No. 2

No. 2

Auction: August 25-30 & September 2-5, 2025 • Costa Mesa, CA

The middle of the calendar is usually a busy time for collectors and dealers, thanks to coin shows big and small across the country. And as we sail into the heart of summer, we find the market is sizzling with hot coins and banknotes streaking across auction blocks from coast to coast.

The coin show bourse floor is usually one of the best places to be if you want to stay cool while landing the pieces you need to round out your collection. As you consider what coins to pursue for your collection over the rest of the summer, perhaps you will find inspiration among the pages of this issue of PCGS Insider. We cover many different collecting areas with this edition, including in-depth looks at the American Silver Eagle, which was authorized by law 40 years ago in July 1985.

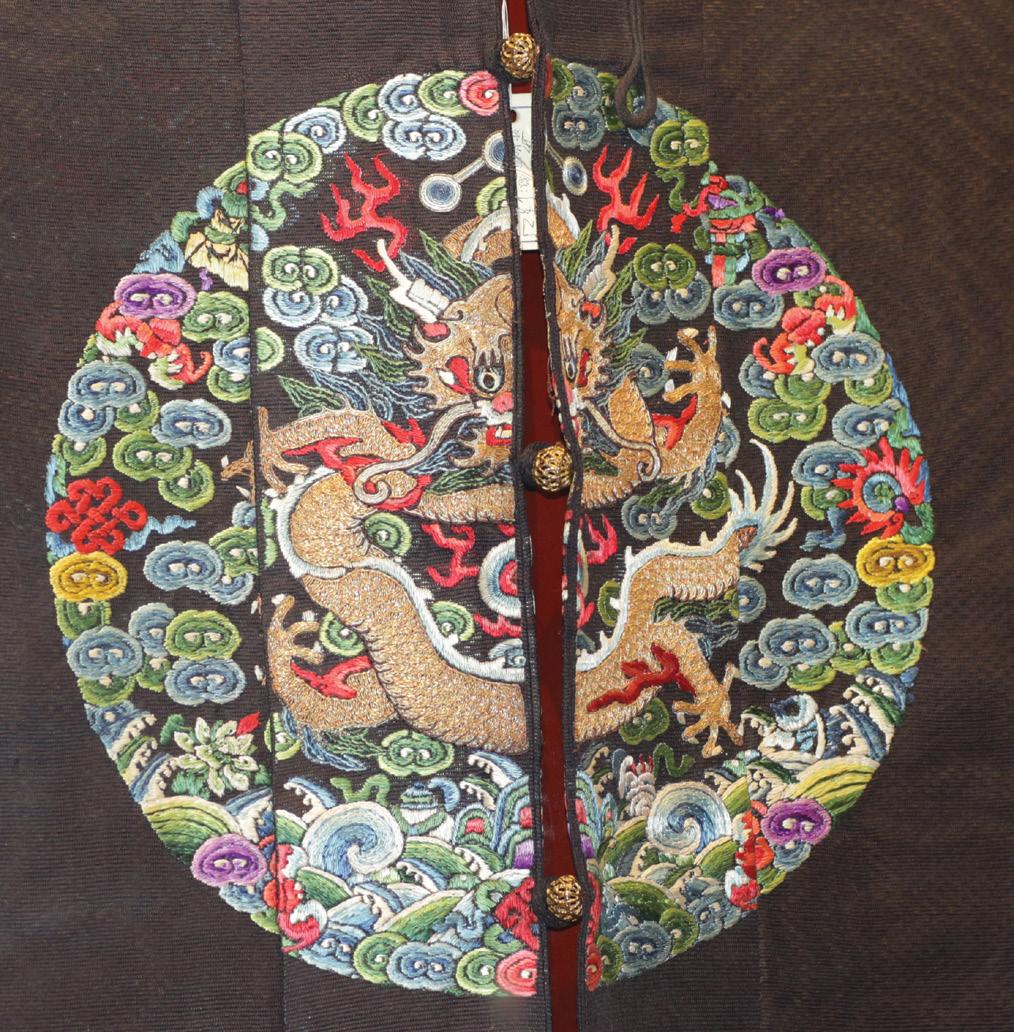

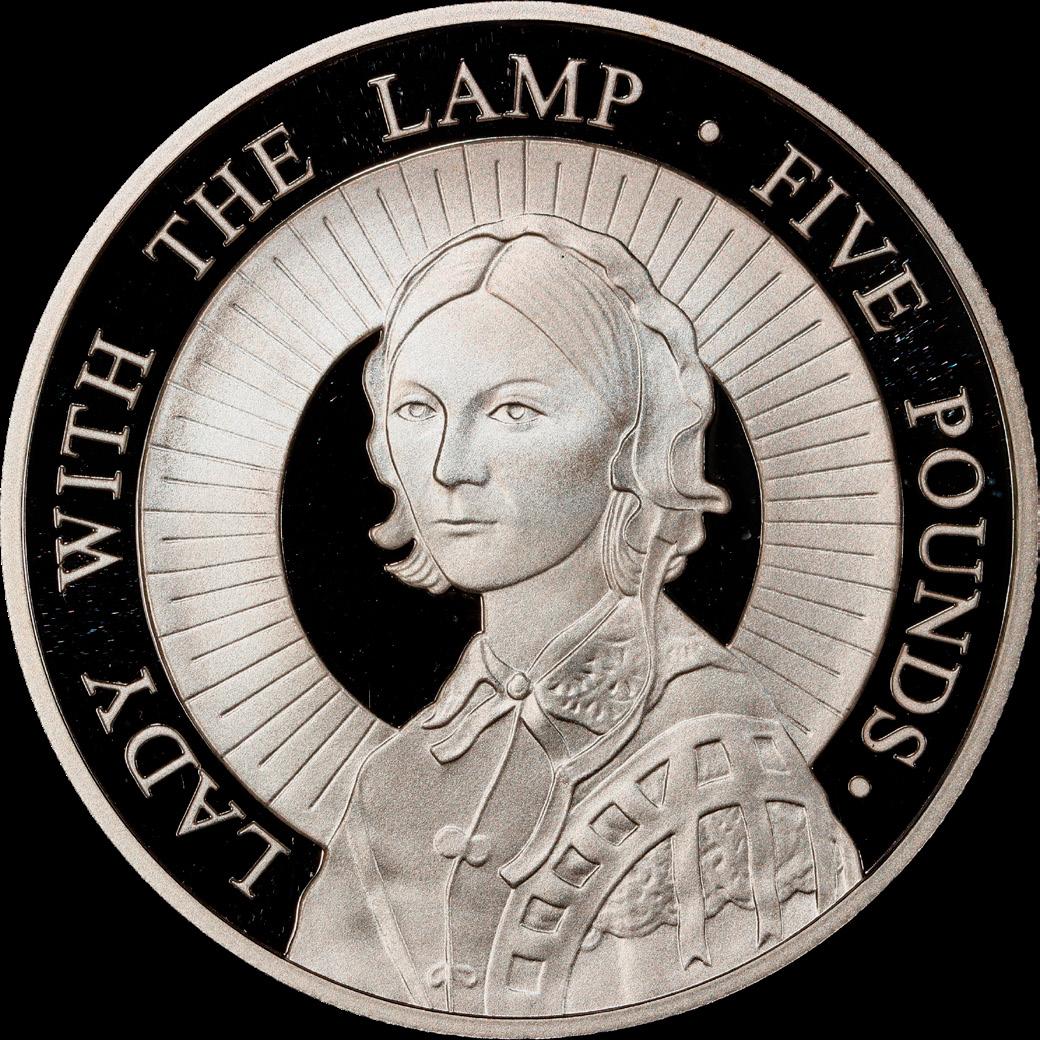

If world coinage is more your scene, then you’re sure to think Peter Anthony’s survey of modern Chinese dragon coins is “fire.” Meanwhile, Abigail Zechman profiles a coin from the British Isles featuring medical hygiene pioneer Florence Nightingale.

Another person you’ll get to meet while reading this issue is PCGS President Stephanie Sabin. Not only is she a numismatic luminary, but she is also a passionate coin collector who shares many of the things she loves about numismatics in a story profiling her remarkable career. You will also find a variety of insightful expert analysis from many other resident experts at PCGS covering a broad range of topics that include buying and selling tips, as well as errors and varieties.

I hope you enjoy the rest of your summer!

Stay cool,

Joshua McMorrow-Hernandez

Insider Editor-in-Chief

Editor-in-Chief

JOSHUA MCMORROW-HERNANDEZ

Creative Director

JACK ARCHER

Art Director

GEOFF PARRISH

KEITH DEWALD

Designer JAMES DAVIS

Production Artist

CHRIS WILSON

Staff Writer

SANJAY C. GANDHI

ABIGAIL ZECHMAN

EDWARD VAN ORDEN

JAY TURNER

JAIME HERNANDEZ

NATHANIEL UNRATH

KYLE C. KNAPP

Contributing Writer

PETER ANTHONY

CHRISTOPHER BULFINCH

Advertising

TARYN WARRECKER ARIANNA TORTOMASI

PCGS INSIDER

PCGS Insider Magazine USPS Pending Periodical #226, Copyright © 2025 by The Collectors Universe is published bimonthly by The Collectors Universe, 1610 E St Andrew Pl, Santa Ana, California, 92705. Application to Mail at Periodicals postage is Pending at Santa Ana, CA and additional mailing offices. Printed in Canada.

Nothing herein is intended to provide financial advice. Past sales do not guarantee future results.

Send address changes to Collectors Universe, 1610 E St Andrew Pl, Santa Ana. California, 92705.

BUSINESS & EDITORIAL OFFICES

1610 E St Andrew Pl Santa Ana, CA 92705 (949) 567-1234

ACCOUNTING & CIRCULATION OFFICES

1610 E St Andrew Pl Santa Ana, CA 92705 (949) 567-1234

Call (949) 567-1234 to subscribe. Periodical postage is paid at Blaine, WA.

The First Gold Coins of British India Did You Hear That?

Inside PCGS: Stephanie Sabin

40 Years of American Silver Eagles

The Silver Eagle Shines Women on Money Collector Highlight Young Collector Profile Varieties, Errors & More

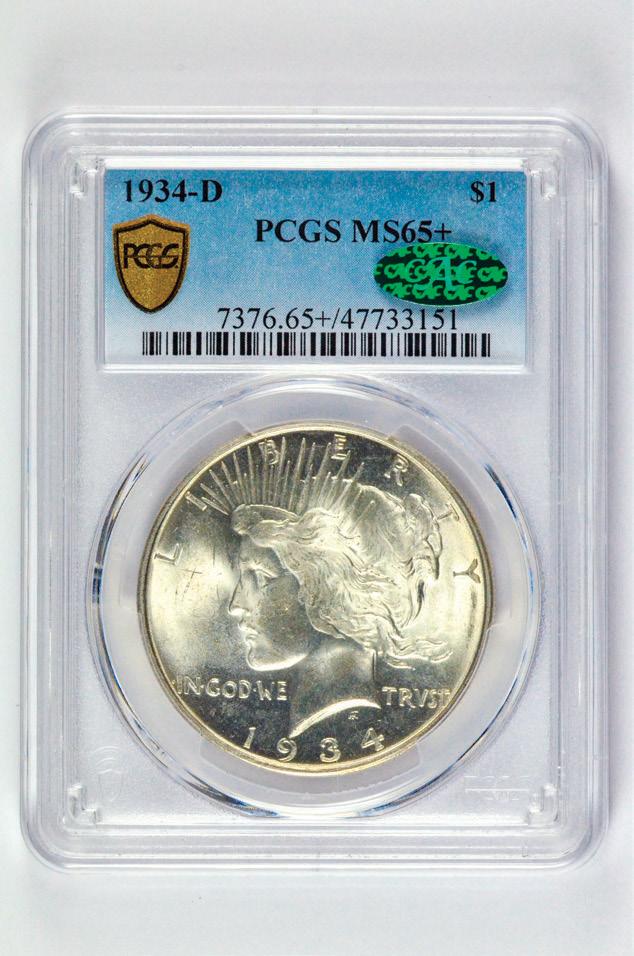

By Joshua McMorrow-Hernandez

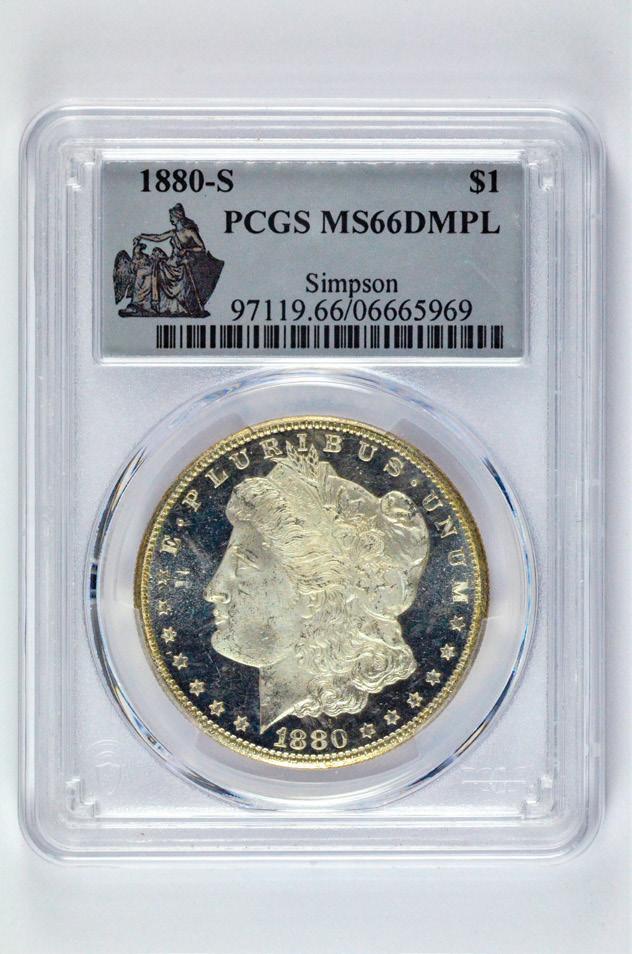

There are few series as popular or as widely beloved as the Morgan Dollar, a quintessentially American coin that was in production from 1878 through 1921. The coin was officially named the Liberty Head Dollar, but numismatists and the American public dubbed it the “Morgan” Dollar in a nod to the coin’s designer, George T. Morgan. The nickname stuck, and so, too, has the collectability of a series that features numerous rare dates and scarcities, either in the absolute or conditional senses.

Several issues in the Morgan Dollar series are tough in all respects, and among those is the 1892-S. This challenging San Francisco issue was struck to the tune of 1,200,000 pieces, a mintage that may not seem all that small at first blush. However, many are believed to have been melted to meet the requirements of the Pittman Act of 1918, which saw the melting of 270,232,722 silver dollars.

Legendary numismatic author Q. David Bowers wrote in his seminal volume Silver Dollars & Trade Dollars of the United States: A Complete Encyclopedia that “many if not most 1892-S Dollars were placed into circulation at or near the time of issue, and few were saved in Mint State.” He went on to say that “it was not until comparatively recent years that the rarity of the 1892-S has been recognized; this after the San Francisco dispersals from storage in the 1940s and 1950s apparently yielded no bags of this date, nor were any among the untold millions paid out by the Treasury during the 1962-1964 emptying of government vaults. However, it is known that at least one bag of 1892-S Dollars was paid out by the San Francisco Mint in 1925-1926. Few coins reached numismatic circles, as there was little collecting interest in Morgan Dollar mintmarks at the time.”

Specimens grading MS65 or better have proven to be downright rare. In fact, PCGS estimates a mere 64 survive in MS65 or higher grades – a numismatically tiny number that simply cannot meet the demands of thousands of Morgan Dollar Registry Set collectors, not to mention countless other numismatists who want the finest examples of this rare silver dollar from the Gilded Age.

Stack’s Bowers Galleries recently received a consignment to their Summer Global Showcase Auction of an outstanding 1892-S Morgan Dollar graded PCGS MS67 and housed in an early generation holder. The coin has been off the market

for nearly four decades. Stack’s Bowers Galleries Executive Vice President Christine Karstedt says the coin is “a simply beautiful example with superb detail and outstanding eye appeal.” She goes on to say, “The surfaces are virtually pristine with strong luster in a soft satin texture. Richly and originally toned, it was obviously preserved with great care since the time of striking.”

The coin boasts a subtle mottling of olive-gold and pearl gray iridescence, and the reverse exhibits warm mauve-gray patina in the fields and atop the devices with bolder and more vivid steel-blue iridescence nestled in the protected areas around the motifs. Karstedt says, “This is a completely original coin that was almost certainly acquired directly from the San Francisco Mint in 1892.”

With an estimated value of half a million dollars, this resplendent 1892-S Morgan Dollar will serve as a crown jewel in a prestigious Morgan Dollar collection. Should it find a home in a PCGS Registry Set, it may mean the difference between landing a top spot or merely running in second place.

By Sanjay C. Gandhi

One country that has long been culturally rich with gold is India. For millennia, gold has been part of religious ceremonies, weddings, and savings for many of its citizens. Standardized gold coinage was first struck around 100 A.D. by Kushan Emperor Vima Kadphises. Many dynasties ruled India, but none was greater in terms of wealth than the Mughal Dynasty. They controlled the Indian subcontinent and other surrounding regions for over two and a half centuries. At the beginning of the 18th century, the Mughal Empire was worth almost 25% of the world’s gross domestic product (GDP), or the equivalent of $21 trillion dollars in today’s terms! One can only imagine how much gold must have been lying around in the Mughal Empire’s treasuries.

The British, like the Spanish, had ambitions to gain wealth from commerce and colonization simultaneously. On December 31, 1600, Queen Elizabeth I approved the formation of the British East India Company, or EIC. The firm was granted sole trading all with Eastern countries, essentially granting the EIC a monopoly over its business region. In 1608, William Hawkins from the EIC visited India and landed in the city of Surat, which is in the state of Gujarat. The EIC wanted to conduct business in India, but first had to seek approval from the emperor.

Hawkins made fast friends with the fourth king of the Mughal Empire, Nur-ud-din Muhammad Salim, or Jahangir. The name Jahangir translates into “conqueror of the world.” This meeting between Hawkins and Jahangir led to further business development within the country by the EIC. In 1613, Jahangir minted a 12-kilogram gold coin denominated as 1,000 mohurs and produced as a presentation piece for Yadgar-Ali, who was the ambassador to the king of Iran. This massive coin known as the “Kaukab-i-Tali” emerged briefly during a Swiss auction in 1987. The seller was unhappy with the bids received, so it was withdrawn by the seller. The whereabouts of the coin today remain unknown. Jahangir’s son, Shah Jahan, took over the rule of the Mughal Empire in 1628, and relations with the EIC continued to strengthen. Tea, textiles, porcelain, spices, and other far eastern goods that were not available within Great Britain were being exported/ imported by the EIC. Tea became the most popular import from China at the beginning of the EIC empire, and opium shipments for China began in 1650, amounting to about 3,000 metric tons. By 1690, the state of West Bengal in India, whose capital is Calcutta, set up a port to accommodate increased commerce. In addition to the port, the EIC arranged poppy flower (opium) growing operations near Calcutta to fulfill blistering demand, and the Calcutta Mint was also established by the EIC as well in 1757. By the end of the 18th century, opium became the primary source of income for the EIC.

Opium exports headed for China continued to flourish and had grown by about 700% or 21,000 metric tons until 1822. By 1835, these sales would grow by an additional 400%, meaning that the East India Company was now exporting 85,000 metric tons of opium destined for China. Money began to pour in for the EIC, and taxes collected by the British Crown ballooned.

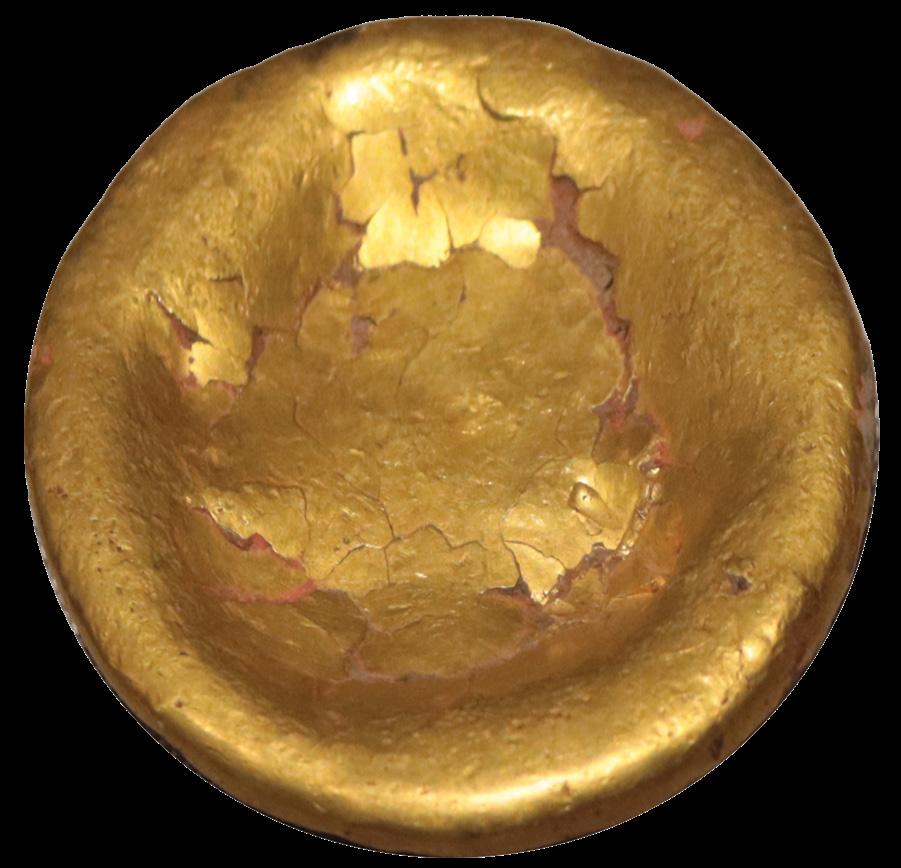

The EIC and the British government decided to mint gold bullion coins bearing the portrait of King William IV in 1835. Two denominations were introduced: the mohur, which weighed 11.66 grams of .917-fine gold, and the 2 mohurs coin, weighing about 23.34 grams. The obverse with the king was designed by Robert Saunders, and the reverse, showing a lion in front of a palm tree, was crafted by John Flaxman. Both coins were available for purchase at the Calcutta Mint beginning on January 1, 1836. The main unit of currency in India is the silver rupee, which would be similar to the United States silver dollar or the British pound sterling. These bullion coins were not legal tender but equivalent to 15 silver rupees (1 mohur) and 30 silver rupees (2 mohurs) respectively.

The 2 mohurs coin has a mintage of 1,174 coins and is also known as the “double mohur.” It is the largest gold coin minted under British India and is exceptionally rare. In 2020, a gold British India PCGS AU50 1835.(C) gold India 2 Mohurs sold for a little over $70,000 at Sincona AG of Switzerland. Less than a handful are known to exist in business strikes, and an uncirculated example is not known to exist. A proof of the double mohur does not exist, however, this large coin became so popular that it could be ordered as a proof restrike up until 1970! Restrikes are coins that were once officially minted and coined again at a later date, bearing the same date. If you provided the proper metal mixture, the Bombay Mint would restrike any coin your heart desired for a fee starting in 1947.

Dealers from the United States, Great Britain, and Australia ordered thousands of restrikes. One of the largest purveyors of Indian restrike coinage was department store Montgomery Ward in the United States. A proof restrike rupee could have been had in a blister pack for about $6.99. Orders were no longer fulfilled beginning on July 1, 1970. The dies at the Bombay Mint were subsequently ordered to be destroyed due to mounting political pressure. On January 10, 2022, Heritage Auctions sold a PCGS PR65DCAM Restrike 1835.(B) 2 Mohurs gold coin for $108,000.

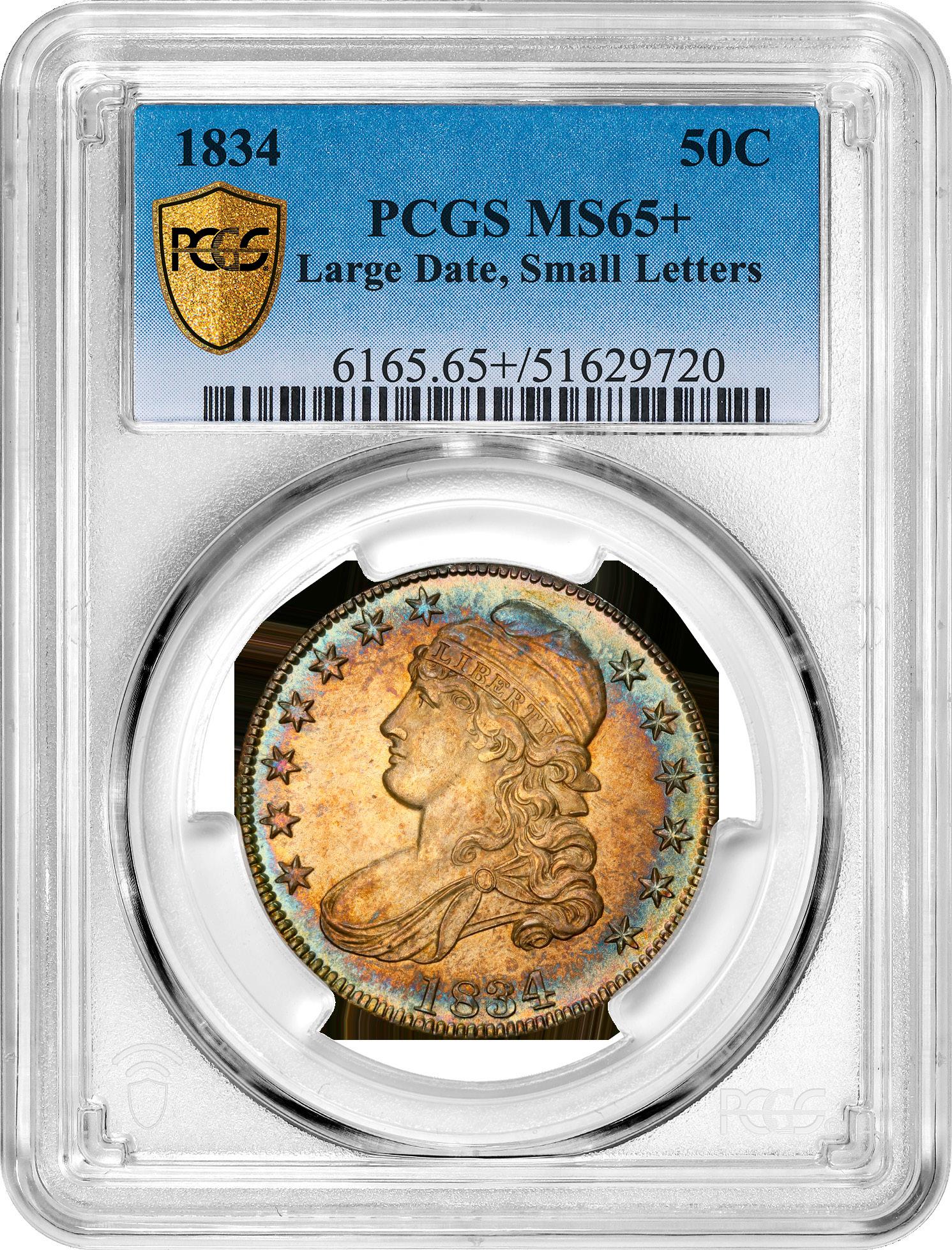

PCGS PR65 Restrike 1835.(B) British India

The 1 mohur coin is more common than the 2 mohurs coin. But, the coin is very difficult to obtain with a PCGS Mint State grade. Auction World Co. Ltd of Japan sold a gold British India PCGS MS62 1835.(C) 1 Muhur for a little less than $18,000 in 2020. Restrikes of the 1 mohur coin exist, and they are more commonly found than the business strike, and they are very modern looking in appearance. Both of the 1 mohur and 2 mohurs coins can be found in the following set titled India Denomination First Design Type Set (1835-1858) within the PCGS Set Registry.

Coining gold for the British East India Company didn’t last very long, as losses began to mount quickly. After a few months of operations, the British government bought all the gold reserves that had piled up in 1836 from the EIC, and operations for coining gold ceased at the Calcutta mint. The citizens of India at the time preferred to trade gold in the form of ingots. Most of the mintage of 1 mohur and 2 mohurs coins that had piled up in the Calcutta treasuries were more than likely melted and recoined later. Business strikes of these coins do not have a large population at PCGS, and they are more frequently found as a restrike.

Even though the first gold coining ventures of the British East India Company failed, the 1835 1 mohur and 2 mohurs coins are highly sought after by collectors nowadays. The year 1835 also marked when the opium trade began its hyper-growth for the British East India Company, which was later dissolved in 1874. However, the brisk opium sales continued by the British Crown, with almost 400,000 metric tons shipped in 1880 headed to China. By the beginning of the 20th century, the opium trade was on a decline and had nearly ceased to exist after World War I. By 1915, the British Crown had an enormous amount of gold, and more gold was extracted from all its colonies after World War II. It is estimated that the Bank of England had over 2,500 metric tons of gold in 1950.

The Taj Mahal in Agra, India, is known as one of the seven wonders of the world. It took over 22 years to complete, and building it in 2025 would cost over $1 billion USD. This magnificent mausoleum was commissioned by Mughal emperor Shah Jahan, and he constructed it in memory of his wife Mumtaz Mahal, who died in 1631. This building is primarily made of white marble, and the project was completed in 1653. The Taj Mahal has one central dome shaped like an onion, four smaller domes beneath, and four pillars that flank the corners. All of these features of the building are decorated with finials, which are metallic twisting decorations. When the central dome was constructed, it had been decorated with a solid gold 31-foot finial. It was removed and melted by the British government in the early 19th century.

Between 1999-2001, the Bank of England sold off 400 metric tons of gold at an average price of $275 per ounce. Currently, The Reserve Bank of India holds over 879 metric tons of gold in its treasuries, and they added 72 metric tons in 2024. Great Britain currently holds 315 metric tons, and that number has been the same ever since 2002.

If Mumtaz Mahal knew what the mughal king Shah Jahan had built in her memory, she might be singing the chorus “you’re the ruler of my heart” which is part of the 1984 soul-soothing smash hit “You’re Love is King” by British smooth jazz singer Sade. Currently, India’s citizens privately hold over 25,000 metric tons of gold. If Shah Jahan knew about this statistic today, he might be smiling as long as the length of the Yamuna River, where the Taj Mahal rests quietly on the banks in Agra.

September 23 - 27, 2025

Donald E. Stephens Convention Center 5555 N River Rd, Rosemont, IL 60018

By Peter Anthony

Long, long ago, at a time when lakes and rivers didn’t exist yet, a crowd clustered together in an open field. A white-haired woman cried aloud, “Heavenly Lord, rid us of this calamity, please save us!” Around her, fruits and cakes were placed on a makeshift altar. Smoke from incense sticks floated upward to smudge an impeccably blue sky. Not a cloud was in sight. After weeks of no rain, the soil was cracked and the crops withered. A gaunt ox watched the hubbub and abruptly bellowed, its voice added to the chorus

In this era, only the constant rains sent by the Jade Emperor in Heaven sustained life. Lately, however, he was distracted by amusements and forgot about the people and their rain. Not even a drizzle fell onto the fields.

A child wailed, and far away in the Eastern Sea, the Pearl Dragon heard it. “Come here!” it called to the three other dragons that lived in the ocean. The Long Dragon, Black Dragon, and Yellow Dragon swam over. “Did you hear that? Follow me!” and it leapt into the sky.

After a while, the Pearl Dragon pointed down. “See,” it exclaimed.

Yellow Dragon said, “Those people will die if there is no rain soon.”

“We must ask the Jade Emperor to send rain,” added Long Dragon.

Although the four wingless dragons knew they were not welcome, they nevertheless went to the Heavenly Palace of the Jade Emperor. He stopped his activity and stared at them crossly. “Did I invite you here?” he thundered.

Long Dragon bowed and murmured, “Your majesty, the land is dry and the people whither just like their crops. Please send rain.”

“Alright, go now, and I will send rain tomorrow,” the emperor responded. Then he turned back to his pleasures.

With much praise, the four dragons flew back to the Eastern Sea. But the next day came and went with no rain, and likewise the following days. The dragons knew that the emperor had deceived them. Then the Long Dragon spoke, “We are surrounded by water here. Let’s bring some to the people.”

“Yes, yes,” the others replied.

“But there will be trouble if the Jade Emperor learns of this,” observed Long Dragon.

“We cannot let the People perish!” the others responded. With that the dragons scooped up water in their mouths. They flew aloft and sprayed the water out so that soon clouds began to form. Eventually the whole world was covered by clouds and rain started to fall.

Water, rain, wind and storms are powers of nature that Chinese tradition accords to dragons. Beloved as powerful protectors and benefactors of humankind, the dragon was adopted as the imperial emblem of China during the reign of Liu Bang, the Han Dynasty founder who lived from 256 BC to 196 BC.

Liu had been born to a common family. An outspoken and charismatic man, after he rose to power and declared himself emperor, he needed a symbol that could validate his new status. According to legend, he asserted that his mother encountered a dragon while she slept beside a marsh. After this, she became pregnant with him. This conferred on Liu, who became known as Emperor Gaozu, a divine origin. In modern coinage, he is honored as a rider, arm raised on horseback, on a 1986 100 yuan, one-third ounce, .999-fine gold coin.

From the Han dynasty onward, the dragon appears on buildings, robes, and all manner of imperial decorated objects. Among the most famous depictions are a trio of walls, or screens, that portray nine dragons. Why nine? Because it is the largest single digit. The oldest of these walls is in the city

of Datong. It was built for the mansion of a son of the first Ming Dynasty emperor who reigned from 1368-1398 AD. The mansion later burned down, but the Nine-Dragon wall somehow survived.

Another of these walls is in the Forbidden City, the imperial palace, in Beijing. The third is also in Beijing, this one in Beihai Park. It may be the most impressive of the three because it is a freestanding monument with nine dragons on each side. It was built in 1756 for the Qing Dynasty emperor, Qianlong.

Walls and robes were one thing and coins another. No dragon appeared on a Chinese coin until the late 19th century. Traditionally, coins in China were manufactured through a casting process. By the mid-1800s, as trade with foreign

countries blossomed, silver coins from Mexico, England, the United States, and France poured into China. As these were not legal tender, merchants had to test and stamp them with a chop mark to certify the quality.

Businesses demanded a home-grown silver coin. China’s answer was to import machinery from the West to strike a new silver Dragon Dollar. The first ones were minted in 1889 at the Kwangtung, or Canton, Mint in what is today Guangzhou. Their design features an imperial dragon similar to the one on the emperor’s robes. These Dragon Dollars contain 27.2 grams of 90% silver and are 38.1 millimeters in diameter, which are the same specifications as the most widely used foreign coins of the period.

When the Qing Dynasty was overthrown in 1911 and a republic was established, the Dragon motif was immediately abandoned. Seventy-seven years would pass before a dragon would again grace a Chinese coin – on the 1988 Year of the Dragon gold, platinum, and silver issues. Two years after that a set of Dragon- and Phoenix-themed coins was minted. Inspired by a painting, the auspicious pair represents female and male qualities in traditional Chinese culture. There are eight different Dragon and Phoenix coins that range from 20-ounce gold and 20-ounce silver coins down to coins containing just two grams of silver and a tiny one gram of gold.

Two years later, in 1992, a pair of Dragon and Horse coins were released. One is a 25-yuan gold coin that contains a quarter ounce of .999-fine gold. The other is a 20 yuan silver coin with two ounces of metal. After that, one more Dragon and Phoenix coin was released in 1994. It is a 10 yuan bimetallic coin that contains one-tenth ounce of gold surrounded by a 1/28-ounce silver ring.

After that, a curtain descended on dragon coin designs. For the next 31 years, the only instances in which a dragon appears on a Chinese coin are for Lunar New Year celebrations. So, collectors were electrified this year when word of a new annual series of silver dragon bullion coins spread. The new Dragon coins each contain one ounce of .999-fine silver. On the opposite side is a view of the Great Wall with dragon-like curves. All will be struck at the Shenzhen Guobao Mint.

The dragon design for 2025 is inspired by the Nine Dragon screen in Beihai Park. It is not an exact copy of any of the figures, but it captures the character and spirit of the mythic Chinese creature that has served the People with water, hope, and strength since ancient times.

This is China’s second series of bullion coins after the Panda. While the Panda series uses the metric weight system, the Dragon coins are measured in ounces, something that should please many international lovers of silver.

Unlike the Panda, the only design change each year will be the date. Of the total 2 million mintage for 2025, 90% are said to be slated for export from China.

At the Dragon coins’ debut at the Singapore International Coin Fair, hundreds of would-be buyers waited for hours in a line that zigged and zagged dragon-like between dealers’ tables. People cheered and phones clicked as a young woman bought the first one. The show limit was one coin per person.

Besides the raw Dragon coins, there are also limited editions of coins sealed in a special card with a different design for each coin show location: Singapore (2,000), Hong Kong (3,000), Tokyo (3,000), and Oklahoma City (in August). As no raw coins were graded at the show, the 2,000 Singapore card coins may turn out to be the only ones specifically linked

to the first release. The Tokyo coin card distribution was entirely online to promote the widest possible distribution. Successful entrants receive their cards at their addresses in Japan.

A local god had watched the dragons take the sea water and spread rain across the land. He reported what happened to the Jade Emperor. The enraged Emperor then sent his Heavenly army to arrest the four dragons. The hapless quartet were hauled up to the Palace. There, the Jade Emperor commanded, “Bury these four scoundrels for all time. Let everyone know what it means to defy me.”

So, the dragons were entombed beneath four peaks. In spite of all this, they did not recant their deeds. Instead, determined to

continue to help the People, the dragons changed themselves into water, flowed out from beneath their prisons, and became four rivers that finally reached the sea. This is how China’s four great rivers formed: in the far north flows the Heilongjian (Black Dragon River), the central area has Huanghe (Yellow River), the Changjiang, or Yangtze (Long River) lies south of that, and in the far south runs the Zhujiang, or Pearl River, that reaches the sea around Shenzhen and Hong Kong.

I stand on the bank of the Yellow River, Huanghe (Wonghe, as in her) in Gansu Province, and watch water swirl and hurtle by only a couple of yards away. It is swift as a mountain stream, but easily a half mile wide. More than a thousand miles downstream, it will reach the sea, but by then it will be tamer. Here, though, in a land that doesn’t get too much more rain than Los Angeles does, this huge river really feels like a living gift from a benevolent dragon. As so often happens in China, present and past are woven together: new silver coins and ancient tales.

Incidentally, the China Mint revived almost the exact physical specifications of the original Dragon Dollar in 1983: the 10 yuan proof silver Panda coins from 1983-1985 contain 27 grams of 90% silver and are 38.6 millimeters in diameter. Another coin that shares the same measurements is the 1986 5 Yuan International Year of Peace silver coin. Happy collecting!

By PCGS President Stephanie Sabin

What an honor to be the first person at PCGS who gets to share their numismatic reflections for this new section of PCGS Insider! As someone who hails from a family of numismatists and collectors, I am proud to say that PCGS is a big part of who I am. My love for the hobby began as a child, spending time at the coin shop where my father worked. I loved looking at all the coins he had for sale and getting to know the stories behind them. This experience of growing up surrounded by pieces of history eventually led me to join PCGS in 2006, where I served as a bulk dealer liaison.

My role with the company evolved and expanded into leading our international operations and launching new business lines. I became president in 2021 just as our company was achieving record growth. We accomplished new goals and reached for the stratosphere through incredible teamwork.

Much of my time is spent with boots on the ground across the country or overseas to attend coin shows, engage with teams at international offices, or meet with partners and clients. Fostering professional relationships and guiding our team toward new horizons is a big part of what I do, and I love it. A key part of my philosophy is leading with the idea that everything is figure-outable. In other words, there is always a way to manage everything – whether it’s handling an unexpected challenge or finding solutions for new opportunities. You take a step back, collaborate, and move forward with a plan.

Running a company like PCGS is multifaceted – it’s as much a vocation as it is a career. I maintain close connections with my passion for numismatics even in my downtime. My coin collection is always growing. Some of my favorite coins are those in the PCGS Sample

Slabs we’ve given out at luncheons, grand openings, and other events over my nearly two decades with the company. Each PCGS Sample Slab represents memories from different chapters of my career, people I’ve gotten to work with or met through PCGS, and other wonderful times from years gone by. I also love my 2009 Ultra High Relief $20 gold coin. It was my first big numismatic purchase and captures a modern restrike of the classic Miss Liberty design by sculptor Augustus Saint-Gaudens, first seen on the double eagle gold coin in 1907. I also love any coin that references Shakespeare and would love an Elizabeth I gold sovereign.

Given my love of “The Bard,” you might guess I’m an avid reader. I also like to crochet and enjoy watching and talking about sports – especially my beloved Anaheim Ducks and Cleveland Browns. Cleveland Rocks!

I am so fortunate to have built a career doing what I love alongside people I have known for most of my life, in a hobby that has shaped me into who I am. Some of my most cherished times are when I get to talk coins with my dad, who still teaches me so much about the hobby I love. That speaks to the larger idea that the value of coins is measured by more than just their intrinsic worth, their art, or their history. Coins help bring people together. I came to realize early on just how big and friendly our numismatic community is; it’s a community where many people not only want to share what they know with others, but where they also want to help others become better collectors and, yes, even become better people. There’s real camaraderie in numismatics, and it’s a place for everyone from all backgrounds and walks of life. It’s a place I feel very lucky to call “home.”

The Liberty Coin Act authorizing the American Silver Eagle was signed into law by President Ronald Reagan on July 9, 1985, with the first coins going into production in autumn 1986

By Christopher Bulfinch

Forty years ago, President Ronald Reagan signed the Liberty Coin Act into law. Among its provisions was the production and issuance of bullion coins, the first such coins produced for sale to the American public. American Gold and Silver Eagles (AGEs and ASEs, respectively), introduced in the fall of 1986, became and remain popular not simply as precious metals investment vehicles but as collectible U.S. coins in their own right. With several genuinely rare dates and numerous finishes, the decades-long series appeals to numismatists interested in ultra-modern Mint products and bullion stackers alike.

Four decades after the enactment of legislation introducing the American Eagle bullion coin program, the coins have emerged as a collectible series in their own right, offering silver stackers and numismatists alike an ongoing selection of products. Beginning in the late 1970s, talk emerged in government circles about liquidating precious metals held in the Defense National Stockpile Center, holdings of strategic raw materials created in the years leading up to the Second

The Liberty Coin Act authorizing the American Silver Eagle was signed into law by President Ronald Reagan on July 9, 1985, with the first coins going into production in autumn 1986

World War. Efforts to make precious metals available to the public and to generate revenue motivated the selloff, further justified by a large domestic silver supply.

In the 2018 third edition of American Silver Eagles: A Guide to the U.S. Bullion Coin Program, John Mercanti explains the thought process of the silver senators navigating legislative efforts to sell the silver by striking bullion coins: “We can’t fight the silver selloff forever; if it has to occur, at least we try to control it.”

Political wrangling through the early-to-mid 1980s resulted in the Liberty Coin Act, legislation authorizing both bullion coins and a trio of commemorative coins honoring the Statue of Liberty.

The silver bullion coins were to “have a design (A) symbolic of liberty on the obverse side; and (B) and [an] eagle on the reverse side” and contain one ounce of .999 fine silver.

The coin’s obverse design was an adaptation of Adolph Weinman’s Walking Liberty motif, which had appeared on the half dollars for decades from 1916 to 1947. According to reporting in CoinWeek, the design was selected because Treasury officials did not have sufficient time to solicit original designs. John Mercanti, a staff engraver at the Mint since 1974, designed the reverse, which was a traditional eagle resembling the Great Seal of the United States. In his book, Mercanti explains: “I didn’t want a flying eagle for the American Silver Eagle coin… I wanted something more formal; more heraldic.” The result was a motif described as the Heraldic Eagle reverse.

The original Adolph A. Weinman design as it appeared on the half dollar from 1916 through 1947

The bill became Public Law 99-61 with President Reagan’s signature on July 9, 1985. The coins entered production in October of 1986 with a ceremony attended by Treasury officials. Bullion strike and proof coins were struck at the San Francisco Assay Office that year, a fact uncovered in 2020 by Paul Gilkes of Coin World via a Freedom of Information Act request. Only the proof issues bore that facility’s “S” mintmark.

Third-party grading entered the numismatic scene around the same time as the American Eagle bullion coins; PCGS launched the same year as the new bullion coins, in 1986. Populations have ballooned over the intervening decades and numerous labels and other encapsulation programs. In an email interview for this piece, Joshua McMorrow-Hernandez, editor-in-chief of PCGS Insider, said that “third-party grading cultivated the rise of the ‘70’ collector -- someone who builds collections of American Silver Eagles graded only MS70, PR70, and / or SP70. This in turn helped the numismatic world realize just how scarce some of these coins really are in the coveted grade of 70. Take a look at some of the populations for 70-graded silver eagles from the 1980s and ‘90s, especially bullion strikes, and you’ll see what I mean. Among the early silver eagles, the 1988 is especially scarce in MS70, while the 1993 and 1994 offer fewer than 120 specimens each in a grade of PCGS MS70. The scarcity of premium-grade American Silver Eagles fosters an exciting degree of competition among collectors on the PCGS Set Registry, a collecting platform that in itself has helped fuel terrific interest in modern coins like the American Silver Eagle.”

The 1994 American Silver Eagle bullion strike in PCGS MS70 is conditionally rare, as are many other issues of similar vintage in the series

is widely regarded as the main key date of the entire series

Major anniversaries or milestones of the program have been marked by the issuance of ASEs differentiated in some way from their bullion or proof counterparts, and a couple of ASEs issued in the last decade blurred the line between bullion and commemorative coins. To mark the series’ 10th anniversary, the Mint produced a proof set of all AGE denominations and an ASE, all struck at the West Point Mint, bearing the facility’s “W” mintmark. Proof ASEs were struck at the Philadelphia Mint at that time, and the mintage at West Point was limited to the coins included in the 10th anniversary sets, 30,125 in total. This small mintage makes the 1995-W Proof the series’ first and major key date.

In 2006, a reverse proof issue was introduced to mark the silver eagle’s 20th anniversary, as were bullion strike examples struck on burnished planchets. The year 2016 saw edge lettering applied to bullion strike and proof issues acknowledging the series’ 30th anniversary. Some “artificial rarities,” ASE issues with limited mintages, command prices substantially higher than typical values for common issues. The 2019-W Enhanced Reverse Proof, issued with numbered certificates of authenticity signed by then-Mint Director David J. Ryder, were selling for five-figure prices in the wake of their issuance. Prices have since settled, but the issue is a notable rarity in the series.

In 2020, a privy mark commemorating the 75th anniversary of the end of the Second World War was added to the American Eagle bullion coins and had a limited mintage of 75,000.

has graced the

In 2021, a new design debuted on the coins. Emily Damstra’s Eagle Coming In For A Landing motif replaced Mercanti’s Heraldic Eagle design. Damstra’s design was the preference of the Commission of Fine Arts for the AGE, rather than the ASE, per Gilkes’ reporting in Coin World. Mint Medallic Artist Michael Gaudioso sculpted Damstra’s design shortly before his retirement.

The changeover offered a collecting opportunity as Stack’s Bowers Galleries, in partnership with the U.S. Mint, conducted the American Eagle At Dusk and At Dawn Sale 35th Anniversary Auction on September 1, 2022. The final 500 examples of the Type I ASEs and AGEs struck and the first 500 of the first 500 of the Type II designs were on offer; then-Mint Director David J. Ryder operated the press that struck all 1,000 coins.

The Mint also offered sets with both ASE designs in various finishes, marking the changeover. The above-mentioned issues are by no means a comprehensive list of the various commemorative issues and sets, including ASEs.

The first-year-of-issue 1986-S Proof American Silver Eagle

By Joshua McMorrow-Hernandez

Emerging from a landmark piece of numismatic legislation, the American Silver Eagle was born on July 9, 1985, when President Ronald Reagan signed the Liberty Coin Act into law to authorize production of the coin. When it was first pitched by legislators, the American Silver Eagle was intended to serve as a bullion coin for investors who wanted to store wealth in the form of tangible assets such as precious metals. And there’s little doubt that the American Silver Eagle has fulfilled that goal many times over since the first specimens were struck in 1986. However, what many of the coin’s earliest proponents may not have foreseen was just how popular a collector coin the American Silver Eagle would become.

Nearly 40 years after the first Silver Eagle was sold to the public, the numismatic merits of the world’s most popular bullion coin – nearly 700 million sold – have come into clear focus. While proof Silver Eagles, principally intended for collectors, have been sold since the year the coin debuted, the collector appeal of the series has grown well beyond proofs. Since 1986, the United States Mint has produced a variety of Silver Eagles in a plethora of finishes to also include reverse proof, enhanced reverse proof, enhanced uncirculated, and “burnished” (what the United States Mint terms uncirculated and what PCGS categorizes as Specimen).

And that’s not all. Collectors even love the regular American Silver Eagles with their “bullion” finish. In fact, these are arguably the most widely collected Silver Eagles, often constituting the basis of many sets, including thousands of PCGS Registry Sets.

But what’s the appeal of the American Silver Eagle anyway? Isn’t it, as some may dismiss, “just a bullion coin”?

Hardly… It’s not “just” a bullion coin.

It’s a versatile modern-day silver dollar that appeals just as much to steely bullion investors as it does diehard numismatists. Surely, there’s the aesthetic factor. What’s not to love about the American Silver Eagle? It has always proudly carried Adolph A. Weinman’s timeless Walking Liberty design, resurrected from the United States half dollar of 1916 through 1947. When the Silver Eagle premiered in 1986, it sported John Mercanti’s modern-esque heraldic eagle reverse, which was replaced in 2021 with a soaring eagle motif designed by Emily S. Damstra and engraved by Michael Gaudioso.

Then there’s the rarity factor. Yes, some American Silver Eagles are absolutely scarce, if not due to mintage, then because of conditional rarity status for some issues. (Yes, not every Silver Eagle gets to earn a “70” grade!). There are even some captivating varieties and other novelties to be found among the American Silver Eagle, making it a terrific modern series for collectors (and investors) of every type.

To celebrate the 40th anniversary of the passage of the Liberty Coin Act that spawned the American Silver Eagle, let’s explore 10 issues hailing from the bullion program that became a numismatic success.

The 1994 bullion silver eagle has become a surprisingly scarce coin, not necessarily because of a lower mintage (it saw a relatively anemic 4,227,319 strikes). Rather, the scarcity of the 1994 bullion issue is seen on the front of conditional rarity, a circumstance of the high frequency of milk spotting seen with this issue and several others from this period. Milk spots, whitish-colored blotches that the Mint acknowledged and may stem from the process of preparing silver planchets for striking, affect grade and can result in grade deductions. This has been the case with 1994 bullion strikes, few of which have been able to earn a PCGS MS70 grade, in part due to the presence of milk spotting. At present, only 97 examples have been conferred the grade of MS70, a threshold of numismatic “perfection” at which PCGS-graded pieces currently command $11,000.

The 1986 bullion strike saw a mintage of 5,393,005, which is not by any means the lowest production figure for the coin. However, its mintage of less than 5.4 million, coupled with the incredible collector demand for this first-year issue, pushes its value significantly above spot price even in lower Mint State grades. Yet, in grades of MS69 and especially MS70 values notably increase. As of this writing, 23,687 examples have been graded by PCGS in MS69, while only 2,101 have earned the MS70 grade. These population dichotomies are reflected in the coin’s price, which as of print time was $110 for an MS69 example but $1,000 for an MS70.

The United States Mint celebrated the 10th anniversary of the American Eagle program by issuing the 10th gold proof set with a special addition: a free 1995-W Proof Silver Eagle. The five-piece set, inclusive of the free bonus Silver Eagle, was sold for $999; it must be remembered that was a high price to pay for a gold bullion coin set at a time when gold prices were still around $385 per ounce. When all was said and done, only 30,125 proof silver eagle strikes were emitted from the West Point Mint, and the 1995-W Proof was quickly recognized as the series key. Before long, thousands of 1995-W silver eagles were being broken out of their proof sets and submitted for grading as an individual rarity, though only a relatively small share scored the coveted PR70DCAM grade. In 2013, one of the then-few examples graded PCGS PR70DCAM fetched an astounding $86,655 at auction, with prices coming down as populations have slowly increased. Today, PCGS has graded around 525 in the grade of Proof-70, a threshold at which specimens currently command some $19,000. The decidedly more “affordable” PR69 specimens trade for closer to $3,500 – a price still well fitting for the “king of American Silver Eagles.”

When it comes to year-over-year regular bullion strikes, the lowest mintage of the series was claimed in 1996 by that year’s bullion issue. Only 3,603,386 strikes were produced, leaving many to wonder why so few were struck in the first place. Remembering that Silver Eagle bullion strikes have been produced to meet general market need, the prevailing factor for low mintages in the case of the 1996 bullion emission was simply anemic demand. In the mid-1990s, precious metals markets were not as mercurial as they are today. Silver traded for around $5.20 an ounce in 1996, and swings of even just a dollar or so for the metal over the course of a year merited headlines in industry-related media. There simply was not enough market fervency around silver to warrant striking tens of millions of silver eagles in the mid-’90s, let alone even seven or 10 million pieces. What that leaves for collectors today is the widely declared “key date” for the bullion date set, with an MS69 example currently trading for $100. PCGS has graded around 300 in MS70, with those pieces retailing for $3,750.

Alongside the unfamiliar Burnished 2006-W Silver Eagle came the 2006-P Reverse Proof, a Philadelphia strike bearing cameo-frosted fields and highly mirrored devices and inscriptions. This unusual offering intrigued the numismatic public and became an instant hit with collectors. This firstyear offering was sold in conjunction with its other inaugural counterpart, the 2006-W Burnished and 2006-W Proof in a three-piece coin set honoring the 20th anniversary of the American Silver Eagle program. The set sold through its maximum authorized production of 250,000 (with a price of $100) units, creating what became the second-lowest mintage of its time for any proof Silver Eagle, behind only the 1995-W Proof key date. Specimens currently trade for about $100 in PR69SDCAM, while those scoring a “perfect 70” take $325 as of this writing.

The 20th anniversary of the American Silver Eagle prompted the United States Mint to produce new offerings that eventually became mainstays of the silver bullion program. One of these is the 2006 Burnished American Silver Eagle, a coin boasting a finish that the Mint terms “Uncirculated” and is recognized as “Specimen” for the purposes of PCGS grading nomenclature. This first-of-its-type product originally sold for $19.95 when purchased directly from the United States Mint, and these pieces could be bought as part of a three-coin 20th anniversary set for $100 that also included that year’s proof and a newfangled novelty known as a reverse proof. Values as of this writing hover around $60 for an SP69 specimen and are about $225 for an example graded PCGS SP70.

The American Silver Eagle series isn’t bereft of die varieties (a few do exist), but certainly the most widely known is the 2008-W Burnished Reverse of 2007. Reported in spring 2008, this variety shows the smooth “U” in “UNITED” on the reverse characteristic of the font used on the coin from 1986 through 2007. In contrast, all 2008 Silver Eagles were supposed to feature a “U” with a little spur or descender on the bottom right of the letter. PCGS pegs the mintage of the 2008-W Burnished Reverse of 2007 to be 46,318, making this a scarce and valuable variety. Current values for the coin start at around $400, with PCGS-graded MS69 specimens going for $490 and MS70 examples garnering some $1,200.

The 2013-W Enhanced Uncirculated Silver Eagle exhibits three different kinds of finishes. A brilliant-mirrored sheen on the obverse date, red stripes and blue field on the American flag, the lines of Miss Liberty’s dress, and on the reverse, many aspects associated with the eagle. Light frosting is seen across the obverse and reverse. Finally, heavy frosting is present on the other design elements. The 2013-W Enhanced Uncirculated Silver Eagle was a first-of-its-kind offering, being offered for sale in the 2013 American Eagle West Point Two-Coin Silver Set, which was offered for $139.95 and saw final sales total 235,689 sets. Values for the coin today are $65 for an SP69 specimen and $90 for one graded SP70.

The 2019-S Enhanced Reverse Proof became the first real contender to unseat the 1995-W Proof from its “rarest issue” status. Released on November 14, 2019, this special issue had an initial price of $65.95 and a limited mintage of just 30,000. All sold out within mere minutes on the United States Mint website and became hot-ticket items in the secondary market, with prices soon approaching – then eclipsing – four figures. As of this writing, PR69 specimens notch $1,175, and PR70 specimens trade for a respectable $2,450. While it’s debatable whether the 2019-S Enhanced Reverse Proof is now considered “the” series key, given its mintage of 29,910 – technically a couple hundred clicks lower than the 1995-W Proof and its mintage of 30,125. For the moment, prices and general popularity of the 1995-W Proof seem to register a little higher, but it’s safe to say both the 1995-W Proof and the 2019-S Enhanced Reverse Proof serve as dual keys that keep collectors very busy when building complete sets of American Silver Eagles.

The 2020-W End of World War II Privy Mark Proof recognizes the 75th anniversary of the end of World War II in 1945. This became the first modern U.S. coin to carry a type of feature known as a privy mark, bearing the characters “V75” inside of a cartouche resembling the shape of the Rainbow Pool – a water element centrally featured at the World War II Memorial in Washington, D.C. The “V” in the privy mark stands for “victory” while the “75” denotes the anniversary of the war’s end. The maximum authorized production figure of 75,000 was quickly reached when the coin was issued for sale by the United States Mint on November 5, 2020. The coin retails in the secondary market today for much more than its $83 Mint-issued price, with PR69 specimens taking $350 as of this writing, and PR70 examples going for $550.

By Abigail Zechman

“I attribute my success to this – I never gave or took any excuse” ~ Florence Nightingale.

Florence Nightingale is known as the founder of modern nursing because of her dedication to personalized patient care and advocacy for proper hygiene practices by medical professionals. She was a powerful leader who spent her whole life fighting for better patient care.

Florence Nightingale was born in 1820 and named after the city where she was born, Florence, Italy. As part of a wealthy British family, she spent most of her childhood at a family estate in Great Britain. Her father homeschooled her and her sister, ensuring they got a proper education and teaching them all subjects, not just those deemed appropriate for women. However, outside of the classroom, her father believed in the traditional gender roles of the time, encouraging Nightingale to settle down and become a wife and mother. She pushed back against those plans, insisting she had a higher calling.

Nightingale believed that she had received a calling from God, telling her to devote her life to serving others and become a nurse. She accepted a position as the superintendent at the Institute for the Care of Sick Gentlewomen, improving the

quality of care there by installing hot water on all floors and finding ways to deliver hot food to each patient.

In 1854, during the Crimean War, reports came back to Great Britain about the horrible conditions soldiers were facing in field hospitals. Due to her dedication to high-quality patient care, Nightingale was asked to assemble a team of trained nurses to travel to the Ottoman Empire and help improve the field hospitals.

Working at a prefabricated field hospital Nightingale lobbied the government to supply, she pushed for proper hygiene practices such as handwashing to help stop the spread of disease. She also found ways to get the patients nutritious meals, and her team was able to provide them with individual care. Their changes transformed the hospital, making it healthier and more efficient and lowering the death rate from 40 percent to 2 percent.

After her return from the military hospital, Nightingale convinced Queen Victoria to launch the Royal Commission, which was tasked with improving the health of the British army. Nightingale also helped set

up the Army Medical College in Chatham, published Notes on Nursing: What it is, and What it is Not, and opened the Nightingale Training School to teach people about better patient care and more hygienic hospital practices. Because of her efforts, she is considered the founder of modern nursing.

In 2004, on the 150th anniversary of the Crimean War, Alderney, part of the Channel Islands, issued a 5-pound coin commemorating Florence Nightingale. The first of multiple coins commemorating the Crimean War, this one specifically honored Nightingale’s efforts and transformation of the field hospitals. The reverse features a portrait of Nightingale, surrounded by a halo of light and the words “Lady with the Lamp.” This was a nickname given to her by the soldiers because she carried her lamp with her as she went from bed to bed, checking on each of the soldiers and providing individual care, even in the pitch black of night.

By Joshua McMorrow-Hernandez

When a young Igor Shikhov was 10 years old, he picked up a few foreign coins that he says gave him “a tangible connection to history and the wider world.” Though he took several breaks from collecting coins as he got older, Igor’s interest in world history kept his passion for numismatics alive. In 2019, he purchased a few coins hailing from British West Africa being offered by an Australian retailer in Brisbane, Queensland. “I have to admit I was driven purely by curiosity and with no specific plan in mind.”

Igor remarks that the coinage of British West Africa is usually far rarer than meets the eye. “[It’s] a prime example where mintage figures often fail to reflect actual rarity. For some time, I had doubts whether it was realistic to put together a sufficiently complete set of one or several denominations, particularly given that the main sources of supply consist of rare auctions of large collections.”

The scholar’s interest in this area of coinage goes beyond numismatic intrigue alone. “I have developed a strong interest

in the political and economic history of the region, which is projected to become one of the three largest in terms of population and economic size by the end of the century. Therefore, I view this aspect of my hobby as a true win-win.”

He joined the PCGS Set Registry in 2018 after getting his first PCGS-graded coins and has since built a variety of challenging sets that include the British West Africa Penny Date Set (1907-1958) and British Elizabeth II Half Crown with Varieties (1953-1967). “I think the British West Africa penny date set is my favorite, which I hope to upgrade into a basic set (with all mintmarks) fairly soon, though such a set is currently unavailable in the registry.”

A recent acquisition came in the form of a 1927 British West Africa Penny, which Igor believes is an “unrecognized rarity” of which he can only trace about half a dozen examples. He still hopes to land a 1922-KN British West Africa Penny, a coin he says offers just one uncirculated specimen. “The story behind it is fairly well known: the King’s Norton mint refused to cancel or reduce the excessive orders it received in 1920 and only agreed to postpone production. As a result, they minted 12 million unwanted pennies (along with millions of halfpennies) during 1921-22, only to have them melted down in 1923-25. Surprisingly, we still have a dozen heavily circulated examples of this coin. Given this background, I’m uncertain if I’ll ever acquire a satisfactory specimen.”

Whether or not Igor ever claims his 1922-KN British West Africa Penny, his desire to study history and share his knowledge runs strong. “Know your coin. Don’t just focus on the specific coin you currently hold, but also delve into the history and context of the entire series or set you’re collecting.”

By Joshua McMorrow-Hernandez

Marc Vazsonyi’s numismatic adventures began at the tender age of seven, when he started collecting Lincoln Wheat Cents he found in circulation and through searching rolls. “I was fascinated by their unusual design and the concept of rarity across different years and mints,” he says. “My grandmother was also very influential in the beginning of my numismatic journey. She often showed me old silver and gold coins when I visited her in Switzerland, further fueling my interest in numismatics and giving me exposure to

Over the last decade, Vazsonyi’s collecting interests have evolved from vintage United States coins to world coinage, which more recently led him to the exciting realm of ancient coinage. “I collect Greek coinage from the archaic and classical period, as well as Swiss cantonal coinage from Zurich, St. Gallen, and Basel.” He loves collecting ancient coins for their artistry and history. “Holding a 2,500-yearold coin and feeling a connection to a person or place so far in the past is truly a surreal experience. I’m also fascinated by monetary history and find that ancient coins serve as the perfect medium for it to

His favorite coin is a hemidrachm from Thrace, Dikaia. “This coin is particularly special to me for several reasons, but what captivates me most is the charming archaic style used to depict Heracles. Very little is known about Dikaia beyond its coinage, which I find to be fascinating, as the coin serves as a legacy of a Greek citystate which existed about 2,500 years ago.”

Vazsonyi has parlayed his love of numismatics and history and a variety of interesting pursuits, including working for well-known coin dealer Jeff Garrett, the founder of Mid-American Rare Coin Galleries. “Jeff’s mentorship has played an instrumental role in my development and growth as a numismatist.” The young collector is also pursuing a degree in mathematical economics at the University of Kentucky.

“While I may not pursue numismatics professionally, in the future I hope to stay deeply involved in numismatics and eventually contribute to the study of ancient coinage with original research. I plan to continue nurturing relationships I’ve already built within the industry, while creating new ones along the way.”

By Edward Van Orden

Morgan Dollar varieties are among the most widely collected and well-publicized areas of United States numismatics. With more than 3,000 of them identified and documented, Morgan Dollar varieties represent virtually every type of variety known: from die doubling to different mintmark styles, repunched dates (RPDs) to repunched mintmarks (RPMs), overdates to overmintmarks, and more.

Known as VAMs (an acronym for the original cataloguers

Leroy “Van Allen” and A. George “Mallis”), they are replete with catchy names like “Wild Eye Spikes,” “Tripled Blossoms and Leaves,” and “Alligator Eye.” PCGS currently attributes 317 VAMs that have been identified by variety collectors as worthy of specific recognition and considered the most important, rarest, and/or most readily discernible.

Let’s discuss some of the well-known VAMs featuring prominent tailfeather variations.

In 1878, the first year of Morgan Dollar production, the Philadelphia Mint used three different reverse die designs (the A, B, and C Reverses) to strike over 10 million coins. The first of these reverses, the original design, features eight tailfeathers (as opposed to the latter two, which have seven tailfeathers). This 8 Tailfeathers (8-TF) design was then used to create at least 19 known 8-TF reverses (each with its own uniquely engraved wing-feathers configuration), which in turn were used to create the 41 known 8-TF Morgan dollar varieties.

Among the rarest of these are the VAM 14.19 (“Broken 8”) and VAM 14.17 (“Chip In Ear”). However, the most desired VAM among specialists and non-specialists alike may be VAM 9 because it was the “1st Die Pair” used to strike Morgan dollars.

The 8 Tailfeathers design was immediately followed by a slightly modified design that would also come to demand collector attention, the 7 over 8 Tailfeathers (7/8-TF) Reverse. After deciding to change the tailfeather count from eight to seven on future strikes, the Mint overpunched a number

of 8-TF working dies with a new 7 Tailfeather (7-TF) hub (specifically, the “long nock” B1 Reverse, one of two variations of the B Reverse, the other having a “short nock”).

This overpunching, however, did not completely obliterate all of the feather tips of the 8-TF design on every overpunched die. The result is 13 known 7/8-TF reverses (more accurately identified as “7/0”, “7/3”, “7/4”, “7/5”, and “7/7”) and are distinguishable by either extra tail-feather tips or doubling on or around the eagle. Of the 16 known 7/8-TF die combinations, the “7/5” VAM 44 (“The King”) is considered by many the number-one Morgan Dollar variety.

The 1901 “Shifted Eagle” Morgan Dollar is perhaps the most sought-after doubled die reverse in the series. While the nickname is derived from the boldly doubled tail feathers, VAM 3 also features doubling of the wings, olive branch, leaves, arrow heads, and shafts, and the eagle’s lower beak as well as the letters “OD” and “W” of “IN GOD WE TRUST.”

This doubling, known as Class IV Offset Hub Doubling, occurs when a die being rehubbed is off center in the hubbing press from a previous hubbing. In the case of the “Shifted Eagle” reverse, the hubbings were misaligned in a north-south direction, resulting in all of the doubling going in the same direction and with the same distance between impressions/images.

Doubling details on 1901 “Shifted Eagle” reverse

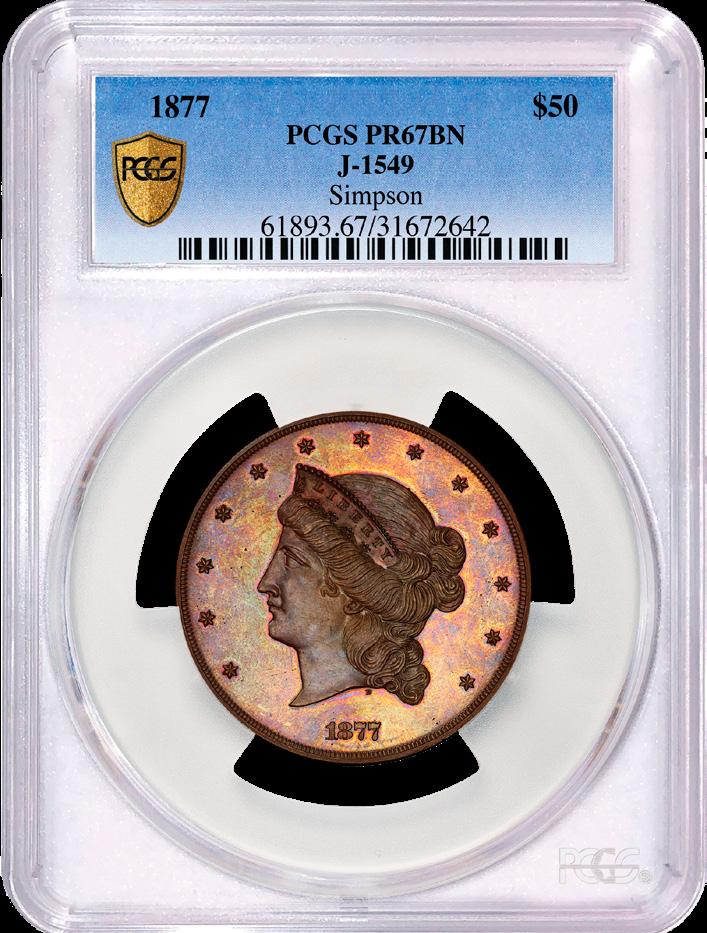

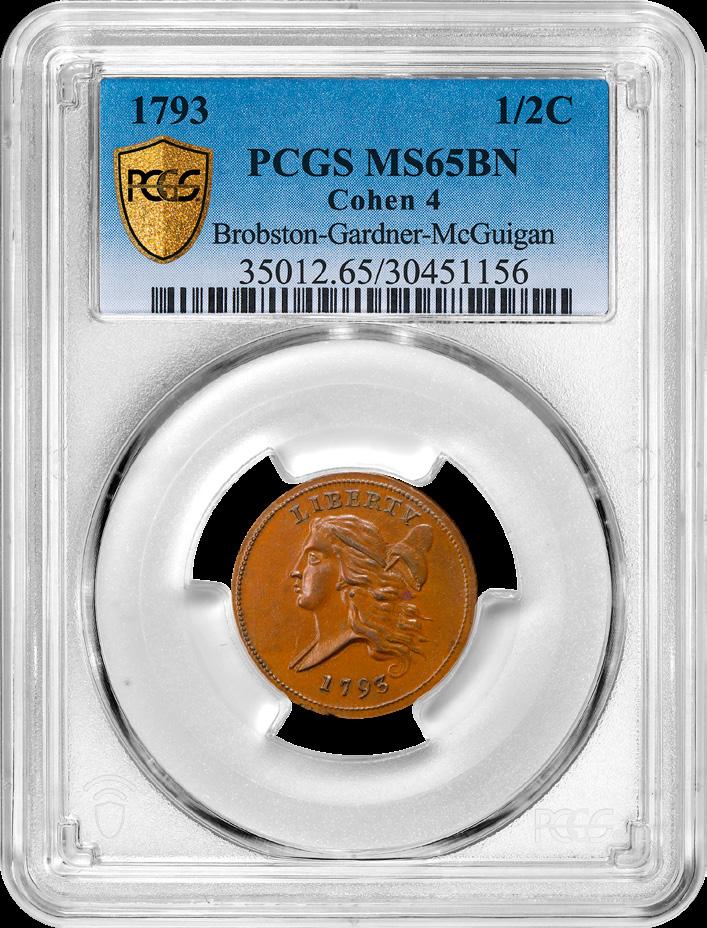

By Jaime Hernandez

Despite their large size and beautiful Coronet design, only seven examples of the 1877 $50 Half Union are known that were struck in copper, and just one coin is believed to be in private hands. Most other surviving examples are held in museums or institutions. The concept behind the 1877 $50 Half Union was first presented in the 1850s. Fast forward more than 20 years, and Director of the United States Mint Henry Richard Linderman ordered examples of the 1877 $50 Half Union patterns struck for himself. Today, these pieces serve as time capsules of a tumultuous time in American history and provide a glimpse of what the coin would have looked like if it was struck for circulation. A spectacular example of this coin, graded PCGS MS67BN, was sold by Heritage Auctions for $408,000 in 2024.

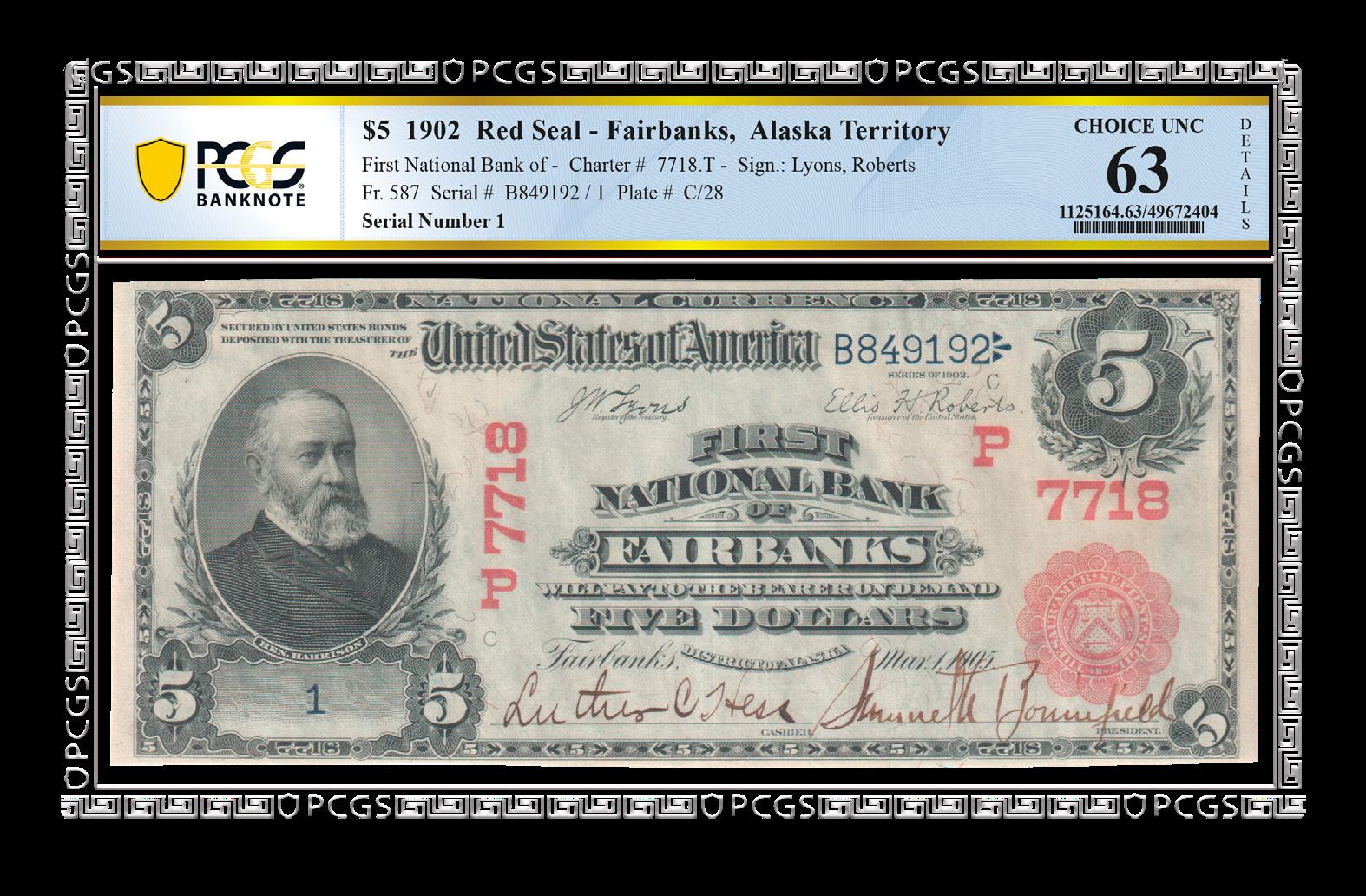

Soon after the United States purchased Alaska from Russia in 1867, there was a demand for banknotes in order to make transactions in the area. As a result, the First National Bank of Fairbanks began issuing National Banknotes. Today, the $5 1902 Fairbanks Red Seal Banknotes are considered special because they were some of the first issued banknotes in one of the most developed cities in Alaska during that time period. In general, Fairbanks Red Seal Banknotes are considered scarce. A $5 Alaska, Fairbanks Red Seal Fr-587 Banknote graded PCGS MS63 Choice Unc Details sold via a Great Collections auction on March 16, 2025, where it realized an impressive $177,187.

The 1793 Liberty Cap Half Cent is a significant coin in American numismatics, as it represents the first year in which the United States Mint produced coins for mass circulation. There are four major die pairings recognized among 1793 Half Cents, which are the Cohen 1, 2, 3, 4, and there’s a total of about 1,000 to 1,250 examples estimated across all varieties and grades combined. Most known examples of the 1793 Half Cents are in lower grades, or are harshly cleaned or damaged; there are very few known uncirculated examples. PCGS has graded a total of about 30 examples in Mint State condition, confirming how scarce this coin really is. In February 2025, Heritage Auctions sold an example for $240,000.

By Jay Turner

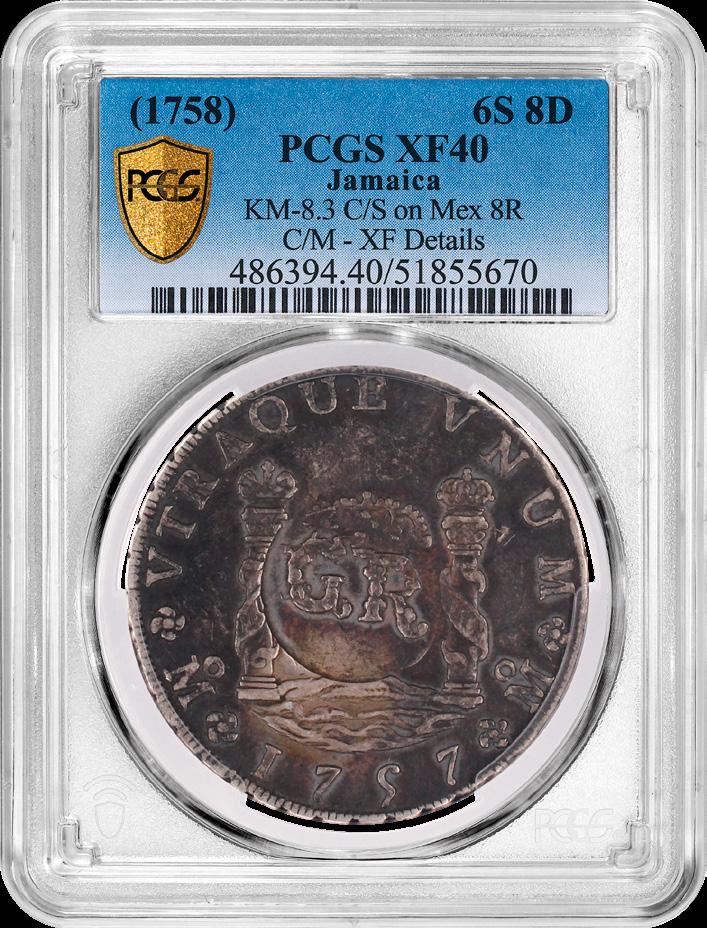

Collectors around the world strive to add great pieces to their collections. It is often thought that a collector from a certain region focuses their numismatic journey on their geographically germane area. After all, the vast majority of the coins from the United States are collected by collectors living in the U.S. Yet, there are many collectors pursuing intriguing, historical pieces from around the world for their collections. This is certainly true of a coin from Jamaica that was submitted to the PCGS office in Hong Kong.

The numismatic history of Jamaica is tied to the colonial history of the island nation, changing from Spanish rule to British to modern-day independence. However, Caribbean numismatics is not straightforward, and just keeping gold, silver, or even copper on the islands was difficult. Often, to retain coins on the island’s soil, Caribbean islands cut, counterstamped, and revalued coins to keep the arbitrage from taking the precious metal out of the Caribbean and sending it to other ports. For Jamaica, like

so many other islands, Spanish colonial coinage was the preferred currency. Even after Jamaica became a British colony, Spanish colonial coinage continued to be used. It was in 1681 when legislation revalued Spanish coinage to British standards. Originally, the coinage from Mexico was valued at five shillings, and between 1707 and 1722, this increased to six shillings, three pence.

The Jamaican Currency Act of 1758 authorized 100,000 pounds of Spanish coins to serve as legal tender money in Jamaica, with a fixed value, distinguishing them with a counterstamp as the authorized coins for commerce. The counterstamp featured a “GR” element symbolizing the current English monarch “Georgius Rex,” or King George II. This act also increased the value of the eight reales coins to six shillings, eight pence. Spanish coins ranging from half-reales to eight reales, and even gold such as eight escudos, were counterstamped for commerce in Jamaica. However, this act did not last long. It was repealed a year

later in 1759 by the English government, which censured the governor of Jamaica for exceeding his power by approving this act.

Today, counterstamped coins from Jamaica representing the 1758 Act are prized numismatic pieces. Some collectors aim to build a denomination set, while others collect by date and mint, aggressively competing for rarer host coins. While these pieces are often found in collections from collectors in Europe or America, they are not often seen in Asia. That is why when a nice original example came into the PCGS office in Hong Kong, it was well noticed. This example is on a host of a Mexico 1757 8 Reales, meaning it would have been counterstamped just one year after mintage. It was graded XF40 by PCGS, and the counterstamps received a Details grade of XF. This coin is an excellent example of understanding that numismatics is enjoyed globally, and rare pieces can turn up anywhere.

By Edwin Lemus

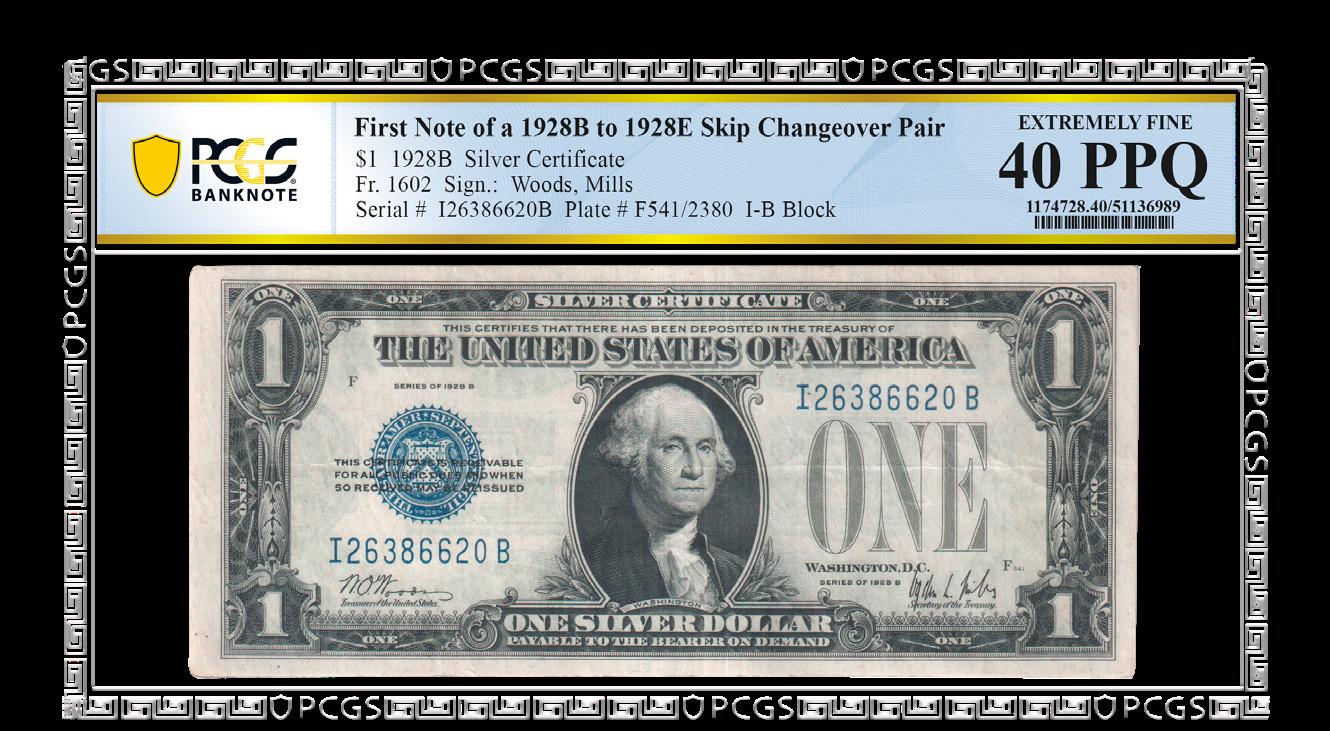

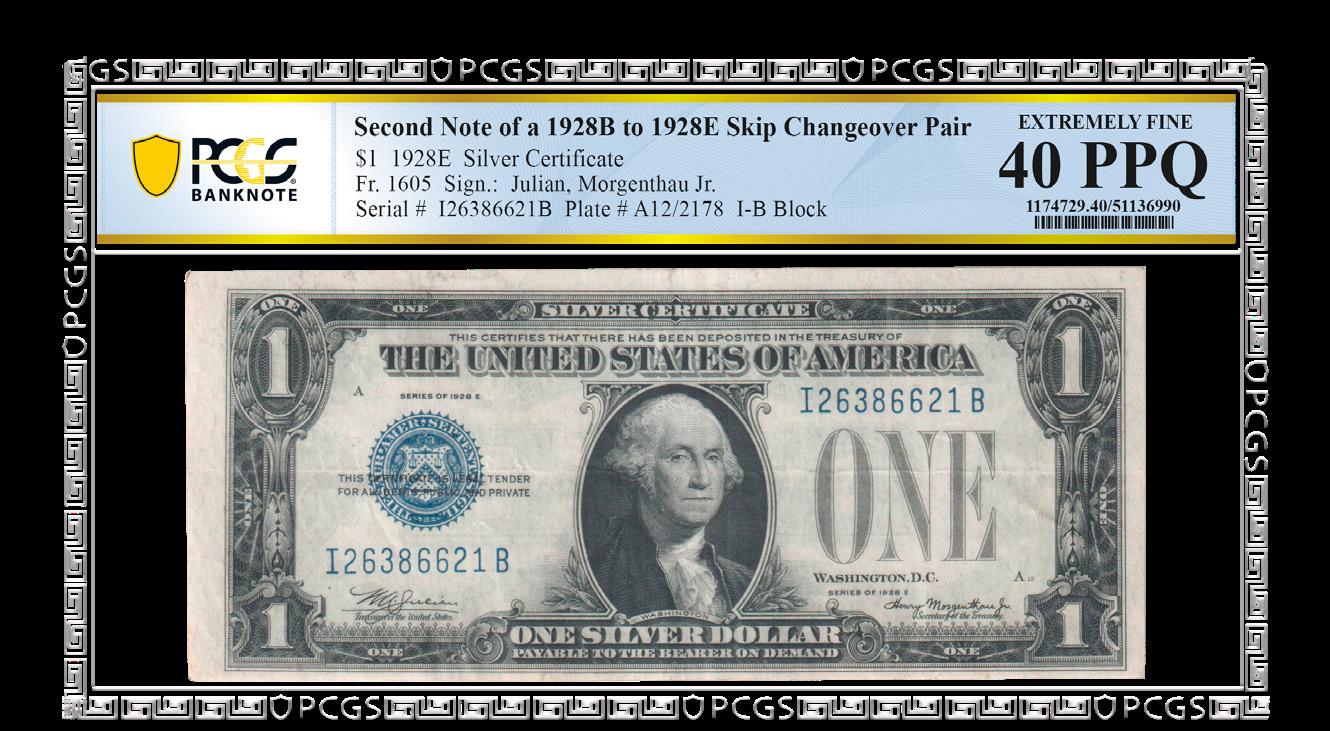

In this installment of Notable Notes, we’re surveying not one, not even two, but three incredible pieces that recently came through the PCGS Banknote Grading Room and really knocked our socks off. All three notes are simply spectacular and help capture a small bit of the more unusual treasures that we in the PCGS Banknote Grading Room get to see.

First up? We take a look at a really cool pair of notes with consecutive serial numbers yet very different designs. We’re talking about changeover pairs, which are two notes with consecutive serial numbers that represent two different series or varieties. “It’s when two notes of consecutive serial numbers show two very distinct types of differences relating to the design, signatures, or other obvious elements,” explains PCGS Banknote Manager Philip Thomas. A fascinating pair of Series 1928B and Series 1928E $1 Silver Certificates turned heads in the PCGS Banknote Grading Room, exhibiting two very different signature pairings that actually skipped two series.

“In this case, one note features the signatures of Register of the Treasury W.O. Woods and Treasury Secretary Ogden

L. Mills printed in early 1932 through early 1933; the next shows the signatures of William Alexander Julian Henry Morgenthau, Jr., a pairing that was not utilized until early 1934,” Thomas says. Pairings of Woods-[William Hartman] Woodin and Julian-Woodin signatures were skipped between the two notes. “We see quite the skip here – advancing two series from the earlier note to the next.” Why did this happen? “You can thank the early Bureau of Printing and Engraving (BEP) plate-management protocol, inspired by cost savings.”

Making these two specimens even more special is that they were both very well

preserved and seemed to have been folded up together. “They even have matching grades,” Thomas adds of the notes, each of which boasts a grade of Extremely Fine 40 PPQ. “Varieties like this really add a new dimension to banknote collecting,” he remarks.

We now turn the clock back to 1776, the year the 13 original American colonies joined together to endorse the Declaration of Independence. The American Revolution was in full tilt as the “Spirit of ‘76” filled the hearts of millions throughout the colonies with the patriotic fervor of self-determination and liberty. An infant America was finding its way

amid the battle against the British, and the colonies flexed their military might and economic strength. New Jersey, like many colonies, produced its own money, with an early form of paper currency helping to nourish the needs of commerce. Among these notes is this incredible 6 Shillings New Jersey Colonial note with the signature of John Hart, a New Jersey delegate to the Continental Congress who signed the Declaration of Independence on July 4, 1776.

This note boasts the signature of one of just 10 Declaration of Independence signatories known on all issues of material from the several colonies. What is exceptional about this is the grade of Superb Gem 67PPQ. Well-contrasted, well-preserved multi-colored printings, it appears as though it was cut just yesterday and is one of the finest specimens known. It was printed by Isaac Collins in Burlington, New Jersey.

“When this note came in on consignment, we knew it was a special piece with potential to receive a Superb Gem grade,” says Raiden Honaker, consignment director of currency for Heritage Auctions, which offered the note for sale in its Central States Signature Auction in April 2025. “This 1776 New Jersey 6 Shillings note is undoubtedly one of the freshest and most immaculate Colonials that I have ever handled. With that being said, I knew this was a note fit for a PCGS holder,” he continues. “Not only does it carry an incredible grade, but also great historical significance tied directly to our nation’s founding with the signature of John Hart. Hart’s sharply signed signature, near-perfect margins and centering, and incredible eye appeal make for a truly outstanding Colonial that we were exceptionally pleased to offer.”

By Kyle C. Knapp

It is not often that a new standard reference for a United States coinage series is published. Consider that Penny Whimsy, the seminal book on large cents that brought 70-point numerical grading to the fore, is now more than 75 years old; the Edward Maris known as A Historical Sketch of the Coins of New Jersey, covering colonial copper coinage from the Garden State, is nearly 150!

Yet, Trade Dollar enthusiasts are in luck, as a new reference geared toward them and more than two decades in the making offers extensive date-by-date die studies. US Trade Dollar: Rarity, Collection Types, and Top 37 Varieties by Joe Kirchgessner offers a comprehensive list of the “Top 37” varieties (as promised by the book’s title) composed of interesting, scarce,

and potentially valuable pieces the astute collector should keep an eye peeled for at the next show or auction.

Just like their “Top 100” counterparts in the VAM listings for Morgan Dollars, PCGS will recognize all “Top 37” Trade Dollar issues (some of which may be co-listed in FivazStanton or other references) under the variety attribution program. A PCGS Registry Set for the list is also in the works.

By way of introduction – and just in case you’re headed to your local show this weekend – here are three of my personal favorites:

While readily available in proof format, the 1875 Type I/I is very rare as a business strike and has been revered by devotees of the series at least since the publication of a reference by expert numismatic author Q. David Bowers more than 20 years ago. Look for the die crack connecting the top left obverse stars, a small chip or die lump in the folds of Liberty’s dress just left of the pedestal, and a Type I reverse with a berry beneath the eagle’s left claw. Given the scarcity of this variety, it may take years of searching to find a nice example. Beware of circulated proofs posing as the rare business-strike version!

The rarest variety in the “Top 37” is found within the historic and popular Carson City series. A mintmark style using two small, widely spaced characters was known on nearby dates even in late numismatic author Walter Breen’s time. Contributors to the Gobrecht Journal in 1998 predicted it might have been used in 1875 as well, but it remained so elusive that its existence was not confirmed until 2016. There are currently only five known examples, all of which reside in PCGS holders. Note the position of the leftmost “C” relative to the lettering above it; you might discover the sixth example

First identified in the Gobrecht Journal in 1996, the 1876 Type I/II with a recut finger is so dubbed due to the presence of a fourth digit on Liberty’s right hand. The vast majority of known examples are proofs, and it is likely a once-proof die that was put in service to produce business strikes (a phenomenon seen in other contemporary series, most notably Indian Cents). While sorting out the method of manufacture can be difficult on circulated examples, the extra (top-most) digit, along with a die bump on the right portion of the reverse scroll, serve to identify this unique and appealing variety.

Extensive, long-term research like that in this newly published work aids in counterfeit detection, adds depth and interest for series specialists, and propels the hobby’s enlightenment forward. Morgan Dollar collectors who collect “VAM”

varieties have had decades of enjoyment collecting the “Top 100” VAM issues and related novelties. Kirchgessner’s research now offers similar opportunities in the Trade Dollar realm. Happy collecting!

By Vic Bozarth

Appreciation isn’t always about the change in value from one point in time to another. Having spent decades trading on the bourse floors of coin shows, I can quantify what will appeal to most coin dealers as well as what will interest many buyers.

My evolution in “appreciation” early in my collecting career was more in search of approval because I was still learning. I wanted to be a coin dealer, and there are some rules about conducting yourself professionally in this industry, albeit many of these “rules” being unwritten. I learned to always try and be positive, regardless of the item before me. The “easiest out” I ever picked up when evaluating an item was saying, “that’s not for me,” with a ready “I don’t know” to follow.

If you can’t say something positive about a coin or set, learn to say, “It’s not for me.” I learned early to try and point out something nice about the item, but follow that up quickly with “It’s not for me.” You will almost always be met with a follow-up question of “will you make me an offer?” or “who would pay the most?” leading the list. Unless you have a fairly reliable concrete answer, reply “I don’t know.”

Some dealers who aren’t interested in buying an item from someone won’t necessarily refer that person to another dealer. But if I had hard knowledge about another dealer actively pursuing something this individual had (that truly “wasn’t for me”), a referral was appreciated and often returned by the dealer I referred. Indeed, at larger coin shows, there were always a few dealers who would make an offer (including some you might not like) on virtually anything and everything.

At some point, my numismatic knowledge and confidence gelled. Sure, I had a lot to learn, but I, too, had a high degree of confidence. I knew both where and how to look for that knowledge.

I knew what to appreciate and what to look for once I found it. You see, appreciation is so much more than the increase in value from one point in time to another. That evolution in appreciation has continued in my numismatic career. I can truly say “that’s cool” about virtually any collection that someone has spent some time and dedication building. I can appreciate both the effort and the organization, if not the collection itself – especially if “it’s not for me.”