COULD THE UK LEAD THE WAY FOR PINK

HYDROGEN PRODUCTION?

Hydrogen Industry Leaders e-magazine September 2023

IN THIS ISSUE:

COULD THE UK LEAD THE PINK HYDROGEN REVOLUTION?

4

16 24

WILL THE IRA HELP PUSH FOR CCUS AND CDR GROWTH?

HOW TO BRIDGE THE HYDROGEN SKILLS GAP

HDF PIN HOPES ON NAMIBIA HYDROGEN PROJECT APPROVAL

INTERNATIONAL PROJECTS

12 29

HYDROGEN BLENDING IN THE EMERGING HYDROGEN ECONOMY

WHICH COST DRIVERS SHOULD THE SECTOR USE TO CALCULATE LCOH?

8 26 e-magazine 2

Hydrogen Industry Leaders e-magazine August 2023

P / 16

PREVIOUS ISSUES

WITH ALL THE FOCUS ON GREEN HYDROGEN, THE UK COULD MISS OUT ON A PINK HYDROGEN REVOLUTION.

As the dust settles on the IRA announcements, the sector looks at whether it will trigger growth for CCUS and CDR. This issue breaks down the movements in legislation, policy announcements and how to bridge the hydrogen skills gap. .

Additionally, Hydrogen Industry Leaders brings you the general objectives of the latest insights into the renewables market, why the HDF have pinned hopes on Namibia for green hydrogen production, and the role of blending in the emerging hydrogen economy.

Through our international projects section, we explore the core innovations across the globe, including a new type of hydrogen refuelling station in Brazil, the $50 million funding

initiative in Canada, how Australia is turning its eyes towards more ammonia production, and a potential collaboration between India and the UK for further hydrogen innovation.

Our new podcast series will bring new insights into the sector

Hydrogen Industry Leaders looks at current hydrogen projects, innovations and policies shaping the hydrogen economy that will undoubtedly lead the way for the future of lowcarbon energy.

FOREWORD

Multimedia Editor Floyd March Multimedia Journalist Chelsea Bailey Multimedia Journalist Hannah Wintle Graphic Designer Paul Rose Floyd March f.march@peloton-events.co.uk e-magazine 3

WILL THE IRA HELP PUSH FOR CCUS AND CDR GROWTH?

BY FLOYD MARCH

With climate deadlines looming and the hydrogen sector looking to decarbonise hard-to-abate areas, the role of CCUS is being widely discussed for use in tandem with hydrogen production.

With the UK recently announcing plans for four CCUS clusters and the IRA, recently published by Joe Biden’s administration, setting out how to decarbonise hard-to-abate areas, there could be a boom in the industry - but how do we guard against a potential bust?

With the Acorn CCS project in Aberdeen securing significant funding in the future, it will become one of four clusters across the UK. This comes after years of deliberation from the central government.

Coming from Track 2 of the £1bn UK Government competition, the funding will secure the future for both blue hydrogen production and wider carbon capture and utilisation projects.

Failing to achieve funding in Track 1, this announcement was widely accepted news as Prime Minister Rishi Sunak visited St Fergus on 31 July 2023.

This, coupled with the US’s position that carbon management solutions like CCS, CDR and CO2 utilisation are essential tools to meet federal climate targets in the US and across the globe.

The latest report from the Oxford Institute of Energy Studies set out that: “The long-term strategy of the United States, announced in 2021, clearly outlines US climate targets:

(a) the Nationally Determined Contribution (NDC) under the Paris Agreement of 50-52% reductions below 2005 levels by 2030, (b) 100% carbon pollution-free electricity by 2035, and

(c) net zero emissions no later than 2050. The Strategy does not make specific commitments on the capacity of CC(U)S or CDR required but emphasises 100% clean electricity and scalingup of carbon removal as key priorities.”

While these policy announcements go a long way to encourage the private sector that CC(U)S has a role in the journey to net zero across the globe, the OIES have posed the question of whether the US Inflation Reduction Act will push Carbon Capture and Storage and Carbon Dioxide Removal technologies over the line?

Attempting to answer this topical question, the authors of the report set out the investment risks involved with CC(U)S in a bid to understand the landscape of CDR on a decision-making level.

e-magazine 4

The report stated: “Policy support for carbon management is important for the US to meet its net zero objectives because of the existence of an array of political, cross-chain, technical, and economic risks at play across carbon management projects.”

Many risks are inherent in the carbon management system and are liable to cause the deployment to deviate from a growth trajectory that remains aligned with net zero outcomes.

Additionally: “Empirical studies observe the inability of financial supports to adequately overcome key technology risks and high failure rates (capture performance, pipeline and storage quality, terrain, distance, and leakage concerns). Unique technical and financial risks

are not easily assessed by private financiers and many carbon management technologies are ‘pure climate technologies’, meaning that their sole purpose is to mitigate the effects of climate change and often do not come with significant monetisable co-benefits.”

Policy support for carbon management is essential for the US

The IRA announced additional financial support and incentives for CCS, CDR and CO2 utilization, most prominently through enhancements to Section 45Q of the Internal Revenue Code. Section 45Q provides a tax credit for CO2 sequestration and CCUS deployment more broadly.

Different types of risks inherent in CCUS projects

Source credit: Muslemani et al. (2020)

Integration risk: risk of impacting industrial operations or product quality Technology performance: capture technologies still in developing phase with uncertainty in pertormance

CAPEX uncertainty: Immaturity of capture technologies and uniqueness of industrial sites: uncertainty in estimating costs; limits replicability

Cross-chain integration: risk inherent in coordination between many stakeholders, volume risks of CO, liability transfer.

T&S availability: uncertain availability of T&S infrastructure or T&S competition might lead to stranded assets

T&S cost uncertainty: T&S monopoly might lead to increase in T&S fees

TECHNICAL CROSS-CHAIN POLITICAL ECONOMIC

OPEX uncertainty: uncertainty in future fuel prices, plant energy consumption, equipment lifetime, etc.

Risk perception: investors require higher ROI due to risk

Lack of revenue model: due to low CO, prices and insufficient utilisation opportunities

Uncertainty in demand for industrial products: demand in industry is less certain than power

Competitiveness: industries risk losing competitiveness as CC(U)S costs cannot be passed on to consumers with globally-traded commodities

Policy uncertainty: lack of a comprehensive framework and business models to facilitate CCS

Carbon price uncertainty: uncertain prices, trade-intensive industries at risk of leakage

e-magazine 5

THE 45Q TAX CREDIT HAS DRAMATICALLY EVOLVED

The 45Q tax credit is widely considered to be one of the most influential government policies in support of CCUS globally. The tax credit provided project owners with $10/t of CO2 used for enhanced oil recovery (EOR)39 and $20/t of CO2 sequestered geologically.

In 2018, the Bipartisan Budget Act (BBA) increased the credit value to $35/t for carbon captured and utilized for enhanced oil recovery (EOR) and $50/t if geologically sequestered. The BBA replaced a 75 Mt per project credit cap, replaced it with a 12-year crediting limit and allowed smaller facilities of less than 500,000 t/y to qualify for the credit.

A broadened definition of those that qualify for the credit allowed smaller projects owners to monetize credits more flexibly by leveraging tax equity markets. Following the IRA, the 45Q tax credit is further enhanced in its value, applicability, and flexibility.

Credit enhancements are estimated to cost the US treasury almost $3.23 billion (cumulative) by 2031, which is equivalent to an additional 37.9 Mt of cumulative CO2 sequestered geologically from point source capture or 53.8 Mt of CO2 sequestered via EOR, or as low as 18.3 Mt of CO2 if captured via direct air capture (DAC) and stored geologically.

Decarbonising hard-to-abate areas through CCUS is a priority

The IRA’s amendments to the 45Q tax credit may greatly increase the number of economic carbon capture projects. Any material change to carbon capture project economics is likely to result from the increase of the credit value, which increases the credit’s effect in reducing revenue-related economic risks.

WILL THE TAX CREDIT HELP HARDTO-ABATE SECTORS THROUGH CARBON CAPTURE?

Authors of the report explained that: “The tax credit however may not be sufficient for carbon capture in the hardest-to-abate industrial applications, where returns and difficult-to-mitigate risks result in carbon capture investment opportunities that do not compete favourably against other carbon capture projects in the power sector or in other industrial sectors.

Government support in addition to the enhanced 45Q tax credit is needed to drive down capital costs in hopes of attracting suitable levels of private investment.”

The increase in this value could be a key indicator for whether CDR and CC(U)S projects are pushed over the line. However, even with the increase in value of the 45Q tax credit, there are still some risks and considerations, according to OEIS.

e-magazine 6

Credit: ANP/AFP

CORE CONSIDERATIONS FOR CARBON CAPTURE DEVELOPERS

Breaking down some of the considerations, the report highlighted the following key points:

1 Government support in addition to the 45Q tax credit is likely to be required to stimulate substantial amounts of private investment for carbon capture in hard-toabate industrial sectors.

2 Deployments are likely to require breakeven CO2 prices that are higher than $85/t and for longer than the 12-year crediting period afforded under the incentive.

The implication is that project capital is more accessible and easily repayable in competing green investment spaces – the low-carbon generation, grids and storage, buildings, and transport sectors than in the industrial sector. Moreover, capital is generally more available to carbon capture in the power sector than in the industrial sector. Data is currently insufficient to draw definitive conclusions in this area, though available cases of first-of-a kind projects may provide early indications.

A small set of successfully financed CCUS projects in North America finds that industrial projects (Air Products Steam Methane Reformer, Illinois Industrial, and Shell’s Quest) reflected a significantly higher proportion of grant funding –60% compared to 25% in power CCS cases.

3Moreover, the cost of capital is generally higher for green, or lowcarbon, investments in the industrial sector compared to green investments in other economic sectors. Also, the cost of capital is generally higher for carbon capture investments in the industrial sector compared to the power generation sector. 4

Green investments typically require a greater share of equity, or lower debtequity ratio. Equity is more expensive than debt, meaning that it requires a higher rate of return (hurdle rate) than debt (interest rate) because it is generally more difficult to repay in instances of project failure.

While the power projects examined here required more equity, the high proportion of grant funding signals that anticipated project returns were likely too low to justify commitments of available equity. Support for this sector is always welcomed, and the changes to legislation to advocate for the development in this industry is a key indicator of the direction the US are willing to go should be enough to encourage the private sector to come forward and deliver on these ambitions.

However, the key considerations and risks are still relatively high, so the timeline of development will be interesting to watch.

The Capital Structure of Clean Energy Investments in Advanced Economies

Source: IEA

Low-carbon generation Debt Equity Grids and Storage Buildings 0 20 40 60 80 100 Industry Transport Low-emissions fuels 65% 63% 70% 42% 72% 35% 35% 37% 30% 58% 28% 65%

e-magazine 7

HOW TO THE HYDROGEN SKILLS

BY HANNAH

Hydrogen is slated to be a key player in the UK’s energy transition over the course of the next few decades, but to get there, it desperately needs a workforce equipped with the necessary skills to take hydrogen from the nascent industry it is today, to the energy carrier of the future.

The Hydrogen Skills Alliance (HSA) is one organisation that seeks to bridge this gap, and prepare the UK for the adoption of hydrogen, which they see as essential to delivering on the nation’s net zero promises.

Cogent Skills, the skills lead for the UK’s science and technology sector, and the National Composites Centre (NCC), part of the High Value Manufacturing Catapult (HVMC), came together to form the HSA in the hopes that it would support the growth and development of the UK hydrogen sector by building a skilled workforce.

With members including the University of Chester, the Department for Business, Energy & Industrial Strategy, and The Engineering Construction Industry Training Board (ECITB), the HSA draws upon industry, academia, research organisations, and government within this collaboration.

e-magazine 8

TO BRIDGE HYDROGEN SKILLS GAP

“It was created as a convening body to help ensure the industry has access to the right skills, at the right time and in the right place,” said Dr Nick Backstrom, Hydrogen Skills Alliance & Low Carbon Strategic Skills Lead at Cogent Skills.

“The HSA uses a systematic, evidence-based approach to identify future workforce needs, develop content and address skills gaps. It does this through the skills value chain method, which is flexible and can be used across different stages of the hydrogen economy – and has been highlighted as an industry requirement in the government’s recent Hydrogen Champion report.”

Chaired by Steve Scrimshaw, Vice President of Siemens Energy Limited UK & Ireland, the HSA is also uniquely positioned to influence government policy, due to Steve’s additional role on the government’s Green Jobs Delivery Group, which sets out to “act as the central forum for continued action on green jobs and skills.”

This link allows the HSA to feed its work into the heart of the government, share its findings, and allow decisions to be made in regard to what needs to happen from a policy perspective to support the uptake of and roll out of provision for hydrogen skills.

HANNAH WINTLE e-magazine 9

IDENTIFYING HYDROGEN SKILLS CHALLENGE AREAS WILL ENABLE ‘FORESIGHTING’

Part of the HSA’s method in bridging the hydrogen skills gap involves skills foresighting. David Nash, Director of Strategy and Policy at the ECITB, explained that this involves working with technologists and manufacturers of key component parts of modular technology, such as electrolysers.

“What we’re trying to do is understand what kind of processes are involved in terms of manufacturing, installing, building, testing, certifying that kit, and those processes involved, and what the challenges are that those people currently see in terms of the UK’s capability of being able to do that.

DIVERSITY AND INCLUSION IS ESSENTIAL IN THE HYDROGEN WORKFORCE

David also highlighted the need for a diverse hydrogen workforce. He said: “It’s really important that that work is delivered in a way that it ensures that the sector taps into the widest possible range of talent.

“As part of understanding what their skills needs are going to be, it’s about ensuring that, at the point at which those training opportunities are made available, we’re spreading the message loud and far and those companies are proactively taking steps to ensure they recruit from underrepresented groups.”

“Then it’s about trying to plot the difference in terms of what those skill sets are that we’re not sure if we’ve got currently within the existing engineering base”.

This work equips the HSA with the knowledge of what skills are already secured and what skills are still required, which enables the alliance to assess the route to building up skills in the right areas, which further informs the type of training intervention on offer.

While many sectors in the UK have needed to introduce diversity schemes to address a lack of representation and ensure their recruitment is inclusive, the hydrogen sector is unique in that it is still young, and is in the advantageous position of being able to ensure inclusivity from a much earlier point in its development.

Furthermore, these underrepresented groups who now have the opportunity to enter this growing workforce will play an essential role in not only the UK’s energy transition, but the wider transformation of the global energy sector.

Underrepresented groups now have opportunities within the sector

Dr Nick Backstrom summarised: “The HSA also actively promotes equality, diversity and inclusion across the industry. By fostering cooperation among industry figures and exploring potential uses of the SVC methodology, the HSA is ensuring workforce development is inclusive and reflective of wider society.”

e-magazine 10

“Foresighting I think is vital, and is not currently be done elsewhere.”

HSA MEMBERS WORK IN COLLABORATION TO...

Map the existing hydrogen skills landscape to create a live database of skills provision available to all

Quantify the skills demand based on known requirements and build in future requirements as they emerge

Identify a prioritised list of Hydrogen skills challenge areas that will enable “Foresighting”

Undertake a series of foresighting cycles to define and map the required skills capabilities

Create a skills framework(s) to support pathway & curriculum development

RAISING AWARENESS AROUND HYDROGEN ROLES WILL HELP BOLSTER THE WORKFORCE

Ultimately, while provisional plans appear to predict hydrogen production projects to be up and running by the end of the decade, the lack of awareness amongst the general public today could be preventing people from entering into careers in hydrogen.

“It seems to be something that is still on the horizon in terms of how people think about it. But, you know, it is very much here and with us today,” David said.

Having an organisation such as the HSA that is dedicated in its mission to bring people into the sector is essential in developing the industry at large and keeping up with the pace required to successfully decarbonise the economy.

Dr Nick Backstrom concluded: “The Hydrogen Skills Alliance is not just helping to build a skilled workforce – it’s shaping the future of the hydrogen industry in the UK. Through careful analysis, forecasting, collaboration, innovation and a commitment to excellence and inclusivity, the HSA is helping make the UK a global leader in hydrogen technology, powered by an innovative workforce which meets technological challenges.”

“The Hydrogen Skills Alliance is not just helping to build a skilled workforce – it’s shaping the future of the hydrogen industry in the UK.”

e-magazine 11

HYDROGEN BLENDING IN THE EMERGING HYDROGEN ECONOMY

BY HANNAH WINTLE

As the UK prepares to decrease its reliance on fossil fuels over the next few decades, attention is increasingly turning towards how to decarbonise domestic properties, and to what extent hydrogen will play a role in this pursuit.

According to the latest government data, gas consumption fell by 6.6% across all sectors in Quarter 1 of 2023, with the domestic sector observing the largest decrease, dropping by 8% compared to the same period last year, though these statistics are largely attributed to the increase in gas prices.

Moreover, gas demand for electricity generation also declined by 6.7% in this period due to lower demand and strong performance from renewable sources.

Despite these enlightening numbers, and the particularly encouraging data regarding renewables, there is still a heavy reliance on the gas network to fuel the domestic sector. With hydrogen slated to emerge as part of the solution in meeting the government’s climate targets, more and more funding is being directed towards demonstrating the energy carrier’s suitability.

e-magazine 12

HYDROGEN BLENDING TRIALS HAVE SEEN SUCCESS

Recently, Ofgem set aside £49.1 million to fund hydrogen blending and de-blending projects, aimed to demonstrate the feasibility of transporting hydrogen through the UK’s existing gas network.

The project aims to prove the economic and technical viability of transporting hydrogen through gas pipelines, thereby eliminating the need for road transportation and cutting costs, while unlocking the potential of a UK hydrogen distribution network.

Currently, however, the UK doesn’t have the appropriate legislation and regulation in place to allow hydrogen blending to come to fruition in the mainstream gas network and serve domestic properties.

Until then, the emphasis falls upon doing the groundwork to prepare for a future where hydrogen blending is fully realised, so that when this time comes, the practice can be implemented as soon as possible.

To delve deeper into the work already being done in this regard, Hydrogen Industry Leaders spoke to Victoria Mustard, Decarbonisation Strategy Lead for Xoserve, the not-for-profit Central Data Services Provider for Britain’s gas market.

Within her role, Victoria works primarily with the distribution and the transmission networks to explore ways of making the gas system work for the future.

“Part of that support is supporting trials such as HyDeploy, which is the first blending trial, working with the likes of H100 and Hydrogen Village, as well as having a look at the settlement and building solutions and processes that are currently in place to understand what we need to do to make them work for hydrogen,” Victoria said.

HyDeploy, which brought together partners including Cadent, Progressive Energy, Northern Gas Networks, the Health and Safety Executive, Keele University, and ITM Power plc, worked through three phases to test hydrogen blending for domestic and industry applications, with the view to eventually enable government policy.

To safely introduce hydrogen to the existing methane network, as HyDeploy trialled, you can blend up to 20% before starting to affect domestic appliances such as gas cookers and boilers. This blend enables a carbon output reduction of around 7%.

e-magazine 13

“It’s not a massive way to decarbonise, and it’s not the only way that we can start to decarbonize, but it’s something we could do now that will instantly start to decarbonize the gas network.”

DECARBONISATION ISN’T THE ONLY BENEFIT OF HYDROGEN BLENDING

For Victoria, hydrogen blending is vital not only in terms of decarbonising the gas network, but in many other ways too, including increasing the public’s awareness and confidence, kickstarting a market, and giving workers the skills to work with hydrogen.

“I think the big tangible requirement for hydrogen blending is it gets people talking about hydrogen, because at the moment hydrogen is a big unknown, particularly within the domestic world,” she said.

“We’ve certainly seen where we are looking to trial hundred percent hydrogen in domestic properties, there’s been big, big pushback around people thinking it’s not safe, not understanding, and not wanting to lose gas.

“Hydrogen is one way of replacing gas usage, but realistically, getting consumers to know and understand and see what hydrogen can do, I think is a big requirement that we need to do with blending.”

Hydrogen blending, Victoria added, addresses the need for market signals, much like how the US has the Inflation Reduction Act.

“If we’ve got blending, that gives some good signals to the private investors that this is a good place to come and start to look at hydrogen investment.”

HYDROGEN BLENDING IS READY TO BE IMPLEMENTED AS SOON AS NEXT YEAR

As it currently stands, hydrogen blending has been trialled to the point where introducing a blend of 20% to the established gas network next year would be an attainable feat.

However, without policy decision, hydrogen blending can’t begin as there are no regulations for the gas network to work within. Until then, emphasis falls upon preparing the UK to a point where, when a policy decision is made, hydrogen blending is ready to be implemented as soon as possible.

Ahead of this policy decision, Victoria added, regulation work is ongoing, with modifications to code currently being reviewed.

“Investment is there, technical understanding is there, health and safety sign off is something we’re waiting for, and that policy decision. As soon as all of that goes through, then we’re ready to go.”

When the appropriate policy is in place to begin hydrogen blending, the benefits it could bring in going some way to decarbonise the gas network, encouraging investment, and instilling confidence in the general public, could help pave the way for a hydrogen-fuelled UK society.

“We’ve got big targets. What we haven’t got yet is policy that supports those targets.”

e-magazine 14

Victoria Mustard, Decarbonisation Strategy Lead for Xoserve

STAY UP TO DATE WITH HYDROGEN INDUSTRY LEADERS

The Hydrogen Industry Leaders Podcast will bring insights from across the hydrogen sector to the forefront. From gold hydrogen to the legality of hydrogen projects, you’ll listen to experts and key players unpack complex topics, answer pressing questions, and shed light on the emerging energy transition.

WE’RE ON TIKTOK

In the meantime, to keep up with all the latest from Hydrogen Industry Leaders, make sure you’re following us on TikTok, where we bring hydrogen news directly to your For You Page through Weekly Recaps, eMagazine Round-ups, and hydrogen news updates.

NEW PODCAST COMING SOON

COULD THE UK LEAD THE WAY FOR PINK HYDROGEN PRODUCTION?

BY FLOYD MARCH

BY FLOYD MARCH

While the hydrogen industry has been established for many years, the growth of green hydrogen, alongside high-profile debates about the best uses of hydrogen, from the likes of Elon Musk and Joe Biden has elevated the topic into mainstream discourse.

e-magazine 16

Peeling away the unhelpful scepticism, the role of hydrogen in decarbonising hard-to-abate sectors is undeniable, and green hydrogen is at the heart of the European Commision’s plans for the future.

With the domination of green hydrogen discourse and R&D plans, could the sector be missing out on the benefits of pink hydrogen from nuclear?

The IEA reported that low-carbon production of hydrogen accounted for less than 1% of global production, so finding more avenues to explore at the early stages of scaling up production will help the sector reap the rewards in the future.

PINK HYDROGEN COULD BE THE SECRET WEAPON TO NET ZERO

Splitting the water for green hydrogen production has been historically expensive, and while policies such as the IRA coming from America have been put in place to reduce this, the process will always require energy, and therefore some level of extra cost.

Pink hydrogen has the unique opportunity to use the energy already produced by nuclear processes. In turn, this means that all hydrogen produced from nuclear can be considered lowcarbon.

Naturally, discussions regarding the business and use case for such hydrogen need to turn into legislation to stimulate the markets and set out a clear vision of what is meant by lowcarbon pink hydrogen.

Potentially, this wouldn’t be too much of a difficult task, after recent progress on what hydrogen is considered renewable was agreed upon by the European Commission. The Delegated Act explained that hydrogen will now be considered renewable when the emission intensity of electricity used is below 18g CO2e/MJ. Interestingly, electricity taken from the grid can be considered fully renewable, which may further open the door for nuclear hydrogen.

In addition to green hydrogen, there have been increased discussions regarding the role of blue hydrogen production, and the recent announcement from Prime Minister Rishi Sunak that the Acorn CCS project in Aberdeen securing significant funding in the future is tantamount to that.

Despite this, there have been limited discussions around the role of pink hydrogen, despite a lot of the technology and infrastructure already existing across the globe.

e-magazine 17

Unlocking the possibilities for pink hydrogen production should become a priority

THERMOCHEMICAL CYCLES COULD UNLOCK MORE PRODUCTION

Alongside electrolysis, nuclear could also be used with a thermochemical cycle. The high temperatures already generated by power plants could be used to split water into oxygen and hydrogen.

Finding ways to utilise alternative energy sources to produce hydrogen is the biggest key to slingshotting pink hydrogen production into the limelight. Acknowledging this opportunity, there has been significant backing from companies such as EDF Energy.

The planned Sizewell C power station, which could produce 3.2 gigawatts of energy could be the perfect testbed for whether pink hydrogen production is a viable option.

EDF Energy has already expressed this interest and announced: “Nuclear is a great way of producing hydrogen as it generates huge amounts of reliable, low-carbon energy. Nuclear and hydrogen are also two clean technologies that can help us make big reductions in carbon emissions. While both technologies are vital on their own, at Sizewell C we have an exciting vision to bring them together.”

Bringing down the costs of implementing pink hydrogen needs supportive policies that encourage investment in early hydrogen production projects and encourage users to switch from fossil fuels to low-carbon hydrogen.

Also, final investment decisions are currently hovering around 10 per cent for green hydrogen projects. This is expected to stay around this figure for the mid-term, so the same could be expected for pink hydrogen, heightening the importance of early policy decisions and funding.

“At Sizewell C, we are exploring how we can produce and use hydrogen in several ways. Firstly, it could help lower emissions during construction of the power station.”

Growing the market for low-carbon hydrogen will deliver economies of scale and “learning by doing” which will help to reduce the costs of production.

e-magazine 18

NUCLEAR ISN’T ALWAYS THE MOST POPULAR CHOICE

Despite the positives of pink hydrogen, there have been vocal critics such as Greenpeace who explained in a previous statement: “Nuclear power is touted as a solution to our energy problems, but in reality it’s complex and hugely expensive to build.”

While the criticisms of cost and time taken to build are valid, the sector could end up in a vicious cycle of increasing costs and time taken to build such projects.

For instance, Back in 2006, then Prime Minister Tony Blair, warned that failing to replace the current ageing plants and build new plants would fuel global warming, endanger Britain’s energy security and represent a dereliction of duty to the country.

If the UK had pressed ahead with nuclear power plant construction, the pink hydrogen landscape could look very different. Sizewell C will play a large role in changing the mindset behind nuclear power and potentially position the UK as a world-leading pink hydrogen producer. However, continued slow policy action could be a limiting factor for the future of pink hydrogen in the UK.

A MULTICOLOURED APPROACH COULD CREATE A GLOBAL FRAMEWORK

No matter the decision postSizewell C construction, the overall landscape of hydrogen production will consist of multiple ‘colours’ ranging from green to gold.

The ultimate goal is to transition away from fossil fuels and from the largely used grey hydrogen production. Hydrogen will go a long way to producing large quantities of fuel and can be used in tandem with electrification.

As with everything, shortterm cost is a huge barrier to the transition away from fossil fuels. This is where pink hydrogen could also make headway compared to the largely preferred green and blue hydrogen.

Lazard’s 2023 Levelized Cost of Energy report estimates the cost of subsidised and unsubsidised ‘pink’ hydrogen from existing nuclear power plants at $0.48-$1.81/kg and $2.75-$4.08/kg respectively, one of the cheapest methods of producing the gas of all generation technologies.

e-magazine 19

Greenpeace has faced calls from younger members to change attitudes around nuclear

SGN: EXPLORING HYDROGEN AS THE FUTURE OF GAS NETWORKS

BY CHELSEA BAILEY

The UK still relies heavily on gas, but to reach the country’s decarbonisation targets, we must make the transition to using cleaner energy. Hydrogen Industry Leaders spoke to SGN about how it is supporting the development of hydrogen.

In the UK, we typically use well over 700 TWh of gas each year, which is approximately one third of the UK’s energy needs.

Transitioning to a low-carbon economy presents the UK with a great opportunity to explore the potential of hydrogen.

The UK is well positioned to play a leading role in decarbonisation through exploring hydrogen, with estimates suggesting it could create 12,000 jobs by 2030 and 100,000 by 2050.

e-magazine 20

DECARBONISING OUR GAS NETWORKS IS KEY TO REACHING NET ZERO

SGN, other gas networks, and National Gas are undertaking a significant body of work to support the development of hydrogen and to demonstrate it can be delivered safely through existing networks.

While there is an opportunity for the UK to play a leading role, there are also several key challenges that need to be addressed including consumer confidence and investor certainty.

Hydrogen Industry Leaders spoke to Marcus Hunt, Business Development Director at SGN about hydrogen’s role in decarbonising the gas networks.

Marcus highlighted the important role that the energy industry must play on the road to net zero: “If we want to reach net zero by 2050, we need to decarbonise gas, which is a huge energy source for the UK.

23% of UK emissions come from domestic heating. If the UK is going to reduce these emissions, it must find an alternative way to heat people’s homes.

To see a shift from natural gas to hydrogen, gas distribution companies need to ensure that it is done safely, cost-effectively, and efficiently.

Marcus explained that SGN is working on many projects to prove that hydrogen can be a viable option to replace natural gas in the home.

SGN’S PROJECTS COULD ENABLE WIDE-SCALE SYSTEM TRANSFORMATION

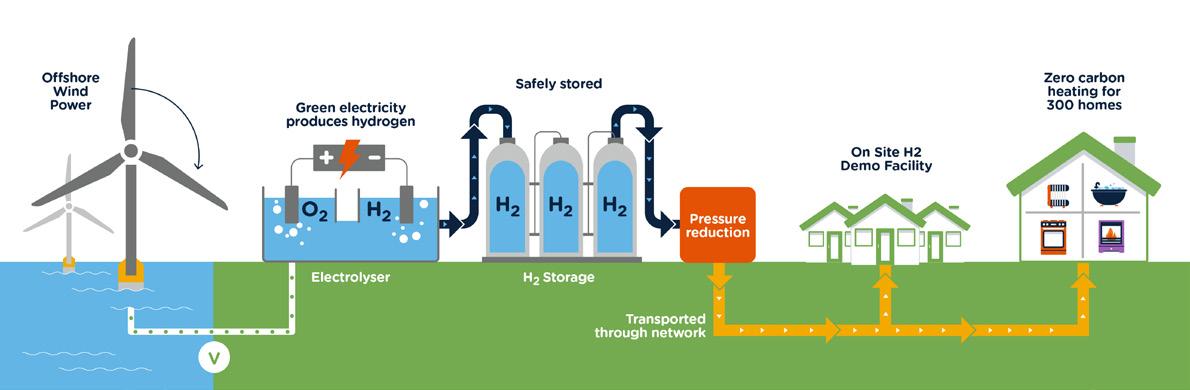

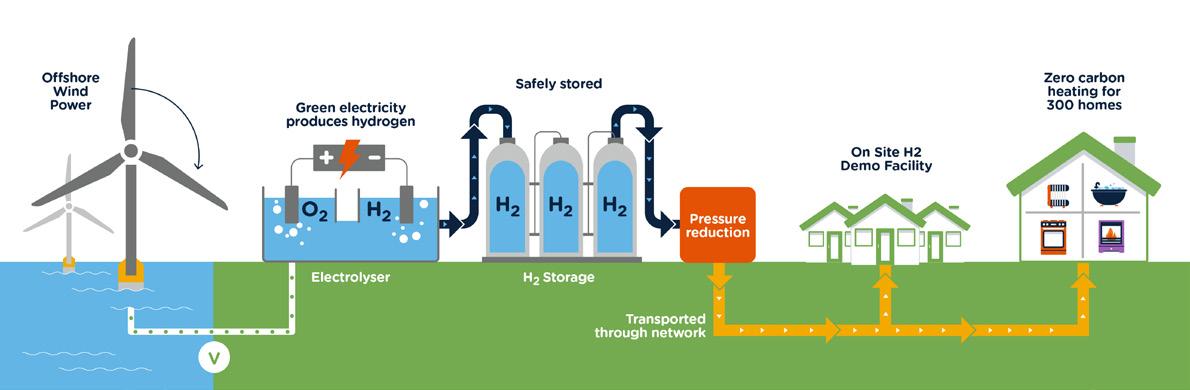

These projects include two large R&D projects, one called H100 Fife and one called LTS Futures. The Local Transmission System (LTS) is delivering gas from National Transmission System (NTS) offtakes to towns and cities across the UK.

The LTS takes gas from the National Transmission System at a reduced pressure, so that it can be transported directly to industry.

It also feeds into gas distribution networks to be used in homes and by businesses after further reductions in pressure.

He said: “We are working to prove that hydrogen can be safe and used in people’s homes. We need to make sure that it is costcompetitive and efficient, and that consumers understand that they have a choice. Hydrogen might not be the answer for everyone and heat pumps, heat networks and other technologies also have an important role to play but we’ll need every tool in the box to achieve net zero by 2050.”

Marcus revealed that LTS Futures will research, develop, test and evidence whether hydrogen can be used: “It is about examining whether we can repurpose our local transmission systems for hydrogen.”

Delivery of the project could enable wide-scale system transformation of the UK gas network to hydrogen, driving decarbonisation.

e-magazine 21

SGN have multiple ongoing projects exploring hydrogen viability

THE WORLD’S FIRST HYDROGEN HOME HEATING PROJECT DELIVERING HYDROGEN TO 100S OF HOMES

The H100 Fife project is giving residents in the local area the opportunity to be at the leading edge of the low-carbon economy.

It is developing a hydrogen network in Buckhaven and Denbeath that will bring renewable hydrogen into homes in 2024, providing zero-carbon fuel for heating.

On the project, Marcus expressed that: “H100 is a world first hydrogen home heating project, which will take green hydrogen produced from an electrolyser, powered by a wind turbine and deliver that to about 300 homes in the Fife area.”

The system will be designed and built to the same high safety and reliability standards expected from the current gas system.

An on-site storage unit will hold enough hydrogen to make sure that the supply will not be disrupted during even the coldest weather conditions and to maintain resilience and security of supply.

THERE IS NO ONE-SIZE-FITS-ALL APPROACH TO DECARBONISING HEAT

Establishing a scalable hydrogen economy and delivering the needed infrastructure is a complex task. It will require synchronicity across the value chain including production, transport, storage, and demand.

To do this, SGN believes a whole system approach is needed, with all possible solutions needing to be looked at.

Greater coordination than ever before across the energy industry will help to ensure that it develops solutions that are not only affordable and resilient but will help the UK meet its net zero targets.

Looking at multiple technology alternatives is crucial if it is to successfully decarbonise heating by 2050.

Marcus revealed that it is important that the right technology choice is explored for the right situation and that it is not a one-size-fits-all approach.

He said: “For example, heat pumps can work in some environments but for some houses where they aren’t as energy-efficient, heat pumps may not be the best solution.”

“We think hydrogen, heat pumps, and heat networks all have a role to play. It is only by taking a whole system approach that we can probably get an optimal solution for everyone.”

e-magazine 22

Marcus Hunt, Business Development Director at SGN

THE

UK MUST EXPLORE HYDROGEN’S POTENTIAL NOW, NOT LATER

To ensure that the customer is making the right decision, the energy industry has an important role to play in giving them the right advice and information.

“Natural gas has been around for a long time and people have become used to how it works and are familiar with it. If you are asking customers to shift their behaviour and move away from that, is a big ask. It takes a significant behavioural change and that isn’t going to happen overnight.”

To bring consumers on this journey, the energy industry must continue to demonstrate that hydrogen is a safe and affordable option for them.

In order to do this, certainty needs to be provided. SGN is urging the UK Government to accelerate the development of business models for hydrogen production, storage, and transport ahead of 2025.

Marcus added that it is essential to make sure that there is an investment framework for hydrogen to boost investor confidence and provide certainty: “Otherwise there is a risk that we will lose out to other countries. The UK has a really strong opportunity with hydrogen but if we don’t act fast and provide investors with certainty, we will miss out.”

By taking a whole system approach and focusing on building consumers’ confidence, SGN is showing hydrogen’s potential to help create a greener gas network.

The industry does face a significant challenge when it comes to decarbonising heat. However, continuous advancements in low-carbon heating technologies, such as hydrogen are changing this. With the right amount of urgency and investment, reaching our net zero targets looks more achievable.

Credit: ORE Catapult

Credit: ORE Catapult

e-magazine 23

A whole system approach will deliver for the environment and the customer

HDF PIN HOPES ON NAMIBIA HYDROGEN PROJECT APPROVAL

BY FLOYD MARCH

Few continents have the optimum conditions for large-scale hybrid hydrogen infrastructure, and fewer countries have the political backing and supply chain to provide one.

Looking to defy expectations, a new largescale hybrid hydrogen plant is hoped to have construction started by mid-2024. Positioned on the outskirts of Swakopmund, the Hydrogen Development Federation is hopeful that the N$4.5 billion investment will position Namibia, and more widely Africa, as world-leading hydrogen producers.

Providing power during the day and night, the project will have significant volumes of solar and storage. Breaking down these figures in greater detail, during the day, 50 MW of power could be generated during the day and a further 6 MW during the night. 85 MW of power will be generated through solar and will provide 230MWh of storage.

Managing curtailed energy has been a wide issue, and Namibia has faced significant challenges in the past with managing this with solar, just as the UK has with wind power generation.

HYBRID METHODS PIQUE INTEREST FROM MAJOR BANKS TO INVEST

In the announcement, Hydrogen Development Federation (HDF) Energy’s Director for Southern and Eastern Africa, Nicolas Lecomte stated: “It will be a hybrid power plant that is a combination of equipment and technologies which all together provide the overall profile.”

The power plant has piqued interest from big commercial banks across Southern Africa committing some level of funding according to the HDF, with Nicolas explaining: “Most of them [banks] have responded with a higher appetite, provided indicative terms and ready to come for the debt.”

Such a huge project such as this will have profound impacts on local communities, not just the typical improvement in skills and increased jobs in the area.

“We are now discussing with investors to point [out] which is the next step in the project and these conversations are going well.”

e-magazine 24

POLICY TO DRIVE SOCIO-ECONOMIC CHANGE

Focusing on long-term impacts for the region of Namibia The HDF Energy Regional Director added that the company recently started working with the United Nations World Food Programme.

This collaboration is to prepare block farms and gardens for the nearby communities like the DRC informal settlement and Mondesa of Swakopmund. This will boost the growing and selling of crops and vegetables in the area.

Furthering the wider economic benefits of such projects will help encourage other nations to transition away from fossil fuel use, and developing spin-off projects that can further local and national GDP is the best way to build the business case and also change public perceptions around transitioning.

Expanding on this, Hydrogen Industry Leaders heard: “This is key for us to maximise the impact of the project and we are very happy to work with the United Nations. They have been successfully growing food in the Sahara Desert, so why not in the desert areas around Swakopmund,” said Lecomte.

Despite the growing optimism surrounding the project, there are considerable challenges with the connections with NamPower.

MOVING FROM PLANS TO IMPLEMENTATION HAS PROVED CHALLENGING

Addressing this, Nicolas has previously stated: “NamPower really appreciates the project and really likes the project. The challenge that we have been facing in the development phase, has been the fact that this was from their view too expensive.”

That project will exist if a (PPA) publicprivate partnership agreement is signed with NamPower, where NamPower buys power from the grid services over a long period of time. With past investment coming from European subsidies, Namibia will be looking inwards for additional funding and gaining energy independence, with the potential to export in the future.

Balancing ways in which energy will be created, the geographical location allows for a desalination plant to feed the power plant with 70 cubic metres of water per day. Just 5km from the Atlantic Ocean, HDF Energy gained the permit to do this, enhancing hopes of full implementation.

Clearance certification is also impending and mining licences are also currently being obtained. If all clearances are approved, construction of the first hybrid hydrogen plant in Africa will begin in mid-2024.

e-magazine 25

Namibia

INTERNATIONAL PROJECTS

HYDROGEN PROJECTS FROM AROUND THE WORLD

In this month’s round up of international projects, hydrogen industry leaders delves into the latest updates from Brazil, Canada, Australia and India.

EXPERIMENTAL REFUELLING STATIONS COULD PAY OFF

Starting in Brazil, The construction of the experimental ethanol-based renewable hydrogen refuelling station has begun at the University of Sao Paulo (USP) campus in Brazil.

It is expected that the project will produce 4.5kg of hydrogen per hour to fuel three buses and one light vehicle. The start of operation is anticipated for the second half of 2024.

This project is aiming to demonstrate that ethanol can be a vector to produce renewable hydrogen, leveraging the industry’s existing logistics.

Equipment installed at the site will include a Hytron ethanol steam reformer which is designed to convert ethanol into hydrogen through steam reforming, in which ethanol is subjected to specific temperatures and pressures to react with water inside the reactor.

During the operation of the experimental station, researchers will validate calculations on the emissions and costs of the hydrogen production process.

Hydrogen produced at the station will fuel

buses provided by the Metropolitan Urban Transport Company of Sao Paulo, to circulate exclusively within the university campus.

Not only will this project help to decarbonise the campus but is the first step in exploring the use of the technology in Brazil. It could show that by using renewable hydrogen from ethanol, sustainable transport may become a reality.

CANADIAN FUNDING TO BOOST HYDROGEN ECONOMY

Moving on, the Government of Alberta has unveiled a $50 million funding initiative aimed at driving hydrogen innovation within Canada. By leveraging the resources of Alberta Innovates and Emissions Reduction Alberta (ERA), this funding endeavor will bolster the efforts of researchers, businesses, and industries working towards the advancement of technologies that align with the Province’s Hydrogen Roadmap and Natural Gas Strategy.

The ERA is set to receive $25 million in funding dedicated to more mature innovations through the Accelerating Hydrogen Challenge. An additional $20-25 million will be contributed by Alberta Innovates to support early-stage innovations via the Hydrogen Centre of Excellence Competition 2. This latter funding pool will be supplemented by contributions from Natural Resources Canada (NRCan).

e-magazine 26

Now open for submissions, proposals are sought for a range of hydrogen-related endeavors, encompassing hydrogen production, storage, transmission, and utilization in heavy-duty transportation, industrial heat, power generation, chemical processes, as well as commercial and residential heating, among other industrial applications.

Projects backed by ERA funding are slated for completion within a 36-month timeframe, while Alberta Innovates-funded projects are expected to conclude within 24 months.

Both initiatives, alongside NRCan, are working cohesively to establish a streamlined approach for the two funding competitions, aiming to minimize bureaucratic hurdles for potential applicants.

AUSTRALIA TO SET SIGHTS ON AMMONIA PRODUCTION

Thirdly, Hiringa Energy and the Sundown Pastoral Co have partnered to build a renewable ammonia and green hydrogen production facility on a cotton farm near Moree, Australia.

The £36 million project has been funded by the New South Wales government, with the aim of producing lowemission fertiliser and fuel for the farmers.

Featuring a 27-megawatt solar farm designed to produce roughly 45,000 MWh of energy a year, the facility will produce green hydrogen through electrolysis, and the ammonia by product will be then used to fertilise crops.

According to Hiringa Energy, the hydrogen produced could displace more than 1.4 million litres of imported diesel and lead to the direct abatement of the equivalent of more than 17,000 tonnes of CO2

The facility is required to be in production by 2025 due to the NSW government’s grant application process.

WILL COLLABORATION BETWEEN INDIA AND THE UK SPARK INNOVATION?

Finally, The Green Hydrogen Electrolyser Manufacturing Ecosystem Assessment Project has been launched to aid Indian companies develop a framework for manufacturing electrolysers in Tamil Nadu.

With an ultimate goal of expanding the production of green hydrogen as a source of power and heating in India, the project was launched by Minister for Industries, Investment and Commerce T.R.B. Rajaa, and U.K. Minister of State for Energy Security and Net Zero Graham Stuart.

S. Krishnan, Additional Chief Secretary, Industries Department, said: “Tamil Nadu has advantages in that it is a coastal state, a leader in renewable energy, has good connectivity and it can support the upswing in supply of renewable energy.”

T.R.B. Rajaa highlighted that Tamil Nadu is India’s greenest State, and that the Chief Minister wishes to increase the tree cover from 23.69% to 33%. He added: “We are keen to use green hydrogen and our policy on the same will be rolled out soon.”

Graham Stuart also commented: “I am impressed by Tamil Nadu’s efforts to adopt lowcarbon energy sources, boost green jobs and growth across the State while strengthening both its energy and climate security.”

e-magazine 27

The volume of international projects leaves the hydrogen sector in an optimistic position

Building the Hydrogen Economy

Radisson BLU, Glasgow

28 November 2023

Continuing our annual Scottish Conference, join key decisionmakers and thought leaders throughout the sector as we look to grow the hydrogen economy and enhance the energy transition through production, storage, distribution, and end-use.

• What role will transport play in hydrogen storage, distribution, and end-use?

• How is Scotland uniquely positioned to explore onshore and offshore renewable options?

• How to unlock further investment opportunities for Scotland

• Explore how oil and gas companies can transition to green solutions

hydrogenindustryleaders.com

GLASGOW 20 2 3

#H2Leaders

Hydrogen Industry Leaders e-magazine July 2023 EEX LAUNCH WORLD FIRST GREEN HYDROGEN INDEX P / 10 € MWh Hydrogen Industry Leaders e-magazine April 2023 HYPE , HOPE AND THE HARD TRUTHS ABOUT $1/KG HYDROGEN P / 10 $1/kg $2.5/kg $5/kg Hydrogen Industry Leaders e-magazine August 2023 WHICH COST DRIVERS SHOULD THE SECTOR USE TO CALCULATE LCOH? P / 16 Hydrogen Industry Leaders e-magazine P / 10 June 2023 BUILDING THE HYDROGEN ECONOMY ACROSS THE NORTH EAST Hydrogen Industry Leaders e-magazine March 2023 UK HYDROGEN CERTIFICATION: UNLOCKING THE NET ZERO ROADMAP P / 10 READ BACK ISSUES SUBSCRIBE TODAY ACCELERATE YOUR INDUSTRY KNOWLEDGE e-magazine 29

Manchester

22 September 2023

Park Inn by Radisson Manchester City Centre

Our HIL 100 Breakfast Hub brings us to Manchester to discuss current and forthcoming projects in the North West, including the £300m which will have the capacity to generate 200MW of energy.

Join us for this informal networking breakfast to engage with key people driving the hydrogen revolution in the city.

Speaker: David Walker , HyNet Project Manager, Progressive Energy

Speaker: David Walker , HyNet Project Manager, Progressive Energy

hydrogenindustryleaders.com #H2Leaders

BY FLOYD MARCH

BY FLOYD MARCH

Credit: ORE Catapult

Credit: ORE Catapult

Speaker: David Walker , HyNet Project Manager, Progressive Energy

Speaker: David Walker , HyNet Project Manager, Progressive Energy