We are delighted to bring you some exciting updates from Pembroke VCT. In the year leading up to January 2024, we have committed £6 million to new companies and an additional £12 million to the current portfolio. Our assets under management are over £200 million, featuring a diverse portfolio of over 40 growth-stage companies.

At Pembroke, our ‘milestone’ approach is focused on delivering long-term stable capital growth, accompanied by annual dividends and special dividends upon profitable exits. Our strategy centres on investing in a diversified portfolio of companies operating within three key sectors we know well: consumer, technology and business services.

Photo: Hackney Gelato (see page 6)Venture capital has become a driving force behind innovation and entrepreneurial growth, providing the financial fuel and expertise to propel start-ups and early-stage businesses into orbit. The landscape of venture capital is, however, not without its challenges, particularly when it comes to valuations.

Intense competition among investors often results in pressure to secure a stake in promising start-ups, which can lead to valuations that don’t align with the business’s intrinsic value. The “unicorn” phenomenon, where start-ups achieve billion-pound valuations even before reaching profitability, adds complexity and raises concerns around inflated valuations and market sustainability.

In the dynamic world of venture capital, the fate of businesses often hinges not only on their operational performance but also on the unpredictable currents of market sentiment. Paradoxically, even when a venturebacked business demonstrates advancements since its last funding round, it may find itself subject to valuation downturns influenced by shifts in market sentiment. This phenomenon can be attributed to external factors such as macroeconomic trends, industry-wide sentiments, or even the whims of investor perception.

In such instances, a business that has evolved positively in terms of product development, customer acquisition, or revenue growth may experience a dip in valuation during subsequent funding rounds. This underscores the intricate dance between a company’s intrinsic value and the external forces that shape the landscape of venture capital.

Venture capital continues to play a pivotal role in fostering innovation and supporting the growth of early-stage businesses. However, the pressure on valuations highlights the challenge of striking a balance between optimism and realistic assessment of a start-up’s worth. Investors must navigate this balance by employing a combination of valuation methods, considering the unique characteristics of each early-stage business, and remaining mindful of the potential for market trends and competitive pressures to influence valuations. Ultimately, successful venture capital investments require a strategic approach that goes beyond monetary considerations, encompassing a deep understanding of the market, the start-up’s potential, and the ability to weather the uncertainties inherent in the world of entrepreneurship.

While we like to believe in the enthusiasm of the founder and the opportunity that lies ahead, we need to value the business based on what we know and not what we don’t know.

by Andrew Wolfson CEO of Pembroke

by Andrew Wolfson CEO of Pembroke

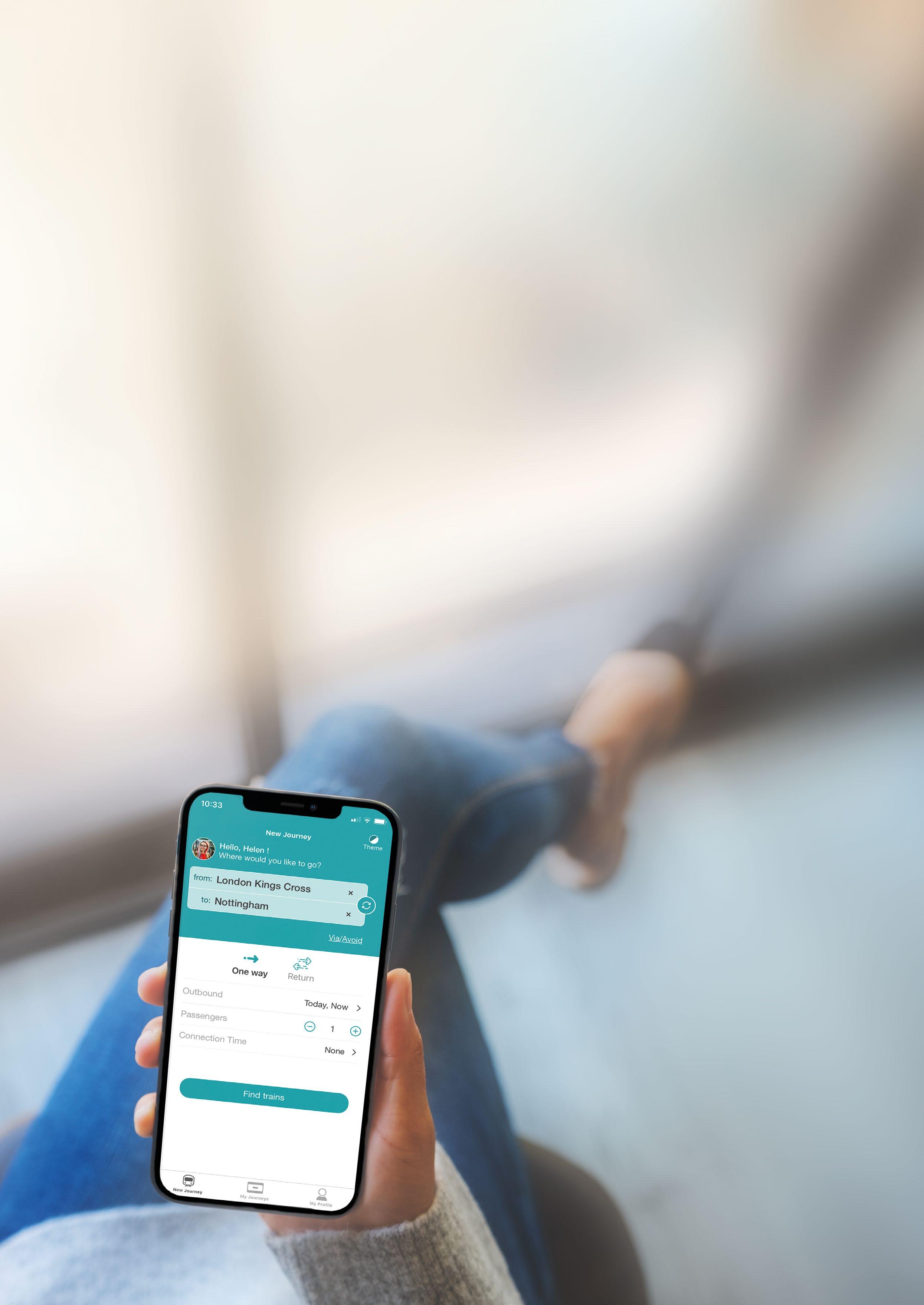

We are thrilled to announce our new investment of £3 million in Transreport, the UK’s fastest-growing accessibility technology company. The SaaS platform and app provides a comprehensive solution for booking and managing travel assistance for older and disabled people. Pembroke’s funding is part of a £10 million raise that will aim to expand the reach of Transreport’s popular Passenger Assistance technology to more users, diverse modes of transport and industries.

Since its launch in May 2021, the Passenger Assistance technology has become one of the most recognised apps for arranging travel assistance, with over 100,000 downloads and millions of passenger journeys facilitated to date. The technology has even been nominated for an Apple Design Award in the Inclusivity category. It has also secured a place as number 20 on Tussell and techUK’s annual Tech200 awards, a list of the 200 fastest-growing technology companies in the UK public sector.

Transreport is gaining not only awards but also the attention of industry professionals and policymakers. In June, the British government and Hankyu invited Transreport’s founder and CEO Jay Shen to the G7 summit in Japan, where he met global leaders, including UK Prime Minister Rishi Sunak.

100,000 downloads, millions of journeys

This significant investment marks a key moment in the growth and history of Transreport. It is a huge vote of confidence and trust from our investors, Puma Private Equity and Pembroke VCT, in our vision and ability to execute on our strategic plans. These funds will accelerate our expansion into the aviation sector and continue supporting our entry into the Japanese market in partnership with Hankyu Corporation, Japan’s worldleading railway operator. Most importantly, it will provide a better experience for disabled and older people.

”

Jay Shen founder and CEO of Transreport

Ranked 55th in Europe and 9th in the UK on FT1000

The LYMA Laser has been acclaimed in the world’s best clinics and spas since its launch in 2020 for its transformative results on skin than any other device. Now, to meet increased demand from the professional audience, LYMA’s scientists have re-engineered its ground-breaking technology to create an official clinic device with more power, faster treatment time and even more outstanding results.

LYMA Laser PRO is set to change the future of in-clinic treatments. The breakthrough technology of the LYMA Laser PRO has three coherent, continuous and ultra-diffused lasers (1450mW), and has a biological effect from the muscle tissue upwards, able to penetrate to a depth of up to 10cm without losing power, all without causing any pain or down time.

The announcement of LYMA Laser PRO has coincided with LYMA being recognised in the FT1000 list of Europe’s Fastest Growing Companies.

Since the very beginning, Pembroke has believed in our mission to create the most powerful products that have redefined the supplement, skincare and beauty tech categories. Pembroke’s support and guidance from concept through to execution of LYMA Laser PRO have been invaluable. Pembroke has been the best partner for LYMA on this journey.

Lucy Goff Founder of LYMA

Since our initial investment in 2023, Seatfrog has experienced significant growth. The company has formed several partnerships with rail networks worldwide, and has launched a number of new, innovative features such as Trainswap with CrossCountry Trains and Secret Fare with TransPennine Express. Trainswap facilitates seamless train changes for customers adjusting their plans, while Secret Fare offers up to 89% off ticket prices by letting Seatfrog decide which train you travel on within a time window of your choice. CrossCountry Trains witnessed an amazing 114% revenue increase in 2023 through Seatfrog’s platform. Seatfrog’s ability to evolve has earned it the travel and transport category title in the Flexa Industry Awards. In Q4 last year alone, 517,000 trips were taken on Seatfrog.

Cross country trains witness revenue increase last year

114%

517,000

trips taken from October to December 2023

Technology

Smartify is leading the digital transformation of culture and heritage attractions. By replacing outdated hardware with a mobile guide, Smartify helps venues generate more income, save through operational efficiencies and gather real-time data on audiences. Smartify works with major sites, including Historic Royal Palaces, the Acropolis Museum, National Gallery, Natural History Museum and Smithsonian. The business is scaling its offerings with new features such as Al personalised tours, allowing visitors to get a customised itinerary based on interests, time available and access requirements.

Smartify has experienced impressive organic expansion, with 142% year on year growth. As global tourism continues to bounce back, Smartify is growing particularly quickly in the UK and USA.

3.5x return on investment for partner cultural attractions

5m registered contactable users

142% year on year growth

Our mission is to be the platform of choice for cultural tourists, helping people plan, book and experience the world’s best sites. We do this while also supporting visitor attractions to run more profitable and engaging experiences.

Thanos Kokkiniotis CoFounder & CEO of Smartify

Secret Food Tours continues to expand its geographical reach, having just launched tours in Kyoto, Osaka and Brussels. The rapidly growing food and beverage tour company has developed a scalable and profitable business model and now operates in over 65 top-tier cities across four continents. Led by passionate guides, the tours highlight the foods loved by locals and overlooked by tourists, creating an authentic and truly unique food experience.

65 Operates in continents 4 Across

cities

Ranked

Readers’ Choice Awards

Pembroke has been an exceptional partner, standing by us during our toughest times, including the challenges brought by the pandemic. Pembroke re-invested at the end of the pandemic to reopen in cities around the world. Thanks to their support, we have significantly grown our business

Oliver Mernick-Levene CoFounder and Executive Director, Secret Food Tours

OnePlan, the event planning software, is at the heart of planning the Paris 2024 Olympic and Paralympic Games, as its Official Supporter of GIS Mapping and Digital Twin Software. As a result of this partnership, the company has expanded its customer base, now including the Crypto.com Arena in Los Angeles, which hosts over 230 events annually, and many sports federations including Netherlands Triathlon, Swiss Ski, The Jockey Club and Sunderland FC.

This year, the Sports Business Journal has already recognised it as one of the Top 10 Most Innovative Sports Tech Companies.

OnePlan’s clientele includes renowned names such as Adelaide Oval, ExCeL London and World Triathlon. This impressive list of blue-chip clients enables OnePlan to showcase its credibility in the market and obtain new customers.

Business Services

40,000+ events powered by OnePlan...

...across 110 countries

Recognised as one of the top 10 most innovative sports tech companies by Sports Business Journal

We are delighted to have made an additional £1.3 million investment into Hackney Gelato, to help scale up its production and meet the growing demand for high-quality gelato. The investment will also be used to expand its presence in alternative locations such as cinemas, theatres and airlines.

Enrico Pavonelli and Sam Newman, both chefs, started the company by selling directly to chefs in London bringing together Italian gelato making skills with the London food scene inspiring the flavours.

In just six years, they have seen incredible success, including winning 46 ‘Great Taste stars,’ securing the top spot for ice cream brands on Ocado, and supplying esteemed London restaurants as well as numerous online retailers and supermarkets. Their products can now be found in Ocado, Tesco, Waitrose, Whole Foods Market, and the Co-op, as well as restaurants such as Brat, Som Saa and Gordon Ramsay.

We recently hosted a roundtable breakfast session for some of our direct-to-consumer (D2C) consumer companies, in collaboration with Dartmouth Partners. The session focused on specific company challenges related to D2C operations. Before the event, we invited attendees to share their unique challenges in digital strategy, customer experience and omnichannel positioning. To help overcome these issues, we brought in industry experts Alicia Thompson, former CEO of Kick Game, and Guljeet Samra, current CCO at Percival. Their invaluable insights and expertise shaped the discussion, ensuring that the topics were not only relevant but also actionable. We would like to thank Ro&Zo, VIEVE, bloobloom, JustWears, Bella Freud, COAT Paints, and LYMA for participating, and our hosts, Alicia Thompson and Guljeet Samra, for facilitating this insightful session.

The Venture Capital Trust Association (VCTA) recently appointed Chris Lewis, Pembroke’s CFO, as its new Chair. The VCTA advocates for the essential role played by Venture Capital Trusts (VCTs) in supporting the UK’s entrepreneurial economy. It currently represents 12 of the largest venture capital trust managers in the UK. Its members account for more than 90% of the VCT industry, managing over £5.5 billion funds invested through a vast network of local offices across the UK.

It is a privilege to represent the VCT industry as Chair of the Association. Will Fraser-Allen of Albion Capital has done a brilliant job representing our members’ interests, culminating in the recent extension of the sunset clause which is key to the continued success of VCTs.

Chris Lewis