09 After digital financial services, could startup acceleration be the new passion of Pakistani telcos?

12 The IMF has raised the alarm bell on Pakistan’s microfinance sector. Where does it stand?

14 PIA is up for sale, and there’s a six-way battle for who will take the prize

18 The federal govt and the provinces have finally agreed on food quality enforcement. Why did it take them six years?

21 A little known Pakistani company is suing Zoom for over $2 million. What in the world is happening?

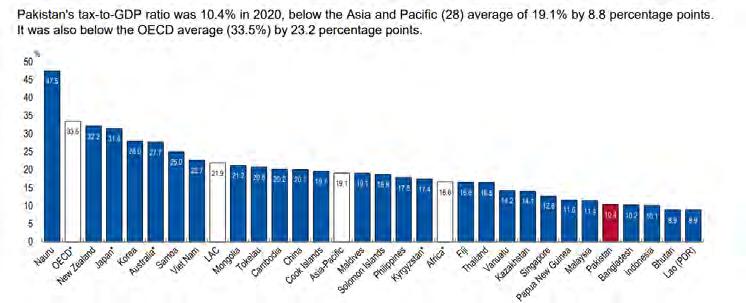

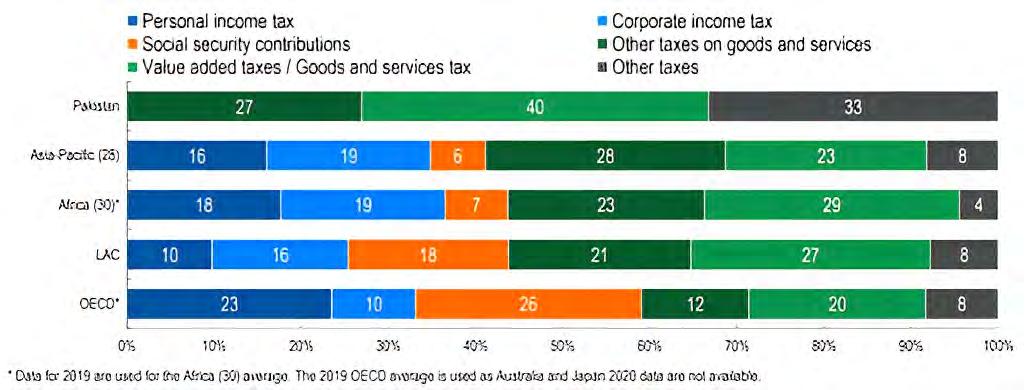

24 Our tax Babus keep beating the same dead horse again and again. Here’s how it affects the stock market

Publishing Editor: Babar Nizami - Editor Multimedia: Umar Aziz Khan - Senior Editor: Abdullah Niazi

Editorial Consultant: Ahtasam Ahmad - Business Reporters: Taimoor Hassan | Shahab Omer

Zain Naeem | Saneela Jawad | Nisma Riaz | Mariam Umar | Shahnawaz Ali | Ghulam Abbass

Ahmad Ahmadani | Aziz Buneri - Sub-Editor: Saddam Hussain - Video Producer: Talha Farooqi Director Marketing : Mudassir Alam - Regional Heads of Marketing: Agha Anwer (Khi) Kamal Rizvi (Lhe) | Malik Israr (Isb) - Manager Subscriptions: Irfan Farooq

Pakistan’s #1 business magazine - your go-to source for business, economic and financial news. Contact us: profit@pakistantoday.com.pk

Telenor Velocity is an accelerator that is hoping to help galvanise the telco into diversifying at a time when their original business is in freefall

By Nisma RiazThe tech scene in Pakistan might seem like it is currently at a standstill but don’t be fooled. While investment may be dwindling, efforts of tech-driven and innovation oriented individuals to continue disrupting the technology landscape have not stopped. If you don’t believe us, just sit at a chai dhaba for a few hours and you will most probably overhear someone discussing what sounds a lot like a promising startup idea at a nearby table.

However, the tech landscape has definitely changed, and even taken quite a hit in the last two years. But with trying times comes innovation. This is perhaps why even telcos are reconsidering their role in the larger scheme of things, thinking beyond mobile operation services and network provision.

The most glaring example of this would be the rising interest of telecom operators in the startup space. And this is not a novel occurrence. A decade and a half ago, most telcos in the country were hyper-focused on tapping into digital financing services, the fruits of which are evident in Telenor’s EasyPaisa and Jazz’s Jazzcash. Now, the time to diversify has arrived once again, and the cool new thing for telcos to get into are accelerators. With the same two companies that were able to crack online digital wallets are the ones with accelerators. Telenor launched its accelerator Velocity in 2016. Soon after, Jazz followed suit by launching xlr8 in 2017.

But why are these telcos interested in accelerating startups?

Profit explores.

One thing is for sure; as organisations grow, they have to tap into newer products and services. And according to Areej Khan, chief people officer (CPO) at Telenor, “The future is definitely digital. The customer need is evolving and with them the role of telco operators is also evolving.”

believes that the startup ecosystem would help private sector players like Telenor to broaden their horizon, by diversifying their product and service offerings. “You know, they have what we need and we have what they need. It just makes sense.”

Let’s start from the beginning.

Telenor Velocity was incorporated almost a decade ago, in 2016. This was a time when the startup ecosystem was just beginning to take hold in the country. “We witnessed many startups with great ideas come forth, who were getting initial funding but we immediately saw that there was a gap,” said Khan.

This gap existed between the initial seed funding stage and scaling. It isn’t a particularly new or innovative idea, but it is an interesting direction for a telco to take. “The needs of that particular stage were being met for the startups, but they were unable to really scale when the time required. And us as a technology organisation, we felt that we could perhaps play a better or a bigger role once the ideas of the startups had been validated. We wanted to come in and provide technology as an enablement tool for these startups,” Khan explained.

Khan told Profit that the idea was to

provide support to the growth stage startups and help them scale their ideas through the infrastructure that Telenor had to offer. “The role that we play currently is quite aligned with our business strategy as well. We work with startups that fall in the verticals that, currently, Telenor Pakistan is actively providing products and services under. So, we work with startups in the areas of agriculture, education, Internet, gaming content and even inclusion.”

Khan revealed that Velocity aids the startups in its portfolio through letting these startups access Telenor’s customer base, while also providing the right kind of mentorship.

Some notable startups from Velocity’s portfolio of 42 graduated startups include Sehat Kahani, Digi Khata, OlaDoc and Deaftawk.

But why would profit-driven companies want to invest in such a high-risk ecosystem? It is common knowledge that venture capital is inherently risky, and tech startups stand on shaky grounds.

We asked Khan what motivated Telenor to venture into this sector, and what potential they see in it.

She highlighted that with funding and capital being an issue globally, venture investments are the first to take a hit due to their risky nature.”However, I actually believe that economic downturn actually is the time that often sparks innovation. And organisations like us [Telenor] thrive on innovation.”

She reiterated that entrepreneurs address emerging challenges arising from the economic situations such as the current one, by creating new problem statements that require innovative solutions. “As an investor, this period is ideal for investing in startups to capitalise on these groundbreaking solutions. Unique problems foster innovative approaches, and with the right investment timing,

Startups don’t actually operate on a very short term horizon. Their success isn’t necessarily tied down to the short term economic fluctuations that we’re seeing. So, investing our time and expertise in a good startup right now means positioning it for the long term growth that will come about once the economy eventually rebounds. It just makes logical business sense to us

Areej Khan, CPO at Telenor

these startups have the potential to disrupt industries in the long run.”

“In my humble opinion, the present moment is particularly opportune for such investments. This strategic approach enables organisations to tap into and benefit from cutting-edge solutions, which is the primary reason why entities like ours are invested in aiding and mentoring startups under the current economic conditions,” Khan concluded.

She also added that no other business venture offers the sort of long term growth potential that a startup would. “Startups don’t actually operate on a very short term horizon. Their success isn’t necessarily tied down to the short term economic fluctuations that we’re seeing. So, investing our time and expertise in a good startup right now means positioning it for the long term growth that will come about once the economy eventually rebounds. It just makes logical business sense to us.”

When inquired what incentive Telenor Velocity has for accelerating startups, Profit learnt that Velocity does not take equity in the companies it trains. Khan highlighted the nature of the transaction by sharing, “We work on multiple models with them, one of them being revenue-share.”

But how is Velocity financed?

According to Khan, Telenor Velocity is part of the company’s Corporate Innovation function which has certain budgets allocated for its activities annually.

But what can accelerators do when there is no money?

One common question that we realise people have lately been asking is of the utility of accelerating startups when there is little to no

international VC funding available right now. This coupled with the fact that most venture capital firms in Pakistan have run out of money and are now struggling to raise another fund paints quite a bleak picture.

It is no secret that international VCs are sceptical of investing in Pakistan and there is also a general decline in overall funding throughout the landscape. So, what is the purpose of an accelerator in this current economy when there is such limited money to flow around anyway? More importantly, how can Velocity even bridge this gap when there is a serious lack of capital?

“I think that startups are an important part of what I believe is called the opportunity entrepreneurship and these are entrepreneurs or individuals that recognize the market gaps or they understand the unmet needs of the customer or have an attack on the emerging trends that exist in the market,” Khan remarked.

She continued to elaborate, “Then they are the ones that put efforts behind these problem statements and come up with innovative products and services or business models. Particularly during economic downturns, organisations should support startups through funding or scaling platforms. Incubators play a crucial role by preparing startups for investment, while accelerators like Velocity offer mentorship, by guiding startups in networking, and customer acquisition strategies, ensuring readiness for future funding opportunities. In the long run, investing in startups fosters job creation and economic growth.” Khan insisted that even when there is a lack of funding, Velocity prepares startups, it is willing to bet on, for securing capital when it is available in the future, or build a product so strong that it attracts foreign and local investors even during a funding crunch like the present one.

Sarah O. Munir, chief executive officer (CEO) of Invest2Innovate, speaking on the

utility and need for accelerators, said, ”The purpose of a good outcome-oriented accelerator program is to identify high potential founders and businesses and help them speed up their growth journey by providing them with targeted training, access to business development resources, mentors and experts that can help escalate their growth journey. While getting to funding is one outcome, there are many other benefits that an accelerator provides such as helping businesses with product, market testing and growth hacking tactics.”

When asked how the role of accelerators have changed, in the current economic downturn, Munir explained, “In an environment like the current one, where funding is dry on all fronts, good accelerator programs become even more relevant because the time and space to make mistakes and burn unnecessary cash is limited.”

She continued, “Founders need to build strong businesses with their fundamentals in place, the problem clearly identified and the solution correctly packaged for the right customer in the most optimised way. That’s where accelerators come in and help them. Good accelerators don’t provide a standard run-of-the-mill standardised curriculum. Instead, they focus on providing specific bespoke coaching that is specific to the founder’s needs in their growth journey.”

Profit was curious to know what sets Telenor Velocity apart from other accelerators. Is there anything that Velocity does differently?

According to Khan, Telenor was the first Telecom accelerator to open up their APIs to startups and showed willingness as a private sector player to work with startups. She believes that this made Telenor’s accelerator stand out in the crowd, showing their commitment to bolstering the tech ecosystem.

She relayed, “We become a local tele -

Good accelerators don’t provide a standard run off-the-mill standardised curriculum. Instead, they focus on providing specific bespoke coaching that is specific to the founder’s needs in their growth journey

Sarah O. Munir, CEO at Invest2Innovate

com partner for their growth. We integrate startup products and showcase them on our digital assets in a business model that proves beneficial for our customers, the startup and Telenor. In true essence, we become a partner more than just an accelerator and that has been our USP.”

Let’s be honest, accelerators do not have the best reputation in Pakistan due to one main reason– the startups that have come out of incubators and accelerators have hardly been the most popular and celebrated ones in the country.

Some people would go as far as to say that this model of incubating and accelerating startups has largely failed in Pakistan. The common perception goes: incubated startups have not been the most heavily funded, compared to ones that organically seek investment on their own.

So, why did Telenor not set up a venture capital fund instead?

“We were actually from the very beginning, very clear as to the role that we wanted to play,” said Khan.

Telenor did not set up Velocity because it wanted in on the startup scene. Khan says that as a tech company, Telenor wanted to diversify, but also tap into areas of its strength nonetheless.

“We’re a digital company. That is our strength, right? And we’re not a VC and we’re not angel investors.”

She continued, “We provide services to our customers to enhance their digital lifestyle. We’re constantly looking for and seeking products that we can probably add to our value mix.

So, then the question is, why even venture into the startup system?”

Answering her own question, Khan elucidated, “I feel that as a tech company, we can use technology as an enablement tool for the startups that we work with. Because again, an incubator is one that provides support to startups when they’re in the seed stage. An accelerator is a unit that steps in

to help a startup to scale. And in order to scale, they don’t only need funding, they need platforms, they need access to a customer base. And Telenor provides them with access to 44 million of our customer base, access to our subscribers on my Telenor app, our IoT cloud. And then we have a huge retailer base, since our distribution network is huge. So, we give them access to that particular distribution network as well.”

She highlighted that the most important role Velocity plays as an accelerator, that it would not have been able to play as an investor related to certain financial aspects, such as API integrations, or support in easypaisa integration. “These are the things we have that startups really need. Moreover, we are constantly looking for products and services that are closely aligned with our strategy. So, when we support them in scaling, there is a potential in the long run that they can be absorbed within our own value chain and provide the services that our customers seek from them. It’s a win-win in my opinion.”

Debunking the myth that accelerated startups, despite better training resources end up lacking when it comes to being generously funded, Khan shared, “I won’t deny that there has been a decrease in funding this last year, but we have quite a few examples of startups that we’ve worked with, which ended up doing quite well. Our alumni startup Sehat Kahani, secured approximately $2.7 million in series A funding from both international and local investors last year. We also have examples like Taleemabad and other EdTech that have received approximately $2.3 million from various funds, including the Malala Fund.”

Khan believes that Pakistan has produced some successful startups that have the potential to become unicorns, and that the current economic downturn shouldn’t deter companies, telcos, the tech industry, and investors alike from investing in this sector.

Khan also shared that Velocity has recently collaborated with the National Incubation Center in Islamabad. She said,

“NIC Islamabad assists startups in their initial stages, and we contribute when they reach the growth stage. By partnering, we’re creating a pipeline of startups attractive to investors. Our goal is to help startups gain more customers, which is crucial for scaling their business and that remains our primary objective with this new collaboration.”

After Khan shared the news of Velocity’s partnership with NIC Islamabad, we asked whether government initiatives, such as the previous interim government’s startup fund are useful in aiding the efforts of entities like Velocity?

Khan, agreeing with the assertion, said, “Yes, definitely. First of all, I believe when it comes to fueling the startup ecosystem, the private sector cannot do the job on its own and neither can investors. The government definitely has to play its part. The Pakistan startup fund is actually a great step by the government to provide support and seed funding for early stage startups.”

She used the analogy of a pyramid to explain the role of each entity in ensuring that the ecosystem does not only survive but also remains healthy. “Many startups with great potential don’t make it to the next stage because of poor economic conditions. So, survival in the initial years is of paramount importance. And with this government fund, startups having the right ideas or solving the right problems won’t be forced to discontinue their efforts to build something because of the lack of capital. The fund would also help accelerators, like us, to come up with a larger pool at the middle of the pyramid, which is a stage where we help the startups to scale.”

She shared that Velocity, while not being an investor, offers $10,000 worth of inkind support to startups for this very reason.

In its eight year journey, Velocity has trained 8 cohorts, done 8 pilot runs and accelerated 42 startups that have gone on to raise $6.8 million worth of collective investment. n

The IMF has raised the alarm bell on Pakistan’s microfinance sector.

Microfinance in Pakistan is in dire straits and has become a bit of a ticking time bomb because of the high risk of loan defaults and Covid era damages

By Mariam UmarIn its recent report released in May 2024, the International Monetary Fund (IMF) has raised a significant alarm regarding Pakistan’s microfinance sector, pointing out ‘persistent vulnerabilities’ in its recent report.This concern is not new; the sector has been grappling with severe challenges for a couple of years.

This has been the case for a few years now. In 2022, Profit did a story on the microfinance sector’s dire state describing it as a “time bomb” ready to explode.

The primary issue threatening the equity of these microfinance banks was the high risk of loan defaults, exacerbated by the COVID-19 pandemic. This crisis is far from resolved, with the situation in 2024 remaining just as precarious.

Despite efforts by the State Bank of Pakistan (SBP) and the government to provide relief and stabilize the sector, the outlook remains bleak. The sector’s current state prompts a crucial examination of its performance and the key players involved.

The main investors in the country’s microfinance banks (MFBs) are commercial banks, telcos, nonprofit entities/rural support programmes and specialised microfinance institutes.

The NGO-backed MFBs include the likes of NRSP Microfinance Bank Ltd, a subsidiary of the National Rural Support Programme, the Kashf Foundation as well as the Aga Khan Foundation’s philanthropy wing. The investments are an extension of the vision of these organisations; a vision based on poverty alleviation through financial inclusion.

The telcos adventure in the sector started after the SBP authorised the issuance of branchless banking licences in 2008. Telenor was the first one to do this when it joined hands with Tameer Microfinance Bank to launch Easypaisa in 2009. Jazz followed them closely by launching Jazzcash in 2012. The telcos soon bought the majority stakes in these banks and rebranded them. Tameer became Telenor Microfinance

Bank, Waseela was converted to Mobilink Microfinance Bank Limited (MMBL) while Rozgar Microfinance Bank was renamed U Microfinance Bank Ltd, more commonly known as Ubank, after acquisition by the PTCL.

Commercial banks are also key players in the sector. The likes of HBL Microfinance Bank Ltd and Khushali Microfinance Bank Ltd which are subsidiaries of commercial banks, with United Bank Limited (UBL) holding a 30% stake in Khushhali and Habib Bank Limited (HBL) holding over 70% in HBL Microfinance Bank.

Overall, there are about 11-12 players in the industry. Out of these, there are five that dominate the scene. These include the three telco

You see when the pandemic came about, lockdowns halted business activity. Microfinance institutions provide small loans to a target audience that is not the most affluent in society. These are loans that could be provided to someone to open a shop for their trade such as to a barber or a carpenter. Unfortunately, these were exactly the people most impacted by the lockdowns with their small businesses being closed for months on end. This meant the microfinance sector was caught in a fix as the majority of its borrowers were not in a position to pay their loan instalments immediately.

The regulators realised that a crisis was brewing. To try and stave off the rot that was setting in, the SBP decided to ease the pressure through the Debt Relief Scheme for deferment or rescheduling of COVID-affected borrowers through BPRD Circular No.14 of 2020. As per the scheme, the payment of loan principal could be deferred for up to 12 months if the borrower continues to service the interest amount. The scheme also provided a restructuring option through which the outstanding principal and interest could be converted into a new loan altogether with revised terms and conditions. The programme remained valid up to 31 March 2021.

Though the relief was for the whole financial sec-

tor, the microfinance entities were the primary beneficiaries. “Since the launch of the scheme, individual borrowers, especially customers of microfinance banks, have been the major beneficiaries of the scheme. The restructured and deferred loans include 1.717 million approved applications of customers of microfinance banks involving an amount of Rs 121 billion, which approximately constitutes 50 percent of total net-loan portfolio of MFBs,” stated SBP website. However, once the scheme expired in 2021, the sector started facing a fallout in the form of a deterioration of portfolio quality. Yet, it must be noted that this wasn’t something the sector didn’t anticipate in the first place. Back in October 2020, the microfinance industry did a collective assessment of the liquidity crisis and reached a conclusion that one-fifth of the portfolio restructured under the SBP scheme is likely to default.

Consequently, the sector’s outlook changed significantly. Overall economic downturn and more specifically asset quality issues of COVID impacted portfolio impacted the sector’s growth. While the central bank stepped up to provide relief to customers, the rescheduling and loan deferment resulted into masking potential losses which were realized later when SBP’s relief period expired.

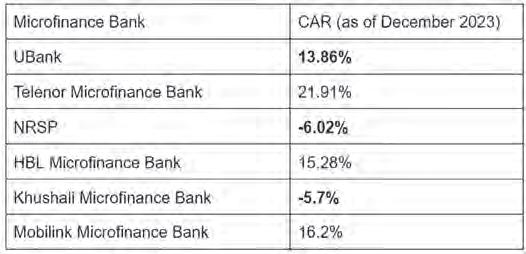

“The core reason behind customer default was the massive decline in the purchasing power of the borrowers. Therefore, the NPLs ratio of the MFBs exceeded 25% of the rescheduled portfolio. Currently, the overall risk profile of the sector is marked by higher cost of doing business in line with increased discount rate, asset quality issues resulting in portfolio losses and liquidity challenges and changed client behavior on account of subsidies offered to clients during pandemic. Consequently, profitability of the entire microfinance sector was adversely affected resulting in capital erosion. All put together, this has contributed to significant operating losses for many players in the sector and to the extent of breaching the regulatory requirement of capital adequacy prescribed by the central bank. The stress on capital adequacy ratio (CAR) was evidenced across the sector as 4 microfinance banks out of 7 major players are facing regulatory breach and in the process of raising capital,” reads VIS rating report.

The microfinance sector in Pakistan is still in recovery mode. Some banks are still reporting losses to the point that they have breached the regulatory requirement for capital adequacy ratio (CAR). CAR is the regulatory liquidity requirement which banks have to maintain. Currently, a minimum CAR of 15% is to be maintained by the MFBs. The calculation of CAR is based on the capital held by banks divided by the aggregate of the bank’s risk weighted assets. As a rule of thumb, to improve CAR you have to decrease risk and increase capital.

The table below shows the CAR for some of the prominent players in the market. As the numbers show, the CAR for most players has declined to dangerously low levels, even going into negative.

“Regarding vulnerabilities in the microfinance sector, the authorities have asked owners to provide time-bound recapitalisation plans where necessary. This approach has been successful in returning two institutions to regulatory minimum standards. Staff welcomed work on a plan to strengthen internal control systems in the SBP’s lending operations but urged that the counterparty eligibility policy include a requirement that counterparties are financially sound,” reads the recent IMF report.

In 2023, PTCL group, parent company of UBank injected Rs1.6 billion to to address potential statutory shortfalls. However, recent reports with corrective measures mandated by the SBP shows that the bank reported a loss of Rs 2.3 billion before taxation in 2022. With tax reversals, the loss amounted to Rs 876 million. The bank’s losses continued in 2023 as UBank recorded a loss before taxation of Rs 1.1 billion, and a profit after tax of Rs 750 million following tax reversals. The bank’s accumulated losses amount to around Rs 1.9 billion which shows that UBank is in the same league as other undercapitalised microfinance banks.

Hence, as of March 2024, equity has further declined to Rs 3.5 billion. Resultantly, the Bank’s capital adequacy ratio fell below the regulatory threshold of 15% to 13.86% at the end of 2023. Interestingly, as per the subsequent financial statement released for Q1 2024, the ratio fell further to 9.4%.

Read: From profitable highs to equity injection calls, what went down with U Microfinance Bank in 2023?

This isn’t the first time this has transpired in the microfinance industry and there are remedies in place. And Ubank is exactly moving towards that. The Board of Directors of

PTCL convened on April 18, 2024, and agreed to support the bank’s capital structure through the following measures:

1. Conversion of PTCL preference shares into ordinary share capital of Rs. 1,000 million.

2. Conversion of PTCL subordinated debt of Rs. 1,200 million into ordinary share capital.

3. Additional cash equity injection of Rs. 1,200 million.

These capital enhancements would have increased the bank’s total capital adequacy ratio to 15.4% as of March 31, 2024, and to 16.6% as of December 31, 2023.

But all is not gloom as the other two telco led microfinance banks not only meet the CAR requirement, but are also profitable. Interestingly, both of them are focussed on digital lending (nano lending).

Telenor Bank has one of the strongest industry CAR of 21.9% at end of December 2023 which improved to 22.75% at the end of first quarter of 2024. The bank’s CAR at the end of 2019 stood at 19%. This improvement is due to successive capital injection from the sponsors.

The sponsors injected the bank with liquidity, cleaned up the books, shut down branches, and migrated to new business model. However, other microfinance banks are stuck because their sponsors are either unwilling to or are unable to clear the books to move forward.

Telenor Bank also managed to become profitable for the first time in five years in 2023 after 2017 with a net profit of Rs 502 million. In the same year, the bank got an

This shift towards profitability came about in the same year when the bank received no objection for digital retail bank license. As per Data Darbar, Telenor Bank’s focus on nano led to growth in income and hence profitability.

Similarly, Mobilink Microfinance Bank’s gross loan portfolio encompassed nano loans totaling Rs. 7.7 billion. The bank’s CAR was above regulatory requirement and net profit of Rs 1,033 million.

HBL Microfinance Bank’s CAR has remained just above the statutory requirement at 15.02%, however, the bank recorded a net loss in first quarter of 2024 of Rs 721 million. Soon after in April 2024, Habib Bank Limted, parent company of HBL MFB announced capital injection of Rs 6 billion into the MFB, which implies that without the injection the ratio might have fallen below the threshold.

On the other hand, Khushali MFB incurred a negative CAR of -5.7% as at December 2023 as per VIS report. The bank has not released its yearly report showing that it is grappling with losses and negative equity.

Overall, the sector has been struggling. Part of the problem is negligence on part of the regulator. “The regulator has not paid much attention to microfinance sector in last 10 years. Regulator was neither progressive nor responsive at the time of crisis. Response was very slow. MFBs repeatedly went to SBP to advocate but the SBP’s stance was that it was ‘observing’,” lamented an industry professional.

To effectively scale productive financing for small agriculturists and farmers, regulatory intervention is crucial. This involves providing loan loss guarantees for risky loans to incentivise microfinance banks to extend credit to these sectors. The shareholders/sponsors of microfinance bank are commercial entities, not not-for-profit organisations. Since these shareholders are driven by commercial interests, they are unlikely to invest their capital in extremely risky loans that support the development sector without a viable business case.

Therefore, the regulators need to step in and participate in risk through guarantees and schemes or offer schemes that incentivises risk taking. “Although there is significant potential for development in this sector, the regulator has shifted its attention to larger economic issues, neglecting the microfinance sector”, lambasted the industry source. As a result, access to finance and credit for MSMEs has not improved.

Besides, The microfinance sector has seen limited innovation, with most banks focusing on gold-backed bullet lending. This lack of diversity in financial products hinders the growth of microfinance. Conversely, there has been substantial progress in digital banking, with initiatives like RAAST, changes in digital onboarding, and the introduction of DRB licenses. These efforts have driven significant advancements in digital banking. However, interest in microfinance licenses could decline unless the regulator revisits the licensing structure of microfinance banks (MFBs).

In fact, fintech players have been expressing their interest in the microfinance bank licence and have been exploring how they can leverage this license for their digital business. For example, ABHI, a fintech operator, and TPL Corporation, a leading conglomerate, have expressed interest in the acquisition of FINCA Microfinance Bank. The regulator allowed the entities to do due diligence on the microfinance bank for the next stage. Similarly, Advans Microfinance Bank is being acquired by MNT Helan, the Egyptian digital payment provider while Advans will be exiting Pakistan’s market. Therefore, the regulator needs to enhance the commercial business case for microfinance banks to reignite shareholder interest and make these ventures viable again. n

PIA is up for sale, and there’s a six-way battle for who will take the prize

Four

different airlines, power producers, and real estate developers are all in the running to buy PIA when the airline is finally privatised

By Abdullah NiaziIt’s finally happening. For years there has been a constant struggle for the privatisation of Pakistan International Airlines. Three successive governments over the past decade have introduced plans to privatise PIA, they have claimed they were committed to the process, and everytime the plans have fallen through either to politicisation, bureaucratic red taping, or governmental hubris.

The process has never gotten this far. Now that it has, the fate of every single Pakistani airline hangs finely in the balance.

Last month, at least eight bidders submitted qualification statements to express their interest in acquiring the airline from the government. This month, two of those initial bids were rejected. No single known company

or individual stands out because all eight bids were placed by newly formed consortiums.

At least four different Pakistani airlines including Fly Jinnah, AirSial, Serene Air, and Air Blue were all part of these eight consortiums. For the airlines this is a matter of survival. PIA currently has the largest fleet and the largest domestic and international network in Pakistan. The national flag carrier is the market leader in Pakistan’s airline industry, and control of it means having a significant advantage over other airlines.

One of two things could happen. The first is that a conglomerate with an airline involved could take over and automatically become the market leader. The other option would be a conglomerate without any airline involvement to take over and a new entity is born and PIA’s position stays the same. In either case, the changes will shake up Pakistani

aviation.

Who are the challengers vying for PIA?

Members of these consortiums include four different airlines, power producers, chemical manufacturers, and real estate developers. And as the process goes on, many of those involved in these multiple consortiums may well drop out and the composition of these consortiums could also change along the way.

The only question is, who are the people behind these consortiums wanting to buy PIA, and just how uphill is the task that faces them if they get what they want.

In the initial qualification statements, eight different consortiums stepped up to the plate.

The leaders of these eight consor-

tiums are Fly Jinnah, Air Blue, Arif Habib, Gerry’s International, Sardar Ashraf D Baluch Builders, Gerry’s International, YB Holdings, Pak Ethanol, and Blue World City. Of these eight, through the initial vetting process, Sardar Ashraf D Baluch Builders and Gerry’s International have been disqualified from the bidding process for different reasons. Of the remaining ones, the consortium led by Fly Jinnah, Pak Ethanol, and YB Holdings are the top runners, but Air Blue, Blue World City, and Arif Habib are still very much in the running.

What you have here for all intents and purposes is a battle between different Pakistani airlines vying to get control of PIA, with some secondary players in the background also throwing their hat in the ring. On the one hand you have Fly Jinnah, which has

This is the powerhouse contender in the bidding for PIA. The party taking the lead is Fly Jinnah, which embarked on its maiden flight in Pakistan in October 2022 when a red-emblazoned plane carried passengers from Karachi to Islamabad at a bargain ticket price of Rs 13,999. Fly Jinnah entered Pakistan’s market at a time when the aviation industry was struggling. They presented themselves as a low-cost carrier that allows you to pick and choose whether you want meals on flights and just how expensive your ticket is going to be. Over time, Fly Jinnah’s position as a low-cost carrier has come into question, but the new airline has fast been making inroads. And why would it not? They have some powerful backers. In Pakistan, Fly Jinnah was the brainchild of the Lakson Group, one of the largest and oldest conglomerates in Pakistan. Founded in 1954 by the Lakhani family, the group first made its money in the tobacco busi-

ness before selling it to Phillip Morris, which runs the business to date. The company is also the owner of McDonalds in Pakistan and also has interests in FMCG in the shape of Colgate-Palmolive, as well as in tech in the form of companies such as Stormfiber. They are also in the media business, running and operating the Express Group which has a news channel, an entertainment channel, as well as an Urdu and an English daily to boot.

The other partner in this partnership is Air Arabia, the UAE based low-cost airline. During the pandemic, Air Arabia was lobbying heavily with the UAE government to be allowed additional international flights to Pakistan but failed to do so. So what did they do instead? They decided to enter an alliance with the Lakson Group to form Fly Jinnah. And the response from within Pakistan’s aviation industry was not particularly welcoming. In fact, it was PIA that was most up in arms.

So much so that the then Chief Executive of PIA, Air Marshal (R) Arshad Malik, penned a missive to the government, imploring them to prohibit Fly Jinnah from taking flight. The letter contended that green-lighting Fly Jinnah would enable Air Arabia to monopolise the local market and circumvent the country’s aviation policy, under which Air Arabia was barred from further rights to operate in Pakistan. Moreover, the letter revealed that Serene Air and Airsial had approached PIA to address the issue as well. The matter was also a topic of heated debate in the Senate’s Standing Committee on Aviation.

The fear amongst these airlines is that Fly Jinnah would serve as a conduit for Air Arabia, who would then whisk them off to other destinations. And the fear might be able to materialise. In 2023, after completing one year of domestic flights, Fly Jinnah can now operate internationally as well and launched their first

flight to Sharjah in February this year.

Now, it seems Air Arabia is in the mood for complete dominance. You see, the consortium bidding for PIA is between Fly Jinnah and Air Arabia. This gives Air Arabia a lot of control since they already have a 45% stake in Fly Jinnah and completely own their UAE airline. Ownership of PIA will give them access to a lot more international flights and routes that they can coordinate with Air Arabia and Fly Jinnah.

The privatisation of PIA, which was their harshest critic when they first showed up on the scene, offers them the chance to completely take over. But they aren’t alone in this desire. In fact, they aren’t even the only new airline in Pakistan vying for PIA, and the toughest competition may come from AirSial and Serene Air.

When Fly Jinnah burst onto the scene in 2022, they began an aggressive attempt to undercut its competitors, with prices dipping to a staggering 3% to 26% of what others demanded. This strategy didn’t work for long, because their competitors were not slow to get into a pricing war. And over time, Fly Jinnah is no longer the cheapest choice.

Two of the main competitors Fly Jinnah was taking on were AirSial and Serene Air. Before Fly Jinnah, these two were the new kids on the block. Serene Air was launched in 2016 while AirSial took off in 2020. Out of the two, AirSial has been an impressive enterprise. An endeavour of the Sialkot business community, specifically the roughly 400 family-owned businesses that form the core of the Sialkot Chamber of Commerce and Industry (SCCI). It is a story of enterprising business families banding together and building an airport to keep their city connected domestically and internationally.

These two airlines are now part of a consortium that is bidding for the ownership of PIA. This will be very important in particular for AirSial. By January 2024, Fly Jinnah had succeeded in completely ousting PIA and AirSial from domestic routes. With the launch of their international flights, AirSial needs a boost.

Interestingly enough, the leader of this consortium is neither of the two airlines. The consortium’s lead is Pak-Ethanol, which is a major producer of ethanol in the country. The company was incorporated in 2010 and is one of Pakistan’s largest ethanol producers and are also exporters. Another part of the consortium, as reported in the media, is Liberty Daharki Power Plant, which is owned by the Mukathay family.

An earlier report in The News Interna-

tional also claimed that the consortium’s international contingent includes Swiss Aviation Group AG from Switzerland, Airport Competence from Austria, Pearl Asset Management PTY Limited from Australia, and Capital A Consultancy (Air Asia Aviation Group) from Malaysia, as outlined in a press statement released by Pak Ethanol.

Another reported investor is AsiaPak Investments. This is a company that has been in the headlines recently. Owned by Sheharyar Chishty, who also owns Daewoo buses in Pakistan, recently led AsiaPak in its purchase of K-Electric in the Cayman Islands, which the group is now trying to get management control of . All in all, while this consortium is not a pure aviation led, it is a very strong contender.

Younus Brother Holdings (Private) Limited-Pioneer Cement Limited Consortium

This is the third major contender that has a good shot but they don’t have any aviation experience in their wings. This is also the second major conglomerate interested in buying PIA. The first, as we discussed earlier, was the Lakson Group through Fly Jinnah. YBH has been around since 1962 when the foundation of a trading house was laid. The establishment of the fabric trading business house, which turned into one of the largest business groups of Pakistan in a period spanning five decades.

Among its subsidiaries, the group counts Lucky Cement.

They have partnered with another cement company, Pioneer Cement, which was incorporated in 1986 and has a Paid up Capital of 227.1 million shares of Rs. 10/= each. Artistic Milliners Limited, a textile company, ANS Capital Private Limited, an investment firm, and Metro Ventures Private Limited, a real estate company are also involved in the consortium. While the group does not have any aviation experience, they will have some financial heft.

The Privatisation Commission also pre-qualified Airblue Limited; a Pakistani low-cost airline, Arif Habib Corporation Limited; a leading financial services firm, and Blue World City; a real estate developer, with its consortium including Blue World Aviation and IRIS Communication Limited.

Out of these three, Blue World’s bid is quite interesting. Blue World City rose to fame as a mega project in Chakri on the outskirts of Islamabad. Owned by Chaudhry Saad Nazir, it was launched as one of many contenders in the Chakri area. Since 2018, however, it has started appearing as a big name. Having presumably collected a decent amount from initial sales of files, they went on a massive marketing cam-

paign that used classic real estate techniques. They even roped in Engin Altan, the Turkish actor that plays the lead role in the Ertugrul Resurrection drama series that has become a phenomenon in Pakistan, to be their brand ambassador.

Since those early high flying days when Blue City became one of the hottest names in the Chakri real estate market, things have gone south. The society still does not have approval from the RDA and the land authority says it is not planning to give its approval any time soon. In fact, on recommendation of the RDA, Blue City is being investigated by the National Accountability Bureau (NAB), and has not bought a fraction of the land they claim to already be in possession of. This is how it all happened.

They have been covered earlier by Profit, in a story titled Chakri’s Gang Wars.

Initially, eight different consortiums had submitted their qualification bids. he consortium of Sardar Ashraf D Baluch Construction Company-Shanxi Construction Engineering Group Co Ltd (China) and Gerry’s International were disqualified from bidding. Gerry’s International was rejected due to a weak financial position, while Sardar Ashraf D Baluch Construction company was barred due to a lack of independent verification of its Chinese partner.

There is a very clear list of contenders for PIA at the moment. Four different airlines, two together, have become part of different consortiums that want to try and buy PIA. Control of the airline, particularly for others in the aviation industry,

means having a large network and routes but also a lot of problems.

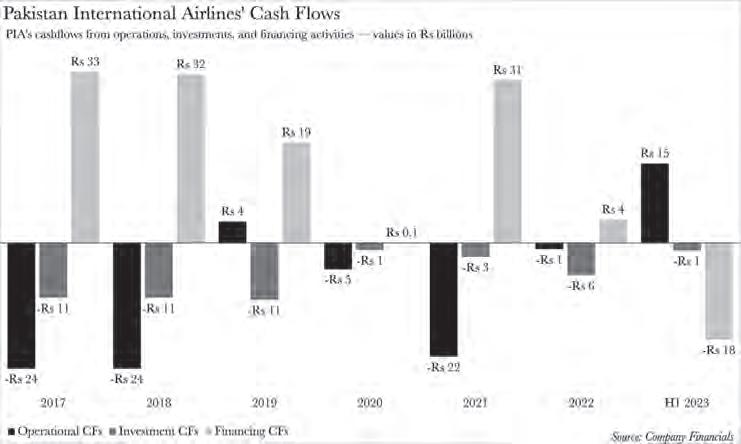

PIA’s losses are so staggering that it is hard to wrap one’s mind around them. PIA’s cash flows are in a state of chaos. A retrospective glance at PIA’s cash flows from 2017 to June 2023 paints a grim picture. PIA only managed to keep its head above water for a fleeting one and a half years. The remaining five years saw PIA grappling with negative cash flows from its operating activities. In layman’s terms, PIA was bleeding money from its core airline operations. So, how has it managed to stay afloat? The lifeline has been debt.

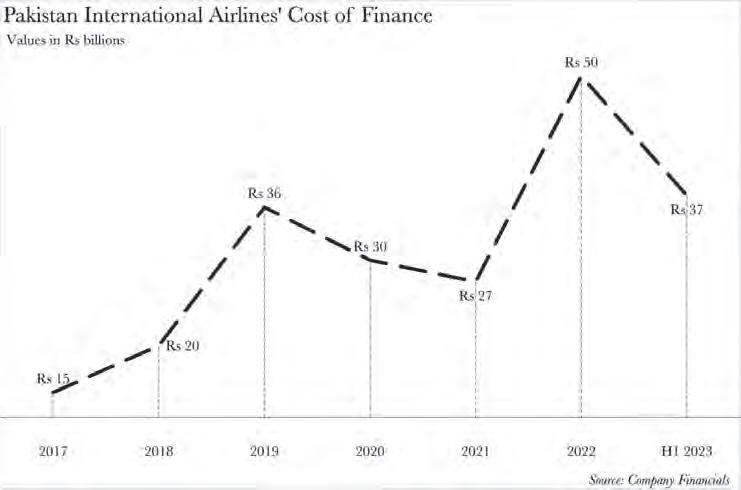

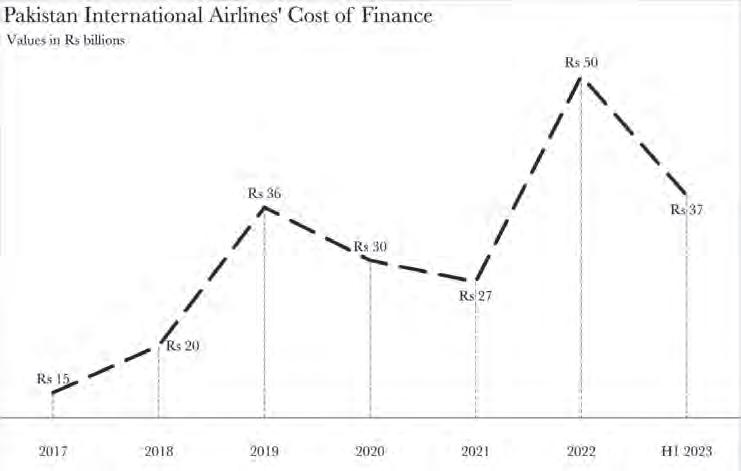

During the aforementioned period, it was only in the first six months of 2023 that PIA managed to repay more loans than it borrowed. That’s not to say it didn’t borrow. It did. This borrowing spree has been the lifeblood of its operations for the past six and a half years. Is this a sustainable model? Far from it. PIA’s finance costs for 2022 alone amounted to a staggering Rs 50 billion — a record high over the past six years. Yet, barely halfway into 2023, PIA has already incurred an alarming 74% of this cost. It is this escalating cost of finance that prompted PIA to engage the government in a dialogue for financial aid to alleviate its debt burden.

So, where does that leave us? Without pointing fingers, it’s just the tale of an organisation trying to do whatever it can to stay afloat in all honesty. The only problem is that it’s a public sector company, and therefore taxpayers are also paying the price.

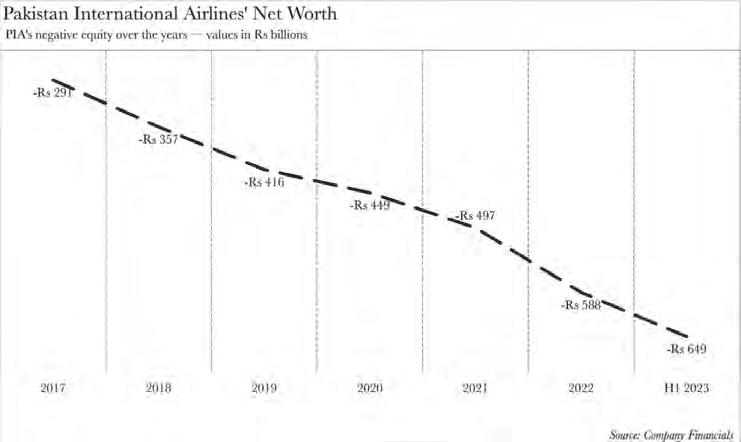

PIA is a negative equity company. Negative shareholder equity is a chilling scenario where a company’s liabilities to its investors eclipse the worth of its assets. In layman’s terms, when a company’s mountain of debt towers over the aggregate value of its assets, even after a complete liquidation, it is branded

with the ominous label of negative equity. The fiscal abyss that PIA finds itself in has only yawned wider with time. The negative equity has mushroomed from Rs 291 billion in 2017 to an astronomical Rs 649 billion in June 2023. This gargantuan sum also symbolises the debt albatross that any prospective buyer would be saddled with upon acquiring PIA. Does it make sense for anyone to want to buy it? Surprisingly, yes. As explained to Profit last year, PIA unfurls an unparalleled opportunity for any ambitious newcomer yearning to penetrate Pakistan’s airspace, or an incumbent aiming to fortify their position. While the buyer would need to brace for the depreciation of the rupee earnings, they stand to reap rich rewards from the dollar-denominated earnings accrued from Pakistanis embarking on overseas journeys. Moreover, they would not only carve out a niche in the country but also tap into the vast and untapped reservoir of the diaspora.

Perhaps the biggest factor in this which will be a boon for potential buyers of the airline is the decision to restructure PIA’s debt. In March this year, The Pakistan International Airline Holding Company approved the restructuring of the airline’s Rs 268 billion commercial debt, incorporating it into the public debt. The term sheet was finalised by the Ministry of Finance with commercial banks. The government’s decision to merge the airline’s debt into public debt means that taxpayers will bear the cost of PIA’s historic inefficiency and mismanagement.

All of this has been done quite hastily and has been quickly agreed to by the banks that are owed by PIA. They agreed to extend their debt for ten years and reduce interest rates from the existing approximately 23.5% to a maximum of 12%. This has been done exclusively to appeal to potential buyers, and as part of the restructuring, a clause has been added to the restructuring in which banks will have the right to reopen the deal and demand an interest rate equal to prevailing rates in 2027 in case the government is unable to privatise PIA in three years.

Essentially, PIA will be split into two companies. That is why the government has created the PIA Holding Company. In May this year, the Competition Commission of Pakistan (CCP) approved the 100% acquisition of PIA by this company. Through this, the airline’s bad debts, including commercial loans, trade debts, and government borrowings, transferred to the holding company. Over Rs 650 billion of the Rs 825 billion PIA debt will be transferred to the holding company, leaving a clean PIA to be sold to investors. Essentially, the holding company will take over all of PIA’s bad assets leaving the rest to be sold off nice and easy.

The privatisation process process itself is pretty transparent. Independent financial advi-

sory teams are engaged through a competitive process. Which then conducts detailed due diligence to arrive at a fair value, identify transaction roadblocks and suggest any changes that are required to optimise the privatisation proceeds. A successful bidder is selected based on the highest bid, through a well defined transparent process,” Ishtiaq adds. A reference price for the bids is normally calculated based on factors such as net asset value, future cash flows, and potential dividend streams.

So what are the buyers actually getting and why is the government so keen to sell?

Based on the balance sheet at June 30th 2023, it can be seen that the company has assets worth Rs 160 billion. The problematic part is the fact that the airline has suffered losses for many years which means it has accumulated losses of Rs 650 billion. In order to fund their operations, they have taken liabilities of more than Rs 825 billion. So what is so attractive in such an investment? Who would want to pay for a company to take on so much debt? In order to make this a viable investment, it was decided to divide the company into two parts. A holding company was created which would absorb all the bad debts, commercial loans, trade debts and government borrowings. This would transfer debts worth Rs 650 billion out of Rs 825 billion to be transferred from the books of PIA itself.

The debt that has been transferred to the holding company has further been restructured. Not talking on the haste with which that was done, the debt that has been transferred to the holding company of Rs 268 billion has been restructured in order to make it digestible for the holding company as well. Even though this is a third of total debt that has been transferred, the goal is to allow the holding company to manage its own debts as well. The debt has been incorporated into pub-

lic debt which means that the government and tax payers will end up bearing this expense.

The restructuring means that banks have agreed to extend the debt for ten years at a reduced rate of interest. This rate was around 23.5% which has been set at a maximum of 12% for the tenor. This would mean that interest payment of Rs 32 billion will be made to the banks. The banks will get Rs 300 billion in interest over the 10 year period which will exceed the total debt.

The 6 buyers looking to buy PIA will see a reduced amount of debt when they take over the aviation business and the government will be able to make it more attractive to them. Currently, debt falls by Rs 650 billion which will reduce the negative equity of the new company. The government has made this arrangement to be able to generate proceeds once they are able to well the company. These proceeds can then be used to pay off some of the debt of the holding company of allow it to make the interest payments.

The biggest advantage that the buyers will get from this deal is that they get to start fresh as much of the debt is wiped off. With assets of Rs 160 billion, they will see their debts fall to Rs 175 billion. Even though this does mean they will bear some of the accumulated losses of the company, they can look to inject more equity in this situation. Rather than setting up a company from scratch, they will be able to use the name and route portfolio of PIA without having to build much of the it by themselves.

With 75% of its debt wiped off, the new company will see its finance cost slashed as well. Recent half year accounts show the finance cost alone was Rs 37 billion. To put this in context, the fuel expense was Rs 49 billion. The new company will have a more manageable expense. n

The federal govt and the provinces have finally agreed on food quality enforcement.

Why did it take them six years?

Why did

despite intervention of CCI?By Ghulam Abbas

After years of contention and multiple interventions by the Council of Common Interests (CCI), the federal government and provincial food authorities have finally reached an agreement on the enforcement of food quality standards in Pakistan. This consensus comes after a prolonged struggle for authority and control over food quality regulations.

Since the inception of Provincial Food Authorities (PFAs) across all four provinces, there has been a continuous dispute with the Pakistan Standard Quality Control Authority (PSQCA), the national standards body under the Ministry of Science and Technology (MoST). The core of the disagreement lay in which entity had the authority to enforce quality standards for food items—a power associated with significant control and potential financial kickbacks for officials.

Despite multiple CCI meetings over six years, the issue remained unresolved. The 18th Amendment to the Constitution, which devolved many powers to the provinces, exacerbated the tug of war between PFAs and PSQCA. While PFAs lacked the mandate to create standards and quality rules for food items—a prerogative of the PSQCA—they sought the authority to enforce these standards, leading to a standoff.

Manufacturers, caught between complying with both PFAs and PSQCA, pushed for a resolution. This pressure culminated in a recent breakthrough during a National Standards Steering Committee (NSSC) meeting at the Ministry of Science and Technology. Attended by representatives from PFAs, PSQCA, and other stakeholders, the meeting marked a significant step towards harmonizing food standards.

According to documents reviewed by this correspondent, PFAs and PSQCA have unanimously agreed on a mechanism for enforcing quality standards and a revenue-sharing formula. Key points of the agreement include:

Implementation and Enforcement: PFAs will now implement and enforce the quality standards for food items as notified by PSQCA. PSQCA’s role will be confined to setting these standards, issuing certificates, and granting logo usage rights.

Operational Changes: PSQCA officers will no longer inspect factories and industrial units; instead, PFA staff will undertake these inspections within provincial limits.

Revenue Sharing: Revenue from PSQCA’s certification marks for the food sector will be shared with PFAs to enhance their testing facilities, after deducting international membership fees and other expenses.

Loose Food Products: For loose food products lacking current standards, PFAs will propose draft standards based on health and safety considerations. PSQCA will provisionally adopt these until they are finalized.

Standard Harmonization: The remaining seven food standards will be harmonized within three months, with PFAs implementing the finalized standards.

After devolution in 2011, food became a provincial subject. Overtime, the provincial food authorities developed their own food standards which resulted in multiple standard regimes.

Hence, compliance to different sets of standards across provinces required extra resources, including time, effort, and money to make themselves eligible to sell. This was an extra burden for food manufacturers who wished to expand their operations across provincial borders.

The issue was brought to the CCI agenda in 2017 by the then prime minister Shahid Khaqan Abbasi. The industry had approached the government, pleading that it was not possible to cater to multiple regulatory regimes and different standards of food laws of the federation and the provinces that had caused confusion on which standards were to be followed.

The CCI decision to implement One Standard across Pakistan also led to the creation of the National Standards Steering Committee (NSSC) under the PSQCA to deliberate upon the updated status of harmonisation of food standards and implementation mechanism of food standards as per the CCI decision.

Nonetheless, the consensus on the issue reached by the CCI is in jeopardy after the Punjab Food Authority’s (PFA) recent decision to implement a QR coding system to help its food safety officers track and trace the product label, approval and registration status. Like the issue of multiple taxation systems in the country, the enforcement of quality standards was also an issue for manufacturers and industry. With most food companies having their manufacturing base in a province operating nationwide, they were at a loss to understand how two different agencies/organizations.

In 2021, following a CCI decision, it was agreed that there should be a single food standard nationwide to facilitate harmonization. The food industry had long demanded the elimination of multiple standards imposed by various federal and provincial authorities, which complicated compliance and hindered business operations.

PSQCA’s initiative to reform and harmonize standards aligns with the government’s aim to improve the Ease of Doing Business (EoDB). Despite a clear directive from the Prime Minister’s Office, provinces were initially reluctant to cede enforcement powers to PSQCA due to the associated revenue.

Historically, PSQCA struggled with enforcement due to corruption and inefficiency, leading provincial authorities to assume de facto control. This dual regulatory burden on manufacturers created significant disruption, particularly in interprovincial trade and food manufacturing.

The Ministry of Law, tasked with resolving the legal ambiguities, referred the issue to the CCI. The lack of consensus delayed the development of national standards and the registration and licensing of manufacturers and trading houses. Consequently, CCI intervened to address constitutional and legal ambiguities, review Provincial Food Authorities Acts, and suggest a mechanism for enforcing technical regulations.

The agreement between PFAs and PSQCA marks a pivotal resolution, promising streamlined food quality enforcement and better regulatory coordination across Pakistan. n

Pakistani tech company D-Tech Consultancy has filed a $2.2 million lawsuit against US tech giant Zoom, claiming they are owed over a million dollars in unpaid commissions

By Nisma RiazAstrange legal document came to Profit a few weeks ago. The document was a court case filed by a Pakistani company called D-Tech Consultancy. In the case they had brought before the court, D-Tech had named Eric Yuan, the CEO of global video conferencing platform Zoom, as a defendant.

D-Tech, a little known Pakistani company based in Karachi, was suing Zoom. Why? Because according to them, Zoom owes D-Tech over a million dollars in unpaid commissions, and the company is now demanding that Zoom cough up $2.2 million in damages and losses.

So what’s the story behind the lawsuit? D-Tech Consultancy was apparently Zoom’s partner in Pakistan and had been given the status of authorised reseller. This essentially meant this company was a sales agent for Zoom, and would pitch the

company’s products to big clients in Pakistan such as universities, government departments, and large corporations. In exchange for selling these deals, Zoom would pay them a one time commission.

D-Tech claims that in their time as a partner, they have made many big sales and Zoom has simply not paid them their commission. In response, Zoom has said nothing. Profit made multiple attempts to reach out to their management to no avail. But something else is strange in this story too. Where did D-Tech come from? How did it convince Pakistani companies to spend hundreds of thousands of dollars on a product like Zoom? And why is an international tech giant holding out a payment to a Pakistani partner that is peanuts to them? There is a lot more than meets the eye in this story.

D-Tech simply applied for a partnership with Zoom online. The partnership is an open offer whereby D-Tech would be acting as an ‘authorised reseller (partner)’ for Zoom’s services and subscriptions in Pakistan. After reaching an agreement, the onboarding process was initiated by Zoom, after which D-Tech officially became a Zoom partner in Pakistan on August 27, 2022.

The partnership meant D-Tech would collaborate with the executive management of Zoom to explore business growth avenues and possibilities that would provide Zoom’s offerings to clients in Pakistan. Through this partnership, it was agreed that D-Tech would earn commission payment on the basis of ‘one-time referral agreement’ for the clients they got for Zoom. This meant that D-tech would get a commission from Zoom for every client it successfully onboarded with Zoom, to utilise their video conferencing services.

It was a pretty simple business partnership model.

D-Tech soon got to work and immediately hit two big home runs. The first prominent organisations that D-Tech successfully onboarded with Zoom was the Central Directorate of National Savings in November 2022, with a deal worth $247,503.

The second big deal D-Tech closed was with Image Garments, worth $553,295. This was a client another partner had been working to onboard but could not close the deal. The legal document seen by this correspondent claims Zoom has yet to pay part of the commission it owes to D-Tech for these two deals.

But this raises a serious question. Why are these organisations and companies paying such massive amounts to Zoom?

Put these amounts in context. A company like Image Garments is signing a deal with Zoom worth Rs 15 crores for a service that will be available to them for three years at the most. Can Image afford to spend Rs 5 crore a year on video conferencing, and do they really need to?

The answer to both those questions is a resounding no. So why then did they make these deals with Zoom? Because the $553,295 and $247,503 amounts are never actually going to be realised or paid. They are just what the deal is “worth”.

Let us explain.

If you have used Zoom for a video meeting, chances are that you might have used the free 40-minute version. For a meeting that allows more time and more participants to attend the meeting, you have to become a paid user or a licensed user.

If a company is a big enterprise that frequently uses Zoom for internal meetings, virtual conferences or training etc, it might want to buy a paid version for many of its employees. Based on the requirement Zoom sales team would quote a price that would allow a certain number of licensed users in the company to avail the Zoom service with the features that come with being a paid customer. Let’s say that Zoom offers these licences to a company for say $100,000 for one year.

Companies like Zoom try to entice their customers into longer contract terms, such as for three years or five years, which increases the total value of the contract. If the customer chooses a longer contract, there is either some leverage offered in form of discounts or some leverage by offering a certain free period. If it is a complicated deal, they can give a free period of certain months and or try and buy.

Sources privy to Zoom’s working said that because Pakistan is a new territory, they would give it companies here for some period for free and start charging the customer after six months or into the second or the third year. Giving a free trial period is how companies entice many subscribers. As many use free trial, the actual number of customers that convert to paid service is higher. Recall your old Netflix days when they launched the service with a 30-day free trial for you to check out Netflix and decide if you wanted to pay for this service. Same goes for LinkedIn Premium which offers a 30-day trial period during which users can navigate functionalities and decide within a month if they want to convert to paid subscription.

In the case of Zoom as well, they give a trial period of their services to customers, hoping that the customer would start

consuming the licences and eventually convert to a paid subscriber, which is when the actual multi year payment would come into effect. This could be a hit or it could be a miss for Zoom. If the customer does not want to continue, they can theoretically use the service for the entire trial period for free and cancel at the last moment without incurring any charges. But if they do not cancel, they are in a multi year contract with Zoom in which case the payment becomes due for all the years.

Now the IT industry works on a three-tier model in which there is the principal, the actual vendor which in this case is Zoom, a distributor and a partner, which in this case is D-Tech.

According to a source familiar with Zoom’s work, the reason why principals would want to work via a partner is because they would want to minimise their financial exposure. As opposed to Zoom speaking to a lot of customers because of a high number of transaction volumes, they choose to work in different markets via partners. The partner basically generates leads and passes them onto the principal. Zoom works with multiple partners in Pakistan that generate these leads for Zoom. The partner then takes the risk of getting paid or not getting paid. And then in turn they owe money to the distributor. It could also work with multiple distributors, which are probably 3-4 in every region and would be the ones responsible for payments to Zoom.

All the deals that have been closed, for instance the deals with IMAGE Garments and CDNS, are between these companies and Zoom after deciding the price based on individual requirements and the length of the contract. These customers might have simply agreed to the prices just to use Zoom services for the trial services but regardless, Zoom owes commission to D-Tech for referring these customers as soon as these deals are signed.

The contract value ascertains to a certain extent what is the commission that D-Tech is going to get. Henceforth, that is how the company has visibility on what the amounts that have been decided between the client and Zoom are.

On Jan 09 2023, D-Tech became the Strategic Partner for Zoom in Pakistan after the closure of the aforementioned deals and for selling a wide range of offerings from the Zoom portfolio. Both these clients, IMAGE Garments and CDNS, were on-boarded with Zoom for its video conferencing licences.

The suit mentions six high profile pub-

lic and private enterprises. These are companies registered and operating in Pakistan, also having registered offices across the country. D-Tech enacted the role of a liaison partner to onboard these customers on the Zoom platform against commission-based incentive. All six of these organisations, including the Central Directorate of National Savings, IMAGE Garments, IBEX Pakistan, Benazir Income Support Program (BISP), RIPHA University, University of Sindh, and Sindh Education and Learning Department are currently utilising the Zoom service packages.

The four deals that followed after the successful onboarding of the Central Directorate of National Savings and Image Garments, were closed between January 2023 and June 2023. All four of these clients onboarded to utilise Zoom’s Contact Centre services. It must be noted that D-Tech is listed with Zoom as their sub-agent for handling these subscription packages, therefore Zoom has been utilising D-Tech’s services since August 2022.

D-Tech was to earn commissions on various accounts, in accordance with the “Zoom Master Agent – Spiff Terms and Conditions’ (“Spiff Terms”), ‘Zoom Contact Center and Zoom Virtual Agent Spiff Promotion’ and ‘Finance and Operations Policy for Zoom Partners”. Spiff stands for sales performance incentive fund formula, which is an immediate bonus given to salespeople as an incentive or commission for their services.

After Zoom gained global popularity during the pandemic, it launched a new product– the Zoom Contact Centre was the new service. Zoom required market penetration for the new offering, so they asked their existing partners in different regions to sell the call centre product in exchange for certain incentives. Zoom offered the service for free for the first year, however, it required clients to sign a three year agreement (PO).

Considering that the Business Process Outsourcing (BPO) industry in Pakistan was on an upward trajectory in 2021 and 2022, this market was a highly attractive one for Zoom’s new cloud contact centre product. D-Tech helped Zoom close deals with four clients for this new offering.

The agreement between Zoom and D-Tech for some clients was a one-time referral agreement (OTRA), therefore a one-time referral fee was to be paid for some customers to D-Tech. For new customers on-boarded by D-Tech, Zoom had agreed to pay SPIFF commissions, which would be calculated based on the annual recurring revenue (ARR) and incremental monthly recurring revenue (MPR) generated from these customers, and the contract term committed.

In order for these commissions to be

realised, D-Tech had to submit the signed POs to Zoom for the services sold to these customers, against which invoices were to be issued by Zoom. These POs and invoices were then used to calculate the commission payable to D-Tech.

Problems started arising when Zoom, according to the lawsuit, failed to meet its end of the agreement - some of these deals never got implemented and customers were never able to use Zoom’s services. D-Tech blames it was the responsibility of Zoom to provide them services. But because they didn’t, not only does this put D-Tech’s reputation with these companies in jeopardy, their commission payments are also in trouble.

Of the cumulative commission payment Zoom owed to D-Tech, $389,927 was released through a financial vehicle corporation (FVC). D-Tech claims that Zoom has yet to release payments worth $1,022,717. Moreover, the calculation method for these payments was never disclosed to D-Tech, which was another suspicious activity on part of Zoom.

When D-Tech had signed up customers to use the Zoom Platform and the customers paid Zoom for the subscription, D-Tech was supposed to receive a commission from these payments, as agreed. However, Zoom held back these commission payments, giving various excuses.

When D-Tech demanded the remaining payments, Zoom first caused delays and later refused to pay altogether. For a certain portion, Zoom informed that the funds were routed through its distributor (FVC)’ based in UAE, which remained withheld on part of the distributor. For another portion, it was communicated that the payment could not be released since the customers had not made those payments. The remaining portion was simply denied as never having accrued to D-Tech, which Zoom was able to do since they never disclosed the calculation methodology for Spiff commissions even with respect to the funds that had been released.

Moreover, the clients on-boarded with Zoom also informed D-Tech that the Zoom team never implemented the program as committed, nor carried out any follow up. This was the primary reason why the clients had not released all payments to Zoom, which Zoom then used as an excuse to withhold D-Tech’s money.

On another occasion, Zoom announced that a deal they had closed with IBEX, with the help of D-Tech, became Zoom’s first global highest sale of 2000 customers. Zoom then invited D-Tech for an award ceremony where a partner’s award was to be presented

to D-Tech. The CEO of D-Tech could not be present in the US to accept this award, however he joined the ceremony virtually. To make matters with D-Tech worse, Zoom cancelled the invite and announcement of D-Tech at the awards event. After this fiasco, and D-Tech consistently demanding its pending payments from Zoom, Zoom unexpectedly sent a ‘letter of audit’ to D-Tech.

Now Zoom had resorted to proper bullying, wherein it actively started trying to dissuade D-Tech from pursuing its right to demand the pending payments.

The lawsuit highlights Zoom’s alleged mistreatment and unethical practices, shedding light on the power dynamics between large corporations and their smaller partners. D-Tech’s lawyer stated, “Zoom’s behaviour towards our client is unacceptable and we will fight for justice on their behalf. No company should be allowed to use threat tactics and bullying to exploit their partners.”

This is what it all boils down to. D-Tech has filed the court case but it unlikely anything will ever come from it.

The lawsuit was filed against the Founder and CEO of Zoom Mr. Eric Yuan, Head of EMEA Zoom Frederik Maris and Head of Pakistan and MENA Zoom Mounir Rachi. The suit filed by D-Tech demands the court to hold Zoom liable to pay the $1,022,717 in pending commission payments and another $10,00,000 in damages for “breach of contract, and the loss of repute and goodwill caused to [D-Tech Consultancy Private Limited].” The suit does not mention the breakdown of damages and how it amounts to $10,00,000. Salman Ijaz, Partner at KhanIjaz Advocates, explained, “Damages are arbitrary, especially loss of repute and goodwill. The company can demand a certain price they believe such damages would amount to, however, the final decision lies with the court. At times the court will reduce the worth of these damages and order the defendant to pay a portion of it, while other times the defendants may have to pay what the plaintiff demanded.”

The case has been filed in Pakistan and D-Tech’s lawyers believe that since Zoom holds no assets in Pakistan, they have no obligation to show up to court or even defend themselves. The legal notice had been sent through FEDEX, and then a later serve was sent through the US embassy. Zoom has finally engaged a counsel in Pakistan, with Velani & Velani as Zoom’s legal counsel.

Zoom has not yet released a statement about the lawsuit. Zoom hasn’t responded to Profit’s request for comment. n

The tax authority looks to constantly squeeze the same sources of taxation rather than looking for newer onesBy Zain Naeem

It seems that Financial Year 2025 is going to be a mad scramble for revenues for the Federal Board of Revenue (FBR). With the International Monetary Fund (IMF) demanding a higher collection target, the FBR will look down the avenues of options that are present to it.

Considering the brain power at the FBR, it can be expected that some of the same sources of income will be squeezed further. Up till now,

some of the measures that are expected are aimed at salaried class, general sales tax, dividend and capital gains. Lo and behold! The same sources which are milked every year round.

In other words, more of the same that has been carried out in the past. It seems that the tax babus sitting in their air conditioned offices are looking to hand out the same treatment that they have done in the days gone by. Why are these sources always singled out? The ease that they provide. Under the Income Tax Ordinance 2001, the FBR has designated withholding agents.

The task of these agents is to collect tax on their behalf and then deposit it with the relevant banks. A swish of the wand and suddenly tax collections go up with little to no effort on the part of the tax walas.

Companies are mandated to cut salary at source which means the salaried class does not even get to see their whole salary. As these rates are changed at a whim, the company has no other choice but to apply the tax that is applicable to it. The plight of the salaried class has long been ignored as they are made target number 1

when any tax reform (read increase) is required.

Recently the Prime Minister did instruct the Finance Ministry to request the IMF to drop the proposed tax hike on salaried individuals. This would be a huge sigh of relief for everyone. However, the Finance Ministry has started considering these orders as more suggestions so don’t rest too easy.

The second easiest option is to increase the general sales tax that is charged. From a toffee to a life saving drug to a luxury car, all of these things are seen as being equal in terms of the tax regime and sales tax is collected from each of these items. Ismail Industries, for example, manufactures a pack of Cocomo. Regardless of the fact that it has 3 or 4 inside a packet, the company tags on the sales tax when it sells it to the wholesaler. As the packet of Cocomo goes from the wholesaler to a child or a childish adult, the sales tax has flowed upwards from the customer to the wholesaler that they had earlier paid.

The simplest job in this whole process is of the FBR. The FBR sees the total amount of Cocomo sold by Ismail Industries and then slaps the sales tax on that. This means that for every packet of Cocomo sold, the company is liable to pay the tax and then collect it from the other participants in the supply chain.

Why are these sources of revenues used? Well it’s the fact that they are automated, onerous to someone else and tax officers have to do the least bit possible in order to show an increase in their tax collection. They have to do so in order to justify buying plazas which cost exorbitant amounts of money on Main Boulevard Gulberg with the government footing the bill.

The last two sources that have been mentioned are strictly applicable to investors on the stock exchange. The attraction of these two sources is again the same. There are participants in the market who have to deduct and collect this tax and then show it as a part of tax collected by the government.

In 2011, the government came up with an application of Capital Gains Tax (CGT) in the stock exchange. The goal of this tax was not to limit or curb any behavior of the people. The purpose was to boost the tax collections by applying a taxation mechanism on another source of income that had been left untouched in the past. How successful has the system been?