08

08 Khushhali bank to force convert its hybrid debt into equity. But is it fair?

12

12 Political patronage and victimisation: Medialogic and the TV ratings story

19

19 Paid Parental Leave — This is not a drill and it is definitely not a vacation

24

24 What does it mean to be a progressive farmer?

28 The Federal Budget is about to be tabled, but will the tables be turned?

Publishing Editor: Babar Nizami - Joint Editor: Yousaf Nizami

Senior Editor: Abdullah Niazi

Executive Producer Video Content: Umar Aziz - Video Editors: Talha Farooqi I Fawad Shakeel

Reporters: Taimoor Hassan l Shahab Omer l Ghulam Abbass l Ahmad Ahmadani

Shehzad Paracha l Aziz Buneri | Daniyal Ahmad |Shahnawaz Ali l Noor Bakht l Nisma Riaz

Regional Heads of Marketing: Mudassir Alam (Khi) | Zufiqar Butt (Lhe) | Malik Israr (Isb) Business, Economic & Financial news by 'Pakistan Today'

Contact: profit@pakistantoday.com.pk

Khushhali Microfinance Bank might become the first institution to convert its Additional Tier 1 bonds to common equity. But what are the implications of this conversion?

By @2paisay & Mariam Umar FarooqWhen Khushhali Microfinance Finance Bank (Khushhali bank) released its latest financials for the first three months of 2023, it reported yet another quarter of losses. Even before this, it was clear that the bank was in trouble. Continuous haemorrhaging in the last year had wiped off a big chunk of the bank’s equity capital. And now the bank is scrambling to find Rs8 billion in fresh capital. To put this number in perspective, it takes Rs10 billion to set up a brand new commercial bank in Pakistan. That is right. With another Rs 2 billion the potential investors could instead open, not a microfinance bank, which has limitations on what it can and can not do, but a full service commercial bank!

What this also means is that if Khushhali bank is unable to find willing investors soon, the State Bank of Pakistan (SBP) might have to come in and do what it did with KASB bank in 2015.

But before the fresh capital comes in (if it ever does), Khushhali Bank has taken one decision that is causing considerable pain to one set of investors. The decision to forcefully convert Rs1.5 of Additional-Tier 1 bonds (ADT1), which is a special type of debt, into equity capital. In simple words, investors in these Khushhali

bank bonds were hoping to enjoy fixed interest payments, while now they are being forced to become shareholders, expected to share losses (and profits, if any) of the troubled bank. The investors are obviously not happy and feel short changed. But more on that later.

At Profit we feel it is our responsibility to raise issues in the corporate world where there are concerns of possible financial wrongdoing, but this story is more important than just that. The outcome of how regulators handle the first ever conversion of this sort could be much more significant, not just for the newly introduced ADT1 bonds asset class, but also for the larger development of Pakistan’s capital markets, and in turn our economy. What makes it even more relevant is that this is happening when very similar cases in Switzerland and India regarding Credit Suisse and Yes Bank are underway, making Pakistan the third country where this discussion is happening.

But first what are ADT1 bonds?

(skip

Additional Tier 1 Term Finance Certificates/bonds (or ADT1 bonds) are a type of debt instrument (loan) issued by banks to meet regulatory capital

requirements. These were introduced as part of the Basel III framework, which was implemented in response to the 2008 financial crisis. The main objective of Basel III was to make the global banking system stronger by increasing the quality and quantity of capital that banks hold, so that in future banks do not need their governments to bail them out. Thus, ADT1 bonds enhance the loss-absorption capacity of banks and provide a safety net to protect depositors’ money in case of financial stress.

The key features of ADT1 bonds include:

1. Perpetual Maturity: ADT1 bonds don’t have a specific maturity date when the money has to be paid back to the bondholder. They can last indefinitely, but the banks that issued them may have the option to pay them back after a certain period if they want.

2. Discretionary Interest Payments: The payment of interest on ADT1 bonds often depends on the bank’s profitability and availability of distributable funds. If the bank’s financial performance deteriorates, it can defer interest payments on ADT1 bonds.

3. Loss Absorption and conversion into shares: ADT1 bonds are designed to absorb losses if the bank faces financial difficulties or is failing and thus goes through a resolution process. In such situations, the bondholders may experience a reduction in the amount they will be paid back (principal) or their debt may be converted into ownership shares (equity).

if you already know)

4. High Yield: ADT1 bonds generally offer higher interest rates (yields) compared to other types of loans because they carry higher risks. These risks come from the possibility of loss absorption and because ADT1 bondholders are in a lower priority position compared to other forms of debts, and might not be paid back in full if a failing bank’s assets fall short of its other debt obligations.

The capital buffer required by banks is divided into two tiers and must meet certain minimum levels. Tier 1 capital is made up mainly of equity, referred to as Common Equity Tier 1 (or CET1), while Tier 2 capital can be made up of debt securities such as bonds and Term Finance Certificates (TFCs).

ADT1 bonds lie between equity CET1 and Tier 2 debt and are considered a distinct category as they can be converted into common equity (CET1) to fulfil regulatory capital requirements.

In terms of hierarchy, Tier 2 instruments rank higher than ADT1 instruments which rank higher than Common Equity Tier 1. In other words, CET1 is subordinate to ADT1, which in turn is subordinate to Tier 2. In the event of a resolution or insolvency, these instruments absorb losses according to the hierarchy of their positions. This means that common equity instruments (shareholders) are the first to bear losses. Only after these instruments have been fully utilised would Additional Tier One instruments, like our ADT1 bonds here, be subject to write-downs, followed by Tier 2 capital instruments. In simple terms, the order of absorbing losses starts with common equity, then moves to ADT1 bonds, and finally to Tier 2 capital instruments.

As mentioned earlier, ADT1 bonds can be converted into equity or can be written off if the capital ratio of the issuing bank falls below a predetermined threshold. Such an event activates the contingency plan, enabling the option of conversion of these debt instruments into equity.

As per Basel III requirements and as also directed by the SBP the ADT1 bonds are convertible under the following contingent scenarios:

1. Point of Non-Viability Trigger Event (PONV Trigger Event): This event occurs when the SBP determines that it is necessary for the Issuer (Khushhali bank in this case) to either convert the bonds or permanently write them off to prevent a troubled bank from defaulting on obligations towards its depositors. It can also be triggered if there is a decision to inject capital or provide equivalent support from the government to prevent the bank from becoming non-viable. The SBP has the authority to declare the PONV Trigger Event at its discretion.

2. CET 1 Trigger Event: This event is triggered when the Issuer’s Shareholders’ Equity Tier 1 (CET1) ratio falls to or below 6.625% of Risk Weighted Assets. When this happens, loss absorption through conversion is initiated. Risk-weighted assets are mainly the loans that the bank has made, weighted (that is, multiplied by a percentage factor) to reflect their respective level of risk of loss to the bank.

3. Lock-in Event: Mark-up will be paid from the Issuer’s current year’s earnings and if the Issuer is in compliance with regulatory Minimum Capital Requirement and Capital Adequacy Ratio requirements set by SBP. Not exercising the lock-in clause may result in conversion of these ADT1s into ordinary shares or write-off at the discretion of SBP.

The Saga: Khushali Microfinance Bank issues ADT1 for Rs 1.5 billion face value

Khushhali bank issued Rs1.5 billion fully subscribed face value ADT1s on June 16, 2022. The instrument was perpetual with profit payable every six months and priced at 6M Kibor+4% and was callable at par after 5 years. The instrument had lock-in and loss absorption clauses.

Such instruments are required to be rated before they can be issued. Khushhali bank solicited Pakistan Credit Rating Agency (PACRA) to issue the rating for the instrument. In its

May 24, 2022, rating report, PACRA rated the ADT1 instrument as A-. While VIS Credit Rating Company Limited (VIS) didn’t rate this particular ADT1, its May 6, 2022 rating report rated Khushhali bank as A+ and two previous Tier 2 TFCs issued by Khushhali bank as A.

Explaining the rating, Maham Qasim, Senior Manager & Lead Financial Analyst at VIS Credit Rating Company Ltd said “TFCs are shadow ratings of the entity. When we rated Khushhali Bank at A+ in April 2022, we had to rate the TFCs in relation to entity’s rating”.

Both rating entities, the PACRA rating and VIS rating, issued reports only a month before the ADT1 subscription and highlighted the risk of the restructured portfolio yet find comfort anticipating support from the sponsors (mainly UBL).

However, both rating agencies also expressed concerns on the recovery of deferred loans. VIS rating explicitly stated the bank’s management has aggressive assumptions with respect to the double restructured portfolio as the bank had set an ambitious recovery target of around 80% on the portfolio rolled over under SBP’s relief which it did not think was possible.

The consortium of investors in the ADT1 include:

a. The Bank of Punjab (BOP)

b. BOP Employees Gratuity Fund,

c. EFU Life Assurance Limited,

d. National Bank of Pakistan,

e. Pak-China Investment Company Limited,

f. United Bank Limited

g. U Microfinance Bank Limited (UBank),

h. Askari Bank Limited,

i. Askari Bank Limited Employees Provident Fund and

j. Khushhali bank Employees Gratuity Fund

UBank subscribed to 15% of the issue amounting to Rs 225 million as per their September 30, 2022, financials. The rest of the investors either don’t have public financial

The conversion of ADT1 to equity is a contractual event/term and does not reflect Khushhali Microfinance Bank’s inability to service these TFCsAameer Karachiwalla, President and CEO of Khushhali Microfinance Bank

Sponsor profile makes up 35-45% of the weightage. UBL which is a AAA-rated bank owns 1/3rd of the equity in Khushhali bank. UBL is one of the biggest banks in the economy. Khushhali bank’s sponsor profile is strong because it has very strong sponsor profiles including UBL and international funds

statements or do not provide details of this investment in their financials.

The most surprising part is ADT1 are the first line of defence when an entity is hit by lack of capital. Both rating entities had flagged concerns surrounding the loan portfolio of the bank. Besides, the relief provided under the SBP program has now ceased. In such a situation, it is only natural for investors to be vigilant and seek reassurances or guarantees from the bank, particularly regarding the troubled loan portfolio.

March 2022 financials would have been the latest public financials available to ADT1 investors. According to these financial statements, Khushhali bank had charged Rs1.25 billion of specific provisions against their loans. However, in the June 2022 financials, the year-to-date specific provisions had increased to Rs3.3 billion implying that Khushhali bank accrued additional specific provision of around Rs 2 billion in the period April-Jun 2022. Net Assets including CET1 stood at Rs10.8 billion

According to the June 2022 financials, which were just 14 days after the ADT1 issue, Net Assets (including CET1) dropped to Rs 9.3 billion.

Were the investors aware that they are looking at a reduction in the equity in 14 days which is almost equal to the ADT1 amount?

It is impossible that Khushhali bank’s management was unaware of the true financial position of the bank 14 days before the date of the financial statement i.e., June 30, 2022, and this loss and reduction in equity came as a surprise to the management. If the management was aware of this, it is expected that this information was shared with investors when they were investing in ADT1s. If the management was unaware of the magnitude of this loss two weeks before the half-year close, then this raises questions about the governance systems in place at Khushhali bank, a fact which will be of relevance when we discuss the Yes Bank case later.

Profit reached out to Aameer Karachiwalla, President and CEO of Khushhali Microfinance Bank whether investors were aware of the true financial position.

“The process for ADT1 issuance was initiated in late 2021. IM (Information Memorandum) including 5 year Forecast along with portfolio analysis were provided to the consortium/ ADT1 investors. Additional information as and when required and financials of the bank were also available to the consortium on our website duly approved by the Board. The ADT1 issue was also rated by PACRA, a leading rating agency.

The portfolio deterioration caused by Covid was well known to the investors prior to drawdown in Q2, 2022, as the COVID related rollovers started maturing and were later compounded by floods in the country. This double calamity caused unprecedented losses that were not in our earlier forecasts. These losses eroded the CET1 to levels triggering the predetermined point for conversion under the SBP regulations. The conversion of

ADT1 to equity is a contractual event/term and does not reflect Khushhali Microfinance Bank’s inability to service these TFCs”, declared Karachiwalla

However he doesn’t answer whether the investors knew about the loss that came on June 30 when they advanced the money on June 16.

In December 2022, PACRA issued the credit report mentioning that Khushhali Bank has invoked the Lock-in clause.

According to the terms of TFCs and Lockin clause, neither profit nor principal is payable if the required levels of capital fall short then specified by the SBP. This means that not a single profit payment was made on this ADT1 that was issued on June 16, 2022.

Despite this, PACRA maintained the rating of TFCs at A- but with a negative outlook. Unfathomable why PACRA is maintaining the rating considering the bank’s capital didn’t increase despite issuance of ADT1 and the bank could not even make first profit payment on the recently issued ADT1. VIS also issued its rating report in December in which it downgraded the two Tier II instruments two notches from A to BB- due to deteriorating financial health of the bank leading to a negative impact on its profits and capital position. Capital adequacy ratio (CAR) decreased below the required minimum set by regulators. Moreover, SBP had activated a lock-in clause. This means that the bank is not allowed to repay any debts covered by the lock-in clause during the period specified.

We can hypothesise what happened here. First, Khushhali bank wrote to SBP that they have breached the Basel III requirements as imposed by SBP and are invoking the lock-in clause for ADT1s (holding off the payment of the first markup on ADT1) whilst also seeking an approval from SBP to pay the markup. Therefore, PACRA maintained the

rating on ADT1 at A-. However, SBP took it a step further and asked Khushhali bank to invoke the lock-in clause on Tier II instruments as well. Seeing this VIS downgraded the Tier II TFCs by two notches to BB-. Thus, at the end of December, the subordinate instrument ADT1 was rated A- while Tier II instruments which rank above ADT1 were rated two notches below, at BB-.

At the end of January 2023, PACRA in its rating report finally brought down the rating of the ADT1 to BB because of invoked lock-in clause and debt repayment of Tier-I instrument was not made.

In its April 2023 rating report, VIS dropped the long term rating of Khushhali bank from A to A-. This downgrade came because Khushhali Bank’s capital fell below the required levels and the microfinance bank lost its market leader position during the ongoing year.

And as stated earlier, the lock-in clause had been invoked on the Tier-II instruments of the Bank by SBP thus preventing any debt repayments. But the ratings still stood at A- because of strong sponsor profile and implicit support of shareholders.

However, the rating agency put the bank on rating watch negative which means that the bank’s ability to pay off its liabilities is deteriorating. The report stated that the actual non-performing loans (NPL) percentage, which is the proportion of loans not recovered, is likely to exceed the one provided by the management as current recovery rate was lower than anticipated. Moreover, the bank had missed payments for two instruments under rating review with TFC-1’s first mark-up payment missed on 19th March, 2023 and two markup payments of TFC-2 have been missed, dated 27th Dec 2022 and 27th March 2023. Given that it is highly unlikely that the Bank will be able to replenish its equity shortfall during the ongoing year; therefore, further missed payment instances are expected. Subsequently, the risk of conversion of both instruments into common equity is on the higher side.

Two points need to be emphasised:

1. Before the ADT1 issue, in their May 6, 2022 rating report, VIS mentioned that Khushhali bank management was projecting an 80% recovery rate on the double restructured portfolio. A double restructured portfolio refers to loans or credit facilities that have been modified twice due to financial difficulties faced by borrowers. VIS pointed out that recovery rate was unrealistic. Almost a year later, in its April 2023 rating report, VIS notes that the actual recovery

rate was much lower at 49%. In VIS’s opinion, Khushhali bank is still under-reporting NPLs.

2. The rating report, however, VIS does not mention that the auditors have raised doubts about the ability of Khushhali bank to continue as a going concern in the Dec 31, 2022 financial statement.

Qasim from VIS retorted saying “We are not auditors, we are not going to comment on whether an entity is a going concern or not”.

The bank issued its financial statements for the year 2022 at the end of April 2023 in which it declared a loss of Rs 3 billion on account of significant losses incurred by it on its lending portfolio.

Under the SBP COVID relief guidelines, Khushhali bank rescheduled loans of approximately Rs 35 billion. At the reporting date, the rescheduled portfolio had reached maturity. But cash recovery stood at 49% (Rs 17 billion). The bank further rescheduled 31% of loans(Rs 11 billion) and wrote off 20% of loans (Rs 7 billion). Given the losses on rescheduled loans, Bank’s capital adequacy ratio (CAR), at 11.50%, fell below the regulatory requirement of 15% at the reporting date. Consequently, auditors raised doubts about the ability of the bank to continue as a going concern which means that the bank does not have enough assets to pay off its liabilities.

Therefore in April 2023, the Khushhali bank’s board of directors gave approval for

conversion of Rs1.5 billion ADT1 bonds to common equity to increase its capital levels to meet the required capital levels. The Bank’s financing agreements for ADT-1 capital contain a loss absorption clause, whereby, the Bank can convert this subordinated loan into common capital, under a mechanism established pursuant to provisions of Basel-III guidelines issued by SBP, if the Bank’s Loss Absorbency Ratio (LAR) falls below prescribed benchmark.

As mentioned earlier, there is no precedent for such a transaction in Pakistani capital markets. As such, the matter discussed here will not have been touched upon previously. There are three key matters that need to be discussed:

1. Hierarchy of claims and write-downs

2. Governance (or lack thereof) and projections when making representations for issuing ADT1s

3. Rating’s reliance on sponsor support which never arrived.

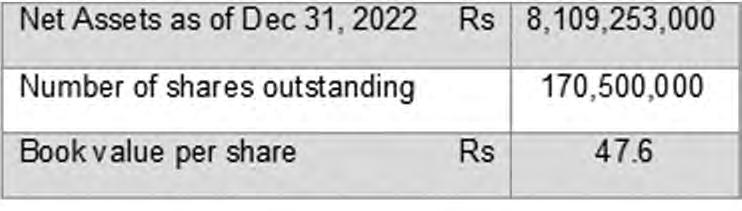

As per the terms of the ADT1 given in the information memorandum of the ADT1, the maximum number of shares to be issued to TFC holders at trigger is 24,941,038 ordinary shares, or as specified by the SBP

The cap on the maximum number of shares that can be issued places the ADT1 investors at a disadvantage with respect to the equity holders. The book value of the shares as of December 31, 2022, is Rs 47.6 per share.

As per the terms of the teaser, the ADT1s will be converted to shares at a price of Rs 60.1 per share

ceptable that the ADT1 investors should get a write-off.

This principle was recently emphasised

Earlier we hinted at a possibility that either there was a lack of governance at Khushhali bank or a wilful masking of losses, as the financial statements issued 14 days after the subscription of ADT1s show a different picture to the one based on statements available before the subscription. This is also substantiated by VIS commenting that Khushhali bank is projecting unrealistic recovery targets of 80% on the double-restructured portfolio. Even now, Khushhali bank is underestimating NPLs as per VIS.

Once the conversion happens, the Net Assets of the bank will increase by Rs 1.5 billion and number of shares will increase by the new shares. The new book value will be Rs 49.2 per share.

by the Bank of England, the European Bank Authority with ECB, and the Monetary Authority of Singapore in the aftermath of Credit Suisse AT1 write-offs.

All three of these institutions empha-

The case of Yes Bank in India provides a good case study for such a scenario. In 2020, Yes Bank collapsed due to various scandals involving questionable investments, high upfront charges, undisclosed non-performing assets (NPAs), and banking frauds like money laundering. The Reserve Bank of India (RBI) imposed a moratorium on the bank and appointed an administrator. Initially, a draft reconstruction scheme was released, which included the write-off of Additional Tier-1 (AT1) bonds. However, the final scheme, approved by the Central government, removed this provision.

The ADT1 investors are getting a share at a price of Rs 60.1 per share when the actual value per share is Rs 49.2. The value per share of common equity before the conversion was Rs 47.6 and after the conversion, it increased to Rs 49.2. What we see here is that common equity holders gaining at the expense of ADT1 investors and ADT1 holders recognizing a write-down or partial write-off of Rs 273 million on their investments.

sised that AT1 instruments rank ahead of CET1 and behind T2 in the hierarchy. Holders of such instruments should expect to be exposed to losses in resolution or insolvency in the order of their positions in this hierarchy. This means that common equity instruments are the first ones to absorb losses, and only after their full use would Additional Tier One be required to be written down followed by Tier 2 capital instruments.

Despite the removal of the provision, the administrator wrote off AT1 bonds worth INR 84.2 billion on March 14, 2020. On January 22, 2023, the Bombay High Court overturned this write-off, stating that the administrator exceeded his powers and authority. Yes Bank and the RBI appealed the Bombay HC’s decision in the Supreme Court, and the stay granted by the Bombay HC was extended by the apex court.

Investors have filed affidavits in Supreme Court highlighting governance lapses by Yes Bank. They argued that the decision to write down the bonds was flawed and the RBI did not consider the bank’s violation of financial rules when supporting the write-down in court.

Earlier we mentioned that the AT1 instruments rank ahead of CET1 and behind T2 in the hierarchy.ADT1 rank ahead of common equity. If the common equity holders, which are subordinate to ADT1 investors, are not getting their equity written off, it is unac-

But in the case of Khushhali bank, ADT1 instruments are being converted into equity in a manner that ADT1 investors will bear a partial write-down (loss) before the common shareholders.

An often-overlooked footnote in the RBI master circular states that a bank may also become non-viable due to non-financial problems, such as the misconduct of affairs of the bank in a manner which is detrimental to the interest of depositors, poor governance issues, etc. In such situations raising capital is not considered a part of the solution and therefore, does not fall under the provisions of this framework. This means that if a bank has hidden losses and deceived investors, a writedown may be difficult to justify. Yes Bank, for instance, faced allegations of masking losses and misleading investors, which resulted in the removal of its CEO and changes in the board of directors. Two AT1 bondholders of Yes Bank believe that this provision supports their

argument that the write-down was illegal and against regulations.

The outcome of the ongoing legal battle between bondholders and the RBI remains uncertain, as the court will have to consider the allegations of governance lapses and the bank’s misleading actions in the context of the AT1 bond write-down.

When granting the A- rating, both PACRA and VIS relied on and sought comfort from the sponsorship of UBL and expected implicit support from UBL.

“We have 9-10 parameters for rating and the Sponsor profile has the highest weightage. Sponsor profile makes up 35-45% of the weightage actually. (Within the sponsor profile), Number one is the group. And then the willingness and capability of the group and sponsors to help the organisation. UBL which is a AAA-rated bank owns 1/3rd of the equity in Khushhali bankL. UBL is one of the biggest banks in the economy. Khushhali bankL’s sponsor profile is strong because it has very strong sponsor profiles including UBL and international funds”, said Qasim.

However, to date, no support has been given by UBL to the extent that the ADT1 investors who relied on the A- rating are not only looking at a conversion of their ADT1 to CET1 but also a partial write-off. VIS’s

Profit reached out to Karachiwalla to understand why UBL has not not injected capital in its microfinance subsidiary.

“UBL only owns 29.8% of the Khushhali, and while they fully support the bank, equity injection is a combined activity with the remaining shareholders who are largely foreign funds. You may appreciate raising fresh equity is a time-consuming process, however, the

process is at an advanced stage”, commented Karachiwalla.

While Karachiwalla’s statement alludes to positivity, VIS’s April 2023 report shows a different picture altogether. According to the report, UBL, the primary sponsor, has agreed to pitch in funds as per their existing shareholding proportion but are not willing to increase their overall stake in the Bank. The contribution from UBL is expected to range between Rs. 1.9-2.7 billion. Moreover, one of the international sponsors, ASN Novib having an ownership of 10%, has also agreed to inject equity; however, the amount of investment has not yet been confirmed. Nevertheless, ASN NOVIB does not plan to contribute more than their current shareholding proportion. On the other hand, the remaining international sponsors having an aggregate stake of around 60% being closed end-funds have not shown any interest in injecting additional capital in

the Bank. On the flip side, the management has approached a Dutch Entrepreneurial Development Bank to buy out the stake of three existing international shareholders. In addition, the management is also hopeful that apart from buyout money the new prospective buyer is also willing to inject additional funds.

Meanwhile, sponsors of other microfinance institutions have provided support to their microfinance institutions most notably Telenor and Alipay injection of Rs 19 billion in Telenor Microfinance Bank between 2020 and 2021, PTCL converting its Rs1 billion Tier II capital provided to U Bank to Tier I and NRSP got Rs1 billion share deposit money from some shareholders.

In light of the issues highlighted above, the conversion of ADT1 isn’t as straightforward as it first appears. If the conversion proceeds as described in the regulations without considering the overarching matters of the hierarchy of claims and governance/ financial projection, this may kill the market of ADT1 as no investment manager who values his career will recommend investing in such an instrument.

This will have a direct impact on the future of the stability of our financial system, which is already under distress. Not just because many bank borrowers might just default on the back of record high interest rates, coupled with a slowing economy, but also because there are talks of the government also defaulting on its domestic debt obligations to the banks. Moreover, this raises the issue of how much value to give to credit ratings when the rating is deriving comfort from the implicit support from sponsors which sometimes never arrives. n

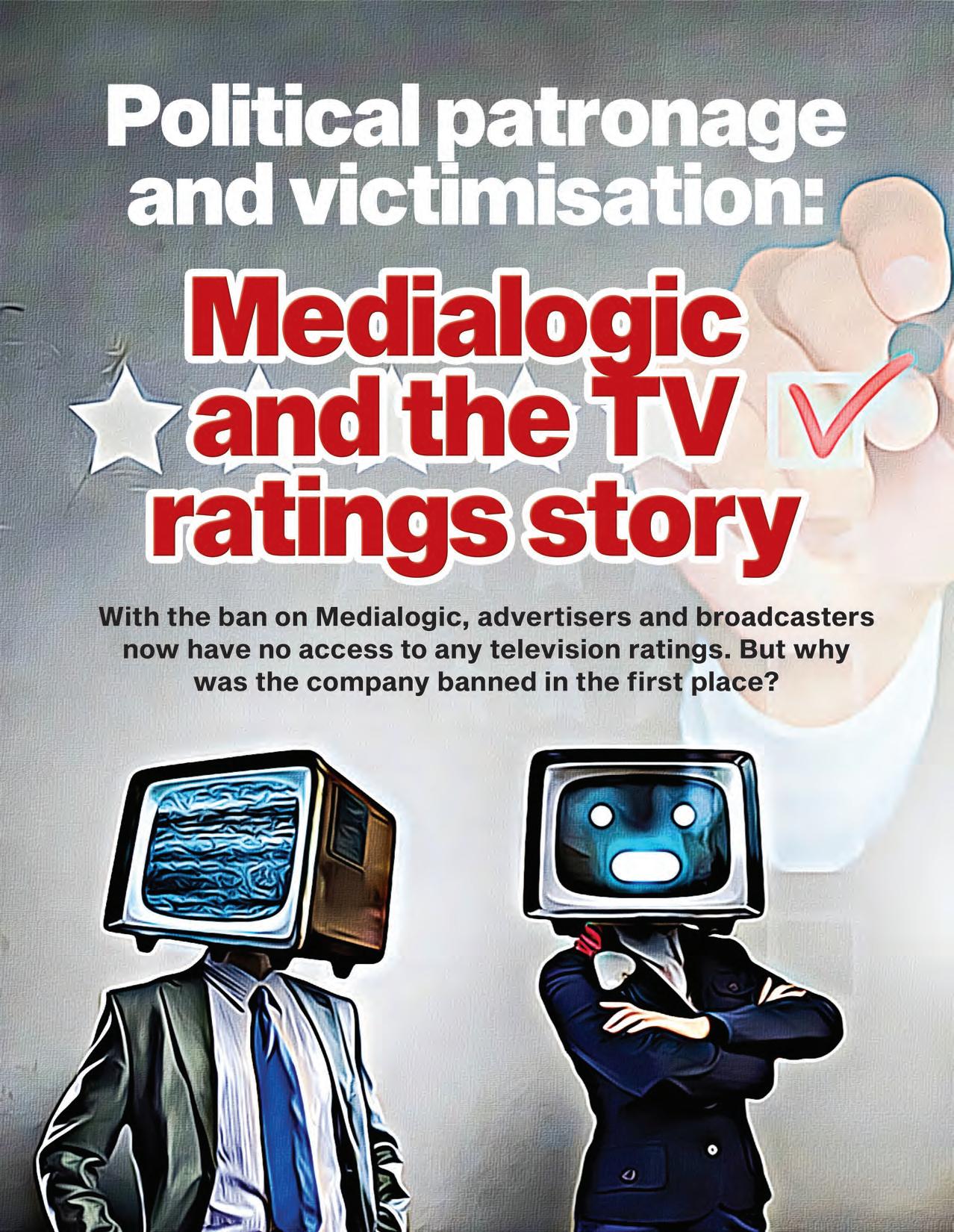

It happened quietly and without warning. Early on the 22nd of May, a small team of law enforcement officials dispatched by the ministry of interior sealed the offices of a seemingly little known company called Medialogic. And as the offices were locked up, Pakistan’s entire advertising and broadcast industries went blind.

Medialogic is (was?) the only provider of television ratings in Pakistan. In the one week since they were unceremoniously banned television ratings have disappeared in the country entirely, leaving television channels and advertisers with no way of knowing which shows are getting the largest audience and most views.

In a brief notification issued on the 22nd of May, the ministry of interior requested that the functioning of Medialogic be ‘halted’ over allegations of “anti-state activities” that were supposedly a threat to national security.

The government has not specified what these anti-state activities were. Both the interior and information ministries have failed to respond to repeated requests for comments on the issue. The overwhelming response from within the industry, however, is that old links between Medialogic’s founder and former CEO Salman Danish and former prime minister Imran Khan became the cause.

For some time during the last decade, Danish had served as a media consultant to Imran Khan’s Pakistan Tehreek i Insaaf (PTI) and Medialogic also handled the party’s advertising account. Danish was also said to be a regular feature at Bani Gala and was among Khan’s inner circle of associates and confidantes.

Has Medialogic also been swept up in the vicious crackdown on leaders, workers, and supporters of the PTI after the events of the 9th of May? If that is the case it marks a sobering moment for the business community in the country. On the one hand advertisers will face an immediate conundrum — if they do not know which channels have the most eyeballs on them how will they plan and

execute their television advertising strategies? And then there is the bigger issue. If links to politicians can result in your business being shuttered up overnight, is anyone safe at all?

The sudden and heavy handed ban has already sent a wave of fear across the broadcast and advertising industries that has made its executives and functionaries skittish and full of jitters. As of now Medialogic is keeping its cards close to its chest, releasing only a brief statement within the broadcasting industry. But is this simply a case of political victimisation or is there more to it? To understand, it is worth looking at how the television ratings business works in Pakistan and why Medialogic occupies (occupied?) such a crucial and powerful position.

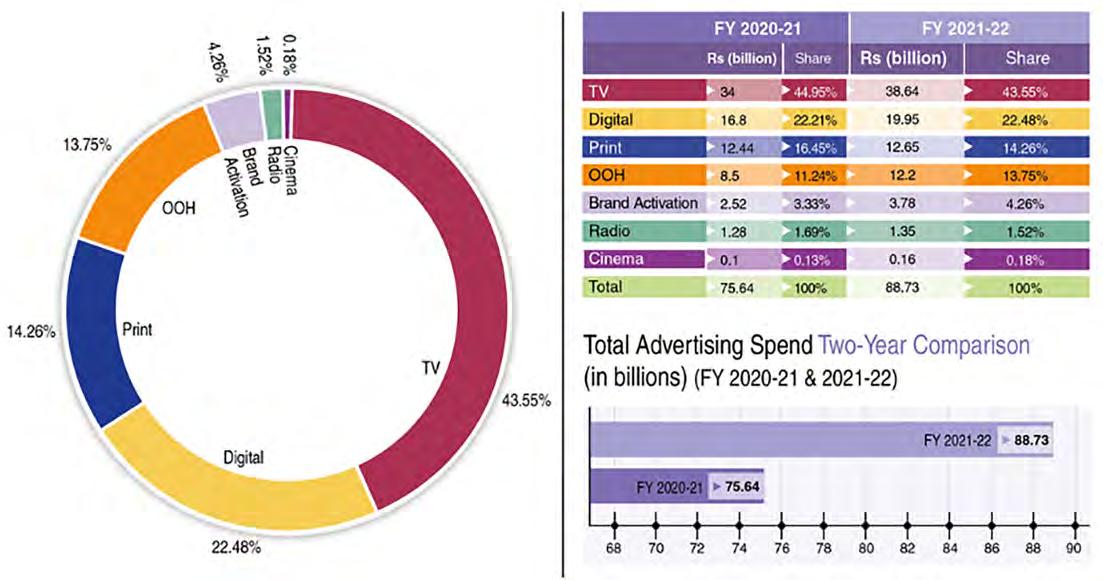

Advertising is big business in Pakistan. And when you’re the fifth most populated country in the world, the television audience is massive. In 2021, the media industry’s total ad spend clocked in at Rs 75.46 billion. This was an increase of nearly 30% compared to 2020 when the total ad spend was just around Rs 58.6 billion.

But there is another interesting statistic within this. In 2021, the ad revenue that went to television channels was a whopping Rs 34 billion — nearly half of all the ad money spent in the entire country. In 2020, the amount of money that advertisers spent on television advertising was just Rs 16.8 billion. This means that from 2020 to 2021 advertisers increased the amount of money they spent on advertising on television by 50%.

There is a story hidden in these numbers. The story tells us that for some years, for as long as television has become a mainstay in Pakistan, advertisers have spent nearly half their budgets on putting their products on television. And we aren’t just talking about small products. Companies like Unilever and banks like HBL have dedicated vast amounts of money to put their adverts on different television channels. And despite the world becoming digital, spending on marketing

through television ads has only increased. What happens when such large sums of money are involved? Companies that spend on advertising want to get the most bang for their buck. They want to make sure their ads are played on the television channels with the most viewers at the time when the most people tune in. The television channels want these numbers too. A news channel, for example, will want to know which anchor draws the most numbers so that they can give them the ‘prime time’ spot. And how do they know what ‘prime time’ is? Once again through television ratings. Marketing departments of television channels also jealously guard these numbers because they determine how well they are competing with other channels and how much they can charge advertisers per second on their airwaves.

Television rating, or Television Audience Measurement (TAM) as they are known in industry jargon, are central to all of these decisions. These are those hallowed numbers that powerful media executives salivate over, and producers and hosts are willing to sacrifice an arm and a leg for. Every time an uncle sees something he does not like on television, the mantra he mutters under his breath is that the media sells out for ratings. But television ratings themselves are a product – a currency as TAM providers like to call it. And measuring TAM can be as tricky a business as the politics behind it.

At the centre of this system in Pakistan is Medialogic, an overnight ratings provider founded by Salman Danish. With a sample size of what they claim is a carefully selected 2,000 households, Medialogic provides advertisers with data such as what age, gender and other demographic are watching what and at what time – allowing advertisers to optimise their buying of media.

READ MORE: The dirty business of television ratings

Here’s the problem. Around 2002, Pakistan was undergoing its television boom. A lot of people were buying TVs for their homes and

private channels other than the state owned PTV were making waves and attracting interest. Companies knew that this was an excellent avenue for advertising and as such the need for specific television rating data became apparent.

Initially, the Pakistan Advertisers Society (PAS) tried to get AC Nielsen Pakistan to take on this task. Nielsen’s parent company in the US is actually famous for television ratings but Nielsen Pakistan expressed distrust in the market meaning they thought ratings would be susceptible to manipulation in a nascent television market like Pakistan. That is when Medialogic first stepped in. And over the years, they have for all intents and purposes been the only provider of television ratings in the country. And tis monopoly has not kept them safe from exactly the kind of controversy Nielsen was afraid of.

As mentioned earlier, Medialogic only

has a sample size of about 2000 homes in a country with a population of 220 million. The scientific method that goes behind TAM numbers seems compromised. Across the border in India, which has a population of more than 1.3 billion, the viewership habits of over 197 million television households accounting for 836 million TV viewing individuals is measured by the Broadcast Audience Research Council (BARC). BARC is a joint industry company founded in 2010 that is the world’s largest television audience measurement service. Its measurement system is based on 40,000 homes all across India.

“This is totally correct and unfortunately not very well understood by people. The larger the panel, the greater the cost of research,” says Salman Danish. “However, our market, while being very large in population, is not very large in terms of its market size. Therefore, clients cannot afford a very large sample. Therefore, they decided to start

with a very small panel.”

The reality is that because the representative sample is so small, it is entirely possible to manipulate television ratings. Whether Medialogic has done this or not over the years is a matter of controversy and would very quickly fall apart into finger pointing and accusatory blows being traded. The only thing we do know is that Medialogic has been accused of such manipulation with matters even going to the Supreme Court.

This is what the entire story hinges upon. Due to the prevailing sense of fear in the country because of the crackdown on political workers

The larger the panel, the greater the cost of research. However, our market, while being very large in population, is not very large in terms of its market size. Therefore, clients cannot afford a very large sample. Therefore, they decided to start with a very small panel

Salman Danish, founder of Medialogic

and their associates, many people did not talk freely about the ban on Medialogic. Senior members of the Pakistan Broadcasters Associations, bankers, marketing heads of MNCs, and television channel owners all expressed their apprehensions in going on the record. Some of them agreed, albeit hesitantly, to speak off the record.

The general perception was that Medialogic had been targeted for the political association its founder Salman Danish has with former prime minister Imran Khan. Back during the 2013 election when Khan’s PTI was first rising as a political force, there was also a lot of advertising that they were doing on television. For this, Medialogic was the company representing the party. Salman Danish was also officially engaged by Khan as a consultant on media buying and strategy.

In fact, Imran Khan’s former wife Reham Khan in her 2018 autobiography mentions Salman Danish as a regular feature at the PTI Chief’s home in Bani Gala. “The leading channel owners were all Imran’s ‘friends’, from Tahir A Khan of News One to Zafar Siddiqi of Samaa.

The head of Pakistan’s only media ratings agency Medialogic, Salman Danish, was a permanent fixture at Bani Gala, as were heads of mega advertising agencies, like Inam Akbar,” she writes.

READ MORE: The legend of Inam Akber and the truth behind his Midas touch

“The government is now taking revenge from Salman Danish for his association with Imran Khan,” explains one senior broadcaster on the condition of anonymity. They fear that going public with these views may result in them being targeted as well. “The PML-N has long believed that because Salman Danish was Imran Khan’s man he would manipulate television ratings to make it seem like more people tuned in to watch when Khan was addressing a rally or a press conference or giving an interview.”

“Within the broadcasting community it is common knowledge that ratings are very high for any content that has to do with Imran Khan. The current government has long felt that these were false numbers meant to give Khan more airtime and make him appear more popular. With a likely election approaching, they may have wanted to ban Medialogic so Khan’s popularity was not so apparent to everyone again.”

So could Salman Danish have manipulated television ratings to make his client Imran Khan seem more popular? It is definitely possible and Danish’s position as the head of the only television rating provider in the country and consultant to a political leader do pose a conflict of interest. However, another factor is that Imran Khan is gen -

uinely popular and attracts a largely urban audience that consumes a lot of television and news media.

While this is unlikely, what we do have is a situation where this isn’t the only time Danish has been accused of ratings manipulation. In 2015, a back and forth spat with the Express Media Group had involved accusations of bribery, kidnapping, extortion and a plethora of unethical behaviours.

In September 2018, a three-member bench led by former Chief Justice of Pakistan Saqib Nisar announced that TAM ratings would from then onwards come through regulatory body PEMRA.

As a measure to curb malpractice in the issuance of ratings, the SC ordered ratings agencies to provide the viewership data they collect to PEMRA, which would then display the data on its website and use it to assign ratings independently.

The case had gone to court after Bol TV accused Medialogic of withholding its ratings, favouring other news channels and being in an unholy alliance with the PBA. In the courtroom, proceedings had gone in a way typical of the Justice Saqib Nisar era. The powerful Salman Danish was paraded in front of court, handed a contempt notice, threatened with the forensic audit and closure of his company, and publicly berated like a petulant child.

Medialogic offices were sealed last night by law enforcement agencies. We believe that this inexplicable action may be the result of some misinformation or misconception. We are trying to get clarity on the situation to move towards a swift resolution. However, until we receive the necessary approval to resume services, we will not be releasing data

Aly Mustansir, CEO of Medialogic

Every time Medialogic has been impacted by policy or politics (it has happened more often than it should), advertisers have had to either continue their plans in the dark or stop advertising

Ali Imran Memon, former head of media at Nestle

During the course of the proceedings, their lordships hammered away at Medialogic for its monopoly, but when it came time to give a decision, PEMRA’s involvement was the only concession TAM providers had to make. In fact, the court also ruled that the PBA would no longer have anything to do with ratings, effectively giving Salman Danish more power and influence over media ratings. And when Bol’s counsel argued that this would simply result in the creation of a cartel all over again, the court said the matter was settled.

Since then, MediaLogic has been operating with impunity. They have expanded their footprint and continued to hold a monopoly on television ratings leaving advertisers and broadcasters all over the country dependent on them. That is until now. The only question is, in the immediate aftermath of this event, how will advertisers and broadcasters manage their affairs with no data?

Advertisers rely on this data to plan their marketing strategies and spending patterns. “Every time Medialogic has been impacted by policy or politics (it has happened more often than it should), advertisers have had to either continue their plans in the dark or stop advertising. The bright side is that the research data collection keeps going, and that data is made available post so advertisers and agencies can still post and evaluate their planned achievements. This is not to take away from the losses incurred - every time I ran campaigns in the dark (both as agency and as client) I saw upwards of 30% losses vs targeted achievements,” says Ali Imran Memom, former head of media at Nestle and one of the very few industry executives willing to speak on the record.

There are of course some initial mur -

Reham Khan in her autobiography

murings. Some people feel that PTCL smart boxes might be used to calculate television ratings in the absence of Medialogic. Others think that PEMRA might have to step in and play the role. As Ali Imran explains to us, neither of these options are viable and unfortunately advertisers will have to work on guesstimates and be in the dark about precise data.

“Media ratings work on the simple research principle of representative samples. In 2021, Medialogic introduced Return Path Data (RPD) - essentially watch time data on a household level from PTCL smart boxes. There is much contest to this in the industry as it mixes individual level data with box data by randomising household results to individual level through an algorithm which was audited by the author of the algorithm (allegedly). Nevertheless, it is currency for all TV advertising now,” he explains on the PTCL smart boxes issue.

The PTCL boxes problem is an old one. Even when Medialogic had started using them in their ratings some advertisers were concerned the numbers would not be accurate. The PTCL boxes can only provide very basic data and not specific information regarding gender, age, and other demographic trends. In that way it could prove to be a poor alternative to the original ratings.

“As far as PEMRA is concerned, they were only involved in media ratings on complaints to the Supreme Court about Medialogics hegemony / monopoly. They initially supported others but quickly changed course and aligned with ML as the only provider. Yes, after being charged to allow / encourage other players. And as a regulatory authority this is not in their charter. It was only with the Supreme Court order that they gained the right to interject in the marketplace. And to create the ratings themselves would further risk the already challenged credibility of the audience viewership data.”

Here is where we stand. Pakistan has only one television ratings provider and that

company has been banned by the federal government seemingly out of nothing more than political vindictiveness. There are, however, issues with Medialogic and conflict of interests that need to be explored. What is saddening are the very serious jitters that have taken over the advertising and broadcasting industry in the wake of this environment of fear and surveillance.

Salman Danish himself is in Dubai, although it is expected that he will challenge the decision in the Supreme Court of Pakistan. Profit reached out to him and he said he would respond to all queries “in time” but has continued to evade questions. Medialogic’s incumbent CEO, Aly Mustansir, has also failed to respond to questions despite repeated attempts to reach out.

“Dear All, This is to inform you that the Medialogic offices were sealed last night by law enforcement agencies. We believe that this inexplicable action may be the result of some misinformation or misconception. We are trying to get clarity on the situation to move towards a swift resolution. However, until we receive the necessary approval to resume services, we will not be releasing data. We regret the inconvenience caused and hope that this episode will soon be behind us,” said Mustansir in a Whatsapp message sent to broadcasters on the 23rd of May. He has been CEO of the company since 2019 when Salman Danish took a backseat from managing everyday affairs.

As things stand, the banning of MediaLogic will be a significant blow to marketing departments all across the country and will also leave broadcasters and television channels in the dark about what content is being received well and how they should plan for the future. The short-term alternatives are not viable or accurate. The only question is, will a new force take advantage of Medialogic being out for the count and rise up, or will ML be back for its monopoly and its throne? Only time will tell. n

Additional reporting by Nisma

RiazThe leading channel owners were all Imran’s ‘friends’, from Tahir A Khan of News One to Zafar Siddiqi of Samaa. The head of Pakistan’s only media ratings agency Medialogic, Salman Danish, was a permanent fixture at Bani Gala, as were heads of mega advertising agencies, like Inam Akbar

By Bakht Noor

By Bakht Noor

“Iremember one of my previous employers wanted to see why they were unable to retain female talent, so they decided to conduct a focus group, where they got different employees, including senior, junior, married, or single and male or female to come together and closely consider different aspects of the business. We were talking about whether we should have a daycare and

In March 2023, Muneeza Iftikar, the Head of Legal at FrieslandCampina shared an anecdote with Profit from almost a decade ago to highlight the plight of pregnant women at workplaces.

“One of the only female engineers on site had joined us and while this discussion was happening, she raised her hand. She was expecting a baby, while working and living on the site. The site had just one female toilet on the opposite end of the plant, and because of the nature of the plant, you couldn’t just

This is not a drill and it is definitely not a vacation

walk around in it. There used to be a van that took you around because it was a dangerous facility. She told us that she had to spend the whole day waiting for that van for one or two bathroom trips during the workday, but as she was pregnant, she required using the loo more often than before,” Iftikar continued.

“We spent millions on conducting other diversity initiatives, without realising that our one main female employee doesn’t have access to basic bathroom facilities. So, at times there are problems as simple as this and we miss them because women are not a part of the conversation,” Iftikar concluded.

And especially pregnant women. In 2022, the International Labour Organization (ILO) revealed that three in every 10 women of reproductive age — or 649 million women — have inadequate maternity protection that does not meet key requirements of the ILO Mater¬nity Protec¬tion Conven¬tion, 2000.

In this dark reality, there is finally a glimmer of hope. On 15 May, the National Assembly passed a bill of profound impact, the Maternity and Paternity Leave Bill, 2020. The legislation has been in the works for years, its first draft was passed by the Senate in 2022 and now, it has finally seen the light of the day.

In January 2020, the Senate passed a bill allowing for a maximum of 30day paternity leave to all employees of “public and private establishments under administrative control of the federal government” with full pay besides a mandatory six-month maternity leave for a female employee on the birth of her first baby.

PPP Senator, Quratulain Marri introduced the bill in November 2018 and it was approved by the house committee on finance headed by another PPP senator and former law minister, Farooq Naek.

Finally in 2020, the bill was passed by the treasury members through a majority vote despite the opposition-dominated Sen -

ate. Minister for Economic Affairs Hammad Azhar opposed the bill, saying there was already a law to give 90-day maternity leave to female employees while male government employees could avail 48-day leaves a year.

After being in the works for more than three years, the bill is now finally applicable in the capital and sets the precedent for other provinces to follow suit and implement similar legislation within their jurisdictions.

The Bill allows for paternity leave as well as the formalisation of maternity leave. Under the legislation, mothers can acquire up to six months of paid maternity leave on the birth of their first child, four months on the birth of a second child and three months on a third.

The law also covers paid paternity leave, providing for the father to take three one-month leaves in the duration of childbirth. This is the first time that paternity leave has been given legal protection, which is a pivotal step insofar as policies of labour welfare are concerned.

The bill extends to all public and private establishments under the federal government’s administrative control including factories, companies, autonomous and semi-autonomous organisations etc.

Presently, Pakistan is ranked as one of the lowest in South Asia and globally for women’s participation in the workforce, with only 20% of women employed in the formal sectors. Moreover, according to the United Nations’ Gender Gap Index Report 2022, Pakistan is one of the worst countries in terms of gender inequality, ranking 145/156 for economic participation and opportunity, 135/156 for educational attainment, 143/156 for health and survival, and 95/156 for political empowerment. Among the many barriers are inadequate maternity leave provisions.

Though such legislation exists across

all provinces, it varies considerably. Sindh offers the longest maternity leave at 16 weeks. Passing a law that stipulated paid paternity leave is being applauded as a step in the right direction. The lack of daycare facilities at the workplace further hinders women’s potential in economic life. This bill therefore incentivises women to remain part of the workforce, acts as a recognition of the role of both parents in the childbirth process, and is thus celebrated as progressive policymaking. However, certain issues undergird it.

Profit spoke to Marva Khan, Professor of Law at Lahore University of Management Sciences. According to Khan, a drawback of the bill was its limited jurisdiction.

“The bill is applicable not in the federal territory but only in the capital. This essentially means that you would have to situate yourself in Islamabad in order to be able to reap its benefits,” Khan elucidates. “This nevertheless establishes a good precedent for other provinces to follow. The bill is already drafted and available in a well-made form. Hence, it can be emulated by other provinces if their assemblies decide to follow this direction.”

Another criticism the bill received was that it entailed no provision of protective leave for the mother and father, after the birth of their first three children. According to Khan, this criticism was linked with concerns of population control, as such provisions could encourage people to have more children.

“I believe that this criticism is misguided primarily because parental leave is not vacation time. Nobody is enjoying looking after a newborn. Only providing protective leave for the first three children and not beyond that is an issue with the bill,” Khan remarked.

Historically, the concept of maternity

We spent millions on conducting other diversity initiatives, without realising that our one main female employee doesn’t have access to basic bathroom facilities. So, at times there are problems as simple as this and we miss them because women are not a part of the conversation

Muneeza Iftikhar, Head of Legal at FrieslandCampinaHadia Majid,

leave has not been absent in Pakistan. In fact, Pakistan is a signatory to the International Labour Organisation (ILO) convention wherein maternity leave is provided for.

“This is another criticism that the bill received. People say that since we already follow ILO conventions, we don’t need another bill which reinstates those. However, this is not true. There is no proper mechanism for enforcing paid leave particularly in the private sector,” Khan added.

“Another criticism is that fathers in public sectors already have leave allowances which they can exercise whenever they wish to. Again, this is a misconception. A lot of men working in the public sector are often denied regular leaves, both paid and unpaid on part of their children.”

While there are certain provisions in the public sector- irrespective of weak enforcement mechanisms- in the private sector, many women end up being demoted within their workspaces or losing jobs when they are expecting a baby. The history of parental leaves is rather dubious, and this bill is nevertheless a step in the right direction.

“At least now we have some sense that the legislature is moving in a positive direction and assemblies can emulate the same practice,” said Khan. “Increasing the maternity leave period for mothers to 6 months is excellent. Even 4 and 3 months’ (respectively) protection for the second and third child is good. Again, this is meant to discourage people from having more children. Yet, even a minimum period of 3 months is important.”

“Even the availability of the father in the initial month is crucial. It is incorrect to attribute that fathers don’t want to be with their families when the child is born. Many are unable to stay behind due to work obligations,” Khan continued. “Paternity leave also signals to men that they have responsibility towards the renewed family unit, particularly towards the mother in the first month of postpartum when she is not very mobile. The child is also extremely fragile and definitely

in need of assistance.”

Moreover, it’s important to be cognisant of the fact that we are gradually drawing away from joint family systems, especially in the urban centers. The extensive family support system that parents may have previously had in raising babies is also steadily fading. Grandparents are in fact often found to be working, given the state of the economy. According to Khan, it is integral to give some provision and protection to the new family in the most vulnerable months of its existence.

Dr Hadia Majid, Associate Professor and Chair of the Economics Department at Lahore University of Management Sciences (LUMS) discussed the economics of paid parental leave.

Right off the bat, let’s ask ourselves the basic question. What are the economic benefits of paid parental leave?

According to Dr. Majid, the benefits of paid parental leave are both short term and long term.

“Firstly, it leads to greater employee retention. You can’t ignore and deny the fact that workers have lives, and if you don’t cater for their personal life, they will be demotivated in their work. This will result in diminishing productivity and higher worker turnover. Workers will simply leave if they are not taken care of,” she explained.

“Then, there are long-term benefits as well, particularly related to child development. Many studies have indicated that the period after childbirth is critical for both the child and the parents. Parental care is necessary for healthy child development. 20 years down the lane, children who received adequate education from their parents will grow to become better workers, as they

would have experienced better cognisant development,” she added.

According to Dr. Majid, this is the “instrumentalist perspective” or the view wherein the value of theories is not determined based on their literal accuracy but by the extent to which they help make empirical predictions.

However, on a more basic level, this is also a “human rights issue.”

“If you are serious about sustainable development and the protection of your fundamental rights as a human being, you have to take into account paid parental leaves,” she emphasised.

Claire Cain Miller, an author of politics, economics and gender wrote in the New York Times that according to economists, more people take time off with paid leave. This is particularly beneficial for low-income parents who may have taken no leave or dropped out of the workforce after giving birth. This not only provides a bigger safety net to people from disparate socioeconomic classes, but also guarantees the reintegration of women in the workforce after childbirth.

“Paid leave raises the probability that mothers return to employment later, and then work more hours and earn higher wages. Paid leave does not necessarily help businesses — but it does not seem to hurt them, either,” added Miller.

While paid parental leave is necessary for healthy child-rearing and greater worker productivity, how can it also manifest as an economic burden that can be expensive for businesses? Is there a possibility that such progressive laws may also backfire?

According to Miller, “scientists say, leaves can backfire on workers if employers penalize them by denying promotions or raises.”

“The most serious consequence is that it may lead to gender and age discrimination at the workplace and during hiring practices. Employers may refuse to hire a young woman due to the expectation of marriage and even -

Firstly, it leads to greater employee retention. You can’t ignore and deny the fact that workers have lives, and if you don’t cater for their personal life, they will be demotivated in their work. This will result in diminishing productivity and higher worker turnover. Workers will simply leave if they are not taken care of

Dr

professor of economics at LUMS

tual child-bearing. This is a bias that many employers may have,” Dr. Majid told Profit.

“However, it can be traced to cost-and-benefit analysis. Paid maternity and paternity leave helps in building healthy work environments and improving workers’ motivation. Of course costs are there, but there is enough research to indicate that the costs tend to be overweight by the benefits,” she concluded.

One may argue that other care facilities are present such as daycare centers and access to nannies, which lessens the need for maternity leave or the length of it. Dr. Majid however disagreed with this.

“You have to look into the kind of structure that is in place, once a child is born. In Pakistan especially, it’s not simply about access to a nanny or daycare facilities but extended family networks. Irrespective of alternate childcare mechanisms, a child needs its parents especially in the first three months after birth. A mother needs time to rest and a father also requires bonding time with the child. Daycares should come into the picture once maternity leave ends,” Dr. Majid stressed.

“Daycare facilities are essential nevertheless. In fact, they are legally mandated in the province of Punjab. You can apply to the government for the setting up of a daycare center, as the reproductive burden is high and pervasive in everyone’s lives. Regardless of affordability, such facilities should be made available to all” she added.

Paid maternity leave is also mostly associated with Western countries such as Canada and Scandinavian countries such as Sweden and Norway. The concept is not perceived as salient in developing countries such as Pakistan. However, Dr. Majid dispelled this myth and provided an alternate view.

“This is a misnomer. We have very progressive laws in the developing world as well. Take India for example: in the public sector, 1 year maternity leave is available to you anytime before your child turns 14,” she exemplified, “then of course, Scandinavian countries have very progressive laws and rank highest in the World Happiness Index.”

Again, the problem lies in the cost

associated with paternity leave which makes employers think otherwise. However, while costs may incur in the short term, the benefits are most certainly long term.

“In developing countries such as India and Pakistan, the population is large. A pertinent reason as to why employers are against paid maternity leaves is that they believe that they can hire someone else to fill in the position. They are not worried about worker turnover. But in recent years, there is an increasing realisation that it’s difficult to find the right person for the job. If an employer has hired someone who is working fine, their policy would focus on trying to retain the person, and this has tremendous impacts on worker productivity,” detailed Dr. Majid.

Should we stop at a paid leave law? Or should we continue to press for changes in public awareness and workspace culture?

“Paid leave is certainly not enough,” Khan asserted. A lot more needs to be doneat the very least, there should be provision of daycares at workplaces. It’s not just about the first few months, a child remains fragile for a long time and requires excessive care. A lack of daycare facilities leads to a reduced number of women in the workforce, as they often lack support systems, and protected spaces where they can leave their children during working hours. Given the economic conditions, it is crucial that women continue to work.”

A Bill was passed related to the provision of daycare facilities. The Day Care Centres Act 2023, mandated all governments within the Islamabad Capital Territory with at least 70 employees to establish daycare centers on their premises. Again, the problem was its limited scope and the fact that its applicability was conditioned on the presence of a minimum of 70 employees.

According to Khan, the workspace culture also necessitates positive development.

“A lot of people see maternity and pa -

ternity leave as a form of vacation, when it’s clearly not. It’s a highly rigorous time period for both the parents. Public awareness can possibly help with this,” she added.

“Furthermore, the state can allow some form of paternal provisions or allowances that can be paid to parents in need- particularly those who don’t earn enough to meet the basic nutritional needs of the mother and child post-birth or during pregnancy. As a result, they suffer from malnutrition leading to high maternal and child mortality rates,” Khan concluded.

The journey clearly does not end here for Dr. Majid as well.

“The issue is not restricted to paid parental leave but about family laws at large. There should be other protective laws in place. What if someone’s child is sick and they require a leave from work? What if an employer is being discriminatory in their hiring practices and asking questions related to your plans for marriage and child-bearing? Firms should be prosecuted under the law for being discriminatory. The ambit for progressive legislation needs to be enlarged,” she asserted.

Despite the fact that women have been entering the workforce for some time now, the workspace culture is still not inclusive enough for women.

According to Dr Nida Kirmani, Associate Professor of Sociology at LUMS, “It is a combination of ignorance and a simple lack of care. There is a general idea that, if a woman is given a job at all, she is lucky rather than the other way around. Companies are designed with the male employee as the standard, and women are expected to conform to that mould.”

This means that women are largely ignored when designing HR policies and incorporating inclusive practices from the get-go. Paid maternity leaves are considered as bonuses whereas they should be the norm, apprehended as a fundamental human right.

Beyond policies and legislations, there is an urgent need for a shift in mindset. n

The bill is applicable not in the federal territory but only in the capital. This essentially means that you would have to situate yourself in Islamabad in order to be able to reap its benefits

Marva Khan, professor of law at LUMS

One of the largest land-owning families in Pakistan and possibly the last of the great farmer-politicians — Ali Tareen talks about agriculture and climate change

By Abdullah NiaziAli Tareen cuts every inch the figure of the young heir to a massive family fortune. Young, an Oxford Graduate, and well-spoken he meets us in a quiet office building nestled in the heart of Lahore’s Gulberg III.

The walls of his office are covered by large, modern art and there are hints of sports equipment strewn across the room in an otherwise clean little space. A single, autographed cricket ball occupies a place of honour on his desk.

Yet Ali Tareen spends very little time in

his Lahore office. Most of the year he is somewhere or the other in South Punjab, flitting between his family’s sugar mills in Rahim Yar Khan or his father’s farm in Lodhran.

The Tareens are one of the largest land-owning families in Pakistan. Over the decades, they have built a fortune off the back of being some of the most progressive farmers in the country that have managed to diversify into sugar mills and other businesses. And through Jahangir Tareen, the family also holds significant political capital.

An overwhelming perception that exists in the urban middle classes and in Pakistan Studies textbooks is that the country’s federal

and provincial legislatures are controlled and heavily occupied by feudal lords. This has not been strictly true for some decades but the link between politics and jagir in Pakistan has been inextricable.

Some of the most prominent names in the country’s history have come from large landowning families. Liaquat Ali Khan was one of the largest landlords in Muslim India before partition. Zulfiqar Ali Bhutto’s father was the largest land-owner in Sindh. Nawab Akbar Bugti until his death held some of the richest lands that Balochistan has to offer. In fact, inherited agricultural land has long been a source of political patronage for many in the corridors

of power. Nawabzada Nasrullah, the last great Churchillian politician Pakistan produced, had famously sold most of his baghat by the end of his career. Former President Farooq Leghari also sold large chunks of his family land in Dera Ghazi Khan to fund his career in politics after he left the presidency. But these are all dinosaurs from a by-gone era.

In the modern day and age, politics is dominated more by seths and industrialists than it is by agriculturalists. As a significant power broker that played a vital role in the formation of the PTI government in 2018 and the ouster of Usman Buzdar from the CM office in Punjab, Jehangir Tareen is perhaps one of the last ‘great’ land-owning politicians of this country. With the current political situation in the country bleak and a power-vacuum emerging in the absence of the now scattered PTI, it seems Tareen will once again be front-and-centre in national politics.

Luckily for him, the family wealth and in particular the agricultural and sugar business have for some years been managed by his son Ali Tareen. Far from the image of a ‘feudal’ politician, the younger Tareen is a dedicated son that has shouldered his father’s responsibilities. He currently spends most of his time managing the JDW Sugar Mills as well as agricultural land in Lodhran. Earlier this month, Profit sat down with Ali Tareen to talk about agriculture, climate change, and food security. The conversation, which stretched on and went from general to technical, hinged around what it means to be a farmer in Pakistan all illustrated through the example of mango farming.

“Our land sucks. It was a sad realisation but I still remember how it happened. It was 5AM, my first day on the farm after coming back to Pakistan after graduating, and I was sitting in the little office we have there,” says Ali Tareen. On his return from Oxford, Ali had made his way to the family farm with the intention of learning the ropes of the family business. That is when he received the reality check.

“Our Australian consultant was in Lodhran those days and he said to me that the land was crap. I still remember his words he said ‘in Australia this would be a housing colony nobody would try to grow anything here’ and that jolted me right up. We have been doing everything we can and putting in all kinds of resources to grow the most basic crops on our land.”

The bulk of the land owned by the Tareens is in Lodhran. The land is canal

irrigated for the most part but is not close to a river and faces water shortages regularly. It is also part of the vast tracts of desert lands that were irrigated and turned green by the British colonial government in the 19th century. Here, however, the Tareens have managed to run an operation that is based on the principles of progressive farming. Behind this has been Jahangir Tareen.

“My father used to work at a bank,” Ali tells us. He is referring, of course, to the few years the elder Tareen worked at Grindlays Bank in Lahore. “The story goes that the bank where my father worked was underground. One morning in 1978 he went into the basement where his office was with the sun at his back and by the time he walked out the sun had gone down. That very day he resigned from the bank and moved back to his father’s farm in Lodhran. Within those few days he was away from Lahore, in the South of Punjab, and waking up at 5AM working as an agriculturalist.”

It was a rare story of a person stuck in the 9-5 corporate rut abandoning the vices and attractions of the urban centre to go live a life of green pastures filled with nature. But very quickly Jahangir Tareen made it work for himself. The family farm in Lodhran was not nearly as large as it is today. In many ways it was as typical a land-holding as there could be in South Punjab. After quitting as a banker, Jahangir Tareen worked to expand his father’s footprint. He became CEO of his family’s beverages business in Multan in 1981. Over the next eight years, he increased the business manifold and in the year 1989 Pepsico International offered him a franchise in Lahore. Mr. Tareen took over the franchise in 1991 as the Chairman of Riaz Bottlers Limited and developed it into one of Pakistan’s best operating franchises.

His biggest focus, however, was the agricultural sector. Agriculture is after all the largest sector of the Pakistani economy and the only ‘real’ sector that we have. Tareen bought barren land adjacent to his family’s farm and quickly began developing it, planting mangoes, cotton, sugarcane, and vegetables using the latest farming techniques and research. At the same time, he also went into the sugar business.

The elder Tareen established his first sugar mills in 1992 as JDW Sugar Mills. This has grown into Pakistan’s largest sugar milling operation. You see, very quickly Tareen realised that the only way to make a sugar mill work well was if farmers were producing more and more sugarcane and were incentivized to do this.

“Rahim Yar Khan used to be a cotton growing area when we set up our mill,” says Ali. “Now it is the biggest sugarcane producing area in the region. That is because we came in and said from the get-go to the farmers that our goal is to have you grow lots of sugarcane for cheap and sell it to us at high rates. Before

this the relationship between the sugar mills and the farmers was that the mills would squeeze the farmers. Eventually, the farmers would simply stop growing sugarcane. And that’s why we provided cash loans, we gave seeds, we held training and sugarcane yield has never been higher,” he explains. The Tareens also made the calculated decision of supporting their mills with their own plantation of sugarcane on over 30,000 acres of land. This quickly transformed them from wealthy landed elite to extremely wealthy landowners and sugar barons.

The ethos behind this entire success story was the concept of progressive farming. Progressive farmers refer to those agriculturalists that seek to actively reduce the dangers involved in agricultural practices by engaging in rigorous scientific testing and use modern technology and techniques to maximise their yield and increase their earning.

“When my father came to work on the family farm he had different ideas. He was foreign educated, he had his own ideas and he sought outside help to transform our land,” says Ali. “So he went to Australia and came back with some consultants that he offered jobs to in Lodhran. One of the first things to happen was that when this consultant came to Lodhran he noticed we were flooding our mango orchards with water in the winter time. He immediately asked why we were doing this and we explained that mango trees would die if not given water in the winter months.”

“He then told us that mango trees don’t need water in the winters. We were using diesel to pump water from the nearby canals and flood our fields. Now, a mango tree takes five years to grow and our consultant said it would take 2-3 years for the effects of this to become apparent. It was a huge leap of faith but my father agreed. Except he didn’t stop flooding the entire orchard. He just set aside a certain part of it as an experiment.”

This little anecdote both encapsulates the inquisitive spirit that allowed Jahangir Tareen to transform his family farm into one of the richest in Pakistan as well as captures the true essence of progressive farming. To do it right, it isn’t about constantly doing one new experiment after another. It is a question of always testing and doing controlled experiments. At the end of the day, farmers want to maximise yield at the lowest cost possible to increase their profits. If an experiment brings an increase of 1% more yield a year but costs a

“You need to always be testing” — what does it mean to be a progressive farmer?

lot more money than the method that would give 1% less yield it isn’t worth it.

“As progressive farmers we are always testing. The latest chemistry, tech, seeds, techniques etc we are always testing to see what our best bet will be. When we are growing our crops, for example a thousand acres of wheat, there is a test happening in every single block for all of these different factors. Whether that is soil testing or anything else we are trying to milk every small advantage. It is very important to always want to learn if you want to be a progressive farmer. The increment you get in yield versus your inputs to get that additional yield is also very important. So there has to be a cost benefit analysis. We have more of an opportunity to do this because we have more land. People with just 5 acres can’t afford to experiment. In addition to yield, we need to focus on efficiency as well. For example our biggest focus in recent times has been water consumption since water availability will go down.”