Prospect to Reality: HOW ALSTOM CREATED THE FIRST OPERATIONAL HYDROGEN TRAIN

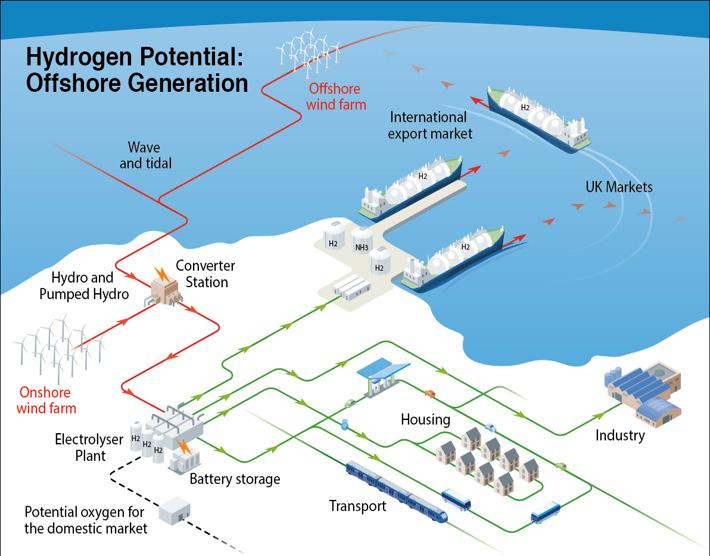

Scotland has a unique opportunity to be an exporter of hydrogen, but

IN SCOTLAND?

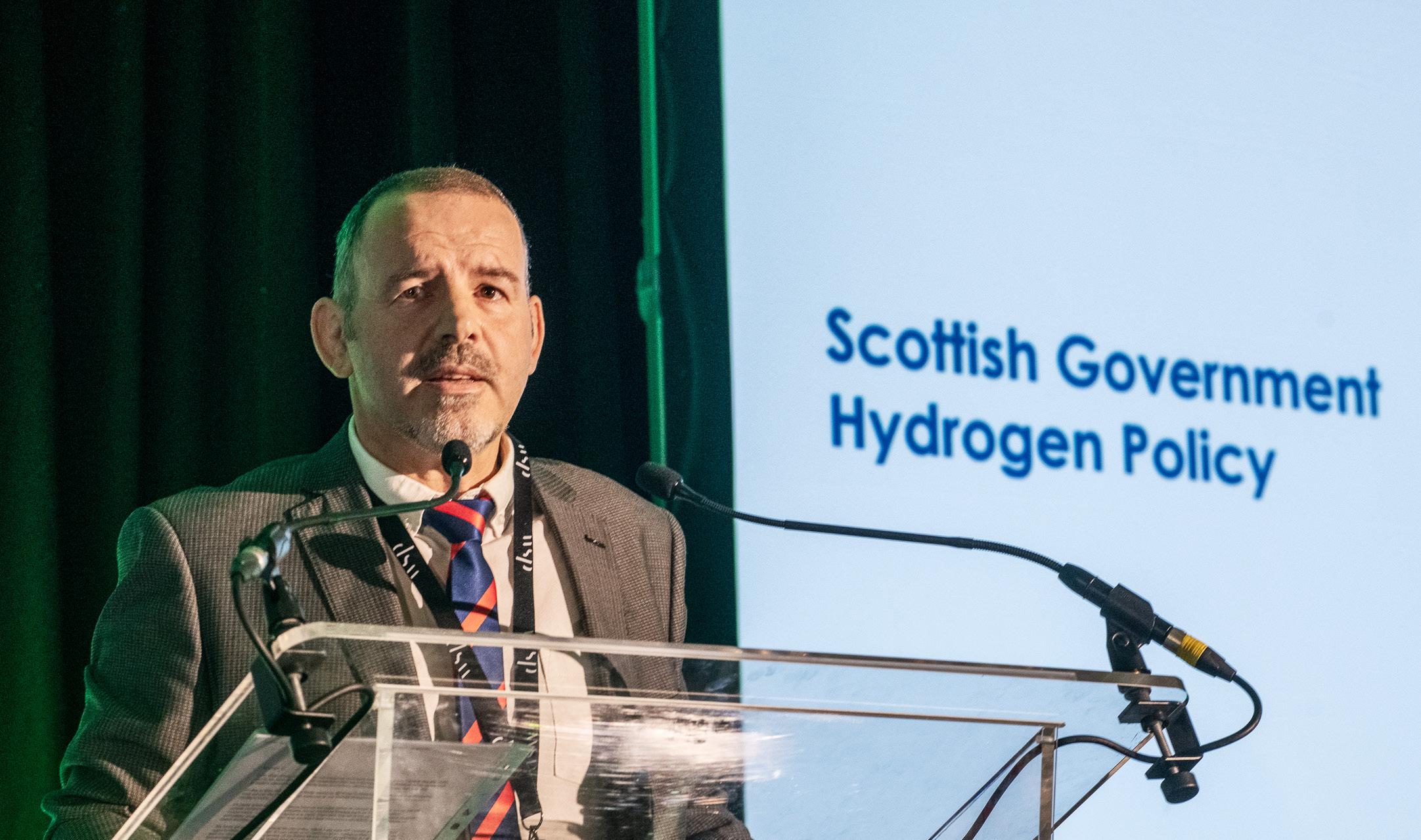

With the hydrogen economy rapidly taking shape, countries around the globe are competing to be first out of the block as hydrogen exporters. Stuart McKay, Head of Hydrogen for the Scottish Government, believes Scotland has a unique opportunity to do this.

The conditions for Scotland to bet big on green hydrogen in a geographical sense are perfect, an abundance of wind power, space for new infrastructure and lots of existing infrastructure ready to be retrofitted across the country.

Stuart McKay expanded on this, informing Hydrogen Industry Leaders: “We’ve been interested in hydrogen for some time in Scotland, and we’ve been funding a lot of demonstrations on a smaller scale. I hope we’re managing to build a reputation for understanding the task at hand with hydrogen.”

An evidence-based approach to hydrogen will secure future investment

Stuart explored the essential aspects of providing an evidence-led approach to the hydrogen economy by ensuring taxpayers’ money is spent effectively while simultaneously proving a business case for the private sector to continue funding into the future and improve FID across the hydrogen sector.

Hydrogen Industry Leaders heard: “Scotland has stretching climate change targets with an ambition to be net zero by 2045, five years before the UK Government. Additionally, we have even more challenging targets of a 75 per cent reduction in emissions by 2030.”

“We have an evidence-based approach in Scotland, so we have to prove hydrogen is good rather than just trusting the process. This will help encourage the markets to see hydrogen as a viable investment, as building the hydrogen economy will be a balance of public and private funding.”

Understanding the role the public sector must play in building a business case for hydrogen, Scotland has spent considerable time studying the sector, writing reports and detailed analyses on early projects. Draft action plans will prove the business case for private investment

The most recent evidence-based report was released on 10 November 2021. The Scottish Government published a draft Hydrogen Action Plan that articulates the actions that will be taken over the next five years to support the development of the hydrogen economy in Scotland, which will further our efforts to reduce greenhouse

SCOTTISH GOVERNMENT READY TO BET BIG ON GREEN HYDROGEN PRODUCTION

gas emissions from Scotland’s energy system, homes, industry and transport while ensuring a just transition.

This has led to a “real robust evidencebased case for hydrogen in Scotland. Scotland is in the perfect position to be an exporter of hydrogen, evidenced in the draft action plan and will be further supplemented in the release of the next action plan in the coming weeks.”

Scotland is uniquely positioned but could fall behind if policy doesn’t match ambitions

Despite the optimism surrounding this, time is of the essence, as once a country secures enough GW of energy to become an exporter of hydrogen, others - such as Scotland - could be left behind.

Determined to push ahead with the hydrogen agenda in Scotland, Stuart explained that: “Transport is one of the aspects we see hydrogen playing a huge role, especially in the heavy goods sector. Our energy strategy will be published later in 2022, and an updated hydrogen action plan is scheduled for release.”

Following a consultation on the release of the last action plan, the Scottish Government will analyse the responses received alongside any other available evidence.

Other countries, such as Germany, are considered massive industrial countries. They have the biggest problems in terms of the energy transition as they are less uniquely positioned geographically than Scotland.

Unlocking Scotland’s potential as an energy exporter to European countries such as Germany is at the core of Scottish hydrogen policy. Stuart echoed this: “Scotland is uniquely placed to have the potential to export hydrogen to energyintensive countries such as Germany that may not have the same capacity for renewables.”

“We have more renewable electricity supply than we need as a country, so we plan to export electricity and hydrogen to Europe. This is the core part of our hydrogen action plan.”

We are optimistic about overachieving in the 5GW installed hydrogen production capacity by 2030.

Stuart McKay Head of Hydrogen Scottish Government

Aligning key transport authorities to build secure infrastructure opens opportunities for the supply chain to connect with the hydrogen economy in new innovative ways and help achieve ambitious climate targets.

The transport sector heavily impacts the environment across the globe, including Scotland, in which 26 per cent of total emissions came from the industry. At an estimated 40 MtCo2e in 2020, Bill Smith, Transport Planning Leader for Scotland at Arup, spoke to Hydrogen Industry Leaders about the framework needed to decarbonise the transport sector.

Bill explained that before we deliver a clear framework for decarbonisation in the transport sector: “The industry needs to change the way it thinks about the movement of people and goods and the role to be played for new and innovative technologies.”

Establishing how Scotland is leading the way in acknowledging the change in attitudes required to connect with the supply chain, Bill explained that there is a: “Whole host of activities being driven in Scotland when it comes to the transport sector. Hydrogen has the potential to significantly reduce emissions from all modes of transport to some degree.”

Hydrogen fuel cell technology has the potential to make vehicles more efficient and quieter due to fewer vibrating parts, and hydrogen fuel allows vehicles to travel further distances with less refuelling. Adding to this, Bill stated: “This makes them ideal for commercial fleets and HGVs, and fortunately, Scotland is looking at different projects and aspects across production,

storage, transfer and use.”

Naturally, barriers to the energy transition include infrastructure requirements and the pace of implementation. Bill explored the notion that infrastructure is often seen as the biggest barrier. Still, if we look at things from a different perspective, the core issue is how to speed up the implementation of hydrogen in transport.

He said: “We need to start thinking about how we can make the best use of hydrogen for transport, we don’t have the infrastructure at the moment, but that isn’t the biggest problem as we have the technologies to do so. The biggest challenge is how to speed up the implementation process.”

As it currently stands, Scotland is starting to see significant progress. However, it is siloed by sector or by geography. “Arup is not seeing a coordinated effort that brings together different sectors and hubs that will bring symmetry in the rollout of hydrogen solutions across the supply chain.”

This is exacerbated globally, as reported in the Hydrogen Insights 2022 report, where 534 hydrogen projects with a total value of $240bn USD have been announced. However: “Only 165 projects have been seen as feasible. A third by number and around 45 per cent by value.” On top of this, only 10 per cent of initial projects have received an FID. Clearly, there are issues with how we bring projects forward and improve final investment decisions. This could be from a funding perspective, global pressures, and unknowns such as risks to scaling up infrastructure, processes and regulations.

ARUP: FOLLOW THESE STEPS TO SUCCESSFULLY IMPLEMENT HYDROGEN IN TRANSPORT

Implementation made easier with the following three

Offering solutions from an Arup perspective, Bill explained if three core questions are carefully considered, implementation processes can be sped up. From a funding perspective: “Status quo is not sustainable; there need to be innovative approaches such as a whole systems approach. Whole life planning will give final investment decision makers more confidence.”

As previously discussed, managing risks is important for securing a hydrogen economy. Arup believes the core risks are reliability as some technologies have not been proven at scale, establishing offtakers and end users and closing the skills gap in the hydrogen sector.

Solutions to the above risks involve increased governance and public sector support to encourage the rollout of the technology and increase knowledge surrounding the capabilities of technology, prioritising a focus on end users where the greatest gains can be made and focus research on how to best utilise the skills the workforce currently has.

Secondly, the sector needs to understand where hydrogen will be an appropriate solution. Arup believes hydrogen will be best used for long-distance heavy goods journeys and areas that are difficult to electrify and the logistics sectors to keep vehicles moving for long periods.

Thirdly, Bill stated. “We need to establish where hydrogen hubs will be and their purpose. Will they be on a regional and city scale, will the hubs be connected, and will they be public and operator facing?” Unpicking these aspects will help implement hubs across Scotland and the rest of the UK faster.

Focussing on the next steps in this process, Bill explained that the six core objectives should be focused on: “Strong and stable commitments from the government, importing learning from other sectors, scaling up capability and capacity, innovating teams and structures, research and development on priority issues and promote crossborder trade.”

If we don’t apply systems thinking, we won’t achieve net zero.

Bill Smith Transport Planning Leader for Scotland Arup

Hypersonix Launch Systems, an Australian aerospace engineering start-up, and the University of Sydney have partnered to build a zero emission hypersonic spaceplane powered by green hydrogen. Could it cross the Atlantic in as little as 90 minutes?

The purpose of the aircraft, called the Delta-Velos, is to make satellite launches more accessible and more sustainable. This is achieved by building the hypersonic capable aircraft to have the ability to deploy small satellites into low earth orbit.

How can the spaceplane withstand extreme temperature challenges?

Since the company was launched back in 2019, Hypersonix has developed Wirraway, a 3-stage satellite launch system that is powered by green hydrogen fuel and uses reusable scramjet [supersonic combustion ramjet] engine technology to meet sustainability challenges.

A scramjet is an oxygen-breathing engine that flies at hypersonic speeds and uses hydrogen fuel; this fuel currently powers all hypersonic vehicles in development at Hypersonix Launch Systems.

Hydrogen Industry Leaders spoke to David Waterhouse – Managing Director at Hypersonix Launch Systems, about the spaceplane and the core technology of this innovation. He said: “The first to launch in the first quarter of 2024 will be DART AE, a vehicle that is entirely 3D printed out of high temperature alloys and will be flying at speeds of Mach 7 [7 times the speed of sound].”

The engine can accelerate between Mach 5 and Mach 12, but the speed depends on the material used. It can cope with extreme temperature challenges by producing the engine and vehicle out of high temperature Ceramic Matrix Composite (CMCs) materials.

Comparing hydrogen fuel to Kerosene or RP-1 fuel, hydrogen provides several benefits. Kerosene-based scramjet engines fly at a speed of Mach 6, while the ones Hypersonix is using can go faster. The engine is self-igniting and can be turned on and off as many times as is required during the flight – this is something that can’t be done with a kerosenebased scramjet.

An important aspect of the SPARTAN scramjet is in the fixed-geometry design, as when a vehicle flies at hypersonic speeds, the temperatures of the engine and the entire vehicle gets extremely hot; this can be up to 2,000 degrees. To cool the engine down, it can be turned off and skipped through the layers of the atmosphere, breathing in oxygen.

David explained that seeing innovations like this one take place in the industry is essential to growing the hydrogen economy and ensuring futureproofing. He said: “We are one of the few companies

actually talking about an application for gaseous and liquid green hydrogen. In our experience, the market mainly talks about developing, transporting, and storing green hydrogen.”

The Delta-Velos will be part of the Wirraway system and is said to be able to fly for 2,500 km at hypersonic speed and then land like a usual aircraft, with it being ready to take off again after refuelling. Hypersonix aims to have the spaceplane fully operational by 2024. While it is currently only working as a satellite launching system, the plan is to join the race for developing hypersonic airlines.

The spaceplane is helping to futureproof the hydrogen industry

The automotive industry has done a lot of work in this area, and we are thrilled to use it for our purposes.

David Waterhouse Managing Director Hypersonix Launch Systems

Aligning ambitions for a hydrogen economy with successful policy and regulatory frameworks is one of the core considerations to avoid a boom and bust in the sector.

Exploring this notion, Fergus Tickell, System Transformation and Business Development Lead at SGN, explained how Scotland should take the appropriate steps to become industry leaders. “The Scottish Government has been leading the way in developing an inspiring future for hydrogen, and SGN is working tirelessly to align the ambition and policy with our decarbonisation goals.”

SGN can play a crucial role in delivering energy systems using hydrogen across different sectors alongside a diverse range of suppliers across multiple sectors. For example, the heating sector will need every available technology to achieve decarbonisation goals, such as electrification and hydrogen.

No silver bullet to net zero, but hydrogen offers unique possibilities

Fergus echoed this, explaining how there is no ‘silver bullet’ for net zero: “SGN does not see other sectors in competition with each other, we all have a common goal to achieve net zero, and we are committed to working with our sector colleagues. SGN think it is imperative to take a whole system approach to the massive challenge of decarbonisation.”

Success from a whole system approach will be achieved if a diverse supply of energy can be found. Implementing this approach has significant barriers that the public sector has a large responsibility to overcome.

One of the core issues of implementing a whole system approach is navigating the current energy crisis and the lack of energy security for many countries around the globe.

Fergus expanded on the role SGN sees decarbonisation can play to ease these concerns: “Net zero and energy security go hand in hand with one another, and green technology must play a leading role in reducing our dependency on global energy markets.”

SGN firmly believes Scotland needs a diverse supply of energy, particularly with the current energy crisis. A resilient energy system is critical in delivering customers’ needs and wants.

Part of a resilient energy system is sufficient long-duration storage and having correct regulatory and legal frameworks is essential to enable the scaling of production, storage and distribution of hydrogen. “The sector is behind in the regulatory framework for storage and the legal framework in place to develop this long-duration storage. This is a huge challenge, but there are plenty of opportunities that come from this,” added Fergus.

Suppose barriers to regulatory and legal frameworks can be resolved. In that case, BEIS estimates savings of £24bn on the road to net zero if the UK can secure longduration hydrogen storage, as there will be a greater supply and demand balance.

Fergus also told Hydrogen Industry Leaders: “One of the key attractiveness of a hydrogen economy is its capabilities to be used as an energy storage source which will help manage intermittency that we can get from renewable energy generation.”

If these obstacles are overcome, a whole systems approach unlocks the huge opportunity to scale up the production of indegiounous hydrogen to help deliver a resilient system that decarbonises the most challenging industries such as transport and domestic heating.

Optimism around meeting these targets continues to grow as 10GW of offshore wind is already operational or under construction/development. Further, there are additional projects in Scotland looking to supply a further 26GW generation.

GLASGOW 20 2 2 Enhancing the Hydrogen EconomyHydrogen can deliver a resilient energy system through the diversity and scale of production and lay the foundations to establish Scotland as a major hydrogen exporter.

It is widely reported that the biggest bottleneck to implementing hydrogen globally is securing final investment decisions and commercialising hydrogen products. Breaking all the barriers, Alstom has the first fully operational hydrogen train across Europe.

Setting new benchmarks for the rail sector, Alstom is uniquely positioned to continue being industry leaders in the future through the maturity of its technology relative to other prominent players in the industry.

Exploring how Alstom and the rail sector as a whole is best placed to roll out the use of hydrogen, James O’Sullivan, Product Manager at Alstom, explained that: “Rail has an advantage over other sectors as it already has experience in decarbonising technology, so converting existing diesel trains at the end of their lifecycle to a hydrogen propulsion is a much easier step to take as the skills base is already embedded in the sector.”

Despite this, it is still a giant leap in terms of the overall technology used to transition to hydrogen trains. Being at the forefront of innovation, Alstom has been able to get ahead of the curve and is ready to implement hydrogen trains at scale with trains already operating successfully in Europe.

Being early adopters allows for a faster rollout of hydrogen trains

James explained how beneficial being early adopters of hydrogen was in allowing processes to play out naturally, helping provide a highly developed product. He told Hydrogen Industry Leaders: “It has taken since 2012 when the concept was first piloted to the initial passenger trials

in 2018, all the way through to in-service operation today. Being an early adopter was essential in being the first to market with these hydrogen trains.”

James continued with a dedicated focus on improving passenger experiences while tackling core climate targets: “It is important to Alstom because it is in our DNA to improve passenger experience but also doing it in an environmentally friendly way. Alstom uses its engineering skills and capabilities to develop something better for the world and improve the passengers’ experiences.”

The world’s first hydrogen train, a decade in the making

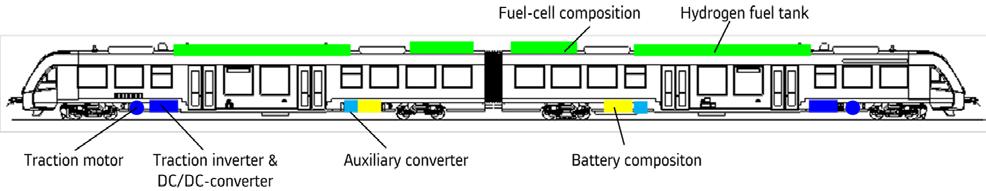

Focussing on the innovation behind the trains, the hydrogen equipment is mounted on the roof and consists of two key elements. The first is the compressed hydrogen storage system which stores the hydrogen at 350 bar, and typically, you’d have about 120kg of hydrogen per car, which is subject to change depending on the carriage.

This hydrogen is released into the fuel cell to create the train’s electricity. Going a step further, “Alstom has hybridised this process to maximise the efficiency of hydrogen use. While hydrogen remains expensive, efficiency is key to creating a business case for hydrogen use.”

To do this, Alstom uses a Li-ion battery, which manages the peaks and troughs for acceleration and deceleration. In turn, this can help regenerate energy when breaking.

Another critical element Alstom can bring as an OEM is the ability to integrate new technologies into complex transportation systems, leverage them to disrupt the sector, and set new benchmarks for others to follow.

Efficiency is an essential aspect of decarbonisation, and Alstom is at the forefront of improving this and reducing the consumption of hydrogen while others in the sector continue to trial the prospect of using hydrogen.

With a range of over 700 miles, operational speeds of up to 100 mph, and performance statistics that match today’s diesel trains, the Coradia iLint regional hydrogen train offers passengers 150 seats and operates with lower noise to enhance the passenger experience.

Aligning public and private investment is at the core of a hydrogen economy

Aligning public and private investment in Germany was essential to implementing hydrogen trains. James added: “A big step in the process was the successful partnerships and support. Alstom works with several suppliers in the supply chain, and support from the German Government brought this project to life.”

As headline sponsor at the Hydrogen Industry Leaders Glasgow event, the takeaway message from Alstom was that rail plays a core role in being an early adopter of the hydrogen economy, propagating its growth, and setting the pace for the rest of the transport sector to follow.

We are constantly on the pulse of the latest hydrogen technology and have the confidence to implement them successfully.

James O’Sullivan Product Manager AlstomGLASGOW 20 2 2

According to the ‘UAE-UK Clean Hydrogen Collaboration’ report, the United Arab Emirates and the United Kingdom have a global leadership opportunity in developing clean hydrogen through collaboration on policy, innovation, trade, and investment.

The ‘UAE-UK Clean Hydrogen Collaboration’ report is a joint initiative between the World Green Economy Organization (WGEO) and Zest Associates, a UAE-based sustainability consultancy, sponsored by HSBC.

From nearly 100 international hydrogen experts, insights have been drawn to highlight priorities of 39 areas across policies, innovation, investment, infrastructure, supply, demand, and skills.

Both countries’ net zero commitments depend on clean hydrogen to deliver emission reductions, especially in hardto-abate sectors. The countries’ abundant renewable energy resources and natural gas endowments will be used to produce green, blue, and potentially turquoise hydrogen.

Hydrogen offers pathways for greater energy independence in the UK, economic diversification in the UAE, and job creation in both countries. By 2050, hydrogen is estimated to deliver up to AED 32 billion ($8.7 billion) annually to Dubai’s economy alone, and £13 billion ($15.5 billion) Gross Value Added to the UK.

The report highlights that the relevance of state-owned enterprises in the UAE’s hydrogen landscape offers a special opportunity for directive coordination of

supply and demand, and that “The UK’s hydrogen strategy and industrial clusters mission are strengthening coordination in the UK and the approach could be emulated in the UAE.”

When investigating trading, partnerships, and investment relationships between the two countries and their partners, the report found that the UAE and the UK are active in building strong relationships.

Hydrogen Industry Leaders spoke to Jeffrey Beyer, Managing Director at Zest Associates, who was the sole author and knowledge partner of the report. He said: “There is already an investment and a substantial partnership between the UAE and the UK. BP and ADNOC, the big oil company, have invested in the Teesside hydrogen hub [H2Teesside] to produce blue hydrogen.”

The countries must work together to scale up both blue and green hydrogen Innovation in the UAE and UK is strong and is seen to be improving. Where the UK excels at early-stage innovation, the UAE excels at later-stage scale-up. This complementarity could be exploited through testing and demonstrations of new UK technologies at UAE facilities, potentially linked to UAE corporate venturing to accelerate scale-up and unlock shared financial returns.

For carbon capture and storage – an enabler of blue hydrogen – the UAE’s leading technical capabilities could be further utilised in the UK’s industrial clusters. The UAE’s Hydrogen Leadership Roadmap lauds the country’s low-cost gas

and amongst the world’s lowest-cost solar PV as critical competitive advantages to produce low carbon hydrogen.

The UK’s Hydrogen Strategy commits to a ‘twin track’ approach, using both clean electricity and gas to produce electrolytic and CCS-enabled hydrogen. This approach casts the net wide, allowing for innovation across all types of production methods to help deliver the volume of clean hydrogen needed to reach net zero. It also lets both countries capitalise on global competitive advantages in terms of natural resources, skills, capabilities, and infrastructure.

Jeffrey said: “So the UAE is very good at carbon capture and storage. They’ve been doing this since the 1970s and have a lot of real capabilities there. It is something the UK is investing a lot in and understanding that the technical capability expertise from the UAE is a great opportunity for the UAEUK partnership.” The two countries have different objectives around markets. The UAE intends to be a significant exporter, capturing 25 per cent of the global export market by 2030 as its goal. It wants to be a major producer of both blue and green hydrogen and trade substantially internationally.

Hydrogen needs to be delivered on its low-carbon promise

In contrast, the UK is doing a lot of innovation and technology partnerships with other countries internationally; it is looking for external and cross-border investment. Unlike the UAE, the UK

doesn’t plan so much to export hydrogen because the country’s government focuses mainly on self-production. Therefore, the partnership between the two will see imports and exports balance.

By working together, the UAE and UK can harness hydrogen’s enormous economic potential and lead the global carbon transition.

Jeffrey explained: “The UK has a solid innovation heritage and is punching above its weight in terms of inputs into innovation versus outputs in terms of products and services that can be sold. The UK is strong in early-stage research, while the UAE is strong in demonstrations and scale-up.”

He added that the UK and the UAE both share an interest in blue and green hydrogen so there is: “an opportunity to develop a joint standard between the two countries that can then be adopted at a regional or global level and can set the standard to make sure that hydrogen genuinely delivers on its low carbon promise.”

With forecast investment in hydrogen at just 40 per cent of global need, the UAE and UK need to improve the bankability of hydrogen projects to mobilise investment. There is an opportunity to enhance UAE-UK cross-border investment into new and refurbished pipelines, storage facilities, electricity transmissions and port infrastructure to enable the market.

RETHINKING SAFETY IN HYDROGEN: ADOPTING A RISK-BASED APPROACH

Safety is an essential aspect of securing a hydrogen economy. While hydrogen production isn’t a new process, the scale of project expansion the sector is expecting is unprecedented.

Exploring the best ways to use data and technology to enhance safety in hydrogen, Safetec is leading the way in independent consultancy, offering specialist risk management across energy assets.

With an integrated approach to managing technical, human, and organisational factors, Safetec enables its clients to capitalise on opportunities while operating safely.

Looking at the large-scale hazards at a facility, Safetec can model the biggest threats that will have the most significant consequences for safety in hydrogen.

Speaking to Hydrogen Industry Leaders, Gemma McIntosh-Mejuto, Principal Safety Engineer and Hydrogen and CCUS Lead at Safetec UK, explored the advantages of cross-sector knowledge: “While part of our background is from the oil and gas sector, there are a lot of transferable skills that can be used for hydrogen safety and there is a lot of great experience Safetec can draw from its work in Norway.”

Safety standards need to evolve at the same pace as hydrogen project growth

While hydrogen production isn’t new, a lot of production is as a by-product or on a smaller scale; as we scale up across the UK, new safety measures must be considered to ensure hazards are mitigated.

Changing the traditional practices is a core aspect of this, as Gemma explained: “The

traditional practice has been to minimise the inventory that we have stored and implement large safety distances. As we transition to net zero, we will see hydrogen production on a completely unprecedented scale.”

Continuing, Hydrogen Industry Leaders heard: “The challenge from a safety perspective for large-scale production is that we can’t impose large safety distances because they are ordinarily proportionate to the amount of hydrogen stored.”

As we scale, we can’t have safety distances that are getting larger because they are prohibitive in terms of costs and availability of land.

A risk-based approach is the best way to adapt to unprecedented levels of hydrogen production

Gemma expanded on alternative options: “It is generally accepted that the hydrogen sector needs to adopt a risk-based approach. It is essential to identify the potential hazards and how we can prevent them.”

To establish a successful risk-based approach: “Quantifying risks to determine whether the risk is acceptable is essential to prove a risk-based approach is viable.”

Some of the challenges to implementing this approach include the fact that the UK is used to dealing with methane and its safety considerations. Hydrogen has specific challenges associated with it that differ from the safety knowledge we currently have.

Gemma explained the ‘consequence’ aspect of safety in hydrogen: “We look at three core consequences, those being gas dispersion, explosion and fires.” This is where

expertise from Norway plays an integral role, as Safetec is experienced in handling the differences between methane and hydrogen.

Hydrogen disperses more quickly, reducing gas accumulation compared to methane. Despite this, the flammability ranges are much wider, so depending on the concentration in the air, it is much more flammable. This means that any accumulation of hydrogen is more likely to ignite than methane.

The relative ignition energies required for hydrocarbon gases and hydrogen are stark, with a fraction of the energy needed for hydrogen to ignite.

facilities. As more projects and pilots occur, the software that Safetec uses can manage the information and analyse it to tweak the consequence modelling.

Collaboration is key to evolving the SAFEN toolkit

Additionally, Safetec is heading up the SAFEN Joint Industry Project, which has been established to address knowledge gaps in the driving factors for the occurrence of undesirable hazards and safety risks.

“We want to use our industry knowledge from other sectors and find what we need to know to get the same level of data from hydrogen to implement a similar approach.”

Safetec UK uses industry-recognised software that can model these consequences. They not only model the size and impacts of potential hazards but, through research knowledge, offer solutions to reduce them.

This is why it is essential that Safetec is involved through the whole life cycle of a project. “Being industry leaders allows us to tweak things and understand exactly what is happening, resulting in us making safety modifications to give the most representative analysis to clients. Safetec can do this best when involved at the very beginning of the process”

To bridge the knowledge gaps, Safetec can use data and technology to utilise the information collected from different

Part of the goal for SAFEN is to create a standardised approach to safety, and it will be an evolving toolkit as the projects get more data from the industry. It has been hailed as a living collaborative tool that everyone can use.

We want a common toolkit that we can share across the industry.

Gemma McIntosh-Mejuto Principal Safety Engineer and Hydrogen and CCUS Lead Safetec UKGLASGOW 20 2 2

IDTechEx’s new report, ‘Materials for PEM Fuel Cells 2023-2033’, revealed that materials for PEM fuel cells will exceed a market value of US$7 billion by 2033.

Despite strong incumbent materials for certain components, the technology landscape for PEM fuel cells is set to change in many ways over the coming years.

As increased materials demand in terms of both volume and units, reducing the cost of components, and the emergence of disruptive technologies are all expected, supply chain agreements are being established and strengthened across the industry.

As the trend towards zero emission vehicles continues, fuel cell electric vehicles (FCEVs) are projected to grow accordingly as a market sector. FCEVs also present significant opportunities in the heavy-duty industry, with hydrogen-powered trucks bringing the possibility of hub-to-hub journeys without the need for a significant overhaul of refuelling infrastructure.

The transportation market is set to grow by nearly 30 per cent

The new report includes 10-year forecasts segmented by vehicle type for key fuel cell components in terms of both units and volume while also detailing the value associated with each component.

Further to these granular market forecasts, the report includes player assessment, technology benchmarking, and analysis of trends for both materials and components incorporated in PEM fuel cells.

A PEM fuel cell operates via the synergistic interaction of the various components. The

bipolar plate (BPP) distributes fuel among the fuel cell before the gas diffusion layer (GDL) transports reactants and products to/from the catalyst layer, respectively.

The catalyst is coated on the membrane (CCM), while the membrane transports protons from one side of the fuel cell to the other.

The PEM, CCM, and GDL are collectively known as a membrane electrode assembly (MEA). The PEM fuel cell for the transportation market is set to grow at a CAGR of 29.9 per cent between 2022 and 2033, but there are still key questions concerning fuel cell components.

Incorporating the proton exchange membrane, the CCM, and the GDL, the MEA is a major component of fuel cells. The value associated with the MEA can be seen in the pie chart, showcasing the importance of the MEA to the overall fuel cell.

The GDL is arguably the most simplistic of the components listed in the chart. However, it plays a major role in water management within the cell.

An understanding of the major players in this market segment is given in the report, together with technological differentiators and information relating to which OEMs are being supplied.

In addition to this, a discussion of material trends is made with respect to enhancing the ability of the GDL to enable water management within the cell.

Allowing the transport of protons from one side of the cell to the other, the PEM typically

consists of a specific family of polymers known as an ionomer.

IDTechEx benchmarks these alternative membrane materials against the incumbent with respect to three of the most important parameters for PEMs; electrical resistance, ion exchange capacity (IEC), and membrane thickness.

High electrical resistance is required to ensure that the fuel cell is not shortcircuited. In contrast, high (IEC) and thin membranes enable rapid proton transport across the cell, thereby increasing cell performance.

Hydrogen Industry Leaders spoke to Dr Conor O’Brien, Technology Analyst at IDTechEx, about the new report: “Despite dominant incumbent materials for given components, such as Nafion for ionomer membranes, disruptive technologies are beginning to emerge, showing signs of early promise.

Novel materials, coatings and manufacturing techniques are seen at an academic stage, with some early commercial uptake, and analysis of these disruptions to the incumbent is included in the report.”

IDTechEx has predicted that the materials demand for components such as proton exchange membranes, bipolar plates, gas diffusion layers and catalysts are forecasted to exceed a market value of USD$7 billion by 2033.

He continued: “It is expected that the cost of components will reduce in a number of ways, from optimisation of incumbent technology to emerging materials and automated manufacturing systems.”

“However, on the back of a growing fuel cell electric vehicle market, a higher material demand is expected for all components within a PEM fuel cell.”

MEA Assembly GDL PEM CCM BPP

SGN keeps communities across the whole of Scotland and much of the South of England safe and warm. Our vision is to give our 6 million customers the best clean energy experience.

Achieving net zero emissions will require transformation across the whole economy. We are investing in world leading R&D projects in the UK, advocating for the solutions that meet our customers’ needs and supporting industry make the transition to net zero to maintain jobs and skills here in the UK.

The UK’s biggest net zero challenge is decarbonising our homes and buildings. It’s the second biggest emitting sector with around 30% of our national emissions coming from around 25 million homes which are connected to gas networks across the UK.

Millions of homes and people will be heavily impacted by this change. The decarbonisation of homes is first and foremost a customer challenge.

Customers react differently to the shared challenges we face: their own experience informs the choices they make. So when it comes to delivery of net zero we know we must put our customers’ different needs at the centre of any solution that is offered to them.

We need to listen to and understand what our customers actually want from their future home heating solutions. By doing this, and really understanding our customers’ needs, we can inform policy development and technological solutions that will help deliver a transition to net zero homes more quickly and at lowest cost.

Our customer attitudes research tells us that the willingness of customers to move to a zero-carbon heating system is high. Importantly, customers do not want to lose the attributes of heat that they have today. They want the

control, flexibility and immediacy of a heat source they can turn on and off, up and down.

But when you ask customers what action they will personally take and how much they are prepared to pay, that support for change drops to around a third. We call this the “action gap”.

For most customers, the technology itself isn’t a relevant consideration for them. It’s what it delivers and how it delivers which they are concerned with.

Some customers tell us they are worried about being left behind when it comes to adopting new technologies. But on the flip side, many customers are also worried about being the first mover. They see a world of uncertainty and risk and for many a do-nothing approach represents the least risk option.

Customers expect government and business to take the lead by providing clarity on what the choices are and a roadmap of how they can be made a reality.

If we are going to make progress on the decarbonisation of our homes in the 2020s, hydrogen needs to be part of the choices on offer to customers.

We know about the home heating technologies available in market today, and we’re very clear – we will need all of them to reach net zero.

To maintain progress on decarbonisation, we in industry need to work alongside regulators and policymakers and ensure a customer centric approach is the backbone of the pathway we use to decarbonise our homes.

Please get in touch or visit our website if you would like to learn more about our world leading R&D or customer analysis, or how we are helping industry to meet net zero. josh.aulak@sgn.co.uk sgn.co.uk/about-us/future-of-gas

The Uganda MEMD has signed an agreement with HDF Energy to establish the country’s first green hydrogen power plant.

Under an MoU, HDF Energy hopes to build one of its power plants in Uganda, which will enable large-scale storage of intermittent renewable solar energy in the form of hydrogen and electricity generation using hydrogen feedstock in a fuel cell.

If the plan comes to fruition, the first hydrogen power plant in Uganda will benefit the country as it currently depends on hydro and thermal power plants. However, it is eager to expand its generation capacity, especially in renewable energy.

It follows HDF Energy’s $181.3 million green hydrogen power plant in Namibia, Africa’s first, which is expected to begin producing electricity by 2024.

Ugandan energy minister Ruth Nankabirwa Ssentamu and Nicolas Lecomte, HDF’s director for southern and East Africa, signed the MoU at COP27.

Lhyfe and French harbour Nantes-Saint Nazaire Port have reached a partnership agreement to develop the offshore renewable sector.

Under the deal, Nantes-Saint Nazaire Port and Lhyfe will combine their efforts and expertise to explore the establishment of an offshore hydrogen production supply chain.

The collaboration aims to identify port areas and facilities capable of accommodating R&D prototypes and the industrial requirements for the construction of equipment and supporting infrastructure needed for largescale offshore hydrogen production.

In addition, the companies will study how best to bring renewable gas ashore and integrate it into the land-based network.

Matthieu Guesné, CEO and founder of Lhyfe, said: “The development of offshore hydrogen production is the next major challenge awaiting us.”

Based in Hawaii, Simonpietri Enterprises has received $1.6 million to generate clean hydrogen fuel out of construction and demolition waste.

The company is co-developing the research project with the University of North Dakota, which will focus on using gasification technology to turn highvolume, highly contaminated organic waste into locally sourced hydrogen.

Simonpietri Enterprises has said that the goal is to design and build modular plants to close waste-to-fuel technical gaps and produce hydrogen for hubs and transportation fuel refining.

In addition, the company and the university’s Energy & Environmental Research Centre will also investigate proprietary techniques to manage the trace metals and heavy metal contamination often found in largescale demolition and construction waste.

Company president Joelle Simonpietri said: “This idea, to make fuel out of construction and demolition debris rather than stick it in the ground, was born here in Hawaii to solve Hawaii’s problems: too many landfills that need to be expanded or relocated in these islands we call home, not enough local supply of renewable fuel to replace imported fossil fuels, and no local supply of renewable fuel that can be used in airplanes.”

Globeleq has signed an agreement to develop and finance a large-scale green hydrogen facility within the Suez Canal Economic Zone (SCZONE).

The agreement was signed during COP27 with the General Authority for SCZONE, the Sovereign Fund of Egypt for Investment and Development (TSFE), the New and Renewable Energy Authority (NREA), and the Egyptian Electricity Transmission Company (EETC).

With 3.6GW of electrolysers powered by up to 9GW of solar PV and wind energy, the project will be developed in three phases over the next 12 years.

During the first phase, a pilot project will produce 100,000 tonnes a year of green ammonia from hydrogen, which is said to be mainly targeting exports to Europe and Asia for use in fertilisers. It is expected to start operations by 2026-27.

Globeleq has been investing in the country since 2003, and due to Egypt’s location; at the crossroads of Africa, Europe, and Asia and with about 13 per cent of global trade flowing through the Suez Canal, the country is in a strategic position to become a global green energy hub.

After the sell-out inaugural HIL Glasgow 2022 Conference, Hydrogen Industry Leaders highlights the main takeaways from the first panel discussion and highlights the opportunities that hydrogen brings to the supply chain and how this can be implemented across different modes of transportation.

The panel discussion featured David Rennie, Head of Low Carbon Energy at Scottish Enterprise, Brian McLean, Strategy Director at AGS Airports, and Gordon Stewart, Rail Planning and Operations at Arup.

Good projects are needed to build the hydrogen economy

When asked what the aviation sector can do to create a business case, Brian addressed the audience: “In short, it is going to happen, so we must be ready. Aviation is going to take a modernised approach to airspace, with a combination of sustainable aviation fuels, hydrogen, and electric where applicable.”

He revealed: “We have done some work to identify around 60 potential production projects of hydrogen, right from the North to the South [of Scotland]. We are also in conversations with a number of international countries and companies to come and invest in Scotland.”

“In some ways, it is as simple as good projects with a plan. We are all about benefiting the Scottish economy; that is what Scottish Enterprise is about.”

Retrofitting can support the decarbonisation of certain sectors

Brian McLean Strategy Director AGS AirportsFrom a Scottish Enterprise point of view, David explained that when it comes to utilising a business case and building the hydrogen economy, it all comes down to good projects.

When asked about Arup’s view on retrofitting the current train fleet, Gordon encapsulated the importance of ensuring that retrofitting is at the top of people’s minds in the industry, especially in the transitional periods from diesel. Expanding on this, the audience heard: “Retrofit is one element; it could be a solution for the short and medium term; for example, in the case of the Scottish Hydrogen Train project, a retired train from ScotRail was converted into a hydrogen-powered train with a lot of success. If you want a short to medium solution to tomorrow’s decarbonisation, that could be the answer.”

However, waiting until brand new trains are available and for those that aren’t being used elsewhere in the world would not be a quick solution and, therefore, would not support the rail sector to meet its net zero goal of 2035.

Transport is the perfect testbed when it comes to hydrogen.

David echoed the need for retrofitting in the transport sector but expressed that some sectors will turn to retrofit more than others: “For some areas, it will be retrofitting. First, retrofitting will be used to test if things can work, largely because of the cost of building a new plane etc.”

Making things work first retrofitwise will be the way for some sectors.

David Rennie Head of Low Carbon Energy Scottish EnterpriseUsing retrofitting to test if certain things work is also key to building confidence in the emerging hydrogen industry. Building this confidence is necessary to support companies in making the energy transition and is needed for companies’ financial, technical and reliability perspectives.

Questions were then opened up to the audience, who asked how standardisation is supporting bringing hydrogen into the UK mobility sector.

Brian took the question and said when it comes to the aerospace sector, if it is to get to the standardisation of hydrogen, decisions need to be made.

He said: “We still need to decide if the sector is going to be electric or hydrogen, though our partners do think it will be hydrogen rather than electric, because how long does it take to charge, for example?

“I think the sooner we get to the point that we are going down, it will be one direction for standardisation.”

To coordinate standardisation efforts, better alignment is needed. This will help to accelerate both the UK and global efforts to achieve its low-carbon energy and net zero future.

The key takeaway from the panel discussion was that the transport industry must collaborate more to help build confidence in hydrogen and that decisions need to be made now rather than later by companies, governments and industry leaders to see hydrogen implemented into the industries that need it most to help them meet their net zero goals.

GLASGOW 20 2 2

GLASGOW 20 2 2

The HIL London conference will bring a wide range of stakeholders responsible for delivering the UK’s hydrogen objectives and discuss practical ways in which we can produce and distribute hydrogen successfully.

Located at the Radisson Hotel & Conference Centre, London Heathrow, on 5 July 2023, join key leaders and decision-makers from within the hydrogen industry and discover the upcoming opportunities available to you.

Radisson Hotel & Conference Centre London, Heathrow