08 Fast, dependable and easy to use. Can SadaPay revolutionize the FinTech landscape in Pakistan?

14

14 A framing bias: Pakistan has finally clinched another IMF deal, but at what cost?

18

18 Who is Shaheryar Chishty and what does he want with K-Electric?

27

27 Spotify in Pakistan: Will Pakistani artists finally be able to make a living off their work?

Publishing Editor: Babar Nizami - Joint Editor: Yousaf Nizami

Senior Editor: Abdullah Niazi

Executive Producer Video Content: Umar Aziz - Video Editors: Talha Farooqi I Fawad Shakeel

Reporters: Taimoor Hassan l Shahab Omer l Ghulam Abbass l Ahmad Ahmadani

Shehzad Paracha l Aziz Buneri | Daniyal Ahmad |Shahnawaz Ali l Noor Bakht l Nisma Riaz

Regional Heads of Marketing: Mudassir Alam (Khi) | Zufiqar Butt (Lhe) | Malik Israr (Isb) Business, Economic & Financial news by 'Pakistan Today'

Contact: profit@pakistantoday.com.pk

Is the EMI model viable in Pakistan? SadaPay seems to think so but can they really have a meaningful effect on FinTech and the banking industry as a whole?

By Areeba FatimaIn the last two years, the State Bank of Pakistan has issued at least 12 different licenses for the provision of digital financial services. This license allows startups like SadaPay and NayaPay to establish an Electronic Money Institution (EMI). Among them, Sadapay stands out as a popular topic of conversation online and offline. Customers and competitors wonder whether Sadapay has managed to live up to its name.

What the SadaPay team has really done is distill financial complexity into a fun, interactive and an incredibly smooth process of participating in banking. However, the idea of financial inclusion and digital financial revolution in Pakistan goes way back and was definitely not pioneered by SadaPay - the question here then becomes, how to evaluate

Sadapay’s success in the FinTech revolution and what really can be said about the viability of this financial model?

Before we step into the FinTech world which is one of the most rapidly evolving industries in the country, we must clarify the assumption that Pakistan hopes to become a digital nation. According to the State Bank of Pakistan’s second quarter report for FY2023, there were a total of 1.1 million EMI accounts when only 4 EMIs had been given a commercial license to operate. This number has been growing rapidly since then.

SadaPay’s growth displays Pakistanis are interested in banking through SadaPay which as of 27 June 2023, had registered 2,988,007 sign-ups on their mobile application which means.. As the startup continues to gear itself towards accommodating each and every one of them, scaling up and not losing sight of the goal, the team has set up a very high bar for

other stakeholders to meet.

So what is attracting banking customers towards EMIs and most importantly, towards SadaPay?

Let’s go back a couple of years and then a couple more. As a first step in the direction of branchless banking and financial inclusion Telenor, Pakistan’s second largest mobile operator at the time purchased 51% stake in Tameer Microfinance Bank and launched a branchless banking joint venture called Easypaisa. It offered over-thecounter and mobile wallet facilities to its customers all over the country and began to be heavily utilized by the unbanked who had only recently left rural life and began struggling in the urban business centers of the country.

“Before Easypaisa was launched, truck drivers used to transport cash from village men working odd jobs in the cities to their families in rural areas. These truck drivers were eventually replaced by ‘agents’, who are able to validate over-the-counter easypaisa transactions from one city to another,” explained Amer Pasha, former head of Visa in Pakistan.

Several carefully explained video and print advertisements were circulated in the media but it took several years to shift consumers from over-the-counter (OTC) payments towards mobile wallets. According to the Financial Inclusion Insights study, by 2014, six years after Easypaisa was launched, only 0.4% of its total users were using digital wallets. This shows that the majority of Easypaisa’s customers preferred over-the-counter user experience via an agent.

Just a year later, 2015 marked the smartphone rush in Pakistan. Not that people had just started buying smartphones but that in an unfortunate but interesting turn of events, after the APS attack, Pakistan state and establishment renewed their fight against local Islamist militancy, a motivation which led to the decision of regulating the proliferation of illegal and untraceable SIM cards. The six terrorists who had carried out a carnage inside the vicinity of the Army Public School, Peshawar, were using cell phones which were all registered to one woman’s name who had no clear connection to the attacker. So the government issued a directive to all mobile companies to verify the owners of all the SIM cards they have issued so far - giving way to the existence of the most instrumental data for the purpose of digitizing the financial landscape of the country.

The auction of 3G and 4G spectrums a year prior in 2014 was also a significant and important development. Apart from raising $1.1 billion at the time, it opened the door for faster internet on mobile devices across the country. Overtime, the cost of mobile internet, more commonly called ‘data’ also reduced, making Pakistan a viable market for investment in IT-driven application companies. It would not

have made sense for companies like SadaPay or Foodpanda and the like to invest in a Pakistan that was still offering 2G mobile internet speeds in a 4G world.

“When we launched Easypaisa, the idea was for the bottom of the pyramid, which is not what NayaPay or SadaPay or the other EMIs are trying to do. Through our business model, customers were suddenly able to transact domestic remittances to hundreds of different locations within a matter of minutes. That was truly a financial revolution, we were helping move 6 to 7% of the GDP. A revolution is defined by tens of millions of people changing their behavior.”, commented Easypaisa founder Nadeem Hussain speaking to Profit

According to the State Bank of Pakistan’s second quarter report for FY2023, there are over 97 million branchless banking accounts in Pakistan (this includes Easypaisa and Jazzcash). Hussain also enlightened us on how exactly the railroads for the digital payments network of today were set by Easypasia in 2015 and later Jazzcash. “When the interior ministry issued the directive for mandatory biometric registration of issued SIM cards in 2015, we went back to the State Bank of Pakistan and we said if someone already has a biometric identification then why can we not open a limited Level zero account for this customer. And then by simply dialing *786# with your CNIC number, customers were able to open a Level Zero account. So that was the hard work put in by Easypaisa and Jazz paved the way forward for the digital nation.”

Level Zero accounts are ones that can get activated with the minimum level of KYC (know your customer). Accordingly, they also have the lowest transfer limit; Rs50,000.

A robust digital payments system is perhaps the most important building block in inching closer and closer towards a safe and secure digital economy. “Towards a financially inclusive digitized future, the most important building block is digital payments. Several actors including the commercial banks, regulators and lawmakers have to work together in an optimal fashion to achieve this goal.

Without a well-protected infrastructure for digital payments, there is no digital nation.” said Habibullah Khan, CEO and Founder of Penumbra Digital.

Founded by Brandon Timinsky who came to Pakistan first in 2018, Sadapay was granted the in-principle approval from the State Bank of Pakistan to launch their Electronic Money Institution (EMI) in April 2020. In just the last three years it has managed to provide services to over 500,000 customers and reached a valuation of $90 million within just one year of beginning operations. But what is the secret behind Sadapay’s success? How did it manage to attract and retain so many users in a highly competitive and regulated market with almost 3 million sign-ups?

In an economy that has become increasingly more difficult to participate in, Sadapay lets you create a digital wallet in 5 minutes of filling an online form and 1 business day with a card that’s acceptable everywhere MasterCard is. The company’s marketing and branding strategy combines innovative features, customer-centric design & user-interface, a referral system, and community building to create a loyal fan base and a strong brand identity. In June last year, Profit reviewed Sadapay and ranked its app as the best and the easiest to use interface. But despite that, the app didn’t make it to the top of our rankings because it did not have the features for utility bill payments and mobile top-ups. In 2023 Sadapay added these missing and necessary features.

“The country has a huge population of young people, everyone is already using smartphones, the 3G and 4G internet connectivity has been optimum, over 90% of the adults had biometric identity. At SadaPay, we have a team of 240 people with 90% of them being in Pakistan and we are not interested in expanding anywhere else, Pakistan is so big on its own”, commented Brandon Timinsky,

What’s interesting about the EMI business model is that banks have to pay thousands of employees in hundreds of branches just to sit and move paper around while they rely on outsourced vendors for their tech. They may update their app once every quarter but we do it five times a day

Brandon Timinsky - Founder Sadapay

Including the initial seed funding of $7.2 million which Sadapay raised in March 2021, its total capital reached $20 million in April 2022. With a staggering growth in the number of smartphones in Pakistan, the unbanked population has found a channel through apps like Sadapay, Nayapay and other EMIs to be able to participate in the economy.

Profit conducted a focused market-survey of Sadapay customers and we found that the majority of these customers were not exclusively using Sadapay and were primarily using their conventional banking accounts to collect their salaries, which they would later transfer into their Sadapay account to make transacting a smoother process. More than 70% of respondents claimed that their favorite feature about Sadapay is how quick and efficient the mobile app is compared to all other banks. Respondents highlighted OTP-fetching, simple security verifications processes and a seamless transaction experience which begins and ends within a minute, as the most important reasons for why they preferred the SadaPay app compared to other banks.

Timinsky is wildly optimistic about SadaPay and EMI’s position in the Pakistani market and especially about scaling it up. He welcomed the revision in the EMI regulations as well and believes that SadaPay’s strategy of targeting the Gen-Z and millennials of the middle income household demographic who are in possession of some disposable income is a workable one and a part of the market that could be acquired rather easily.

“The first problem we wanted to solve was about what young people want to do online. How we can make everyday transactions simpler, quicker and efficient. When we designed the app, we stuck with the parable that someone who is using a smartphone for the first time should be able to carry out a transaction with ease”, he explained.

As a happy customer and an industry expert, Habibullah Khan said, “SadaPay has single-handedly legitimized banking for the youth. Let me tell you this, the Gen Z and the

millennials, they are sick of the uncle hierarchies in the conventional brick and mortar banks. Even existing customers hate the soulless, kafkaesque environments of the banking institutions.”

Before SadaPay even received their EMI license, just by signing up over 50,000, people registered interest in the service before it was even officially launched.

“We were surprised to see hundreds of emails pouring in every day asking us when they will be getting their account numbers and debit cards and when will we officially launch. We didn’t know what to tell them because we were waiting for the license so we gamified our waitlist where one can move up the list by referring SadaPay to their friends, and we would reward them by moving them up the list and give those customers a black debit card saying "SadaPay Founders’ Club”. Instead of the standard teal card, instead of giving out Zinger burgers or paying people to sign-up, we just focused on making the product so perfectly seamless that you can not wait to tell your friends about it and it worked because we were seeing top decile activity and retention figures out of all the FinTechs in the world,” Brandon told us.

“And now we are able to clear the list every 3 to 5 days and then on average 50,000 people sign up again. But in total we will cross 3 million people who have signed up for SadaPay by the end of this month.” When someone signs up for a FinTech app, a majority of those who signed up disappear after the first month but Brandon TIminsky claims that at SadaPay anyone who has made two or more transactions through the app, there is a 70% probability of those people sticking with SadaPay until a year later.

And this is pretty much undeniable. SadaPay’s brand positioning and marketing mantra as articulated by their CEO has been holding up so far. The simplicity of the app and the speed of the transaction with which it goes through makes it incomparable to other banking apps. Most of the respondents to our survey said they use their primary banking

apps just to transfer their entire salaries into their SadaPay account and make transactions from there. And every one of our respondents has retained the SadaPay account ever since they first signed up.

SadaPay’s perhaps accidental marketing strategy was such that it leveraged young people’s feeling of missing out to get the most excited customers to sign-up first, these are customers who eventually became SadaPay brand-ambassadors or advocates since the very beginning, they were invested enough to refer the app to as many friends as possible to get a chance to use it before others.

“We are not paying people to join SadaPay but we asked them to refer it to their friends to be able to join sooner, so only the most excited customers got to join first and that meant that they became our ambassadors and advocates because they absolutely loved the product. So when you are able to foster superfans, then the brand can have lasting power.” said Brandon Timinsky.

Habibullah Khan described this phenomenon as the construction of a customer tribe. “SadaPay customer service has a 30-second response time where a very empathetic and aware representative speaks to you like a friend. I saw a screenshot where someone shared news about their break up with a SadaPay customer service agent and received life advice in return - you can never pay enough for moments like these to go viral. SadaPay essentially bridges the trust deficit created by these old banking uncles and works on the basic common sense that is driving empathy and empowering the user experience. First the gamification of their waitlist created the virality and buzz, positioning it as a cool brand to be associated with. On top of that they have the country’s best customer service which truly warrants the customer love that SadaPay gets.” said Khan.

The ultimate stage a brand can reach in terms of its branding style is when the customer becomes its advocate. Habibullah Khan not only showered the SadaPay team with praises but recalled several instances when the

HBL has set an arbitrary limit of sending 10,000 per day because HBL customers just started putting all their salaries in SadaPay and using it for transactions. How will this work if the SBP cannot protect these EMIs despite issuing the licenses?

Habibullah Khan, CEO and Founder of Penumbra DigitalAmer Pasha, Former Senior Director at Visa

team has directly helped him resolve financial disputes and carry out financial transactions. “There are two things about a FinTech that make or break it – how durable its tech is and how fast things can happen. In this age of 15-second TikTok reels, if the banking app crashes, you lose a customer. SadaPay has gotten a great CTO and built an in-house tech team from the ground up.” SadaPay has on boarded Jon Sheppard, formerly the CTO for Gojek in Indonesia, as SadaPay’s Chief Technology Officer.

It is indeed a remarkable feat to achieve the smoothness with which the SadaPay app runs and the selection of information that is shown on your screen at a particular time –unlike Easypaisa and JazzCash, the screen is never too crowded or too overwhelming or asking for too many pin codes or pass codes for various transactions and unlike the banks, the app never crashes and is always functional. With the recent revisions in the EMI regulations the wallet’s holding limit has been increased to 400,000 rupees and 1,000,000 for advanced digital wallets. Although this is great news for SadaPay, it has been noticed that major commercial banks like HBL have been throttling payments to SadaPay placing arbitrary daily limits on transactions. “HBL has set an arbitrary limit of sending 10,000 per day because HBL customers just started putting all their salaries in SadaPay and using it for transactions. How will this work if the SBP cannot protect these EMIs despite issuing the licenses?” wondered Habibullah Khan.

Considering the SBP’s favorable attitude towards digitization of the economy and the commercial banks’ rather ungraceful crackdown on mutual customers’ desire to transact through SadaPay, the question arises…

What if the banks one day wake up and commit to providing the same user experience as SadaPay for its customers.

This is a question first posed by Amer Pasha during our conversation, “If tomorrow HBL wakes up and their Product Head says you know what, we are going to improve our user experience and we are going to be at par with this SadaPay, NayaPay, then what are these Pays going to do? For HBL, it is just the last mile experience they need to work on.” Pasha believed that it was entirely possible for the success of SadaPay to urge commercial banks to inch closer towards improving their digital payments system. According to him, it is in the gaps in tech, where EMIs have a relative chance at success if commercial banks have erected themselves as competitors rather than collaborators.

“The real question is what is the viability and future of digital wallets as banks are improving more and more. HBL’s app has improved, UBL’s app has improved – a smarter direction to go in is to assess the feasibility of the merger of these two industries – what is SadaPay’s long term viability? The banks are no longer sleeping.” As Pasha posed this very pertinent but perhaps slightly rude question, we thought it best to consider a second and maybe third opinion on this note.

“This will never happen. The banks are run by uncles in hierarchical organization. You know culture always eats strategy for breakfast. These banks have intense bureaucratic muddles and are very unlikely to make the customers’ lives easier any time soon. Their tech is legacy-based, they can’t even update their apps in a timely manner.” said Habibullah Khan. “The intersection of culture and technology is where it is at.” he added.

Not surprisingly, Timinsky concurred Khan when he said, “What’s interesting about the EMI business model is that banks have to pay thousands of employees in hundreds of branches just to sit and move paper around while they rely on outsourced vendors for their tech. They may update their app once every quarter but we do it five times a day.”

But Brandon Timinsky also went farther when he expressed the one sure-fire way of success for all stakeholders is simply to

collaborate. “The EMI business model is that of a distribution channel, it attracts customers, creates scale and then cross sells different products and services. There are only certain things we can do, so if we want to launch a credit card we can collaborate with a bank like HBL and we would also like to do it with zero interest.”

His idea was that the EMIs’ future success and viability lies in solidarity because the customers will always have a primary bank so far as SadaPay is a digital wallet. “So even if we are just a payments app, it’s still a good business. And then it is important to remember that what we seek today for SadaPay is only a sliver of what will come through SadaPay in the future.”

An Oxford Internet Institute (OII) report ranks Pakistan 4th in the global digital gig marketplace, with about 8% of the total freelance work in 2017. Since then and especially post-COVID-19, the gig economy has grown. As of last year, 2% of Pakistan’s total workforce was engaged in the gig economy. In 2020, Pakistan generated $1 billion in revenues entirely from freelancing gigs. Pakistan’s digital gig economy growth was among the world’s fastest, with a 47% increase in 2019. These statistics very clearly show that Pakistan has an untapped potential for a freelancers boom if the digital payments railroad is stabilized. “The remarkable thing to note is that SadaPay has in fact caught on to this. They are trying to resolve the big questions around making this process smoother – How much do freelancers get paid? How do they get paid? How do I open a financial instrument outside Pakistan while being in pakistan? Sadapay is focusing on a more seamless experience, it is trying to do deals and collaborations with whether it is transfer wise or anyone else.” Amer Pasha told us. “

Before Easypaisa was launched, truck drivers used to transport cash from village men working odd jobs in the cities to their families in rural areas. These truck drivers were eventually replaced by ‘agents’, who are able to validate over-the-counter easypaisa transactions from one city to another

It is true that if one truly understands their customers’ experiences then they might be in the best position to create a profitable journey out of this understanding.

Brandon Timinsky himself worked as a freelancer in the gig economy for a couple of years with over 8000 paid orders to his name. Understanding the circumstances inside out, SadaPay has also introduced SadaBiz to cater to the gig economy. India’s IT boom began with their freelancers, their now $150 billion IT industry is supported on the shoulders of skilled workers earning through Fiverr and Upwork and eventually scaling up their operations. This is the inspiration for Brandon Timinsky, when he looks at the Pakistani freelancers market, still at its nascent stage.

“We could help with international payments for freelancers and give them the lowest cost and the best exchange rate – one of our shareholders also has licensing abroad so it is incredibly cost-effective for us to bring money into Pakistan.” said Brandon Timinsky while introducing SadaBiz. “You will be able to send a link directly to your client where they can make the payment from anywhere around the world while simultaneously avoiding any platform commissions.”

This indeed serves as a possibly very successful journey which SadaPay has embarked on but doubts around the venture’s scalability remain. Compared to the monster share of the market that the major banks own, SadaPay and other EMIs stand little chance of putting up a fight if a path to collaboration is not cleared by regulators and stakeholders alike. But is

anyone really trying to bank the unbanked? Or is that just a statement industry players like to throw around.

Major banks’ requirement of formal employment excludes a significant majority of Pakistanis with informal employment to be able to open bank accounts, let alone conduct digital transactions. Currently, their options are Easypaisa and Jazzcash because the education and awareness around EMI products has been restricted to target a certain class of young professionals who have disposable income and are likely to subscribe to SadaPay for the user experience.

Elaborating on this concern, Nadeem Hussain explained, “For Easypaisa we had 150,000 physical locations of Telenor where we could cash-in and cash-out, we also had 35 million customers who we could onboard, simultaneously we had a very profitable lending business at Tameer Bank which made a $12.5 million of pre-tax profit 6 years ago. But the payments business [the EMIs] need serious gains to become profitable, so if I had an EMI license today, I would follow the strategy that these young EMI professionals are following which means I can not take on the mantle of financial inclusion when I need to first ensure that my unit economics is perfect.”

“We have received offers and we have already said no. We have launched SadaBiz, we are looking to evolve and improve business banking in Pakistan, these things can keep us busy over the next 3 or 4 years. I will be very sad if SadaPay gets acquired. Everything I built before is small and silly. This is the first time tens of thousands of people have sent me personal messages saying thank you for doing this.” said Brandon Timinsky.

This should definitely put at ease the concern regarding SadaPay getting acquired eventually, however, maybe not completely. Another way forward could be the route to collaborating with or getting licensed to become – a Digital Retail

Bank (DRB). The State Bank of Pakistan has recently also issued 5 NOCs to Digital Retail Banks (DRB) – Easypaisa DB, Hugo Bank, KT Bank, Mashreq Bank, a subsidiary of the UAE’s Mashreq Bank; and Raqami, by Kuwait Investment Authority, which Nadeem Hussain is also affiliated with. “Most of these banks will be deployed between 1st and 2nd quarter FY24 and their true impact on the economy and pushing it towards digitization could only be judged in the 3rd or 4th quarters.”

The digital financial landscape of Pakistan is rapidly changing, DRBs have now been introduced and this has perhaps opened up a fresh avenue of collaboration with the EMIs. However, the major commercial banks’ response towards the small successes of EMI operations such as SadaPay makes one wonder whether a digital nation is even possible without the effective collaboration between multiple stakeholders.

Commenting on the commercial banks’ throttling of payments to EMIs, Nadeem Hussain said, “So this coalition needs to work and I think the commercial banks are being parochial and too cautious in their outlook with these arbitrary limits settings.” He added, “I think it is a combination of two things – one that banks are worried about AML and KYC requirements and therefore trying to be extra cautious so they are not penalized in the FATF world. And second is that they are simply not interested in facilitating the EMI regime. I can tell you when the digital banks come out, the first thing they are going to do is facilitate the EMIs which make sense and have gotten scaled, as much as they can.”

Pakistan is a difficult market, the regulators have their favorites and are saddled with nepotistic mind-numbing bureaucratic red-tape. Despite these extremely unfavorable conditions and a consistently deteriorating economy, start-ups are attempting to safely invest in Pakistan.

SadaPay’s success would not just be an indicator of Gen-Z marketing success but also it will make real the possibility that there is a sector, in this chaos, which can still make foreign investors the money that a market as big as Pakistan can make. “The EMI, as a business, should be focused on distribution and then partner with banks. The bank can be the manufacturer of financial services and then FinTech can be the distributor of these services and this can be a beautiful partnership.” said Timinsky. He told us that SadaPay is already working in close partnerships with Bank of Punjab and Bank Al-Falah among others.

The ultimate cohesion of this trifecta [commercial banks, DRB and EMIs] of institutions can potentially propel the industry forward in an extremely favorable direction for all stakeholders. n

An amended federal budget was passed in a hush and rush, to bag the IMF program. With the program approved, is the danger averted?

By Shahnawaz AliIt was fast, almost rushed, the way the federal budget was presented and then approved in the National Assembly on Saturday, the 24th of June. Stuck in the confusion of the already presented budget and budget measures, all the stakeholders received a shock when the finance minister pulled up a pile of papers on the Assembly floors that day.

The house that was supposed to accept or reject the deliberated and debated budget from 2 weeks ago, was suddenly presented with another one proposing Rs 415 billion in additional taxes, and a number of new expenditures. A proverbial gun of IMF prior actions, was held to their foreheads as they acted to scour through these documents. The present members, then, without an ounce of deliberation approved the budget. After that they ironically made their way to the airport where a special flight was waiting for them to perform the holy pilgrimage of sacrifice and devotion.

There were bound to be irregularities in a budget approved in the absence of an opposition and the actual president. But let us first see how this budget is different from the one presented a fortnight ago? Why was there a need for a change and will the objective be achieved if these changes are made?

Before the weekend had unfolded, the word on the block was that the IMF deal had fallen through. And it was not being said without due cause. After the budget was presented in front of the National Assembly on the 9th of June, the IMF representative for Pakistan, Ester Perez Ruiz, criticised the country’s budgetary preferences. She said that Pakistan is missing “an opportunity to broaden the tax base in a more progressive way, and the long list of new tax

expenditures reduces further the fairness of the tax system and undercuts the resources needed for greater support for vulnerable people.” The move was first followed by a stiff response by Ishaq Dar but in a later statement the government ensured that they would listen to the IMF.

But why is the IMF’s take on the budget important? To begin with, Pakistan has accounted for a huge amount of aid in both the versions of the next year’s budget, a majority of which is predicated on the Fund’s disbursement of its extended fund facility. If the IMF doesn’t mark a check on Pakistan, Pakistan’s bilateral creditors also would not come to our aid, as has been made clear.

Talking to Profit, Senior business journalist Khurram Hussain said that, “Pakistan possesses $4 billion in foreign exchange reserves and $4.7 billion in debt servicing payments between July and December, presuming all rollovers transpire smoothly”. He continues: “If we sustain a zero current account balance, signifying no inflows and no outflows of foreign exchange, then we will exhaust our foreign exchange reserves by or prior to December. The sole method to circumvent this is to get a bailout of somewhere between $4 billion to $5 billion in the ensuing few months.”

To orchestrate that amount without the IMF is almost unattainable under Pakistan’s current credit ratings. This rudimentary mathematical exercise is also predicated on the assumption that Pakistan receives rollovers for its bilateral obligations during this time.

One of our sources on the subject of anonymity added that the IMF wanted purview on the budget to ensure that it would incorporate debt servicing over the next two quarters and that one of the primary reasons for their disapprobation is that the presented budget did not account for this.

A week before the federal budget was presented, Senior Advisor to UNDP Pakistan and former Minister of State, Haroon Sharif, while talking to Profit said that “We don’t

have an alternative to a longer term IMF program in the coming years. And if you need that program, the budget needs to be signed off by the fund.”

It was expected that the federal government would approve the budget before Eid, but such an extent of amendments was not foreseen. The government seems to be on a full path of commitment as it tries to do good with the IMF before Eid as well. And it finally happened. The step that had taken Pakistan months of deliberation, when the time came, got taken within a week. The restrictions on imports were lifted, taxes were hiked, the budget was changed, presented and approved, and finally on the second day of Eid, the IMF announced that even though the previous extended fund facility would not be extended, the fund would give Pakistan another $3 billion dollar worth of a short term loan program.

While the IMF has provided respite to the current account’s crises with its announcement, it is important to have a look at our primary account that was changed for this deal. The government has set a new revenue target of Rs9.415 trillion for the Federal Board of Revenue (FBR), indicating an increase from the earlier target of Rs 9.200 trillion. The provincial share is also expected to rise from Rs 5.276 trillion to Rs 5.390 trillion in the upcoming fiscal year. To mitigate the impact on development budgets, salaries, and pensions of federal government employees, the government plans to reduce running expenditure by Rs 85 billion.

The ministry of Finance believes that the additional taxes, combined with expenditure adjustments, would lead to a reduction in the overall budget deficit. The measures, amounting to Rs 300 billion (Rs215 billion from taxes and Rs 85 billion from expenditure cuts), are expected to alleviate the deficit burden.

To achieve the revenue targets, the government has passed a revised version of the Finance Bill 2023-24. The bill proposes a number of measures despite the ones that were initially proposed in the Finance Bill 2023-24, that was presented on the 9th of June. These revised measures include:

• Increased Tax on High-Income Individ-

uals: Individuals earning above Rs2.4 million annually will face an additional 2.5% tax.

• Federal Excise Duty on Fertilisers: A 5% Federal Excise Duty has been imposed on fertilisers.

• Property Transaction Tax: A 1% increase in tax on the sale and purchase of property has been introduced.

• Progressive Super Tax: The super tax has been made more progressive, now applicable to all sectors or categories rather than being confined to only 15 sectors. The tax rates range from 1% to 10% based on income brackets.

• Advance Adjustable Withholding Tax: Non-Active Taxpayer List (ATL) individuals making cash withdrawals exceeding Rs 50,000 from banks will face a 0.6% withholding tax, aiming to promote economic documentation and broaden the tax net.

• Withholding Tax on Bonus Shares: Shareholders will pay a 10% withholding tax on bonus shares issued by companies.

• Windfall Gain Tax: A proposal for windfall gain tax has been included in the Finance bill, targeting sectors that have earned exceptional profits due to external factors.

• Energy Inefficient Fan Tax: A Federal Excise Duty of Rs2,000 per fan will be applicable on energy inefficient fans from January 1, 2024, with the intention of promoting energy efficiency.

Apart from the newly made changes in the finance bill there are also a number of other taxes that were a part of the government’s plans of an already ambitious Rs 9.2 trillion target.

JS Global’s recent report reveals a forecast for Pakistan’s non-tax collection in the upcoming fiscal year. This collection is projected to skyrocket, almost doubling compared to the

If we sustain a zero current account balance, signifying no inflows and no outflows of foreign exchange, then we will exhaust our foreign exchange reserves by or prior to December. The sole method to circumvent this is to get a bailout of somewhere between $4 billion to $5 billion in the ensuing few months

Khurram Hussain - Former editor Profi

previous year’s revised base.

In the front line of these revenues is the State Bank of Pakistan (SBP) profits, set to unleash an awe-inspiring triple-fold increase in profits year-on-year. It seems that the SBP has been piling up repurchase agreements at high interest rates. No wonder that the SBP profits in the last fiscal year matched the levels of their nine-month performance from the previous fiscal year. Attributed to the enormous policy rate that is currently in effect, the SBP has all the reasons to expect high profits.

But that’s not all; the government is set to project another boost in revenue, this time coming from the petroleum levy. A mind-boggling 60% YoY growth in this sector has been predicted based on the new finance bill. Even if the growth in petroleum, oil, and lubricant (POL) products remains in the low single digits the target is expected to be met. How? No one really knows.

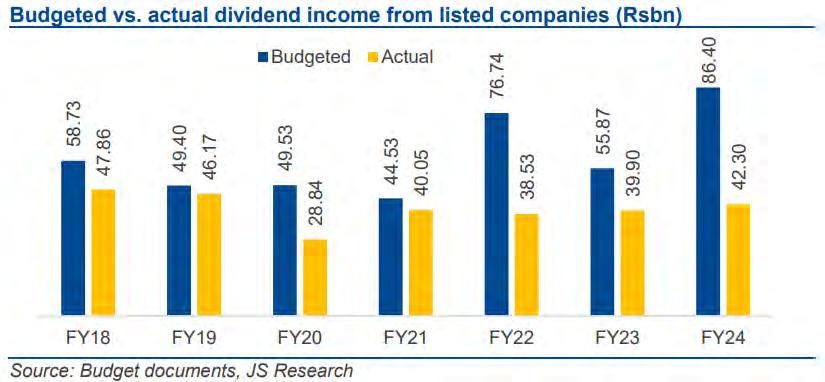

The government also plans on gaining dividend income from listed and unlisted corporations. In the upcoming fiscal year, a heart-pounding 50% YoY increase, totaling Rs 121 billion is projected. This sum constitutes a tantalising 1% of the Rs 12 trillion total revenue

size. More than 70% of this dividend frenzy belongs to listed companies, with the crown jewel being none other than Oil & Gas Development Ltd (OGDC), commanding nearly 50% of the total dividends.

However, achieving this ambitious target might just be too difficult, as historical trends show dividends falling short of both corporate announcements and revised government budget figures. In the last fiscal year, the total collection from dividends of listed companies amounted to a mere Rs 27 billion, a stark contrast to the anticipated Rs 56 billion.

Apart from the tax impositions, and non tax revenues the government has introduced additional initiatives to address various challenges. Alternative Dispute Resolution Committee (ADRC): The ADRC will be strengthened to resolve 62,000 tax cases worth Rs3.2 trillion pending in courts. A committee comprising retired high court judges, the Chief Commissioner, and a taxpayer nominee will decide

these cases.

The proposed levy on diesel and MOGAS has been increased from Rs50 per litre to Rs60 per litre. An allocation of Rs 80 billion has been made to facilitate remittances from overseas Pakistanis, recognizing their importance as valuable assets to the country.

The IMF has signed a new program and for now the pressures on the economy might subside. But is the amended budget sustainable? Despite its insistence upon not burdening the people and subsidising the poor, the IMF seems to be appeased with a far fetched budget. One that in no way, shape or form, has aimed to change the status quo. The new budget hence induces amongst the viewers, what is referred to in psychology as a framing bias. A wolf in sheep’s cloth, a monster in disguise, a discernible calamity showcased as relief.

As the sun rises on the Monday morning, the 2nd of July, numbers will follow each other to their stock market portals, expecting a bull-run. Many would aim to sell the dollars that they have been holding on to, for the good part of the last one year, weakening the dollar against the rupee, but only for the very short term; it will gain lost ground again because the fundamentals have not changed. And many more would seek solace in lunch time debates about how Pakistan has made it once again. But have we truly made it?

In such times it is important to realise that this is not a win, it is merely the aversion to a terrible loss. Nasim Beg, Founder Arif Habib Investments and Director at Arif Habib Corporation aptly says that: “One can only hope that all these individuals in leadership positions will discern the writing on the wall. They should sit down together and work towards a survival strategy in the immediate to midterm, and thereafter concur on structural changes to make the economy self-sustaining for the longer term.” n

One can only hope that all these individuals in leadership positions will discern the writing on the wall. They should sit down together and work towards a survival strategy in the immediate to midterm, and thereafter concur on structural changes to make the economy self-sustaining for the longer term

Nasim Beg - Founder Arif Habib Investments

True change will likely come when the country’s economic team is held responsible for missteps, and will be built on a different politics from the one we are seeing today. For now, we live quite literally on more borrowed time

Dr. Ali Hasnain, Economist, LUMS

Shaheryar Chishty has gone from the owner of Daewoo to being one of the most influential men in Pakistan’s energy sector. Can he turn KE around?

By Abdullah NiaziK-Electric has a new owner. The sale happened quietly, and nearly 14,000 kilometres away in the Cayman Islands, far away from Pakistani regulators and investors. With very little fuss and almost completely out of the public eye, Pakistan’s only vertically integrated utilities company changed hands from the infamous Abraaj Group to a little known company by the name of AsiaPak Investments — an energy investment company owned and operated by Shaheryar Chishty.

A former high-flying international banker, Chishty is also the owner of Daewoo in Pakistan and has significant interests in multiple energy projects including mining rights in Block 1 of Thar Coal. Largely a private individual, Chishty has had his eyes on K-Electric for more than a decade. And now that he owns it, he is here to stay.

The transaction was complicated, and it does not mean Chishty has taken control of the management at K-Electric. He has simply acquired Abraaj’s position in the company. So who is the new owner of KE? How did he come to acquire Karachi’s only electricity provider, and what are his plans to turn it around? According to him, the goal behind changing the fate of K-Electric is to look beyond the company and look at the city of Karachi itself and change it for the better. But can he pull it off?

Profit sat down with Chishty for a one-on-one interview to understand what the future holds for K-Electric and where Shaheryar Chishty fits into it.

There are two stories to tell here. The main one, of course, is the story of K-Electric. It is a story that goes back more than a hundred years and has in many ways been told before, including by this publication. There is of course a pretty significant new event in the life of this company: a new owner. And that is the second story that needs to be told. Who is Shaheryar Chishti and what role does he have to play in this saga that dates back longer than living memory? So let us begin there.

In 2011, Shaheryar Chishty was coming back home. For the past 15 years he had spent most of his time abroad as a high-flying international banker. He moved to Hong Kong in 1997 as an investment banker with Salomon Smith Barney, Citigroup. Spending most of his professional life in Citigroup,

Chishty served in various senior roles including as Head of Asia Industrials Investment Banking, and Head of North Asia Mergers & Acquisitions. From 2009 to 2011 he worked at Nomura International in Hong Kong first as Asia Head of Industrials Investment Banking then also as Global Head of Industrials Investment Banking. During his 18-year investment banking career, Shaheryar was one of Asia’s most prolific deal makers having advised on completed mergers & acquisitions transactions valued at over $60 billion and raised over $18 billion in debt and equity capital.

But by this point he was ready to give it all up. “Around this time I had started feeling there was more to be done. For 15 years I had seen economies grow and become massive from nothing. I constantly used to think of how this could be replicated in Pakistan as well,” Chishty tells us. Sitting in his office right next to Daewoo’s main terminal on Ferozpur Road in Lahore, he is calm and affable. “At the same time Daewoo was a very good client of mine in Korea. They had a business in Pakistan which wasn’t a core business for them and they were looking to get out of the country. Now, I was always talking about Pakistan this and Pakistan that with my clients so they told me to put my money where my mouth and to buy them out. And that was that they took the option and bought them out in 2011.”

It is an admittedly strange trajectory. Before his career as a banker, Chishty was a typical upper class kid from Karachi. His father served in the navy, retiring as an admiral and Chishty went to Karachi Grammar School completing his A levels from there before studying economics at Ohio Wesleyan University in the US. He briefly worked at KASB Securities as an associate right out of college before joining Citibank in Karachi. From here his career was a series of promotions that kept him mostly in Hong Kong but flying all over the world.

So what finally brings the scion of a navy family and a career banker to take on something as large and convoluted as the transport business in Pakistan? “I’ve done some really big deals in my life. I’ve served at very senior positions. When I started thinking about moving back to Pakistan the idea of coming back and serving at another bank really didn’t appeal to me. What I did want to do was pick up an orphan asset, pour some attention into it and make it thrive,” he tells us.

On a fatherly scale, Chishty is on the stoic end of the equation. Speaking to us his voice is stable, his words measured, and his tone calm but confident. He does not quite give the impression of a man interested in rescue missions. Yet as he explains to us, his entire schtick as a banker was working on a lot of companies that are considered “orphan assets” — meaning businesses that are profitable but

Since as early as 2005, the fate of KE has been in a state of flux. Over the past two decades the company has changed ownership four times while a fifth attempt to buy it has consistently fallen through the cracks. The latest change of hands took place just 10 months ago in September 2022. Very briefly put, KE was set up privately before partition by Karachi based business owners that wanted the city to be powered by electricity. In 1951 the company was listed on the Karachi Stock Exchange. In 1952 it was nationalised and managed by the government for the next half century. Then came the Musharraf era and the first push towards privatisation — a part of which was the sale of KE to a Saudi consortium. The Saudis realised quickly that this was a clean-up job beyond their capacity and in 2009 KE was up for sale again. That is where Abraaj stepped in. From 2009 onwards Abraaj put in a significant amount of money and capital and managed to turn things around. By 2016, the private equity firm was looking for a buyer and China’s state owned Shanghai Electric stepped up to the plate. And that is when things started going south. The deal constantly faced red-tapping and in the middle of it came the Abraaj scandal. Once the company went bankrupt, KE found itself suspended in a liminal space. That is until September last year when, away from the PSX and regulators in the country, a little known company by the name of AsiaPak acquired KE entirely in the Cayman islands. Its Chairman, Shaheryar Chishyi, has made it clear he is not looking for a quick flip and that his company is here to stay the course.

too small for their parent company to really focus on and hence not doing well.

Investors like Chishty make it their life’s mission to pick up such businesses and turn them around. Daewoo was one such company. Chishty explains this to us calmly and with brevity. The wall behind his desk is littered with pictures of Chishty posing with Chinese officials and senior officers of the Pakistan Army at different project sites of the China Pakistan Economic Corridor (CPEC).

While Chishty is most well known among the public for his ownership of Daewoo, which was also the reason for his return to Pakistan in 2011, his real area of interest lies in the energy sector. In February 2012, Chishty formed and became the CEO of AsiaPak Investments. The company owns Daewoo but two of its other key investments are Thar Coal Block 1 (a CPEC “early harvest” project consisting of 7.8 mln tons per annum coal mine and 1,320 MW mine mouth IPP) and Liberty Power Limited (a 235 MW gas fired IPP).

“More than anything else I was once again backing my orphan asset strategy. I realised very quickly that the energy sector is one area where there is a lot of inefficiency and thus a lot of room for expansion. The electricity consumption in Pakistan per capita is half of what it is in India and South Korea which tells you how much more people would want to use electricity. These are economies that were once in similar positions to the one Pakistan is in today,” Chishty tells us.

“I had a background in finance within the energy sector as well and so we bought power plants in Quetta. They were gas powered and owned by American shareholders who were exiting. We bought this in 2012, sold it in 2016 to some local investors, provided a profitable transaction, and then moved on

to our next project which was a gas powered power project in Sakhar which was owned by a Malaysian company.”

And thus Chishty and AsiaPak Investments continued on their merry way. Over the next few years, aside from running Daewoo, the company would invest in a number of energy projects that were down in the dumps, revive them, and make handsome amounts off them. Throughout all of this, however, Chishty had his eyes on one particular company in the energy industry. And that company was K-Electric.

It isn’t really surprising that Shahreyar Chishty was impressed with K-Electric. At the time that he returned to Pakistan, the company was undergoing a massive rehaul under the ownership of Abraaj. The story of KE is one that started with business ingenuity and is now at a point of desperate reform. The brief history of the company was concisely summarised in 2016 by Profit’s then Managing Editor in these words:

“Thirty-two years after Thomas Edison created the world’s first utility company in Lower Manhattan, the Karachi Electric Supply Company (KESC) was founded in 1913 (rebranded in 2013 as K-Electric). It is the country’s only vertically integrated utility, with its own power generation, transmission, and distribution assets. While it is not the oldest utility in the country (the Lahore Electric Supply Company was founded a year earlier in 1912), it is the oldest company to still be listed on the Pakistan Stock Exchange, having first been listed in 1948 on what was then the Karachi Stock Exchange, though the company

was nationalised in 1952.

Until the late 1960s, KESC was largely a financially self-sustaining entity. In the 1980s, the company briefly became a subsidiary of the Water and Power Development Authority (WAPDA) and was at one point placed under the management of the Pakistan Army.

In 2005, the Musharraf Administration sold off a 66.4% stake of the company to a consortium of the Al-Jomaih Holding Company, a diversified Saudi Conglomerate, and the National Industries Group, a publicly listed Kuwaiti financial conglomerate (which also owns a large stake in Meezan Bank). For three years, the Saudi-Kuwaiti conglomerate failed to make any headway in turning around the company, finally turning in 2008 to Arif Naqvi, the former Karachiite who had gone on to create Abraaj Capital in Dubai.

Abraaj was already the largest private equity firm in the Middle East by then, and

had previously made forays into the Pakistani market before. In October 2008, Abraaj bought out half of the Jomaih-NIG stake in KESC, injecting $391 million into the company. It then began a turnaround effort the likes of which have never been seen in Pakistan before. Abraaj spared no expense in trying to turn around KESC, investing upwards of $1 billion in the company’s power generation and transmission infrastructure, which brought the utility’s power generation efficiency rate from 30% in 2008 to 37% in 2016, and its transmission losses from 4% to 1.4% in the same period.” It was right in the middle of this turnaround that Chishty landed in Pakistan. “I started my business in Pakistan in 2011 and separately this was also happening with Abraaj and K-Electric. Now, I had nothing to do with K-Electric back then but I was aware of the happenings there because a lot of the people involved were from the same

circles as me.”

“I was simply watching from the sidelines. If you play cricket, a good way to understand it is that I was sitting in the dressing room watching Abraaj play a good knock. At the seven year mark, Abraaj said you know what, we have put in a lot of work and it is time to reap our rewards so they put it up for sale. Remember Abraaj was a private equity fund so they were never going to be long term owners.”

And that is when, in 2016, Chishty decided to shoot his shot. At that point, CPEC was at its peak and Chinese investors were deeply interested in putting money into Pakistan. Because of his involvement in CPEC projects in the past, particularly in Thar Coal, Chishty was well connected in China and put together a consortium that would bid for control of KE. “There were Chinese investors, other Asian investors, and a couple others with interests in KE as well but in the end Abraaj ended up receiving a very good offer from Shanghai Electric.”

Shanghai Electric’s $1.77 billion acquisition of $66.4% of K-Electric would have been the second largest acquisition in Pakistani history and the largest in a decade, after Etisalat’s $2.6 billion acquisition in 2006 of management control in Pakistan Telecommunications Company Ltd.

At first glance, K-Electric’s sale by Abraaj Capital is the epitome of a successful private equity-led turnaround story. Indeed. It is the very reason private equity firms came into existence in the first place. A storied company, sullied by bad management but still serving a unique economic purpose, bought out by a skilled private equity firm at its nadir, turned around through a combination of strategic capital investments and modern management

We have not acquired “control” over either KESP or KE. We simply aim to protect our rights as interested shareholders and investors, and we believe that as Pakistan focused energy and infrastructure investors, operators and builders, we have significant relevant experience to bring to bear and assist KE and its management to overcome the company’s many challenges

Shaheryar Chishty - CEP AsiaPak

techniques, and then sold off in a healthy, relatively unleveraged state to a strategic buyer. And a Harvard Business Review case study to document it all.

But then came the roadblocks. To cut a very long story short, consistent delays on the part of the government meant the Shanghai deal could not go through. Despite a lot of political lobbying on the part of Abraaj’s Arif Naqvi, the deal was dead in its tracks. And then came the crash. In 2019, Arif Naqvi and Abraaj were involved in an international scandal that ended with the company utterly bankrupt. And along with it the Shanghai Electric deal went kaput. For six years Abraaj’s baggage weighed the Shanghai deal down and KE remained unsold. That is of course until a quiet, seemingly normal September day last year.

Now this is the important part. How exactly did Chishty go about buying K-Electric? Since KE is owned by Abraaj, which as a company has gone bankrupt, its assets are a little all over the place. Just take a look at the ownership structure of KE. When the Al Jomaih group entered the picture in 2005, they created KES Power Limited (KESP) which was a Cayman Islands company. This company paid the government of Pakistan directly and acquired a 66.4% stake in K-Electric in Pakistan.

In 2009 when Al Jomaih decided to sell, Abraaj funnelled over $370 million in foreign

direct investment into KE through the KESP company in Cayman. To date, the US$360 million invested by Abraaj in KE (routed through KESP) remains the only equity FDI invested into KE as new capital used principally to fund capital expenditures driving efficiency.

Abraaj’s investment in KE was undertaken through the Infrastructure & Growth Capital Fund L.P. (“IGCF”), a $2 billion Cayman Islands private equity fund with investment contributed by over 100 different international investors, managed then by Abraaj Investment Management. The amounts invested by the Al Jomaih consortium in 2005 were paid directly to the GOP for purchase of existing shares with nil proceeds actually being invested into KE.

So when Chishty wanted to acquire Abraaj’s stake in KE, it could not acquire KE in Pakistan. It had to go to the KESP in Cayman. Chishty’s company, AsiaPak Investments, created a special purpose company called Sage Venture Group Limited (Sage) and registered it in Cayman. Sage then bought out the Infrastructure Growth and Capital Fund LP (IGCF or the Fund), which holds an indirect material stake in K-Electric Limited. These transactions were authorised in proceedings at a court in the Cayman Islands, according to court documents. Further, for the sake of clarity, the Fund does not have a controlling interest in K-Electric nor a controlling position on the K-Electric Board of Directors.

“The ultimate beneficial owner of Sage and AsiaPak is Shaheryar Arshad Chishty who is a Pakistani national. Following the acquisition of IGCF GP shareholding, the IGCF GP

has decided to update certain directorships as it relates to K-Electric. The new IGCF directors to the KE board will include Shaheryar Chishty,” read a letter that reported this acquisition.

“I didn’t buy K Electric itself, I bought the fund. The fund had other things in it and KE was one of those assets,” explains Chishty. “It is a pretty simple process. KE is a company in Pakistan but it is mostly owned, I think around 66%, by a fund in the Cayman Islands and this has been true since the Aljomaih sale back in 2005. They had set it up there because of the tax exemptions in Cayman. The holding company is a Cayman Islands company. Any dividends that go to Cayman from Pakistan will be taxed there. That’s the first thing, there’s no loss to Pakistan for that. Second is that Cayman is a very normal and acceptable jurisdiction. Even Saudi and Kuwaiti investors decided to form a Cayman company. They could form it anywhere. So, these are legitimate business groups in their own countries and they formed a company in Cayman.”

“We have not acquired “control” over either KESP or KE. We simply aim to protect our rights as interested shareholders and investors, and we believe that as Pakistan focused energy and infrastructure investors, operators and builders, we have significant relevant experience to bring to bear and assist KE and its management to overcome the company’s many challenges.”

Chishty did not disclose the amount of money that went into buying the fund. However, given his history of picking up orphan assets it can be safely assumed that it was a significantly smaller amount than what Shanghai Electric was going to pay Abraaj back in 2016.

There is a bigger question in the middle of all this. Why would anyone want to buy K-Electric? The company is plagued by problems and is far from an investor’s dream. The only thing it has going for it is the monopoly it holds over electric supply in one of the world’s largest cities. Yet even this is under threat with people slowly coming to rely more and more on home based solar solutions.

As things stand, Karachi is caught in a vicious cycle of energy being insufficient, unaffordable, uncompetitive, unreliable. Unaffordable energy reduces consumer purchasing power and lowers quality of life, leads to reduced tax base, as well as growing dissatisfaction with provincial and municipal leaders.

Uncompetitive energy and disruptions in power supply lead to Karachi’s deindus-

trialization, eliminating employment, and reducing taxable economic activity. High rates of loss, theft, and non-payment further reduce investor confidence for making new capital investments, worsening energy problems. On top of this, most of our electricity generation is dependent on expensive, unreliable, and imported sources such as gas and oil.

In a letter to the Chairman of the Federal Board of Investment, Chaudhry Salik Hussain, Chishty outlined what he felt had resulted in K-Electric’s reversal of fortunes. According to him, Abraaj had come in and undone a lot of the damage that K-Electric had suffered from, but most of that work had been undone after Abraaj’s unravelling in 2019.

“We observed that the progress made by KE started reversing after the Abraaj bankruptcy in 2019 when senior KE Management officials left the company, the board lacked a common vision for growth and oversight of day to day management reduced, KE started making a series of strategic blunders, including:

1. A quixotic 900 MW gas power plant in a country that has no more gas to give

2. Failure to procure LNG when rates were compellingly low

3. A failed attempt to build an imported coal power plant, ignoring alternative domestic coal reserves;

4. Failure to secure electricity from Thar coal at a time when the federal government managed to set up over 3,000 MW of Thar coal based capacity;

5. Failure to develop renewable power (except for 100 MW solar IPPs) at a time when the federal government has managed to secure over 1,100 MW of wind power right on Karachi’s door-step;

6. Failure to address operating inefficiencies, adopt modern technologies and control ballooning generation and operating costs and thus significantly increasing the burden of subsidies on the government and taxpayers;

7. Failure to continue improving the distribution network and service quality, reduce load shedding, facilitate new connections,

8. Ballooning of debt to over Rs 300 billion vs approximately Rs 70 billion in 2018

9. Failure to prepare for impending competition in the electricity market.

“The result is that KE now has the highest cost generation fleet in Pakistan and is almost wholly dependent on imported fuels. Were it not for lower-cost electricity purchases from the national grid and subsidies from the federal government, Karachi consumers would have to pay the highest electricity prices not just in Pakistan but also in the region.”

This is where we stand. Chishty has made it painfully clear that he is not interested in a quick flip — his stated goal is to come on board as a long term owner and stay the ship. But with competing energy sources such as solar fast on the heels of KE, what does he plan on doing?

The problems are clearly in front of us. Over the years, KE has become sluggish and inefficient. The number of people wanting electricity has increased. According to Chishty, the solution is to make K-Electric central to a modern, thriving metropolis. And that requires Karachi to change. One of his biggest claims is that the city itself is surrounded by ample area to utilise solar and wind power. The biggest problem with solar and wind is that it is very expensive to setup for the average household. So if a utilities company like K-Electric can harvest this energy it can provide significantly cheaper electricity to households.

According to KE estimates, in the case of solar there are 20% to 22%+ capacity factors easy to achieve. There are already well-developed ecosystems vendors, EPC contractors, and operating teams in Pakistan. There is also strong interest from international financiers. According to the company’s estimate, this would require around $1.8 billion in investment. Similarly for wind energy, there is a capacity factor of over 40% which is significant. Karachi is only 50 kilometres from one of the most high potential wind corridors; and there is also strong international investment interest in this as well. The estimated investment required would be around $1.3 billion.

And then there is the biggest card that Chishty has up his sleeve to save K-Electric; Thar Coal. When you think about it, the problem is actually very simple. Pakistan relies heavily on imported fuel sources such as reliquified natural gas (RLNG) to produce electricity. Whenever there is an international crisis, such as the Russia-Ukraine war, Pakistan’s energy sector is rocked by the ripple effect. There is a simple solution. Cheaper fuel — something like coal perhaps. And the source is right there too. Spread over more than 9000 square kilometres, the Thar coal fields are one of the largest deposits of lignite coal in the world — with an estimated 175 billion tonnes of coal that according to some could solve Pakistan’s energy woes for, not decades, but centuries to come.

Discovered in the early 1990s by the Geological Survey of Pakistan (GSP), Thar Coal accounts for around 660 MW of electricity produced in the country. The potential is much greater. If new projects that are currently

under construction become operational, in the next year electricity production from the Thar coalfields is expected to increase to as much as 2000MW. In short, Thar Coal offers a cheap, alternative, local source of energy that can be used to produce electricity and help Pakistan escape its topsy-turvy reliance on international markets to maintain its energy supply.

“The total reserves from Thar Coal are more than the combined oil reserves of Saudi Arabia and Iran. The reserves are around 68 times higher than Pakistan’s total gas reserves. Compared to this potential the current utilisation of Thar Coal in the total power generation mix is less than 10% which means that there is huge opportunity to expand in this sphere,” explains Amir Iqbal, CEO of Sindh Engro Coal Mining Company.

Chishty has a similar although more colourful explanation. “Thar Coal for Pakistan is like the Plains Buffalo for the Native Americans”, he explains. This was a very particular kind of bison that was found in America which the Native Americans relied upon heavily for their economic activity.

“This buffalo provided everything to the Native Americans. They would hunt these animals and consume their meat for sustenance but that is not all. They would use its bones to create instruments and use its skin to create leather and its fur to keep warm — everything and every part of the animal was vital to the movement of this native economy,” he explains. “That is what Thar Coal can be for us”.

Of course, choosing to rely on fossil fuel like coal comes at a price. It is one of the most environmentally damaging sources of energy there is, and will give pause to environmental scientists — particularly given the state of the smog-addled Punjab region. There are also concerns such as transport costs and the quality of coal that is to be found in Pakistan.

But let us be very real here. Environ-

mental reasons are not why the potential of the Thar coalfields have not been realised. In fact, in the wake of the current commodity supercycle, the government has attempted to increase its already existent reliance on coal as an energy source. To do that, the government is relying on imports of coal. And while this is a queasy thing for environmentalists to think about, if coal is going to be used to produce electricity in Pakistan, it might as well be domestic coal rather than imported coal — at least electricity will be cheap that way.

Chishty is naturally a big believer in Thar Coal. Two blocks of this project are already ready for operations. And according to a K-Electric document, the company feels they can easily be expanded at a low marginal cost. Located only 300 kilometres from Karachi, transportation is also not going to be a major expense. Already a rail line linking Thar to the national rail network is expected to be completed during 2023, and it will require an additional investment of just over $3 billion to produce 3600MW of electricity.

Using these three sources, K-Electric could increase domestic, industrial, and transport customers. And this isn’t where it ends. Chishty plans on also working with authorities in Karachi to build the City into a modern metropolis based on sustainable living. One of his goals is to introduce electric public transport and electric bikes with charging stations all over the city. Essentially, Chishty would also be synergizing his businesses. On the one hand he is in transport which can run the buses, on the other he owns KE which could provide the electricity, and he also has interest in Thar Coal which provides the raw material to create electricity in the first place.

In his letter to Saliq Hussain which was mentioned earlier, Chishty detailed the purpose and ideas behind why he came in and bought the Abraaj interest in K-Electric:

Our reasons for acquiring the Abraaj position in KE (through KESP) are:

1. Be a long-term owner. We are not looking for a “quick flip”

2. Take positive long-term decisions to enable KE to better serve all of its stakeholders (consumers, employees, the state of Pakistan, and shareholders)

3. Dramatically increase the supply of electricity in Karachi at lower rates to trigger a quantum leap in demand through greater industrial and commercial activity and greater demand from households once power is made affordable and reliable

4. Integrate KE with the Thar coal fields thereby delivering significant quantities of cheap, indigenous, base load power to Karachi;

5. Facilitate KE’s finally taking advantage of the massive wind and solar potential right at Karachi’s doorstep;

6. Cause KE to lead Karachi’s transition to electric mobility and waste to energy so that KE can play its uniquely qualified role in making Karachi an environmentally friendly city, and reduce demand for imported fuel;

7. Continually improve operating efficiencies, adopt modern technologies and control operating costs.

“For the sake of Karachi’s consumers and economic revival, we appeal to your good offices to help us set KE on the path to recovery. We hope that our Saudi and Kuwaiti partners in KESP will also share the same goals, and we are keen to work with them for the betterment of KE”.

This is what it all boils down to. Chishty has acquired a majority stake in the holding company that owns K-Electric. That holding company also has a number of other shareholders. This means that while Chishty is the new owner of KE, he does not have the controlling stake to overhaul the management on his own.

What he can have is a seat on the board of directors. The success of his visions will now be dependent on how well he can navigate the boardroom and how well he can get along with the rest of the stakeholders involved in the company. As an entity, K-Electric has many legacy costs and is plagued with the indecision of any highly bureaucratized organisation. To fix its ills will require a concentrated and united effort. As things stand, the vision that Chishty brings along with his ownership is one that most can appreciate. The focus on renewable energy and Thar Coal as well as the efforts to transform Karachi along with K-Electric are commendable and the only real way forward. But getting there won’t be easy. n

By Saneela Jawad

By Saneela Jawad

The music industry in Pakistan has witnessed significant growth and evolution in recent years. With a rich musical heritage and a large population of music enthusiasts, Pakistan has become a vibrant market for music consumption and production. Traditionally, the music industry relied heavily on physical music sales, such as CDs and cassettes, as well as television and radio airplay. However, with the development of digital technology, the landscape has transformed. Online streaming platforms have gained prominence as the preferred method of music consumption.

One notable addition to the Pakistani music scene was the introduction of Spotify in 2021 as an online streaming platform. With a huge library of local and international music, this platform has had a significant impact on the way people access and discover music in the country. It provided Pakistani artists with a platform to showcase their work to a wider audience. Having said that, it allows users to stream music on-demand, create personalized playlists, and discover new artists and genres. Spotify’s algorithms also provide recommendations based on users’ listening habits, further enhancing the music discovery experience.

But what does this mean for existing online streaming platforms in Pakistan? Is Spotify going to sustain itself in this market? We find out…

Spotify offers a new avenue for distribution and monetization for musicians. They can upload their music to the platform, potentially reaching millions of listeners worldwide.

Moreover, Spotify’s analytics and data insights enable artists to gain valuable information about their audience and tailor their marketing strategies accordingly.

The arrival of Spotify in Pakistan has brought competition to the existing online streaming market. Local streaming platforms, such as Patari and Saarey Music, have also been popular among Pakistani listeners. What sets each platform apart, in terms of its business model, number of subscribers and how they plan to sustain itself?

When we talk about Spotify, it made a fan base in the country much before it decided to launch here. We spoke to the Spotify Pakistan team who told us that the way it generates revenue is from both brand advertisements on the free service and users who pay for subscriptions.

The platform uses a Freemium model which allows users to choose the tier that works best for them. It introduces users to the Free service and then offers subscriptions. Payments can be made via cards or local partnerships. The updated ad-supported Free experience in Pakistan allows users to choose any song, skip tracks, and stay connected to new releases. Premium offerings provide uninterrupted, ad-free music and cater to different user needs with plans for students, couples, families, and more. Increased engagement leads to growth in the advertising business and subscription base. Spotify aims to increase monetization and subscriber growth through-

out the life cycles of its listeners.

Spotify shares 70% of revenues with the rights holders. It has paid over $30 billion in royalties to the music industry, contributing to major music and record labels earning over $4 billion in profits in 2021.

Faisal Sherjan, a founding member of Patari, launched in 2015 and was one of the pioneering online streaming platforms in Pakistan, told Profit that the platform started with a realization that artists needed to be paid for their work to sustain their careers. The founders understood the market dynamics and had expertise in monetizing music.

He stated that the platform initially faced difficulties due to the lack of micropayment options and the high revenue share demanded by mobile networks of around 70%. To support the platform, sponsorships were sought, but these were primarily focused on branding rather than directly benefiting the artists.

“The monetization aspect remained a challenge for Patari. Unlike Spotify, which expanded to Pakistan without creating specific features for the local market, Patari had to navigate the complexities of the Pakistani music industry,” Faisal told Profit.

Patari differentiated itself by exclusively focusing on Pakistani music, showcasing the country’s diverse sounds and creativity. It aimed to promote and highlight local talent rather than relying on popular Indian item songs, which were dominant at that time. Over time, it expanded its offerings beyond music to include podcasts and audio literature, making Urdu literature more accessible through audio files.

Patari’s current user numbers are not readily available, as the platform has not been actively promoted or marketed recently. How-

ever, it is estimated to have around 20,000 to 25,000 active users, with minimal costs involved in maintaining the platform.

In Q1 2023, Spotify achieved its strongest performance since going public in 2018. Monthly Active Users increased by 22% YoY to 515 million, driven by all age groups and markets. Premium Subscribers grew by 15% YoY to 210 million, with Europe and Latin America leading the way. Total revenue reached €3.0 billion, a 14% YoY growth, primarily attributed to subscriber gains. Gross Margin improved to 25.2%, reflecting enhanced profitability in music and podcasts. Operating loss/income stood at €156 million, benefiting from reduced marketing expenses.

Similarly, Faraan Irfan, Founder of Saarey Music spoke to Profit about how the platform works. “It is a digital music platform focused on providing access to South Asian classical music. The sustainability of their focus on classical music in Pakistan has been surprisingly successful. The platform was initially launched as a passion project to provide access to quality music and they have received a grant from the UK government to build their platform and plan to generate revenue through subscription fees, service fees for transactions and bookings, and institutional subscriptions”, he said.

“The subscription fee for Pakistan is Rs 490/- per month, and we offer monthly, half-yearly, and yearly plans for individuals. The platform also has institutional plans starting at $1,000, allowing universities and other organizations to use the platform for research, classrooms, and events,” he said.

Since 2022, Saarey Music has experienced significant growth with a 70x increase. Although the total number of subscribers remains undisclosed, it is mentioned that they have surpassed half a million users. Their user base comprises mostly 18–35-year-olds, with 53% falling within this age range. Moreso, 70% of their users consider themselves beginners to the genre, highlighting the appeal of accessing classical music. The attention of paid subscribers is exceptionally high at 94% per month, compared to an industry average of less than 20%. This suggests that classical music has a special appeal that larger streaming services have not fully realized.

Spotify prioritizes supporting musicians and songwriters, maintaining the same approach in Pakistan as in other markets. The platform stimulates industry growth and ensures fair compensation for rights holders. Having said that, Profit spoke to Roshaan Sherwani of Hassan and Roshaan, a Lahore-based pop duo who told us how Spotify works every time they release a new song on the platform.