17 23

17 23

08 Sher Afzal Marwat has locked horns with Lucky Cement over how they spend their CSR money. Does he have a point?

12 PostEx’s acquisition of CallCourier has propelled them to the top of the logistics market in Pakistan. What’s next?

17 The boardroom meltdown at Al-Shaheer

21 Federal government to drop ADR once again

23 Will an AI revolution kill Pakistan’s BPO industry?

Publishing Editor: Babar Nizami - Editor Multimedia: Umar Aziz Khan - Senior Editor: Abdullah Niazi

Editorial Consultant: Ahtasam Ahmad - Business Reporters: Taimoor Hassan | Shahab Omer

Zain Naeem | Saneela Jawad | Nisma Riaz | Mariam Umar | Shahnawaz Ali | Ghulam Abbass

Ahmad Ahmadani | Aziz Buneri - Sub-Editor: Saddam Hussain - Video Producer: Talha Farooqi Director Marketing : Mudassir Alam - Regional Heads of Marketing: Agha Anwer (Khi) Kamal Rizvi (Lhe) | Malik Israr (Isb) - Manager Subscriptions: Irfan Farooq Pakistan’s #1 business magazine - your go-to source for business, economic and financial news. Contact us: profit@pakistantoday.com.pk

he have a point?

Legally speaking, there is nothing binding Lucky Cement to have a CSR budget and to spend it in a certain way. But things are often done differently in countries with more developed legislation

By Ghulam Abbas

At the beginning of June, Sher Afzal Marwat was given the floor in the lower house of parliament. The address he made was unusual from the many other speeches he has given in parliament. With his leader imprisoned,and his party in shambles, Mr Marwat was speaking on this occasion not as a PTI parliamentarian but as a constituency politician.

The normally fiery lawyer turned politician spoke with relative calmness as he made a case for the people of Lakki Marwat. Outside the parliament house, a small group of people from the KP District were sitting in protest. The subject of their ire, and of Mr Marwat’s speech, was the Lucky Conglomerate.

Since 1993, the Lucky Group has been operating a massive factory in Darra Pezu in Lakki Marwat, which is one of the largest cement manufacturing facilities in the entire country. Sher Afzal Marwat’s contention was

that in the past two decades, Lucky Cement had failed to give back to the district in any tangible way.

It was an interesting debate on the floor of the national assembly raising an important question: Do companies have a legal responsibility in addition to a moral one to look after their local communities? Mr Marwat and the people of his constituency, NA47 Lakki Marwat in KP, were of the opinion that there should be. But it turns out Pakistan doesn’t really have any legislation that compels

Lucky Cement has invested significantly in social welfare initiatives, with around Rs 78.6 million dedicated to education programs annually and Rs 81.5 million annually to healthcare efforts, benefiting underprivileged communities. Additionally, the company has allocated approximately Rs 214.1 million to support infrastructure projects and provide assistance during disasters, showcasing its dedication to both economic development and social responsibility

Muhammad Ali Tabba, CEO of Lucky Cement

companies to spend in the way of Corporate Social Responsibility (CSR), let alone where they should be spending any CSR budget they might have.

The question is whether such laws should exist.

In his speech to the National Assembly, Mr Marwat claimed that despite having its factory in his district since 1993, Lucky Cement hasn’t invested a single penny in the area under the head of CSR, royalty or what he calls as “surface rent” to the local community, despite earning billions of rupees in profit from the business.

He claimed that the cement company, which employs over 5000 people across the country provides a job to only 44 people of Lucky Marwat, and that too of lower grade. The company, according to him, has established a welfare hospital, but in Karachi and has not done anything of the sort in the vicinity of their factory in Lucky Marwat. Even when due to unchecked manufacturing, supply and transportation activities of the company, the infrastructure and environment of the area have been badly damaged. Pollutants putting public health at risk and industrial activity destroying the native ecosystem. Chemical dust created by the factory is also causing health issues to the lives of people living in the area.

He also claims that roads are damaged after every one or two years due to heavy trucks roaming around the factory and area.

The company, according to him, has paid billions of rupees as dividend to its shareholders but it has not made a contribution to the wellbeing of people of Lucky Marwat. “I have talked to the district administration, provincial

government and military officials to take notice of the issue and I will not spare the case until it is resolved”, said Marwat while addressing a protest in the area.

He claims at least a five percent dividend of the company needs to be given to the area under CSR. District administration confirmed that not a single rupee has been given by the company since its establishment in 1993 to date under the three heads.

But wait, how can a lawmaker hold a company to give its rightfully earned and taxed profit to the people? Does Lucky Cement legally owe anything to the people of Lucky Marwat? And does it amount to Rs 65 crores (5% of its FY23 profit)?

In one word, the answer is, no. When approached sources in the ministry of industries, SECP and industry, Profit found out that neither the company rules set by SECP nor the licence being issued by the industries ministry bind a manufacturing company to spare a specific share of its CSR fund to the locals and community living in the surroundings of the factory.

As such, Mr Marwat’s speech was also a bit of a surprise for the management at Lucky Cement. Speaking to Profit, Lucky Cement’s CEO, Muhammad Ali Tabba, confirmed what the SECP and ministry of industries had also said: there is nothing that binds a company to use a specific share of its CSR to the local community where it is based. Mr Tabba went on to say that despite this the company is already carrying out a number of CSR activities in the area.

“Lucky Cement affirms commitment to national development amidst criticisms. The company has played a vital role in Pakistan’s economic growth, contributing approximately Rs 285 billion to the national exchequer since

its establishment. Notably, over 70% of its workforce hails from Khyber Pakhtunkhwa and our neighbouring areas, emphasising the company’s commitment to local employment and community involvement near its manufacturing facilities,” he said in a written response.

“Moreover, Lucky Cement has invested significantly in social welfare initiatives, with around Rs 78.6 million dedicated to education programs annually and Rs 8.15 crores annually to healthcare efforts, benefiting underprivileged communities. Additionally, the company has allocated approximately Rs 21.4 crores to support infrastructure projects and provide assistance during disasters, showcasing its dedication to both economic development and social responsibility.”

Of course, this written response does not really address the question. Why has Lucky Cement not invested in their local community? It is true enough that they are not under any legal obligation to do so, but if they do have a CSR budget does it not make sense to spend it in Lakki Marwat?

The problem is one cannot fault Lucky Cement for this. It can be argued that the company should have been more aware of this, but the responsibility falls on local administrations.

To cut a long story short, does the company legally owe anything to these areas while it uses their resources? Not in Pakistan. Is there a logic and precedent for it? Absolutely.

Most of the developed world employs community based agreements (CBAs) before they allow any industrial activity in their constituency. It is a legally binding contract between a company and a community that outlines the benefits the company will provide to the community in exchange for the community’s support or acceptance of a project.

It can range from assurances on job creation and infrastructural improvements to environmental protections and sometimes elaborate community programs.

While most CBAs are done by the virtue of the far sightedness of a city’s administration or government. There are even examples of jurisdictions in the world that mandate a Community Based CSR or CBA, before any industrial activity is started. This includes specific jurisdictions or states in countries like the United States, Canada or Australia, and other developed countries.

When it comes to legislation around CSRs, Pakistan is far behind other countries. The country does not mandate any form of CSR for the companies. Meanwhile countries like India and Brazil have specific laws in place whereby a company is required to spend a certain percentage of their profit in CSR, which is what Sher Afzal Marwat wants from Lucky Cement as reparation.

Even though there is no such law in place, examples of community welfare by companies are more than plenty, even in Pakistan. And for a company like Lucky such CBA agreements would be greatly beneficial. Not only do they have one factory in Lakki Marwat, their other production facility is in a similarly low-development area in Sindh’s Jamshoro District.

While analysing the existing rules, it was also revealed that the environmental protection agency (EPA) under the Ministry of Climate Change was the only government body, which has some rules to force any company to make investment into the environment and wellbeing of locals.

However, the EPA rules largely bind the firms to ensure the reducing risk of environmental hazards through different means and procedures set in the rules and guidelines.

Director General EPA Farzana Altaf Shah, when contacted said that the EIA/IEE regulations are set for conducting environmental impact assessment for any project and related issues.

“We, through the EPA rules, give specific guidelines of inspection related to socio economic issues while asking the companies to invest in environmental protection, water supply, school, hospital and other possible facilities to the locals being the immediate affectees of any intervention in the environment,” she added.

Interestingly, in guidelines given by EPA Khyber Pakhtunkhwa to Lucky Cement for extension of its factory in Lucky Marwat, the agency, while sharing other rules and guidelines, has clearly mentioned the mandatory facilities to be provided to the local community.

“A proper CSR document keeping in

I have talked to the district administration, provincial government and military officials to take notice of the issue and I will not spare the case until it is resolved

Sher Afzal Marwat, MNA from NA47 Lakki Marwat

view the quantum of the project activity and demands of the locals shall be finalised specifically for the proposed line having year to year project wise activities detail. The activities may include but are not limited to provision of new water supply schemes, school construction, scholarship, dispensary etc for locals,” the guidelines read.

“Furthermore, two committees for social and environmental issues shall be constituted in consultation with locals with intimation to the agency,” it adds.

According to the guidelines the share of the locals in managerial /skilled jobs shall be increased and proper plan/documents shall be submitted in this regard to the agency. Moreover, employment shall be provided to the local people of the nearest union councils in technical/non-technical jobs. Details of the same shall be provided to EPA.

And then there is the flip side. It is clear that Pakistan does not have any laws for CSR management, and as such Lucky Cement is under no obligation to spend on the people of Lakki Marwat as part of its CSR activities.

One can of course argue that there should be, and plenty of precedent exists in the world for this. The only problem is that of shareholders. For a publicly listed company like Lucky Cement, one might argue that it is the right of the shareholder to decide whether they want to invest any of their earnings that they get through dividends into some kind of charitable or CSR activity, and what this activity should be.

That, of course, is an ideal world. In reality, corporations take on lives of their own and become entities that have decision making power. As a part of that, it would not be so strange if the government legislated on CSR

laws or at least negotiated with companies on the behalf of small districts where these companies operate.

The numbers:

According to an earlier Profit report published in September 2023, Lucky Cement has resolved to conclude a three-year intermission in its dividend disbursements to shareholders by dispensing a Rs 18 per share dividend to end its fiscal year (FY). At Rs 18 per share, this is the most substantial dividend payment per share the company has made since FY 2018 — when the company made a payment of Rs 13 per share.

However, cement companies are renowned for not paying large dividends to begin with. The matter is further bewildering when viewed in conjunction with Lucky’s share buyback activity over the past few months.

The company claimed Lucky Cement’s flagship business is cement, but now only 20% of its profits emanate from local cement operations. The remaining 80% are derived from the company’s of autos, power, chemicals, and international operations.

As per a report Lucky Cement’s profit-after-tax amounted to Rs 38.32 billion, a massive increase of over 109%, during the half year that ended December 31, 2023, compared with Rs18.32 billion in the corresponding period of the previous year on account of higher sales and lower cost of sales.

On a consolidated basis, the company’s Earnings per Share (EPS) jumped to Rs117.19 against Rs49.23 in the same period of the previous year. Lucky Cement’s net revenue increased by nearly 12% to Rs206.52 billion as compared to Rs185.21 billion recorded in the previous year.

However, the cost of sales declined to Rs143.46 billion in 1HFY24, as compared to Rs146.14 billion recorded in the previous year.

Resultantly, the gross profit of Lucky stood at Rs63.06 billion, as compared to Rs39.06 billion, an increase of over 61%. n

PostEx’s acquisition of CallCourier has propelled them to the top of the logistics market in Pakistan.

The logistics business has not been easy for anyone in Pakistan. After its acquisition of CallCourier, what is PostEx’s plan forward?

By Taimoor Hassan

Many of today’s tech giants began their journey in the most humble of settings, transforming smallscale operations into global powerhouses. A startup that started in an apartment can draw inspiration from the success stories of Amazon and Google, both of which began with modest beginnings and grew exponentially through innovation, determination, and strategic vision.

Amazon, for instance, was founded by Jeff Bezos in 1994 in the garage of his rented home in Bellevue, Washington. With a clear vision of leveraging the internet’s potential to revolutionize retail, Bezos started Amazon as an online bookstore. Despite the limitations of space and resources, Bezos meticulously planned his operations, focusing on customer satisfaction and building a robust logistics network. This relentless focus on scalability and innovation allowed Amazon to diversify its offerings rapidly, moving from books to a wide array of products and services. Today, Amazon is a global e-commerce and technology giant, symbolizing how far a startup can go with the right vision and execution.

Similarly, Google’s inception in a garage is now legendary. In 1998, Larry Page and Sergey Brin, then Stanford University Ph.D. students, launched Google from a friend’s garage in Menlo Park, California. Initially a research project, their search engine quickly gained traction due to its superior algorithm that provided more relevant search results. The modest garage setting did not hinder their ambition; instead, it fostered a culture of creativity and innovation. As Google grew, it maintained its startup ethos, continuously evolving its technology and expanding into new domains like advertising, cloud computing, and hardware. Today, Google is synonymous with internet search and has diversified into numerous tech fields, illustrating the potential for massive growth from small beginnings.

Why do these examples matter? Because for a startup that is originating in an apartment and has since come a very long way in a very short time, these stories are powerful examples of how visionary thinking, strategic planning, and an unwavering commitment to the cause it has dedicated itself to can drive exponential growth. By leveraging limited resources wisely, focusing on solving real problems, and scaling operations thoughtfully, such a startup can carve out its path to success. This startup is PostEx which had very humble beginnings in a shabby apartment in Lahore’s Barkat Market.

The humble beginnings become all the more important when you have achieved success. PostEx has been significantly successful

in what it set out to do: logistics and fintech for small, medium and large businesses. And it has been able to do that in a very short period of three years.

Founded in 2020, PostEx has been able to come at the top, overtaking many of the established eCommerce delivery companies in the market such as Leopards Courier and even TCS, according to data from Data Darbar. One of its competitors among startups, Swyft Logistics, is practically dead while others maintain a small scale. Thanks to an acquisition, PostEx was able to get to the top spot in a short time.

The eCommerce logistics sector in Pakistan, though still in its infancy, is poised for significant growth. With a population exceeding 220 million and a growing shift towards digital transactions, the potential for eCommerce is enormous. Currently, the eCommerce market in Pakistan is estimated to be around $6 billion, a small fraction of the total retail market, with eCommerce sales accounting for only 1-2% of the total retail transactions. This is in stark contrast to the global average of around 15% pre-COVID.

The major companies in the market included TCS, which is the largest and most established player. TCS has been operational since 1983 and has a vast infrastructure built primarily for delivering letters and documents. Despite its traditional focus, TCS has been investing heavily in eCommerce logistics, leveraging its extensive network and experience.

Leopards Courier is another significant player with a large network, which has also been adapting its services to cater to the eCommerce sector.

Like TCS and Leopards, M&P has a long history in logistics and is expanding its services to include eCommerce deliveries.

In the mid-tier logistics companies, we have BlueEx, CallCouriers. Initially focused on document deliveries, these companies have pivoted towards eCommerce logistics, capitalizing on their early entry into the market. They have made notable progress but trailed behind the major players. CallCourier has been acquired. And fintech Abhi, which is also a competitor to PostEx, acquired a stake in BlueEx.

Then we have startups PostEx, Rider, Swyft Logistics Trax and. These newer companies were making waves with their tech-driven approaches to eCommerce logistics. Unlike the traditional companies, these startups are designed specifically for eCommerce deliveries, offering more accurate and customer-friendly services. Out of these, Swyft

Logistics has met an unfortunate ending with the company deciding to shut down at the beginning of this year.

The competition among these players was fierce. The major companies like TCS and Leopards have the advantage of established infrastructure, experience, and lower costs. However, they are trying to adapt their traditional models to fit the needs of eCommerce, which is a different ball game altogether.

On the other hand, startups like PostEx, Rider, Swyft, and Trax were leveraging technology to offer better accuracy and customer experience, crucial factors in the eCommerce world. Their challenge lies in scaling up quickly and managing costs to compete with the established giants.

PostEx isn’t your usual eCommerce delivery company that delivers parcels; it has redefined the logistics landscape by integrating an innovative financial service model. Beyond traditional delivery services, PostEx offers invoice factoring for small and medium-sized enterprises (SMEs), addressing a critical gap in the market. Invoice factoring allows SMEs to convert their outstanding cash on delivery (COD) invoices into cash in a very short duration, providing them with the liquidity needed to manage operations, pay suppliers, and invest in growth. To understand this, think of yourself as an online eCommerce store. When an order is placed on your website, the time between the delivery of the order to the customer and reimbursement of cash to you could take days. The long cash flow cycle is make or break for small businesses that would ideally want that cash to be reimbursed to them as soon as the order is placed. This can happen when customers pay for the purchase digitally via a debit or a credit card. But cash is the dominant form of payment in Pakistan, forming about 80% of the total volume of eCommerce.

With a large volume of payments stuck with customers for days, you as a merchant would face delays in paying your bills and purchasing new inventory, leading to limited growth. PostEx settles the value of invoice upfront giving the merchant relatively quicker access to cash. PostEx charges a percentage to merchants for upfront invoice financing and recovers the money when the customer pays in cash. PostEx does this form of financing under an NBFC license.

On top of that PostEx gives the merchant access to its fleet for deliveries to customers. By combining logistics with fintech, for SMEs, this means streamlined cash flow management alongside reliable delivery services. This dual approach not only enhances PostEx’s service

portfolio but also supports the financial health of its clients.The ability to access funds quickly through invoice factoring can be a game-changer for these businesses, enabling them to seize new opportunities and scale more efficiently. This innovative business model positions PostEx as a key player in the logistics and fintech industries, showcasing how versatile and adaptive strategies can drive success in an evolving market landscape.

PostEx scaled this hybrid model until 2022 on its own on the back of significant funding raised in 2021. In the November of that year, PostEx completed an $8.6 million raise in seed funding, making PostEx’s seed round one of the largest in Pakistan.

With abundant capital but a downturn around the corner, PostEx did something daring: it acquired CallCourier in 2022. It was a daring move given that PostEx acquired a company larger than its size and scale, meaning increased financial liabilities when the funding winter was setting in.

According to BlueEx Information Memorandum (IM) at the time of its GEM Board listing in 2021, Call Courier’s market share was 10%, making it the fifth largest third party logistics company in Pakistan. PostEx was then not even mentioned in the IM.

“We were scaling, we had a product, it had a demand and we had made the tech and all,” says Omer Khan, the founder and CEO of PostEx. “We knew there is a lot of demand coming in and we had to scale it quickly.”

Omer explains that at the time of the acquisition, PostEx recognized a critical need to expand its delivery network to new cities to better serve its existing merchants and attract new ones. The company had a clear product-market fit and a fintech product that thrived on the scalability of logistics.

However, their limited presence in only a few cities meant their market share was restricted in logistics as well as fintech, with an estimated 50-60% potential, according to Omer, even if their merchants were fully committed. The competitive landscape in 2022 was intense, with numerous active players vying for dominance in the same markets. TCS and Leopards Courier had a formidable presence. Swyft Logistics, Trax, Rider, all of these had brought in their A-game and were well funded as well.

This fragmented approach, where merchants used multiple courier services, posed a significant challenge. Without nationwide delivery capabilities, PostEx couldn’t guarantee comprehensive service coverage, making it difficult to secure 100% of merchants’ delivery needs.

The acquisition was necessary because the only viable way to rapidly scale and ensure full coverage was either to organically expand into new cities or to partner with an established player through merger or acquisition. Given the competitive pressures and the need for immediate scale, opening new cities on their own would have been time-consuming and resource-intensive. On the other hand, an acquisition would provide instant access to a wider network, established infrastructure, and experienced personnel. By acquiring CallCourier, PostEx could leverage its existing logistics network and operational efficiencies, allowing for a seamless integration that would immediately enhance its market position.

Additionally, the acquisition was a strategic move to gain a competitive advantage. With numerous players in the market, being present and active in every city was crucial. PostEx needed to ensure that it could offer 100% delivery coverage to its merchants, eliminating the need for them to rely on multiple courier services. This comprehensive service offering would not only attract more merchants but also foster stronger loyalty among existing ones. By providing a one-stop solution for all their logistics needs, PostEx could differentiate itself from competitors and secure a larger market share.

The decision to acquire CallCourier was also influenced by industry insights and relationships, says Omer Khan. Being in the logistics sector, PostEx had a good understanding of the market dynamics and knew the strengths and weaknesses of other players. CallCourier was identified as a strategic fit due to its established presence and alignment with PostEx’s growth objectives. The acquisition provided the perfect synergy, combining PostEx’s fintech capabilities with CallCourier’s logistics expertise, resulting in a powerful hybrid model poised for growth.

It has turned out to work really well for PostEx. According to Omer Khan, the post-merger growth has been fourfold, roughly translating into over 40 lakh deliveries on a per month basis. This is nothing short of astonishing, really. A startup which was set up only three years ago, had surpassed TCS in market share by 2023.

According to a report by Data Darbar, by April 2023, PostEx had achieved a scale of an estimated 1.45 million shipments per month, securing a significant market share of 23.2%. In comparison, industry veterans TCS and Leopards each had approximately 1.15 million shipments, translating to an 18.4% market share for both. Trax held an 11.6% market share, while BlueEx and Swyft each captured 7.6%, and Rider trailed with 6%. The acqui-

sition of CallCourier has undeniably fueled PostEx’s impressive growth, enabling it to outpace traditional logistics giants and establish a commanding lead in the market.

However, the question remains whether this growth and the underlying strategy are sustainable in the long run. Sustainability is a crucial consideration for any rapidly growing company. While the acquisition has provided immediate scale and market share gains, maintaining this growth trajectory requires continued investment. The logistics sector is capital-intensive, and the need to expand infrastructure, technology, and human resources could strain financial resources. Furthermore, the challenge of managing a larger, more complex organization might pose risks to service quality and operational coherence.

The answer on the sustainability front is that PostEx has been able to turn profitability. Founder Omer Khan did not disclose numbers pertaining to profitability and only disclosed that the company was doing $21 million in annualized recurring revenue combined from both logistics and fintech operations.

“Our net profitability gives us unlimited runway as well without worrying about the funding dry down,” says Khan.

The logistics segment is likely the bigger contributor to revenue as well as profitability for PostEx, benefiting significantly from economies of scale. In contrast, the fintech product, while promising, requires substantial investment to achieve similar profitability levels, something that PostEx is holding back on for now. Khan explains that the demand for the

product is there and it is open for everyone but we are not allowing everyone to take this facility. 4 million deliveries in a month translates into thousands of merchants which can not be financed all at once because it would require a lot of capital. “We recognize the importance of systematic and strategic investment in fintech, ensuring that growth in this area is sustainable and well-managed.”

PostEx has successfully completed a fundraising round, securing the capital needed to fuel its expansion plans. The amount was not disclosed by Khan but he disclosed that this capital was sourced from existing investors rather than external sources. With this financial backing, PostEx is focused on scaling its operations and enhancing its market presence not only in Pakistan but in the region, with the company set to expand in the Middle Eastern markets.

Notably, PostEx is setting up operations in Dubai and Saudi Arabia on the back of the new funding raised. Both are very tough markets, given the abundance of capital for SMEs already in these markets and multiple players offering similar services.

Omer recognizes the challenges associated with moving into such markets and says that they want to enter difficult markets. “We have teams in Pakistan that have executed well. We are on track in Pakistan, hence the initative to go outside. We are going there to lead it. It is not to compromise operations in Pakistan.” n

Is the revolving door culture in the boardroom a cause or symptom of the company’s recent downturn?

By Zain Naeem

There was a time when Al-Shaheer was used as a shining example of companies on the Pakistan Stock Exchange. In an index dominated by oil refineries, textile companies and banks, Al Shaheer was a company which broke the mould. A company involved in distribution, marketing and sales of meat products in Pakistan and outside the country, Al Shaheer was the pioneer in terms of being listed on the stock exchange. Al Shaheer walked so companies like The Organic Meat Company

could run.

Recently, Al-Shaeer has been going through some serious issues. A company which was seeing profits and dividends has suffered its worst year till date in 2023. June 2023 saw the company making losses of Rs 1.8 billion. This fact was compounded by the recent quarterly earnings which saw the company going from a profit of Rs 13.6 crores last year to a loss of Rs 90.3 crores this year for the same quarter.

As the losses have started to accumulate, there has also been an exodus taking place in the board of directors with the company seeing almost five of its seven directors leave in a span of six months. The company has seen many of

its top level executives leave and the accounts for December 2023 have still not been posted by the company. There is a history at the company to ask for extensions from the Securities and Exchange Commission of Pakistan (SECP) for extension in filing of accounts. The latest extension was sought by the company on 29th of February 2024, however, no such extension was granted to the company. The accounts which should have been filed by the start of March are still pending in June.

With so much chaos taking place at the company, what exactly is going on and how did things get so bad? Profit tries to piece together the puzzle.

Al-Shaeer was established in 2008 as a partnership and in 2012 it was converted into a private limited company. The company quickly became a household name in the meat industry of the country as it developed its own branded retail network all over the country. From a small company, the brand quickly grew to be a fresh meat retailer and exporter exporting halal meat products as far as the Middle East. The company started with fresh beef, mutton and poultry before it developed its own range of ready to cook products. The company’s meat processing facility was HACCP certified which made sure the meat was of top quality and free from any external contamination. Even the company’s abattoirs were certified by International bodies in order to maintain high standards and quality assurances. The company prided itself for generating most of its revenues in the form of exports.

The company has been operating Meat One, Khaas and Al Shaheer farms under the umbrella of the company. Meat One and Khaas provide retail based solutions to the Pakistani market while the company also provides B2B solutions by providing meat to notable clients like Agha Khan University, Abbott Pharmaceuticals and Pizza Hut. Under the leadership of its founder, Kamran Ahmed Khalili, the company was able to expand its brand name in the local and international market.

In 2015, the company also ventured into the farming business which allowed it to source its own livestock. The company felt that it was depending on an antiquated system in order to get access to the meat and set up its own farming setup from which it could source healthy and high yielding animals.

By 2015, the company was exporting meat worth around $45 million and was expecting to expand into other markets like China and Russia as the meat export market had a potential to expand further. Sitting on such an amazing opportunity, the company planned to get listed on the stock exchange in order to gain access to a cheap source of funding. The Initial Placement Offer (IPO) was carried out at Rs 92 per share and it was received well by the market.

The initial years after the IPO proved that the company was performing very well. In 2015, the company had earned profits of Rs 19.4 crores which had grown to Rs 35.7 billion by 2016. The share price of the company also breached the Rs 100 level mark in November 2015 owing to the performance of the company itself. The company also gave out bonus shares of 35% and 15% in 2015 and 2016 respectively. It seemed like things could only get better.

After sales slumped in 2017 and 2018, sales and profits rebounded in 2019, 2020 and 2021 as the company looked to consolidate on its product portfolio. By 2022, it was becoming apparent that the company was starting to face issues which needed to be addressed. Even when the rupee depreciated in 2022, the company saw its losses grow to Rs 23.5 crores despite the fact that exchange gains were around Rs 57.1 crores for the year. The increase in cost of goods sold and administrative expenses was weighing down the profitability of the company. These costs only increased in 2023 and the company saw operating losses of Rs 2 billion for the year. Again, the exchange gain was able to cushion some of the losses as they were valued at Rs 1 billion by themselves but the company still made a net loss of Rs 1.8 billion for the year.

The downturn in the performance can be attributed to different factors which took the turn for the worst. First of all, the company was earning more than 80% of its revenues in the form of exports. Due to the pandemic and the worsening economic conditions, the exports have fallen to almost 45% of the sales. This shows that the company was losing one of its biggest advantages, which was exporting to the foreign markets.

The company also saw its gross profit margin fall in recent years as its direct costs have been on the upward trajectory. Gross profit margin was around 16% in 2015 and more than doubled to 33% by 2020. In recent years, this margin has shrunk vastly as gross profit margins have fallen to 9% in 2023. This reflects the fact that the company has not been able to maintain its margins and costs which have grown out of control.

As the gross margins have been hit, operating margin and net profit margin have gone through a similar trend. Operating margins were around 5% in 2015 which had improved to 9% by 2020 but clocked in at -29% in 2023. As direct costs have increased, the company has also seen an increase in its administrative expenses which are having an influence on the operating margin. Similarly, the net profit margin was 4% in 2015 which has fallen to 26.3% in 2023.

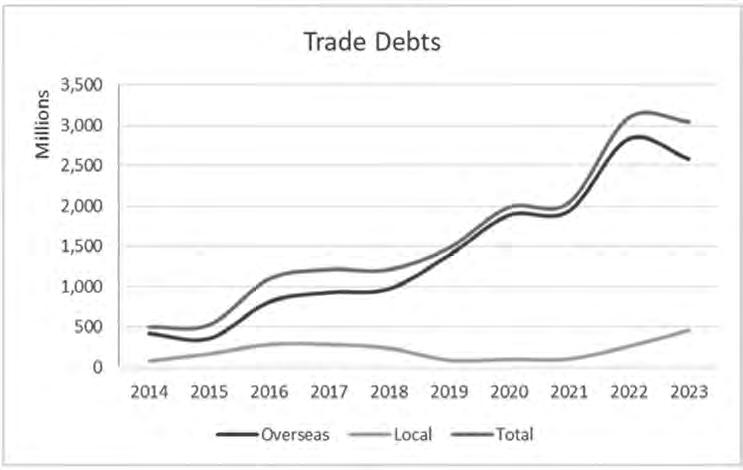

One of the biggest expenses booked by the company for the year was provision for doubtful debts which meant that an amount of Rs 1.2 billion was written off. In past years, provisions for doubtful debts were around 5% of total debts. This year the company has had to account for IFRS 9 which is in relation to expected credit loss. The company had trade debt of Rs 50 crore in 2014. The business mod-

el of the company is to extend a credit facility to overseas and local suppliers. As a greater credit facility is extended, the trade debts of the company have grown to 3 billion in 2023. Due to IFRS 9, the company has had to realize credit losses of Rs 1.2 billion which is around 40% of its total trade debts.

According to the accounting standards, these are considered as losses and have to be booked accordingly. Considering the size of the loss suffered by the company, most of the loss was suffered due to writing off of this debt. Considering the accounts for the first quarter ended September 2023, it can also be seen that the company has shown other expenses of Rs 500 million almost which have led to the company making a loss of Rs 900 million. If a breakdown was given, it would be evident that the jump in other expenses from Rs 9o lakhs last year to Rs 50 crores this year would have some portion of bad debts in it as well.

So it is evident to be seen that the company has been suffering financially. Some of the debts it considered good have turned bad while the cost of the company has increased which has turned profits into losses. One bright light for the company has been exchange rate gains that it has been able to earn as the rupee has depreciated considerably since 2015. The company has been able to earn cumulative gains of around Rs 2 billion in the last 9 years with Rs 1.6 billion seen in 2022 and 2023 alone. Some of the hit from the losses has been cushioned by this gain seen.

But there is another development that has taken place at the company that needs to be investigated further. The revolving door at its own board room.

When the company was listed in 2015, the company had 8 directors. Some of the directors were executives who had worked to make the company into the powerhouse that it was. The Chief Executive Officer at the company was Kamran Ahmed Khalili who was also serving as the Chairman of Al Shaheer Corporation. Kamran had established the company from scratch and had been the reason behind the success of the company. Before establishing the company, Kamran had been a member of Karachi Stock Exchange having been CEO of Fortune Securities and had experience as an Investment Banker at MCB Bank Limited.

In terms of the shareholding, Kamran Ahmed Khalili had 36.66% of the shares of the company after the IPO had taken place. Some of the other major shareholders were directors like Naveed Godil, Muhammad Ali Ghulam and Noorrur Rahman who held 7.17%, 3.23%

Board in 2015

Board in Board in Board in

Board in Resignations Current Board 2019 2022 June 2023 Jan 2024

Kamran Ahmed Khalili Kamran Kamran Kamran Kamran Resigned in Muhammad Ahmed Khalili Ahmed Khalili Ahmed Khalili Ahmed Khalili Februar y 2024 Haris

Muhammad Ali Ghulam Muhammad Zillay A Nawab Zillay A Nawab Zillay A Nawab Zillay A Nawab Resigned in June 2024

Noorur Rahman Abid Jamil Akbar

Rizwan Jamil Umair Khalili Umair Khalili Umair Khalili Umair Khalili Resigned in Februar y 2024 Muhammad M Qaysar Alam M Qaysar Alam M Qaysar Alam M Qaysar Alam M Qaysar Alam Resigned in June 2024 Idris

Naveed Godil Zubair Haider Imtiaz Jameel Imtiaz Jameel Resigned in June 2024

Adeeb Ahmed Adeeb Ahmed Adeeb Ahmed Babar Sultan Muhammad Altaf Resigned in Februar y 2024

Rukhsana Asghar Sabeen Fazli Alavi Sabeen Fazli Alavi Sabeen Fazli Alavi Amir Shehzad Resigned in Februar y 2024

and 2.34% of shares respectively. There were also certain sponsors like Shaikh Qaisar, Aftab Zahood Raja and Rehan Mansoor Khawaja who held 7.17%, 5.52% and 1.94% of shareholding respectively.

Other directors serving on the board were Muhammad Ali Ghulam Muhammad, Noorrur Rahman Abid, M Qaysar Alam, Rukhsana Asghar, Rizwan Jamil, Adeeb Ahmed and Naveed Godil. All of these directors had worked at local and international firms in the past and brought an array of skills and experiences to Al-Shaheer in some capacity. Due to their successes elsewhere, the company benefitted as it looked to improve its financial positions and performance.

The board had been elected in a staggered manner which meant that their date of retirement did not coincide with each other. After the company got listed, its first elections were held in 2016. The number of directors were increased from 8 to 10 and new board members were inducted like Zafar Siddiqui, Sarfaraz Rahman and Umair Khalili.

SECP mandates that elections are to be held after every 3 years which meant elections were held in 2019 and then 2022. After the recent elections were held in November of 2022, the new board composition meant the board now had 7 members. These were Kamran Ahmed Khalili, Zillay A Nawab, Qaysar Alam, Adeeb Ahmed, Sabeen Fazli Alavi, Zubair Haider and Umair Khalili.

It is common for the board of a company to go through a change from time to time as they try to gain experience from different directors and their relevant skill sets. The thing that raises eyebrows is what happened to the board from November 2022 to June of 2024 which confounds the mind.

First of all, Adeeb Ahmed left the board and was replaced by Babar Sultan and Zubair Haider left and was replaced by Imtiaz Jameel. This happened before June 2023 and the company announced these changes to the stock exchange. Then in December 2023, Kamran Ahmed Khalili sold 10 million of his shares while Babar Sultan and Sabeen Fazli also left the board on 6th of December 2023. They were replaced by Muhammad Altaf and Amir

Shehzad. It has to be noted that Babar Sultan had been appointed less than one year and had chosen to resign.

Amir Shehzad also disclosed to the market that he had bought 10 million shares from Kamran Ahmed Khalili in December of 2023. While this is going on, the company also removed its company secretary and appointed Syed Muhammad Tariq Nabeel Jafri on 15th of January 2024. January also saw Kamran Ahmed Khalili and Umer Ahmed Khalili sell 10 million more shares from their holdings.

Are you with us so far? Good as this gets more convoluted.

The company announced that the board came together and decided to close the factory for two weeks starting from 26th January 2024 in lieu of maintenance being carried out at the factory. The company also announced that it had accepted the resignation of Kamran Ahmed Khalili from the position of Chief Executive Officer which would come into effect from 24th of April 2024. A new CEO would be appointed in due time.

The fun did not stop there. On 2nd February 2024, the company announced that both Kamran Ahmed Khalili and Umer Ahmed Khalili would be resigning from their directorships from February 1st 2024 as well. On a lat-

er date, it was disclosed that Kamran Ahmed Khalili was replaced by Muhammad Haris and Umair Ahmed Khalili had been replaced by Muhammad Idrees.

Next, the company announced that Muhammad Altaf and Amir Shehzad were resigning as directors at the company on 28th of February 2024. These two had become directors in December 2023 and were choosing to resign within two months of signing on as directors. Just when it was looking like things were beginning to settle down, the recently appointed company secretary Syed Muhammad Tariq Nabeel Jafferi resigned and was replaced by Mubasshar Asif as of 16th of May 2024. Jafri served for 5 months at the company. The latest development that has taken place is that Imtiaz Jaleel, Zillay A Nawab and Qaysar Alam have also resigned and none of these have been replaced.

Overwhelmed? You should be.

After the dust settles, it can be seen that the current board only comprises of Muhammad Haris and Muhammad Idris. These two had taken over from Kamran Ahmed Khalili and Umer Ahmed Khalili since February 2024. The company secretary has been changed twice in the last year while many of the directors signed on and then resigned later as

well. With five vacant director seats and so many directors failing to even last more than 6 months, the questions do come to mind. What is going on at the company?

And there is still the pending question in terms of who the CEO is going to be at the company. The last CEO was asked to leave in January and his tenure ended in April. Two months have passed and there is still no name that has been given for the replacement. With so much turmoil at the company, it is no wonder that it is having difficulty meeting the deadline for its accounts which is almost 3-4 months past due.

One thing that might be deduced from this chaos is that there can be certain decisions that are being made at the company that are not approved by most of the directors at the company. Till December 31st of 2023, it was evident that the board was stable at the company. There was a full strength of board which existed with Kamran Ahmed Khalili at the helm. Since then, both the Khalili brothers resigned by 1st of February and were replaced. Once this took place, there were further resignations that took place as Amir Shehzad and Muhammad Altaf left after serving less than 2 months.

This left the board with 5 active members as the previous ones had not been replaced. Recently, the company called a board meeting on 6th of June 2024 which was postponed due to lack of quorum. After this, three more directors resigned. What can be gleaned from this information is that some of the directors were proving to be holding out to the agenda which was being steered in a direction which was against the company’s benefit. With only 5 active directors, three of them were not participating in the board meetings which would mean that no board meeting could be held without them. Any such meeting would not have the prerequisite number of directors participating and would have to be adjourned.

In order to work around this formality, three of the directors have resigned. Now that only two directors can be considered as being active, they can drive the agenda of the board meetings in the manner that they wish.

The real situation will start to reveal itself in the coming months as the new board sets a path it wants to achieve. Till then it can be seen that the company which was paving a path forward in the industry is suffering from uncertainty within its own board of directors for the time being. First the results of the company started to take a nosedive, then many of the founding members and directors have left the company and now the board members are falling like flies. The next 6 months will give some clarity on what has been going on at the company and why such drastic resignations were seen. n

By Mariam Umar Farooq

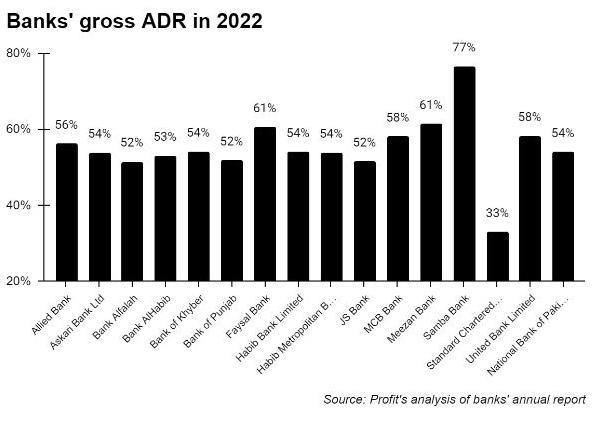

The banks have done it again. They have once again managed to avoid paying the Advance to Deposit Ratio (ADR) based income tax. According to a report by Express Tribune, commercial banks and the federal government have reached a consensus to abolish the ADR income tax.

As per another report by Dawn, the Pakistan Banks Association (PBA) remained engaged with the finance ministry and the Federal Board of Revenue (FBR) on ADR-linked taxation as well as other levies on the banks in the weeks leading up to the Finance Minister and former banker’s budget announcement. . The PBA argued that how the sector’s balance sheet look should remain within the regulator, the State Bank of Pakistan (SBP)’s purview. It seems their efforts have finally come to fruition.

The PBA asserted that the ADR tax was unsustainable as the 2022 data showed it did not result in a sustainable increase in banking

sector advances and that it was was merely a revenue collection measure.

The ADR has been a contentious issue for the past couple of years. Very basically explained, a bank’s business is to accept deposits from customers and lend funds to other customers. But over the past few years, the interest rate in Pakistan has been so high that banks have found it easier to accept deposits compared to lending money.

So what do the banks do? They lend to the one entity that does constantly need money no matter what: the government. This proved a pretty good system for the banks which have been making huge profits. But the government felt this was bad business. In a bid to force banks to lend more rather than just buy government-backed securities, the government placed an additional tax on any bank with an ADR lower than 50% in 2022. ADR is basically advances (lending) divided by deposits. Banks had to pay a 10% additional

tax if the ADR is between 40% and 50%, a 16% additional tax if the ADR falls below 40%, and no additional tax if the ADR is above 50%. This additional tax was applicable on income from federal government securities.

This was seemingly a way to encourage banks to lend more and encourage business at a time when the economy has been in the doldrums. But a lot went down behind the scenes, and the banks were able to window dress their accounts to avoid these taxes despite successive finance ministers doubling down on it.

To avoid paying hefty taxes, the banks had no option but to increase their lending. “Previously, maintaining a 50% ADR was a top priority for banks in 2022. This led to aggressive loan book expansion and restrained deposit growth. Consequently, sector advances witnessed a healthy 17% year on year growth, while deposits saw a meagre 7% year on year rise, pushing ADR to 53%”, said Amreen

Soorani in her report ‘Potential removal of ADR-related tax: Banks to cheer, government may get more borrowing’.

Therefore, the policy did not last too long. In 2023, banks were exempted from this tax as announced in the fiscal year 2024 budget, so that banks had enough liquidity to lend to the cash-strapped government. However, the tax was to be effective in calendar year 2024. The removal of tax in 2023 resulted in rebound in deposit growth. As per JS research report, deposits grew by 24% year on year in 2023 as compared to 2022, while the ADR dropped to 44%.

For the next fiscal year, the government has set a Rs12.97 trillion tax collection target, requiring an unprecedented 40% growth within a year.

Thus, to ensure that the banking sector does not avoid paying less ADR tax through window dressing, the FBR proposed calculating the tax liability based on average annual lending to the government rather than on the last day of the year. As the banking sector’s current average ADR is around 42%, this move could have generated an additional 10% income tax for the government. However, instead of closing the loophole, the government plans on abolishing this ADR income tax altogether.

So what is in for the government to abolish this tax?

Firstly, more finances to fund fiscal deficit. For the next fiscal year, the government plans to borrow Rs 24 trillion from banks to service existing debt. Thus, the removal of ADR tax presents a positive development for the government facing a widening fiscal deficit and limited borrowing avenues. As per JS Researhc, in

the last two years, lower external borrowings have necessitated the need for increased domestic borrowings. As per JS Research, the government received Rs 493 billion in the first nine months of fiscal year 2024 in external borrowings as compared to budgeted amount of Rs 2.7 trillion.

In fiscal year 2024, the government’s domestic borrowings have increased significantly. “Our estimates indicate the government has already borrowed a net Rs 11 trillion through government security auctions (gross issuance minus maturities) in fiscal year 2024, out of which Rs 6 trillion were raised in the first half of fiscal year 2024. This figure represents the potential investments, whose income would have been subject to the higher tax policy”, reads JS Research report.

At the same time, the government plans on increasing domestic borrowing in fiscal year 2025. “The fiscal year 2025 Budget outlines a net increase of Rs2.5trn in

domestic debt, with Rs19trn in repayments and Rs21.5trn in fresh borrowing. Given the Budget also reflects heavy reliance on banks for financing, to absorb this Rs2.5trn net increase banks would likely need to maintain their current low ADR of around 42%, assuming 12% year on year deposit growth in FY25 (~Rs3.5trn fresh deposits).” added the report. Analysts anticipate repo borrowings levels to remain elevated in the coming fiscal year.

Moreover, as per the Express Tribune report, banks would pay advance income tax for the first quarter of the next fiscal year before June 30. They will also pay the super tax for 2023 and 2024. In return, the government has agreed to abolish the additional tax.

Currently, sector’s ADR is at its alltime low levels of 42%. At the smae time, deposits continue to grow year on year by around 20%. This policy shift of abolishing ADR tax would reduce the pressure on banks to maintain artificial ADR levels. Instead the banks could potentially focus on prioritising deposit growth and/ or increased borrowings for investments in governemnt securities. “This trend could favor longer-tenor and fixed-income securities, aligning with the recent monetary easing cycle,” reads the JS Research report.

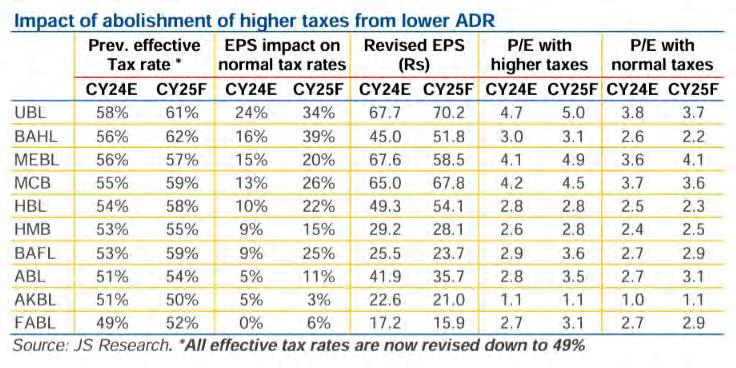

As per JS Research, the abolishment of ADR tax is expected to translate to a 5% –24% increase in earnings for banks in JS Banking Universe for 2024 and a 3% – 39% boost for 2025, with United Bank (UBL) and Bank Al Habib (BAHL) likely to benefit the most. n

While the government insists our BPO sector is bursting with potential — is it prepared for the AI storm awaiting it?

By Nisma Riaz

Over the last decade or two, Pakistan’s business process outsourcing (BPO) industry has emerged as a significant sector in the country’s economy. Of the different offshore information technology (IT) services large companies seek, Pakistan has become a prominent destination for BPO services, due to the cheap labour it promises. The BPO sector has seen substantial growth, driven by a combination of cost advantages, a young and educated workforce, and the increasing global demand for outsourcing services.

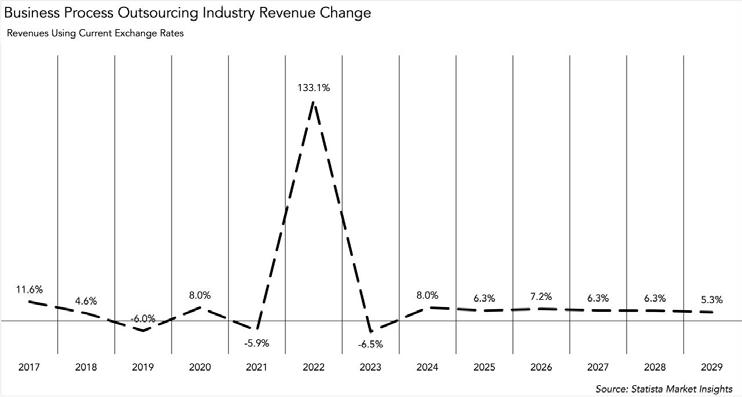

According to recent estimates by Statista, revenue in Pakistan’s IT services market is projected to reach US$2.46 billion in 2024, with BPO dominating the market, accounting for a projected market volume of US$0.85 billion. The overall revenue is expected to grow at a compound annual growth rate (CAGR) of 7.31% from 2024 to 2029, resulting in a market volume of US$3.50 billion by 2029. This growth trajectory positions Pakistan as a promising player in the global BPO landscape.

As the local economy continues to stand on shaky grounds and our ever flailing local currency anticipates further devaluation, many, including the IT ministry of Pakistan, believe that the BPO sector will be the saving grace of Pakistan and its economy.

Sounds too good to be true? Well, despite the transformative potential of the sector, it might actually be too good to be true if we fail to get our act straight. Hot on the sector’s heels is an AI revolution, which poses a serious threat of not only disrupting the BPO landscape globally and in Pakistan but also creating mass unemployment.

Is artificial intelligence (AI) a real and pressing threat and what can be done to safeguard Pakistan’s IT sector from going under? Profit explore.

In Pakistan’s BPO sector of Pakistan the core of the business primarily revolves around customer service, traditionally managed through call centres handling inbound customer inquiries. Agents provide services via phone calls, but a significant portion of the industry has now shifted towards nonvoice communication channels, such as chat and email. These non-voice services are increasingly prevalent. Besides customer service, there are substantial operations in back office services, including data analytics, marketing analytics, HR, and finance. While customer service and call centres still dominate, other segments like non-voice support and back office functions are growing steadily and gaining prominence.

As AI technology rapidly advances, its applications have become both innovative and

surprising. From teenagers using AI to generate witty diss tracks to companies like Toyota experimenting with highly interactive chat bots capable of human-like responses without any human intervention, AI seems to be performing tasks that previously required humans. And it might be some consolation that while AI tools are becoming more accessible, mastering their use requires significant expertise and understanding of the right commands to unlock their full potential, it may still very much be a serious threat to certain individuals and their jobs.

Capital will help as more of it goes into this space, but it has to come with experienced restructuring of the AI practice otherwise we’ll keep doing “bottom of the barrel” type work.

Now you may be wondering how long it might take for AI to significantly impact jobs in call centres and business processes? Specifically, when companies in the West adopt AI to a degree that they no longer need to outsource these services to countries like Pakistan.

Nadeem Elahi, Country Head and CEO of ibex Pakistan, Middle East & North Africa, answered this question, “Industry analysts project that about one-third of business processes could transition to AI, primarily due to its advanced capabilities in using large language models for intelligent human interaction. However, it is unlikely that the entire industry will move to AI.”

Elahi explained that generative AI excels in managing straightforward tasks such as providing product information or making simple decisions, which can be efficiently automated.

AI is certainly effective, but eking out actual gains from it requires investment into technology infrastructure and workforce training. For now, I think such an investment remains significant for smaller businesses but seeing the rapid pace of AI’s progression, I give it less than 5 years before even more complex tasks can be delegated to agentic AI

Soban Raza, Founder and CEO of Antematter

More complex issues that require nuanced decision-making will still require human involvement. Therefore, while AI will significantly impact the sector, it will not completely replace human roles. The future likely holds a hybrid approach, with AI handling simpler queries and humans addressing more intricate problems.

He told Profit, “Our company (ibex), like many others, is exploring how to integrate AI into our services. Globally, it’s projected that about a third of the business may transition entirely to AI. However, predicting the timing is challenging.”

According to Elahi, in the short term, over the next one to two years, the BPO sector might actually expand rather than shrink until the transition to generative AI fully materialises, considering that human involvement remains crucial in the interim to manage and train AI systems effectively. Elahi estimates that, “In the short term, businesses might experience a temporary spike before a decline to the predicted 30-40% reduction due to AI integration. This shift faces two main challenges. Firstly, AI requires extensive training, involving human oversight, to ensure accurate customer interactions. Secondly, large companies must address potential legal liabilities if AI provides incorrect

responses. The timeline for these developments is uncertain, as companies are still working on resolving these issues. Both the training of AI and mitigating liability risks are crucial steps that will take time to fully implement and stabilise.”

Speaking on the timeline of AI advancement and reverberating Elahi’s point, Soban Raza, Founder and CEO of Antematter, commented, “AI is certainly effective, but eking out actual gains from it requires investment into technology infrastructure and workforce training. For now, I think such an investment remains significant for smaller businesses but seeing the rapid pace of AI’s progression, I give it less than 5 years before even more complex tasks can be delegated to agentic AI.”

Is Pakistan’s BPO sector braced to

In the Pakistan Export Strategy for Business Process Outsourcing 2023-2027, the government argues that the sector currently possesses certain key fundamentals that

can be leveraged as a competitive advantage against other BPO industries in the world.

The report claims that Pakistan’s high-value segments are emerging, with companies exporting digital tech to the U.S. for industries like oil, gas, and healthcare. Freelancing is booming, ranking Pakistan in the top three globally. Despite some weaknesses, Pakistan ranks 31st in the 2021 Global Services Location Index and is the second most financially attractive for offshoring IT-BPO services. Operational costs are 60% lower than in the Philippines. The IT and ITES industry benefits from a large, young, trainable workforce, producing 25,000 IT graduates annually. Pakistan has the third-largest number of English speakers, enhancing its competitiveness in customer-centric services.

Elahi agrees that there is an opportunity, however, saying that the industry, at this current stage, possesses key fundamentals to compete with other BPO regions might be a bit of a stretch.

When

people lack critical thinking and rely on scripts or specific instructions without contextual understanding, they become vulnerable to AI. Integrating AI into our curriculum could help address this issue by fostering better thinking and adaptability

Ahmed Khattak

,

Founder and CEO at US Mobile

“Compared to destinations like the Philippines, India, South Africa, and the Caribbean, Pakistan offers lower costs. This presents a short-term opportunity to employ many people. The challenge is reskilling these workers. Initially, employment should be the focus, following India’s model of moving from call centres and BPOs to knowledge process outsourcing (KPO) and IT over time. Pakistan has abundant, quality human resources and low costs, making it well-positioned to capitalise on this opportunity. The strategy should be to employ people in the short term and reskill them in the long term, viewing this situation as an opportunity rather than a threat,” Elahi shared.

As Elahi said, the third of the industry might be lost to AI, but exactly what sort of jobs currently performed by humans are expected to get replaced? Profit asked Elahi to elaborate on the sort of disruption AI is expected to cause.

He informed that basic information and simple tasks at call centres will likely be handled by AI in the near future. However, complex decision-making processes will still require human involvement for now. But as AI technology evolves, it might handle more

In general, the state and scale of AI development in Pakistan lag significantly behind global standards. This is due to a lack of understanding of complex problems and the foundational data work accomplished over the past decade. Only a few focused companies in Pakistan are developing AI agents and tools that meet global standards

Ahsan Jamil, Managing Partner at sAi Venture Capital

intricate tasks. “Areas like finance, HR, and marketing will be less impacted by AI due to the need for specialised training and expertise. To adapt, businesses should focus on advancing to higher-end services, specifically KPO, while expecting basic information tasks to be increasingly automated,” Elahi concluded.

But how ready are we to reskill our labour force to perform KPO functions?

Well, globally BPO companies are seriously considering AI as it threatens a significant portion of their business. They’re exploring AI tools for handling lower-level queries while reserving human staff for higher-level tasks. However, Pakistani companies might not be as equipped to transform quickly and may not be doing everything they should to survive an AI takeover.

“I don’t think companies are well-prepared. Unlike India or the Philippines, Pakistan lacks a large freelancer industry, so job losses may be significant, though there’s no data on that yet,” said Elahi.

He insisted again that the only thing that can prepare Pakistan is a shift in focus whereby an active effort to upskill areas less affected by AI, such as knowledge process outsourcing roles in human resource (HR) management and analytics is required. “Companies in Pakistan aren’t prioritising retraining yet, but this will become crucial in the next year or two.”

He added that Pakistan produces fewer engineers now, but AI can be an equaliser, reducing the need for software engineers. However, there’s a mismatch between the skills engineers have and what the industry needs, highlighting the need for reskilling. Additionally, many prefer freelancing over working in the organised, regulated sector, which pays taxes but cannot match the handsome income one could make through freelancing. “This imbalance pressures the industry and government tax revenues. Freelancers should also pay taxes to ensure a level playing field and support government revenue. Encouraging freelancing is good, but tax policies should be fair for both freelancers and organised sector employees.”

Commenting on the current state of AI advancement in Pakistan, Ahsan Jamil, Manag-

ing Partner at sAi Ventures said, “In general, the state and scale of AI development in Pakistan lag significantly behind global standards. This is due to a lack of understanding of complex problems and the foundational data work accomplished over the past decade. Only a few focused companies in Pakistan are developing AI agents and tools that meet global standards.

“Increased capital investment will help, but it must be accompanied by experienced restructuring of AI practices. Without this, Pakistan will continue to perform low-level work rather than achieving higher-value contributions,” Jamil emphasises.

This tells us that Pakistan is not nearly ready to tackle challenges that an AI revolution may throw at its BPO sector and neither is it close to challenging it when the time arrives.

When asked if investors, like himself, are eager to invest in the traditional systems of BPO or advanced AI integrated ones, Jamil said investing in “traditional BPO” would be a mistake right now. “While there is interest in investing in this area, it may not be the best idea at the moment. Historically, local companies in the BPO sector did not pursue or were not positioned for higher-end work, which is an area that needs significant improvement now.” Jamil added.

Raza told Profit, “Currently, AI is remarkably good at text-based reasoning. Ergo, any task dependent on a well-defined set of

rules can be undertaken by GenAI. For example, HR operations like screening candidate profiles against job descriptions, or customer service chatbots drawing upon the company’s knowledge bases to answer a query. Tasks like managing invoices or payrolls, while still controversial, can also be handled by GenAI.”

He added, “In cases where AI can’t take over end to end (because the rules just aren’t that precise and mostly tacit), it can still assist a human overseer or decision maker. Then there are tasks where AI’s utility is still up in the air. For example, it’s potential to replace human software engineers.”

As bleak as the situation seems to be, there are some actions that can be taken to prepare the BPO sector to be able to embrace AI and all that it has to offer, rather than taking a hit from it.

Ahmed Khattak, Founder and CEO at US Mobile, in conversation with Profit, stated, “Pakistan can benefit from its cheaper labour costs by integrating AI with human workers, particularly in product support roles. For instance, US Mobile can continue hiring staff while using AI to efficiently provide accurate support, enhancing customer experience by solving issues

About one-third of business processes could transition to AI, primarily due to its advanced capabilities in using large language models for intelligent human interaction. However, it is unlikely that the entire industry will move to AI

Nadeem Elahi, Country Head and CEO of ibex Pakistan, Middle East & North Africa

promptly. AI offers a significant opportunity to improve Pakistan’s infrastructure, especially in BPO services, which are among the first to be impacted by AI. Case studies from companies like Booking.com show a 70% reduction in staff load with improved service quality.”

He continued to add, “Despite AI’s impact, there’s still a high demand for human talent, and Pakistan’s younger generation is producing remarkable talent, keeping it away from saturation. However, the current challenges for Pakistan’s BPO industry are political instability and infrastructure issues, not AI. Political uncertainty and negative perceptions need to be addressed to grow the industry. If these issues are resolved, Pakistan could significantly expand its business. So, Pakistan should focus on achieving political and economic stability before worrying about AI disruptions. Stability is the foundation for developing and growing any business.”

He also highlighted that larger Pakistani companies are more prepared, however, smaller software houses and BPO companies may require serious upskilling and infrastructural investments to prepare themselves to complement the use of AI in BPO. “IBEX and similar companies benefit from having a strong presence in Pakistan while being American at their core, with most management based in the US. This allows them to adapt quickly and stay ahead of trends due to their significant resources and established operations. In contrast, companies that are entirely based in Pakistan, with no exposure to US market trends, face a real threat. Smaller software houses in Pakistan might not realise industry shifts until it’s too late, potentially leading to significant revenue losses. Therefore, Pakistani companies need to work harder to stay ahead of the curve.”

While acknowledging that Pakistan is producing talented new-generation engineers from liberal arts and engineering colleges, Khattak argued that these institutions alone don’t make great software engineers. “Top-tier companies like Netflix or Microsoft cultivate such talent. Pakistan’s challenge is fostering critical thinking, which is often lacking due to cultural norms. Overcoming this requires promoting questioning and logical thinking in educational

and professional settings,” he suggested.

Khattak concluded his argument by pointing out that the lack of critical thinking is why AI poses a threat in the first place. “When people lack critical thinking and rely on scripts or specific instructions without contextual understanding, they become vulnerable to AI. Integrating AI into our curriculum could help address this issue by fostering better thinking and adaptability.”

In agreement with Khattak, Elahi also highlighted that reskilling of the current labour force is of paramount importance.

“The work in fields like finance, accounting, and legal requires significant human interaction due to regulatory complexities, making them suitable for remote operations such as US-based bookkeeping. Moreover, specialist functions like HR and employee audits also necessitate human involvement. It’s essential to advance skills beyond basic BPO and customer service roles. There’s a concern that young individuals may pursue entry-level opportunities for quick earnings rather than focusing on future-proof skills. However, many are ambitious and seek career progression, often using BPO roles as stepping stones to higher education or management tracks, despite some complacency observed.”

When asked whether companies like IBEX can contribute to the training and

upskilling of the existing labour force, Elahi said, “Companies are grappling with a daunting challenge – out of approximately 30,000 BSc engineers, only 8,000 to 9,000 are deemed employable. The scale of this issue exceeds what individual companies can manage alone.”

He continued, “However, advancements in AI and e-learning offer promising solutions. Remote learning tools empower individuals to self-train and enhance their skills independently, reducing dependence on traditional educational institutions. Despite government efforts and funding over the past five years, effective implementation remains a hurdle due to bureaucratic inefficiencies and vendor complications. Yet, technological advancements have transformed training methodologies, enabling flexible and accessible learning experiences beyond conventional classrooms.”

However, it is not Pakistan alone that AI threatens to take over. Looking ahead, the next two years promise significant disruptions across industries. To navigate this landscape, it’s crucial for both Pakistan’s government and the BPO industry to leverage the current surge in human resources requiring AI training. Simultaneously, efforts should focus on reskilling initiatives to elevate workforce competencies and adaptability. This way Pakistan can capitalise on emerging opportunities while preparing individuals for evolving job demands and technological shifts. n