Welcome to Open Enrollment!

Open Enrollment is your annual opportunity to review and make benefit elections. Open Enrollment will be held February 2nd – 15th .

Unless you experience a qualified life event, you cannot make changes to your benefits until the next Open Enrollment. Your new benefits will be effective March 1, 2023 – February 29, 2024.

This Benefits Guide contains a summary of the benefits available to all full-time employees and their eligible dependents. Complete plan information can be found on the TeamOne Logistics Employee Portal. If there is any conflict between the summary of benefits included in this Guide and the Plan Document, the Plan Document will govern. TeamOne Logistics reserves the right to interpret and resolve any differences in plan language and the terms of the benefits program can change at any time. Table

Eligibility & Enrollment What’s New? Say Hello to Anthem BCBS Sydney Health Medical Benefit Summary Health Savings Account Ways to Save on Your Prescriptions TelaDoc Virtual Care Dental Benefits Vision Benefits Life & AD&D Benefits Disability Benefits Supplemental Benefits Employee Assistance Program Financial Benefits Open Enrollment Checklist Online Enrollment Instructions Benefits Contact Information 3 4 5 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21

of Contents

2

Eligibility & Enrollment

All full-time employees working 30 hours or more per week are eligible for benefits effective on your date of hire.

Eligible Dependents

Your eligible dependents include:

• Your legal spouse*

• Dependent children up to age 26 regardless of student or employment status (must be able to validate)

• Dependent children over age 26 that are incapable of self- support due to total physical or mental disability (under most benefits outlined).

• If you choose to enroll your spouse/dependent child(ren), you will need to provide:

• Name

• Social Security Number

• Date of Birth

• Address (if different)

Qualifying Life Event

Unless you experience a life-changing qualifying event, you cannot make changes to your benefits until the next Open Enrollment period.

Qualifying events include things like:

• Marriage, divorce or legal separation

• Birth or adoption of a child

• Change in child’s dependent status

• Death of a spouse, child or other qualified dependent

• Loss/Addition of other coverage

• Eligibility change due to relocation

• Qualified Medical Child Support Order

*Spousal Coverage

If your spouse is employed and has coverage available at her/his place of employment, she/he will not be eligible to participate in our medical plan. You must complete the Spousal Coverage Section within the TeamOne Logistics Employee Portal if you are electing medical coverage for the upcoming plan year.

If you experience a qualifying life event during the year, notify Human Resources within 30 DAYS of an event to ensure the desired benefit coverage going forward.

Please note: Not every change in status permits a change in benefits plan elections. The election change must be consistent with the change in status that has occurred.

3

What’s New?

TeamOne Logistics is excited to announce a new partnership with Anthem Blue Cross Blue Shield (BCBS) that will be managing your benefits.

ELECTRONIC ONLY

• Printed materials will not be provided

• Enrollment completed via TeamOne Logistics Employee Portal

• Check the Employee Portal frequently for updates and instructions

Anthem BCBS will be the administrator for your medical, dental, vision & EAP benefits

You will receive new ID cards in the mail

Sydney mobile app or Anthem.com will be your one-stop to manage your benefits

Anthem BCBS is our new HSA Administrator. Health Equity HSA is ending 2/28/23. If you currently have an HSA with Health Equity you have the option to roll-over existing funds to the new bank.

The Hartford is our new carrier for supplemental benefits for Accident, Critical Illness and enhanced Short Term Disability

If you would like to continue your current Colonial Life and/or UNUM Policy, call 404-845-0171 to set up a direct pay option. These policies will no longer be payroll deducted and will terminate if you do not take action.

BENEFIT BUTLER

The Benefit Butler is an expert on claims processing, coverage and anything benefits related. Our benefits partner and consultant, Palmer & Cay, provides this service to you at no cost. The Benefit Butler is available via phone or email and can help explain your situation and seek a resolution.

benefitbutler@palmerandcay.com

(404) 991-6070

Have a question? Scan the QR code to email the Benefit Butler.

Our team at TeamOne Logistics is made up of caring and generous people, always willing to go the extra mile. That’s why TeamOne Logistics is partnering with Uncommon Giving to help us #AwakenGenerosity by assisting in collecting donations company-wide and presenting quarterly contributions to our chosen charity. Making donations will be easy with payroll deductions, and these gifts are tax-deductible (talk to your tax advisor about how to do that).

4

Say Hello to Anthem BCBS!

TeamOne Logistics is partnering with Anthem BCBS for Medical, Dental, Vision and EAP in 2023! Below are a few useful tips to help you fully utilize the benefits offered by Anthem. In addition to the below, you can also ask questions, search for a provider, manage your prescriptions – all on the Sydney Mobile App!

Medical, Dental, Vision, Pharmacy and HSA Questions

• Call 855-397-9267

• Register* on anthem.com

• Once you’re logged in, choose Customer Support and Select Contact Us

• Pick your preferred communication option

*You will need your Anthem BCBS Member ID to register. This number is on your member ID card that will be mailed to your home upon enrollment. If you have not received your ID card by March 1st and need to log-in for prescriptions or services, contact The Benefit Butler at 404-991-6070 for your member ID #

Medical Provider Search

Anthem.com/find-care

• “Basic Search”

• “Medical Plan or Network”

• Always select “Georgia” for where the plan or network is offered since TeamOne Logistics’ primary office is in Georgia

• “Medical (Employer-Sponsored)”

• Network

• Blue Open Access POS (Select Network) for residents of Georgia

• National PPO (Blue Card PPO) for non-Georgia residents

Pharmacy Benefits

Pharmacy benefits are provided by Anthem BCBS, powered by CarelonRx. Track and manage all of your prescriptions in one convenient place

• Refill and renew prescriptions

• Find a pharmacy

• Check the cost of medications

To get started, log in to anthem.com, go to My Plans, and then go to Pharmacy.

24/7 Nurse Line

Anthem BCBS offers members 24/7 access to registered nurses. Simply call 888-724-2583 anytime, day or night, to speak with a medical professional.

5

Say Hello to Anthem BCBS!

Sydney Mobile App

Anthem BCBS offers TeamOne Logistics employees enrolled in one of the Anthem BCBS plans SydneySM Health to keep track of your health and benefits all in one place. Full details on the new Sydney app can be found on the next page of this guide.

Anthem BCBS Virtual Care

Employees enrolled in one of the Anthem BCBS medical plans have options for Virtual Care: LiveHealth Online and via Sydney Health app. Doctors are available on demand 24/7 with no appointments or long wait times. During an online video visit, doctors can assess your condition, give medical advice, and send prescriptions to the pharmacy of your choice, if needed. Get started at: livehealthonline.com

Cost: $0 copay per visits, deductible does not apply. HSA Plan: For those covered under the HSA Plan – there is a $59 Consult Fee per visit until the annual deductible is met. Once you have met the annual deductible, virtual visits are $0 copay

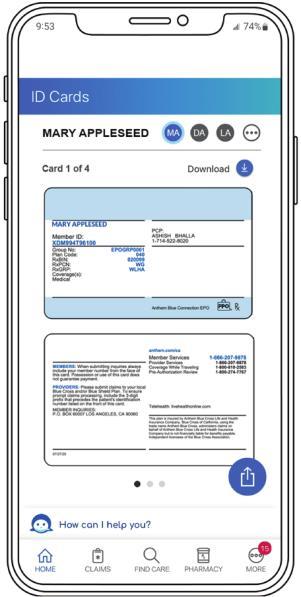

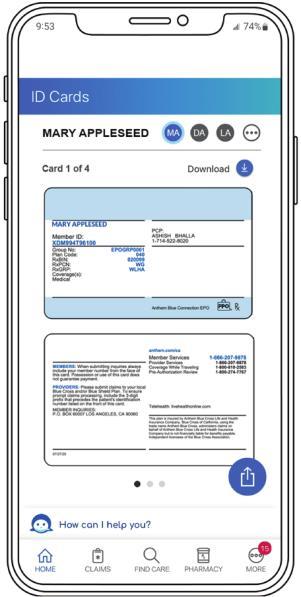

How to View Your Anthem

BCBS ID Cards:

1. Login to Anthem.com or open the Sydney Health Mobile App.

2. Select ID Card in the top right corner of the homepage.

3. Your ID card will appear. If you have dependents enrolled in your plan, you will see an option to view their card(s) in the top right corner.

4. Choose whether you want to print, email, fax, or download your ID card(s).

6

The Sydney Health mobile app makes healthcare easier

Use SydneySM Health to keep track of your health and benefits all in one place. With a few taps, you can quickly access your plan details, Member Services, virtual care, and wellness resources. Sydney Health stays one step ahead moving your health forward by building a world of wellness around you.

Find Care

Search for doctors, hospitals, and other healthcare professionals in your plan’s network and compare costs. You can filter providers by what is most important to you, such as gender, languages spoken, or location. You’ll be matched with the best results based on your personal needs.

My Health Dashboard

Use My Health Dashboard to find news on health topics that interest you, health and wellness tips, and personalized action plans that can help you reach your goals. It also offers a customized experience just for you, such as syncing your fitness tracker and scanning and tracking your meals.

Chat

If you have questions about your benefits or need information, Sydney Health can help you quickly find what you’re looking for and connect you to an Anthem BCBS representative.

Virtual Care

Connect directly to care from the convenience of home. Assess your symptoms quickly using the Symptom Checker or talk to a doctor via chat or video session.

Community Resources

This resource center helps you connect with organizations offering no-cost and reducedcost programs to help with challenges such as food, transportation, and child care.

My Health Records

7

Download

the Sydney Health app

Find care and compare costs.

See what’s covered and check claims.

View and use digital ID cards.

Check your plan progress.

Fill prescriptions.

Scan the QR code to download the Sydney Health app.

personalized health and wellness information wherever you are

Access

See a full picture of your family’s health in one secure place. Use a single profile to view, download, and share information such as health histories and electronic medical records directly from your smartphone or computer. today

Use the app anytime to:

Youcan also set up an account at anthem.com/register to access most of the same features from yourcomputer.

*PLEASE NOTE: All employees are required to complete an annual physical each year. All medical plan options cover annual preventive care exams at 100%. DOT Physicals DO NOT count toward this requirement. You must complete a routine physical exam that is filed as a claim with Anthem. If you do not complete this requirement, your monthly medical premium will be increased $75 per covered adult (employee/spouse).

Core Core Plus Core Basic HSA Qualified Health Plan In-Network In-Network In-Network In-Network Plan Year Deductible (03/01/2023 - 02/28/2024) Individual $4,000 $1,500 $7,150 $3,500 Family $12,000 $4,500 $14,300 $7,000 Coinsurance (member share responsibility) 20% 20% 0% 0% Out-of-Pocket Maximum (Includes Deductible, Medical & Rx Copays) Individual $6,600 $6,600 $7,150 $5,000 Family $13,200 $13,200 $14,300 $10,000 Physician Services Office Visit $40 Copay $30 Copay $50 Copay Deductible; then 0% Specialists $50 Copay $50 Copay $100 Copay Walk-In Clinic $35 Copay $30 Copay $35 Copay Routine Physicals* Covered at 100% Covered at 100% Covered at 100% Covered at 100% Inpatient Services Facility Deductible; then 20% Deductible; then 20% Deductible; then 0% Deductible; then 0% Physician Services Outpatient Services Facility Deductible; then 20% (Ambulatory Facility $200 copay) Deductible; then 20% (Ambulatory Facility $200 copay) Deductible; then 0% Deductible; then 0% Physician Services Emergency Room True Emergency - $250 Copay + Deductible, then Coinsurance Non-Emergency Copay - $1,000 copay + Deductible, then Coinsurance Deductible; then 0% Emergency Room Doctor and Other Services 20% coinsurance 20% coinsurance 0% coinsurance Deductible; then 0% Urgent Care Services $75 Copay $75 Copay $75 Copay Deductible; then 0% Advanced Imaging (MRI, PET, CAT Scans) Outpatient Hospital $500 Copay; Ded & Coin $500 Copay; Ded & Coin $500 Copay: Ded & Coin Deductible; then 0% Physicians Office $40 or $50 Copay $30 or $50 Copay $50 or $100 Copay Freestanding Facility $150 Copay $150 Copay $150 Copay Prescription Drugs Medical Deductible Applies, then Copays: Tier 1 $10 $10 $25 $10 Tier 2 $40 $40 $60 $40 Tier 3 $60 $60 $100 $60 Tier 4 30% of prescription drug cost Specific High Cost Rx Subject to Step Therapy to Determine Effectiveness of Lower Cost Rx Mail Order (90 day supply) Included The above offers a brief outline of benefits. A complete explanation of covered services, exclusions and limitations is available in the carrier’s summary of benefits. 8

Anthem BCBS Medical Plan Options

Health Savings Account (HSA)

The HSA Plan combines a High Deductible Health Plan (HDHP) with a health savings account (HSA). The HSA gives you ownership of a tax-exempt savings bank account you can use to put aside pretax dollars to pay for current or future medical, pharmacy, dental and other IRS approved health care expenses. To be eligible to contribute to any HSA, you must be enrolled in the HSA Qualified Health Plan option and meet the other IRS HSA eligibility requirements.

How to use your HSA:

Add money to your HSA anytime or contribute through paycheck deductions. IRS sets annual contribution limits:

Employee Only: $3,850

Family: $7,750

Catch Up Contribution Limit (age 55+): $1,000

Anyone enrolled in the HSA effective 3/1/23 will receive a NEW DEBIT CARD – watch for it in the mail! Your HSA debit card works the same as a credit card after you activate it.

Use your HSA debit card to pay for doctor visits, prescriptions, and other qualified medical expenses. You can also use the HSA online bill-pay tool to pay medical bills or reimburse yourself with the funds in your account.

NOTE: You must have money in your HSA to cover the cost of care, up to the annual deductible, when you benefit plan will pay for a portion of the care.

Manage your HSA Via Anthem

Go to anthem.com and download the Sydney Health mobile app to:

• See your HSA balance and claims.

• Find a doctor in your plan’s network.

• Estimate your costs before you go for care.

• Set your preferences to receive important information electronically.

Current HSA Enrollees with Health Equity

If you choose to enroll in the HSA Qualified Plan for the upcoming plan year, you will have an HSA established by Anthem. If you are also currently enrolled in the Health Equity HSA, you may transfer your funds from Health Equity to Anthem BCBS via a Transfer Form available by contacting Anthem BCBS at 800-8433831 or anthem.com

Invest your HSA funds to save even more

After your HSA balance reaches $1,000, anything over that amount can be invested. Your contributions will grow tax-free and can help you pay for future medical expenses.

Review your investment options on the Spending Accounts page when you log in to our mobile app or anthem.com.

1 2 3 4 9

Medical Care Savings

For employees who choose not to enroll in one of the Anthem BCBS medical plans offered by TeamOne Logistics, there are several other options to help you with your medical care cost: Prescription Savings and Teladoc Virtual Care.

Ways to Save on Your Prescriptions

Generic vs. Brand Name

Generic drugs are less expensive and can be just as effective as brand name which will lower your out-of-pocket cost.

Discount Cards

GoodRx, BlinkHealth and WellRx provide discount prescription cards – most are free and provide discounts or coupons to help lower costs. Visit the company websites to sign up and get your discount card.

CostPlus Drug Company (costplusdrugs.com)

CostPlus Drug Company is recent addition to the marketplace as an alternative way to purchase medications. Joining is free and medications are mailed to your home but do require a written prescription from your provider.

Manufacturer Coupons

When a high-cost brand or specialty drug is your only option:

Step 1: Go to the manufacturer website

Step 2: Search the drug name itself

Step 3: Print the coupon

Step 4: Take to the pharmacy to apply to your prescription

10

Medical Care Savings (continued)

Teladoc Health

TeamOne Logistics' employees who are not enrolled in any TeamOne Logistics medical plan options may enroll in Teladoc Health. Teladoc Health provides virtual benefits via phone, video or mobile app.

Talk to a U.S. licensed doctor for non-emergency conditions 24/7 from anywhere you are for $0. Teladoc treats:

• Bronchitis

• Flu

• Rashes

• Sinus infections

• Sore Throats

This is a great benefit for those employees who don’t wish to enroll in a regular medical plan but want to have access to consult with a physician for a minor illness for themselves or any of their dependents.

How it works?

1. Elect Teladoc during Open Enrollment

2. Download the app. 3. Go online to Teladoc.com or call 800-Teladoc to set up your account or log in

4. Complete or update a brief medical history

5. Request a visit and talk to a doctor within minutes

800-Teladoc Teladoc.com

11

Dental Benefits

NEW! Two dental plans options from Anthem BCBS

Dental Provider Network

Search:

Before enrolling,

• Anthem.com/find-care

• Select “Dental”

• Select “Georgia” no matter where you live

• Network: Dental Complete

Once enrolled: Anthem.com or Sydney

Health mobile app

Anthem BCBS Dental Plans – In-Network* Benefits Essential Max Essential Deductible Individual FamilyMaximum $25 $75 $50 $150 Deductible Applies To Basic & Major Basic & Major Annual Benefit Maximum $3,000 $1,000 Preventive Services 100% 100% Basic Services 80% 70% Major Services 70% 60% Periodontics 80% 60% Endodontics 80% 60% Implants 70% Not Covered Orthodontia Lifetime Maximum Benefit Age Limitation $2,000 To age19 Not Covered

a non-network

*Balance billing may occur when using

provider.

12

Vision Benefits

NEW! Vison plan from Anthem

BCBS

Vision Provider Network Search

Before enrolling:

• Anthem.com/find-care

• Select “Vision”

• Select “Georgia” no matter where you live

• Network: Blue View Vision

Once enrolled: Anthem.com or Sydney Health mobile app

Anthem BCBS Vision Plan* Plan Attribute In-Network Out-of-Network Lenses Single Bifocal Trifocal Lenticular $15 Copay $15 Copay $15 Copay $15 Copay Up to $30 Up to $40 Up to $50 Up to $80 Contact Lenses Medically Necessary Elective Coverage in Full $150 Allowance Up to $210 Up to $210 Frames $150 Allowance Up to $100 Exams No Copay Up to $35 Network National Vision Administrators Frequency Exams every 12 months Contacts every 12 months Frames every 12 months *Hearing Aid Discount Program included in Vision Plan.

13

Life Insurance

All full-time employees receive $30,000 in Basic Life Insurance. A matching benefit in Accidental Death & Dismemberment (AD&D) Insurance is also provided at no cost to you. The Hartford administers our life and AD&D benefit.

Voluntary Life Insurance

Employees may purchase voluntary coverage for yourself, and in so doing, you may purchase coverage for your spouse and/or your dependent child(ren). With Voluntary Life Insurance, you are responsible for paying the full cost of coverage through payroll deductions.

Employee

Spouse

Child

$10,000 increments to lesser of 5 times your annual earnings or $500,000

$5,000 increments to $250,000, not to exceed 50% of the Supplemental Employee Life election

$2,000 per child aged 15 days to 19 years; coverage terminates at age 19 unless child is a full-time student, in which case coverage will terminate at age 23

Evidence of Insurability (EOI)

If you enroll within 31 days of your first day of eligibility – not required to provide EOI for the Guaranteed Issue Amount. If you first enroll outside this period, add or increase coverage during Open Enrollment or elect an amount in excess of the Guaranteed Issue Amount – are required to apply for some or all the coverage elected.

Effective Date

The insurance company must approve your application and will determine your coverage effective date.

Up to $100,000 if enrolled timely when newly eligible

Up to $50,000 if enrolled timely when newly eligible

$2,000

Beneficiary Information

Remember to review and update your life and 401(k) beneficiary information. Update this information throughout the year in the event of any life change such as a birth, death, divorce, etc.

Voluntary Life Benefit Guaranteed Issue Amount

14

Disability Benefits

TeamOne Logistics full-time employees have the option to enroll in voluntary short and long-term disability income plans. These benefits are paid by the employee. This coverage provides income protection for regular expense items, which are typically covered by your paycheck. If you experience a disability that impacts your ability to work and earn a paycheck, disability insurance helps cover the gap.

In the event that you become disabled from a non-work-related injury or sickness, disability income benefits will provide a partial replacement of lost income. Please note, though, that you are not eligible to receive short-term disability benefits if you are receiving workers’ compensation benefits.

Please note, these plans are a voluntary benefit, meaning the employee is responsible for the full cost. Complete details, including cost, can be found on TeamOne Logistics Employee Portal.

Value Added Benefits

TeamOne Logistics employees have access to additional benefits and programs through The Hartford. These plans do not require enrollment and are offered at no additional cost.

Travel Assist

Identity Theft Assistance when traveling more than 100 miles from home and for 90-days or less

• 800-243-6108 (US and Canada); 202-828-5885 (outside of US) or assist@imglobal.com

Ability Assist

Counseling from master’s level clinicians for those with a disability. 800-964-3577 or guidanceresources.com

Code: HLF902 Name: ABILI

Beneficiary Assist –

Counseling for times of loss - 800-411-7239

Funeral Planning and Concierge Service

Provides support for planning services in time of loss. 866-854-5429 or everestfuneral.com/Hartford Code: HFEVLC

EstateGuidance Will Service

Create a simple will from the convenience of your home. Estateguidance.com Code: WILLHLF

15

Supplemental Benefits

Critical Illness Insurance

Voluntary Critical Illness Insurance provides an added layer of protection that you need and want when you are diagnosed with a critical illness. You can decide how to use the benefits to best support recovery for you and your family.

This plan pays a lump sum cash benefit of your choosing at diagnosis of a covered critical illness. You may select a $10,000, $20,000 or $30,000 benefit for yourself, 100% of your elected benefit for your spouse and children are covered for 50% of your benefit.

Covered critical Illnesses include Heart Attack, Cancer, Stroke, Renal Failure, Major Organ Transplant, Paralysis, Alzheimer’s, ALS, Loss of vision/speech/hearing, Benign Brain Tumor and more.

Health Screening Benefit

You and your covered dependents can each earn a health screening benefit when you get preventative tests like mammograms, colonoscopies, or fasting blood glucose tests

Accident Insurance: $100 Critical Illness: $50

Accident Insurance

Voluntary Accident Insurance protects you from financial loss due to off-the-job accidents. This benefit offers 24-hour coverage for injuries away from work due to an accident and provides a cash benefit in one lump sum. Coverage includes a $1,500 hospital admittance benefit for accidents as well as $400 daily hospital benefit, doctor and emergency room visits, injuries, therapy, testing, and much more. An AD&D benefit is also included. You may cover yourself, spouse and children.

Short Term Disability Plan

The Hartford’s DisabilityFlex helps protect employees who are injured or become ill outside of work.

Employees may elect a flat weekly benefit amount from $100 to $1200 in increments of $50, not to exceed 60% of your weekly income. Employees in CA, HI, NJ, RI, NY and PR are not eligible for this benefit.

Legal Plan – CDL Defender

TeamOne Logistics employees can enroll in a legal plan through U.S. Legal

• Access to 3,000 attorneys experienced in traffic law

• Benefit pays U.S. Legal will pay 100% of your attorney’s fees for all covered services

• Covered services include moving violations, representation in major accident case, personal legal consultation matters and more.

Family Defender

Employees may also enroll in a Family Legal Plan through U.S. Legal. With Family Defender you are covered for virtually all of your personal legal needs. It’s like having your own “Attorney on Retainer” 24 hours a day, 7 days a week.

16

Employee Assistance Program (EAP)

All employees and their family members have access to Anthem BCBS’s EAP.

• Provided at no cost

• Confidential - information will never be shared with TeamOne Logistics Human Resources

Anthem BCBS EAP representative will:

• Talk to you about your therapy options, including video visits through LiveHealth Online.

• Provide a coupon code you can use to access the sessions provided by your EAP.

Commonly treated conditions:

• Anxiety

• Stress

• Depression

• Relationship troubles

• Parenting issues

• Grief

• Coping with illness

• Post-traumatic stress

• disorder

Anthem BCBS also provides emotional well-being resources via Sydney Health, to any employees covered on one of the medical benefit plans.

Personalized, one-on-one coaching

Team up with an experienced coach who can provide support and encouragement by email, text or phone.

Build a support team

Add friends or family members as “Teammates.” They can help you stay motivated and accountable while you work through programs.

Anthem BCBS EAP

800-865-1044

Practice mindfulness on the go

Receive weekly text messages filled with positivity, quick tips and exercises to improve your mood.

Live and on-demand webinars

Learn how to improve mental well-being with useful tips and advice from experts.

17

Financial Benefits

Retirement Savings - 401(K)

A 401(k) is an investment tool with tax advantages. As a participant, your taxable income is reduced by the amount you contribute. This means you do not pay income tax on the earnings in the account (such as interest) until you start making withdrawals, typically at retirement. Employees may contribute a percentage of your salary up to the annual limit set by the IRS.

TeamOne Logistics 401(k) Retirement Plan is administered through Fidelity Investments. If you have met eligibility requirements, you can go online to either view your account or enroll at www.netbenefits.com

TeamOne Logistics does not provide financial advice regarding your retirement; we do, however, recommend that you seek the advice of a professional advisor of your choice. You may also speak with the authorized financial advisors associated with the plan, Trey Haydon and Leon Taylor. There is no charge to speak and meet with Trey Haydon and Leon Taylor regarding the TeamOne Logistics 401 (k).

Raymond James & Associates

404-240-6750

2023

401(k) Contribution Limit $22,500

Additional $7,500 for employees 50+ years of age

Trey Haydon & Leon Taylor

Trey Haydon & Leon Taylor

18

Open Enrollment Checklist

Open Enrollment Checklist

1. Review the Benefits Guide & Make Decisions

2. Process Your Elections on the TeamOne Logistics Employee Portal

Deadline: Wednesday, February 15th.

- Employees must complete the Tobacco and Spousal Coverage Questions within the Portal as a part of Open Enrollment. Reminder, MONTHLY Surcharges:

- Tobacco Surcharge -$150 per covered employees/spouse

- Physical Surcharge (for not completing an annual physical exam): $75 per covered employee/spouse

- Employees must complete online enrollment, or you will not have benefits on March 1, 2023.

3. New Benefits Effective March 1st, 2023

TRANSITION TO ANTHEM BCBS

If you are currently covered on one of the TeamOne Logistics medical benefit plans, please note the impact to current care of our transition from HealthComp/Cigna to Anthem BCBS:

Medications – If you are on a maintenance medication or a prescription that requires authorization (prior authorization, step-therapy, etc), you are encouraged to have sufficient medication for treatment through the first week of March.

Ongoing therapy or scheduled procedures – If you are in the middle of a therapy regiment or have a procedure scheduled for March/April, please complete Anthem’s Transition of Care form available from the Benefit Butler at 404-991-6070.

If you have not received your ID card by March 1 and need to log-in for prescriptions or services, contact The Benefit Butler at 404-991-6070 for your member ID #

If you do not complete the Open Enrollment process and are currently enrolled in benefits, those benefits will cancel effective February 28, 2023.

19

Enrollment Instructions

All Employees must complete online enrollment by February 15th. To get started, go to our TeamOne Logistics Employee Portal and click on ‘About Open Enrollment’.

Enter Open Enrollment Information

Navigation: Menu > Myself > Open Enrollment

1. From the About Open Enrollment page, review the Open Enrollment session information.

2. Select Next. The Verify Beneficiary Information page appears.

Verify Beneficiaries and Dependents

1. Review the summary information to ensure it is accurate.

2. Update information by completing one of the following using the Add/Change contact page.

• Select the Name link and then select Edit to update existing beneficiary or dependent information. To add a beneficiary or dependent, select Add.

3. Select Save and Next.

Enroll in a Plan

Navigation: Menu > Myself > Open Enrollment

1. Select or decline each plan.

2. Depending on how the plans are configured, additional fields may appear.

3. Select the dependents to be enrolled in the plan.

4. Confirm or enter each dependent’s Social Security Number, date of birth, and gender. Then, select Next.

Review and Submit Elections.

1. Review the election information on the Confirm Your Changes page.

2. Select Draft to continue the elections at a later time or Submit to complete your elections.

3. Select Ok and the Confirmation page will appear. Be sure to print a summary of your elections.

1 2

3 4

20

The Benefit Butler is an expert on claims processing, coverage and anything benefits related. Our benefits partner and consultant, Palmer & Cay, provides this service to you at no cost. The Benefit Butler is available via phone or email and can help explain your situation and seek a resolution.

Resource Provider Name Contact Information Medical, Dental, Vision & HSA Anthem BCBS anthem.com Anthem Virtual Care LiveHealth Online livehealthonline.com 24/7 NurseLine Anthem BCBS 888-724-2583 Basic Life / Voluntary Life The Hartford 800-523-2233 thehartford.com Disability The Hartford 866-945-4558 thehartford.com Accident & Critical Illness The Hartford 866-547-4205 thehartford.com Legal Plan U.S. Legal Services 800-356-LAWS uslprotects.com TelaDoc Virtual Care Teladoc 800-Teladoc Teladoc.com Employee Assistance Program Anthem BCBS 800-865-1044 Anthem BCBS Sydney App Human Resources TeamOne Logistics 770-232-9902 benefitbutler@palmerandcay.com (404)

Have a question? Scan the QR code to

Benefit Butler.

991-6070

email the

Benefit

21

Contacts

Trey Haydon & Leon Taylor

Trey Haydon & Leon Taylor