13 minute read

Leading the way

Pavan Vyakaranam, GlobalData,

India, discusses Asia’s success in the global renewable power market, and how the region proposes to extend its lead as renewable energy takes off around the world.

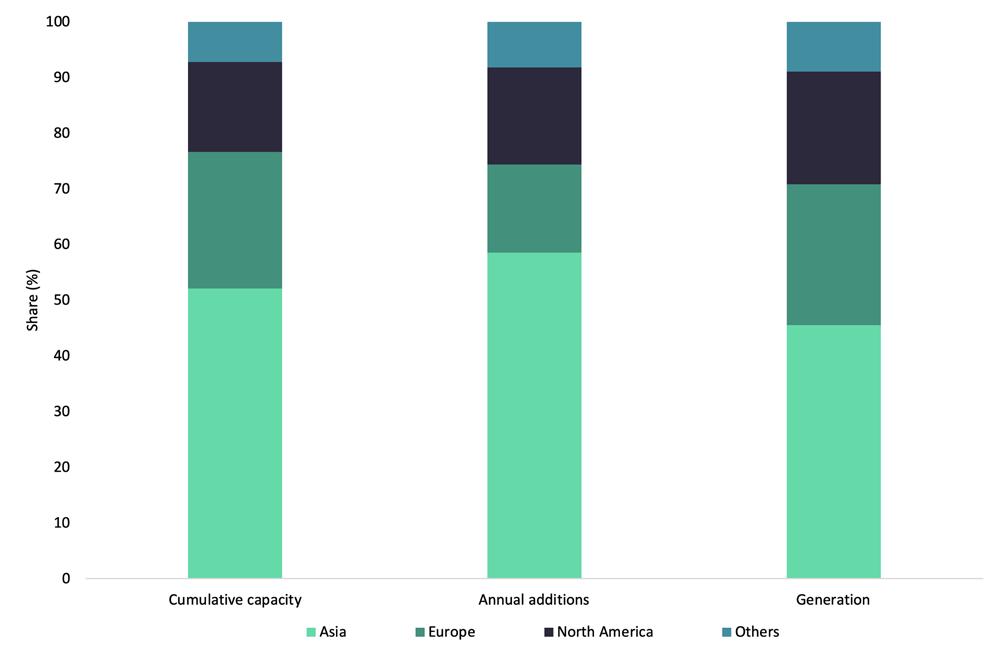

Asia is at the forefront in the adoption of renewable sources for power generation and is one of the fastest growing regions in the world. It is the largest regional renewable power market, and the region accounted for 51.1% of the global cumulative renewable capacity in 2020. Of the total renewable capacity additions in 2020, the region had over a 60% share, and in terms of generation from renewables it had a share of 43.6%.

In 2021, Asia is estimated to account for 52.1% of global renewable installed capacity, a 58% share in annual renewable capacity additions, and a 45.5% share in electricity from renewables. It is expected that the region will continue to lead the global renewable power market during the forecast period until 2030.

Market status

Power consumption across the world declined in 2020 due to the COVID-19 pandemic. Countries imposed lockdown measures to control the spread of COVID-19. These lockdown measures resulted in the closure of industries and commercial establishments for long periods of time. This resulted in a steep decline in power consumption. Several Asian countries including India, Japan, Indonesia, Malaysia, Singapore, South Korea, and Thailand, reported steep declines in their power consumption in 2020. However, overall the Asian

region witnessed an increase in power consumption in 2020, increasing by 1.5% compared to 2019. This was driven by an increase in power consumption in countries such as China, Pakistan, Taiwan, and Vietnam.

There was no negative impact of COVID-19 in terms of capacity additions in 2020 - 2021 in the region. However, there were some minor supply disruptions and an increase in raw material prices which resulted in an increase in cost trajectory for the first time in a decade. In terms of capacity augmentation, 2020 was the best year for renewable installations with a 56.5% increase in annual additions for renewables in Asia. It is estimated that 2021 will surpass 2020 annual renewable additions with a y/y increase of 7%.

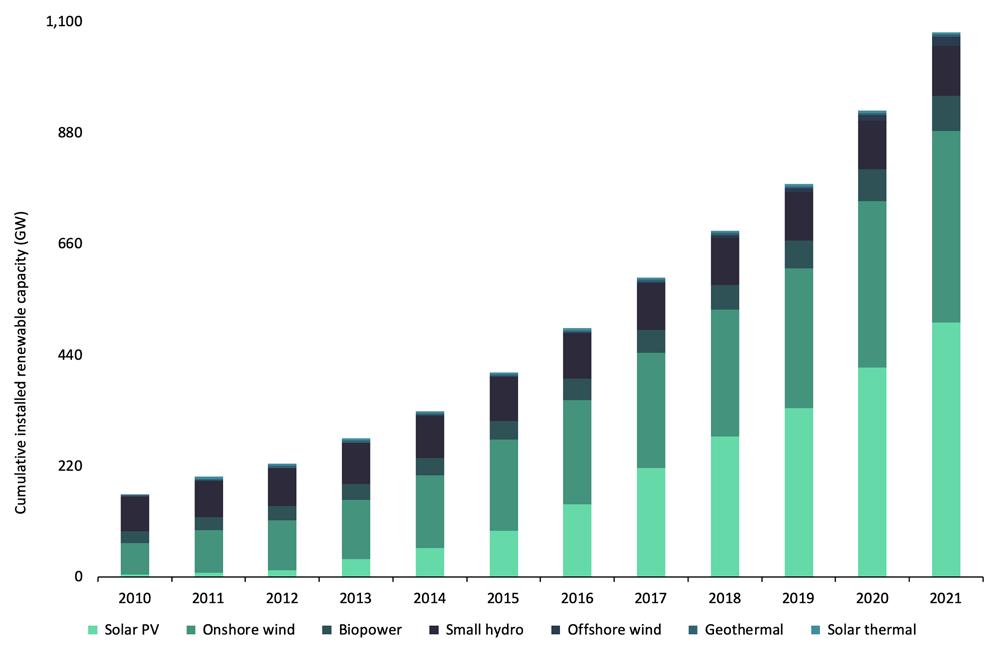

The cumulative installed renewable capacity in Asia stood at 1076.8 GW in 2021, holding a significant share of 52% globally. The cumulative installed renewable capacity in the region has witnessed significant growth in the last decade and increased from 163.6 GW in 2010 to the present level.

Figure 2 illustrates cumulative installed renewable power capacity by source in Asia during 2010 - 2021.

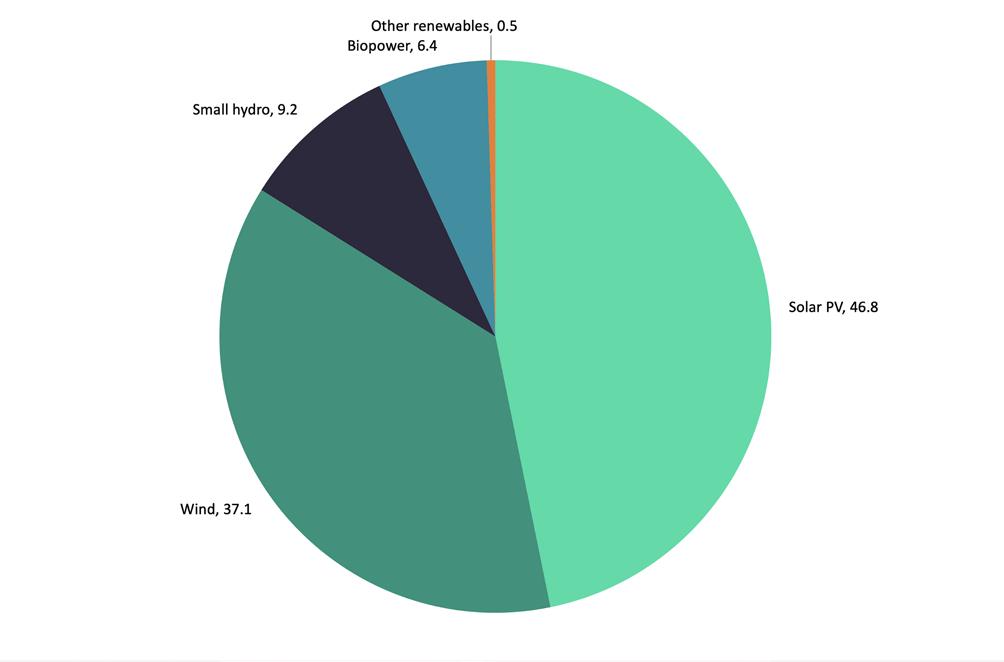

Solar photovoltaics (PV) leads the renewable power capacity in the region with a share of 45% in 2020 and 46.8% in 2021. Solar PV was followed by wind, small hydro, biopower, and other renewables (such as solar thermal and geothermal) which accounted for 37.1%, 9.2%, 6.4%, and 0.5% respectively in 2021.

Figure 3 illustrates the technology-wise split of the cumulative installed renewable power capacity in Asia in 2021.

Figure 1. Renewable power market, share by region (%), 2021. Source: GlobalData Power Database.

Figure 2. Renewable power market, Asia, cumulative installed capacity, 2010 - 2021. Source: GlobalData Power Database.

Major countries

China, India, Japan, South Korea, and Vietnam are the top five renewable markets both in terms of cumulative installed capacity and annual capacity additions in 2020. The top five countries accounted for 95.9% of the region’s total renewable capacity in 2020 and 2021. These countries held a 97.4% and 96.3% share of the annual renewable capacity addition in Asia in 2020 and 2021 respectively.

Governments across Southeast Asia have accelerated their investments in the renewable power sector to revive their economies which were impacted by the COVID-19 pandemic. Under the second phase of the Association of Southeast Asian Nations (ASEAN) Plan of Action for Energy Co-operation 2021 - 2025, the governments across ASEAN, which includes Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam, have set a target of increasing the share of renewables in the installed power capacity to 35% in the region by 2025.

China is the largest renewable power market not only in Asia but also across the world. It is currently the world’s largest producer of renewable electricity, the world’s largest investor in renewable energy, and the world’s largest manufacturer of solar PV modules and wind turbines. China alone accounted for a 71.2% share of the cumulative renewable installed capacity in 2020 and it holds a share of 75.1% in annual renewable capacity additions in 2020. China’s renewable installed capacity additions can be attributed to targets assigned in its five year plans (FYPs)

Table 1. Renewable power market in Asia: Cumulative installed capacity (GW) by country, 2020 - 2021. Source: GlobalData Power Database

2020 2021 2020 vs 2021 2020 2021

Country Wind China 289.0 Solar PV Others Total renewables Total renewables % Growth % Share % Share

253.7 113.0 655.7 774.1 18.1 71.2 71.9

India 39.3 41.2 15.7 96.2 108.5 12.8 10.4 10.1

Japan 4.4

Vietnam 0.6

South Korea 1.6 71.5

16.8

15.8 9.5

3.4

7.2 85.4

20.9

24.6 93.3

28.5

28.6 9.2

36.4

16.3 9.3

2.3

2.7 8.7

2.6

2.7

Rest of Asia 5.0

Asia Total 340.0 15.8

414.8 17.2 38.0

166.0 920.8 43.8

1076.8 15.1

16.9 4.1 4.1

100.0 100.0

and political will. In 2016, the government introduced the 13th FYP for the period 2016 - 2020. Key objectives of the 13th FYP included increasing the share of non-fossil energy in total primary energy consumption to 15% by 2020, increasing installed renewable power capacity to 680 GW by 2020, promoting offshore wind and ocean power development, leading renewable energy technology innovation, resolving renewable power curtailment issues, and reducing reliance on foreign companies. China could achieve most of the objectives outlined in its 13th FYP and overachieved wind and solar targets for 2020.

India possesses immense renewable energy potential. It is one of the five leading countries in the world in terms of total renewable energy installed capacity. This means that the country is capable of powering its growing economy with secure and affordable energy supply. Wind power installations in India during the historic period are mainly driven by accelerated depreciation, excise duty exemption for manufacturers, concessional import duties on certain components of wind electric generators, an auction mechanism, and a 10 year tax holiday on income generated from wind power projects. Solar in India is mainly driven by specific targets, solar carve-outs in renewable purchase obligations, an auction mechanism for large scale solar, net metering for rooftop solar, and safeguard duty to promote domestic manufacturing. India is the second largest renewable market in Asia with a 10.4% share in total capacity in 2020. It is expected that India’s share in annual renewable capacity additions in the region is 7.9% in 2021.

Japan is currently the third largest renewable power market in Asia. The country emerged as the leading renewable power market, mainly for solar, after the implementation of a feed-in tariff (FIT) mechanism in 2012. Currently, Japan provides FIT for PV installations up to 250 kW and installations greater than 250 kW are allotted through an auction mechanism. Japan also offers FIT for other renewable sources such as wind, biomass, small hydro, and geothermal. Cumulative installed capacity for renewable power in Japan was 85.4 GW in 2020 and 93.3 GW in 2021. Japan had a 6.2% share of annual capacity additions in Asia in 2020.

Vietnam has found a place among the top five countries in the Asia region as the country increased its renewable power capacity by a massive 118.2% in 2020 as compared to 2019. This growth was mainly driven by the generous FITs offered by the Vietnamese government for solar PV installations. Vietnam had a share of 7.8% of annual capacity additions in 2020 and its share in cumulative renewable capacity was 2.3% in 2020 and 2.6% in 2021.

South Korea is the fifth largest renewable power market in Asia and accounted for a 2.7% share in the region’s total renewable capacity in 2021. Renewable portfolio standard (RPS) is one of the key drivers for the increase in renewable capacity in the last decade. South Korea has raised its RPS for 2022 to 12.5% from 10%. The country, to attain its climate objectives, has set long-term renewable targets with specific capacity targets for wind (mainly offshore wind) and solar.

Table 1 shows the cumulative capacity of renewable power in the top five Asian countries in 2020 and 2021.

Figure 3. Renewable capacity mix in Asia (%), 2021. Source: GlobalData Power Database.

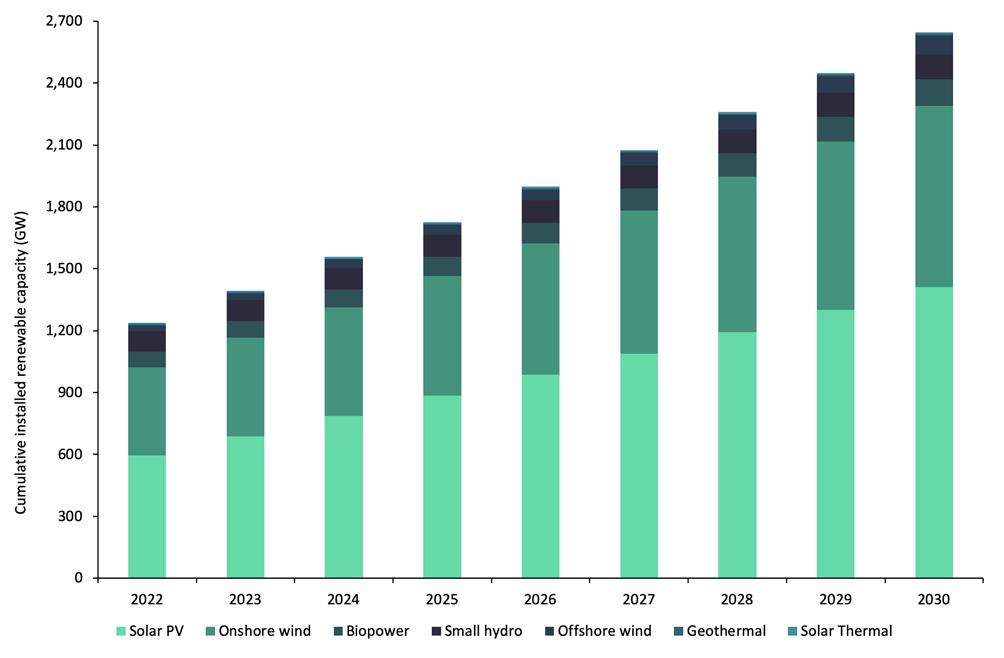

Figure 4. Renewable power market, Asia, cumulative installed capacity, 2022 - 2030. Source: GlobalData Power Database.

Outlook

Renewable installations in Asia are mainly driven by the increase in electricity demand, decarbonisation goals, renewable targets, renewable auctions, FIT, and other incentives. Electricity consumption in Asia is expected to increase from 11 008 TWh in 2020 to reach 16 460 TWh in 2030 at a CAGR of approximately 4.1%.

All major Asian countries have set ambitious targets for renewables and reduction in greenhouse gas (GHG) emissions which will continue to spur the addition of renewable power capacity in the region. Countries including China, India, Malaysia, Singapore, Kazakhstan, South Korea, and Thailand, among others in the region, are party to the Paris Climate Agreement and have submitted their Nationally Determined Contributions (NDC) to the United Nations (UN) aimed towards reducing their GHG emissions.

China’s 14th FYP set for 2021 - 2025 has even more aggressive goals. The plan aims at 20% energy from renewable sources, extensive expansion of solar PV and wind power, construction of several clean energy complexes (hybrid), and focuses on increasing energy storage facilities, especially for solar PV. Based on these plans, China’s solar PV capacity will likely exceed 550 GW by 2025. The Indian government set a renewable power installed capacity target of 450 GW by 2030 comprising of

300 GW for solar PV, 140 GW for wind, and 10 GW for biopower. The target is further revised to 500 GW by 2030 in line with its NDC.

Table 2 provides carbon neutral target years and renewable targets of select countries in Asia.

Governments across Asia have framed favourable policies for the development of the renewables sector in their respective countries to attain their climate goals or targets. Strong policy support from governments has enabled rapid renewable capacity additions across the region, particularly for solar PV and wind power in the historic period and will continue to do so in the future. FITs were the most preferred form of incentive for renewables. However, FITs paved way for a more competitive auction mechanism for large scale installations, mainly in the case of wind and solar. FITs remain a preferred mechanism to promote small scale renewable installations such as rooftop solar, small hydro, bioenergy, and geothermal. Auctions or competitive bidding have gained popularity among Asian countries. The auction mechanism promoted large scale renewable installations, mainly wind and solar. Auctions also helped in price discovery and lowering the costs of wind and solar projects. India and Japan have been successfully implementing tenders and auctions for large scale wind and solar. Many others, such as China and Vietnam, are in transition from FIT to a competitive auction mechanism. China stopped providing FITs for renewable projects from 2021 and shifted to a reverse bidding mechanism.

In January 2022, the Philippines opened a tender for 2 GW of renewable capacity on the islands of Luzon (1.4 GW), Visayas (400 MW), and Mindanao (400 MW). Solar accounts for 1260 MW, wind 380 MW, biomass 230 MW, and hydro 130 MW of capacity offered under the tender. The first-round tender under the Green Energy Auction Program (GEAP) is part of the Philippine government’s aim of achieving a 35% renewables share by 2030 and 50% by 2040. The Philippine utility Meralco launched a 850 MW renewables tender, of which 600 MW is expected to commission in February 2026 and another 250 MW in February 2027.

In October 2021, Solar Energy Corporation of India (SECI) declared winners for the supply of 2.5 GW round the clock (RTC) power from grid connected renewable projects bundled with thermal power. SECI is likely to retender a 2.25 GW capacity this year as the winners failed to match the lowest tariff to secure the letter of award (LOA). According to the RTC tender document, the bidders should match the lowest bid of INR3.01 (US$0.04)/kWh won by Hindustan Thermal for a 250 MW project.

In Japan’s first fixed-bottom offshore wind auction results declared in December 2021, the Mitsubishi-led consortium was selected for the 819 MW Yurihonjo offshore wind farm, the 478.8 MW Noshiro Mitane Oga project, and the 390.6 MW Choshi project. The Choshi project is expected to be commissioned in September 2028, the Noshiro Mitane Oga project is expected to commission in December 2028, and the Yurihonjo project will commission in December 2030.

China auctioned 12 GW of wind capacity in 2H20, and the country auctioned 22.8 GW solar PV capacity in 2019 and 25.9 GW in 2020. The auctioned capacity is expected to commission from 2022.

To attain renewable targets and climate goals, an auction mechanism will be the predominant driver to promote large scale renewable installations in Asia. By 2030, the cumulative installed renewable power capacity in the region is expected to reach 2644.6 GW, at a CAGR of 10.5% during the 2021 - 2030 period. Asia will continue to lead the global renewables market with a steady share of approximately 52% of the total global renewable capacity during 2022 - 2030. Solar (both PV and solar thermal) will continue to be a leading renewable source and its share in cumulative renewable capacity in Asia will increase from 47% in 2021 to approximately a 54% share in 2030. Wind power is expected to add approximately 572.5 GW during 2022 - 2030. China, India, Japan, Vietnam, and South Korea will remain key renewable countries in the region during 2022 - 2030.

Table 2. Renewable energy and carbon neutral targets of select Asian countries. Source: UNFCCC, Country Regulatory Agencies, GlobalData

Country

China Carbon neutral target year

2060 Renewable target

To achieve 25% non-fossil in its primary energy in 2030.

To build over 1200 GW of solar and wind power by 2030. The achieve renewable power capacity of 500 GW by 2030.

India

Japan 2070

2050 To achieve a target of 50% share of energy from non-fossil fuels by 2030. Renewable power generation to achieve 22 - 24% share in total power generation by 2030.

Aims to increase the share of renewable electricity to 20% by 2030 and to 42% by 2034.

South Korea

Vietnam

Taiwan

Kazakhstan

Malaysia 2050

2050

2050

2060

2050 Cumulative installed capacity for wind power to reach 17.7 GW (12 GW for offshore), and solar PV to reach 36.4 GW by 2030. Plans to increase solar capacity to 18.6 GW and wind capacity to 18.0 GW by 2030. Target of 27 GW of installed renewable power capacity by 2025.

To increase the share of renewable power generation to 20% by 2025 To increase the share of renewable energy in domestic electricity generation to 6% by 2025, 10% by 2030, and 50% by 2050. To achieve 31% of its power generation from renewables by 2025 and 40% in 2035.