07

08 Has UBL paved the way for other banks to maximize arbitrage opportunities?

07 This is the fastest growing sport in the world. Can it take root in Pakistan?

11 A policy abyss Ammar H. Khan

14

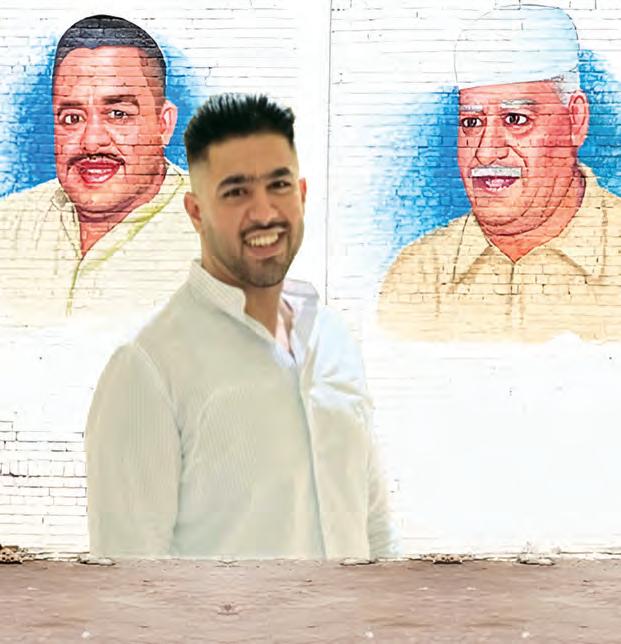

12 The Tragedy of the Truckanwalas

14 Time of Death: Pakistan’s Super-App Dream

16 How inflation killed Retailistan

18 With an eye on profits and a focus on sustainability, HBL launches agricultural subsidiary

19

19 Productive policies or PR fluff — How useful were the interim government’s IT initiatives?

23 The cost of non-renewable energy and missed opportunities– K-Electric’s failure to deploy renewable energy is expensive

23 Need raw materials? Zaraye hopes you’ll turn to them

Publishing Editor: Babar Nizami - Editor Multimedia: Umar Aziz Khan - Senior Editor: Abdullah Niazi

Sub-Editor: Basit Munawar - Video Editors: Talha Farooqi | Fawad Shakeel

Business Reporters: Daniyal Ahmad | Shahab Omer | Zain Naeem | Saneela Jawad | Ghulam Abbass | Ahmad Ahmadani

Shehzad Paracha | Aziz Buneri | Nisma Riaz | Mariam Umar | Urooj Imran | Shahnawaz Ali | Meerub Amir

Regional Heads of Marketing: Mudassir Alam (Khi) | Sohail Abbas (Lhe) | Malik Israr (Isb)

Pakistan’s

CON TENTS

go-to source for business, economic and financial news.

Profit Profit CONTENTS

#1 business magazine - your

Contact us: profit@pakistantoday.com.pk

23 23 08

08 12

12

Has

paved the way for other banks to maximize arbitrage opportunities?

The recent financials of the banking juggernaut unveil a significant risk appetite

By Ahtasam Ahmad and Mariam Umar

Pakistani banks have had a ball in the past one year with record profitability at the back of high-interest rates. The government’s never-ending appetite for deficit financing means that the local financial institutions have ample liquidity in the form of benevolent lending by the State Bank of Pakistan (SBP) aka repo transactions.

Profit has previously covered how Development Finance Institutions (DFI) like Pak Kuwait Investment Company (PKIC) and Microfinance players like U Microfinance Bank (UBank) have leveraged the current monetary and fiscal environment to increase the size of their balance sheets by 3-6 times.

Read: Grow your company size by 3 to 6 times in just months. At least two Pakistani companies have done this & you can too. Here is how

Little did we knew back then that one of the largest commercial banks in the country, United Bank Limited (UBL) would be inspired by this high-risk strategy and go all guns blazing in 2023 as a loaded investment entity.

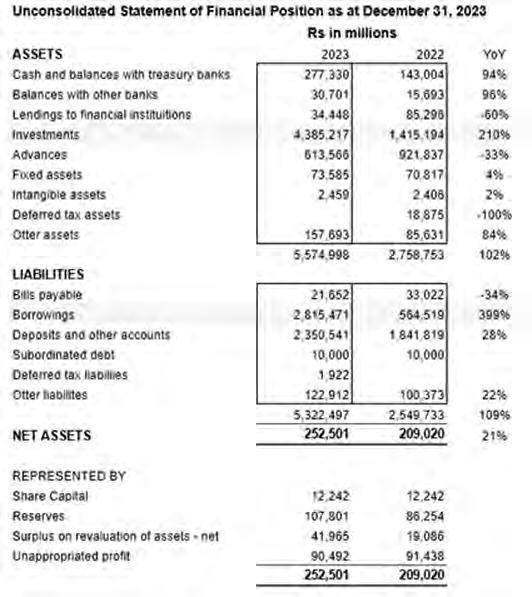

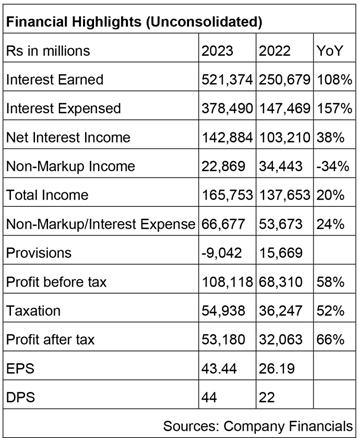

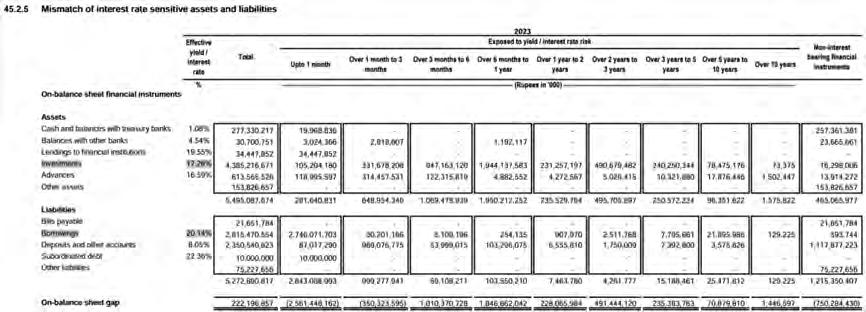

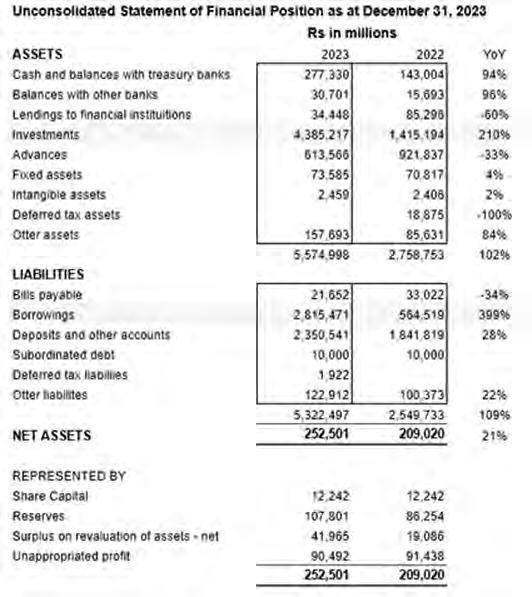

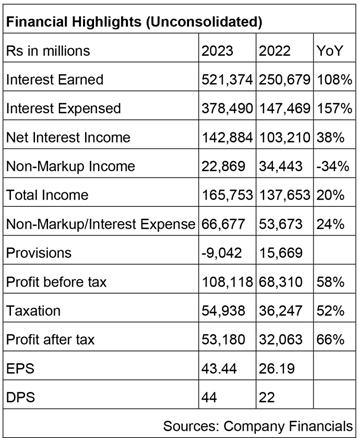

The quantum of investments by UBL skyrocketed, tripling from Rs 1,415 billion in 2022 to Rs 4,385 billion in 2023. The surge in investments outpaced the growth in total deposits, which stood at Rs 2,351 billion by the end of 2023, reflecting a 28% increase from Rs 1,842 billion in 2022. This brings the bank’s investment-to-deposit ratio (IDR) to 187%. During this period, UBL earned a net interest income of Rs 143 billion, showing a 38% year-on-year increase. And if that isn’t impressive enough, the bank’s profitability soared by 66% year-on-year, with a profit after tax of Rs 53.2 billion for the calendar year 2023.

Source: Company financials

What catches the eye is that the bank has excelled through a smart investment strategy, but is that the whole story or is there more

8

to it? Let’s delve deeper and find out.

Banking 101: building a “ Repo-tation”

As previously mentioned, 2023 was a great year for the banking sector, with several players posting record profits. This may seem like an anomaly, considering the previous year was marked by economic challenges and struggles for businesses. However, due to the nexus between the government and banks, commercial banks were able to weather the storm.

The nexus operates through a tripartite arrangement wherein the SBP lends to commercial banks to enhance their liquidity for purchasing government securities, effectively transferring the initial injection to the sovereign.

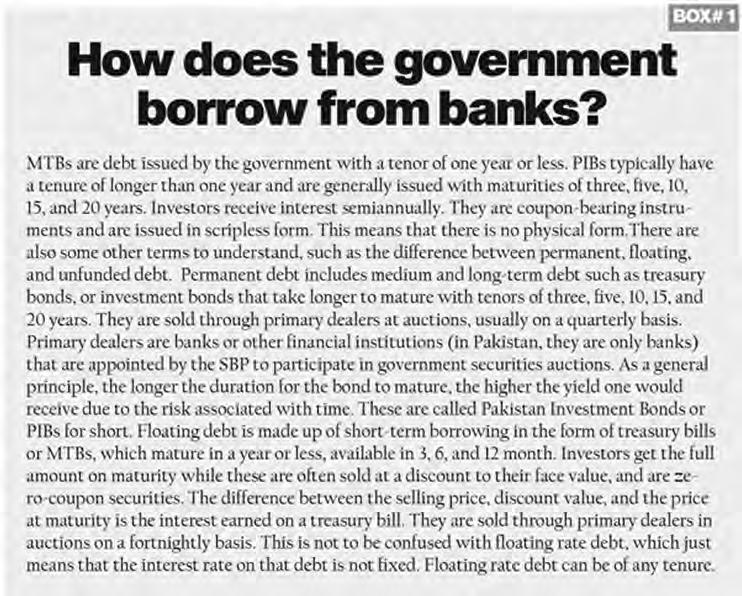

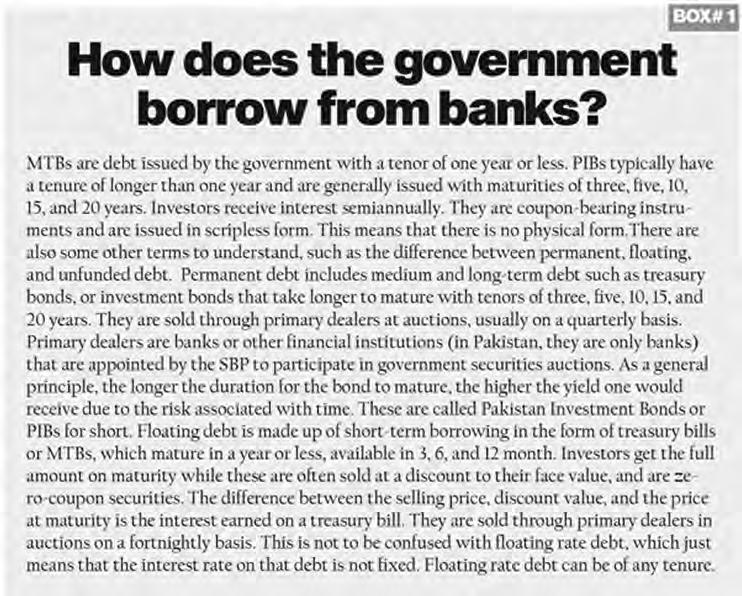

Central to this scheme are repurchase agreements, repos, or injections, a tool used by the SBP to manage liquidity in the interbank money market. In repos, the SBP (injects) lends money to commercial banks against eligible collateral. The banks then use this money to buy government securities like Pakistan Investment Bonds (PIB) and Market Treasury Bills (MTB).

The SBP earns interest on the money it lends, while the banks make a profit by charging a higher interest rate to the government. For instance, if the SBP lends money to banks at 21%, the banks can lend this money to the government at 21.5% or 22%, earning a spread of 0.5% or 1%.

A more comprehensive explanation of the latter part of this mechanism can be found in the following boxed item from Profit’s earlier feature, “Banks that don’t bank” authored by Ariba Shahid.

Note: DFIs are now also eligible to become primary dealers of government securities in Pakistan

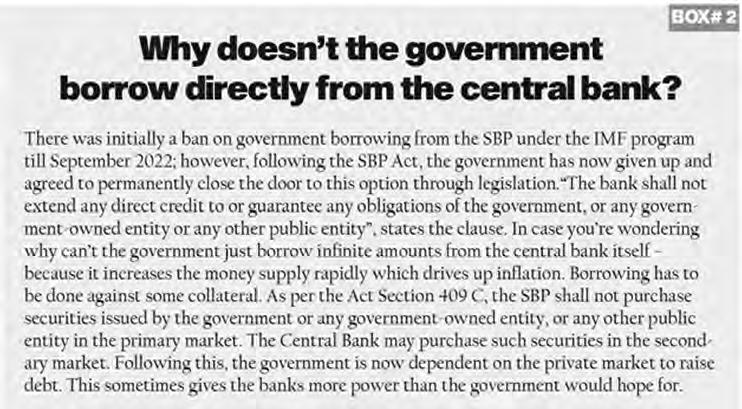

Before delving deeper into how UBL leveraged this scheme to its benefit, let’s address two very obvious questions: Why does the government need to borrow, and if it does, why not borrow directly from the central bank?

The government borrows money from banks to finance its fiscal deficit, which is the gap between its revenues and expenditures. This gap exists because the government’s expenditures exceed revenues, primarily due to massive interest payments, salary, and pension expenses of its employees, while low revenue collections keep the national treasury under pressure, leading to cash-strapped government borrowing from the banks.

As far as borrowing directly from the SBP is concerned, read box 2.

UBL’s playbook

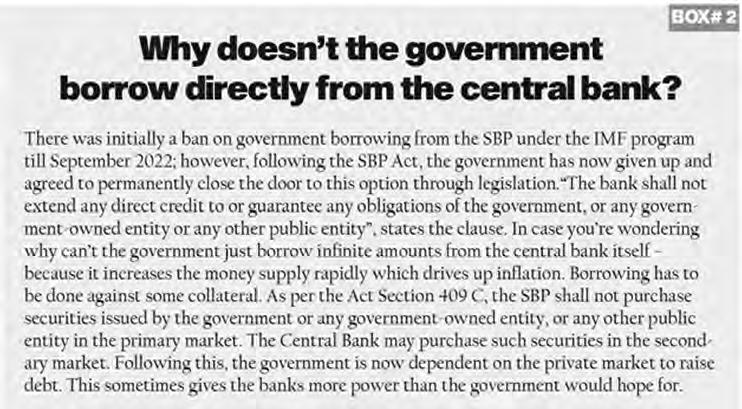

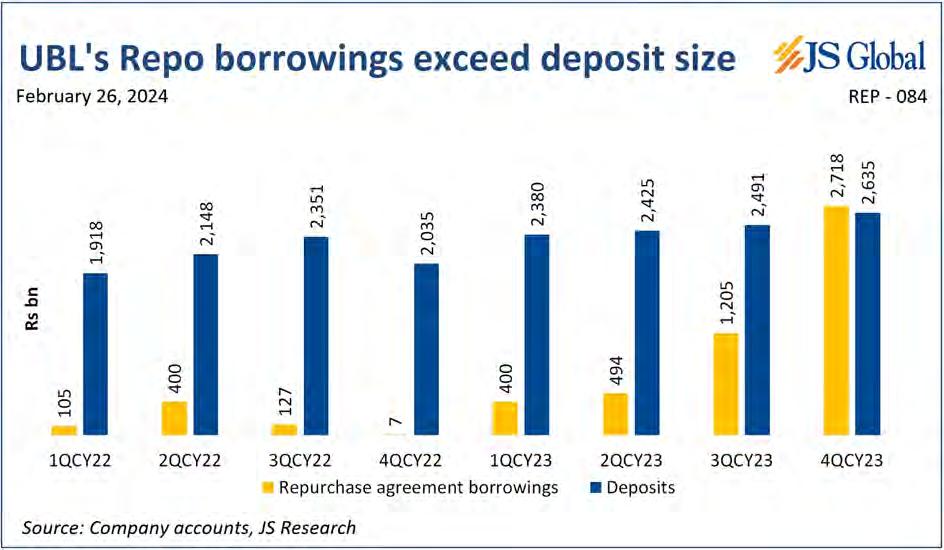

Aquick look at UBL’s financials reveals that the bank has significantly increased its investments at the expense of its lending activities. However, what may go unnoticed is that these investments are not solely supported by the bank’s deposits. Instead, a substantial portion originates from repo borrowings from the SBP.

The strategy is straightforward: the bank borrows from the SBP using government securities as collateral to finance additional purchases of government securities. These securities, in turn, serve as collateral to borrow

further, perpetuating the cycle.

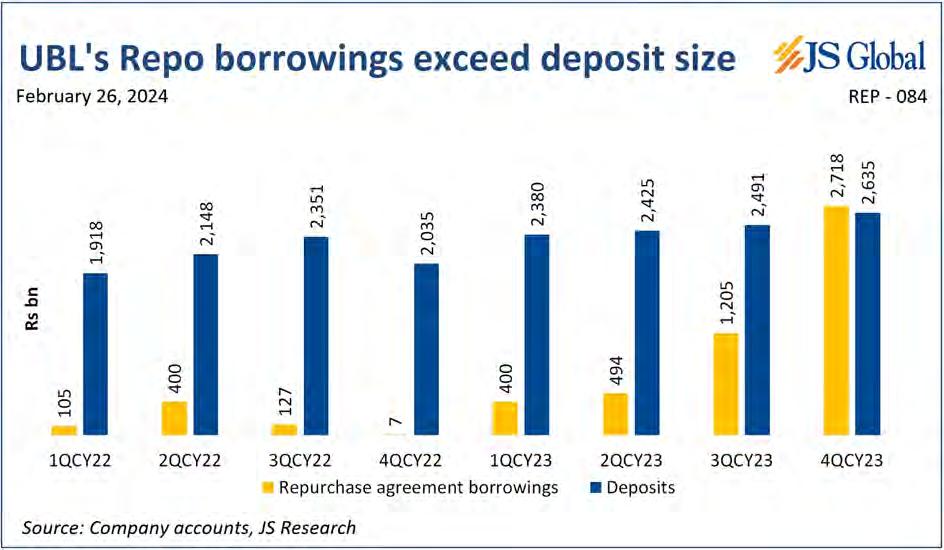

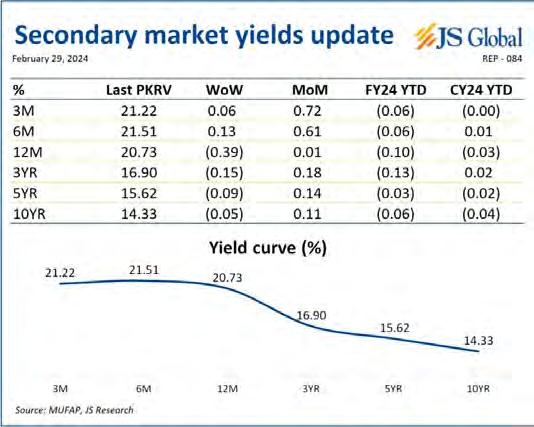

However, there’s a catch. The repo rate is tied to the policy rate (interest rate) set by the SBP. Although government treasuries are also significantly impacted by the policy rate, they are also influenced by sentiments in the secondary market.

The bank has been earning decent margins on these transactions as the government securities consistently yielded higher returns compared to the borrowing rate. However, recently, these yields have come down as the market anticipates a rate cut.

“This represents repurchase agreement borrowing from SBP at rates ranging from 22.04% to 22.06% (2022: 16.11% to 16.21%) per annum having maturity upto January 2024,” read a disclosure in the bank’s annual financial statement for 2023.

The risk for the bank lies in the expectation of rate cuts persisting while the SBP holds on to the current policy rate. This scenario could significantly diminish the bank’s margins and potentially turn them negative, especially

for certain tenured securities.

“UBL thought interest rates would fall drastically and the repo rates would come down while their T-bill investments would stay locked in at higher rates. This strategy has gone south because the T-bill rates have come down yet the repo rate, which is linked with the policy rate, is still high. So this is a

loss-making strategy now. A negative 1.5% cost of carry, if it continues, on borrowing of a trillion rupees for a year will result in significant losses that will show up in their profit and loss account in their June/December 2024 accounts,” remarked Naveen Ahmed, an investment banker and a development consultant.

The possibility of undesired interest rate movements has led to heightened market risk for the bank as evident from its Capital Adequacy Ratio (CAR) which has come down from 19.2% in 2022 to 16.6% in 2023, but is still significantly above the regulatory requirement of 11.5%.

Moreover, the bank’s leverage ratio has decreased to 2.46%, falling below the regulatory limit of 3%. The only reason this has not caused a panic reaction is that the SBP has temporarily permitted a relaxation for banks by reducing the leverage ratio threshold to 2% until December 31, 2024.

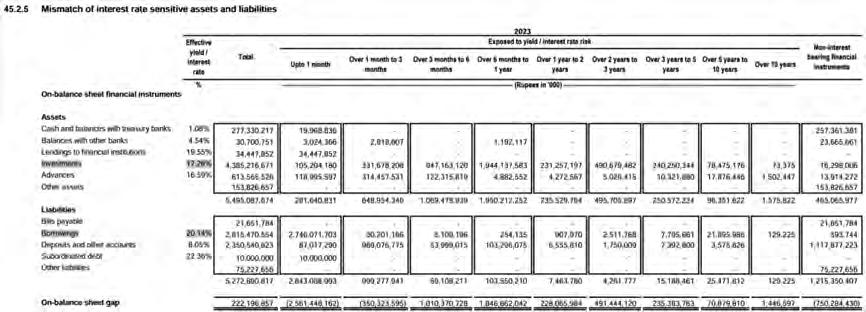

As per Saad Hanif, deputy head of research at Ismail Iqbal Securities, “If the bank’s investments are predominantly interest rate-sensitive while its borrowings are not adequately matched to these assets, it could face challenges in managing interest rate risk. For example, if interest rates decrease, the value of the bank’s fixed-income investments may decline, leading to potential losses or impairments. It suggests that the bank may face challenges related to interest rate risk management, which could impact its financial performance and capital adequacy.”

UBL’s play, though profitable, is a risky venture. If the borrowing through repos exceeds its deposits, various risks arise. The primary concern being liquidity, where an excessive dependency on repo borrowings in the absence of sufficient deposits may result in funding shortages and liquidity difficulties especially if UBL encounters hurdles in renewing or rolling over its borrowings.

Furthermore, there is interest rate risk

If the bank’s investments are predominantly interest ratesensitive while its borrowings are not adequately matched to these assets, it could face challenges in managing interest rate risk. For example, if interest rates decrease, the value of the bank’s fixed-income investments may decline, leading to potential losses or impairments. It suggests that the bank may face challenges related to interest rate risk management, which could impact its financial performance and capital adequacy

Saad Hanif, deputy head of research at Ismail Iqbal Securities

10

UBL thought interest rates would fall drastically and the repo rates would come down while their T-bill investments would stay locked in at higher rates. This strategy has gone south because the T-bill rates have come down yet the repo rate, which is linked with the policy rate, is still high. So this is a loss-making strategy now

Naveen Ahmed, an investment banker and a development consultant

arising from the disparity in maturity and interest rate profiles of repo borrowings and investments, potentially affecting profitability if borrowing expenses surpass returns on investments.

Yet, many analysts believe that UBL has capitalized on a significant opportunity to enhance value for its shareholders, considering the strategy a smart business move.

“The game is about the margins. All additional borrowing is done at a rate where the bank ends up making money on additional investments,” remarked Yousuf Farooq, director of research at Chase Securities.

So, if this is such a remarkable strategy why haven’t other banks followed suit?

There are multiple reasons for this as explained by Hanif, “Firstly, many banks exhibit a conservative risk appetite, preferring to avoid leveraging borrowed funds for investments due to the inherent risks involved. The potential losses from unsuccessful investments or adverse market conditions could outweigh the benefits, leading to a preference for more traditional and lower-risk strategies. Additionally, regulatory constraints play a significant role. Banks operate within a regulatory framework that imposes limits and guidelines on their capital adequacy, liquidity management, and investment activities.”

UBL’s strategy transitioned within the last 10-12 months. The most recent credit rating report for the bank is dated June 27, 2023, covering the financial period up to the first

quarter of 2023.

As per the report, until Q1 2023, UBL’s total investments portfolio followed its deposit growth trajectory, carrying on from last year where a significant increase in investments was funded mainly through deposits.

Further, the report highlights that the majority of UBL’s investments remained concentrated in government securities, accounting for almost 90% of its total investment portfolio.

The rating report highlighted that the bank was exposed to increased market risk, with around half of its PIB portfolio consisting of fixed-income instruments. Moreover, by the end of Q1 2023, the investment portfolio showed significant provisions for diminution across various categories. It was inevitable as the bank possessed fixed-rate securities in a rising rate environment.

the composition of PIBs held, which represent almost 43% of the total investments, has likely shifted, with a significant portion of the investment now allocated to floaters.

This might as well have been the eureka moment for the bank which triggered a strategy of aggressively leveraging the arbitrage available between borrowing rate and investment yields. Moreover, analysts suggest that

Further scrutiny of the bank’s strategy will occur following its analyst briefings. Analysts are anticipated to question the management regarding investment details, offering more clarity on the investment composition and the bank’s objectives.

However, it appears that the bank’s gamble is likely to pay off, given that the latest inflation rate for February 2023 clocked in at 23.1%, the lowest since June 2022. This development sets the stage for potential interest rate cuts in the upcoming months, beginning from March.

To sum it up, UBL has actually played smart, cashed on the opportunity provided and maximized shareholders returns. It is the government that has failed to ramp up its revenue streams and bridge the fiscal deficit. Banks are just taking a piece of the profits that are on the table. n

12

By Shahab Omer and Abdullah Niazi

By Shahab Omer and Abdullah Niazi

When the first shot rang out, most people thought it was fireworks.

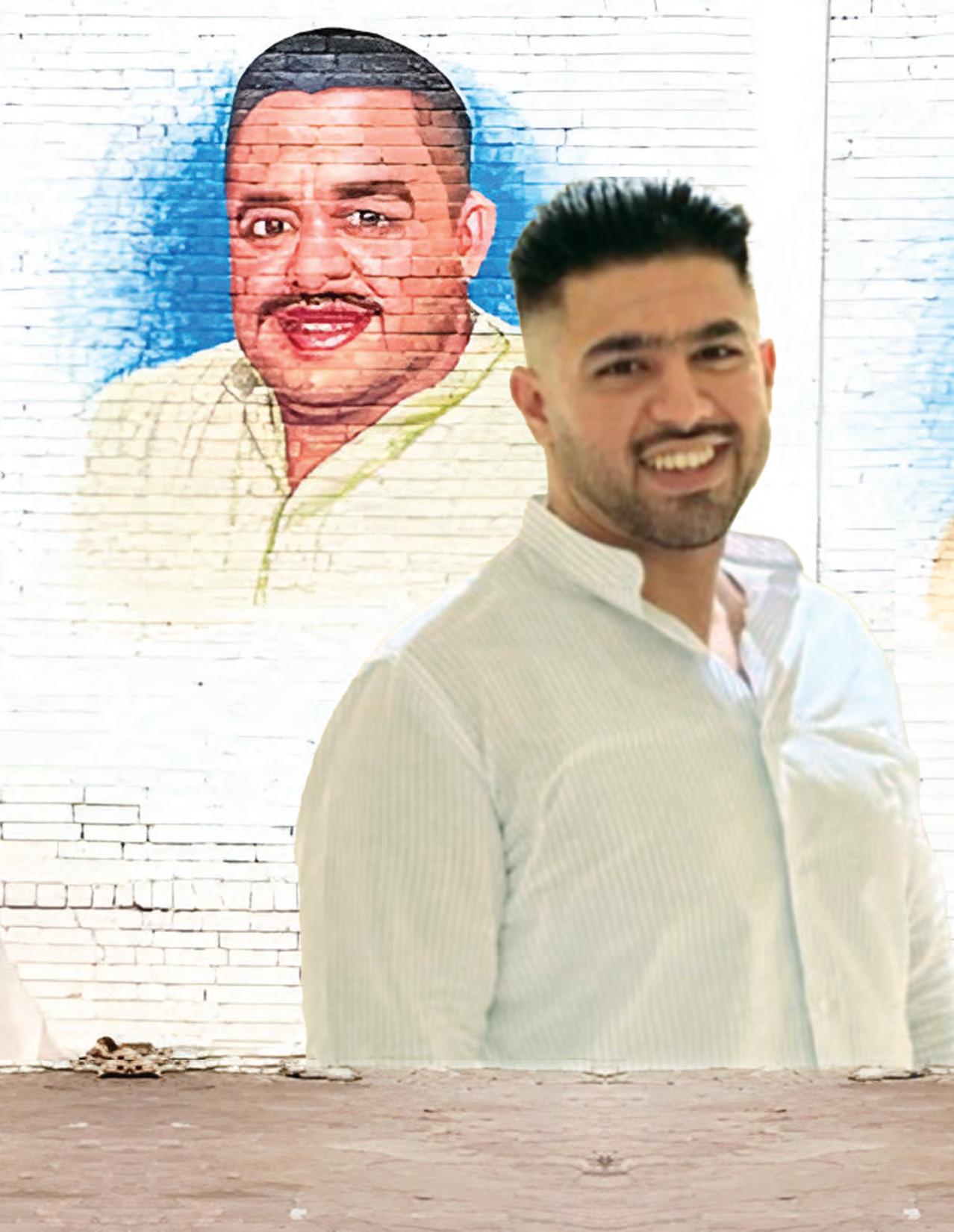

By the time the assassin’s fourth bullet thumped into Ameer Balaj Tipu there was pandemonium. One can only wonder what thoughts were going through the young crime boss’ mind as he slumped to the floor in the middle of a wedding.

Was he thinking of his father? How Tipu Truckanwala, famous for his booming laugh, love of pet lions, and steely gaze, was chased around the parking structure of Lahore’s Allama Iqbal International Airport before being gunned down in a hail of bullets? Did he think of how his father lay lifeless but breathing for two days at Mayo Hospital’s Intensive Care Unit despite six bullets inside him; the two dozen bottles of blood given to him by the doctors all in vain?

The Tragedy of the Truckanwalas

Three generations. Three murders. Endless blood disputes. What will become of Lahore’s criminal underworld after the murder of Balaj Tipu?

Perhaps he thought even further back, to the murder of his indomitable grandfather Billa Truckanwala. How the gigantic man from Ichraa had been gunned down near his Dera in the walled city whilst exiting his local masjid after the fajar prayer. Maybe the young Balaj wished that his turn had come at a similarly pious moment.

Or perhaps his final considerations in life were about the future. Were his two infant sons on his mind as he lay dying in a pool of blood? Did he wonder if years from now they would meet the same fate? The dying musings of Balaj Tipu will forever remain between him and his maker. By all accounts, the young scion of La-

hore’s most famous crime family succumbed to the bullets without uttering any final words.

The days since his murder have been marked by an eerie silence completely different from his father and his grandfather before him. No sprees of revenge shootings have been reported, and a blanket of silence has fallen over Lahore’s underworld. It is perhaps testament to the changing nature of criminal enterprise. After all, blood feuds are exhausting and expensive, and even gangsters have to worry about their bottom lines. But could this simply be the calm before the storm?

Already Balaj’s younger brother Musab

COVER STORY

has taken over the family’s Dera in the Walled City where lions roam freely. For three generations this Dera has served as sanctuary, courtroom, prison, and home all wrapped into one for the damned, the wicked, and the undesirables of Lahore. But perhaps more than anything else, it has also been a hub of business ranging from transport to security and extortion. Inextricably tied with this business of crime is a network of bureaucrats, senior police officers, and politicians that have at different points given this family their patronage.

To understand this web of violence, malfeasance, and blood rivalry we must go back to the very beginning. As far back as the birth of Pakistan, when Billa Truckanwala was what his name suggested — an up-and-comer in the transport business.

What in the truck?

The partition came and went for the Truckanwals rather uneventfully. Of course, in 1947 the “Truckanwala” moniker was still quite new. This was one of the many Kashmiri families that had made the walled city of Lahore their home. The Truckanwals were a family of pehalwans — traditional akhara wrestlers that wowed audiences with their might and rigorous training.

Billas’s father was one such wrestler and had trained his son in the art too. He was of the family of the Great Gama, and was as such also a relative of the family of Kulsoom Nawaz who would go on to be the wife of Mian Nawaz Sharif and first lady of Pakistan three times. But the tradition of wrestling was already on the wane by the time of partition. The sport had historically been alive through the patronage of Kings, Nawabs, and the aristocratic class of the Punjab. In Lahore, the Pehalwans of the Akharas had long turned to becoming enforcers and bone-breakers for businessmen in the Androon.

And while Billa had cut his teeth as a wrestler, his ambition dictated that he find a business of his own. As a young man, he shadowed a number of transporters and learned the networks of roads that were the lifeline of the domestic trade supply chain for Pakistan. Eventually, he began running his own transport routes. As a business, transport is perhaps one of the harshest businesses there is. Rivalries for control of routes are hotly contested and “addas” are closely guarded. New entrants into the business are often bullied and harangued with very little intervention available on a government level.

But Billa was not above getting his hands dirty. Big, burly, powerful and backed by a family of Kashmiri Pehalwans, Billa ran a successful goods transport business, managing a fleet of over three hundred trucks nationwide. Existing players in the market quickly made way for him after he gained a reputation for talking with his

fists as much as with his tongue. This is where Billa, whose father had first named him Ameer ud Din, first became known as “Billa Truckanwala”.

The Dera

The Dera of the Truckanwala family is hiding in plain sight. One only has to find the initial turn at Bansnawala Bazaar at Shah Alam Chowk (known to Lahoris as ‘Shalmi market’) and walk a straight path down this road towards Gawalmandi. This is at the intersection between Mayo Hospital and Food Street — the heart of what would eventually become the traditional garh of the Pakistan Muslim League Nawaz (PML-N). It is here through narrow winding streets that one approaches the Dera.

At the time, it was a large shady area with a house towards the backside and a vast space that could accommodate large gatherings. In the initial days, it served as a sort of aram gah for Billa’s drivers and business associates. Cups of tea and other drinks would flow freely, food was always available, hookahs blew like chimneys and in the centre of it all would sit Billa, resplendent on his colourful charpai with his iconic dhotis. In later years, he would start donning a prayer hat.

But the Dera served many functions. As a man of significant influence and sway in the region, Billa was often approached with pleas. Shopkeepers in the adjoining markets would come to him to settle disputes. At the time, the police were not where you went with your problems. You went to Billa. Your tenant isn’t paying his rent? Go to Billa and he will summon the shopkeeper and have him pay it. Your mamu isn’t giving your mother’s portion of the inheritance? Billa would have a word. Two neighbours are having a spat over some shared courtyard space? Billa would known exactly whose father had bought the property and how much of it belonged to who better than any

Patwari of Tehsildar in the country.

The Dera was equal parts headquarters and courtroom for Billa Truckanwala. For decades he operated from here as judge, jury, and when required executioner. Of course, he did not do this entirely out of the goodness of his heart. Billa was a businessman after all. And there was a small economy built around his Dera.

There are a few sources of revenue available in criminal enterprises of this nature. Billa’s were actually quite defined:

• The trucking business he had established for himself with hundreds of trucks which eventually became thousands. With an iron fist, Billa controlled his trade routes and was the man for the job for anyone that wanted their goods moved from one place to another with the assurance that they would get from Point A to Point B without any security concerns.

• Billa was also a property owner. He had shops and other small businesses set up all around the Shah Alam Gate and the Ichraa Bazaar. This not just brought him revenue but also planted him well into the markets. With his family members installed in these positions, Billa knew exactly what was going on and who, if anyone, dared to challenge his authority.

• Billa also provided arbitration services. Businessmen and residents alike came to him to help settle disputes. His dispensation of justice came at a small commission, and if Billa ever helped you, you’d be indebted to him forever.

• And then there was the classic source of revenue: Extortion. Billa and others like him call it protection money. Shopkeepers murmur the word “Bhatta’’ under their breaths. Everyone accepted the reality that to conduct business in peace, giving Billa his pound of flesh was the easiest way to go about things.

Of course the Dera did not operate in a vacuum. Where Billa was terrifying and dangerous, he was also charming and magnanimous. It is a painfully typical quality really for

14

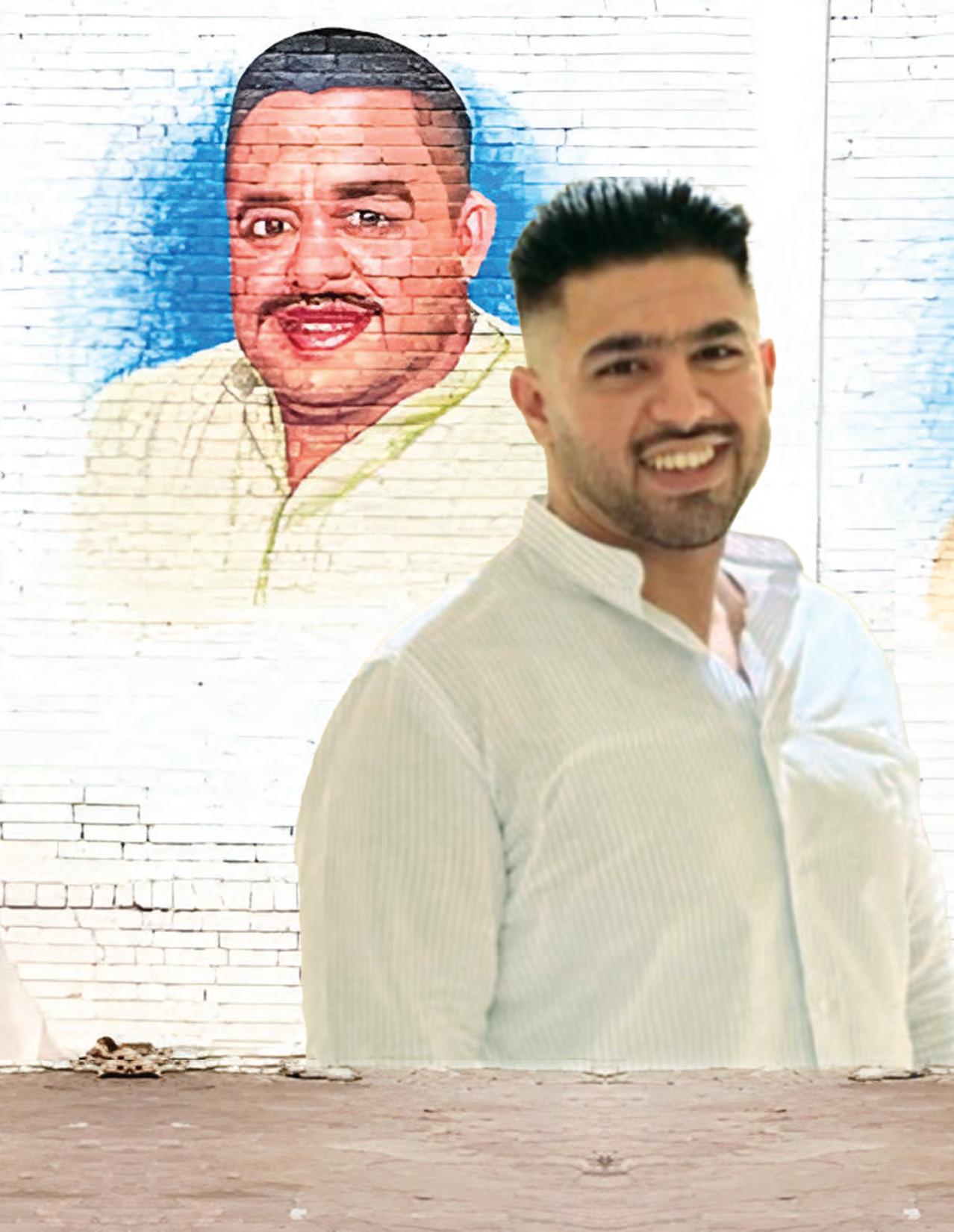

Balaj Tipu

crime bosses to have. It was not just gangsters and transporters that frequented Billa’s Dera. The police would often come to him for leads, tips, assistance, and yes, for bribes. At the same time, Billa was making political connections. Through his blood ties with Kulsoom Nawaz, he became an important campaigner for the then up-and-coming Mian Nawaz Sharif. The Kashmiri biradri in Androon was stronger than ever and Billa was one of its most illustrious sons.

By the mid 1970s, Billa’s Dera was a sight to be seen and it was very much a family affair. Billa’s son Tipu was his right-hand man, with father and son running the business side by side. But as Billa’s influence grew, so did the number of his enemies. Those unhappy with Billa’s power and his dispensation of justice were becoming vocal with their complaints. But there was more than one Truckanwala in town now. Billa’s son, Tipu, was far more aggressive and decisive than his older, more measured father. He had grown up entirely in the business of crime surrounded by his father’s henchmen. It would be Tipu who took things to the next level.

Billa’s business

Things changed after Tipu joined the family business. For starters, lions began roaming the Dera. In his time as crime boss and transporter Billa had made a lot of money. His son had expensive tastes, one of which was exotic animals. The lions changed the entire atmosphere of the Truckanwala business. And as per those close to Tipu, it was a very deliberate choice.

“When a person would come to the Dera now they would sit in front of either Billa or Tipu whoever was holding court that day. The lions, which Tipu had personally tamed himself, would circle the plaintiff. This was enough to strike fear into the hearts of any that might dare come to the Truckanwalas.”

The business was fast becoming more and more reliant on criminal elements. And perhaps nothing marked this transition more than the arrival of Hanif, commonly known as “Neefa”. The story goes that Billa’s Dera needed some work done on its boundary wall. As Billa’s influence had grown so had the threats and he wanted to raise the walls higher. The labourer that came to do the work was accompanied by his two sons Hanif and Shafiq. Billa was struck by the two young men. The wrestler inside them recognised their strong physiques and he requested the labourer to leave the two sons at his Dera to serve as bodyguards for his son Tipu, who had by now become known as a brash and reckless youth about town.

Up until this point Billa’s circle had largely consisted of his own family members. That meant Tipu’s power was restricted since

the family was loyal exclusively to Billa. Hanif and Shafiq gave Tipu muscle of his own. The two young men started carrying firearms openly and Tipu would saunter around with them by his side.

Aided by several employees, the brothers expanded their operations from rent collection to extortion, particularly targeting Shah Alam Market. This move cemented Billa Truckanwala’s control over the criminal underworld of Lahore. As Billa’s reputation and influence expanded, so did his entanglement in illicit activities, which inevitably led to a rise in hostilities. For all of this they were backed by Tipu. Billa was worried at the increasing trouble they were getting into with the police and the growing number of rivals that were popping up in response to these criminal business activities. At the same time he was pleased by the money all of this was bringing in. Business was booming after all. At his peak, Billa maintained control over local gangs and fugitives through his extensive network and numerous tenants. The only problem was that the violence they had inflicted to build this business was about to catch up with them.

Blood feuds

Tipu’s gunslinging methods were bearing great profits. The transport business was better than ever with a number of rivals mysteriously bumped off. On top of this, Billa’s cousin Kulsoom Nawaz was married to the Chief Minister of Punjab Mian Nawaz Sharif. As part of his election campaign, Billa had provided great support to the Sharifs and mobilised his forces to help him win his seat from Gawalmandi. In fact, Billa was an active campaigner for the Sharifs with whom he was on a first name basis.

But Tipu was also getting reckless. In around 1988, Tipu went with his loyal Hanifa to settle a matter of rent collection with a shopkeeper called Ameer ud Din. The fact that the old man shared a name with his father meant little to Tipu. Who fired the shots that killed Ameer ud Din is disputed to this day. But even Billa’s influence couldn’t save Tipu and Hanif from being put behind bars.

At this point Billa stepped in. The sense of honour among gangsters is rarely well developed and it is a world where it is every man for themselves. Using his contacts in the police, Billa had his son removed from the murder case Hanifa and his brother were sentenced for the crime, igniting a vendetta.

The incident proved a sobering moment for Tipu as well. His actions from this point onwards were more measured and he seemed to focus more on the moneymaking side of his father’s business than on lording his power over small shopkeepers and picking fights.

The Dera, however, had changed forever.

There were no longer the free flowing cups of tea and card games that it was once known for. It was now teeming not just with lions but with armed guards with the instruction to kill at the slightest provocation. While Hanif and his brother Shafiq rotted in jail and plotted revenge, another force was rising in the Gawalmandi area.

Khawaja Taarif, known as Teefi Butt, and his cousin Khawaja Aqeel, alias Gogi Butt, established a formidable reign of fear. The Butt brothers had once worked with Billa but as Tipu’s proclivities had asserted an environment of fear over Androon. The feud between Bilan Truckanwala and Tafi Butt started over a small plot near Mochigate and then the feud turned into a family rivalry and two big factions faced each other in Lahore. The Butts responded in turn, setting up their own gangs and carving out sections of the Gawalmandi area and in particular the Shalmi Bazaar.

There was now a rival Dera to the Truckanwalas and one that was behaving actively hostile towards them. Tensions rose more than a few times at the end of the 1980s and the early 1990s. There was one particular cricket match that proved to nearly be the spark that ignited a war. But by the end of the match men from both sides returned bloody and bruised only for Billa to announce a general pardon and truce.

Deeper issues of territorial dominance kept the animosity alive. The influence wielded by Teefi and Gogi Butt in Gawalmandi was so extensive that no real estate transactions could proceed without their approval, and they allegedly routinely extorted protection money from local merchants. But it would not all explode until the mid 1990s, when Hanif and his brother Shafiq were released from prison.

Bye bye Billa

In 1994 Hanif and Shafiq were released from prison and had one thing on their mind: revenge. At the time Billa and Tipu had security but still walked about time like normal people. After all, who would dare come after Billa Truckanwala? Who would want a blood feud with his gun-toting, lion taming son Tipu?

But their former men Hanif and Shafiq knew all of the ins and outs of Billa’s movements and Dera. Immediately after coming out of prison they allied with Teefi Butt’s company and with their blessing went after Billa. It happened in the wee hours of the morning in 1998. Billa, now of a distinguished age with thinning white hair and a wispy snow coloured moustache, was exiting the mosque after the morning prayer when Hanif and a number of armed bodyguards burst into his Dera and gunned down Lahore’s most powerful crime boss.

The incident drew the attention of Nawaz Sharif among other dignitaries and senior police

COVER STORY

officials who even attended the funeral of Billa. Police officers loyal to the Truckanwalas urged Tipu to let the murder go unanswered and let peace prevail in the city. Tipu Truckanwala was many things but he was also a devoted son that loved his father deeply. That he was murdered in his own home in cold blood was a personal and professional afront to Tipu. Maddened by his grief and egged on by his compatriots, Tipu launched a vicious campaign. This marked the onset of a relentless feud, with Tipu introducing the phenomenon of armed security in Lahore, ensuring his movements were safeguarded by a cohort of armed guards, effectively unchecked.

What followed were hit after hit between the two rival factions. At this point, Tipu’s personal life was taking a hit too. Back in the 1990s, Tipu had fallen in love with a woman in his neighbourhood. He had sent his mother on a number of occasions to her house and asked for her hand in marriage. The girl’s family were eventually impressed by the expensive gifts he would send her and married her off to Tipu. It is reported that on the occasion of his wedding, Tipu broke social convention by placing two 10 tola bangles each on both of his wife’s wrists in front of the wedding guests.

But with the murder of his father and increased need for protection, Tipu’s family could rarely venture outside their home out of fear of the Butt Brothers attacking them. As a result, Tipu’s wife reportedly became depressed. A family insider relates one conversation where Tipu very lovingly told his wife that he had enough money to bring her any wonder from the world and place it in front of her but only within the walls of his safehouse. His wife responded by asking if he could have an aeroplane land in the Dera and take them away to a different country.

Whether it was this that convinced Tipu or something else can be left up to the imagination. Over the years the Truckanwalas had made connections in Dubai as well and were frequent visitors to the Gulf. Around 2004 a significant attempt on Tipu’s life was made outside the Aiwan Adal, leading to the murder of several of his bodyguards. Among those accused were Gogi Butt, Teefi Butt, and the notorious encounter specialist Abid Boxer, though they were ultimately acquitted, with Mobeen Butt identified as the main perpetrator and arrested.

Around this time Tipu moved his entire family to Dubai and flitted between Lahore and the Gulf city himself. And it would be on one of these trips that the rivalry would see its bloodiest moment.

Tipu’s TIme

On the 21st of January 2010, Tipu Truckanwala landed at the Allama Iqbal International Airport in Lahore on his way back from Dubai.

The burly Tipu was alone when he came out of arrivals. His men were waiting outside to receive their boss and take him on to his Dera.

An unfortunate surprise awaited Tipu. Upon moving towards the parking structure of the airport, armed gunmen Khurram Butt himself along with a number of his supporters opened fire at Tipu. The crime boss was hit but not down. What followed was a messy chase around the parking lot which ended with Tipu being hit in the abdomen and left for dead on the ground.

He was rushed to Mayo Hospital. It took two days for Tipu to die with six bullets inside him. His son, Ameer Balaj Tipu, and the rest of his family arrived in preparation for the inevitable. Doctors pumped over 24 bottles of blood into Tipu who lay lifeless but breathing for two days before finally succumbing to his injuries. At the time, Tipu’s children were young. There was no one really to take over the business either.

This was a time when Shehbaz Sharif was the Chief Minister. As far as political patronage was concerned, it was known that the Truckanwalas were allied with Nawaz Sharif through Kulsoom Nawaz. However the Butt Brothers had actually managed to establish a relationship with Mian Shehbaz Sharif which in a way eliminated the influence that Tipu’s family held.

As a result, the business of the Truckanwala family suffered. The Butt brothers were able to take over a large chunk of the markets they once controlled. According to one family insider, the family lost nearly a quarter of their business at this point with a number of their enforcers breaking away and revenue falling significantly. The only saving grace was that Tipu had bought property both inside and outside Pakistan in his family’s name and set up legitimate businesses for them as well. As such, his family could very easily have closed up the Dera, moved away, and started afresh. But that was not the end of the rivalry. Because much like his father and grandfather before him, the then young and now murdered Balaj knew no other life.

The Prince returns

It seems that with every passing generation the Truckanwala boss gets younger and younger. Billa made it to a distinguished age before his son took over the family business as a young man. He spent over a decade as the head of the family before being murdered as a middle ager crime boss. So when his son Balaj took over the mantle and sat on his ancestral charpai at the Dera, he was barely into the first few years of adulthood.

Balaj had actually been studying abroad when his father was murdered and came back

to Pakistan to handle his family’s house of cards. Balaj was measured and mature for his age. Immediately he had the desire to strike a note of reconciliation. He was well aware of the carnage his own family had caused to the opposing side as well. Before he could get to this he had to consolidate his own position. With a twenty-something leading the Truckanwala family the Butts were sinking their teeth into Balaj’s territory.

Immediately, he went in a spree of recruiting gangsters and bolstering his strength. As time went on, it became clear that Balaj meant business resulting in the very tense rivalry becoming more of a Cold War. At the same time, it was obvious that Balaj needed some sort of political protection as well. The Butts had ingratiated themselves to the Sharifs who held political control at the time. Balaj also felt scorned by the Sharifs after none of them arrived at his father Tipu’s funeral and hadn’t come to commiserate with him either.

That is why he started cosying up with the PTI. Balaj was seen actively campaigning for the PTI for years, posting pictures with party flags and even meeting Imran Khan. In 2018, by the time the PTI came to power, Balaj had restored the family’s position and actually led an effort to bury the old rivalry with Teefi Butt. Balaj actually took the first step and acknowledged that his father and grandfather had gone overboard in the rivalry and wanted to finally bury the hatchet once and for all.

It was with all of these matters settled that Balaj was gunned down. That it happened at the wedding of a DSP’s son makes it all the more shocking. Many rumours have come out since then. The Butt Brothers have been named in the FIR for his murder and have since fled the country. At the same time, the Lahore police are scrambling to avoid any retaliatory attacks from Balaj’s younger brother. Whether the enmity will take another ugly turn or not is yet to be seen.

We started this story with three generations of murders. Bill, Tipu, and Balaj. But before these three, even Billa’s father, had been murdered as well. This is a tragic series of underworld killings that have continued across families and across generations. The seeds of these killings were planted more than six decades ago, several enmities were sown in the city’s neighbourhoods. Shortly after gaining independence, power struggles erupted in various parts of the city, witnessing bloodshed in different areas, including the historic walled city. These conflicts stemmed from disputes over land, personal grudges, clashes of ego, financial matters, and properties. The influence of political patronage weakened the enforcement of law in dealing with these enmities. And as another generation is set to take the mantle, one can only wonder with trepidation when the next murder will be. n

TEXTILES 16 COVER STORY

With an eye on profits and a focus on sustainability, HBL launches agricultural subsidiary

The first non-financial subsidiary of a bank to get approval from the SBP, HBL Zarai has already been approached by the SIFC and is set to work with the government of Punjab as well as small farmers

By Abdullah Niazi

Why is Pakistan’s largest bank about to get into the business of agriculture? And no, we aren’t talking about agricultural financing. We are talking about the bank opening a fully owned subsidiary whose function is providing facilities and services ranging from storage space and farming equipment to seeds, fertiliser, and agronomic advice.

Essentially, they are creating an agricultural consultancy that also doubles as a one-stop shop for the average farmer. But why now? HBL first announced their new company by the name of HBL Zarai back in July 2023. At the launch of their 2022-23 sustainability report, the bank’s President, Muhammad Aurangzeb, had received permission from the State Bank of Pakistan (SBP) to set up a special subsidiary to help small and medium-sized farmers improve their agricultural output.

The permission came as a bit of a surprise really. The central bank is nothing if not conservative, and this was the first time the SBP was granting permission to a bank to set

up a fully owned subsidiary that was involved in a non-financial business.

And that is really what is so strange about HBL Zarai.

The company, while owned entirely by HBL, is a completely independent entity. That means this is not a corporate-social-responsibility gimmick, but a company with its very own balance sheet. The idea behind HBL Zarai is that it will promote good agricultural practices and help farmers at a time when HBL is trying to ramp up their lending towards the agricultural sector. The idea is solid. Agricultural lending in Pakistan has remained low despite it being the largest sector of the economy. The little lending that existed to the agricultural sector was largely unhelpful because it was based on collateral, with banks rarely putting in any effort to understand the needs of farmers and designing products specifically aimed towards them. HBL Zarai is supposed to be part of a move to understand and serve the sector.

But there is a catch. To really make this work, HBL will have to make sure that the new subsidiary is not reliant on the bank and can prove that it has good business fundamentals. This is the only way that other banks will follow suit. How do they plan on doing so? By

their recently launched Deras set to be spread all across the country.

The lending problem

Agricultural financing in Pakistan has long been considered high-risk and has mostly been a collateral base. The issue has been that Pakistani banks have never really cared enough to try and understand agriculture. Think of it this way. Banks have branches in large cities. Over here, the business they get is for industries and other businesses that are more understood in urban centres. Meanwhile, there are very few bank branches in rural areas.

When a farmer walks into one of these rural branch offices looking for financing, they find there is very little leeway for what they can get. The bank might offer, for example, a loan that requires returning in 45 days. But this does not suit the farmer because his crop cannot be grown, harvested, and sold in the market in less than say 90 days. A loan under such conditions makes little sense for farmers. Adding on to this misery banks have often looked at farming and agriculture as a risky business. How will the bank collect its interest

18

The first thing is this is not CSR. We have given projections to the SBP as well and they have agreed that this has to be sustainable. We’re not looking at this as a big moneymaker, but we cannot have a situation where it is being treated like CSR.

The agronomy services are for small farmers but also for larger landowners. We are also doing international consulting for foreign clients as well coming into Pakistan and this will hopefully be a profitable venture

Muhammad Aurangzeb, President HBL

if a flood hits the crops or the weather means the yield is low? As a result of this most borrowing was based on skewed collateral.

All of this combined to mean that farmers, in particular smaller landowners, have not been able to access formal banking channels because they do not have much to put up as collateral, and also because bank repayment timelines are rarely catered to crop cycles.

As a result, lending to farmers remains low. In 2022 for example, according to a PWC study, allocation of loans to priority segments, namely Small and Medium Enterprises (SME) and Agriculture, has been relatively low, accounting for less than 8% of the total loans. Specifically, SME loans constitute 4.2% of the portfolio, while Agriculture loans account for 3.6%. Moreover, these penetration levels have been witnessing a decline over the past several years. This declining trend highlights the need for attention and support to bolster lending in these crucial sectors to foster their growth and development.

But this is a trend that has been changing now. There seems to be a realisation within banking circles that agriculture is a sector that needs to be serviced and brought into formal financial channels. Last year the agriculture

sector saw a 27.5% growth in agri loans, after the agriculture lending financial institutions disbursed Rs 1.222 trillion on account of agricultural financing during the first nine months (July-March) of this fiscal year.

HBL has been a leader in these efforts. The bank’s agricultural portfolio in 2022 hit an all-time high of Rs 50.6 billion. This increase came after a lot of conscious introspection. Back in June 2023 when the bank released its sustainability report, its President, Muhammad Aurangzeb, told Profit that as a bank HBL had realised it had to do a better job in understanding this potential customer base of farmers and agriculturalists.

“We are going into this with a lot of clarity and detail about why we’re doing HBL Zarai. And we will appreciate it if other institutions also go in this direction,” he said. “As you’ve said, even HBL has been missing a trick up until this point. Why weren’t we in dairy and livestock farming? And by the way, the repayment capacity is okay. There isn’t a higher risk of default or anything. It is about understanding better,”

That is all well and good of course. HBL wants to increase their agricultural lending and to help the process along they have set up

HBL Zarai — a company that will help farmers on their journeys. But what exactly is the plan to do so and how will the company work? According to the senior management at the bank and the new team of HBL Zarai, they will begin by taking their business directly to the farmers.

The HBL Zarai Dera

The 26th of February this year marked an important milestone in the history of Habib Bank Limited. It was the 20th anniversary of the bank’s privatisation. HBL was privatised back in 2004, when management control was handed over to the Aga Khan Fund for Economic Development (AKFED). One would have thought that the bank’s senior management would have marked the occasion at one of their new headquarters at Karachi, or their main office in Lahore, or perhaps at the iconic HBL Plaza on I I Chundrigar road out of a sense of nostalgia.

Instead, the bank’s President Muhammad Aurangzeb found himself at a brand new dera located in Burewala — a relatively small and agrarian Tehsil of the Vehari district in South Punjab. Known mostly for its most prodigal son, former Pakistan Captain Waqar

HBL is the largest bank in Pakistan with a lot of resources. But for this initial step to have an impact other banks must follow suit; it cannot just be HBL. And since these other banks have fewer resources, they will have to feel that this sort of service is profitable. The reason we gave the permission is that we sense this can be profitable and this is what HBL must do

Dr Inayat Hussain, Deputy Governor of the State Bank of Pakistan

AGRICULTURE

With the formation and launch of HBL Zarai, Insha’Allah, we will be able to host advisory and input services along with offtake and warehousing right at the farmers doorstep through Deras – dedicated distribution and service centres etched among the heart of the farmlands thus ensuring food security and income enhancement for the farming communities throughout the country

Sultan Ali Allana, Chairman HBL

Younus, Burewala has now become the location for the first HBL Zarai Dera in the country.

The dera itself is a red brick building with an office and an area to display farm machinery as well as storage space. “We could have had this launch at any of our offices. The reason for coming here is the same as why we’re doing this. We want to get into these villages and rural spaces and go to the farmers that might need help,” explains Muhammad Aurangzeb.

By providing access to essential resources and expertise, HBL Zarai Services aims to empower farmers and enhance productivity, efficiency, and profitability throughout the agriculture value chain. With a focus on sustainability and environmental stewardship, HBL Zarai Services seeks to promote responsible agricultural practices that ensure the long-term viability of farming communities and natural resources.

The business model

The goal from this point onwards, however, will be to scale HBL Zarai and make it a company that farmers can rely on. In an exclusive conver-

“The prime values that HBL Zarai holds will remain, raising farm yields and empowering farmers by increasing their income levels. We will be guided by our vision of ‘We are who we serve’

Amer Aziz, CEO HBL Zarai Services

sation with Profit, Muhammad Aurangzeb stressed that the company was not a CSR project and had to be based on strong business fundamentals.

“The first thing is this is not CSR. We have given projections to the SBP as well and they have agreed that this has to be sustainable. We’re not looking at this as a big moneymaker, but we cannot have a situation where it is being treated like CSR. The agronomy services are for small farmers but also for larger landowners. We are also doing international consulting for foreign clients as well coming into Pakistan and this will hopefully be a profitable venture.”

The indication is clear. The purpose behind HBL Zarai was to create a company that would aid in promoting agriculture in Pakistan and serve as a sort of respite house for small farmers. At the same time, the company needs to sustain itself and not become a burden for its parent company. It is a sentiment that was also echoed by Dr Inayat Hussain, the Deputy Governor of the SBP who was the chief guest at the launch of the Dera.

“We weren’t initially sure if a non-financial subsidiary should be established by a bank but we gave the go-ahead which was a first. I would hope that HBL Zarai becomes viable, credible, and reputable. HBL is the largest bank in Pakistan with a lot of resources. But for this initial step to have an impact other banks must follow suit; it cannot just be HBL. And since these other banks have fewer resources, they will have to feel that this sort of service is profitable. The reason we gave the permission is that we sense this can be profitable and this is what HBL must do.”

That is how Muhammad Aurangzeb and the team at HBL see the venture too. He indicated that HBL Zarai was ready to partner with anyone and was in fact also looking into certain projects with the Special Investment Facilitation Council (SIFC) which has

taken a keen interest in the country’s agricultural sector. “We have gone to Pakpattan and Sahiwal. We are talking to Faisalabad Agricultural University which is going to give us five sites as well. We are already poised to work with the government of Punjab as well,” he told Profit in an exclusive sidelines chat.

“We have already been approached by the SIFC with the view that if they give us sites we will work with them as well. Our financing will continue on the HBL balance sheet. Even Zarai aside we are expanding by going into livestock and dairy for example. What will happen now is that there will now be more cash flow lending.”

On the occasion of the ceremony marking the launch of HBL Zarai, Sultan Ali Allana, Chairman – HBL said, “We have been actively pursuing programs and introducing solutions for the growth and progress of the Agricultural Sector since the privatisation of the bank in 2004. Al’Humdullilah HBL Group today is the single largest institutional provider of financial services for this segment of the economy directly impacting over 350,000 farmers. With the formation and launch of HBL Zarai, Insha’Allah, we will be able to host advisory and input services along with offtake and warehousing right at the farmers doorstep through Deras – dedicated distribution and service centres etched among the heart of the farmlands thus ensuring food security and income enhancement for the farming communities throughout the country.”

Amer Aziz, CEO – HBL Zarai Services stated, “This unique venture positions HBL to play a leading role in improving value chains across every economically significant sector, thus fostering sustainable agricultural practices and promoting food security nationwide. The prime values that HBL Zarai holds will remain, raising farm yields and empowering farmers by increasing their income levels. We will be guided by our vision of ‘We are who we serve’.” n

20 AGRICULTURE

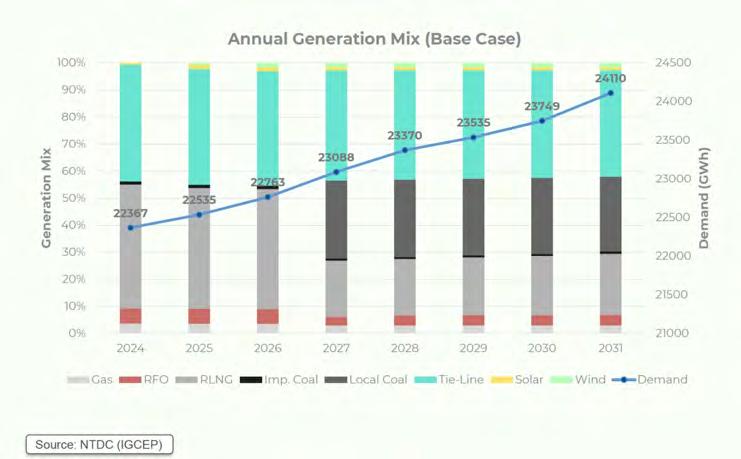

The cost of non-renewable energy and missed opportunities–K-Electric’s failure to deploy renewable energy is expensive

K-Electric could have saved over $200 million had it adopted renewable energy in its generation fleet

By Nisma Riaz

By Nisma Riaz

K-Electric is old enough to know better. It is, in fact, over a century old and has witnessed its fair share of ups and downs. Yet, its lack of foresight is astonishing. As the world shifts

towards sustainability and renewable energy, Pakistan is not even late to the party, it never made it to the party!

Pakistan’s sole vertically integrated power utility, K-Electric, remains reliant on thermal power generation. The country’s dependence on non-renewable sources stands in sharp contrast with the global trend towards

greener energy solutions. Renewables can offer a lifeline to developing countries like Pakistan, promising reliable and affordable access to electricity while mitigating the environmental impact of traditional energy sources.

But K-Electric continues to fumble the opportunities Pakistan’s high wind and solar resources have to offer. And missed opportuni-

23 ENERGY

ties don’t come without costs.

Renewables First (RF), an Islamabad based think tank, in collaboration with the Policy Research Institute of Equitable Development (PRIED) published a white paper titled, “Examining K-Electric’s Cost of Inaction in Deploying Renewables”. Using the insights from RF’s report, this article will take you through a journey of K-Electric’s phases of organisational development, strategic decisions, challenges, and the road ahead with renewable energy integration.

But before delving into the implications of K-Electric’s failure to adopt renewables and the potential of green energy to save the country’s energy crisis, let’s first recap the major events that took place at K-Electric in the last century.

From KESC to K-Electric

Back in 1913, in a small port town called Karachi, the Karachi Electric Supply Company (KESC) was born. Back then, Karachi was just a tiny fishing village, and not the metropolis that it is today. Fast forward four decades, in 1952, the government took over KESC so they could keep up with the city’s growing population.

Then in 2005, KESC was once again privatised, with most of the ownership going to a group from Saudi Arabia, while the government maintained a minority stake. The majority stake, 73% to be specific, was acquired by a consortium led by Kanooz Al-Watan of Saudi Arabia. Three years later, in 2008, The Abraaj Group took over 50% of the company and appointed Tabish Gauhar, a Karachi native in his late 30s, as CEO.

Over the years, different companies came and went, with new bosses and big changes.

Around 2013-14, to celebrate its centenary, KESC had a reinvention, with a new approach and a new name. The company became K-Electric Limited. In 2016, Shanghai Electric Power (SEP) entered a Sale and Purchase Agreement (SPA) with K-Electric’s holding company, KES Power, with the aim of acquiring up to 66.4% shareholding in the Company.

In August 2023, K-Electric once again underwent a change in ownership, however, this time a discrete one. Majority stakes were transferred from the Abraaj Group to AsiaPak Investments, based in the Cayman Islands, under the stewardship of Shaheryar Chishty. The new owner also happened to be the owner of Daewoo in Pakistan and mining rights in Thar Coal Block 1.

Today, K-Electric serves power across a vast 6,500 square km service area encompassing Karachi, Uthal, Bela, Vinder, Hub, Dhabeji,

and Gharo. Since its privatisation in 2005, KE has invested a staggering PKR 474 billion across the power value chain, as outlined in the Company’s Investment Plan 2030.

However, K-Electric has yet to adopt a cheaper and environmentally friendly source of energy, but it seems renewables are still not a priority for the company.

K-Electric’s Existing Power System

K-Electric is the biggest and only power company in Pakistan that handles everything from making electricity to delivering it to customers. According to the whitepaper, K-Electric’s current infrastructure is heavily dependent on non-renewable energy sources, with thermal power plants constituting 97% of its installed capacity. The utility serves over 3.4 million customers across a network spanning 6,500 square kilometres, with a total capacity of 4,485 MW, including imports from the NTDC system. The peak demand for fiscal year 2022 was recorded at 3,670 MW.

The company has expanded exponentially since when it was founded to lighten up the small town of Karachi.

Since privatisation in 2005, K-Electric has invested around 474 billion rupees in the power value chain, with a significant portion, approximately 204 billion rupees, directed towards generation functions. Over the past twenty years, K-Electric has made significant strides in enhancing its generation capacity, adding a substantial 2,132 MW to its fleet and doubling its power generation capacity since 2009.

However, something has still been missed. Even though growth is good, most of K-Electric’s expansion has relied on fossil fuels.

24

They have notably lacked substantial contributions from renewable sources, with only a modest addition of 100 MW of solar photovoltaic (PV) capacity under the Independent Power Producer (IPP) mode.

As a consequence, K-Electric currently relies heavily on imported electricity, sourcing nearly half of its 1,100 MW demand from the national grid. The remaining portion of its demand is met by K-Electric’s existing thermal generation fleet, which despite its reliability, comes at a considerable cost.

A cost that could have been reduced had K-Electric diversified its energy sources and embraced renewable alternatives to reduce its dependency on costly thermal power and bolster its sustainability efforts.

Let’s consider the potential and ease of integrating renewable energy in Pakistan.

Pakistan is sitting on a goldmine of renewable energy sources

According to the Pakistan Economic Survey FY22, Pakistan possesses a vast potential for generating electricity from wind, estimated at approximately 50,000 MW. These wind corridors are conveniently located in close proximity to K-Electric, particularly in Karachi and Balochistan.

Similarly, Pakistan also boasts a high solar power potential. Leveraging these abundant renewable resources to produce cost-effective power could alleviate the burden on consumers grappling with inflation. This would also strategically aid K-Electric in achieving its target of 30% renewable energy (RE) by 2030. On a broader scale, embracing renewables would also align with Pakistan’s sustainability

objectives.

Despite this potential, K-Electric’s current plans indicate a hesitance to capitalise on renewable energy sources, with approximately 50% of its future capacity additions projected to be fossil-fuel based. This is concerning to say the least because 97% of the company’s existing fleet already comprises thermal power plants.

Operating in a region rich in wind and solar potential, K-Electric’s utilisation of renewable energy remains minimal, with only 100 MW of solar capacity and no operational wind plants in its system.

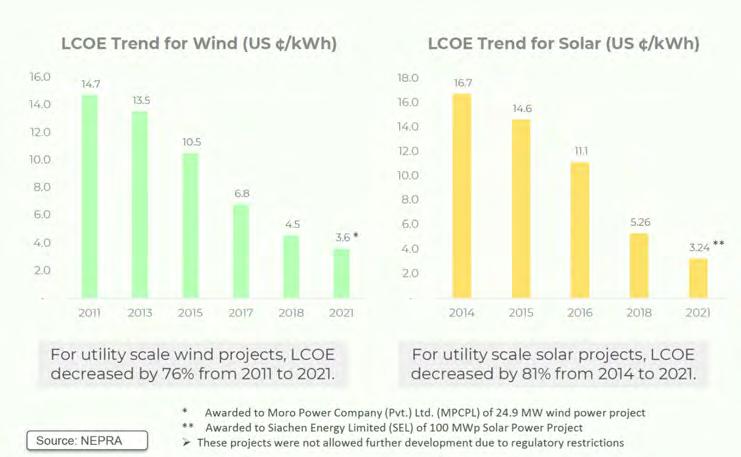

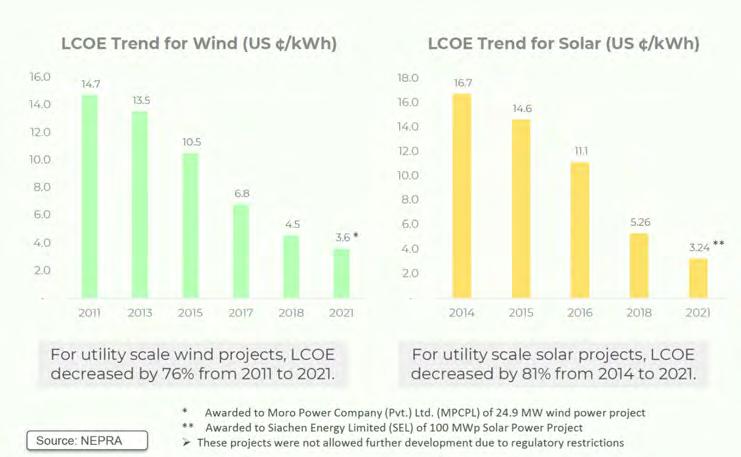

In the past decade, there has been a significant decline in the global Levelized Cost of Energy (LCOE) for utility-scale wind and solar projects, a trend mirrored in Pakistan with substantial cost reductions in renewable

energy (RE) sources. RF reports that specifically, levelized tariffs for wind energy have plummeted by 76% from 2011 to 2021, while solar photovoltaic (PV) projects have seen an even more dramatic reduction of 81% from 2014 to 2021.

Despite the favourable cost trends in renewable energy, K-Electric failed to capitalise on this opportunity, opting to remain reliant on fuel-based power generation. This inaction has led to financial losses for the company and increased electricity costs for consumers, unnecessarily burdening them.

Although K-Electric has set an ambitious goal of achieving 30% renewable energy by 2030, its projections for the FY 24-30 period, inclusive of hydro, fall short at 28%. The company’s plan lacks a specific target for reducing fossil fuel usage within its system, indicating a gap in its strategy. In a region abundant with wind and solar potential, K-Electric’s continued reliance on fossil fuel-based generation and emphasis on coal projects for future capacity expansions represent a missed opportunity to transition towards cleaner, sustainable energy sources.

Timely integration of renewable energy could have mitigated these issues and provided a more sustainable solution for K-Electric and its consumers.

The cost of K-Electric’s failing to integrate renewables

K-Electric’s has collected significant financial losses and missed opportunities from its decision to extend Power Purchase Agreements (PPAs) for two inefficient thermal power plants, Gul Ahmed and Tapal Energy, in 2019, instead of

ENERGY

integrating low-cost renewable energy sources. These plants, along with the Korangi Power Complex, have been operational despite their low merit order.

By not capitalising on renewable energy, K-Electric has incurred substantial costs for its consumers, amounting to up to US $204 million in fiscal years 2022 and 2023 alone.

Analysis conducted by RF and PRIED indicates that renewable energy plants could have replaced the generation of these thermal power plants without compromising system operations.

The report highlights, for instance, a 200 MW wind power plant could generate about 736 GWh annually, comparable to the output of these thermal plants. Similarly, a 200 MW hybrid power plant (3:1, wind to solar) could produce around 650 GWh per year.

A two-year lead time for the development of renewable energy projects was also considered in PRIED’s calculations. The scenarios factored in the replacement of thermal power generation by equivalent renewable energy generation, allowing substantial cost savings.

The white paper presented two cases.

The first case proposed adding 400 MW of renewable energy in fiscal years 2020 and 2021 combined could have resulted in savings of up to US $204.03 million. Similarly, in another case they showcased how adding 600 MW of renewable energy during the same period could have led to savings of up to US $253.03 million.

The projections emphasise the potential of K-Electric to prioritise renewable energy integration in its future plans, which would not only mitigate financial losses but also contribute towards a more sustainable energy landscape for Pakistan.

RF-PRIED’s Model for Future Power Expansion

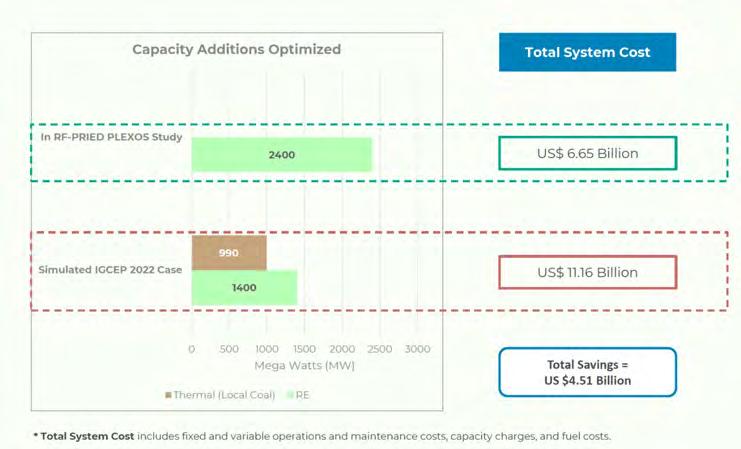

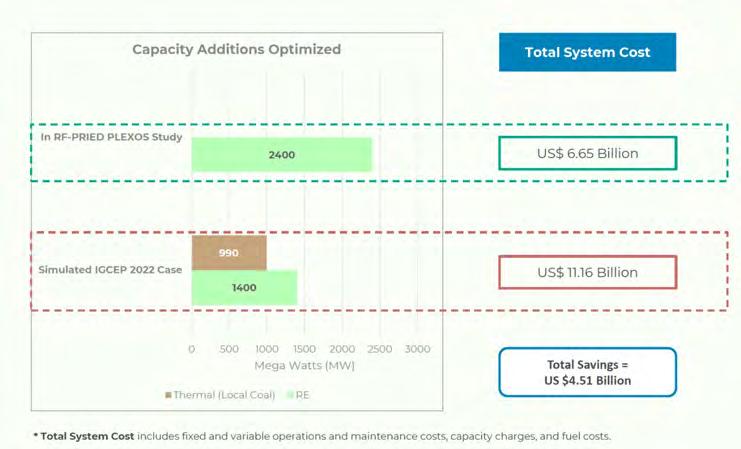

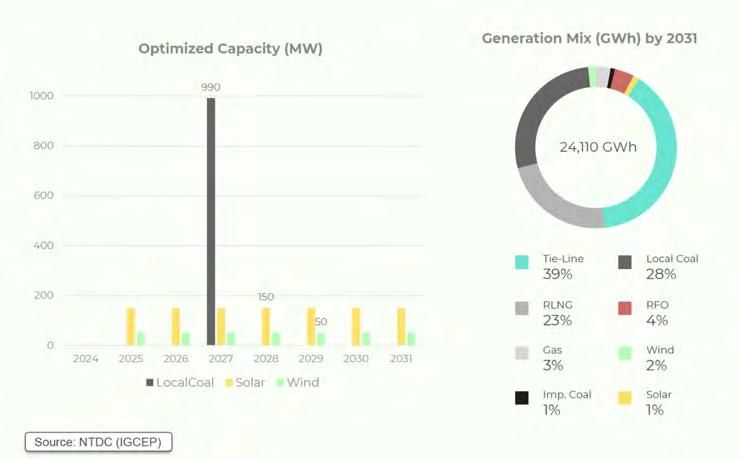

RF and PRIED presented a PLEXOS model-based analysis in its white paper, to assess the viability of K-Electric’s generation expansion choices. The analysis contrasted K-Electric’s planned capacity expansions against optimised scenarios favouring renewable energy.

Despite all this effort by external entities, can K-Electric do anything now?

Well, yes. The paper proposed the RFPRIED’s Model for future plans of capacity expansion.

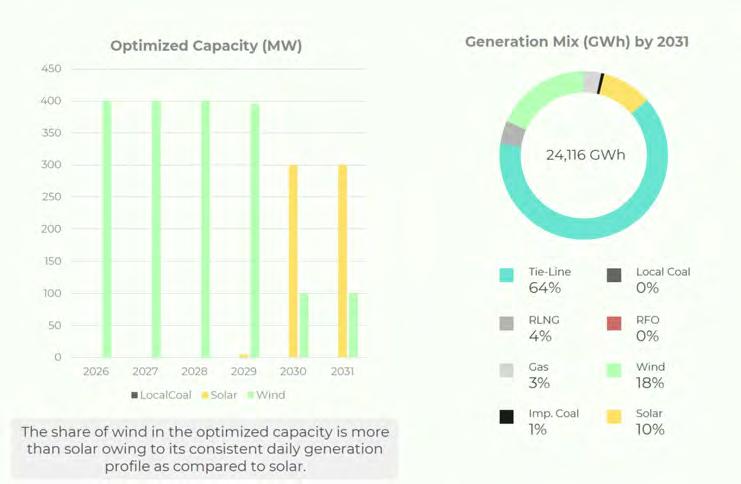

RF-PRIED’s alternative modelling approach advocates for removing caps on renewable energy capacity additions, demonstrating potential for K-Electric to save up to USD 4.51 billion from FY24 to FY30 by proactively integrating renewables into its system.

How?

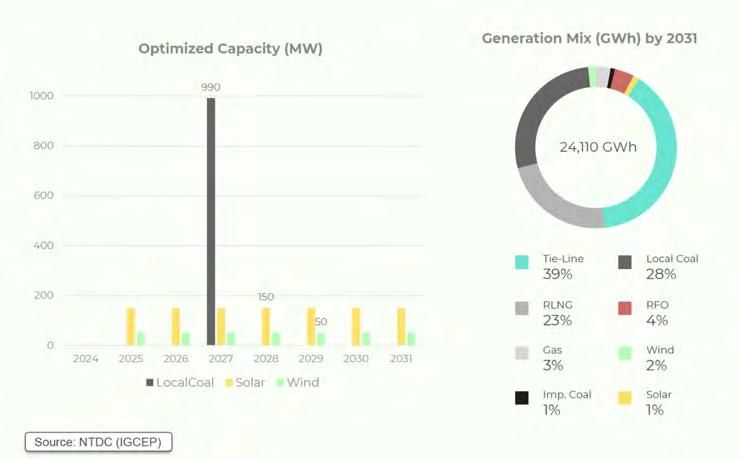

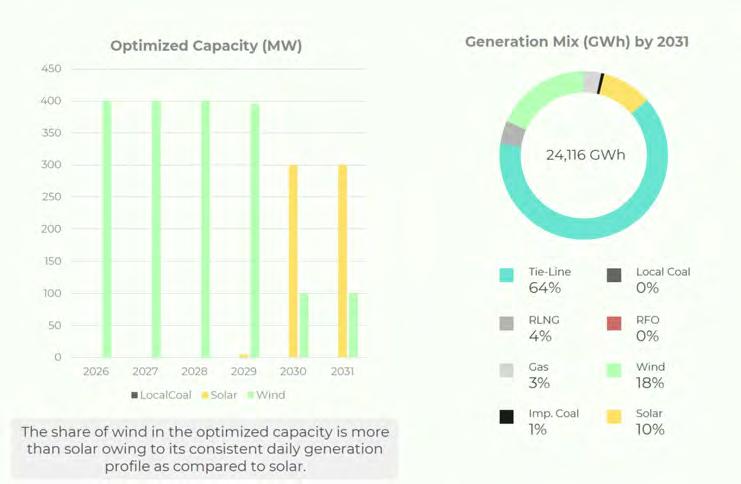

The study conducted by RF demonstrates how. It was observed that in the optimised capacity, wind energy surpasses solar by over 10%, benefiting from its consistent daily generation profile compared to solar. With the removal of the 200 MW capacity build cap per year for renewable energies (REs), no thermal capacity is optimised in the system. Solar and wind energy are consistently optimised throughout the study period based on leastcost criteria, resulting in a total optimised capacity of 2,400 MW for REs, evenly split between solar and wind at 1,200 MW each.

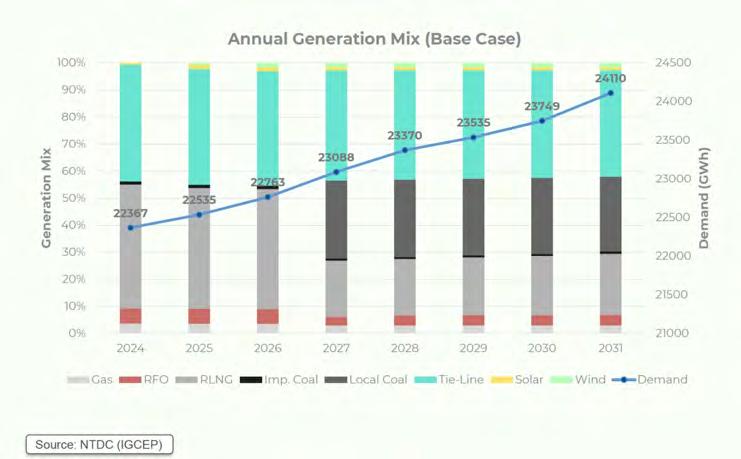

This optimization signals a notable shift in K-Electric’s system towards wind, solar, and electricity imported from the NTDC system, diversifying the generation fuel mix. By 2031, solar and wind collectively contribute 28%

to total generation and account for 38% of installed capacity.

Moreover, there’s a significant increase in the share of affordable electricity imported from the NTDC system, reaching 64% of total generation by 2031, minimising the need for new local coal plants.

The current overreliance on the national grid raises concerns about the affordability of electricity generated by K-Electric’s own system and questions the utility’s planning decisions. And this presents an urgent need for specialised research to investigate the implications of the supply from the national grid to K-Electric through the Tie-Lines thoroughly.

Can this potential translate into progress?

According to RF and PRIED’s analysis, a decisive shift towards renewable energy has the potential to enhance sustainability, reduce operational costs, and diversify the energy mix, making it less reliant on imported fuels.

This could be a chance for K-Electric to rectify its past oversights. Costly Power Purchase Agreement extensions have burdened the company financially, requiring proactive measures to alleviate future strains on consumers. And embracing renewable energy integration might just be the answer.

By leveraging optimization tools like PLEXOS, K-Electric can strategically integrate renewable energy into its system based on least-cost criteria. This shift towards renewables aligns with global sustainability goals and offers significant cost-saving opportunities.

RF and PRIED’s model forecasts substantial savings of up to 4.51 billion US dollars from FY24 to FY30 through proactive renewable energy integration. The report projects that solar and wind could collectively supply 28% of the total generation and 38% of installed capacity by 2031.

Finally, the report presented some strategic recommendations for K-Electric, including ceasing extensions in PPAs for costly thermal power plants, ensuring consistent integration of least-cost wind and solar projects, and avoiding new fossil-fuel-based generation additions. By committing to adding 30% renewables in its generation fleet by 2030, K-Electric can achieve sustainability targets and provide economical and reliable power to its consumers.

There is a much needed strategic shift, which not only aligns with global sustainability efforts but also promises significant cost savings and operational efficiencies for K-Electric, and a more sustainable future for the country. n

26 ENERGY

By Shahab Omer and Abdullah Niazi

By Shahab Omer and Abdullah Niazi

By Nisma Riaz

By Nisma Riaz