About CMG Home Loans. CMG Financial is a well-capitalized mortgage bank founded in 1993 by Christopher M. George, a former Mortgage Bankers Association Chairman. CMG makes its products and services available to the market through three distinct origination channels: retail lending, wholesale lending, and correspondent lending. CMG also operates seven joint venture companies with builder & realtor partners, holds an impressive MSR/servicing portfolio, and serves the capital markets of fixed income trading & sales through CMG Securities. CMG currently operates in all 50 states, the District of Columbia, Guam, and holds approvals with FNMA, FHLMC, and GNMA. The company is consistently recognized as a top-producing lender and top mortgage employer, and it prides itself on helping clients achieve the dream of homeownership through product innovation and streamlined servicing.

TURNING MARKET ADVERSITY INTO MOMENTS OF OPPORTUNITY:

Three decades in the mortgage industry spans some of the greatest market downturns in history. From the Great Recession to the COVID pandemic and beyond, CMG has weathered many storms, and come out of them even stronger than before. When many companies face layoffs and cutbacks, CMG has seen standout growth in size and origination.

APRIL 2023

SEPT 2023

OCT 2023

OCT 2023

NOV 2023

DEC 2023

APRIL 2024

Retail acquisition of Homebridge Financial Services

$12 BILLION ORIGINATION VOLUME IN 2022

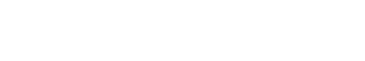

CMG is top growth lender for annual origination volume from Sept 2022 to Sept 2023

CLIMBING BY 17.5% WHILE MOST OTHER LENDERS SAW DECREASES

New Salem Branch following the addition of Premier Mortgage Lending

CMG named Top Employer for Women by National Mortgage Professional Magazine once again

Addition of Shamrock Home Loans in New England area expansion

CMG experienced a 73% growth in the amount of Loan Officers and a 60% overall employee growth from the end of 2022 to the end of 2023

CMG Adds 25 Branches Through Retail Acquisition of Norcom Mortgage

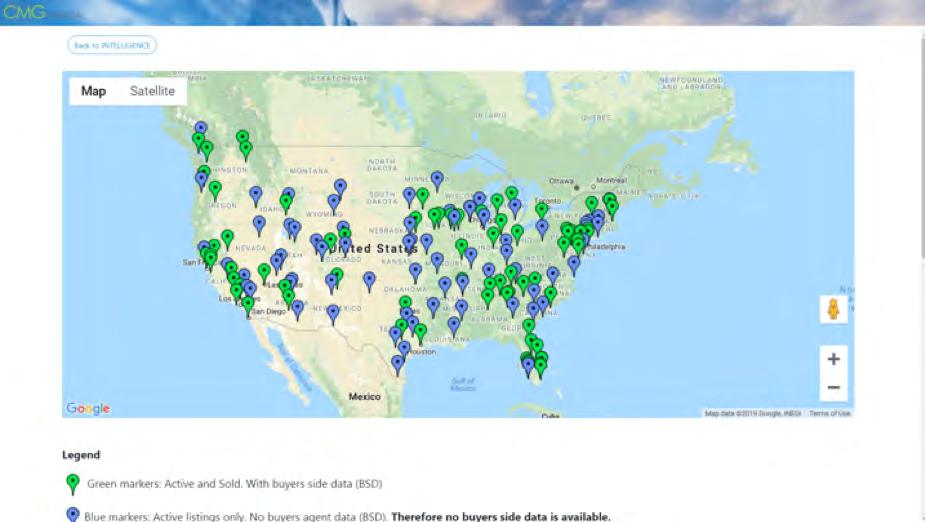

Our retail channel includes 1300+ loan officers in 390+ branches nationwide serving homeowners and home buyers for all new purchase and refinance needs. We also partner with residential builders and real estate professionals to offer streamlined service.

Our wholesale channel serves mortgage brokers and select partner lenders nationwide, sharing our robust product menu, competitive pricing, and personalized service.

Our correspondent lending channel offers competitive pricing structure, by maintaining an agile operations platform designed to purchase loans quickly and efficiently from its partners’ lines, allowing the team to capitalize on industry-prevalent narrow margins.

$21,503,166,974.96 2023 Total Loan Volume

$530,829,910

$2,040,702,396

$4,898,976,581

$14,032,658,087

2024 Total Monthly Loan Volume by Channel

Builders, realtors, and other organizations partner with CMG Financial to create a new mortgage experience. There are 6 active Joint Ventures, and continued growth.

CMG Securities was created to focus its knowledge and experience on the capital markets of fixed income trading and sales in order to serve the origination community in its entirety, as well as institutional investors.

Today we have over 300,000 loans in servicing that help augment income streams. This gives us revenue for investment to adjust for volatility in the marketplace as well as investments.

At CMG Home Loans, our focus is your success! Take a look at the success our top producers have achieved since working at CMG Home Loans.

NMLS# 256638 • Personal Production 2023 – Units: 265 | Volume: $227,344,622

At CMG Home Loans Since 2023

Brian Minkow has been a fixture at the top of all the industry’s awards and recognition lists throughout the duration of his 26-year career. For the past 24 consecutive years, he has been a top-ranked producer. Brian is the #1 producing Loan Officer by volume at CMG, and in 2022, he was the 5th highest-producing loan officer in the entire nation, closing over $412M in loan volume and serving 738 happy families. At CMG, he leads his hardworking team, which prioritizes customer service, constant communication, and personalized loan education.

NMLS# 273165 • Personal Production 2023 — Units: 625 | Volume $226,167,839

At CMG Home Loans Since 2014

Chris Minjarez has held mortgage management positions for over a decade, including both the Area Texas Manager and Senior Market Manager roles at CMG Home Loans. He operates on CMG’s core principles of striving to create affordable mortgage solutions for clients while achieving the company’s financial goals. Chris is well-versed in the loan process from initial origination to a satisfied close. He provides a superior customer experience and fulfills the goal to make every transaction extraordinary.

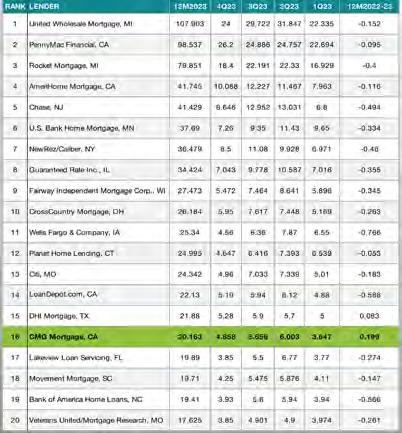

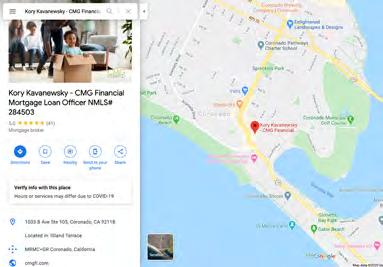

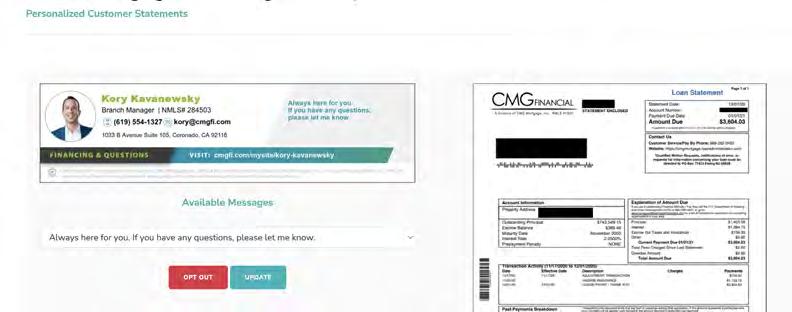

NMLS# 284503 • Personal Production 2023 — Units: 287 | Volume $183,614,033

At CMG Home Loans since 2010

Kory Kavanewsky’s mortgage career spans 23 years, 13 of which has been spent at CMG Home Loans. Kavanewsky is consistently recognized for his production volume by Scotsman Guide, Mortgage Executive Magazine and other respected trade publications. He was voted “Best Mortgage Pro in Coronado” by Coronado Lifestyle Magazine for 10 consecutive years. He attributes his success to CMG’s progressive loan origination process and impeccable operations efficiency. When asked why he chose to work for CMG Home Loans, Kavanewsky says, “company culture really does matter here. We have experienced tremendous growth, yet we still function as a tight-knit community of nimble mortgage professionals”.

NMLS# 160055 • Personal Production 2023 — Units: 489 | Volume $170,041,716

At CMG Home Loans Since 2013

Carey Ann Cyr brought her mortgage team to CMG Home Loans because they liked its entrepreneurial spirit, its unique product mix allowing them to be different from the competitors, its straightforward underwriting, and a culture that is based on doing the right thing for the customer and referral partners. Cyr is regularly recognized as a top producer by Scotsman Guide, Mortgage Executive Magazine, and other trade publications. She and her mortgage team continue to break company records every year and have earned the distinction of one of the top producing branches in the nation.

NMLS# 284503 • Personal Production 2023 — Units: 383 | Volume $154,417,317

At CMG Home Loans since 2017

Justin Hrabovsky is a Producing Area and Branch Manager for CMG Home Loans and team lead for The Hrabovsky Team. Justin is a Top 9 loan officer in Central Texas based on 2018, 2019, 2020 and 2021 loan production per the Austin Business Journal. He has been in the real estate/mortgage industry for 20 years and his primary focus is educating every customer on the best loan options available to them to ensure their mortgage financing is in line with their short- and long-term financial goals.

NMLS# 160055 • Personal Production 2023 — Units: 245 | Volume $120,070,809

At CMG Home Loans Since 2019

Tyler Hughes has been providing the greater Austin area top-notch home financing service for over a decade. He’s a top producer at CMG and consistently a top-200 loan officer in the U.S. Austin Business Journal named him among the top 25 lenders in the area. At CMG, he leads the Tyler Hughes Team and helps homeowners and buyers achieve their goals.

Get hands-on training in professional workshops. Systems trainers, business development partners, marketing professionals, and corporate videographers are on-site and at your disposal.

Our originators are consistently recognized in top-tier trade publications for exceptional volume and client service.

A culture of service from the top down. We encourage communication throughout our organization. From immediate managers to top executives, we want to hear your thoughts and help you succeed.

Our leadership has a structured plan and the resources to grow your career.

I have always considered myself a top producer, but upon joining CMG in 2017 I realized I was among the best of the best. Since joining my production has Doubled!! closing out 2021 with over 90 Million in Personal Funded Volume. While Managing a Branch that has done Over $220 Million in 2021. I can say that CMG gives EVERY Loan Officer, Manager, and support staff the tools to be successful. CMG is a company built by producers, and MADE for Producers!

DON BLAIZE

BRANCH MANAGER/AREA SALES MANAGER • NMLS# 184888 - BILOXI, MS

You ask anybody that works here, we are a family. The ability to communicate with underwriters on a loan officer level to problem solve challenging loans. It doesn’t stop with operations, I have access to upper management right on my cell phoneand when you call, they really pick up the phone. The difference between CMG and other companies is they actually listen when you have something to say.

TIM LOSS

LOAN OFFICER • NMLS# 187037 - MT. PLEASANT, SC

It takes a combination of proven leadership, a realistic outlook, a willingness to change, financial stability, and a connection to the community to be the retail mortgage banking company of choice. Our success depends on our ability to think differently.

Our roots are in retail mortgage banking. Every senior leader has more than 20 years in the industry, with time spent successfully originating or in fulfillment roles, managing smaller teams and then organizations. We believe everyone involved in the transaction is the customer including the home buyer, the loan officer, the agent, the processor, the underwriter, and anyone who touches the loan.

We invest in better products to continue to enhance the lending experience for our customers. Our dedication to product development ensures we are always improving the experience for everyone.

From HomeFundIt™, the down payment gifting platform to the All In One Loan™, the smarter way to borrow, to List & LockTM, the one-of-a-kind way to help you market to home sellers, CMG designs mortgage solutions that serve the needs of every borrower.

Change in the mortgage industry is part of our business. We’ve made recent and significant investments in the right systems and added our own expertise to ensure that we stay ahead. We’re improving the way you interact with your partners and your customers. A better home buying experience starts with better communication, education,and transparency.

CMG loan officers specialize in all new purchase and refinance mortgage needs and act as financial counselors to help borrowers make informed decisions. Delivering the right loans for the right reasons in a way that exceeds all expectations. That’s our business.

► Seasoned sales professionals supported by management with years of experience.

► Operational leadership that is dedicated to managing your pipeline, and to ensure that each transaction moves along quickly.

► Seasoned underwriters and underwriting leaders that are empowered to make decisions and offer solutions, that take pride in figuring out ways to say “yes”.

► Local processing, sitting side by side with the sales team, supported by regional sites prepared to process overflow and originations.

► Open door and easy lines of communications between sales, processing, and underwriting— everyone is solution-oriented.

► A closing department that works ahead and realizes that the last impression is the only lasting impression.

► It’s about meeting our customers’ and referral partners’ expectations. We over-communicate, and we close on time, every time.

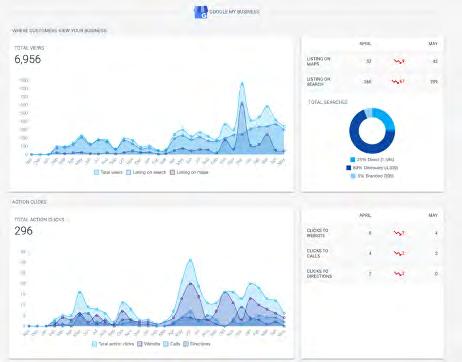

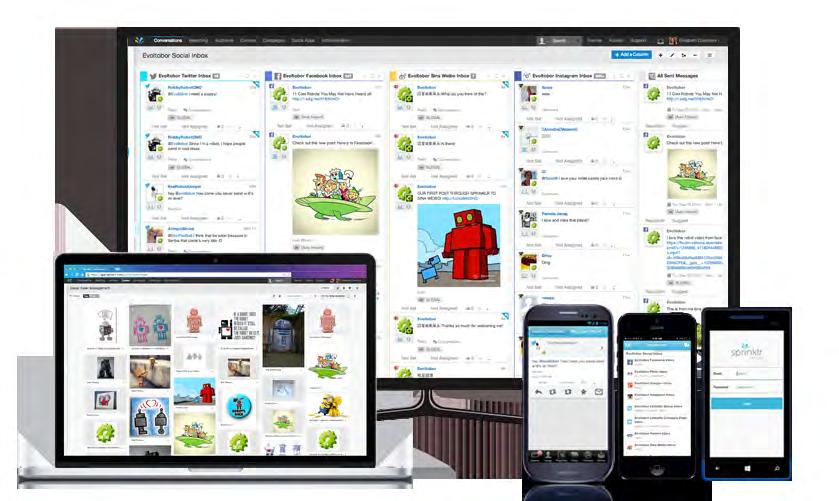

The second you sign on to CMG, you’ll have access to customized marketing tools from one of the top agencies in the industry. From your own CMG-branded website, to social media, to lead generation, you’ll get everything you need to hit the ground running. We’ll be there to hold your hand as much or as little as you want. If you want us to handle all your marketing so you can focus on closing more loans, we can do that. If you want a personal marketing strategist, it’s yours. If you have an idea that can help drive more business, we’ll make it happen. We have loads of collateral created weekly that you can push out to business partners and consumers. Each week, you’ll receive an email update from the Marketing Department that outlines new products, new tools, graphics, and other marketing materials you can take advantage of and share with your partners and clients. In addition, we create weekly market update emails that you can opt-in to auto send to your network. This keeps YOU as their go-to source for rate movement and market news. Social media graphics, reels, and posts keep you at the front of their mind.

Increase your visibility in your market - potential clients and partners will see you EVERYWHERE . E VERYWHERE

Dedicated website to promote your brand and engage your customers.

1. Automatic blog posts 2. Mortgage Calculators for every home buying scenario

3. Fully integrated into your marketing lead capture tools

Taking the time to register you on all major directories for the maximum coverage.

► We list you as a business to increase SEO presence

► 80% of LO website visitors come from SEO discovery

Automatic daily posts to keep you in front of your network.

► Social media automation

► Can drive traffic back to LO mysites for lead capture

► Focused on developing new content

► Automated campaigns (opt-in)

► Manual campaigns

► Multi-device access

► Over 1500 custom social graphics

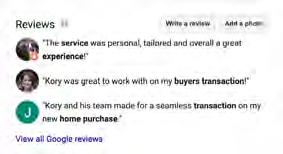

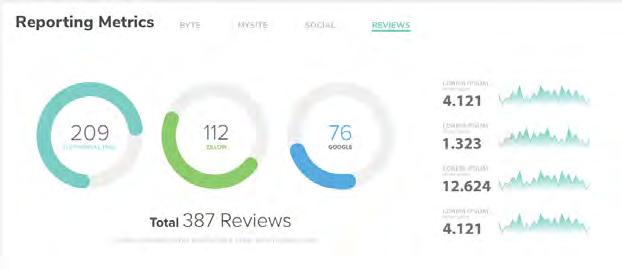

Survey that promotes happy customers to advocate in places that it counts like Facebook, Zillow, Google my Business, and more.

► Video Testimonials

► SEO

► Website Widgets

► Facebook App

► Social Media

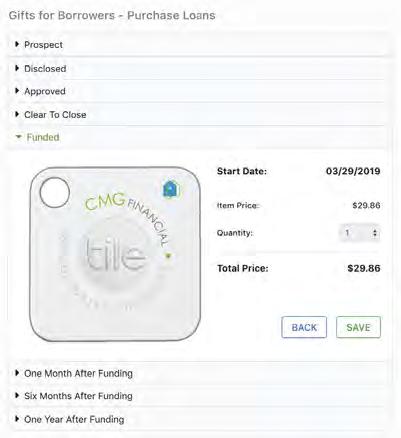

► Automated gifts to your customers at multiple milestones throughout the loan process and after closing

► These gifts are hyper personalized with individual branding to the LO

Fully integrated CRM to nuture and build your relationship with leads, clients, and partners.

► Videos personalilzed for borrowers

► Cobranded buying agent

► Copy listing agent to create opportunity

► Daily search of past client database for opportunities

► Listing Alerts to communicate to Referral Partner

► Refinance opportunities due to rate gap

► Dynamic in-line text message videos from the Loan Officer directly integrated to our LOS system.

► Library of available content (educational, product, etc.)

► Instantly available

► Referral Partners

► Pre-Qual

► In Process

► Post-Close & Past Clients

► Compliance already approved

► Interactive educational online games

Opportunity to help your agent partners grow their business and help you reach new customers.

1. Imports from MLS

2. Prebuilt pricing integration

3. Lead capture tools for you and your agent partner

In a crowded mortgage market, you NEED to stand out. The Agency Plan by CMG Home Loans makes sure your message is heard by everyone who needs to hear it. Other mortgage companies rely on “set it and forget it” cookie cutter campaigns. CMG Home Loans delivers custom marketing content designed to build your brand and reach your audience.

With three tiers to choose from, you can get as much hands-on marketing focus as you need.

Above our Valley tier, we have three additional tiers: Base Camp, Ridge, and Peak. Each has increasing support. All of the tiers above Valley come with a dedicated marketing assistant who will help enhance your business development strategies, identify growth opportunities, and maximize the potential of your personal brand. They accomplish this through: MANAGING YOUR SOCIAL MEDIA PLATFORMS AND CRM HARVESTING & MINING YOUR DATABASE

We are dedicated to ensuring you have the best tools to be efficient and data to give you an edge.

With the CMG Home App you are able to monitor your client’s entire loan process.

► Your clients can compare loan programs and down payment scenarios

► Live pipeline updates, know what’s going on at every step

► Cobranding opportunities within the application

► Mortgage calculator, estimate payment in your office and update as needed

► Direct integration to CRM to add new agents

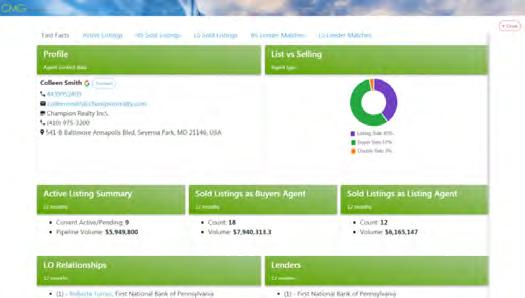

► Track your referral partners’ production in all states where available

► Find new referral partners and be more efficient with your prospecting

► Access to referral partners you’ve previously done business with.

Suite of specific automation systems available to the LO.

► Build co-branded HomeFundIt™ websites for your referral partners

► Automated customized branding options

► Opt-in platforms available to stay connnected to database

► Personalized LO branded mortgage statements

► Opt-in to receive corporate marketing leads

LITVIDS: A Featured Marketing Hub Platform Video deployment system that generates customized videos.

► Enhance relationships with customers and referral partners with a specific video message

► Ability to upload right from your mobile device

Push listing leads to your partners and maximize refinance and new buyer opportunities.

► Reduced subscription price through our partnership

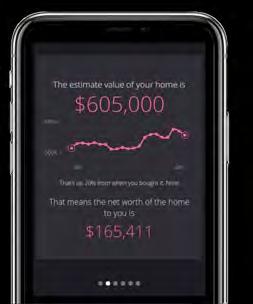

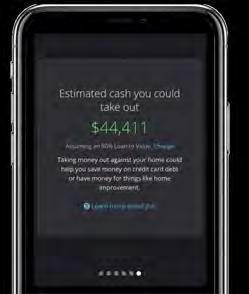

► Industry-leading client home wealth tracking tool

► Delivers personlized actionable insights to help clients track and build wealth with their home

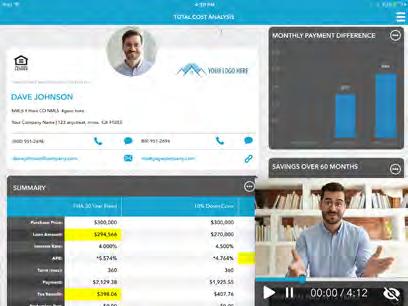

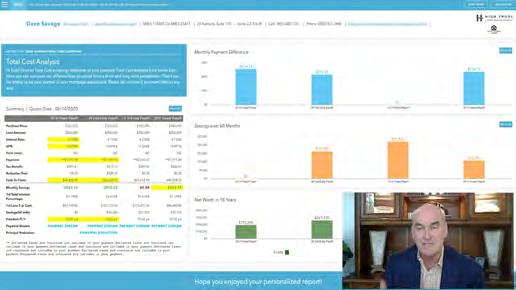

Professional presentation tool to give you an advantage when presenting options to your clients.

► Reduced subscription price through our partnership

► Helps present home loan strateges to clients

► Integrated with our CRM to automate email campaigns

► Helps attract more referrals and refinance opportunities

► Keep your customers for life!

We are the only mortgage company that has total cost analysis built out. This automatically gets sent to customers to show how they can lower their payment & save $ by refinancing.

Like most lenders, we offer the typical conventional and government loans as well as jumbo, construction, reverse, non-QM, ARM, and home equity line of credit (HELOC) options. Unlike most lenders, we offer much more.

► Rate Rebound – Clients can buy now and refi to a lower rate (if rates fall) within the next 5 years with no lender fees

► FHA Buyer’s Choice – 101.5% LTV on FHA Loans with no income, geographic, military, or first-time buyer requirements

► Halal Financing Program – We’re one of few lenders in the nation to offer this unique financing with the Ijara Community Corp

► Fast Funding HELOCS – Homeowners can get access to equity in as little as 5 days with our FLEX HELOC or the 5-Day HELOC

One Time Close Construction

► First Responders’ Extra Savings for Heroes (FRESH) Program – Reduced closing costs for eligible first responders and military members

► On-Time Closing Guarantee – Eligible buyers can receive a guaranteed on-time close w/ a $2,000 credit if we close late**

► 2x Close Construction – Financing for land, construction, and a mortgage

► Doctor Loan Program - 95% LTV, no mortgage insurance, and loan amounts of up to $2 million for qualified medical professionals

The first-lien HELOC, functions as a checking account and mortgage to help clients pay off their own home or investment property faster.

One loan that allows borrowers to finance the purchase and build of their dream home all while paying down the principal balance more aggressively during and after construction.

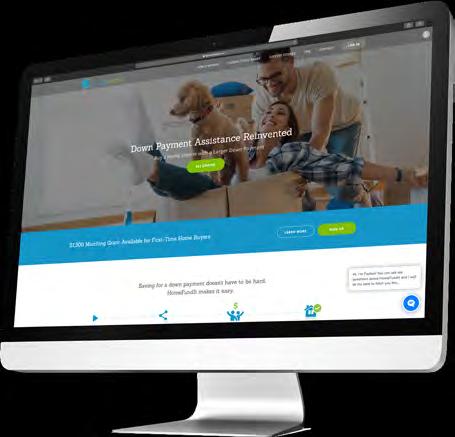

Unique down payment gifting platform designed to help home buyers buy a home sooner with a larger down payment.

One-of-a-kind way to help sellers advertise discounted rates on their listings.

New home builders of all sizes prefer working with CMG Financial because we are a direct lender with nationwide coverage. Builders need a lender that can deliver reliable service, on-time closings, and a variety of loan programs to serve customers of all needs.

u Local processing and underwriting

u Quick upfront approvals

u 24-hour turn times

u Educational supplements for home buyers

u Extended Rate Lock Programs

u Spec Lock Program

u Flex Forward

u Rate Rebound

u Customized Marketing Solutions

Builders can reach more buyers by providing reduced interest rates for their properties while they are still under construction.

Through our partnership, qualifying first-time home buyers can get up to $1,250 toward their down payment or closing costs.

What I show my clients is it’s not the rate of interest that’s important, but rather the amount of interest. The All In One Loan™ has helped my clients save money by reducing their interest expenses and giving them more cash flow from month to month.”

— Kory Kavanewsky

VICE PRESIDENT,

► Reach more first-time home buyers earlier in the shopping process.

► Streamline down payment gifting in a safe and secure online platform.

► Get exclusivity in your market - only CMG Home Loans and its joint venture partners can use HomeFundIt™.

► $2,000 closing costs grant opportunity for qualifying first-time home buyers.*

► Your buyers can start accepting down payment gifts from family and friends as soon as they launch their campaign.

► Anyone with a credit or debit card can give up to $7,500 per gift.

► Your buyer gets extra pledges toward their down payment when they shop online at over 1,000 participating retailers.

► Reach buyers earlier in the funnel and secure their business when they’re ready to buy.**

$2,000 CLOSING COST GRANT*

► Qualifying first-time home buyers earn up to $2,000 toward closing costs.

► We match $2 for every $1 received through gifting. PLUS they earn even more when they shop or share.

Rates are making buyers think twice about purchasing. List and Lock™ eliminates buyers’ biggest hurdle, generates more interest in sellers’ listings, and helps Realtors and their clients sell faster without dropping a sales price.

We are an approved lender of the Freddie Mac BorrowSmartSM Program, an opportunity for your clients to get up to $1,500 toward down payment or closing costs.*

QUALIFYING HOME BUYERS CAN GET:

$1,250* $1,000*

When their income is greater than 50% and less than 80% of the county’s Area Median Income (AMI)

When their income is greater than 80.01% and equal to or less than 100% of the county’s Area Median Income (AMI).

Through our partnership, we also offer exclusive live and online events for real estate agents, home buyers, anyone you want to connect with and share this exclusive opportunity.

These virtual events were attended by hundreds of real estate agents eager to connect with our loan officers and share the Freddie Mac BorrowSmartSM Program with their clients.

With CMG Financial's FreddieMac partnership, you can help your real estate partners reach more buyers and grow their market base, making you their go-to lender.

CHRISTOPHER M. GEORGE FOUNDER, PRESIDENT, & CEO OF CMG FINANCIAL

► ALWAYS ADVANCING

► CONSTANTLY CURIOUS

► EXTRAORDINARY BY DESIGN

As businesses scale, many leaders make the mistake of growing just for growth’s sake. Christopher M. George has grown his business from a garage to a national brand because of his ability to grow efficiently and scale effectively.

For the past 30 years, Christopher M. George has been a champion for the lender and the consumer. He is an advocate for responsible lending practices and regulation. In 2017, he spearheaded the launch of a first of its kind product, completed a national media tour, and testified before Congress on behalf of the Mortgage Bankers Association.

In addition to serving as the President and CEO of CMG Financial, Christopher M. George is the former Chairman of the Mortgage Bankers Association. He understands that the best way to succeed in an industry is to influence it. CMG Financial continues to thrive after 30 years under his inspirational guidance.

AJ George began his mortgage-banking career with CMG in 2005. He gained a comprehensive background of Correspondent, Wholesale, and Retail Lending and now serves as Chief Administrative Officer. In 2014, AJ George was selected as a HousingWire Rising Star and in 2021, he was selected as a HousingWire Finance Leader. He has a natural affinity for service volunteering for the non-profit organization CMG Foundation and participating in multiple AIDS LifeCycle bicycle rides from San Francisco to Los Angeles.

Paul Akinmade oversees the strategy and tactics to grow CMG’s business while creating brand awareness and marketing plans for a wider reach of the CMG name. Akinmade is an accomplished leader with recognized achievements in business development, process improvement, execution, and market growth. He is effective at fostering multi-channel cooperation from business units of varying disciplines, allowing for efficient execution and lasting results. His efforts have gained industry-wide recognition, earning him several HousingWire awards in recent years: Rising Star (2018), Tech Trendsetter (2020 & 2024), and Marketing Leader (2021 & 2023).

Melissa Harbourne has been leading the charge of operations and human resources at CMG for over 7 years. Her strength lies in her ability to navigate complex situations, solve problems, and streamline processes. Her role is pivotal in enhancing communication and process integration across various departments, playing a critical behind-the-scenes role in resolving issues, mediating disputes, and leading teams towards common objectives. The Chief of Staff role is crucial for fostering unity and progress within our organization. Melissa’s mission will be to lead teams, facilitate communications, and align efforts across the company to maintain our momentum.

With over 40 years of experience in the mortgage industry, Susan Walker has been a driving force behind operational excellence and cross-functional efficiency at CMG Financial since joining the company in 2019. As Executive Vice President of Corporate Efficiency and a member of the Executive Management Team, she oversees Post Closing, Vendor Management, and Product Strategy, while leading enterprise-wide process improvements. She has held senior leadership roles in both Sales and Operations at American Residential, Wells Fargo, and Stearns, giving her a wellrounded and strategic perspective on the entire mortgage process. Known for cutting complexity and aligning teams around shared goals, Susan delivers scalable solutions that enhance business performance for lasting impact.

Charlie Rogers serves as CMG Financial’s Executive Vice President, Head of Production. Rogers has more than 30 years of experience in the banking and mortgage industry with loan process and pipeline management, recruiting, and developing productive originators. He has held prestigious positions including President, CEO, Managing Director, Regional Vice President, and Executive Vice President at his previous companies. In his role at CMG Financial, Rogers oversees the production and operations of both the Retail and Wholesale channels.

Joe Cabrall joined CMG Financial in 2005 and throughout his tenure has excelled in many different roles within the organization. His experience is diverse, including managing multiple Wholesale Operation centers, supporting Retail Operations, Sales and Capital Markets. While managing the Operation centers Joe was responsible for the complete loan process; from setup to the sale of the loan to the investor. Within Retail Lending his focus was on sales, and working closely with the operations team to ensure exceptional customer service and support.

Tony Giglio joined CMG in 2016 and is responsible for leading the Distributed Retail Channel. His career spans 3 decades, with successful stints as a loan officer at Barnett Bank and Chase until entering leadership in 2003. After stays at Countrywide Home Loans, Preferred Trust and New Penn Financial, Tony has the privilege of calling CMG Home Loans home. With a career entirely focused on Retail Mortgage Banking, Tony and his leadership team have proven successful in expanding CMG’s footprint nationally and take the most pride in helping their sales professionals be more successful today than they were yesterday.

Candy Nowak has over 30 years of industry experience. She has been with CMG for over 12 years, managing various roles across different departments including credit, operations, and sales – both in retail and wholesale. As Chief Credit Officer, she is responsible for developing and maintaining credit and company culture while managing credit risk and policy. Before this role, she oversaw all aspects of underwriting as the SVP, National Underwriting Manager. She brings an invaluable wealth of knowledge to her day-to-day responsibilities and is an invaluable asset to the Executive Team.

Rick Floyd brings more than 28 years of mortgage banking experience as passionate leader and dedicated coach. As a partner and Executive Vice President of Homebridge Financial Services, he oversaw the company’s retail sales, operations, training, and marketing teams. Like many who have been in the mortgage industry for more than 25 years, Rick has held many positions along the way. Regardless of his role, he has held fast to the same mantra throughout his career. “Attitude, passion, and enthusiasm” for not only the industry, but also for the associates he is privileged to lead. “I truly believe that as a leader it is my job to place people in the position where they can and will be most successful,” Rick says. “Finding out exactly what motivates and drives each person is so important.”

Rose Marie David has been in the mortgage industry for three decades. Prior to joining CMG, she was the Executive Vice President of Retail Lending at Homebridge Financial Services, a Top 25 National Independent Mortgage Banker. Here, she co-led over the company’s retail sales, operations, training, recruiting, and marketing. Before Homebridge, she served as Director of Mortgage Lending at HomeStreet Bank, where she helped grow the business by over 400% and finish in Scotsman Guide’s Top 20 Retail Mortgage Lenders from 2016-2018. At CMG, she is set up to continue her success leading the way in performance and growth.

Tammy Turner manages retail’s Southcentral Division, and is responsible for growth, operating and support strategies. During her 25 years in the finance and mortgage banking industry, she’s held leadership roles at New Penn Financial, Nationstar, and Bank of America/Countrywide Home Loans, and has been recognized as a top performer at each company. In 2021, Tammy was recognized as a HousingWire Woman of Influence. She’s repeatedly displayed her ability to grow market share, drive profitability and productivity. Tammy focuses on creating a collaborative environment, with open communication lines, and a goal of delivering unparalleled customer service.

Chip has over 27 years in the industry. Previously, he has worked as the Managing Director of Southwest Retail at First Magnus/Charter Funding, and he was the Regional Retail Director at Primary Residential Mortgage. Prior to joining CMG 7 years ago, he was the Senior Vice President of Business Development and Recruiting at AmeriFirst Financial. Chip knows how to build strong teams and leads in a way that establishes accountability and facilitates development. His primary goal is to create quality, sustainable growth for the division.

CMG Home Loans is committed to rewarding employees with highly competitive compensation and a comprehensive benefits package that aligns with our commitment to work-life balance.

When compared to other companies in our industry, CMG offers top-tier compensation, rewarding you for your commitment to advancing homeownership and exceeding our customers’ expectations, and for your contributions to our collective growth:

► Market and industry competitive base pay rates

► Aggressive, Dodd-Frank compliant commission plans for originators

► Competitive compensation plans, that reward topperforming operational and support personnel

► For producing and non-producing branch managers, flexible compensation plans aligned with agreed upon goals and performance standards

► Top-tier compensation plans for regional leadership

We’re committed to setting an industry standard benefits package for our employees and their eligible dependents. Understanding how significant the cost of health insurance can be, CMG contributes a higher percentage towards the cost of healthcare than legally required, meaning you pay much less than with other companies in our industry. We offer an extensive benefits package:

► Comprehensive choice of medical plans (Regional HMO, National PPO and HDHP with HSA) from industry leading health carriers

► Dental, vision, life/AD&D, Long-term disability, short-term disability and supplemental insurance

► 401(k) plan with employer matching a portion of your contribution, for retirement security

► HomeFundIt™ employee match program

► Wellness programs, including partnerships and discounted rates with national health clubs

► Pet insurance available

Our HR department is available to work with you and walk you through the process to select the best plan for you and your family.

For more details and a benefit comparison, please ask your CMG recruiter or hiring manager.

“

Victoria Caliri has been so helpful, answering all my questions and steering me in the right direction. This was difficult for our team as things happened so quickly/abruptly with the HMA Team coming over but the welcome and help has been unbelievable. Thanks so much! Love everything I see and hear so far.

CINDY EMERINE

“

The speed and professionalism that CMG was able to bring our entire team on was incredible and very appreciated.

ZEPHRA CLEMENT

“ “ “ “

“

I received a lot of support. I was impressed with the training and support and ease that I could get answers to my questions.

VIC BISCOE

The Red Team is an exceptional asset to the new hires and I think this was a great tool in place for New Hires. “The Best”.

SYLVIA RODRIGUEZ

“ “

I’m blown away by CMG, I’m impressed by the programs available to clients & referral partners. I don’t know why anyone would choose another lender. I’m proud to be part of CMG.

MICHELLE JENNINGS

“ “

“

I am beyond impressed with the conceirge servicesI’verecieved from the onboarding and RED teams. They’e been extremely helpful and always get back to me with a solution or reply in an expedited fashion You are all appreciated!

JESSICA POLENDEY

Excellent onboarding process. The best I have had at any mortgage company I have worked for. Thank you for the support!

NORA M c CULLOUGH

“

CMG’s onboarding experience was the best I have ever experienced at an employer! You all made me feel at home and very much at ease about coming over to CMG. Thank you!

JENNI SCHWAGER

“

Exceptional onboarding process here like no other lender I’ve experienced. I’m truly grateful for their level of organization, resources and efficiency.

TORI GRAVES-WILSON

“

“

“

OUR PEOPLE

We will treat people fairly – like family, and in a way in which they will feel empowered, respected and valued.

OUR PROMISE

We will be honest, open and communicate transparently so that we are always earning our clients’ trust.

OUR PRACTICE

We will listen to our clients’ needs, treat them the way they would treat themselves, and engage in collaborative solutions that exceed their expectations.

OUR PASSION

We will remain driven to build on our individual and organizational success through an insatiable desire to challenge the status quo, learn every day and grow.

Since its founding in 2011, the CMG Foundation has been dedicated to making an impact on society through its support of nonprofit organizations that improve the lives of those in needs.

The Gary Sinise Foundation provides adapted smart home for those wounded in the line of duty through its R.I.S.E. program (Restoring Independence Supporting Empowerment).

The Cancer Support Community provides counseling, support groups, nutrition, exercise, and education programs to those battling cancer and their families.

The MBA Opens Doors Foundation creates mortgage assistance programs for families who are in financial need while their child is undergoing medical treatment for cancer or other illness.