® Volume 23 Number 4 - April 2023

The leading innovator supplying cutting-edge integrity solutions. Together we can ensure sustainable decision-making. Our combination of advanced inspection systems and expert consultants delivers a comprehensive understanding of asset safety, lifetime, and performance.

Comprehensive Asset Integrity Management

www.rosen-group.com

C O NTENTS

03. Editor's comment

05. Pipeline news

Updates on Power of Siberia 2, EastMed and Transgaz Black Sea pipelines.

KEYNOTE ARTICLES: COMPLIANCE AND STANDARDS

8. On the path to zero

To achieve our safety goals, we need to thoroughly study lower consequence events to learn from past mistakes, says Sara Lyons, Pipeline Accident Investigator, National Transportation Safety Board (NTSB), USA.

lexible pipes have been revolutionary force in beginning in World War when they were used to supply fuel to troops in northern France. The pipe used readily available materials arranged in way that made flexible and easy to install subsea at record speeds, mitigating the risk of bombing raids and casualties. Today, flexible pipes are used in offshore Despite their versatility, flexible pipes make up only 15% of the worldwide pipeline market With diameters ranging from 22 in., the most pipes were initially designed for shallow waters, but have waters, with the deepest on record being 3000 m in the Gulf of Mexico. In the coming years, there significant demand for flexible risers and flowlines at 2900 m. Today, design pressure capacities reach as high as 750 bar (10 in.)

and 900 bar (8 in.) with design temperatures reaching as and they continue to be a critical tool for the oil and gas industry. Rigid or flexible pipes? There are several reasons why both flexible and rigid pipes can be technical enablers, and consequently the only pipes, however, could go either flexible or rigid, often triggering passionate debate: Is there significant cost most reliable? How does the type of field layout impact What is the most economic considering the complete Answering these questions is task for talented concept and front end engineering design teams. However, certain variables come into play as well: lack of experience with either option, out of date information, or an incorrect

Roberta Pires, Flexible Pipe Systems Early Engagement Director, Baker Hughes, discusses features to be considered in a comparison between rigid and flexible pipes. 25

injuries. To achieve zero, the focus must extend beyond these minimum safety standards. For example, in the NTSB’s investigation of an accident that reviewed two industry guidance documents intended to help pipeline operators maintain PHMSA-compliant operator as one that was subject to PHMSA’s OQ rules. Similarly, the affected pipeline operator did not include this task in Nevertheless, the NTSB determined that the operator’s procedures and training practices did not prepare workers to recognise and safely respond to abnormal operating conditions. the lives of two men, leaving five surviving witnesses, two of whom were also injured. regulations]”. Industry representatives said that launching and receiving pigs did not meet this criterion. In adopting workers to safely respond to foreseeable, abnormal operating Let’s examine the circumstances of the Farmersville completed the first in a series of pig loadings, when they suspected that the mainline valve was leaking because the flare did not extinguish as expected. They adjusted the valve subsequent runs. On the day of the accident, worker opened in. valve tip, where it successfully ignited. As natural gas pressure the launcher decreased and less natural gas flowed to the flare tip, the work crew observed the flame die down and extinguish. 9 8

PAGE 8 To achieve our safety goals, we need to thoroughly study lower consequence events to learn from past mistakes, says Sara Lyons, Pipeline Accident Investigator, National Transportation Safety Board (NTSB), USA.

15. Managing the Mega Rule

Dr James Dean, CEO, Plastometrex, UK, introduces a novel tool for pipeline integrity management programmes and Mega Rule compliance.

21. Meeting a range of requirements

By working with the end user, product designs can be offered to meet a wide variety of specifications, thereby streamlining project acceptance, says Morgan Sledd, Stark Solutions, USA.

PIPELINE INTEGRITY SYSTEMS

25. Flexible or rigid: the big debate

Roberta Pires, Flexible Pipe Systems Early Engagement Director, Baker Hughes.

INTEGRITY AND INSPECTION

31. Analysing ILI tools

Lance Wethey, Technical Solutions Specialist, ROSEN, USA.

DAMAGE AND DEFECT ASSESSMENT

39. NDT: the ticket to pipeline damage assessment

Danny Keck, President, American Society for Nondestructive Testing (ASNT) and Independent Inspection, USA.

43. Inspect the unexpected Sylvain Cornu, Electromagnetic Engineer, NDT Global.

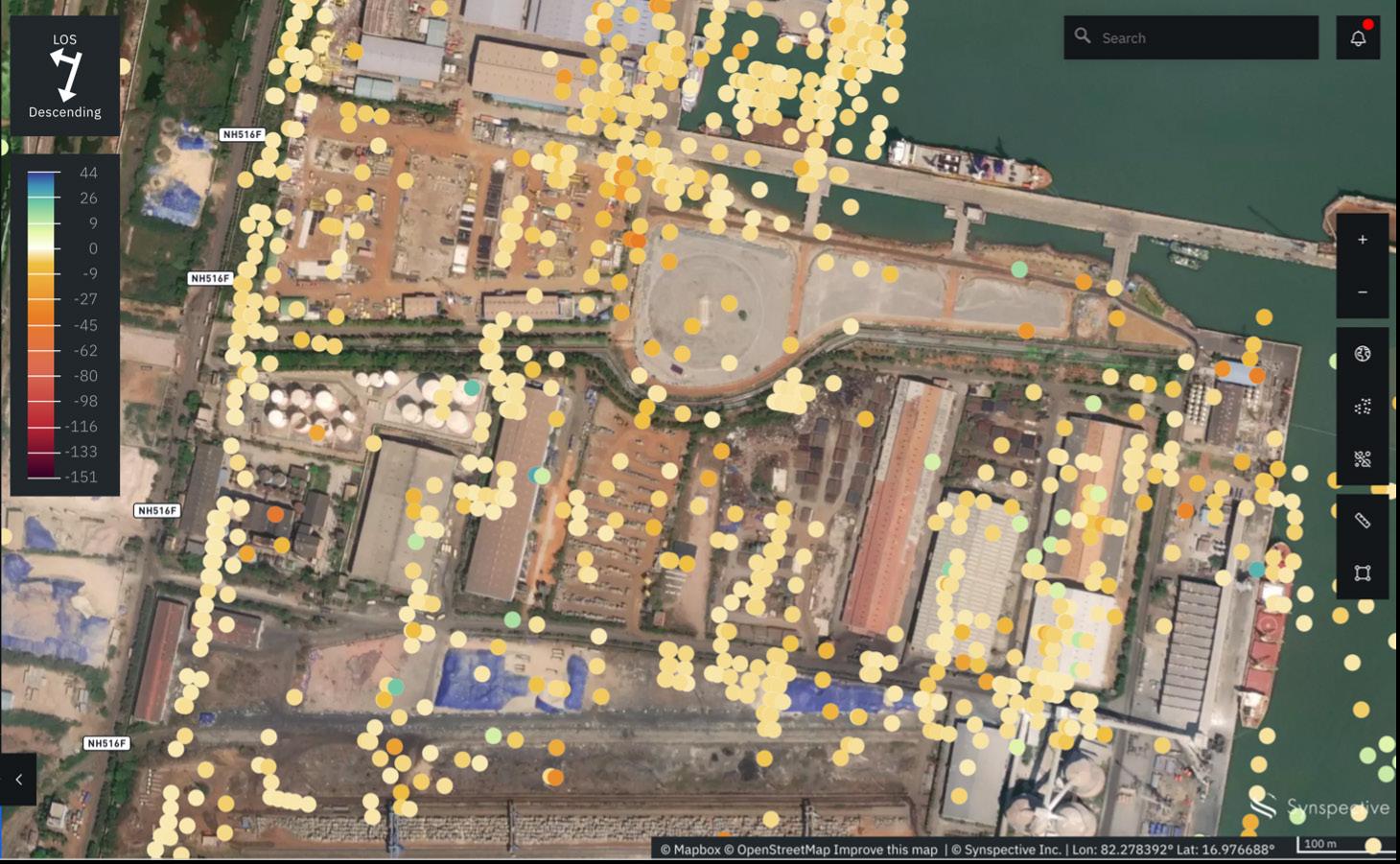

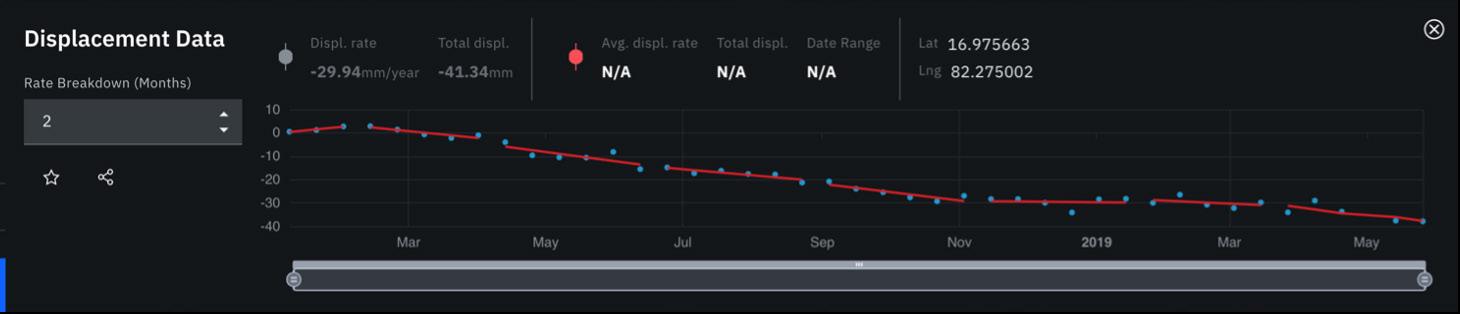

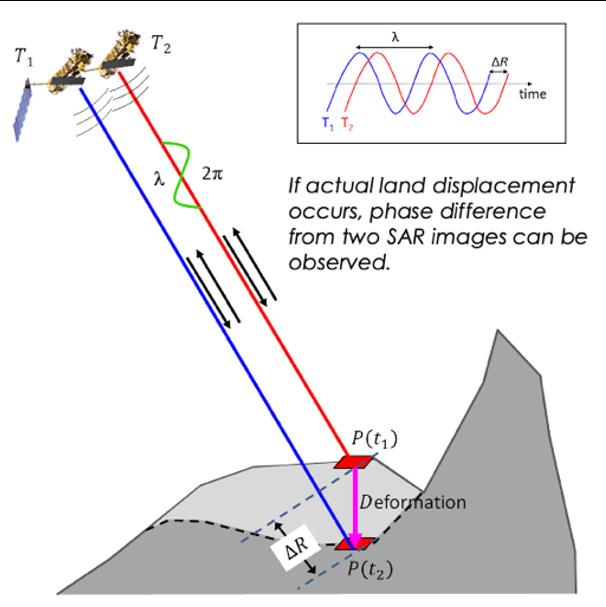

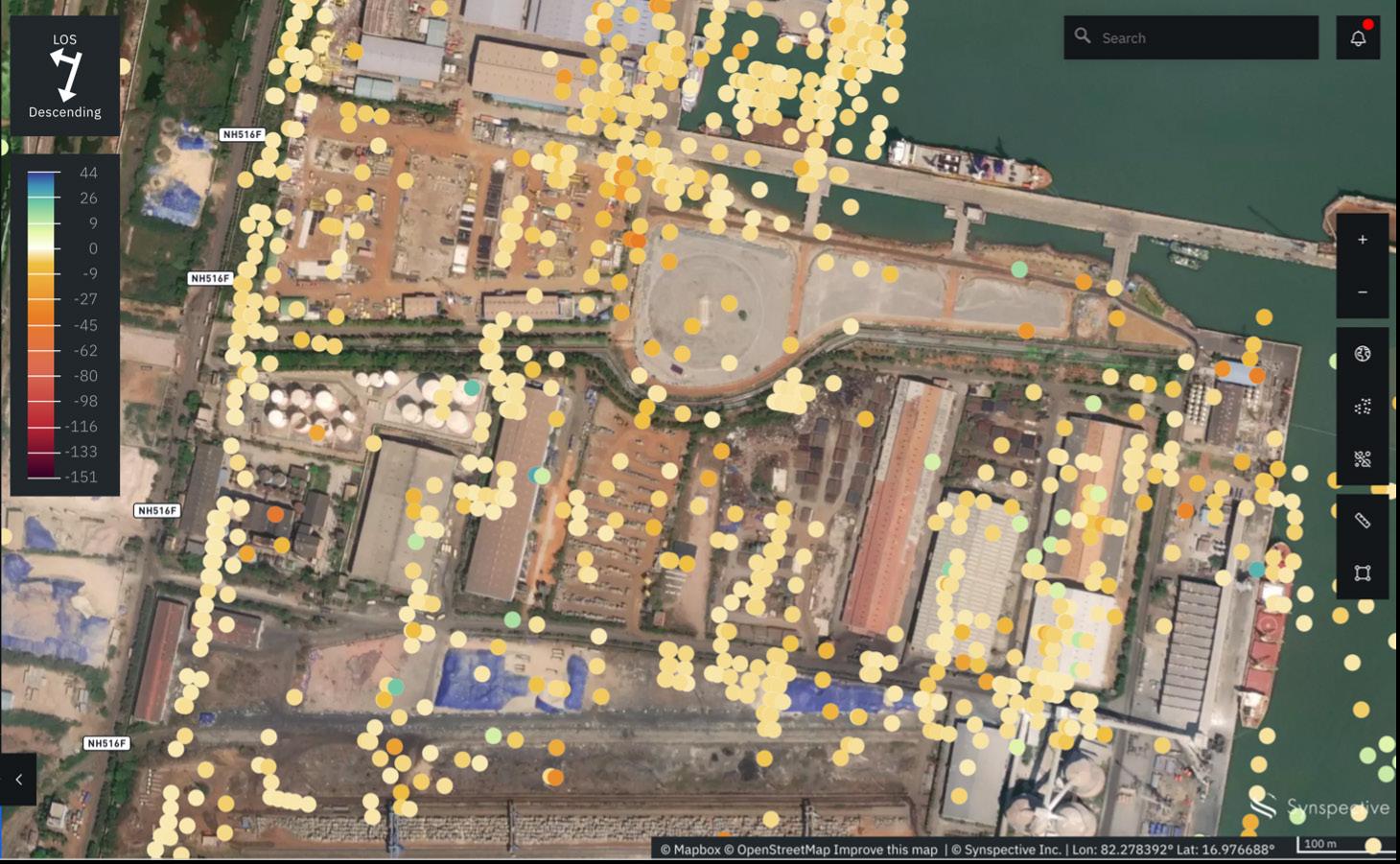

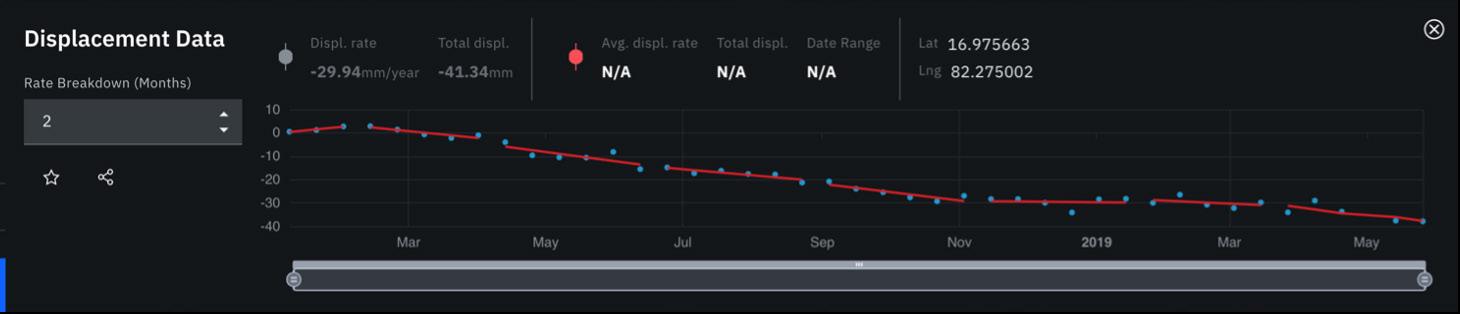

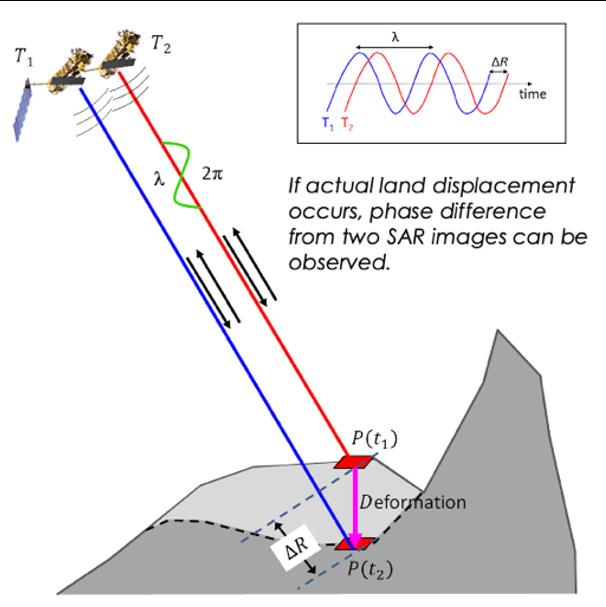

47. Looking above for the answers below

Abhinandan Arya, Vice President, Head of Technology – Solutions, Synspective Inc., Japan.

PIPELINE SERVICES AND MAINTENANCE

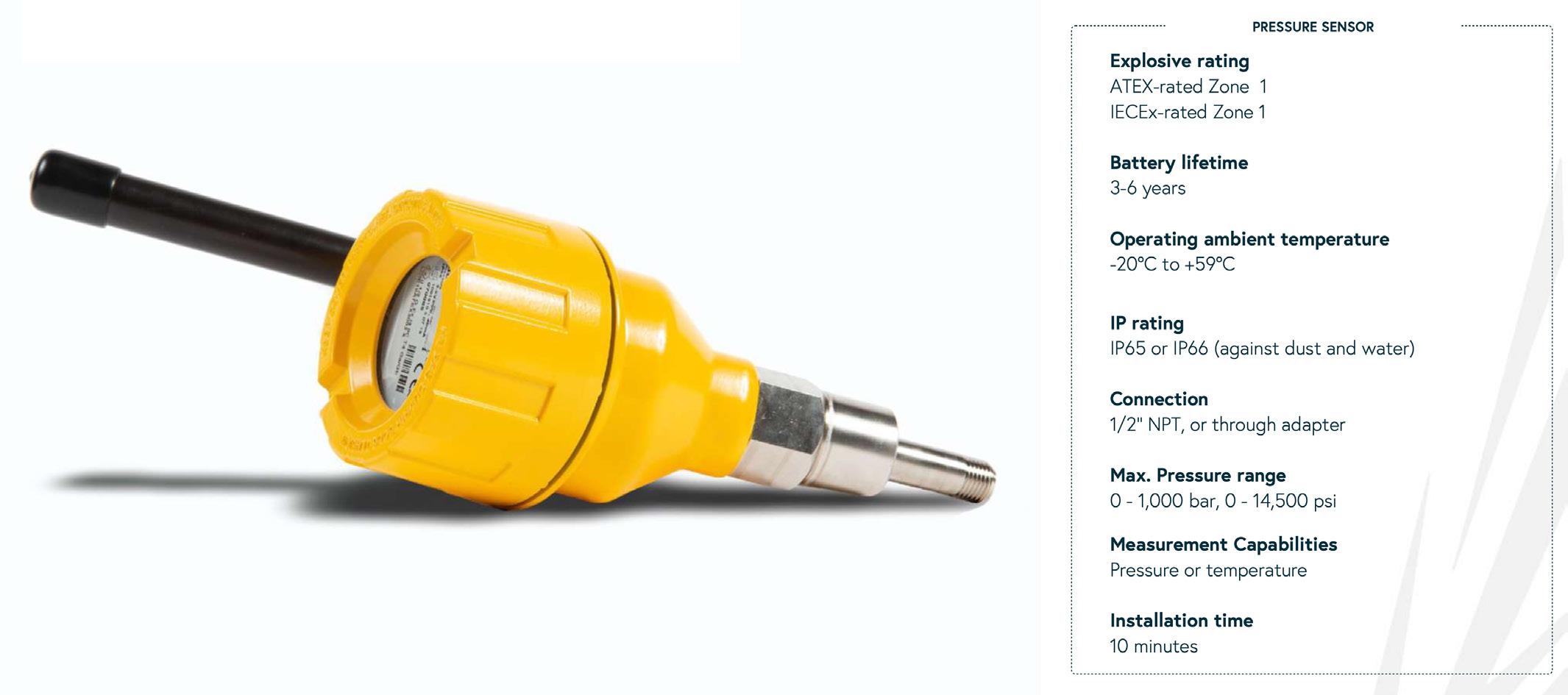

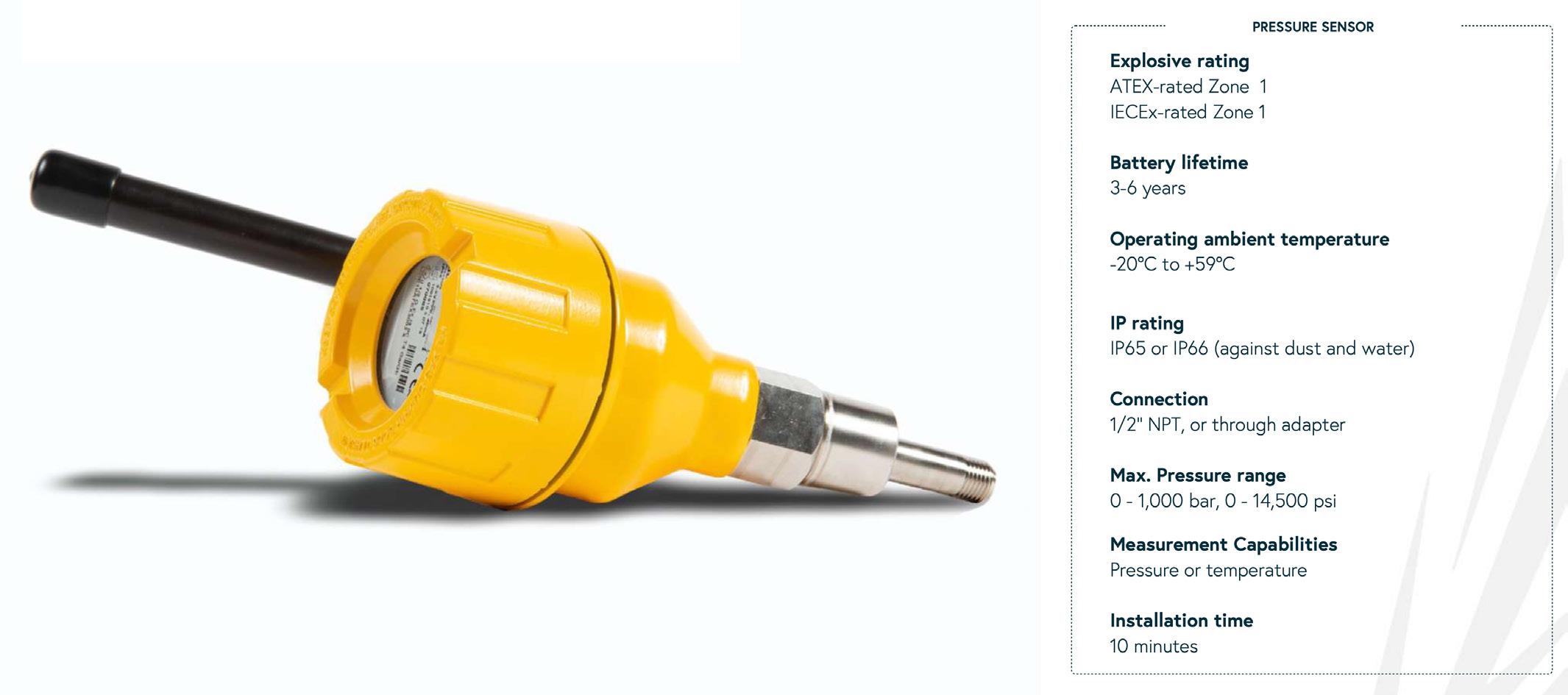

53. Automating data collection

Tom Krikke, Commercial Director, HiberHilo, Netherlands.

OFFSHORE OPERATIONS

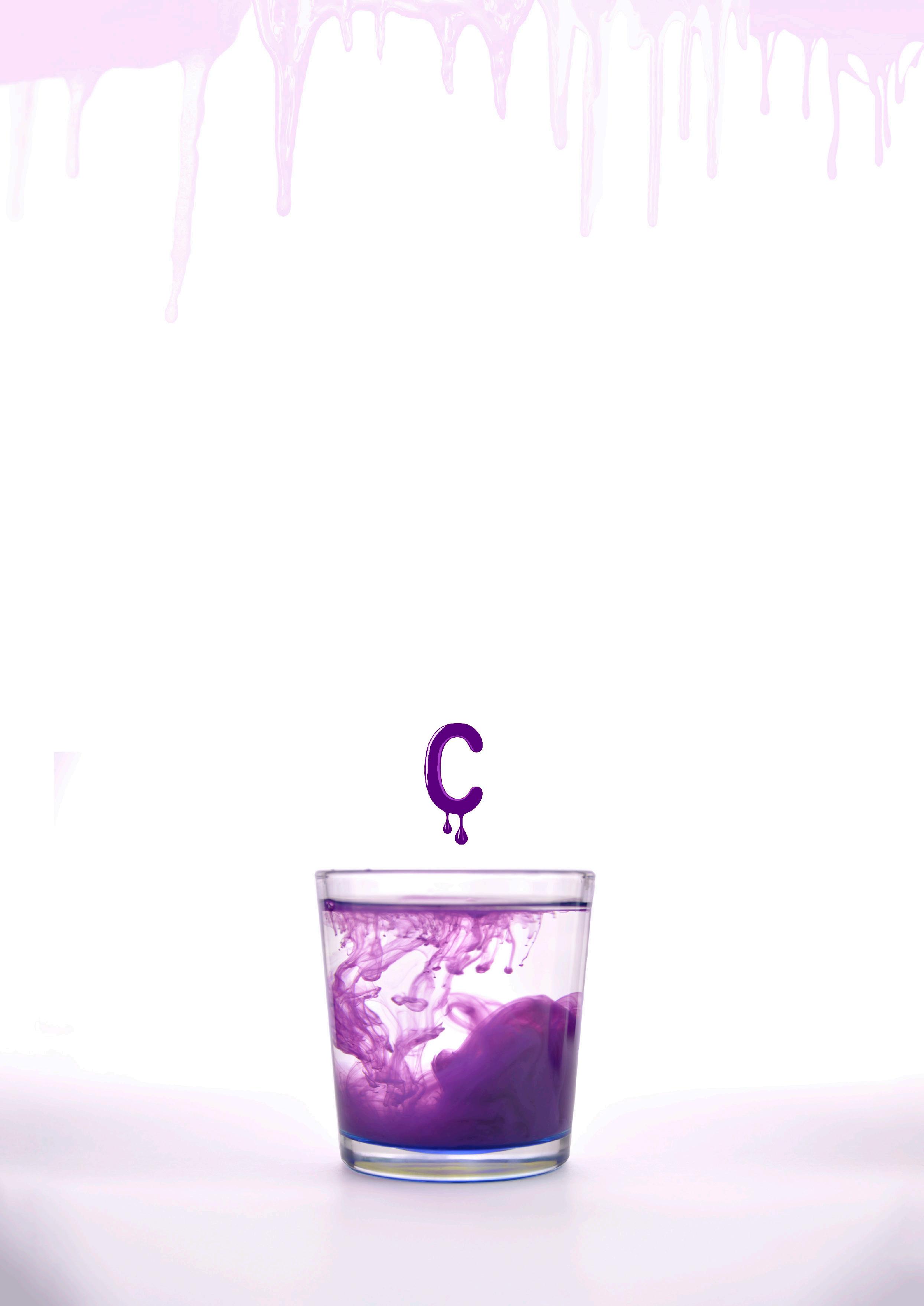

59. Dye as detection?

Kevin Parker, Managing Director, OceanTools Ltd, UK.

OFFSHORE ASSETS

For over 30 years, 3X ENGINEERING (3X) has been one of the world leading companies specialising in pipeline maintenance using composite technology. Developer, manufacturer, seller and installer of our products, 3X offer to our clients a complete integrated service. From our head offices in Monaco, we operate worldwide, in any environment (onshore, offshore and subsea), thanks to our large qualified distribution network of over 60 partners. For more information, visit www.3xeng.com.

ISSN 14727390 Member of ABC Audit Bureau of Circulations ON THIS MONTH'S COVER Reader enquiries [www.worldpipelines.com]

Copyright© Palladian Publications Ltd 2023. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the copyright owner. All views expressed in this journal are those of the respective contributors and are not necessarily the opinions of the publisher, neither do the publishers endorse any of the claims made in the articles or the advertisements. Printed in the UK. WORLD PIPELINES | VOLUME 23 | NUMBER 4 | APRIL 2023

31

43

CBP006075

21 ® Volume 23 Number 4 April 2023

PAGE 25

61. Leading the way in asset integrity management Garry Kidd, Managing Director, Wellube, UAE. A bout 68% of energy consumed in the US comes from through pipelines. Although these sources fuel our transportation, industrial, residential, and commercial needs, they like other energy sources present potential injuries occur each year, while government, industry, and public leaders urge us to do more to prevent these tragic events. Homendy, encourages us to “fearlessly pursue zero” as our only goal: zero deaths from pipeline operations. We know that be taken to turn this ambitious goal into reality? Compliance with minimum federal safety Let’s first consider the regulatory framework that’s already in place. Congress charged the US Department of Transportation’s Pipeline and Hazardous Materials Safety Administration pipeline transportation and pipeline facilities to provide “adequate protection against risks to life and property”. Before that its benefits justify its costs. This means that compliance with the minimum safety standards necessary but may not be sufficient to eliminate the potential for fatalities and

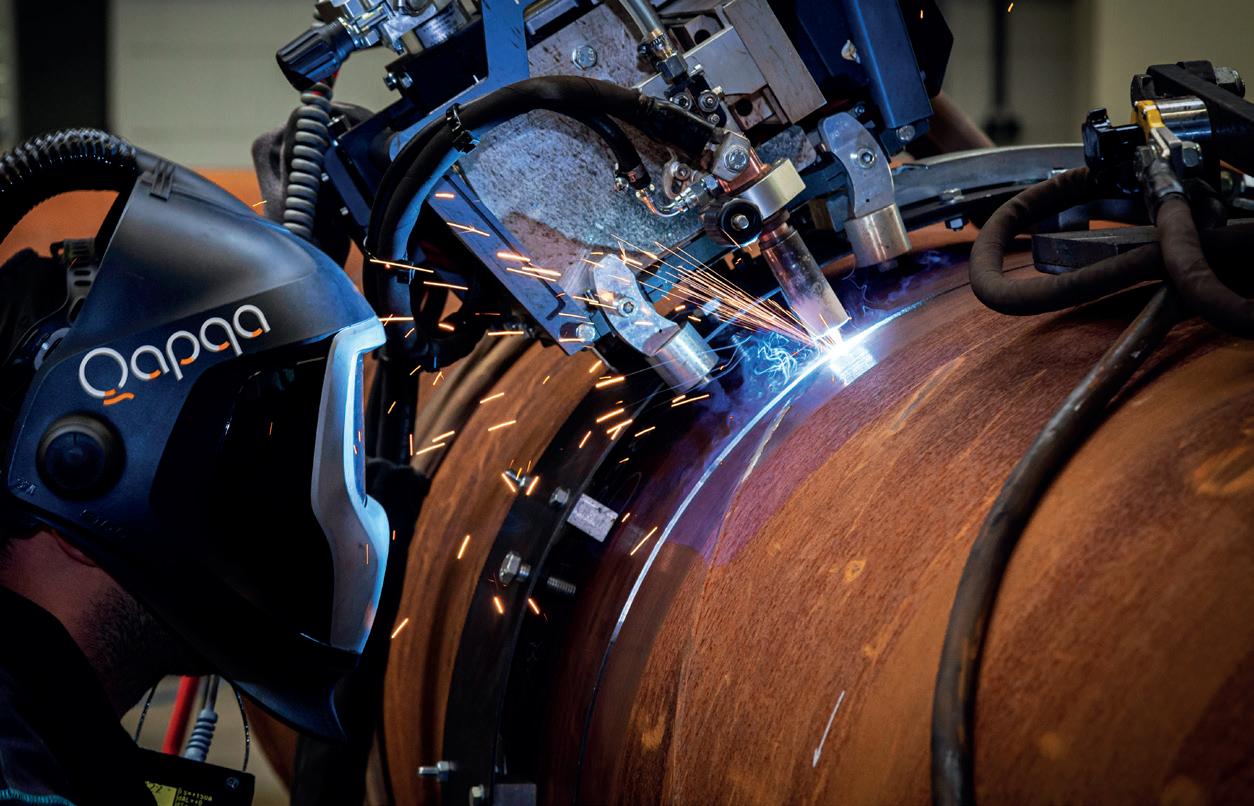

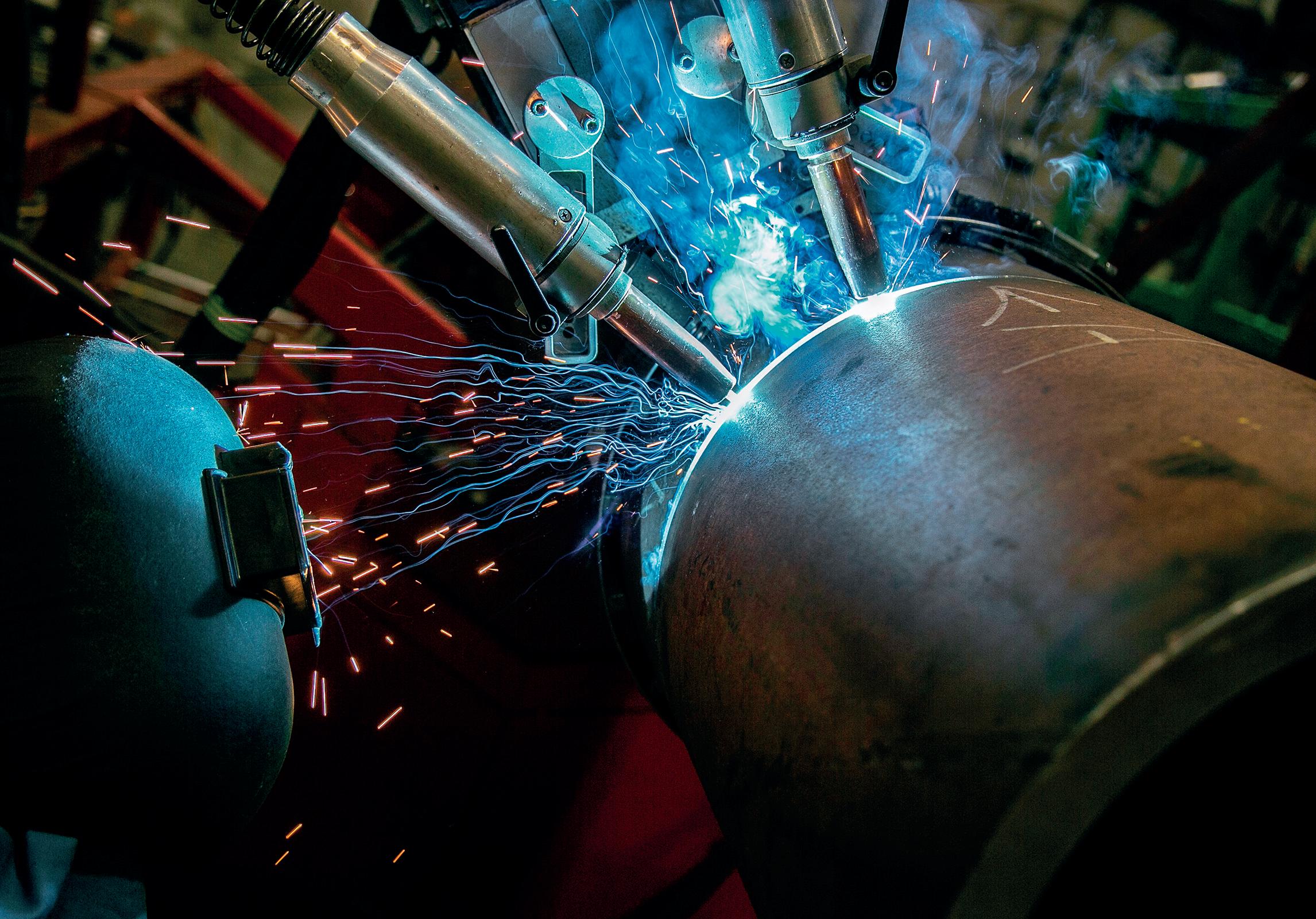

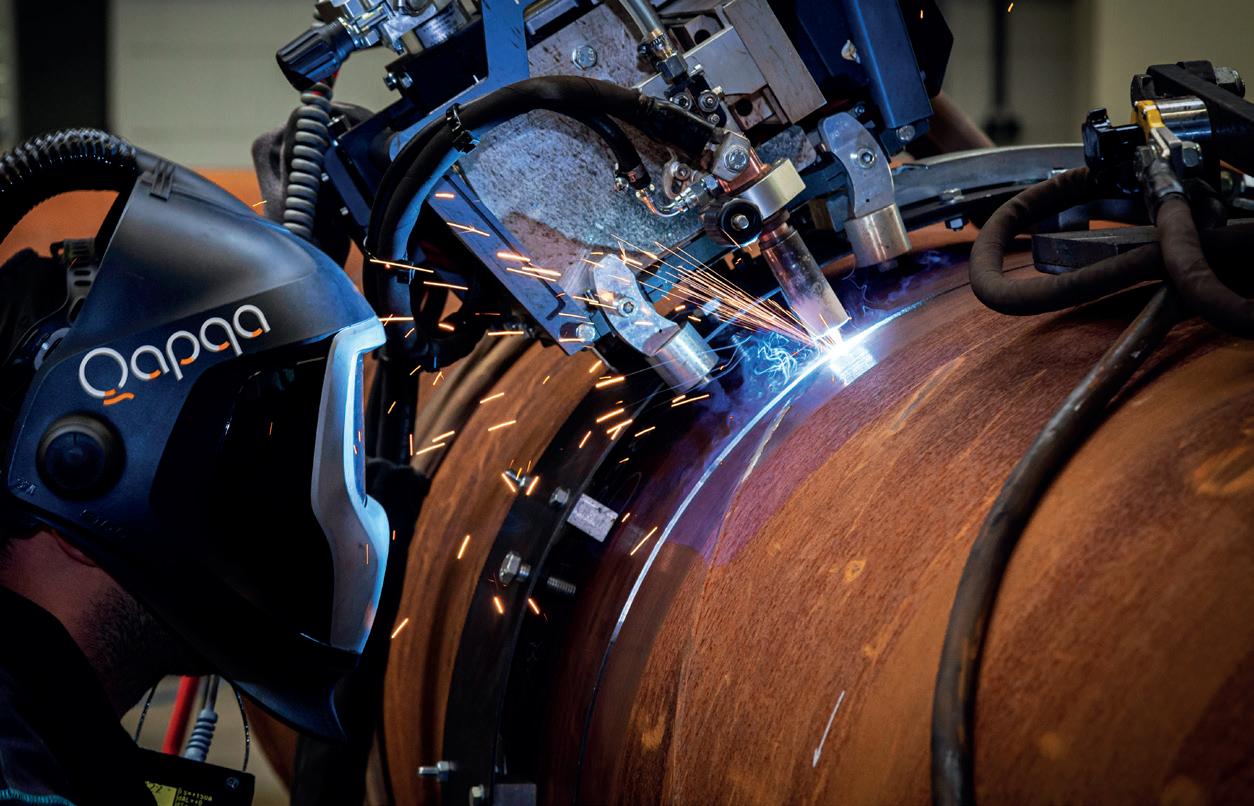

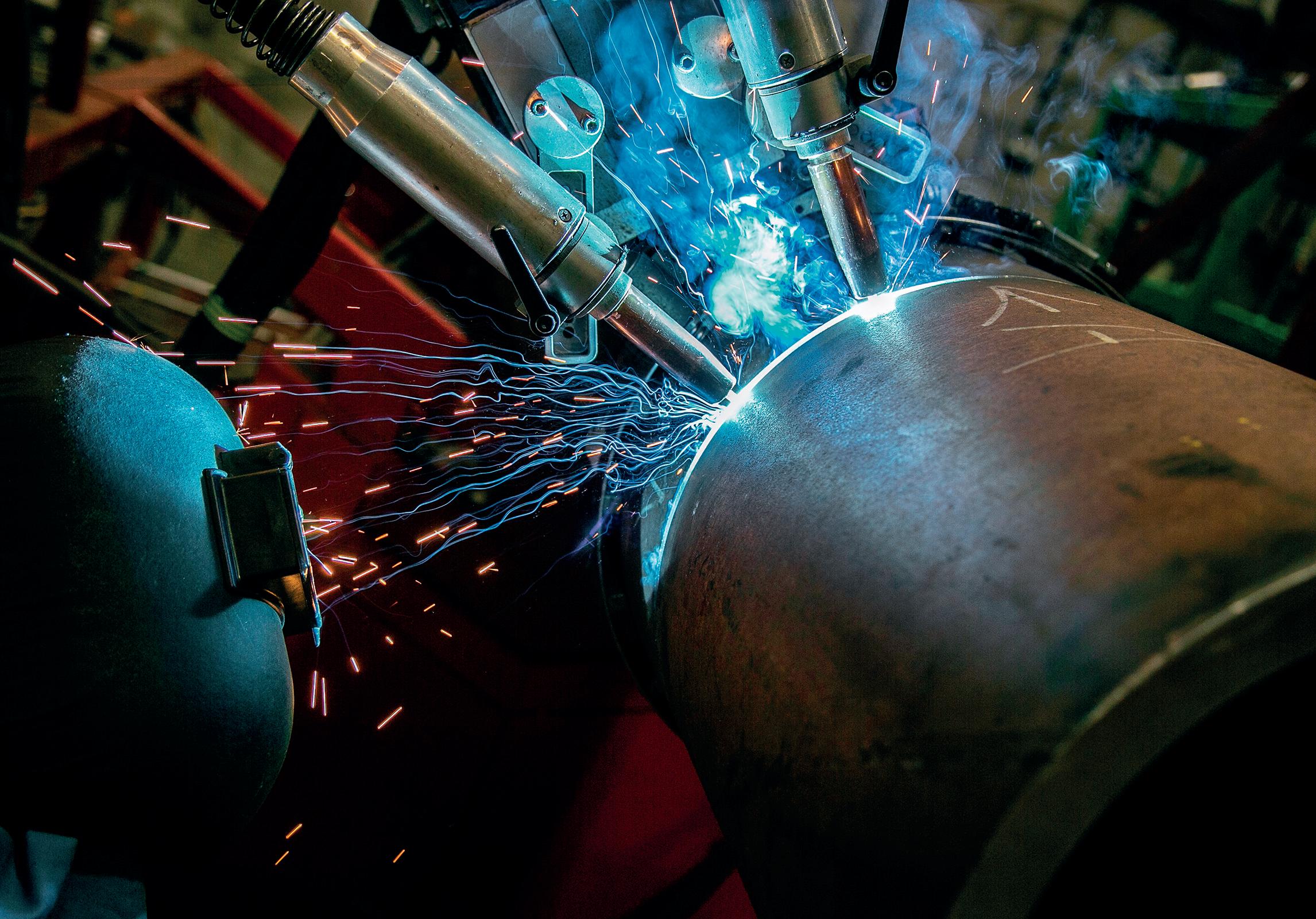

• Increase productivity

• Increase quality

• Lower repair rates

• High level of support

Together, we create the most distinctive and integrated welding solutions for the construction of reliable and sustainable pipelines. As a family business, we think long term. Dedicated and continuously improving, we always challenge ourselves to go the extra mile.

Qapqa. Joining solutions.

Van Oord - Mexico

Van Oord - Mexico

EDITOR’S COMMENT

CONTACT INFORMATION

MANAGING EDITOR

James Little james.little@palladianpublications.com

EDITORIAL ASSISTANT

Sara Simper sara.simper@palladianpublications.com

SALES DIRECTOR

Rod Hardy rod.hardy@palladianpublications.com

SALES MANAGER

Chris Lethbridge chris.lethbridge@palladianpublications.com

SALES EXECUTIVE

Daniel Farr daniel.farr@palladianpublications.com

PRODUCTION MANAGER

Calli Fabian calli.fabian@palladianpublications.com

EVENTS MANAGER

Louise Cameron louise.cameron@palladianpublications.com

DIGITAL EVENTS COORDINATOR

Stirling Viljoen stirling.viljoen@palladianpublications.com

DIGITAL CONTENT ASSISTANT

Merili Jurivete merili.jurivete@palladianpublications.com

DIGITAL ADMINISTRATOR

Leah Jones leah.jones@palladianpublications.com

ADMINISTRATION MANAGER

Laura White laura.white@palladianpublications.com

Palladian Publications Ltd, 15 South Street, Farnham, Surrey, GU9 7QU, UK

Tel: +44 (0) 1252 718 999

Website: www.worldpipelines.com

Email: enquiries@worldpipelines.com

Annual subscription £60 UK including postage/£75 overseas (postage airmail). Special two year discounted rate: £96 UK including postage/£120 overseas (postage airmail). Claims for non receipt of issues must be made within three months of publication of the issue or they will not be honoured without charge.

Applicable only to USA & Canada:

World Pipelines (ISSN No: 1472-7390, USPS No: 020-988) is published monthly by Palladian Publications Ltd, GBR and distributed in the USA by Asendia USA, 17B S Middlesex Ave, Monroe NJ 08831. Periodicals postage paid New Brunswick, NJ and additional mailing offices. POSTMASTER: send address changes to World Pipelines, 701C Ashland Ave, Folcroft PA 19032

The US Department of Transport’s Pipeline and Hazardous Materials Safety Administration (PHMSA) has announced a strategic partnership with NASCAR, to increase awareness of the ‘Call 811’ initiative. Members of the American public are urged to call 811 or visit call811.com two days before digging on their property. The service provides homeowners, contractors and other professionals with information about the location of underground utilities. April was declared Safe Digging Month in the US in 2007, and every year the month continues to see increased focus on safety and preventing damage.

Under the NASCAR partnership, ‘Call 811’ will be displayed on NASCAR vehicles, fire and pit crew suits in more than 30 races during the 2023 season of the NASCAR Xfinity Series. The National Volunteer Fire Council is also promoting free excavation damage incident training resources to first responders, via a 30 second streaming advert on Spotify.

“Incidents caused by unsafe digging put workers, the public, and first responders at risk – that’s why we’re partnering with NASCAR and states from across the country to raise the public’s awareness about this important safety issue,” said PHMSA Deputy Administrator, Tristan Brown.

Visibility is an important part of this ongoing safety campaign, and it’s as important as ever to push the 811 message: the most recent version of the Common Ground Alliance’s Damage Information Reporting Tool (DIRT) report identified more than 192 000 damages to underground facilities caused by unsafe digging in the USA in 2021.

In this month’s issue of World Pipelines, our keynote feature focuses on compliance and standards, with safety goals in mind. On p.8, Sara Lyons, Pipeline Accident Investigator from the National Transportation Safety Board (NTSB), argues that compliance with minimum federal safety standards is not enough to eliminate the potential for fatalities and injuries. To achieve its safety goals, she goes on, the pipeline industry must thoroughly study lower consequence events and learn from past mistakes. The article offers valuable insight into the NTSB’s pipeline safety investigation work, and how it (along with PHMSA, the state and pipeline operators) can push for zero deaths from pipeline operations. Read the piece for more details on the Farmersville, Texas accident (2021) in which an explosion took place in a pig launcher; the Danville, Kentucky incident (2019) in which a 30 in. pipeline ruptured; and the Merrimack Valley, Massachusetts overpressurisation accident (2018). By careful examination and documentation of these failures, and others like them, Lyons is convinced that the industry can succeed in eliminating serious accidents.

Also in this issue, Plastometrex considers new ways to meet Mega Rule legislation when it comes to material verification requirements (p.15); Stark Solutions gets technical about product development on quick opening closures (p.21); and the American Society for Nondestructive Testing (ASNT) writes about the importance of routine pipeline inspection, the need for innovative NDT techniques and how the standards for condition assessment of pipelines are evolving.

SENIOR EDITOR Elizabeth Corner elizabeth.corner@palladianpublications.com

The welding and coating experts you can trust

Ensure the efficient, on-time delivery of your onshore and offshore projects with CRC Evans’ market-leading welding and coating services, technologies and integrated solutions, and extensive fleet of pipeline equipment

americas Europe Middle East Africa Asia Pacific crcevans.com enquiries@crce.com @crcevansglobal CONNECT WITH CRC EVANS

Power of Siberia 2 update: pipeline delay following Russia-China talks

Russian President, Vladimir Putin and Chinese leader, Xi Jinping met in Moscow for two days of talks in March, during which they discussed the Power of Siberia 2 pipeline project, to deliver gas to China via Mongolia.

Ahead of the meeting, Putin said Russia, China and Mongolia had completed “all agreements” on finishing the pipeline to ship Russian gas to China, and that Russia will deliver at least 98 billion m3 of gas to China by 2030, although a subsequent Russian statement said pipeline details still need to be resolved.

Russia proposed the route years ago but the plan has gained urgency as Moscow looks to Beijing to replace Europe as its major gas customer.

The Chinese and Russian leaders’ talks did not yield decisive agreements on economic issues important to helping Moscow weather western sanctions. Putin’s main goal during the Chinese leader’s stay was to secure agreement for his planned Power of

Siberia 2 gas pipeline set to supply China via Mongolia. Xi remained silent on the topic. A lengthy joint statement said only that Russia and China would “make efforts to advance work on studying and agreeing” plans to build the pipeline.

The proposed pipeline would bring gas from the huge Yamal peninsula reserves in west Siberia to China, the world’s top energy consumer and a growing gas consumer.

The first Power of Siberia pipeline runs for 3000 km (1865 miles) through Siberia and into China’s northeastern Heilongjiang province.

The new route would cut through eastern Mongolia and into northern China.

Gazprom began a feasibility study on the project in 2020, and has aimed to start delivering gas by 2030.

The 2600 km pipeline could carry 50 billion m3/y of gas, slightly less than the now defunct Nord Stream 1 pipeline linking Russia to Germany under the Baltic Sea.

Edison decision on EastMed pipeline due by end of the year

Energy group Edison plans to take the final investment decision (FID) on a proposed pipeline to deliver east Mediterranean gas to European markets by the end of this year, the Italian project developer told news source Reuters.

The EastMed-Poseidon pipeline, which would initially connect several gas fields offshore Israel to Italy, and have an annual capacity of 10 billion m3 of gas, could be ready by 2027, Edison said.

The project, supported by Israel, Cyprus and Greece, would guarantee alternative supplies for Europe, which is weaning itself off of Russian piped gas. In addition, it would better connect Cyprus to its EU partners.

For these reasons, the European Commission could be interested in partly funding the project, whose cost is estimated at around €6 billion (US$6.4 billion), Edison said.

“We expect to take the FID by the end of this year. With a

Transgaz to build pipeline for Black Sea gas

Romania’s gas pipeline operator Transgaz is to build a new pipeline worth an estimated €500 million (US$529.30 million) designed to bring offshore Black Sea gas to the national grid once the two gas producers make a final investment decision (FID), Prime Minister, Nicolae Ciuca said on 16 March.

Romanian oil and gas group OMV Petrom, majority controlled by Austria’s OMV and state-owned Romgaz, is expected to make a final decision to invest in a long-awaited offshore project by mid-2023. The project is estimated to cost €4 billion and produce at least 6 billion m3/yr.

“We are readying the transport infrastructure (for the project),” the Prime Minister said. “Transgaz has signed the contract, with [...] works set to start after a final investment

FID in 2023, the project would be realised by 2027,” Fabrizio Mattana, Edison’s Executive Vice President for gas assets, told Reuters.

Italy’s Edison, a subsidiary of France’s EDF, and Greece’s DEPA International Projects, are promoting the project through their joint venture IGI Poseidon. Last year, they received independent positive assessments over the feasibility of the pipeline, which would be 2000 km (1243 miles) long, with at least 800 km offshore.

The pipeline would be fed by Israeli gas fields already in production and others under development. These are Leviathan, Tamar and also the Tanin and Karish fields that have additional reserves to be developed, Mattana said.

These fields produce around 28 billion m3/yr, with about a third exported to Egypt and Jordan. Production is expected to climb in the coming years as current projects are expanded and any discoveries are brought online.

decision is made.”

The Neptun Deep block is expected to have a production capacity of at least six billion m3/yr of gas.

The 308.3 km gas pipeline will be built as part of the ‘Gas transmission pipeline Black Sea – Podisor’ project.

The transmission pipeline Tuzla-Podisor will connect the available gas in the Black Sea to the BRUA corridor.

Transgaz said in a statement: “The implementation of a transmission infrastructure allowing for the connection of the gas available at the Black Sea shore to the BRUA corridor is a project of vital importance for Romania, in terms of energy security, and the conclusion of these gas transmission contracts represents the pre-requisite for the development of this infrastructure.”

APRIL 2023 / World Pipelines 5

WORLD NEWS

CONTRACT NEWS

ICR Integrity announces major contract win with Petrofac

Perma-Pipe announces Gulf of Mexico project award

20 April 2023

Global Hydrogen Conference 2023 Online www.accelevents.com/e/ghc2023

1 - 4 May 2023

Offshore Technology Conference 2023

Houston, USA 2023.otcnet.org

8 - 11 May 2023

Pipeline Technology Conference (ptc) Berlin, Germany www.pipeline-conference.com

9 - 11 May 2023

Canada Gas & LNG Exhibition and Conference

Vancouver, Canada www.canadagaslng.com

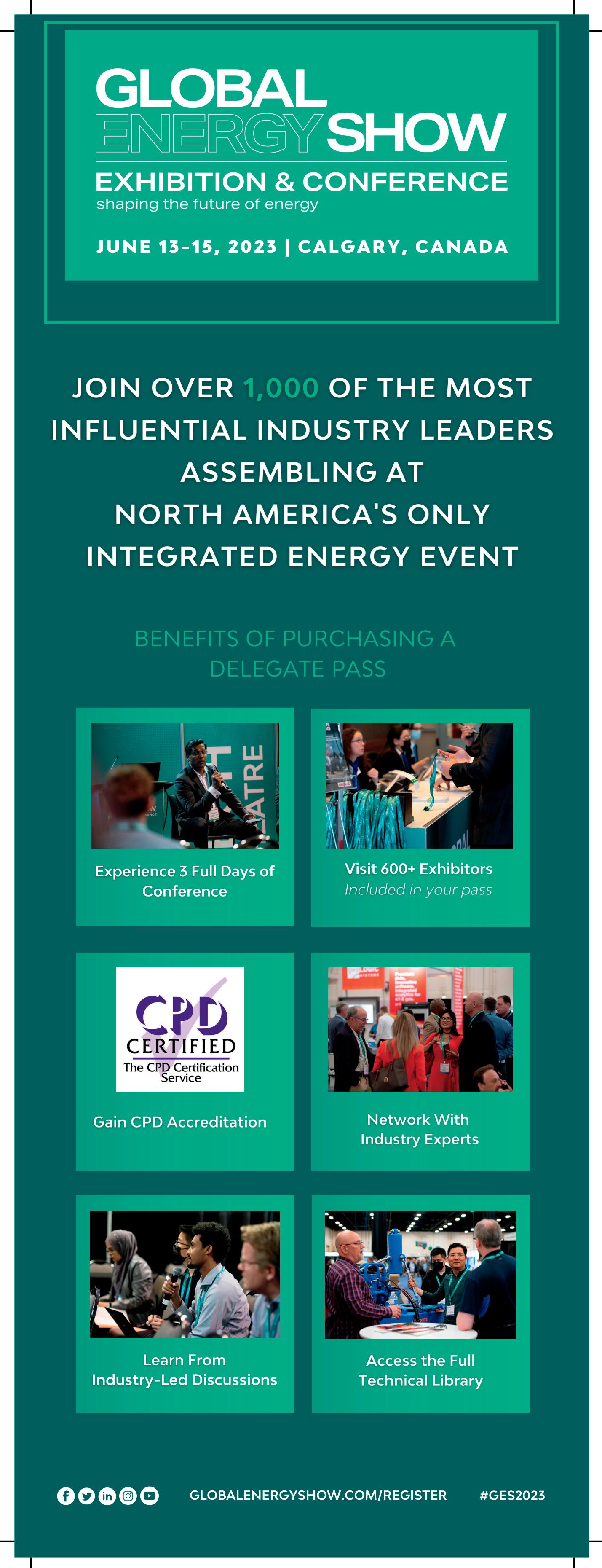

13 -15 June 2023

Global Energy Show 2023 Calgary, Canada www.globalenergyshow.com

5 - 8 September 2023

Gastech 2023 Singapore www.gastechevent.com

21 - 22 September 2023

Subsea Pipeline Technology Congress (SPT 2023)

London, UK sptcongress.com

2 - 5 October 2023

ADIPEC 2023

Abu Dhabi, UAE www.adipec.com

ICR Integrity has announced the re-award of its master service agreement (MSA) with Petrofac valued at over £1 million per annum following a successful tender exercise.

The MSA was initially awarded in 2019, as a result of ICR’s well-established partnership with Petrofac delivering specialist repair and inspection services for all duty holder assets in the North and Southern North Sea, with the purpose of strategically aligning the various ICR services delivered to Petrofac under a single cross-asset agreement.

ICR will continue to provide Petrofac with innovative repair solutions including: TechnowrapTM engineered composite and clamp repairs, QuickflangeTM weldless connection solutions, chemical injection pump skids, corrosion inspection services and drone inspection through its SkyFuturesTM team.

Overall O&G contract value up by 27%

The oil and gas industry contract value has seen a significant q/q increase of 27% in 4Q22, according to GlobalData.

GlobalData’s latest report, ‘Oil and Gas Industry Contracts Analytics by Sector (Upstream, Midstream and Downstream), Region, Planned and Awarded Contracts and Top Contractors, Q4 2022’, shows that the overall contract value increased from US$47.38 billion in 3Q22 to US$60.36 billion in 4Q22. Contract volume, however, decreased from 1673 in 3Q22 to 1443 in 4Q22.

Pritam Kad, Oil and Gas Analyst at GlobalData, comments: “The key drivers for the value momentum were Saipem’s US$4.5 billion contract from Qatargas for the EPC of the North Field Production Sustainability Natural Gas Compression Complex Project, offshore north-east coast of Qatar; and ADNOC’s US$4 billion framework with ADNOC Drilling, Schlumberger, and Haliburton for the integrated drilling fluids services (IDFS) for projects in the UAE.”

Operations and maintenance (O&M) represented 55% of the total contracts in 4Q22, followed by procurement with 19%, and contracts with multiple scopes, such as construction, design and engineering, installation, O&M, and procurement accounted for 13%.

Perma-Pipe International Holdings, Inc. has been awarded a contract in excess of US$9 million. The contract is for the Winterfell Project in the US Gulf of Mexico for Beacon Offshore Energy LLC. The project will be executed at Perma-Pipe’s facility in the Port of Iberia, Louisiana in the latter part of 2023 and will be completed before the end of the year.

The newly awarded project involves the application of PermaPipe’s FLOW-THERM® subsea wet insulation to the flowline that forms a part of Beacon’s Winterfell Project, located in the US Gulf of Mexico at a water depth of approximately 5800 ft (1600 m).

ON OUR WEBSITE

• Object found next to Nord Stream pipeline

• Colombia’s Ecopetrol criticises new attacks on oil pipeline

• Oil flow halts in BatmanDörtyol pipeline due to leak

• Xage selected by Kinder Morgan to cyber-harden critical infrastructure

• Reaction to IPCC report

• AMPP names new CEO

Follow us on LinkedIn to read more about the articles linkedin.com/showcase/worldpipelines

6 World Pipelines / APRIL 2023

EVENTS DIARY

PROTECTIVE OUTERWRAPS

HEAT SHRINKABLE SLEEVES

SOIL-TO-AIR INTERFACE

INTERNAL

DENSO™ are leaders in corrosion prevention and sealing technology. With 140 years’ service to industry, our mainline and field joint coating solutions offer reliable and cost effective protection for buried pipelines worldwide.

United Kingdom, UAE & India

USA & Canada

Australia & New Zealand

Republic of South Africa

FOR CORROSION PREVENTION

www.denso.net

www.densona.com

www.densoaustralia.com.au

www.denso.co.za

LIQUID EPOXY COATINGS

PETROLATUM TAPE WRAP SYSTEMS

BUTYL TAPE WRAP SYSTEMS

PIPE LININGS

BITUMEN TAPE WRAP SYSTEMS

A MEMBER OF WINN & COALES INTERNATIONAL

VISCO-ELASTIC COATINGS

To achieve our safety goals, we need to thoroughly study lower consequence events to learn from past mistakes, says Sara Lyons, Pipeline Accident Investigator, National Transportation Safety Board (NTSB), USA.

bout 68% of energy consumed in the US comes from petroleum and natural gas, which are often transported through pipelines.1 Although these sources fuel our transportation, industrial, residential, and commercial needs, they – like other energy sources – present potential hazards to our health, safety, and environment. Fatalities and injuries occur each year, while government, industry, and public leaders urge us to do more to prevent these tragic events.

Given the NTSB’s long history of investigating catastrophic pipeline accidents, it’s not surprising that NTSB Chair, Jennifer Homendy, encourages us to “fearlessly pursue zero” as our only goal: zero deaths from pipeline operations.2 We know that these accidents are preventable, but what practical steps can be taken to turn this ambitious goal into a reality?

Compliance with minimum federal safety standards is not enough

Let’s first consider the regulatory framework that’s already in place. Congress charged the US Department of Transportation’s Pipeline and Hazardous Materials Safety Administration (PHMSA) with prescribing minimum safety standards for pipeline transportation and pipeline facilities to provide “adequate protection against risks to life and property”. Before enacting a safety standard, PHMSA typically must determine that its benefits justify its costs. This means that compliance with the minimum safety standards is necessary but may not be sufficient to eliminate the potential for fatalities and

injuries. To achieve zero, the focus must extend beyond these minimum safety standards.

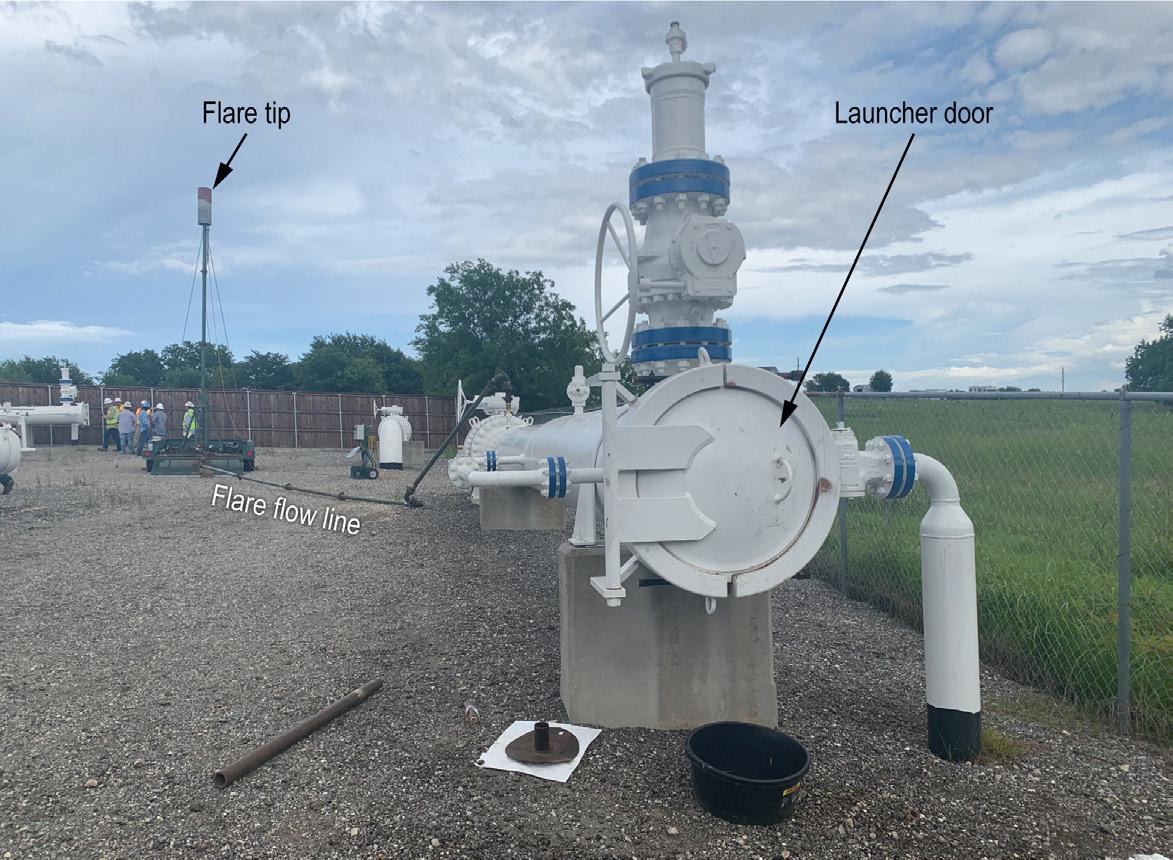

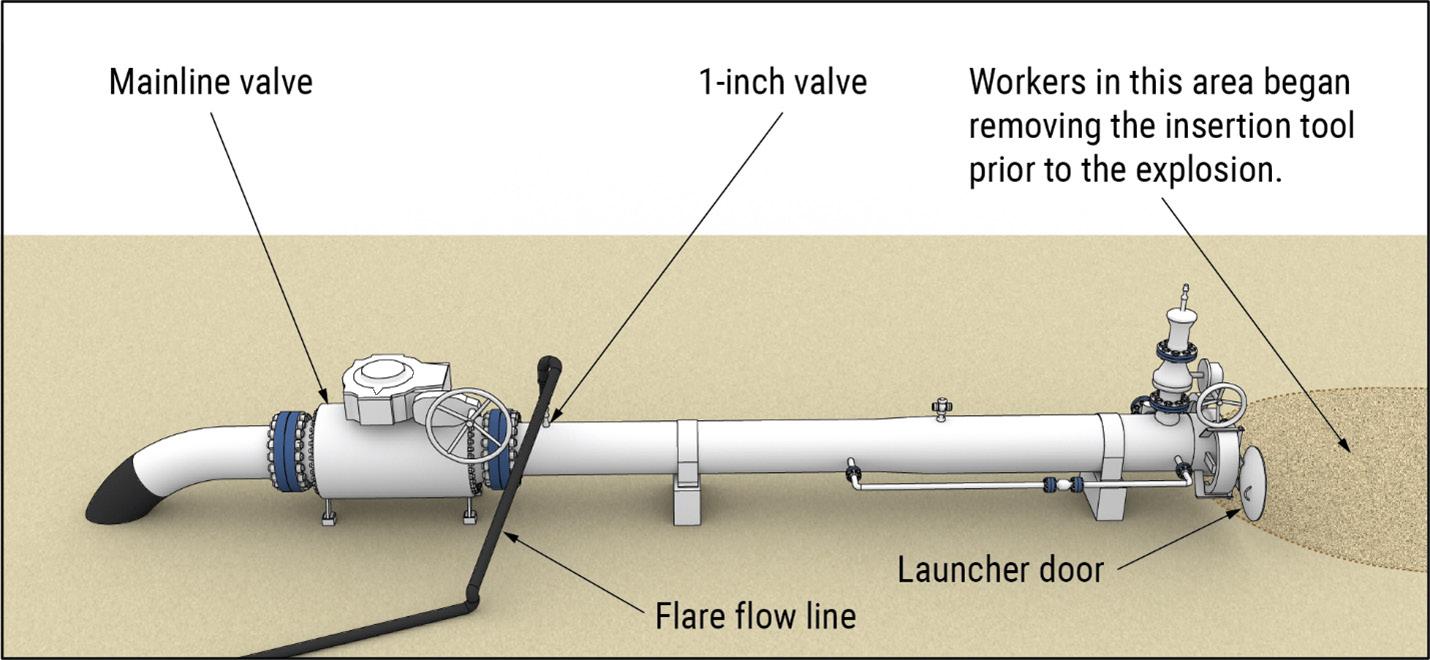

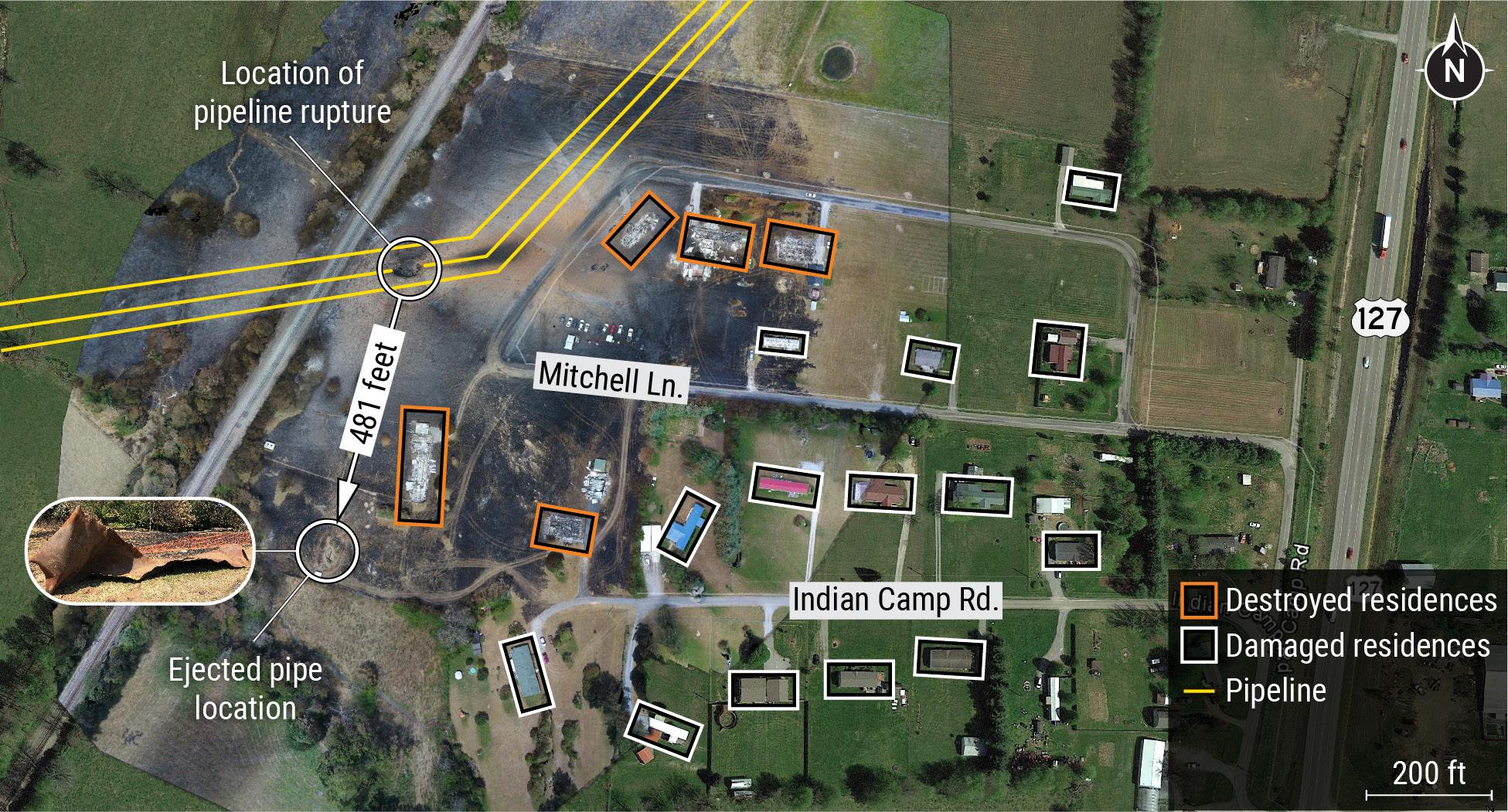

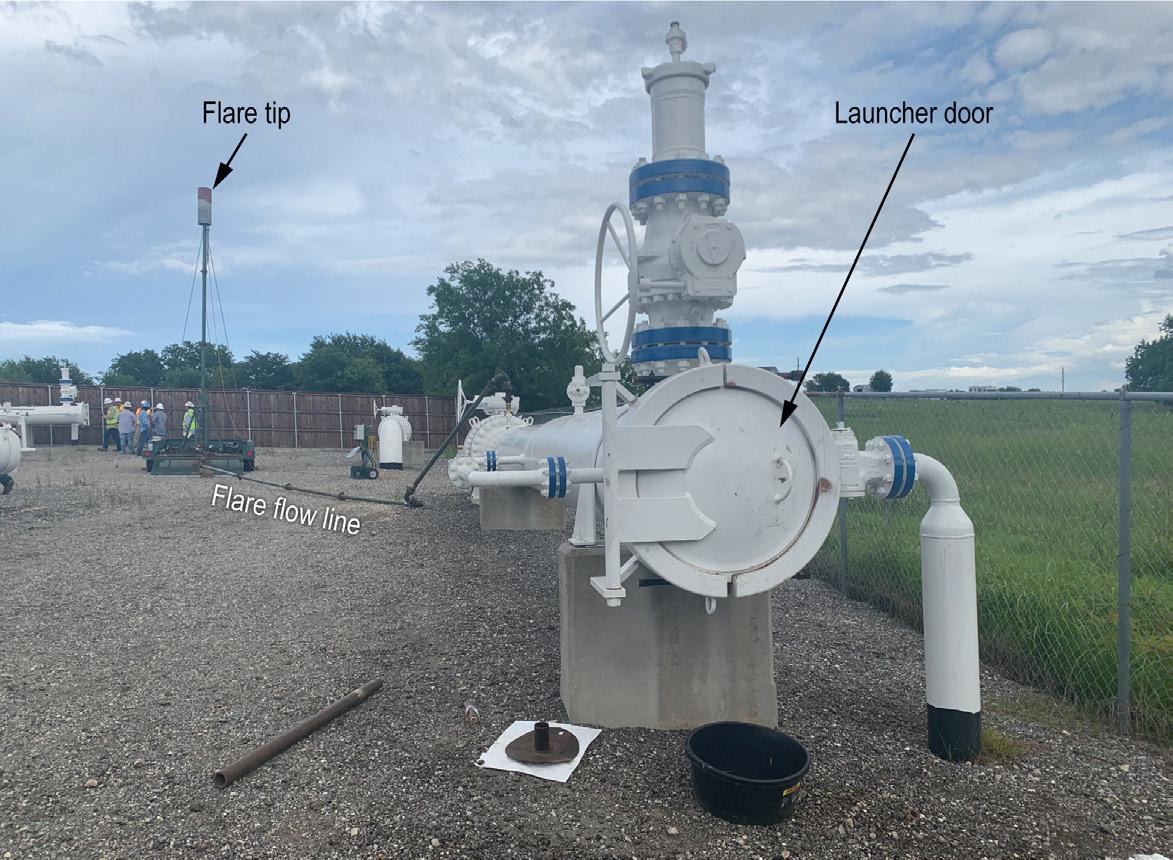

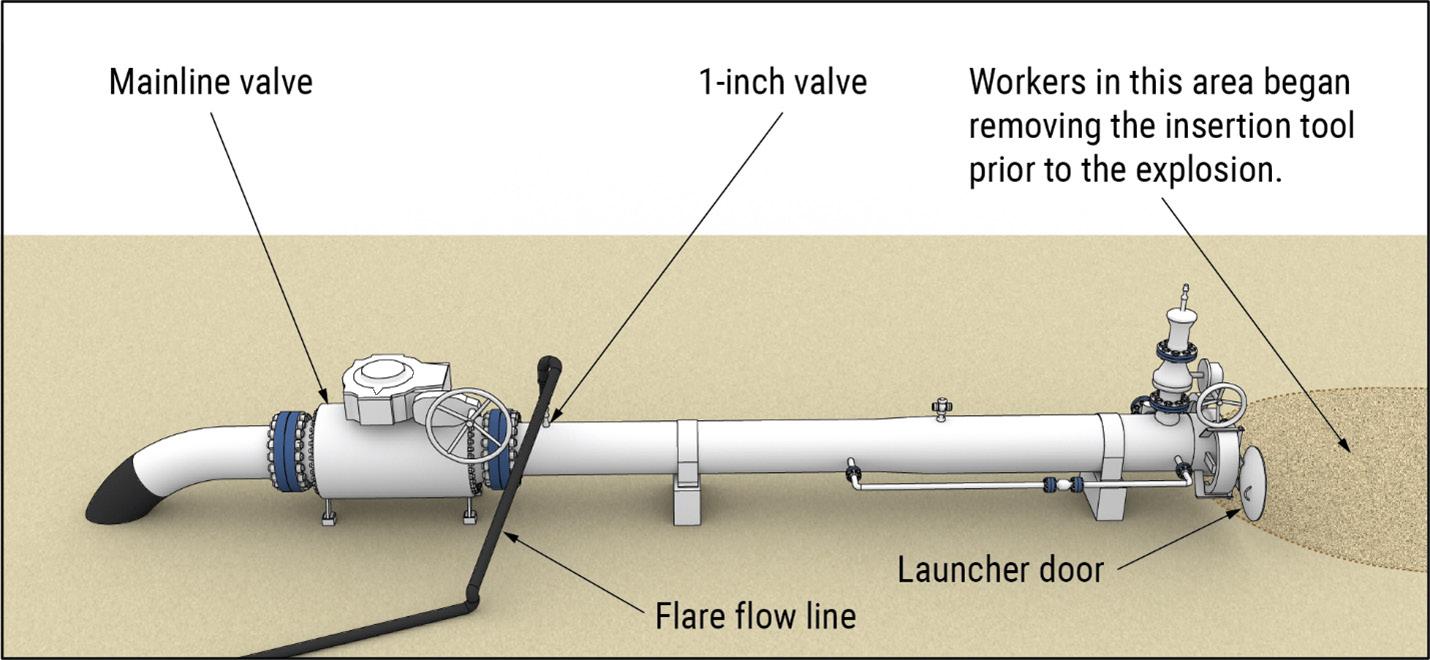

For example, in the NTSB’s investigation of an accident that occurred near Farmersville, Texas on 28 June 2021, investigators reviewed two industry guidance documents intended to help pipeline operators maintain a PHMSA-compliant operator qualification (OQ) programme.3,4 Neither document identified the task that was being performed at the time of the accident as one that was subject to PHMSA’s OQ rules. Similarly, the affected pipeline operator did not include this task in their OQ programme, relying instead on on-the-job training. Nevertheless, the NTSB determined that the operator’s procedures and training practices did not prepare workers to recognise and safely respond to abnormal operating conditions. This contributed to the severity of the accident, which took the lives of two men, leaving five surviving witnesses, two of whom were also injured.

PHMSA’s OQ rules apply to tasks that meet certain criteria, such as being “performed as a requirement of [specific PHMSA regulations]”. Industry representatives said that launching and receiving pigs did not meet this criterion. In adopting this narrow interpretation, the opportunity to fully prepare workers to safely respond to foreseeable, abnormal operating conditions was missed.

Let’s examine the circumstances of the Farmersville accident. About a week prior to the accident, workers completed the first in a series of pig loadings, when they suspected that the mainline valve was leaking because the flare did not extinguish as expected. They adjusted the valve and did not have any issues with the flare extinguishing during subsequent runs.

On the day of the accident, a worker opened a 1 in. valve that allowed natural gas to vent from the launcher to the flare tip, where it successfully ignited. As natural gas pressure in the launcher decreased and less natural gas flowed to the flare tip, the work crew observed the flame die down and extinguish.

8

9

Workers then took photos of the pig and began loading and inserting it into the launcher. An explosion in the launcher occurred before the insertion tool was completely removed. The NTSB found that a leaking mainline valve allowed natural gas to enter the launcher where it mixed with air, creating a flammable gas-air mixture that was ignited by an undetermined source.

Notably, the workers did not monitor pressure while depressurising the launcher, nor did they monitor for hazardous vapours before and during loading. These are steps recommended in another industry guidance document that was available prior to the accident, American Society of Mechanical Engineers (ASME) standard B31Q, ‘Pipeline Personnel Qualification’. Instead of focusing on minimum safety standards, ASME B31Q sought to specify requirements for identifying tasks that impact safety, such as launching and receiving pigs. ASME B31Q identified possible abnormal operating conditions, such as an unplanned escape of product from a pipeline. This is exactly what occurred in the Farmersville accident.

Although PHMSA later clarified that launching and receiving pigs is a covered task according to their regulations, the guidance that was developed from the broader lens of

minimising impacts on safety could have helped prevent this accident.5 The guidance that focused on minimum safety standards did not.

Continuous improvement of integrity management programmes

Pipeline integrity management is another critical safety programme that is used to identify, assess, and manage pipeline risks from all threats. Risk, a measure of the probability and severity of adverse events, is often estimated by answering the following questions:

) What can go wrong?

) How likely is this to happen?

) If it does happen, what are the consequences?

The first step is identifying the potential threats to pipeline integrity. All threats must be considered, including material degradation, incorrect operational procedures, and vandalism, to name a few. ASME standard B31.8S, ‘Managing System Integrity of Gas Pipelines’, considers 21 threats which are divided into nine categories and three time-related groups: time-dependent, stable, and time-independent. This ASME standard also requires that the interactive nature of threats be considered.

Risks are managed by performing integrity assessments, acting to reduce risks, and continuing to evaluate risks as they change. Integrity management programmes can be iteratively improved over time as additional information is gathered, risks are better understood, and assessment techniques are further developed. PHMSA’s minimum safety standards require pipeline operators to develop and implement integrity management programmes for pipeline segments that could affect high consequence areas.

In the NTSB’s investigation of a 30 in. diameter pipeline that ruptured in Danville, Kentucky on 1 August 2019, investigators found that the fracture originated at a hard spot on the outer surface of the pipeline, which resulted from unintentional localised rapid cooling during manufacture.6 The pipe was manufactured in 1957 to standards that did not specify rejectable criteria for

April

April

October

Table 1. Overpressurisation incidents (USA).

10 World Pipelines / APRIL 2023 1960s 1970s 1980s 1990s 2000s 2010s June 1969 Gary, Indiana August 1977 El Paso, Texas January 1982 Centralia, Missouri January 1992 Chicago, Illinois June 2001 Pittsfield, Massachusetts January 2011 Fairport Harbour, Ohio

1969 Burlington, Iowa May 1978 Mansfield, Ohio September 1983 East Boston, Massachusetts

1992

Illinois

2003

New York

2018 Merrimack Valley, Massachusetts

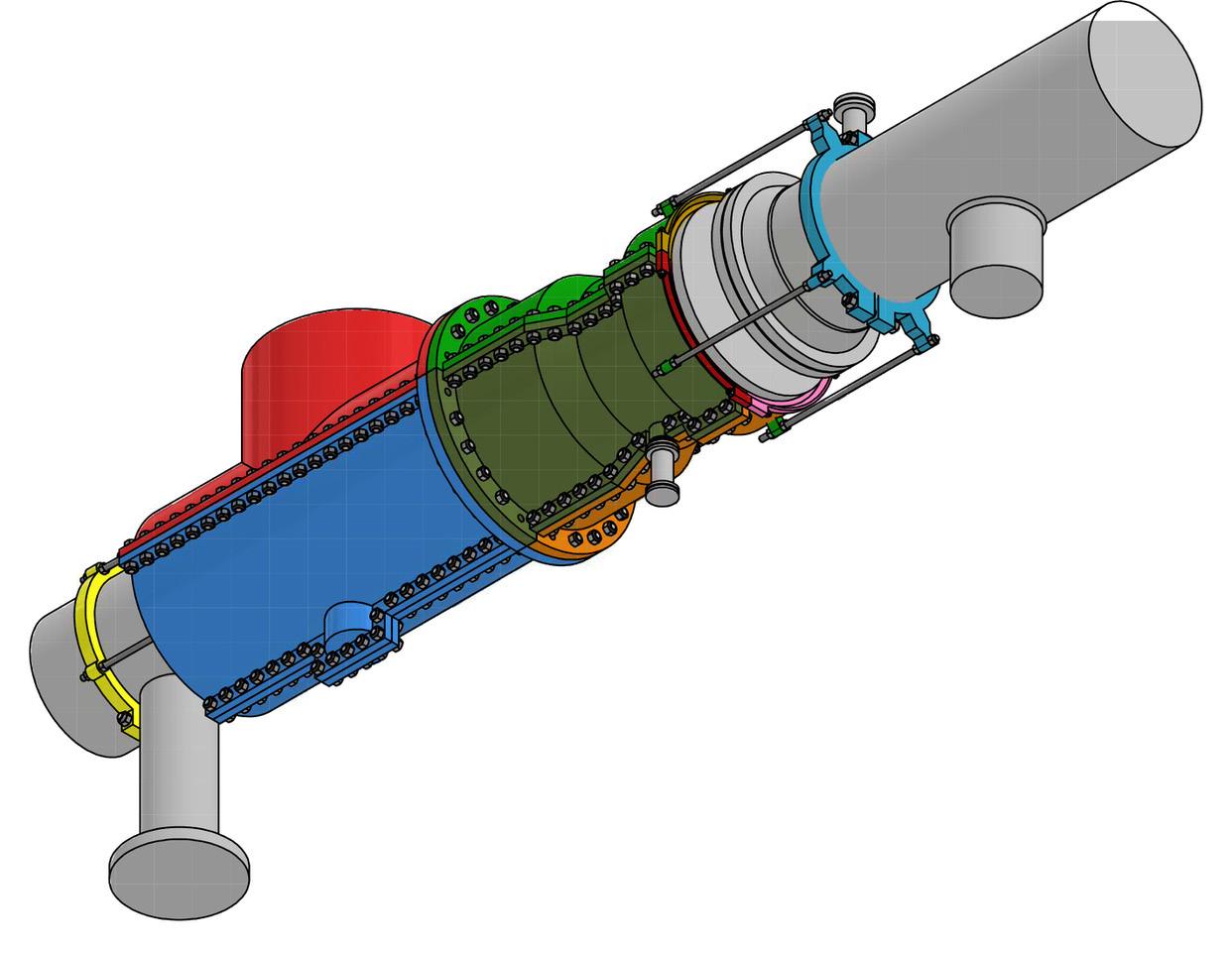

Figure 1. The pig launcher near Farmersville, Texas.

November

December

Springfield,

November

Cohoes,

September

1993

South Buffalo, Pennsylvania

2005

Boonville, Missouri

1994

Alameda, California

hard spots. Pipe of this vintage was known to have a history of hard spots. By current standards, the 5.85 x 3 in. hard spot found at the rupture location is considered a rejectable defect. Hard spots fall under the category of manufacturingrelated defect, considered a stable threat in ASME B31.8S. In 2011, an inline inspection (ILI) to identify and classify hard spots on the affected segment was completed, but none of the identified hard spots were located at the Danville, Kentucky failure origin. After this ILI, the pipeline operator no longer identified hard spots as a threat for this pipeline segment. However, the NTSB found that the Danville rupture was caused by the combination of a pre-existing hard spot, degraded coating, and ineffective cathodic protection, which resulted in hydrogen-induced cracking at the outer surface.

A 2016 study found that changes in operating conditions, such as reversal of flow direction, could intensify certain threats, including those posed by hard spots.7 The pipeline operator did not assess how a change in operating conditions from reversing the flow in 2014 affected the hard spots, missing the opportunity to improve their integrity management programme in time to prevent the Danville accident. Thus, the NTSB found that the operator’s

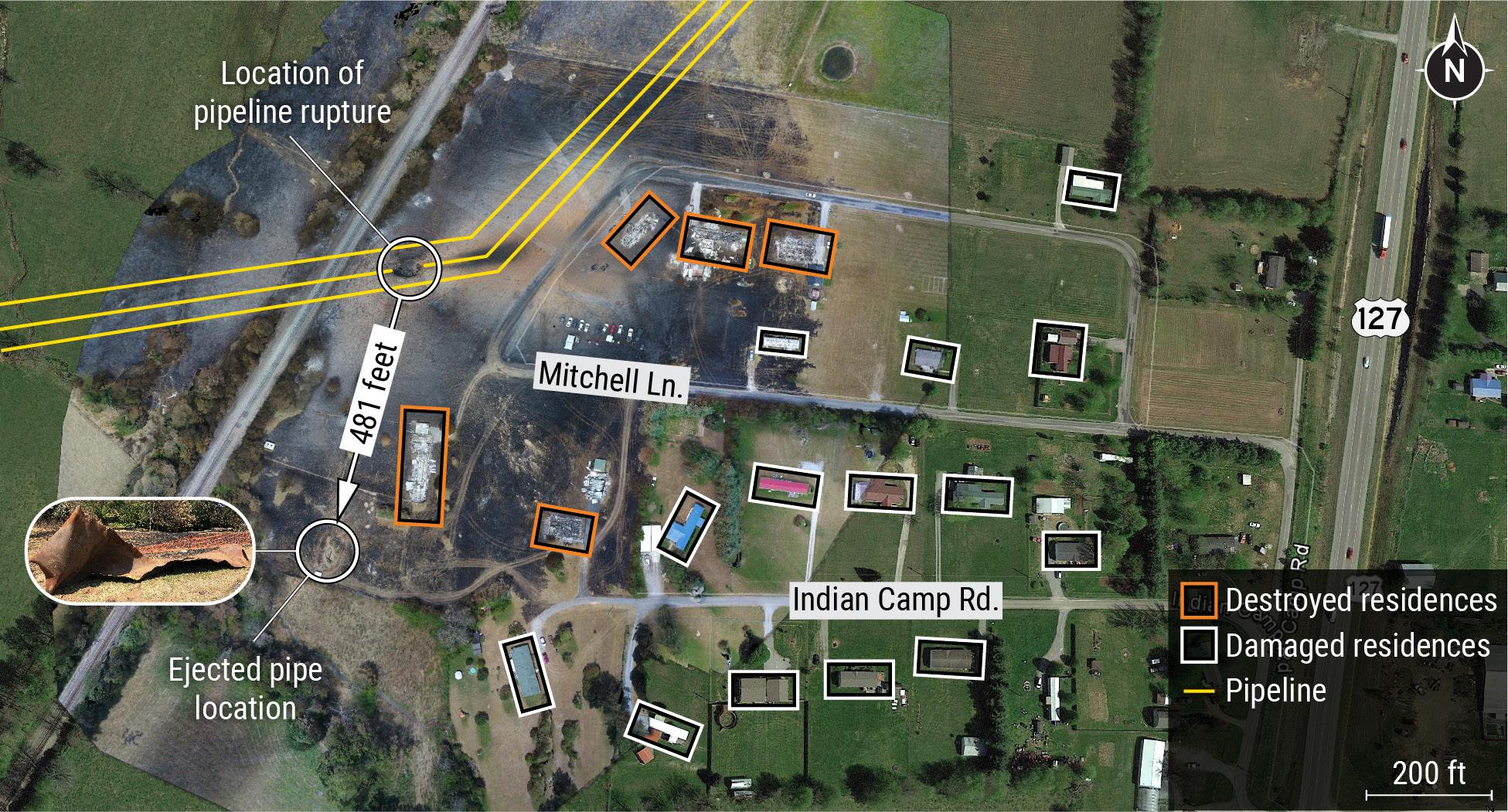

integrity management programme did not accurately estimate the risk from interacting threats, a contributing cause of the rupture that resulted in one fatality, six injuries, the evacuation of over 75 people, destruction of five homes, and damage to 14 other homes.

Revisiting our shared history

Getting to zero is not just about learning from the major tragedies the NTSB investigates. To achieve our safety goals, we need to thoroughly study lower consequence events to learn from past mistakes and remember what went well.

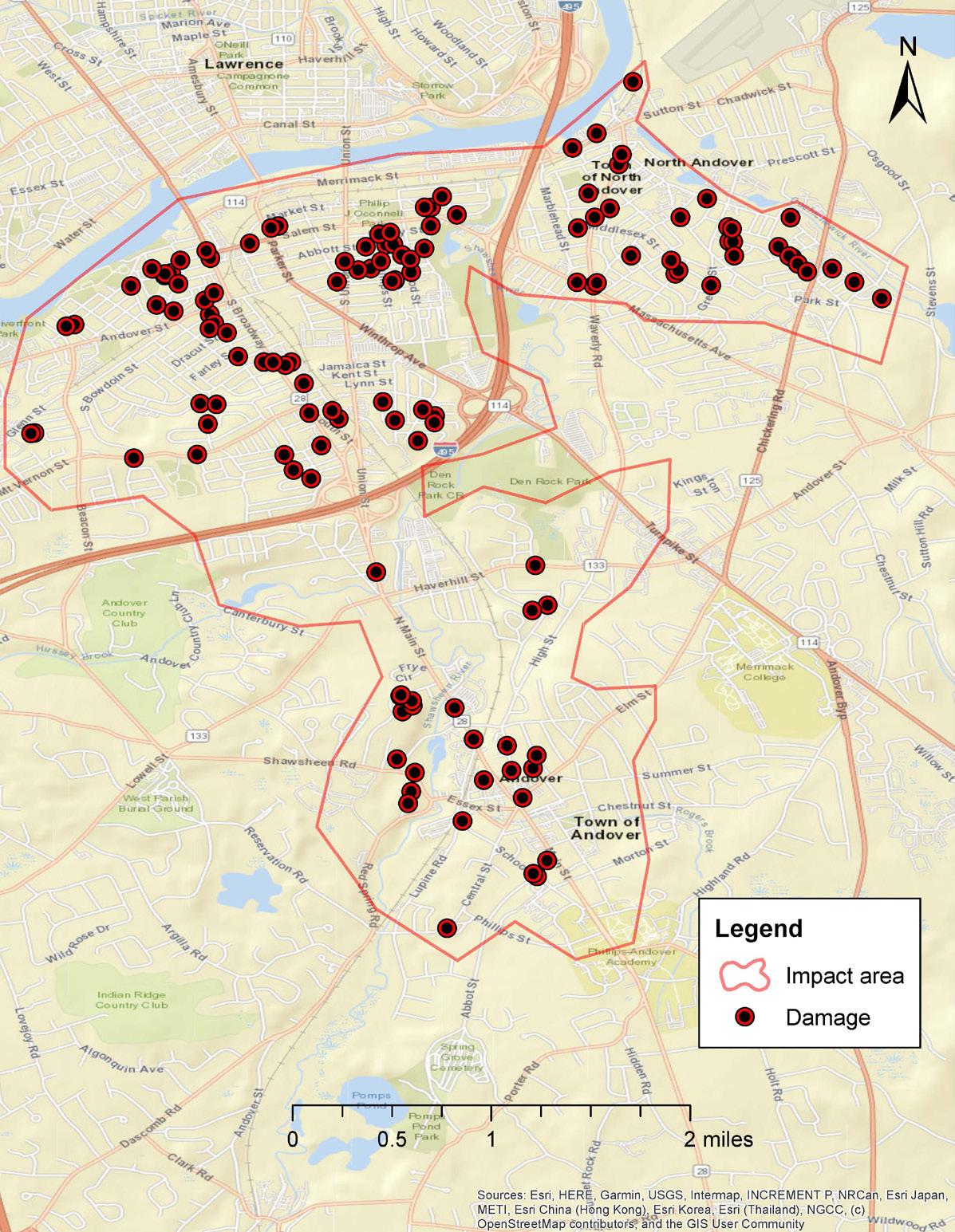

This was evident in the NTSB’s investigation of an accident that occurred in Merrimack Valley, Massachusetts on 13 September 2018.8 This accident occurred when high-pressure natural gas was released into a low-pressure natural gas distribution system. But this wasn’t the first time a low-pressure distribution system had been overpressurised.

Before the Merrimack Valley accident occurred, the NTSB had investigated seven overpressurisation accidents. Seven other overpressurisation incidents had been reported to PHMSA, making at least 14 previous incidents in the public record to learn from.

The potential catastrophic consequences of overpressurising a low-pressure system was known, and these 14 incidents could have been studied well before the Merrimack Valley accident occurred. Doing so would have revealed that they were all experienced by different operators. The affected systems typically had redundant components intended to help prevent overpressurisation accidents, such as workermonitor regulators. However, redundant components are more susceptible to failure due to a single threat, or common cause (such as flooding, lightning, or human error). Common cause failures can significantly increase safety risk because they negate the safety benefits of redundant components. They are often addressed by using different (diverse) components, such as a regulator and a relief valve.

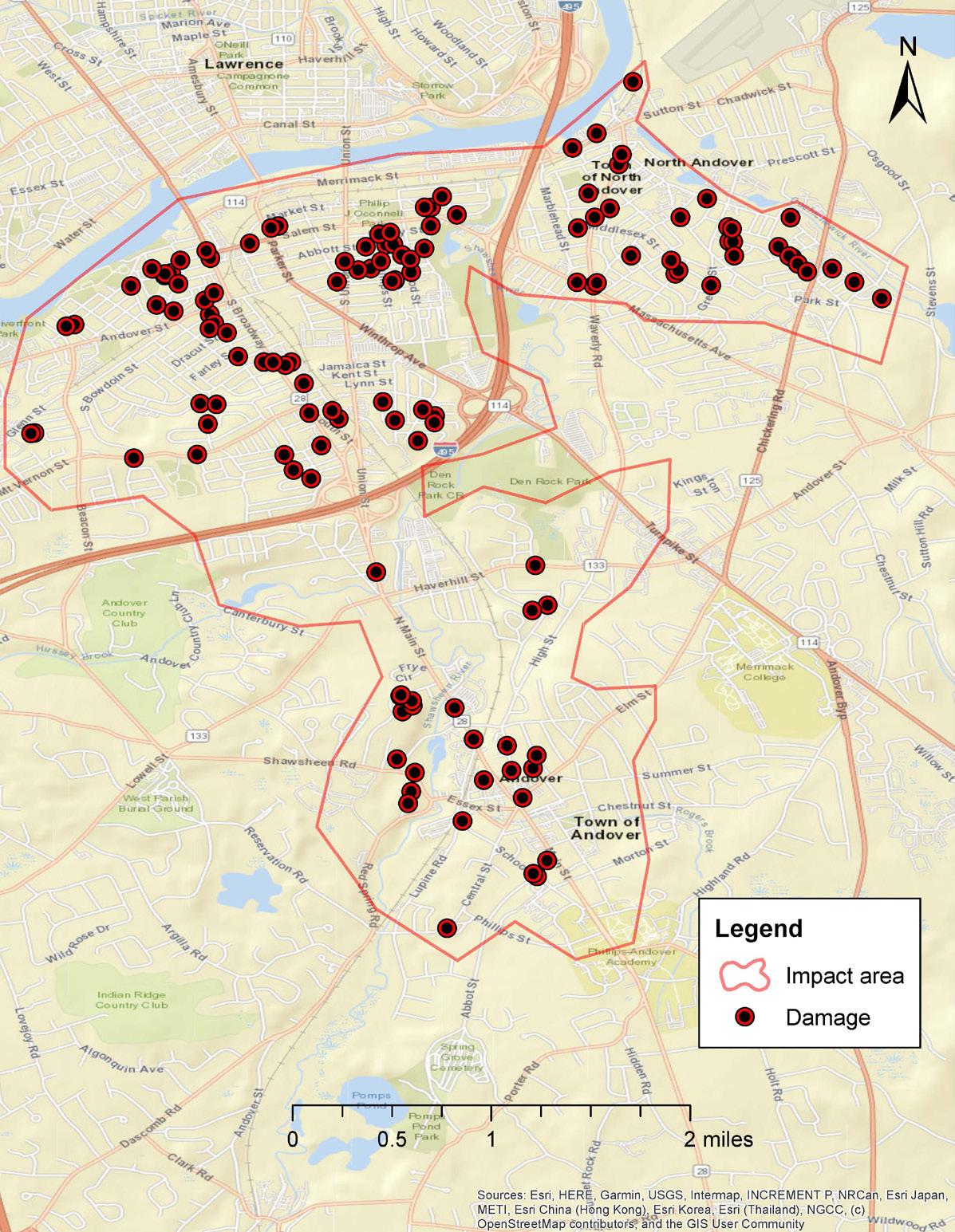

Had this information been studied prior to the Merrimack Valley accident, safety improvements could have been made in time to prevent it. Instead, the accident devastated a community, resulting in 1 fatality, 29 injuries, damage to 131 structures, and estimated costs exceeding US$1.5 billion.

The NTSB identified organisational failures in the probable cause of the Merrimack Valley accident. Contributing to the accident, the NTSB found, was a low-pressure natural gas distribution system designed and operated without adequate overpressure protection. Adequate overpressure protection could have helped safeguard the system against human error. By

Figure 2. Diagram of pig launcher near Farmersville, Texas (Source: NTSB graphics by Christy Spangler).

12 World Pipelines / APRIL 2023

Figure 3. Ejected pipeline segment in Danville, Kentucky.

studying our shared history and revisiting these topics as more experience is gained, we can glean insights that can help us act before catastrophic accidents occur.

Pipelines are the safest way to transport hazardous materials, but there is still room for improvement. While the failure rates are low (about one serious accident occurs for each 100 000 miles of pipeline each year), this amounts to 260 deaths and 1110 injuries in the last 20 years, according to data reported to PHMSA.

The NTSB puts a lot of energy into making sure that our investigations are accurate accounts of what happened, and we provide transparency for these investigations with publicly available supporting documentation. But many incidents are investigated, not by the NTSB, but by PHMSA, state regulators, or pipeline operators. The operator-provided information contained in PHMSA’s database can be a powerful resource to guide our path to zero, especially if it is combined with other available sources, such as NTSB, PHMSA, state, and pipeline operator investigative reports. Together, we can eliminate these serious accidents.

References

1. www.eia.gov/energyexplained/us-energy-facts

2. www.ntsb.gov/Advocacy/Activities/Pages/Homendy-20230111.aspx

3. www.ntsb.gov/investigations/Pages/PLD21FR002.aspx

4. ANSI/GPTC, Guide for Gas Transmission, Distribution, and Gathering Piping Systems (2018).

5. www.phmsa.dot.gov/regulations/title49/interp/PI-22-0008

6. www.ntsb.gov/investigations/Pages/PLD19FR002.aspx

7. Muñoz, E., Rosenfeld, M. J., DTPH56-14-H-00004: Improving Models to Consider Complex Loadings, Operational Considerations, and Interactive Threats (2016).

8. www.ntsb.gov/investigations/Pages/pld18mr003.aspx

14 World Pipelines / APRIL 2023

Figure 5. Aerial view of the Danville, Kentucky, accident site.

Figure 4. Map of damaged structures in Merrimack Valley, Massachusetts.

or engineers tasked with managing multi-dimensional, data-rich, pipeline integrity management programmes and Mega Rule compliance initiatives, staying ahead of new regulations can be a daunting endeavour. Fortunately, there’s a new PMI tool in the final stages of validation testing that simplifies material verification and enables resourceful teams to collaborate more efficiently on their regulatory obligations.

Legislation – PHMSA and the Mega Rule Integrity management of pipelines is a complex issue, and global legislations exist to guarantee their safe operation. In the US, the Pipeline & Hazardous Materials Safety Administration (PHMSA), part of the Department of Transportation, sets the rules and regulations in this domain – with their most recent ‘Mega Rule’ legislation demonstrating just how critical pipeline integrity is at a national level. Such guidelines

establish standards for the design, construction, operation, and maintenance of pipelines. They might also provide guidelines for conducting integrity assessments and developing integrity management plans, as well as determining the roles and responsibilities of the various parties involved in the management of pipeline integrity.

In a move to enhance safety for onshore gas transmission pipelines, this new legislation broadens the scope of existing rules and regulations. Industry professionals well-versed in these measures will find that several additions have been included with an emphasis on ensuring maximum safety, such as additional material verification requirements and re-confirmation of maximum allowable operating pressure (MAOP).

The Mega Rule ensures that pipelines are operating safely and remain in good condition by requiring operators to implement comprehensive integrity management

15

Dr James Dean, CEO, Plastometrex, UK, introduces a novel tool for pipeline integrity management programmes and Mega Rule compliance.

programmes. These programmes assess potential risks, such as cracks or corrosion, and take corrective steps where needed, thereby ensuring optimal performance is maintained (as much as is feasibly possible) across all pipeline infrastructure.

Pipeline integrity management – methods and tools

Of course, the legislative frameworks are helpful, but the importance of pipeline integrity management is already well understood in an industry that has, historically, prioritised safety, and spent billions of dollars implementing these complex integrity management programmes. These programmes are geared towards the detection, classification,

and remediation of defects including, but not limited to, those that are listed below:

) Corrosion, or the deterioration of material due to its exposure to environments that contain, for example, water, salts, and other contaminants that can facilitate unwanted chemical reactions.

) Cracks, which can occur in pipelines due to various reasons, including manufacturing defects, applied loads (stresses), and corrosion.

) Dents, which are often present after some type of localised impact event, can weaken the pipeline and accelerate its failure.

) Weld defects that arise in many different forms during welding processes, often exacerbated by the creation of large residual stresses, and the complex evolution of unwanted microstructural features.

) Manufacturing defects that were introduced during the manufacturing process.

In addition, it’s well recognised that pipeline failures are serious incidents with potentially significant consequences that include environmental damage, injury, and, in the worst cases, fatalities. They also result in costly repairs, and significant disruption to the supply of energy, with the recent spill from the Keystone Pipeline (December 2022) being just one example. Integrity management programmes are designed to prevent these types of incidents by identifying and addressing such issues before they become hazardous, but it is an ongoing process that involves inspecting and testing the pipelines, and monitoring their condition on a regular basis. There are established tools and methods for doing so – some of the most common include:

) Visual inspection, which is considered the first line of defence in detecting defects in pipelines. It can be

Figure 1. A render of the portable Indentation Plastometer being developed by Plastometrex for in-ditch PMI and grade determination.

Figure 1. A render of the portable Indentation Plastometer being developed by Plastometrex for in-ditch PMI and grade determination.

16 World Pipelines / APRIL 2023

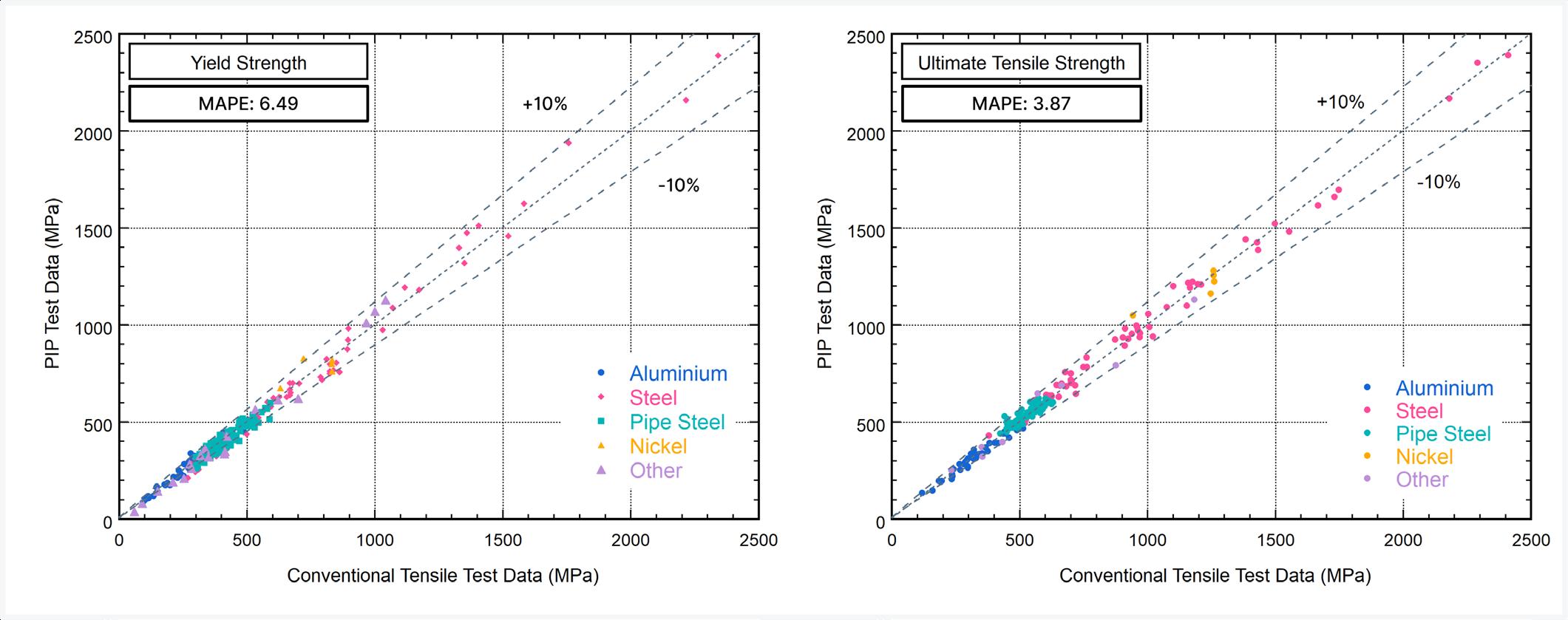

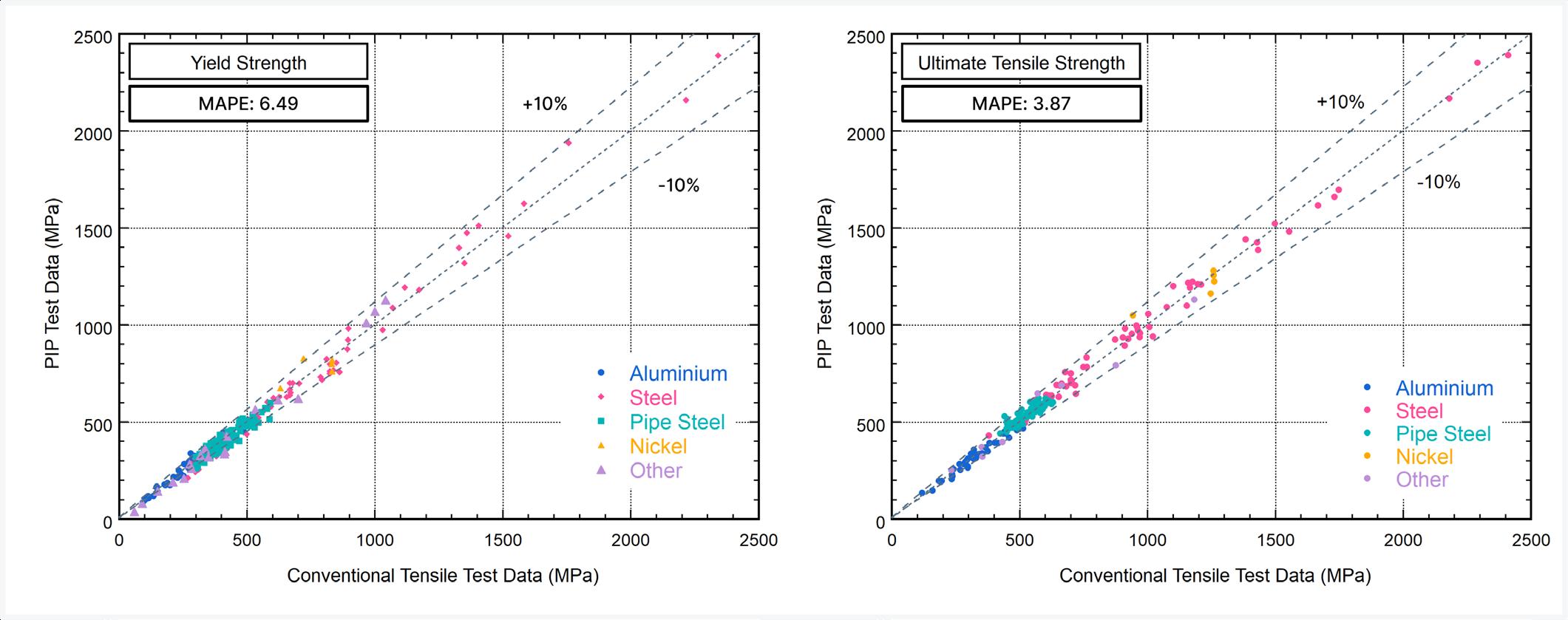

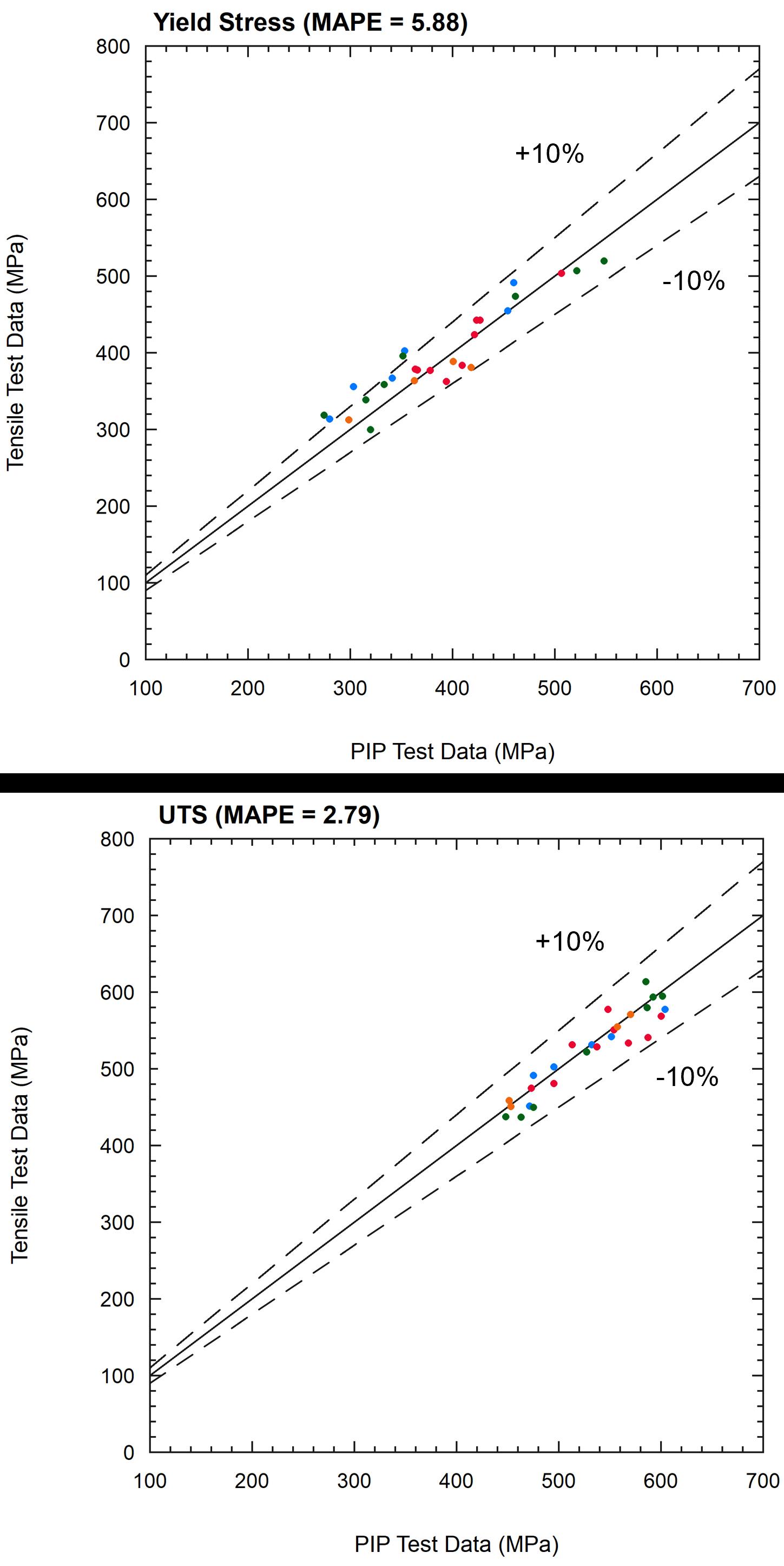

Figure 2. Unity plots for yield stress and UTS for the benchtop Indentation Plastometer including MAPE values (correct at January 2023).

BID NOW! purplewave.com BUY SELL Call us today! 866.608.9283 e Bid anytime, anywhere - 24/7 e Add items to your watchlist e Set it and forget it with MAX bid e ALL ITEMS SELL NO RESERVE! e Multiple auctions held every week e No transportation or preparation cost e We handle post auction payment/titles e ALL EQUIPMENT IS SOLD “AS IS, WHERE IS” *fees may vary based on equipment volume and value

performed manually by trained personnel using visual inspection equipment, including remotely operated vehicles (ROVs) and drones.

) Ultrasonic testing, whereby disturbances in the patterns of high-frequency sound waves are correlated to certain types of defects.

) Hydrostatic testing, which involves pressurising the pipeline with water or another liquid to check for leaks.

) Inline inspection using ‘smart pigs’ that are inserted into pipelines with instruments that can detect a variety

of defects using ultrasonic, magnetic, and radiographic techniques.

) Corrosion monitoring for detecting and monitoring the initiation and evolution of corrosion.

However, new tools are also now emerging, primarily in response to the requirements set out in Part One of the Mega Rule legislation around MAOP reconfirmation and material verification. In both cases it is necessary to measure the yield and/or tensile strength of the metal (steel) pipelines. The MAOP, for example, is determined from a calculation involving the yield strength.

Satisfying material verification requirements –a new way

One of these new tools is the portable Indentation Plastometer (Figure 1) from Plastometrex. This is a device for in-ditch measurement of yield and tensile strength to support positive material identification (PMI) and pipe grade determination. The portable device is a derivative of the company’s current flagship product, which is a benchtop Indentation Plastometer that was released commercially in January 2021. The benchtop Indentation Plastometer performs a ‘PIP’ test, which is simply an indention test that is conducted in much the same way that a hardness test is.

The main difference between a PIP test and a hardness test is that PIP test data are used to calculate metal stressstrain curves (not hardness numbers), thereby capturing important strength parameters such as the 0.2% proof stress and the stress at 0.5% elongation under load. To do this, the device measures the full shape of the indent using an optical profilometer (which takes just a few seconds) and passes this data through a proprietary software package that combines an accelerated inverse finite element analysis with optimisation algorithms to derive stress-strain curves.

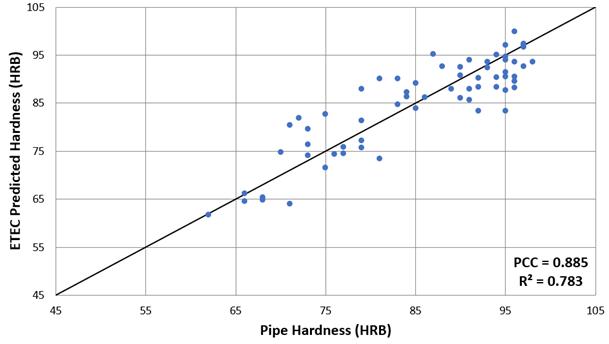

The underlying scientific methodology is already proven, having been developed by former University of Cambridge Scientists, and validated by some of the world’s largest technology companies and most prestigious universities. Comparison data for the benchtop Indentation Plastometer are shown in Figure 2. A common metric for assessing the level of agreement between the PIP test data and conventional tensile test data is the mean absolute percentage error (MAPE). MAPE values for the benchtop Indentation Plastometer are provided in the figure.

The portable Indentation Plastometer uses the same scientific approach as the benchtop Indentation Plastometer, albeit deployed in a different (portable) configuration (Figure 1). Industry representatives are now asking, justifiably, for validation data for the portable device that is equivalent to what is presented in Figure 2, not least because such data exists for competing technologies already operating in the PMI space. Data for those technologies were acquired during a Pipeline Research Council International (PRCI) funded project which concluded in 2018 (report number PR-335-173816), and it is evidently clear that the Plastometrex solution for in-ditch PMI should perform

18 World Pipelines / APRIL 2023

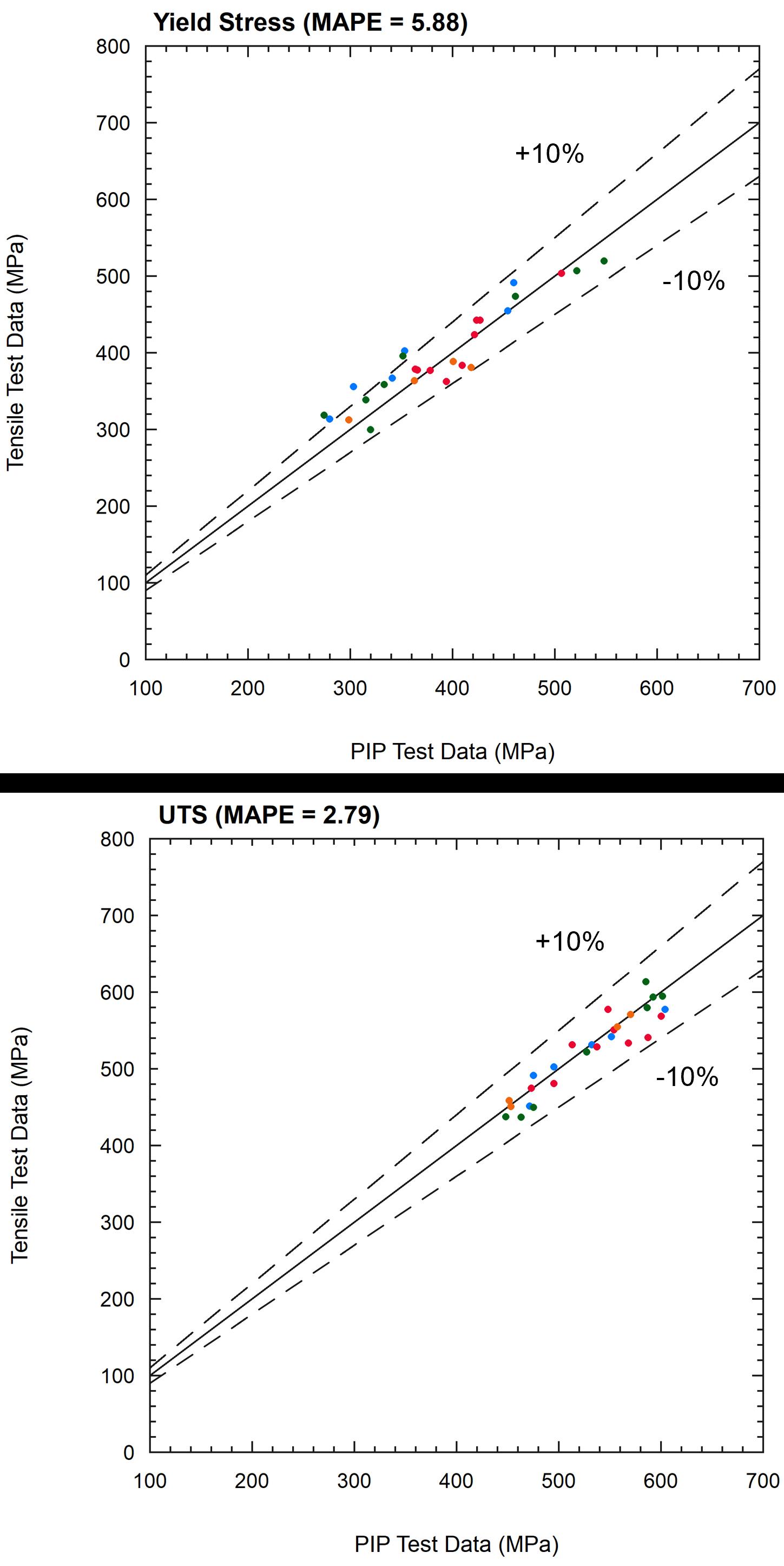

Figure 3. Unity plots for yield stress and UTS for the portable Indentation Plastometer including MAPE values (correct at January 2023 and not yet subject to independent review).

comparably to (or better than) those technologies if it is to be successful commercially.

Validation work

The necessary validation testing project for the portable Indentation Plastometer is now well underway, with support and/or contributions from TC Energy, PG&E, ROSEN, ADV Integrity, the Integrity Assessment Group, the PRCI, RSI Pipeline Solutions, Blade Energy, and Structural Integrity Associates. The objective of the project is to test almost 200 pipeline samples, and to compare portable PIP test results with conventional tensile test results (which have been tested in accordance with the specifications laid out in API 5L).

The project started in January 2023 and some early results are presented in Figure 3, where the MAPE figures

are better than those of the two competing technologies when compared with data from the PRCI report of 2018. However, at the time of writing, the validation project is several months from completion, and the MAPE numbers for the portable Indentation Plastometer will inevitably change, so final judgement on the accuracy of the tool is currently being reserved. Nevertheless, the early signs are encouraging, and confirmation of accuracy levels will undoubtedly help as the company moves to commercialise the technology later this year, but there are other characteristics of the device that are expected to strengthen the case for its inclusion in integrity management programmes. For example, the system is modular, requiring only one minimally trained technician to operate the device. This is likely to be an advantage as owner/operators and service providers seek to scale their teams to satisfy the enormous testing demand that has been created by the Mega Rule legislation. In addition, a software wizard guides users through the testing process in an automated way, minimising the scope for user error, and a full quadrant can be tested in under 30 minutes.

Importantly, full strength data are available immediately and there is no requirement for the data to be finessed or in some way augmented offsite (which is a characteristic of some PMI tools). Finally, the device is linked to a cloud-based digital platform called PLXUS, which automatically stores the testing data in TVC-compliant form. This capability also enables engineering teams that are situated away from the dig to provide remote assistance to colleagues that are in-the-ditch, thereby enabling real-time decisionmaking based on real-time data. These attributes are already generating interest and excitement amongst industry representatives ahead of the commercial launch later this year.

The validation project is expected to conclude in the summer of 2023, with preorders (subject to successful validation) being taken now.

s a manufacturer whose products are used in the oil and gas industry, it is Stark’s professional duty to ensure that the products manufactured comply with various governmental organisations. Businesses, or their contracted third-party representatives, can be expected to want proof that the products they purchase fulfil their requirements of compliance with more than just a simple Certificate of Conformance. Furthermore, some companies have created their own additional specifications, beyond governmental or industry requirements, to confirm their operation or installation meets these additional standards.

Standards and requirements

Operating in North America, it is typical to see American Society of Mechanical Engineers’ (ASME) rules and requirements for oil and gas products. From the simple (but lengthy) pipeline standards to the well-known flange standards, to the ever-present pressure vessel standards, product design is a study in not running afoul of the various requirements while still fitting in all the features and benefits that these product users have come to expect. Quick opening closures are no different than other manufactured products in that regard. Quick opening closures must be capable of withstanding internal and external pressures, having sometimes intricately

moving components to provide entry and access inside the product, and provide repeatable, dependable operation in a variety of services and climates. Each component must meet the material requirements, pressure minimum, structural needs, and operator usability requirements. Proof of compliance is not only requested in the form of a document but is also pursued by the use of third-party companies whose job is to pore over the design and verify that they, too, can confirm the product is acceptable based on the specifications laid out.

Through years of operational expertise and a not-toosmall amount of trial and error, companies with a vested interest in the continued operation of their assets have written their own requirements for products or systems. These often take the form of company or projectspecific standards. Through these standards, a product that may already comply with the requirements set forth by governmental standards will need to meet additional design criteria. These standards can take on a variety of different shapes. The most common tend to add slightly more requirements to existing rules. It is common to see: material chemistry ranges being stricter to help meet welding procedures; higher than normally required physical properties of materials; material matching multiple certifications; material going through additional finishing processes to increase

21

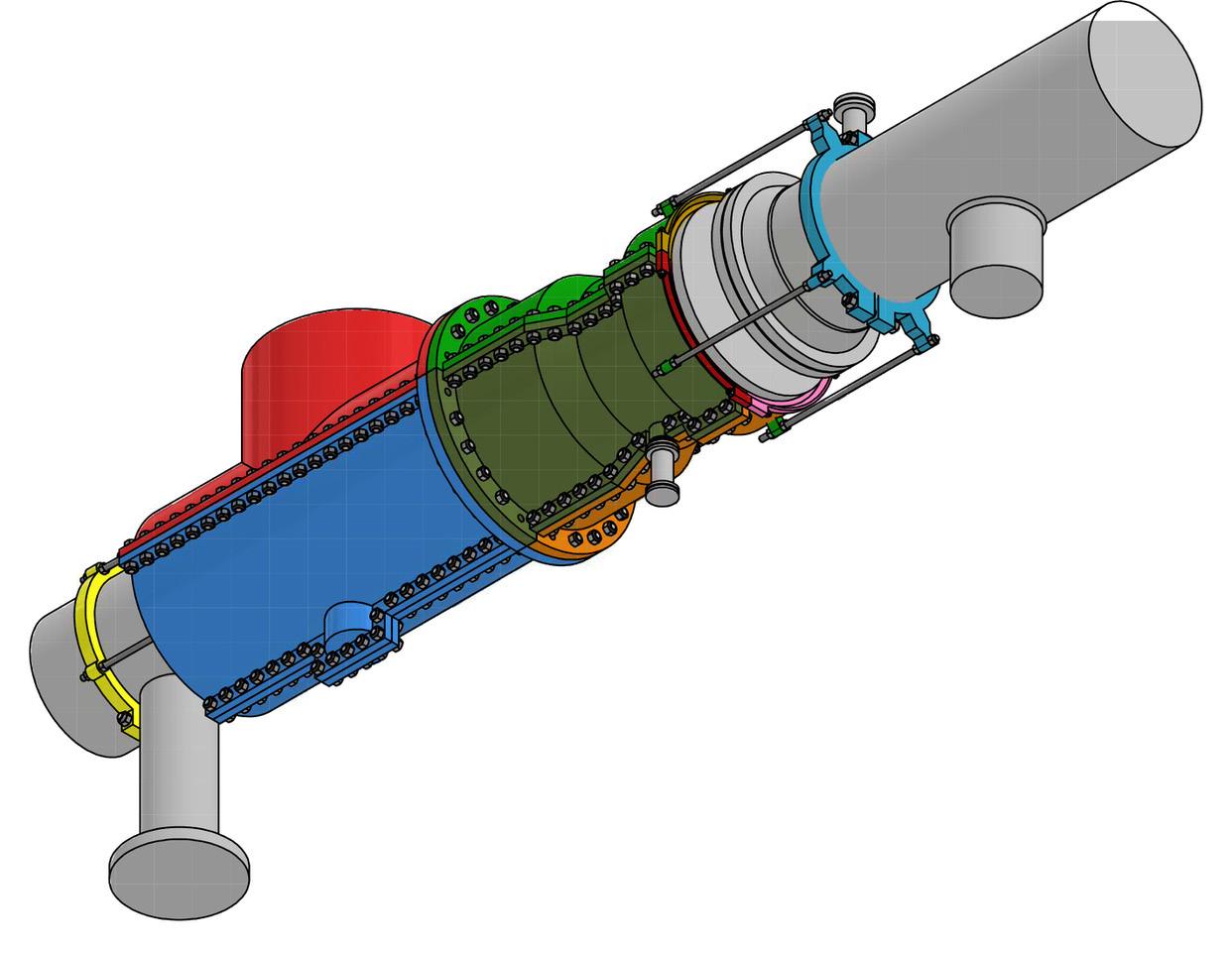

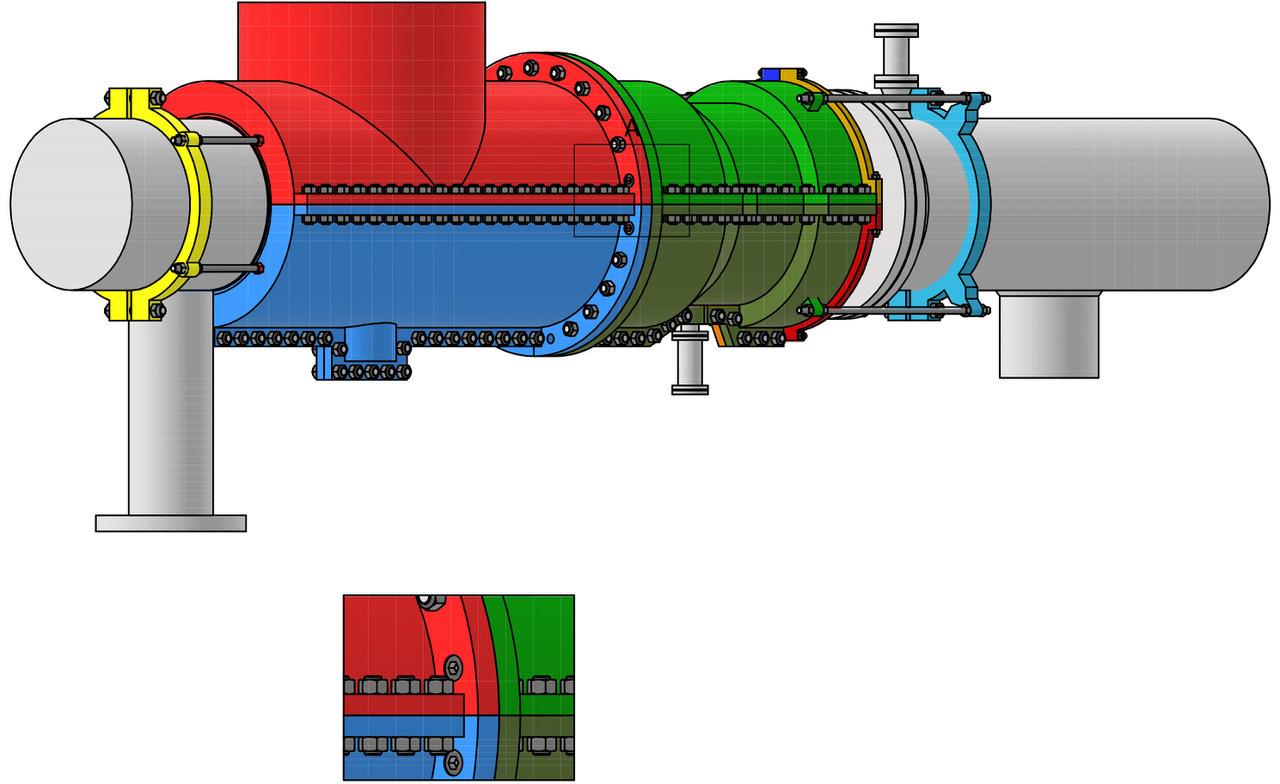

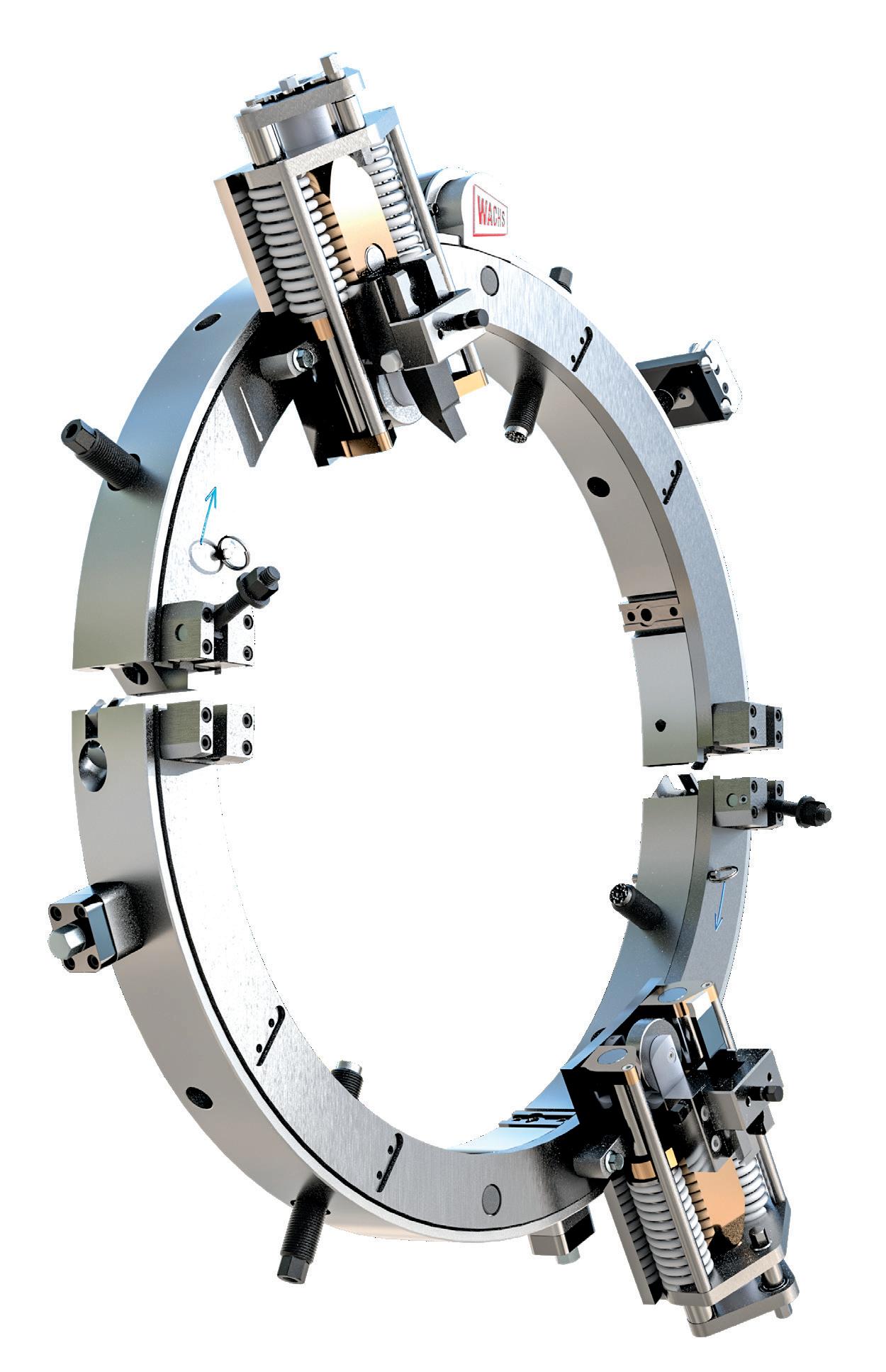

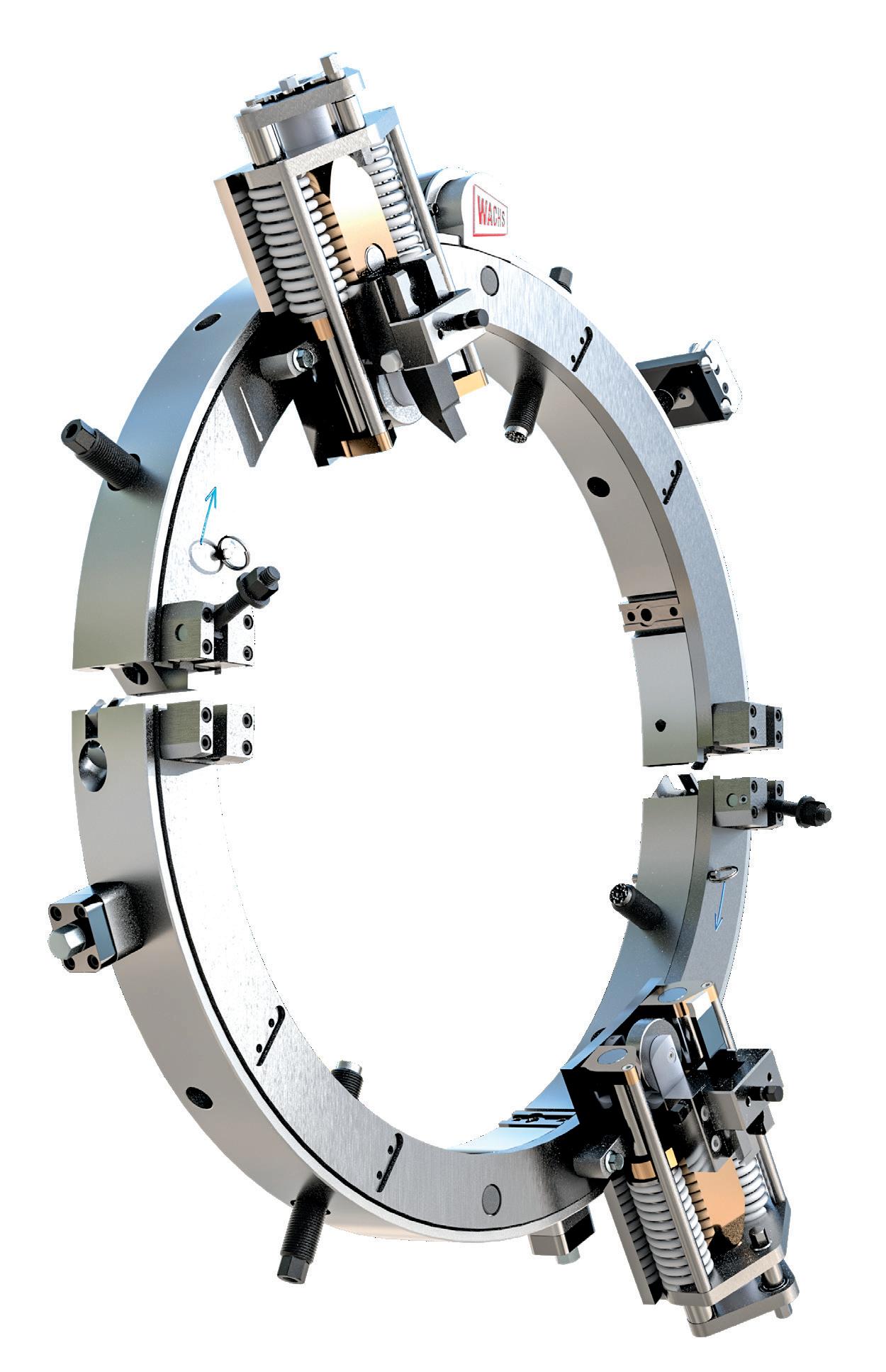

By working with the end user, product designs can be offered to meet a wide variety of specifications, thereby streamlining project acceptance, says Morgan Sledd, Stark Solutions, USA.

performance in specific environments; as well as sacrificial material undergoing further testing.

A product for each project

Occasionally a specific project will present unique challenges to a product. When this occurs, the project specifications can cause a minor addition, or a major overhaul to meet the needs. Some jobs require high temperature operational capability, such that material strength becomes a concern. Some jobs require higher performance materials such as duplex or super duplex stainless steels, for their corrosion resistance and strength at higher temperatures. Some applications are known to cause such problems that special alloys are used in the sealing areas to prevent material attack in those critical areas, but the rest of the unit is allowed to degrade, within the scope of the project of course. The addition of materials like stainless steel, Inconel or Monel can greatly extend the life of the areas it is added to, prolonging the life of the product.

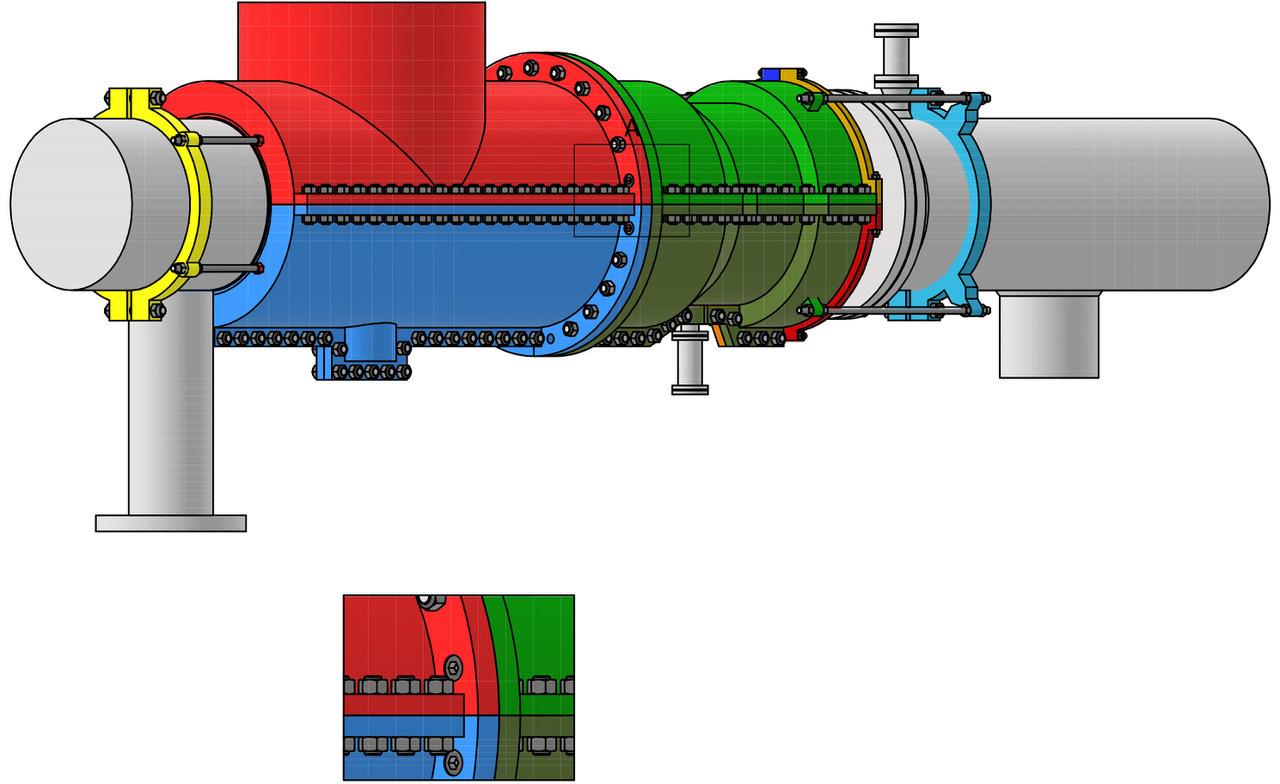

Stark Solutions, located north of Houston, Texas, has positioned itself to be able to provide product meeting and exceeding requested specifications. Through Stark’s proximity to the vast array of oil and gas suppliers in the greater Houston area, as well as strategic partnerships with leading suppliers, Stark offer products that ensure industry leading companies will have success in their projects. The onsite engineering department works with end users and suppliers both to guarantee compliance to specifications and project design goals as well as provide proof of compliance in the form of test results, calculations, or 3D analysis. Due to the variety of job specific demands, Stark Solutions manufactures quick opening closures in the three following styles.

S-500

The S-500 is a threaded quick opening closure, which is Stark’s most economical option. This closure is useful for smaller applications including sampling lines, vessel blowdown caps or vessel sump drains, or for larger applications with less frequent usage, like filter separators, and launchers and receivers. The S-500 line is offered in range from 2 - 52 in. and comes in a variety of carbon steels as standard options. These are compatible with most North

American code requirements. An array of upgrades are available, including additional ports in a variety of NPT sizes, provided by the manufacturer. Many see having the manufacturer provide these additional access points a benefit, as they can be part of the design that is certified. For more exacting applications, alternative materials such as stainless steels can be entertained, and performance weld overlay alloys can be applied in most configurations. This is useful for those applications that may require a more customised solution.

S-2000

The S-2000 product is a clamp-style closure, having two clamp halves that pivot apart to allow the door to open. Unlike traditional clamp products, the S-2000 does not use a double rod design, which allows the operators to more easily open and close the unit, as well as ensuring it is properly closed before pressurisation. Available in a size range of 2 in. through 48 in., the S-2000 complies with ASME’s B31.8 and B31.4 codes as a standard but is also available to meet other regulatory codes like ASME Sec VIII Div. 1. Like the threaded product, the S-2000 clamp-style closure can be configured in different steel materials to meet strength requirements, in addition to stainless steels. Weld overlay of the sealing surfaces or entire wetted surfaces are offered on this product as well. Additional ports in the door or hub can be requested and provided by the manufacturer for various needs. The main advantage of the S-2000 clamp-style is the ease of opening and closing by separating the clamp halves.

S-3000

The S-3000 product is an internal door closure, so-named due to the fact the door is actually inserted into the hub component, and preventing from opening due to a locking ring that expands between the two; similar to how an ID snap ring works to prevent a shaft or bearing from leaving its housing. The S-3000 has a broad size range from 6 in. to 84 in. and beyond for custom applications. In addition to the large size range, the S-3000 also offers the most customisations to meet the myriad of different application requirements a job may require. A variety of carbon steel grades, stainless steel grades, and Duplex stainless-steel options exist to allow longevity no matter the media or environment. Weld overlay is available on sealing surfaces, or all wetted surfaces, depending on the application requirements. Standard horizontal hinging is offered, as well as multiple vertical options ranging from manual operation to hydraulic lifting to no additional lifting device at all, which can be useful if the product is situated in a facility that already has overhead lifting capabilities. As a standard, the S-3000 uses an O-ring to seal to protect media inside, allowing a variety of material options. Depending on size and pressure, a lip seal is provided to adequately handle the higher pressures and potential warpage the hub may see during fabrication.

Conclusion

Stark provides the oil and gas industry with bespoke quick opening closure solutions that meets and exceeds regulatory requirements. Working with the end user, product designs can be offered to meet a wide variety of specifications, streamlining project acceptance. Along with those products come the knowledge and experience to show compliance, providing the consumer with a partner who can stand behind their products.

22 World Pipelines / APRIL 2023

Figure 1. S-2000 Clamp Ring Closure in field.

PIPELINE INSTALLATION IN ONE STEP

With the Direct Pipe ® technology, Herrenknecht has pushed the boundaries of what is feasible in trenchless pipeline construction. Applicable in all kinds of ground conditions, in diameters of 24" to 60". Impressively proven in more than 170 crossing and landfall projects worldwide, with record lengths over 2,000 meters.

herrenknecht.com/directpipe

DIRECT PIPE ®

GGT Solutions S.A.

Gaz-System S.A.

Contractor:

Client:

READY-TO-USE (EPRS)

ONSHORE /OFFSHORE OIL & GAS

Roberta Pires, Flexible Pipe Systems Early Engagement Director, Baker Hughes, discusses features to be considered in a comparison between rigid and flexible pipes.

lexible pipes have been a revolutionary force in the oil and gas industry for more than 75 years, beginning in World War II when they were used to supply fuel to troops in northern France. The pipe used readily available materials arranged in a way that made it flexible and easy to install subsea at record speeds, mitigating the risk of bombing raids and casualties. Today, flexible pipes are used in offshore fields across the globe to transport oil, gas, water, and even dense CO 2. Despite their versatility, flexible pipes make up only 15% of the worldwide pipeline market share.

With diameters ranging from 2 - 22 in., the most commonly used internal diameter is 6 or 8 in. These pipes were initially designed for shallow waters, but have gradually been developed for use in deep and ultradeep waters, with the deepest on record being 3000 m in the Gulf of Mexico. In the coming years, there is significant demand for flexible risers and flowlines at 2900 m. Today, design pressure capacities reach as high as 750 bar (10 in.)

and 900 bar (8 in.) with design temperatures reaching as high as 170°C. The future looks bright for flexible pipes, and they continue to be a critical tool for the oil and gas industry.

Rigid or flexible pipes?

There are several reasons why both flexible and rigid pipes can be technical enablers, and consequently the only choice for a given application. A vast amount of infield pipes, however, could go either flexible or rigid, often triggering a passionate debate: Is there a significant cost difference? Which is installed the fastest? Which one is the most reliable? How does the type of field layout impact pipe type choice and should different types be considered? What is the most economic considering the complete service life?

Answering these questions is a task for talented concept and front end engineering design teams. However, certain variables come into play as well: lack of experience with either option, out of date information, or an incorrect

25

perception of the technical or commercial pros and cons could default to leaning to the familiar, rather than the best, option.

Development drivers

The most common indicators to drive field architecture and pipe selection are:

) Total cost of ownership (TOTEX), which groups capital expenditures of the subsea umbilicals risers and flowlines (SURF), the subsea production systems (SPS) and the costs related to pipes transportation, installation and vessel mobilisation.

) Net present value (NPV), setting to present value the revenue and operational expenses forecast combined with the TOTEX.

) Faster access to first oil, due to shorter supply time, increased vessel availability and faster installation speeds.

) Early on the level of return on investment (ROI).

) Breakeven oil price.

) Lowest CO 2 emission; a factor becoming increasingly important for decision-making.

) Pipeline re-use or re-purpose and field decommissioning.

Comparing TOTEX, as opposed to pipe price per meter is critical when comparing rigid and flexible pipe scenarios. Let’s break down the cost layers.

Flexibles cost per metre is often more expensive than rigid when it is solely carbon steel, without internal coating. When rigid pipe must be clad or full CRA, the cost of flexibles becomes cheaper per metre. This is more evident now due to geopolitical instabilities, post-pandemic supply chains being severely impacted, and inflation hitting several commodities, including the alloy elements used for these materials.

However, it‘s best not to compare rigid pipe price per metre directly with flexibles because the former is not the cost of a finished product, while the latter is. A rigid pipe is not a finished product until it is installed, and all 12 m rigid joints (or pre-welded bi, quad and even hexa-joints) are welded offshore using a J-Lay or S-Lay installation vessel. Moreover, often flexible pipe installation is cheaper than that of rigid pipes since it takes fewer installation days and daily rates tend to be lower. Thus, installation cost must be accounted for.

For the reel lay method, rigid pipe is welded and almost fully prepared at onshore spoolbases in 1 - 2 km lengths. After preparing and welding the 12 m joints, performing non-destructive testing (NDT) and protecting welds, the now continuous 1 - 2 km long pipe (stalk) is spooled onto massive reels (inner dia. ~20 m, whereas flexibles are typically 4 - 7 m). After reeling a stalk, the next one is prepared and the two are welded together until the full length is on the reel and

PLET XT RF XT RF PLET XT Offshore facility Rigid riser Rigid flowline Full rigid Rigid jumper Offshore facility Flexible riser Flexible flowline Full flexible VCM VCM VCM Offshore facility Rigid riser Flexible flowline Rigid riser + flexible flowline

26 World Pipelines / APRIL 2023

Figure 1. Elimination of rigid jumper and PLET with flexible flowlines. More compact horizontal distances with flexible risers.

Expect A Higher Standard

the product is at a finished state. For reel lay, it’s important to correctly account for installation cost as duration and daily rates can be different. It may also be necessary to add the cost of trips to the spoolbase to re-load, depending on pipe volume, pipe weight and reel capacity when using the reel lay method. Whereas re-loading of reels of flexible pipe onto the installation vessel may, if needed, occur in sheltered waters near the field location, with the help of a supporting lift-vessel. All of these durations and costs must be factored in.

A reduced installation campaign has benefits on overall execution certainty and allows the installer to take advantage of shorter weather windows. Faster installation and fewer vessels means less fuel consumption and lower CO2 emissions; flexible installation vessels CO2 emissions are, on average, 30 - 60 % lower.

The amount of associated subsea hardware may also differ. Flexible flowlines can be directly connected without pipe line end terminations (PLET) and rigid jumpers. If there is extra length when approaching the subsea hub, it can simply be laid on the seabed, creating a side curve. Some of the subsea structures will contain sensors, controls, and valves and are not there only to allow a precise subsea installation but to manage production and the life of the pipe. The SPS equipment eliminated, therefore, must be assessed for each field carefully.

When exposed to temperature and pressure cycles, flexible flowlines expansion and contraction are mild thanks to flexible pipe natural construction, eliminating the need for sliding structures to absorb axial movement. They do not require mitigation against free spans or vortex induced vibrations (VIV), and no need for buckle initiation sleepers as flexibles are made to bend and buckle, within limits. Generally, the amount of engineering for flowlines is much smaller for flexibles.

Flexibles may also eliminate rigid jumpers. This means eliminating long baseline metrology (LBL), jumper drawing elaboration, jumper cutting, welding, weld NDT, jumper factory acceptance testing, jumper subsea integration testing, and jumper rigging and transportation to quayside using mobile cranes. This process takes 14 - 35 days per jumper, depending on remoteness and teams’ efficiency.

The number of rigid jumpers depends on field layout and can vary significantly. For instance, it is common to have 10, 20 or even 35 jumpers. The elimination of jumper quantity and all associated design, transport, manufacture, test, and installation removes risk while creating an optimised installation schedule. There are some jumpers that will never be eliminated, like the ones that connect Xmas trees to manifolds or to a gathering flowline. If these are selected to be flexible, they will come as a finished product ready to be rigged, installed, subsea connected, and system tested; a process that will take one to two days per jumper.

Comparatively, rigid jumpers can be up to 45 m long, whereas flexibles can have any length and are adaptable to seabed bathymetry – providing flexibility for manifold and wells’ location late changes if needed.

Flexibles inner carcass material makeup is qualified to resist corrosion throughout its entire service life (316L, duplex, super duplex or super-austenitic stainless steels, or even nickel alloy carcass may be employed, depending on fluids corrosivity)

so regular inspection through pigging is not required. This is relevant when topsides space is scarce or non-existent.

Taking into account all the light construction vessels that can be easily adapted with rented laying equipment, there are twice as many installation vessels for flexible than for rigid. This may minimise risk of delays or enable cheaper and earlier installations.

Flexible components are highly standardised, which allows an optimised supply chain, often leading to shorter engineering and supply times. One of the most common critical path items for rigid pipes is the equipment that smooths riser top bending at connection to its offshore facility (flexjoints or tappered stress joints). For rigid, it typically takes two years to supply during regular demand periods, while flexibles equivalent takes 12 months.

Different types of field layouts and their financial impact

The main types of field architectures are satellite, manifold, loop and a combination of all three. While we review the technical differences between them, a key driver for the field layout definition is flow assurance, which ultimately aims to maximise the field production.

Satellite type, the most common field layout type offshore Brazil, is characterised by each Xmas tree being individually connected to the platform. Oil flows up directly, without being grouped with that from other wells. Satellite pipes ID are typically 8 or 6 in., diameters known today to have produced 45 000 boe/d and 6 000 000 gas m3/d (at 620 bar), respectively. Each well is typically serviced by a service and/or gas lift pipe. Umbilicals can be individually connected from the platform or from a system distributing unit, that is linked to the platform through a dynamic umbilical and allows control of up to five wells each.

Manifold type is characterised by using a manifold to group the production of neighbouring wells and then flowing oil up using two flowlines and two risers per manifold. The wells are typically all directional and located close to the manifold in so-called drill centres. Depending on the quantity of wells and manifolds, these risers must accommodate oil coming from 2 - 20 wells needing larger diameters, typically 10 - 14 in. The flowlines and risers come in pairs for redundancy and to allow for intermittent cleaning with hot oil, diesel or chemicals circulation (in case a pipe experiences constriction due to wax or hydrates buildup, for example) using one pipe system to provide the cleaning fluid to the other. In such a situation or even in preventive regular pigging, all wells must be shut. Manifolding reduces the number of risers and flowlines compared to satellite. On the other hand, there is increased SPS (manifold and connectors) and bigger pipes. Manifolds can be long lead items and critical equipment, which increases installation and operational risk for the field.

Pipes are also grouped in the loop type production. The main flowline is set to pass reasonably close to the wells and to be fitted with tee connectors called ‘In Line Ts’, which connect to the well’s Xmas trees. The main flowline is typically 8, 10 or 12 in., and the well jumpers or flowlines typically 6 or 8 in. As the main flowline and associated riser need to be cleanable, they are connected to an adjacent main flowline – another pipe

28 World Pipelines / APRIL 2023

grouping production for other wells. The two are connected with a flowline, all forming a loop. When there is a need to clean or pig one of the pipes all wells must be shut. The number of risers and flowlines is smaller than in satellite and potentially bigger than in manifold, depending on oil production volume from each well and field layout. The SPS hardware here is light and small, and most importantly, installed in line with the pipe in a continuous operation, saving time and mitigating risk.

One of the fundamental differences between those options is the profit lost due to production interruption for cleaning and well tax metering. The lost revenue can be estimated and should, whenever possible, be factored into the NPV as numbers can be significant.

Pipe ID is another fundamental difference. The greater the ID, the greater:

) The pipe cost, with a variance in a non-linear way and that differs between flexibles and rigid.

) The likelihood a higher capacity installation vessel is required. What the satellite option allows is ID minimisation; it is usually possible to remain below 8 in., which is cost beneficial, especially for flexibles and particularly in deep waters.

Expenditures with SURF and SURF installation account for 50 - 90% of SURF and SPS total expenditures, so is a key piece to optimise. Assessing different field layout arrangements, each

with its internal diameter and covering the two types of pipes, all while maintaining total production per day, is what may unlock optimisation.

Technical enabling

Pipes with ID greater than 22 in. must be rigid as no flexible supplier can produce larger flexibles. There are combinations of pipe ID and design pressure, or pipe ID and water depth, where rigid has a track record and flexibles don’t. Flexible qualification and track record varies for each supplier, and manufacturers should be consulted for their qualification limits. Fluid corrosiveness may also lead to rigid selection. This has been the case in the past five years for part of the Brazilian pipes that transport the world’s highest levels of CO2: part of the infield pipes are clad or mechanically lined rigid pipes. Stringent thermal requirements may require rigid pipe in pipe with passive insulation inbetween or actively heated pipes, of which there are qualified suppliers for both flexible and rigid options.

A classic case of enablement through flexible pipes is the North Sea. All oil produced with floating host facilities passes through a flexible pipe as it is hard to design a working rigid pipe configuration in its shallow water depths (average 90 m, deepest 700 m). A floating facility’s offset and movements are transmitted down along pipe leading to small bending radii at touch-down on the seabed, resulting in compression and fatigue that can be too strict for rigid but suitable for flexibles. Other technical benefits for flexibles are as follows.

Rough seabed topography and straighter flowline routings

• Flexibles accommodate to the seabed passing through free spans with no mitigation equipment, allowing optimised routes.

• Flexibles allow for sudden route turns at much smaller radius (for example ~3 m for an 8 in. pipe).

Reusability

• Reconnecting an existing flexible to a new well that produces more oil is an efficient way to revamp an asset’s production and is regularly done offshore Brazil.

• Flexibles offer versatility for field life extension, for example, a dynamic flexible can be re-purposed to be static and the fatigued top section of flexible risers can be replaced or just re-terminated.

Congested fields

• Flexibles touch down zone horizontal distance is smaller, making efficient use of limited space.

• During installation, flexibles don’t require an installation pile to be initiated, thus reducing risks of initiation wire touching already installed subsea structures. Also, it is simpler to solve crossings non-destructively.

Reliability

• Despite the general perception, flexible and rigid pipes failure rate are of the same order of magnitude.

• This is the conclusion reached by a joint industry programme that included key industry stakeholders.

• The most frequent flexible incident is seawater ingress into the annulus, an event that does not usually lead to pipe failure as long as it is accounted for in design.

Integrity and monitoring (I&M):

Today, the I&M portfolio includes tools that allow understanding:

• Is annulus flooded?

• Are tensile wires intact?

• What is annulus fluid composition along time?

• Is it safe to extend pipe service life?

• A pipe health dashboard can be accessible on your smart phone.

Conclusion

From World War II to the present day, the inventiveness and passion of thousands of people have brought flexibles to constantly push past technology limitations, enabling deeper, hotter and higher-pressure field development, and bringing execution certainty to oil and gas developments. The need to transition towards greener technology and resources is a new challenge in product and business development; one to ignite the passion for innovation guided by the vision of safe, secure and affordable energy to all corners of the world.

Detects pinholes and holidays using pulse DC High voltage Holiday Detector

n Lightweight, ergonomic design provides comfortable all-day use, reducing operator fatigue

n Regulated pulse DC voltage output that won't change under load ±5% voltage accuracy

n Voltage calculator feature choose one of 11 international standards, and input the coating thickness to automatically calculate the required test voltage

n Long Form Certificate of Calibration included with each instrument

DeFelsko Corporation l Ogdensburg, New York USA Tel: +1-315-393-4450 l Email: techsale@defelsko.com Choose from a wide range of rolling spring and

ava +1-315-393-4450 www.defelsko.com

Optional handheld wand accessor y converts the detector into a wand configuration ideal for testing hard-to-reach areas

wire brush electrod custom sizes

he Pipeline and Hazardous Materials Safety Administration (PHMSA) introduced a new rule in 2019 that required natural gas transmission operators to reconfirm maximum allowable operating pressures (MAOP) of certain pipelines located in Class 3 or 4 locations, high consequence areas (HCA), or moderate consequence areas (MCA). To address this requirement, PHMSA outlined six separate methods operators may pursue:

• 1. Pressure test.

• 2. Pressure reductions.

• 3. Engineering critical assessment (ECA).

• 4. Pipe replacement.

• 5. Pressure reductions for segments with small potential impact radius.

• 6. Alternative technology.

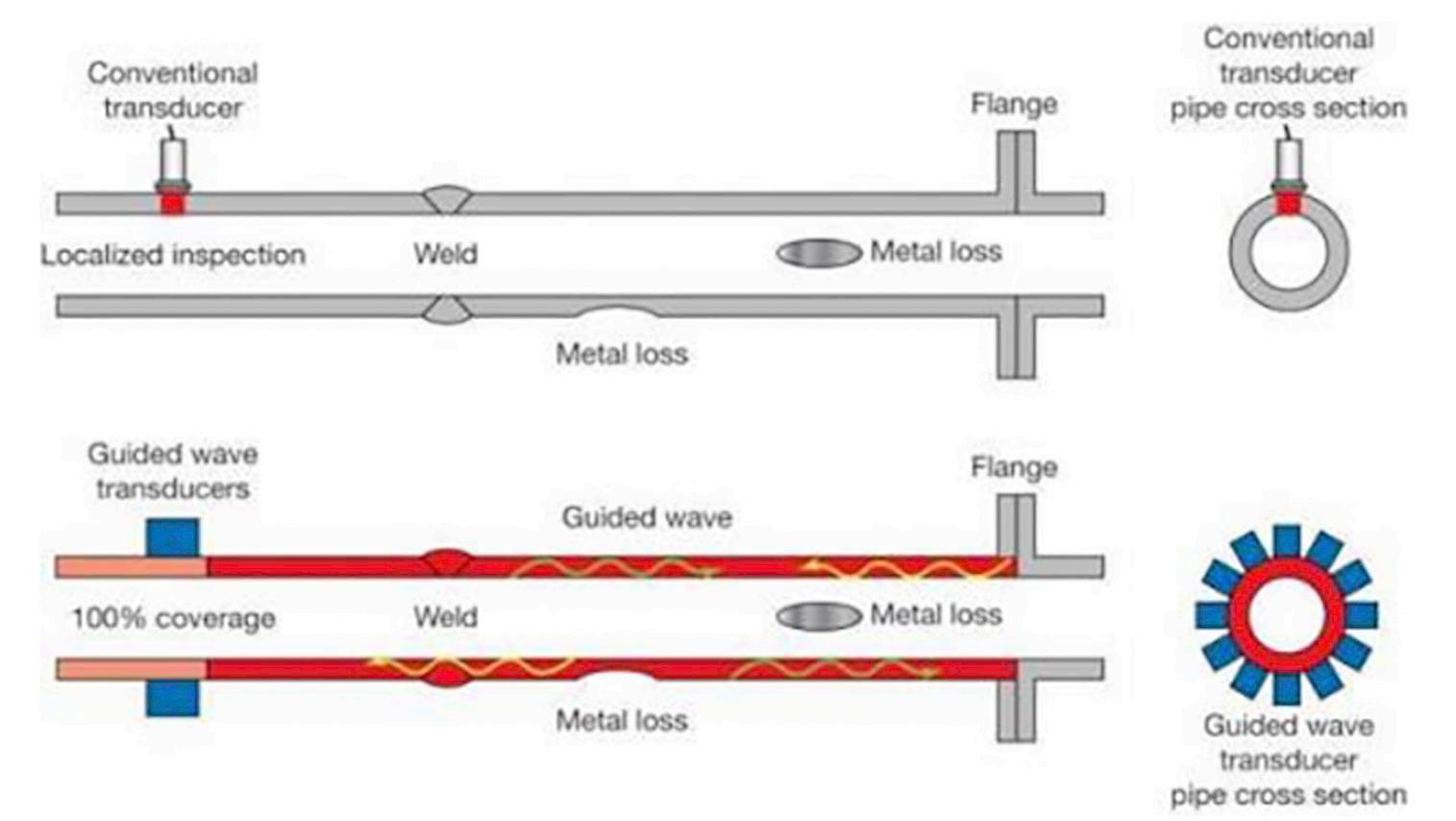

To minimise the impact on operations, pipeline operators may opt to conduct an ECA. This procedure can allow the avoidance of hydrostatic pressure tests and pressure reductions that interrupt product delivery. An ECA is essentially a fitness for service analysis of material properties, historical data, survey reports, and threat assessments. The result determines a predicted failure pressure thereby reconfirming or re-establishing the pipeline’s MAOP. A key component of an ECA is determining the defects remaining in the pipe which can be efficiently performed with inline inspection (ILI). Potential threats such as geometric anomalies, metal loss, and crack-like defects can be detected utilising various technologies deployed

via ILI tools propelled by product flow with minimal interruption to pipeline operations.