10 The OGDCL’s $80 million bid saga in Uch 14

14 Shutting shop by 8PM: Do market closures really do anything?

18

18 Pending subsidy payments on the import of DAP Hamza Nizam Kazi

20

20 Nutritionally Challenged Pakistan? Afia Salam

22 Foodpanda might have found its easiest source of money. So easy, that they might squander it

Publishing Editor: Babar Nizami - Joint Editor: Yousaf Nizami

Senior Editor: Abdullah Niazi

Executive Producer Video Content: Umar Aziz - Video Editors: Talha Farooqi I Fawad Shakeel

Reporters: Taimoor Hassan l Shahab Omer l Ghulam Abbass l Ahmad Ahmadani

Shehzad Paracha l Aziz Buneri | Daniyal Ahmad |Shahnawaz Ali l Noor Bakht l Nisma Riaz

Regional Heads of Marketing: Mudassir Alam (Khi) | Zufiqar Butt (Lhe) | Malik Israr (Isb)

Business, Economic & Financial news by 'Pakistan Today'

Contact: profit@pakistantoday.com.pk

Forgive us for how long this has taken, but we did put a lot of thought into this decision. From now on Profit will be using the terms lakhs and crores in its reportage instead of millions, tens of millions, hundred million and so on.

The question of how subcontinental publications should deal with numerals and their linguistic representation is not a new one. In India, for example, English publications and in particular financial publications use the terms lakhs and crores when talking about numbers. Generally, the trend in Pakistani English language newspapers and magazines has remained to write numbers in the millions and billions. Most old-school editors in the country believed in using the ‘proper’ British brand of the English language, where missing a letter or using the American spelling is considered sacrilege.

It is perhaps that same stiff upper lip that has resulted in millions being the core word with which we represent numbers. But for a long time there has been a general sense of unease in Profit about these terms. After all, our readership is predominantly Pakistani and that is also the audience we cater to. The question that has continued to bother us has been this: What does it mean when someone says something costs Rs 4 million?

For most of our readership, the figure of Rs 4 million is a vague one. How much is Rs 4 million? What can you buy in it? How many months of salary would it take to save up that much money? The term seems vague because people don’t think in millions. But if you were to say something costs Rs 40 lakh, that would immediately ring a bell. Why? Because Rs 40 lakh is how much a new Suzuki Swift costs. Or it might be how much a person spent on their child’s wedding. Or perhaps it was the amount that you paid for the first installment on your house.

The same goes for the term crore. If you mention Rs 45 million to a person, they might have a hard time placing how much money that is. But if you say Rs 4.5 crores, they will immediately think that is how much a 1 kanal plot costs in Lahore’s DHA Phase 6.

Our contention is that if the reader is thinking in lakhs and crores, it will be easier for them to comprehend and understand numbers in these terms when they read them too. Similarly, this is not just limited to money. It is easier, for example, to understand that Pakistan has a population of 28 crore rather than 280 million.

That said, there are some caveats. For example, when the terms we are talking about are in dollars. If a venture capitalist invests $250,000 in a Pakistani startup, for example, it would be strange to read $2.5 lakh. Most people hear about dollars and dollar terms from foreign media whether it is through film, books, or newspapers. Which is why it is easier to think of what $1 million means rather than what Rs 1 million means.

On top of that, if an investor puts in money in dollar terms it would be irresponsible and financially erroneous to report that in rupee terms - especially with how the forex market fluctuates. However, since the money is being spent in Pakistan, wherever appropriate we will clarify how much money this term means in rupees. In this example, $250,000 would translate to Rs 7.1 crores.

There is also another caveat. The western and subcontinental categories for values are all different but they become the same at the billion mark. So while 1 million is equivalent to 10 lakhs and 10 million is equivalent to 1 crore, 1 billion is the same as 1 arab. Because billion is a more familiar number to most people than arab, in both rupee and dollar terms we will be using the term billion instead of arab since it represents the same numerical value.

More than anything else the purpose behind this change in style sheet is to make our content more easily digestible for our readers. We are sure that there are plenty of readers that are used to thinking in millions by now and comfortable in it. But we also believe that those that find it difficult to understand financial journalism deserve news that is simple and written in a language they can understand. It is this novice reader that we are targeting. We hope this will make their journey easier.

Dear reader, we’ll be talking in lakhs and crores from now on

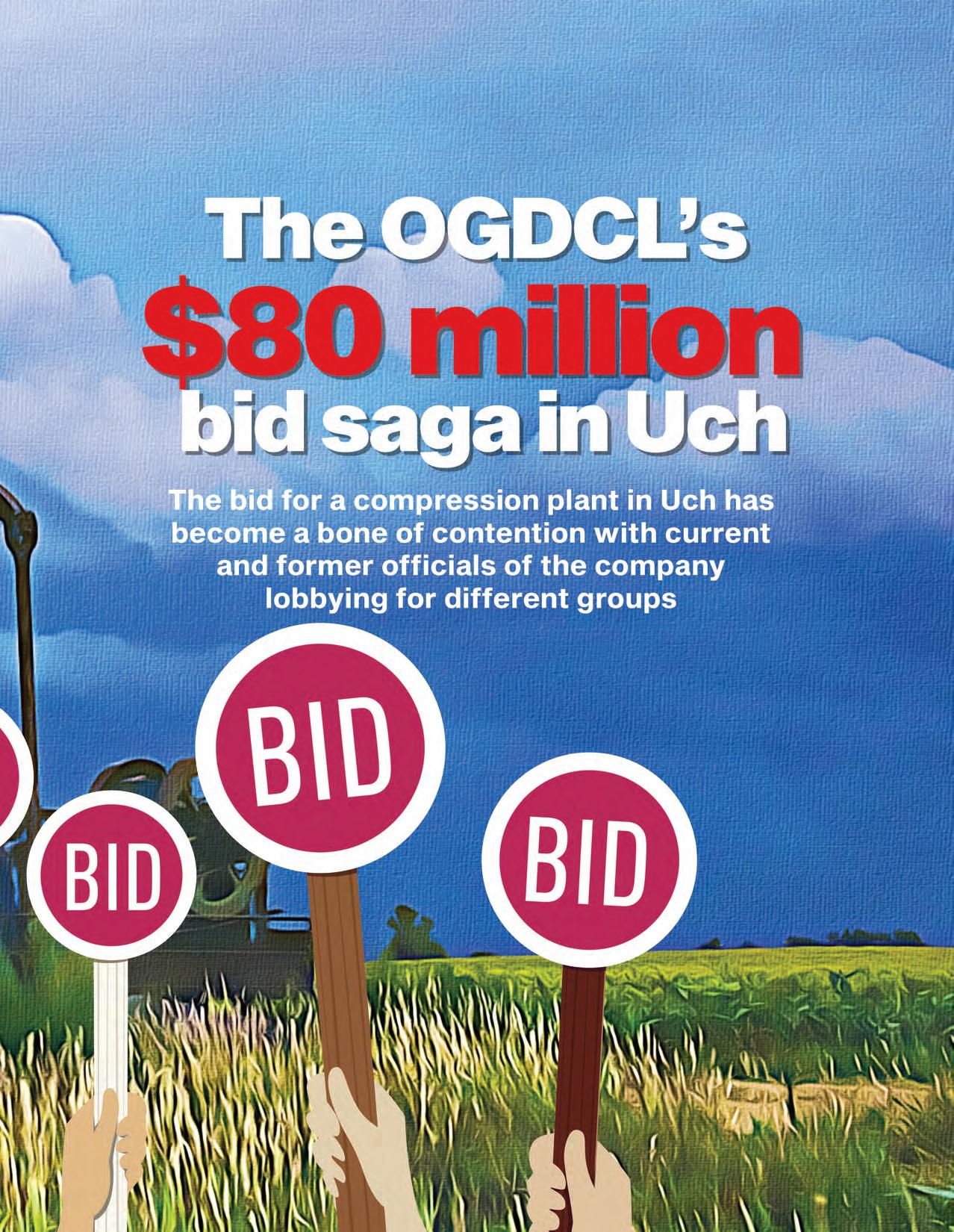

For the past 10 months, a cold war has been looming within the Oil and Gas Development Company Limited (OGDCL). The bone of contention is an $80 million contract for a compression project in phase II of the Uch gas fields that OGDCL controls.

Ever since the company first invited investors to make bids for the plant it has been a sordid tale filled with bidding wars, rival groups within the company, former employees working as lobbyists, and a complete disregard for proper procedure.

So what is going on? Essentially, two different consortiums applied for bids for the compression plant. The first one was a joint venture between Sui Northern Gas Pipelines Limited (SNGPL) and Presson Descon International. The other was also a joint venture between Hong Kong HuiHua Global Tech. Ltd. and a local company called the AJ Corporation.

Initially, it seemed that the bid was going to go to the consortium formed by SNGPL and Presson Descon. However there has been strong lobbying from former officials of the OGDCL that hold significant influence within the company despite being retired. As a result, it now seems that the contract will go to the second consortium despite it not meeting the criteria required and being what is none as a ‘non-responsive bidder.’

Before we get into the specifics it is important to understand what the OGDCL is, what it does, and the significance of this project in which the blatant disregard for corporate ethics has been on full display.

OGDCL, which stands for Oil and Gas Development Company Limited, operates in the Exploration and Production (E&P) business. In this sector, OGDCL begins by acquiring interests in oil and natural gas fields, which includes obtaining mineral rights, exploration rights, and development rights necessary for petroleum development. Once the interests are acquired, OGDCL conducts geological surveys and drills exploration wells in promising lo-

cations within these fields. The data obtained from these wells allows OGDCL to estimate the size of oil and natural gas reservoirs and determine whether they have commercially viable reserves.

This is perhaps its most vital function. There are a lot of countries with a lot of oil and gas fields all around them. In most cases, however, these locations are not commercially feasible. It is either so expensive to extract the oil or gas that it does not make monetary sense or the amount of gas and oil are in such small amounts that it would not be worth the investment. The OGDCL, which is a government functionary, essentially acts as the government of Pakistan’s exploratory agent when it comes to oil and gas.

Most of the time, however, they are dealing with foreign clients. Take the Uch fields for example. Located in Dera Murad Jamali in Balochistan, the fields are owned by a French company called Engie. Now the Uch field is divided into two different phases. The first one is up and running and has been quite successful with 15 dedicated wells. For the second phase, the OGDCL was supposed to develop 15 more wells.

Now, for fields with reserves deemed commercially viable, OGDCL proceeds with drilling production wells for oil and natural gas extraction. Additionally, the company constructs the necessary facilities for processing and storage of the extracted oil and gas.

During the production phase, OGDCL extracts petroleum gas from the production wells and separates it into crude oil and natural gas, while also removing any impurities. Furthermore, OGDCL assesses the need for additional field development to maintain or increase production volume as required.

In the supply phase, OGDCL takes on the responsibility of transporting and distributing the extracted oil and natural gas to its clients. Overall, OGDCL’s operations encompass acquiring interests in oil and gas fields, conducting exploration and drilling, estimating reserves, establishing production wells and facilities, processing the extracted petroleum, and ensuring the efficient supply of oil and natural gas to customers.

OGDCL, the leading Exploration and Production company in Pakistan, is currently producing over 1,025 MMSCF/d of gas from its own and operated joint ventures. Major gas-producing fields for the company include Uch Gas Field, Qadirpur Gas Field, Kunnar

Pasakhi Deep-Tando Allah Yar Gas Condensate Field, Nashpa Oil Field, and Sinjhoro Gas Condensate Field.

In the grand scheme of things, the Uch compression plant bid could result in serious financial harm if it goes to the wrong bidder. The over $80 million translates to over Rs 25 billion - that is over Rs 2500 crore in spending money for the OGDCL. So how bad have things gotten and why did they get to this point in the first place?

In September 2022 the former General Manager of OGDCL, Imran Shaukat, sent a message on a Whatsapp group named OGDCL YOUNG GOLDIES. The group, which contained retired and serving officials from the company, was informed in the message that the company’s managing director, Khalid Siraj Subhani, had already decided who the contract would be awarded to.

Immediately this caused waves within the OGDCL. Why was a retired GM spreading news about the award of a bid that he had nothing to do with anymore? That is when allegations began to spread that Shaukat was in fact working for one of the manufacturers trying to get the bid and trying hard to benefit a Karachi-based company which is also a partner of the same manufacturer.

The matter went so far that later on Shaukat’s entry was banned in OGDCL and a spokesman of the company when contacted informed that OGDCL will conduct an inquiry in this regard.

The OGDCL’s own audit department recommended cancelling the tender as the criteria seems to be tailor made, bringing the competition down to only two bidders. In addition, both bidders are supplying equipment produced by a single manufacturer despite different vendors being available in the market.

And this is what the matter boils down to. Former officials of the OGDCL have been lobbying not on behalf of either one of the consortiums, but on behalf of the manufacturing company that provides the equipment to these two consortiums. To do this, the bid was manipulated and specific stipulations were added so that only the bidder using equipment from a specific company would remain in the running.

Profit was informed by well placed

sources that the matter was actually raised for the first time by a multinational company that manufactures similar material that is needed for the project has raised concerns regarding the bidding process. The said company has alleged that OGDCL’s bidding process for the procurement is suspicious and will cause a hefty loss worth billions to the national exchequer annually.

In its complaint, the potential vendor has highlighted that it is rather strange that the bidding competition policy of such a huge state-owned exploration and production giant is between only the two bidders. The vendor has claimed that there will be 20 to 30 per cent saving in the cost of the UCH project if OGDCL adopts a transparent method for awarding the contract.

As per OGDCL’s spokesperson, all procurement cases involving Rs 50 million or above are sent for a pre-audit as a matter of standard practice and no exception was made in this case either. “An internal audit is an obligation wherein files are reviewed, clarifications sought and comments added. Thereafter, the concerned department and the Supply Chain Management address the queries or take remedial action if required,” he added.

The fundamental question here is whether or not applicable processes and procedures have been followed in letter and spirit. Initially, according to the evaluation uploaded on the company’s website, the consortium comprising SNGPL and PDIL has emerged successful because it is technically qualified and offers the lowest bid. This would indicate that a successful bidder in this case was finalised without any deviation.

But this was only up until September. In March 2023 it became apparent that the bid by the SNGPL and an emerging local firm was in absolute shambles. The firm has enhanced the bid bond of Sui Northern worth Rs 13.5 crores on March 3, 2023 over a failure of depositing the performance guarantee of Rs 1 billion. The decision made the OGDCL unhappy as the company doesn’t want to afford any delay in completion of the project. The OGDCL, of course, is afraid of making the owners of the Uch field operations unhappy. The Uch gas field compression project is scheduled to be completed and commissioned by July-September 2024 under the gas sales agreement (GSA) with the French company owning Uch power plant. If the project gets

delayed, then OGDCL’s reputation will not only be at stake but it will have to pay a penalty of $6,60,000 per day to the French company.

A spokesperson of the OGDCL has said that the management is committed to completion of the project on time and it has all rights to evaluate all options, including encashment of bid bond of the local firm worth over Rs 26 crores.

Now, it is becoming apparent that with the SNGPL bid falling apart, the contract will now go to the Hong Kong based JV. However, there are issues with this as well. As a bidder, the JV had earlier been regarded as non- responsive and partially compliant.

According to sources, OGDCL has submitted a summary to its Board of Directors (BoD), seeking approval to award the Uch Compression Project to the bidder which had initially dropped from the bidding process due to non-compliance.

The consortium of M/s Hong Kong Hui Hua Global Technology Limited (lead partner) and AJ Corporation Lahore (JV partner) had failed to fulfil the bid document requirements according to an available copy of OGDCL’s financial/commercial evaluation report. The consortium lodged grievances with OGDCL’s committee, but their case was deemed hopeless and lacking the necessary qualifications for the UCH Compression Project.

The grievances raised by M/s Hong Kong Hui Hua Global Technology Limited was heard in the 92nd meeting of Bidder Grievance & Redressal Committee (BGRC) of OGDCL which was held on August 02, 2022. But, the grievance of M/s Hong Kong Hui Hua Global Technology Ltd (M/s HHGTL) found not tenable so it was disposed- off, said the OGDCL grievance committee report.

Well placed sources in the OGDCL have said that after first pushing for the SNGPL and Presson Descon consortium to be given the bid, the same retired officials are now lobbying very strongly for the contract to be awarded to Hui Hua and the AJ Corporation despite them not meeting compliance standards.The reason is the same. Back when the bidding process first started, the criteria was set in a way that only two bidders qualified - both of which used equipment from the same manufacturer.

When contacted with a spokesman of OGDCL to secure his stance, he said,” It is our duty to evaluate all options. The best course would be selected which helps in timely completion of the project in a cost-effective manner.” AJC was also approached to ensure its stance, but its official did not answer the sent questions despite multiple reminders.

As this matter unfolds, questions regarding OGDCL’s procurement practices and the potential implications of awarding the contract to a questionable consortium are likely to be examined by relevant authorities, raising concerns about accountability and fair competition within the public sector. n

On the 3rd of January this year, a federal cabinet meeting chaired by Prime Minister Shehbaz Sharif approved the National Conservation Plan on the advice of the Power Division. This introduced measures to ensure the judicious utilisation of national resources, such as the early closure of markets.

Finally on the 6th of June, the Minister of Planning, Development and Special Initiatives, Ahsan Iqbal, announced that the National Economic Council (NEC) had approved the proposal to close countrywide markets at 8

pm under the energy conservation project. He additionally mentioned that there was an agreement to implement this in all provinces. “The government’s greatest expenses are incurred on energy. If measures are taken to control these expenses, many issues will be resolved,” emphasised Iqbal.

Why has the government decided to close marketplaces at 8pm? We know that it’s related to energy conservation but why is there a need for precisely this

measure?

Profit spoke to Ahsan Iqbal, the federal minister for planning and development, who has taken a leading role in raising this policy. According to Iqbal, this policy is the solution for both the energy and foreign reserves crisis.

“The country is facing a severe crisis of foreign reserves. It’s therefore crucial that we use our foreign exchange prudently, and conserve energy,” he stressed.

You may wonder what connects energy conservation with the foreign exchange. It’s therefore pertinent to understand that Pakistan is largely dependent on imported energy.

In a recently released Energy Out -

The decision of marketplace closure at 8pm is not simply a measure of energy conservation but also a careful utilisation of foreign exchange

look 20239 report, CAREC elucidated that, “Pakistan’s energy production consists of oil, natural gas and coal. However, insufficient investment in exploration and development activities has made the country heavily reliant on imports as nearly 40% of its total primary energy supply is imported.”

“Our country is heavily dependent on imports. Imported energy alone costs $1 billion annually,” Iqbal asserted. It is, perhaps, difficult to picture just how much and how significant a billion dollars are. Right now, Pakistan’s foreign exchange reserves are just over $4 billion. The $1 billion spent annually on energy requirements makes up a fourth of Pakistan’s forex reserves which do not cover more than a month’s imports.

The government is aiming to conserve precisely $1 billion worth of energy as a result of this policy.

“For an economy starved of foreign exchange, we’ll save about $1 billion annually, which will substantially contribute to our economy. We have to be prudent with our resources. The conserved amount will help Pakistan build foreign reserves, and meet other needs such as supporting exporters or importing plant/machinery which will more profoundly enable our development,” Iqbal explained.

This essentially means that the decision of marketplace closure at 8pm is not simply a measure of energy conservation but also of the careful utilisation of foreign exchange.

“If you have travelled across the USA, Europe or China, you’ll notice that commercial centres usually close by 6 pm. Only in Pakistan you find marketplaces running till midnight. This is definitely not sustainable for our country which already has depleting

foreign reserves,” Iqbal added.

All Karachi Retail Grocers Association agreed with Iqbal, saying that closing down shops by 5-6 pm was a ‘worldwide practice,’ and expressed support for the federal government’s plan.

The All Pakistan Traders Association voiced criticism against this policy, alleging that this will hurt business. They vehemently demanded a withdrawal of this decision.

“Every government has failed in the unsuccessful practice of closing shops at 8pm. In the summer season, no purchases are made during the day; buying only occurs from 8pm to 11pm,” remarked the All Pakistan Traders Association President, Jamil Baloch in a press release.

“It is in fact the traders who purchase the most expensive electricity in the country. It is absurd to stop the economic wheel to save energy. The government should cease the supply of free electricity and the rulers should turn off their air conditioners. Every household’s fan will be operational then. It is unfortunate that when it comes to energy conservation, either the defence minister speaks or the planning minister does. The energy minister should sit with trader representatives and have a discussion,” he further opposed.

In the same vein, during a press conference, APTMA North Chairman Hamid Zaman said, “Any such notification without consultation between stakeholders and the government will plummet retail sales in the country and will reduce the demand for locally produced textile and other products.”

“Peak shopping hours are considered to be between 8pm and 10pm as many consumers typically shop after work. Most workplaces will continue to operate as per normal timings, ending their day at around 7pm,” he said. “Reduced timing may curtail sales by 30%, costing $15 billion or Rs3.5 trillion in economic activity.”

“The move will erode hundreds of billions in sales tax and income tax collection – all for a mere annual electricity saving of Rs 62 bn,” lamented Zaman.

Istead, the APTMA leadership suggested the government implement daylight saving timings across the country to save approximately 1% of the annual energy costs, translating into annual savings of $230 million of the total fuel import bill currently standing at $23 billion.

Iqbal disagreed though.

“This will not hurt business, it will require some readjustment,” Iqbal poignantly

Ahsan Iqbal, federal minister for planning and development

responded.

“By means of drawing a parallel, let’s look at the time when the Prime Minister, Shehbaz Sharif implemented the policy of ending wedding ceremonies at 10 pm,” Iqbal said.

In June 2022, as a bid to conserve energy, the government decided to ban wedding functions after 10 pm. Facing an accelerating power crisis, the government undertook a plethora of measures to reduce electricity consumption and tackle load sheddings. Pakistan’s foreign exchange reserves were under severe stress, declining by USD 190m to USD 10.308m during the week ending on May 6 according to the State Bank of Pakistan (SBP).

“This policy incited a lot of outrage, as our announcement of closing shopping centres at 10 pm. However, soon everyone adjusted to the system and now people are relieved to see wedding functions ending at 10 pm,” Iqbal scoffed.

“It’s important that we synchronise our body clock with the day and night clock. As a nation, we tend to remain up till late. This is not a lifestyle that gives you productivity and consequently, people are not able to fully devote themselves to work. In fact, labour productivity has been declining over the years. Such a lifestyle is not sustainable for the development of any country,” he continued.

“These energy-saving reforms are being introduced to encourage people to change

their habits and conserve energy. The business community and the government have agreed to the initiative,” said the Defence Minister, Khwaja Asif.

According to Iqbal, this decision had already been taken by the Cabinet. However, the provinces had not been complying with the policy as the federal government lacks enforcement power in the provinces. Therefore, the matter was taken to the National Economic Council (NEC), where all the provinces were present, and asked to engage with other stakeholders such as the All Pakistan Traders Association on the importance of implementing this policy.

Iqbal said that representatives from all provinces were present during the meeting of NEC today. “After assessing the prevailing situation, it was unanimously decided to close all shops from 8pm starting from July 1,” he added.

Similar measures have been taken by various governments in the past but remained largely ineffective. Yet, Iqbal expressed unmitigated faith in the potential of this renewed policy.

“We can only implement such measures

by taking the stakeholders in confidence. Previously, the policy was only implemented at an administrative level. Without the support and cooperation of all the stakeholders, it could obviously not reap fruit,” he said.

Given the energy crisis that we find ourselves grappling with, how can we find other sustainable sources and supplies of energy?

According to Iqbal, the government is increasingly preoccupied with finding renewable sources of energy. “The government recently launched an initiative regarding 10,000 MW (mega watts) of solar energy.”

In September 2022, Shehbaz Sharif tweeted that the government had plans to regenerate 10,000 MW of solar power, as a result of which the government offices and tube wells depending on diesel for power generation will switch to solar.

“A major chunk of electricity is produced from imported fuel whose prices have gone up in recent months. Our National Solar Energy Initiative is aimed at substituting costly energy with cheap solar power, which will provide massive relief to people & save precious foreign exchange,” he added.

“Apart from this, the government is also imposing a ban on new energy projects that are based on imported fuel,” Iqbal highlighted.

In September 2022, Minister of Power Khurram Dastgir announced that the government will not establish any new power projects based on important fuel in the future. This was intended to optimally utilise indigenous sources of energy instead of relying on expensive imported fuel for generation of electricity. “The shift will not only help lessen the burden on the national exchequer but would also provide power to consumers at an affordable rate.” n

“Every government has failed in the unsuccessful practice of closing shops at 8pm. In the summer season, no purchases are made during the day; buying only occurs from 8pm to 11pm”

Jamil Baloch, President of the All Pakistan Traders Association

For an economy starved of foreign exchange, we’ll save about $1 billion annually, which will substantially contribute to our economy. We have to be prudent with our resources.

The conserved amount will help Pakistan build foreign reserves, and meet other needs such as supporting exporters or importing plant/machinery which will more profoundly enable our development

Hamza Nizam Kazi OPINION

Hamza Nizam Kazi OPINION

Most individuals are well aware of the current state of the government, given the release of this year’s budget and the conditions set forth by the International Monetary Fund (IMF) that loom over us. Although the budget will likely be released by the time this article is published, there are certain issues that the government has chosen to overlook, specifically the outstanding payments owed to local commercial importer companies.

One such issue pertains to the pending subsidy payment for Imported DAP Fertilizer. To provide context, the federal government had introduced subsidies on fertilisers purchased by farmers in the 2015-16 and 2016-17 budgets, in order to ensure the availability of affordable farming inputs. In 2017-18, the federal government discontinued this subsidy scheme by rationalising and reducing the rates of Sales Tax imposed during fertiliser imports.

Despite more than five years passing, a significant amount of subsidy reimbursement remains outstanding. Both the previous and current governments, along with the relevant ministries, have been unresponsive and have failed to fulfil their commitments outlined in the notifications they had issued.

Numerous local commercial importers are still awaiting

The writer is a corporate and technology lawyer having experience in the telecom industry and advising digital startups. He can be reached on hamza.n.kazi@ gmail.com for advice on legal and regulatory issues pertaining to the telecom sector and electronic media.

their subsidy payments. Based on available information, an approximate amount of Rs 483 million remains unpaid, which the government has thus far ignored.

The subsidy amount per 50kg bag was reduced from Rs 500 in the 2015/16 budget to Rs 300 in the 2016/17 budget. However, the fundamental procedures remained unchanged as specified in various notifications from the Ministry of National Food Security and Research. Under these procedures, fertiliser producers and importers were expected to supply agricultural inputs to the market at subsidised rates and subsequently claim the subsidy from the government.

Back in 2017, Profit reported that 52 lakh farmers would benefit from a subsidy of Rs 150 per bag of Diammonium Phosphate (DAP) fertiliser.

With the upcoming budget for this year, which will likely include a relief package for farmers, and considering the recent government’s pattern of making significant announcements prior to the budget, such as the Kissan Package or Khadim-e-Kisan Package, the government’s primary focus should be on clearing the long overdue subsidy payments to importers, who had placed their trust in the government. Additionally, assurance should be given to the Ministry that they will be reimbursed for these payments.

The importers of DAP have fulfilled all the necessary requirements for claiming the subsidy amounts, and some payments were even made until 2018. Fortunately, the entire quantity of DAP supplied by importers can be easily verified through the import paperwork, specifically customs clearance and sales tax returns. However, despite such clear evidence, the government continues to ignore the issue and hold on to the payments.

As it stands, if local companies are not given encouragement and their outstanding payments are further delayed, it will have a severe financial impact on the local industry and the market for DAP fertiliser.

Over the past few years, more than 50% of fertilisers supplied to farmers have been imported. The commercial importers have diligently ensured market-based competition and, as instructed by the government, have maintained lower domestic prices for DAP fertiliser.

The question that now arises is what steps local importers are required to take, in order to make their voices heard. Despite numerous communications and correspondence through written letters submitted to the Finance Division, no one seems willing to consider and settle the owed amounts. This directly affects the trust of local commercial importers, who have supported the government every step of the way. On one hand, the government aims to encourage local industries to invest and have a significant stake, while on the other hand, the failure to pay the due amounts continues to shake the confidence of suppliers and discourages further investment in this sector. Ultimately, this will result in losses for the country. n

It is said that we are what we eat, and data tells us that Pakistanis are not eating enough, and not eating right enough! Choice does not play a very great part in either of these cases. This is a nation of over 245 million people with an average annual growth rate of 2.4%, and fertility rate as high as 3.6, as mapped during 1998-2017 period covered by the last census.

This is also a nation that has been waxing lyrical about its ‘youth bulge;’ The fact that by 2030 more than 60 % of its population will be under 30 years of age. But the realization that needs to sink in is that the bulge made up of a large number of malnourished, wasted and stunted youth will not bear a positive dividend for the country. Instead it will be a drain on national resources as well a source of lifelong stress and disappointment to their families.

Figures drawn from reports from FAO, as well as the 2018 National Nutritional Survey show that almost half the children under 5 are suffering from these developmental deficiencies. The 2017 census revealed that the largest demographic group is between the ages of 5-9 years. If the children mapped in 2018 by the National Nutrition Survey were 5 years or less, by 2030 they will be on the threshold of the ‘youth’ bracket, and about to make their entry into that ‘bulge.’

We are also a country that ranks amongst the top ten vulnerable to climate change, and not just a highly vulnerable country but one that is a multi-threat country. The compendium of threats extend beyond floods, which have garnered the maximum attention due to their geographic extent and physical damage.

The other challenges of desertification, water and heat stress on humans and decrease in crop productivity, and in turn, its macro and micro-nutrient value have come into focus only recently. Even if one took the case of the 2022 floods, a 53% increase in the case of malnutrition was registered by the related agencies and authorities due to the difficulties in access and distribution of food.

Whichever way we look at them, the numbers do not present a pretty picture. We must also bear in mind that all these figures have human faces, and stunted, malnourished faces do not present a pretty picture either, especially our most vulnerable and precious; our children! These children need to have a better future. In fact

they need to be a part of crafting a future for themselves and the country. However, this is exactly what malnutrition, stunting and wasting prevents. Nutritional deficiencies lead to delayed developmental milestones, posing physical challenges and cognitive challenges.

If we are to move towards meeting the Sustainable Development Goal commitments, for which we have only 7 more years to reach the goal post, immediate, intensive measures will be needed to address the issue that has ballooned to the proportions of an emergency.

It may require to move rapidly through the SDG grid by aiming to address Goal 2 calling for the achievement of Zero Hunger, which are directly linked to the next four goals of Good Health and Wellbeing (Goal 3), Quality Education (Goal 4), Gender Equality (Goal 5), Clean Water & Sanitation (Goal 6), and treading the pathway to reach Goal 17 calling for partnerships for the achievement of the SDG targets.

One way of course is to get the inequitable developmental paradigm on an even keel to reach all children under 5 years of age. This is easier said than done. SCANS, the School Age Nutrition Survey of 2020 indicates that almost 90% of the children suffer from Iron deficiencies. This had earlier been identified as the top deficiency by the National Nutrition Survey of 2018. Micronutrient and macronutrients were found to be well below the Acceptable Macronutrient Distribution Range. For instance, 30% above the AMDR for total fat, while 10% are above the AMDR for carbohydrate. The situation is no less alarming where micronutrient deficiencies are concerned. Data shows that more than 80% of children are below calcium, iron, zinc, and vitamin A recommended intakes, 60% for vitamin C, 25% for B-vitamins, and 75% for folate.

These deficiencies manifest themselves through impaired growth, frequent illness, fatigue, shortness of breath, and a reduced ability to learn. This leads to absence from school, and also hinders the physical and cognitive development of children.

The Aga Khan University conducted a health economics study and calculated the cost of income loss to the tune of US$ 3 Billion annually or 1.33% of GDP. Direct medical costs of micronutrient deficiencies (in 6-23 month old children) are estimated at US$ 19m.

What do these numbers tell us? There is a clear emergency at hand, and needs to be dealt with by recognizing it as an emergency. Like in the times of disasters, this too requires a mapping, strategic planning, and resource mobilization to tackle it.

While on a broader level, there needs to be Research and Development into better, more nutritious crop varieties, efforts at behaviour change about dietary habits through introduction of a greater variety in intake, some focused interventions will also be needed.

One clear fix is the addition of the missing nutrients, macro and micro, in the diet of the group of children mapped under SCANS. This can be done by providing these school children with age specific, complimentary fortified nutritious food and dairy solutions. Such food fortification interventions demand the recognition of the emergency nature of the need, and adequate resource allocation. However, some other solution will have to be devised for the over 25 million out of school children of Pakistan, as well as those whose normal education is disrupted during disasters, displacement and climate-induced migration. Their numbers are growing exponentially, and they need to have access the solutions being devised to increase the nutritional intake of school children. Focusing on the health and nutrition of this very important demographic group is crucial to their individual development, wellbeing and prosperity, but the same goes for the country. Physically and mentally healthy children will be the biggest contributors to the nations’ health. n

OPEN A MOBILE BANK ACCOUNT IN LESS THAN 2 MINUTES FINANCIAL ACCESS TO UNDERPRIVILEGED PEOPLE

VIRTUAL REMITTANCE

HOW TO OPEN AN ASAAN MOBILE ACCOUNT

1. Dial *2262#

2. Select Option #1

3. Select Your Desired Bank (e.g: Bank Alfalah, EasyPaisa, etc)

4. Enter Your CNIC Number (e.g: 4230112345678)

5. Enter CNIC Date of Issue

6. Select Option #1

7. Nationality Check

YOUR MOBILE BANK ACCOUNT HAS BEEN OPENED FINANCIAL SERVICES & TECHNOLOGY DIVISION PATHFINDER GROUP

By Daniyal Ahmad

By Daniyal Ahmad

Waiting for your order is a maelstrom of anticipation, and anxiety. You yearn for your food and groceries, fantasising their flavour, and freshness. But you also worry about the perils that imperil your rider. You map their journey on

the map, like a guardian watching over a child. You marvel at them, tackling through challenges: zoom, brake, and swerve. You also empower them, like a coach giving pep talk. Your fingers shiver on the screen, as if you could assist them along the way. Your eyes scorch on the screen, as if you could pierce through it to your rider.

As your eyes dance across the screen, a novel feature on the waiting page will now demand your attention. A tantalising, or perhaps irksome, advertisement pops up right below your order

status. If you haven't indulged in the app for some time, you might be scratching your head. These advertisements are fresh off the press, having been incorporated into the app just last year. Foodpanda calls them ‘Panda Ads,’ and let me tell you, this could be the most effortless money Foodpanda has ever made. They just need to seduce you into acting on that urge to tap the screen — just not your rider, but a few centimetres below him.

It's such a no-brainer way to generate revenue that one can't help but wonder if Foodpanda will eventually become complacent and settle for crumbs. So what is Profit on about this week? Let’s start with how Foodpanda actually makes money.

Foodpanda has three sources of revenue: Commission, delivery, and advertising - in that order of significance. This breakdown was not available in financial statements prior to 2019.

Delivery is straightforward. “Commission is the fee we levy on restaurants for our

services,” elucidates Syed Waqas Azhar, Director of Marketing at Foodpanda. What about advertising? Specifically, advertising prior to Panda Ads.

“Before Panda Ads, we provided in-app services such as swim-lanes. Some restaurants may be less conspicuous due to their rating or other factors such as click-through rate or performance. They could purchase a premium spot on the app to augment their visibility and feature in the top listings,” expounds Azhar. This ad-tech differs from Panda Ads. The former appears upon opening the app, while Panda Ads display on the waiting screen tracking order progress.

Looking at the revenue breakdown, advertising is neither the largest nor the fastest growing. At Rs 70.2 crore, it's the lowest of the three streams when compared to the Rs 7.7 arab netted from commissions and Rs 2.17 arab from deliveries. Its compounded annual growth rate (CAGR) is second at 196% compared to commissions' 146%, and delivery's 549%. How much can Panda Ads really contribute to advertising revenue? Especially when we'll have to wait for the results to be released at the end of this calendar year.

These are valid questions, but here's where it gets interesting.

This is our focal point, and we implore your forbearance as we distil everything. This is paramount.

What precisely is Foodpanda?

“Our primary objective is facilitating customer orders,” elucidates Azhar. Delivery is their principal business and commission earnings' bedrock. How do they vindicate commission charges? “Collaborating with an aggregator like Foodpanda augments restaurants' business pie,” Azhar articulates.

Advertising is the revenue Foodpanda accrues by empowering companies to enhance their ecosystem positioning. An increase in deliveries leads to more companies desiring to join and remunerate the commission. The more commission-paying restaurants, the more congested the platform becomes, amplifying advertising necessity. Advertising is ancillary to their core business.

“They're not media purveyors or proprietors. They're engaged in quick commerce,” asserts Agha Zohaib, Managing Director at Mindshare. “Their marketing opportunities, particularly Panda Ads, are them proclaiming 'hey, while conducting quick commerce - we have another opportunity for advertisers.' Zohaib juxtaposes them with Facebook and Google's platforms, which he believes are closer to advertising than Foodpanda.

In summation, advertising links to the platform's number of restaurants and deliveries. Restaurants primarily concern themselves with delivery numbers and commission remuneration. Advertising is just the cherry on top, and will burgeon as the other two flourish. Consequently, as will Panda Ads. It’s just a layer of that advertising, and

You'll have a captive audience that's not merely browsing through channels or passing by an out-of-home. It's a space where you scrutinise your rider multiple times. Every time you check, there's positive reinforcement that an event might be transpiring or a beverage might be available

will do so by just association.

Remember how we stated this was Foodpanda's most facile revenue? Panda Ads just being another layer of advertising, and growing by association was part of the answer. The second part is that Panda Ads deviates from traditional advertising in its cost structure. Particularly, the cost incurred to generate revenue from this medium.

As with delivery revenue, there's a cost associated with delivering food and groceries and commission revenues. In conversation with Azhar, Profit discovered that while this cost is not a major component of cost of goods sold (COGS), it does add to it.

“It depends on the vertical and whether additional integration is required. A restaurant would be simpler, but adding a shop would necessitate app-based product modifications and redevelopment. This incurs a cost that is not necessarily passed onto the partner,” expounds Azhar.

“We have lifestyle and fashion brands as well. In such cases, a single stock-keeping unit could have multiple sizes. This would require further modifications and redevelopment,” Azhar elaborates. Advertising incurs a cost too. However, how much would the cost of services increase because of Panda Ads? We don’t know.

There is a cost of technology included in Foodpanda's COGS. However, attributing all of this to advertising would be asinine because Foodpanda is an app-based service. That cost will be spread over all revenue streams. What about non-COGS technolo -

"There are two ways to boost sales," explains Arfa Syed, Senior Vice President at Oula. "One is to invest in long-term brand building or equity measures, where you create and promote actual digital assets. Similarly, you can create an asset on your DVC and push it. When it comes to in-app advertising, you don't have a large window to push brand-related or equity-related content."

gy costs? Foodpanda has a technology cost listed as its administrative expenses, but that cost will also be borne by all other services. “Panda Ads does not incur significant incremental cost increases,” Azhar explains. “The costs are for product upgrades and feature development. There is a separate research and development cost that occurs at a central level.”

In all of this, it would not be incorrect to say that Panda Ads might just be icing on the cake for Foodpanda’s revenue streams. At a negligible incremental cost, Foodpanda might earn a lot more revenue. Finding revenue streams that do not incur high costs is important because Foodpanda burns a lot of money. It has incurred an average loss of Rs 3.1 arab from 2015-2022, with the latest coming in at whopping Rs 11 arab.

Now that we know this is the easiest money Foodpanda can make, the question is: do advertisers want in on this? Are they willing to advertise here?

"Instead," Syed continues, "you focus on short-term promotions such as discounts, sales or buy-one-get-one-free offers. You can increase impulse purchases. For example, if you want to push a product trial or launch a particular promotion, you can do it better here compared to Facebook and Google because the person who comes here is already willing to buy something. They are already in the mood to make a purchase. As a tactical tool, this is a good space."

"However," Syed cautions, "from a branding perspective, this is not always seen as positive because traditionally there needs to be a balance between harvesting and sowing. This means that your investment should focus more on long-term brand building or equity behind the ad, which results in an uptake in sales. When you move into performance-driven marketing, you start focusing on the shorter term. And that's where in-app advertisements come into play. It’s ideal for promos, discounts etc."

"Brand equity building is not its forte," Azhar concedes. "This medium would be part of a campaign with a very specific objective. If it were to feed into equity, it would serve as a complementary medium to achieve a certain reach with your target audience and reach out to an incremental audience. For instance, if

They're not media purveyors or proprietors. Their marketing opportunities, particularly Panda Ads, are them proclaiming 'hey, while conducting quick commercewe have another opportunity for advertisers

Agha Zohaib, Managing Director at Mindshare

there is a newly launched product, this would be an excellent medium to introduce it. If you're talking about apparel during the apparel season, it would be a great space to discuss a particular launch or proposition," Azhar elaborates.

Adil Ahmed, Director & Co-founder at the Symmetry Group, however, questions the performance marketing aspect. “Do customers actually want to leave the ecosystem when tracking their order? Are they inclined to go to another website to acquire knowledge about additional products? Foodpanda would have to educate us before we make these assumptions." Ahmed reflects.

"Nonetheless," Ahmed muses, "in my estimation, their first-party data presents an opportunity for advertisers to deliver personalised and germane experiences, which could assist with targeted brand awareness."However, Syed believes the ambiguity pertaining to how Panda Ads can be used is natural. Syed elaborates, "In-app advertising is still in its infancy. Market norms are yet to be established, making it difficult for advertisers to gauge returns. The return on investment for using Panda Ads remains a mystery. Has anyone determined the returns from this platform or

any form of in-app advertising?" Saad Khalique, former Director of Operations at Orient McCann, concurs. “On a business model level, this is entirely new for a media agency,” he adds.

So, how does Foodpanda plan to entice advertisers to their platform amidst all this ambiguity?

Azhar elucidates, "You'll have a captive audience that's not merely browsing through channels or passing by an out-of-home. It's a space where you scrutinise your rider multiple times. Every time you check, there's positive reinforcement that an event might be transpiring or a beverage might be available." Azhar adds, "We furnish advertisers with data that, although not as vast in scale as Facebook and Google, is specific and actionable. For instance, you can discern the desires of individuals within a certain age bracket in a specific locale of Lahore at a particular time. There’s an abundance of rich data for any brand or category who want to tailor their advertisements.”

But do advertisers care about this data?

Syed exclaims, "Data is only useful when it is predictive. It’s not just about data collectionit's about what sort of people will do what sort of things. Your interaction with Foodpanda is limited to food choices or, at most, grocery choices. What can you guess from this? That's something I'll leave for the advertisers to decide."

Khalique exclaims, “It can track your location and discern your gender. Let’s postulate it doesn’t know my gender, but it picks up on the fact that I frequently visit Dolmen Mall and visit Gul Ahmed. It can probably infer that I’m male because of it. Similarly, if it sees that I go to Dolmen Mall Clifton, it can identify that I fall under socio-economic class (SEC) A.” This means more targeted advertising.

The quintessential ad for perhaps the quintessential customer, and even perhaps at the quintessential time. “It provides me with a select audience. Let's postulate that I'm a ketchup brand, and I want to target all users ordering burgers. Ketchup is, after all, an ingredient in burgers, so I can have my ad played immediately after someone places an order for a burger" Ahmed explains the matter.

What about the opportunity cost? Can't we already achieve this through other social media platforms? Zohaib exclaims, “On many social media platforms, you're not always actively engaged. You might use them as background noise if they play music. But with this, you're glued to your rider.”

Zohaib adds, “For our high-end brands, their higher-income customers with larger basket sizes and deeper pockets use Foodpanda. Sometimes Google and Facebook just don't cut it. There are a plethora of touchpoints. It's predominantly the same audience across all these social platforms. Foodpanda simply offers us another avenue to captivate them.”

So does Foodpanda have a golden goose on its hands? By the looks of it, yes. Will they kill it? We don’t know but they will most definitely lock it up and ensure they get as limited number of eggs as possible.

Adil Ahmed, Director & Co-founder at the Symmetry Group

In-app advertising is still in its infancy. Market norms are yet to be established, making it difficult for advertisers to gauge returns. Has anyone determined the returns from this platform or any form of in-app advertising?

Arfa Syed, Senior Vice President at Oula

Do customers actually want to leave the ecosystem when tracking their order? Are they inclined to go to another website to acquire knowledge about additional products? Foodpanda would have to educate us before we make these assumptions

You're taken aback, aren't you? How can we critique something after praising it? The benefits we've extolled pertain to ad-tech, Foodpanda itself, and their fusion. Everything will likely pan out so well for them that they might settle for the low-hanging fruit.

Ahmed queries, “If they're displaying the ad post-purchase, then that window is exceedingly narrow for them. They’re limiting their ad exposure. Not many stick around after placing their order. Ad integration throughout the purchase journey, and personalisation instead is key.” This conundrum isn't exclusive to Foodpanda. Syed interjects, “Dwell time is universally low across digital platforms. There's a rationale behind skippable ads on YouTube. No one lingers for more than 10 seconds.” However, Foodpanda offers no creative solution.

Ahmed elaborates, “Digital media is about customised experiences. They can offer

contextual and personalised advertising solutions. I understand Foodpanda's reluctance to inundate their platform with advertisements and undermine organic customer decision-making. However, customers frequenting Foodpanda and Panda Mart can select from multiple options which provides the opportune moment to deliver data-driven and targeted advertisements in that phase of the customer journey.”

Ahmed persists, “If it's merely placing an ad at the conclusion of the checkout screen, how does that differ from an in-stream video ad? That becomes dubious because when I envisage video, I picture more native video ad placements and platforms.”

How can we conclude this in a manner that encapsulates everything? "There will inevitably be a bidding war. It will be a microcosm of what transpired when YouTube launched their mastheads" Khalique declares.

Khalique persists, “An increase in ad spend on Foodpanda can only be justified if the

return has been augmented.” Perhaps the ambiguity surrounding what Panda Ads is and isn't might contribute to the premiums Foodpanda can command. Allow advertisers to do whatever they want with it. However, left to their own devices, advertisers will simply revert to their usual ways.

Ahmed laments, “In advanced markets, exceptional campaigns are crafted through the leveraging of platform expertise. However, in this market, many players in the value chain adopt a ‘one size fits all’ approach across all platforms, which is ineffective” Khalique chimes in, “The day our companies start creating separate DVCs for different mediums and categories, then maybe they'll do it for Panda Ads too.”

Ahmed continues. “As the market’s dominant force, they must educate advertisers on their platform’s opportunities. Their ad sales team must divulge consumer insights and successful case studies to facilitate capitalisation. This mutually beneficial relationship empowers both parties,” Zohaib proclaims. “We've benefited from their media services and look forward to deepening our partnership with them.”

Have they pulled up their socks then? It is on this note that we can conclude. Profit reached out to a plethora of additional sources for this piece, many of whom were blissfully unaware of this platform. There wasn't a whisper of hype. And that perhaps best encapsulates the current state of Panda Ads. It will generate a trickle of revenue for them, but these returns are so effortless that it doesn't seem like Foodpanda will even bother attempting to use it to plug their staggering Rs 11 arab deficit. They might just settle for the crumbs. n

The day our companies start creating separate DVCs for different mediums and categories, then maybe they'll do it for Panda Ads too

Saad Khalique, former Director of Operations at Orient McCann

In a move widely criticised at messes across merge nation, the federal government has slated for around half of the entire federal budget to be given to the civilians for their supposed needs.

”I guess we know who runs this country, then,” said a source in the ministry of defence, on the condition of slipping him a thousand rupee note. “I guess the non-non-representative forces still hold sway.”

”The greed of the civilian-industrial complex will continue, unabated,” he added, upon further payment.

Analysts are already cautioning the civilian government that such proportions of non-defence expenditure are unsustainable.

”Yes, they are,” said Islamabad-based analyst Mosharraf Zaidi. “It is a shameful for a nation to be spending as much on education (all provinces combined) as on defence.”

The federal budget has again continued the practice of slotting military pensions under the civilian budget. It has also included the costs associated with starting the Istehkam-e-Pakistan Party (IPP).

“Since military pensions go the retired officers and jawans and since technically they are civilians, it shouldn’t be an issue if they are not counted in the

military budget,” said a source in the defence ministry.

“And the costs of the IPP have nothing to di with the military because the army is neutral and has nothing to do with politics,” he said.

The defence ministry source also offered your correspondent a fully paid trip to the northern areas where a training seminar is going to be conducted for journalists who fail to not see the connection between the military and the IPP