat, Neva said. He is on his third o ce worker since the pandemic shut down in-person dining, pushing over the rst domino that upended the restaurant world. Telling a potential employee they have to spend several hours each evening inputting meat orders has not proved appealing.

“For a family run meat company, we had to do something,” Neva said.

Northwest Meat pays $1,100 a month for its new AI tool, Neva said. It is called Choco AI, made by a German tech company to help food distributors manage their orders. ( e company’s U.S. headquarters is in Chicago.) Neva estimates the tool saves him at least $22,000 a year in labor costs.

Choco AI uses a combination of machine learning and automation, a spokeswoman said in an email. It reads and understands orders from voicemails, emails or other formats, then matches orders with past data. It uses generative AI, but instead of creating answers like ChatGPT does, Choco AI is focused on understanding and organizing information. It learns, for example, what a restaurant wants when its employee places an order for “the usual.”

On a recent afternoon, catering company Jordan’s Food of Distinction called in and asked for 15 pounds of sirloin; Northwest Meat sells three di erent types. e AI, which had learned from Jordan’s past orders, populated the order with the speci c type of sirloin: beef top butt, center-cut, prime.

“How is somebody who’s been here three months supposed to know (that)?” Neva said, reviewing the order at his computer.

Neva has to watch to make sure the orders come through correctly. When Lonesome Rose emailed an order that same afternoon for seven 10-pound packs of Northwest Meat’s ground beef house blend, the AI read it as seven pounds.

Training these AI tools is vital, said Swami Chandrasekaran, a principal in AI and digital innovation at KPMG. Like children, they learn through feedback and reinforcement. If the tools are not trained properly, they will not work.

Northwest Meat is not alone in its decision to dip its toe into the AI waters in a non- ashy, quotidian way.

Resistance to tech

Business owners in the restaurant world tend to have a philosophical resistance to using technology to take away any human aspects, said Huy Do, research

and insights manager at market research rm Datassential. It is the hospitality industry, after all. Forty-four percent of respondents to a recent Datassential survey said they are worried incorporating AI could lead to the loss of the human touch and creativity that forms food service.

Only 12% of restaurants that responded to Datassential’s survey said they had used AI to accomplish some task or function within their business. ose that do use it seem to relegate the technology to back o ce-type jobs: e task restaurant operators have deployed AI for the most is customer feedback analysis, and only 7% of respondents said they had used the tech for that purpose.

“If this gains any traction, it’s going to have to start at the mundane level,” Do said. “I don’t think everybody is going to be installing a fully robotic server, or replacing all (their) line cooks with burger- ipping robots. at’s (not) going to be the thing that ips the scale.”

For Northwest Meat, though, AI has already made a noticeable di erence, Neva said.

“At the end of the day, is it going to help lower the cost of meat? No. Is it going to help improve my bottom line? Probably not,” he said. “But it gives us more free time, more marketability, which will create a better ecosystem.”

Former CVS Health exec joins WellBe Senior Medical as CFO

By Diane Eastabrook, Modern Healthcare

Former CVS Health executive Mario Ramos is the new chiefnancial o cer at WellBe Senior Medical.

Ramos will oversee nancial decision-making within WellBe’s value-based care model, the inhome healthcare provider said in a Dec. 2 news release. Ramos

served in several leadership roles at CVS from 2013 to 2019, including as CFO of CVS Caremark, its pharmacy bene t management unit. Prior to joining WellBe, Ramos was the CEO of money management company RWA Wealth Partners.

WellBe also announced the addition on Dec. 2 of Ananth Ramkrishnan as chief information ocer. Ramkrishnan was previously

an operating partner for healthcare investment company Rubicon Founders. He also served as CIO at Zing Health and chief technology o cer at Landmark Health.

e company did not respond to requests for comment regarding the previous structure of its leadership team.

Chicago-based WellBe has been on a growth spurt this year.

CVS Ventures, the venture capital arm of CVS, invested an undisclosed sum in the company in January. Excellus Blue Cross Blue Shield of upstate New York and Intermountain Ventures, the venture capital unit of Salt Lake Citybased Intermountain Health, made a joint investment in WellBe in July.

WellBe partners with health insurance companies to provide

home-based care to older adults through capitated risk arrangements. e company furnishes health assessments, care coordination and medication management to older adults with chronic conditions, mobility problems and cognitive decits. It o ers services in 10 states.

Diane Eastabrook writes for Crain's sister brand Modern Healthcare.

Northwest Meat co-owner Andrew Neva | ALYCE HENSON

TrendSpider rolling out new AI trading tool

The Deer eld-based software rm says it’s looking to level the playing eld between retail and institutional investors

By Mark Weinraub

Financial trading software rm TrendSpider is rolling out a new product allowing its users to develop custom-based trading strategies with arti cial intelligence.

e product, called AI Strategy Labs, will let the Deer eld-based company’s 15,000 customers set parameters based on their own variables and run them through a machine-based learning application to identify the probable success rate of any potential trade at a given time.

“It makes it easier to take that bet,” said Dan Ushman, TrendSpider’s CEO and founder. “It is like a second set of eyes, and that second set of eyes is a theme we have throughout TrendSpider. It is not meant to completely replace human intuition and eyeballs, but it is meant to augment them.”

Ushman, who also founded Chicago-based tech startups SingleHop and Concurra, said the recent buzz around arti cial intelligence will speed traders’ adoption of AI Strategy Labs.

“ ere is a super trend of mov-

ing toward machine learning, and I think it's something that there's a lot of pent-up demand for from investors,” Ushman said. “I think there is a lot of appetite for that type of e ciency in trading.”

AI Strategy Labs requires no previous experience with computer coding or arti cial intelligence. It also takes emotion out of the equation, which can be a hinderance to traders working on a minute-to-minute basis.

“It is done with no technical experience needed on the part of the investor,” Ushman said. “ ey do not need a computer science degree. ey do not need to even understand how machine learning works. ey just select what they want to predict and what assets they want to predict it on and what data they think might be relevant, and it just gures it out in the background.”

TrendSpider’s new product puts retail investors on the same footing that traders at large rms have been on for years, leveling the playing eld in the markets. e company’s customer mix is 90%

retail investors and 10% institutional, Ushman said.

“Machine learning has been, obviously, used in nance and investing for years, but it has been guard-railed by the need to have some serious technical chops to be able to do it," he said. "I think

this is the great kind of equalizer. is is a capability that was siloed in the institutions for a long time and now it is becoming available to retail investors, and that aligns with our overall mission.”

Smaller hedge funds, nancial planners and portfolio managers

also stand to bene t from AI Strategy Labs. e company is offering the product to all of its customers for the rest of the year. In 2025, it will be available to customers whose TrendSpider accounts cost between $1,200 to $3,000 per year.

O u r 2 0 2 4 R e c i p i e n t s !

M i d - S i z e N o t - F o r - P r o f i t

K a r e n K o c h - S a i n t V i a t o r H i g h S c h o o l

T h e C h i c a g o C h a p t e r o f F i n a n c i a l E x e c u t i v e s

I n t e r n a t i o n a l P r o u d l y A n n o u n c e s t h e R e c i p i e n t s

o f i t s 1 3 t h A n n u a l C h i c a g o C F O o f t h e Y e a r ®

A w a r d s

T h e e v e n t w a s h e l d N o v e m b e r 1 9 , 2 0 2 4 , a n d

r e c o g n i z e d t w e n t y - f i v e f i n a l i s t s a n d s i x c a t e g o r y

r e c i p i e n t s . M o r e t h a n 8 0 0 g u e s t s a t t e n d e d t o

c e l e b r a t e t h e b e s t o f t h e b e s t o f C h i c a g o l a n d

f i n a n c e l e a d e r s

E v e n t S p o n s o r s

L a r g e N o t - F o r - P r o f i t

J o n a t h a n T i n g s t a d - S h i r l e y R y a n A b i l i t y L a b

M i d - S i z e P r i v a t e C o m p a n y

T r i c i a P u c e k - T h e H o r t o n G r o u p

L a r g e P r i v a t e C o m p a n y

N a t a l i e L a a c k m a n - M e d S p e e d L L C

M i d - S i z e P u b l i c C o m p a n y

S u s a n K r e h - O i l - D r i C o r p o r a t i o n o f A m e r i c a

L a r g e P u b l i c C o m p a n y

D i r k L o c a s c i o - U S F o o d s H o l d i n g C o r p

A b o u t F E I C h i c a g o

F E I ' s C h i c a g o C h a p t e r i s t h e p r e e m i n e n t a s s o c i a t i o n

f o r C F O ’ s a n d o t h e r s e n i o r f i n a n c i a l e x e c u t i v e s i n t h e

C h i c a g o l a n d a r e

Dan Ushman

Michigan design rm with Chicago roots lists Lake Macatawa spec home for $3.5M

The residence is known as ‘Interlok House’ for its Japanese-inspired interlocking courtyards

By Rachel Watson, Crain's Grand Rapids Business

A new residential development rm in Douglas, Mich., with Chicago roots has its rst speculative home up for sale — a spacious hilltop residence on Lake Macatawa inspired by California’s modern oceanfront architecture.

Mark Lauterbach and his cousin, Douglas Kopp, listed their rst house produced under the banner Modl Development, a modern residential development rm they recently co-founded in Douglas as an o shoot of Mark Lauterbach’s solo venture, Lauterbach Architecture LLC.

Dubbed “Interlok House” for its Japanese-inspired interlocking courtyards, the nearly 3,500square-foot, three-bedroom and four-bathroom residence was completed in August and listed for $3.5 million.