WHICH COST DRIVERS SHOULD THE SECTOR USE TO CALCULATE LCOH?

CONTENTS

P / 16

Which Cost Drivers Should the Sector Use to Calculate LCOH?

P / 04

How the Three Pillars Will Support the US Hydrogen Market

P / 08

Is Biohydrogen the Key to Meeting Europe’s Energy Needs?

P / 12

Building Artificial Islands for Domestic Energy Production

P / 16

Which Cost Drivers Should the Sector Use to Calculate LCOH?

P / 26

International Projects

P / 12

Building Artificial Islands for Domestic Energy Production

P / 22

Irish National Hydrogen Strategy: Highlighting the Vision for Ireland

P / 26

International Projects

P / 18

HIL Glasgow 2023

P / 29

Previous Editions

P / 30

HIL Next Up: Breakfast Hub

WHICH COST DRIVERS SHOULD THE SECTOR USE TO CALCULATE LCOH?

Different cost drivers can impact LCOH massively.

US HYDROGEN MARKET

HOW THE THREE PILLARS WILL SUPPORT THE US HYDROGEN MARKET

by Hannah WintleEnforcing the ‘three pillars’ could support the rapid scaleup of clean hydrogen production in the US while still qualifying for the 45V tax credit, a new study has found.

In 2022, the US Inflation Reduction Act introduced a $3.0/kg H 2 credit for clean hydrogen production (45V). To qualify for this tax credit, hydrogen production must be less than 0.45kg CO2e/kg.

By contrast, hydrogen produced through steam methane reforming falls between $1.25 and $1.50/kg H2, making the 45V tax credit twice as valuable.

Now, a new analysis by Evolved Energy Research has concluded that enforcing the ‘three pillars’ of hydrogen production allows for the significant deployment of clean hydrogen within the next ten years, while still cutting carbon emissions and qualifying for the 45V tax credit.

Of the three pillars, the first is new clean supply, meaning that electrolysers must be supplied by clean sources of electricity that are not already serving the grid.

The second pillar is hourly matching, which dictates that electrolyser loads must match the clean energy portfolio production every hour.

Finally, the third pillar is deliverability, and commands that electrolyser loads must be located in the same region as the clean electricity resources.

Such pillars are the minimum guardrails against increasing carbon emissions and subsequently undermining the US’s climate targets.

The study ultimately found that despite claims that the three pillars would slow down electrolyser deployment, the results are actually very similar when compared to a loose rules approach.

Moreover, the three pillars could help avoid between 250 and 650 MMT of cumulative carbon emissions between 2024 and 2032. 650 MMT of carbon is equivalent to over 40% of annual US power sector emissions, illustrating the huge impact the three pillars could have.

Finally, the three pillars could incentivise investments into hydrogen projects featuring flexible electrolysers capable of operating in accordance with varying renewable energy supplies, which primes the industry for long-term success.

The report states: “The opportunity for flexibility is critical to the economics. Encouraging this type of learning is as important to the development of hydrogen markets as is simply buying down the cost of electrolysers.”

The three pillars help to address additionality problems

While the three pillars don't necessarily solve most of the additionality problems in the US, they certainly have an impact due to their ability to separate hydrogen producers from other renewable electricity consumers.

The three pillars could incentivise investments into hydrogen projects featuring flexible electrolysers capable of operating in accordance with varying renewable energy supplies.

Under the adoption of the three pillars, additional constraints are imposed on electrolyser loads that are not imposed on other loads.

Ben Haley, Co-Founder of Evolved Energy Research and author of the report explained: “[This] is actually what we want because these loads are different. The whole point of hydrogen in a net zero economy is that the loads can operate flexibly.”

“We can use hydrogen storage instead of electricity storage to balance. That sector coupling advantage is actually what we want to encourage.”

The three pillars therefore have the potential to separate hydrogen from the grid and prevent the buying of renewable energy from elsewhere in the US. Doing so would qualify for the 45V tax credit on an accounting basis, but without materially changing the deployment of clean electricity.

Ben added: “[This would] fundamentally cost us emissions because if clean electricity doesn't develop at the same scale as electrolysis load, then we're costing ourselves emissions functionally. The three pillars is meant to align those two things”

There is optimism for the US to meet its hydrogen targets

This analysis ultimately points to a positive future in meeting the US’s longterm energy targets, Ben explained.

He said: “You can meet those targets and you can apply these guardrails to protect against the case of hugely increasing emissions, and the reason you can do both is that the generosity of the 45V tax credit means that hydrogen producers can purchase renewable energy on an hourly basis. They can produce hydrogen and they can use that tax credit to basically make that converge.

" We can use hydrogen storage instead of electricity storage to balance. That sector coupling advantage is actually what we want to encourage

Ben Haley

Co-Founder

Evolved Energy Research

“It's very consistent in volume and application to the US's hydrogen strategy. Fundamentally, I think we would consider it really consistent with its net zero ambitions in the long term. It also encourages the operation of and location of electrolysers in places that we actually want it in the long term, which makes it even more consistent.”

Ben also pointed out that the 45V tax credit, being as generous as it is, means that economics may not prove to be a constraining factor when it comes to moving towards energy targets.

He explained: “Our initial reaction to the 45V tax credit was that it’s a big tax credit. It's a really aggressive tax credit, certainly in this area.

“What we are trying to do is make sure that that money is well spent, fundamentally on reducing emissions and setting us up in the long term for achieving some of those targets.

I think, certainly in this case, the largesse of that tax credit means that we're pretty optimistic that it will have a big impact.”

This study emerges during a time when the US has taken to the world stage to announce its hydrogen strategy, and despite claims that the three pillars would stunt industry growth and delay electrolyser deployment, the analysis makes an encouraging case for opting for the three pillars over a loose rules approach.

EUROPE’S ENERGY NEEDS

IS BIOHYDROGEN THE KEY TO MEETING EUROPE’S ENERGY NEEDS?

by Hannah WintleA recent report by the European Biogas Association (EBA) has made recommendations for an EU regulatory framework to support the production and use of biohydrogen, citing benefits in its carbon footprint and production costs.

Given the importance of hydrogen’s role in reaching climate neutrality by 2050, the report claims that the adoption of biohydrogen, alongside biogas and biomethane, will be key to supporting Europe’s climate strategies.

In 2020, 95% of hydrogen production was derived from fossil fuels. Green hydrogen represented 1% of all hydrogen production that year, demonstrating the challenge hydrogen production faces in decarbonising.

Biohydrogen, a type of green hydrogen, is produced from biogenic sources such as biogas or biomass through a range of production technologies including biological and thermochemical processes.

Carbon negative biohydrogen is possible if combined with carbon capture and storage

Perhaps biohydrogen’s biggest draw is its potential to decarbonise Europe’s hydrogen production methods. While grey hydrogen’s carbon footprint ranges from 10-20kg CO2/kg H2, biohydrogen’s could even be carbon negative, at -26.510.8kg CO2/kg H2.

EBA Secretary General, Giulia Cancian, explained: “In contrast to the other forms of hydrogen, biohydrogen can be zero or even carbon negative if it is obtained from feedstocks such as wastes and manure and/or when coupled with carbon capture and storage technologies.”

According to the report, using organic wastes to produce biohydrogen not only replaces fossil fuels but also avoids emissions that would have otherwise been released into the atmosphere. These production methods can then be paired with CCS technologies, which then removes even more carbon dioxide from the atmosphere.

Giulia continued: “In addition, depending on the biohydrogen technology, biohydrogen production can generate co-products such as pure biogenic carbon dioxide, digestate or biochar. These co-products further support the decarbonisation of industries, contributing to the circular economy and helping to permanently store carbon in the soil.”

Additionally, biohydrogen can be generated from domestically produced biogases, reducing the need to import gas and directly improving both Europe’s security of supply and energy independence.

Biohydrogen is cheaper to produce than hydrogen from electrolysis

Despite decarbonisation targets all around the world, economics still plays a huge part in hydrogen production, with fossil fuels remaining the cheapest option for hydrogen production today.

According to the report, green hydrogen production through electrolysis is the most expensive hydrogen production method, in the range of €2.51-11.94/kg H2, with the cost of the renewable electricity making up between 50-90% of this expense, depending on the price of the electrcitiy and the full-load hours of the renewable electricity supply.

Biohydrogen, on the other hand, costs between €1.15-9.65/kg H2, with or without CCS, and poses other economic benefits including its ability to use domestically produced biogas in its production, reducing the need to import gas, as is the case with grey hydrogen, and therefore protecting against fluctuating natural gas prices.

Perhaps biohydrogen’s

its potential to decarbonise Europe’s hydrogen production methods. While grey hydrogen’s carbon footprint ranges from 10-20kg CO 2 / kg H 2 , biohydrogen’s could even be carbon negative, at -26.5-10.8kg CO 2 /kg H 2 .

biggest draw is

An enabling regulatory framework can be achieved by:

• Enforcing legal and market recognition: Biohydrogen should be recognised as hydrogen of renewable origin in EU and national legislation.

• Driving market access through consumption targets: The RED III should expand targets for renewable fuels of non-biological origin to include all types of renewable hydrogen.

• Using taxation to send a price signal in support of renewable sources of hydrogen: In the revision of the minimum taxation levels in the Energy Taxation Directive, a level playing field should be established for all sources of renewable hydrogen. If hydrogen of non-biological origin is awarded the lowest minimum, this should also be the case for hydrogen of biological origin.

• Facilitating network access: The Gas Directive and the Gas Regulation should allow flexibility in the distribution methods for biohydrogen so as to facilitate its integration into gas markets.

A number of recommendations for an enabling EU biohydrogen framework were proposed

While the report highlighted the many benefits biohydrogen has to offer, Giulia offered an insight into the current bottlenecks obstructing its wider adoption.

She said: “Biohydrogen is an innovative product, and the regulatory framework lacks drivers to reach commercial maturity. The targets set under REDIII for industry and transport focus on hydrogen from RFNBOs, actively discriminating against biohydrogen.

“The directive does not feature to date an inclusive definition of renewable hydrogen covering all possible production pathways, such as raw biogas and biomethane steam reforming.”

The report therefore made recommendations for an enabling EU framework to address these bottle necks.

The first recommendation to be put forward seeks to tackle ‘discrimination’ by recognising biohydrogen as hydrogen of a renewable origin. The report calls for an EU-wide definition of renewable hydrogen, allowing biohydrogen to be fully integrated into the gas and hydrogen markets.

The current definition of renewable hydrogen, which was put forward in February 2023, states that hydrogen can be considered renewable when the emission intensity of electricity used is below 18g CO2e/MJ.

Giulia explained that revising this definition to include biohydrogen is key for the deployment of hydrogen, and should lead to a technology neutral approach to renewable hydrogen and to the further development of biohydrogen production technologies.

“This would allow to obtain bigger amounts of biohydrogen, which can be used to help decarbonise highly energyintensive industrial process such as iron and steel, it can contribute to fuel diversity and energy system flexibility, and it can be a local source of green energy for rural areas,” she explained.

Ultimately, the time to develop laws governing the future of biohydrogen is now, as the European Union moves increasingly closer toward the establishment of a single market for energy.

For the EBA, the inclusion of biohydrogen, alongside biogas and biomethane, is important in ensuring the sustainability, affordability, and accessibility of green gases in Europe.

"

Reaching climate neutrality by 2050 will take all the tools in the toolbox and biohydrogen can certainly help achieving this ambitious target.

Giulia Cancian Secretary General EBA

ARTIFICIAL ISLANDS

BUILDING ARTIFICIAL ISLANDS FOR DOMESTIC ENERGY PRODUCTION

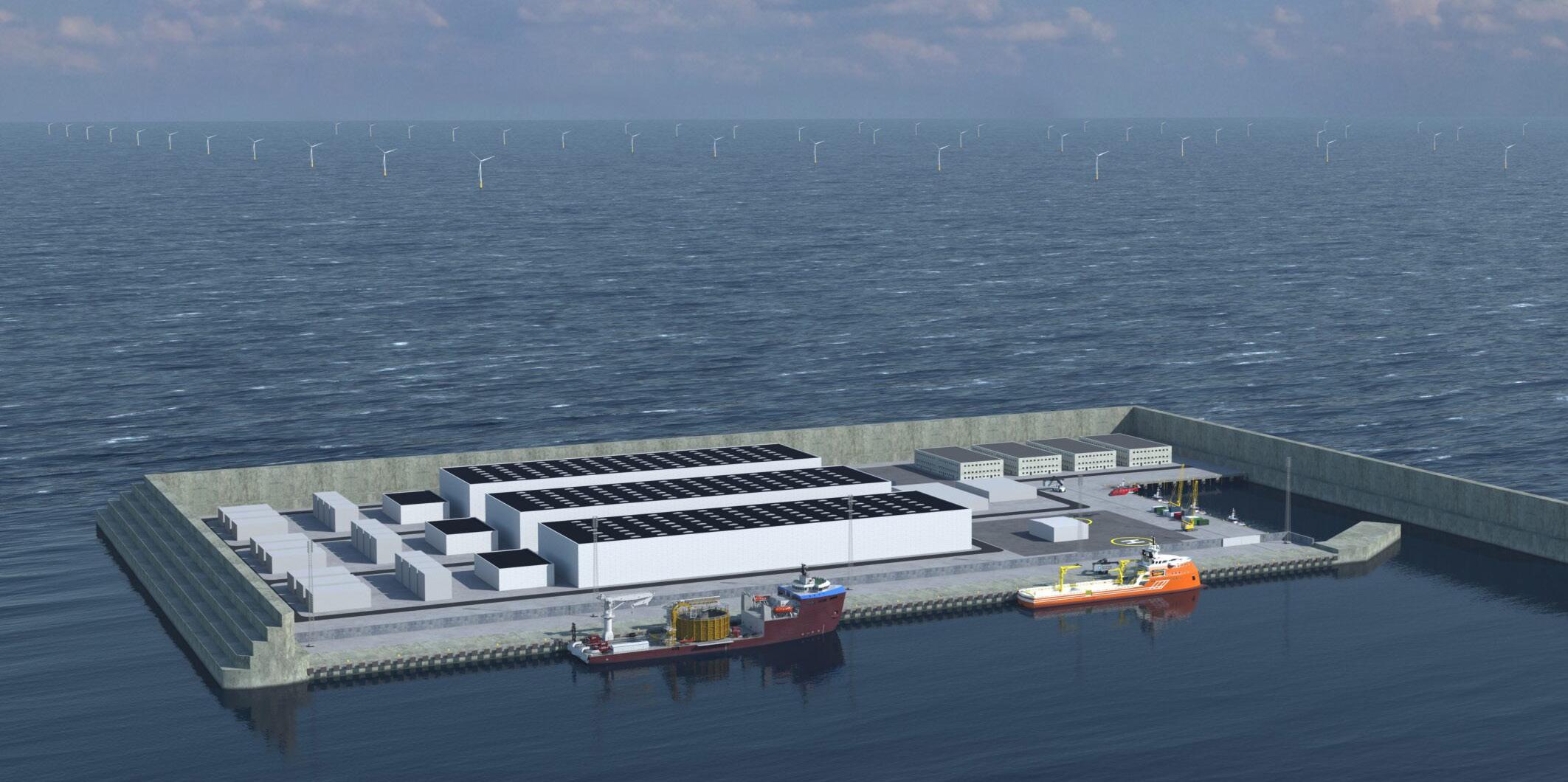

by Floyd MarchDenmark has historically led the way for renewable developments, most notably with the first offshore wind farm in 1991. Expanding on this proven track record for renewables, an artificial island was announced in the early 2020s. Hydrogen Industry Leaders examines the viability of further ‘artificial islands.’

Built across multiple phases, once the artificial island is completed, it will be capable of producing enough energy for over 10 million homes. Looking to boost offshore wind capacity by 2050, innovative projects such as this have been hailed as ‘history-making’.

Acting primarily as a transmission centre for wind turbines surrounding the North Sea, the first energy hub will be located just under 100km off the Danish coastline. At a cost totalling $34 billion, this will be the largest construction project in the country’s history.

Image: Global Wind Energy Council

Whether other countries will follow the lead in this innovative project or wait to see how it plays out, Denmark is determined to show the export opportunities available and reassure the hydrogen market on the global stage.

The island is expected to cover an area between 120.000 and 460.000 square meters, depending on whether the hub will host 3 or 10 GW. The exact size and outline of the island are subject to negotiations with the private partner that wins the bid to construct it.

$34bn to install up to 10GW capacity

Initial capacity of the hub will be 3 GW of offshore wind energy, roughly equivalent to half of Denmark's current offshore production. Over time, this capacity can be increased to 10 GW, nearly 1.5 times the current Danish electricity consumption, The energy hub will have the capacity to power approximately 10 million households across Europe.

Volume of wind turbines and their size will be determined by the winning tender, ranging between 200 to 600 turbines, potentially measuring over 260 meters from sea level to blade tip, making them unprecedented in scale.

This ambitious project represents the largest construction endeavour in Denmark's history, with an estimated total cost of around 210 billion DKK (approximately 34 billion USD). Its success could serve as a blueprint for other coastal nations seeking to develop their own green energy sources, as it has the potential to be implemented in various locations worldwide.

Denmark shaping up to become renewable energy exporters

When the hub reaches its full capacity of 10 GW, Denmark will produce one and a half times its domestic electricity needs, with plans to export renewable energy to neighbouring European countries and

beyond. The island will also become a hub for green hydrogen production, primarily derived from seawater, with an emphasis on exporting it to countries facing geographical challenges in hydrogen production.

To manage surplus electricity efficiently, the hub will incorporate battery storage systems, reducing curtailment and ensuring a future-proof approach for potential advancements in battery technology.

Though holding a majority stake in the project, the Danish Government has invited private companies to participate in a partnership to construct the hub. This approach aims to incentivise private sector involvement and is expected to garner significant interest.

In the context of the hydrogen economy, the Danish Government has adopted a traditional policy-driven approach to encourage industry investment, similar to the strategies employed in solar, wind, and other renewable energy sectors. This project signifies a step forward in Denmark's commitment to sustainable energy, and showcases the potential for global energy transformation.

Can this be replicated by other nations - perhaps not?

Despite a slight downturn in offshore wind installations during the mid-2000s, there has been a rapid deployment across the globe. This has been significant since 2020, which according to The Renewables Consulting Group saw record-breaking levels of investment.

There are many moving parts to a development of this size, including political backing, planning permissions, private sector support, sufficient green skills in the supply chain, and geographical landscapes. All of which have their own nuances that require detailed navigation to achieve the GW of power required to power 10 million homes. It is likely to be a ‘seeing is believing’ scenario where other nations look towards Denmarks’ innovative plans to see if there is a more secure business case formed from the successes and vital lessons learned from the world's first project.

Jeppe Kofod Minister of Foreign Affairs Denmark

It is clear that the development of this artificial island has the potential to produce an inspiring amount of hydrogen and renewable power. Implementing this across other parts of the globe might be more difficult, however.

Whether artificial islands become a new trend to tackle limited space and geographical concerns or whether this world-first will remain a solo project, it is undeniable that this pioneering engineering design will help boost decarbonisation hopes across the globe.

To win the battle against climate change, we need to decarbonise the heavy industries - and this can only be done through close collaboration between governments and industries.

Becoming an exporter of energy is a top priority.

Moving the world towards zero emissions

Our 11,500 sqm state-of-the-art research & innovation centre at the Bristol & Bath Science Park delivers a wide range of expertise to facilitate multidisciplinary collaboration across all propulsion types and transport sectors, accelerating the pace of innovation in future mobility. Established as a secure environment for testing, research and validation, IAAPS offers unrivalled expertise and innovation capabilities to safely develop new hydrogen fuel technologies from fundamental research to new product introduction.

400kW solar array feeding 500kW electrolyser

10kg/h of Green H2

Better than 99.97% purity to meet ISO14687

270kg low pressure H2 storage tank

30bar distribution system to 4 test cells

Closed Loop Cryogenic Helium Gas Cooling System

Digital system, simulation and modelling

Test systems, HiL, PiL and ViL

Up to 750kW, 1200V Battery emulation

Supporting multiple collaborators in pursuit of onsite LH2 storage

We are excited about talking to potential partners to understand their challenges and how we can work together to solve them.

Email iaaps@iaaps.co.uk for more information.

www.iaaps.co.uk

COST DRIVERS

WHICH COST DRIVERS SHOULD THE SECTOR USE TO CALCULATE LCOH?

by Floyd March

by Floyd March

The levelised cost of hydrogen is in constant discussion across the hydrogen sector and is an increasingly used methodology when looking at the business case for hydrogen production and final investment decisions.

Building on this, and the significant influence high-level studies have on key decision makers in the hydrogen sector, Agora recently released their levelised cost of hydrogen report that focuses on making the application of the LCOH concept more consistent, and more useful.

While there has been an increased use of said methodology, the calculations involved in the LCOH must be consistently performed. This includes the same system boundaries and cost drivers.

The report highlighted: “If the selection of system boundaries is unclear in different studies, policymakers may draw the wrong conclusions. For this reason, Agora Industry commissioned umlaut to investigate the system boundaries and cost drivers used in high-level studies in calculating the levelised cost of hydrogen.”

Certain cost drivers impact LCOH more than others

One of the findings was that how system boundaries are dealt with in high-level studies varies and that consequently a sufficiently transparent description of the LCOH calculation in terms of system boundaries and cost drivers is not given.

Some cost drivers have a negligible impact on LCOH and can therefore readily be omitted, while others are very significant and must be taken into account. Further investigations were therefore carried out in which cost drivers were classified according to their importance. While the discount rate, electricity costs, the costs for engineering, procurement, and construction (EPC), the costs of the stack, the expected lifetime and the balance of plant (BoP) are among the major cost drivers, the costs of cooling, gas purification and water treatment are classified as minor cost drivers.

Examining the system boundaries is an essential step in ensuring that a consistent LCOH can be established.

Comparison of system boundaries and other cost drivers in high-level studies on LCOH*

The classification of cost drivers is shown in Figure 1. To ensure consistent LCOH calculation in future studies, recommendations are made here for a pragmatic approach to the calculation which can provide orientation in the preparation of studies.

Authors of the report explained: “The recommendations include that revenues that can be recovered from the sale of the by-products oxygen and wasteheat should be excluded from the LCOH, as should funding, since both are strongly contingent on individual project setups. For the calculation of the LCOH, the total energy demand of the electrolyser –including auxiliary power – should be considered.”

Additionally: “The costs for buildings and foundations must also be included in the calculation. However, the costs of land should not be considered. It should be assumed that the necessary connections to the electrical and water grids are already in place and that the electrolyser can be connected directly.”

Examining the system boundaries is an essential step in ensuring that a consistent LCOH can be established. For example, the calculation of the LCOH may or may not include costs for land, buildings, and EPC.

The approach may vary from study to study, and often the selection of system boundaries or the exclusion of cost drivers is not transparently presented. In the bulk of the literature, the researchers highlighted that no relationship is drawn between the application of a system boundary and costs.

Result of meta-study on LCOH: Classification of Cost Drivers

Revenues from selling by-products: oxygen, heat**

Umlaut (2023). *Generic term. BoP. There is no standard definition of BoP, but it typically includes power supply, water conditioning, and process utilities like pumps, process-value-measuring devices, and heat exchangers. **Despite their importance in real projects, the revenues from the sale of oxygen and heat as well as funding are not included in the consideration as they are not cost components.

The factors briefly described below are included in the evaluation shown in Figure 2, above but include the following:

1 | Efficiency: Is the efficiency or the specific energy demand of the system given, and is its influence on the LCOH described properly? For example, is the total auxiliary consumption taken into account in the specific energy demand, and are reference points specified?

2 | Electrical components: Are power electronics completely or partially included?

3 | Stack lifetime and replacement costs: Is the lifetime mentioned? Is stack degradation considered, and are costs for stack replacement given?

4 | Pressure: Is the pressure in the electrolyser and at the hydrogen outlet specified? Is a distinction made between internal and external pressure, and is the influence on the LCOH analysed?

5 | Purity: Is the hydrogen gas quality specified and is its influence on costs given?

6 | Water: Are the type of water supply and any necessary water treatment specified?

7 | Greenfield or brownfield: Has a distinction been made between new facilities on previously undeveloped land and projects on land with existing facilities?

8 | Mode of operation: Is any information given on whether the electrolyser is operated at nominal or partial load, whether it is an island network, and whether it is operated flexibly?

9 | Storage: Is on-site storage considered, and if so, what is the storage capacity taken into account?

10 | Engineering, procurement, and construction: Is EPC included in the LCOH? And if so, what value is assumed?

11 | Transport infrastructure: Are costs for on-site transport infrastructure considered, or are connections already available at the electrolyser?

12 | Other Balance of Plant (BoP): Are costs for other balance of plant components or contingencies specified? BoP typically includes power supply, water conditioning, and process utilities like pumps, process-value-measuring devices, and heat exchangers.

Visual indicators of the influence on LCOH

From the twelve cost drivers to consider that have been indicated above, figure 3 highlights the influence of overarching cost drivers that can change, highlighting the importance of using the correct methodology for LCOH.

Agora give recommendations on specific cost drivers

The report then spent significant time giving recommendations on each specific classification of cost drivers beginning with the recommendation the costs for EPC are included in the LCOH.

Illustrative calculation of the four overarching cost drivers, and relevant assumptions

In the example on the right, a scenario with relatively high CAPEX (1.700 Euro/ kWel) and low electricity costs (0.02 Euro/ kWh) is shown. In the example on the left, relatively low CAPEX (800 €/kWel) and high electricity costs (0.07 Euro/ kWh) are assumed. Otherwise, the same assumptions apply.

The report expanded on these examples: “It can be observed that the influence of the cost drivers can vary strongly. More interesting for the development of the pragmatic approach, however, is the discussion of the other more detailed cost drivers, which have already been addressed in the section above.”

AGORA INDUSTRY

" We recommend that everything that can reasonably be estimated for the turnkey construction of an electrolyser as well as for its operation should be included in the LCOH.Umlaut (2023) based on provided tool. Note: General assumptions: specific energy demand: 55.5 kWh, 4 000 h/a, discount rate 7%, OPEX 3% of CAPEX, lifetime 30 a. CAPEX 800 €/kW electricity costs 0.07 €/kW

Despite the inclusion of EPC within the LCOH, the report concluded that contingency costs should not be included in the LCOH as: “They are not usually considered in high-level studies, and can also vary considerably.”

As buildings, including foundations and land, are essential for the construction of an electrolyser, it would be expected that they would be involved in the LCOH. However, the report argued that: “Data gathering for this is challenging, especially when comparing properties in different countries and rural as well as urban locations. This recommendation is also in line with the objective of our study to identify and provide reasonable simplifications for future cost comparisons of LCOH.”

With regard to the connection of the electrolyser plant to the electrical network, it is assumed that an existing network is available and that the electrolyser can be connected directly to it. About electricity costs, everything the operator of the electrolyser has to pay must also be included in the calculation of the LCOH.

The same is applied to the water supply element unless a seawater desalination plant has to be built to supply the electrolyser with water. This should also be included in the costs.

Due to the multiplicity of further potential applications, the costs for the subsequent use or transport of hydrogen cannot be easily taken into account, and are therefore omitted from the calculation in the pragmatic approach.

Moving on, If LCOH calculations are made using the reference pressure of 30 bar but the electrolysers investigated operate at lower internal pressures, additional costs should be included in the LCOH via the entries for the cost of the compressor, its efficiency and pressure ratio.

The report concluded: “We recommend including the stack replacement costs in the CAPEX. For this purpose, the actual lifetime of the stack has to be calculated from the lifetime specified by the manufacturer as well as from the full load hours of the electrolyser.”

The recommendations include that revenues that can be recovered from the sale of the byproducts. Oxygen and waste-heat should be excluded from the LCOH, as should funding, since both are strongly contingent on individual project setups. recommendations include that revenues that can be recovered from the sale of the by-products. Oxygen and waste-heat should be excluded from the LCOH, as should funding, since both are strongly contingent on individual project setups.

VISION FOR IRELAND

IRISH NATIONAL HYDROGEN STRATEGY: HIGHLIGHTING THE VISION FOR IRELAND

by Floyd MarchAfter the Irish National Hydrogen Strategy was announced and the main takeaways continue to be discussed, Hydrogen Industry Leaders brings the detailed breakdown of the hydrogen production pathways involved, operating models and the long-term vision for the Irish hydrogen strategy.

Recapping the release of the strategy's core takeaways, there will be a focus on kickstarting production with a 2 GW target of offshore wind by 2030, and more clarity for future end users that there is a strong commitment to hydrogen production in Ireland.

Additionally, there were policy announcements regarding the steps to enable the development of infrastructure, the importance of safety and regulation, and enabling innovation and skills across the value chain.

The national strategy then went on to break down the hydrogen production pathways, operating models, roadmap to scalability and the long-term vision for the Irish Government.

One of the biggest pathways to secure large volumes of hydrogen will come from the use of electrolysis of water. Ireland will be focussing on overcoming some of the barriers and challenges currently involved with this.

It was announced that before 2030, hydrogen will be produced from gridconnected electrolysis from surplus renewables. This will initially be needed to meet EU targets in specific end-use sectors such as transport, and will likely be used in the power system. The operating models for these should be beneficial to the electricity system and sufficient grid infrastructure is needed to facilitate this.

Rules on additionality being navigated by Irish Government

The availability of Renewables is an important issue to address, especially with rules regarding additionality. As hydrogen from electrolysis requires significant volumes of renewable electricity to produce it, energy losses during the conversion process mean that the hydrogen produced contains only around 60-70% of the energy content of the original renewable electricity supplied. While Ireland has the resource potential to produce significant volumes of renewable hydrogen, it will take time to deploy the required onshore and offshore renewables at a sufficient scale.

Speaking about the National Hydrogen Strategy, Hydrogen Industry Leaders heard: “Our target of 80% renewable electricity by 2030 will mostly be dedicated to decarbonising power generation and supporting the expanding electrification of the heat and transport sectors.”

Ireland could propel itself as an industry leader in Europe.

Floyd March, Editor, HIL

IS POSITIONED TO BUILD A SECURE HYDROGEN ECONOMY

However, analysis undertaken as part of the Climate Action Plan 2023 estimates that the 80% target could also support as much as 2-4 TWh of renewable hydrogen production by 2030. “This may increase substantially with the detailed design of the electricity network in the second version of 'Shaping Our Electricity Future' to be published this year.”

A portion of this potential would be directly attributed to the potential role hydrogen could play in reducing system curtailment, also estimated to be c. 16% by 2030 (or 9.7 TWh).

EirGrid is currently finalising its work on Shaping Our Electricity Future and will provide updated figures on this as part of this work. Beyond this, greater use of Ireland’s offshore renewable energy resources will be required.

In March 2023, the Department launched the Policy Statement on the Framework for Phase Two Offshore Wind. The Framework sets out Ireland’s longer-term vision for offshore wind energy, targeting 20 GW of offshore production by 2040 and at least 37 GW by 2050, opening the opportunity to significantly ramp up renewable hydrogen production post-2030.

Cost barriers could be a thing of the past

Costs are a natural challenge to overcome, especially with some technology being in its infancy when used on a GW scale. These costs are primarily driven by two key factors, the cost of renewable electricity and the capital costs of electrolysers.

Positively, Electrolyser capital costs have dropped significantly in recent years and are projected to continue to do so. Utility-scale solutions are now becoming available and supply chains are ramping up with many equipment

providers beginning to offer products in the 100 mega-watt scale and moving towards the giga-watt scale.

The report highlighted:

“These technological developments are putting significant downward pressure on the production costs of renewable hydrogen with electrolyser costs predicted to roughly halve by 2030 and drop to one-third by 2050. With renewables costs also continuing to fall, renewable hydrogen costs are expected to fall dramatically over the coming decades, with some predicting it may become the cheapest form of low-carbon hydrogen production by as early as 2030.”

Ireland’s renewable energy resources are some of the most energy productive in the world, and these falling costs will greatly improve the competitiveness of Irishproduced renewable hydrogen.

The Hydrogen Council, an initiative that includes 150 multinational companies representing the entire hydrogen value chain, predicts the costs of renewable hydrogen could fall to as low as 0.9-1.6 $/kg by 2050, which equates to roughly €2.5-4.5 c/kWh by 2050.

Focusing on the LCOH is also an important consideration to prove the business case for hydrogen and incentivise the private sector to match the ambitions of the Irish Government and help deliver. Arguably, this is one of the most important aspects of delivering a hydrogen economy.

As well as electricity, electrolysis also requires large quantities of water as an input. While this can prove to be a bottleneck for many countries across the globe, Ireland is not expected to have significant issues supplying the quantities of water required to produce renewable hydrogen.

For example, supplying 2 GW is estimated to require less than 1% of Ireland’s current water supply including leakages. In addition, water can also be sourced from local sources, such as rainwater, aquifers/streams, as well as through desalination of seawater, which is particularly relevant in the case of hydrogen production from offshore renewable sources.

However, the report stated: “It will be important to engage with Uisce Éireann as the sector develops to ensure any potential future water needs for the hydrogen sector are understood and that sufficient infrastructure investment in the water network can be made in advance so that no localised supply issues emerge.”

Hydrogen can be produced from electrolysis by either directly connecting to a renewable electricity source, or alternatively by using power from the national electricity grid. When using the latter, the emissions intensity of the hydrogen is determined by the sources of electricity feeding the national grid. In 2021, 23.9% of Ireland’s primary energy inputs to electricity came from renewables.

While the foundations for electrolysers are built, the Irish Government will be utilising electrolysis from the grid. The decision was explained in the strategy, where it was stated that: “In the interim period, clear rules are needed to determine if and when electrolysis connected to the electricity grid can be deemed renewable or not, as discussed in more detail below.

This also correlates well with times when the electricity market prices and the emission intensity of the grid are lowest, potentially offering opportunities for hours of low-cost sustainable hydrogen production.

Rules for Determining if Grid Electrolysis is Renewable

The flexibility of operation that grid electrolysis provides also means it is possible to operate them in a manner which is less beneficial to the grid and produces less sustainable hydrogen.

While grey hydrogen’s carbon footprint ranges from 10-20kg CO 2 /kg H 2 , The Irish Government are looking at reducing this impact through green hydrogen production across multiple sectors.

To reduce this risk, the European Commission has developed its draft delegated act on additionality. This sets out the criteria under which grid electrolysis can be deemed to be renewable, as summarised below:

• A power purchase agreement must be in place with a renewable electricity source, constructed within 36 months of the electrolyser, and which has not received operating aid.

• The electrolyser must be located within the same bidding zone as the renewable source.

• The time difference between the renewable electricity and the hydrogen being produced cannot exceed one month initially, reduced to hourly in 2030.

Hydrogen produced from grid electrolysis can also be considered renewable if produced in an electricity system with greater than 90% renewables over a calendar year or if produced during periods of curtailment or dispatch down.

The technologies and developments will lead to an industry structure that is quite comparable to what we see in energy infrastructure today.

INTERNATIONAL PROJECTS

HYDROGEN PROJECTS FROM AROUND THE WORLD

Germany

ITM Power has announced the award of a contract for a 100MW hydrogen project in Germany.

The contract is for the procurement of long lead-time materials and components required for the manufacturing of its stateof-the-art MEP30 skids for the German project.

In recent years, interest in green hydrogen has increased rapidly worldwide. To help meet demand and accelerate progress towards net zero, ITM Power is amplifying the use of hydrogen.

Headquartered in Sheffield, UK, ITM Power designs and manufactures electrolysers based on proton exchange membrane (PEM) technology to produce green hydrogen.

It has been revealed by ITM Power that the final investment decision (FID) is aimed to be taken by its customer this year.

US

It has been revealed that the California Air Resources Board (CARB) has launched a Clean Truck Partnership with leading US truck manufacturers and the Truck and Engine Manufacturers Association. How could this amplify the use of hydrogenpowered vehicles?

The Truck and Engine Manufacturers Association works to advance the development of zero-emission vehicles for the commercial trucking industry, while still reaching the state’s climate and emission reduction targets.

CARB has agreed to work collaboratively with manufacturers to provide reasonable lead time to meet CARB’s requirements before imposing new regulations and to support the development of necessary zero-emission vehicle infrastructures.

Terms of the Clean Truck Partnership include that CARB will align with EPA’s 2027 regulations for nitrogen oxide emissions.

Gran Canaria

Stargate Hydrogen Solutions OÜ will deliver an electrolyser as part of an offshore wind energy project after receiving a €3 million grant from the European Commission under the Horizon Europe programme. The project, which will receive €10.7 for demonstrating the full value chain of green hydrogen, will be overseen coordinated by the Oceanic Platform of the Canary Islands (PLOCAN).

When the 1 MW electrolyser is installed on the PLOCAN site on Gran Canaria, it will draw renewable energy from a 6 MW offshore wind facility to produce green hydrogen and oxygen, which will be used at a local hospital complex.

The grant awarded by the European Commission will oversee the delivery and installation of the electrolyser system including Stargate Stellar series stacks, alongside H2/O2 compression and storage equipment.

Rainer Küngas, Stargate CTO, said: “Stargate looks forward to delivering our Gateway series electrolyser specifically developed for maritime applications.”

Netherlands

A joint study between the Port of Rotterdam and the Tasmanian Government has highlighted the potential in importing green hydrogen from the island.

Tasmania, an island to the southeast of Australia, has the capability to produce clean electricity from wind, solar, and balancing with hydroelectric power, meaning they have some of the lowest green hydrogen production costs globally.

Additionally, the study found that the cost of transporting green hydrogen over a longer distance is not costly and therefore is not considered a limiting factor.

Green hydrogen from Tasmania could enter the supply mix at the Port of Rotterdam, who are becoming an international hydrogen distribution hub, consequently strengthening the hydrogen economy in northwestern Europe.

The verdict of this study comes after the Tasmanian government and the Port of Rotterdam signed a Memorandum of Understanding to explore the viability of importing Tasmanian green hydrogen in 2021.

Ultimately, the low cost of producing green hydrogen in Tasmania, where renewable energy sources are abundant, cancels out transportation costs.

Building the Hydrogen Economy

Radisson BLU, Glasgow

28 November 2023

Continuing our annual Scottish Conference, join key decisionmakers and thought leaders throughout the sector as we look to grow the hydrogen economy and enhance the energy transition through production, storage, distribution, and end-use.

• What role will transport play in hydrogen storage, distribution, and end-use?

• How is Scotland uniquely positioned to explore onshore and offshore renewable options?

• How to unlock further investment opportunities for Scotland

• Explore how oil and gas companies can transition to green solutions

Manchester

22 September 2023

Our HIL 100 Breakfast Hub brings us to Manchester to discuss current and forthcoming projects in the North West, including the £300m which will have the capacity to generate 200MW of energy.

Join us for this informal networking breakfast to engage with key people driving the hydrogen revolution in the city.

Park Inn by Radisson Manchester City Centre hydrogenindustryleaders.com

Speaker: David Walker , HyNet Project Manager, Progressive Energy

Speaker: David Walker , HyNet Project Manager, Progressive Energy