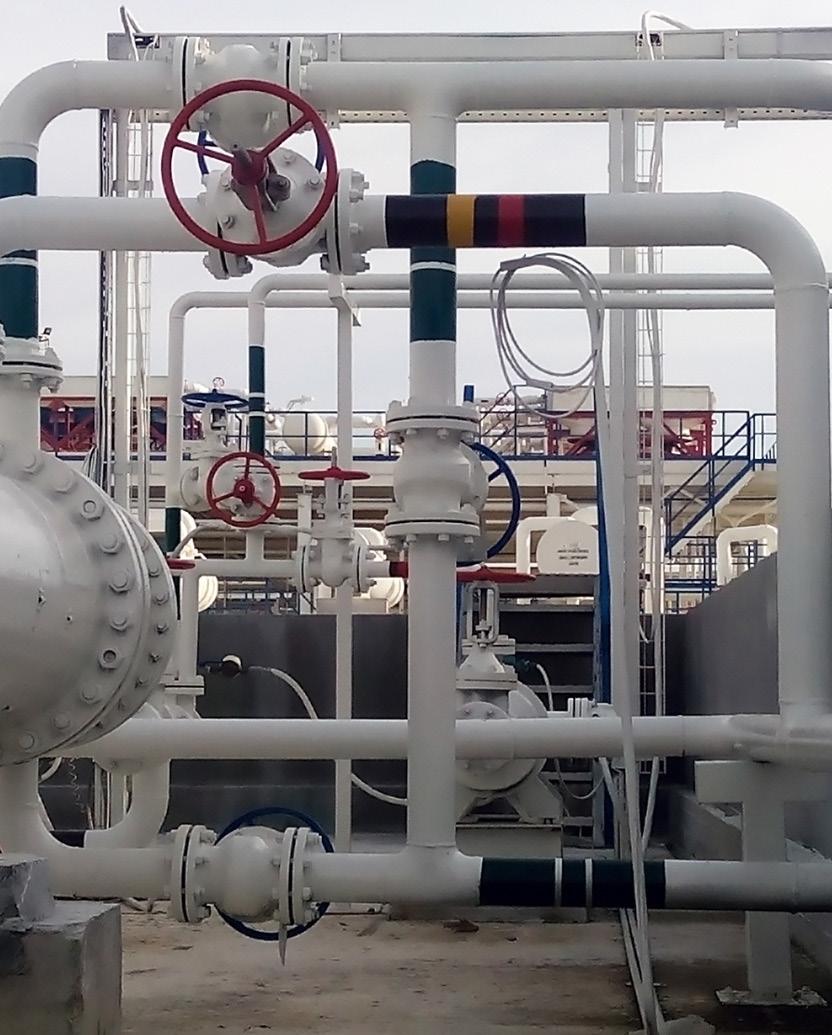

While Europe will produce a lot of hydrogen in the future, there will be a strong need to import too.

FROM WHICH AVENUES WILL EUROPE IMPORT HYDROGEN?

While Europe will produce a lot of hydrogen in the future, there will be a strong need to import too.

FROM WHICH AVENUES WILL EUROPE IMPORT HYDROGEN?

Eighteen months after the LGIM announced the first pure Hydrogen Economy ETF in Europe, how successful has the scheme been, and what exactly are the main objectives?

Back in February 2021, Legal & General Investment Management (LGIM) announced the launch of the L&G Hydrogen Economy UCITS ETF, which provides investors with exposure to the long-term investment opportunity offered by the transition to a low-carbon, hydrogen economy.

Targeting technologies and firms that are enabling and boosting the production of clean, cheap hydrogen, LGIM are hoping to incentivise industry leaders to play a crucial role in the hydrogen economy.

As of August 2022, the fund size was approximately $560.8m, highlighting how incentivised the hydrogen economy is and will be over the next decade.

The ETF was set out to build on and complement LGIM’s existing suite of sustainable thematic ETFs, such as the L&G Clean Energy UCITS ETF and the L&G Battery Value-Chain UCITS ETF.

As we have seen with Joe Biden and the Inflation Reduction Act, policy and economics are starting to align towards a sustainable energy economy, which includes the use of green hydrogen.

In an attempt to increase the exposure of clean hydrogen for investors, this hydrogen ETF can be used alongside the above funds.

The ETF is determined to include the whole supply chain for green hydrogen, meaning companies with a minimum market cap of $200 million, including electrolyser manufacturers, hydrogen producers, fuelcell manufacturers, specialist mobility providers, fuel-cell component suppliers, critical industrial and utility companies, can come together and scale up hydrogen production at a faster rate.

Looking to explore developments across Europe, the strategy was and currently is listed on the London Stock Exchange, Deutsche Boerse, Borsa Italiana, Six Swiss Exchange and the NYSE Euronext.

Access to clean hydrogen will be key to lowering emissions in harder to abate industries

Speaking in an address when the fund was first announced, Howie Li, Head of ETFs at LGIM, said: “Access to clean hydrogen will be key to lowering emissions in harder to abate industries where electrification alone is not enough. The commitments being made to the hydrogen economy by governments and businesses around the world are creating long-term investment opportunities with short-term catalysts.”

“We believe this fund offers investors early access to this fast-evolving industry and allows investors to control the amount of hydrogen exposure into their portfolio alongside our clean energy and battery ETFs. As a package, the hydrogen ETF will complement these other two funds to provide investors with the ability to capture growth found in clean energy generation and energy storage.”

Adding to this, James Crossley, Head of UK Retail Sales at LGIM: “At LGIM, we believe in giving investors targeted, specific exposure to the full value chain of low-carbon solutions across the power production, storage and distribution energy cycles.”

Performance for the USD accumulating ETF class in USD, listed on 10 February 2021. The source for this analysis was Lipper, and it is important to note the performance assumes all ETF charges have been taken and that all income generated by investments, after deduction of tax, remains in the ETF.

“The launch of the L&G Hydrogen Economy UCITS ETF expands on our market-leading thematic range. It underscores our commitment to equipping investors with the portfolio tools they need to access the key themes that will help us transition to a more sustainable world.”

How well is this ETF performing 18 months in?

So, 18 months later, how exactly is the L&G Hydrogen Economy UCITS ETF? The graphs below represent the Cumulative monthly rating, six month performance, year-to-date, and since launch statistics.

It is also worth considering that past performance doesn’t reflect future performances, and a clearer picture of where the successes can be found will come with further analysis in the future.

At the 18 month stage, the fluctuations in monthly performance make it difficult to see the overall trend in the hydrogen economy, which will only become more evident in time. However, from other funds and ETFs, the bigger picture of the hydrogen economy is becoming more apparent, which paints ETFs such as this one in good light.

Canada and Germany have signed an agreement to forge a hydrogen alliance that aims to build a transatlantic supply chain for green hydrogen. How will this secure alternative energy supplies following the decreasing imports from Russia?

The alliance was sealed late last month, marking the conclusion of a three-day visit to Canada by German Chancellor Olaf Scholz, his Economics and Climate Minister, Robert Habeck and German industrial heavyweights such as Volkswagen, Siemens Energy and Uniper.

It builds upon an already existing energy partnership between the two countries. Canada has pledged to set up the production of hydrogen and as part of its H2Global initiative, Germany will support potential importers and consumers of green hydrogen, including by co-financing joint projects.

Building a transatlantic green hydrogen supply chain

As the international market roll-out of green hydrogen is accelerated and clears the way for a new transatlantic supply chain to be built, the Hydrogen Alliance between the countries is a significant milestone and will see Canada help Europe’s biggest economy reduce its reliance on fossil fuels.

Germany typically gets about half of its natural gas from Russia and now is looking for both short and long-term solutions to move away from Russian exports. At a press conference at the conclusion of the summit, Canadian Prime Minister Justin Trudeau suggested infrastructure

used to carry liquefied natural gas could be adapted to carry hydrogen, as one of the examples of how Canada could help Germany.

Canada’s hydrogen strategy, developed in 2020, aims to be one of the world’s first top-three hydrogen exporters within 30 years. However, the International Renewable Energy Agency currently doesn’t include the country on its list of the six places most likely to become hydrogen superpowers.

Though at a press briefing in Toronto, Scholz said that Canada was the partner of choice as Germany moves away from Russian energy imports: “Your country has almost boundless potential to become a superpower in sustainable energy and sustainable resource production,”

Canada’s government has said it will strengthen collaboration with provinces and territories, through Regional Energy and Resource tables, and the private sector. This will be through leveraging programs such as the C$1.5bn Clean Fuels Fund, and the C$8bn Strategic Innovation fund Net Zero Accelerator and the Canada Infrastructure Bank.

Accelerating the development of Canada’s resources to produce hydrogen and its derivatives are the aims. Habeck said: “The Hydrogen Alliance between Canada and Germany is a significant milestone as we accelerate the international market roll-out of green hydrogen and clear the way for new transatlantic cooperation.”

Specifically, we aim to build up a transatlantic supply chain for green hydrogen. The first shipments from Canada to Germany are to begin as early as 2025.

Following this, German energy companies Eon and Uniper recently announced that they have signed an MoU with Canada’s Everwind on the side-lines of the talks between the countries.

Scholz called the agreement an important step, “not only for strengthening our bilateral economic relations but also for a sustainable energy supply for the future.”

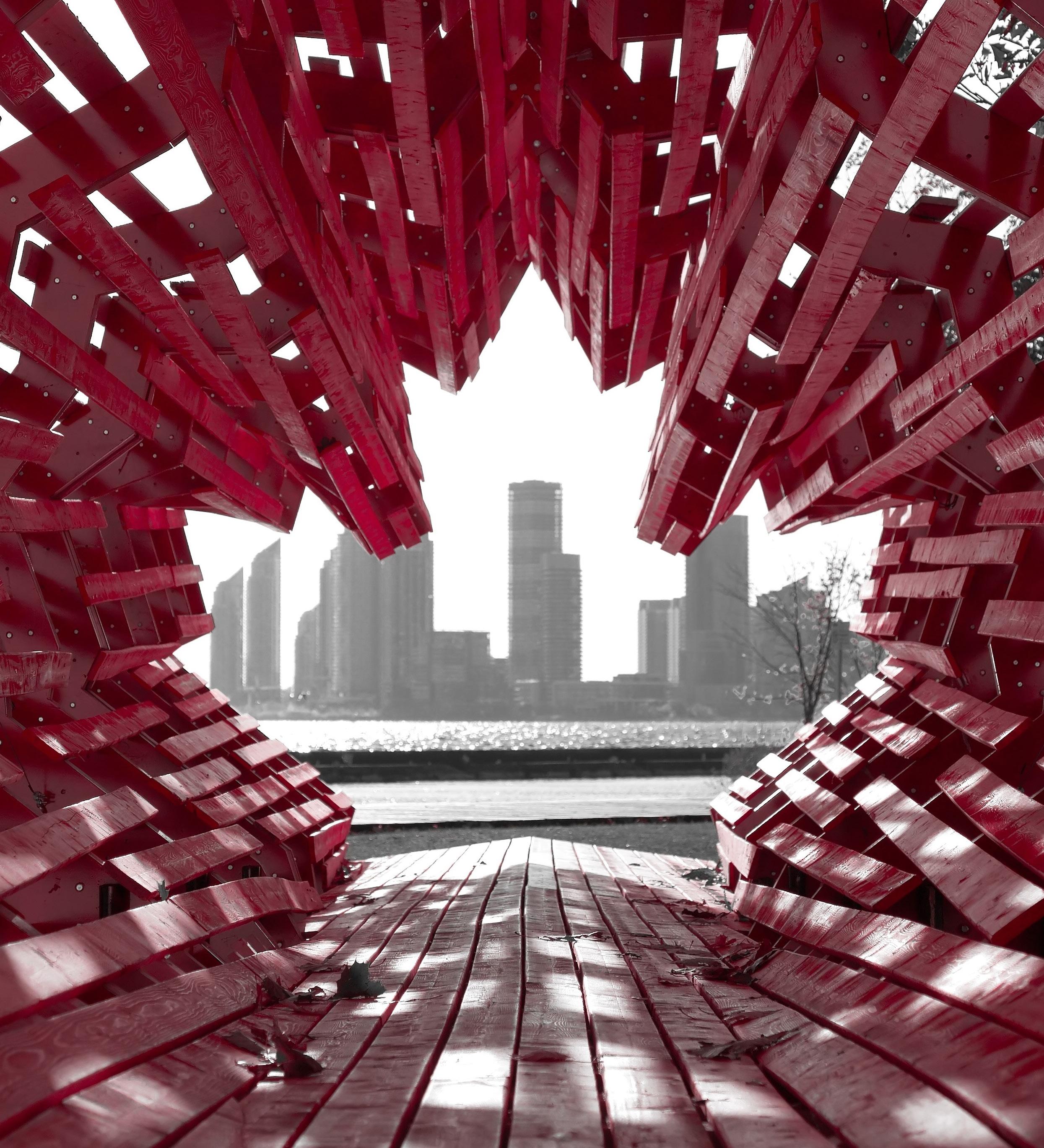

In our case, we don’t need absolutely pure water to produce, and there’s no waste from technology. CPH2 don’t need reverse osmosis, whereas a lot of other technologies require much higher purity water. This can create a waste stream, which itself can be an issue. Instead, the technology uses nine litres of water for every kilogram of hydrogen. That hydrogen is produced at a pressure of 35 bar or thereabouts for onward compression and storage. So, we don’t do any of the congressional storage at this point, although we get involved with cooperative companies in order to get

being developed to do that, it’s a long way off at this point.

Additionally, we offer a 25-year warranty on our stakes, which is unheard of in the industry. That matches up with the sort of warranties that asset owners, solar and wind farm owners are looking at. So with a 25-year warranty, the levelized cost of hydrogen that we produce is exceptionally competitive.

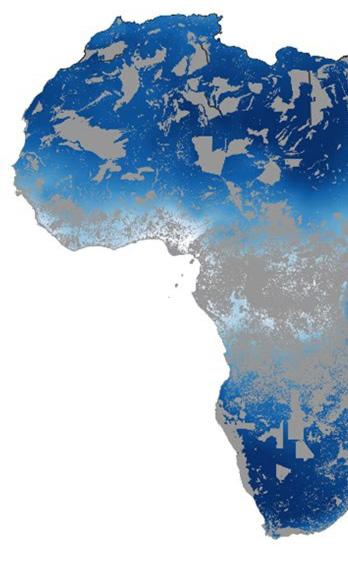

As the International Energy Agency released its African Energy Outlook for 2022, Hydrogen Industry Leaders delves into the key findings of the report and explores how the continent can become a leading player in the hydrogen economy.

As energy prices soar across the globe, the urgency of an energy transition has arguably grown more over the last 12 months than in the previous decade.

Significant world events such as the pandemic and Russia’s invasion of Ukraine have caused overlapping strains on African economies and energy systems.

Before the pandemic, Africa as a continent was seeing large improvements in people’s overall access to electricity. However, in the years since, it was reported that 4% more people were living without electricity in 2021 than in 2019.

These problems are exacerbating the sharp increase in extreme poverty in subSaharan Africa (SAS), with the number of people affected by food crises quadrupling in some areas.

On top of this, Africa is already facing more extreme weather events than other continents around the world, despite contributing to global emissions less than other continents.

With nearly one-fifth of the world’s population today, Africa accounts for less than 3% of the world’s energy-related CO2 emissions to date and has the lowest per capita of any region.

Despite being disproportionately affected by climate change, the global clean energy transition deal holds new promise for

AFRICA TO DELIVER GREEN HYDROGEN TO EUROPE AT INTERNATIONALLY COMPETITIVE PRICE POINTS BY 2030Africa’s economic and social development. Twelve African countries that represent over 40% of the continent’s total CO2 emissions signed up for the pledge.

Africa is on the precipice of becoming a world-leading exporter of green hydrogen

This is where Africa can become a leading player in hydrogen made from renewables. With the vast potential for solar energy, wind and even high tidal ranges, Africa can not only become energy independent

but also exporters of green hydrogen to other continents, including Europe.

We are seeing many countries beginning to explore a number of low-carbon hydrogen projects, including Egypt, Mauritania, Morocco, Namibia and South Africa. These are focused primarily on using renewables-based power to produce ammonia for fertiliser, which would also improve food security.

Global declines in the cost of hydrogen production could allow Africa to deliver renewables-produced hydrogen to Northern Europe at internationally competitive price points by 2030. Hopes for this to come to fruition have been boosted since Joe Biden announced the US Inflation Reduction Act.

If predictions for further cost declines ring true, Africa has the potential to produce 5000 megatonnes of hydrogen per year at less than USD 2 per kg—equivalent to the global total energy supply today.

The report explored the types of energy sources Africa can use to produce green hydrogen and some obstacles to overcome. “Variable renewables comprise the bulk of the increase in electricity generation in Africa in the SAS, mainly solar PV and wind. Their combined share of total generation is rising from 3% in 2020 to 27% by 2030. However, the deployment of variable renewables varies widely across the continent.”

The report said that the continent could overcome these issues through various solutions. “A range of assets and measures are developed to support flexibility in the SAS, including energy storage, hydrogen electrolysis, hydropower facilities, geothermal plants and demand response.”

All forms of energy transitions should have a people-centred approach, focussing on jobs, building local capital base, and reducing imports. The report explored this notion in more detail, stating: “Homegrown energy industries can reduce imports, create jobs and build the local capital base. In the SAS, around 4 million additional energy-related jobs are needed across the continent by 2030, largely to reach universal energy access in subSaharan Africa.”

Implementing an African Continental Free Trade Area also helps broaden domestic markets for African energy firms.

The report explained that Multilateral development banks must make increasing financial flows to Africa an absolute priority.

“To mobilise the amount of investment envisioned in the SAS, they will need to increase concessional finance to Africa and use it more strategically to better leverage private capital.”

According to the report, this includes domestic financial markets, which need to more than double in size by the second half of the 2020s. New capital sources, such as climate finance and carbon credits, can bring more international financial flows into Africa.

The report rounded up by explaining: “Africa’s energy future requires stronger efforts on the ground that are backed by global support. The COP27 Climate Change Conference in Egypt in late 2022 provides a crucial platform for African leaders to work globally to identify ways to drive these changes.”

A people-centred approach must be in government’s minds

After steel venture H2 Green Steel recently announced it had raised €190 million from a group of investors for building a fossil fuel-free steel plant, where will the site be, and when is production likely to start?

The new round of funding was co-led by investors including AMF, GIC, Schaeffler and Altor. Swedbank Robur Alternative also participated in the equity raise.

Sweden has unique opportunities for green steelmaking

Situated in the North of Sweden, the steel plant is set to start production in 2024, and H2 Green Steel plans to have a production capacity of five million tonnes of green steel by 2030. If these ambitious targets come to fruition, 95% of CO2 emissions will be reduced compared with traditional steelmaking.

As steel is one of the most commonly used materials in the world, reducing the carbon emissions in the steelmaking process is one of the core challenges if we are to reach a climate change target that a rapidly slipping away.

Green steelmaking can secure over six million jobs

It is also essential to increase jobs available within the sector, something which green steelmaking can do. There are currently more the six million people directly employed in the manufacturing process of steel.

Additionally, this is one of the most polluting and energy-intensive industries across the globe due to the extreme reliance on fossil fuels in the blast furnaces. Traditional steelmaking processes account for around 7% of global CO2 emissions.

The Oxford Institute for Energy Studies recently released its latest report on the global trade of hydrogen, exploring the decentralisation of hydrogen, difficulties in energy intensity of long-distance transportation, and the techno-economic characteristic of potential hydrogen carriers.

Within the report is an extensive analysis of the possibilities and options of distributing hydrogen internationally and how different the global trade of hydrogen will look compared to the traditional trade of fossil fuels.

Picking up on this notion in more detail, the report explained that as a manufactured fuel, hydrogen could, in fact, be produced in a decentralised way in most countries around the world.

Naturally, restrictions on solar and wind availability may impact how hydrogen is manufactured. Still, on the whole, it means that in a net zero economy, the global trade of the commodity will look very different to the current distribution streams of fossil fuels, as mentioned above. This opens the door for countries with an abundance of wind, solar and high tidal ranges to contribute to the hydrogen economy and become exporters of hydrogen across the globe.

Regions which have lower cost renewable electricity may develop an economic advantage

The report picks up on this notion and explains: “With further declines in the costs of renewable electricity and electrolysers, regions which have lower cost renewable electricity may develop an economic

advantage in the production of low-cost hydrogen.”

However, for hydrogen to become a globally traded commodity, the cost of imports needs to be lower than the cost of domestic production. As it currently stands, this is a significant question mark as to who will be the exporters of hydrogen and who will become the importers.

Transporting hydrogen is extremely energy-intensive

In a practical sense, the transportation of hydrogen over long distances is an extremely difficult task. Liquefaction seems to be one of the most spoken about options for long-haul distribution despite the intense energy process, which is also high in costs.

Expanding on this, the report said: “Maintaining the low temperature required for long-distance transportation and storage purposes result in additional energy losses and accompanying costs.”

Despite this specific disadvantage, “the upside is that hydrogen can be converted into multiple carriers that have a higher energy density and higher transport capacity and can potentially be cheaper to transport over long distances.”

As these upsides are merely predictions at the moment, it is essential that funding from the public and private sectors are directed into the international distribution of hydrogen, even if those countries don’t currently have the capacity to distribute this much right now.

The country that invests in the future will thrive and overtake all other countries in the race to be the number one hydrogen distributor in the world.

In the report, it was said that: “Among the substances currently identified as potential hydrogen carriers suitable for marine shipping, liquid ammonia, the so-called ‘liquid organic hydrogen carriers’ in general (toluene- methylcyclohexane (MCH) in particular), and methanol have received the most attention in recent years.”

Continuing, it stated: “In these circumstances, choosing the most appropriate hydrogen carrier will be extremely important, as it will help to make the entire H2 value chain more economical and efficient.”

While creating a hydrogen economy is generally viewed as an important step towards comprehensive decarbonisation, governments, businesses, and researchers are still largely uncertain about whether the hydrogen economy will become truly global or whether it will remain a largely local or regional phenomenon.

Within the conclusion of the report, it was highlighted that: “At the same time, if geographical and other country-specific factors continue to determine the costs of hydrogen production, delivery of H2 over long distances, including those of a transoceanic nature, might make sense when the cost of import (production and delivery) is lower than that of domestic production.”

Although each of these fuels has its own advantages and offers a special set of benefits, none of them are flawless or possesses the characteristics of a perfect hydrogen shipping solution. However, as with all net zero solutions, there is no silver bullet for decarbonisation.

Credit: C-Job Naval ArchitectsA hydrogen economy is an important step towards comprehensive decarbonisation

“Out of all the long-distance hydrogen delivery options, liquid hydrogen and ammonia, methylcyclohexane, and methanol have gained the most attention in the literature and have already been tried by industries as H2 carriers.”

Missouri S&T is partnering with industry, business groups and academic institutions to form the Greater St. Louis and Illinois Regional Clean Hydrogen Hub Industrial Cluster.

Collaborating on developing infrastructure for hydrogen fuels and using technology to help individual businesses meet their decarbonisation goals, the group aim to reduce GHG emissions for Missouri by 2035.

As well as Missouri S&T, the newly formed group’s members include Ameren, Burns McDonnell, MPLX LP, Marquis Industrial Complex, Alton Steel, Walmart, Mitsubishi Power, Plug Power, Spire, Washington University in St. Louis and more.

The collaborative believes that the Greater St. Louis and Illinois region is well positioned to provide continuity with other clean hydrogen hubs through existing infrastructure and natural resources.

In addition, the Port of St. Louis is said to make for excellent CO2 storage and has a good natural gas pipeline and delivery systems.

Nippon Express Italia (NX Italy) has announced it has launched a last-mile delivery service using hydrogen-powered boats for deliveries.

The hydrogen-powered boats are said to be equipped with removable hydrogen generators, and it is hoped that they will contribute to the European Union’s goal of reducing GHG emissions by at least 55% from 1990 levels no later than 2030.

As well as striving to address climate change by cutting its own carbon dioxide emissions in its operations, the company will create products and services that will help its customers reduce their emissions.

It comes after Venice’s first hydrogen refuelling station was opened in June 2022, offering over 100kg of hydrogen per day to its customers.

According to Nippon Express, the company will continue to actively work to create a sustainable society by striving to reduce the environmental impact of logistics.

The first hydrogen bunkering license in the Netherlands has been granted within the port of Ijmuiden, allowing Windcat Workboats to bunker the Hydrocat 48 with hydrogen in that port.

Windcat Workboats has collaborated with the IJmond Environmental Service, Port of Ijmuiden, NV, and Port of Amsterdam to research the necessary elements to make bunkering hydrogen possible.

A licence for the activity was granted by the IJmond Environmental Service on behalf of the Velsen Municipality.

Willem van der Wel, Managing Director of Windcat Workboats, said: “This license represents a major step in the possibility to use hydrogen as a fuel for vessels and increasing the sustainability of the sector.”

It was said that the pilot for bunkering hydrogen in the port of IJmondhaven went smoothly. Now the vessel’s normal operational activities – the maintenance of 44 Vestas turbines for Belgian wind farm Norther will be based out of the port of Oostende. Windcat Workboats aims to take more hydrogen-powered vessels into use in the future.

A €1bn industrial-scale project to produce green hydrogen and ammonia in Sines, Portugal, has been announced. The project could reduce CO 2 emissions and create more than 200 jobs.

Portuguese project developer Madoqua Renewables has announced the partnership with Dutch energy transition project developer and consultancy Power2x and Danish fund manager Copenhagen Infrastructure Partners’ Energy Transition Fund (CIP) to build MadoquaPower2X, an industrial-scale project.

MadoquaPower2X will use renewable energy and 500MW of electrolysis capacity. It is the first project to be installed at the future energy and technological hub at Sines, with a production scale of 50,000 tons of green hydrogen and 500,000 tons of green ammonia per year.

It is said that the hydrogen produced under this project can be used by the local industry and processed to create green ammonia to export from the terminal at Port of Sines.

The project is currently under development and is expected to be fully permitted and ready for a final investment decision by the end of 2023.

large projects trying to get to the market to take advantage of the early demand incentivisation.

In Japan, the potential for ammonia is an obvious market opportunity for some of these projects on a fairly large scale.

So, you’re seeing quite a lot of competition. If you look around the Middle East, you’ve got major hydrogen projects in Africa, the Emirates, Qatar and Saudi Arabia. Most of the big economies in the Middle East have a very clear hydrogen export strategy.

Some are going to be longer-term projects because they simply can’t find the market;

The Hydrogen Insights webinars are 90-minute sessions, led by industry professionals, for industry professionals. These events allow you to see best practices from the experts and allow for greater communication through direct Q&A discussions.